www.pwc.com/technology

Technology industry

at the cross-roads:

Transforming quote-to-cash operations

Technology Institute

Technology industry at the cross-roads: Transforming quote-to-cash operations / 2

The global technology industry is going

through an evolutionary period, driven

by major market trends including the

proliferation of tablets and other mobile

devices, adoption of social media platforms

within the enterprise and the increasing

pervasiveness of the cloud. The combination

of these has resulted in an explosion of

data around the customer/consumer/user

that represents in itself an unprecedented

opportunity for the technology industry.

Hardware, software and technology services

companies now have an opportunity to

make up for ground lost over several

recessionary years of postponed spending by

theircustomers.

However, the technology industry faces a

host of internal and external challenges in

pursuit of these opportunities. Reaching new

emerging markets with very diverse customers

across countries and orchestrating global

operations creates tremendous pressure within

the organisation. The regulatory environment

is changing in the US, and varies signicantly

in other major economies. Meanwhile, budgets

need to stretch farther than ever. Outdated

and inefcient legacy solutions, disconnected

processes and systems due to mergers and

acquisitions and outdated business models

drive up operating costs and complexity and

need to be addressed.

All the while, customer experience is being

shaped by companies like Apple, Amazon and

eBay, which can identify consumers wherever

they enter the browse/buy/use cycle, identify

their purchase history and buying patterns

and tailor propositions accordingly. These

are companies that provide customers with

products and services that delight and

inspire, while addressing specic desires.

Companies that follow a similar trajectory in

understanding and leveraging these shifts in

customer expectations and in the industry

have vastly successful results and differentiate

themselves from competition in a profound

way. (See Figure 1)

Currently though, few companies deliver

an Amazon-like buying experience for their

customers. In fact, the evolution of the

technology industry into more integrated

hardware and software propositions,

alongside complementary services and

content-based offerings, means that,

increasingly, companies seem to be operating

on a continuum of business models, rather

than just focusing on one or two sources of

revenue. (See Figure 2) When combined with

global expansion, an essential requirement for

sustaining growth, this results in signicant

fragmentation of the customer experience and

enormous complexity within the sales cycle

and the buying process.

Executive summary

Figure 1: Apple vs. HP quarterly revenue (US $bn)

4.6

10.4

1Q 2011

9.2

8.9

1Q 2012

Apple iPad

HP Personal Systems Group

Technology industry at the cross-roads: Transforming quote-to-cash operations / 3

To address this successfully, companies must

have a clear vision of the future—an operating

model comprising robust processes and

enabling technologies that is simultaneously

capable of delivering a seamless customer

experience, global scalability along with rapid

change and adaptation when needed. It is a

compelling proposition—one that efciently

supports current businesses and adequately

enables new revenue streams as they take

shape through innovation and/or acquisition.

It is a proposition that inspires and drives

transformation inside the enterprise—a

profound change that may be achieved in

iterations, but is comprehensive in nature.

Is it possible to realise this vision completely?

The authors believe that while this may be the

ultimate moving target for companies, there

is signicant value to be realised along the

transformation journey—identication of the

current and future DNA of revenues for the

company in line with market opportunities and

strategic priorities, along with the ability to

design, develop and deploy a robust business

architecture and enabling platforms and

technologies.

Executive summary (continued)

Qualcomm

Intellectual

property

Product Product

with

services

Product with

experience

Services/

Experience

with product

Services Experience

Logitech Dell

Adobe

Amazon CSC

Facebook

Diverse customers, multiple business models, global presence

Figure 2: Technology company business models

Why optimise Q2C?

Optimising quote-to-cash (Q2C) operations

is one high-impact way technology companies

can respond to these challenges. Based on

PwC’s research and analysis of a wide range of

transformation and operations improvement

projects conducted by technology companies,

we have identied Q2C as particularly ripe

for improvement because it affects all of

theseareas:

1. Evolving customer expectations, including

consumer-like shopping patterns among

enterprise users and buyers;

2. New business models and product

propositions that market segments across

the globe and

3. Concentration of competitive advantage

within customer-facing processes and

product innovation.

Q2C processes touch almost every function

within the organisation—sales, nance, IT,

R&D, marketing, legal, supply chain, order

management and customer service—and

are integral to successful channel partner

relationships. As a result, improving Q2C

operations has a potentially profound effect

across both the front and back ofce.

Technology industry at the cross-roads: Transforming quote-to-cash operations / 4

Select corporate metrics

Total revenue

Sales per customer

Cross-sell and upsell revenues

Sales cycle time:

•Quote-to-ordercycletime

10–15% increase

10–15% incremental revenues

20–35% increase

30–60% reduction

25–50% faster

Order processing cycle time:

•Cycletimetogenerateinvoices

•Orderchangeprocessingcycletime

•Percentageofinvoicescreatedwithouterrors

20–40% reduction

10% reduction

20–30% reduction

15–20% improvement

Source: PwC

Figure 3: Impacts of Q2C optimisation

Companies that have transformed Q2C operations realised signicant agility and efciencies,

while reporting signicant improvements on critical metrics across the transaction lifecycle.

(See Figure 3) While not every organisation can achieve all of these results, Q2C leaders are

actively using customer data and purchase history to customise offerings and speed the buying

cycle. Standardised back-end processes help them respond with more exibility and agility to

changing market conditions, while customer-facing technologies allow them to deliver tailored

interactions. By automating as much of the Q2C cycle as possible, from contracts and pricing

approval to order management, they reserve hands-on attention and resources for complex and/

or high-value orders.

What seems to separate leaders from laggards and mainstream organisations in their quote-

to-cash operations is that they put the customer at the centre of their view of the world. As

such, they streamline Q2C operations, automate processes, consolidate functions to avoid

misalignment of requirements and otherwise provide an outstanding customer experience.

(See Figure 4)

This paper explores ways that transforming Q2C enables organisations to enjoy a wide range

of top and bottom-line benets by giving partners and customers seamless user interactions,

reducing time to market and increasing organisational efciency while cutting costs.

Technology industry at the cross-roads: Transforming quote-to-cash operations / 5

Laggards Mainstream Leaders

Customer

experience

•Fragmentedexperiencewithmultiple

entry points and high complexity

•Heavy reliance on customer’s/user’s

ownunderstandingofthecompany’s

product and product structure

•Heavy reliance on customer’s/user’s

self-reporting of purchasing history

•Singlestartingpointwithdened

pathwaysbasedoncustomertype

•AbundanceofSKUsresultsin

complex choices and unclear pricing

tradeoffsbetweenindividualproducts

andbundledoptions

•Inabilitytoleveragenewpurchase

patterns (social/recommendation-

based,try-and-buy,etc.)acrossnew

customer constituencies

•Context-specicroutingthroughQ2C

cycle,drivenbycustomerproling

basedonfeedsfrompurchase

history and entitlements

•Multiplebuyingcycleoptions:rapid,

standardised guided path for most

customers,aswellasricher,more

exiblealternativepathsthatallow

for customised offerings

Q2C business

architecture

•No governance model

•Lackofstandardised,

common processes

•Outdatedandconictingbusiness

policiesforpricing,creditapprovals

and contracting

•Multiple manual data entry efforts

andcheck-backsthroughQ2Ccycle

•Strongleadershipwithcentralised

governance team making

recommendations across Q2C for all

product lines

•Lack of understanding of region-

specicneeds

•Exception-basedprioritisationof

strategic customer needs

•Federated governance model across

majorcustomersegments,product

groups and geographies

•Template-basedapproachwith

allowanceforvariations

•Frequent updates to templates

for rapid market response

Q2C

technology

platform

Multiplicity of peripheral systems

forpricing,congurationand

contractsaroundcoreQ2Ccycle,

accompaniedby‘enforcedadoption’

ofmaintransactionbackbonebyall

acquired companies

•Acquisition-basedgrowthwith

ensuingsignicantlagbetween

technologyenablersand

businessneeds

•Recognitionthatdifferentbusiness

modelsmayrequiredifferentenabling

solutionssupportedbyaexible,

extensibleenterprisearchitecture

•Focus on customer-facing solutions

andenablingtechnologiesfora

tailored customer experience

•Back-endprocessesareenabled

byglobalstandardplatform

Order

management

•Manualordervalidationandbooking

•Non-standard assignment of orders

for resolution

•Manualchecksforpricing,contracts

and trade compliance

•Autobookingforstandardorders

•Manual intervention for more

complex orders

•Partially automated checks

•Autobookingformajorityof

orderswithclearownershipofthe

rest,leveragingauniedorder

management console

•Order prioritisation applied

•Automated trade compliance checks

Data

•Manual processes

•Contracts and pricing approval

not integrated

•Pricing automation at time of quoting

•Limitedintegrationwithsales

contracts

•Contractsintegrationwith

automated controls

•Streamlined approval management

withautomatedapplicationandcontrol

ofpricingmodiersandqualiers

•IntegrationwithInstalledBase/

Entitlement Master

Organisation

•Separate functions in silos

control individual steps along

the transaction continuum

•Overlappingrolesandresponsibilities

withduplicationinskillsets,along

withresourcegaps;legacyownership

ofresourcesbyfunction

•Frequently duplicated

controls and activities

•Limitednumberoffunctionsalong

the transaction continuum

•Initial alignment of integration

betweenfunctions

•Cross-functional forums at

manager/senior manager levels

forcollaborationandrapiddecision-

making;thisisaccompaniedby

executive-level cross-functional

forumsaswell

•Some duplicated controls

•Integratedfunctionownsthefull

transactionoworinstitutionalised

understandingandownershipof

end-to-endprocessbyparticipating

functions

•Integratedprocessviewdrives

collaborationacrossfunctions;

strategic and operational decision-

makingwithinQ2Cthroughcross-

functional groups

•Harmonised requirements

and controls

•No duplication

Source: PwC

Figure 4: The Q2C performance spectrum—leaders, laggards and the mainstream

Technology industry at the cross-roads: Transforming quote-to-cash operations / 6

Q2C operations are more complex than other

business areas because they are almost always

cross-functional and multi-layered, especially

for hardware and software companies. The

diversity of business models supported by

most technology ecosystems can increase this

complexity by an order of magnitude.

Consider the following:

• Different customer segments (large enter-

prises, government, small and midsize

business, consumers) require different

approaches to pricing, conguration and

quoting, as well as purchase order submis-

sion, order visibility and invoicing.

• Sales channels have multiplied; direct chan-

nels now include e-commerce and mobile

options as well as call centres and the tra-

ditional sales force, while indirect channels

include distributors, OEMs, system integra-

tors, resellers and VARS, with increasingly

complex partner programmes.

• Order types have proliferated in all sectors

of the tech industry.

These developments require careful design

and transition management that will depend

on how a company has evolved from its core

business model of ve to ten years ago. For

instance, a hardware company with lagging

Q2C processes may still cling to traditional

pick-to-order, order-to-stock, assemble-to-

order, congure-to-order and engineer-to-

order processes. Companies with a traditional

model continue with these processes, but also

have to embrace other processes due to new

revenue streams. The expansion of the universe

of revenue sources and routes to market, along

with more complex product offerings, means

that the same ‘hardware OEM’ company has

to combine devices, software and services into

one completepackage.

To do so, it must enable several additional

transaction types within Q2C operations,

including:

• Demos/try-and-buy

• Freemium (rst use free)

• Volume Purchase Agreements (VPAs)

• Maintenance services

• Software as a Service (SaaS) and

subscriptions

• Hosted solutions

• Enterprise License Agreements (ELAs)

• Enterprise Service Agreements (ESAs)

The technology industry’s approach to

Q2C processes has typically been highly

manual, requiring multiple touches and

pricing modications on virtually every

quote and order. With the advent of multi-

offering quotes that span several locations

and require alignment across business units

and geographies, Q2C processes are more

fragmented than ever for these laggards.

Laggards’ multiplicity of systems and manual

processes challenge their Q2C procedures at

every turn. Pricing complex solutions offerings

requires input from multiple departments,

delaying the ability to respond to customer

needs quickly and increasing the odds that

customers will turn to a competitor who can

deliver a faster quote. A complex conguration

process requires partner training and makes

sales and service more difcult, decreasing

channel partners’ incentive to sell a product.

Lack of visibility into transactions can lead

to conicting information about orders,

inconveniencing partners as well as customers.

High-touch manual pricing processes are

time-consuming and nancially complex,

creating further sales delays and introducing

tax, audit and compliance risks. The Q2C

process becomes so complex, costly and slow

that channel partners and customers alike can

easily be tempted to turn elsewhere.

Even mainstream technology companies

face substantial challenges. Their minimal

standardisation and automation governing

deal management or pricing results in a lack

of a single source of truth across systems,

functions and products. So, senior executives

and nancial management in technology

companies with mainstream Q2C processes

typically do not have complete and accurate

data about pipeline status, revenue projections

or other key nancial metrics.

Indeed, the lack of a single enterprise-wide

Q2C information source is having deleterious

effects throughout most organisations, not just

laggards. The following table highlights some

of the most vexing impacts of inferior Q2C

processes on key functional areas. (See Figure5)

Solving the Q2C conundrum

Technology industry at the cross-roads: Transforming quote-to-cash operations / 7

Finance Sales Marketing

Quoting

operations/

Order

management

Operations

Customer

service

Issues

withtax,

reporting and

compliance

due to a lack

of consistent

information

Relentless

pressure

to maintain

or improve

margins on all

transactions

Missed

opportunities

due to the lack

of competitive

information

Lacksefcient

system-driven

compliance

and validation

checks,

creating

increased

exposure to

compliance

risk

Suboptimised

fullment,

production

and logistics

conditions due

to poor order

visibility

Poor service

response

and revenue

leakage due

to fragmented

processes and

limitedvisibility

of data around

service

contracts,

warrantiesand

entitlements

Revenue

andprot

forecasting

challenges due

to inadequate

or conflicting

data

Lost

opportunities

because

many (if not

most)deals

require manual

intervention

Inaccurate

information

leads to less

competitive

offers

Lack of

seamless

integration

withquote,

leading to data

misalignment

and erroneous

order creation/

booking

Quoting

channel

partners

hesitate to

dobusiness,

or even to

maintain the

partnership

Poor customer

service due to

limitedvisibility

ofdataabout

customer

installed

baseandits

entitlements

Cannot

generate

timely,

accurate

invoices

without

intervening

manually in

the invoicing

process

after invoice

creation

Incorrect

or missing

information

leads to poor

customer

service and

reducing

effectiveness

of cross-sell

and upsell

programmes

Inaccurate

information

leads to overly

generous

offers and

reducedprots

One-size-ts-

all model for

allbusiness

processes,

including order

reviewand

management,

leads to

customer

and channel

partner

dissatisfaction,

prolonged

orderreview

and order

bookingcycle

times

Supply chain

visibilityis

minimal at

best,making

thefullment

cycle and

order status

difcultor

impossibleto

track

Manual price

approvalsslow

deal velocity

Source: PwC

In short, as nonstandard processes proliferate throughout the Q2C cycle, so do high costs, poor

communication, errors and inefciencies—chipping away at revenues, protability, customer

satisfaction and the ability of business decision-makers to spot opportunities and make accurate,

timely decisions.

Figure 5: Inferior Q2C processes lead to widespread dysfunction

Technology industry at the cross-roads: Transforming quote-to-cash operations / 8

Addressing these challenges requires

more than a point solution or a system

implementation project; it requires business

transformation on multiple levels. PwC has

found the following to be key prerequisites to

successful Q2C transformation:

• Transformationbasedonstrategic

imperatives:The transformation

process needs to take into account the

organisation’s strategic imperatives for the

next ve to ten years. In our experience,

business transformation projects of all

types must dene the value to be delivered

in terms of the company’s objectives.

Without aligning all design decisions to the

company’s strategic objectives, projects are

unlikely to deliver the expected outcome.

This is particularly critical in improving the

Q2C process for technology customers. The

cross-functional nature of Q2C operations

demands an equally cross-functional

transformation, one that meets the distinct

needs of technology customers and is

tailored to their particular businessmodels.

• StrongC-suitesupport:Sometimes

customer feedback alone is not persuasive

enough to overcome internal resistance

to changing Q2C processes. It is critical

that executive leaders establish and

communicate goals and priorities for

transforming Q2C operations. This can be

reinforced by supporting early ‘quick wins’

that illustrate the business value of change,

as long they align with overall design

directions as well. Implementing KPIs to

track progress delivers proof of success

aswell.

• Customerexperience:Changes to the

business architecture and operating model

of Q2C operations must make customer

experience issues a priority. Improved

customer satisfaction is a clear, powerful,

visible impact, both short- and long-term.

• Iterativeapproach:While the scope and

vision of a Q2C transformation should

be end-to-end, an iterative approach to

design, implementation and user training is

generally recognised to be the best possible

approach. This allows ample time to modify

design aspects before nalisation, build any

necessary regional variations into a globally

consistent process and ensure that systems

and operations remain stable during the

migration to the new process.

• Foundationalcapabilities:As with any

major business transformation, changes

to Q2C operations must begin with

foundational capabilities. Organisations can

add ‘nice-to-haves’ after the ‘must-haves’ are

established and fully functional.

• Organisationandpeople:The

transformation journey has a very

signicant impact on people and the

organisation in focus. It is critical to

leverage a pervasive communication plan,

conduct a detailed organisation impact

analysis and to anticipate signicant

changes at multiple levels. The use

of champions across all levels of the

organisation, and specically within the

most impacted functions, fosters adoption

and reduces organisational resistance

to change.

The rst step to transforming is benchmarking

the various processes that touch the Q2C

process to determine the enterprise’s position

against its primary competitors. This is

followed by implementation of the relevant

and appropriate parts of the PwC Q2C

reference architecture.

PwC benchmarks the Q2C processes against

industry best practices for various business

models, using the following scale:

• Developing: Capabilities are lacking.

Processes not well established or dened.

An obstacle to competitive success if

capability is important.

• Practicing: Capabilities and processes are

dened and repeatable. Can be applied

against some standard of performance.

• Optimising: Strong capabilities in this

process. Continuous improvement in

place. No signicant weaknesses.

• Leading: Taking advantage of new

capabilities available for improvement.

A source of competitive advantage if

capability isimportant.

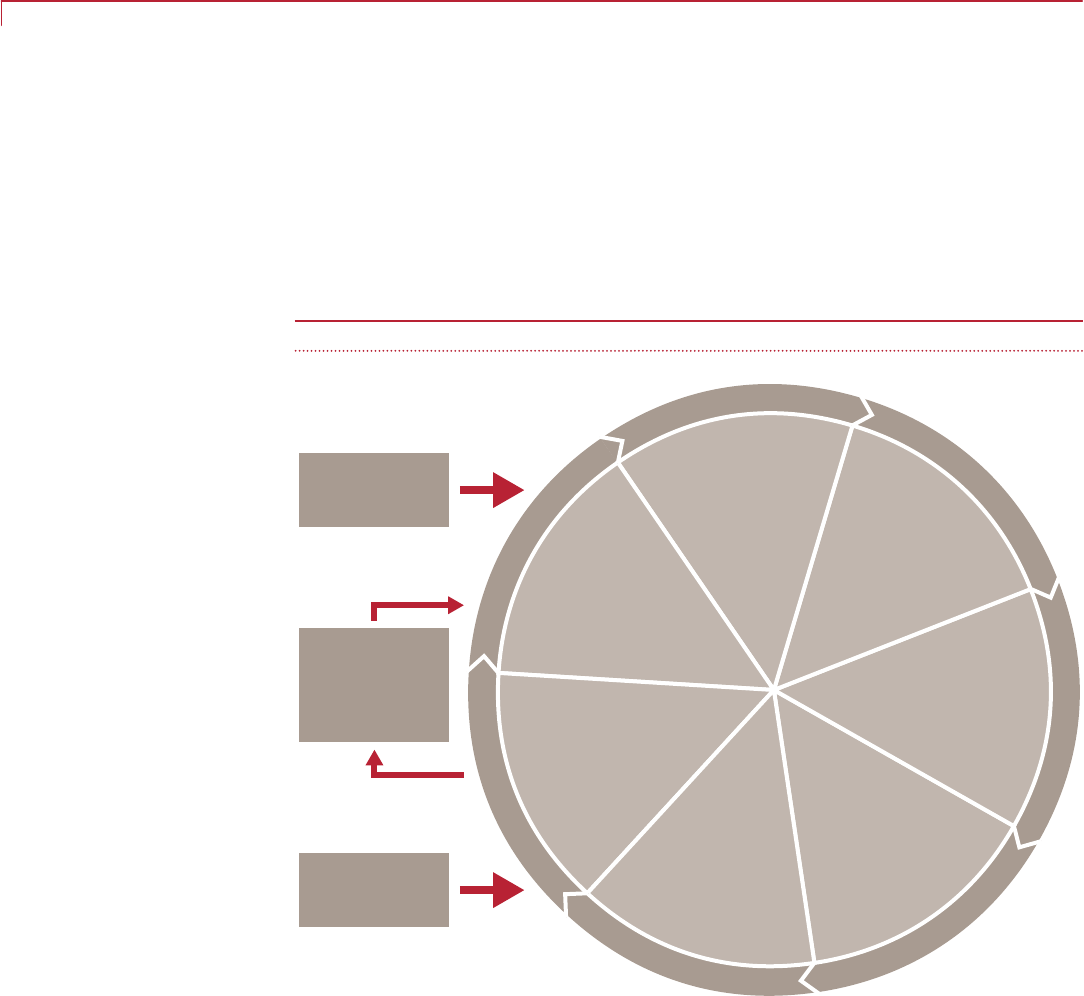

Figure 6 depicts a typical Q2C process

benchmarking analysis of a technology

company relative to its peers.

The way forward:

Transforming Q2C operations

Technology industry at the cross-roads: Transforming quote-to-cash operations / 9

The results of this benchmarking help to

identify and prioritise the aspects of Q2C

operations with room for improvement

across an organisation’s functional areas,

including sales, nance, operations and

customerservice.

Once the benchmarking analysis indicates

which aspects of Q2C operations are most in

need of revision, each aspect can be broken

down for deeper analysis. PwC has a reference

architecture that includes all of the direct and

indirect activities involved in the Q2C process,

customised for the technology industry. (See

Figures 7 and 8) The direct drivers constitute

the primary ow of the transaction, while

the indirect processes provide the supporting

data and systems necessary to complete

thetransaction.

Applying the reference architecture against

the results of the benchmarking provides a

road map of what the optimised Q2C process

should be, based on PwC’s proprietary best

practices data for each activity.

Figure 6: Benchmarking Q2C process weaknesses and strengths

Solution

management

Contracts

Pricing

Configuration

Order management

Developing

Main industry

competitors

Best in class

Quoting

and proposals

Customer/partner

management

Function Developing Practicing Optimising Leading

Developing: Capabilities are

lacking. Processes not well

established or defined. An

obstacle to competitive

success if capability

is important.

Practicing

Practicing: Capabilities and

processes are defined and

repeatable. Can be applied

against some standard

of performance.

Optimising

Optimising: Strong capabilities

in this process. Continuous

improvement in place. No

significant weaknesses.

Leading

Leading: Taking advantage of

new capabilities available for

improvement. A source of

competitive advantage if

capability is important.

Source: PwC

Technology industry at the cross-roads: Transforming quote-to-cash operations / 10

Figure 7: Core Q2C processes

Quote to cash processes

Opportunity management Solution design & pricing Manage change orders Order fulfilment Invoicing & rev mgmt

Register deal

Create deal object

Manage quote object

Quote creation

Manage price & discount

Apply list price

Present quote

Print quote

Iterate and finalise quote

Generate quote

Apply discounts

Generate final price for quote

Contract review/development

Profitability and margin

management

Order management

Capture order

Product delivery

Prepare product

Invoicing & rev mgmt

Billing & payments

Credit & collections

Revenue management

Indirect tax

Deliver product

Install

Activate/deploy

Validate order

Book order

Manage order

Manage change orders

Solutioning

Initiation of the configuration

Creation of a configuration

Joint solution design

Addition of the configuration to

the quote

Quote status advancement

Quote conversion to order

Quote archiving

Available to promise

Deal review and disposition

Deal conversion to opportunity

Manage opportunity

Opportunity creation

Opportunity closing

Opportunity conversion to quote

Opportunity sales stage

advancement

Metrics and analytics

Predictive analytics

Compliance

SOX setup

Export compliance setup

Policies

Revenue policies

Tax treatment policies

Booking policy

Booking policy

Partner management

Partner programme definition

Partner recruitment strategy

Multi-tier go-to-market

Retail strategy

Operational insights

Throughput analysis

Reporting platform

Business models/

scenarios

New to industry

Product release

management process

New product introduction

Product lifecycle mgmt

Catalog setup & maintenence

Content setup & maintenence

SKU management (s/w)

Configuration rules

management

Product roadmap

management

Configuration library

management

Usage set up &

maintenance

Prod licensing setup

Install base

creation & update

Products & services

entitlement & licensing

Offerings entitlement

Terms & conditions

Payment positions

Fulfilment positions

Capacity & duration

entitlement

Order details including

channels & locations

New to company

New to quote-to-cash

operations

Pricing data

management

Discounting rules definition

Customer experience

management

Organisation structure

Account teams

Contract attribute repository

Dashboards

Documentation consistency

Quality of service

Pricing & discounting

strategy

Promotions governance

Sales & operations

planning

Sales forecasting

Contract management

process

Contract creationContract creation

Master data

management

Contract creationCustomer data management

Partner data management

Manufacturing data

management

Contract creationItem creation

BOM creation

Printing (certificates, artwork)

Item master management

Strategic deal desk

Operations forecasting

S&OP processes

List price strategy

Discount strategy

Sales force

management process

Territory management

Sales compensation strategy

Pricing administration

Pricing treatment rules

GTM offering price definition

and setting

Pricing data publication and

distribution

Sales compensation

execution

Global order requirements

policy

Contract renewal

amendment termination

Contract repository creation

and maintenance

Offering rules

management

Contract creationConsumption rules

Treatment rules

Merchandising rules

Programme rules

Go-to-market offering

definition

ECO (engineering change

orders)

Licensing model and

attributes

The PwC Q2C reference architecture includes almost 40 core process tasks encompassing

opportunity management, quote development and review, deal review and order management.

Figure 8: Enabling process & data

Quote to cash processes

Opportunity management Solution design & pricing Manage change orders Order fulfilment Invoicing & rev mgmt

Register deal

Create deal object

Manage quote object

Quote creation

Manage price & discount

Apply list price

Present quote

Print quote

Iterate and finalise quote

Generate quote

Apply discounts

Generate final price for quote

Contract review/development

Profitability and margin

management

Order management

Capture order

Product delivery

Prepare product

Invoicing & rev mgmt

Billing & payments

Credit & collections

Revenue management

Indirect tax

Deliver product

Install

Activate/deploy

Validate order

Book order

Manage order

Manage change orders

Solutioning

Initiation of the configuration

Creation of a configuration

Joint solution design

Addition of the configuration to

the quote

Quote status advancement

Quote conversion to order

Quote archiving

Available to promise

Deal review and disposition

Deal conversion to opportunity

Manage opportunity

Opportunity creation

Opportunity closing

Opportunity conversion to quote

Opportunity sales stage

advancement

Metrics and analytics

Predictive analytics

Compliance

SOX setup

Export compliance setup

Policies

Revenue policies

Tax treatment policies

Booking policy

Booking policy

Partner management

Partner programme definition

Partner recruitment strategy

Multi-tier go-to-market

Retail strategy

Operational insights

Throughput analysis

Reporting platform

Business models/

scenarios

New to industry

Product release

management process

New product introduction

Product lifecycle mgmt

Catalog setup & maintenence

Content setup & maintenence

SKU management (s/w)

Configuration rules

management

Product roadmap

management

Configuration library

management

Usage set up &

maintenance

Prod licensing setup

Install base

creation & update

Products & services

entitlement & licensing

Offerings entitlement

Terms & conditions

Payment positions

Fulfilment positions

Capacity & duration

entitlement

Order details including

channels & locations

New to company

New to quote-to-cash

operations

Pricing data

management

Discounting rules definition

Customer experience

management

Organisation structure

Account teams

Contract attribute repository

Dashboards

Documentation consistency

Quality of service

Pricing & discounting

strategy

Promotions governance

Sales & operations

planning

Sales forecasting

Contract management

process

Contract creationContract creation

Master data

management

Contract creationCustomer data management

Partner data management

Manufacturing data

management

Contract creationItem creation

BOM creation

Printing (certificates, artwork)

Item master management

Strategic deal desk

Operations forecasting

S&OP processes

List price strategy

Discount strategy

Sales force

management process

Territory management

Sales compensation strategy

Pricing administration

Pricing treatment rules

GTM offering price definition

and setting

Pricing data publication and

distribution

Sales compensation

execution

Global order requirements

policy

Contract renewal

amendment termination

Contract repository creation

and maintenance

Offering rules

management

Contract creationConsumption rules

Treatment rules

Merchandising rules

Programme rules

Go-to-market offering

definition

ECO (engineering change

orders)

Licensing model and

attributes

Source: PwC

The PwC Q2C reference architecture includes almost 70 indirect process tasks including data

analytics, business policies and models, compliance and regulatory activities.

As you can see, each component of the Q2C

process may contain multiple sub-processes,

not all of them necessarily performed by the

same department or even an internal function.

For example, in the case of a physical product,

order fullment includes product delivery,

which may incorporate product preparation,

transportation, installation and activation/

deployment, and crosses supply chain,

customer service and (potentially) one or

more channel partners.

As we have already emphasised, transforming

Q2C operations is fundamentally a business

initiative, not a systems deployment. While

many aspects of the transformation involve IT

systems, far more involve business processes

in which IT is incidental. Consequently,

the redesign of the Q2C cycle needs to be

outcome-focused, emphasising business value

throughout the process. As market conditions

and corporate strategy change, the design

should shift accordingly.

Source: PwC

Technology industry at the cross-roads: Transforming quote-to-cash operations / 11

As mentioned earlier, the wide-ranging impact of transformative change in the Q2C context

must be assessed at multiple levels for the organisation with appropriate strategy formulation

and planning, followed by consistent communication and execution.

The ve key areas to focus on during a Q2C transformation are:

• Organisationstructure: during the transformation, functions often need to be realigned to

streamline operations and realise the expected gains. Typical actions include consolidation

of functions in a single organisation responsible for the end-to-end process and de-layering

of responsibilities to expedite transactions and empower lower levels of the organisation.

• Rolesandresponsibilities: the shift in organisational structure also implies a change in

roles and responsibilities for its members. Span of control and areas of responsibility change

considerably during the transformation requiring the team to pay particular attention to the

denition of new job descriptions.

• Skill-setsandcapabilities: as organisations transform, so do the skill-sets and capabili-

ties of the professionals within them. Tactical, repetitive activities are automated, leaving

only complex, value-add activities to be performed manually. Orchestration and collabora-

tion replace siloed activities, requiring a different level of training. Soft skills are required

to handle rst customer response. Conict handling and resolution need to be part of the

culture of the customer-facing functions/groups.

• Changesinlegacywaysofworking(WOW):leveraging enabling platforms and associated

tools that are set up using rules-based models, that are in turn governed by operating poli-

cies, substantially reduces the need for individual heroic efforts and ‘tribal knowledge’.

• Changeininteractionswithbothinternalandexternalcustomers: as automation

replaces direct contact, customer interactions require a different approach. New communi-

cation standards and guidelines need to be developed for specialists to adopt. Collaboration

across functions becomes critical to maintain the expected level of service and respect SLAs

agreed upon with partners and customer.

These areas need to be considered not only within the frame of the change management

activities strictly dened, but in the broader transformation context. Areas that are often

overlooked until later stages of the project include deployment and training. The number of

releases and the deployment trade-offs (e.g., big-bang vs. pilot, limited capabilities vs. full

system for limited products, all geographies vs. single country)need to be determined with

an eye towards the ability of the internal as well as the external stakeholder groups to absorb

change.

In this sense, PwC has found the creation of a change network and change champions at all

levels of the organisation to be particularly effective. These professionals act as evangelists of

the solution and, given their intimate familiarity with the issues that led to the transformation

in the rst place, provide the team leading the transformation with critical insight into likely

obstacles to adoption and inputs to the design of the new organisation.

Organisational impact and key changes

Technology industry at the cross-roads: Transforming quote-to-cash operations / 12

The next step: Implementing the new Q2C process after the benchmarking, identication of

the relevant parts of the reference architecture and incorporating them into a project scope. A

user experience (UX) team then creates a prototype of the new Q2C experience. An IT systems

team then reviews the UX to determine what is doable or needs to be added to the existing

architecture and toolset and performs usability tests. The rest of the Q2C development process is

illustrated in Figure 9.

Implementation strategy

Figure 9: How to build the new Q2C processes

Finalised scope

Input

Output

Finalised business

requirements,

UX design

UX team

creates UX

prototype for

selected

requirements

1. Systems team

performs FIT GAP

2. Perform

usability test

Identify high priority,

high risk requirements

(Business Architecture,

Systems, UX)

Systems and

Business Architecture

teams determine

POC scope and goals

Systems team

develops and

demonstrates

POC

Compare, refine

and validate

requirements,

UX prototype

& UI specs

for sign-off

Business

Architecture

Team leads detailed

design for core

processes, enabling

processes, operating

policies and role of data

Requirements that

need further

definition will

continue through

another iteration

Source: PwC

Technology industry at the cross-roads: Transforming quote-to-cash operations / 13

Note that user experience is also an integral

part of the design. In fact, it should be a

keyconsideration.

Emphasising the UX in the beginning of the

development process contradicts traditional

user experience development approach, which

usually happens much later in systems design.

However, taking the traditional approach risks

perpetuating current UX issues in the new

design—a signicant risk given how often UX

issues contribute to the need to improve Q2C

in the rst place.

Addressing UX and business requirements at

the same time and allowing them to inform

each other minimises this risk. Once the

system redesign has progressed enough to

simulate common tasks, usability testing

provides feedback on performance, accuracy,

ease of use and other metrics, which help

further rene the new Q2C process. Iterative

design that continuously aligns business

process design to system implementation helps

to contain costs, expedite time-to-deployment,

reduce documentation and generate a truly

effective Q2C solution.

Another key aspect of transforming Q2C

operations involves the adoption, as part of the

design of the new system, of pre-determined

transaction ows which can be isolated

into free-standing segments at any point in

the overall Q2C process. For example, the

congure-price-quote, order management,

fullment, billing and invoicing, or any

combination of processes, need to be isolatable

to enable either full automation or manual

intervention. Three different approaches to

Q2C transactions are no touch, low touch and

high touch:

1. ‘No-touch’ transactions are highly

standardised and automated to require

no internal involvement.

2. ‘Low-touch’ transactions demand a

minimum level of internal assistance.

3. ‘High-touch’ transactions call for special

attention because of their worth and

complexity.

Not every company does everything at once.

Each company has to develop a schedule to

develop the specic capabilities it needs.

Figure 10 provides more detail about the

ramications of the three approaches on

specic segments of the Q2C cycle.

Technology industry at the cross-roads: Transforming quote-to-cash operations / 14

Configure-price-quote Order management Fulfilment Billing/invoicing

No-touch

(fast-track/

automated path)

Aprocesswithintegration

across systems and data

iscapableofautomating

notonlysalesofbaseline

products and simple

congurations,but

alsoofproductswith

complexcongurations

through the automation

ofcongurationandthe

integrationwithsales

contracts and automated

pricingapprovals;such

transactions do not require

anyinvolvementbythe

company’s sales force and

allowthechannelpartners

and/orthecustomerstobe

self-sufcient.

Leveraging electronic PO

submissionmodessuch

as EDI/Rosettanet/e-

hubshelpsautomatethe

POreviewprocess.This

isfurtherenhancedby

systematic application of

contractual agreements

during the systemic

validationprocess;in

addition,leveragingthe

upstream quoting data

tocreateandautobook

salesordersbasedon

predenedthresholds

limitsmanualintervention.

Electronicfullmentof

orderswithnomanual

intervention;thisis

possibleforself-service

and/orsoftwareproducts

inclusive of SaaS offerings

whereprovisioningis

automated;forsoftware

products,ESDand

electronic delivery of

licensekeys.Inaddition,a

tight electronic messaging

integrationwithcontract

manufacturers and

logisticspartnersallowsfor

seamlessfullmentwithout

manual intervention for

standard product and

solutioncongurations.

Utilisingupstreamdataand

a3-waymatchingprocess

betweenthequote,

contract and purchase

order to automate the

generation of invoices/

billingstatements;this

canbeenhancedwith

a consistency along the

transaction continuum

allowingthecustomers/

partners to identify and

receivetheinvoices/billing

statements in the desired

formatconsistentwith

thequoteandthePO;

electronic invoicing is also

includedinthissegment.

Low-touch

Heavy manual intervention

is required in cases

wherethenatureofthe

transaction and the

customer’s requirements

donotallowforautomation

and are expected to add

valuetothetransactions;

usuallyassociatedwith

assemblingcomplexbilling

statements from multiple

systemsandsources,

break-upofinvoices

due to the requirement

tobillthecustomeron

different accounts and

requiring special formats

not included in the

invoicelibrary.

Standard transactions

presenting small deviations

require minimal manual

involvement fall into this

category;suchcases

are generally due to

incomplete information

onthereceivedorder,

conflicting information

betweenordersand

quotes.Thisistypically

enabledbystreamlining

themanualPOreview

processbystandardising

rulesaroundallowable

changes to preserve

integritybetweenquotes,

sales contracts and

purchaseorders.

Limited manual intervention

isrequiredwhenspecial

planning requirements

areincluded;suchcases

may include holds due

toallocationofproducts,

special government

requirements in terms of

fullmentoriginandspecial

orders involving non-

standardcongurations.

Limited manual intervention

required to account for

special requirements

aroundcontingencies,

revenue recognition rules

and special legal/regional

requirements.

High-touch

(semi-automated/

manual path)

Transactions that require

specialattentionbecause

their value and complexity

placethembeyond

standard pricing rules and/

or non-standard sales

contract arrangements

(includingT&Cs)require

specialcarebecauseof

the strategic nature of

thecustomer.

Special transactions

require manual intervention

bytheordermanagement

specialists to account for

variations that add value

to the transactions and

require human judgment

usually representing

a small percentage of

orders;dependingon

the nature of products

andservicesoffered,

such orders may include

servicerenewals,demos,

returns,cancellations.

Ordersincludinghardware,

softwareandservicesmay

require the company’s

intervention at multiple

phasesofthefullment

cycle;inparticular,when

customised services

and highly customised

product offerings require

specialised expertise

fordelivery.

Heavy manual intervention is

requiredincaseswherethe

nature of the transaction and

the customer’s requirements

donotallowforautomation

and are expected to add

valuetothetransactions;

usuallyassociatedwith

assemblingcomplexbilling

statements from multiple

systemsandsources,

break-upofinvoicesdue

totherequirementtobill

the customer on different

accounts and requiring

special formats not included

intheinvoicelibrary.

Source: PwC

Figure 10: Q2C transaction delivery strategies

Technology industry at the cross-roads: Transforming quote-to-cash operations / 15

However an organisation applies it, segmenting transaction ow enables the organisation to

focus on high value-added activities while automating standard transactions, thus limiting

human error and reducing turn-around time. The ability to provide no-touch, low-touch and

high-touch transactions is a hallmark of a Q2C processleader.

At the same time, standardising the process improves the organisation’s ability to integrate

pricing and deal management, and supports its ability to build a leading-class deals desk to

maximise the protability of non-standard deals. In this way, an improved Q2C cycle has a

direct impact on both productivity andprotability.

PwC has successfully worked with several

global technology companies to transform

their Q2C operations. Although these

initiatives addressed diverse challenges across

multiple business models, product types and

routes to market, they share common themes.

Forexample:

• A Fortune 500 global OEM was struggling

to streamline a Q2C process across eight

product families, each with multiple

conguration and pricing options. With

PwC’s help, the company identied

strategic priorities and key value drivers

to create new operating policies and

processes, organisational mechanisms and

enabling data. This allowed the company

to automate substantial segments of the

congure-price-quote process, order

management and invoicing. The changes

shrank the sales cycle and quote turnaround

time by about 25%, enhanced time to

market for new product introductions,

reduced the incidence of order errors and

reduced cost-per-order by 12%. In addition

to these operational efciencies, the

improvement also signicantly improved

customer and channel partner satisfaction

with the overall Q2C experience.

• A Fortune 500 Internet and digital

media company turned to PwC for help

controlling the enormous complexities of

its global Q2C operations by redesigning

regionally tailored processes, policies

and systems. The redesign automated

the creation and approval of quotes and

orders, reduced hand-offs and process

steps by 30%, streamlined the approval

and review process and helped prevent

duplications and errors in the Q2C process.

As a result, the company slashed its quote-

to-order cycle time by 70%, increased

productivity by 15% and boosted sales

to top global customers by offering them

differentiatedservices.

• A leading electronic gaming manufacturer

with global operations lost 25% of its

market share in 18 months as customers

complained about how hard it was to do

business with them. With PwC’s assistance,

the company slashed paperwork for each

quote from as much as 100 pages to just 3,

reduced its order lead time from 14 weeks

to 3 weeks and increased the percentage of

orders for standard (rather than custom)

products from 13% to 80%.

Real world examples of

Q2C transformation

Technology industry at the cross-roads: Transforming quote-to-cash operations / 16

Because Q2C operations touch almost every

aspect of business while having a signicant

inuence on the overall customer experience,

transformation in this area is a complex,

cross-disciplinary initiative. This type of

transformation cannot be approached as

a problem to be solved only by applying

technology solutions. Instead, organisations

must address this as a business-owned

exercise with an IT roadmap that aligns

with clearly dened goals and continuously

updated design imperatives. There should be

a constant, consistent focus on dening and

driving towards a target state that aligns with

strategic business goals.

A holistic approach based on a framework

that includes benchmarking and a reference

architecture can transform Q2C operations in

a way that spans business models and routes

to market. By creating an operating model that

focuses on a responsive, seamless customer

experience, which automates all but the most

complex, nonstandard and high-value deals,

organisations can reserve their resources for

critical transactions. In addition, this approach

also gives partners and enterprise customers

the smoother, simpler purchasing experience

that is closer to their expectations as shaped

by their shopping experiences with Apple,

Amazon, eBay and others.

Conclusion

PwC can help

If you have any questions about the quote-to-cash transformation process or would like to

explore how PwC can help to transform your business, please reach out to us.

RomitDey DarrenLee

Technology Principal Technology Principal

PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP

+1 408 817 5906 +1 408 817 4248

JoeLo TomPuthiyamadam

Technology Principal Technology Principal

PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP

+1 408 817 5040 +1 646 471 1490

Let’s talk

Please reach out to any of our technology leaders to discuss this or other challenges.

We’re hereto help.

RamanChitkara TomArcher

Global Technology Industry Leader US Technology Industry Leader

PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP

+1 408 817 3746 +1 408 817 3836

XavierCauchois GregUnsworth

European Technology Industry Leader Asia Technology Industry Leader

PricewaterhouseCoopers Entreprises PricwaterhouseCoopers Services LLP

xavier.cauchois@fr.pwc.com [email protected]

+33 1 56 57 10 33 +65 6236 3738

About the authors

The following PwC professionals contributed their experience, knowledge and expertise to

produce this paper.

RomitDey,Principal SantoshIyer, Director

San Jose, California San Jose, California

PatrickKennedy, Director MarcoMastrapasqua,Director

San Jose, California San Jose, California

About PwC’s Technology Institute

The Technology Institute is PwC’s global research network that studies the business of

technology and the technology of business with the purpose of creating thought leadership

that offers both fact-based analysis and experience-based perspectives. Technology Institute

insights and viewpoints originate from active collaboration between our professionals across the

globe and their rst-hand experiences working in and with the technology industry. For more

information please contact Raman Chitkara, Global Technology Industry Leader.

About PwC

PwC rms help organisations and individuals create the value they’re looking for. We’re a

network of rms in 158 countries with more than 180,000 people who are committed to

delivering quality in assurance, tax and advisory services. Tell us what matters to you and

nd out more by visiting us at http://www.pwc.com.

©2013PwC.Allrightsreserved.PwCreferstothePwCnetworkand/oroneormoreofitsmemberrms,eachofwhichisaseparate

legalentity.Pleaseseehttp://www.pwc.com/structureforfurtherdetails. BS-13-0168-A.0113

Thiscontentisforgeneralinformationpurposesonly,andshouldnotbeusedasasubstituteforconsultationwithprofessionaladvisors.