Renewables Portfolio Standards in the

United States: A Status Update

Galen Barbose

Lawrence Berkeley National Laboratory

Renewable Energy Markets 2014

December 4, 2014

This analysis was funded by the National Electricity Delivery Division of the Office of Electricity Delivery and Energy Reliability and by the Solar

Energy Technologies Office of the Office of Energy Efficiency and Renewable Energy of the U.S. Department of Energy under Contract No. DE-

AC02-05CH11231.

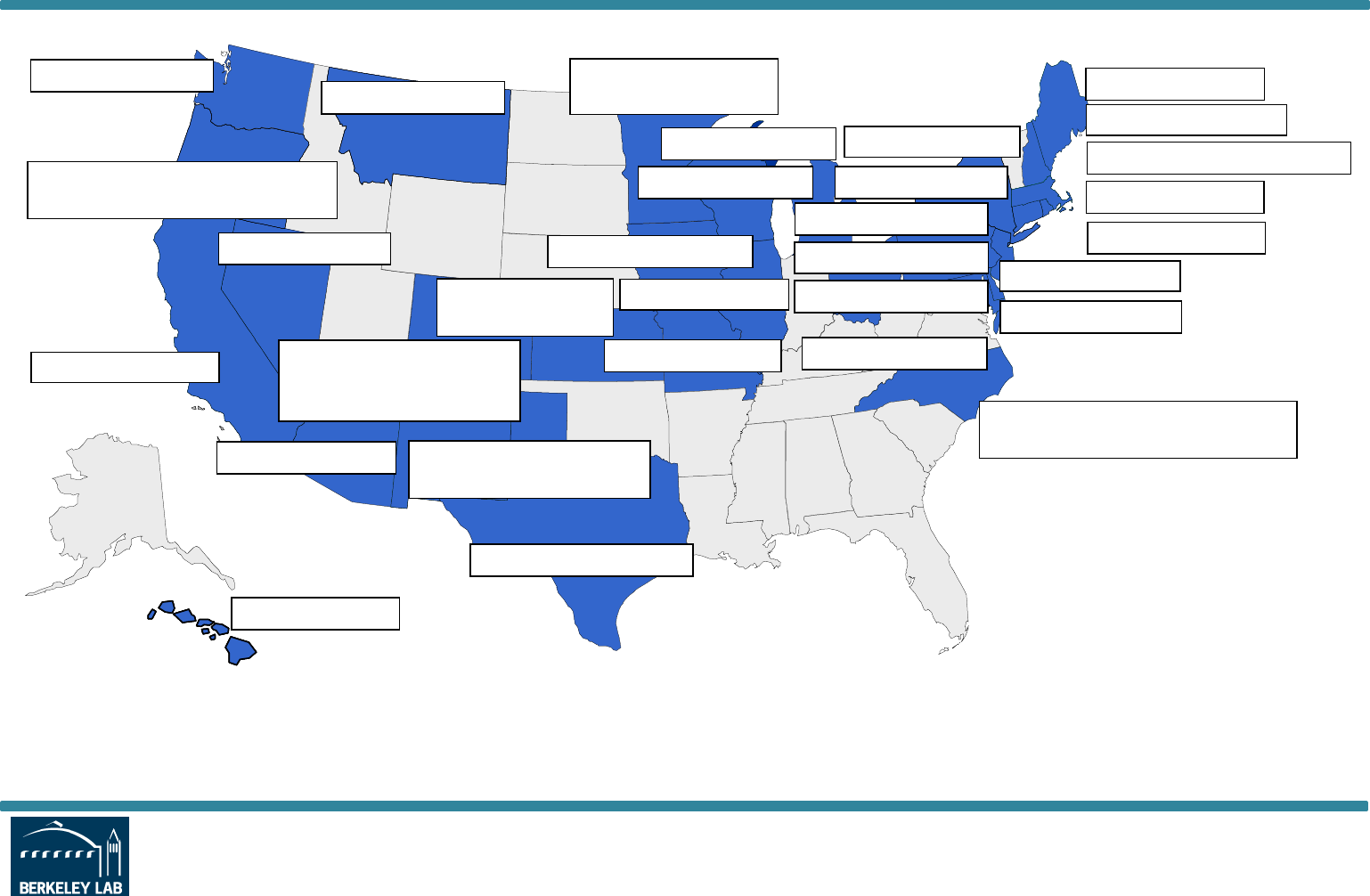

RPS Policies Exist in 29 States and DC

Apply to 56% of Total U.S. Retail Electricity Sales

2

Source: Berkeley Lab

WI: 10% by 2015

NV: 25% by 2025

TX: 5,880 MW by 2015

PA: 8.5% by 2020

NJ: 22.5% by 2020

CT: 23% by 2020

MA: 11.1% by 2009 +1%/yr

ME: 40% by 2017

NM: 20% by 2020 (IOUs)

10% by 2020 (co-ops)

CA: 33% by 2020

MN: 26.5% by 2025

Xcel: 31.5% by 2020

IA: 105 MW by 1999

MD: 20% by 2022

RI: 16% by 2019

HI: 40% by 2030

AZ: 15% by 2025

NY: 30% by 2015

CO: 30% by 2020 (IOUs)

20% by 2020 (co-ops)

10% by 2020 (munis)

MT: 15% by 2015

DE: 25% by 2025

DC: 20% by 2020

WA: 15% by 2020

NH: 24.8% by 2025

OR: 25% by 2025 (large utilities)

5-10% by 2025 (smaller utilities)

NC: 12.5% by 2021 (IOUs)

10% by 2018 (co-ops and munis)

IL: 25% by 2025

VT: 20 by 2017

MO: 15% by 2021

OH: 12.5% by 2024

MI: 10% by 2015

KS: 20% of peak

demand by 2020

Notes: Compliance years are designated by the calendar year in which they begin. Mandatory standards or non-binding

goals also exist in US territories (American Samoa, Guam, Puerto Rico, US Virgin Islands)

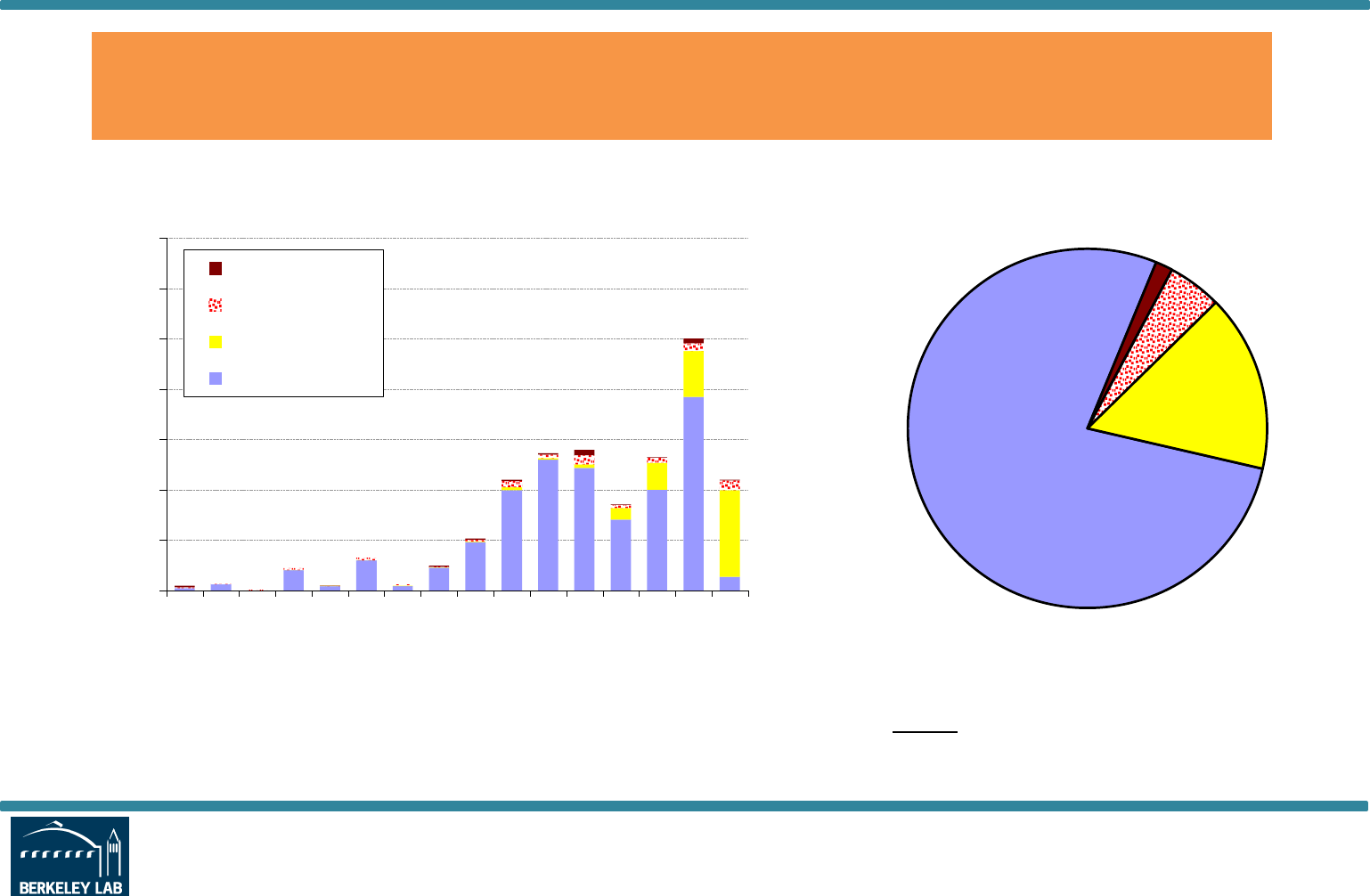

A Substantial Portion of RE Capacity Additions

Have (At Least Partially) Been Driven by RPS

3

Of the 75 GW of non-hydro renewable capacity additions from 1998-2013,

61% (46 GW) serve entities with RPS obligations

U.S. Non-Hydro Renewable Energy Capacity

0

10

20

30

40

50

60

70

80

90

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Nameplate Capacity (GW)

Cumulative Non-Hydro RE Capacity

Non-RPS

RPS

0

2

4

6

8

10

12

14

16

18

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Nameplate Capacity (GW)

Annual Non-Hydro RE Capacity Additions

Non-RPS

RPS

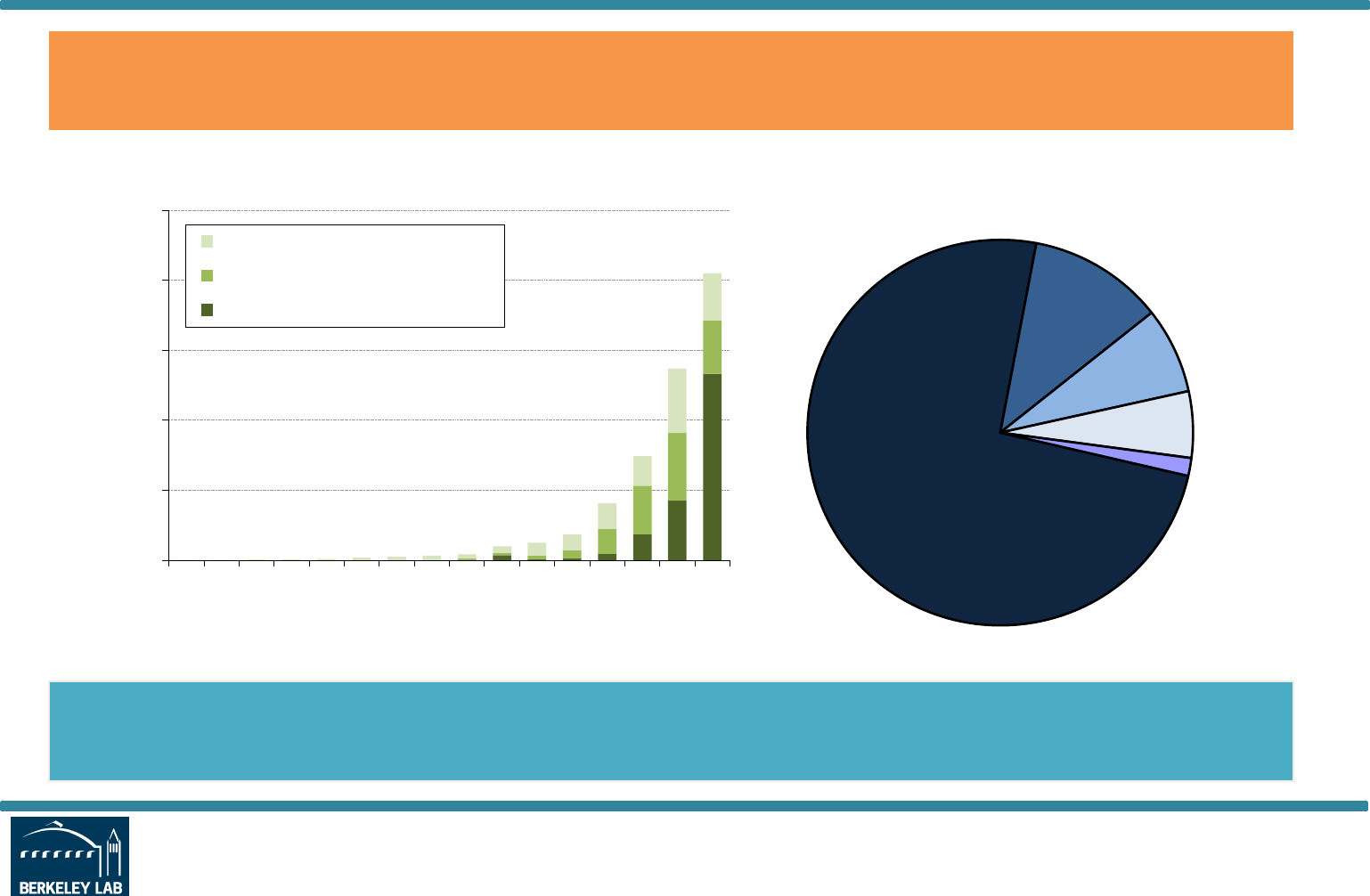

State RPS’ Have Largely Supported Wind,

Though Solar Has Become More Prominent

4

RPS-Related* Renewable Energy Capacity Additions

from 1998-2013, by Technology Type

* Renewable additions are counted as “RPS-related” if and only if the entity receiving RECs from the project is subject to RPS

obligations, and the project commenced operation after enactment of the RPS. On an energy (as opposed to capacity) basis,

wind energy represents approximately 76%, biomass 12%, solar 8%, and geothermal 4% of cumulative RPS-related renewable

energy additions, if estimated based on assumed capacity factors.

78%

1%

5%

16%

Cumulative RPS Capacity Additions

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Nameplate Capacity (MW)

Annual RPS Capacity Additions

Geothermal

Biomass

Solar

Wind

More than Half of All RPS Programs Have a Solar

or DG Set-Aside

5

17 states + D.C. have solar or DG set-asides, sometimes combined

with credit multipliers; 3 other states only have credit multipliers

11 states created

solar/ DG set-

asides since 2007:

DE, IL, MA, MD, MO, MN,

NC, NH, NM, OH, OR

Differential support for solar/DG also provided via long-term contracting

programs (CT, DE, NJ, RI) and via up-front incentives/SREC payments

NV: 1.5% solar by 2025

2.4x multiplier for PV until 2015

PA: 0.5% solar PV by 2020

NJ: 4.1% solar electric by 2027

AZ: 4.5% customer-sited DG

by 2025 (half from residential)

NY: 878 GWh retail DG by 2015

CO: 3% DG by 2020 for IOUs

(half from retail DG)

1% DG by 2020 for coops

3x multiplier for munis/coops for

solar installed before July 2015

DC: 2.5% solar by 2023

WA: 2x multiplier for DG

NM: 4% solar electric by 2020

0.6% customer-sited DG by 2020

(2x multiplier for all solar)

DE: 3.5% solar by 2025

3x multiplier for solar installed

before Jan. 2015 (applies only to

solar used for general RPS target)

MD: 2% solar by 2020

Set-aside

Multiplier

NC: 0.2% solar by 2018

NH: 0.3% solar electric by 2014

Set-aside with multiplier

TX: 2x multiplier for all non-wind

OH: 0.5% solar electric by 2024

MA: 456 GWh customer-sited

solar PV (no specified target year)

MO: 0.3% solar electric by 2021

MI: 3x multiplier for solar

OR: 20 MW solar PV by 2020

2x multiplier for PV installed

before 2016

IL: 1.5% solar PV by 2025,

1% DG by 2015 (50% <25 kW)

Note: Compliance years are designated by the calendar year in which they begin

Source: Berkeley Lab

MN: 1.5% solar by 2020 for IOUs

Impact of Solar/DG Set-Asides is Substantial:

60-80% of Non-CA PV Additions Since 2005

6

*PV capacity additions are attributed to the solar/DG set-aside only if installation occurred no more than one year before commencement

of set-aside compliance obligations in the host state and if eligible for the set-aside and not applied towards general RPS obligations.

Dip in set-aside capacity additions in 2013 reflects depressed SREC

pricing and reduced or eliminated incentives in a number of states

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

0

200

400

600

800

1,000

1,200

1,400

2000 2001 2002 2003 2004 2005 2006

2007

2008

2009

2010

2011

2012

2013

Percent of U.S. Annual

Grid-Connected PV Installations (%)

NH

MO

DC

IL

DE

OH

MD

NY

PA

NM

NV

MA

NC

CO

AZ

NJ

Percent of Total U.S. grid-connected PV

capacity additions [right axis]

Percent of U.S. grid-connected PV capacity

additions, excluding California [right axis]

Annual Grid-Connected PV Installations

for Solar/DG Set-Asides (MW

ac

)

General RPS Obligations Also Driving Significant

Solar Additions in California and Elsewhere

7

Sizable number of large solar projects (9 PV + 2 CSP, 100-300 MW each)

added to meet general RPS obligations in CA & AZ in 2013

Substantial solar capacity in excess of set-aside requirements also built

and applied towards general obligations in NC and NV

0

1,000

2,000

3,000

4,000

5,000

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Nameplate Capacity (MW)

Annual Solar Capacity Additions

Non-RPS

RPS Set-Asides

General RPS Obligations

CA

3038 MW

AZ

462 MW

NC

295 MW

NV

227 MW

Others

61 MW

Solar for General RPS Obligations

Future RPS Requirements are Sizable, But Within

Recent RE Growth Rates

8

• 98 GW of RE capacity

required by 2020 (123 GW

by 2035) to meet RPS

requirements

• Depending on availability

of existing RE capacity, will

require incremental build of

3-7 GW/yr. through 2020

and 1-2 GW/yr. thereafter

• By comparison, RPS-

driven additions averaged

6 GW/yr. since 2008

(10 GW/yr. for all RE)

Note: Values shown in figures represent required renewable capacity beyond what was supplied to each state at the time its RPS was

enacted. The values do not represent incremental renewables required relative to current supply.

0 5 10 15 20 25 30 35 40

IA

ME

RI

MT

NH

DC

DE

HI

NM

CT

NV

WI

KS

MI

NY

AZ

NC

OR

PA

MO

WA

MD

CO

MA

TX

MN

OH

NJ

IL

CA

2020 2035

RPS Demand

(Est. Nameplate GW)

0% 5% 10% 15% 20% 25% 30% 35% 40%

IA

TX

NC

NY

MI

PA

AZ

ME

WI

MO

MT

OH

WA

KS

NM

RI

DE

IL

MD

DC

CO

OR

NV

CT

NJ

NH

MN

MA

CA

HI

2020 2035

RPS Demand

(Percent of Statewide

Retail Sales)

RE Currently Under Development May Be Enough to

Meet Future RPS Demand in Some Regions

9

Notes: RE under development and under construction refer only to RPS states within each region and therefore do not include additional

new RE from other states in the region or from outside the region. RPS requirements in MW terms reflect regionally specific assumptions

about RPS resource mix and capacity factors. Data source for RE Under Construction and Under Development: SNL Energy.

Future RPS Requirements Compared to Current RPS Supply plus New RE Capacity

Under Construction and Under Development

0

20,000

40,000

60,000

80,000

100,000

120,000

West

RE Capacity Capacity (MW)

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

Mid-Atlantic

0

5,000

10,000

15,000

20,000

25,000

Midwest

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

New England

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

New York

RE Under Development (RPS States) RE Under Construction (RPS States) RPS Capacity Additions to-Date

RPS Requirement (2020) RPS Requirement (2035)

Compliance with RPS Targets Has Generally

Been Strong

10

Percent of Main Tier RPS Target Met with Renewable Electricity or RECs

(including available credit multipliers and banking, but excluding ACPs)

Note: Percentages less than 100% do not necessarily indicate that “full compliance” was not technically achieved, because of ACP

compliance options, funding limits, or force majeure events.

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

AZ

CA

CO

CT

DC

DE

HI

IA

IL

KS

MA

MD

ME

MI

MN

MO

MT

NC

NH

NJ

NM

NV

NY

OH

OR

PA

RI

TX

WA

WI

2010

2011

2012

2013

REC Prices in Compliance Markets Vary with

Supply-Demand Balance

• Rising Class I REC prices in Northeastern states reflect tightening

supply, while pricing in Mid-Atlantic states and TX remain low

• Depressed SREC prices in most states show enduring over-supply

of solar, muting the cost impacts of rising set-aside targets

11

Main Tier/Class I RECs

SRECs

Sources: Spectron, SRECTrade, Flett Exchange, PJM-GATS, and NJ Clean Energy Program. Depending on the source used, plotted values are either the mid-point of monthly average bid and offer prices, the

average monthly closing price, or the weighted average price of all RECs transacted in the month, and generally refer to REC prices for the current or nearest future compliance year traded in each month.

$0

$10

$20

$30

$40

$50

$60

$70

$80

2010 2011 2012 2013 2014

CT Class I

DC Tier I

DE Class I

IL Wind

MA Class I MD Tier I ME New NH Class I

NJ Class I OH In-State PA Tier I RI New

TX

Avg Monthly REC Price (2013$/MWh)

$0

$100

$200

$300

$400

$500

$600

$700

$800

2010 2011 2012 2013 2014

DC DE MA MD

NH

NJ

OH PA

Avg Monthly REC Price (2013$/MWh)

RPS Compliance Costs Thus Far Low, But Face

Upward Pressure from Rising Targets

12

• Final-year RPS targets (closed circles) constitute, on average, roughly a three-fold

increase in RPS obligations compared to most-recent year targets (open circles)

• Future RPS costs will depends on many factors: RE technology costs, natural gas

prices, federal tax incentives, environmental regulations, and RPS cost caps

• RPS

compliance

costs have

been equal to

less than 3%

of average

retail rates in

most states

• Costs have

risen as

targets ramp

up

-20%

-10%

0%

10%

20%

30%

40%

-4%

-2%

0%

2%

4%

6%

8%

CT

DC

DE

IL

MA

MD

ME

NH

NJ

NY

OH

PA

RI

TX

AZ

CO

HI

MI

MN

MO

NC

NM

OR

WA

WI

Restructured Regulated

Estimated Incremental RPS Costs (Most-Recent Year)

RPS Target or Procurement (Most-Recent Year)

RPS Target (Final Year)

Estimated Incremental RPS Costs

(% of Average Retail Rates)

RPS Target

(% of Retail Sales)

* For most states shown, the most-recent year RPS cost and target data are for 2012 or 2013. MA does not have single terminal

year for its RPS; the final-year target shown is based on 2020. Excluded from the chart are those states without available data on

historical incremental RPS costs (CA, KS, HI, IA, MT, NV). The values shown for RPS targets and costs exclude any secondary

RPS tiers (e.g., for pre-existing resources). For most regulated states, data for the most-recent historical year reflect actual RPS

procurement percentages in those years .

Most States Have Capped Rate Impacts Below

10% and Many Below 5%

13

• Where ACPs used, they generally cap costs at 6-9% of average retail rates

• Among states with some other form of cost containment, effective cost caps are

more restrictive (1-4%) and have already become binding in several states

The figure

compares

each state’s

“effective”

cost cap

with actual

costs for the

most-recent

year

0%

5%

10%

15%

20%

CT

DC

MA

MD

ME

NH

NJ

RI

CO

DE

IL

MI

MT

NM

NC

NY

OH

OR

TX

WA

Cost Containment Based on ACP Other Cost Containment Mechanisms

Historical Compliance Cost Estimate (Most-Recent Year)

Effective Cost Cap (Max Retail Rate Increase)

* For states with multiple cost containment mechanisms, the cap shown here is based on the most-binding mechanism. MA does not

have a single terminal year for its RPS; the calculated cost cap shown is based on RPS targets and ACP rates for 2020. "Other cost

containment mechanisms" include: rate impact/revenue requirement caps (DE, KS, IL, NM, OH, OR, WA), surcharge caps (CO, MI,

NC), renewable energy contract price cap (MT), renewable energy fund cap (NY), and financial penalty (TX). Excluded from the chart

are those states currently without any mechanism to cap total incremental RPS costs (AZ, CA, IA, HI, KS, MN, MO, NV, PA, WI),

though some of those states may have other kinds of mechanisms or regulatory processes to limit RPS costs.

RPS Cost Containment Mechanisms*

(Equivalent Maximum Percentage Increase in Average Retail Rates)

The Future Role and Impact of State RPS

Programs Will Depend On…

The outcome of ongoing and future legislative and legal challenges

Outcome of EPA carbon emissions regulations

Whether cost caps become binding (which in turn depends on RE

costs, gas prices, PTC/ITC, etc.)

How other related issues and barriers affecting RE deployment are

addressed (transmission, integration, siting, net metering, etc.)

How policymakers re-tune RPS’ in response to all of the above and

to changing market conditions more generally

14

Thank You!

For further information:

LBNL RPS publications and resources:

rps.lbl.gov

LBNL renewable energy publications:

emp.lbl.gov/reports/re

Contact information:

Galen Barbose, [email protected], 510-495-2593

15