UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For transition period ___________ to ___________

Commission File Number of issuing entity: 333-261397

Central Index Key Number of issuing entity: 0001128250

BA CREDIT CARD TRUST

*

Commission File Number of issuing entity: 333-261397-02

Central Index Key Number of issuing entity: 0000936988

BA MASTER CREDIT CARD TRUST II

(Exact name of issuing entity as specified in its charter)

(Issuer of the Notes)

(Exact name of issuing entity as specified in its charter)

(Issuer of the Collateral Certificate)

Commission File Number of depositor: 333-261397-01

Central Index Key Number of depositor: 0001370238

BA CREDIT CARD FUNDING, LLC

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor: 0001102113

BANK OF AMERICA, NATIONAL ASSOCIATION

(Exact name of sponsor as specified in its charter)

Delaware Delaware

(State or other jurisdiction of incorporation

or organization of the issuing entity)

(State or other jurisdiction of incorporation

or organization of the issuing entity)

c/o BA Credit Card Funding, LLC

1020 North French Street

DE5-002-01-05

Wilmington, DE 19884

c/o BA Credit Card Funding, LLC

1020 North French Street

DE5-002-01-05

Wilmington, DE 19884

(Address of principal executive offices

of issuing entity)

(Address of principal executive offices

of issuing entity)

(980) 683-4915 (980) 683-4915

(Telephone number, including area code) (Telephone number, including area code)

N/A N/A

(I.R.S. Employer Identification No.) (I.R.S. Employer Identification No.)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

N/A N/A N/A

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes

☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No [Rule 405 of

Regulation S-T is not applicable.]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

Large accelerated filer ☐ Accelerated filer ☐

Non-accelerated filer ☒ (Do not check if a smaller reporting company) Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit

report. ☐ [Not applicable]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Registrant has no voting or non-voting common equity outstanding held by non-affiliates.

*

In accordance with relevant regulations of the Securities and Exchange Commission (the “Commission”), the depositor files annual and other reports with the

Commission in respect of BA Credit Card Trust and BA Master Credit Card Trust II under the Central Index Key (CIK) number (0001128250) for BA Credit Card

Trust.

PART I

The following Items have been omitted in accordance with General Instruction J to Form 10-K:

Item 1: Business.

Item 1A: Risk Factors.

Item 2: Properties.

Item 3: Legal Proceedings.

Item 1B. Unresolved Staff Comments.

Not Applicable.

Item 4. Mine Safety Disclosures.

Not Applicable.

Substitute information provided in accordance with General Instruction J to Form 10-K:

Item 1112(b) of Regulation AB. Significant Obligors of Pool Assets (Financial Information).

The primary asset of BA Credit Card Trust is the collateral certificate, Series 2001-D, representing an undivided interest in BA Master Credit Card Trust II, whose

assets include the receivables arising in a portfolio of unsecured consumer revolving credit card accounts. BA Master Credit Card Trust II, therefore, may be considered a

significant obligor in relation to BA Credit Card Trust. Pursuant to Instruction 2.b. to Item 1112(b) of Regulation AB, the information required by Instruction J to Form 10-K

in respect of BA Master Credit Card Trust II has been disclosed in this report on Form 10-K in lieu of the information otherwise contemplated by Item 1112(b).

The pool assets held by BA Master Credit Card Trust II do not include any significant obligors.

Item 1114(b)(2) of Regulation AB: Credit Enhancement and Other Support, Except for Certain Derivatives Instruments (Financial Information).

Based on the standards set forth in Item 1114(b)(2) of Regulation AB, no information is required in response to this Item.

Item 1115(b) of Regulation AB: Certain Derivatives Instruments (Financial Information).

Based on the standards set forth in Item 1115(b) of Regulation AB, no information is required in response to this Item.

Item 1117 of Regulation AB: Legal Proceedings.

Industry Developments

Bank of America, National Association (“BANA”) issues credit cards on MasterCard’s and Visa’s networks. MasterCard and Visa are subject to settlement obligations

relating to certain litigations and continue to be subject to significant ongoing litigations, including class actions, and increased competition. These settlements and litigations

are based on, among other things, claimed violations of United States federal antitrust laws, claims that currency conversion fees were wrongly applied on purchases of goods

and services in foreign countries, and claims alleging that the interchange charged by MasterCard and Visa is impermissible. The costs associated with these settlements,

litigations and other matters could cause MasterCard and Visa to invest less in their networks and marketing efforts and could adversely affect the interchange paid to their

member banks, including BANA.

2

Litigation

In 2005, a group of merchants filed a series of putative class actions and individual actions directed at interchange fees associated with Visa and MasterCard payment

card transactions. These actions, which were consolidated in the U.S. District Court for the Eastern District of New York under the caption In re Payment Card Interchange

Fee and Merchant Discount Anti-Trust Litigation (Interchange), named Visa, MasterCard and several banks and bank holding companies, including Bank of America

Corporation (“BAC”), as defendants. Plaintiffs alleged that defendants conspired to fix the level of default interchange rates and that certain rules of Visa and MasterCard

were unreasonable restraints of trade. Plaintiffs sought compensatory and treble damages and injunctive relief.

On October 19, 2012, defendants reached a settlement with respect to the putative class actions that the U.S. Court of Appeals for the Second Circuit rejected. In 2018,

defendants reached a settlement with the representatives of the putative Rule 23(b)(3) damages class to contribute an additional $900 million to the approximately $5.3 billion

held in escrow from the prior settlement. BAC’s additional contribution is not material to BAC. The District Court approved that settlement with the putative Rule 23(b)(3)

damages class on December 13, 2019, but that approval is being appealed.

In addition, the Rule 23(b)(2) action seeking injunctive relief is pending with a class certified on September 27, 2021, and a number of individual merchant actions

continue against the defendants, including one against BAC. As a result of various loss-sharing agreements, however, BAC remains liable for a portion of any settlement or

judgment in individual actions where it is not named as a defendant.

Legal Proceedings Involving The Bank of New York Mellon

In the ordinary course of business, The Bank of New York Mellon, The Bank of New York Mellon Trust Company, N.A., and BNY Mellon Trust of Delaware

(collectively, “BNY Mellon”) are named as a defendant in legal actions. In connection with its role as trustee of certain residential mortgage-backed securitization (“RMBS”)

transactions, BNY Mellon has been named as a defendant in a number of legal actions brought by RMBS investors. These lawsuits allege that the trustee had expansive duties

under the governing agreements, including the duty to investigate and pursue breach of representation and warranty claims against other parties to the RMBS transactions.

While it is inherently difficult to predict the eventual outcomes of pending actions, BNY Mellon denies liability and intends to defend the litigations vigorously.

The Bank of New York Mellon has provided us with the information in the paragraph above in response to the requirements of Regulation AB. Other than the above

paragraph and the information concerning The Bank of New York Mellon specified in this Form 10-K under the caption Item 1122 of Regulation AB: Compliance with

Applicable Servicing Criteria and in Exhibit 33.2 to this Form 10-K, The Bank of New York Mellon has not participated in the preparation of, and is not responsible for, any

other information contained in this Form 10-K.

PART II

The following Items have been omitted in accordance with General Instruction J to Form 10-K:

Item 5: Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Item 6: [Reserved]

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Item 7A: Quantitative and Qualitative Disclosures about Market Risk.

Item 8: Financial Statements and Supplementary Data.

Item 9: Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Item 9A: Controls and Procedures.

Item 9B: Other Information.

None.

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections.

Not Applicable.

3

PART III

The following Items have been omitted in accordance with General Instruction J to Form 10-K:

Item 10: Directors, Executive Officers and Corporate Governance.

Item 11: Executive Compensation.

Item 12: Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

Item 13: Certain Relationships and Related Transactions, and Director Independence.

Item 14: Principal Accountant Fees and Services.

Substitute information provided in accordance with General Instruction J to Form 10-K:

Item 1119 of Regulation AB: Affiliations and Certain Relationships and Related Transactions.

Information required by Item 1119 of Regulation AB has been omitted from this report on Form 10-K in reliance on the Instruction to Item 1119.

Item 1122 of Regulation AB: Compliance with Applicable Servicing Criteria.

Each of BANA, with respect to itself and its affiliated servicing participants, and The Bank of New York Mellon (each, a “Servicing Participant”) has been identified

by the registrant as a party participating in the servicing function with respect to the pool assets held by each of BA Master Credit Card Trust II and BA Credit Card Trust.

Each Servicing Participant has completed a report on assessment of compliance with the servicing criteria applicable to such Servicing Participant (each, a “Report on

Assessment”), which Reports on Assessment are attached as exhibits to this Form 10-K. In addition, each of the Servicing Participants has provided an attestation report

(each, an “Attestation Report”) by a registered independent public accounting firm regarding its related Report on Assessment. Each Attestation Report is attached as an

exhibit to this Form 10-K. We have not independently verified the accuracy of The Bank of New York Mellon’s assertions or the related attestations of its registered

independent public accounting firm.

A Servicing Participant may engage one or more vendors to perform specific and limited activities that address all or a portion of one or more servicing criteria

applicable to such Servicing Participant. Each Servicing Participant indicates that it has instituted policies and procedures to monitor whether its vendors’ activities comply in

all material respects with such servicing criteria, and has elected to take responsibility for assessing compliance with the servicing criteria applicable to its vendors’ activities

in such Servicing Participant’s Report on Assessment.

No Report on Assessment or related Attestation Report has identified (i) any material instance of noncompliance with the servicing criteria identified in such Report on

Assessment as applicable to the related Servicing Participant or (ii) any material deficiency in such Servicing Participant’s policies and procedures to monitor vendor

compliance.

Platform-Level Reports:

Regulations of the SEC require that each servicing participant complete a report on assessment at a “platform” level, meaning that the transactions covered by the

report on assessment should include all asset-backed securities transactions involving such servicing participant that are backed by the same asset type. Subsequent guidance

from the SEC staff identifies additional parameters that a servicing participant may apply to define and further limit its platform. For example, a servicing participant may

define its platform to include only transactions that were completed on or after January 1, 2006 (the effective date for Regulation AB) and that were registered with the SEC

pursuant to the Securities Act of 1933. Each servicing participant is responsible for defining its own platform, and each platform will naturally differ based on various factors,

including the servicing participant’s business model, the transactions in which it is involved and the range of activities performed in those transactions.

Item 1123 of Regulation AB: Servicer Compliance Statement.

BANA has been identified by the registrant as a servicer with respect to the pool assets held by each of BA Master Credit Card Trust II and BA Credit Card Trust.

BANA has provided a statement of compliance with the related servicing agreement (the “Compliance Statement”), signed by an authorized officer of BANA. The

Compliance Statement is attached as an exhibit to this Form 10-K.

4

PART IV

Item 15. Exhibit and Financial Statement Schedules.

(a)(1) Not Applicable.

(a)(2) Not Applicable.

(a)(3) Not Applicable.

(b) Exhibits

Exhibit Index

Exhibit

Number

Description

3.1 Second Amended and Restated Limited Liability Company Agreement of BA Credit Card Funding, LLC (included as Exhibit 3.1 to the

registrant’s Form 8-K filed with the Securities and Exchange Commission on July 8, 2015, which is incorporated herein by reference).

4.1 Fourth Amended and Restated Pooling and Servicing Agreement, dated as of December 17, 2015 (included in Exhibit 4.2 to the

registrant’s Form 8-K, as filed with the Securities and Exchange Commission on December 18, 2015, which is incorporated herein by

reference).

4.2 First Amendment to Fourth Amended and Restated Pooling and Servicing Agreement, dated as of December 9, 2016 (included in Exhibit

4.1 to the registrant’s Form 8-K, as filed with the Securities and Exchange Commission on December 9, 2016, which is incorporated herein

by reference).

4.3 Fifth Amended and Restated Series 2001-D Supplement to Fourth Amended and Restated Pooling and Servicing Agreement relating to the

Collateral Certificate, dated as of December 17, 2015 (included in Exhibit 4.3 to the registrant’s Form 8-K, as filed with the Securities and

Exchange Commission on December 18, 2015, which is incorporated herein by reference).

4.4 Fourth Amended and Restated Trust Agreement of the BA Credit Card Trust, dated as of October 1, 2014 (included in Exhibit 4.3 to the

registrant’s Form 8-K, as filed with the Securities and Exchange Commission on October 1, 2014, which is incorporated herein by

reference).

4.5 First Amendment to Fourth Amended and Restated Trust Agreement, dated as of December 17, 2015 (included in Exhibit 4.6 to the

registrant’s Form 8-K, as filed with the Securities and Exchange Commission on December 18, 2015, which is incorporated herein by

reference).

4.6 Fourth Amended and Restated Indenture, dated as of December 17, 2015 (included in Exhibit 4.4 to the registrant’s Form 8-K, as filed with

the Securities and Exchange Commission on December 18, 2015, which is incorporated herein by reference).

4.7 Third Amended and Restated BAseries Indenture Supplement, dated as of December 17, 2015 (included in Exhibit 4.5 to the registrant’s

Form 8-K, as filed with the Securities and Exchange Commission on December 18, 2015, which is incorporated herein by reference).

4.8 Asset Representations Review Agreement, dated as of December 17, 2015 (included in Exhibit 4.7 to the registrant’s Form 8-K, as filed

with the Securities and Exchange Commission on December 18, 2015, which is incorporated herein by reference).

5

4.9 First Amendment to Asset Representations Review Agreement, dated as of May 25, 2016 (included in Exhibit 4.1 to the registrant’s Form

8-K, as filed with the Securities and Exchange Commission on May 25, 2016, which is incorporated herein by reference).

4.10 Dispute Resolution Agreement, dated as of December 17, 2015 (included in Exhibit 4.8 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on December 18, 2015, which is incorporated herein by reference).

4.11 Second Amended and Restated Receivables Purchase Agreement (included as Exhibit 4.1 to the registrant’s Form 8-K filed with the

Securities and Exchange Commission on July 8, 2015, which is incorporated herein by reference).

4.12 First Amendment to Second Amended and Restated Receivables Purchase Agreement (included as Exhibit 4.1 to the registrant’s Form 8-K

filed with the Securities and Exchange Commission on December 18, 2015, which is incorporated herein by reference).

4.13.1 Class A(2018-1) Terms Document, dated as of February 23, 2018 (included in Exhibit 4.2 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on February 23, 2018, which is incorporated herein by reference).

4.13.2 Class A(2018-2) Terms Document, dated as of May 17, 2018 (included in Exhibit 4.1 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on May 17, 2018, which is incorporated herein by reference).

4.13.3 Class A(2018-3) Terms Document, dated as of August 16, 2018 (included in Exhibit 4.1 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on August 16, 2018, which is incorporated herein by reference).

4.13.4 Class A(2019-1) Terms Document, dated as of September 13, 2019 (included in Exhibit 4.1 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on September 13, 2019, which is incorporated herein by reference).

4.13.5 Class A(2020-1) Terms Document, dated as of December 17, 2020 (included in Exhibit 4.1 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on December 17, 2020, which is incorporated herein by reference).

4.13.6 Class A(2021-1) Terms Document, dated as of May 14, 2021 (included in Exhibit 4.1 to the registrant’s Form 8-K, as filed with the

Securities and Exchange Commission on May 14, 2021, which is incorporated herein by reference).

31.1 Certification pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

33.1 Report on Assessment of Compliance with Servicing Criteria for Bank of America, National Association and its affiliated servicing

participants.

33.2 Report on Assessment of Compliance with Servicing Criteria for The Bank of New York Mellon as of, and for the twelve months ended,

December 31, 2021.

34.1 Attestation Report of PricewaterhouseCoopers LLP on Assessment of Compliance with Servicing Criteria relating to Bank of America,

National Association and its affiliated servicing participants.

34.2 Attestation Report of KPMG LLP on Assessment of Compliance with Servicing Criteria relating to The Bank of New York Mellon filed as

Exhibit 33.2.

35.1 Servicer Compliance Statement of Bank of America, National Association.

99.1 Amended and Restated Defaulted Receivables Supplemental Servicing Agreement, dated as of October 1, 2014, between Bank of America,

National Association and BA Credit Card Funding, LLC (included in Exhibit 4.8 to the registrant’s Form 8-K, as filed with the Securities

and Exchange Commission on October 1, 2014, which is incorporated herein by reference).

99.2 First Amendment to Amended and Restated Defaulted Receivables Supplemental Servicing Agreement, dated as of July 8, 2015, between

Bank of America, National Association and BA Credit Card Funding, LLC (included in Exhibit 4.4 to the registrant’s Form 8-K, as filed

with the Securities and Exchange Commission on July 8, 2015, which is incorporated herein by reference).

(c) Not Applicable.

Item 16. Form 10-K Summary.

Not applicable.

6

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

BA Credit Card Trust

By: Bank of America, National Association,

as Servicer

By: /s/ Joseph L. Lombardi

Name: Joseph L. Lombardi

Title: Director

(senior officer in charge of the servicing function)

Date: March 25, 2022

EXHIBIT 31.1

Certification

I, Joseph L. Lombardi, certify that:

1. I have reviewed this report on Form 10-K and all reports on Form 10-D required to be filed in respect of the period covered by this report on Form 10-K of BA Credit

Card Trust (the “Exchange Act periodic reports”);

2. Based on my knowledge, the Exchange Act periodic reports, taken as a whole, do not contain any untrue statement of a material fact or omit to state a material fact

necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by

this report;

3. Based on my knowledge, all of the distribution, servicing and other information required to be provided under Form 10-D for the period covered by this report is

included in the Exchange Act periodic reports;

4. I am responsible for reviewing the activities performed by the servicer and based on my knowledge and the compliance review conducted in preparing the servicer

compliance statement required in this report under Item 1123 of Regulation AB, and except as disclosed in the Exchange Act periodic reports, the servicer has

fulfilled its obligations under the servicing agreement in all material respects; and

5. All of the reports on assessment of compliance with servicing criteria for asset-backed securities and their related attestation reports on assessment of compliance with

servicing criteria for asset-backed securities required to be included in this report in accordance with Item 1122 of Regulation AB and Exchange Act Rules 13a-18 and

15d-18 have been included as an exhibit to this report, except as otherwise disclosed in this report. Any material instances of noncompliance described in such reports

have been disclosed in this report on Form 10-K.

In giving the certifications above, I have reasonably relied on information provided to me by the following unaffiliated parties: The Bank of New York Mellon.

Date: March 25, 2022

By: /s/ Joseph L. Lombardi

Name: Joseph L. Lombardi

Title: Director

(senior officer in charge of the servicing function)

EXHIBIT 33.1

Certification Regarding Compliance with Applicable Servicing Criteria

1. Bank of America, National Association (the “Asserting Party” or “BANA”), for itself and on behalf of its affiliated servicing participants, is responsible for assessing

compliance as of and for the year ended December 31, 2021, with the servicing criteria applicable to the Asserting Party under paragraph (d) of Item 1122 of

Regulation AB, as set forth in Appendix A hereto (such servicing criteria, excluding the criteria listed in the column titled “Inapplicable Servicing Criteria” on

Appendix A hereto, the “Applicable Servicing Criteria”). The transactions covered by this report include all asset-backed securities transactions backed by credit card

receivables issued by the BA Credit Card Trust on or before December 31, 2021, for which transactions the Asserting Party acted as servicer, that were registered with

the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, where the related asset-backed securities were outstanding during the

period from January 1, 2021 to December 31, 2021 (the “Platform”), as listed in Appendix B hereto;

2. The Asserting Party has engaged two vendors (each, a “Vendor”), each of which is not considered a “servicer” as defined in Item 1101(j) of Regulation AB, to

perform specific, limited or scripted activities, and the Asserting Party elects to take responsibility for assessing compliance with the servicing criteria or portion of the

servicing criteria applicable to each such Vendor’s activities as set forth in Appendix A hereto. The Asserting Party has policies and procedures in place designed to

provide reasonable assurance that each Vendor’s activities comply in all material respects with the servicing criteria applicable to each Vendor;

3. Except as set forth in paragraph 4 below, the Asserting Party used the criteria set forth in paragraph (d) of Item 1122 of Regulation AB to assess the compliance by the

Asserting Party with the Applicable Servicing Criteria as of and for the year ended December 31, 2021 with respect to the Platform taken as a whole;

4. The criteria listed in the column titled “Inapplicable Servicing Criteria” on Appendix A hereto are inapplicable to the Asserting Party based on the activities it

performs with respect to the Platform;

5. The Asserting Party has complied, in all material respects, with the Applicable Servicing Criteria as of and for the year ended December 31, 2021 with respect to the

Platform taken as a whole;

6. The Asserting Party has not identified and is not aware of any material instance of noncompliance by either Vendor with the Applicable Servicing Criteria as of and

for the year ended December 31, 2021 with respect to the Platform taken as a whole;

7. The Asserting Party has not identified any material deficiency in its policies and procedures to monitor the compliance by each Vendor with the Applicable Servicing

Criteria as of and for the year ended December 31, 2021 with respect to the Platform taken as a whole; and

8. PricewaterhouseCoopers LLP, an independent registered public accounting firm, has issued an attestation report for the Platform on the Asserting Party’s assessment

of compliance with the Applicable Servicing Criteria as of and for the year ended December 31, 2021.

March 24, 2022

Bank of America, National Association

By: /s/ Joseph L. Lombardi

Joseph L. Lombardi

Director

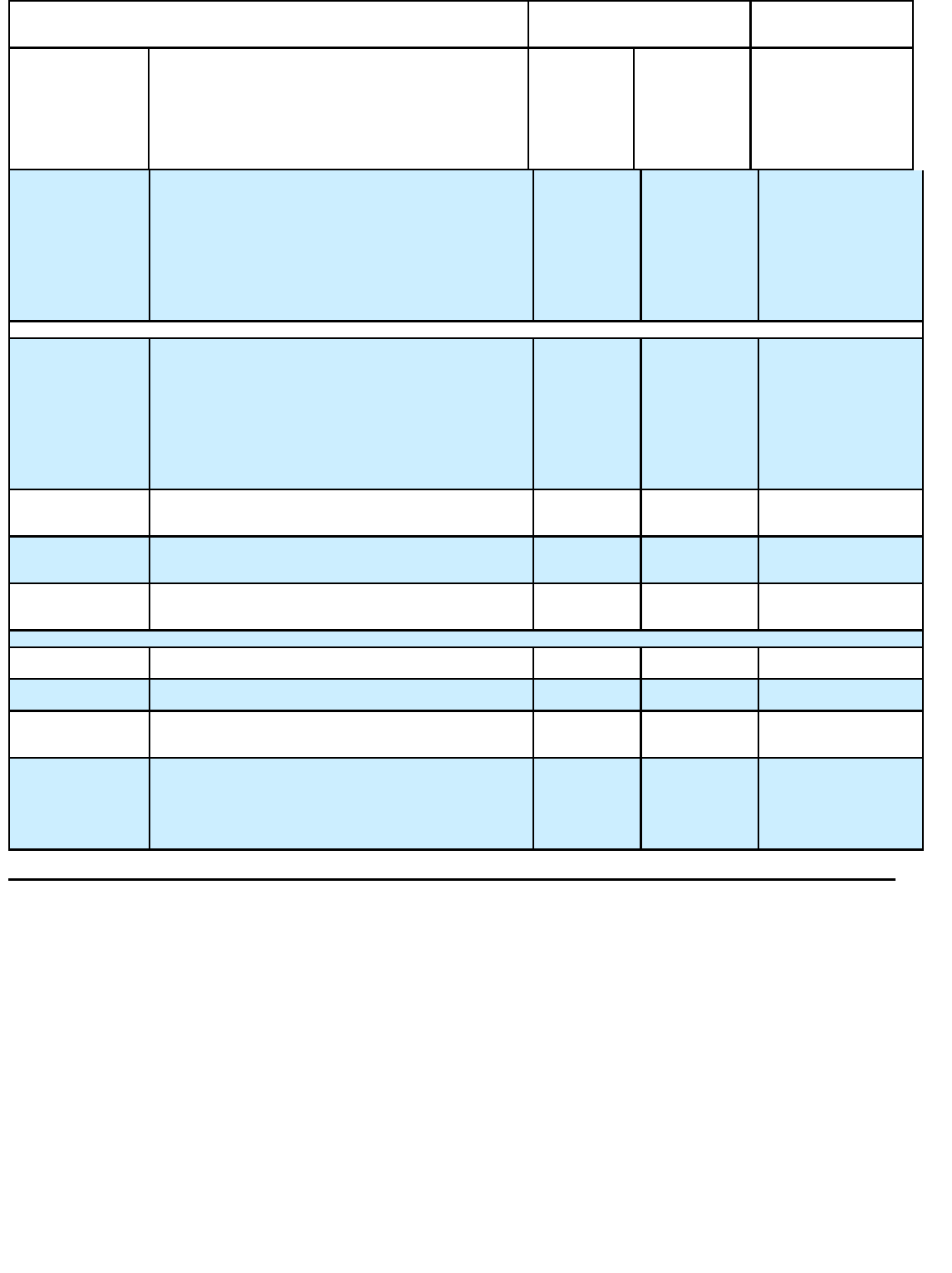

APPENDIX A

SERVICING CRITERIA

APPLICABLE

SERVICING

CRITERIA

INAPPLICABLE

SERVICING

CRITERIA

Reference Criteria

Performed

Directly

by

Asserting

Party

Performed

by

Vendor(s)

for which

Asserting

Party is the

Responsible

Party

General Servicing Considerations

1122(d)(1)(i)

Policies and procedures are instituted to monitor any performance or

other triggers and events of default in accordance with the transaction

agreements.

X

1122(d)(1)(ii)

If any material servicing activities are outsourced to third parties,

policies and procedures are instituted to monitor the third party’s

performance and compliance with such servicing activities.

X

1122(d)(1)(iii)

Any requirements in the transaction agreements to maintain a back-up

servicer for the pool assets are maintained.

X

1122(d)(1)(iv)

A fidelity bond and errors and omissions policy is in effect on the party

participating in the servicing function throughout the reporting period in

the amount of coverage required by and otherwise in accordance with

the terms of the transaction agreements.

X

1122(d)(1)(v)

Aggregation of information, as applicable, is mathematically accurate

and the information conveyed accurately reflects the information.

X

1&2

X

1&2

Cash Collection and Administration

1122(d)(2)(i)

Payments on pool assets are deposited into the appropriate custodial

bank accounts and related bank clearing accounts no more than two

business days following receipt, or such other number of days specified

in the transaction agreements.

X

1&2

X

1&2

1122(d)(2)(ii)

Disbursements made via wire transfer on behalf of an obligor or to an

investor are made only by authorized personnel.

X

1122(d)(2)(iii)

Advances of funds or guarantees regarding collections, cash flows or

distributions, and any interest or other fees charged for such advances,

are made, reviewed and approved as specified in the transaction

agreements.

X

1122(d)(2)(iv)

The related accounts for the transaction, such as cash reserve accounts

or accounts established as a form of overcollateralization, are separately

maintained (e.g., with respect to commingling of cash) as set forth in

the transaction agreements.

X

1122(d)(2)(v)

Each custodial account is maintained at a federally insured depository

institution as set forth in the transaction agreements. For purposes of

this criterion, “federally insured depository institution” with respect to a

foreign financial institution means a foreign financial institution that

meets the requirements of Rule 13k-1(b)(1) of the Securities Exchange

Act.

X

1122(d)(2)(vi) Unissued checks are safeguarded so as to prevent unauthorized access. X

SERVICING CRITERIA

APPLICABLE

SERVICING

CRITERIA

INAPPLICABLE

SERVICING

CRITERIA

Reference Criteria

Performed

Directly

by

Asserting

Party

Performed

by

Vendor(s)

for which

Asserting

Party is the

Responsible

Party

1122(d)(2)(vii)

Reconciliations are prepared on a monthly basis for all asset-backed

securities related bank accounts, including custodial accounts and

related bank clearing accounts. These reconciliations are (A)

mathematically accurate; (B) prepared within 30 calendar days after the

bank statement cutoff date, or such other number of days specified in the

transaction agreements; (C) reviewed and approved by someone other

than the person who prepared the reconciliation; and (D) contain

explanations for reconciling items. These reconciling items are resolved

within 90 calendar days of their original identification, or such other

number of days specified in the transaction agreements.

X

Investor Remittances and Reporting

1122(d)(3)(i)

Reports to investors, including those to be filed with the Commission,

are maintained in accordance with the transaction agreements and

applicable Commission requirements. Specifically, such reports (A) are

prepared in accordance with timeframes and other terms set forth in the

transaction agreements; (B) provide information calculated in

accordance with the terms specified in the transaction agreements; (C)

are filed with the Commission as required by its rules and regulations;

and (D) agree with investors’ or the trustee’s records as to the total

unpaid principal balance and number of pool assets serviced by the

Servicer.

X

1122(d)(3)(ii)

Amounts due to investors are allocated and remitted in accordance with

timeframes, distribution priority and other terms set forth in the

transaction agreements.

X

1122(d)(3)(iii)

Disbursements made to an investor are posted within two business days

to the Servicer’s investor records, or such other number of days

specified in the transaction agreements.

X

1122(d)(3)(iv)

Amounts remitted to investors per the investor reports agree with

cancelled checks, or other form of payment, or custodial bank

statements.

X

Pool Asset Administration

1122(d)(4)(i)

Collateral or security on pool assets is maintained as required by the

transaction agreements or related pool asset documents.

X

1122(d)(4)(ii)

Pool assets and related documents are safeguarded as required by the

transaction agreements.

X

1122(d)(4)(iii)

Any additions, removals or substitutions to the asset pool are made,

reviewed and approved in accordance with any conditions or

requirements in the transaction agreements.

X

1122(d)(4)(iv)

Payments on pool assets, including any payoffs, made in accordance

with the related pool asset documents are posted to the Servicer’s

obligor records maintained no more than two business days after receipt,

or such other number of days specified in the transaction agreements,

and allocated to principal, interest or other items (e.g., escrow) in

accordance with the related pool asset documents.

X

2

X

2

SERVICING CRITERIA

APPLICABLE

SERVICING

CRITERIA

INAPPLICABLE

SERVICING

CRITERIA

Reference Criteria

Performed

Directly

by

Asserting

Party

Performed

by

Vendor(s)

for which

Asserting

Party is the

Responsible

Party

1122(d)(4)(v)

The Servicer’s records regarding the pool assets agree with the

Servicer’s records with respect to an obligor’s unpaid principal balance.

X

2

X

2

1122(d)(4)(vi)

Changes with respect to the terms or status of an obligor's pool assets

(e.g., loan modifications or re-agings) are made, reviewed and approved

by authorized personnel in accordance with the transaction agreements

and related pool asset documents.

X

1122(d)(4)(vii)

Loss mitigation or recovery actions (e.g., forbearance plans,

modifications and deeds in lieu of foreclosure, foreclosures and

repossessions, as applicable) are initiated, conducted and concluded in

accordance with the timeframes or other requirements established by the

transaction agreements.

X

1122(d)(4)(viii)

Records documenting collection efforts are maintained during the period

a pool asset is delinquent in accordance with the transaction agreements.

Such records are maintained on at least a monthly basis, or such other

period specified in the transaction agreements, and describe the entity’s

activities in monitoring delinquent pool assets including, for example,

phone calls, letters and payment rescheduling plans in cases where

delinquency is deemed temporary (e.g., illness or unemployment).

X

1122(d)(4)(ix)

Adjustments to interest rates or rates of return for pool assets with

variable rates are computed based on the related pool asset documents.

X

1122(d)(4)(x)

Regarding any funds held in trust for an obligor (such as escrow

accounts): (A) such funds are analyzed, in accordance with the obligor’s

pool asset documents, on at least an annual basis, or such other period

specified in the transaction agreements; (B) interest on such funds is

paid, or credited, to obligors in accordance with applicable pool asset

documents and state laws; and (C) such funds are returned to the obligor

within 30 calendar days of full repayment of the related pool asset, or

such other number of days specified in the transaction agreements.

X

1122(d)(4)(xi)

Payments made on behalf of an obligor (such as tax or insurance

payments) are made on or before the related penalty or expiration dates,

as indicated on the appropriate bills or notices for such payments,

provided that such support has been received by the Servicer at least 30

calendar days prior to these dates, or such other number of days

specified in the transaction agreements.

X

1122(d)(4)(xii)

Any late payment penalties in connection with any payment to be made

on behalf of an obligor are paid from the Servicer’s funds and not

charged to the obligor, unless the late payment was due to the obligor’s

error or omission.

X

1122(d)(4)(xiii)

Disbursements made on behalf of an obligor are posted within two

business days to the obligor’s records maintained by the Servicer, or

such other number of days specified in the transaction agreements.

X

1122(d)(4)(xiv)

Delinquencies, charge-offs and uncollectible accounts are recognized

and recorded in accordance with the transaction agreements.

X

2

X

2

1122(d)(4)(xv)

Any external enhancement or other support, identified in Item 1114(a)

(1) through (3) or Item 1115 of Regulation AB, is maintained as set

forth in the transaction agreements.

X

3

1

Bank of America, National Association (“BANA”) is responsible for the processing of collections received with respect to the credit card receivables held by BA

Master Credit Card Trust II.

• BANA has engaged one vendor – FiServ Solutions Inc. (“Fiserv”) – as an obligor payment processor. Fiserv performed specific and limited payment processing activities

addressed by criterion 1122(d)(2)(i) during the twelve-month period ended December 31, 2021.

• FiServ conveyed data relevant to the aforementioned activity – which is addressed by criterion 1122(d)(1)(v) during the twelve-month period ended December 31, 2021.

2

BANA is responsible for transaction processing, clearing and settlement, and posting and billing services with respect to the credit card receivables held by BA Master

Credit Card Trust II.

• BANA has engaged one vendor – Total System Services, Inc. (“TSYS”) - as a technology provider for the consumer credit card processing platform/system of record.

TSYS performed transaction processing, clearing and settlement, and posting and billing services for US Consumer Credit Cards – activities addressed by criteria 1122(d)

(2)(i), 1122(d)(4)(iv), 1122(d)(4)(v), and 1122(d)(4)(xiv) during the twelve-month period ended December 31, 2021.

• TSYS aggregated and conveyed data relevant to the aforementioned activities – which is addressed by criterion 1122(d)(1)(v) during the twelve-month period ended

December 31, 2021.

3

There were no credit enhancements or other support requiring maintenance during the twelve-month period ended December 31, 2021.

APPENDIX B

Outstanding BAseries Tranches of Notes in the Platform

Tranche of Notes

Date of Applicable

Indenture Supplement

Issuance Date

BAseries Class A (2018-1) December 17, 2015 February 23, 2018

BAseries Class A (2018-2) December 17, 2015 May 17, 2018

BAseries Class A (2018-3) December 17, 2015 August 16, 2018

BAseries Class A (2019-1) December 17, 2015 September 13, 2019

BAseries Class A (2020-1) December 17, 2015 December 17, 2020

BAseries Class A (2021-1) December 17, 2015 May 14, 2021

EXHIBIT 33.2

ASSESSMENT OF COMPLIANCE WITH

APPLICABLE SERVICING CRITERIA

Management of The Bank of New York Mellon (formerly The Bank of New York), BNY Mellon Trust of Delaware (formerly BNYM (Delaware)) and The Bank of New

York Mellon Trust Company, N.A. (formerly The Bank of New York Trust Company, N.A.), (collectively, the “Company”) is responsible for assessing the Company’s

compliance with the servicing criteria set forth in Item 1122(d) of Regulation AB promulgated by the Securities and Exchange Commission. The Company’s management has

determined that the servicing criteria are applicable in regard to the servicing platform as of and for the period as follows:

Platform: Publicly-issued (i.e., transaction-level reporting initially required under the Securities Exchange Act of 1934, as amended) asset-backed securities issued on or after

January 1, 2006 and like-kind transactions issued prior to January 1, 2006 that are subject to Regulation AB (including transactions subject to Regulation AB by contractual

obligation) for which the Company provides trustee, securities administration, paying agent or custodial services, as defined and to the extent applicable in the transaction

agreements, other than residential mortgage-backed securities and other mortgage-related asset-backed securities (the “Platform”).

Period: The twelve months ended December 31, 2021 (the “Period”).

Applicable Servicing Criteria: All servicing criteria set forth in Item 1122(d), to the extent required by the related transaction agreements as to any transaction, except as set

forth in the column titled “Not Applicable to Platform” in Appendix 1 attached hereto.

With respect to servicing criterion 1122(d)(2)(vi), the Company’s management has engaged a vendor to perform the activities required by the servicing criterion.

The Company’s management has determined that this vendor is not considered a “servicer” as defined in Item 1101(j) of Regulation AB, and the Company’s management has

elected to take responsibility for assessing compliance with the servicing criterion applicable to this vendor as permitted by the SEC’s Compliance and Disclosure

Interpretation 200.06, Vendors Engaged by Servicers (“C&DI 200.06”). The Company’s management has policies and procedures in place designed to provide reasonable

assurance that the vendor’s activities comply in all material respects with the servicing criterion applicable to the vendor. The Company’s management is solely responsible

for determining that it meets the SEC requirements to apply C&DI 200.06 for the vendor and related servicing criterion.

With respect to the Platform as of and for the Period, the Company provides the following assessment of compliance in respect of the Applicable Servicing Criteria:

1. The Company’s management is responsible for assessing the Company’s compliance with the Applicable Servicing Criteria.

2. The Company’s management has assessed compliance with the Applicable Servicing Criteria, including the servicing criterion for which compliance is determined based

on C&DI 200.06 as described above as of and for the Period. In making this assessment, management used the criteria set forth by the Securities and Exchange Commission

in paragraph (d) of Item 1122 of Regulation AB.

3. With respect to servicing criterion 1122(d)(4)(i), for certain transactions in the Platform the Trustor (as such term is defined in the related transaction agreements) may

direct the Trustee (as such term is defined in the related transaction agreements) to file, or cause to be filed, all filings identified by the Trustor to be necessary to maintain the

effectiveness of any original filings identified by the Trustor to be necessary under the Uniform Commercial Code as in effect in any jurisdiction to perfect the Trustee’s

security interest in or lien on the Underlying Securities (as such term is defined in the related transaction agreements). As of and for the twelve months ended December 31,

2021, the Company was not instructed by any Trustors to perform such activities. Absent the receipt of instruction from a Trustor to perform such activities, the Company’s

responsibility for criterion 1122(d)(4)(i) for the Platform is solely with regard to the manner of holding trust assets and investment of trust assets in eligible investments and the

Company does not have any duties as to the original UCC filing and any continuations to perfect the security interest unless instructed to do so by other parties in the

transaction agreement.

4. Based on such assessment, as of and for the Period, the Company has complied, in all material respects, with the Applicable Servicing Criteria.

KPMG LLP, an independent registered public accounting firm, has issued an attestation report with respect to Management’s assessment of the Company’s compliance with

the Applicable Servicing Criteria as of and for the Period.

2

The Bank of New York Mellon BNY Mellon Trust of Delaware

/s/ Carlos Lima /s/ WilliamD. Lindelof

Carlos Lima

William D. Lindelof

Authorized Signatory Authorized Signatory

The Bank of New York Mellon Trust Company, N.A.

/s/ Antonio I. Portuondo

Antonio I. Portuondo

Authorized Signatory

Dated: February 28, 2022

3

APPENDIX 1

REG AB

REFERENCE SERVICING CRITERIA

Applicable to Platform

Not Applicable to

Platform

Performed Directly

by the Company

Performed by

Vendor(s) for which

the Company is the

Responsible Party

General servicing considerations

1122(d)(1)(i)

Policies and procedures are instituted to monitor

any performance or other triggers and events of

default in accordance with the transaction

agreements.

X

1122(d)(1)(ii)

If any material servicing activities are outsourced

to third parties, policies and procedures are

instituted to monitor the third party’s performance

and compliance with such servicing activities.

X

1122(d)(1)(iii)

Any requirements in the transaction agreements to

maintain a back-up servicer for the pool assets are

maintained.

X

1122(d)(1)(iv)

A fidelity bond and errors and omissions policy is

in effect on the party participating in the servicing

function throughout the reporting period in the

amount of coverage required by and otherwise in

accordance with the terms of the transaction

agreements.

X

1122(d)(1)(v)

Aggregation of information, as applicable, is

mathematically accurate and the information

conveyed accurately reflects the information.

X

Cash collection and administration

1122(d)(2)(i)

Payments on pool assets are deposited into the

appropriate custodial bank accounts and related

bank clearing accounts no more than two business

days of receipt, or such other number of days

specified in the transaction agreements.

X

1122(d)(2)(ii)

Disbursements made via wire transfer on behalf of

an obligor or to an investor are made only by

authorized personnel.

X

1122(d)(2)(iii)

Advances of funds or guarantees regarding

collections, cash flows or distributions, and any

interest or other fees charged for such advances, are

made, reviewed and approved as specified in the

transaction agreements.

X

1122(d)(2)(iv)

The related accounts for the transaction, such as

cash reserve accounts or accounts established as a

form of over collateralization, are separately

maintained (e.g., with respect to commingling of

cash) as set forth in the transaction agreements.

X

4

REG AB

REFERENCE SERVICING CRITERIA

Applicable to Platform

Not Applicable to

Platform

Performed Directly

by the Company

Performed by

Vendor(s) for which

the Company is the

Responsible Party

1122(d)(2)(v)

Each custodial account is maintained at a federally

insured depository institution as set forth in the

transaction agreements. For purposes of this

criterion, “federally insured depository institution”

with respect to a foreign financial institution means

a foreign financial institution that meets the

requirements of Rule 240.13k-1(b)(1) of this

chapter.

X

1122(d)(2)(vi)

Unissued checks are safeguarded so as to prevent

unauthorized access.

X

1122(d)(2)(vii)

Reconciliations are prepared on a monthly basis for

all asset-backed securities related bank accounts,

including custodial accounts and related bank

clearing accounts. These reconciliations (A) Are

mathematically accurate; (B) Are prepared within

30 calendar days after the bank statement cutoff

date, or such other number of days specified in the

transaction agreements; (C) Are reviewed and

approved by someone other than the person who

prepared the reconciliation; and (D) Contain

explanations for reconciling items. These

reconciling items are resolved within 90 calendar

days of their original identification, or such other

number of days specified in the transaction

agreements.

X

Investor remittances and reporting

1122(d)(3)(i)

Reports to investors, including those to be filed

with the Commission, are maintained in accordance

with the transaction agreements and applicable

Commission requirements. Specifically, such

reports (A) Are prepared in accordance with

timeframes and other terms set forth in the

transaction agreements; (B) Provide information

calculated in accordance with the terms specified in

the transaction agreements; (C) Are filed with the

Commission as required by its rules and

regulations; and (D) Agree with investors’ or the

trustee’s records as to the total unpaid principal

balance and number of pool assets serviced by the

servicer.

X

1122(d)(3)(ii)

Amounts due to investors are allocated and

remitted in accordance with timeframes,

distribution priority and other terms set forth in the

transaction agreements.

X

1122(d)(3)(iii)

Disbursements made to an investor are posted

within two business days to the servicer’s investor

records, or such other number of days specified in

the transaction agreements.

X

1122(d)(3)(iv)

Amounts remitted to investors per the investor

reports agree with cancelled checks, or other form

of payment, or custodial bank statements.

X

Pool asset administration

5

REG AB

REFERENCE SERVICING CRITERIA

Applicable to Platform

Not Applicable to

Platform

Performed Directly

by the Company

Performed by

Vendor(s) for which

the Company is the

Responsible Party

1122(d)(4)(i)

Collateral or security on pool assets is maintained

as required by the transaction agreements or related

pool asset documents.

X

1122(d)(4)(ii)

Pool asset and related documents are safeguarded

as required by the transaction agreements

X

1122(d)(4)(iii)

Any additions, removals or substitutions to the

asset pool are made, reviewed and approved in

accordance with any conditions or requirements in

the transaction agreements.

X

1

1122(d)(4)(iv)

Payments on pool assets, including any payoffs,

made in accordance with the related pool asset

documents are posted to the applicable servicer’s

obligor records maintained no more than two

business days after receipt, or such other number of

days specified in the transaction agreements, and

allocated to principal, interest or other items (e.g.,

escrow) in accordance with the related pool asset

documents.

X

1122(d)(4)(v)

The servicer’s records regarding the pool assets

agree with the servicer’s records with respect to an

obligor’s unpaid principal balance.

X

1122(d)(4)(vi)

Changes with respect to the terms or status of an

obligor's pool assets (e.g., loan modifications or re-

agings) are made, reviewed and approved by

authorized personnel in accordance with the

transaction agreements and related pool asset

documents.

X

1122(d)(4)(vii)

Loss mitigation or recovery actions (e.g.,

forbearance plans, modifications and deeds in lieu

of foreclosure, foreclosures and repossessions, as

applicable) are initiated, conducted and concluded

in accordance with the timeframes or other

requirements established by the transaction

agreements.

X

1122(d)(4)(viii)

Records documenting collection efforts are

maintained during the period a pool asset is

delinquent in accordance with the transaction

agreements. Such records are maintained on at least

a monthly basis, or such other period specified in

the transaction agreements, and describe the

entity’s activities in monitoring delinquent pool

assets including, for example, phone calls, letters

and payment rescheduling plans in cases where

delinquency is deemed temporary (e.g., illness or

unemployment).

X

1

With respect to applicable servicing criterion 1122(d)(4)(iii) the Company has determined that there were no activities performed during the twelve months ended

December 31, 2021 with respect to the Platform, because there were no occurrences of events that would require the Company to perform such activities.

6

REG AB

REFERENCE SERVICING CRITERIA

Applicable to Platform

Not Applicable to

Platform

Performed Directly

by the Company

Performed by

Vendor(s) for which

the Company is the

Responsible Party

1122(d)(4)(ix)

Adjustments to interest rates or rates of return for

pool assets with variable rates are computed based

on the related pool asset documents.

X

1122(d)(4)(x)

Regarding any funds held in trust for an obligor

(such as escrow accounts): (A) Such funds are

analyzed, in accordance with the obligor’s pool

asset documents, on at least an annual basis, or

such other period specified in the transaction

agreements; (B) Interest on such funds is paid, or

credited, to obligors in accordance with applicable

pool asset documents and state laws; and (C) Such

funds are returned to the obligor within 30 calendar

days of full repayment of the related pool asset, or

such other number of days specified in the

transaction agreements.

X

1122(d)(4)(xi)

Payments made on behalf of an obligor (such as tax

or insurance payments) are made on or before the

related penalty or expiration dates, as indicated on

the appropriate bills or notices for such payments,

provided that such support has been received by the

servicer at least 30 calendar days prior to these

dates, or such other number of days specified in the

transaction agreements.

X

1122(d)(4)(xii)

Any late payment penalties in connection with any

payment to be made on behalf of an obligor are

paid from the servicer’s funds and not charged to

the obligor, unless the late payment was due to the

obligor’s error or omission.

X

1122(d)(4)(xiii)

Disbursements made on behalf of an obligor are

posted within two business days to the obligor’s

records maintained by the servicer, or such other

number of days specified in the transaction

agreements.

X

1122(d)(4)(xiv)

Delinquencies, charge-offs and uncollectible

accounts are recognized and recorded in

accordance with the transaction agreements.

X

1122(d)(4)(xv)

Any external enhancement or other support,

identified in Item 1114(a)(1) through (3) or Item

1115 of this Regulation AB, is maintained as set

forth in the transaction agreements.

X

7

EXHIBIT 34.1

Report of Independent Registered Public Accounting Firm

To the Board of Directors of Bank of America, National Association

We have examined management’s assertion, included in the accompanying Certification Regarding Compliance with Applicable Servicing Criteria, that Bank of America,

National Association (the “Company”) complied with the servicing criteria set forth in Item 1122(d) of the Securities and Exchange Commission's Regulation AB for the

asset-backed securities transactions backed by credit card receivables issued by the BA Credit Card Trust on or before December 31, 2021, for which transactions the

Company acted as servicer, that were registered with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, where the related asset-

backed securities were outstanding during the period from January 1, 2021 to December 31, 2021 (the “Platform”), as of December 31, 2021 and for the year then ended,

excluding the criteria noted in Appendix A to management’s assertion, which the Company has determined are not applicable to the servicing activities performed by it, with

respect to the Platform. Appendix B to management’s assertion identifies the individual asset-backed transactions and securities defined by management as constituting the

Platform. Bank of America, National Association’s management is responsible for its assertion and for the Company's compliance with the applicable servicing criteria. Our

responsibility is to express an opinion on management's assertion about the Company’s compliance with the applicable servicing criteria based on our examination.

Our examination was conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States) and in accordance with attestation

standards established by the American Institute of Certified Public Accountants. Those standards require that we plan and perform the examination to obtain reasonable

assurance about whether management’s assertion about compliance with the applicable servicing criteria is fairly stated, in all material respects, and, accordingly, included

examining, on a test basis, evidence about the Company’s compliance with the applicable servicing criteria and performing such other procedures as we considered necessary

in the circumstances. Our examination included testing of selected asset-backed transactions and securities that comprise the Platform, testing of selected servicing activities

related to the Platform, and determining whether the Company processed those selected transactions and performed those selected activities in compliance with the applicable

servicing criteria. Our procedures were limited to the selected transactions and servicing activities performed by the Company during the period covered by this report. Our

procedures were not designed to detect noncompliance arising from errors that may have occurred prior to or subsequent to our tests that may have affected the balances or

amounts calculated or reported by the Company during the period covered by this report. We believe that our examination provides, and that the evidence we obtained is

sufficient and appropriate to provide, a reasonable basis for our opinion. Our examination does not provide a legal determination on the Company’s compliance with the

servicing criteria.

In our opinion, management’s assertion that Bank of America, National Association complied with the aforementioned applicable servicing criteria as of and for the year

ended December 31, 2021 for the Platform is fairly stated, in all material respects.

/s/ PricewaterhouseCoopers LLP

Charlotte, North Carolina

March 24, 2022

EXHIBIT 34.2

Report of Independent Registered Public Accounting Firm

The Board of Directors

The Bank of New York Mellon

BNY Mellon Trust of Delaware

The Bank of New York Mellon Trust Company, N.A.:

We have examined management’s assertion, included in the accompanying Management’s Assessment of Compliance with Applicable Servicing Criteria, that The Bank of

New York Mellon (formerly The Bank of New York), BNY Mellon Trust of Delaware (formerly BNYM (Delaware)) and The Bank of New York Mellon Trust Company,

N.A. (formerly The Bank of New York Trust, Company, N.A.), (collectively, the “Company”) complied with the servicing criteria set forth in Item 1122(d) of the Securities

and Exchange Commission’s Regulation AB for the publicly issued (i.e., transaction level reporting initially required under the Securities and Exchange Act of 1934, as

amended) asset backed securities issued on or after January 1, 2006 and like kind transactions issued prior to January 1, 2006 that are subject to Regulation AB (including

transactions subject to Regulation AB by contractual obligation) for which the Company provides trustee, securities administration, paying agent, or custodial services, as

defined and to the extent applicable in the transaction agreements, other than residential mortgage backed securities and other mortgage related asset backed securities (the

“Platform”), except for servicing criteria 1122(d)(1)(iii), 1122(d)(1)(iv), 1122(d)(1)(v), 1122(d)(2)(iii), 1122(d)(4)(iv), 1122(d)(4)(v), 1122(d)(4)(vi), 1122(d)(4)(vii), 1122(d)

(4)(viii), 1122(d)(4)(ix), 1122(d)(4)(x), 1122(d)(4)(xi), 1122(d)(4)(xii), 1122(d)(4)(xiii), 1122(d)(4)(xiv) and 1122(d)(4)(xv), which the Company has determined are not

applicable to the activities it performs with respect to the Platform (the Servicing Criteria), as of and for the twelve months ended December 31, 2021. With respect to

Servicing Criterion 1122(d)(4)(i), the Company has determined that for certain transactions in the Platform the Trustor (as such term is defined in the related transaction

agreements) may direct the Trustee (as such term is defined in the related transaction agreements) to file, or cause to be filed, all filings identified by the Trustor to be

necessary to maintain the effectiveness of any original filings identified by the Trustor to be necessary under the Uniform Commercial Code as in effect in any jurisdiction to

perfect the Trustee’s security interest in or lien on the Underlying Securities (as such term is defined in the related transaction agreements). As of and for the twelve months

ended December 31, 2021, the Company was not instructed by any Trustors to perform such activities. Absent the receipt of instruction from a Trustor to perform such

activities, the Company’s responsibility for Servicing Criterion 1122(d)(4)(i) for the Platform is solely with regard to the manner of holding trust assets and investment of trust

assets in eligible investments and the Company does not have any duties as to the original UCC filing and any continuations to perfect the security interest unless instructed to

do so by other parties in the transaction agreement. With respect to applicable servicing criterion 1122(d)(4)(iii), the Company has determined that there were no activities

performed during the twelve months ended December 31, 2021 with respect to the Platform, because there were no occurrences of events that would require the Company to

perform such activities. Appendix A to Management’s Assessment of Compliance with Applicable Servicing Criteria identifies the individual asset backed transactions and

securities defined by management as constituting the Platform. Management is responsible for the Company’s compliance with the Servicing Criteria. Our responsibility is to

express an opinion on management’s assertion about the Company’s compliance with the Servicing Criteria based on our examination.

Our examination was conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States) and in accordance with attestation

standards established by the American Institute of Certified Public Accountants to obtain reasonable assurance and, accordingly, included examining, on a test basis, evidence

about the Company’s compliance with the Servicing Criteria and performing such other procedures as we considered necessary in the circumstances. Our examination

included testing selected asset backed transactions and securities that comprise the Platform, testing selected servicing activities related to the Platform, and determining

whether the Company processed those selected transactions and performed those selected activities in compliance with the Servicing Criteria. Furthermore, our procedures

were limited to the selected transactions and servicing activities performed by the Company during the period covered by this report. Our procedures were not designed to

determine whether errors may have occurred either prior to or subsequent to our tests that may have affected the balances or amounts calculated or reported by the Company

during the period covered by this report for the selected transactions or any other transactions. We believe that our examination provides a reasonable basis for our opinion.

Our examination does not provide a legal determination on the Company’s compliance with the Servicing Criteria.

As described in Management’s Assessment of Compliance with Applicable Servicing Criteria, for Servicing Criterion 1122(d)(2)(vi), the Company has engaged a vendor to

perform the activities required by this Servicing Criterion. The Company has determined that this vendor is not considered a “servicer” as defined in Item 1101(j) of

Regulation AB, and the Company has elected to take responsibility for assessing compliance with the Servicing Criterion applicable to this vendor as permitted by the SEC’s

Compliance and Disclosure Interpretation (C&DI) 200.06, Vendors Engaged by Servicers (C&DI 200.06). As permitted by C&DI 200.06, the Company has asserted that it

has policies and procedures in place designed to provide reasonable assurance that the vendor’s activities comply in all material respects with the Servicing Criterion

applicable to the vendor. The Company is solely responsible for determining that it meets the SEC requirements to apply C&DI 200.06 for the vendor and related Servicing

Criterion as described in its assertion, and we performed no procedures with respect to the Company’s eligibility to apply C&DI 200.06.

In our opinion, management’s assertion that the Company complied with the aforementioned Servicing Criteria, including servicing criterion 1122(d)(2)(vi) for which

compliance is determined based on C&DI 200.06 as described above, as of and for the twelve months ended December 31, 2021 is fairly stated, in all material respects.

/s/KPMG LLP

Chicago, Illinois

February 28, 2022

2

EXHIBIT 35.1

SERVICER COMPLIANCE STATEMENT

Bank of America, National Association

BA Credit Card Trust

The undersigned, a duly authorized officer of Bank of America, National Association (the “Bank”), as Servicer pursuant to the Fourth Amended and Restated Pooling

and Servicing Agreement, dated as of December 17, 2015, as amended by the First Amendment to Fourth Amended and Restated Pooling and Servicing Agreement, dated as

of December 9, 2016 (as further amended, supplemented, or otherwise modified from time to time, the “Pooling and Servicing Agreement”) by and between the Bank and The

Bank of New York Mellon, as trustee (the “Trustee”), as supplemented by the Fifth Amended and Restated Series 2001-D Supplement, dated as of December 17, 2015 (as

amended, supplemented or otherwise modified from time to time, the “Supplement”), by and between the Bank and the Trustee, and the Fourth Amended and Restated

Indenture, dated as of December 17, 2015 (as amended, supplemented, or otherwise modified from time to time, the “Indenture”) by and between BA Credit Card Trust and

The Bank of New York Mellon, as indenture trustee, does hereby certify that:

1. The Bank is Servicer under the Pooling and Servicing Agreement.

2. The undersigned is duly authorized as required pursuant to the Pooling and Servicing Agreement and the Supplement to execute and deliver this Certificate to the

Trustee.

3. This Certificate is delivered pursuant to Section 3.05 of the Pooling and Servicing Agreement and Section 20 of the Supplement.

4. During the twelve-month period ended December 31, 2021 (the “Reporting Period”) a review of the Servicer’s activities and of its performance under the Pooling and

Servicing Agreement, the Supplement and the Indenture has been made under my supervision.

5. To the best of my knowledge, based on such review, the Servicer has fulfilled all of its obligations under the Pooling and Servicing Agreement, the Supplement and

the Indenture in all material respects throughout the Reporting Period.

IN WITNESS WHEREOF, the undersigned has duly executed this Certificate this 25th day of March 2022.

By: /s/ Joseph L. Lombardi

Name: Joseph L. Lombardi

Title: Director