Dear Community Bank and Trust of Florida Customer:

We are pleased to announce that the shareholders of Florida Community Bankshares, Inc., the Bank Holding

Company for Community Bank and Trust of Florida, have voted to merge with MIDFLORIDA Credit Union.

There are many reasons the shareholders felt that choosing MIDFLORIDA was in the best interest of their

customers; here are a few:

MIDFLORIDA Credit Union’s mission is to improve the financial well-being of its customers. The credit

union offers a full suite of retail and commercial products and services; unparalleled convenience with

its 7 am to 7 pm drive-thru hours and full-service Saturday hours; and an array of financial education

resources.

MIDFLORIDA Credit Union has served Central Florida since 1954 and offers membership to anyone who

lives, works, worships or attends school within 38 Florida counties. (A list of counties is available on the

branch listings page enclosed or at midflorida.com.) Currently, the credit union serves more than

320,000 customers through a branch network of 49 locations and more than 60 proprietary ATMs.

Throughout its 65 year history, the credit union has enjoyed solid financial performance and steady

growth, and has enjoyed a consistent five-star rating from Bauer Financial® year over year. At $3.5

billion in assets, the credit union is strong, secure and well capitalized.

MIDFLORIDA is committed to the areas it serves and shows that commitment through partnerships

with various public school districts, colleges and other organizations.

Pending regulatory approval by the Federal Deposit Insurance Corporation (FDIC), the National Credit Union

Administration (NCUA), and the Florida Office of Financial Regulation, an account conversion date has been set

for Saturday, April 4, 2020.

What to expect:

MIDFLORIDA Credit Union and Community Bank and Trust of Florida will be working to make this transition as

seamless as possible. These elements will take effect at closing which is expected to be November 8, 2019:

All employees of Community Bank and Trust of Florida will become employees of MIDFLORIDA Credit

Union.

All deposit and loan products will be combined into MIDFLORIDA’s records for accounting purposes.

However, there will be no change to account naming, structure or fees until conversion when all accounts

are fully integrated.

Deposit accounts will now be insured by NCUA up to $250,000 per account category. The NCUA is a

federal agency created by the United States Congress which administers the National Credit Union Share

Insurance Fund (NCUSIF) and offers similar deposit insurance to that of the FDIC. (See the NCUA and FDIC

Insurance comparison chart in this document.)

The insured status of Community Bank & Trust of Florida, under the provisions of the Federal Deposit

Insurance Act, will terminate as of the close of business on December 31, 2019 (“termination date”).

Insured deposits in Community Bank & Trust of Florida on the termination date, less all withdrawals

from such deposits made subsequent to that date, will continue to be insured by the Federal Deposit

Insurance Corporation, to the extent provided by law, until December 31, 2019. The Federal Deposit

Insurance Corporation will not insure any new deposits or additions to existing deposits made by you

after the termination date. This Notice is being provided pursuant to 12 CFR 307.3.

Please contact David Denyer with Community Bank & Trust of Florida, 1603 SW 19

th

Avenue, Ocala, FL

34471, if additional information is needed regarding this Notice or the insured status of your account(s).

Signage on all branches of Community Bank and Trust of Florida will transition to MIDFLORIDA Credit

Union. However, Community Bank and Trust of Florida customers will need to rely upon these locations

only for service until all accounts are integrated at account conversion. Following conversion in April

2020, Community Bank and Trust of Florida customers will have access to all MIDFLORIDA branches and

can access additional credit union locations through the shared branching network as well.

All direct deposits (social security, payroll, etc.), automatic withdrawals or transfers, and any

transactions (debit card transactions or checks) will continue to process and post to your account.

Your existing Community Bank and Trust of Florida debit card and checks will continue to function

normally and will not need to be replaced.

Community Bank and Trust of Florida customers can become a shareholder in MIDFLORIDA Credit

Union and MIDFLORIDA will pay your $5 share. MIDFLORIDA is a mutually-owned cooperative that

requires each customer to have a $5 share to access the many products, services and benefits

MIDFLORIDA offers. However, if you do not elect to accept this free offer, it will not impact your ability

to access or use your existing accounts (deposit accounts, non-deposit accounts or loans) once

transferred from Community Bank and Trust of Florida. To get your free share and full access to all that

MIDFLORIDA has to offer, complete the form enclosed or visit midflorida.com/CBT to complete an

online document. Business accounts and accounts without a Tax Identification Number on file cannot

opt in online.

Customers can call toll free (877) 727-1ASK with any merger-related question. Hours of operation will

be Monday – Saturday, 7 am to 8 pm. (Note: there may be extended hours over conversion weekend.

Details will be included on future correspondence.)

On or around March 11, 2020:

You will receive important information about the weekend of conversion and the transition of

products and services as well as an outline of your account with MIDFLORIDA (which will be built to

match the features you currently enjoy), account terms and conditions brochure and a fee schedule.

Community Bank and Trust of Florida credit cardholders will be sent new MIDFLORIDA credit cards.

Conversion weekend (Friday, April 3, through Sunday, April 5, 2020):

With a few exceptions, Community Bank and Trust of Florida account numbers will not change. (If

your account is an exception and your number must be altered, you will be contacted separately.)

On Friday, April 3, 2020, Community Bank and Trust of Florida’s online banking (including mobile

banking) will be unavailable and will no longer be accessible at the cbtfl.com web address after this

date. (Online banking services will be restored later in the weekend and Community Bank and Trust of

Florida customers will be redirected to midflorida.com for services.) However, any payments or

transfers set up prior to conversion will continue to clear.

On Sunday, April 5, 2020, access to some MIDFLORIDA services (such as online banking and phone

banking) will become available. Directions regarding access and initial login will be sent in future

correspondence. If possible, this communication will also outline any specific times when we anticipate

the services to be available. Customers can also look for updates on MIDFLORIDA’s website

(midflorida.com) and social media sites.

You will be able to use any branch (Monday) or ATM within MIDFLORIDA’s network as well as any

credit union participating in the Co-Op Shared Branch network. (The Co-Op Shared Branch network

allows MIDFLORIDA customers to access their account and conduct transactions at more than 5,000

credit union locations nationwide.)

A final Community Bank and Trust of Florida account statement (account history since your last

statement and through April 3, 2020) will be generated and mailed via regular U.S. Mail.

Following conversion, you will receive your first MIDFLORIDA account statement in April following the

same statement delivery time and method that you enjoyed with Community Bank and Trust of

Florida. Note: Your first statement will serve as reference to verify balances, etc. by matching it to your

Community Bank and Trust of Florida statement.

If you have questions about the merger or anticipated conversion, please feel free to contact either financial

institution:

MIDFLORIDA Community Bank and Trust of Florida

Merger Hotline Toll free (888) 388-1007

Toll free (877) 727-1ASK Monday – Friday

Monday – Saturday 9 am to 5 pm

7 am to 8 pm

We are excited about this transition and look forward to serving you!

Sincerely,

D. Kevin Jones Hugh F. Dailey

CEO President & CEO

MIDFLORIDA Credit Union Community Bank and Trust of Florida

Questions & Answers

Merger of Community Bank and Trust of Florida with MIDFLORIDA Credit Union

When will the conversion take place?

The account conversion will take place on Saturday, April 4, 2020. While access to some services may truncate at

different intervals leading up to and through the weekend of conversion, there should be no impact to the

customer’s ability to use their account up to and through conversion.

Will my account number change with the conversion?

With a few exceptions, the account numbers for Community Bank and Trust of Florida will not change. Any

customer affected by having to change their account number will be contacted directly.

Will the product account names change?

While product account names may differ slightly, a detailed outline of each account and how it will be labeled

will be provided to you approximately three weeks prior to conversion.

Will I need to update my ACH (Automated Clearing House) transactions (social security, payroll, etc.)?

ACH transactions (credits and debits) will continue to post without interruption and without any need for an

update on your part. However, if you prefer, you can contact any business with whom you execute ACH

payments or deposits to provide MIDFLORIDA’s routing and transit number (263179804) along with your

account information.

Will fees change?

You will receive a copy of MIDFLORIDA’s fee schedule in future correspondence. While you may notice different

terminology and the interval at which fees may be charged, it is MIDFLORIDA’s goal to keep fee amounts the

same or less than what was historically charged.

Will new debit cards be issued as part of the conversion?

Existing Community Bank and Trust of Florida debit cards, as well as existing personal identification numbers

(PIN) will continue to work throughout the conversion process. The only reason a new debit card may be

reissued is if the card is lost or stolen or the card is reaching its expiration date.

Will new credit cards be issued as part of the conversion?

Existing Community Bank and Trust of Florida credit cardholders will have new MIDFLORIDA credit cards issued

as well as be provided cardholder account disclosures.

What is MIDFLORIDA’s routing and transit number?

MIDFLORIDA’s routing and transit number is 263179804.

Will my Community Bank and Trust of Florida checks still work, or do I need to order new ones?

All Community Bank and Trust of Florida checks will still be accepted and processed as normal. Closer to the

conversion date, customers will have the option to order a box of MIDFLORIDA checks by contacting

MIDFLORIDA’s check processor directly or stopping by a branch. More details will be included in future

correspondence.

Will my consumer loan(s) remain the same following conversion?

Your existing consumer loans will transfer to MIDFLORIDA and will retain the same terms. All loan payments will

continue to post through conversion regardless of whether the payment is made electronically or mailed.

Will my mortgage remain the same?

Any mortgage loan currently being serviced by Community Bank & Trust of Florida will move to MIDFLORIDA

and retain the same contractual terms.

When will I receive my mortgage statement?

MIDFLORIDA Mortgage Center sends monthly mortgage statements to all mortgage holders. Statements are

processed and delivered by mail or electronically mid-month, each month.

When will I receive my account statement from MIDFLORIDA?

A final Community Bank and Trust of Florida account statement (account history since your last statement and

through April 3, 2020) will be generated and delivered using your chosen delivery method.

Following conversion, you will receive your first MIDFLORIDA account statement in April following the same

statement delivery time and method that you enjoyed with Community Bank and Trust of Florida. Note: Your

first statement will serve as reference to verify balances, etc. by matching it to your Community Bank and Trust

of Florida statement. Going forward, customers with a savings account only will receive quarterly statements in

January, April, July and October while customers with checking or lending accounts will receive statements on a

monthly basis.

Will my certificate rates change?

All certificate products will retain their rate structure and term when converted to MIDFLORIDA.

Will my beneficiaries transfer with my account(s)?

Any previously designated beneficiaries will follow the account when integrated with MIDFLORIDA’s system.

When will I be able to use a MIDFLORIDA ATM?

After the closing on November 8, 2019, Community Bank and Trust of Florida debit cards will be accepted at any

MIDFLORIDA proprietary ATM (including the existing Community Bank and Trust of Florida locations) or at any

Publix Presto! ATM for withdrawals and transfers and will not incur a transaction fee (no surcharge fee).

However, deposits can only be accepted at Community Bank and Trust of Florida ATMs until after conversion. (A

list of branches and ATMs is included with this letter or you can visit midflorida.com for more details.)

Does MIDFLORIDA offer banking by phone and when will it be available to me?

MIDFLORIDA offers Direct Touch, a phone banking system that allows access to account balances, history, and

more. This service is accessible when calling MIDFLORIDA’s toll-free number (866) 913-3733. More information

outlining your first time access to Direct Touch will be provided in future correspondence. MIDFLORIDA

anticipates this service being available to Community Bank and Trust of Florida customers sometime on Sunday,

April 5.

When will online/mobile access be available through MIDFLORIDA?

Online services will be available sometime on Sunday, April 5. A detailed communication about initial access will

be sent in future correspondence.

Community Bank and Trust of Florida’s online banking and bill pay (including mobile banking) will be inaccessible

beginning Friday, April 3. You will no longer have access to log in, check balances, conduct transactions or review

information from the Community Bank and Trust of Florida site as of this date. Customers will receive more

specific details prior to conversion.

Does MIDFLORIDA support Mobile Wallet transactions?

MIDFLORIDA supports Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

How can I connect and learn more about MIDFLORIDA?

To learn more about MIDFLORIDA, stop by any branch (either MIDFLORIDA or Community Bank and Trust of

Florida), visit midflorida.com or call the Help Desk toll free at (866) 913-3733. Also follow us on Facebook,

Instagram, Twitter and SnapChat.

What are MIDFLORIDA’s hours?

Branch Lobby Hours

Monday, Tuesday & Thursday 9 am to 5 pm

Wednesday 10:30 am to 5 pm*

Friday 9 am to 6 pm

Saturday 9 am to 1 pm

Branch Drive-Thru Hours

Monday – Friday 7 am to 7 pm

Saturday 8:30 am to 1:00 pm

Help Desk Call Center Hours

Monday – Saturday 7 am to 8 pm

*Lobbies open later on Wednesday to allow for staff training.

Note: Branches located within an employer group (like a hospital or manufacturing plant) may have

different hours and services. For a complete listing, visit midflorida.com.

Who can join MIDFLORIDA?

MIDFLORIDA is a mutually-owned cooperative that requires each customer to have a $5 share to access the

many products, services and benefits MIDFLORIDA offers. Membership is open to anyone who lives, works,

worships or attends school within the following 38 Florida counties:

Alachua

Gilchrest

Levy

Polk

Bradford

Glades

Manatee

Putnam

Brevard

Hardee

Marion

Sarasota

Broward

Hendry

Martin

Seminole

Charlotte

Hernando

Okeechobee

St. Lucie

Citrus

Highlands

Orange

Sumter

Collier

Hillsborough

Osceola

Union

Columbia

Indian River

Palm Beach

Volusia

DeSoto

Lake

Pasco

Flagler

Lee

Pinellas

MIDFLORIDA Branch Locations as of August 2019

(All branches have ATMs)

Branch Name

Address

City

State

Zip

Longwood

1199 Spring Center South Blvd.

Altamonte Springs

FL

32714

Arcadia

128 S. Brevard Ave.

Arcadia

FL

34266

Auburndale

2146 US Highway 92 W.

Auburndale

FL

33823

Avon Park

930 US Highway 27

Avon Park

FL

33825

Bartow

105 E Van Fleet Dr.

Bartow

FL

33830

Bay Pines

10000 Bay Pines Blvd.

Bay Pines

FL

33744

Central Brandon

825 W Brandon Blvd.

Brandon

FL

33511

Gulf To Bay

2400 Gulf To Bay Blvd.

Clearwater

FL

33765

Countryside

29383 US Highway 19 N.

Clearwater

FL

33761

Haines City

1006 Old Polk City Rd.

Haines City

FL

33844

Kissimmee

1001 Buenaventura Blvd.

Kissimmee

FL

34743

Lake Placid

6 North Main Avenue

Lake Placid

FL

33852

Lake Wales

237 S.R. 60 W.

Lake Wales

FL

33853

South Lakeland

6040 S. Florida Ave.

Lakeland

FL

33813

Mall

1090 Wedgewood Estates Blvd.

Lakeland

FL

33809

North Lakeland

7301 US Highway 98 N.

Lakeland

FL

33809

Hollingsworth

3008 S. Florida Ave.

Lakeland

FL

33803

Tower

129 S Kentucky Ave.

Lakeland

FL

33801

Tower Annex

205 South Florida Ave.

Lakeland

FL

33801

Highland City

5301 US Highway 98 S.

Lakeland

FL

33812

Crystal Lake

1817 Crystal Lake Dr.

Lakeland

FL

33801

Harden Blvd

2100 Harden Blvd.

Lakeland

FL

33803

Largo

13075 Walsingham Rd.

Largo

FL

33774

Land O’ Lakes

23551 SR 54

Lutz

FL

33559

Lutz

19203 N. Dale Mabry Hwy.

Lutz

FL

33548

Maitland

450 S. Orlando Ave.

Maitland

FL

32751

Trinity

7401 S.R. 54

New Port Richey

FL

34653

Okeechobee

3261 Hwy 441 S.

Okeechobee

FL

34974

Waterford Lakes

11411 Lake Underhill Rd.

Orlando

FL

32825

Eastside*

100 Global Innovation Circle

Orlando

FL

32825

Sand Lake*

5600 Sand Lake Rd.

Orlando

FL

32819

Pinellas Park

4300 Park Blvd.

Pinellas Park

FL

33781

Plant City

2903 James L Redman Pkwy.

Plant City

FL

33566

St. Lucie West

771 NW St Lucie West Blvd.

Port St Lucie

FL

34986

Gatlin

1692 S.W. Gatlin Blvd.

Port St Lucie

FL

34953

Port St. Lucie

8351 South US Highway 1

Port St Lucie

FL

34952

4th Street St Pete

2646 4th Street N.

St. Petersburg

FL

33704

North Sebring

6105 US Hwy. 27 N.

Sebring

FL

33870

MIDFLORIDA Branch Locations (cont.)

South Sebring

3863 US Hwy. 27 S.

Sebring

FL

33870

Spring Hill

11098 Spring Hill Dr.

Spring Hill

FL

34608

Central Tampa

3202 W. Waters Ave.

Tampa

FL

33614

Haley VA Hospital

13000 Bruce B. Downs Blvd.

Tampa

FL

33612

New Tampa

20401 Bruce B. Downs Blvd.

Tampa

FL

33647

South Tampa

1112 S. Dale Mabry Hwy.

Tampa

FL

33629

Central Vero

2800 20th St.

Vero Beach

FL

32960

Wauchula

1490 US Hwy 17 N.

Wauchula

FL

33873

No. Winter Haven

2075 8th Street NW

Winter Haven

FL

33881

Spirit Lake

3025 SR 540 W.

Winter Haven

FL

33880

So. Winter Haven

5540 Cypress Gardens Blvd.

Winter Haven

FL

33884

*Locations available to Lockheed Martin Employees Only.

MIDFLORIDA Offsite ATM Locations as of August 2019

ATM Location Name

Address

City

State

ZIP

Bartow Ford

2800 US Hwy 98 N.

Bartow

FL

33830

Bartow - Polk County Courthouse

220 West Church St.

StSt.Street

Bartow

FL

33830

Davenport - Four Corners

300 Ambersweet Way

Davenport

FL

33897

Lakeland - Courthouse

930 E. Parker St.

Lakeland

FL

33801

Lakeland - Cypress Lakes

10000 US Hwy 98

Lakeland

FL

33809

Florida Polytechnic University

4700 Research Way

Lakeland

FL

33805

Florida Southern College

111 Lake Hollingsworth Dr.

Lakeland

FL

33801

Lakeland - Gary Road

1551 Gary Rd.

Lakeland

FL

33801

Lakeland Regional Medical Center

1324 Lakeland Hills Blvd. Dr.

Lakeland

FL

33805

Highlands Regional Medical Center

3600 S Highlands Ave

Sebring

FL

33870

St. Petersburg - Bay Pines Plaza

9603 Bay Pines Blvd.

St. Petersburg

FL

33708

St. Petersburg - VA Regional Office

9500 Bay Pines Blvd.

St. Petersburg

FL

33744

Winter Haven Courthouse

3425 Lake Alfred Rd.

Winter Haven

FL

33881

Winter Haven Hospital

200 Avenue F NE

Winter Haven

FL

33881

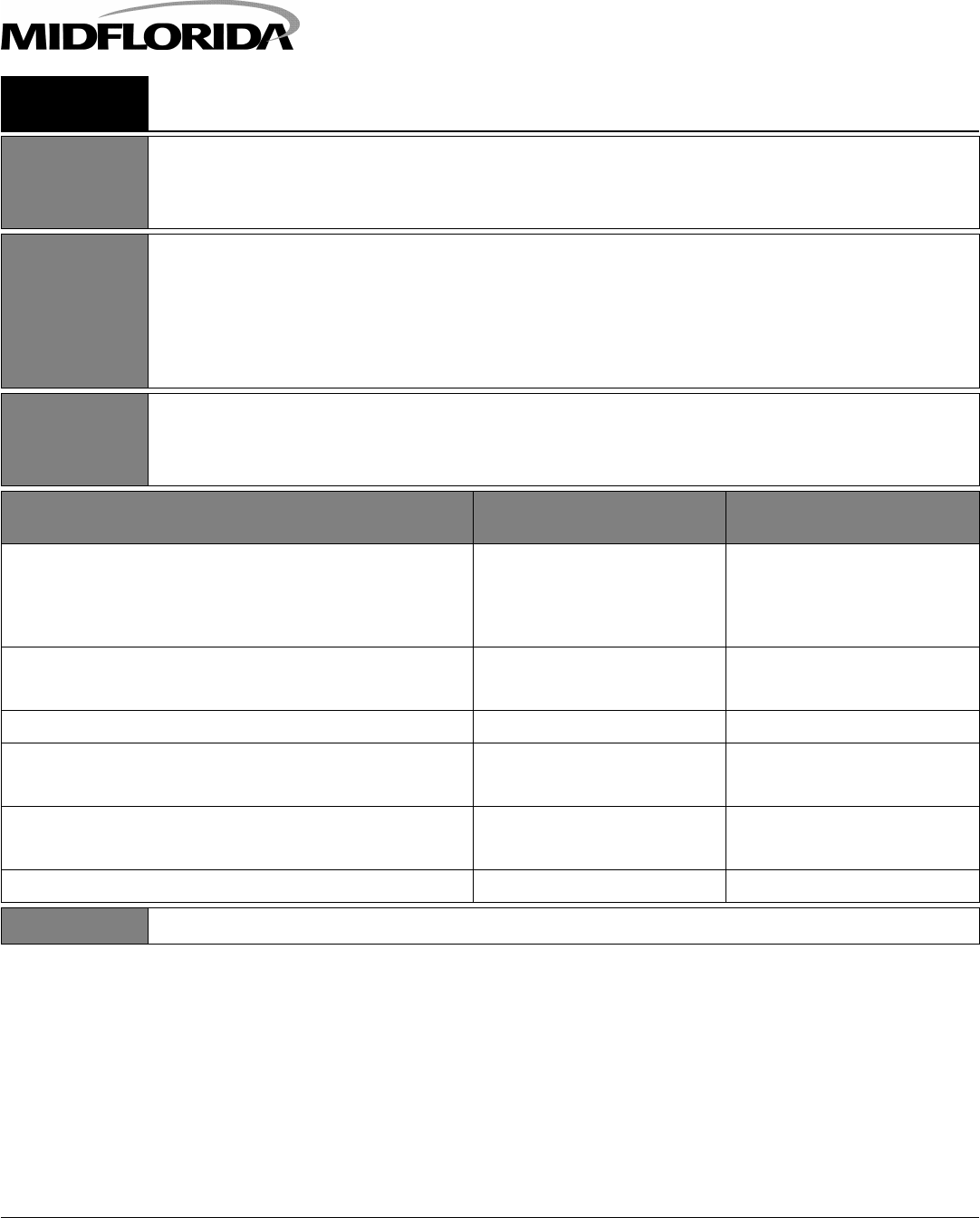

NCUA and FDIC Insurance Comparison

Single

Account

(one owner)

Joint

Account

(more than

one owner)

Retirement

Accounts

(includes IRAs)

Revocable

Trust

Accounts

Corporation,

Partnership, and

Unincorporated

Association Accounts

NCUA

Insured

$250,000

per

owner

$250,000

per

co-owner

$250,000

aggregate for

Roth and

Traditional

$250,000 for

Keogh

All IRA coverage

is separate

and in addition

to coverage for

other credit union

accounts

$250,000

per owner

per beneficiary

up to

5 beneficiaries

(Includes

Coverdell

Education

Savings

accounts)

$250,000 per

corporation,

partnership or

unincorporated

association

FDIC

Insured

$250,000

per

owner

$250,000

per

co-owner

$250,000

per owner

$250,000

per owner

per beneficiary

up to

5 beneficiaries

$250,000 per

corporation,

partnership or

unincorporated

association

Rev. 02/2014

FACTS

WHAT DOES MIDFLORIDA CREDIT UNION DO WITH YOUR PERSONAL

INFORMATION?

Why?

Financial companies choose how they share your personal information. Federal law gives consumers

the right to limit some but not all sharing. Federal law also requires us to tell you how we collect,

share, and protect your personal information. Please read this notice carefully to understand what we

do.

What?

The types of personal information we collect and share depend on the product or service you have

with us. This information can include:

l

Social Security number

l Account balances

l Payment history

l Transaction history

l Overdraft history

l Account transactions

When you are no longer a member, we continue to share your information as described in this notice.

How?

All financial companies need to share members' personal information to run their everyday business.

In the section below, we list the reasons financial companies can share their members' personal

information; the reasons MIDFLORIDA Credit Union chooses to share; and whether you can limit

this sharing.

Reasons we can share your personal information Does MIDFLORIDA Credit

Union share?

Can you limit this sharing?

For our everyday business purposes -

such as to process your transactions, maintain your

account(s), respond to court orders and legal

investigations, or report to credit bureaus

Yes No

For our marketing purposes -

to offer our products and services to you

Yes No

For joint marketing with other financial companies Yes No

For our affiliates' everyday business purposes -

information about your transactions and experiences

Yes No

For our affiliates' everyday business purposes -

information about your creditworthiness

No We don't share

For nonaffiliates to market to you No We don't share

Questions?

Call toll-free (866) 913-3733

Privacy Model Disclosure PRIV-MODEL 8/1/2010

VMP® Bankers Systems™

Wolters Kluwer Financial Services © 2010 2012.1/0641 4009231-010 EPRV0641

What We Do

How does MIDFLORIDA Credit

Union protect my personal

information?

To protect your personal information from unauthorized access and use, we use

security measures that comply with federal law. These measures include computer

safeguards and secured files and buildings.

We also maintain other physical, electronic and procedural safeguards to protect

this information and we limit access to information to those employees for whom

access is appropriate.

How does MIDFLORIDA Credit

Union collect my personal

information?

We collect your personal information, for example, when you

l

Open an account

l Apply for a loan

l Use your credit or debit card

l Make deposits or withdrawals from

your account

l Make a wire transfer

We also collect your personal information from others, such as credit bureaus,

affiliates, or other companies.

Why can't I limit all sharing?

Federal law gives you the right to limit only

l

sharing for affiliates' everyday business purposes - information about your

creditworthiness

l affiliates from using your information to market to you

l sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights to limit sharing.

Definitions

Affiliates Companies related by common ownership or control. They can be financial and

non-financial companies.

l

Our affiliates include:

l Financial companies such as: MIDFLORIDA Insurance Services, LLC.

Nonaffiliates Companies not related by common ownership or control. They can be financial and

non-financial companies.

l

MIDFLORIDA Credit Union does not share with nonaffiliates so they can

market to you.

Joint Marketing A formal agreement between nonaffiliated financial companies that together market

financial products or services to you.

l

Our joint marketing partners include securities broker dealers and insurance

companies.

Page 2