First customer

1 If you are an existing customer, please enter your

customer reference number

2 Title

Mr

Mrs

Ms

Miss

Other (please specify)

First name

Middle name(s)

Surname

Alternative names you’re known by or commonly use (not nicknames)

Previous name(s) – please give any title, forename or surname by

which you have previously been known, e.g. maiden name

3 Nationality

Additional country of Citizenship (if applicable)

Dual nationality?

Yes

No

If Yes, please specify below

4 Marital status

Married

Single

Civil partnership

Divorced

To be married

Separated

Widowed

Living with partner

5 Date of birth

D D

M M

Y Y Y Y

6 City/Town of birth

7 Country of birth

Second customer

1 If you are an existing customer, please enter your

customer reference number

2 Title

Mr

Mrs

Ms

Miss

Other (please specify)

First name

Middle name(s)

Surname

Alternative names you’re known by or commonly use (not nicknames)

Previous name(s) – please give any title, forename or surname by

which you have previously been known, e.g. maiden name

3 Nationality

Additional country of Citizenship (if applicable)

Dual nationality?

Yes

No

If Yes, please specify below

4 Marital status

Married

Single

Civil partnership

Divorced

To be married

Separated

Widowed

Living with partner

5 Date of birth

D D

M M

Y Y Y Y

6 City/Town of birth

7 Country of birth

Please fill in the form using BLOCK CAPITALS and black ink. Tick any boxes which apply.

2 Personal details

1 Type of mortgage

House purchase application

Remortgage application

If buying a new build property, please tick this box

Please complete all the questions so that we can deal with your application as quickly as possible. If you need any help filling in this form, just call us

on 08000 84 28 88 if calling from a UK landline or mobile, or +44 (0)1534 885 000 if calling from overseas. Calls are recorded and may be monitored.

OurJersey branch is open Monday to Friday 9am to 5pm and on Wednesdays 9.30am to 5pm except for public holidays.

To make an application by post, please complete this form and send it to Santander International, 13-15 Charing Cross, St Helier, Jersey JE2 3RP,

Channel Islands along with the requested supporting documents.

Completing this form

Application for a mortgage

Jersey branch

Santander International is able to provide this document in large print, Braille and audio CD. If you would like to receive this document in one of these

formats, please contact us.

Continues…

Page 1 of 12

2 Personal details (continued)

First customer

8 Do you have full housing qualifications?

Yes (Entitled)

No (not Entitled/Licensed/Registered)

Entitled to Work

Licensed

Registered

9 If you don’t own a home are you currently:

Living with friends or relatives?

Renting

10 Home address: If you’ve lived there for less than three years,

give your address(es) for the last three years and state how long

you lived at each.

Present address

Postcode

Time at current address

Y Y

M M

Previous address

Postcode

Time at previous address

Y Y

M M

Previous address

Postcode

Time at previous address

Y Y

M M

(If you need to provide more addresses please do so on a separate sheet)

Correspondence address if dierent from residential address

Postcode

11 Primary phone number (including area code)

Secondary phone number (including area code)

Mobile phone number

Email address

A member of sta may need to contact you regarding the progress

of your application; please indicate the best time below

(between 9am and 5pm, Monday to Friday – except Jersey bank holidays)

Second customer

8 Do you have full housing qualifications?

Yes (Entitled)

No (not Entitled/Licensed/Registered)

Entitled to Work

Licensed

Registered

9 If you don’t own a home are you currently:

Living with friends or relatives?

Renting

10 Home address: If you’ve lived there for less than three years,

give your address(es) for the last three years and state how long

you lived at each.

Present address

Postcode

Time at current address

Y Y

M M

Previous address

Postcode

Time at previous address

Y Y

M M

Previous address

Postcode

Time at previous address

Y Y

M M

(If you need to provide more addresses please do so on a separate sheet)

Correspondence address if dierent from residential address

Postcode

11 Primary phone number (including area code)

Secondary phone number (including area code)

Mobile phone number

Email address

A member of sta may need to contact you regarding the progress

of your application; please indicate the best time below

(between 9am and 5pm, Monday to Friday – except Jersey bank holidays)

Continues…

Page 2 of 12

2 Personal details (continued)

12 Have you ever been declared bankrupt or made

arrangements withcreditors?

Yes

No

Are you a discharged bankrupt?

Yes

No

Have you ever had property repossessed?

Yes

No

Are there any CCJs or defaults registered against you

or yourbusiness?

Yes

No

Have you ever had a payday loan?

Yes

No

Please provide any relevant additional information below

13 Purchase price of the property not including the value of any

furnishings, carpets, curtains, etc. or concessions oered by

thevendor.

Purchase price

£

Deposit

£

Please state source and amount of deposit

Equity in current property

£

Customer’s own savings

£

Gift from family

£

Previous property sale

£

Sales proceeds from current home

£

Inheritance

£

Other

(please specify)

£

What is the full market value of the property

£

Name(s) the property being secured will be registered in?

Is the ownership of the property to be held in name of a property

holding company?

Yes

No

Are you receiving a vendor’s sale cash incentive (e.g. paying legal or

other costs, cashback, carpets, soft furnishings, etc.)?

Yes

No

If Yes, what is the incentive and for how much?

£

14 Address of the property you want to buy

Postcode

15 Previous mortgage application

Have you applied for a mortgage on this property before?

Yes

No

If Yes, who with?

If Yes, why didn’t you go ahead with the application?

16 Please confirm that you currently live, or are intending to live, in the

whole of the property, either on the completion of your mortgage

or at a later time?

Yes

No

If No, will a member of your immediate family live in the whole

of the property, either on completion of your mortgage or at a

latertime?

Yes

No

If No, will you and/or a member of your immediate family live

in more than 40% of the property, either on completion of your

mortgage or at a later time?

Yes

No

If No, what other use will the property have (including full details

of any business which will be carried out there)? Please continue

on a separate sheet if necessary.

a) Could the property be used solely for people to live in without any

structural change?

Yes

No

b) Is any part of the property rented out?

Yes

No

If Yes, please give details of tenants on a separate sheet.

17

Will you have anyone aged 17+ living with you at the property who

is not party to the mortgage?

Yes

No

If Yes, please provide details

18 Type of property?

Bungalow

Detached house

Semi-detached house

Terraced house

Converted flat/maisonette

Purpose-built flat/maisonette

Other

(please describe)

If a flat, how many floors are there? floors

Which floor is the flat situated on? The floor

Number of bedrooms?

To be completed by first time buyers, customers moving home and customers buying a second property. If you are remortgaging and moving

your property to us from another lender, go to question 22. If there is more than one person applying, please answer these questions together.

3 Property and mortgage details

Continues…

Page 3 of 12

19 Is the property you want to buy?

Freehold

Flying Freehold

Leasehold

Share Transfer

Number of years left on lease per year

Ground rent

£

per year

If this varies, please give details

Service charge

£

per year

20

Year of construction of the property?

Y Y Y Y

If a new build property, please provide name of builder

21 Is this a private sale?

Yes

No

Is the vendor related to you?

Yes

No

If Yes, will the property be vacant on completion?

Yes

No

3 Property and mortgage details (continued)

To be completed by remortgage customers only (if you are moving your mortgage to us from another lender).

22

Estimated value of property

£

What is the purpose of this mortgage? (tick one or more boxes

andfill in the amount of money required for each purpose)

a) To pay back the original amount you

borrowed to buy the property

£

b) To pay for further home improvements

(please provide full estimates)

£

c) To pay back existing non-home improvement loan(s)

£

d) To use for personal purposes

£

Total

£

23 Do you already have a mortgage or loan secured on this

propertyother than with Santander International?

Yes

No

If Yes, please give the followingdetails:

Full names of all borrowers

Name and address of lender

Postcode

Mortgage account number

Monthly payment

£

How much did you borrow to buy the property?

£

Total amount still to pay

£

Have you used this property for security on any other loan or

financial commitment (including home improvement loans)?

Yes

No

If Yes, please give the following details:

Name and address of second lender(s)

Postcode

Your Account/Reference number

Monthly payment

£

Total amount still to pay

£

Page 4 of 12

4 Mortgage Repayment

To be completed by all customers in all cases.

24

How do you want to repay the mortgage? Please indicate the

loan amount, repayment type and term as required, as well as

the Product or Rate Type as published on our website.

Repayment type:

Repayment

Interest only

Part capital and part interest

Mortgage amount

Product/Rate Type

(i.e. 2 Year Tracker, 2, 5

or 10 Year Fixed Rate)*

Term

Yrs Mths

* For current Product and Rate Types, refer to the ‘Mortgage rates – Jersey

Branch’ document on our website, and note that the Product Code and Rate

availability will be strictly subject to the valuation received.

If you have chosen repayment please go to question 25.

If you have chosen interest only please indicate how the amount

you’ve borrowed will be repaid:

Sale of mortgaged property

Sale of other property assets

Managed investment portfolio

Other (please specify)

Are any of the above repayment vehicles held in a foreign currency?

Yes

No

(If yes, please specify which ones and which currency)

25 How do you want to pay a product fee?

Paid upfront

Add to mortgage

26 Choosing your payment day

For your convenience and control you can choose the day of the

month that we collect your mortgage payment by standing order.

Thiswill, for example, enable the payment to coincide with the day

you are paid.

This should be between the 1st and the 28th of the month

inclusive. Which day of the month do you want us to collect your

mortgage payment?

Please specify a date

D D

You must ensure that your Gold Account is funded with the

mortgage payment amount at least one working day before the

date chosen.

Property details

If there is more than one person applying, please answer these

questions together.

First customer

27 Employment status

Employed Contract

Self employed Homemaker

Employee with

own company

Retired

Student Unemployed

Other

(please specify)

28

Employer name

29 If contracted:

Contract start date

D D

M M

Y Y Y Y

Contract end date

D D

M M

Y Y Y Y

What is the contract type?

Fixed/Short term

Temporary

30 At what age do you intend to retire?

31 If retired:

Date of retirement

D D

M M

Y Y Y Y

32 If employed:

Occupation

Start date

D D

M M

Y Y Y Y

Second customer

27 Employment status

Employed Contract

Self employed Homemaker

Employee with

own company

Retired

Student Unemployed

Other

(please specify)

28

Employer name

29 If contracted:

Contract start date

D D

M M

Y Y Y Y

Contract end date

D D

M M

Y Y Y Y

What is the contract type?

Fixed/Short term

Temporary

30 At what age do you intend to retire?

31 If retired:

Date of retirement

D D

M M

Y Y Y Y

32 If employed:

Occupation

Start date

D D

M M

Y Y Y Y

5 Employment and financial details

Continues…

Page 5 of 12

5 Employment and financial details (continued)

First customer

33 If self-employed:

(please provide Tax Calculations covering at least 2 years;

or an Accountant’s certificate; or at least 2 years’ accounts.)

Occupation

Name and address of business

Postcode

Type of business

How long have you been trading? How long under your control?

Y Y

years

Y Y

years

Please enter, in the boxes below, your income before tax for the past

three years, as declared to the Comptroller of Taxes:

Year ended Share of net profit Net profit amount

M M

Y Y Y Y

%

£

M M

Y Y Y Y

%

£

M M

Y Y Y Y

%

£

34 To be completed by all customers

Earnings

Basic wage/salary

before tax

£

wk/mth/qtr/yr

Other primary income/

allowances

£

wk/mth/qtr/yr

Secondary income/

regular overtime/allowances

£

wk/mth/qtr/yr

Other employment in

the same field

£

wk/mth/qtr/yr

Other secondary income or

employment not in the same

£

wk/mth/qtr/yr

field as main employment

From where?

If this other income is from employment please give details on a separate sheet,

including full name and address of any other employer.

How do you get paid?

Directly into

a bank account

In cash

By cheque

Other

(please specify)

Are you paid in a foreign currency?

Yes

No

If Yes, please state which currency you’re paid in

Second customer

33 If self-employed:

(please provide Tax Calculations covering at least 2 years;

or an Accountant’s certificate; or at least 2 years’ accounts.)

Occupation

Name and address of business

Postcode

Type of business

How long have you been trading? How long under your control?

Y Y

years

Y Y

years

Please enter, in the boxes below, your income before tax for the past

three years, as declared to the Comptroller of Taxes:

Year ended Share of net profit Net profit amount

M M

Y Y Y Y

%

£

M M

Y Y Y Y

%

£

M M

Y Y Y Y

%

£

34 To be completed by all customers

Earnings

Basic wage/salary

before tax

£

wk/mth/qtr/yr

Other primary income/

allowances

£

wk/mth/qtr/yr

Secondary income/

regular overtime/allowances

£

wk/mth/qtr/yr

Other employment in

the same field

£

wk/mth/qtr/yr

Other secondary income or

employment not in the same

£

wk/mth/qtr/yr

field as main employment

From where?

If this other income is from employment please give details on a separate sheet,

including full name and address of any other employer.

How do you get paid?

Directly into

a bank account

In cash

By cheque

Other

(please specify)

Are you paid in a foreign currency?

Yes

No

If Yes, please state which currency you’re paid in

Continues…

Page 6 of 12

5 Employment and financial details (continued)

If there is more than one person applying, please answer questions 35 and 36 together.

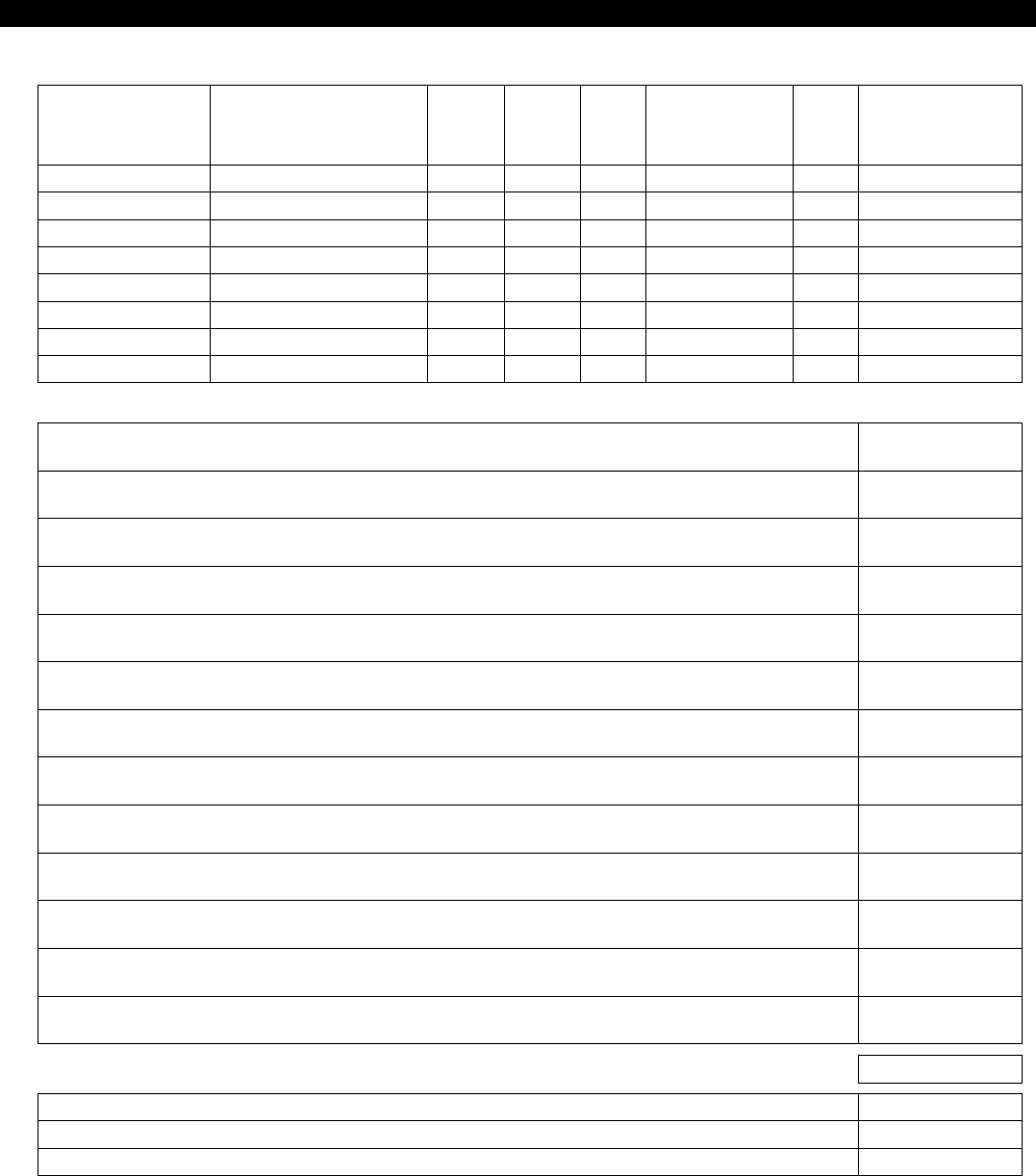

35 Please provide all your credit commitments in the table.

Type of credit

e.g. secured loan, credit

card, unsecured loan,

hirepurchase

Single/Joint name(s)

If ‘single’, indicate which customer

Balance

(£)

Monthly

payment

(£)

Interest

Rate (%)

Lender No. of

payments

remaining

If you’re consolidating this

debt, how much is there to

repay (£) (include any early

repayment charge)

36 Monthly Outgoings Monthly cost

Food, drink and clothing (e.g. groceries, eating out, drinks and clothes) £

Household goods and services (e.g. property maintenance, ground rent, shared ownership rent, service charges,

buildings and contents insurance and mortgage payment protection)

£

Utility bills and rates (e.g. gas, electricity, oil, water, rates, phone and TV packages, TV licence) £

Transport (e.g. petrol, car tax and insurance, maintenance, public transport, season tickets and taxis) £

Entertainment and recreation (e.g. regular social activities like gym and clubs memberships, etc.) £

Holidays £

Nursery, childcare, school, college and university fees £

Maintenance for financial dependants (for anyone who is a dependant, not just children) £

Miscellaneous spending (e.g. luxury items, gifts, etc.) £

Other spending (any other regular spend, e.g. pet costs, dental insurance, bank account fees, etc.) £

Life assurance, private health premiums, private pensions contributions and any endowments £

Costs relating to other properties you own (include both let and non let properties)

(e.g. mortgage payments, ongoing maintenance and costs for second or buy to let properties)

£

Rent per month if a tenant or living with family or relatives £

37 Number of financial dependants

Relationship to applicant Age of dependant

Page 7 of 12

6 Retained Properties (if applicable)

We need to have details for each property you decide to retain after your new mortgage application completes. If there’s more than one retained

property, please continue on a separate sheet.

38 Property details

Address

Postcode

Estimated value

£

Is the property currently let?

Yes

No

39 Mortgage details

Lender

Current mortgage balance

£

Type of mortgage

Remaining term

Monthly mortgage payment

£

Is the mortgage in a foreign currency?

Yes

No

40 Let property costs (if the property is let)

Monthly gross rent

£

Agent’s fees (if applicable)

£

Monthly allowance for rental voids

£

Monthly property maintenance

£

Total costs (please add up the total costs)

£

7 Individual tax status

Please list ALL the countries you are resident in for the purposes of that country’s tax system.

If you are a US citizen, US Green Card holder, or US resident, you must include ‘United States’ in the table below along with your US Tax Identification

Number. Please note, for example if you have inherited US citizenship from your parents (but have never lived in the US), you are still considered a

Specified US Person for tax purposes and must state so in the table below.

First applicant

If a TIN or other tax reference is unavailable please provide the appropriate reason A, B or C:

Reason A: The country/jurisdiction where I am resident for tax purposes does not issue TINs to its residents

Reason B: I am unable to obtain a TIN or equivalent tax reference (please explain why you are unable to obtain a TIN or equivalent tax reference

in the table below)

Reason C: No TIN is required (you should only select this reason if the domestic law of the relevant jurisdiction does not require the collection of

the TIN issued by such jurisdictions)

Your primary country of tax residence

Tax Identification Number (TIN)/National Insurance

Number (NINO) or any other taxreference

If no TIN/NINO or other tax reference is available please

select a reason from the list provided

I confirm that I am not a tax resident in any other jurisdiction.

Additional countries of tax residence

(ifapplicable)

Tax Identification Number (TIN)/National Insurance

Number (NINO) or any other taxreference

If no TIN/NINO or other tax reference is available please

select a reason from the list provided

If your residential address is not in the same jurisdiction in which you claim to be resident for tax purposes, please provide an explanation and

supporting documentation (as appropriate) to allow us to understand the reason for this:

Continues…

Page 8 of 12

7 Individual tax status (continued)

Second applicant (if applicable)

If a TIN or other tax reference is unavailable please provide the appropriate reason A, B or C:

Reason A: The country/jurisdiction where I am resident for tax purposes does not issue TINs to its residents

Reason B: I am unable to obtain a TIN or equivalent tax reference (please explain why you are unable to obtain a TIN or equivalent tax reference

in the table below)

Reason C: No TIN is required (you should only select this reason if the domestic law of the relevant jurisdiction does not require the collection of

the TIN issued by such jurisdictions)

Your primary country of tax residence

Tax Identification Number (TIN)/National Insurance

Number (NINO) or any other taxreference

If no TIN/NINO or other tax reference is available please

select a reason from the list provided

I confirm that I am not a tax resident in any other jurisdiction.

Additional countries of tax residence

(ifapplicable)

Tax Identification Number (TIN)/National Insurance

Number (NINO) or any other taxreference

If no TIN/NINO or other tax reference is available please

select a reason from the list provided

If your residential address is not in the same jurisdiction in which you claim to be resident for tax purposes, please provide an explanation and

supporting documentation (as appropriate) to allow us to understand the reason for this:

8 Details of your lawyer and details for valuers

Jersey Lawyer who will act for you

Name and address of firm

Postcode

Name of Lawyer/Conveyancer acting

Telephone number (including area code)

Completion date. To help us manage expectations, do you have an

expected completion date? You may need to speak to the present

owner or your Jersey lawyer before replying.

D D

M M

Y Y Y Y

A professional bank valuation will be required, this must be instructed

via our approved panel of surveyors. Who should our valuer contact to

obtain access to the property?

Estate agent/developer name

Estate agent/developer telephone number (including area code)

Current owner/other name

Current owner/other telephone number (including area code)

The information in the valuation will be limited because of the nature

of the inspection. We therefore recommend you obtain a survey. For

further details, refer to the Valuation details in Section 11.

Page 9 of 12

9 Regulatory requirements

I/We have discussed whether there are any future circumstances that may impact income and expenditure and these have

been considered with the aordability calculation.

Yes

The following changes in circumstance have been reflected in the aordability calculation:

First customer Second customer

None

None

Birth of a child Birth of a child

Maternity, paternity or parental leave Maternity, paternity or parental leave

Returning to work on reduced hours Returning to work on reduced hours

Retirement Retirement

Increase to childcare expenses, school fees or university fees Increase to childcare expenses, school fees or university fees

Other Other

Please provide full details of all change in circumstances that have

been considered and how these have been reflected in the aordability

calculation.

Please provide full details of all change in circumstances that have

been considered and how these have been reflected in the aordability

calculation.

Aordability declaration

To support this application we need you to complete the following questions.

First customer Second customer

Do you have any discretionary payslip deductions?

Discretionary payslip deductions include additional voluntary

pension contributions, private healthcare, employee share

schemes, e.g. sharesave.

Yes

No

Do you have any discretionary payslip deductions?

Discretionary payslip deductions include additional voluntary

pension contributions, private healthcare, employee share

schemes, e.g. sharesave.

Yes

No

Would you be prepared to cancel all discretionary payslip deductions

if required in the future if you experience financial difficulties?

Yes

No

If no, please detail any discretionary payslip deductions you would be

prepared to cancel.

Would you be prepared to cancel all discretionary payslip deductions

if required in the future if you experience financial difficulties?

Yes

No

If no, please detail any discretionary payslip deductions you would be

prepared to cancel.

Investment income – I confirm that I intend to retain the capital

for investment purposes.

Investment income – I confirm that I intend to retain the capital

for investment purposes.

Page 10 of 12

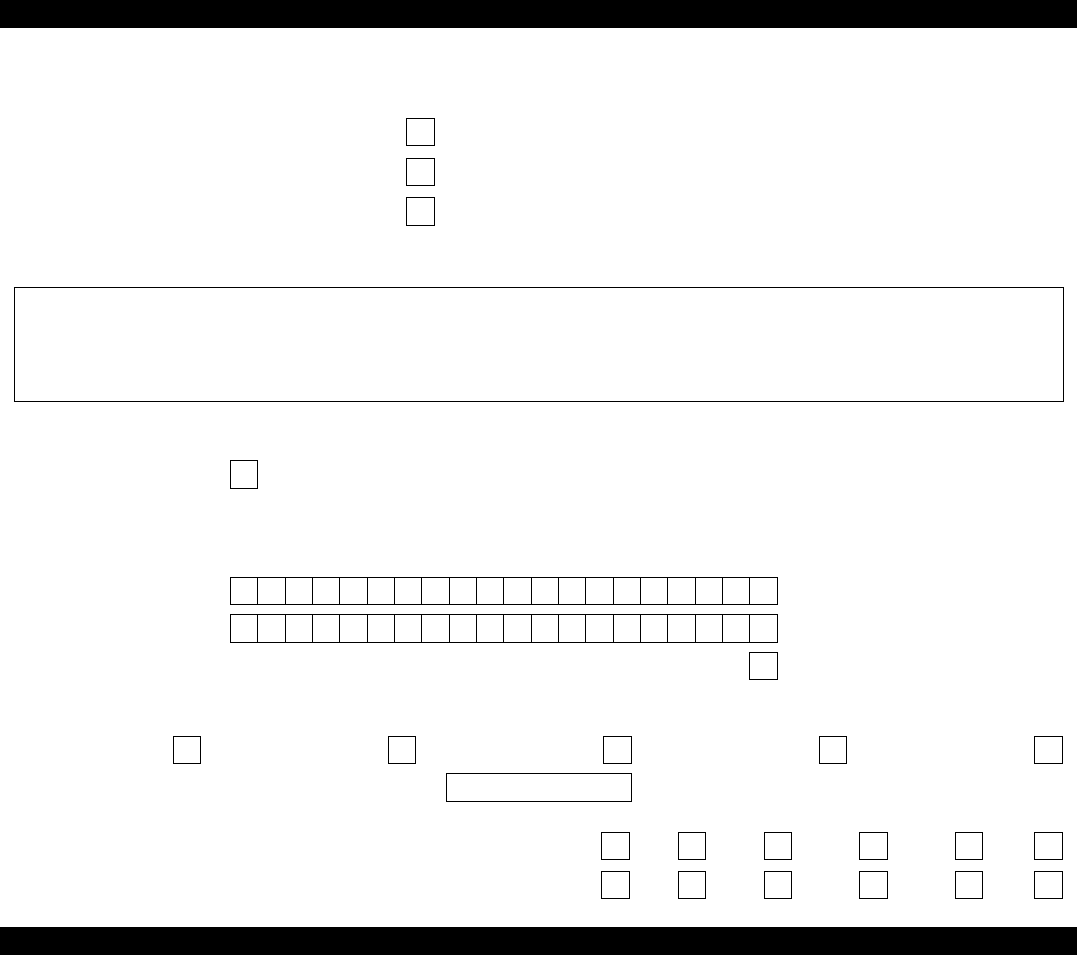

10 Purpose of Gold Account

We require you to open a sterling Gold Account in order to service your mortgage. Please ensure you have read our leaflet for the General

Terms and Conditions that apply to the Gold Account. The sterling Gold Account offers a Visa debit card.

Please indicate the primary use of your Gold Account:

Service mortgage only*

* If you select ‘Service mortgage only’, a sterling Visa debit card will not be issued. If you require a Visa

debit card for your sterling Gold Account, please select ‘Service mortgage and day to day transactions’.

Service mortgage and day to day transactions

Mortgage and other

If you’d like to use the account for other purposes, please explain as fully as possible what you will use the account for, including the type of

transactions you expect to carry out.

The sterling Gold Account oers a Visa debit card.* Please complete the relevant boxes below if you wish to apply for a Visa Debit card for the

sterling Gold Account that will be opened automatically for you when you take out a mortgage with us.

Sterling Visa debit card

Please note: You will need to provide a mobile telephone number and/or personal email address for each applicant in section2 of this form if you

wish to use your Visa debit card for online purchases which are ‘Verified by Visa’.

How would you like your name(s) to appear on your Visa debit card? e.g., Mrs J Smith or Jane Smith.

First applicant

Second applicant

If you would like a cheque book for your sterling Gold Account, please tick this box.

Please also indicate the expected level of turnover you anticipate for this sterling Gold Account during a normal year (excluding the transactions for

the mortgage that is being applied for).

Up to 10,000

10,001-25,000

25,001-100,000

100,001-250,000

250,001-500,000

If over 500,000 please enter expected level of turnover

On a monthly basis

i) The anticipated number of monthly incoming transactions:

None

1-5

5-10

10-15

15-20

>20

ii) The anticipated number of monthly outgoing transactions:

None

1-5

5-10

10-15

15-20

>20

11 Declaration, marketing preferences and signatures – to be signed by all mortgage applicants in all cases

Declaration

All those applying for a mortgage should read and sign this declaration.

General

This declaration relates to the information (the information) which I

(the applicant) have given on this form and to any other information

which I and third parties provide to you, SantanderInternational, or

which you hold onme.

I confirm that I am entitled to disclose information about any

joint applicant, partner/spouse or other third party named on the

applicationform.

I understand that a sterling Gold Account will be automatically opened

in the name(s) of the person(s) applying for this mortgage in order to

service this mortgage. I have read and understood the General Terms

and Conditions which apply to the Gold Account.

I acknowledge that for the purposes of this mortgage application and

declaration, ‘SantanderInternational’ includes your successors in title

and assigns as well as any service providers or agents appointed by

you to manage my application and mortgage.

I agree that:

1

To the best of my knowledge and belief, the information is

true and complete and Iwill notify you of any changes in my

circumstances which occur before the mortgage is completed.

I acknowledge that this information will be used to assess

aordability of the mortgage and that I am aware of my

approximate monthly payments and that I can aord these

payments. I also understand that if I have chosen a variable interest

rate and the interest rate increases, my monthly payment could

increase. Iam aware that taking on new or additional financial

commitments of any kind during the period of the mortgage,

where I have not received any corresponding increase in income,

could aect my ability to meet the mortgage payments as they

fall due and that my property will be at risk if I fail to maintain the

mortgage payments. You may take up such references and make

such enquiries about me as you consider necessary (e.g.from an

employer or other financial institution). Igive my permission to

any person to disclose information to you in connection with this

application. I understand that this may include a request to confirm

my income and that you may also request this information from

me if I originally self-certified my income in this application.

2

I have been provided with information about how the Bank

processes personal data and that I can also refer to the ‘Using

my personal data’ booklet which can be found on Santander

International’s website.

3 You may release any information relating to this application or the

mortgage to any person consenting to the mortgage, to your Jersey

lawyer and our Jersey lawyer acting on the mortgage, any company

managing them, any financial adviser and any service provider or

agent appointed by you to manage my application and mortgage

and I give each of them permission to release any such information

to you.

4

You may transfer, assign or otherwise deal with any interests you

may have in the mortgage or any other security and enter into

contractual arrangements with other parties in connection with

the funding of the mortgage. This includes passing any information

relating to this mortgage account to such other parties, their

agents or advisers for the purpose of funding the mortgage.

Continues…

Page 11 of 12

11 Declaration, marketing preferences and signatures – to be signed by all mortgage applicants in all cases (continued)

5 You may pass any information or documentation relating to this

mortgage account (and any additional loans) to any guarantors

while they remain liable on their guarantees.

6

I acknowledge that details of the property and the purchase

price may be recorded on a database which will be used by

you and other organisations to value properties, as well as for

administration, research and statistical purposes.

7

I confirm that if this application is successful, the provisions of

this declaration will continue to apply throughout the life of the

mortgage.

8

If I have paid a booking fee for a particular product then I

acknowledge that the fee is non-transferable and non-refundable.

9 I acknowledge that to assist you in improving your service, you may

record or monitor telephone calls.

10

You may disclose the information to insurers, reinsurers and their

respective advisers and agents for any purpose relating to any

insurance you may arrange. The information may also be disclosed

to regulatory bodies and other organisations so they can check

your compliance with regulatory requirements and voluntary

codes of practice.

11

If the mortgage will not be for the benefit of all borrowers (e.g.the

mortgage is for the benefitof one borrower and not both, or the

mortgage is for the benefit of a third party), thenIshould tick

the box, provide details of the purpose of the mortgage, and the

nameand address of the person who will benefit. I understand I

should also takeindependent legal advice.

12 I confirm that SantanderInternational’s mortgage will be afirst

ranking legal security on the property.

Valuation

I have read the Valuation section in ‘A straightforward guide to your

mortgage with the Jersey branch’.

I understand that for the valuation:

{

You’ll provide me with a copy of the valuation

{

Santander International is not the agent of the valuer or firm of

valuers, or my agent, and I’m not making an agreement with the

valuer or firm of valuers.

{

I must satisfy myself without reference to the valuation or to any

mortgage oer by Santander International, as to the condition of the

property and the reasonableness of the sale price.

Note: The information in the valuation will be limited because of the

nature of the inspection. We therefore recommend you obtain a survey.

My marketing preferences and related searches

You will use my home address, phone numbers, email address

and social media (e.g. Facebook and message facilities in other

platforms) to contact me according to my preferences. I can change

my preferences or unsubscribe at any time by contacting you. If I am

over 18, you may search the files at credit reference agencies before

sending marketing communications or doing marketing in-branch

to me about credit. The credit reference agencies do not record

this particular search or show it to other lenders and it won’t aect

my credit rating. You do this as part of your responsible lending

obligations, which is within your legitimateinterests.

I understand that from time to time you would like to contact me with

details of other products and services you think may interest me or to

get my opinion on how you are doing. I understand I can choose to stop

receiving information at any time by contacting you.

Applicant 1 – I have ticked any box(es) I WOULD like you to use:

Post

Phone

Email, text, social media and messaging services

Market research, including customer satisfaction surveys

All of the above

I understand that I may receive details of products and services from

other Santander group companies if I have agreed with them to receive

such information.

Applicant 2 – I have ticked any box(es) I WOULD like you to use:

Post

Phone

Email, text, social media and messaging services

Market research, including customer satisfaction surveys

All of the above

I understand that I may receive details of products and services from

other Santander group companies if I have agreed with them to receive

such information.

For joint applicants, if your marketing preferences selection are

dierent we may decide not to contact you using that preference,

ifyour individual marketing preferences are not the same.

I agree that:

{

I am aged 18 or over.

{

I understand that it is an oence to make a false declaration.

{

I have read and understand the General Declaration (and in particular point 2).

Please do not sign this form until you have read ‘A straightforward guide to your mortgage with the Jersey branch’.

First customer’s signature

First customer’s name (please use BLOCK capitals)

Date

D D

M M

Y Y Y Y

Second customer’s signature

Second customer’s name (please use BLOCK capitals)

Date

D D

M M

Y Y Y Y

IF ANY OF YOUR PLANS CHANGE PLEASE TELL US IMMEDIATELY

Please provide additional information which has been requested in any of the questions or which you feel

will help with the assessment of your application on a separate sheet if necessary.

Santander International is the trading name of Santander Financial Services plc, Jersey Branch. Santander Financial Services plc is incorporated in England and Wales with number 2338548 and its registered

office is 2 Triton Square, Regent’s Place, London NW1 3AN, United Kingdom. Santander Financial Services plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority

and the Prudential Regulation Authority. Santander Financial Services plc’s Financial Services Register number is 146003. Santander Financial Services plc, Jersey Branch has its principal place of business at

13-15 Charing Cross, St Helier, Jersey JE2 3RP, Channel Islands and is regulated bythe Jersey Financial Services Commission. www.santanderinternational.co.uk Santander Financial Services plc, Jersey Branch is a

participant in the Jersey Bank Depositors Compensation Scheme. The Scheme offers protection for eligible deposits of up to £50,000. The maximum total amount ofcompensation is capped at £100,000,000 in any

5 year period. Full details of the Scheme and banking groups covered are available on the States of Jersey website www.gov.je/dcs, or on request. Santander and the flame logo are registered trademarks. The latest

audited accounts are available upon request. Calls to Santander International are recorded and may be monitored for security and training purposes.

ABIN 0594 MAR 23 F

Page 12 of 12