DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

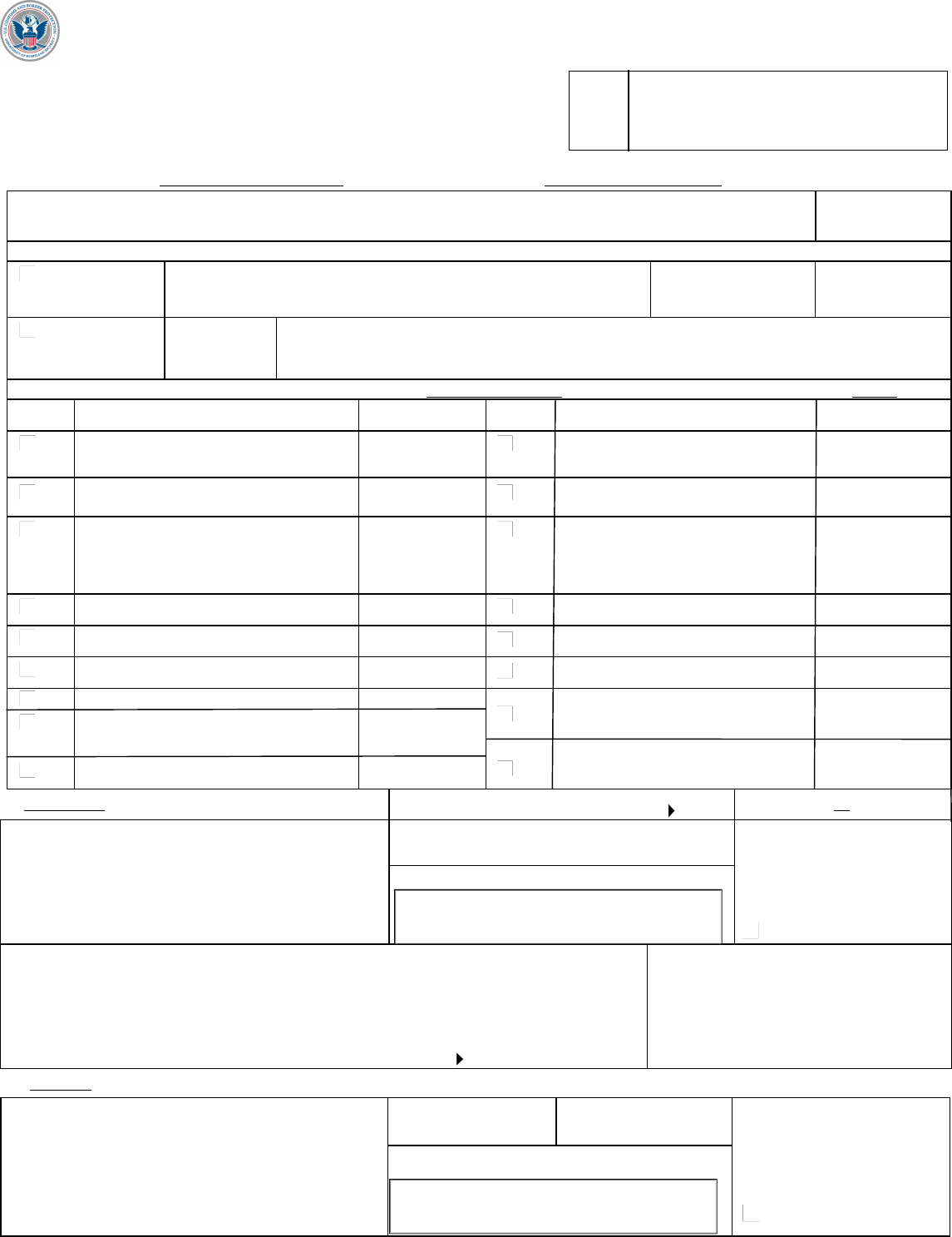

CUSTOMS BOND

19 CFR Part 113

By checking the box you agree that you have a

seal in accordance with 19 CFR 113.25

OMB APPROVAL NO. 1651-0050

EXPIRATION DATE 08/31/2025

In order to secure payment of any duty, tax or charge and compliance with law or regulation as a result of activity

covered by any condition referenced below, we, the below name principal(s) and surety(ies), bind ourselves to the

United States in the amount or amounts, as set forth below.

Execution Date

SECTION I – Select Single Transaction OR Continuous Bond (not both) and fill in the applicable blank spaces.

SINGLE

TRANSACTION

BOND

Identification of transaction secured by this bond (e.g., entry number,

seizure number, etc.)

Transaction Date Port Code

CONTINUOUS

BOND

Effective Date

This bond remains in force for one year beginning with the effective date and for each succeeding

annual period, or until terminated. This bond constitutes a separate bond for each period in the

amounts listed below for liabilities that accrue in each period. The intention to terminate this bond

must be conveyed within the period and manner prescribed in the CBP Regulations.

SECTION II – This bond includes the following agreements. Check one box only. (Except 3a may be checked independently or with 3.)

Activity

Code

Activity Name and CBP Regulations

in which conditions codified

Limit of Liability

Activity

Code

Activity Name and CBP Regulations

in which conditions codified

Limit of Liability

1

Importer or broker ………………..…..§113.62

8

Detention of Copyrighted Material

…………………………………… §113.70

-Single Transaction Only-

1a

Drawback Payments Refunds ……...§113.65

9

Neutrality .......................... §113.71

-Single Transaction Only-

2

Custodian of Bonded Merchandise §113.63

(Includes bonded carriers, freight forwarders,

cartmen and lightermen, all classes of

warehouse, container station operators)

-Continuous Bond Only-

10

Court Costs for Condemned Goods

……………………………………..§113.72

-Single Transaction Only-

3

International Carrier………………..…§113.64

11

Airport Security Bond……Part 113 App A

3a

Instruments of International Traffic... §113.66

-Continuous Bond Only-

12

International Trade Commission (ITC)

Exclusion Bond…………..Part 113 App B

4

Foreign Trade Zone………….……....§113.73

-Continuous Bond Only-

5

Public Gauger……………………… §113.67

15

Intellectual Property Rights (IPR)

6

Wool & Fur Products……………….. §113.68

Labeling Acts Importation

-Single Transaction Only-

16

Importer Security Filing (ISF)

..............................Part 113 App D

7

Bill of Lading…………………………§113.69

-Single Transaction Only-

17

Marine Terminal Operator

-Continuous Bond Only-

PRINCIPAL AFFIX SEAL or Check Box

Name and Physical Address (including legal description

and state of incorporation)

CBP Identification Number:

Check Box

Signature

Principal and surety agree that any charge against the bond under any of the listed names is as

though it was made by the principal(s). Principal and surety agree that they are bound to the

same extent as if they executed a separate bond covering each set of conditions incorporated

by reference to the CBP regulations into this bond. If the surety fails to appoint an agent under

Title 31, United States Code, Section 9306, surety consents to service on the Clerk of any

United States District Court or the U.S. Court of International Trade, where suit is brought on

this bond. That clerk is to send notice of the service to the surety at:

Mailing Address (Street Address, Zip code,

City) Requested by the Surety.

SURETY

CBP

USE

ONLY

BOND NUMBER (Assigned by CBP)

Surety Reference Number:

Broker Filer Code:

Name and Physical Address (including legal description

and state of incorporation)

Surety Number Agent ID Number

Check Box

Signature

Page 1 of 3CBP Form 301 (04/24)

Broker Filer Code:

Principal Name:

CO-PRINCIPAL

CBP Identification Number:

AFFIX SEAL

or

Check Box

By checking the box you agree

that you have a seal in

accordance with 19 CFR 113.25

Name and Physical Address

(including legal description

and state of incorporation)

CBP Identification Number:

Check Box

Signature

SECTION III – List below the complete name of all trade names or unincorporated divisions that will be permitted to obligate this bond in

the principal’s name including their CBP Identification Number(s).

CBP Identification Number Name CBP Identification Number Name

Total Number of Importer Names listed in Section III:

CO-SURETY

Name and Physical Address (including legal description and state of

incorporation)

Surety Number Agent ID Number

Check Box

Signature

Surety Reference Number:

Page 2 of 3CBP Form 301 (04/24)

Page 3 of 3

DHS Privacy Act Statement

CBP Form 301, Customs Bond

Pursuant to 5 U.S.C. § 552a(e)(3), this Privacy Act Statement serves to inform you of the following concerning the collection of the information on this form.

A. AUTHORITY:

Bonds are authorized under 19 U.S.C. 1608, and 1623; 22 U.S.C. 463. CBP has the authority to collect information on CBP Form 301 pursuant to 19 CFR

Part 113. The collection of applicants tax information (e.g., Social Security Number (SSN)) on the CBP Form 301 is pursuant to Executive Order (E.O.) 9397,

as amended by E.O. 13478.10.; 31 U.S.C. §7701(c); and 26 U.S.C. §6109(d).

B. PURPOSE:

The primary purpose for requesting the information on CBP Form 301 is used to ensure that duties, taxes, charges, penalties, and reimbursable expenses

owed to the Government for imported goods are paid. CBP requires this form be used to verify that the individual or entity (importer, broker, surety) are

responsible for payment of these expenses.

C. ROUTINE USES:

Consistent with DHS's information-sharing mission, information related to Customs Bonds may be shared with DHS and partner government agencies that

have a need to know the information to carry out their homeland security, international trade, or import safety functions, including activities related to the

collection of duties, taxes, and fees, for imported goods. In addition, information may be shared with appropriate federal, state, local, tribal, territorial, foreign,

or international government agencies consistent with the routine uses authorized under the Privacy Act. A complete list of the routine uses can be found in the

system of records notice associated with this form, "Department of Homeland Security/U.S. Customs and Border Protection - DHS/CBP-001 Import

Information System of Records" The Department's system of records notices can be found on the Department's website at http://www.dhs.gov/system-

records-notices-sorns

D. CONSEQUENCES OF FAILURE TO PROVIDE INFORMATION:

Providing this information is not legally required, however failure to do so may result in you or your company (as the importer, broker, or surety) from being

unable to receive imported goods in a timely manner and without having to pay in advance the full amount of funds owed to the government for assessment of

duties, taxes, and fees on imports.

CBP Form 301 (04/24)

SECTION II

Activity Code: Check the appropriate Activity Code. Only one (1) box may be checked, except 3a may be checked independently or with 3. Filers may opt to

line out all unused activity codes.

For Airport Security Bonds, check continuous and Activity Code 11.

NOTE: Do not check boxes 12, 15, or 17. Until further notice, this Form will not be used for those Activity Codes. Separate bonds must be filed. For Activity

Code 12, see Appendix B to Part 113 of the CBP Regulations (19 CFR Part 113). For Activity Code 17, see the Notice of Specific Instruction, Customs

Bulletin and Decisions, Vol. 40, No. 52, December 20, 2006, at page 7 for the terms and conditions of the Marine Terminal Operator Bond. For Activity Code

15, see the Port Director at the port in which the bond is to be filed.

• Limit of Liability: Provide a number indicating the amount of the bond next to the activity code checked. The

amount must be in whole dollars (always round up if there are cents for a Single Transaction Bond).

• Enter “N/A” in all other Limit of Liability areas next to the lined out activity codes. (This is optional)

Instructions Page 1 of 2

SECTION I

NOTE: The Single Transaction Bond or the Continuous Bond box must be checked as appropriate, but not both.

• Single Transaction Bond: Check box next to Single Transaction Bond and line out Continuous Bond (lining out is

optional). Check only if the bond will cover a single transaction.

• Continuous Bond: Check box next to Continuous Bond and line out Single Transaction Bond (lining out is optional).

Identification of transaction secured by this bond (e.g., entry number, seizure number, etc.): For a Single Transaction only. Do not complete this box if you are

filing a Continuous Bond. If this Single Transaction Bond covers Activity Code 1 or 1a, provide an entry number. If this Single Transaction Bond covers

Activity Code 10, provide a seizure number. If this Single Transaction Bond covers Activity Code 16, provide unique ISF transaction number. If the Single

Transaction Bond covers Activity Codes 1 and 16 (a unified filing), provide an entry number and a unique ISF transaction number. For any other activity code

for which a Single Transaction Bond is allowed, you may provide an identifying number.

Transaction Date: If this is a single transaction bond, provide the date the transaction occurs, if known.

• Single Transaction Bond: Required field

○ Activity Code 1, 1a, 3, 5, 6, 7, 8, 9, 10

• If known, enter date of transaction

• If not known, transaction due date would be the execution date

○ Activity Code 16

• Enter date of ISF transmission

• Continuous Bond: Not applicable, leave blank

Port Code: Provide the 4-digit code of the Port where the single transaction is to occur. Leave blank for continuous bonds.

Effective Date: For a continuous bond only. Provide the date that transactions under the continuous bond may begin to be accepted by CBP.

• The effective date must be the same or after the execution date

CUSTOMS BOND

INSTRUCTIONS FOR COMPLETION

All fields are required unless otherwise stated in these instructions.

PAGE 1 CBP FORM 301

Broker Filer Code: Provide a number that identifies the filer of the bond, whether a Customs broker or surety agent or other party authorized to file the

bond.

Surety Reference Number: A 9-digit self-generated surety reference number that a surety may opt to submit to CBP instead of a social security number to

be used as a bond control number.

Execution Date: Provide the date that the last required signature of the surety or the bond principal is affixed to the bond.

• Continuous Bonds: Must be the same date or earlier than the effective date

• Single Transaction Bonds: Must be the same date or earlier than the transaction date

CBP Form 301 (04/24)

PAGE 2 CBP FORM 301

If there is no substantive information on page 2 of the CBP 301 form, it need not be filed with CBP (Single Transaction or Continuous Bonds). Substantive

information is limited to Co-Principal, Section III Divisions/Users, and Co-Surety. If page 2 is required, the four header data items (Broker Filer Code, Surety

Reference Number, Principal Name, and CBP Identification Number) must be provided and identical to those fields on page 1.

CO-PRINCIPAL

Follow the same instructions as for the principal.

SECTION III

List the complete name of all trade names or unincorporated divisions that will be permitted to obligate the bond in the principal's name including their CBP

identification numbers: Provide the complete name for each entity listed (e.g., ABC Company DBA 123 Company.) If the identification number is based upon

an EIN, the number must match the base number (the first nine digits of a principal's identification number on the bond).

Total Number of Importer Names Listed in Section III: Provide total number of entities listed. If none, enter a 0 (zero).

Do not include the main principal or any co-principals in the total number of Section III users.

CO-SURETY

Follow the same instructions as for the surety.

OTHER INSTRUCTIONS

If a bond has more than two (2) co-principals, a CBP Form 301A must be used. Note that co-principals cannot be added by rider. The bond must be

terminated and replaced to add (or delete) a co-principal.

For bond conditions, refer to Part 113, Subpart G, CBP regulations and the Appendices to that Part.

Paperwork Reduction Act Notice: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information

unless it displays a current valid OMB control number and an expiration date. The control number for this collection is 1651-0050. The estimated time to

complete this application is 15 minutes. If you have any comments regarding the burden estimate you can write to U.S. Customs and Border Protection,

Office of International Trade, Regulations and Rulings, 799 9

th

Street, NW., Washington, DC 20229.

Instructions Page 2 of 2CBP Form 301 (04/24)

PRINCIPAL

Name and Physical Address (including legal description and state of incorporation): Provide the full name and legal description (i.e. corporation, partnership,

individual, etc.) of the bond principal, a physical address (not a P.O. Box), and the state of incorporation, if applicable.

For Continuous Bonds: If a limited partnership, provide a copy of the partnership agreement. If a general partnership, provide the names and addresses of the

partners on the bond form (e.g., A general partnership comprised of <name>, <name>, etc.)

CBP Identification Number: Provide the CBP identification number filed pursuant to 19 CFR 24.5. When the Internal Revenue Service (IRS) Employer

Identification Number (EIN) is used, the two-digit suffix code must be included and an eleven-digit number must be provided.

Signature: Provide the signature of a party authorized to bind the principal to the bond contract. The name and title (or Attorney in Fact) of the party signing the

bond must be typed in this box also. If Attorney in Fact is signing the bond, the Company Name of the Attorney in Fact must be typed in this box.

SEAL: Principal must determine if a seal is required under the law of the state in which the bond is executed. A checked box indicates a seal is affixed or

submitted electronically to CBP as per 19 CFR 113.25. An unchecked box is an acknowledgment that no seal is required.

Mailing Address Requested by the Surety: Provide a mailing address where the surety may receive notice of service.

SURETY

Name and Physical Address (including legal description and state of incorporation): If applicable provide the full surety name as it is set forth the in the

Treasury Listing of Approved Sureties published in the Federal Register by the Department of the Treasury (Treasury Department Circular 570), and a

physical address. If an individual surety, provide name and legal description of the surety, and a physical address.

Surety Number: Provide the 3-digit identification code assigned by CBP to a surety company.

Agent ID Number: Provide an identification number as identified by the surety granting such power of attorney. If an individual, a social security number may

be provided, but a CBP-assigned number may also be used.

Signature: Provide the signature of a party authorized to bind the surety to the bond contract. The name and title (or Attorney in Fact) of the party signing the

bond must be typed in this box also.

SEAL: Surety must determine if a seal is required under the law of the state in which the bond is executed. A checked box indicates a seal is affixed or

submitted electronically to CBP as per 19 CFR 113.25. An unchecked box is an acknowledgment that no seal is required.