1

July 2024

IMPORTANT UPDATE TO THE MARYLAND SENATOR EDWARD J. KASEMEYER COLLEGE INVESTMENT PLAN

This supplement amends the Maryland Senator Edward J. Kasemeyer College Investment Plan Disclosure Statement, dated

December 2021, and supplemented in January 2022, April 2022, December 2022, June 2023, December 2023, and February

2024. You should review this information carefully and keep it with your current copy of the Plan Disclosure Statement and

supplements. In Plan materials, the Plan Disclosure Statement may alternately be referred to as the Plan Description.

Changes to Underlying Investments

Beginning in August 2024, an additional underlying Fund is being added to some of the Investment Options.

Participation Agreement

The Representations, Warranties, Certifications, and Acknowledgements section beginning on page 36 has been

updated and renamed Participation Agreement for the Maryland College Investment Plan.

Temporary Withdrawal Restriction Update

Previously, if a contribution was received in good order, the Plan reserved the right to restrict distribution of that

contribution from your Account for up to seven calendar days after deposit. Effective immediately, if a contribution is

received in good order, distribution of that contribution from your Account may be restricted for up to five business

days after deposit.

Therefore, the following changes are made to the Maryland Senator Edward J. Kasemeyer College Investment Plan

Disclosure Statement:

On page 13, the “Temporary Withdrawal Restriction” subsection of the How to Contribute to Your Account section is

hereby deleted and replaced with the following:

Temporary Withdrawal Restriction. If you make a contribution by check, money order, or electronic funds transfer (assuming

all are in good order), we reserve the right, subject to applicable laws, to restrict distribution of that contribution from your

Account for up to five business days after deposit. The Portfolios will be closed for wire purchases and redemptions on days

when the Federal Reserve Wire System is closed.

The following information is added to the “Changes to Underlying Funds” subsection of the Investment Information

section on page 14:

Beginning in July 2024, Hedged Equity Fund—I Class will be added to the enrollment-based portfolios beginning 10 years to

matriculation, increasing each quarter to ultimately reach a maximum neutral allocation of 10% of the total neutral allocation to

equity (stock) funds at five years to matriculation, and remaining at that proportion thereafter. The Portfolio for Education Today

will have a neutral allocation to Hedged Equity equal to 10% of its total neutral allocation to equity (stock) funds. This addition is

expected to be completed by the end of the third quarter of 2024. Further information about the new underlying Fund can be

found in section The Underlying Fund Characteristics.

Allocations for enrollment-based portfolios not reflected in this supplement are not immediately affected by this glide path

change and will be affected on the timeline described above.

The following updates the Neutral Allocations at the end of the third quarter 2024, upon completion of the addition of

the Hedged Equity Fund—I Class portfolio:

2

Portfolio 2033—This Portfolio seeks long-term capital appreciation by investing in Funds focused on equity markets with

additional exposure to fixed income. The strategy is based on the understanding that the volatility associated with equity

markets may be accompanied by the greatest potential for long-term capital appreciation.

Portfolio 2033

68.25% Stocks

31.75% Bonds

NEUTRAL

ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class

10.60%

Value Fund—I Class

10.60%

Equity Index 500 Fund—I Class

7.07%

U.S. Large-Cap Core Fund—I Class

7.07%

International Stock Fund—I Class

5.37%

International Value Equity Fund—I Class

5.37%

Overseas Stock Fund—I Class

5.37%

Small-Cap Stock Fund—I Class

4.42%

Real Assets Fund—I Class

3.41%

Mid-Cap Growth Fund—I Class

2.21%

Mid-Cap Value Fund—I Class

2.21%

Hedged Equity Fund—I Class

1.71%

Emerging Markets Discovery Stock Fund—I Class

1.42%

Emerging Markets Stock Fund—I Class

1.42%

U.S. Equity Research Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class

31.75%

Short-Term Bond Fund—I Class

0.00%

U.S. Limited Duration TIPS Index Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class

0.00%

3

Portfolio 2030—This Portfolio seeks long-term capital appreciation by investing in Funds focused on equity markets, with

additional exposure to fixed income. The strategy is based on the understanding that the volatility associated with equity

markets may be accompanied by the greatest potential for long-term capital appreciation.

Portfolio

2030

52.5%

Stocks

47.5%

Bonds

Portfolio 2027—This Portfolio seeks capital appreciation and income by investing in a balanced mix of stock and fixed income

investments. This mix of Funds offers reduced exposure to equities while diversifying in fixed income markets to reduce the risk

and volatility typically associated with equity markets.

Portfolio 2027

64.25%

Bonds

35.75% Stocks

NEUTRAL

ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class

7.63%

Value Fund—I Class

7.63%

Equity Index 500 Fund—I Class

5.09%

U.S. Large-Cap Core Fund—I Class

5.09%

Hedged Equity Fund—I Class

4.46%

International Stock Equity Fund—I Class

3.86%

International Value Equity Fund—I Class

3.86%

Overseas Stock Fund—I Class

3.86%

Small-Cap Stock Fund—I Class

3.17%

Real Assets Fund—I Class

2.63%

Mid-Cap Growth Fund—I Class

1.59%

Mid-Cap Value Fund—I Class

1.59%

Emerging Markets Discovery Stock Fund—I Class

1.02%

Emerging Markets Stock Fund—I Class

1.02%

U.S. Equity Research Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class

47.50%

Short-Term Bond Fund—I Class

0.00%

U.S. Limited Duration TIPS Index Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class

0.00%

NEUTRAL

ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class

5.11%

Value Fund—I Class

5.11%

Hedged Equity Fund—I Class

3.58%

Equity Index 500

Fund—I Class

3.40%

U.S. Large-Cap Core Fund—I Class

3.40%

International Stock Fund—I Class

2.58%

International Value Equity Fund—I Class

2.58%

Overseas Stock Fund—I Class

2.58%

Small-Cap Stock Fund—I Class

2.14%

Real Assets Fund—I Class

1.79%

Mid-Cap Growth Fund—I Class

1.06%

Mid-Cap Value Fund—I Class

1.06%

Emerging Markets Discovery Stock Fund—I Class

0.68%

Emerging Markets Stock Fund—I Class

0.68%

U.S. Equity Research Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class

32.00%

Short-Term Bond Fund—I Class

18.00%

U.S. Limited Duration TIPS Index Fund—I Class

14.25%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class

0.00%

4

Portfolio 2024—This Portfolio seeks income by investing primarily in fixed income Funds with some exposure to stocks. For

additional diversification and some capital appreciation, the Portfolio also invests a small component in international equity

markets. This mix of Funds limits the exposure to equities while diversifying in fixed income markets in an effort to reduce the

risk and volatility typically associated with equity markets.

Portfolio

2024

80.0% Bonds

20.0% Stocks

NEUTRAL

ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class

2.85%

Value Fund—I Class

2.85%

Hedged Equity Fund—I Class

2.00%

Equity Index 500 Fund—I Class

1.90%

U.S. Large-Cap Core Fund—I Class

1.90%

International Stock Fund—I Class

1.45%

International Value Equity Fund—I Class

1.45%

Overseas Stock Fund—I Class

1.45%

Small-Cap Stock Fund—I Class

1.19%

Real Assets Fund—I Class

1.00%

Mid-Cap Growth Fund—I Class

0.60%

Mid-Cap Value Fund—I Class

0.60%

Emerging Markets Discovery Stock Fund—I Class

0.38%

Emerging Markets Stock Fund—I Class

0.38%

U.S. Equity Research Fund —I Class

0.00%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Short-Term Bond Fund—I Class

40.00%

U.S. Limited Duration TIPS Index

Fund—I Class

40.00%

Spectrum Income Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class

0.00%

5

Portfolio for Education Today— Emphasizing a mix of high-quality fixed income Funds, this Portfolio also has a modest

allocation to equity Funds. The allocations reflect a lower-risk investment approach. Designed with a more conservative strategy,

this Portfolio seeks stability of principal by attempting to limit the risk associated with equity markets. This Portfolio is designed for

Beneficiaries who are already enrolled or about to enroll in school. It maintains an approximate 20% allocation to equity Funds and

is not guaranteed to preserve principal. There is also a small exposure to international stocks. The strategy’s objective is to

conserve principal while generating income at a time when the Account Holder may be withdrawing from an Account for Qualified

Education Expenses. However, an Account may experience losses, including losses near, at, or after the enrollment date. There is

also no guarantee that the Portfolio will provide adequate income at and throughout enrollment in college or other schools.

Portfolio for

Education Today

80% Bonds

20% Stocks

Additionally, the following description is added to the section The Underlying Fund Characteristics beginning on page

20 under T. Rowe Price Funds Focusing on Equities (Stock Funds):

Hedged Equity Fund—I Class Seeks long-term capital growth by investing at least 80% of its net assets in equity securities

and derivatives that have similar economic characteristics to equity securities or the equity markets. The fund focuses on U.S.

large-cap stocks while using hedging strategies designed to mitigate tail risk and provide strong risk-adjusted returns with lower

volatility than the overall equity markets.

The following information replaces the Representations, Warranties, Certifications, and Acknowledgement section

beginning on page 36:

Participation Agreement for the Maryland College Investment Plan

By submitting an Account Application for a Maryland College Investment Plan (the “Plan”) Account and maintaining a Plan

Account, I, as an Account Owner, hereby consent and agree to all terms and conditions set forth in the Plan Description

https://cdn.unite529.com/jcdn/files/MDD/pdfs/plandescription.pdf (the “Current Plan Description”), the Declaration of Trust

https://cdn.unite529.com/jcdn/files/MDD/pdfs/MCIP_Declaration_of_Trust_2023.pdf (the “Current Declaration”), this Agreement

(as defined below) and all applicable statutes, regulations, and policies concerning the Plan, which are all expressly

incorporated by reference herein. The Current Plan Description and the Current Declaration of Trust, as they may be amended

from time to time are referred to herein as the “Plan Description” and the “Declaration”). I acknowledge and agree that this

Agreement and the incorporated documents, as they may be amended from time to time, will govern all aspects of my

participation in the Plan and I agree to be bound by the terms and conditions of the Plan as set forth therein.

DEFINED TERMS. Together, the Account Application and this Participation Agreement are referred to as the “Agreement.”

Each capitalized term used and not defined in this Agreement has the meaning set forth in the Plan Description, and such

meanings are incorporated herein as if they were set forth in the body of this Agreement.

NEUTRAL

ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class

2.85%

Value Fund—I Class

2.85%

Hedged Equity Fund—I Class

2.00%

Equity Index 500 Fund—I Class

1.90%

U.S. Large-Cap Core Fund—I Class

1.90%

International Stock Fund—I Class

1.45%

International Value Equity Fund—I Class

1.45%

Overseas Stock Fund—I Class

1.45%

Small-Cap Stock Fund—I Class

1.19%

Real Assets Fund—I Class

1.00%

Mid-Cap Growth Fund—I Class

0.60%

Mid-Cap Value Fund—I Class

0.60%

Emerging Markets Discovery Stock Fund—I Class

0.38%

Emerging Markets Stock Fund—I Class

0.38%

U.S. Equity Research Fund—I Class

0.00%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Short-Term Bond Fund—I Class

40.00%

U.S. Limited Duration TIPS Index Fund—I Class

40.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class

0.00%

6

CERTAIN AGREEMENTS, REPRESENTATIONS AND WARRANTIES. I hereby represent and warrant to the Plan Officials,

and acknowledge and agree as follows:

1. I have received, read, and understand the terms and conditions of the Current Plan Description and will keep a copy for

my records.

2. I understand that the Current Plan Description may be amended from time to time and I understand and agree that I and

my Account will be subject to the terms of those amendments.

3. I have been given an opportunity to obtain additional information concerning the terms and conditions of the Plan and an

opportunity to obtain any additional information needed to accurately complete the Account Application.

4. In making the decision to open a Plan Account and enter into this Agreement, I have not relied on any representations or

other information, whether oral or written, other than as set forth in the Current Plan Description and this Agreement.

5. I have carefully reviewed all information provided by the Program Manager with respect to the Plan and have determined

that an investment in the Plan is a suitable investment for me as a means of saving for Qualified Educational Expenses.

I understand that I am solely responsible for determining which Qualified Tuition Program is best suited to my needs and

objectives.

6. The information I provided in the Account Application was accurate and complete and I covenant that any information or

documentation furnished by me to Plan Officials in the future shall be accurate and complete. I agree to notify the

Program Manager promptly of any material changes in such information.

7. Plan Officials will use the information I have provided to verify my identity. If after making reasonable efforts, Plan

Officials are unable to verify my identity, they are authorized to take any action permitted by law, including closing my

Account and redeeming my Account at the NAV calculated the day the Account is closed.

8. I am a United States citizen or a U.S. resident alien at least 18 years of age and have a U.S. residential address and my

Beneficiary is either a U.S. citizen or a U.S. resident alien.

9. I have full authority and legal capacity to establish an Account for the benefit of the Beneficiary.

10. I am opening this Account to provide funds for Qualified Higher Education Expenses of the designated Beneficiary of the

Account.

11. I certify that if I am funding this Account from a prior 529 distribution for the same Beneficiary, that there have been no

other rollovers for the same Beneficiary in the previous 12 months except as permitted by Notice 2024-23 from the

Internal Revenue Service. I further certify that any contributions that are rollovers from a Coverdell Education Savings

Account, qualified U.S. Savings Bonds, or a prior 529 plan distribution will be disclosed as such and that the applicable

earnings and basis information will be provided

.

12. If I am establishing an Account as a Custodian for a minor under UGMA/UTMA, I assume responsibility for any adverse

consequences resulting from the establishment, maintenance, or termination of the Account.

13. If I am establishing an Account as a trustee for a trust, I represent that: (i) the individual signing the online enrollment or

paper Account Application, as applicable, is duly authorized to act as trustee for the trust; (ii) the Plan Description may

not discuss tax consequences and other aspects of the Plan of particular relevance to the trust and individuals having an

interest in the trust; and (iii) the trustee, for the benefit of the trust, has consulted with and relied on a tax and/or financial

professional, as deemed appropriate by the trustee, before becoming an Account Owner.

14. I have not been advised by the Plan Officials to invest, or to refrain from investing, in a particular Investment Option or

Portfolio. I understand and acknowledge that no Plan Official is authorized to provide investment or tax advice.

15. I will not have a direct beneficial interest in the underlying Funds and other investment products offered by the Plan from

time to time and I will not have the rights of an owner or shareholder of those underlying Funds.

16. After I make a contribution to a specific Investment Option or Portfolio, I will be allowed to change the Investment Option

or Portfolio for that contribution no more than twice per calendar year for the same Beneficiary.

17. An Investment Option or Portfolio may at any time be merged, terminated, reorganized or cease accepting new

contributions which may result in my contributions being reinvested in an Investment Option or Portfolio different from

the Investment Option or Portfolio in which my contributions were originally invested.

18. My Account and certain transactions to or from my Account are subject to the fees and charges set forth in the Plan

Description. I understand further that these fees and charges may change in the future. I agree that the payment of the

administrative fees, asset-based charges, and any other fees set forth in the Plan Description are an unconditional

obligation of mine and the Account and shall be payable on my behalf by the Program Manager from contributions or

transfers of funds to my Account or from assets in my Account as provided in the Plan Description.

19. I cannot use my Account as collateral for any loan. Any attempt to use my Account as collateral for a loan will be void. I

also acknowledge and agree that the Trust will not lend any assets to my Beneficiary or to me.

20. Except as described in the Plan Description, I will not assign or transfer any interest in my Account. I understand that,

except as allowed by law, any attempt to assign or transfer that interest is void.

21. If I so elect, the Program Manager has the right to provide the financial professional I have identified to the Plan with

access to financial and other information regarding my Account. I acknowledge the Program Manager may terminate my

financial professional’s authority to access my Account at the Program Manager’s discretion.

22. Federal and state laws are subject to change, sometimes with retroactive effect, and Plan Officials cannot make any

representation that such federal or state laws will not be changed or repealed. I understand and agree that such

changes could have a negative impact on my Account.

7

23. By opening an Account, I am consenting to receive emails from Plan Officials about the Plan and my Account. I

understand that I may unsubscribe from emails about the Plan at any time. I also understand and agree that even if I

unsubscribe from emails about the Plan, Plan Officials reserve the right to send me administrative emails regarding my

Account or as otherwise permitted by law.

24. Any notice sent from Plan Officials to me or the Account’s designated Beneficiary shall be effective when sent by mail,

special delivery or electronic transmission.

25. I authorize Plan Officials to act on instructions believed to be genuine, and from me, for any service authorized in this

application, including telephone/computer services and I agree to hold harmless Plan Officials for any loss, damage,

liability, cost, or expenses including reasonable attorney’s fees resulting from such instructions reasonably believed to be

genuine. I understand that anyone who can properly identify my Account can make telephone/computer transactions on

my behalf. I understand that receiving reimbursement for unauthorized activity as part of the Ascensus Asset Protection

Policy requires me to meet the eligibility terms of the Program, including following certain security best practices.

26. Plan Officials collect personally identifiable information provided by me in the Account Application and in future

submissions. I hereby authorize Plan Officials to disclose such information in accordance with the Privacy Policy

[https://maryland529.com/home/about-maryland-529.html?tab=about-tab-5&id=section-title] of the Plan, as such policy

may be amended from time to time. I hereby specifically consent to disclosure to regulatory agencies, authorized

auditors and compliance personnel for regulatory, audit, or compliance purposes and to third parties in connection with

the performance of administrative and marketing services relating to the Plan.

27. Plan Officials may, in the future, alert me to other savings or investment programs. I understand that I may contact the

Program Manager if I do not wish to receive such information.

28. Plan Officials may ask me to provide additional documentation that may be required by applicable law, including anti-

terrorism and anti-money laundering laws, in connection with my Account and I agree to promptly comply with any such

requests for additional documents.

29. I will not make any contribution to the Account if, to the best of my knowledge, the total value of the Account combined

with the total value of all other accounts established for the Beneficiary in other qualified tuition programs under Section

529 of the Internal Revenue Code exceeds either the amount necessary to provide for the Qualified Higher Education

Expenses of the Beneficiary or the total maximum account balance as described in the Plan Description.

30. Non-Qualified Distributions will be subject to taxes and penalties as described in the Plan Description.

31. I am solely responsible for retaining adequate records relating to distributions from the Account for my own tax reporting

purposes.

32. Plan Officials will not be responsible for any losses that may be incurred as a result of the timing of any transfer or

Rollover Distribution from or to another tuition program.

33. If enrolling through a payroll deduction plan, the payroll deduction plan is being made available to me by my employer,

and my employer is responsible for collecting and forwarding my contributions to the Program Manager.

34. The State Treasurer chooses the Program Manager. The State Treasurer, in his sole discretion, may decide to change

the Program Manager and any such decision may impact the Investment Options or Portfolios available for my Account.

35. It is the Plan’s policy to send only one copy of the Plan Description for all Account Holders residing at the same address.

This policy applies to all existing Accounts and any Accounts I may open in the future. I consent to this policy and agree

to contact the Program Manager if I wish to receive more than one copy of the Plan Description per address.

ELECTRONIC FUNDS TRANSFERS. If I have elected to make contributions by electronic funds transfers (EFT) or automatic

draft, I authorize the Plan Officials to initiate debit and/or credit entries in accordance with my instructions designated in the

Account Application or any future instructions against my account designated in this Agreement or later designated by me. I

authorize the financial institution to accept any such debits or credits to my account. I understand that my authorization for any

such credit or debit must comply with applicable law, and I agree to hold harmless the Plan Officials for any credits or debits

related to my Account that result in any losses, damage, liability, cost, or expenses. This authorization will remain in effect until

I notify the Program Manager in writing of its termination and until the Program Manager has reasonable time to act on that

termination. Plan Officials may correct any transaction errors with a debit or credit to my financial institution account and

Account. I further agree to maintain the balance in my designated account at a level sufficient to satisfy each debit transaction,

and I understand that if the balance is insufficient, the Program Manager may assess a fee in accordance with this Agreement

and the Plan Description.

NO EDUCATIONAL GUARANTEES. I understand and agree that the Plan Officials, individually and collectively, do not

guarantee that my Beneficiary will (i) be accepted as a student by any institution of higher education, other institution of

postsecondary education, or elementary or secondary school; (ii) if accepted, be permitted to continue as a Student; (iii) will be

treated as a state resident of any state for Tuition purposes; (iv) will graduate from any institution of higher education, other

institution of postsecondary education, or elementary or secondary school; or (v) will achieve any particular treatment under

any applicable state or federal financial aid programs. I understand that Maryland state residency is not established for the

Beneficiary merely because I have designated him or her as the Beneficiary of the Account.

NO GUARANTEED RATE OF RETURN OR BENEFIT. I recognize that the investment in the Plan involves risks as described

in the Plan Description. The value of my Account will depend upon the performance of the Funds, and at any time, the value of

my Account may be more or less than the amounts contributed to the Account. I understand and agree that the Plan Officials,

individually and collectively, do not guarantee any rate of return or benefit for contributions made to my Account.

8

NO LIABILITY OF PLAN OFFICIALS. I understand and agree that the Plan Officials, individually and collectively, are not

liable: (i) for a failure of the Plan to qualify or remain a Qualified Tuition Program under the Code, including any subsequent

loss of favorable tax treatment under state or federal law; (ii) for any loss of contributions to my Account or for the denial to me

of a perceived tax or other benefit under the Plan; or (iii) for any loss, failure or delay in performance of each of their

obligations related to my Account or any diminution in the value of my Account arising out of or caused, directly or indirectly,

by circumstances beyond its reasonable control in the event of Force Majeure.

NO WAIVER OF SOVEREIGN IMMUNITY. Nothing in this Agreement shall be construed as a waiver of any Plan Officials’

sovereign immunity. This Agreement shall not constitute or be construed as a waiver of any of the privileges, rights, defenses,

remedies or immunities available to any Plan Officials. The failure to enforce, or any delay in the enforcement, of any

privileges, rights, defenses, remedies, or immunities available to any Plan Official under this Agreement or under applicable

law shall not constitute a waiver of such privileges, rights, defenses, remedies, or immunities or be considered as a basis for

estoppel. Plan Officials do not waive any privileges, rights, defenses, remedies, or immunities available by entering into this

Agreement or by its conduct prior to or subsequent to entering into the Agreement.

INDEMNIFICATION. I understand and agree that the establishment of my Account is based on my agreements,

representations and warranties set forth in this Agreement. I, through the Account Application and this Agreement, indemnify

and hold harmless the Plan Officials from and against any and all loss, damage, liability, penalty, tax, or expense, including

costs of reasonable attorneys’ fees, to which they shall incur by reason of, or in connection with, any misstatement or

misrepresentation that is made by me or my Beneficiary, any breach by me of the acknowledgements, representations, or

warranties in the Account Application or this Agreement or the Plan Description, or any failure by me to fulfill any covenants or

agreements in the this Agreement, the Account Application, the Declaration, or the Plan Description.

FINALITY OF DECISIONS AND INTERPRETATIONS. I understand and agree that all decisions and interpretations by the

Plan Officials in connection with the operation of the Plan shall be final and binding on each Account Holder, Beneficiary and

any other person affected thereby.

TERM. I understand and agree that this Agreement will become effective upon the opening of the Account by the Program

Manager and shall terminate upon closing of the Account.

HEADINGS. I understand and agree that the heading of each provision of this Agreement is for descriptive purposes only and

shall not be deemed to modify or qualify any of the rights or obligations set forth in each such provision.

GOVERNING LAW. I understand and agree that this Agreement shall be construed in accordance with and shall be governed

by the laws of the State of Maryland, without regard to choice of law rules of any state.

BINDING NATURE, THIRD-PARTY BENEFICIARIES. I understand and agree that this Agreement will survive my death and

will be binding on my personal representativ

es, heirs, successors, and assigns. The Plan Officials are beneficiaries of my

agreements, representations, and warranties in this Agreement.

AMENDMENT AND TERMINATION OF PLAN. I understand and agree that Plan Officials may amend this Agreement or the

Plan Description at any time, or may suspend or terminate the Plan if it is determined to be in the best interest of the Plan or

required by law.

SEVERABILITY. I understand and agree that if any provision of this Agreement is held to be invalid, illegal, void, or

unenforceable, by reason of any law, rule, or administrative order, or by judicial decision, such determination will not affect the

validity of the remaining provisions of this Agreement.

ES_MD_SUP_072024

1

February 2024

IMPORTANT UPDATE TO THE MARYLAND SENATOR EDWARD J. KASEMEYER COLLEGE INVESTMENT PLAN

This supplement amends the Maryland Senator Edward J. Kasemeyer College Investment Plan Disclosure Statement, dated

December 2021, and supplemented in January 2022, April 2022, December 2022, June 2023, and December 2023. You

should review this information carefully and keep it with your current copy of the Plan Disclosure Statement and supplements.

The Maryland Senator Edward J. Kasemeyer College Investment Plan’s Program Manager is delegating certain program

management services to a new provider, Ascensus College Savings Recordkeeping Services, LLC (Ascensus) on

March 11, 2024.

Conversion Period

In order to facilitate an orderly transfer of records and administrative responsibilities to Ascensus, beginning on Thursday,

March 7, 2024, after the close of the New York Stock Exchange (“NYSE”) (generally 4 p.m. Eastern Time), the College

Investment Plan will experience a “blackout period” during which time you will not be able to transact on your Account. During

this time, you will be unable to open or close a College Investment Plan Account, change Investment Options, deposit money

into a College Investment Plan Account (including any recurring contributions), request or receive a distribution, update your

Account information, or effectuate any other College Investment Plan transaction. Any transaction requests that the College

Investment Plan receives in good order after the close of the NYSE on Thursday, March 7, 2024, will be processed as soon

as administratively reasonable when the blackout period ends on or after Monday, March 11, 2024. Transaction requests

received in good order during the blackout period will receive the trade date in effect on the date the transaction is processed.

If a current College Investment Plan form is received and the transaction cannot be completed before the blackout period

begins, or if you submit a current College Investment Plan form after the blackout period, you may be required to complete

a new form for the request, depending on the nature of the transaction.

Plan Address

Effective March 11, 2024, the College Investment Plan’s regular delivery address is updated to P.O. Box 55913 Boston,

MA 02205-5913 and the expedited delivery address is updated to 95 Wells Avenue Suite 160, Newton, MA 02429. All

correspondence addressed to the Maryland College Investment Plan should be sent to the updated addresses accordingly.

Any correspondence received at the prior address may be considered not in good order and returned to the sender.

Therefore, under Plan Governance and Administration, the following replaces the second sentence of the section titled

“Program Manager Address” on page 34:

All general correspondence, however, should be addressed to Maryland College Investment Plan, P.O. Box 55913 Boston,

MA 02205-5913.

Document Delivery Election Update

The new platform combines delivery preferences for Account statements and Plan Disclosure Statements into a single

election. Your delivery preference for statements and Plan Disclosure Statements will be based upon your current statement

delivery preference (for example, if you have currently elected electronic delivery of statements, you will be automatically

enrolled in electronic delivery of statements and Plan Disclosure Statements on the new platform). Delivery preferences for

confirmations and tax forms will remain the same and will be automatically carried over to the new platform. Account Holders

with online access will be prompted to review and reconfirm your document delivery preferences the first time you log in to

re-establish your online access at Maryland529.com.

Payroll Direct Deposit Process Update

Account Holders who are contributing to their Accounts through payroll deductions will receive a separate mailing with

transition instructions.

Investment Allocations

Prior to conversion, one Account was established for each Portfolio for each Beneficiary/Account Holder registration.

Contributions were allocated (and transactions processed) with respect to each Account in accordance with your instructions,

and you were required to include all applicable Account numbers in your transaction instructions. Effective March 11, 2024,

a single Account number will be assigned for all Portfolios linked to a Beneficiary/Account Holder registration, and investment

allocation percentages will be set for future contributions and other transactions.

You can set or update investment allocation percentages at any time after the conversion by logging into your Account at

Maryland529.com. Otherwise, if you have an AMC program on file, your investment allocation percentages will be set based

2

on your current AMC program. If you do not have an AMC program on file, your investment allocations will be set according to

the percent of current market value of each investment, unless you provide instruction to invest your contributions otherwise.

If you do not have an AMC program on file and your balance is currently at zero, you will need to provide instruction on how

you would like your investment to be made.

Gifting Portal

The online gifting tool, GoTuition

®

will be decommissioned with the platform change, and existing GoTuition

®

profiles will

no longer be accessible as of March 11, 2024. Account Holders can register to use the new gifting tool, Ugift, when

re-establishing online access at Maryland529.com, for future gifts to the College Investment Plan.

Service-Based and Other Fees

Effective March 11, 2024, a distribution request in which proceeds are sent by priority delivery service or electronically to a

school may be charged a Fee that is deducted directly from your Account. Fees assessed for priority delivery and electronic

payment to school will be treated as distributions, will be reported on Form 1099-Q, and may be considered Non-Qualified

Distributions. Additionally, returned checks or rejected ACH transactions will result in a Fee that may be deducted directly

from your Account.

Therefore, under Fees and Costs, the following replaces the “Service-Based and Other Fees” section on page 9:

We reserve the right to charge additional service-based and other Fees if we consider them to be necessary and reasonable.

In particular, if you request delivery of distribution proceeds by priority delivery service or, if available, electronic payment to

schools, we will deduct the applicable Fee listed in the chart below directly from your Account. Additionally, returned checks

or rejected ACH transactions will result in a Fee that may be similarly deducted directly from your Account. In our discretion,

if applicable, we may also deduct directly from your Account the other fees and expenses identified in the chart below or

similar fees or charges. We will report Fees assessed for priority delivery and electronic payment to schools as distributions

on Form 1099-Q. Such convenience Fees may be considered Non-Qualified Distributions. Please consult your tax professional

regarding calculating and reporting any tax liability associated with the payment of any of these Fees out of your Account.

TRANSACTION FEE AMOUNT*

Returned Check $25

Rejected ACH $25

Priority Delivery

of Checks

$25 weekday;

$60 foreign

Electronic Payment to

Schools (where available)

$10

*Subject to change without prior notice.

We reserve the right to not reimburse fees charged by financial institutions for contributions that are cancelled due to

insufficient funds in the bank account from which the money is withdrawn.

CCON0171324

GoTuition

®

is a trademark of T. Rowe Price Group, Inc.

K117-042 02/24

1

December 2023

IMPORTANT UPDATE TO THE MARYLAND SENATOR EDWARD J. KASEMEYER COLLEGE INVESTMENT PLAN

This supplement amends the Maryland Senator Edward J. Kasemeyer College Investment Plan Disclosure Statement, dated

December 2021, and supplemented in January 2022, April 2022, December 2022, and June 2023. You should review this

information carefully and keep it with your current copy of the Plan Disclosure Statement and supplements.

Tax Reform Measures

The SECURE 2.0 Act of 2022, which was signed into law on December 29, 2022, expanded rollover options for Section

529 college savings plans. Specifically, effective January 1, 2024, distributed amounts from a Section 529 college savings

plan account paid to a Roth IRA maintained for the college savings plan account’s Beneficiary will be considered Qualified

Distributions and excluded from taxation, subject to certain restrictions:

• The college savings plan account for the designated Beneficiary must have been maintained for at least 15 years;

• only contributions (and any earnings attributable thereto) made more than five years prior to the distribution are eligible;

• the amount eligible for transfer each year cannot exceed the annual IRA contribution limit; and

• the aggregate amount of all such distributions from 529 plans to any Roth IRA for the designated Beneficiary for all

taxable years cannot exceed $35,000.

As of the time of this publication, the IRS has not clarified how a college savings plan account must be maintained in order to

meet the 15-year requirement; for example, at this time, it is unclear if a rollover from one college savings plan to another, a

Beneficiary change, or an Account Holder change would impact an Account’s completion of the 15-year requirement. If you

have questions about your specific situation, discuss the matter with a qualified tax professional. The IRS may issue additional

guidance that may impact college savings plan account rollovers to Roth IRAs, including the above referenced conditions.

Therefore, in the Glossary beginning on page 2, the definition of “Qualified Distribution” is expanded to include this new

rollover option.

Annual Updates

On an annual basis, the Maryland Senator Edward J. Kasemeyer College Investment Plan and Portfolios are reviewed and

updates are made, as needed, to the information presented in the Disclosure Statement. This supplement includes updates to

the Portfolio details and descriptions, Neutral and Asset Allocations, Fees, the Approximate Cost for a $10,000 Investment,

and Investment Performance.

Also included are the federal gift tax exclusion limits, which have been updated for 2024.

Therefore, the following changes are made to the Maryland Senator Edward J. Kasemeyer College Investment Plan

Disclosure Statement:

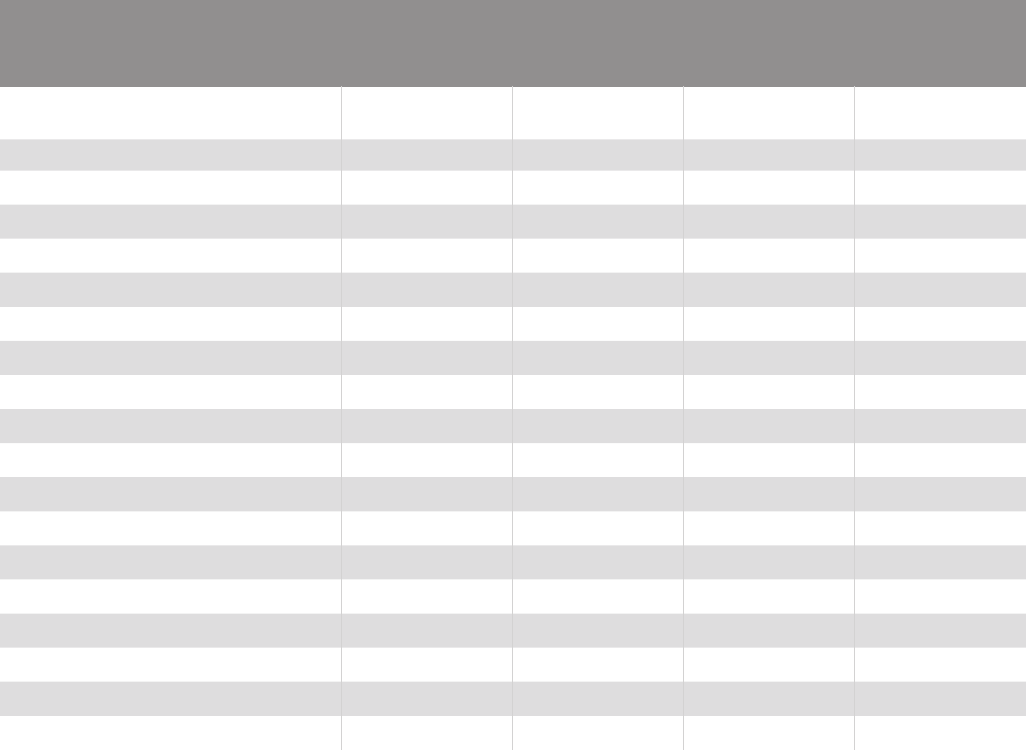

The following information updates the “Fee Structure” table in the Fees and Costs section on page 8.

FEE STRUCTURE

(As of October 1, 2023)

Investment Options

Estimated

Underlying Fund

Expenses

1

Program Fee

2

State Fee

3

Total Annual

Asset-Based

Fees

4

Portfolio 2042

5

0.58% 0.03% 0.05% 0.66%

Portfolio 2039

5

0.58% 0.03% 0.05% 0.66%

Portfolio 2036

5

0.56% 0.03% 0.05% 0.64%

Portfolio 2033

5

0.55% 0.03% 0.05% 0.63%

Portfolio 2030 0.53% 0.03% 0.05% 0.61%

Portfolio 2027 0.46% 0.03% 0.05% 0.54%

2

FEE STRUCTURE

(As of October 1, 2023)

Investment Options

Estimated

Underlying Fund

Expenses

1

Program Fee

2

State Fee

3

Total Annual

Asset-Based

Fees

4

Portfolio 2024 0.31% 0.03% 0.05% 0.39%

Portfolio for Education Today 0.29% 0.03% 0.05% 0.37%

Equity Index 500 Portfolio 0.05% 0.03% 0.05% 0.13%

Equity Portfolio

5

0.58% 0.03% 0.05% 0.66%

Extended Equity Market Index Portfolio 0.14% 0.03% 0.05% 0.22%

Global Equity Market Index Portfolio 0.14% 0.03% 0.05% 0.22%

Social Index Equity Portfolio 0.14% 0.15% 0.05% 0.34%

Balanced Portfolio 0.52% 0.03% 0.05% 0.60%

Bond and Income Portfolio 0.47% 0.03% 0.05% 0.55%

Inflation Focused Bond Portfolio 0.11% 0.03% 0.05% 0.19%

U.S. Bond Index Portfolio 0.12% 0.03% 0.05% 0.20%

U.S. Treasury Money Market Portfolio

6

0.23% 0.03% 0.05% 0.31%

1

The estimated underlying Fund expenses are based on a weighted average of each Fund’s expense ratio (net of any

expense limitations in place) based on a Fund’s most recent prospectus, in accordance with the Investment Option’s

neutral asset allocations among the applicable Funds as of October 1, 2023. You can call us to obtain the most recent

weighted average Fund expenses for each Investment Option. Additional information for each underlying Fund’s fees and

expenses can be found in the Fund’s most recent prospectus.

2

The Program Manager, T. Rowe Price, receives the Program Fee based on the assets in the College Investment Plan

to help offset certain recordkeeping and Account Holder servicing expenses associated with managing the College

Investment Plan. Payment of the Program Fee by each Portfolio is already reected in the Portfolio’s NAV.

3

The Trustee, Maryland 529, receives the State Fee of 0.05% based on the assets in the College Investment Plan to

help offset certain administrative and marketing expenses associated with administering the Maryland 529 programs.

Payment of the State Fee by each Portfolio is already reected in the Portfolio’s NAV.

4

This total is assessed against assets over the course of the year. Please refer to the Approximate Cost for a $10,000

Investment table that shows the total assumed investment cost over the 1-, 3-, 5-, and 10-year periods.

5

Contractual Fee limitations have been put in place for this Portfolio. Please see Program Fee in the Fees and Costs

section for details.

6

The Program Fee (and, if necessary, the State Fee) will be waived in whole or in part in the event that the Portfolio’s

expenses would result in a negative return for the U.S. Treasury Money Market Portfolio. For more information, see

Program Fee in the Fees and Costs section for details.

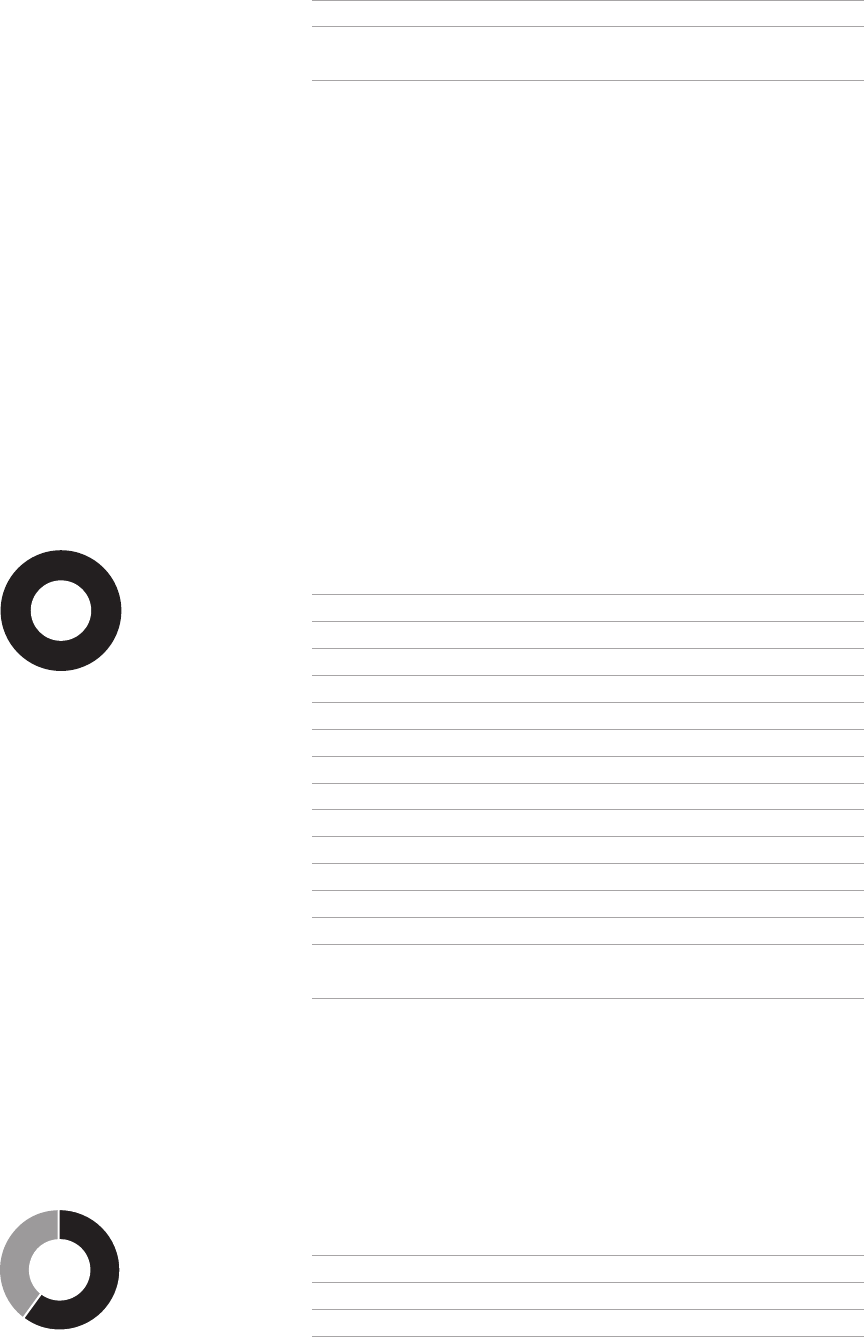

The following information updates the Approximate Cost for a $10,000 Investment section on page 9, as of

October 1, 2023.

The following table compares the approximate cost of investing in the College Investment Plan over different periods of time.

Your actual cost may be higher or lower. The table is based on the following assumptions:

• A $10,000 contribution is invested for the time period

shown.

• There is a 5% annually compounded rate of return on the

amount invested throughout the period.

• The Account is redeemed at the end of the period shown

to pay for Qualied Education Expenses.

• The table does not consider the impact of any potential

state or federal taxes on contributions or distributions.

• Total annual asset-based Fees remain the same as those

shown in the Fee Structure table. Future Fees may be higher

or lower.

• The table uses the weighted average of the Fund expenses

based on the neutral asset allocations as of October 1, 2022,

and assumes these allocations remain static throughout the

entire 10-year period. The actual allocations may change

over time.

3

APPROXIMATE COST FOR A $10,000 INVESTMENT

(As of October 1, 2023)

Investment Options One Year Three Years Five Years Ten Years

Portfolio 2042 $67 $211 $368 $822

Portfolio 2039 $67 $211 $368 $822

Portfolio 2036 $65 $205 $357 $798

Portfolio 2033 $64 $202 $351 $786

Portfolio 2030

1

$62 $195 $340 $762

Portfolio 2027

1

$55 $173 $302 $677

Portfolio 2024

1

$40 $125 $219 $493

Portfolio for Education Today $38 $119 $208 $468

Equity Index 500 Portfolio $13 $42 $73 $166

Equity Portfolio $67 $211 $368 $822

Extended Equity Market Index Portfolio $23 $71 $124 $280

Global Equity Market Index Portfolio $23 $71 $124 $280

Social Index Equity Portfolio $35 $109 $191 $431

Balanced Portfolio $61 $192 $335 $750

Bond and Income Portfolio $56 $176 $307 $689

Inflation Focused Bond Portfolio $19 $61 $107 $243

U.S. Bond Index Portfolio $20 $64 $113 $255

U.S. Treasury Money Market Portfolio $32 $100 $174 $393

1

Portfolio 2024, Portfolio 2027, Portfolio 2030, and Portfolio 2033 will be moved into Portfolio for Education Today in

2024, 2027, 2030, and 2033, respectively. At those times, the Portfolios will bear the expenses of Portfolio for Education

Today, which are likely to be lower than the expenses shown in this table.

Under How to Contribute to Your Account beginning on page 14, the following is added to Option for Unused

Contributions:

Effective January 1, 2024, you may also roll over unused assets to a Roth IRA established for the designated Beneficiary, subject

to certain restrictions, without incurring federal income taxes or the Distribution Tax. See Rollover to a Roth IRA under How to

Take a Distribution for additional information.

The following information updates the Portfolios section on page 15, as of October 1, 2023:

Enrollment-Based Portfolios

The following Neutral Allocations are depicted as of the fourth quarter of 2023. They are rounded to the nearest one-hundredth

of a percent and, therefore, may not total exactly 100%. Graphical depictions of the allocations to the broad asset classes for

each Portfolio may also be rounded. You should monitor your investments on a regular basis to ensure that they are consistent

with your savings goals. For the most recent allocations, please visit our website or call us.

4

Portfolio 2042—This Portfolio seeks long-term capital appreciation by investing in equity Funds. The strategy is based on the

understanding that the volatility associated with equity markets can be accompanied by the greatest potential for long-term

capital appreciation. Portfolio 2042 will typically begin to shift each quarter three years later than Portfolio 2039.

Portfolio 2039—This Portfolio seeks long-term capital appreciation by investing in equity Funds. The strategy is based on the

understanding that the volatility associated with equity markets can be accompanied by the greatest potential for long-term

capital appreciation.

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 18.62%

Value Fund—I Class 18.62%

Equity Index 500 Fund—I Class 10.63%

International Stock Fund—I Class 8.07%

International Value Equity Fund—I Class 8.07%

Overseas Stock Fund—I Class 8.07%

Small-Cap Stock Fund—I Class 6.65%

Real Assets Fund—I Class 5.00%

U.S. Equity Research Fund—I Class 3.72%

Mid-Cap Growth Fund—I Class 3.33%

Mid-Cap Value Fund—I Class 3.33%

Emerging Markets Discovery Stock Fund—I Class 2.14%

Emerging Markets Stock Fund—I Class 2.14%

U.S. Large-Cap Core Fund—I Class 1.60%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Short-Term Bond Fund—I Class 0.00%

Spectrum Income Fund—I Class 0.00%

U.S. Limited Duration TIPS Index Fund—I Class 0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2042

100% Stocks

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 18.62%

Value Fund—I Class 18.62%

Equity Index 500 Fund—I Class 10.63%

International Stock Fund—I Class 8.07%

International Value Equity Fund—I Class 8.07%

Overseas Stock Fund—I Class 8.07%

Small-Cap Stock Fund—I Class 6.65%

Real Assets Fund—I Class 5.00%

U.S. Equity Research Fund—I Class 3.72%

Mid-Cap Growth Fund—I Class 3.33%

Mid-Cap Value Fund—I Class 3.33%

Emerging Markets Discovery Stock Fund—I Class 2.14%

Emerging Markets Stock Fund—I Class 2.14%

U.S. Large-Cap Core Fund—I Class 1.60%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Short-Term Bond Fund—I Class 0.00%

Spectrum Income Fund—I Class 0.00%

U.S. Limited Duration TIPS Index Fund—I Class 0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2039

100% Stocks

5

Portfolio 2036—This Portfolio seeks long-term capital appreciation by investing in Funds focused predominantly on equity

markets with a small allocation to fixed income. The strategy is based on the understanding that the volatility associated with

equity markets may be accompanied by the greatest potential for long-term capital appreciation.

Portfolio 2033—This Portfolio seeks long-term capital appreciation by investing in Funds focused on equity markets with

additional exposure to fixed income. The strategy is based on the understanding that the volatility associated with equity

markets may be accompanied by the greatest potential for long-term capital appreciation.

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 13.45%

Value Fund—I Class 13.45%

Equity Index 500 Fund—I Class 7.69%

International Stock Fund—I Class 5.84%

International Value Equity Fund—I Class 5.84%

Overseas Stock Fund—I Class 5.84%

Small-Cap Stock Fund—I Class 4.81%

Real Assets Fund—I Class 3.61%

U.S. Equity Research Fund—I Class 2.69%

Mid-Cap Growth Fund—I Class 2.40%

Mid-Cap Value Fund—I Class 2.40%

Emerging Markets Discovery Stock Fund—I Class 1.54%

Emerging Markets Stock Fund—I Class 1.54%

U.S. Large-Cap Core Fund—I Class 1.15%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class 27.75%

Short-Term Bond Fund—I Class 0.00%

U.S. Limited Duration TIPS Index Fund—I Class 0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2033

72.25% Stocks

27.75% Bonds

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 16.29%

Value Fund—I Class 16.29%

Equity Index 500 Fund—I Class 9.31%

Overseas Stock Fund—I Class 7.07%

International Stock Fund—I Class 7.06%

International Value Equity Fund—I Class 7.06%

Small-Cap Stock Fund—I Class 5.82%

Real Assets Fund—I Class 4.38%

U.S. Equity Research Fund—I Class 3.26%

Mid-Cap Growth Fund—I Class 2.91%

Mid-Cap Value Fund—I Class 2.91%

Emerging Markets Discovery Stock Fund—I Class 1.87%

Emerging Markets Stock Fund—I Class 1.87%

U.S. Large-Cap Core Fund—I Class 1.40%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class 12.50%

Short-Term Bond Fund—I Class 0.00%

U.S. Limited Duration TIPS Index Fund—I Class 0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2036

87.5% Stocks

12.5% Bonds

6

Portfolio 2030—This Portfolio seeks long-term capital appreciation by investing in Funds focused on equity markets, with

additional exposure to fixed income. The strategy is based on the understanding that the volatility associated with equity

markets may be accompanied by the greatest potential for long-term capital appreciation.

Portfolio 2027—This Portfolio seeks capital appreciation and income by investing in a balanced mix of stock and fixed income

investments. This mix of Funds offers reduced exposure to equities while diversifying in fixed income markets to reduce the risk

and volatility typically associated with equity markets

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 7.45%

Value Fund—I Class 7.45%

Equity Index 500 Fund—I Class 4.26%

International Stock Fund—I Class 3.23%

International Value Equity Fund—I Class 3.23%

Overseas Stock Fund—I Class 3.23%

Small-Cap Stock Fund—I Class 2.66%

Real Assets Fund—I Class 2.00%

U.S. Equity Research Fund—I Class 1.49%

Mid-Cap Growth Fund—I Class 1.33%

Mid-Cap Value Fund—I Class 1.33%

Emerging Markets Discovery Stock Fund—I Class 0.85%

Emerging Markets Stock Fund—I Class 0.85%

U.S. Large-Cap Core Fund—I Class 0.64%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class 38.00%

Short-Term Bond Fund—I Class 12.00%

U.S. Limited Duration TIPS Index Fund—I Class 10.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2027

60% Bonds

40% Stocks

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 10.52%

Value Fund—I Class 10.52%

Equity Index 500 Fund—I Class 6.01%

International Stock Fund—I Class 4.56%

International Value Equity Fund—I Class 4.56%

Overseas Stock Fund—I Class 4.56%

Small-Cap Stock Fund—I Class 3.76%

Real Assets Fund—I Class 2.83%

U.S. Equity Research Fund—I Class 2.10%

Mid-Cap Growth Fund—I Class 1.88%

Mid-Cap Value Fund—I Class 1.88%

Emerging Markets Discovery Stock Fund—I Class 1.21%

Emerging Markets Stock Fund—I Class 1.21%

U.S. Large-Cap Core Fund—I Class 0.90%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Spectrum Income Fund—I Class 43.50%

Short-Term Bond Fund—I Class 0.00%

U.S. Limited Duration TIPS Index Fund—I Class 0.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2030

56.5% Stocks

43.5% Bonds

7

Portfolio 2024—This Portfolio seeks income by investing primarily in fixed income Funds with some exposure to stocks. For

additional diversification and some capital appreciation, the Portfolio also invests a small component in international equity

markets. This mix of Funds limits the exposure to equities while diversifying in fixed income markets in an effort to reduce the

risk and volatility typically associated with equity markets.

Portfolio for Education Today—Emphasizing a mix of high-quality fixed income Funds, this Portfolio also has a modest

allocation to equity Funds. The allocations reflect a lower-risk investment approach. Designed with a more conservative

strategy, this Portfolio seeks stability of principal by attempting to limit the risk associated with equity markets. This Portfolio is

designed for Beneficiaries who are already enrolled or about to enroll in school. It maintains an approximate 20% allocation to

equity Funds and is not guaranteed to preserve principal. There is also a small exposure to international stocks. The strategy’s

objective is to conserve principal while generating income at a time when the Account Holder may be withdrawing from an

Account for Qualified Education Expenses. However, an Account may experience losses, including losses near, at, or after the

enrollment date. There is also no guarantee that the Portfolio will provide adequate income at and throughout enrollment in

college or other schools.

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 3.72%

Value Fund—I Class 3.72%

Equity Index 500 Fund—I Class 2.13%

International Stock Fund—I Class 1.61%

International Value Equity Fund—I Class 1.61%

Overseas Stock Fund—I Class 1.61%

Small-Cap Stock Fund—I Class 1.33%

Real Assets Fund—I Class 1.00%

U.S. Equity Research Fund—I Class 0.74%

Mid-Cap Growth Fund—I Class 0.67%

Mid-Cap Value Fund—I Class 0.67%

Emerging Markets Discovery Stock Fund—I Class 0.43%

Emerging Markets Stock Fund—I Class 0.43%

U.S. Large-Cap Core Fund—I Class 0.32%

Portfolio for Education Today

80% Bonds

20% Stocks

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 4.23%

Value Fund—I Class 4.23%

Equity Index 500 Fund—I Class 2.42%

International Stock Fund—I Class 1.84%

International Value Equity Fund—I Class 1.84%

Overseas Stock Fund—I Class 1.83%

Small-Cap Stock Fund—I Class 1.51%

Real Assets Fund—I Class 1.14%

U.S. Equity Research Fund—I Class 0.85%

Mid-Cap Growth Fund—I Class 0.76%

Mid-Cap Value Fund—I Class 0.76%

Emerging Markets Discovery Stock Fund—I Class 0.49%

Emerging Markets Stock Fund—I Class 0.49%

U.S. Large-Cap Core Fund —I Class 0.36%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

U.S. Limited Duration TIPS Index Fund—I Class 36.25%

Short-Term Bond Fund—I Class 36.00%

Spectrum Income Fund—I Class 5.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Portfolio 2024

77.25% Bonds

22.75% Stocks

8

Fixed Portfolios

The following asset allocations to the broad asset classes generally do not change over time. The asset allocations to particular

underlying Funds are rounded to the nearest one-hundredth of a percent and, therefore, may not total exactly 100%. The

Fixed Portfolios that invest in more than one underlying Fund may vary within the limits described under Variances to Neutral

Allocations.

There are no changes to the asset allocations for the Equity Index 500 Portfolio, Extended Equity Market Index Portfolio, Global

Equity Market Index Portfolio, Social Index Equity Portfolio, Bond and Income Portfolio, Inflation Focused Bond Portfolio, U.S.

Bond Index Portfolio, and the U.S. Treasury Money Market Portfolio. Please see pages 17–19 of the Fixed Portfolios section of

Portfolios for the allocations of these Portfolios.

Equity Portfolio—Emphasizing long-term capital appreciation, this equity Portfolio invests in a broad range of Funds focused

on both domestic and international equity markets. It is designed for Account Holders who want a broadly diversified Portfolio

composed primarily of actively managed equity mutual Funds. Because this Portfolio invests in many underlying Funds, it will

have partial exposure to the risks of different areas of the market. This strategy is based on the understanding that the volatility

associated with equity markets may be accompanied by the greatest potential for long-term capital appreciation.

Balanced Portfolio—This moderately aggressive Portfolio seeks capital appreciation and income and focuses on a mix

of approximately 60% of its holdings invested in equity markets, including exposure to international stocks, while seeking

diversification through approximately 40% of its holdings allocated to fixed income. This strategy is based on accepting the risks

associated with stocks, which have the potential to provide high returns, and seeking to balance the effects of volatility through

diversification in fixed income securities.

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 18.62%

Value Fund—I Class 18.62%

Equity Index 500 Fund—I Class 10.63%

International Stock Fund—I Class 8.07%

International Value Equity Fund—I Class 8.07%

Overseas Stock Fund—I Class 8.07%

Small-Cap Stock Fund—I Class 6.65%

Real Assets Fund—I Class 5.00%

U.S. Equity Research Fund—I Class 3.72%

Mid-Cap Growth Fund—I Class 3.33%

Mid-Cap Value Fund—I Class 3.33%

Emerging Markets Discovery Stock Fund—I Class 2.14%

Emerging Markets Stock Fund—I Class 2.14%

U.S. Large-Cap Core Fund—I Class 1.60%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

Equity Portfolio

100% Stocks

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

Short-Term Bond Fund—I Class 40.00%

U.S. Limited Duration TIPS Index Fund—I Class 40.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

NEUTRAL ALLOCATION

T. Rowe Price Funds Focusing on Equities (Stocks):

Blue Chip Growth Fund—I Class 11.17%

Value Fund—I Class 11.17%

Equity Index 500 Fund—I Class 6.39%

Overseas Stock Fund—I Class 4.85%

International Stock Fund—I Class 4.84%

Balanced Portfolio

60% Stocks

40% Bonds

9

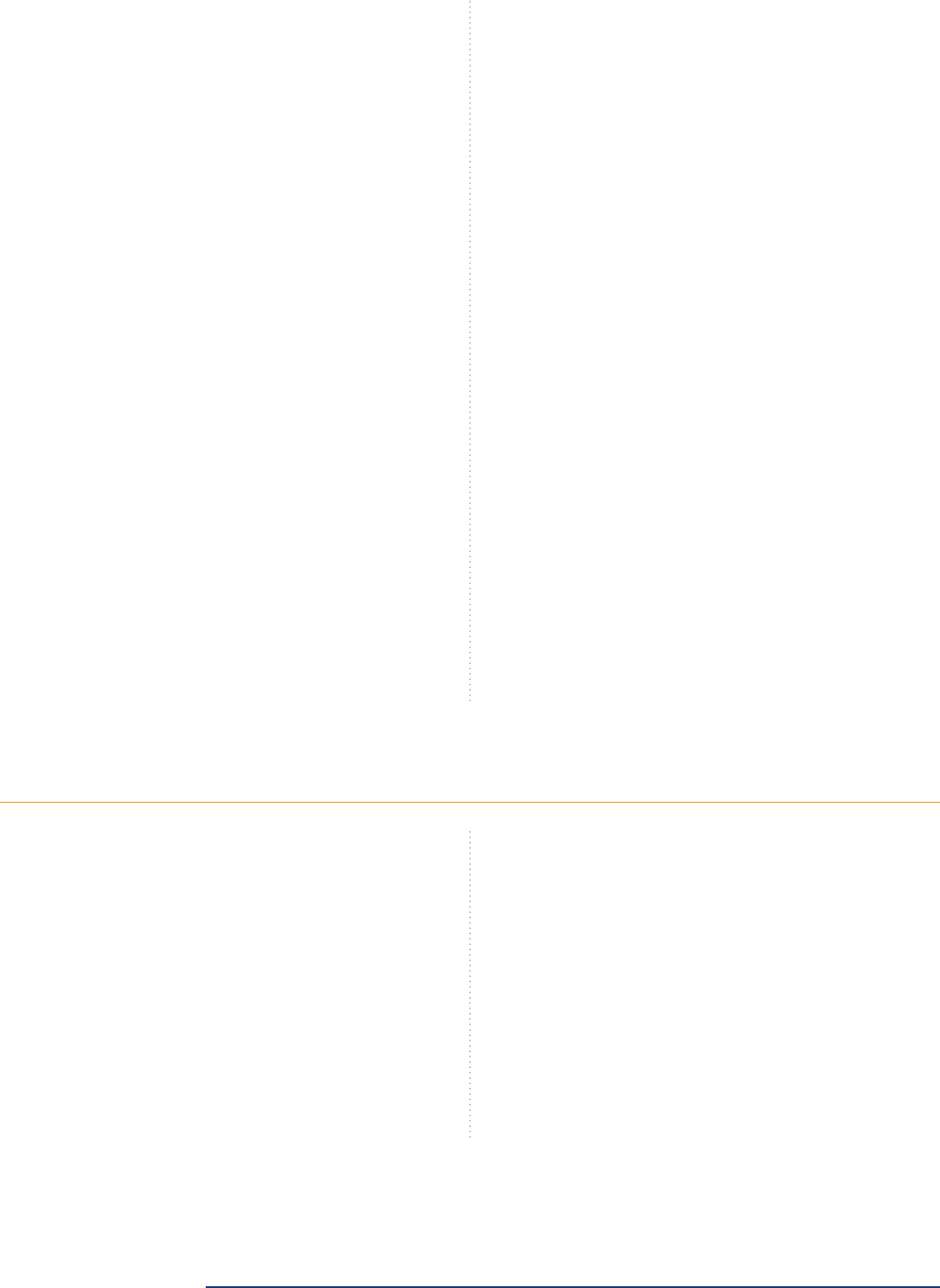

The following information updates the Investment Performance section on page 26, as of September 30, 2023.

Total Return (net of Fees) as of September 30, 2023

1

Portfolio Name

One-Year

Return

Annualized

Three-Year

Return

Annualized

Five-Year

Return

Annualized

Ten-Year

Return

Annualized

Return

Since

Inception

Annualized

Return-

Weighted

Benchmark

2

Inception

Date

Portfolio 2042 19.87% N/A N/A N/A -2.56% -1.05% 5/26/2021

Portfolio 2039 19.76% 6.62% 6.37% N/A 6.68% 7.74% 5/31/2018

Portfolio 2036 18.20% 6.67% 6.39% N/A 8.56% 9.14% 11/30/2015

Portfolio 2033 16.01% 5.72% 5.78% 8.04% 9.16% 9.36% 12/31/2012

Portfolio 2030 13.59% 4.60% 5.09% 7.37% 8.87% 8.81% 12/31/2009

Portfolio 2027 11.32% 3.50% 4.36% 6.55% 6.28% 6.02% 6/30/2006

Portfolio 2024 7.66% 2.94% 4.11% 5.89% 6.47% 6.29% 10/31/2003

Portfolio for Education Today 5.63% 1.53% 3.12% 2.94% 3.17% 3.31% 11/26/2001

Equity Index 500 Portfolio 21.50% 10.00% 9.71% N/A 10.92% 11.13% 3/29/2018

Equity Portfolio 19.80% 6.63% 6.36% 8.36% 7.08% 7.40% 11/26/2001

Extended Equity Market Index Portfolio 13.02% 5.18% 4.56% N/A 6.02% 10.39% 3/29/2018

Global Equity Market Index Portfolio

4

21.70% 7.87% 6.92% 8.72% 7.68% 8.06% 6/30/2006

Social Index Equity Portfolio 22.15% N/A N/A N/A -3.04% -2.71% 3/22/2022

Balanced Portfolio 12.67% 2.42% 4.11% 5.64% 6.07% 6.03% 11/26/2001

Bond and Income Portfolio 5.26% -0.63% 1.51% 2.42% 4.57% 3.25% 11/26/2001

Inflation Focused Bond Portfolio

4

1.81% 0.72% 2.16% 1.15% 1.93% 2.18% 10/31/2003

U.S. Bond Index Portfolio 0.30% -5.30% 0.08% N/A 0.04% 0.07% 3/29/2018

U.S. Treasury Money Market Portfolio

5

4.40% 1.65% 1.50% 0.89% 0.64% 0.83% 12/31/2009

The performance data shown represent past performance. Current performance may be higher or lower than the quoted past

performance, which cannot guarantee future results. Unit price, principal value, and return will vary, and you may have a gain

or loss when you take a distribution or change to a different Portfolio.

1

Total return gures include changes in principal value and income. Reinvested dividends and capital gain distributions

from the underlying Funds will become income to the Portfolios. However, the Portfolios do not distribute any dividends

or capital gains, so changes in the total return are reected by changes in the NAV. Performance information reects the

International Value Equity Fund—I Class 4.84%

Small-Cap Stock Fund—I Class 3.99%

Real Assets Fund—I Class 3.00%

U.S. Equity Research Fund—I Class 2.23%

Mid-Cap Growth Fund—I Class 2.00%

Mid-Cap Value Fund—I Class 2.00%

Emerging Markets Discovery Stock Fund—I Class 1.28%

Emerging Markets Stock Fund—I Class 1.28%

U.S. Large-Cap Core Fund—I Class 0.96%

T. Rowe Price Funds Focusing on Fixed Income (Bonds):

New Income Fund—I Class 28.00%

Emerging Markets Bond Fund—I Class 4.00%

High Yield Fund—I Class 4.00%

International Bond Fund—I Class 4.00%

T. Rowe Price Funds Focusing on Money Markets:

U.S. Treasury Money Fund—I Class 0.00%

10

deduction of the annualized State Fee and/or Program Fee, as applicable, and the underlying expenses of the Fund(s) in

which each Portfolio invests.

2

The weighted benchmark for each Portfolio is an unmanaged Portfolio composed of certain established indexes, which

do not reect any deductions for Fees, expenses, or taxes. You cannot invest directly into any weighted benchmark or

in any of the indexes that compose them. The amount that each weighted benchmark allocates to a particular index

is representative of the total mix of investments contained in each Portfolio. Benchmark performance commenced

on November 30, 2001, for the Portfolios with an inception date of November 26, 2001. Benchmark performance for

all other Portfolios commenced on the same date as the Portfolio’s inception date. More detailed information about

each weighted benchmark’s composition can be found in the College Investment Plan’s annual report, available at

Maryland529.com.

3

On January 2, 2013, Total Equity Market Index Portfolio became Global Equity Market Index Portfolio and Short-Term

Bond Portfolio was replaced with Ination Focused Bond Portfolio. The performance shown for certain periods reects

the performance while the Portfolio operated under its original name.

4

During certain time periods depicted, the Program Fee and/or State Fee was waived in whole or in part to prevent a

negative return for U.S. Treasury Money Market Portfolio.

Under How to Take a Distribution beginning on page 28, the following section is added after “Rollover Distribution”:

Rollover to a Roth IRA. Effective January 1, 2024, a Rollover Distribution is expanded to include reinvestment into a Roth IRA

established for the designated Beneficiary, provided certain additional requirements are met. Specifically, the college savings plan

Account must have been maintained for at least 15 years; only contributions (and any earnings attributable thereto) made more than

five years prior to the distribution are eligible; the amount cannot exceed the designated Beneficiary’s IRA contribution limit for the

year; and the aggregate amount of all rollovers from Qualified Tuition Programs to any Roth IRAs for the designated Beneficiary for

all taxable years cannot exceed $35,000.

To request a rollover to a Roth IRA, contact us for the appropriate distribution form. The Beneficiary must establish the Roth IRA to

receive the distributed amount, if not already established, and provide you (as the college savings plan Account Holder) with the

payee instructions to be included on the form. The assets must be transferred directly to the Roth IRA custodian.

Under Key Federal Tax Issues, beginning on page 29, the following replaces the section titled “Federal Gift/Estate Tax” in its

entirety:

Generally, if all amounts contributed by you on behalf of the Beneficiary, including any other gifts to the Beneficiary (over and above

any made to your Account) during the year do not exceed $18,000 ($36,000 for married couples making the proper election), no gift

tax will be imposed for the year. For 529 plans, gifts of up to $90,000 ($180,000 for married couples making a proper election) can

be made in a single year for a Beneficiary and averaged out over five years without gift taxes being imposed.

This allows you to move assets into tax-deferred investments and out of your estate more quickly. Generally, assets in your Account

are not included in your estate for federal estate tax purposes, unless you elect the five-year averaging and die before the end of the

fifth year.

If your Beneficiary dies, the value of the Account may be included in the Beneficiary’s estate for federal tax purposes. Further rules

regarding gifts and the generation-skipping transfer tax may apply in the case of distributions, changes of Beneficiaries, and other

situations. You should consult with a tax professional when considering a change of Beneficiary, transfers to another Account, or the

specific effect of the gift tax and generation-skipping transfer tax on your situation.

The federal limits discussed above are for the 2024 tax year. In future years, the IRS may change the annual amount that can be

excluded from federal gift taxes, so you should consult with your tax professional for details.

Under Key Federal Tax Issues, beginning on page 29, the following section is added after “Rollovers”:

Roth IRA Rollovers. Effective January 1, 2024, you may roll over part of or all of the money in your Account directly to a Roth IRA

established for the designated Beneficiary without adverse federal income tax consequences. Any rollover from a Qualified Tuition

Program to a Roth IRA is subject to the Beneficiary’s IRA annual contribution limit; furthermore, the aggregate amount of all rollovers

from Qualified Tuition Programs to any Roth IRAs for the designated Beneficiary for all taxable years cannot exceed $35,000. Addi-

tionally, for the rollover to be considered a Qualified Distribution, the rollover must meet other requirements as described in the Code,

such as the 15-year requirement and the 5-year contribution requirement described under “Rollover to a Roth IRA.”

The first paragraph in the section titled “Maryland Gift/Estate Taxes” on page 32 is deleted and replaced with the following:

Maryland law does not impose gift taxes. Therefore, in the event that you elect five-year averaging of contributions of up to $90,000

($180,000 for married couples making the proper election) and die prior to the end of the fifth year, a portion of the assets in your

Account, while subject to the federal gift tax, would not be subject to a Maryland gift tax.

11

This page is intentionally left blank.

12

This page is intentionally left blank.

CCON0166171 K117-041 12/23

Page 1 of 3

June 1, 2023

IMPORTANT UPDATE TO THE

MARYLAND SENATOR EDWARD J. KASEMEYER COLLEGE INVESTMENT PLAN

This supplement amends the Maryland Senator Edward J. Kasemeyer College Investment Plan

Disclosure Statement dated December 2021, as previously amended and supplemented in January

2022, April 2022, and December 2022 (as so amended and supplemented, the “Disclosure

Statement”). You should review this information carefully and keep it with your current copy of the

Disclosure Statement.

Background

Pursuant to Chapter 113 of the 2023 Laws of Maryland (the “2023 Legislation”), the Maryland 529

Board (the “Board”) has been abolished and the Maryland State Treasurer (the “State Treasurer”)

has both been named the successor to the Board and given the responsibility for administering the

Maryland Senator Edward J. Kasemeyer College Investment Plan.

Amendments to Disclosure Statement

As a result of the 2023 Legislation, the Disclosure Statement is amended as follows:

(a) On page 2, the definition of “Board” in the “Glossary” section i

s

hereby deleted.

(b) On page 2, the definition of “Enabling Legislation” is hereby deleted

and replaced with:

“Enabling Legislation: The law that established the Maryland 529

Program and the college savings programs administered by the

State Treasurer.” (Md. Code Annotated Education Art. §18-1901 et

seq. and §18-19A-01 et seq.).

(c) On page 3, the definition of “Maryland 529” in the “Glossary” section

is hereby deleted.

(d) On page 4, there is hereby added to the Glossary section a definition

of “State Treasurer” that reads as follows:

“State Treasurer: The Maryland State Treasurer.”

(e) On page 4, the definition of “We or our” is hereby revised as follows:

Page 2 of 3

“We or our: State Treasurer, the College Investment Plan, and/or the

Program Manager.”

(f) On page 5, in the “Plan Disclosure Statement Summary” section, the

f

irst sentence in the subsection titled “What is the College Investment Plan?” is

hereby deleted and replaced with:

“The College Investment Plan is a 529 Plan administered by the

State Treasurer.”

(g) On page 5, in the “Plan Disclosure Statement Summary” section, th

e

f

irst sentence in the subsection titled “Who is responsible for the College

Investment Plan” is hereby deleted and replaced with:

“The State Treasurer is the issuer and the administrator of the

College Investment Plan.”

(h) On page 30, in the "Key Federal Tax Issues” section, the first

sentence of the subsection titled “Rollovers” is hereby deleted and replaced with:

“You may roll over all or part of the money in your Account to

another Qualified Tuition Program (including, subject to limitations

in State law, the Prepaid College Trust) or to an eligible ABLE

account (by December 31, 2025) without adverse federal income

tax consequences if the transfer occurs within 60 days of the

withdrawal from your Account.”

(i) On page 32, in the “Plan Governance and Administration” section,

the second paragraph in the subsection titled “The College Investment Plan” is

hereby deleted and replaced with the following:

“The College Investment Plan is administered by the State

Treasurer. Monies held in the College Investment Plan are not

considered monies of the State and may not be deposited into the

General Fund of the State.”

(i) On page 32, in the “Plan Governance and Administration” section,

the “Legislative History” subsection is hereby amended to include reference to the

passage of the 2023 Legislation in the 2023 Legislative Session.