BUSINESS RULES AND PROCESS

DOCUMENT

(Trade-External)

Automated Commercial Environment (ACE)

Entry Summary (Version 11.0)

March 2023

CBP Publication No. 3125-0323

2

THIS PAGE LEFT INTENTIONALLY BLANK

3

Version 11.0

Date: 03/29/2023

Chapter Changes Summary

Chapter 1

(Entry Summary)

Section 1.11 added information about

for supporting documents.

responding to requests

Chapter 3

(Bonds)

The following information was added: bond definition; purpose

of bond forms and a hyperlink to the most current Office of

Management and Budget (OMB)-approved versions;

information required on the bond forms for eBond versus non-

eBond test participants; definitions for the parties to a bond and

the responsibilities of each party; information regarding

customs activities that require a bond with regulatory citations

for the bond requirement and bond conditions; clarification on

pipeline operator bonding requirements; guidance on the

revocation of CBP’s authority to permit use of continuous

bonds by suspended or debarred persons to secure customs

activities; guidance for CBP verification of bond amounts and

requesting additional security for temporary importation under

bond (TIB) entries; background on the ACE eBond test, bonds

eligible for transmission under the test, and how to transmit

bonds under the test; guidance on cash in lieu of surety; and an

additional references section.

Chapter 4

(Blanket Declarations)

Updated references from NAFTA to USMCA.

Chapter 5

(Temporary Importations

under Bond)

Section 5.3-TIB Extensions added mention of CBPF 3173.

Section 5.5 - New section titled TIB Export Examination

Procedures.

Section 5.6 - Added information about partial exportations.

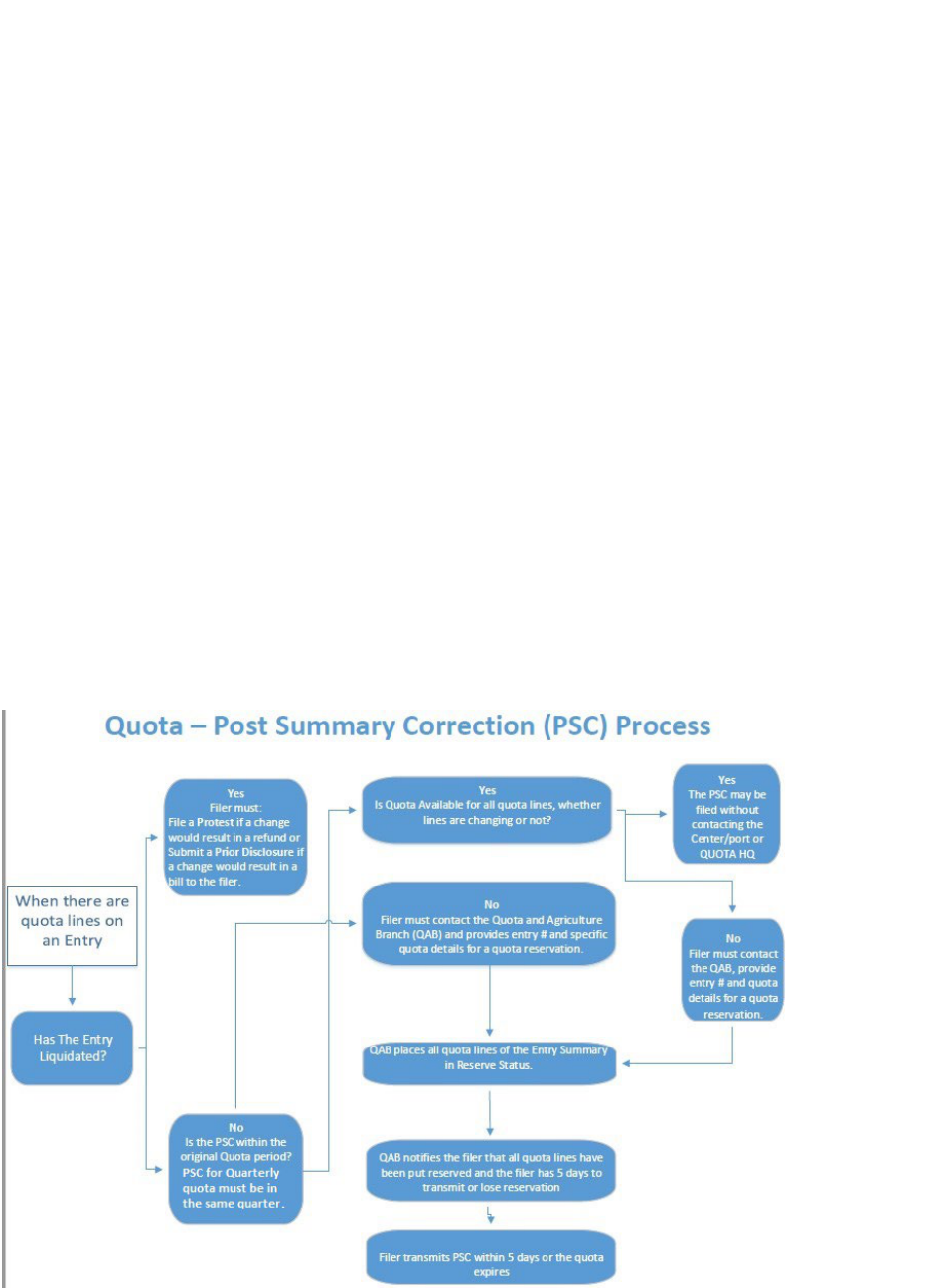

Chapter 6

(Post Summary Correction

(PSC))

Minimal grammatical changes for clarity.

NAFTA with USMCA.

Section 6.5 Replaced

Chapter 7

(Quota)

Typos/grammar fixes. Clarification of ET for eastern time

instead of EST (includes year-round and EDT instead of just

EST). Change for consistency in appearance of three items

required for presentation date throughout the document.

4

Chapter Changes Summary

Clarification of local port time vs ET for presentation date

requirements.

Chapter 9

(Liquidations)

Updates made to Section 9.20 Official Notice Search.

Chapter 10

(Reconciliation)

Section 10.7 - Added information about the new ACE

capability that requires original amounts for double flagged

Recon entries.

Chapter 11

Addition of Protest Issue changes and minimal grammatical

(Protest and 520(d))

changes for clarity.

Section 11.4 Added submitting a spreadsheet with a protest as a

best practice.

Chapter 12

(Warehouse Entries and

Withdrawals)

General updates throughout the section. Added information

regarding new permit file folder label available in DIS, In-

Bond movements, ACE Reports for Final Withdrawal Indicator

and submission of the permit file folder or activity summary

report.

Chapter 15

(Defense Contract

Management Agency

(DCMA) Entries)

General updates added regarding Harbor Maintenance Fee

(HMF) exemption when merchandise is classified under some

HTS chapter 98 provisions and reference to (CSMS #47138649

and CSMS #46189077), general recordkeeping requirements

and the Duty Free Entry (DFE) eTool System replaced by the

new Procurement Integrated Enterprise Environment (PIEE)

Platform.

Chapter 16

(USMCA Duty Deferral)

References to the NAFTA have been changed to the USMCA.

Chapter 17

(

Foreign Trade Zones (Entry

Type 06))

General updates regarding entry type 06 (FTZ), weekly entry

filed in ACE, the time limits specified in 19 CFR 142.12(b)

and

the 9-character Zone ID unique identifier assigned to each FTZ

Site location plus further resources available and related CSMS

messages.

Chapter 18

(

Trade Fair Foreign Exhibits

(Entry Type 24))

Updates made to the entire section by differentiating between

sections regarding a trade fair entered for consumption or when

exported.

Minor grammatical changes for clarity.

Chapter 19

(Collections)

Updates to Available Reports in Section 19.6.

Chapter 20

(Informal Entries)

Updates made to the entire section to reflect

processes governing informal entries.

regulations and

5

Chapter Changes Summary

Chapter 22

Updates made regarding reporting a cyber-event outage.

(Outage and Closure

Chapter title changed from “Downtime Procedures” to “Outage

Procedures)

and Closure Procedures”.

Chapter 23

Various elements throughout CBP Form 5106 chapter were

(Create Update Importer

amended including form link, removal of 5106 inbox, changes

Identification Form (CBP

to statuses and DIV/DBA/AKA section. Also provided

Form 5106))

additional guidance on where to submit CBP Form 5106 if

trade community is unable to process.

Chapter 24

Updates made regarding express consignment entities and

(Consolidated Express Filing

entries that are not allowed to be filed via CEF. A note section

(CEF))

added regarding CEF Information Notice, which provides the

changes in ACE and other additional resources.

Other

Chapter on Remote Location Filing removed.

6

THIS PAGE LEFT INTENTIONALLY BLANK

7

Table of Contents

Chapter 1 Entry Summary Processing ............................................................................................ 9

Chapter 2 Non-ABI/Manual Entry Summary ............................................................................... 15

Chapter 3 Bonds ............................................................................................................................ 16

Chapter 4 Blanket Declarations .................................................................................................... 35

Chapter 5 Temporary Importation under Bond (TIB) .................................................................. 40

Chapter 6 Post Summary Correction (PSC) .................................................................................. 43

Chapter 7 Quota ............................................................................................................................ 48

Chapter 8 Antidumping and Countervailing Duties (AD/CVD) .................................................... 59

Chapter 9 Liquidation ................................................................................................................... 74

Chapter 10 Reconciliation ............................................................................................................. 75

Chapter 11 Protest and 520(d) Claims .......................................................................................... 85

Chapter 12 Warehouse Entries and Withdrawals ......................................................................... 89

Chapter 13 Drawback .................................................................................................................... 94

Chapter 14 ACE Reports ............................................................................................................. 108

Chapter 15 Defense Contract Management Agency (DCMA) Entries ....................................... 110

Chapter 16 United States-Mexico-Canada Agreement (USMCA) Duty Deferral ...................... 111

Chapter 17 Foreign Trade Zones (Entry Type 06) ...................................................................... 112

Chapter 18 Trade Fair Foreign Exhibits (Entry Type 24) ........................................................... 115

Chapter 19 Collections ................................................................................................................ 116

Chapter 20 Informal Entries ........................................................................................................ 118

Chapter 21 HTS Reporting For Multiple Classifications ............................................................ 119

Chapter 22 Outage and Closure Procedures .............................................................................. 120

Chapter 23 Create/Update Importer Identification Form (CBPF 5106) ..................................... 122

Chapter 24 Consolidated Express Filings (CEF) ........................................................................ 132

8

Summary Processing

Overview

T

he purpose of this document is to outline entry summary processing in the

Automated Commercial Environment (ACE). ACE is the system of record for all

entry summaries. This change moves the import process from a paper-based system

to a true electronic system of recordkeeping, please see Recordkeeping in ACE. A

change this significant requires revised operational policies and procedures, which

this document addresses. This document is a living document and will be updated as

additional ACE functionality is added.

This document has been updated to clarify several processes and procedures

related to ACE entry summary business rules.

If you have any comments or questions about this document, please email:

OTENTRYSUMMAR[email protected]OV

For the latest information on the ACE Mandatory Dates, go to:

https://www.cbp.gov/trade/automated/ace-mandatory-use-dates

ACE Background

The importation of goods into the United States, is generally a two-part process

consisting of:

1 . ) Filing the cargo release documents necessary to determine

whether merchandise may be released from U.S. Customs and

Border Protection (CBP) custody, and

2 . ) Filing the entry summary documents that pertain to

merchandise classification, duty, taxes, and fees.

Currently, over 99% of all entry summaries are filed electronically using the Electronic

Data Interchange (EDI). The interface system that allows EDI transmissions to CBP’s

automated systems is the Automated Broker Interface (ABI). Entry summaries are

categorized by “entry type” to facilitate more effective processing of these

transactions. Ninety-six percent of all entry summaries filed are type 01-consumption

and type 11-informal. Consumption entries are generally filed for commercial

shipments and are supported by a surety bond to ensure compliance and payment of

duties, taxes, and fees. Informal entries are typically low-value commercial and

personal imports entered into the U.S. for consumption. In general, informal entries

are valued at $2,500 or less unless the goods are subject to import restrictions for which

other rules apply.

9

Chapter 1

Entry Summary Processing

1.1 Entry Summary Transmission

The Automated Commercial Environment (ACE) is an integrated system for tracking information

on imports and exports. It enables the Trade to electronically submit forms, data, and electronic

documents. It enables CBP to electronically retrieve and review Trade information and CBP

documentation.

ACE is used by CBP, Trade, and Partner Government Agencies (PGAs).

The interface system that allows Electronic Data Interchange (EDI) transmissions to ACE is the

Automated Broker Interface (ABI).

All entry summaries filed in San Juan (SJFO) and the U.S. Virgin Islands (USVI) must be

processed by those ports of entry regardless of Center assignment of the Importer of Record

(IOR).

The Client Representatives are the first point of contact for the trade community when it relates to

automating their systems for interactions with CBP for system-related problems after automation

and any questions on transmitting data to CBP.

If a census warning occurs when the filer is transmitting the entry summary, the filer may correct

or override the census warning and retransmit.

1.2 System Generated Notification (Cargo Release)

If the filer receives a “documents required” message upon entry submission in ACE Cargo

Release, that is an indicator that CBP and/or a Partner Government Agency (PGA) is requesting

supporting documentation for further review.

1.3 Entry Filing

The time of entry is the time CBP authorizes the release of the merchandise; or the time the entry

documentation is filed, and the merchandise has arrived within port limits; or the time the

merchandise arrives within the port limits, if the entry documentation is submitted before arrival,

and if requested by the importer on the entry documentation at the time of submission.

Entry documents must be filed within 15 calendar days of the date that a shipment arrives in the

U.S.

The entry must be accompanied by evidence that a bond has been posted with CBP to cover any

potential duties, taxes, and fees that may accrue. Bonds may be secured through a resident U.S.

surety company but may be posted in the form of United States currency or certain U.S.

government obligations. In the event that a customs broker is employed for the purpose of making

entry, the broker may permit the use of their bond to provide the required coverage.

10

1.4 Entry Summary Filing

If an entry summary serves as both the entry documentation and entry summary, the time of entry

will be the time the entry summary is filed in proper form with estimated monies owed to CBP.

An entry summary for consumption must be filed and estimated duties deposited within 10

working days after entry of the merchandise.

1.5 Control Status

Once ACE accepts the transmission, the control status remains in Trade control and the filer can

delete the entry summary record, remove the entry summary from a daily statement or reschedule

the entry summary by placing it on a future daily statement until the entry summary is in CBP

control.

Control status types and trade action conditions include:

• Trade - The entry summary has been accepted in ACE and has not yet been paid.

• CBP - The entry summary has been accepted in ACE and has been fully paid or is on

statement

1.6 Entry Summary Record-Keeping

Except for drawback, any record required to be made, kept, and rendered for examination and

inspection by CBP under the record-keeping requirements or any other provision shall be kept for

five years from the date of entry, if the record relates to an entry, or five years from the date of the

activity that required creation of the record.

1.7 Data Changes

All data changes should be made by the filer as early as possible. CBP should reject the entry

summary if data changes are needed, in accordance with the Entry Summary Acceptance and

Rejection Policy.

Filers have the ability to revise transmitted entry summary data until the entry summary is in fully

paid status and under CBP control.

1.8 Center ID

If a Center ID is assigned to an importer, ACE will automatically populate the Center ID field in

the entry summary.

1.9 Entry Summary Versions

Filers can view the entry summary versions, if any, through an ACE entry summary query or an

ACE Report.

The number to the right of the decimal reflects how many times the entry summary changed by

CBP (e.g., 1.01).

The number to the left of the decimal reflects how many times the entry summary changed by the

filer (e.g., 2.0).

11

1.10 Entry Summary Edits

The filer should make the changes affecting the entry summary in most circumstances; however,

there may be instances in which CBP users may have to make the changes on the entry summary,

such as editing prior to reliquidation from the approval of a protest.

1.11 Supporting Documents

CBP will request supporting documents if the CBP reviewer determines additional information is

needed to review and process the entry summary.

CBP will issue a CBP Form 28 for any additional information needed, through CBP’s Forms

module. The importer will respond to the request for additional information through the ACE

portal or the Document Imaging System (DIS) if applicable. The time frame to respond is 30

days from the date of issuance of notice. If requested, an extension may be authorized under the

discretion of CBP.

A courtesy copy of each CBP Form 28, paper or electronic, should be provided to the broker.

Supporting documents may include, but are not limited to:

CBP Form 247 (Cost Submission)

• Detailed header and line-level spreadsheets

• Cost analysis spreadsheets

• Commercial invoice

• Packing list

• Bill of lading

• Purchase orders

• Contracts

• Manufacturers affidavit

• Inventory records

• Documents supporting apportionment of assists

• Free Trade Agreement (FTA) certificate of origin

1.12 CBP Form 29

A CBP Form 29 is a Notice of Action. It may include a change in the classification and/or value

of the imported merchandise on the entry summary and may result in a rate advance of duty.

The Center of Excellence and Expertise (Center) will provide, through the CBP Forms module, a

written explanation on the form as to why the action was taken on the entry summary. If the

action is proposed, the importer will have 20 days to respond through the ACE Portal or DIS if

applicable. If the action is taken and the entry liquidated, the trade will have to protest CBP’s

decision.

A courtesy copy of each CBP Form 29, paper or electronic, should be provided to the broker.

1.13 ACE Entry Summary Review Notification

ACE notifies the filer via ABI with an entry summary status notification message that an entry

summary has been selected for team review.

12

The filer may receive the following electronic notifications prior to the filing of the entry

summary:

• Request for entry summary package (UC2; also commonly referred to as “documents

required.”) These documents must be provided to CBP, by the time of summary filing in

accordance with 19 CFR 142.3. The filer may choose to respond to the request for the

entry summary package via the ACE Portal or the Document Image System (DIS). Once

the filer receives the action number (via ABI message), the filer may upload the requested

documents in the portal. The filer will receive a document receipt acknowledgement

message (ABI message UC7).

The filer may also receive the “documents required” electronic notification after filing the entry

summary:

• CBP users may also electronically request documents within the first 30 days of the

submission of the entry summary. The filer may receive a UC2 or UC3 message when the

CBP user generates the request for documents, depending on the request. After the 30-day

period, the CBP user will use the CBP Form 28, Request for Information, to issue requests

for documents.

Notification Codes Received (also found in the ACE Entry Summary Status Notification

CATAIR on cbp.gov): on cbp.gov):

UC1 – Request for electronic invoice

UC2 – Request for the entry summary package

UC3 – Request for specific documents

UC4 – Entry summary rejected/PSC rejected

UC5 – ACE entry summary inactivated

UC6 – Entry summary canceled

UC7 – Document receipt acknowledgement

UC8 – Partner Government Agency (PGA) processing status information

UCP - PGA processing status information

UCQ - Quota accepted

UCE - TIB extension denied

UCR – Post Summary Correction (PSC) filed was reverted.

1.14 Entry Summary Rejections

When CBP rejects an entry summary, the filer will receive an ABI notification message “entry

summary rejected.”

The filer may request a rejection after filing entry summary; however, the entry summary must be

paid and not liquidated. See the Entry Summary Acceptance and Rejection Policy for rejection

time limits.

If the entry was initially submitted to CBP and rejected before the 10

th

day of filing entry

summary, the filer has the remainder of the 10

th

working day deadline to resubmit the entry

summary but not less than two working days to resubmit entry summary.

13

Rejected entry summaries must be returned to CBP with any additional payment (if applicable)

within two working days from the date of rejection or a no-file liquidated damage case may be

issued. If the rejected entry summary is received after two working days from the date of

rejection, a late-file liquidated damage case could be issued. Exception: AD/CVD, refer to the

section “AD/CVD” in the Business Rules and Process Document for additional information.

1.15 Collections

All goods imported into the United States are subject to duty or duty-free entry in accordance

with their classification under the applicable items in the Harmonized Tariff Schedule of the

United States.

Duties, fees, taxes, and interest owed to CBP must be deposited at the time of filing an entry

summary.

Initial payment must be made at the port of entry designated on the entry summary.

To expedite the collection process, CBP recommends that additional payments, such as for post

summary corrections, for entry summaries be filed at the port of entry designated on the entry

summary. Payments made at another port of entry may slow down the collection process.

Upon retransmission of a rejected entry summary, if additional money is owed, the filer must pay

by check. If paying by check, the filer should include the entry summary number on the check

along with a copy of a CBP Form 7501 or equivalent document.

If there is a net difference of less than $20 between the total amount of duties, taxes, fees,

including interest in the original liquidation, CBP has the authority to disregard the difference and

liquidate “as entered” per 19 CFR 159.6 (De Minimis Rule). There are exceptions for

reliquidation at the importers request.

Due dates:

ACE calculates to the date and if the due date falls on a weekend or a holiday, the due date will be

the next business day.

If the filer uses the Automated Clearing House (ACH) debit method of payment, then the entry is

considered paid when authorized. If the filer uses daily or monthly statements, then the entry is

considered paid when received.

Refer to the Collections Chapter for additional information.

1.16 Informed Compliance

Informed compliance is a shared responsibility between CBP and the import community. CBP

communicates its requirements to the trade, and the trade is expected to exercise reasonable care

in their importing operations. Reasonable care means that importers and trade entities must be

familiar with trade laws and regulations affecting imported merchandise. Not complying with

CBP’s import regulations, whether intentional or not, can result in penalties.

14

1.17 Liquidated Damages

Liquidated damages could be initiated if the entry summary is filed without payment, filed late,

not filed at all or other conditions of the basic importation and entry bond are not met.

1.18 Entry Summary Cancellation

There may be instances in which the filer requests a cancellation of an entry/entry summary. The

filer must follow the policy/procedures when requesting a cancellation. It is the importers

responsibility to request and provide supporting information for the cancellation.

All Center entry summary cancellation request must be uploaded in DIS with the cover letter

outlining the issue as to why the entry summary should be cancelled along with all back-up

documents to substantiate the request. The broker will then send an email to the Center inbox

utilizing https://www.cbp.gov/trade/centers-excellence-and-expertise-information/cee-directory

to determine what Center is affected and alerting them of the cancellation request.

If payment was made on the entry summary prior to the cancellation request and the entry

summary is not liquidated, the filer should request an administrative refund.

Once an entry summary is liquidated, it cannot be canceled.

1.19 Liquidation

An entry not liquidated within one year from the date of entry of the merchandise, the date of the

filing of a reconciliation entry, or the date of final withdrawal of all merchandise covered by a

warehouse entry, will be deemed liquidated by operation of law at the rate of duty, value,

quantity, and amount of duties asserted by the importer of record.

Notice of liquidation will be given electronically as provided in 19 CFR 159.

Once an entry summary is liquidated, it cannot be cancelled.

Refer to the Liquidation Chapter for additional information.

1.20 Status Updated

Status updates and processing requests for an entry summary by the filer should be sent to the

Center of Excellence and Expertise that is processing the entry summary.

1.21 References

• 19 CFR 141 for the legal citations on entry of merchandise.

• 19 CFR 142 for the legal citations on entry process.

• 19 CFR 159 for the legal citations on liquidation of duties.

• 19 CFR 163 for recordkeeping requirements.

• 19 CFR 172 for liquidated damages; penalties information.

• CBP.gov Trade Programs

• ACE Automated Broker (ABI) and CBP and Trade Automated Interface Requirements

(CATAIR)

• ACE Support

• Centers of Excellence and Expertise

15

Chapter 2

Non-ABI/Manual Entry Summary

2.1 Non-ABI Review

Non-ABI means the entry summary was not transmitted electronically through the Automated

Broker Interface (ABI).

Non-ABI entry summary documents and timeliness requirements are the same as ABI entry

summary requirements.

The Trade can submit their non-ABI entry summary via paper through the Document Imaging

System (DIS). CBP will review the documents and manually place the entry/entry summary

information in ACE.

If the documents are submitted to CBP in person, the invoice can serve as the release notification

when given back to the filer. If the documents are submitted to CBP electronically, an electronic

notification of the release is sufficient.

The Client Representatives are the first point of contact for the trade community when it relates to

automating their systems for interactions with CBP.

2.2 Filer Codes

CBP assigns a unique (3) three-character entry filer code to all licensed brokers and self-filing

Importers based on qualifications. The Importer or filer will place an 11-character entry number

they assign on the entry/entry summary documentation.

If the filer needs to request an entry filer code, the filer must submit their request in writing on

their company letterhead to their Center or Port of Entry assigned.

2.3 Non-ABI/Manual Entry Summary Collection

Non-ABI entry summaries must be paid via single pay, they are not allowed on statement.

2.4 Non-ABI/Manual Entry Summary Lineless Processing

Only U.S. Virgin Island ports may use lineless Non-ABI entry summary input for the following

entry types; 01, 06, 08, 11, 21, 22, 23, 24, 25, 31, 51, and 52. Excluding Quota, AD/CVD,

Reconciliation, Drawback and Vessel Repair.

2.5 References

19 CFR 142.3a (Entry Numbers)

19 CFR 142.48 (Release Procedures)

Non-ABI/Manual Entry Summary

16

Chapter 3

Bonds

3.1 Bonding Authority

Section 623 of the Tariff Act of 1930, as amended (19 U.S.C. 1623), provides CBP with broad

authority to require a bond, by regulation or specific instruction, where CBP deems it necessary to

protect the revenue of the United States or ensure compliance with any provision of law,

regulation, or instruction which CBP is authorized to enforce. See 19 U.S.C. 1623(a). Section 623

also provides the authority to prescribe the conditions and form of the bond, the manner in which

the bond may be filed (including electronically), and the amount of the bond. See 19 U.S.C.

1623(b)(1).

The CBP regulations governing bonds are found in part 113 of Chapter 1 of title 19 of the Code of

Federal Regulations (19 CFR §113). Per 19 CFR § 113.1, where a bond or other security is not

specifically required by law or regulation, the Commissioner of CBP may by specific instruction

require, or authorize the Director, Revenue Division, or the port director

1

to require, such bonds

or other security considered necessary for the protection of the revenue or to assure compliance

with any pertinent law, regulation, or instruction. These regulations outline a paper-based bond

process designed to complement other paper-based processes in Title 19. However, after the

promulgation of these regulations, many aspects of the customs entry process are now electronic

(as opposed to paper-based) and conducted in the Automated Commercial Environment (ACE).

3.2 Bond Definition and Bond Forms

A bond is an ‘insurance policy’ taken out by a party engaging in transactions or activities with

Customs to adequately protect the revenue of the United States and to ensure compliance with any

pertinent law, regulation, or instruction regarding the conduct of that business.

The most current OMB-approved versions of CBP Form 301 (Customs Bond) and CBP Form

301A (Addendum to CBP Form 301) can be found on the CBP Forms page on CBP.gov.

The purpose of the Customs Bond (CBP Form 301) is to bind the named parties to the United

States for the amount(s) of any duty, tax, or charge and compliance with law or regulation as a

result of activity covered by any condition on the bond.

The purpose of the Addendum to CBP Form 301 (CBP Form 301A) is to identify additional co-

principals not listed on the CBP Form 301 and to bind the named parties to the United States for

the amount(s) of any duty, tax, or charge and compliance with law or regulation as a result

of activity covered by any condition on the bond. If a bond has more than two co-principals, a

CBP Form 301A is required.

The information required to be submitted on the bond depends on whether the bond is filed by an

eBond test participant or a non-eBond test participant.

1

See Delegation Order 14-004: Delegation of Authorities to Center Directors, in which the Commissioner of CBP

granted Center Directors all functions, authorities, rights, privileges, powers and duties vested in Port Directors by

law, regulation, or otherwise.

17

For non-eBond test participants, the bond must meet the requirements of 19 CFR Part 113. Per 19

CFR Part 113.21 the information required on the bond includes:

•

Identification of principal and sureties,

•

Identification of trade names and unincorporated divisions of a corporate principal,

•

Date of execution, and

•

Statement of Amount.

Per 19 CFR Part 113.26 the effective dates of bonds are as follows:

•

Continuous Bond –

o

Effective on the effective date identified on the CBP Form 301.

o

May be filed up to 60 days prior to the effective date listed on the CBP Form 301.

•

Single Transaction Bond (STB) –

o

Effective on the date of the transaction identified on CBP form 301.

Non-eBond test participants must submit the full set of information required on the OMB-

approved Form 301 and 301a (if applicable).

See the eBond Test Overview section of this chapter for the information required to be submitted

on the bond by an eBond test participant.

3.3 Parties to a Bond and Party Responsibilities

The bond is a contract between two parties: the principal and surety. The principal is the party

contracting for the bond with the surety. The surety is the guarantor, normally an insurance

company. The principal and the surety, together, are considered obligors.

Other parties to a bond include:

• Co-Principal - a party, in addition to the principal, sharing the same bond.

• User - an unincorporated division of a company authorized to use the bond in the

principal’s name.

• Obligee - the party to whom the Obligor is responsible for fulfilling the conditions of the

bond (i.e., the beneficiary of the bond) – in most cases CBP is this beneficiary but may be

another party.

The principal and co-principal are responsible for:

• Obtaining a bond as necessary

• Complying with all applicable laws and regulations

• Paying all revenue due (estimated & liquidated duties, taxes, and fees) even if it

exceeds the bond amount

• Paying liquidated damages (or mitigated amount) not to exceed the bond amount.

The surety is responsible for:

• Submitting bonds on behalf of parties to a bond

• Paying revenue due (estimated & liquidated duties, taxes, and fees) only up to the

bond amount

18

• Paying liquidated damages (or mitigated amount) not to exceed the bond amount.

The user(s) are responsible for:

• Complying with all applicable laws and regulations.

3.4 Bond Requirement

A bond is required for a variety of customs activities. Below are the customs activities which

require a bond. The regulatory citations for the requirement, as well as the regulatory citations for

the bond conditions have been provided.

A bond is required:

• When a party imports merchandise into the United States (whether entered for

consumption, entered for warehouse, imported temporarily under bond, or released

conditionally) (19 CFR § 142.4 (formal entries), 19 CFR § 10.31(f) (temporary

importations), 19 CFR § 113.62 (basic importation and entry bond conditions));

• When a party imports merchandise subject to other Federal agency requirements where

failure to redeliver could pose a threat to public health and safety or merchandise is

subject to quota or visa requirements (19 CFR § 12.3 (bond required for goods subject to

the Federal Food, Drug, and Cosmetic Act, the Federal Insecticide, Fungicide, and

Rodenticide Act, and the Federal Hazardous Substances Act), 19 CFR § 142.4 (formal

entries), 19 CFR § 113.62 (basic importation and entry bond conditions));

• When carriers are transporting imported merchandise that has not been entered from one

place to another (19 CFR § 18.1(e), 19 CFR § 113.63 (basic custodial bond conditions));

you may hear this referred to as in-bond or in-bond movement;

• When a warehouse or facility operator is approved to store or secure imported

merchandise (19 CFR § 19.2(c) or (e), 19 CFR § 113.63 (basic custodial bond

conditions));

• When an international carrier transports cargo or passengers via air, vessel or vehicle from

a foreign destination (19 CFR 4.3(b)(2) (formal entry of the vessel at an optional location),

19 CFR 4.30(c) (request for a permit or special license to unlade or lade a vessel); 19 CFR

122.38(d) (request for a permit or special license to unlade or lade an aircraft); 19 CFR §

123.8(c) (permit or special license to unlade or lade a vessel or vehicle from Canada or

Mexico), 19 CFR § 113.64 (international carrier bond conditions));

• When a party is approved for accelerated drawback payments (19 CFR § 191.92(d), 19

CFR § 113.65 (repayment of erroneous drawback payment bond conditions));

• When a party brings in and takes out of the Customs territory of the U.S. an instrument of

international traffic (19 CFR 10.41a(c), 19 CFR § 113.66 (control of containers and

instruments of international traffic bond conditions));

• When a party serves as an accredited gauger or laboratory (19 CFR § 151.12(f)(1)(vii)

(laboratories), 19 CFR § 151.13(d)(1)(vii) (gaugers), 19 CFR § 113.67 (commercial

gauger and commercial laboratory bond conditions));

19

• When a party seeks to make entry of any merchandise and is unable to present a valid bill

of lading or other evidence of right to make entry on that merchandise with CBP (19 CFR

§ 141.15, 19 CFR § 113.69 (production of bills of lading bond conditions));

• When clearance is granted to a vessel manifestly built for warlike purposes and about to

depart from the United States with a cargo consisting principally of arms and munitions of

war when the number of people intending to sail or other circumstances render it probable

that the vessel is intended to commit hostilities against the subjects, citizens, or property

or any foreign country with which the United States is at peace (19 CFR § 4.73(b), 19

CFR § 113.71 (bond condition to observe neutrality));

• When a person claims an interest in seized property pursuant to 19 USC 1608 (19 CFR §

162.47(b) (summary forfeitures), 19 CFR § 113.72 (bond condition to pay court costs

(condemned goods)));

• When a party is approved to operate a foreign trade zone or subzone (19 CFR § 146.6(d),

19 CFR § 113.73 (foreign trade zone operator bond conditions));

• When a party imports merchandise subject to an International Trade Commission (ITC)

exclusion order (19 CFR § 12.39(b)(2), 19 CFR § 113.74, 19 CFR Part 113 Appendix B

(bond to indemnify complainant under section 337, Tariff Act of 1930, as amended));

• When a party imports a large yacht for sale at a U.S. boat show and seeks deferral of entry

completion and duty deposit (19 CFR § 4.94a(a)(2), 19 CFR § 113.75, 19 CFR Part 113

Appendix C (bond for deferral of duty on large yachts imported for sale at U.S. boat

shows));

• When a party seeks access to the secure CBP area of an airport (19 CFR § 122.182(c)(1),

19 CFR § 113.62(i) (basic importation and entry bond conditions), 19 CFR § 113.63(f)

(basic custodial bond conditions), 19 CFR § 113.64(k) (international carrier bond

conditions), 19 CFR Part 113 Appendix A (Airport Customs Security Area Bond));

• When a trademark or copyright owner wants a sample of potentially violative or violative

imported merchandise for examination (19 CFR §§ 133.21(c)(2) (trademarks; following

presentation for examination) or (f) (trademarks; following seizure), 133.42(e)

(copyrights; following seizure), 133.43(c) (copyrights; following presentation for

examination), 19 CFR § 113.70 (bond condition to indemnify U.S. for detention of

copyrighted material));

• When a party is required to provide Importer Security Filing information to CBP (19 CFR

§ 149.5(b), 19 CFR § 113.62(j) (basic importation and entry bond conditions), 19 CFR §

113.63 (g) (basic custodial bond conditions), 19 CFR § 113.64(f) (international carrier

bond conditions), 19 CFR § 113.73(c) (foreign trade zone operator bond conditions), 19

CFR Part 113 Appendix D (Importer Security Filing Bond)).

Bonds may be waived in certain circumstances. See the References section of this chapter for

citations related to the waiver of bonding requirements.

When merchandise is imported, bonds are generally required to secure the revenue of the United

States because the final determination of duties, taxes, and fees (referred to as liquidation) is not

made when merchandise is imported, but possibly many months or years afterwards. CBP permits

20

the release of merchandise prior to the final determination of all duties, taxes, and fees owed,

provided the importer of record posts a bond or other security to insure payment and compliance

with other applicable laws and regulations. Importers of record obtain (either directly or through

licensed customs brokers) a bond from a company referred to as a surety. The importer of record

(or its licensed customs broker) purchases the bond and is thus the principal on the bond. The

surety issues the bond and the beneficiary of the bond in most cases, is CBP; but may be another

party. Continuous bonds secure transactions for a period of up to one year and renew

automatically for successive one-year periods unless they are terminated sooner. Single

transaction bonds secure only one transaction.

In most formal entry transactions, a bond is on file in eBond at the time the entry is filed, and

estimated duties, taxes, and fees are deposited by the importer of record shortly thereafter. The

imported merchandise may be released from CBP custody while the final amounts of duties,

taxes, and fees owed await final determination by CBP at a later point in time. With a bond in

place, the revenue is considered to be protected from, among other risks, the risk that the importer

of record will be unable or unwilling to pay the difference between the estimated duties, taxes,

and fees deposited by the importer of record at or shortly after entry and the amounts actually

determined to be due at liquidation. However, the protection offered is limited by the amount of

the bond.

CBP clarified the bonding requirement for pipeline operators in Memorandum, INFORMATION:

Clarifying Bond Requirements for Pipeline Operator (August 31, 2021). It states that:

•

The movement of imported merchandise through a pipeline must be secured by either a

basic importation and entry bond or a basic custodial bond. Specifically, a basic custodial

bond with the conditions found at 19 C.F.R. § 113.63 (Activity Code 2) is required to be

filed by the owner or operator of a pipeline to secure any movement of merchandise

imported through the pipeline that is otherwise not secured by a basic importation and

entry bond with the conditions found at 19 C.F.R. § 113.62 (Activity Code 1).

•

A basic custodial bond is still required to transport merchandise that is not yet entered and

is intended to be entered later after transport to a different port or is intended for export

(also known as “transportation in bond” or “in-bond movement”).

• At this time, pipeline operators are not required to obtain an international carrier bond

with the conditions found at 19 C.F.R. § 113.64 (Activity Code 3) in addition to the basic

custodial bond or basic importation and entry bond.

On May 21, 2021, Office of Trade, Trade Policy and Programs, issued Memorandum,

INFORMATION: Revocation of Authority to Permit Use of Continuous Bonds by Suspended or

Debarred Persons. It states that:

21

• When U.S. Customs and Border Protection (CBP), or any other Federal agency, suspends

or debars a person (the word “person” means any individual, corporation, partnership,

association, unit of government, or legal entity, however organized), it excludes that

person from participating in certain procurement or nonprocurement Federal transactions,

such as government contracts, subcontracts, grants, cooperative agreements, scholarships,

fellowships, contracts of assistance, loans, loan guarantees, subsidies, and other Federal

assistance programs, for the duration of his or her suspension and/or debarment. Such

exclusion protects these Federal transactions from waste, fraud, abuse, poor performance,

or noncompliance.

• Effective May 11, 2021, pursuant to the authority granted by 19 U.S.C. § 1623 and 19

C.F.R. § 113.2, the Senior Official Performing the Duties of the Commissioner of CBP

revoked the authority of all CBP officials to permit a person who is suspended or debarred

by CBP to meet the bond requirements of any customs activity using a continuous bond,

for the duration of that person’s suspension or debarment, unless a continuous bond is the

only form of bond acceptable for that activity, such as operating a foreign trade zone (19

C.F.R. § 113.73). For persons who are suspended or debarred by another Federal agency,

the Office of Trade, Trade Policy and Programs, is authorized to evaluate and decide,

either categorically or on a case-by-case basis, whether to permit such persons who are

suspended or debarred by another Federal agency to use a continuous bond to secure their

customs activities during the period of their suspension or debarment.

• The Office of Trade, Suspension and Debarment Branch, will ensure that persons

suspended or debarred by CBP are listed as excluded by CBP on the System for Award

Management (SAM) website (www.SAM.gov).

• The Office of Finance, Revenue Division, will provide written notice to any person

suspended or debarred by CBP or any person suspended or debarred by another Federal

agency that CBP has decided not to permit use of a continuous bond to secure that

person’s customs activities, and that person’s continuous bond surety (as applicable), at

least 15 calendar days prior to the first customs activity that cannot be secured by a

continuous bond under this policy.

• Sureties and surety filers are encouraged to ensure that new or replacement continuous

bonds are not filed in the Automated Commercial Environment (ACE) eBond module and

that any existing continuous bonds are terminated in ACE eBond for persons suspended or

debarred by CBP and listed as excluded by CBP on the SAM website.

• Sureties and surety filers are also encouraged to work with their clients to ensure that new

or replacement continuous bonds are not filed in the ACE eBond module and that any

existing continuous bonds are terminated in ACE eBond for persons who have been

suspended or debarred by another Federal agency and listed as excluded by that Federal

agency on the SAM website, where written notice has been issued to the person and that

person’s continuous bond surety (as applicable) by the Office of Finance, Revenue

Division, because CBP has decided not to permit use of a continuous bond to secure that

person’s customs activities.

22

• The Office of Finance, Revenue Division, will continue to monitor continuous bonds and

will ensure that any continuous bonds that are not terminated after issuance of the written

notice described above are rendered insufficient, as necessary, for persons suspended or

debarred by CBP or for persons suspended or debarred by another Federal agency that

CBP has decided not to permit use of a continuous bond to secure that person’s customs

activities. In addition, any new or replacement continuous bonds will be rendered

insufficient, as necessary, if filed for persons suspended or debarred by CBP or for

persons suspended or debarred by another Federal agency that CBP has decided to not to

permit use of a continuous bond to secure that person’s customs activities.

• When a person’s suspension and/or debarment terminates, use of a continuous bond to

secure customs activities may resume.

• Consistent with existing CBP regulations and policy, persons not permitted to use a

continuous bond are still permitted to use single transaction bonds or cash in lieu of surety

(for single transactions only) to engage in customs activities. CBP officials remain

authorized to take additional actions as authorized by law, regulation, or agency policy

when the circumstances so warrant, such as requiring additional bonding to protect the

revenue or to ensure legal compliance.

• Trade was notified of the bond policy for suspended or debarred persons in CSMS

message #47894086 issued May 21, 2021, which included the ‘Finding CBP Exclusions in

SAM’ PDF as an attachment.

• A link to the CSMS message, a copy of the ‘Finding CBP Exclusions in SAM’ PDF, and

Frequently Asked Questions have also been posted to the Bond section of CBP.gov.

3.5 Bond Amounts

CBP establishes required bond amounts for imported merchandise pursuant to 19 CFR 113.13 and

Customs Directive 3510-004, Monetary Guidelines for Setting Bond Amounts, dated July 23,

1991, which sets forth guidelines and specific formulas for CBP personnel to follow when setting

bond amounts that may be issued for imported merchandise. Certain bond formulas in the

Directive have been amended since the Directive was originally published, and those amended

formulas (last amended on Oct. 24, 2013) are available on CBP.gov under Current Bond

Formulas.

As a matter of practice, and with few exceptions, because CBP made these formulas public,

importers of record and the sureties with whom they do business typically calculate the required

bond amount and transmit such bonds to CBP.

Note: The continuous bond reviewer and analytical formulas in the Current Bond Formulas

document are used by the Office of Finance, Revenue Division, to determine bond sufficiency.

Only the Office of Finance, Revenue Division, may issue notice regarding the sufficiency of a

continuous bond and require a new continuous bond amount.

23

Foreign Trade Zone (FTZ) Operator Bond Interim Guidance:

On Oct. 28, 2020, CBP issued CSMS #44578062 to provide Interim Guidance for Foreign Trade

Zone (FTZ) Operator Bond Amounts. Per the CSMS, on Aug. 28, 2020, CBP, Office of Trade,

issued internal interim guidance to the Ports of Entry regarding the computation and request of

new and annual of Foreign Trade Zone (FTZ) operator bonds.

The interim guidance serves as a supplement to Customs Directive 3510-004, Monetary

Guidelines for Setting Bond Amounts, dated July 23, 1991 and takes precedence over FTZ

Manual - Section 12.2. This guidance will remain in effect from the date of issuance until either

updated interim guidance or an updated directive is issued with a risk-based FTZ operator bond

formula.

FTZ Manual, Section 12.2, states:

“The initial FTZ operator bond will generally be in the amount of the duties and fees owed on the

average value of foreign status non-duty paid merchandise held in the zone and the bond should

be evaluated on an annual basis.”

Customs Directive 3510-004 states:

“Activity 4 - Foreign Trade Zone Operator – Continuous: When the bond is for a Foreign Trade

Zone operator, the bond limit of liability amount shall be fixed in an amount the district director

may deem necessary to accomplish the purpose for which the bond is given, but not less than

$50,000.”

While discretion is an important aspect in setting bond amounts, the principles of national

uniformity or standardization must also be followed regardless of the particular technique or

formula used to determine the bond amount. Setting the amount of a bond must not be an

arbitrary action.

Effective Aug. 28, 2020 the following interim guidance applies to FTZ operator bonds:

• Ports of Entry may only require a $50,000 FTZ operator bond for each initial FTZ

activated location.

o If the FTZ operator is filing a bond for an individual FTZ activated location, the

bond amount on file must be in an amount not less than $50,000.

o If the FTZ operator is filing a consolidated bond to cover all FTZ activated

locations nationwide, the bond on file must be in an amount not less than $50,000

for each activated FTZ location.

• A new bond may be warranted under the following circumstances:

o the activated zone area is substantially altered per FTZ manual, Section 4.11;

o the character of merchandise admitted to the zone or operations performed in the

zone are substantially changed;

24

o the annual review reveals that growth in estimated liability exceeds 10%;

o a zone violation(s) or potential violation(s) is deemed a threat to the revenue or

proper law enforcement; or

o any other reason substantially affecting liability of the Operator under the bond.

If a new bond is required, the Office of Finance, Revenue Division, will issue a letter to the

impacted parties indicating that the current bond is not sufficient and must be terminated and

replaced with a new bond. No other type of notice from the Port of Entry or other CBP office will

serve as official notice of insufficiency.

If you have any questions or concerns or receive instructions from a Port of Entry to the contrary,

please contact Bond Policy within the Commercial Operations, Revenue and Entry (CORE)

Division at [email protected].

Temporary Importations under Bond (TIB) interim guidance:

On November 12, 2022, CBP Office of Trade issued CSMS # 53992279 - CBP Verification of

Bond Amounts and Requests for Additional Security for Temporary Importation Under Bond

(TIB) Entries. The message states that:

On November 7, 2022, U.S. Customs and Border Protection (CBP), Office of Trade issued an

internal memorandum to CBP personnel to provide guidance for verifying bond amounts for

Temporary Importation Under Bond (TIB) entries and requesting additional security under a

Single Transaction Bond (STB) when a Continuous Bond (CB) is on file but is not sufficient to

cover the TIB requirements in 19 CFR § 10.31(f).

The Bond Amounts Required for TIB entries are as follows:

• For all merchandise except the categories below, the bond shall be in an amount equal

to 2x the estimated duties, including fees, determined at the time of entry per 19 CFR §

10.31(f).

• In the case of samples solely for use in taking orders entered under subheading

9813.00.20, HTSUS, motion-picture advertising films entered under subheading

9813.00.25, HTSUS, and professional equipment, tools of trade and repair

components for such equipment or tools entered under subheading 9813.00.50,

HTSUS, the bond shall be in an amount equal to 110 percent of the estimated duties,

including fees, determined at the time of entry per 19 CFR § 10.31(f).

• In the case of restricted/prohibited merchandise, the bond shall be in an amount equal

to the greater of 2x the duty including fees or 3x the value (19 CFR § 113.62(n)(1)) of the

merchandise.

CBP Requests for Additional Security for TIB entries:

The regulations under 19 CFR § 10.31(f) allow for the use of either a CB or STB to secure TIB

entries. There are situations where the CB on file with CBP is not in an amount sufficient to meet

the TIB bonding requirements, noted above, placing the revenue at risk.

25

If the CB is not sufficient to cover the TIB requirements, the Office of Finance – Revenue

Division (OF-RD), Port of Entry, or Center may require an additional STB to protect the revenue.

The additional STB will be in an amount equal to the difference between the CB amount and the

bond amount required for the TIB entry.

For example:

If the CB used to secure the TIB entry is for $50,000 and the bond amount required for the

TIB entry, is $150,000, an additional STB in the amount of $100,000 is required.

As stated above, the regulations under 19 CFR § 10.31(f) allow for a CB to be used to secure TIB

entries, and further, multiple TIBs can be filed using the same CB. If an STB is needed, the

amount requested should be the difference between the CB and the TIB bond amount for that

entry, regardless of how many entries are secured by the same valid CB.

For example:

If 3 TIB entries are submitted on the same $50,000 CB and the TIB bond amount required

for each TIB entry is $100,000, the amount requested for the additional STB will be

$50,000 for each TIB entry.

Notice of the required additional STB from CBP must be in writing to the Importer and must

contain the amount of the additional bond required, as well as information about the reason for

the additional bonding. The notice can be provided in an entry summary reject notice, a cargo

reject notice, on a CBP Form 29 Notice of Action, or via insufficiency letter (from OF-RD only).

When notice is provided by CBP in an entry summary or cargo reject notice, the timeframes for

rejecting entries in the Entry Summary Acceptance and Rejection policy apply.

This guidance serves as a supplement to Customs Directive 3510-004, Monetary Guidelines for

Setting Bond Amounts, dated July 23, 1991 and will remain in effect from the date of issuance

until either updated guidance or an updated Directive is issued.

If you receive instructions from CBP to provide additional security for a TIB entry contrary to

this notice, please contact Bond Policy within the Commercial Operations, Revenue and Entry

(CORE) Division at [email protected].

Questions related to bond policy for TIB entries should be sent to Office of Trade, Bond Policy at

[email protected]. All other TIB questions should be sent to Office of Trade at

Activity Code 1 (Basic Importation and Entry) Continuous Bond ACE Validations:

Effective June 20, 2020, the following validations for Activity Code 1 (Basic Importation and

Entry) Continuous Bonds were deployed to ACE:

• Verify bond amount is greater than or equal to $50,000

• Verify bond amount is incremented by $10,000 when between $50,000 and $100,000, and

by $100,000 when greater than $100,000

26

Note: Validations will be triggered only when a new bond is added or if the incremented

amount is less than the prescribed amount. Should the new continuous bond not pass the

validations listed above, Trade users will receive error code “S15” with narrative text “BOND

AMOUNT INVALID OR MISSING”, which is an existing error message.

The ACE Activity Code 1 (Basic Importation or Entry) Continuous Bond validations align with

the requirements outlined in the Current Bond Formulas document.

3.6 eBond Test Overview

On Nov. 28, 2014, CBP published a notice in the Federal Register (see 79 FR 70881) announcing

a test of an electronic bonding system (eBond), designed to evaluate the functionality of the

system, its impact on trade, and CBP’s ability to protect the revenue of the United States and

enforce applicable laws. Pursuant to the eBond test, participating sureties were invited to

transmit electronic bonds, riders, and terminations to ACE through an electronic data interchange

(EDI). The test requires that all bonds and riders be transmitted by the surety obligated on the

bond, or by a surety filer authorized to transmit bonds on behalf of the surety obligated on the

bond.

The ACE eBond test commenced on January 3, 2015 and is a voluntary program that

allows approved eBond test participants (sureties, surety agents, or principals who authorize an

approved surety or surety agent to transmit a bond on their behalf), to transmit certain activity

code bonds to ACE via the CBP-approved electronic data interchange (or EDI) or via email to

CBP’s Office of Finance-Revenue Division for manual input into ACE.

The list of approved eBond test participants is maintained by the Office of Finance – Revenue

Division.

eBond Test Participants may transmit certain Single Transaction Bonds or Continuous Bonds:

• Electronically to ACE eBond, using the surety’s software, via the Electronic

Data Interchange (EDI), or

• Email them to the Office of Finance – Revenue Division at [email protected]

for manual input into ACE.

• These transmissions only require a sub-set of information from the OMB-approved Form

301. See ACE CATAIR – Customs eBond Create/Update Chapter for the sub-set of

information required.

The electronic transmission memorializes the agreement of the principals and sureties on the bond

to be bound by the terms and conditions of that bond.

The eBond test utilizes an automated system (eBond system) that provides for the transmission of

electronic bond contracts (eBonds) between principals and sureties, generally with CBP as the

third-party beneficiary (although it may be another party), in the Automated Commercial

Environment (ACE) for the purpose of linking those eBonds to the transactions they are intended

to secure. The eBond system works with ACE to ensure that transactions secured by an eBond

have the proper bond coverage to protect the revenue and secure legal compliance.

27

ACE will validate the bond number referenced on an entry/entry summary against bonds on file in

eBond. If a match cannot be found in eBond, the entry/entry summary will be rejected.

The eBond test, which began on January 3, 2015, has been modified in subsequent Federal

Register notices and is ongoing. See 80 FR 899 (January 7, 2015) and 83 FR 12403 (March 21,

2018).

3.7 eBond Test Participant Transmission via EDI or Email

All single transaction or continuous eBonds and eBond riders transmitted pursuant to this test

must be transmitted to ACE electronically, either via the CBP-approved Electronic Data

Interchange (EDI) or emailed to CBP Office of Finance at [email protected] for

manual input into ACE. The transmission of eBonds to CBP must be made by a surety or surety

agent.

The below chart lists each bond activity code eligible for transmission via the eBond test, in

accordance with Federal Register notices 79 FR 70881 eBond Test, 80 FR 899 eBond Test

Modifications and Clarifications, and 83 FR 12403 Extension of NCAP; eBond Test. It contains

the name of the activity, whether a single transaction and/or continuous bond may be filed, and

how each bond activity code may be transmitted to CBP.

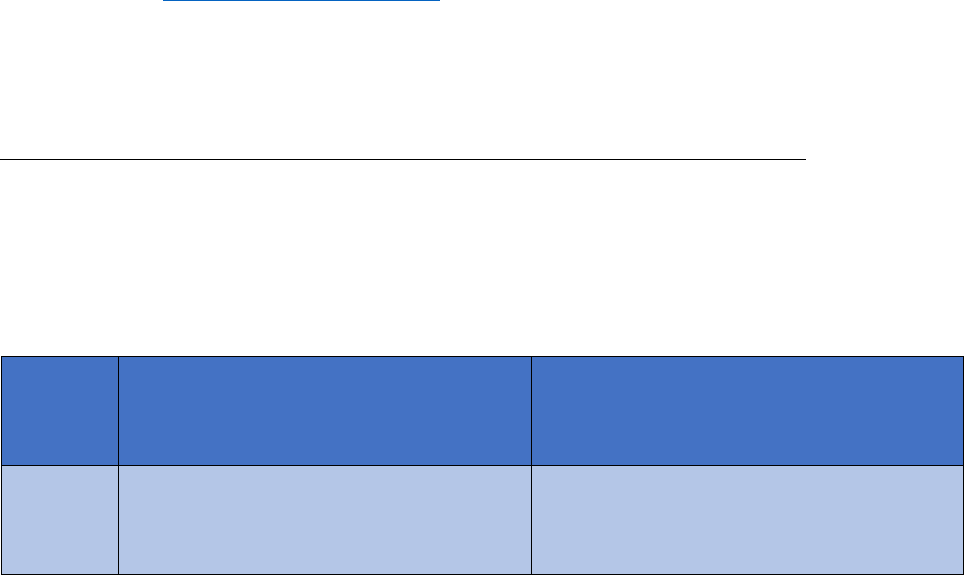

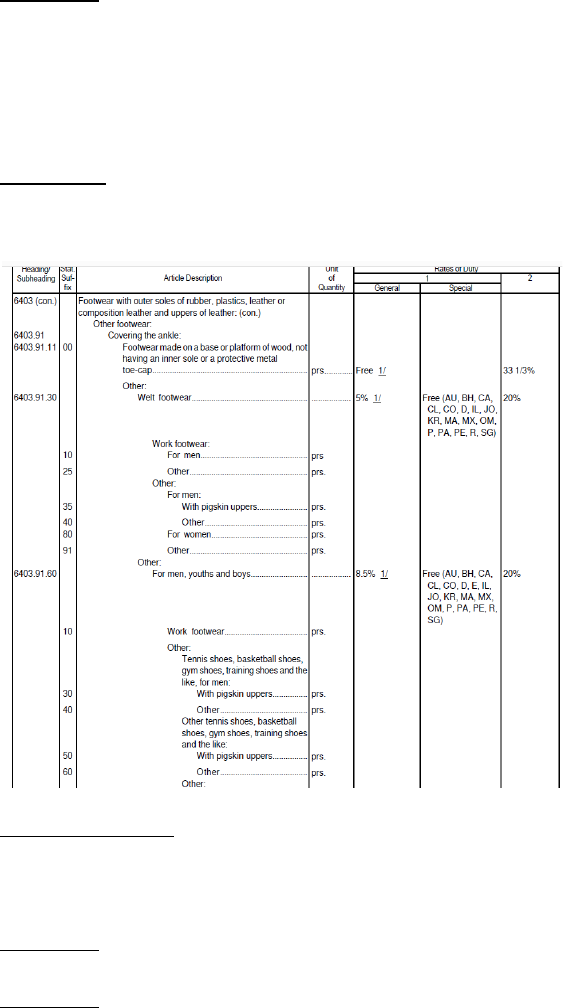

Bonds Eligible for Transmission via the ACE eBond Test

Activity

Code

Activity Name

Single Transaction

and/or Continuous

Bond

Surety/Surety Agent may

transmit via

1

Basic Importation and

Entry

Single Transaction &

Continuous Bonds

EDI or Email to OF-RD

1A

Drawback Payments

Refunds

Single Transaction &

Continuous Bonds

EDI or Email to OF-RD

2

Custodian of Bonded

Merchandise

Continuous Bonds

EDI or Email to OF-RD

3

International Carrier

Single Transaction &

Continuous Bonds

EDI or Email to OF-RD

3A

Instruments of

International Traffic

Continuous Bonds

EDI or Email to OF-RD

3A3

Carrier of International

Traffic

Continuous Bonds

EDI or Email to OF-RD

4

Foreign Trade Zone

Operator

Continuous Bonds

EDI or Email to OF-RD

5

Public Gauger

Continuous Bonds

EDI or Email to OF-RD

28

6

Wool & Fur Products

Single Transaction

Bonds

EDI or Email to OF-RD

7

Bill of Lading

Single Transaction

Bonds

EDI or Email to OF-RD

8

Detention of Copyrighted

Material

Single Transaction

Bonds

EDI or Email to OF-RD

9

Neutrality

Single Transaction

Bonds

Email to OF-RD

10

Court Costs for

Condemned Goods

Single Transaction

Bonds

EDI or Email to OF-RD

11

Airport Security Bond

Continuous Bonds

EDI or Email to OF-RD

12

International Trade

Commission Bond (ITC)

Single Transaction

Bonds

N/A; Must be submitted to

Port of Entry/Center

15

Intellectual Property

Rights

Single Transaction &

Continuous Bonds

Email to OF-RD

16

Importer Security Filing

Single Transaction &

Continuous Bonds

EDI or Email to OF-RD

17

Marine Terminal

Operator

Continuous Bond

Email to OF-RD

All

Above

Cash in Lieu of Surety

See each activity type

above.

Email to OF-RD (except for

Activity Type 12)

eBonds and eBond riders may be emailed to CBP at [email protected] for manual

input into ACE. eBonds transmitted via email must be on a CBP Form 301 signed by the

principal(s) and surety(ies). eSTBs must include direction to CBP as to how the eSTB is to be

used and the entry type the eSTB will secure. Email transmission is available or eBonds and

eBond riders with any Activity Code. eBonds and eBond riders transmitted by this method are

subject to policies and procedures issued by the Office of Finance for the manual input of eBonds

and eBond riders.

3.8 Non-eBond Test Participant Transmission via Email

Non-eBond test participants cannot transmit bonds via EDI, and must transmit single transaction

or continuous bonds:

• Via email to the OF-RD mailbox at [email protected], or

• Via email, mail, or Document Image System (DIS) to a Port of Entry or Center of

Excellence and Expertise (Center), in accordance with the chart below.

29

Bonds Eligible for Transmission by Non-eBond Test Participants

Activity

Code

Activity Name

Surety/Surety Agent/Filer (Principal or

Broker) may transmit via

1

Basic Importation or Entry

Email to OF-RD

1A

Drawback Payments Refunds

Email to OF-RD

2

Custodian of Bonded Merchandise

Email to OF-RD

3

International Carrier

Email to OF-RD

3A

Instruments of International Traffic

Email to OF-RD

3A3

Carrier of International Traffic

Email to OF-RD

4

Foreign Trade Zone Operator

Email to OF-RD

5

Public Gauger

Email to OF-RD

6

Wool & Fur Products

Email to OF-RD

7

Bill of Lading

Email to OF-RD

8

Detention of Copyrighted Material

Email to OF-RD

9

Neutrality

Email to OF-RD

10

Court Costs for Condemned Goods

Email to OF-RD

11

Airport Security Bond

Email to OF-RD

12

International Trade Commission (ITC)

Exclusion Bond

Email, Mail, or DIS to a Port of

Entry/Center Only (including Cash in

Lieu of Surety)

15

Intellectual Property Rights

Email to OF-RD

16

Importer Security Filing

Email to OF-RD

17

Marine Terminal Operator

Email to OF-RD

All

Above

Cash in Lieu of Surety

Email to OF-RD (unless Activity type 12)

30

If a Port of Entry or Center receives bond documentation for any activity code other than the

Activity Code 12 – ITC Exclusion Bond, in any form (e.g., paper, email, or through the DIS):

• The Port of Entry or Center will reject the bond documentation back to the surety, surety

agent, or filer, and request that the bond documentation be submitted to the OF-RD

mailbox, [email protected] for processing.

• The Port of Entry or Center will not forward any erroneously filed bonds or bond

documentation to the OF-RD. Documentation not received directly from the surety/surety

agent or filer will not be processed.

Activity Code 12 - ITC Exclusion Bond for eBond and non-eBond Test Participants

The Activity Code 12 – ITC Exclusion Bond is eligible for submission under the eBond test;

however, it cannot be transmitted via EDI or be input manually by OF-RD because it contains

certain information that ACE eBond cannot accept at this time. As a result, the ITC Exclusion

Bond is the only bond that may be transmitted to the Port of Entry or Center by eBond or non-

eBond test participants.

Activity

Code

Activity Name

Surety/Surety Agent/Filer (Principal or

Broker) may transmit via (Email to

OF-RD or Port of Entry/Center)

12

International Trade Commission (ITC)

Exclusion Bond

Email, Mail, or DIS to a Port of

Entry/Center Only (including Cash in

Lieu of Surety)

If the principal opts to use cash in lieu of surety (19 CFR 113.40), the cash in lieu of surety bond

should be submitted to either the OF-RD, or a Port or Center Director (ITC Exclusion Bonds

only). See Cash in Lieu of Surety section below.

3.9 Cash in Lieu of Surety

Per 19 CFR 113.40(a), the Director, Revenue Division or, in the case of single transaction bonds,

a Port or Center Director, may accept cash or U.S. obligations in lieu of surety in an amount equal

to the face amount of the bond that would be required.

The deposit of cash or U.S. obligations in lieu of surety is at the option of the party conducting the

customs activity that requires a bond.

A CBP Form 301, CBP Form 301A (if applicable), or other CBP-approved bond, designating the

appropriate activity for the cash or U.S. obligation being deposited in lieu of surety, must be filed.

In addition, cash or U.S. obligations being deposited in lieu of surety must be for a term of no

more than one year.

• Cash in Lieu of Surety for All Activity Codes (except for the Activity Code 12 – ITC

Exclusion Bond)

31

• In cases where a bond and bond documentation with cash in lieu of surety (except for

Activity Code 12 - ITC Exclusion Bond) is sent to the Port of Entry or OF-RD, the

trade should:

1. Confirm that the bond meets the criterion listed in 19 CFR 113.40

Note: A completed CBP Form 301, 301A (if applicable), or other CBP-

approved bond is required when the principal is submitting a cash in lieu of

surety bond. Without a completed CBP Form 301, 301A (if applicable), or other

CBP-approved bond, it is not considered cash in lieu of surety, it is considered a

cash deposit.

2. Affirm the bond is in the proper amount.

In cases where the bond documentation was submitted to the Port of Entry, that

documentation will be rejected back to the filer to submit the bond to the OF-RD

mailbox, [email protected], for processing. Documentation not received by

OF-RD directly from the filer will not be processed.

Note: The filer should receive a copy of the CBP Form 368 to reflect that CBP has

accepted payment.

• Cash in Lieu of Surety – Activity Code 12, ITC Exclusion Bond Only

• In cases where a bond or bond documentation with cash in lieu of surety is sent to the

Port of Entry for an ITC Exclusion Bond, the trade should:

1. Confirm that the bond meets the criterion listed in 19 CFR 113.40

Note: The ITC Exclusion Bond cannot be filed using the CBP Form 301/301A; a

CBP-approved bond containing the Appendix B to Part 113 language must be

submitted. If a CBP-approved bond containing the Appendix B to Part 113

language is not submitted, it is not considered cash in lieu of surety; it is

considered a cash deposit.

2. Affirm the bond is in the proper amount. The exclusion order notice will contain

the percentage of the value of the goods to be used in computing the bond amount.

3.10 Single Transaction Bonds

In the limited circumstance that a Single Transaction Bond (STB) has been given in error, the

STB may be voided. The action to void the STB must occur prior to being matched to an entry in

Cargo Release. In addition, the amount of an eBond STB may be changed, such as obtaining a

lower bond amount for an unconditionally duty-free entry but may only occur between Cargo

Release and Entry Summary. If a Superseding or Substitution STB is filed as part of the Entry

Summary (at Entry Summary filing or after the submission of the Entry Summary), that filing will

be subject to eBond validations. The Substitution or Superseding STB must be present in ACE for

that Entry Summary to be accepted.

32

CBP can receive and validate STBs either received electronically from a Surety or Surety Agent

or received from a Surety or Surety Agent emailing a copy of the STB to

[email protected] for input into ACE. CBP will monitor eBond STBs and when CBP

finds the bond amount is insufficient for the transaction, CBP will contact the entry filer and

Surety/Surety Agent to provide proper bonding.

3.11 Customs and Trade Automated Interface (CATAIR) documents

The ‘eBond: Create/Update’ CATAIR document provides input and output EDI record

information for the electronic transmission of bonds to CBP. The document presents both the

bond input transaction proprietary records used by sureties and surety agents to file and maintain

an eBond as well as the output transaction proprietary records returned in response. The input

record layouts describe the data elements required by the automated EDI interface. The output

record layouts describe a response to filing as generated and returned by the automated EDI

interface.

The ‘eBond: Status Notification’ CATAIR document provides information on the eBond Status

Notification message, which is an ABI message generated from CBP’s ACE bond processing,

from an action transmitted by the bond filer, from an action taken on the bond by CBP, or from a

related entry and entry summary action. This message will only be sent to ACE ABI filers for

bonds filed in ACE. The filer of bond and secondary notify parties nominated by the bond filer

may receive a Bond Status Notification message indicating that an action has been taken on the

bond by the Surety/Surety Agent or by CBP. In addition, the filer of the bond will receive a Bond

Status Notification message whenever an action has been taken for an entry or entry summary

related to the bond.

Note: At a mutually agreed upon date in the future, this will replace the ‘Customs Daily &

Quarterly Entry Summary Surety Downloads’.

The ‘Customs Daily & Quarterly Entry Summary Surety Downloads’ CATAIR document

provides information on the Entry Summary Surety Download message, which is an ABI message

generated from CBP ACE Entry Summary. The messages are generated and only sent to the ACE

ABI surety agent filer for bonds of the sureties that they represent. The messages include all

entries associated with a surety agent filer that have been added or changed during the stated

timeframe.

The following downloads are available via EDI:

• Daily Entry Summary (AS) download

• Quarterly Entry Summary (AQ) download

Although the records are the same for the Daily Entry Summary (AS) download and the Quarterly

Entry Summary (AQ) download sent to sureties, there is a difference in the timing and how they

are generated. The AS is generated every morning for associated entries that have been

updated/had an action taken on them the day before. The AQ is generated quarterly and provides

the entry information for all associated entries that have not been liquidated.

Note: At a mutually agreed upon date in the future, these downloads will be replaced by the

‘eBond: Status Notification’ message.

33

The ‘Customs Daily Surety Billing Download’ CATAIR document provides information on the

Surety Billing Download message, which is an ABI message generated from CBP’s ACE system.

The AR message provides updates on the daily activity of bills issued by CBP to sureties for the

importers they guarantee. It is generated daily and is sent only to ACE ABI Surety Agent filers

for the Sureties they represent.

The ‘Customs Monthly Continuous Bond Surety Download’ CATAIR document provides

information on the Continuous Bond Surety Download message, which is an ABI message

generated from CBP’s ACE system. The messages are generated and only sent to the ACE ABI

surety agent filers for the bonds of the sureties they represent. The messages include all bonds

associated with a surety agent filer that are effective during the stated timeframes. The message is

sent monthly.

3.12 Real-time Automated Surety Interface

Effective Jan. 9, 2021, CBP implemented changes to the eBond User Interface as part of the Real-

Time Automated Surety Interface (ASI) enhancement in ACE. This enhancement expands the

data provided to sureties and surety agents in real-time, via the Bond Status (BS) message, with

the goal of eventually replacing the current nightly and quarterly downloads that provide Trade

users with cargo release and post-release processing information. These enhanced messages will

consist of both the existing information sent in eBond Status Notification messages and additional

messages triggered by both Cargo Release and Post Release events.

The Real-time ASI enhancement may result in an increase in the number of messages filers

receive. CBP discontinued the generation of messages for parties listed as Secondary Notify

Parties (SNPs) on a bond for certain cargo release and post release events, as these would be

duplicate messages already received upon transmission of entry and/or entry summary. SNPs will

continue to receive duplicate test messages for various bond events, such as when a bond is