China Monetary Policy Report

Q4 2021

(February 11, 2022)

Monetary Policy Analysis Group of

the People's Bank of China

I

Executive Summary

In 2021, under the strong leadership of the CPC Central Committee with Comrade Xi

Jinping at its core, China maintained a leading position worldwide both in economic

development and COVID-19 containment. With relatively high growth and low

inflation in tandem with low unemployment, we have made new achievements in

pursuing high-quality development and ensured a good start for the 14th Five-Year Plan

period. Following the guidance of Xi Jinping Thought on Socialism with Chinese

Characteristics for a New Era, the People's Bank of China (PBC) resolutely

implemented the decisions and arrangements of the CPC Central Committee and the

State Council. Maintaining a sound monetary policy, which was flexible, targeted,

reasonable, and appropriate, the PBC strengthened intertemporal adjustments and

coordinated the policies for the turn of the year. As a result, the monetary policy

improved both in quality and efficiency in serving the real economy.

First, liquidity was kept adequate at a reasonable level. Using a mix of monetary policy

instruments for liquidity injections, the PBC cut the required reserve ratio (RRR) for

financial institutions by 0.5 percentage points in July and in December, respectively,

which released RMB2.2 trillion of long-term funds. Financial institutions were guided

to make proper credit arrangements for the turn of the year so that the stability of

aggregate credit growth was improved. Second, the overall financing costs were guided

to remain stable with a slight decline. The PBC lowered the interest rate on central bank

lending for rural development and micro and small businesses (MSBs) by 0.25

percentage points in December 2021, and it guided the rates on 1-year Medium-term

Lending Facility (MLF) and 7-day open market operations (OMO) to drop by 10 basis

points in January 2022, which brought down money market and bond market rates. The

benefits of the loan prime rate (LPR) reform were continuously unleashed. Since

December 2021, the 1-year LPR and over-5-year LPR has dropped 15 and 5 basis points,

respectively, which guided corporate loan rates to fall as well. The weighted average

rate on corporate loans in 2021 reached a record low for the past four decades since the

reform and opening-up. Third, more support was given to the key areas and weak links

in the national economy. At the beginning of 2021, additional central bank lending in

the amount of RMB200 billion was provided to guide locally incorporated banks in

regions with slow credit growth to increase their credit supply. In September, an

additional RMB300 billion central bank lending for MSBs was provided to encourage

locally incorporated banks to increase their loans for MSBs and self-employed

businesses. In November, the Carbon Emission Reduction Facility (CERF) and

RMB200 billion of special central bank lending targeted for the clean and efficient coal

use was launched to support the transition towards low-carbon development. Fourth,

attention was paid to maintaining a balance between internal and external equilibria.

While deepening the market-oriented reform of the exchange rate and maintaining a

II

managed floating exchange rate regime based on market supply and demand with

reference to a basket of currencies, the PBC enhanced the flexibility of the RMB

exchange rate and strengthened expectation management to give play to the role of the

exchange rate in adjusting the macro economy and as an auto stabilizer for the balance

of payments. Fifth, new achievements were made in forestalling and defusing financial

risks. The PBC upheld market principles and the rule of law in risk resolution, and

financial risks were generally contained.

Overall, in 2021 monetary policy was more forward-looking, stable, precise, effective,

and independent, while remaining flexible, targeted, reasonable, and appropriate. With

major financial indicators maintaining strong growth on 2020’s high base, the financial

sector has provided solid support for the real economy. In 2021, new RMB loans

reached RMB19.95 trillion, RMB315 billion more than that in 2020. At the end of 2021,

inclusive MSB loans and medium and long-term (MLT) loans to the manufacturing

sector grew by 27.3 percent and 31.8 percent year on year, respectively; broad money

(M2) and outstanding aggregate financing to the real economy (AFRE) recorded year-

on-year growth of 9.0 percent and 10.3 percent, respectively; the macro leverage ratio

registered 272.5 percent, down 7.7 percentage points from end-2020. In 2021, the

weighted average rate on corporate loans registered 4.61 percent, down 0.1 percentage

points from 2020 and 0.69 percentage points from 2019. The RMB exchange rate

moved in both directions and remained basically stable at an adaptive and equilibrium

level. The central parity of the RMB against the US dollar was 6.3757 at end-2021, an

appreciation of 2.3 percent from end-2020.

The Chinese economy is large and highly resilient. Its fundamentals for sound growth

in the long run remain unchanged, so do the favorable conditions for building a new

development paradigm. However, it should also be noted that domestically the

economy is facing triple pressures, namely, shrinking demand, supply shocks, and

waning expectations, and externally the environment is more serious and uncertain. In

the next stage, under the guidance of Xi Jinping Thought on Socialism with Chinese

Characteristics for a New Era, the PBC will follow the guidelines of the 19th CPC

National Congress, the plenary sessions of the 19th CPC Central Committee, and the

Central Economic Work Conference. Following the decisions and arrangements of the

CPC Central Committee and the State Council, the PBC will apply the new

development philosophy fully, faithfully, and comprehensively. It will deepen the

supply-side structural reform, speed up the building of a new development paradigm,

develop a modern central banking system, and improve the modern monetary policy

framework, so as to contribute to high-quality development. Pursuing stability as its top

priority and adhering to the principle of seeking progress while ensuring stability, the

III

PBC will be proactive in implementing the guidelines of the Central Economic Work

Conference. While strengthening financial support for the real economy, and continuing

its efforts to ensure Six Stabilities and to maintain Six Securities, it will create a

favorable monetary and financial environment so that the economic indicators will

move within a reasonable range.

While keeping the sound monetary policy flexible and appropriate, the PBC will

intensify intertemporal adjustments and give play to the role of monetary policy

instruments in adjusting both the aggregate and the structure. Aiming to be forceful,

precise, and proactive, the monetary policy will refrain from a deluge of strong stimulus;

instead, it will be implemented to satisfy the reasonable and bona fide financing

demands of the real economy and to enhance financial support for key areas and weak

links so as to achieve a sound combination of stable aggregates and an optimal structure.

First, monetary and credit aggregates will grow at a steady pace. The mechanism for

money supply management will be improved to keep liquidity adequate at a reasonable

level. Financial institutions will be guided to vigorously increase loan issuances so that

the aggregate credit will grow at a more stable pace. The growth of M2 and the AFRE

will be basically in line with that of nominal GDP, and the macro leverage ratio will be

basically stable. Second, the credit structure will be improved steadily. The structural

monetary policy tools will play a greater role and the market-oriented tools in support

of MSBs will be effectively implemented. The PBC will make good use of the CERF

and the special central bank lending targeted for clean and efficient coal use, and it will

guide financial institutions to increase their loan issuances in regions where credit

growth is slow. With these targeted efforts, the PBC will ensure more support for MSBs,

sci-tech innovation, and green development. Third, the overall financing costs for

businesses will be lowered. The PBC will enhance the market-oriented interest rate

formation and transmission mechanism, tap into the LPR reform, stabilize the liability

costs of banks, and facilitate the decline of corporate loan rates. Fourth, the RMB

exchange rate will be kept basically stable at an adaptive and equilibrium level.

Focusing on domestic issues, the PBC will properly balance the internal and external

equilibria. The RMB exchange rate will be more flexible, based on market supply and

demand, thereby playing its role as an automatic stabilizer in adjusting the macro

economy and the balance of payments. The PBC will strengthen macro-prudential

management for cross-border capital flows, enhance expectation management, and

guide market entities to be risk-neutral. Meanwhile, the PBC will coordinate prevention

and resolution of major financial risks by firmly defending the bottom line, improving

the holistic approach, and following market principles and the rule of law. The PBC

will welcome the convening of the 20th CPC National Congress with great efforts to

stabilize the macro economy and to keep the economy on a steady development

trajectory for the long run.

IV

Contents

Part 1. Money and Credit Analysis ................................................................................................... 1

I. Liquidity in the banking system was adequate at a reasonable level ..................................... 1

II. Lending by financial institutions grew reasonably, with the annual corporate loan interest

rate at a record low since the reform and opening up ............................................................... 4

III. Money supply and aggregate financing to the real economy grew at a reasonable pace .. 11

IV. The RMB exchange rate remained basically stable at an adaptive and equilibrium level . 17

Part 2. Monetary Policy Operations ................................................................................................ 18

I. Conducting open market operations in a flexible manner ................................................... 18

II. Timely conducting Standing Lending Facility and Medium-term Lending Facility

operations ................................................................................................................................ 21

III. Adjusting the required reserve ratio for financial institutions ........................................... 21

IV. Further improving the macro prudential management framework .................................... 22

V. Actively giving play to the role of structural monetary policy instruments ........................ 23

VI. Leveraging the structural guidance role of credit policies ................................................ 29

VII. Deepening the market-based interest rate reform ............................................................ 30

VIII. Improving the market-based RMB exchange rate formation mechanism ...................... 31

IX. Forestalling and defusing financial risks and deepening the reform of financial institutions

................................................................................................................................................ 32

X. Deepening reform of foreign exchange arrangements ....................................................... 35

Part 3. Financial Market Conditions ............................................................................................... 36

I. Financial market overview................................................................................................... 36

II. Development of institutional arrangements in the financial markets ................................. 42

Part 4. Macroeconomic Overview................................................................................................... 45

I. Global economic and financial developments ..................................................................... 45

II. Macroeconomic developments in China ............................................................................ 49

Part 5. Monetary Policy Outlook .................................................................................................... 56

I.Outlook for the Chinese economy ..................................................................................... 56

II. Outlook for monetary policy in the next stage ................................................................... 58

V

Boxes

Box 1 Factors Influencing Liquidity in the Banking System and the Central Bank’s Liquidity

Management ...................................................................................................................................... 2

Box 2 Maintaining Stable Growth of Credit Aggregates .................................................................. 6

Box 3 China’s Macro Leverage Ratio Remains Generally Stable .................................................. 13

Box 4 Two Instruments Directly Supporting the Real Economy Continue with Modified

Arrangements .................................................................................................................................. 25

Box 5 Exploring the Conducting of Stress Tests on Climate Risk .................................................. 27

Box 6 Key Achievements in Forestalling and Defusing Major Financial Risks ............................. 32

Tables

Table 1 The Structure of RMB Loans in 2021 .................................................................................. 5

Table 2 New RMB Loans by Financial Institutions in 2021 ............................................................. 5

Table 3 Weighted Average Interest Rates on New Loans Issued in December 2021 ....................... 8

Table 4 Shares of RMB Lending Rates at Different Levels, from January to December 2021 ........ 9

Table 5 Average Interest Rates on Large-value USD-denominated Deposits and Loans from January

to December 2021 ........................................................................................................................... 10

Table 6 The Structure of RMB Deposits in 2021 ............................................................................ 11

Table 7 Aggregate Financing to the Real Economy in 2021 ........................................................... 12

Table 8 Trading Volume of the RMB against Other Currencies in the Interbank Foreign Exchange

Spot Market in 2021 ........................................................................................................................ 31

Table 9 Fund Flows Among Financial Institutions in 2021 ............................................................ 37

Table 10 Interest Rate Swap Transactions in 2021 ......................................................................... 38

Table 11 Bond Issuances in 2021 .................................................................................................... 40

Table 12 Asset Allocations in the Insurance Sector at End-2021 .................................................... 41

Table 13 Macroeconomic and Financial Indicators in the Major Advanced Economies ................ 46

Table 14 Floor Area of Real Estate Projects that were Newly Started, under Construction, and

Completed in 2021 .......................................................................................................................... 54

Figures

Figure 1 Movement of Money Market Interest Rates ....................................................................... 2

Figure 2 Monthly RMB Settlements under the Current Account ................................................... 18

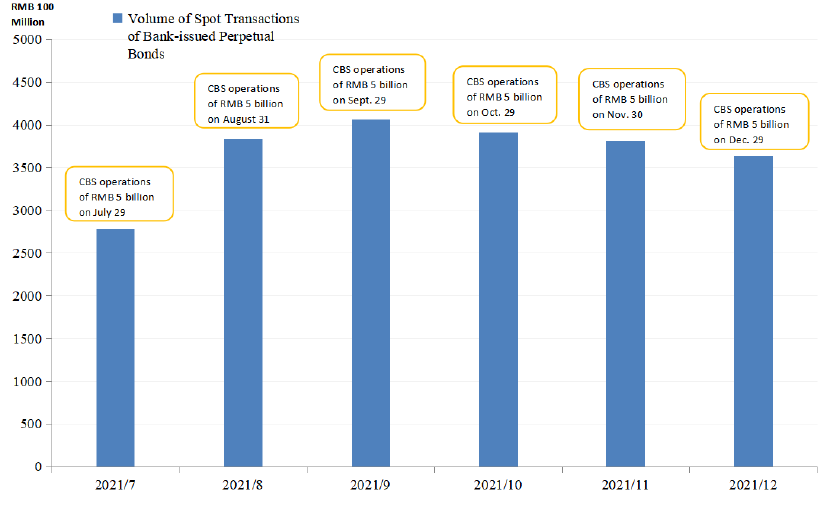

Figure 3 Volume of Spot Transactions of Bank-issued Perpetual Bonds ........................................ 20

Figure 4 Yield Curves of Government Securities on the Interbank Market .................................... 39

Figure 5 Interest Rate Hikes in 2021 by Central Banks in Several Economies .............................. 48

1

Part 1. Money and Credit Analysis

Since 2021, under the guidance of Xi Jinping Thought on Socialism with Chinese

Characteristics for a New Era, following the guidelines of the Fifth and Sixth Plenary

Sessions of the 19th CPC Central Committee and the Central Economic Work

Conference, and implementing the requirements set forth in the Report on the Work of

the Government, the People's Bank of China (PBC) kept its sound monetary policy

flexible, targeted, reasonable and appropriate. Money, credit, and aggregate financing

to the real economy (AFRE) gained reasonable growth, the credit structure continued

to improve, and overall financing costs steadily declined, thereby notably propelling

high-quality development of the real economy.

I. Liquidity in the banking system was adequate at a reasonable level

In 2021, according to the requirement that “the sound monetary policy should be

flexible, targeted, reasonable, and appropriate,” the PBC pursued stability as its top

priority and implemented intertemporal policy designs. A variety of policy tools, such

as the required reserve ratio (RRR) cut, the Medium-term Lending Facility (MLF),

central bank lending and discounts, and open market operations (OMOs) for liquidity

provision were employed in a more forward-looking, flexible, and effective manner. In

July and December, the PBC announced two RRR cuts, each of 0.5 percentage points,

which released long-term funds of about RMB1 trillion and RMB1.2 trillion,

respectively. Meanwhile, the PBC guided money market rates to move around the OMO

rates by stabilizing market expectations in different ways. In 2021, the 7-day repo rates

between depository institutions with government-backed bonds as the collateral in the

interbank market (DR007) averaged 2.17 percent, close to the 7-day OMO rate at 2.2

percent, implying a further decline in the volatility of interest rates. At end-2021, the

excess reserve ratio of financial institutions registered 2 percent, a high level for 2021

Liquidity in the banking system was adequate at a reasonable level.

2

Figure 1 Movement of Money Market Interest Rates

Source: www.chinamoney.com.cn.

Box 1 Factors Influencing Liquidity in the Banking System and the Central

Bank’s Liquidity Management

Liquidity in the banking system mainly refers to excess reserves deposited by financial

institutions in the central bank. It is influenced by a number of factors, including cash

in circulation (M0), government deposits at the PBC, required reserves, net foreign

assets held by the PBC, clients’ payment-settlement provisions held by payment

institutions, etc.

These factors have short-term and medium- to long-term impacts on liquidity. The latter

is mainly caused by the following factors: the long-term growing trend of M0 led by

economic and residential income growth; the part of government deposits with a steady

increase; the increase in required reserves due to deposit creation as loans are issued in

support of the real economy; and the growing trend of client provisions held by payment

institutions.

Meanwhile, the following factors contribute to the short-term impact. First, fluctuations

in the fiscal deposits at the PBC. Their rapid rise reduces the liquidity of the banking

system during peak tax periods (usually in the middle of a month) or when there are

massive issues of government bonds. On the other hand, the concentrated fiscal

expenditures at month/quarter/year-end boost liquidity. Second, a rise in the demand

for cash during holidays. The public tend to withdraw large amounts of cash from banks

on holidays, especially before the Spring Festival, causing liquidity in the banking

0

1

2

3

4

5

2021.07 2021.08 2021.09 2021.10 2021.11 2021.12

7-day repo rate (DR007) between depository institutions with government-backed bonds as collateral in the interbank…

3

system to temporarily drop by RMB1.5–2 trillion and then to bounce back quickly as

cash returns to the banking system after the Spring Festival. Third, temporary changes

in required reserves as well as client provisions held by payment institutions.

Based on analysis and projections of these short-term and medium- to long-term factors,

the PBC undertakes a wide array of monetary policy tools, such as the required reserve

ratio, the MLF, and open market operations to manage liquidity, so that liquidity

remains adequate at a reasonable level, and supply and demand for each maturity is

basically balanced. This guides market rates to move around the central bank’s policy

rate. Based on their growth patterns, when addressing medium- to long-term factors,

the PBC mainly uses the required reserve ratio and the MLF to increase medium- to

long-term liquidity when and as appropriate so as to fully meet the demand for medium-

to long-term liquidity that supports reasonable money and credit growth. In terms of

short-term factors, while fully comprehending their historical patterns, the PBC uses

tools such as open market operations for forward-looking and targeted marginal

liquidity adjustment to iron out short-term factors and stabilize market expectations. In

recent years, money market rates in China have stabilized. The weighted average rate

on 7-day repos between depository institutions in the interbank market (DR007)

fluctuated around the open market’s 7-day reverse repo rate, with generally less

volatility.

When analyzing the liquidity conditions of the banking system, it is best to focus on the

overall liquidity management framework other than particular factors. It is

inappropriate to estimate the liquidity surplus or deficit by simply adding up short-term

and long-term factors, or, furthermore, to assume that monetary policy instruments

reaching maturity will have an influence and to judge liquidity conditions accordingly.

In fact, under the current liquidity management framework, the PBC closely tracks

market rates to conduct operations. Various monetary policy tools will be used flexibly

to keep liquidity adequate at a reasonable level, no matter how the factors influencing

liquidity may change. Regarding maturing monetary policy tools, the PBC will properly

arrange the pace of maturities and maintain inter-temporal liquidity management. Some

maturing instruments will be rolled over in light of market developments to fully meet

the reasonable demand for liquidity.

From a market perspective, the most direct, accurate, and timely indicator of liquidity

conditions is the market rate. Observations of the monetary policy stance should focus

on policy rates such as rates on open market operations and the MLF, and on the overall

movement of market rates during a certain period. It would be inappropriate to focus

excessively on quantity factors including the quantity of liquidity and the size of open

market operations.

4

II. Lending by financial institutions grew reasonably, with the annual corporate

loan interest rate at a record low since the reform and opening up

Growth of total credit was more stable. Amid positive factors for economic growth and

flourishing loan demands at the beginning of 2021, the PBC guided financial

institutions to stabilize the pace of loan issuances in the first half of the year, especially

in the first quarter, so as to leave some room for uncertainties in the second half of the

year. In the second half of the year, the domestic economy faced downward pressure,

and credit demands slowed down sharply. In response, through the PBC’s forward

guidance, financial institutions enhanced the stability of credit growth, coordinated

cross-year credit policies, and consolidated financial support for the real economy. Thus,

RMB loans achieved a stronger year-on-year increase in 2021. At end-2021,

outstanding loans issued by financial institutions in domestic and foreign currencies

grew 11.3 percent year on year to RMB198.5 trillion, increasing RMB20.1 trillion from

the beginning of 2021, or a year-on-year acceleration of RMB308.8 billion.

Outstanding RMB-denominated loans grew 11.6 percent year on year to RMB192.7

trillion, up RMB19.95 trillion from the beginning of 2021, or a year-on-year

acceleration of RMB315 billion. Loans grew by RMB7.7 trillion, RMB5.1 trillion,

RMB4.0 trillion, and RMB3.2 trillion for each of the four quarters of 2021, respectively.

Quarterly increments accounted for 38.5 percent, 25.5 percent, 19.9 percent, and 16.2

percent, respectively, which were basically flat with the previous year.

The credit structure has been improving. At end-2021, medium and long-term loans to

enterprises and public entities grew by RMB9.2 trillion from the beginning of the year,

accounting for 76.8 percent of total corporate loans. Medium and long-term loans to

the manufacturing sector increased by 31.8 percent. In particular, the high-tech

manufacturing sector witnessed a year-on-year increase of 32.8 percent. Outstanding

inclusive loans to micro and small businesses (MSBs) grew by 27.3 percent year on

year to RMB19.2 trillion. These loans supported 44.56 million MSBs, rising 38 percent

year on year.

5

Table 1 The Structure of RMB Loans in 2021

Unit: RMB100 million

Outstanding amount

at end-December

YOY growth

(%)

Increase from the

beginning of the

year

YOY

acceleration

RMB loans to:

1926903

11.6%

199490

3150

Households

711043

12.5%

79195

539

Enterprises and public

entities

1204537

11.1%

120189

-1483

Non-banking financial

institutions

4275

-16.5%

-847

3859

Overseas

7048

15.6%

952

235

Note: Loans to enterprises and public entities refer to loans to non-financial enterprises, government

departments, and organizations.

Source: The People’s Bank of China.

Table 2 New RMB Loans by Financial Institutions in 2021

Unit: RMB100 million

Increase from the beginning of

the year

YOY acceleration

Chinese-funded large-sized banks

1

93722

6292

Chinese-funded small and medium-sized

banks

2

104966

-2002

Small-sized rural financial institutions

3

26607

1398

Foreign-funded financial institutions

1492

854

Notes: 1. Chinese-funded large-sized banks refer to banks with assets (in both domestic and foreign

currencies) of RMB2 trillion or more (according to the amount of total assets in both domestic and

foreign currencies at end-2008). 2. Chinese-funded small and medium-sized banks refer to banks

with total assets (both in domestic and foreign currencies) of less than RMB2 trillion (according to

the amount of total assets in both domestic and foreign currencies at end-2008). 3. Small-sized rural

6

financial institutions include rural commercial banks, rural cooperative banks, and rural credit

cooperatives.

Source: The People’s Bank of China.

Box 2 Maintaining Stable Growth of Credit Aggregates

Since the beginning of 2021, in line with the arrangements made by the CPC Central

Committee and the State Council, the PBC has implemented a prudent monetary policy

that is flexible, targeted, reasonable, and appropriate. In the first half of the year, the

PBC employed a mix of monetary policy instruments to keep liquidity adequate at a

reasonable level, made good use of central bank lending and two monetary policy tools

that provide direct support for the real economy, improved supervision of deposit rates,

and guided financial institutions to maintain their support for the real economy. In the

second half of the year, in response to the triple pressures on the economy, i.e., shrinking

demand, supply shocks, and waning expectations, the PBC enhanced intertemporal

adjustments, coordinated cross-year policies, and urged financial institutions to step up

their support for the real economy so as to promote stable growth of credit aggregates

and to keep economic performance within a reasonable range.

First, keeping liquidity adequate at a reasonable level. The PBC injected liquidity

into the market by RRR cuts, open market operations, and the MLF. In July 2021, a

preemptive RRR cut of 0.5 percentage points was made, and approximately RMB1

trillion of long-term funds were unleashed, paving the way for the sustainable and stable

economic recovery in the second half of the year. In December, the PBC cut the RRR

by another 0.5 percentage points, which freed up about RMB1.2 trillion of long-term

funds, effectively broadened the stable long-term funding source of financial

institutions, and thus buttressed the development of the real economy in a better way.

At the beginning of 2022, the PBC increased liquidity injections by the MLF and open

market operations, creating a favorable liquidity environment for an appropriate growth

of money and credit and a stable macro economy as a whole.

Second, guiding financial institutions to step up their support for the real economy.

The PBC held a meeting with financial institutions on the monetary and credit situation

in August and December, respectively, guiding financial institutions to maintain stable

growth in credit aggregates. The PBC made efforts to further improve the macro

prudential assessment (MPA) framework and encouraged banks to increase their

support for inclusive loans to MSBs as well as medium and long-term loans to the

manufacturing sector. Central bank bills swap (CBS) operations were conducted on a

regular basis to support banks to replenish capital through perpetual bond issuances,

thereby further enhancing sustainability of the financial sector’s capacity to serve the

real economy.

7

Third, giving full play to both aggregate and structural monetary policy

instruments. The structural monetary policy instruments have actively done a good job

in providing additional financial support. At the beginning of 2021, RMB200 billion in

central bank lending was added to support locally incorporated banks in areas with

sluggish credit growth to expand lending. In September, the PBC increased central bank

lending in support of micro, small, and medium-sized enterprise (MSME) financing

by RMB300 billion. In November, the PBC launched the carbon emission reduction

facility (CERF) and set up RMB200 billion worth of special central bank lending

targeted for clean and efficient coal use, aiming to promote the development of clean

energy, energy conservation, environmental protection, carbon reduction technology,

clean and efficient use of coal and other relevant key areas, and to boost overall energy

supply. In December, the two monetary policy instruments that directly support the real

economy were converted into market-based policy tools in support of MSBs. These

structural monetary policy instruments not only promoted optimization of the credit

structure but also boosted the stable growth of credit aggregates.

Fourth, steadily bringing down overall financing costs of enterprises. The role of

the loan prime rate (LPR) reform has been brought into full play, the quality of quotes

by LPR quoting banks have been improving, and financial institutions have been

encouraged to use the LPR as a pricing reference for bank lending. The one-year LPR

rate went down by 5 basis points in December 2021. In January 2022, both the one-

year MLF rate and the 7-day open market operation rate dropped by 10 basis points,

while the one-year and over-5-year LPR rates declined by 10 basis points and 5 basis

points, respectively, further bringing down actual lending rates. In December 2021,

rates of central bank lending in support of agro-related businesses and MSBs were cut

by 0.25 percentage points, marking stepped-up support for these sectors. The PBC also

made significant achievements to improve the supervision of deposit interest rates. The

self-regulatory ceiling for deposit interest rates has shifted from multiplying the

benchmark deposit rates by a designated multiplier to adding the basis points to the

benchmark interest rates. In the meantime, the PBC strengthened its management of

non-local deposits absorbed by locally incorporated banks. All these efforts contributed

to reducing debt costs for banks. The PBC, together with the China Banking and

Insurance Regulatory Commission (CBIRC) and other relevant departments, strived to

reduce the overall financing costs of enterprises, especially MSBs, through multiple

measures, including cutting interest rates, reducing fees, and launching a number of

tools that could directly support the real economy.

A series of policies and measures have achieved remarkable results. RMB loans saw an

increase of RMB19.95 trillion in 2021, which surpassed that recorded in 2020 by

RMB315 billion, indicating stable growth of credit aggregates. At end-2021, M2 and

8

the AFRE witnessed year-on-year growth of 9 percent and 10.3 percent, respectively,

which were basically in line with the nominal economic growth rate. As for the two-

year average, the growth rates of M2 and the AFRE in 2020 and 2021 were 9.5 percent

and 11.8 percent, respectively, which were basically in line with or slightly higher than

the two-year average nominal economic growth.

Going forward, the PBC will continue to follow the guidelines of the Central Economic

Work Conference. Pursuing stability as its top priority and seeking progress while

ensuring stability, the PBC will continue to implement a prudent monetary policy that

is flexible and appropriate, enhance intertemporal policy adjustments, and keep the

liquidity adequate at a reasonable level through a mix of monetary policy instruments

so as to maintain stable growth of credit aggregates and to keep the growth rates of

money supply and the AFRE basically in line with nominal economic growth.

The PBC continued to deepen the market-based reform of interest rates and to tap into

the efficiency of the LPR reform. Play was given to the guiding role of the LPR, and

the one-year LPR in December 2021 was decreased by 0.05 percentage points. In the

meantime, the PBC optimized regulation of deposit rates and lowered the interest rate

on central bank lending for rural development and MSBs by 0.25 percentage points,

promoting a steady drop in the actual loan rates. In December, the one-year LPR and

the over-five-year LPR stood at 3.80 percent and 4.65 percent, respectively, with the

one-year LPR down 0.05 percentage points and the over-five-year LPR on par with that

in December 2020. The weighted average lending rate recorded 4.76 percent in

December, a decline of 0.27 percentage points year on year. In particular, the weighted

average interest rate on ordinary loans registered 5.19 percent, down 0.11 percentage

points year on year. The weighted average corporate lending rate fell by 0.04 percentage

points year on year to 4.57 percent. The average corporate loan interest rate in 2021

was 4.61 percent, a drop of 0.1 percentage points from 2020 and 0.69 percentage points

from 2019, reaching its lowest level in the past four decades of the reform and opening

up.

Table 3 Weighted Average Interest Rates on New Loans Issued in December

2021

Unit: %

December

Change from last December

Weighted average interest rate on new loans

4.76

-0.27

9

On ordinary loans

5.19

-0.11

Of which: On corporate loans

4.57

-0.04

On bill financing

2.18

-0.92

On mortgage loans

5.63

0.29

Source: The People’s Bank of China.

In December, the share of ordinary loans with rates above, at, or below the LPR

registered 67.75 percent, 6.98 percent, and 25.27 percent, respectively. Compared with

2021, the floating range of loan rates around the LPR as a whole moved downward.

Table 4 Shares of RMB Lending Rates at Different Levels, from January to

December 2021

Unit: %

Month

LPR-bps

LPR

LPR+bps

Subtotal

(LPR,

LPR+0.5%)

[LPR+0.5%,

LPR+1.5%)

[LPR+1.5%,

LPR+3%)

[LPR+3%,

LPR+5%)

LPR+5%

and above

January

23.93

7.51

68.56

15.45

24.38

13.24

8.09

7.39

February

26.24

7.02

66.74

14.26

23.59

12.28

8.25

8.36

March

22.03

8.42

69.54

14.98

24.79

13.56

8.76

7.45

April

21.08

7.46

71.46

14.45

23.88

14.78

9.69

8.68

May

22.89

7.38

69.73

14.27

23.60

14.00

9.04

8.82

June

24.25

8.07

67.67

15.46

23.79

13.36

8.10

6.97

July

22.37

7.15

70.48

14.20

24.18

13.76

9.25

9.10

August

22.48

7.42

70.10

14.20

23.25

13.91

9.37

9.37

September

23.52

8.36

68.13

14.94

23.42

13.24

8.59

7.93

October

24.62

7.38

68.00

13.22

22.05

13.45

9.35

9.93

November

25.48

7.36

67.17

14.40

22.33

13.31

8.77

8.36

December

25.27

6.98

67.75

16.17

22.98

13.25

8.49

6.86

10

Source: The People’s Bank of China.

Interest rates on foreign-currency deposits and loans declined slightly. In December,

the weighted average interest rates on demand and large-value USD-denominated

deposits with maturities within 3 months registered 0.10 percent and 0.31 percent, down

0.06 and 0.28 percentage points from December 2020, respectively. The weighted

average interest rates on USD-denominated loans with maturities within 3 months and

with maturities between 3 months (including 3 months) and 6 months both registered

1.11 percent, down 0.11 percentage points and 0.25 percentage points from December

2020, respectively.

Table 5 Average Interest Rates on Large-value USD-denominated Deposits and

Loans from January to December 2021

单位:%

Month

Large-value deposits

Loans

Demand

deposits

Within

3

months

3–6

months

(including

3 months)

6–12

months

(including

6 months)

1

year

Over

1 year

Within

3

months

3–6

months

(including

3 months)

6–12

months

(including

6 months)

1

year

Over

1 year

January

0.14

0.65

0.88

0.92

1.10

1.17

1.25

1.12

1.06

1.04

1.94

February

0.14

0.61

0.72

0.90

1.05

1.04

1.23

1.17

1.05

1.16

2.37

March

0.14

0.55

0.77

0.91

1.09

0.99

1.23

1.09

1.01

0.90

2.14

April

0.12

0.51

0.77

0.81

0.99

1.07

1.32

1.15

1.16

1.03

1.93

May

0.11

0.46

0.69

0.73

0.92

0.84

1.31

1.11

0.86

0.90

2.20

June

0.10

0.43

0.62

0.77

0.91

0.90

1.15

0.99

0.90

0.78

2.22

July

0.11

0.43

0.65

0.70

0.93

0.59

1.14

1.03

0.93

0.86

1.93

August

0.09

0.41

0.64

0.69

0.99

0.88

1.25

1.05

0.94

0.90

2.24

September

0.10

0.40

0.55

0.71

0.85

0.80

1.11

1.05

1.10

0.93

2.16

October

0.11

0.41

0.55

0.76

0.85

1.02

1.16

1.15

1.11

0.96

1.32

November

0.11

0.42

0.68

0.72

0.85

1.00

1.20

1.01

1.02

1.06

2.03

December

0.10

0.31

0.65

0.78

0.97

0.96

1.11

1.11

0.98

1.09

2.00

11

Source: The People’s Bank of China.

Deposits grew steadily. At end-2021, outstanding deposits in domestic and foreign

currencies in all financial institutions increased 9.3 percent year on year to RMB238.6

trillion, up RMB20.2 trillion from the beginning of 2021 and an acceleration of

RMB70.3 billion. Outstanding RMB deposits grew 9.3 percent year on year to

RMB232.3 trillion, an increase of RMB19.7 trillion from the beginning of the year and

an acceleration of RMB32.3 billion. Outstanding deposits in foreign currencies stood

at USD996.9 billion, an increase of USD107.7 billion from the beginning of 2021 and

a deceleration of USD23.8 billion.

Table 6 The Structure of RMB Deposits in 2021

Unit: RMB100 million

Deposits at

end-December

YOY growth

(%)

Increase from the

beginning of the year

YOY

acceleration

RMB deposits:

2322500

9.3%

196780

323

Households

1025012

10.7%

99002

-13952

Non-financial enterprises

696695

5.5%

37577

-28164

Public entities

311530

4.3%

12074

10505

Fiscal entities

50389

12.6%

5617

1686

Non-banking financial

institutions

223546

22.1%

40106

29461

Overseas

15329

18.5%

2404

786

Source: The People’s Bank of China.

III. Money supply and aggregate financing to the real economy grew at a

reasonable pace

Money and credit aggregates maintained reasonable growth, providing strong support

for the real economy. Outstanding M2 recorded RMB238.3 trillion at end-2021,

increasing 9.0 percent year on year. Outstanding M1 and M0 registered RMB64.7

trillion and RMB9.1 trillion, respectively, increasing 3.5 percent and 7.7 percent year

12

on year, respectively. The year of 2021 witnessed a net cash injection of RMB651

billion, which was RMB61.5 billion less than that in the previous year.

According to preliminary statistics, the outstanding AFRE reached RMB314.13 trillion

at end-December. Year-on-year growth registered 10.3 percent, decelerating 3

percentage points compared to the growth recorded at end-2020. The AFRE increment

in 2021 totaled RMB31.35 trillion, dropping RMB3.44 trillion year on year. Growth of

money supply and the AFRE featured the following: first, loans issued by financial

institutions to the real economy maintained stable growth. In 2021, loans issued to the

real economy denominated in both RMB and foreign currencies increased by

RMB20.11 trillion, which was on par with 2020 and RMB3.36 trillion more than that

in 2019. Second, debt financing returned to normal, while equity financing exhibited a

significantly larger year-on-year increase. In 2021, net financing through government

bonds posted RMB7.02 trillion, RMB1.31 trillion less than that in 2020 when RMB1

trillion of special government bonds was issued for the COVID-19 response. Net debt

financing by non-financial enterprises dropped by RMB1.09 trillion to RMB3.29

trillion, while their domestic equity financing registered RMB1.24 trillion, an increase

of RMB343.4 billion over that in the previous year. Third, off-balance sheet financing

recorded a notable year-on-year drop. Net financing through entrusted loans, trust loans,

and undiscounted bankers’ acceptances exhibited a net decrease of RMB2.67 trillion,

which was RMB1.35 trillion larger than the decrease in 2020.

Table 7 Aggregate Financing to the Real Economy in 2021

End-December 2021

2021

Stock

(RMB

trillion)

YOY

growth (%)

Flow

(RMB100

million)

YOY

change

(RMB10

0 million)

AFRE

314.13

10.3

313509

-34408

Of which: RMB loans

191.54

11.6

199403

-907

Foreign-currency loans (RMB

equivalent)

2.23

6.3

1715

2

6

5

Entrusted loans

10.87

-1.6

-1696

2258

Trust loans

4.36

-31.3

-20074

-9054

13

End-December 2021

2021

Stock

(RMB

trillion)

YOY

growth (%)

Flow

(RMB100

million)

YOY

change

(RMB10

0 million)

Undiscounted bankers’ acceptances

3.01

-14.0

-4916

-6662

Corporate bonds

29.93

8.6

32866

-10882

Government bonds

53.06

15.2

70154

-13063

Domestic equity financing by non-

financial enterprises

9.48

15.0

12357

3434

Other financing

9.43

16.9

13631

-491

Of which: Asset-backed securities of

depository institutions

2.17

14.7

2781

672

Loans written off

6.32

19.5

10299

-1923

Notes: ①AFRE (stock) refers to outstanding financing provided by the financial system to the real

economy at the end of a period. AFRE (flow) refers to the volume of financing provided by the

financial system to the real economy within a certain period of time. ②Since December 2019, the

PBC has further improved AFRE statistics by incorporating “central government bonds” and “local

government general bonds” into the AFRE and combining them with the existing “local government

special bonds” into the “government bonds” item. The value of this indicator is the face value of

bonds under custody. Since September 2019, the PBC has further improved the “corporate bonds”

statistics included in the AFRE by incorporating “exchange-traded asset-backed corporate

securities.” To improve the AFRE statistical methodology, the PBC has incorporated “local

government special bonds” into the AFRE since September 2018 and has incorporated “asset-

backed securities by depository institutions” and “loans written off” into the AFRE statistics under

the item of “other financing” since July 2018. ③Year-on-year statistics in the table are on a

comparable basis.

Sources: The People’s Bank of China, China Banking and Insurance Regulatory Commission, China

Securities Regulatory Commission, China Central Depository & Clearing Co., Ltd., National

Association of Financial Market Institutional Investors, etc.

Box 3 China’s Macro Leverage Ratio Remains Generally Stable

First, China has achieved notable results in stabilizing its leverage ratio.

14

The macro leverage ratio is measured by a country’s aggregate debts in its non-financial

sectors to its GDP. Preliminary data show that China’s macro leverage ratio at end-2021

dropped by 7.7 percentage points from the year before to 272.5 percent, a decline for

the fifth successive quarter, and China has made notable progress in stabilizing its

leverage ratio. By sectors, at end-2021, the leverage ratio for the country’s non-financial

companies, households, and government agencies registered 153.7 percent, 72.2

percent, and 46.6 percent, respectively, compared with the previous year, a decline of

8.0 percentage points and 0.4 percentage points for the first two sectors, and a rise of

0.7 percentage points for government agencies.

Compared with the major economies, the increase in China’s macro leverage ratio is

relatively manageable in the wake of COVID-19. The latest data from the BIS show

that the leverage ratio in the U.S. (286.2 percent), Japan (416.5 percent), and the euro

area (284.3 percent) at end-Q2 in 2021 added 31.3 percentage points, 37.1 percentage

points, and 27.2 percentage points from end-2019, respectively. Over the corresponding

period, China’s leverage ratio rose 19.9 percentage points from end-2019 to 275.9

percent, and its increase was 11.4 percentage points, 17.2 percentage points, and 7.3

percentage points lower than the U.S., Japan, and the euro area, respectively. Therefore,

China has supported the rapid post-COVID economic recovery with relatively fewer

new debts and, comparatively, its macro leverage ratio is not high.

Table: China’s Macro Leverage Ratios since 2016 (%)

Overall

Leverage Ratio

Household

Leverage Ratio

Government

Leverage Ratio

Non-Financial

Enterprise Leverage

Ratio

2016

248.6

52.2

36.7

159.8

2017

252

57

36

159

2018

249

60.5

36.4

152.2

2019

256

65.1

38.6

152.2

2020Q1

270.1

67.3

40.8

162

2020Q2

277.5

69.5

42.7

165.2

2020Q3

281.6

71.8

45.1

164.7

2020

280.2

72.6

45.9

161.7

2021Q1

278.1

72.3

44.7

161.1

2021Q2

275.9

72.2

45

158.6

2021Q3

275.1

72.5

45.9

156.8

2021

272.5

72.2

46.6

153.7

Source: The People’s Bank of China.

15

Second, the solid COVID-19 response, steady economic recovery, effective macro

policies, and other factors all contribute to China’s generally stable macro

leverage ratio.

On the one hand, the key to stabilizing the macro leverage ratio lies in China’s

notable progress in its COVID-19 response and its sustained economic recovery.

Nominal GDP is the denominator in the calculation of the macro leverage ratio, and its

growth rate significantly affects the movement of the leverage ratio. China’s GDP

growth slowed markedly under the impact of COVID-19, and its macro leverage ratio

rose during this period. The CPC Central Committee, with Comrade Xi Jinping at the

core, oversaw the general situation and made the important decision to coordinate the

COVID-19 response with economic and social development. These efforts made China

the first country to bring COVID under control, to restart work and production, and to

achieve positive economic growth. Economic growth became more resilient, which

played a prominent role in stabilizing the leverage ratio. China’s nominal year-on-year

GDP growth accelerated by 10.1 percentage points to 12.8 percent in 2021, markedly

driving the macro leverage ratio lower. By quarters, starting from Q2 in 2020, the

growth margin of macro leverage ratio moderated until it turned downward. The

increase in the leverage ratio during the first three quarters of 2020 stood at 14.1

percentage points, 7.4 percentage points, and 4.1 percentage points, respectively, while

the ratio declined by 1.4 percentage points, 2.1 percentage points, 2.2 percentage points,

0.7 percentage poinst, and 2.7 percentage points, respectively, from Q4 2020 to Q4

2021, falling for five consecutive quarters.

On the other hand, macro policies with strength, appropriate intensity, and

efficiency stabilized the fundamentals of the economy with manageable new debts.

First, policies are strong. Prudent monetary policies have become more flexible,

appropriate, and targeted with a prompt and strong response since the outbreak of

COVID-19. Monetary support measures of over RMB9 trillion have been introduced,

and financial institutions made RMB1.5 trillion in interest concessions to boost the real

economy. All sectors have greater awareness of the financial support. Therefore, the

sense of fulfillment of the sectors in the real economy has grown stronger. Meanwhile,

fiscal policies have become more proactive to offset the impact of COVID-19, with the

introduction of large-scale measures to help businesses get through the tough times. Net

government bond financing in 2020 reached RMB8.32 trillion, an increase of RMB3.6

trillion from the previous year. On balance, macro policies were coordinated

appropriately to foster strong synergies to ensure stability on six key fronts and to

maintain security in six key areas, and the fundamentals of the economy were kept

stable. Second, policies have been introduced with appropriate intensity. The PBC has

maintained a prudent monetary policy by refraining from a deluge of strong stimulus

policies and continuing with conventional monetary policies. Monetary policy has

16

gradually shifted since May 2020 to its conventional stance, and since 2021 the PBC

has maintained a forward-looking policy with continuity and consistency, stepped up

intertemporal adjustments, and provided an enabling environment for a steady

economic recovery. During 2020 and 2021, the growth rate of M2 and the AFRE

averaged 9.5 percent and 11.8 percent, respectively, in line with and modestly higher

than the average nominal GDP growth rate. Thanks to these developments, debt growth

in China’s non-financial sectors was rather measured and manageable. Outstanding

debt aggregates in 2021 increased 9.7 percent year on year, 2.7 percentage points lower

than the growth at end-2020. This figure is at a historically low level, 7.3 percentage

points lower than the average growth rate of debt aggregates from 2009 to 2019. Third,

policies are effective. By focusing on serving the real economy and ensuring that

stability is a top priority, monetary policy maintained steady growth of money and

credit. By smoothing the transmission of monetary policy and continuously advancing

the LPR reform, monetary policy guided the marked decline in corporate funding costs.

By making policies more targeted and providing direct support to the real economy,

financial support policies were phased in to leverage the dual functions of monetary

policy instruments in the adjustment of aggregates and structure. Moreover, the difficult

fight against financial risks curbed both funds from being diverted out of the real

economy and from disorderly expansion, and financial reforms advanced steadily with

enhanced quality and efficiency in financial services. All these measures enhanced the

efficiency of financial services for the real economy and helped the relatively quick

post-COVID economic recovery with fewer new debts.

Third, the macro leverage ratio in 2022 is expected to remain generally stable.

The Central Economic Work Conference noted that economic work next year should

prioritize stability while pursuing progress, and macro policies should be prudent and

effective to strengthen the driving force for self-generated development. The steady

decline in China’s macro leverage ratio will provide room for the financial system to

ramp up support for its real economy. Meanwhile, good COVID-19 prevention and

control and growing economic resilience will also provide conditions for continued

stability of its macro leverage ratio. In the next phase, the PBC will keep prudent

monetary policy flexible and appropriate, step up intertemporal adjustments, enhance

the stability in the growth of credit aggregates, and see that increases in money supply

and aggregate financing are generally in step with economic growth in nominal terms.

This “in step with” mechanism itself contains the notion of “keeping the macro leverage

rate generally stable.” As the economic recovery continues and the driving force for

self-generated development strengthens, the macro leverage ratio will remain generally

stable in 2022.

17

IV. The RMB exchange rate remained basically stable at an adaptive and

equilibrium level

In 2021, cross-border capital flows and foreign exchange supply and demand have been

basically in equilibrium, and market expectations have been generally stable. The

managed floating exchange rate regime based on market supply and demand with

reference to a basket of currencies worked well. Based on market supply and demand,

the RMB exchange rate moved in both directions with enhanced flexibility, playing its

role as an automatic stabilizer in adjusting the macro economy and the balance of

payments. Market factors and policy factors effectively corrected exchange rate

deviations, and the RMB exchange rate remained basically stable at an adaptive and

equilibrium level.

During 2021, the RMB appreciated modestly against a basket of currencies. At year-

end, the China Foreign Exchange Trade System (CFETS) RMB exchange-rate index

and the RMB exchange-rate index based on the special drawing rights (SDRs) basket

closed at 102.47 and 100.34, respectively, up 8.1 percent and 6.5 percent from end-

2020. According to calculations by the Bank for International Settlements (BIS), from

end-2020 to end-2021, the nominal effective exchange rate (NEER) and the real

effective exchange rate (REER) of the RMB appreciated 8.0 percent and 4.5 percent,

respectively, and from the reform of the exchange rate formation mechanism that began

in 2005 to end-2021, appreciation of the NEER and the REER of the RMB registered

48.7 percent and 58.2 percent, respectively. At end-2021, the central parity of the RMB

against the US dollar was 6.3757, appreciating 2.3 percent from end-2020 and 29.8

percent on a cumulative basis since the reform of the exchange-rate formation

mechanism that began in 2005. In 2021, the annualized volatility rate of the RMB

against the US dollar was 3.0 percent.

In 2021, cross-border RMB settlements increased 29 percent year on year to RMB36.6

trillion, with RMB receipts and payments posting RMB18.5 trillion and RMB18.1

trillion, respectively. Cross-border RMB settlements under the current account grew by

16 percent year on year to RMB7.9 trillion, among which RMB settlements of trade in

goods registered RMB5.8 trillion, whereas RMB settlements of trade in services and

other items registered RMB2.1 trillion. Cross-border RMB settlements under the capital

account registered RMB28.7 trillion, increasing 33 percent year on year. Specifically,

RMB settlements of direct investments posted RMB5.8 trillion, while RMB settlements

of securities investments recorded RMB21.2 trillion.

18

Figure 2 Monthly RMB Settlements under the Current Account

Source: The People’s Bank of China.

Part 2. Monetary Policy Operations

In Q4 2021, the PBC resolutely implemented the decisions and arrangements made by

the CPC Central Committee and the State Council, kept the sound monetary policy

flexible, targeted, reasonable and appropriate, enhanced intertemporal adjustments,

coordinated cross-year policies, and brought into play the dual functions of monetary

policy tools in adjusting the credit aggregate and structure. By lowering the required

reserve ratio (RRR), strengthening the use of structural monetary policy instruments,

unleashing the benefits of the LPR reform and other approaches, the PBC put emphasis

on strengthening the stability of aggregate credit growth, continuously scaled up

support for weak links and key areas, further promoted the steady decline of overall

financing costs for enterprises, and contributed to stabilizing the whole macro economy,

thereby fostering a favorable monetary and financial environment for high-quality

economic development.

I. Conducting open market operations in a flexible manner

Conducting open market operations in a flexible manner. In Q4 2021, the PBC

strengthened market monitoring and cross-cyclical liquidity adjustments. Based on the

adoption of monetary policy instruments such as RRR cuts and the Medium-term

Lending Facility (MLF) to provide medium and long-term liquidity, the PBC conducted

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

2012.12

2013.03

2013.06

2013.09

2013.12

2014.03

2014.06

2014.09

2014.12

2015.03

2015.06

2015.09

2015.12

2016.03

2016.06

2016.09

2016.12

2017.03

2017.06

2017.09

2017.12

2018.03

2018.06

2018.09

2018.12

2019.03

2019.06

2019.09

2019.12

2020.03

2020.06

2020.09

2020.12

2021.03

2021.06

2021.09

2021.12

RMB100

million

Trade in services and other items

Trade in goods

19

successive daily open market operations and managed the intensity of operations

flexibly to timely offset the impacts of fiscal expenditures and revenue, issuance of

government bonds, and temporary or seasonal factors such as the National Day holiday

and the year end, thus maintaining liquidity in the banking system at a reasonable and

adequate level. In late December, the PBC conducted 14-day reverse repos in a phased

manner to release cross-year liquidity in advance, and it moderately intensified

operations in an attempt to maintain a basic equilibrium between supply and demand

of the cross-year funds. Meanwhile, by properly arranging the operation timing and

maturities, the PBC ensured that the funds that had been supplied at year-end would be

withdrawn timely upon their maturity after New Year’s Day so as to effectively ensure

the stability of liquidity and money market operations across the year.

Guiding market rates to move around central bank policy rates in a reasonable

manner. In Q4 2021, the rates paid on open market operations (OMO) remained

unchanged. Since the beginning of 2021, the institutional building of open market

operations has achieved remarkable results. First, the PBC sent successive short-term

policy rate signals through daily open market operations in a bid to stabilize market

expectations. In addition, the PBC clarified that OMO rates were short-term policy rates

and guided the weighted average rate on 7-day repos between depository institutions in

the interbank market (DR007) to move around the policy rates within a range. Liquidity

expectations of financial institutions became more stable at key junctures, such as

quarter-end and year-end. Demand for precautionary liquidity dropped significantly,

and money market rates remained stable. In 2021, the DR007 averaged 2.17 percent,

approximating the 2.20 percent of the central bank’s 7-day OMO rate.

On January 17, 2022, the PBC conducted a total of RMB700 billion of MLF operations

and RMB100 billion of 7-day reverse repos. The rates paid on the MLF and the open-

market operations both declined by 10 basis points to 2.85 percent and 2.10 percent,

respectively. The operations increased liquidity supply and offset the impacts of the tax

payment peak in January, the accelerated issuance of government bonds, cash

provisions before the Spring Festival, and other short-term factors in advance, thus

keeping liquidity adequate at a reasonable level. The declined rates paid on the MLF

and the open-market operations showed that the proactive response and quick measures

taken at an early stage regarding monetary policy were conducive to uplifting market

confidence and to promoting a steady decline in the comprehensive financing costs for

enterprises.

Continuously conducting central bank bill swap (CBS) operations. In Q4 2021, the

PBC conducted CBS operations three times, with the total amount registering RMB15

billion. The maturity of each operation was three months, at a fixed rate of 0.10 percent.

20

In 2021, the PBC conducted CBS operations regularly on a monthly basis, and these

operations have played a positive role in boosting liquidity in the secondary market of

bank-issued perpetual bonds and in supporting the issuance of perpetual bonds to

replenish capital as well as in enhancing the stability of aggregate credit growth by

banks, especially by small and medium-sized banks.

Figure 3 Volume of Spot Transactions of Bank-issued Perpetual Bonds

Issuing central bank bills in Hong Kong on a regular basis and introducing the

market-maker mechanism for central bank bill repos. In Q4 2021, the PBC issued

three batches of RMB-denominated central bank bills in Hong Kong, totaling RMB30

billion. Specifically, the 3-month, 6-month, and 1-year bills registered RMB10 billion,

RMB5 billion, and RMB15 billion, respectively. In 2021, the PBC issued twelve

batches of RMB-denominated central bank bills totaling RMB120 billion. In January

2021, the Bank of China (Hong Kong) introduced the market-maker mechanism for

RMB-denominated central bank bill repos in Hong Kong. A total of RMB309 billion

of central bank bill repo transactions were completed in 2021, with the scope of

institutional participants continuously expanding. The regular issuance of central bank

bills and the introduction of the market-maker mechanism for central bank bill repos in

Hong Kong enriched the scope of RMB investment products and RMB liquidity

management tools in Hong Kong, which played an active role in promoting the sound

development of the offshore RMB money market and bond market and in propelling

both domestic and overseas market entities to issue RMB-denominated bonds and to

conduct RMB business in the offshore market. According to statistics, in 2021 offshore

RMB bond issuances, excluding RMB-denominated central bank bills issued in Hong

21

Kong, registered over RMB180 billion, an increase of 38 percent year on year. The

RMB offshore money market and bond market are becoming increasingly buoyant.

II. Timely conducting Standing Lending Facility and Medium-term Lending

Facility operations

Conducting MLF operations in a timely manner. To ensure an appropriate supply of

medium and long-term liquidity and to give play to the signaling and guiding functions

of the medium-term policy rates, the PBC conducted a total of RMB4.55 trillion of

MLF operations in 2021, all with a maturity of one year and an interest rate of 2.95

percent. In particular, the amount of MLF operations posted RMB0.8 trillion, RMB0.45

trillion, RMB1.3 trillion, and RMB2.0 trillion in Q1, Q2, Q3, and Q4, respectively. At

end-2021, the outstanding MLF registered RMB4.55 trillion, RMB0.6 trillion less than

that at the beginning of 2021. On January 17, 2022, MLF operations were conducted

with a rate paid at 2.85 percent, down 10 basis points.

Advancing the reforms of electronic SLF operations. The entire process of

conducting SLF operations became electronic in an orderly manner, which enhanced

operational efficiency, stabilized market expectations, and strengthened the stability of

liquidity in the banking system. In 2021, the PBC conducted a total of RMB76.03

billion SLF operations, of which RMB47.51 billion, RMB11.55 billion, RMB2.75

billion, and RMB14.22 billion of SLF operations were conducted in Q1, Q2, Q3, and

Q4, respectively. At end-2021, the balance of SLF operations registered RMB12.68

billion. The SLF rate played its role as the ceiling of the interest rate corridor, and it

promoted the smooth operation of money market rates. At end-2021, the overnight, 7-

day, and 1-month SLF rates stood at 3.05 percent, 3.20 percent, and 3.55 percent,

respectively, on par with the rates at end-Q3. On January 17, 2022, SLF rates of all

maturities were lowered by 10 basis points each. After the rate cut, the overnight, 7-day,

and 1-month SLF rates stood at 2.95 percent, 3.10 percent, and 3.45 percent,

respectively.

III. Adjusting the required reserve ratio for financial institutions

In Q4, 2021, the required reserve ratio for financial institutions was lowered by

0.5 percentage points in an attempt to support the real economy and to promote

the steady decline of overall financing costs. The PBC reduced the required reserve

ratio by 0.5 percentage points, effective on December 15, 2021 (not applicable to

financial institutions that had already implemented a required reserve ratio of 5 percent).

Meanwhile, financial institutions that participated in the assessment of the targeted

22

RRR cut for inclusive finance were all entitled to the most preferential required reserve

ratio, releasing about RMB1.2 trillion of long-term funds. After this round of RRR cuts,

the weighted average required reserve ratio for financial institutions stood at 8.4 percent.

This RRR cut is a conventional operation, aimed at enhancing intertemporal

adjustments, improving the funding structure of financial institutions, and

strengthening the capacity of the financial sector to serve the real economy. First, the

PBC kept liquidity adequate at a reasonable level, effectively expanded the sources of

long-term stable funding for financial institutions, and enhanced their capability to

allocate funds. Second, the PBC guided these institutions to actively use the funds

released from the RRR cut to boost support for the real economy, especially micro,

small, and medium-sized enterprises (MSMEs). Third, the RRR cut lowered the

funding costs of financial institutions by approximately RMB15 billion per year, which

further reduced the overall financing costs for enterprises through the transmission of

financial institutions. The two across-the-board RRR cuts of 0.5 percentage points for

each in 2021 released a total of about RMB2.2 trillion of long-term funds.

The foreign exchange required reserve ratio was raised for financial institutions,

and foreign exchange liquidity management of financial institutions was enhanced.

The PBC raised the foreign exchange required reserve ratio by 2 percentage points,

from 7 percent to 9 percent, effective on December 15, 2021, freezing around USD20

billion of foreign exchange liquidity. In 2021, the PBC raised the foreign exchange

RRR twice, both by 2 percentage points, freezing a total of about USD 40 billion of

foreign exchange liquidity.

IV. Further improving the macro prudential management framework

The role of the macro prudential assessment (MPA) was effectively brought into

play to optimize the credit structure and to promote the supply-side structural

reform of the financial sector. In 2021, the PBC further improved the framework of

the MPA and the assessment mechanism, and it attached importance to their guidance

on both the aggregate and the structure of credit. By adjusting and optimizing relevant

assessment indicators in a dynamic manner, the PBC guided financial institutions to

enhance the stability of growth of credit aggregates and to continue to ramp up support

for the real economy, especially by issuing loans to inclusive MSBs and medium and

long-term loans to the manufacturing sector.

Guidelines on Macro-Prudential Policies (Trial) were released. On December 31,

2021, the PBC released the Guidelines on Macro-Prudential Policies (Trial)

(hereinafter referred to as the Guidelines). Based on the actual situation in China, the

Guidelines specify elements for establishing a sound macro-prudential policy

framework. First, they define concepts related to macro-prudential policies, such as the

macro-prudential policy framework, systemic financial risks, and the working

23

mechanisms of the macro-prudential management. Second, they lay out the major

content of the macro-prudential policy framework, including its policy objectives,

assessment of systemic financial risks, policy tools, transmission mechanisms, and

governance mechanisms. Third, they put forward the support and safeguards as well as

the policy coordination requirements necessary for the effective implementation of

macro-prudential policies. Promulgation of the Guidelines is a major measure for

establishing a sound macro-prudential policy framework, which is conducive to

building a smooth governance mechanism of macro-prudential policies, to developing

a coordinated system of forestalling and defusing systemic financial risks, and to

promoting sound development of the financial system.

The regulatory framework for systemically important financial institutions was

improved. To improve the regulatory framework of Systemically Important Banks

(SIBs), the PBC drafted the Additional Regulatory Rules on SIBs (Trial) jointly with

the CBIRC, and solicited public opinions starting from April 2, 2021, which were

officially released on October 15, entitled Order No.5 [2021] of the PBC and CBIRC.

The Order specifies. requirements for additional regulation, recovery and resolution

plans, and prudential regulation, providing guidance and standards for implementing

regulation of the SIBs. On October 15, the PBC and CBIRC also published a list of

domestic SIBs. A total of nineteen banks were identified as domestic SIBs on the basis

of the data assessment in 2020, including six state-owned commercial banks, nine joint-

stock commercial banks, and four city commercial banks.

The regulatory system for financial holding companies (FHCs) was further

improved. Since the beginning of 2021, the PBC has made proactive efforts to carry

out administrative approvals of FHCs. On March 31, it released the Interim Regulations

on Filing-based Management of Directors, Supervisors, and Senior Executives of

Financial Holding Companies (Order No.2 [2021] of the PBC) (hereinafter referred to

as the Regulations). The Regulations clarify that the PBC should perform the duties of

filing and supervising directors, supervisors, and senior executives of FHCs, and they

specify the eligible conditions for personnel and the relevant filing procedures. In

addition, the PBC reinforced appointment management so as to regulate the operation

of FHCs and to guard against relevant risks.

V. Actively giving play to the role of structural monetary policy instruments

Actively using central bank lending to support rural development, central bank

lending for MSBs, central bank discounts, and other instruments to guide

financial institutions to enhance support for key areas and weak links in the

national economy and for coordinated regional development. The PBC gave full

play to the role of central bank lending to support rural development and central bank

24

lending for MSBs in providing targeted liquidity and serving as positive incentives, and

it guided locally incorporated financial institutions to expand credit supply for MSBs,

private firms, agriculture, rural areas, and rural people. Central bank lending for poverty

alleviation was rolled over according to the current regulations so as to support and

consolidate the effective connections between achievements in poverty eradication and

rural revitalization. In ten provinces with slow credit growth, locally incorporated

financial institutions were guided further to make good use of the quota of RMB200