67

Abstract

is chapter proposes a direct payment to individuals that would

automatically be paid out early in a recession and then continue annually

when the recession is severe. Research shows that stimulus payments that

were broadly disbursed on an ad hoc (or discretionary) basis in the 2001 and

2008–9 recessions raised consumer spending and helped counteract weak

demand. Making the payments automatic by tying their disbursement to

recent changes in the unemployment rate would ensure that the stimulus

reaches the economy as quickly as possible. A rapid, vigorous response to

the next recession in the form of direct payments to individuals would help

limit employment losses and the economic damage from the recession.

Introduction

Direct payments to individuals are an eective way to stimulate spending

and making these payments automatic would guarantee that stimulus

arrives early in a recession. ese two arguments are supported by a growing

body of high-quality research on the eects of stimulus to individuals

in the past two recessions, in 2001 and 2008–9. is chapter proposes

establishing direct payments to individuals as an automatic stabilizer. e

lump-sum annual payments would be made to individuals, regardless of

their income level, when the national unemployment rate rises by at least

0.50 percentage points. e amount of the individual payments would be

set such that total payments equaled 0.7percent of GDP, or 1percent of

personal consumption expenditures (PCE). Payments in subsequent years

would be made only in the case of severe, prolonged recessions that lead

to cumulative unemployment rate increases of at least 2.0 percentage

points. Automatic stimulus payments to individuals would provide a rapid,

frontline defense early in a recession and a commitment to sustained

support in a severe recession.

Direct Stimulus Payments to

Individuals

Claudia Sahm, Board of Governors of the Federal Reserve System

Claudia Sahm

68

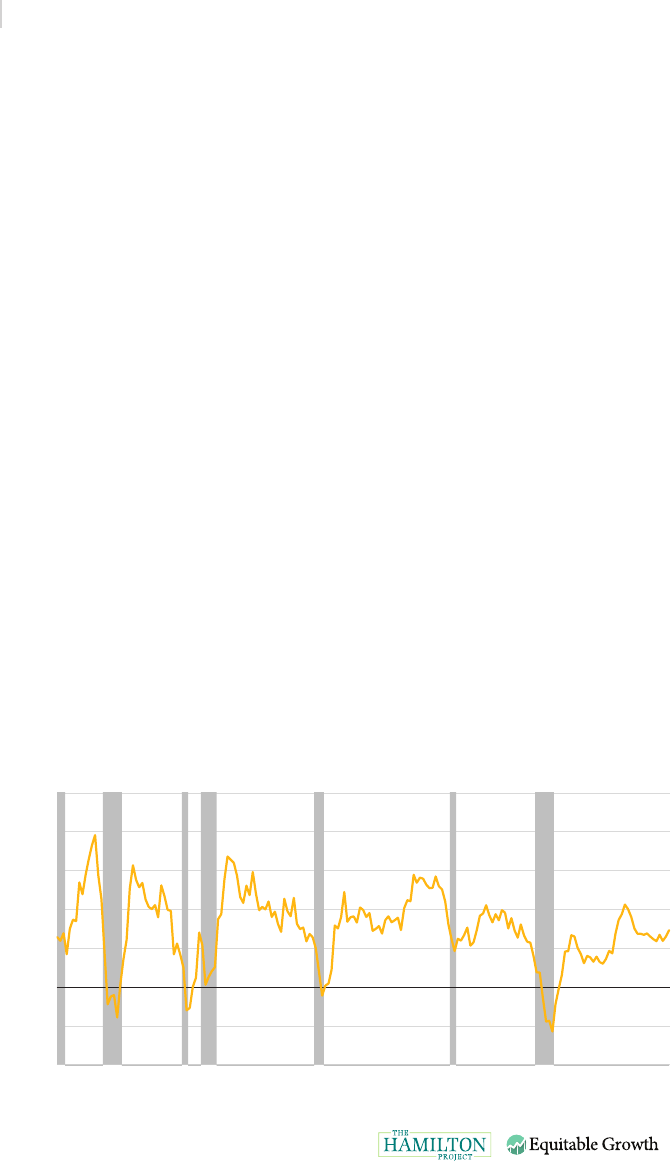

Growth in consumer expenditures slows sharply during recessions—and

in many cases turns negative (gure 1). Consumer expenditures make up

about 70percent of aggregate demand; a pullback in spending by consumers

can lead to employment losses and reduced production. Consumers are

therefore a key focus of eorts to stabilize the economy, and policymakers

have oen used stimulus payments to individuals (also referred to as tax

rebates) and temporary reductions in taxes to support household spending

during recessions.

In fact, during the Great Recession and the recovery, individuals received

more than $420billion in broad-based stimulus from the federal government

through three large, consecutive policies: a stimulus payment in 2008, a tax

credit in 2009 and 2010 (the Making Work Pay tax credit), and a payroll

tax reduction in 2011 and 2012. ese programs were broad based in the

sense that they applied to many households with few qualications, such

as having a minimum amount of income. In each case, the administration

and Congress craed the specics of the stimulus program in real time,

along with other scal policies, including targeted discretionary changes in

taxes and transfers to support individuals, businesses, and state and local

governments. e range of stimulus programs in the Great Recession has

supported a rich body of research on the ecacy of various tools.

Automatic stabilizers are already an important feature of scal stabilization

policy, two of the most notable examples being progressive income taxation

#4a4a4a

#67c2a5

#d94343

#bd9f45

#5c7aa5

#776493

#f1e764

Website colors

Ocial logo

Dark

Reverse

Chart branding horizontal

Multimedia branding

Equitable

Growth

#f1f0f0 background

#006ba6

#f6511d

#711c77

#178c58

#b400

#CE0A1A

#5bc0be

Chart color palatte

FIGURE 1.

Real Personal Consumption Expenditures, 1970–2018

Source: Bureau of Economic Analysis (BEA) 1969–2018; author’s

calculations.

Note: Shaded areas denote recessions.

-4

-2

0

2

4

6

8

10

1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018

Four-quarter percent change

Direct Stimulus Payments to Individuals

69

and unemployment insurance (UI). Incomes tend to decline in recessions,

but given that marginal income tax rates are lower at lower income levels,

taxes fall more than income does. e disproportionate decline in income

tax burden helps to oset some of the loss in disposable income. e UI

system, by contrast, is a more narrowly targeted automatic stabilizer

that supports consumption for eligible workers who lose their jobs. In

a recession, as the unemployed rise in numbers so do payments from

UI. In both cases, these automatic stabilizers (and others including the

Supplemental Nutrition Assistance Program [SNAP], formerly the Food

Stamp Program) are oen paired with additional discretionary measures,

such as temporary tax cuts or temporary extensions of UI benets.

e choice between automatic and discretionary scal policy depends on

several factors. First, we want to do only what we know works, and the

evidence shows that direct, lump-sum payments are an eective scal tool.

Adding a new automatic stabilizer would be a commitment to increase

government support to households in a recession. Improved stabilization—

such as shortening the length or severity of a downturn—would limit the

economic costs of a recession. Even so, stabilizers are unlikely to pay for

themselves. Sucient scal space for such policies could require either

higher taxes or lower transfers outside of recessions. In this case, one could

view the budget for the automatic stimulus payments as a rainy-day fund

for payments to individuals that would be administered by the government.

e fund would accrue savings in good times and make payments in

bad times. Given the thin nancial buers of many households, the

direct stimulus payments would increase households’ resiliency during a

recession.

Making the stimulus payments to individuals fully automatic could have

some drawbacks. One concern is that it might give the incorrect appearance

that policymakers are inactive in the face of recession. One response

to this concern would be to implement the stimulus payments in two

legislative phases. First, legislation prior to a recession would determine

the features of prospective stimulus payments, such as size and targeting,

and would allow the preparation of administrative systems. en when

macroeconomic conditions warrant (according to a prespecied economic

trigger), Congress would vote on whether to enact the stimulus payments.

e precommitment to the form and delivery of payments would increase

the speed with which stimulus can be distributed but still allow Congress

to control the exact timing. e development of macroeconomic triggers

and schedules for additional payments would provide additional guidance

to policymakers, even if the implementation is not fully automatic.

Claudia Sahm

70

Policymakers would only want to make automatic the policies that have

proven to be cost eective in the past. In turn, the eectiveness of stimulus

payments in a recession largely depends on the spending response of

households. A temporary reduction in taxes or increase in transfers, if

either action boosts spending, can mitigate the job losses, underutilization

of productive resources, and widespread pessimism in recessions.

Nonetheless, simple economic models with forward-looking consumers

and well-functioning nancial markets tend to predict a small increase in

spending from a temporary boost to income. In fact, some models even

predict that individuals would save all of any rebate (yielding what is known

as Ricardian equivalence), under the assumption that people would have to

repay the debt-nanced stimulus with higher taxes in the future. Empirical

evidence (summarized below) across numerous research studies of the

Great Recession strongly suggests that at least some forms of stimulus to

households can measurably boost spending in the near term.

The Challenge

EVIDENCE ON THE EFFECTS OF DIRECT STIMULUS PAYMENTS PROVIDED

TO INDIVIDUALS

Mounting evidence in the past decade nds that broadly distributed

payments to individuals increase spending during a recession and help

stabilize the economy. is new research has overcome a methodological

challenge: previously, a challenge in showing the eectiveness of these

direct payments was the diculty in distinguishing the positive eects of

the direct payments from the negative eects of the recession. When these

stimulus payments are disbursed, the overall economy is weakening and so

the trajectory of total spending can make the stimulus look ineectual. In

other words, a simple comparison of consumer spending before and aer

a stimulus payment to individuals is not enough to determine whether

stimulus is eective.

A novel feature in the delivery of stimulus payments in 2001 and 2008

provided an opportunity to tease apart and separately identify the eect

of the payments. e resulting studies have bolstered the view that such

payments are an eective and fast-acting stimulus. Due to administrative

constraints on the number of payments that could be sent out at one time,

the timing of individuals’ payment in 2001 and 2008 was determined by

the last two digits of their Social Security number. is random variation

in the timing provided a way to measure spending before and aer a

stimulus payment under the same macroeconomic conditions. Comparing

the spending of individuals who have (randomly) already received their

payment with the spending of those who will (randomly) receive it in a

Direct Stimulus Payments to Individuals

71

BOX 1.

Stimulus Payments to Individuals During the Great

Recession

e mix of discretionary stimulus to individuals in the Great

Recession and subsequent research on the eects has provided

several lessons on the best ways to structure stimulus payments.

Early in the recession, the Economic Stimulus Act of 2008 enacted

on February 13, 2008, included one-time recovery rebates to

individuals. Most single tax lers received a $600 payment while

couples that were married and led jointly received $1,200 at some

point between May and July of 2008. Filers received an additional

$300 for each qualifying child. e rebates were phased out for

high-income earners, while individuals with nontaxable Social

Security or pension income were eligible for smaller lump-sum

payments.

Aer the nancial crisis and recession intensied in the second

half of 2008, a large array of scal stimulus policies was used. On

February 17, 2009, the Making Work Pay tax credit, a broad-based,

two-year tax cut for individuals, was signed into law as one part of

the expansive American Recovery and Reinvestment Act of 2009

(ARRA). e Making Work Pay tax credit was implemented via

lowering withholdings, so the annual tax savings of $400 for singles

and $800 for married couples was spread out in smaller amounts

across pay periods. As the Making Work Pay tax credit was set to

expire, a temporary 2-percentage-point cut in the payroll tax for

2011 was signed into law on December 17, 2010, in the Tax Relief,

Unemployment Insurance Reauthorization, and Job Creation Act

of 2010. A year later, on December 23, 2011, e Temporary Payroll

Tax Cut Continuation Act of 2011 extended the payroll tax cut for

the rst two months of 2012, and then on February 22, 2012, the

Middle Class Tax Relief and Job Creation Act of 2012 extended the

payroll tax cut through the end of 2012.

Notably, this last stimulus policy required three legislative actions,

underscoring how precommitment could simplify the process and

reduce uncertainty for households. As with the tax credits in 2009

and 2010, the reduction in payroll taxes was spread throughout the

year in the form of larger paychecks. One dierence is that this last

Claudia Sahm

72

matter of weeks helps to isolate the eect on spending of having (versus not

having) the stimulus payment.

Studies of the 2001 and 2008–9 recessions have yielded stimulus spending

estimates that are uniformly positive. Johnson, Parker, and Souleles (2006)

analyzed Consumer Expenditure Survey data in their study of the 2001

tax rebates. ey used the random variation in timing of payments to

estimate that, on average, households spent 20 to 40percent of their rebates

on nondurable goods in the three-month period when the rebate was

distributed. Within the rst six months, individuals spent nearly two thirds

of the rebate on nondurable goods. In their follow-up study of the 2008

rebate, Parker et al. (2013) estimate that 12 to 30percent of the rebate was

spent on nondurables within three months of receipt. Including durables

spending, 50 to 90percent of the rebate was spent over three months. With

the same data, Misra and Surico (2014) estimate that 40 to 50percent of the

households who received a payment in 2001 or 2008 did not change their

spending, but about 20percent spent half or more of their stimulus. Other

analyses using dierent data sources and randomized timing also nd

that the 2001 and 2008 tax rebates quickly boosted consumer spending.

Broda and Parker (2014) use transactions data in 2008 for a narrower set

of consumer goods and nd a 10percent increase in spending in the week

of receipt. Using credit card data, Agarwal, Liu, and Souleles (2007) nd

that initially the 2001 rebate led to a reduction in debt but then credit

card spending rose by about 40percent of the rebate amount within nine

months. Altogether, these studies nd a sizeable boost to spending from the

payments.

Aer making the case for sending income to many households in a recession,

the next challenge is structuring the payments to most eectively increase

demand. A key nding that draws on results in multiple research studies is

that larger one-time payments lead to more spending, more quickly, than

payments that are smaller or more spread out. e composition of spending

induced by the payments in 2001 and 2008 is one piece of the explanation.

Parker et al. (2013) nd that the larger payments in 2008 (almost twice the

size of the payments in 2001) led to a large increase in durable spending

stimulus was proportional to income (up to the taxable maximum),

whereas the earlier stimulus to individuals were closer to a lump-

sum payment. e temporary payroll tax cut was allowed to expire

at the end of 2012. Across these three stimulus programs more

than $420 billion in additional income was sent to individuals

from 2008 to 2012.

Direct Stimulus Payments to Individuals

73

within three months of receipt. In 2001 most of the spending response

came from nondurables and occurred over six months. Similarly, Misra

and Surico (2014) nd that some people increased their durable purchases

by more than the amount of their rebate, for example by using the stimulus

to make a down payment on a motor vehicle.

Another source of evidence in favor of large one-time payments comes

from a method developed by Shapiro and Slemrod (2003a, 2003b, 2009)

that asks individuals directly in surveys whether they planned to “mostly

spend,” “mostly save,” or “mostly pay o debt” with the stimulus. With the

one-time payments in 2001 and 2008, they found that about 20percent of

adults said that they had “mostly spent” the rebates.

1

When this method

was applied to the Making Work Pay tax credit in 2009–10, the spending

response was more muted. Sahm, Shapiro, and Slemrod (2012) nd that

the smaller, repeated boost to income from lower tax withholding led to

less additional spending than the one-time payments. e share of people

who planned to “mostly spend” the lower withholding from Making

Work Pay was about two-thirds the share who planned to spend the tax

rebate. e structure of the stimulus payments—not the deterioration in

macroeconomic conditions between the spring of 2008 and the spring of

2009—appears to have dampened the spending response. In both years

retirees received a small, lump-sum payment, and in both years their self-

reported spending rates were similar. In addition, among non-retirees

a hypothetical one-time payment elicited a spending rate higher than

the withholding change (similar to the eect observed for the 2008 tax

rebate). Similarly, Sahm, Shapiro, and Slemrod (2015) nd a similarly small

spending response to the payroll tax cut.

2

e evident lack of public awareness of the more gradual stimulus like

the Making Work Pay tax credit—as documented in Sahm, Shapiro, and

Slemrod (2012)—raises some additional questions. In particular, one role

of economic stabilization policy is to assuage the negative views on the

economy. Pessimism and uncertainty could lead households to pull back on

spending and instead save as a precaution. Durables spending, which can

be more easily delayed than nondurable necessities, is particularly sensitive

to precautionary savings motives. A stimulus payment—even disbursed

annually—is not large enough to make up for a job loss but it could temper

the need to build up extra savings as a precaution. Stimulus that is not

seen or recognized by individuals is unlikely to aect their sentiment and

tendency to engage in precautionary saving. e direct boost to spending

is the key criterion for ecacy of stimulus payments, but the saliency (or

sentiment) eects are also worth considering.

Claudia Sahm

74

RELEVANT EVIDENCE FROM OTHER CONSUMPTION RESEARCH

e nding that additional income boosts spending on receipt is conrmed

by other research, not specically related to stimulus payments or

discretionary tax cuts. Moreover, the initial spending response does not

appear to depend on the additional income being a surprise to households

(as has been the case with stimulus payments in the past). Simple, forward-

looking economic models predict an increase in spending only if the

temporary increase in income is unexpected. One concern with making

stimulus payments automatic is that they would be less of a surprise to

households than discretionary stimulus payments. Yet, research shows

that additional income will oen generate additional spending, even if

individuals anticipate the income and it is a regular, large payment, such as

the annual Alaska Fund payments (Kueng 2018) or the Earned Income Tax

Credit (Aladangady et al. 2018). Empirically, spending is tied to the receipt

of the income, a relationship that does not appear to dier much across

predictable and unpredictable income.

Research ndings are mixed on the benets of targeting stimulus to

low-income individuals. A common—but not universal—nding is that

households with low liquid assets relative to their income tend to spend

more (and more quickly) out of additional income than those households

with ample liquidity. us, as argued by Kaplan and Violante (2014),

even high-income households with illiquid assets, such as housing wealth

or retirement savings accounts, would spend out of stimulus income.

Targeting current low-income or low-wealth households may not identify

the households most likely to spend the stimulus, which could include

some wealthy households.

3

However, it would be dicult to target stimulus

payments to individuals with low liquidity, since the government does not

readily have information about households’ assets.

The Proposal

is section lays out the case for direct stimulus payments to individuals

to become part of our system of automatic stabilizers, building on the

evidence in the previous sections that additional income translates quickly

into additional spending. I discuss several economic considerations that

militate in favor of automatic stimulus payments. I then propose a specic

policy to deliver automatic scal stimulus through direct payments to

individuals.

ECONOMIC CONSIDERATIONS RELEVANT TO AUTOMATIC PAYMENTS

ere are three reasons why I argue that direct payments should be made

into an automatic stabilizer. First, automatic stimulus payments would

Direct Stimulus Payments to Individuals

75

provide a policy precommitment to broadly support aggregate demand in

a recession. Second, analysis and deliberation over the size, structure, and

funding of stimulus payments, as well as the development of administrative

procedures to disburse payments, could occur at a time other than the

crisis of a recession. Finally, automatic payments could also commit scal

policymakers to maintain support if the recession is severe and the recovery

is drawn out. e payroll tax cut, the last of the broad-based household

stimulus aer the Great Recession, expired in the rst quarter of 2013. At

that time, the national unemployment rate was still 2.7 percentage points

above its prerecession level—a sign that stimulus was withdrawn while the

economy was far from a full recovery.

4

Fiscal support during the Great

Recession was less than in prior recessions, and the additional stabilization

later in the recovery was largely due to monetary policy.

Putting administrative systems in place ahead of time could ensure that the

stimulus is delivered more quickly and more broadly. It is also important

to minimize errors and ensure that only intended populations receive the

payment. With the 2008 stimulus payments, the Internal Revenue Service

(IRS) estimated that it would require 60 days to program the system to

calculate payments aer the legislative details were settled (Joint Committee

on Taxation 2008). In addition, the payments could not be disbursed

during the peak tax ling system. us, without advance preparation of the

system, it is not currently possible to send out payments from late January

to mid-May each year.

Moreover, advance planning could also be used to reach a wider population

than those ling income tax returns. A key impediment to sending out

payments is the lack of a centralized, up-to-date address or electronic funds

transfer information on individuals. e IRS maintains this information for

tax lers, as does Social Security for all its benet recipients. Collaboration

between the IRS, the Social Security Administration, and other agencies

that interact with non-lers could also extend the receipt of payments to

more individuals than tax lers and ensure that individuals receive only a

single payment from the government.

Automatic stimulus payments in recessions and recoveries—paid for by

higher taxes during expansions—would provide additional liquidity when

uncertainty about employment and income is high. Many households

have low savings and even outside of recessions would have diculty

paying a modest unexpected expense (Board of Governors of the Federal

Reserve 2018). Given the thin nancial buers of many households and the

heightened uncertainty in a recession, automatic stimulus payments could

be a popular form of rainy-day savings and support to spending.

Claudia Sahm

76

Automatic stimulus payments to individuals would also be a broad-based,

transparent source of macroeconomic stabilization. Lump-sum payments

disbursed annually to households based on macroeconomic conditions

would be a more direct, easier-to-understand form of stimulus than changes

in interest rates or asset purchases via monetary policy. Income payments

would go directly to individuals and would not rely on propagation through

nancial and labor markets. Monetary policy is an eective way to stabilize

business cycles—lowering interest rates to increase demand during a

recession—but its initial direct eects vary across individuals (depending,

for example, on their assets and debts) and the overall, benecial eects

are oen hard to communicate.

5

e broad-based nature of the stimulus

payments would also make it easier to explain the details of the program to

the public, increasing its salience and eectiveness. Recessions coincide with

heightened pessimism and the stimulus payments would directly counter

that pessimism. Understanding how the government is directly supporting

individuals in the recession could create public support for more targeted

policies or for those policies with less direct eect on individuals.

POLICY PROPOSAL

I propose a new automatic stimulus payment—lump-sum annual payments

to individuals—that would be triggered automatically by a rise in the

unemployment rate. Key details of the proposal are as follows:

• Automatic lump-sum stimulus payments would be made to individuals

when the three-month average national unemployment rate rises by

at least 0.50 percentage points relative to its low in the previous 12

months.

• e total amount of stimulus payments in the rst year is set to

0.7percent of GDP.

• Aer the rst year, any second (or subsequent) year payments would

depend on the path of the unemployment rate.

○ An increase of 2.0 percentage points or more from the initial

unemployment rate would result in a second year’s payments with

aggregate stimulus again equal to 0.7percent of GDP.

○ Aer the second year and aer the unemployment rate has peaked

(whichever comes later), the total stimulus amount would be scaled

down as the unemployment rate declines.

○ Annual payments would continue in the third (and subsequent)

years until the unemployment rate is no more than 2.0 percentage

points above the level at the time of the rst payment.

Direct Stimulus Payments to Individuals

77

• Eligibility for direct stimulus payments would not be restricted to

households with taxable income.

• All adults would receive the same base payment, and in addition,

parents of minor dependents would receive one half the base payment

per dependent.

Each aspect of the policy, including its administration, is discussed in more

detail below. is section concludes with an example of how the automatic

payments would have been applied in the Great Recession and recovery.

ese automatic stimulus payments to individuals should be thought of as a

rst line of defense in the recession and not a replacement for discretionary

scal policy or other automatic stabilizers, which could add to stimulus as

macroeconomic conditions evolve.

Trigger to Start Automatic Stimulus Payments

is proposal requires an explicit trigger that will turn on during a

cyclical downturn. is trigger could be used to automatically disburse the

payments or to initiate a congressional vote on payments. In this proposal,

the trigger is based on changes in the national unemployment rate.

e direct stimulus payments to individuals begin aer a 0.50 percentage

point increase or more in the three-month moving average of the

unemployment rate relative to its low in the prior 12 months (gure 2). e

three-month average smooths out some of the monthly random variation

in the rate and avoids false positives, such as stimulus payments made

outside economic downturns. e trigger depends on recent changes in the

unemployment rate, as opposed to a xed unemployment rate threshold,

because this type of trigger accommodates changes over time in the natural

rate of unemployment.

6

Even a modest rise in the unemployment rate such

as 0.50 percentage points (shown by the orange dashed line in gure 2) has

occurred only during or closely following recessions. In other words, by this

rule the stimulus payments would have been triggered only in recessions.

7

Based on past recessions (and the data available to policymakers at the

time), the change in the unemployment rate would be a highly eective

trigger for the stimulus payments. Early in each recession since 1970, the

unemployment rate rose at least a 0.50 percentage points (gure 3).

8

On

average, payments would have been triggered within three months of the

start of the past six recessions. e automatic trigger would have been met

four months aer the 2008–9 recession began and two months aer the

2001 recession began. e specic trigger in this proposal—comparing

the three-month average unemployment rate to its low over the prior 12

months—signals a recession well before the ocial dating of a recession.

Claudia Sahm

78

e proposed trigger would reliably deliver stimulus to the economy early

in recessions.

e unemployment rate has other advantages as the basis for the trigger

in an automatic stabilizer. e unemployment rate has been used as a core

signal of labor market strength and overall economic well-being, and has

been measured consistently for many decades. It is a timely measure: a

given month’s unemployment rate estimate is available at the beginning

of the subsequent month. By contrast, output growth is measured with a

lag, is revised frequently, and, given its volatility, would require waiting

for at least two to three weak quarters to signal recession. Partly due to

these advantages, the U.S. government has extensive experience using the

unemployment rate as a trigger for social programs. Making the stimulus

payments to individuals automatic once the unemployment rate trigger

is met would guarantee that stimulus ows to the economy quickly. If

administrative systems are already in place to disburse payments, then

individuals would receive their automatic payments early in the recession.

In contrast, for discretionary payments work also has to be done on both the

legislation and the logistics before stimulus can be delivered to households.

ere are some concerns with using the unemployment rate as a trigger

to start stimulus payments. First, the unemployment rate tends to lag the

business cycle, such that unemployment usually peaks aer the recession

has ended. e slow-moving nature of the unemployment rate implies

FIGURE 2.

Unemployment Rate (3-Month Average) Relative to Prior

12-Month Low, 1970–2018

Source: BLS 1969–2019; author’s calculations.

Note: Shaded areas denote recessions. Dashed orange line denotes

the proposed trigger threshold. Calculation uses real-time estimates

of the unemployment rate.

#4a4a4a

#67c2a5

#d94343

#bd9f45

#5c7aa5

#776493

#f1e764

Website colors

Ocial logo

Dark

Reverse

Chart branding horizontal

Multimedia branding

Equitable

Growth

#f1f0f0 background

#006ba6

#f6511d

#711c77

#178c58

#b400

#CE0A1A

#5bc0be

Chart color palatte

-0.5

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010 2014 2018

Percentage point dierence

Direct Stimulus Payments to Individuals

79

that it gives little advance warning of recessions. Still, as seen in gure 3,

this trigger would signal a downturn nearly immediately and long before

it has been ocially recognized. Second, the rise in unemployment prior

to a recession does not predict the severity of the recession. For example,

the increases in the unemployment rate prior to the 2001 and 2008–9

recessions were similar, even though the subsequent rise during and

aer the 2008–9 recession was more than double the rise with the 2001

recession. In other words, a prerecession unemployment rate rise is not a

good guide to the shortfall in demand in a recession and speaks to having

a plan for additional payments in severe recessions. Finally, one may worry

about whether people leaving the labor market or reentering it mask the

quality of the signal from the unemployment rate, but, at least at the start

of recessions, the change in the unemployment rate is a remarkably reliable

signal.

Aggregate Amount of Stimulus Payments

Because the goal of the direct payments to individuals is macroeconomic

stabilization and shallower recessions, the total amount of the stimulus is

a core concern. During the initial months of the recession when the rst

payment arrives, the eventual severity of the downturn will be unknown.

And, in fact, one goal of such fast-acting stimulus is to help stave o the

negative dynamics that oen accompany recessions—that is, the stimulus

can itself reduce the severity of the downturn. Fiscal stimulus can provide

FIGURE 3.

Date that Unemployment Rate Trigger Activated Relative to the

Start of Selected Recessions

Source: BLS 1969–2019; author’s calculations.

Note: Calculation uses real-time estimates of the unemployment

rate.

#4a4a4a

#67c2a5

#d94343

#bd9f45

#5c7aa5

#776493

#f1e764

Website colors

Ocial logo

Dark

Reverse

Chart branding horizontal

Multimedia branding

Equitable

Growth

#f1f0f0 background

#006ba6

#f6511d

#711c77

#178c58

#b400

#CE0A1A

#5bc0be

Chart color palatte

0

1

2

3

4

Mar 1974 Apr 1980 Nov 1981 Nov 1990 Jun 2001 Apr 2008

Month of trigger activation

Months since start of recession

Claudia Sahm

80

additional spending power to those who are liquidity constrained and

counteract the rise in precautionary savings that might otherwise lead to a

reduction in spending, particularly for purchases of durables that can more

easily be delayed.

I propose setting the total dollars of rst-year direct payments to address the

weakness in a typical recession. Since the mid-1970s, a typical recession has

entailed a slowdown in real consumer spending growth—on a four-quarter

basis—of about 2 percentage points, with substantially larger slowdowns

in growth in 1973 and 2008. In this proposal, direct payments that are half

of a typical recession’s slowdown in consumer spending growth—equal to

approximately 1percent of real PCE (or about 0.7percent of GDP)—would

be a substantial commitment to stabilize the economy.

9

is additional

income, on aggregate, is on the high end of past discretionary payments.

By comparison the 2001 tax rebates were about 0.4percent of GDP, and

the payments in 2008 were about 0.7percent of GDP (Shapiro and Slemrod

2003b, 2009).

Several considerations speak in favor of a large initial stimulus to

households. First, the costs of recession, whether at the macroeconomic

level or at the household level, are substantial.

10

us, vigorous eorts to

stabilize demand early in a recession would have large payos. Second,

larger aggregate stimulus translates into larger individual payments. Large

direct payments to individuals are spent more quickly since their size can

support the purchase of (or the down payment on) large consumer durables,

such as automobiles (Parker et al. 2013). For consumers, large payments

are also more salient than small ones (Sahm, Shapiro, and Slemrod 2012),

allowing them to more eectively counter precautionary saving motives

and bolster popular support for stimulus. Finally, these direct stimulus

payments—especially if made automatically—would be some of the earliest

support to the economy in the recession. Most of the support from other

automatic stabilizers, including progressive income tax rates or UI benets,

arrive later than the initial months of a recession. Large, direct payments

to individuals would provide an aggressive, frontline defense against the

negative eects of a recession.

Structure and Targeting of Payments

With the aggregate amount of stimulus set, the next step is to structure the

individual payments to maximize the immediate boost to spending. From

the empirical research on the 2001 and 2008 to 2012 stimulus policies, the

propensity to spend out of the stimulus payments is likely to be highest

for one-time, lump-sum payments (Sahm, Shapiro, and Slemrod 2012). In

addition, one-time payments add stimulus spending more quickly to the

Direct Stimulus Payments to Individuals

81

economy than a change in tax withholding (which would spread scal

stimulus throughout the year). Consider two hypothetical $100 billion

stimulus packages. e rst is paid out in one-time payments (with all

individuals receiving checks within 10 weeks) and the second is spread out

evenly during the year in the form of higher take-home paychecks (via lower

tax withholding). Even if individuals responded to both forms of stimulus

in the same way—in other words, if the marginal propensity to consume

(MPC) out of each dollar was identical—it would not be until early in the

next year that the full stimulus spending occurred under the second option

(gure 4). e delay in payments necessarily delays individuals’ spending.

In contrast, the increase in spending from one-time payments would

occur within three months (Parker et al. 2013). Furthermore, because

research shows that the individual spending response is larger from one-

time payments than from changes in withholding (Sahm, Shapiro, and

Slemrod 2012), the overall stimulus boost would be both larger and more

rapid. e faster timing and higher spend rate favor one-time payments for

macroeconomic stabilization.

11

e speed—supported by empirical research—with which direct payments

increase aggregate demand is particularly important. To meet its primary

objective macroeconomic stabilization needs to occur when resources are

underutilized in the economy. e outright declines in output occur early

FIGURE 4.

Cumulative Spending by Disbursement Form and Spend Rate

Source: Author’s calculations.

Note: Spending is based on a $100 billion stimulus. The MPC, which

determines the spend rate, for lump sum payments is set at 0.7, with

60percent of the spending response in the rst month, 30percent

in the second month, and 10percent in the third month. The MPC for

withholding is alternately assumed to be 0.5 or 0.7.

#4a4a4a

#67c2a5

#d94343

#bd9f45

#5c7aa5

#776493

#f1e764

Website colors

Ocial logo

Dark

Reverse

Chart branding horizontal

Multimedia branding

Equitable

Growth

#f1f0f0 background

#006ba6

#f6511d

#711c77

#178c58

#b400

#CE0A1A

#5bc0be

Chart color palatte

Lump sum,

MPC = 0.7

Withholding,

MPC = 0.7

Withholding,

MPC = 0.5

0

25

50

75

100

3 months 6 months 9 months 12 months

Months since stimulus begins

Billions of dollars

Claudia Sahm

82

in recessions, and stimulus that quickly supports aggregate demand would

be particularly benecial. e direct spending out of stimulus payments

to individuals is followed by indirect (i.e., second-round or multiplier)

eects, in which production responds to the initial boost to spending.

ese multiplier eects are likely larger in a severe recession when more

slack exists in the economy (and even more so when monetary policy is

constrained at the zero lower bound). Stimulus demand, then, is less

likely to crowd out other spending (Auerbach and Gorodnichenko 2012).

is nding argues both for a rapid rst payment and for a commitment

to repeated payments in a severe recession until the lingering economic

weakness has subsided. Finally, as mentioned previously, other forms of

stabilization policy—for example, UI benets or reductions in interest rates

via monetary policy—tend to work with a lag, so stimulus payments oer

one of the most rapid responses in a recession. us, the direct payments to

individuals should be structured to maximize timeliness.

e direct stimulus payments to individuals would be made broadly

available and would not be restricted to those working or with tax

liabilities. e broad nature of the recipient pool aligns with the broad

negative economic eects of recessions. A dening feature of a recession is

the pullback in demand across a wide range of households: recessions lead

high- and low-income households alike to sharply reduce their assessments

of buying conditions (gure 5). Stimulus intended to boost demand in a

recession should therefore encompass a range of households.

12

Generally,

the fastest spending responses to additional income are from low-

liquidity individuals, but targeting liquidity is more dicult in existing

administrative data, and low liquidity also exists among higher-income

households.

However, some criteria are needed for eligibility for stimulus payments.

Individuals with any taxable or nontaxable income (like Social Security or

Veterans Aairs benets) would be eligible, though the stimulus payments

would not be tied directly to tax liability.

13

(Non-lers without any

income would also be eligible, though locating them can be a challenge.)

e presence of dependent children would increase the amount of the

stimulus payment. One important criterion would be that no individual

(or dependent) receives more than one payment in a round of stimulus

payments. Further limitations on eligibility, such as residency requirements

or no unpaid taxes, could be added to the legislation authorizing the

automatic stimulus payments.

Administration and Marketing of Stimulus Payments

e closest existing structure to the proposed stimulus has been the advance

payment of refundable, temporary tax credits. Given its experience with

Direct Stimulus Payments to Individuals

83

past discretionary stimulus payments and access to payment information

of lers, the IRS would be the appropriate agency to review and approve

disbursement of the stimulus payment. Making the payments automatic

and setting the structure in advance would allow for administrative systems

to be designed in advance. is would be especially important if the start

of the recession coincided with the annual processing of tax returns, when

administrative demands on the IRS are high.

An important administrative challenge in delivering broad-based

stimulus is that individuals without taxable income, such as many Social

Security beneciaries, would not normally le tax returns. Despite

multiple outreach eorts, Treasury estimates that only 59 percent of the

20million Social Security and Veterans Aairs benets recipients led a

stimulus-only return in 2008 and received a payment (U.S. Department

of the Treasury [Treasury] 2009). Another 24 percent were claimed as

dependents on other tax lings, but that le 17percent who were eligible

but did not receive the stimulus. Getting information—and instructions

on how to complete the forms—to eligible non-lers was one of the areas

where the IRS viewed its initial guidance as incomplete (Treasury 2008). A

commitment to cover these non-lers in future stimulus payments would

allow time for more coordination with Social Security, Veterans Aairs,

and other agencies delivering other benet payments. Social Security, for

example, has information to deliver payments, but only to those receiving

FIGURE 5.

Index of Consumer Purchasing Sentiment by Household Income

Quartile, 1980–2018

Source: Survey of Consumers, University of Michigan 1980–2018.

Note: Shaded areas denote recessions. Index for each income group

is the percent of consumers responding that they think it is a “good

time to buy major household items” minus the percent reporting it

is a bad time to buy, plus 100. Values above 100 indicate that more

consumers think it is a good time to buy durable goods. Series is a

four-quarter moving average.

#4a4a4a

#67c2a5

#d94343

#bd9f45

#5c7aa5

#776493

#f1e764

Website colors

Ocial logo

Dark

Reverse

Chart branding horizontal

Multimedia branding

Equitable

Growth

#f1f0f0 background

#006ba6

#f6511d

#711c77

#178c58

#b400

#CE0A1A

#5bc0be

Chart color palatte

60

80

100

120

140

160

180

200

1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2009 2012 2015 2018

Index

Bottom

quartile

Top quartile

Upper-middle

quartile

Lower-middle

quartile

Claudia Sahm

84

benets from Social Security. A centralized system for approving stimulus

payment recipients, overseen by the IRS, could use payment information

(mailing addresses or electronic funds transfer) from various agencies. e

coordination would expand the reach of the stimulus payments and still

avoid duplication of payments.

e marketing of the stimulus is another aspect of administering the

payments. e terms in which the stimulus is described are important.

Studies from psychology (Epley, Mak, and Idson 2006) have argued that

describing the additional income as a “tax rebate” yields a smaller spending

response than framing it as a “bonus.” Leigh (2012) found a larger response

to stimulus payments in Australia than in the United States during the

Great Recession and argued that the dierence may have been due to the

Australian government calling their payments “bonuses,” though of course

it is dicult to rule out other dierences between the two countries as the

determining factor.

Sending out information about the stimulus payments to recipients may also

be important. e U.S. Treasury sent letters to individuals about the 2008

stimulus payments prior to disbursement, but there were no information

campaigns to recipients of the subsequent Making Work Pay tax credit and

payroll tax cut. Awareness of the stimulus would highlight the government

support for individuals in the recession, but it is unclear how this aects

the spending response. Notably, none of the empirical studies of the earlier

stimulus payments found evidence of consumer spending responses prior

to the arrival of stimulus payments, either at the passage of the legislation

or at the receipt of informational mailings. Rather, the spending response

occurs at the time the income is received.

Stimulus Payments after the First Year of the Recession

Some recessions are more severe and prolonged than the typical recession,

and in such cases I propose additional rounds of direct payments to

individuals aer the rst year. e goal of these additional payments is

further macroeconomic stabilization and reduction of slack resources in

the economy as quickly as possible. A cumulative increase of 2 percentage

points or more in the unemployment rate in the four quarters aer the

initial trigger would result in a second round of payments. e aggregate

stimulus in the second year would be the same as in the initial year

(0.7 percent of prerecession GDP) and would follow the same payment

structure to individuals. Direct payments would continue each year until

the unemployment rate is no more than 2 percentage points above its initial

trigger level, though the total amount of the payments scales down aer the

unemployment rate has peaked. Specically, if the prerecession, the peak,

Direct Stimulus Payments to Individuals

85

and the current unemployment rates were 5, 10, and 9percent, respectively,

the total stimulus would be set at (9 – 5 – 2) / (10 – 5 – 2) = 2/3 of the rst-

year amount (or 2/3 of 0.7percent of GDP). When the unemployment rate

gap falls to less than 2 percentage points, stimulus is entirely discontinued.

Payments aer the rst year would be triggered in severe recessions: the

1973–75, 1981–82 and 2008–9 recessions are the only three recent examples

that would have met this criterion.

In each recession since the mid-1970s, the unemployment rate eventually

rose at least 2 percentage points during or immediately following the

recession, but with a sucient delay that it would not have qualied for

a second payment round under this proposal. One could argue that a

second payment to individuals would have been useful in these other

recessions. However, other more-targeted policies such as UI or SNAP

payments would better direct resources to those most in need. In addition,

discretionary scal policy could add further support, specic to the shocks

of that particular recession.

Simulation of Proposed Stimulus Payments in the Great Recession

e macroeconomic comparison of automatic stimulus payments to the

discretionary policies deployed in the Great Recession (see gure 6) serves

two purposes. One is to compare a quantitative example of automatic

stimulus payments with discretionary payments that have been used in the

past. e second is to be able to compare with other more-targeted automatic

stabilizers. Two advantages of automatic stimulus payments are the speed

and the scale with which they can deliver stimulus to the economy. Even if

this scal stabilization policy remains largely discretionary, these exercises

will help us understand and critically evaluate the menu of policy options

that are available to ght recessions.

In April 2008 the (three-month average) unemployment rate was 5.0percent,

up 0.50 percentage points from its low in April 2007. Under the proposal,

this rise would have automatically triggered a direct stimulus payment to

individuals. e disbursement of the direct payments would have begun

within a few months aer the trigger was reached. In this case, the rst

stimulus payments would have been disbursed in the second quarter of

2008, somewhat sooner than were the tax rebates in 2008. Total stimulus

payments of $100 billion—equivalent to 0.7 percent of GDP in 2006—

would have been issued. e automatic payments in 2008 would have been

around $500 for singles or $1,000 for couples, with higher payments for

those with dependent children.

e main dierence between the actual stimulus to individuals (from the

2008 tax rebates, Making Work Pay tax credit, and payroll tax reduction)

Claudia Sahm

86

and the proposed direct payments would have arisen aer the rst year.

In April 2009, the unemployment rate (on three-month average basis) was

8.5 percent—a 12 month increase of 3.5 percentage points from its level

at the time of the rst trigger—and was still rising. is rapid, rst-year

increase (above the 2-percentage-point threshold) in the unemployment

rate would signal a severe recession and would have triggered an additional

round of direct stimulus payments to individuals. e second round of

direct payments to individuals in 2009 would have again been $100billion,

larger and more quickly distributed than the $50 billion in additional

income from the Making Work Pay tax credit. Subsequent annual payments

would continue at that level until the unemployment rate had peaked and

was no longer rising relative to its level at the prior year’s payment. At that

point, the annual payments would scale down as the unemployment rate

declines and end when the unemployment rate is within 2 percentage points

of its initial trigger. e total amounts of the direct payments in gure 6 are

only a rough approximation to show the trajectory and timing, and do not

take into account how the direct payments might aect the unemployment

rate. e purpose of the larger, more-rapid stimulus payments is to make

the recession shallower and the recovery faster. In fact, under the proposal

(and the assumptions above about MPCs) the boost to spending in 2008

and 2009 together would have been about one and a half times larger than

under actual policy.

Repeated, large direct payments to individuals oers three main benets

relative to the discretionary policy mix of broad-based stimulus to

FIGURE 6.

Automatic Proposal Versus Discretionary Stimulus Income in the

Great Recession, 2008–13

Source: BLS 2008–13; BEA 2009; BEA 2015; author’s calculations.

#4a4a4a

#67c2a5

#d94343

#bd9f45

#5c7aa5

#776493

#f1e764

Website colors

Ocial logo

Dark

Reverse

Chart branding horizontal

Multimedia branding

Equitable

Growth

#f1f0f0 background

#006ba6

#f6511d

#711c77

#178c58

#b400

#CE0A1A

#5bc0be

Chart color palatte

policy (left)

5

6

7

8

9

10

11

0

20

40

60

80

100

120

2008:Q1 2009:Q1 2010:Q1 2011:Q1 2012:Q1 2013:Q1

Proposal (left)

Actual policy

(left)

Unemployment rate

(right)

Billions of dollars

Percent

Direct Stimulus Payments to Individuals

87

individuals that was used in the Great Recession. First, the proposed stimulus

payments are more concentrated in the initial years of the recession when

the unemployment rate and slack in the economy was highest. Second, the

proposal commits to maintaining stimulus while the unemployment rate

remains elevated. In contrast, during the Great Recession the payroll tax

cut expired when the unemployment rate was nearly 8percent. ird, the

relevant research indicates that the proposal’s lump-sum annual payments

are expected to have an MPC of 0.7 within a quarter or two of receipt, one

third higher than the MPC of 0.5 on the smoothed stimulus (distributed

via lower withholding) that was used during the Great Recession. Taken

together, this proposal for direct payments to individuals is designed to

deliver timely, substantial, and ongoing support to the economy in the

event of a severe recession.

Ongoing Research Evaluation

To further study the macroeconomic eects of scal stimulus, the proposal

establishes a process for rigorous evaluation of the eects on spending.

Fortuitously, administrative constraints on the number of paper checks that

the federal government could send out in week led to a natural experiment

during the past two recessions. e timing of stimulus payments in 2001

and 2008 were randomized by Social Security numbers. In conjunction

with the addition of information to ocial consumer surveys, this allowed

researchers to credibly demonstrate the ecacy of stimulus payments.

With the rise in electronic funds transfers, the constraint on the volume

of payments that can be processed at once has been relaxed. Even so, for

evaluation purposes it would be benecial to maintain some randomization

in the timing of payments. Social Security numbers remain an option,

though this information is not regularly collected in ocial household

surveys, and the data on spending would be available only with a substantial

delay. Account level data, such as from nancial apps or bank account data

sources, might be another option for tracking incoming payments and the

spending response, but a nontrivial portion of the population does not

have such accounts. Another option for randomization in disbursement

would be physical location, such as timing based on the nal digit of a zip

code. Geographic variation in the stimulus payments would widen the

set of evaluation data sources and could be used to explore dierences in

underlying macroeconomic conditions that aect the spending responses

to the stimulus. e main policy goal is to deliver stimulus quickly to

households, but given the large commitment of resources some design

features should be studied to inform the design of future policies.

Claudia Sahm

88

Questions and Concerns

1. Are there other macroeconomic indicators that could be used as triggers for the

stimulus payments?

e unemployment rate has the benets of being simple to explain and

widely followed. Indicators from the nancial market, such as the yield

curve or near-term forward spread (Engstrom and Sharpe 2018), are also

potential predictors of recessions. However, nancial market indicators

tend to produce more false positives (in part due to monetary policy

responses).

2. How would the Congressional Budget Oce score an automatic stimulus

payment?

If the proposal was enacted during an expansion, precommitting to

stimulus payments in the event of a recession would necessitate the use of

probabilistic scoring by the Congressional Budget Oce (CBO), according

to which the CBO would project the expected value of the payments over

a ten-year window. In contrast, a two-stage implementation in which the

payments must be authorized by Congress would be scored according to

the full cost of the payments, given that the recession would already have

started. Consequently, the estimated cost would likely be lower outside a

recession, but at the time the pressing need for the outlay would be lower,

too.

3. Would the payments have to be annual or could multiple payments occur

during the year?

e baseline proposal is for annual payments, but once the infrastructure of

distributing payments is in place, it could be used at any time. Accelerating

the schedule of payments based on changes in economic conditions via

additional legislation would be another way to reintroduce legislative

control. For example, the case could have been made for a second stimulus

payment at the end of 2008 aer the severe disruption in nancial markets.

4. Would a smaller, more geographically targeted stimulus be preferable?

One option to limit the overall costs and to still support demand would be

to target payments aer the rst year to parts of the country in which the

unemployment rate has risen most. For example, the 2-percentage-point

threshold applied nationally in the baseline proposal for a second round

could instead be applied at the state level. is would allow the stimulus to

take into account both national and local economic conditions. However,

this geographic targeting would move away from the principle of broad-

based income and consumption support. Other policies, such as federal

grants to states and localities, would likely be a more eective way to

Direct Stimulus Payments to Individuals

89

geographically target stimulus. e baseline automatic stimulus payments

could provide broad national support and then be combined with the other

discretionary, geographically targeted policies.

Conclusion

Direct stimulus payments would quickly deliver extra income to millions

of households at the start of a recession and maintain income support until

the recession has subsided. High-quality research on similar payments

in the past shows that this form of stimulus directly boosts spending and

helps stabilize demand. Making the payments automatic and tying them to

changes in the national unemployment rate would guarantee a timely and

transparent source of demand in recessions. e individual payments in

the proposal are designed—based on available research—to maximize the

spending out of the stimulus and thereby increase the ecacy of the scal

stimulus. As part of a broad portfolio of automatic stabilization policies,

the proposal can help mitigate the worst costs of economic downturns.

Acknowledgments

e views expressed here are those of the author and not necessarily those

of other members of the Federal Reserve System. I am grateful for many

insightful comments and encouragement from the project editors, Heather

Boushey, Ryan Nunn, and Jay Shambaugh, as well as from participants in a

Hamilton Project author’s conference. Jana Parsons and Jimmy O’Donnell

provided excellent research assistance. is work draws on several years of

research collaboration with Matthew Shapiro and Joel Slemrod.

Endnotes

1. ese survey responses on stimulus do not map directly to a fraction of the payment spent, but

Parker and Souleles (forthcoming) nd a strong, positive correlation between spending behavior

and self-assessments in the Consumer Expenditure Survey.

2. With another survey, Graziani, van der Klaauw, and Zafar (2016) found that the self-reported

fraction spent out of the payroll tax cut rose from 14percent in early 2011 to 36percent at the end

of 2011. e spending out of this gradual stimulus may slowly rise over time, but the boost is still

less immediate than the boost from one-time payments.

3. e evidence (and interpretation) of the role of liquidity in spending responses varies to some

extent across empirical studies. For example, Parker (2017) nds that low liquidity in years prior

to receiving the tax rebate predicts a spending response nearly as well as low liquidity at the time

of receipt. is nding could suggest dierences in preferences and relates to earlier work such as

the Campbell-Mankiw spender-saver model and research from Carroll et al. (2017) on patience

that appeals to individual-specic preferences for spending. In addition, Kueng (2018) nds a large

spending response to payments among high-income households with ample liquid assets.

4. Compared to past business cycles and including estimates of discretionary scal policy and

automatic stabilizers, Cashin et al. (2018) nd that the scal support during the Great Recession

Claudia Sahm

90

was substantial but the support in the recovery was less than in earlier recessions.

5. As one example of the diculty in communicating the benets of monetary policy: Savers who

hold interest-bearing assets will initially receive less interest income due to expansionary monetary

policy; however, these policies to boost aggregate demand and stabilize the economy will lead to

higher interest rates in the future. On net, savers benet from monetary policy, but this is not as

transparent as receiving a direct payment.

6. e unemployment rate consistent with minimal labor market slack—sometimes called the natural

rate of unemployment—may change as demographics, labor market frictions, and other variables

evolve over time (see, e.g., estimates from the Congressional Budget Oce [CBO 2019] that range

from a high of 6.2percent in 1978 in to a low of 4.6percent in 2019).

7. Earlier in the postwar period (not shown in gure 2) the only false positive by this rule was in 1959,

and it was followed six months later by a recession.

8. roughout, I use the data on the unemployment rate available to policymakers at a given moment

in time. In general, the real-time data trigger a few months later than would the fully revised data.

9. Measured growth in GDP (or PCE) reects the eect of past scal and monetary stimulus. e

typical shortfall in aggregate demand in a recession—in the absence of stimulus—would be larger.

An estimate of that counterfactual time series could be a better way to calibrate the size of the total

stimulus. e estimates of scal policy eects in Cashin et al. (2018) could be used to calibrate the

underlying GDP changes.

10. As one recent example of the individual eects, Davis and von Wachter (2011) estimate that

workers who are laid o when the unemployment rate is above 8percent lose 2.8 years of potential

earnings, twice the loss when the unemployment rate is below 6 percent. For the economy as a

whole, Reifschneider, Wascher, and Wilcox (2013) argue that weak demand in severe recessions

like the Great Recession can lead to slower growth in the economy’s overall productive capacity (or

aggregate supply). Large, long-lasting costs from recessions are why it is important to stabilize the

economy as quickly as possible.

11. Other policy goals, such as increasing take-home pay or making taxes more progressive, could favor

withholding changes over one-time payments. e argument here for one-time payments is based

on trying to bring additional support to the economy during a recession and time of weak aggregate

demand. One-time payments could also be combined with broader changes in the tax code.

12. Other automatic stabilizers such as UI or SNAP are targeted to those who are most severely aected

by the recession. is proposal has a broader aim. Moreover, decoupling the stimulus payments

from an individual’s tax liability simplies the structure of the payments and allows for anchoring

on the overall stimulus level desired.

13. While retirees are not exposed to the risk of losing their jobs or reduced wage growth, those living

on xed incomes are oen aected by the low interest rates in recessions.

References

Agarwal, Sumit, Chunlin Liu, and Nicholas Souleles. 2007. “e Reaction of Consumer Spending

and Debt to Tax Rebates—Evidence from Consumer Credit Data.” Journal of Political Economy

115 (6): 986–1019.

Aladangady, Aditya, Shifrah Aron-Dine, David Cashin, Wendy Dunn, Laura Feiveson, Paul

Lengermann, Katherine Richard, and Claudia Sahm. 2018. “High-frequency Spending

Responses to the Earned Income Tax Credit.” FEDS Notes. Board of Governors of the Federal

Reserve, Washington, DC.

American Recovery and Reinvestment Act of 2009 (ARRA) Pub. L. 111–5 (2009).

Auerbach, Alan J., and Yuriy Gorodnichenko. 2012. “Measuring the Output Responses to Fiscal

Policy.” American Economic Journal: Economic Policy 4 (2): 1–27.

Board of Governors of the Federal Reserve. 2018. Report on the Economic Well-Being of U.S.

Households in 2017. Washington, DC.

Direct Stimulus Payments to Individuals

91

Broda, Christian, and Jonathan A. Parker. 2014. “e Economic Stimulus Payments of 2008 and the

Aggregate Demand for Consumption.” Journal of Monetary Economics 68: 20–36.

Bureau of Economic Analysis. 1969–2018. “Table 1.1.6. Real Gross Domestic Product, Chained

Dollars: Personal Consumption Expenditures.” Last revised on December 21, 2018. U.S.

Department of Commerce, Suitland, MD.

———. 2009. “Government Receipts and Expenditures: ird Quarter of 2009.” Survey of Current

Business 89 (12): 11–14.

———. 2015. “Federal Recovery Programs and BEA Statistics: Tax Provisions.” Last updated August

27, 2015. U.S. Department of Commerce, Suitland, MD.

Bureau of Labor Statistics. 1969–2019. “Civilian Unemployment Rate.” Bureau of Labor Statistics,

Washington DC. Retrieved from ALFRED, Federal Reserve Bank of St. Louis, St. Louis, MO.

Carroll, Christopher, Jiri Slacalek, Kiichi Tokuoka, and Matthew N. White. 2017. “e Distribution

of Wealth and the Marginal Propensity to Consume.” Quantitative Economics 8: 977–1020.

Cashin, David, Jamie Lenney, Byron Lutz, and William Peterman. 2018. “Fiscal Policy and

Aggregate Demand in the USA Before, During, and Following the Great Recession.”

International Tax and Public Finance 25 (6): 1519–58.

Congressional Budget Oce (CBO). 2019. “An Update to the Budget and Economic Outlook: 2019 to

2029.” Congressional Budget Oce, Washington, DC.

Davis, Steven J. and Till von Wachter. 2011. “Recessions and the Costs of Job Loss.” Brookings Papers

on Economic Activity, 2011 (2): 1–72.

Economic Stimulus Act, Pub.L. 110–185, 122 Stat. 613 (2008).

Engstrom, Eric, and Steve Sharpe. 2018. “e Near-Term Forward Yield Spread as a Leading

Indicator: A Less Distorted Mirror.” Finance and Economics Discussion Series No. 2018-055,

Federal Reserve Board, Washington, D.C.

Epley, Nicholas, Dennis Mak, and Lorraine Chen Idson. 2006. “Bonus of Rebate?: e Impact of

Income Framing on Spending and Saving.” Journal of Behavioral Decision Making 19 (3):

213–27.

Graziani, Grant, Wilbert van der Klaauw, and Basit Zafar. 2016. “Workers’ Spending Response to the

2011 Payroll Tax Cuts.” American Economic Journal: Economic Policy 8 (4): 124–59.

Johnson, David, Jonathan A. Parker, and Nicholas S. Souleles. 2006. “Household Expenditure and

the Income Tax Rebates of 2001.” American Economic Review 95 (5): 1589–610.

Joint Committee on Taxation. 2008. “Overview of Past Tax Legislation Providing Fiscal Stimulus

and Issues in Designing and Delivering a Cash Rebate to Individuals.” U.S. Congress Joint

Committee on Taxation, Washington, DC.

Kaplan, Greg, and Giovanni L. Violante. 2014. “A Model of the Consumption Response to Fiscal

Stimulus Payments.” Econometrica 82 (4): 1199–239.

Kueng, Lorenz. 2018. “Excess Sensitivity of High-Income Consumers.” e Quarterly Journal of

Economics 133 (4): 1693–1751.

Leigh, Andrew. 2012. “How Much Did the 2009 Australian Fiscal Stimulus Boost Demand? Evidence

from Household-Reported Spending Eects.” e B.E. Journal of Macroeconomics. 12 (1):

1935–1960.

Middle Class Tax Relief and Job Creation Act of 2012 Pub.L. 112–96, H.R. 3630, 126 Stat. 156 (2012).

Misra, Kanishka, and Paolo Surico. 2014. “Consumption, Income Changes, and Heterogeneity:

Evidence from Two Fiscal Stimulus Programs.” American Economic Journal: Macroeconomics

6 (4): 84–106.

Parker, Jonathan A. 2017. “Why Don’t Households Smooth Consumption? Evidence from a $25

Million Experiment.” American Economic Journal: Macroeconomics 9 (4): 153–83.

Parker, Jonathan A., and Nicholas S. Souleles. Forthcoming. “Reported Eects vs. Revealed

Preference Estimates: Evidence from the Propensity to Spend Tax Rebates.” American

Economic Review: Insights.

Parker, Jonathan A., Nicholas S. Souleles, David S. Johnson, and Robert McClelland. 2013.

“Consumer Spending and the Economic Stimulus Payments of 2008.” American Economic

Review 103 (6): 2530–53.

Claudia Sahm

92

Reifschneider, David, William L. Wascher, and David W. Wilcox. 2013. “Aggregate Supply in the

United States: Recent Developments and Implications for the Conduct of Monetary Policy.”

Federal Reserve Board Finance and Economics Discussion Series No. 2013-77.

Sahm, Claudia R., Matthew D. Shapiro, and Joel Slemrod. 2012. “Check in the Mail Or More in the

Paycheck: Does the Eectiveness of Fiscal Stimulus Depend on how it is Delivered?” American

Economic Journal: Economic Policy 4 (3): 216–50.

———. 2015. “Balance-Sheet Households and Fiscal Stimulus: Lessons from the Payroll Tax Cut and

Its Expiration.” Finance and Economics Discussion Series No. 2015-037.

Shapiro, Matthew D. and Joel Slemrod. 2003a. “Consumer Response to Tax Rebates.” American

Economic Review 93(1): 381–96.

———. 2003b. “Did the 2001 Tax Rebate Stimulate Spending? Evidence from Taxpayer Surveys.”In

Tax Policy and the Economy, vol. 17, edited by James Poterba 83–109.Cambridge, MA:MIT

Press.

———. 2009. “Did the 2008 Tax Rebates Stimulate Spending?” American Economic Review Papers

and Proceedings 99: 374–9.

Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010, Pub.L. 111-312

(2010).

Temporary Payroll Tax Cut Continuation Act, H.R. 3765 (2011).

University of Michigan. 1980–2018. “Survey of Consumers.” University of Michigan, Ann Arbor,

MI.

U.S. Department of the Treasury (Treasury). 2008. “Evaluation of Planning Eorts for the Issuance

of Economic Stimulus Payments” Treasury Inspector General for Administration, U.S.

Department of the Treasury, Washington, DC.

———. 2009. “Evaluation of Eorts to Ensure Eligible Individuals Received eir Economic

Stimulus Payment” Treasury Inspector General for Administration, U.S. Department of the

Treasury, Washington, DC.