The Math Behind HECMs

P R E S E N T E R :

C R A I G B A R N E S , R E V E R S E M O R T G A G E F U N D I N G

Session Objectives

Today’s session will:

Illustrate how reverse mortgage interest rates are calculated.

Explain vital application doc calculations, including:

Amortization Schedule

TALC

TIL (Fixed Rate)

Describe reverse mortgage loan growth

LESA

Loan balance

Line of Credit

Partial Repayments

Review how to read a monthly statement

Agenda

Interest Rates

Expected Rates and Look Up Floor

Note Rates

Principal Limit Factors

Payment Plan Math

Ongoing MIP

Amortization Schedule

TALC

TIL

Loan Growth

LESA

Line of Credit

Expected Rate

Initial Rate +

Yield Curve

Monthly Statements

I N T E R E S T R A T E S , P L F S , M I P , A N D P A Y M E N T S

The Numbers

Principal Limit Factors

Principal limit tables determine the % of maximum claim

amount borrower(s) will receive.

The youngest borrower or non-borrowing spouse’s age

(within 6 months of Closing), and expected interest rate

determines what factor will be used.

HUD changes these factors from time to time; depending

on the projected performance of the HECM portfolio.

Currently there is an Effective Interest Rate Floor of 5%.

Expected rates of 5.06% (rounded) or less will provide the

same principal limit.

Principal limit factors stop increasing at age 90.

PLF Table – Sample

The partial table below shows the

factor used to calculate principal

limits for expected rates near 5% for

borrowers between 70-80. Rates are

rounded to the nearest 1/8%.

To see the table click HERE.

Illustration

72 year old borrower

with a $300,000

max claim

Expected Rate Principal Limit

5.06% $177,300

5.25% $168,000

70

5.000 0.576 5.125 0.560 5.250 0.544 5.375 0.529 5.500 0.513

71

5.000 0.583 5.125 0.568 5.250 0.552 5.375 0.537 5.500 0.521

72

5.000 0.591 5.125 0.575 5.250 0.560 5.375 0.545 5.500 0.529

73

5.000 0.599 5.125 0.583 5.250 0.568 5.375 0.552 5.500 0.537

74

5.000 0.606 5.125 0.591 5.250 0.575 5.375 0.560 5.500 0.545

75

5.000 0.614 5.125 0.598 5.250 0.583 5.375 0.568 5.500 0.553

76

5.000 0.622 5.125 0.607 5.250 0.592 5.375 0.577 5.500 0.562

77

5.000 0.631 5.125 0.616 5.250 0.601 5.375 0.586 5.500 0.571

78

5.000 0.640 5.125 0.625 5.250 0.610 5.375 0.595 5.500 0.580

79

5.000 0.648 5.125 0.633 5.250 0.618 5.375 0.604 5.500 0.589

80

5.000 0.657 5.125 0.642 5.250 0.627 5.375 0.612 5.500 0.598

Interest Rates – Expected Rate

• Based on the 10 year SWAP

from the previous week’s

average as published on the

Federal Reserve’s website.

• Add the lender’s margin to

the current 10 year SWAP to

calculate the expected rate.

• Expected rates of 5.06 or less

will maximize proceeds.

• Increasing expected rates will

decrease principal limit

amounts.

• The 10 year SWAP is a likely

indicator of what rates

MIGHT be in the future.

For the week

beginning

3/22/16, the

Expected Rate for

a LIBOR 300

would be 4.78%

Principal Limit Lock

Most lenders offer a Principal Limit Lock. A PLL allow the

borrower to receive the expected rate at application or

closing to be used which provides the most money,

provided they close within 120 days of FHA Case Number

Assignment.

LIBOR History

• Prior to 2007,

industry used the

Constant Mature

Treasury index.

• Industry adopted

LIBOR when

Mortgagee Letter

2007-13 was

published.

• LIBOR used more

on in the

secondary market

Interest Rates – Initial Rate

Used to calculate the loan balance.

The Monthly product is based on the 1-month LIBOR + the applicable

margin.

The Annual product is based on the 1-year LIBOR + the applicable margin

The rate is published in Monday’s Wall Street Journal effective Tuesday

through the following Monday. If Monday is not a business day, then the

rates are published on Tuesday.

Monthly adjusts the first day of the

second or third month after funding.

Yearly adjusts the first day of the

second year after funding.

Becomes the Note Rate.

All ARM loans have a interest rate

cap that is generally 5 or 10% of the

Note Rate.

For the week beginning 3/22/16, the Initial

Rate for an Annual LIBOR 300 would be

4.211%. Rates are rounded to 3 decimal

places

Calculating Tenure Payments

Tenure payments are

calculated using:

Available funds

Age of the youngest

borrower

Expected interest rate

When available funds are

equal, products (rates)

with a higher expected

rate will provide higher

monthly tenure payments.

Mandatory Obligations

Borrowers are limited to the amount they can access in the first 12 months

the loan is outstanding.

Select an ARM loan to set up payment plans.

Traditional single disbursement lump sum fixed rate products are closed-

end with no payment plans. Borrower leaves all additional funds

permanently unclaimed.

% of PL

Max Proceeds

in first

12mos.

MIP Paid

<=50% MO

60% PL

.5%

>50%

-60%

Up to +10%

.5% up to 60%

2.5% over 60%

>60%

Up to +10%

2.5%

A M O R T I Z A T I O N S C H E D U L E , T A L C A N D T I L

The Disclosures

Amortization Schedule

Uses expected rate by default; most likely average long-

term rate over a period of several years.

Although projections are shown annually the rate is

applied monthly.

The property value growth rate assumes 4% annual

growth.

Assumptions can be changed, but the final Amortization

Schedule will use the expected rate and 4% property

appreciation.

The rate is 1.25% annualized (set by HUD).

Amortization Schedule (cont.)

Projections go to the

youngest borrower’s 99

th

birthday.

May show bi-annually

depending on the

borrower’s age.

Will always show at least

5 years, regardless of age.

Calculating Monthly Totals

This monthly

breakdown

illustrates how

interest is

compounded

monthly. It

corresponds to

the Amortization

Schedule on the

preceding page.

Original Principal Limit

$225,200.00

Assumed Int

Rate

5.30%

FHA MIP

$2,000.00

MIP

1.25%

Orig

Fee

$6,000.00

Prop Value

$400,000.00

3rd Party Closing Costs

$3,571.95

Apprec

Rate

4.00%

Payoffs

$10,000.00

Net principal Limit

$203,628.05

* does NOT include selling expenses

Remaining

Prop

Remaining

Loan Balance

LOC

Value

Equity*

Advances

Interest

MIP

$21,571.95

$203,628.05

$400,000.00

$378,428.05

1

$95.28

$22.47

$21,689.70

$204,739.52

$401,333.33

$379,643.64

2

$95.80

$22.59

$21,808.09

$205,857.06

$402,671.11

$380,863.02

3

$96.32

$22.72

$21,927.12

$206,980.69

$404,013.35

$382,086.23

4

$96.84

$22.84

$22,046.81

$208,110.46

$405,360.06

$383,313.25

5

$97.37

$22.97

$22,167.15

$209,246.40

$406,711.26

$384,544.11

6

$97.90

$23.09

$22,288.14

$210,388.54

$408,066.96

$385,778.82

7

$98.44

$23.22

$22,409.80

$211,536.91

$409,427.19

$387,017.39

8

$98.98

$23.34

$22,532.12

$212,691.54

$410,791.94

$388,259.83

9

$99.52

$23.47

$22,655.11

$213,852.49

$412,161.25

$389,506.14

10

$100.06

$23.60

$22,778.77

$215,019.76

$413,535.12

$390,756.36

11

$100.61

$23.73

$22,903.10

$216,193.41

$414,913.57

$392,010.47

12

$101.16

$23.86

$23,028.11

$217,373.47

$416,296.62

$393,268.50

Annual total

$1,178

$278

Total Annual Loan Cost (TALC)

The TALC provides

an estimate of the

loan’s cost using a

given set of

conditions.

Disclosure periods

vary on the youngest

borrower’s age.

Disclosure periods are 2 years, ½ life expectancy, life expectancy

and 1.4 times life expectancy.

The annual cost is affected by the appreciation rate and the length of

time the loan is outstanding.

Calculated using a non-recourse formula assuming the property

might be sold at 93% of the projected property value.

TALC (cont.)

Property Value 400,000.00$ $193,822

0% 4% 8%

220,170.77$ 2 400,000.00$ 432,640.00$ 466,560.00$

343,957.03$ 9 400,000.00$ 569,324.72$ 779,601.85$

572,699.12$ 17 400,000.00$ 779,160.20$ 1,480,007.22$

$894,686.84 24 400,000.00$ 1,025,321.67$ 2,536,472.29$

Estimated Property Value

Loan Balance

Year

Beginning Loan Balance

2 9 17 24

0% Balance Balance Property Value Property Value

4% Balance Balance Balance Balance

8% Balance Balance Balance Balance

Disclosure Period (Years)

Appreciation

Rate

Only when the

loan balance

surpasses the

value, is the rate

affected.

Because of the

loan’s non-

recourse

provision, the

borrower has

received the full

benefit of the

loan, but is only

responsible to

pay back the

value of the

property.

This illustration shows whether the loan balance or the property

value must be paid back. When the loan balance must be paid

back, the cost is not effected by property appreciation. The cost

will decrease when the loan balance becomes greater than the

property’s value.

L E S A , L O C G R O W T H , L O A N G R O W T H ,

P R E P A Y M E N T S

The Projections

LESA – Example

Refer to HUD’s FA Guide sections 5.3 and 5.6 pages 76-77

Life Expectancy = 12 years x 12 = 144 months

Annual Taxes and HOI = $4,000 x 1.2 / 12 = $400

Expected Rate + Annual MIP = 5.25% / 12 = 0.4375%

Fully Funded LESA Partially Funded LESA

Expected Interest Rate

4.00%

Expected Interest Rate

4.00%

MIP

1.25%

MIP

1.25%

5.25%

5.25%

Rate+MIP/12

0.4375%

Rate+MIP

/12

0.4375%

Youngest Borrower Life Expectancy

(Column 3 on TALC)

12

Youngest Borrower Life Expectancy

(Column 3 on TALC)

12

Life Expectancy x 12

144

Life Expectancy x 12

144

Annual

Property Charges (property

taxes, HOI, Flood)

$ 4,000.00

MRIS (monthly

shortfall)

$ 100.00

Allowance for property charge

increases

1.2

Allowance for property charge

increases

1.2

Annual Property Charges

$4,800.00

Shortfall including allowance for

Property Charge increases

$120.00

Monthly Property Charges

$400.00

Annual Shortfall

$1,440.00

LESA

$42,854.18

LESA

$12,856.25

Line of Credit Growth

Growth is determined by the Note Rate on the last day of the previous

month + 1.25% / 12.

LOC growth allows borrowers to take advantage of the anticipated

property value growth.

The growth of the line is similar to a increase on a credit card. It is not

interest.

The growth rate will change in tandem with the Note Rate.

LOC Growth Calculation

Monthly

Growth

Note Rate on

3/31

4.211%

0.351%

+ Growth Rate

1.250%

0.104%

LOC Balance on

3/31

$75,000

Estimated Annual Growth Rate

5.461%

0.455%

Monthly LOC Growth for

April

$341.25

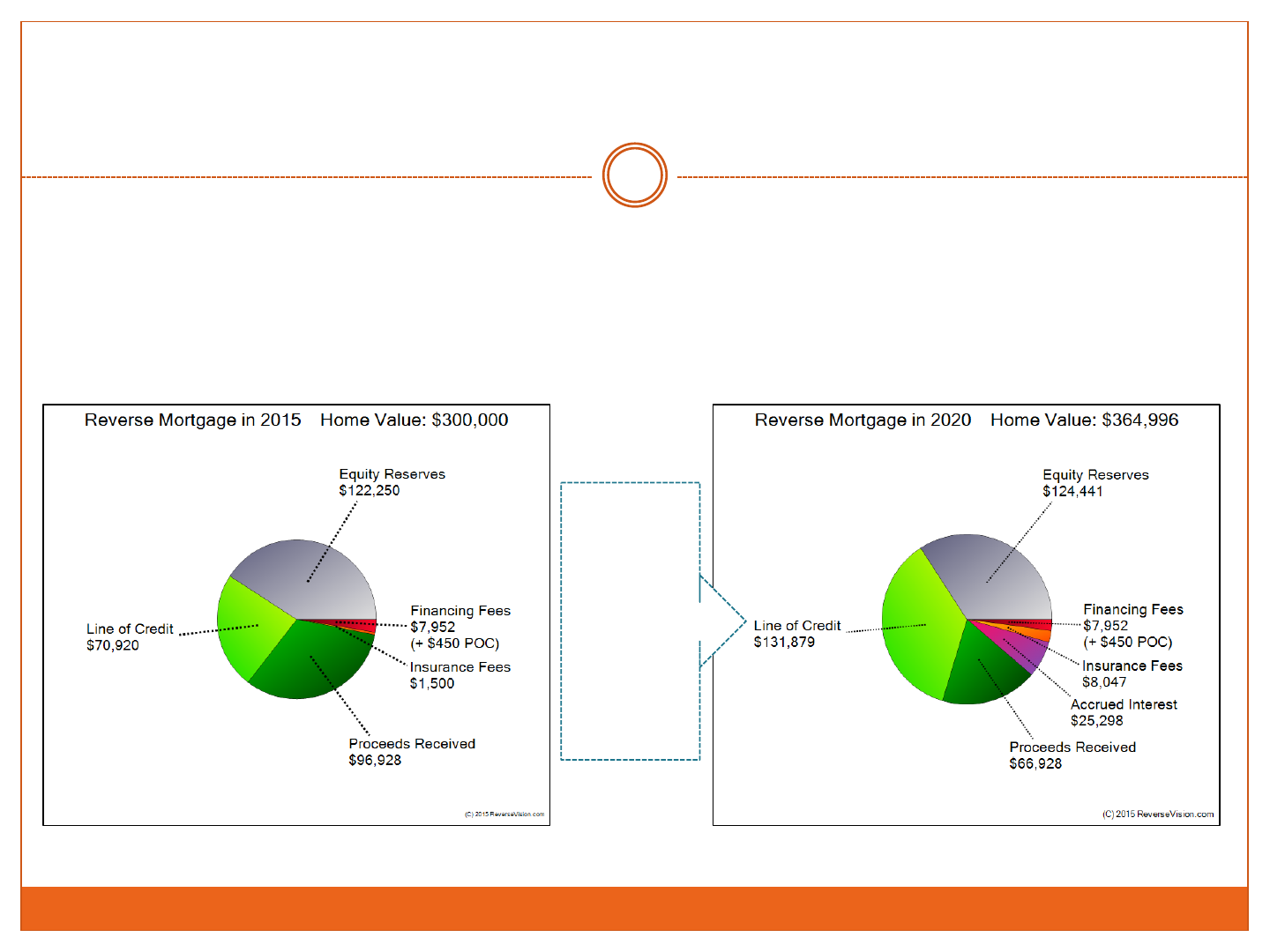

Loan Growth – Expected Rate

Loan balance grows to

$109,480 in year 10.

The LOC available: $215,677

Remaining equity: $334,143

Scenario/Assumptions

72 year old borrower

LIBOR 250

$300,000 Max Claim

$59,697 UPB

$46,683 LOC first year - $70,920

after

No LOC withdrawals

4% property appreciation

Expected rate (AM Sch. Default)

Loan Growth – Initial Rate +1%

With a 1% rate increase each year,

the loan balance grows to $150,591

in year 10.

The LOC available is $296,663.

Remaining equity is $ 296,663.

Scenario/Assumptions

72 year old borrower

LIBOR 250

$300,000 Max Claim

$59,697 UPB

$46,683 LOC first year - $70,920 after

No LOC withdrawals

4% property appreciation

Initial rate increase of 1% annually for 10

years.

Loan Growth – Yield Curve

Using the yield curve, the loan

balance grows to $111,232 in year

10.

The LOC available is $198,648.

Remaining equity is $332,841.

Scenario/Assumptions

72 year old borrower

LIBOR 250

$300,000 Max Claim

$59,697 UPB

$46,683 LOC first year - $70,920

after

No LOC withdrawals

4% property appreciation

Yield Curve

Loan Growth - Summary

Expected

Rate

Initial +

1%

Yield

Curve

Loan

Balance

$109,480

$150,991

$111,232

Available LOC

$215,677

$296,663

$198,648

Remaining

Equity

$334,143

$296,663

$332,841

Partial Repayments

When a repayment is made on a closed-end product, funds cannot be

re-drawn.

Partial repayments on ARM loans, however, go directly to reducing

the loan balance and increasing their LOC.

Although, the borrower sees a direct increase in their LOC and

decrease in their loan balance, behind the scenes the payment is

applied to the loan balance in a specific way:

Accrued MIP

Accrued monthly service fees (if app.)

Accrued interest

Principal

When a partial repayment is made that is large enough to reduce

accrued interest borrowers will receive a 1098 interest statement

according to IRS regulation.

Partial Repayment Illustration

Have a borrower struggling to make their monthly P&I payments?

All HECMs allow partial repayments

Loan balance

in 5 years

with $6,000

annual

payments.

Balance is

$108,225

Over 5 years the borrower saved nearly $5,838 in interest and

fees.

The $6,000 partial prepayments are available to be redrawn at

anytime, since this is an ARM loan.

No Partial Repayment

Loan balance

with no

payments or

withdrawals in

year 5.

Balance is

$144,063

Review

Interest Rates

Expected Rates and

Look Up Floor

Note Rates

Principal Limit

Factors

Payment Plan Math

Ongoing MIP

Amortization

Schedule

TALC

TIL

Loan Growth

Line of Credit

Expected Rate

Initial Rate +

Yield Curve