2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-1

VOLUME 2A, CHAPTER 1: “GENERAL INFORMATION”

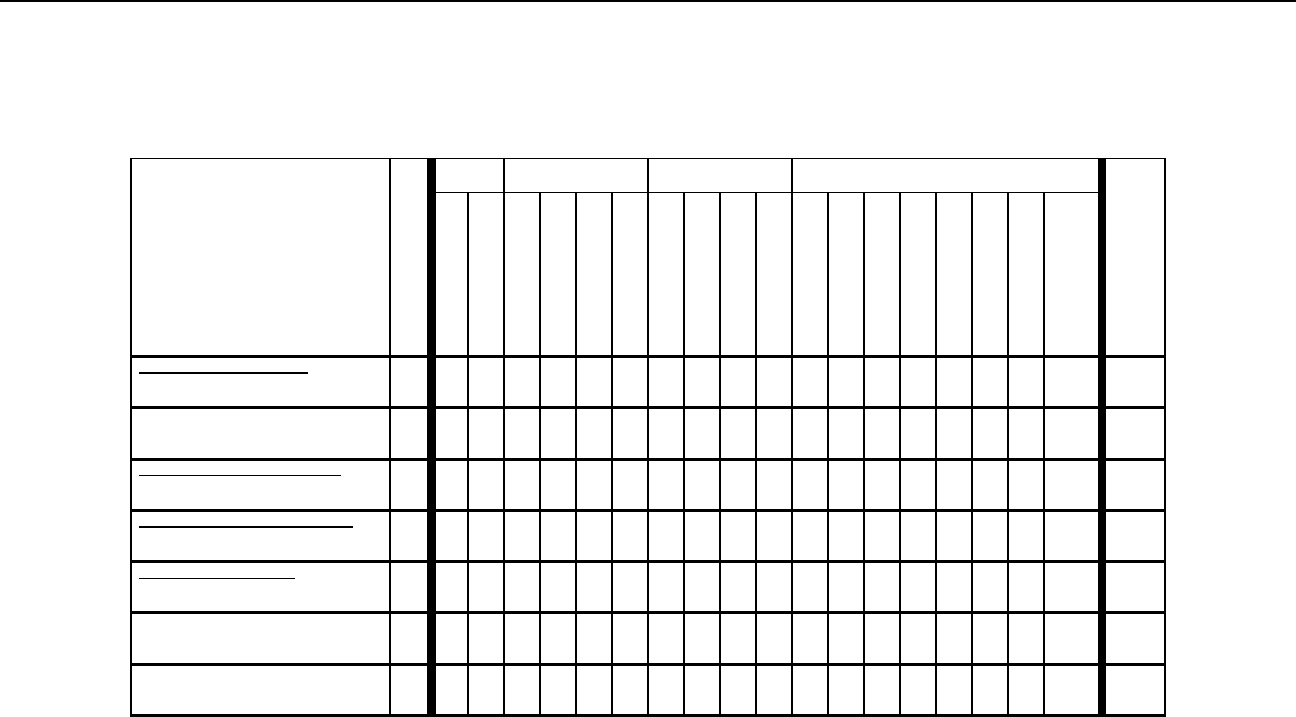

SUMMARY OF MAJOR CHANGES

Changes are identified in this table and also denoted by blue font.

Substantive revisions are denoted by an * symbol preceding the section, paragraph,

table, or figure that includes the revision.

Unless otherwise noted, chapters referenced are contained in this volume.

Hyperlinks are denoted by bold, italic, blue, and underlined font.

The previous version dated August 2007 is archived.

PARAGRAPH

EXPLANATION OF CHANGE/REVISION

PURPOSE

Overall

Formatting and room location changes

Revision

1.7

(010107)

Paragraph 1.7.2.28 – Expanded explanation of the full

funding policy

Addition

2.2

(010202)

Expanded explanation of full funding of procurement Addition

2.24

(010224)

Glossary of Terms – Expanded explanation of full funding Addition

3.6

(010306)

Disaster Situations and Management of

Disaster/Contingency Supplemental funds

Addition

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-2

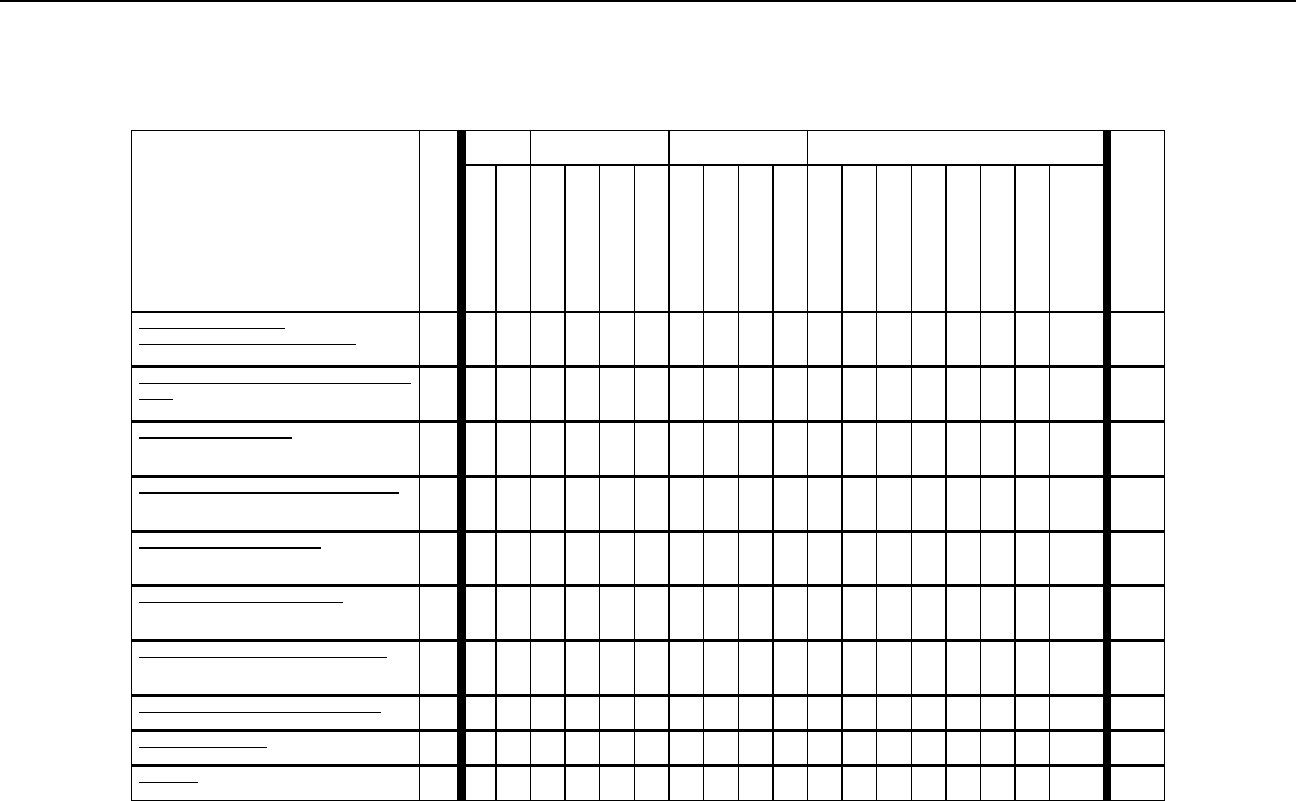

Table of Contents

VOLUME 2A, CHAPTER 1: “GENERAL INFORMATION” .................................................... 1

1.0 GENERAL POLICIES (0101) .......................................................................................... 7

1.1 Purpose (010101) .................................................................................................... 7

1.2 Organization (010102) ............................................................................................ 7

1.3 Changes to Volume 2 (010103) .............................................................................. 7

1.4 Reports Control Symbol (010104) .......................................................................... 7

1.5 Requests for Exceptions to OMB Circular A-11 (010105) .................................... 7

1.6 Proposed Changes in Budget Structure and Appropriation Language (010106) .... 8

1.7 Budget Terminology/Definitions (010107) ............................................................ 9

1.8 Security Classifications (010108) ......................................................................... 18

1.9 Budget and Performance Integration (010109) ..................................................... 19

1.10 Combatant Command Business Rules (Joint Task Assignment Process (JTAP))

(010110) ……………………………………………………………………………………19

2.0 FUNDING POLICIES (0102) ......................................................................................... 20

2.1 Criteria for Determining Expense and Investment Costs (010201) ...................... 20

*2.2 Full Funding of Procurement Programs (010202) ................................................ 26

2.3 Multiyear Procurement (010203) .......................................................................... 29

2.4 Buy-to-Budget for Acquisition of End Items (010204) ........................................ 32

2.5 Transportation (010205) ....................................................................................... 32

2.6 Engineering Change Orders (010206) .................................................................. 34

2.7 Factory Training (010207) .................................................................................... 34

2.8 Interim Contractor Support (010208) ................................................................... 34

2.9 Commercial Off-the-Shelf (COTS) and Non-Developmental Item (NDI)

Procurement (010209) ............................................................................................................ 34

2.10 Spares and Repair Parts (010210) ......................................................................... 35

2.11 Direct and Reimbursable Budget Plans (010211) ................................................. 35

2.12 Budgeting for Information Technology and Automated Information Systems

(010212) ……………………………………………………………………………………37

2.13 Research, Development, Test and Evaluation (RDT&E) - Definitions and Criteria

(010213) ……………………………………………………………………………………39

2.14 RDT&E - Incremental Programming and Budgeting Basis (010214) .................. 50

2.15 Defense Working Capital Funds - Operating Budget (010215) ........................... 52

2.16 Defense Working Capital Funds - Mobilization/Surge Costs (010216) ............... 52

2.17 Defense Working Capital Funds - War Reserve Materiel (010217) ..................... 52

2.18 Defense Working Capital Funds - Military Personnel Costs (010218) ................ 52

2.19 Defense Working Capital Funds - Full Recovery of Costs/Setting Prices (010219)

……………………………………………………………………………………53

2.20 Defense Working Capital Funds - Capital Budgeting (010220) ........................... 55

2.21 Defense Working Capital Funds - Base Support (010221) .................................. 56

2.22 Defense Working Capital Funds - Dual Funded Organizations (010222) ............ 56

2.23 Defense Working Capital Funds - Customer Mandated Schedule (010223) ........ 57

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-3

Table of Contents (Continued)

2.24 Glossary of Terms – Procurement (010224) ......................................................... 57

2.25 Glossary of Terms – RDT&E (010225)................................................................ 59

2.26 Prohibition on Parking of Funds (010226) ........................................................... 60

2.27 Use of Operation and Maintenance Funds under Contingency Construction

Authority (CCA) (010227) ..................................................................................................... 61

3.0 PROGRAM AND BUDGET REVIEW SUBMISSION (0103) ..................................... 61

3.1 General (010301) .................................................................................................. 61

3.2 Distribution (010302)............................................................................................ 64

Table 1. Justification Material Supporting the OSD/OMB Budget Submission Summary 67

Table 2. Justification Material Supporting the OSD/OMB Budget Submission Operation

and Maintenance, and Military Personnel Budget Material ................................................... 68

Table 3. Justification Material Supporting the OSD/OMB Budget Submission Procurement

Account Budget Material ....................................................................................................... 69

Table 4. Justification Material Supporting the OSD/OMB Budget Submission Research,

Development Test & Evaluation Account Budget Material .................................................. 70

Table 5. Justification Material Supporting the OSD/OMB Budget Submission Revolving

and Management Fund Budget Material ................................................................................ 71

Table 6. Justification Material Supporting the OSD/OMB Budget Submission Military

Construction & Family Housing Account Budget Material .................................................. 72

Table 7. Justification Material Supporting the OSD/OMB Budget Submission Special

Interest Requirements Budget Material.................................................................................. 73

3.3 Preparation of the Biennial Budget Estimates (010303) ....................................... 74

3.4 Second Year of the Department’s Two-year Budget Review Cycle - Budget

Material. (010304) .................................................................................................................. 77

3.5 Budget Estimates Summaries and Transmittal (010305)...................................... 78

*3.6 Supplemental Appropriations Submissions (010306) .......................................... 79

3.7 Additional Budget Submissions (ABS) (010307)................................................. 81

3.8 Major Budget Issues (MBIs) (010308) ................................................................. 82

3.9 Budget Review Procedures (010309) ................................................................... 82

4.0 CONGRESSIONAL JUSTIFICATION/PRESENTATION (0104) ............................... 84

4.1 General (010401) .................................................................................................. 84

4.2 Supplemental and Amended Appropriations Requests (010402) ......................... 89

4.3 Distribution/Internet Posting of Budget Material (010403) .................................. 91

Table 8. Justification Material Supporting The President’s Budget Request Military

Personnel Accounts ................................................................................................................ 95

Table 9. Justification Material Supporting the President’s Budget Request Operation and

Maintenance Accounts ........................................................................................................... 97

Table 10. Justification Material Supporting the President’s Budget Request All Military

Department Procurement Accounts ..................................................................................... 100

Table 11. Justification Material Supporting the President’s Budget Request Procurement

Accounts - Army .................................................................................................................. 101

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-4

Table of Contents (Continued)

Table 12. Justification Material Supporting the President’s Budget Request Classified

Procurement Accounts -Navy .............................................................................................. 102

Table 13. Justification Material Supporting the President’s Budget Request Procurement

Accounts - Navy. .................................................................................................................. 103

Table 14. Justification Material Supporting the President’s Budget Request Procurement

Accounts - Air Force ............................................................................................................ 104

Table 15. Justification Material Supporting The President’s Budget Request Procurement

Accounts - Other .................................................................................................................. 106

Table 16. Justification Material Supporting the President’s Budget Request Procurement

Accounts - Defense-Wide .................................................................................................... 107

Table 17. Justification Material Supporting the President’s Budget Request Research,

Development Test & Evaluation Accounts .......................................................................... 108

Table 18. Justification Material Supporting the President’s Budget Request Research,

Development Test & Evaluation Accounts .......................................................................... 109

Table 19. Justification Material Supporting the President’s Budget Request All Military

Department Working Capital Fund Accounts ...................................................................... 110

Table 20. Justification Material Supporting the President’s Request Revolving and

Management Funds .............................................................................................................. 111

Table 21. Justification Material Supporting the President’s Budget Request All Military

Department Military Construction, Family Housing and BRAC Accounts......................... 112

Table 22. Justification Material Supporting the President’s Request Military Construction &

Family Housing Accounts .................................................................................................... 113

Table 23. Justification Material Supporting the President’s Request Base Realignments And

Closures (BRAC) ................................................................................................................. 115

Table 24. Justification Material Supporting The President’s Request Other Account

Requirements ........................................................................................................................ 116

Table 25. Justification Material Supporting the President’s Request Special Interest

Requirements ........................................................................................................................ 117

Table 26. Justification Material Supporting The President’s Request Special Interest

Requirements ........................................................................................................................ 118

4.4 Witness Statements (010404) ............................................................................. 120

4.5 Transcript Processing (010405) .......................................................................... 121

4.6 Appeal Process on Congressional Actions (010406) .......................................... 123

5.0 BUDGET AUTOMATION REQUIREMENTS (0105) ............................................... 125

5.1 Automated Military Personnel Programs Database (010501) ............................ 125

5.2 Automated Operation and Maintenance Programs Databases (010502) ............ 126

5.3 Automated Procurement Programs Database (010503) ...................................... 129

5.4 Automated RDT&E Programs Database (010504)............................................. 132

5.5 Automated Construction Program Database (010505) ....................................... 133

5.6 CIS Automation Requirements for the Biennial Program and Budget Review

Submission (010506)............................................................................................................ 136

5.7 CIS Budget Structure Listing (BSL) (010507) ................................................... 138

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-5

Table of Contents (Continued)

6.0 UNIFORM BUDGET AND FISCAL ACCOUNTING CLASSIFICATIONS (0106) 141

6.1 General (010601) ................................................................................................ 141

6.2 Functional Titles – Military Functions (010602) ................................................ 141

6.3 Definitions of Functional Titles and Subdivisions – Military (010603) ............. 142

6.4 Functional Titles and Definitions – Other Defense Civil Programs (010604) ... 154

7.0 AUTOMATED FUTURE YEARS DEFENSE PROGRAM (FYDP) DATABASES

(0107)....................................................................................................................................... 155

7.1 Standard Data Collection System (SDCS) (010701) .......................................... 155

7.2 FYDP Resource Structure Management (RSM) System (010702) .................... 158

8.0 AUTOMATED BUDGET, INTELLIGENCE, AND RELATED DATABASE (BIRD)

(0108)....................................................................................................................................... 159

9.0 SELECT AND NATIVE PROGRAMMING (SNaP) DATA INPUT SYSTEM (0109)

…………………………………………………………………………………………159

9.1 Select and Native Programming (SNaP) Data Collection System (010901) ...... 159

10.0 GENERAL GUIDANCE SUBMISSION FORMATS (0110)................................... 161

10.1 Purpose (011001) ................................................................................................ 161

10.2 Exhibits in Support of Section 3.0 – Program and Budget Review Submission

(011002) …………………………………………………………………………………..161

10.3 Exhibits in Support of Section 4.0 – Congressional Justification/Presentation

(011003) …………………………………………………………………………………..161

10.4 Exhibits in Support of Section 5.0 (011004) ...................................................... 162

10.5 Exhibits in Support of Section 7.0 (011005) ...................................................... 162

Exhibit PB-1A. Fiscal Guidance Track ................................................................................ 163

Exhibit PB-3. Reprogramming/Transfers Between Appropriations ..................................... 164

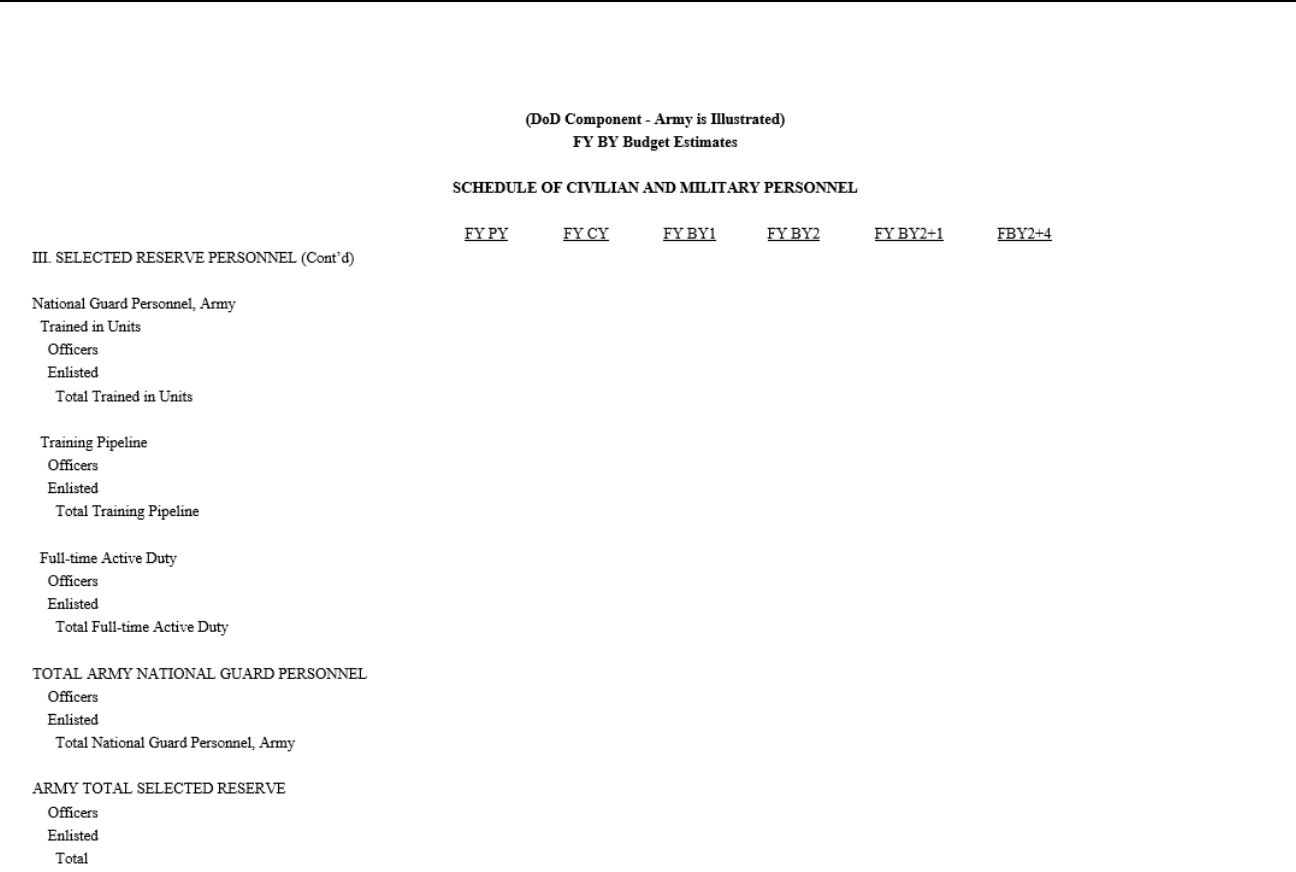

Exhibit PB-4. Schedule of Civilian and Military Personnel ................................................. 166

Exhibit PB-8. FY 20CY. Supplemental Appropriation Requirements ................................ 170

Exhibit PB-10. Additional FY 20BY Budget Estimates ....................................................... 172

Major Budget Issue Format ..................................................................................................... 174

Exhibit PB-37A. Justification of Supplemental Requirements ............................................. 175

Exhibit PB-37R. Budget Amendment Summary .................................................................. 176

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-6

Table of Contents (Continued)

Exhibit PB-37S. Program and Financing Schedule (Abbreviated) ....................................... 177

Exhibit PB-37T. Narrative Justification ............................................................................... 178

Exhibit PB-39A-1. Format - Appeal Input (Program Adjustments) ..................................... 179

Exhibit PB-39A-2. Format - Appeal Input (Language Items) .............................................. 180

Exhibit DD 1587. Record of Congressional Transcript Review ........................................... 181

Exhibit DD 1790. Prepared Testimony Review ................................................................... 182

HAC QFR ................................................................................................................................ 183

HASC QFR .............................................................................................................................. 184

SAC QFR ................................................................................................................................. 185

SASC QFR .............................................................................................................................. 186

INSERT - ALL COMMITTEES ............................................................................................. 187

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-7

CHAPTER 1

GENERAL INFORMATION

1.0 GENERAL POLICIES (0101)

1.1 Purpose (010101)

1.1.1. Volume 2 of the Financial Management Regulation (FMR) provides general

guidance on the formulation and submission of the budget requests to the Office of the Secretary

of Defense for the program and budget review submission and the presentation and justification of

the budget requests to the Congress. This volume is established under the authority of

DoD Instruction 7000.14.

1.1.2. Volume 2 is intended as a comprehensive reference book on budget matters of the

Department of Defense. Budget policy memoranda issued throughout the year will provide any

necessary changes or revisions to this standing document, as well as special instructions and

nonrecurring requirements unique to that year’s budget cycle.

1.1.3. The provisions of Volume 2 apply to all military and specified civil functions of the

Department of Defense.

1.1.4. An introduction to the total Financial Management Regulation, DoD 7000.14-R can

be found in Volume 1.

1.2 Organization (010102)

Volume 2B is organized into 19 chapters that provide specific guidance, required budget

exhibits and formats along with instructions for their preparation, and automated submission

requirements.

1.3 Changes to Volume 2 (010103)

1.3.1. Changes to Volume 2 will be issued biennially, prior to the program and budget

review of the initial biennial budget cycle. Pen and ink changes will not be issued.

1.3.2. Generally, significant changes on a page will be indicated by preceding the

paragraph or section containing a change and the changed material will be printed in blue ink.

1.4 Reports Control Symbol (010104)

Data requirements established by this volume are exempt from the requirement for

assignment of a Report Control Symbol.

1.5 Requests for Exceptions to OMB Circular A-11 (010105)

1.5.1. Each year the Office of Management and Budget (OMB) issues Circular No. A-11,

which addresses the preparation and submission of budget estimates for all Federal agencies.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-8

1.5.2. Federal agencies are allowed to request exceptions to the requirements of

Circular A-11 by submitting in writing to OMB all required exceptions by August 1. Exceptions

approved by OMB are valid only for 1 year.

1.5.3. Each year the USD(Comptroller) requests certain exceptions to

OMB Circular A-11. Generally, these exceptions concern special situations that are unique to the

Department of Defense.

1.5.3.1. Subsequent to the issuance of Circular A-11 by OMB each year, any

DoD Component requiring an exception to the requirements of Circular A-11 should submit in

writing the specific section for which an exception is required and provide adequate rationale to

justify the exception. The memorandum addressing the requested exceptions should be submitted

directly to the Office of the USD(Comptroller), Program/Budget, Program and Financial Control

Directorate (Room 3C689, telephone (703) 697-0021) no later than July 15 of each year.

1.5.3.2. If the requested exception is acceptable to the USD(Comptroller), these

proposals will be consolidated and forwarded to OMB for approval. Components will be advised

of any exceptions approved by OMB.

1.5.3.3. All DoD Components are required to comply with any requested

exceptions not approved and to properly reflect the information in the budget submissions.

1.6 Proposed Changes in Budget Structure and Appropriation Language (010106)

1.6.1. Under the provisions of OMB Circular A-11, the following types of changes must

be cleared with OMB:

1.6.1.1. Changes in the appropriation pattern, including proposed new accounts

and changes in the titles and sequence of existing accounts.

1.6.1.2. Changes in the methods of funding a program.

1.6.1.3. Changes in program or budget activity classifications for the program and

financing schedules for all appropriation accounts and funds.

1.6.2. Any proposed changes on the items listed above must be submitted by memorandum

to the Office of the USD(Comptroller) that explains the proposal and the rationale for the changes.

If acceptable to the USD(Comptroller), these proposals will be forwarded to OMB for approval.

1.6.3. Proposed changes in the wording of appropriation language should be submitted to

the Office of the Deputy General Counsel (Fiscal) (Room 3B688, telephone (703) 697-7228) as

soon as possible after the passage of the current year’s appropriations acts. ODGC(Fiscal) will

coordinate changes with OMB.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-9

1.7 Budget Terminology/Definitions (010107)

1.7.1. Standard Government-wide definitions of budget terminology are provided in the

Office of Management and Budget’s issuances, most notably Circular A-11 (Section 20).

1.7.2. For the Department of Defense, some of the more common budget concepts

applicable to budget formulation follow:

1.7.2.1. Accrual Basis of Accounting. A method of accounting in which revenues

are recognized in the period earned and costs are recognized in the period incurred, regardless of

when payment is received or made. There have been many initiatives over the years to convert

the Federal Budget to an accrual accounting basis. Although the budget is on a cash basis, DoD

accounting is on the accrual basis.

1.7.2.2. Advance Procurement. Authority provided in an appropriations act to

obligate and disburse during a fiscal year before that in which the related end item is procured.

The funds are added to the budget authority for the fiscal year and deducted from the budget

authority of the succeeding fiscal year. Used in major acquisition programs for advance

procurement of components whose long-lead-times require purchase early in order to reduce the

overall procurement lead-time of the major end item. Advance procurement of long lead

components is an exception to the DoD “full funding” policy and must be part of the President’s

budget request.

1.7.2.3. Appeal. A request for reconsideration of an action taken to adjust, reduce,

or delete funding for an item during the congressional review of the Defense budget (authorization

and appropriation). This process is discussed in Section 4.6.

1.7.2.4. Apportionment. A distribution by the Office of Management and Budget

of amounts available for obligation in appropriation or fund accounts of the Executive Branch.

The distribution makes amounts available on the basis of specified time periods, programs,

activities, projects, or combinations thereof. The apportionment system is intended to achieve an

effective and orderly use of funds. The amounts so apportioned limit the obligations that may be

incurred.

1.7.2.5. Appropriations. A provision of legal authority by an act of the Congress

that permits Federal agencies to incur obligations and to make payments out of the Treasury for

specified purposes. An appropriation usually follows enactment of authorizing legislation. An

appropriation act is the most common means of providing budget authority

(see Budget Authority). Appropriations do not represent cash actually set aside in the Treasury

for purposes specified in the appropriation act; they represent limitations of amounts which

agencies may obligate during the time period specified in the respective appropriation acts.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-10

1.7.2.6. Authorization (Authorizing Legislation). Basic substantive legislation

enacted by the Congress which sets up or continues the legal operation of a Federal program or

agency either indefinitely or for a specific period of time or sanctions a particular type of obligation

or expenditure within a program. Such legislation is normally a prerequisite for subsequent

appropriations or other kinds of budget authority to be contained in appropriation acts. It may

limit the amount of budget authority to be provided subsequently or may authorize the

appropriation of “such sums as may be necessary.”

1.7.2.7. Biennial Budget. The FY 1986 Department of Defense Authorization Act

required the submission of two-year budgets for the Department of Defense and related agencies

beginning with FY 1988/FY 1989. The Department has fully institutionalized a biennial cycle for

the Planning, Programming, Budgeting and Execution (PPBE) Process, including the Strategic

Planning Guidance (SPG), the Program Objective Memorandum (POM), Volume 2 of the

Financial Management Regulation (FMR) and budget formulation memoranda. A biennial budget,

as currently structured, represents program budget estimates for a two-year period in which fiscal

year requirements remain separate and distinct.

1.7.2.8. Budget Activity. Categories within each appropriation and fund account

which identify the purposes, projects, or types of activities financed by the appropriation or fund.

1.7.2.9. Budget Amendment. A formal request submitted to the Congress by the

President, after his formal budget transmittal but prior to completion of appropriation action by

the Congress, that revises previous requests, such as the amount of budget authority.

1.7.2.10. Budget Authority. The authority becoming available during the year to

enter into obligations that result in immediate or future outlays of Government funds.

1.7.2.11. Budget Deficit. The amount by which the Government’s budget outlays

exceed its budget receipts for any given period. Deficits are financed primarily by Treasury

borrowing from the public.

1.7.2.12. Budget Receipts. Amounts received by the Federal Government from the

public that arise from the exercise of governmental or sovereign power (primarily tax revenues,

but also receipts from premiums of compulsory social insurance programs, court fines, license

fees, etc.); premiums from voluntary participants in Federal social insurance programs; and gifts

and contributions. Excluded from budget receipts are collections resulting from business-type

transactions and payments between government accounts as a result of intragovernmental

transactions.

1.7.2.13. Change Proposal. Components use this mechanism to revise programs

and approved budgets in the second year of the 2-year program and budget cycle, in lieu of

submitting a Program Objective Memorandum and a Budget Estimate Submission with complete

documentation. A format will be provided with the annual program and budget guidance.

See “Two-year Program and Budget Cycle.”

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-11

1.7.2.14. Closed (Canceled) Appropriations. An appropriation that is no longer

available for the adjustment or payment of obligations. Appropriation accounts are closed

(canceled) after being in the expired status for five years. A Comptroller General opinion has

provided the DoD with authority to make disbursement adjustments to closed appropriations to

correct errors only. (See Expired Appropriation.)

1.7.2.15. Concurrent Resolution. A resolution passed by both Houses of Congress,

but not requiring the signature of the President, setting forth, reaffirming, or revising the

congressional budget for the United States Government for a fiscal year. A concurrent resolution

on the budget, due by April 15, must be adopted before legislation providing new budget authority,

new spending authority, new credit authority or changes in revenues or the public debt limit is

considered. Other concurrent resolutions for a fiscal year may be adopted at any time following

the first required concurrent resolution for that fiscal year.

1.7.2.16. Constant Dollars. A dollar value adjusted for changes in prices. Constant

dollar series are derived by dividing current dollar estimates by appropriate price indices, a process

generally known as deflating. The result is a time series as it would presumably exist if prices

were the same throughout as in the base year - in other words, as if the dollar had constant

purchasing power. Any changes in such a series would reflect only changes in the real (physical)

volume of output. Constant dollar figures are commonly used for gross national product and its

components.

1.7.2.17. Continuing Resolution. Legislation enacted by the Congress to provide

budget authority for specific ongoing activities in cases where the regular fiscal year appropriation

for such activities has not been enacted by the beginning of the fiscal year. The continuing

resolution usually provides formulas which the agency uses to compute amounts available for

continuing programs at minimum levels. Formulas typically include obligation rates of the prior

year, the President’s budget request, or an appropriation bill passed by either or both Houses of

the Congress.

1.7.2.18. Current Services Estimates. Estimated budget authority and outlays for

the upcoming fiscal year based on continuation of existing levels of service, i.e., assuming that all

programs and activities will be carried on at the same level as in the fiscal year in progress and

without policy changes in such programs and activities. These estimates of budget authority and

outlays, accompanied by the underlying economic and programmatic assumptions upon which

they are based (such as the rate of inflation, the rate of real economic growth, pay increases, etc.),

are required to be transmitted by the President to the Congress.

1.7.2.19. Deferral of Budget Authority. Any action or inaction by any officer or

employee of the United States that withholds, delays, or effectively precludes the obligation or

expenditure of budgetary resources, including the establishment of reserves under the

Antideficiency Act, as amended by the Impoundment and Control Act. Section 1013 of the

Impoundment Control Act of 1974 requires a special message from the President to the Congress

reporting a proposed deferral of budget authority. Deferrals may not extend beyond the end of the

fiscal year in which the message reporting the deferral is transmitted and may be overturned by

the passage of an impoundment resolution by either House of Congress.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-12

1.7.2.20. Disbursements. In budgetary usage, gross disbursements represent the

amount of checks issued, cash, or other payments made, less refunds received. Net disbursements

represent gross disbursements less income collected and credited to the appropriation or fund

account, such as amounts received for goods and services provided.

1.7.2.21. Discretionary Authority. Budgetary resources (except those provided to

fund mandatory spending) provided in appropriations acts.

1.7.2.22. Emergency Appropriations. Appropriations that have been designated by

the Congress and the President as an emergency requirement under the Balanced Budget and

Emergency Deficit Control Act of 1985, as amended.

1.7.2.23. End Strength. In general, strength at the end of a fiscal year. Single point

strengths for other points in time must be specified, such as end first-quarter strength.

1.7.2.24. Expenditures/Disbursements. A term generally used interchangeably

with outlays (See outlays).

1.7.2.25. Expired Appropriation. An appropriation whose period of availability

for incurring new obligations has expired but the appropriation is not closed (canceled). During

this period, the appropriation is available for adjustment to, or payment of, existing obligations.

Appropriations remain in an expired status for 5-years as shown in the table below. At the end of

the five-year expiration period, the appropriation is closed (canceled) and is no longer available

for the payment of unliquidated obligations. (See Closed (Canceled) Appropriations.)

Normal Life Cycle of Appropriations:

Approp

Years For

New

Obligations

Unexpired

Years For

Obligation

Adjust. &

Disburse.

Expired

Years For

Closed

End of

Year

Canceled

MilPers

1

2-6

6

O&M.

1

2-6

6

RDT&E

2

3-7

7

Proc.

3

4-8

8

SCN

5

6-10

*10

Mil. Con.

5

6-10

10

* Extended to 15-years under certain circumstances.

1.7.2.26. Federal Debt. Federal debt consists of public debt and agency debt.

Public debt is that portion of the Federal debt incurred when the Treasury Department or

Federal Financing Bank (FFB) borrows funds directly from the public or another fund or account.

Agency debt is that portion of the Federal debt incurred when a Federal agency authorized by law,

other than Treasury or the Federal Financing Bank, borrows funds directly from the public or

another fund or account.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-13

1.7.2.27. Fiscal Year. Any yearly accounting period without regard to its

relationship to a calendar year. The fiscal year for the Federal Government begins on October 1

and ends on September 30. The fiscal year is designated by the calendar year in which it ends.

Fiscal years are further designated as follows:

Past Year-1: Also referred to as Prior Year-1, the fiscal year immediately preceding the

past year

Past Year (PY): Also referred to as Prior Year, the fiscal year immediately preceding the

current year; the last completed fiscal year.

Current Year (CY): The fiscal year in progress. Immediately precedes the budget year.

Budget Year (BY): The next fiscal year for which estimates are submitted if not a biennial

budget.

Budget Year 1 (BY1): In a biennial budget submission (Department of Defense), the first

fiscal year of a 2-year period for which the budget is being considered.

Budget Year 2 (BY2): In a biennial budget submission (Department of Defense), the

second fiscal year of a 2-year period for which the budget is being considered.

Budget Year(s)+1 (BY(s)+1): The fiscal year immediately following the budget year(s).

This format continues through Budget Year +5 (BY+5), the fifth fiscal year following the budget

year(s).

* 1.7.2.28. Full Funding Policy. The practice of funding the total cost of major

procurement and construction projects in the fiscal year in which they will be initiated. The full

funding policy requires the total estimated cost of a complete, military useable end item or

construction project funded in the year in which the item is procured. If a future year’s

appropriation is required for delivery of an end item, the end item is not fully funded. It prevents

funding programs incrementally and provides a disciplined approach for program managers to

execute their programs within cost. See Section 2.2 for further information.

1.7.2.29. Full-time Equivalent (FTE). Reflects the total number of regular straight-

time hours (i.e., not including overtime or holiday hours) worked by employees divided by the

number of compensable hours applicable to each fiscal year. Annual leave, sick leave and

compensatory time off and other approved leave categories are considered to be “hours worked”

for purposes of defining full-time equivalent employment.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-14

1.7.2.30. Future Years Defense Program (FYDP). The Future Years Defense

Program is the program and financial plan for the Department of Defense as approved by the

Secretary of Defense. The FYDP arrays cost data, manpower and force structure over a 6-year

period (force structure for an additional 3 years), portraying this data by major force program for

DoD internal review for the program and budget review submission. It is also provided to the

Congress in conjunction with the President’s budget.

1.7.2.31. Impoundment. Any action or inaction by an officer or employee of the

United States that precludes the obligation or expenditure of budget authority provided by the

Congress.

1.7.2.32. Impoundment Resolution. A resolution of the House of Representatives

or the Senate disapproving a deferral of budget authority set forth in a special message ordinarily

transmitted by the President under section 1013 of the Impoundment Control Act of 1974. Passage

of an impoundment resolution by either House of Congress has the effect of overturning the

deferral and requires that such budget authority be made available for obligation.

1.7.2.33. Incremental Funding. The phasing of total funding of programs or

projects over two or more fiscal years based upon levels and timing of obligational requirements

for the funds. Differs from full funding concept where total funds for an end item, program or

project are provided in the fiscal year of program or project initiation, regardless of the obligational

requirement for the funds.

1.7.2.34. Mandatory Authority. (Also known as Entitlement Authority) Authority

controlled by laws other than appropriations.

1.7.2.35. Management Initiative Decision (MID). A decision document similar to

a Program Budget Decision, but designed to institutionalize management reform decisions.

A MID may be issued at any time during the year. The Comptroller will incorporate any funding

adjustments into the next President’s Budget.

1.7.2.36. Multiyear Procurement. Procurement of a particular end item or system

under a multiyear contract approved by specific provision of law. For the Department of Defense,

multiyear procurement contracting of military hardware or systems must generally be specifically,

and individually, approved by the Congress (see 10 U.S.C. 2306b(1).

1.7.2.37. Object Classification. A uniform classification identifying the

transactions of the Federal Government by the nature of the goods or services purchased without

regard to the agency involved or the purpose of the programs for which they are used.

1.7.2.38. Obligations. Binding agreement that will result in outlays immediately

or in the future.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-15

1.7.2.39. Offsetting Collections. Payments to the Government that are credited

directly to the expenditure account and deducted from gross budget authority and outlays of the

expenditure account. They result from business-type or market oriented activities with the public

and intragovernmental transactions with other government accounts (commonly called

reimbursable transactions).

1.7.2.40. Outlays. The amount of checks issued or other payments made

(including advances to others), net of refunds and reimbursements collected. Outlays are net of

amounts that are adjustments to obligational authority. The terms “expenditure” and “net

disbursement” are frequently used interchangeably with the term “outlay.” Gross outlays are

disbursements and net outlays are disbursements (net of refunds) minus reimbursements collected.

1.7.2.41. President’s Budget. The budget for a particular fiscal year transmitted to

the Congress by the President in accordance with the Budget and Accounting Act of 1921, as

amended. Some elements of the budget, such as the estimates for the legislative branch and the

judiciary, are required to be included without review by the Office of Management and Budget or

approval by the President.

1.7.2.42. Program Budget Decision (PBD). A budget decision document issued

during the joint review of Service budget submissions by analysts of the Office of the Secretary of

Defense (OSD) and the Office of Management and Budget (OMB). PBDs reflect the decisions of

the Secretary of Defense as to appropriate program and funding to be included in the annual

Defense budget request which, in turn, is included in the President’s Budget.

1.7.2.43. Program Decision Memorandum (PDM). A document containing the

decisions by the Secretary of Defense reflecting broad strategic trades related to the program and

resource levels identified in the Program Objectives Memorandum.

1.7.2.44. Program Objectives Memorandum (POM). The final product of the

programming process within the Department of Defense, the Components Program Objectives

Memorandum (POM) displays the resource allocation decisions of the Military Departments in

response to and in accordance with Strategic Planning Guidance (SPG) and Joint Programming

Guidance (JPG).

1.7.2.45. Program Year. The fiscal year in which authorization was provided and

in which funds were appropriated for a particular program, regardless of the fiscal year in which

funds for that program might be obligated.

1.7.2.46. Reapportionment. A revision by the Office of Management and Budget

of a previous apportionment of budgetary resources for an appropriation or fund account.

A revision would ordinarily cover the same period, project, or activity covered in the original

apportionment.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-16

1.7.2.47. Reappropriation. Congressional action to restore the obligational

availability, whether for the same or different purposes, of all or part of the unobligated portion of

budget authority that has expired or would otherwise expire in an annual or multi-year account.

Obligational authority in a current appropriation may also be extended by a subsequent

appropriation act.

1.7.2.48. Reconciliation Process. A process used by the Congress to reconcile

amounts determined by tax, spending, and debt legislation for a given fiscal year with the ceilings

enacted in the second and required concurrent resolution on the budget for that year. Section 310

of the Congressional Budget and Impoundment Control Act of 1974 provides that the second

required concurrent resolution on the budget, which sets binding totals for the budget, may direct

committees to determine and recommend changes to laws, bills, and resolutions, as required to

conform with the binding totals for budget authority, revenues, and the public debt.

1.7.2.49. Recovery of Prior Year Obligations. Amounts made available for

obligation in no-year and unexpired multi-year accounts through downward adjustment of prior

year obligations.

1.7.2.50. Reimbursable Obligation. Obligation financed by offsetting collections

credited to an expenditure account in payment for goods and services provided by that account.

See Offsetting Collection.

1.7.2.51. Reprogramming. Utilization of funds in an appropriation account for

purposes other than those contemplated at the time of appropriation. Reprogramming is generally

accomplished pursuant to consultation with and approval by appropriate congressional

committees. Instructions are contained in Volume 3.

1.7.2.52. Rescission. The consequence of enacted legislation which cancels

budgetary resources previously provided by the Congress prior to the time when the authority

would otherwise lapse. Section 1012 of the Impoundment Control Act of 1974 requires a special

message from the President to the Congress reporting any proposed rescission of budgetary

resources. These proposals may be accepted in whole or in part through the passage of a rescission

bill by both Houses of the Congress.

1.7.2.53. Rescission Bill. A bill or joint resolution that provides for cancellation,

in whole or in part, of budgetary resources previously granted by the Congress. Under Section

1012 of the Impoundment Control Act of 1974, unless Congress approves a rescission bill within

45 days of continuous session after receipt of the proposal, the budgetary resources must be made

available for obligation.

1.7.2.54. Revolving Fund. A fund established to finance a cycle of operations

through amounts received by the fund. Within the Department of Defense, such funds include the

Defense Working Capital Fund, as well as other working capital funds.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-17

1.7.2.55. Sequestration. The reduction or cancellation of new budget authority;

unobligated balances, new loan guarantee commitments or limitations; new direct loan obligations,

commitments, or limitations; spending authority; and obligation limitations. OMB Circular A-11,

section 20 provides additional information on sequestration rules of the Budget Enforcement Act

of 1990 (BEA).

1.7.2.56. Supplemental Appropriation. An act appropriating funds in addition to

those in an annual appropriation act. Supplemental appropriations provide additional budget

authority beyond original estimates for programs or activities (including new programs authorized

after the date of the original appropriation act) for which the need for funds is too urgent to be

postponed until enactment of the next regular appropriation act.

1.7.2.57. Total Obligational Authority (TOA) Availability. The sum of

(1) all budget authority granted (or requested) from the Congress in a given year,

(2) amounts authorized to be credited to a specific fund, (3) budget authority transferred from

another appropriation, and (4) unobligated balances of budget authority from previous years which

remain available for obligation. In practice, this term is used primarily in discussing the

Department of Defense budget, and most often refers to TOA as “direct program” which equates

to only (1) and (2) above.

1.7.2.58. Transfer Authorities. Annual authorities provided by the Congress via

annual appropriations and authorization acts to transfer budget authority from one appropriation

or fund account to another.

1.7.2.59. Two-year Program and Budget Cycle. For the budget review, this cycle

coincides with the biennial budget process required by law. It is part of the Department’s internal

2-year Planning, Programming, Budgeting, and Execution (PPBE) process. The first year of the

cycle includes a full review of the budget for the following two years. Full budget documentation

is required. The end result is a budget baseline for the next two years. The second year of the

cycle limits changes to the baseline program. It focuses on fact-of-life changes to include

congressional action and program execution. Components will request adjustments to the baseline

through Change Proposals (CP). However, while the second year of the process will require only

limited budget documentation for the internal review, full budget documentation is still required

for the President’s budget submission.

1.7.2.60. User Fee. A fee, charge, or assessment levied on those directly benefiting

from, or subject to regulation by, a Federal government program or activity, to be utilized solely

to support the program or activity. Collections from other Federal accounts are not user fees. (See

OMB Circular A-11, section 20.7)

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-18

1.8 Security Classifications (010108)

1.8.1. General

1.8.1.1. Instructions concerning premature disclosure of budget information prior

to presentation to the Congress are contained in OMB Circular A-11.

1.8.1.2. Instructions concerning security classification of the program and budget

review submissions to OSD are contained in Section 3.5.

1.8.1.3. Paper copies of the P-1 and R-1 exhibits must be submitted by

DoD Components with a certification signed by the Security Office confirming that all line items

are classified properly.

1.8.1.4. Instructions concerning security classification of congressional

justification material are contained in Section 4.1.

1.8.2. Classification of Military Personnel M-1 line items, Operation and Maintenance O-1

line items, Procurement Exhibit P-1 line items, RDT&E Exhibit R-1 line items, and the

Construction Programs (C-1):

1.8.2.1. The Military Personnel Programs (M-1) is designed to be an unclassified

document. See Section 5.1 for instructions.

1.8.2.2. The Operation and Maintenance Exhibit O-1 line items will be unclassified

to the maximum extent possible. Classify only those line items for which the program’s Security

Classification Guide so dictates or when conditions in paragraph C. (below) apply.

1.8.2.3. Procurement Exhibit P-1 line items: P-1 line items will be unclassified to

the maximum extent possible. Classify only those line items for which the program’s

Security Classification Guide so dictates or when conditions in paragraph C. (below) apply.

1.8.2.4. RDT&E Exhibit R-1 line items: R-1 line items will be unclassified to the

maximum extent possible. Classify only those line items for which the program’s

Security Classification Guide so dictates or when conditions in paragraph C. (below) apply.

1.8.2.5. The Construction Programs (C-1) is designed to be an unclassified

document. See Section 5.5 for instructions.

1.8.3. Security classification instructions for Intelligence Programs/Activities Resource

Information are contained in Chapter 16.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-19

1.9 Budget and Performance Integration (010109)

1.9.1. The President’s Management Agenda (PMA) targets the most apparent deficiencies

in the government where the opportunity to improve performance is the greatest. The Office of

Management and Budget (OMB) developed standards for success in the government-wide Budget

and Performance Integration Initiative of the PMA. As a result, the OMB requires federal agencies

to use performance measures in managing and justifying program resources.

1.9.2. Components shall use performance measures to justify 100 percent of the resources

requested in the Budget Year. The Components shall comply with the performance measure

requirements that are included in other chapters. Additionally, OMB has directed the use of the

Program Assessment Rating Tool (PART) for some programs. The PART is a diagnostic tool that

formalizes performance evaluation. The Components shall comply with PART taskings and

suspense dates. For those programs that have been assessed using the PART, the Components

shall include OMB’s PART Summary (published in February each year) in congressional budget

justification materials, press releases, testimony, and briefings to congressional committee staffs.

OMB Circular A-11, section 26 – Summary of Performance Information Requirements, and the

OMB PART Web site (www.whitehouse.gov/omb/part), provide additional information about the

PART and the PART process. Absent a PART or performance measures prescribed in other

chapters, the Components may use existing, or create new, performance measures.

1.10 Combatant Command Business Rules (Joint Task Assignment Process (JTAP)) (010110)

1.10.1. The following business rules will be followed to govern the financial management

arrangements between Combatant Command Support Agents (CCSAs) and Combatant

Commands (COCOM). The CCSA assignments are as follows:

1.10.1.1. Initial funding for new COCOM missions will be established by OSD.

Funding for new missions assigned by the Secretary or Deputy Secretary will be established and

provided for by OSD as part of the JTAP process and in conjunction with the

Planning, Programming, Budgeting and Execution (PPBE) processes.

1.10.1.2. It is the responsibility of the Combatant Command Support Agent

(CCSA) to maintain funding for the directed COCOM missions.

1.10.1.2.1. CCSAs will adjust COCOM accounts across the FYDP

consistent with the OSD/OMB approved inflation indices.

1.10.1.2.2. COCOMs will be subjected to a proportionate share

(on a percentage basis) of total CCSA reductions from undistributed congressional and/or OSD

general reductions.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-20

1.10.1.3. All Service business and efficiency reductions require prior COCOM or

OSD approval to ensure they do not impede the conduct of directed missions.

CCSAs will pre-coordinate any Service-initiated reductions to COCOM resources

with the COCOMs during each phase of the PPBE process for all years in the FYDP, and Service-

initiated reductions will not be applied to any COCOM funds without the prior approval of the

COCOM or the OSD staff.

1.10.1.4. OUSD(C), PA&E, Joint Staff, Combatant Commands and Combatant

Command Support Agents will meet annually to validate, and adjudicate as necessary, all

adjustments to COCOM resources.

OUSD(C) will review and coordinate CCSA budget exhibits that specifically pertain to COCOM

resources with COCOMS prior to approval and publication to ensure that CCSA’s have fully

complied with Program Budget Decision or Program Decision Memorandum direction.

1.10.2. Combatant Command Support Agents must ensure adequate visibility of COCOM

directed missions and other costs for each O&M funded COCOM. A minimum of two Sub

Activity Groups (SAG)s within each Military Department’s active components’ Operation and

Maintenance Appropriation will be established as follows:

1.10.2.1. Mission Funding (one or more SAGs);

1.10.2.2. Headquarters (HQ) and Headquarters Support Funding: (single SAG)

1.10.3. Budget and execution structure for USTRANSCOM will continue to follow the

normal Working Capital Fund business area structure.

1.10.4. USSOCOM budget structure is not governed by this guidance as USSOCOM

resources are already visible in Major Force Program-11 (MPF-11).

2.0 FUNDING POLICIES (0102)

2.1 Criteria for Determining Expense and Investment Costs (010201)

2.1.1. Appropriation accounts form the structure for the President’s budget request and are

the basis for congressional action. The appropriations are further organized into budget activities

of appropriations with programs, projects or activities of similar purposes. To support

management of the Department of Defense’s programs, projects or activities, resource

requirements should be organized and categorized consistently within the appropriation and budget

activity structure. The following sections provide guidance for categorizing resource requirements

into the various appropriations.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-21

2.1.2. Basic Distinctions Between Expense and Investment Costs. The criteria for cost

definitions consider the intrinsic or innate qualities of the item such as durability in the case of an

investment cost or consumability in the case of an operating cost and the conditional circumstances

under which an item is used or the way it is managed. In all cases where the definitions appear to

conflict, the conditional circumstances will prevail. The following guidance is provided to

determine whether a cost is either an expense or an investment. All costs are classified as either

an expense or an investment.

2.1.2.1. Expenses are the costs incurred to operate and maintain the organization,

such as personal services, supplies, and utilities.

2.1.2.2. Investments are the costs that result in the acquisition of, or an addition to,

end items. These costs benefit future periods and generally are of a long-term character such as

real property and personal property.

2.1.3. Policy for Expense and Investment Costs

2.1.3.1. DoD policy requires cost definition criteria that can be used in determining

the content of the programs and activities that comprise the Defense budget. The primary reasons

for these distinctions are to allow for more informed resource allocation decisions and to establish

criteria for determining which costs are appropriate to the various defense appropriations.

2.1.3.2. The cost definition criteria contained in this policy are only applicable to

the determination of the appropriation to be used for budgeting and execution. Cost definitions

for accounting purposes are contained in Volume 1.

2.1.3.3. Costs budgeted in the Operation and Maintenance (O&M) and

Military Personnel appropriations are considered expenses. Costs budgeted in the

Procurement and Military Construction appropriations are considered investments. Costs

budgeted in the Research, Development, Test and Evaluation (RDT&E), Base Realignment and

Closure (BRAC), and Family Housing appropriations include both expenses and investments.

Definitions for costs within the Defense Working Capital Funds are provided in Chapter 9 and in

Section 2.14.

2.1.3.4. Items procured from the Defense Working Capital Funds will be treated

as expenses in all cases except when intended for use in weapon system outfitting, government

furnished material (GFM) on new procurement contracts, or for installation as part of a weapon

system modification, major reactivation, or major service life extension.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-22

2.1.4. Procedures for Determining Expenses Versus Investments. The following criteria

will be used to distinguish those types of costs to be classified as expenses from those to be

classified as investments for budgeting purposes:

2.1.4.1. Expenses. Expenses are costs of resources consumed in operating and

maintaining the Department of Defense. When costs generally considered as expenses are

included in the production or construction of an investment item, they shall be classified as

investment costs. Military personnel costs are an exception to this rule. The following guidelines

shall be used to determine expense costs:

2.1.4.1.1. Labor of civilian, military, or contractor personnel.

2.1.4.1.2. Rental charges for equipment and facilities.

2.1.4.1.3. Food, clothing, and fuel.

2.1.4.1.4. Supplies and materials designated for supply management of the

Defense Working Capital Funds.

2.1.4.1.5. Maintenance, repair, overhaul, rework of equipment.

2.1.4.1.6. Assemblies, spares and repair parts, and other items of equipment

that are not designated for centralized item management and asset control and which have a system

unit cost less than the currently approved dollar threshold of $250,000 for expense and investment

determinations. This criterion is applied on the basis of the unit cost of a complete system rather

than on individual items of equipment or components that, when aggregated, become a system.

The concept of a system must be considered in evaluating the procurement of an individual end

item. A system is comprised of a number of components that are part of and function within the

context of a whole to satisfy a documented requirement. In this case, system unit cost applies to

the aggregate cost of all components being acquired as a new system.

2.1.4.1.7. Cost of incidental material and items that are not known until the

end item is being modified are conditional requirements and are considered expenses because the

material is needed to sustain or repair the end item.

2.1.4.1.8. Engineering efforts to determine what a modification will

ultimately be or to determine how to satisfy a deficiency are expenses.

2.1.4.1.9. Facilities sustainment, O&M-funded restoration and

modernization projects. Planning and design costs are excluded from the cost determination for

purposes of determining compliance with the amounts established in 10 U.S.C. 2805 for minor

construction projects; however, design costs are not excluded from capitalization.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-23

2.1.4.2. Investments. Investments are costs to acquire capital assets such as real

property and equipment. The following criteria shall be used to determine those costs to be

classified as investments:

2.1.4.2.1. All items of equipment, including assemblies, ammunition and

explosives, modification kits (the components of which are known at the outset of the

modification), spares and repair parts not managed by the Defense Working Capital Funds, that

are subject to centralized item management and asset control.

2.1.4.2.2. All equipment items that are not subject to centralized item

management and asset control and have a system unit cost equal to or greater than the currently

approved expense and investment dollar threshold of $250,000 (for working capital funds

investment criteria see Volume 2B, Chapter 9, Section 090103C). The validated requirement may

not be fragmented or acquired in a piecemeal fashion in order to circumvent the expense and

investment criteria policy.

2.1.4.2.3. Construction, including the cost of land and rights therein

(other than leasehold). Construction includes real property equipment installed and made an

integral part of such facilities, related site preparation, and other land improvements.

(See paragraph 2.1.4.2.6 below for special guidance concerning real property facilities.)

2.1.4.2.4. The costs of modification kits, assemblies, equipment, and

material for modernization programs, ship conversions, major reactivations, major remanufacture

programs, major service life extension programs, and the labor associated with incorporating these

efforts into or as part of the end item are considered investments. All items included in the

modification kit are considered investment even though some of the individual items may

otherwise be considered as an expense. Components that were not part of the modification content

at the outset and which are subsequently needed for repair are expenses. The cost of labor for the

installation of modification kits and assemblies is an investment.

2.1.4.2.5. Supply management items of the Defense Working Capital

Funds designated for weapon system outfitting, government-furnished material on new

procurement contracts, or for installation as part of a weapon system modification or

modernization, major reactivation or major service life extension.

2.1.4.2.6. Also considered as investments are support elements such as

data, factory training, support equipment and interim contractor support (ICS), which are required

to support the procurement of a new weapon system or modification.

2.1.4.3. Conditional Cases. The following are conditional cases that take

precedence over the criteria contained in paragraphs 2.1.4.1 and 2.1.4.2 above:

2.1.4.3.1. A major service-life extension program, financed in

procurement, extends the life of a weapon system beyond its designed service life through

large-scale redesign or other alteration of the weapon system.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-24

2.1.4.3.2. Depot and field level maintenance is the routine, recurring effort

conducted to sustain the operational availability of an end item. Depot and field level maintenance

includes refurbishment and overhaul of end items, removal and replacement of secondary items

and components, as well as repair and remanufacturing of reparable components. The maintenance

effort may be performed by a depot maintenance activity in the Defense Working Capital Fund,

by a direct funded DoD activity, by another government agency, or by a contractor.

2.1.4.3.3. Maintenance, repair, overhaul, and rework of equipment are

funded in the operation and maintenance appropriations. However, maintenance of equipment

used exclusively for research, development, test, and evaluation efforts will be funded by the

RDT&E appropriations. Continuous technology refreshment is the intentional, incremental

insertion of newer technology to improve reliability, improve maintainability, reduce cost, and/or

add minor performance enhancement, typically in conjunction with depot or field level

maintenance. The insertion of such technology into end items as part of maintenance is funded by

the operation and maintenance appropriations. However, technology refreshment that

significantly changes the performance envelope of the end item is considered a modification and,

therefore, an investment (See section on “Product Improvement” 2.13.3.7). This definition applies

equally to technology insertion by commercial firms as part of contractor logistics support, prime

vendor, and similar arrangements and to technology insertion that is performed internally by the

Department.

2.1.4.3.4. Initial outfitting of an end item of investment equipment, such as

a ship or aircraft, with the furnishings, fixtures, and equipment necessary to make it complete and

ready to operate is a part of the initial investment cost. Material procured through the Defense

Working Capital Funds for initial outfitting will be financed by procurement appropriations when

drawn from the supply system. This concept includes changes to the allowance lists of ships,

vehicles, and other equipment. Changes to allowance lists will be budgeted as investment costs.

Procurement appropriations are not required to satisfy initial outfitting requirements if assets are

available for issue through reuse/redistribution programs, such as the Navy's Consumable Asset

Reutilization Program.

2.1.4.3.5. Initial outfitting of a facility construction project financed by a

Military Construction appropriation is financed as either expense or investment based on the

general criteria. Collateral equipment and furnishings are not considered construction costs since

these items are movable and are not installed as an integral part of the facility.

2.1.4.3.6. When family housing is initially outfitted with kitchen

equipment to include refrigerator, shades, carpeting, etc., these items are considered part of the

construction costs.

2.1.4.3.7. Construction program costs, associated with construction

management in general, as distinguished from supervision of specific construction projects, are

expenses. Costs incident to the acquisition (i.e., design, direct engineering, technical

specifications) and construction of a specific project are investments. The cost of administering

the facilities sustainment program is an expense at all levels.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-25

2.1.4.3.8. Costs of facilities restoration and modernization projects, not

financed by Military Construction appropriations, meeting the current criterion for funding from

appropriations available for operation and maintenance are considered expenses. However, this

definition does not abrogate the prohibition against the planned acquisition of, or improvements

to, a real property facility through a series of minor construction projects (i.e., incremental

construction).

2.1.4.3.9. The cost of civilian personnel compensation and other direct

costs (i.e., travel, office equipment leasing, maintenance, printing and reproduction) incurred in

support of procurement and/or production programs by departmental headquarters staff,

contracting offices, contract audit offices, system project offices, and acquisition managers are

expenses. Procurement and/or production direct support costs such as production testing, quality

assurance, production engineering, and equipment assembly, whether performed under contract or

by in-house personnel funded on a reimbursable basis are investments.

2.1.4.3.10. When investment equipment is to be installed in a real property

facility, the costs of both the equipment and its installation are considered investments.

2.1.5. Special Guidance Concerning Real Property Facilities

2.1.5.1. Construction includes real property equipment (often called installed

equipment) which is affixed and built into a facility as an integral part of a facility. The cost of

this equipment and its installation is part of the construction cost.

2.1.5.2. Items of equipment that are movable in nature and not affixed as an

integral part of a facility are not normally considered construction costs, except for initial outfitting

of family housing, as detailed in paragraph D3 above. This equipment includes all types of

production, processing, technical, information systems, communications, training, servicing and

RDT&E equipment. The cost of this equipment is an expense or an investment according to the

policy criteria above. In addition, modifications to an existing facility required to support the

installation of movable equipment, such as the installation of false floors or platforms,

prefabricated clean rooms, or utilities, will be considered an integral part of the equipment costs.

As such, the costs are either expense or investment, as long as the modifications do not include

structural changes to the building. If the modifications include structural changes, they will be

considered investment costs and budgeted as construction.

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-26

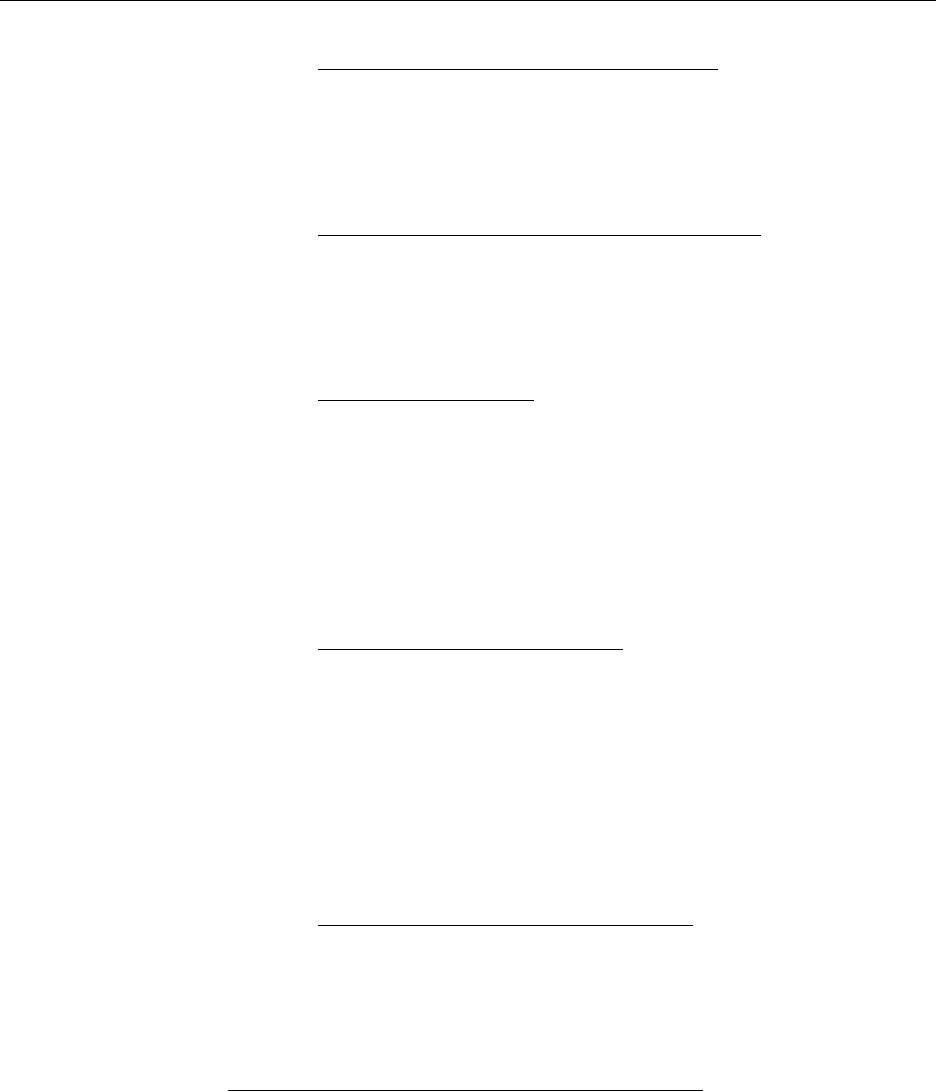

2.1.6. Expense/Investment Cost Determination

Expense/Investment Cost Determination

Is the item a

If

Then

If

Then

If

Then

Centrally

Managed/Asset

Controlled

Item?

Yes

Is the item

purchased from

DWCF?

Yes

Is the item part of

a full funding

effort? *

Yes

Classify as

Investment

Centrally

Managed/Asset

Controlled

Item?

Yes

Is the item

purchased from

DWCF?

Yes

Is the item part of

a full funding

effort? *

No

Classify as

Expense

Centrally

Managed/Asset

Controlled

Item?

Yes

Is the item

purchased from

DWCF?

No

Classify as

Investment

Blank

Blank

Centrally

Managed/Asset

Controlled

Item?

No

Is the unit cost

more than

$250,000?

Yes

Classify as

Investment

Blank

Blank

Centrally

Managed/Asset

Controlled

Item?

No

Is the unit cost

more than

$250,000?

No

Classify as

Expense

Blank

Blank

* When intended for use in weapon system outfitting, government furnished material on new

procurement contracts or for installation as part of a weapon as part of a weapon system

modification, major reactivation or major service life extension.

*2.2 Full Funding of Procurement Programs (010202)

2.2.1. General. A budgeting rule that requires the total estimated cost of a, military useable

end item, be funded in the fiscal year in which the item is procured. Under the full funding policy,

the entire procurement cost of a weapon or piece of military equipment is to be funded in the year

in which the item is budgeted. An end item budgeted in a fiscal year cannot depend upon a future

years funding to complete the procurement. Regulations governing the full funding policy are

found in Office of Management and Budget (OMB) Circular A-11 and DoD Directive 7000.14-R.

2.2.1.1. The full funding policy is intended to prevent the use of incremental

funding, under which the cost of a weapon system is divided into two or more annual portions or

increments. Thus, full funding provides disciplined approach for program managers to execute

their programs within cost and available funding.

2.2.1.2. There are two general exceptions to the full funding policy: one permits

the use of Advance Procurement (AP) funding for components or parts of an item that have long

production lead times; the other permits advance procurement funding for economic order quantity

(EOQ) procurement, which normally occurs in programs that have been approved for multiyear

2BDoD 7000.14-R Financial Management Regulation Volume 2A, Chapter 1

*October 2008

1-27

procurements (MYP). Advance Procurement funding is used routinely and extensively in the

procurement of components for major end items due to manufacturing and production lead times.

The use of MYP has to be approved by the Congress on a program-by-program basis.

Congressional approval permits DoD to use a single contract to procure multiple copies of a given

item that are scheduled to be procured across a series of years. MYP arrangements are governed

by 10 USC 2306(b). EOQ procurement involves procuring multiple copies of a key component

of a weapon covered by an MYP at the start of the MYP period in order to achieve significantly

reduced costs on that component.

2.2.2. Policy for Full Funding. The total estimated cost of a complete, military useable

end item or construction project must be fully funded in the year it is procured. There are 2 basic

policies concerning full funding.