DANAHER BUSINESS SYSTEM

Tom Joyce, President & CEO

Dan Comas, EVP & CFO

MAY 2018

2

Forward Looking Statements

Statements in this presentation that are not strictly historical, including any statements regarding events or developments that we anticipate will or may occur in the future are "forward-

looking" statements within the meaning of the federal securities laws. There are a number of important factors that could cause actual results, developments and business decisions to

differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors

include, among other things deterioration of or instability in the economy, the markets we serve and the financial markets, contractions or growth rates and cyclicality of markets we

serve, competition, our ability to develop and successfully market new products and technologies and expand into new markets, the potential for improper conduct by our employees,

agents or business partners, our compliance with applicable laws and regulations (including regulations relating to medical devices and the health care industry), our ability to effectively

address cost reductions and other changes in the health care industry, our ability to successfully identify and consummate appropriate acquisitions and strategic investments and

successfully complete divestitures and other dispositions, our ability to integrate the businesses we acquire and achieve the anticipated benefits of such acquisitions, contingent

liabilities relating to acquisitions, investments and divestitures (including tax-related and other contingent liabilities relating to the distributions of each of Fortive Corporation and our

communications business), security breaches or other disruptions of our information technology systems or violations of data privacy laws, the impact of our restructuring activities on

our ability to grow, risks relating to potential impairment of goodwill and other intangible assets, currency exchange rates, tax audits and changes in our tax rate and income tax liabilities,

changes in tax laws applicable to multinational companies, litigation and other contingent liabilities including intellectual property and environmental, health and safety matters, the rights

of the United States government to use, disclose and license certain intellectual property we license if we fail to commercialize it, risks relating to product, service or software defects,

product liability and recalls, risks relating to product manufacturing, the impact of our debt obligations on our operations and liquidity, our relationships with and the performance of our

channel partners, uncertainties relating to collaboration arrangements with third parties, commodity costs and surcharges, our ability to adjust purchases and manufacturing capacity to

reflect market conditions, reliance on sole sources of supply, the impact of deregulation on demand for our products and services, labor matters, international economic, political, legal,

compliance and business factors (including the impact of the UK’s decision to leave the EU and changes in US policy stemming from the current administration, such as changes in US

trade policies and the reaction of other countries thereto), disruptions relating to man-made and natural disasters, and pension plan costs. Additional information regarding the factors

that may cause actual results to differ materially from these forward-looking statements is available in our SEC filings, including our 2017 Annual Report on Form 10-K and Quarterly

Report on Form 10-Q for the first quarter of 2018. These forward-looking statements speak only as of the date of this presentation and except to the extent required by applicable law, the

Company does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise.

All references in this presentation (1) to company-specific financial metrics relate only to the continuing operations of Danaher’s business, unless otherwise noted; (2) to “growth” or

other period-to-period changes refer to year-over-year comparisons unless otherwise indicated; (3) to Operating Profit below the segment level exclude amortization; and (4) to “today”

refers to the Company’s performance for the first quarter of 2018. We may also describe certain products and devices which have applications submitted and pending for certain

regulatory approvals.

DBS OVERVIEW: EVOLUTION FROM LEAN TO BALANCED

APPROACH INCLUDING GROWTH & LEADERSHIP

DBS is our sustainable competitive advantage

Impact of DBS on Growth

What You’ll Learn About the Danaher Business System (DBS)

DBS in action at recent acquisitions: from process to results

3

Building outstanding leaders through DBS

DBS is Our Competitive Advantage

4

1984 1991 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017E

Evolution of the Danaher Business System (DBS)

As portfolio evolved, so has DBS – from Lean to a balanced approach

OUR SHARED PURPOSE

HELPING REALIZE LIFE’S POTENTIAL

Leadership

Lean Growth

Leadership

Lean Growth

Leadership

Lean Growth

Leadership

Lean Growth

TODAY

Mid-1980s

LEAN

FOCUSED

ADDED

GROWTH

2001

2016

ADDED

LEADERSHIP

2009

LAUNCHED

SHARED

PURPOSE

5

“OMX” is Operating Margin Expansion; “WC” is Working Capital

SHAREHOLDER

CORE REVENUE GROWTH

OMX

CASH FLOW / WC TURNS

ROIC

CUSTOMER

QUALITY (EXTERNAL PPM)

ON-TIME DELIVERY (OTD)

ASSOCIATE

INTERNAL FILL RATE

RETENTION

8 CORE VALUE DRIVERS

Core Value Drivers (CVDs) are How We Quantitatively Measure

Success

All operating reviews begin with discussion of CVDs

Leadership

Lean Growth

6

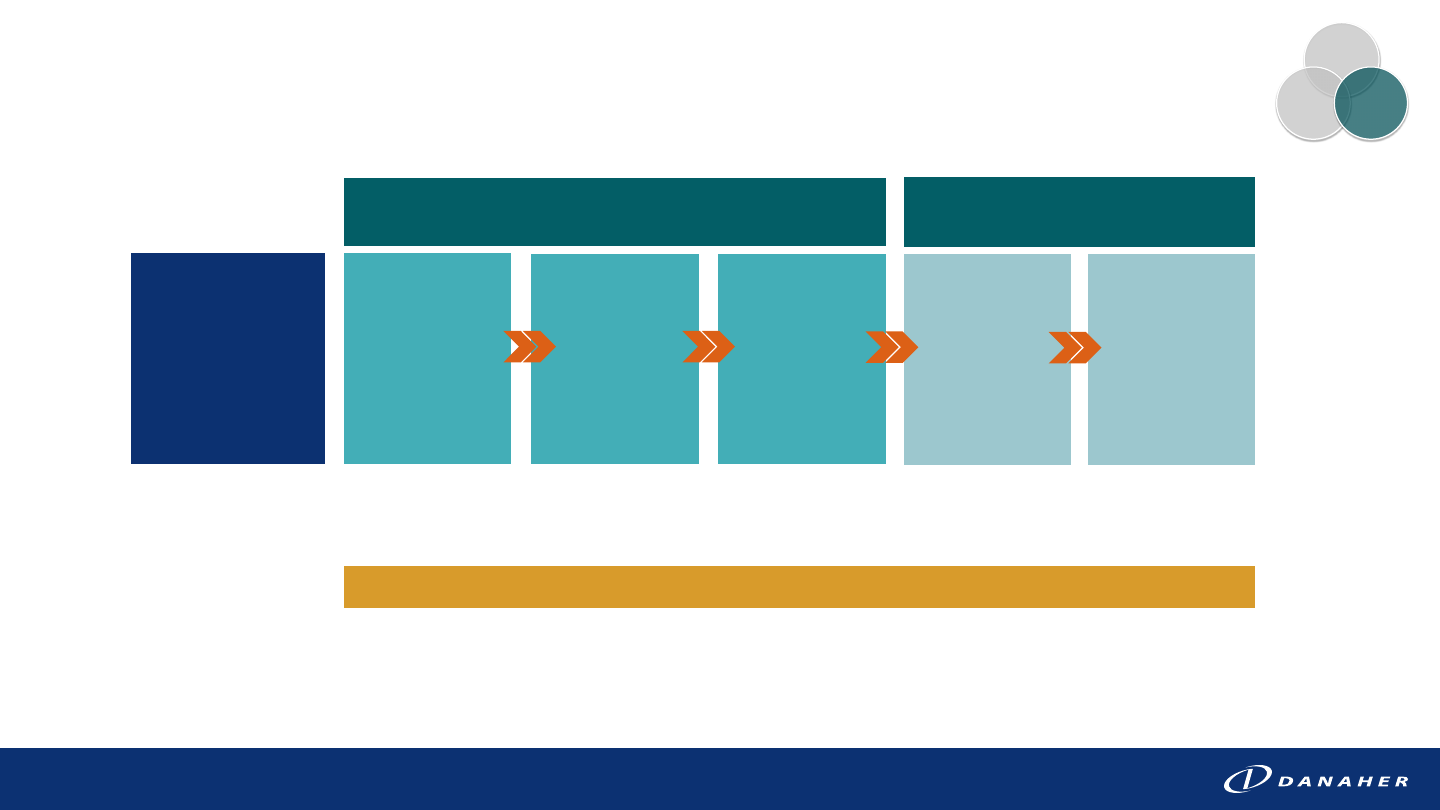

Strategic Plan/

3-5 Year Break-

through

Objectives

Develop Annual

Breakthrough

Objectives

Determine

Improvement

Priorities

ID Measures,

Metrics and Key

Resources

Deploy

Improvement

Priorities with

DBS

Keep Score

Monthly &

Annually

Problem

Solving

Process

What

How Much

Who

By When

How

What is the Annual Process to Drive Performance?

Converting our strategy into execution through Policy Deployment

7

8

DBS Fundamentals are the Foundation

Expand capabilities, drive consistent execution and sustain outstanding results

DBS FUNDAMENTALS

PROBLEM SOLVING

PROCESS

VOICE OF THE

CUSTOMER

STANDARD WORK

VALUE STREAM MAPPING

TRANSACTIONAL

PROCESS IMPROVEMENT

VISUAL & DAILY

MANAGEMENT

KAIZEN 5S

Leadership

Lean Growth

“Common sense, vigorously applied”

What Differentiates DBS

9

DBS is diversely applicable and always relevant – at any business, in

any end-market

It is a mindset and it is our culture – DBS is who we are, and how we do

what we do

DBS is constantly evolving: in the spirit of continuous improvement, we

are always “DBSing” DBS

DBS overview: evolution from Lean to balanced approach including

Growth & Leadership

DBS is our sustainable competitive advantage

IMPACT OF DBS ON GROWTH

What You’ll Learn About DBS

DBS in action at recent acquisitions: from process to results

10

Building outstanding leaders through DBS

11

DBS Growth Tools

DBS Growth comprised of innovation & commercial tools

Strategic Product

Envelope

Product Planning

Group

Customer

Segmentation

Danaher Innovation

Process

Accelerated

Product Development

Speed Design

Review…

COMMERCIAL TOOLS

EXAMPLES:

EXAMPLES:

Transformative

Marketing

Value

Selling

Lead

Nurturing

Funnel Management

Strategic

Negotiations

Sales Force

Initiative…

Leadership

Lean Growth

Leadership

Lean Growth

INNOVATION TOOLS

12

DBS Innovation Tools

Replicable process for innovation provides competitive advantage

Strategic

Product

Envelope

Problem to

Portfolio

(P2P)

Product

Planning

Group

NPD

Project

Management

Launch

Excellence

Define the

attractive domain

for innovation

Define a winning

roadmap for

attractive segments

Coordinate execution

& resources across

multiple projects

Drive cross-functional

development

of each new product

Generate & fulfill

demand for the

new product

DOMAIN

ROADMAP

EXECUTION &

RESOURCES

CROSS-

FUNCTIONAL DEV.

FULFILL DEMAND

FROM MARKET

INSIGHT…

…TO MARKET

SHARE

Leadership

Lean Growth

13

DBS Innovation in Action: Speed Design Review at Hach

BASICS OF SPEED DESIGN

REVIEW (SDR)

• Gather VOC; go to Gemba

• Obeya room with cross-functional

teams together

• Simultaneous product & process

optimization

• Rapid prototyping & evaluation

SDR IN ACTION: HACH CM130 CHLORINE

MONITORING SYSTEM FOR DIALYSIS

RESULTS

NEW ADJACENT

ADDRESSABLE MARKET

+$50M1

ST

FDA

CLEARED

ONLINE CHLORINE ANALYZER

FOR DIALYSIS

Customer purchased Hach drinking water

product to try in a dialysis capacity

VOC

GEMBA

SPEED

15 product design “sprints”

Dialysis clinics are required to test

water every 4 hours

14

DBS Commercial Tools

Integrated marketing & sales tools to drive commercial execution, accelerate growth

DAILY MANAGEMENT | GROWTH ROOM | STANDARD WORK

Market Insight

and Visibility

Sales

Productivity

and

Prospecting

Lead

Generation

and Campaign

Awareness

Customer

Buying

Journey &

Insight

TRANSFORMATIVE MARKETING

SALES

STANDARD WORK

Market Overview

and Channel

Strategy

Sales Funnel

Management

Market attractiveness

—

How do we win?

Market segmentation

—

Customer profile

What triggers interest?

—

Sources of info

Value Proposition

—

Customer benefit

Customer Buying

Behavior

Monthly “Key”

Opportunity Review

Are we in control? What’s working? What’s not working?

Leadership

Lean Growth

Commercial Execution Driving Growth at Pall

Using DBS to improve S&M processes and drive better growth

+50%

CONTACTS / VISIBILITY

LEADS

+6.5x

OPPORTUNITIES

+2x

WIN RATE %

+15%

2017

RESULTS

MARKETING

FUNNEL

SALES

FUNNEL

SITUATION AT ACQUISTION

• Limited process for improving market visibility

• Little to no digital marketing capabilities

• No repeatable process for generating / nurturing high-quality

sales leads

DBS ACTIONS

• Transformative Marketing: Disciplined marketing campaigns to

improve visibility & account coverage

• Lead Handling: Prioritize & deliver more qualified leads to sales

• Funnel Management: Streamlined sales funnel process to improve

win rates

BIOPHARMA

“WIN THE SPEC”

15

DBS overview: evolution from Lean to balanced approach including

Growth & Leadership

DBS is our sustainable competitive advantage

Impact of DBS on Growth

What You’ll Learn About DBS

DBS IN ACTION AT RECENT ACQUISITIONS: FROM PROCESS TO

RESULTS

16

Building outstanding leaders through DBS

MARKET

COMPANY

VALUATION

Our Strategic Approach to M&A is a DBS Process

• Secular growth drivers

• Fragmented

• Higher barriers to entry

• Optionality with multi-industry

portfolio

• Competitive market position

• Strong brand / channel

• Consistent revenue visibility

• Higher margin businesses

• Cultural fit

• Focus on ROIC

• DBS opportunities

• Sustainability

• Synergies with DHR OpCos

• Combination of value & growth deals

Selectively pursuing value creation opportunities

“ROIC” is Return on Invested Capital

17

Core Revenue Growth

+

Margin Expansion

+

Strong Free Cash Flow

+

Acquisitions

=

TOP QUARTILE EPS GROWTH &

COMPOUNDING RETURNS

How We Create Value: Running the Danaher Playbook

IMPROVE COST

STRUCTURE

Balanced approach to create shareholder value

G&A

S&M

OMX

Core

Growth

R&D

Gross

Margins

REINVEST

FOR GROWTH

ACCELERATE

MARGINS &

CORE GROWTH

18

INITIAL PRIORITIES / KEY AREAS OF DBS FOCUS

Initial priorities and areas of DBS focus are tailored to each acquisition

Acquisitions: a Tailored Approach with DBS

19

Outstanding franchise

in attractive, fast-

growing markets

Highly innovative,

differentiated products &

technology

Added attractive packaging

print inspection adjacency

Strong global dental brand

that brought presence in

implants & digital dentistry

1) ACCELERATE INNOVATION

2) IMPROVE EXECUTION

3) REDUCE COSTS

1) ENHANCE COMMERCIAL

EXECUTION

2) IMPROVE OPERATIONAL

LEVERAGE

3) BUILD SCALE GLOBALLY

1) IMPROVE MARKET

VISIBILITY

2) BUILD OFF EXISTING PID

CUSTOMER BASE

3) ENHANCE MARGINS

1) BUILD ON NEW PRODUCT

INITIATIVES

2) ENHANCE GO-TO-MARKET

STRATEGY THROUGH

SALES-FORCE EXPANSION

3) REDUCE G&A

Tailored Integration with DBS: 2015 Pall Acquisition

Rapid DBS adoption has been a critical driver of Pall’s great start

20

• >50 DHR associates facilitating

DBS post close

• >300 kaizen events in year one

post close

• >70% of associates completed

DBS training in the first 90 days

INTEGRATION PROCESS

NUMBER OF

NEW PRODUCT

LAUNCHES

COST SAVINGS

ACHIEVED

>$200M

+50%

ON-TIME-

DELIVERY

IMPROVEMENT

>2,000BPS

ACCELERATE

INNOVATION

IMPROVE

EXECUTION

REDUCE

COSTS

RESULTS SINCE ACQUISITION

DD DD

~50% ~55%

Flat/LSD

Mid-

teens

AT ACQ.

TODAY

1 YEAR IN

LSD MSD

~50% >50%

High-

teens

~25%

Core Growth

Gross Margin

Operating

Profit Margin

Flat/LSD MSD

~70% >70%

LDD >20%

Core Growth

Gross Margin

Operating

Profit Margin

Update on Recent Larger Acquisitions

AT ACQ.

TODAY

AT ACQ.

TODAY

Deals at or above initial expectations

2 YEARS IN

3 YEARS IN

ACQUIRED DEC 2014

ACQUIRED AUG 2015

ACQUIRED NOV 2016

Core Growth

Gross Margin

Operating

Profit Margin

21

DBS overview: evolution from Lean to balanced approach including

Growth & Leadership

DBS is our sustainable competitive advantage

Impact of DBS on Growth

What You’ll Learn About DBS

DBS in action at recent acquisitions: from process to results

22

BUILDING OUTSTANDING LEADERS THROUGH DBS

Associates are key to sustaining our competitive advantage

Leadership: Evolving Strategic Approach to Talent

DEVELOPING LEADERS

• Development primarily “on the job”

TALENT

• General industrial talent

• Outsourced talent acquisition

ORGANIZATION

• OpCos & Corporate

10+ YEARS AGO

• Progressive responsibilities &

formalized development programs

• Science & technology talent

• Internal talent acquisition & cultivation

• Platform leadership driving strategic

moves & portfolio evolution

• OpCos execute strategic decisions

TODAY

*OpCo Presidents & Above

~80%

*

AVG. INTERNAL

FILL RATE

SINCE 2015

+15%

R&D NEW

HIRES 2017

+15%

CUSTOMER-

FACING NEW

HIRES 2017

23

Stretch roles

Application of key

learnings, develop

Delivering results

Experiential learning in

trainings

EXPERIENCE

COACHING

TRAINING

Development plan

execution

Senior leader coaching

Mentoring

Best practice sharing

Coaching guides

70%

20%

Situational Leadership

General Manager

Development Program

Danaher Leadership

Program

10%

DBS Building Leadership: Developing Leaders at Danaher

Utilizing a combination of development programs and processes

LEADERSHIP ANCHORS

• Models humility, transparency & integrity

• Builds people, teams & organizations

• Drives innovation & growth

• Charts the course

• LEADS THROUGH DBS

What Good Leadership Looks Like at Danaher

Compensation based on both CVD performance and Leadership behavior

25

“OMX” is Operating Margin Expansion; “WC” is Working Capital

SHAREHOLDER

CORE REVENUE GROWTH

OMX

CASH FLOW / WC TURNS

ROIC

CUSTOMER

QUALITY (EXTERNAL PPM)

ON-TIME DELIVERY (OTD)

ASSOCIATE

INTERNAL FILL RATE

RETENTION

8 CORE VALUE DRIVERS (CVDs)

LIFE

SCIENCES

DIAGNOSTICS DENTALENVIRONMENTAL & APPLIED SOLUTIONS

Leadership Development Across Danaher: Recent Moves

Multi-industry structure a differentiator in talent attraction, development, retention

WATER QUALITY PRODUCT ID

PREVIOUSLY

PRESIDENT

EVP OF LIFE SCIENCES

PLATFORM

PREVIOUSLY

PRESIDENT

PRESIDENT

PREVIOUSLY EVP OF

LS & PID PLATFORMS

EVP OF DX & DENTAL

PLATFORMS

PREVIOUSLY EVP OF

LS & PID PLATFORMS

EVP OF DX & DENTAL

PLATFORMS

PREVIOUSLY

PRESIDENT

PRESIDENT

PREVIOUSLY

HEAD OF R&D

PRESIDENT

PREVIOUSLY HEAD OF T&M

GROUP EXECUTIVE FOR

DENTAL

PREVIOUSLY

PRESIDENT

PREVIOUSLY

PRESIDENT IND.

PREVIOUSLY

PRESIDENT

PREVIOUSLY GROUP EXEC

OF PID PLATFORM

EVP OF EAS PLATFORM

PREVIOUSLY

HEAD OF R&D

PRESIDENT

PREVIOUSLY

PRESIDENT

GROUP EXECUTIVE FOR

WATER QUALITY

PREVIOUSLY

FINANCE

CFO

26

“Common sense,

vigorously applied”

DBS is our sustainable competitive advantage

27