COMBINED ANNUAL REPORT

2023 LOUISIANA INSURANCE FRAUD TASK FORCE

2

Insurance fraud is any fraudulent act, knowingly and willfully committed by any person in an attempt to

injure, defraud, or deceive an insurance company. In Louisiana, insurance fraud is a felony, and when

convicted, penalties could include incarceration, fines, community service, probation and/or restitution.

NOTE: If the amount of the benefit that is the subject of the criminal act does not exceed $1,000.00, the insurance fraud will be classified as a misdemeanor.

Louisiana Department of Insurance

Office of Insurance Fraud

&

Louisiana Auto Theft and

Insurance Fraud Prevention Authority

Louisiana State Police

Insurance Fraud

&

Auto Theft Unit

Office of The Attorney General

Insurance Fraud Support Unit

The Insurance Fraud Task Force is a partnership between three state agencies created to collectively investigate and deter

acts of insurance fraud and auto theft in Louisiana.

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

3

Table of Contents

Letter From Louisiana State Police Superintendent

5

Louisiana State Police Insurance Fraud / Auto Theft Unit

6

Program Notes

8

Referral Information

9

Investigations and Arrests

11

Investigations by Type

12

Judicial Actions

13

Budget Expenditures

14

Investigative Highlights

15

Law Enforcement Training

20

American Educational Institute Certifications / Awards

21

Vehicle Thefts and Recoveries

22

Personnel Movement and Highlights

23

Office of the Attorney General / Insurance Fraud Support Unit

25

Basic Information, Statutory Authority, Purpose and Expenditures

27

Statistical Information and Other Accomplishments

28

Department of Insurance / Office of Insurance Fraud & LATIFPA

30

Claims Fraud / Charges Against Claimants or Licensee

31

Producer, Claims Adjuster and Company Fraud Actions,

Background Investigations / LATIFPA

32

2023 Expenditures / LATIFPA Budget

33

How to Report Fraud

34

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

4

PAGE INTENTIONALLY LEFT BLANK

5

February 13, 2024

Office of the Governor

Honorable Jeff Landry

900 North 3

rd

Street

Baton Rouge, Louisiana

Dear Governor Landry:

I hope this letter finds you in good health and high spirits. I am writing to express my sincere appreciation for the outstanding efforts of the men and women of the Louisiana

Insurance Fraud Task Force in their efforts to combat insurance fraud within our great state. Enclosed herewith is the combined annual report of the Louisiana Insurance Fraud

Task Force, as mandated by Louisiana Revised Statute 40:1427. The report comprehensively details the task force's diligent work, to include statistical and summary

information, budget expenditures, and the achievements made by the task force throughout the 2023 calendar year.

The collaboration between the Louisiana State Police, the Louisiana Attorney General's Office, and the Louisiana Department of Insurance has proven to be instrumental in

identifying, investigating, and prosecuting individuals engaged in committing insurance fraud across the state. The tireless efforts of the men and women on the task force, along

with their collaboration with local and federal law enforcement, non-profits, the public, prosecutors, and industry stakeholders, continues to play a pivotal role in deterring and

reducing insurance fraud in our state. I am particularly impressed by the ongoing commitment of the task force members to stay updated on the latest trends, while employing

the best practices in investigating insurance fraud. Their dedication to maintaining up-to-date training and education ensures task force members remain at the forefront of the

field, effectively combating fraudulent activities and safeguarding the financial well-being of our citizens.

As you are well aware, insurance fraud continues to have a negative impact on the citizens of Louisiana, costing millions of dollars annually. I want to assure you that the

Louisiana Insurance Fraud Task Force will remain resolute in utilizing all available resources to consistently conduct quality criminal investigations to help eradicate the

detrimental effects of this crime on our state. Your support for the Louisiana Insurance Fraud Task Force is vital in ensuring our state remains a relevant leader in the field of

fighting insurance fraud. Together, we can further strengthen our collective efforts to protect the interests of the citizens of Louisiana.

Thank you for your time and consideration.

Sincerely,

Colonel Robert P. Hodges

Deputy Secretary, Public Safety Services

Superintendent, Louisiana State Police

Letter From The Superintendent

State of Louisiana

Department of Public Safety and Corrections

Public Safety Services

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

6

LOUISIANA STATE POLICE

INSURANCE FRAUD & AUTO THEFT UNIT

The Mission of the Insurance Fraud / Auto Theft Unit is to seek justice on

behalf of the citizens of the State of Louisiana and industry stakeholders

by the execution of superior, professional, and effective investigations

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

7

Insurance Fraud /

Auto Theft Unit

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

8

Insurance Fraud / Auto Theft Unit

Program Notes

In 1999 the Louisiana Legislature passed House Bill 1868, statutorily creating the Insurance Fraud Investigation Unit within Title

40 of the revised statutes; specifically, sections 40:1421–1429 provide the outline for unit operations. The Unit became operational

January 1, 2000, within the Bureau of Investigation (BOI) of the Louisiana State Police (LSP), thereby implementing a law

enforcement function to combat insurance fraud. In 2006, the State Police formally added auto theft responsibilities to the unit’s

role. At that time it was renamed the Insurance Fraud and Auto Theft Unit (IFAT). The primary focus of the IFAT is the

investigation of insurance acts that violate LRS 22:1921-1929.

Currently, IFAT is divided into six field offices and three satellite offices which covers the 64 parishes of the state. State Police

Troopers along with State Police Criminal Investigators within the field offices are tasked with investigating criminal complaints

from the LA Dept. of Insurance and from the public. Each field office is supervised by an IFAT Sergeant who answers directly to

the LSP-IFAT Program Coordinator. The Program Coordinator holds the rank of State Police Lieutenant and is under the

supervision of a State Police Captain who commands the LSP Special Investigation Section. The Program Coordinator is tasked

with working alongside State Police supervisors, staff, industry representatives, and governmental partners to ensure the success of

the unit’s mission. Excluding the IFAT seven supervisors, there were 17 State Police investigators, and two civilian support

personnel assigned to the Insurance Fraud / Auto Theft Unit at the time this report was finalized.

Baton Rouge area

Sgt Mindi Keith

7919 Independence Blvd, Box A-19

Baton Rouge, LA 70806

(225) 925-3850

New Orleans area

(includes the Northshore areas)

Sgt. Leander Journee

1450 Poydras St, Suite 1300

New Orleans, LA 70112

(504) 310-7066

REGION I

REGION III

Bossier City area

Sgt. David Jernigan

4185 Viking Dr

Bossier City, LA 71111

(318) 741-2787

Alexandria area

Sgt. Rodney Owens

5903 Coliseum Blvd

Alexandria, LA 71302

(318) 484-2171

Monroe area

Sgt. Justin Morris

1900 N. 18th Street, Suite 701

Monroe, LA 71201

(318) 362-4588

REGION II

Field Office Contacts

Breaux Bridge area

(includes the Houma and

Sulphur areas)

Sgt. Dale Latham

437 West Mills Ave

Breaux Bridge, LA 70517

(337) 332-8062

Program Coordinator: Lt. Michael Wilkerson (318) 741-2726

Administrative Program Specialist : Ms. Car ol Holder (225) 925-3536

Investigative Specialist: Mr s. Ciar a Stoute (337) 332-8061

Unit Email Address: lsp.insurance.fraud.unit@la.gov

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

9

The Insurance Fraud and Auto Theft Unit receives insurance fraud referrals from the Louisiana Department of Insurance (LDI) on a monthly basis. In 2023, the Unit received

2168 referrals from the LDI, of which 318 were accepted and 1850 were rejected or declined.

In addition to the 2168 referrals received from the LDI, the IFAT Unit also accepted 93 non-LDI criminal complaints related to insurance fraud, vehicle theft, and other

crimes. These complaints were received from various entities, including IFAT Unit generated operations, other law enforcement agencies, citizens complaints, etc.

Referrals Received...

Referrals Received from LDI

2168

LDI Referrals Rejected

1850

LDI Referrals Accepted

(Number denotes # of LDI referrals received by

LSP minus # of LDI referrals rejected by LSP)

318

Non-LDI Investigations (referrals)

93

Total Referrals

2261

2023 Referral Information

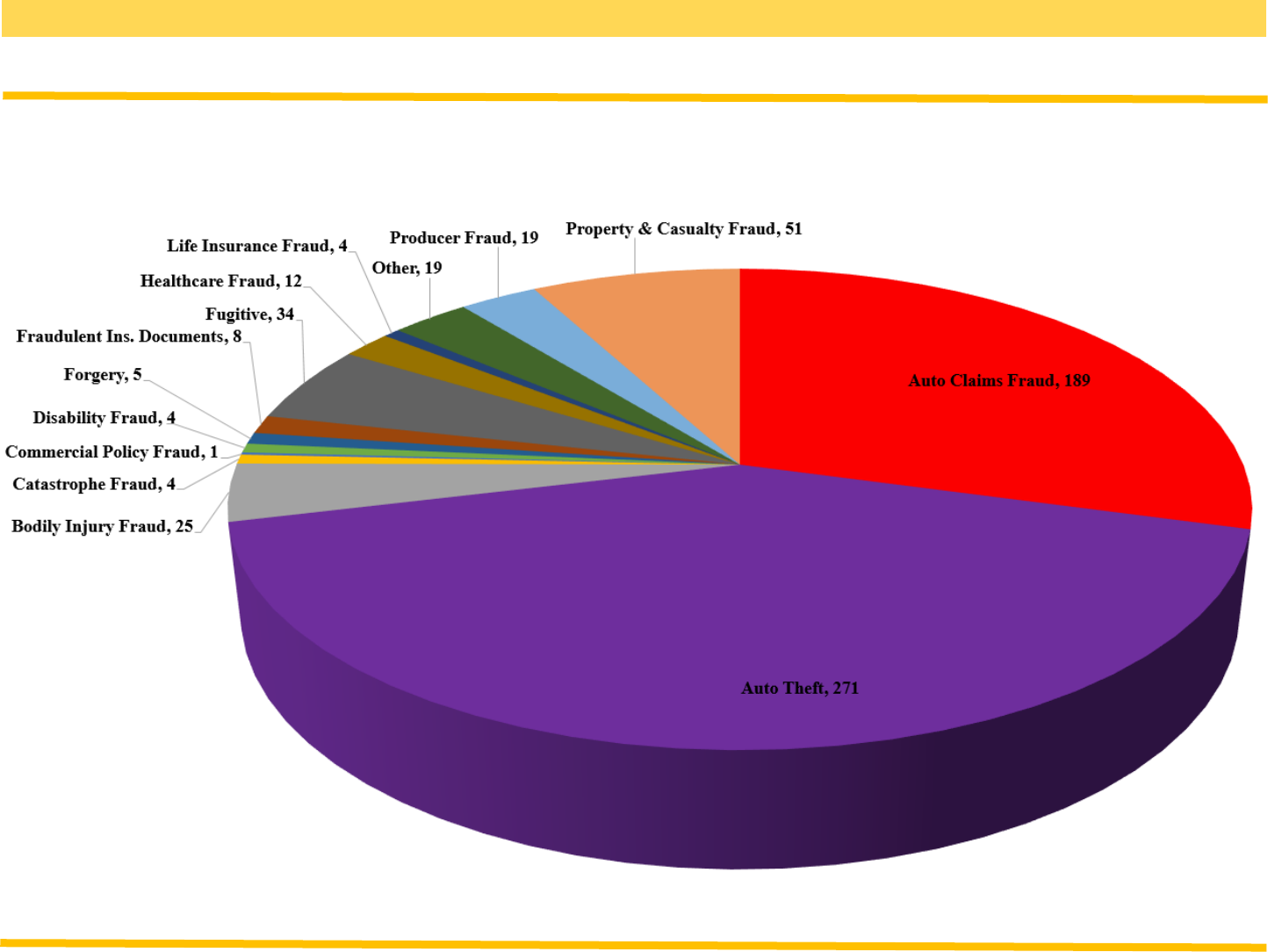

In 2023, 63.9% of the referrals received from the Department of Insurance were

related to auto claims fraud, followed by property & casualty fraud at 13.8%,

bodily injury fraud at 5.5%, and healthcare fraud at 4.3%. The remaining types

of LDI referrals, listed in the table to the right make up the remaining 12.5%.

2023 LDI Referrals & Non-LDI Referrals Received

Type of Investigation… LDI Non-LDI

Arson 5 0

Auto Claims Fraud 1386 7

Auto Theft 22 35

Bodily Injury Fraud 119 0

Catastrophe Fraud 32 0

Commercial Policy Fraud 4 0

Disability Fraud 23 0

Forgery 3 4

Fraudulent Ins. Documents 12 5

Fugitive 8 26

Healthcare Fraud 93 0

Life Insurance Fraud 55 0

Other 73 14

Producer Fraud 32 1

Property & Casualty Fraud 298 1

Worker's Compensation Fraud 3 0

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

10

2023 Referrals Accepted by Type...

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

11

2023 Investigations and Arrests...

Investigations Carried Over from Prior Years 35

Investigations Opened 247

Investigations Closed 250

Arrests 191

Three Year Statistical Profile...

In 2023, there were 247 criminal investigations opened and 250 investigations closed in relation to complaints received by IFAT.

OPENED: The Baton Rouge & New Or leans field offices accounted for 155 opened investigations, Region 2 - Breaux Bridge Field Office (which includes Houma &

Sulphur) recorded 34 investigations opened, and Region 3 - Alexandria, Monroe, and Bossier initiated 58 investigations.

CLOSED: Of the 250 investigations closed, 144 or 57.6% wer e closed by arr est. Additionally, 191 individuals wer e arrested in 2023 in relation to complaints

received by IFAT. Statewide, 45.5% of the arrests were in Region 1, 28.3% were in Region 2, and 26.2% were in Region 3.

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

12

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

2023 LSP Investigations Conducted by Type...

13

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

2023 Judicial Actions...

Convictions 74

Jail Time Ordered 63.17 yrs

Probation Ordered 47 years

Community Service 392 hours

Pre-Trial Intervention 16 entries

Restitution $475,801.67

Court Fines $23,316.25

2023 Judicial Actions

In 2023, the LSP Insurance Fraud / Auto Theft Unit had 17.6%

of their convictions declared in Orleans Parish and 14.9% in

Caddo Parish. The remaining convictions were spread

throughout 28 other parishes. The table on the right shows all

convictions and pretrial interventions by parish. Parishes not

listed in the chart did not have any convictions or pretrial

interventions, or no data was available.

14

2023 Budget Expenditures

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

15

Auto Thefts from the Norfolk Southern Rail Yard

(Orleans) - In 2022, the New Orleans Police Department (NOPD) and Norfolk

Southern Rail Yard (NFS) requested assistance from the Louisiana State Police

Insurance Fraud/Auto Theft Unit New Orleans Field Office with the investigation

of a mass cargo theft incident from a rail yard located in New Orleans, Louisiana.

This was in response to the theft of approximately (63) new Infiniti, and Nissan

vehicles from the site. LSP-IFAT-NFO initiated a joint state and federal

investigation into the thefts. The thefts continued into March of 2023, driving the

number of stolen vehicles to approximately (80) with a projected loss amount of

3.2 million dollars. From the inception of the investigation, LSP-IFAT-NFO has

federally indicted (14) subjects related to the theft or subsequent possession of

these vehicles and arrested several others on state charges. Almost all of these

defendants are poised to plea in 2024. Investigators have also recovered

approximately (75) of the stolen vehicles. This case has been a focus of the United

States Attorney’s Office (USAO) Project Safe Neighborhoods initiative and has

been classified by HSI Headquarters’ as a Significant Case Review (SCR), which

involves the dismantling of a criminal organization.

Property & Casualty Fraud / Identity Theft

(Tangipahoa) On Febr uary 1, 2023, the Louisiana State Police Insurance

Fraud / Auto Theft Unit received a criminal referral from the LA Dept of

Insurance (LDI) related to a suspicious insurance claim. This referral alleged

Crystal Cook and Diamond Mack committed Insurance Fraud against USAA on

or about August 9, 2022, in Tangipahoa Parish. According to the referral, Cook,

the mother of Diamond Mack, submitted a fraudulent itemized invoice pertaining

to medical services her daughter received by North Oaks Hospital in Hammond,

LA. The invoice totaled $16, 033.50. The LSP investigation revealed on August 9,

2022, three juveniles were involved in a motor vehicle crash. The juveniles sought

medical treatment at North Oaks Medical Center in Hammond, LA. Due to the

patient's juvenile age, parents/guardians were financially responsible for the

medical services rendered to the juveniles. The three adults submitted itemized

invoices from North Oaks Hospital to USAA as proof of payment in order to be

reimbursed for the hospital bill. A medical search warrant was applied for and

submitted to North Oaks Hospital along with the itemized invoice submitted to

USAA. Through a review of the documents, it was confirmed the itemized invoice

submitted to USAA, which totaled $16, 033.50, was fraudulent. The investigation

concluded Ashley Gatlin and Shunyell Mack, who were associates of Crystal

Cook and Diamond Mack, financially defrauded USAA. Gatlin alone

defrauded USAA out of approximately $12,918.00 in funds she was not

entitled to. She thereafter attempted to defraud USAA out of another $16,

033.50 while impersonating herself to be Crystal Cook, by submitting

fraudulent invoices to USAA. North Oaks Hospital confirmed ALL invoices

submitted by Gatlin were fraudulent. Gatlin, the legal guardian for Carmiya

Brim, also deprived Medicaid of funds that were received on behalf Brim.

North Oaks Hospital provided the true itemized invoice billed to Medicaid,

which was $977.02. Gatlin’s accomplice, Shunyell Mack, financially

defrauded USAA out of approximately $6, 480.00 in funds she was not

entitled to. Mack submitted fraudulent itemized invoices to USAA in a scheme

to deprive USAA of funds she was not entitled to receive. Again, North Oaks

Hospital confirmed ALL invoices submitted were fraudulent. Shunyell Mack

also deprived Medicaid of funds that were received on behalf of Taniyah

Mack. North Oaks Hospital provided the true itemized invoice billed to

Medicaid which was $977.02. Arrest warrants were issued for both Gatlin and

Mack on numerous criminal charges ranging from identity theft, theft, and

forgery.

Identity Theft / Auto Theft

(Orleans and Jefferson) - In late 2021, Progressive Insurance initiated an

investigation into Bruce Brewer after determining he stole the identity of a

Colorado citizen and used the individual’s identity to purchase a car insurance

policy and two vehicles in his name. After confirming their findings,

Progressive forwarded the case to LSP for a criminal investigative follow-up in

April 2022. In November 2022, LSP commenced an investigation into

Progressive’s allegation and concluded Brewer knowingly stole the identity of

Lance Franklin of Colorado. Brewer used Franklin's identity multiple times,

violating LA.R.S. 14:67.16 in Orleans and Jefferson Parishes. Brewer utilized

a fraudulently-obtained identity of Franklin, and by unknown means, came

into possession of a very convincing, yet fake, Colorado driver's license,

violating LA R.S. 14:70.7. Brewer initially insured a Honda Accord by

All persons are presumed innocent until proven guilty.

Region 1 Investigative Highlights

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

16

Identity Theft / Auto Theft (continued)

securing a Progressive Insurance policy, again using Franklin's identity, violating

LRS 14:72.1.1. It is presumed he purchased the Progressive policy while at his

Metairie residence. Brewer then used his fraudulent driver's license and insurance

policy to purchase a 2016 Lexus from Premier Chrysler-Jeep-Dodge in New

Orleans East. On September 9, 2021, Brewer was involved in a vehicle crash with

a NOPD unit. During the crash investigation, Brewer was captured on bodycam

video advising NOPD Officers he was “Lance Franklin” and he just purchased

the Lexus. While at the scene, Brewer provided officers Progressive insurance

information and a fake Colorado driver's license, both in Franklin’s name. On

September 16, 2021, Brewer was involved in a second crash while operating the

Lexus. This crash, which occurred in Kenner, LA (Jefferson Parish), totaled the

vehicle. Brewer was arrested on charges related to the crash and booked in jail

under the name of “Franklin”. Several days after his release, Brewer filed a claim

with Progressive for a payout for the 2016 Lexus. Later, on September 30, 2021,

Brewer returned to the Premier Chrysler-Jeep-Dodge Dealership and purchase yet

another vehicle, a 2014 Jaguar, while using the identity of Franklin. In the days

after acquiring the vehicle, Brewer removed the 2016 Lexus from his insurance

policy and replaced it with the 2014 Jaguar. Brewer was involved in yet another

crash the following month, while driving the 2014 Jaguar in New Orleans. He

subsequently filed another claim with Progressive Insurance, again posing as

Franklin. Eventually, the real Lance Franklin became aware of the fraud and

contacted Progressive and the Premier Car Dealership about the identity theft. In

February 2023, LSP detectives procured arrest warrants for Brewer in Orleans and

Jefferson Parishes, based on the evidence obtained for a multitude of charges, to

include insurance fraud, identity theft, auto theft, forgery, filing false public

records, etc. On November 17, 2023, Brewer was arrested on an unrelated

attempted murder charge and was subsequently booked by detectives on his active

arrest warrants related to the aforementioned investigation.

Property Fraud

(East Baton Rouge) - In January 2021, the LA Dept of Insurance forwarded a

criminal referral to the LA State Police Insurance Fraud/Auto Theft Unit.

According to the referral, American Bankers Insurance alleged Denitria Honore

and Trey Francis committed Insurance Fraud beginning on or about February of

2020. Between February of 2020 and June of 2021, Honore and Francis filed at

least 43 separate insurance claims, in relation to 17 different smartphones, to

American Bankers Insurance for lost or damaged cellphones. The phones,

which were claimed lost or damaged, were claimed multiple times and

possibly still being used during and after claims were made. The LSP

investigation revealed Honore and Francis purchased cell phone insurance

policies from American Bankers Insurance when the cellular accounts were

opened. Because the insurance policy followed the line, or phone account, and

transferred to the devices in use on the account, Honore and Francis were able

to perpetrate a scheme to fraudulently claim damaged or lost/stolen cell

phones. The scheme included at least 43 claims over the course of more than

one year. A total of 11 claims were paid, valued at $11,104.17. A total of 32

claims were attempted but denied and/or closed, with reserve value set at

$500.00 each. These denied claims had a total value of $16,000.00. The

combined value of paid and attempted claims was $27,104.17. On February 1,

2023, warrants were secured for Honore and Francis. Both were later arrested

on February 3, and February 6, 2023, respectively for violating LRS 22:1924

(Insurance Fraud), and booked into the East Baton Rouge Parish Jail.

Auto Claims Fraud / Forgery of Insurance Certificate

(East Baton Rouge) - In April 2023, the LA State Police Insurance Fraud /

Auto Theft Unit received a criminal complaint from GoAuto Insurance, and a

local attorney, in relation to Terica Johnson. According to the complaint,

Johnson represented herself as qualified to sell insurance and issued fraudulent

GoAuto Insurance cards to an individual for $40.00. This individual was then

involved in a crash and presented the insurance card as proof of insurance,

only to learn it was not a valid policy. The LSP investigation determined

Johnson was producing the fraudulent cards and was distributing them via her

email account to multiple individuals who contacted her through social media.

In June 2023, the LSP Insurance Fraud / Auto Theft Unit received a separate

criminal complaint from GoAuto Insurance alleging Johnson had committed

insurance fraud. The LSP investigation determined Johnson was involved in a

crash and subsequently made a claim with GoAuto. Further investigation

revealed Johnson provided material misrepresentations to the auto insurer in

All persons are presumed innocent until proven guilty.

Region 1 Investigative Highlights

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

17

support of her claim, more specifically by fabricating the date the crash occurred.

Johnson then attempted to conspire with the other driver to cover up her

misrepresentation. By doing so, Johnson attempted to defraud GoAuto out of

approximately $1,615.90, to which she was not entitled. On September 13, 2023

Johnson was arrested and booked in East Baton Rouge Parish for violation of

L.R.S. 22:1925 Insurance Fraud - Auto Policies and L.R.S. 14:72.1.1 Forgery of a

Certificate of Insurance.

Tax Evasion, Forgery & Filing False Public Records

(Statewide) - In J anuary 2022, the LA Office of Motor Vehicles notified the

LSP Insurance Fraud / Auto Theft Unit (LSP-IFAT) of disparities related to the

titling of numerous vehicles in Louisiana. The disparities were specifically link to

transactions processed at various Public Tag Agents (PTAs) and Auto Title

Companies (ATCs) in Louisiana. The PTAs and ATCs were authorized by the

state to title, register, issue license plates, and collect sales/use tax associated with

the transactions. The bulk of the transactions took place at offices located in or

around the Lake Charles, LA area. The case, coined “Operation Dirty Deeds” was

assigned to the LSP-IFAT’s Breaux Bridge Field Office. During the investigation,

33 suspects were identified and were found to have collectively transacted 180

vehicles, valued at $9,916,970.00. An audit of Louisiana Office of Motor Vehicle

records revealed these suspects applied for expedited Louisiana titles using

fraudulent out of state vehicle titles, manufacturer certificates of origins (MCO),

manufacturer statement of origins (MSO) and other suspicious documents. As the

investigation unfolded it was learned many of these vehicles were acquired

through a variety of ways, including but not limited to “Lien Fraud” where in an

individual produced a fake identity at the time of a vehicle purchase, removes the

lien holder information from the paperwork, and sells the vehicle to an

unsuspecting victim. These fictitious documents were ultimately used to obtain

genuine Louisiana titles, registrations, and license plates. After obtaining seeming

ligament paperwork for these vehicle, they were immediately sold to used car

dealerships, retitled in other states, or shipped out of the country. During each

transaction, the suspects grossly undervalued the vehicles which resulted in a

lower sales tax being assessed. Collectively these individuals deprived the State

of Louisiana of $306,485.05 in sales tax revenue. As a result of the investigation,

troopers obtained full extradition arrest warrants for 33 members of the criminal

enterprise for multiple counts including forgery, filing or maintaining false public

records and tax evasion. To date, more than half of these suspects have been

arrested and extradited back to Louisiana for prosecution. This includes the

suspected ringleader, Cameron Standhart. Following the issuance of an

international RED NOTICE by Texas and LSP-IFAT law enforcement,

Standhart was apprehended overseas in the Republic of Georgia and deported

back to Houston (Harris County, TX). Subsequent to answering to unrelated

charges in Texas, Standhart will be extradited back to Louisiana for

prosecution. Looking back on this massive undertaking, the success of

“Operation Dirty Deeds” would not have been possible without the

collaboration between, the LSP-IFAT, the LA Office of Motor Vehicles, the

Louisiana Department of Revenue, the National Insurance Crime Bureau, our

partners in the insurance industry, and the guidance offered by the Louisiana

Office of the Attorney General’s Insurance Fraud Support Unit.

Producer Fraud

(Terrebonne) In June 2021, the Louisiana State Police Insurance Fraud

and Auto Theft Unit (LSP-IFAT) received a criminal complaint from the

Louisiana Department of Insurance (LDI). According to the complainant, Joel

Martinsen, a licensed insurance producer, submitted seven (7) falsified Liberty

Mutual Insurance Company declaration pages to Progressive Insurance to

obtain lower premiums on commercial insurances. At the time the complaint

was received, LDI had served Martinsen with a Cease and Desist Order. The

Order indicated Martinsen’s producer’s license (#294410) was suspended

effective immediately. During the criminal investigation, LSP-IFAT detectives

determined there was sufficient evidence to support the allegation that

Martinsen, acting in his capacity as licensed Louisiana insurance producer and

employed by Terrebonne Insurance Agency, falsified and submitted the seven

(7) fraudulent commercial insurance policies in the name of Liberty Mutual to

Progressive Insurance in Terrebonne Parish. Martinsen’s actions directly

violated Louisiana Revised Statute Title 22:1562 - Prohibited Acts (Unfair

Trade Practices /Insurance Producer). At the conclusion of the investigation,

detectives secured an arrest warrant for Martinsen. On July 12, 2023,

Martinsen surrendered to LSP detectives and was booked in the Terrebonne

Parish Correctional Center without incident. The potential fraud amount

related to Martinsen’s actions was $3,272.00.

Medical Fraud

(Terrebonne) In May 2021, the LSP - Insurance Fraud and Auto Theft Unit

received a criminal complaint from Melinda Baron, a fraud investigator for

All persons are presumed innocent until proven guilty.

Region 2 Investigative Highlights

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

18

AFLAC Insurance Company. According to the complaint, AFLAC’s

investigation revealed a ring of 17 suspects sharing the same manufactured

documents in order to obtain financial benefits / payments from AFLAC.

Following subsequent investigations of the complaint, LSP-IFAT detectives

determined AFLAC representatives mailed certified letters to all 17 policyholders

indicating an investigation was ongoing in relation to the previous claims

submitted under their individual policies. After AFLAC received no responses,

they mailed certified restitution letters to the policyholders indicating fraudulent

claims were found and payments were paid to them in error. AFLAC thereafter

requested those paid in error to submit repayments, in full, in the form of a

cashiers’ check or money order. AFLAC received restitution payments from three

of the 17 suspects. After completing the criminal investigation, IFAT detectives

secured arrest warrants for 13 suspects for a violation of LRS: 22:1924, General

Medical Insurance Fraud and LRS: 14:67 Felony Theft. Additionally, arrest

warrants were secured on three other suspects for a violation of LRS: 22:1924

General Medical Insurance Fraud. The cumulative potential fraud related to this

investigation was approximately $87,680.00.

Insurance Fraud

(Lincoln) - In October 2022, the LSP - Insurance Fraud & Auto Theft Unit (LSP

-IFAT) received two separate complaints of insurance fraud from the LA

Department of Insurance (LDI). The complaint involved the Prescription Shoppe

Pharmacy (PSP) in Ruston, LA., and the Pharmacist in Charge (PIC) Joshua

Miller. The complaint stemmed from an investigation by Express Scripts, an

independent company that serves as the pharmacy benefit manager for Blue Cross

Blue Shield of Louisiana (BCBSLA). According to complaint, PSP and/or PIC

fraudulently billed BCBSLA for 703 prescriptions. The LSP-IFAT investigation

revealed that during the timeframe of November 2017 through March 2022, Miller

filled fraudulent prescriptions for his family members and using the DEA# of a

Physician’s Assistant (PA), in West Monroe, as the prescriber. According to the

PA, she had no knowledge of Miller's actions until she was contacted by Express

Scripts. Approximately 229 fraudulent prescriptions were identified to be filled

under the PA’s DEA# by Miller. On November 7, 2022, Miller surrendered his

pharmacist license. On November 16, 2023, Miller was arrested at the Lincoln

Parish Sheriff's Office and booked for 229 counts of Insurance Fraud in relation to

the LSP-IFAT investigation. The potential fraud amount related to this

investigation was $136,530.95.

Insurance Fraud / Theft of a Motor Vehicle, & Identity Theft

(Rapides) - In May 2023, the LSP - Insurance Fraud & Auto Theft Unit (LSP-

IFAT) was notified by Hixson Ford in Alexandria, LA, of a possible theft of a

motor vehicle and identity theft. LSP-IFAT initiated an investigation and

learned that on May 06, 2023, a subject using a stolen identity from Ohio,

purchased a 2023 Ford Mustang from the Hixson Ford dealership. The subject

was also able to obtain insurance from Progressive Direct Auto on the vehicle

using the stolen identity. Subsequent to reviewing the sales file and

investigative follow-up, detectives learned the true identity of the suspect was

Truth Ulschak, from Roseland, LA. Law enforcement was able to successfully

recover the Ford Mustang from Ulschak's residence. Subsequently, detectives

secured an arrest warrant for Ulschak. On July 18, 2023, Ulschak was arrested

at the Rapides Parish Sheriff's Office, at which time he was booked on the

charges of Insurance Fraud, Theft of a Motor Vehicle, Forgery, and Identity

Theft. The potential fraud related to this investigation was $54,385.00.

Producer Fraud

(Caddo) - In April 2023, the LSP - Insurance Fraud & Auto Theft Unit (LSP-

IFAT) received a criminal referral from the LA Department of Insurance

(LDI). According to the referral, New York Life Insurance Company alleged

their former employee, William Tyler Rodriguez (Producer), committed

forgery and fraud in relation to insurance policies from July 2020 – April

2022. The complaint alleged Rodriguez forged numerous client’s signatures to

policies, and therefore created fraudulent policies in their name, without their

knowledge or consent, in order to collect additional insurance commissions. In

August 2023, following the conclusion of the LSP investigation, an arrest

warrant was obtained for Rodriquez for violations of LRS 22:1562 D (2);

Unfair Trade Practices (5 counts) and LRS 14:72; Forgery (8 counts). On

August 14, 2023, Rodriguez voluntarily surrendered at the Caddo Correctional

All persons are presumed innocent until proven guilty.

Region 3 Investigative Highlights

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

19

Center on the aforementioned charges at which time he was arrested and booked

accordingly. The potential fraud amount was approximately $7,964.00.

Bodily Injury – Altered Medical Records

(Bossier) - In June 2023, the Louisiana Department of Insurance forwarded a

criminal referral to the LSP -IFAT Unit. According to the referral, USAA

Insurance Company alleged Craylon McGhee committed Insurance Fraud on or

about January 22, 2023, in Bossier Parish. The LSP-IFAT investigation revealed

McGhee was involved in a two-vehicle accident in Bossier City. At the time of

the accident, there were no reported injuries. Several weeks later, McGhee

contacted USAA and stated he had suffered injuries as a result of the crash.

McGhee provided USAA medical records showing he received treatment at Willis

Knighton Hospital in Bossier City; however, it was determined the documents he

submitted were altered and belonged to his girlfriend, Kedra Blalock. The

investigation also revealed Blalock spoke to the insurance company on McGhee's

behalf and stated he had received medical treatment. At the time of her

conversation with USAA, Blalock identified herself as McGhee's mother.

Following the completion of the LSP investigation, detectives secured arrest

warrants for McGhee and Blalock through the 26

th

JDC of Bossier Parish, for

violations of LRS 22:1924; Insurance Fraud. On October 29, 2023, and November

1, 2023, respectively, Blalock and McGhee surrendered at the Bossier Parish Jail.

Following their surrender, they were arrested and booked accordingly. The

potential fraud amount, had their scheme been successful, would have been

$22,026.00.

Insurance Fraud

(Franklin) - On December 5, 2022, Louisiana State Police, Insurance Fraud/Auto

Theft Unit, received a criminal referral from Louisiana Department of Wildlife

and Fisheries in reference to a possible insurance fraud violation involving an

alleged stolen ATV from Franklin Parish. Facts of the case confirmed that in

December of 2020, Frederick W. Fudickar Sr. reported to State Farm Insurance

Company that his 2016 Polaris ATV was stolen from his residence. State Farm

paid $15,904.78 for the total loss of the Polaris ATV; accounting for a $500.00

deductible, $5,661.53 to Citizen's Progressive finance lien, and $9,743.25 to

Fudickar Sr. During LSP IFAT’s investigation, it was revealed Fudickar Sr.

fraudulently reported to State Farm that his ATV was stolen, when in fact, he

conspired with his son, Frederick W Fudickar Jr, with the intent to receive an

insurance settlement. As a result, arrest warrants were obtained from the 5

th

JDC charging both Fudickar Sr. and Fudickar Jr. for violating the provisions of

LRS 22:1924, Felony Insurance Fraud. On March 7, 2023, Fudickar Jr was

arrested and booked on the aforementioned charge. Later, on March 30, 2023,

Fudickar Sr. was arrested at Franklin Parish Detention Center where he was

booked without incident.

All persons are presumed innocent until proven guilty.

Region 3 Investigative Highlights (continued)

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

20

One of the critical roles of the LSP-IFAT Unit is to teach Louisiana law

enforcement officers the proper method of performing a physical inspection of a

motor vehicle and how to complete the Affidavit of Physical Inspection form. To

accomplish this task, IFAT detectives frequently provide auto theft related training

to officers at various law enforcement agencies and Louisiana P.O.S.T. academies

throughout the state. During the training, detectives emphasize to attendees the

significance of conducting detailed physical examinations of vehicles and

answering questions attendees have about accurately filling out the affidavit of

physical inspection form. During the same training block, detectives briefly

educate attendees on the various types of auto theft commonly committed by

criminals.

Throughout the course of the year, members of the LSP-IFAT Unit attended and

participated in numerous training events across the country to stay abreast of the

best practices as it relates to combating insurance fraud. The various training and

educational events provided members of LSP–IFAT with necessary information to

assist in the collaborative efforts with industry stakeholders to effectively fight

fraud while ensuring legal compliance. Members of the Louisiana Insurance Fraud

Task Force will consistently promote public awareness, foster industry

cooperation, and continuously adapt strategies to counter emerging fraud schemes,

thereby safeguarding the integrity of insurance processes in the state.

Law Enforcement Training

2023 Training Sessions Conducted by IFAT

Number ocers trained 468

Number of sessions conducted 27

Conferences

LSP-IFAT members Darren Foil, Morgan Todd, and Dale

Latham attend the 2023 International Association of SIUs

conference in Dallas, TX.

Inv. Jason Gagliano of the LSP-IFAT New Orleans Field

Office gives a presentation on vehicle theft trends during the

LA Department of Insurance Fraud Conference in March

2023.

In December 2023, members of the LA Insurance Fraud Task

Force attended the Coalition Against Insurance Fraud’s end

of the year meeting in Washington DC. Attendees (L-R)

included Sgt. Rodney Owens (LSP-IFAT-Alexandria),

Nathan Strebeck (LA Dept of Insurance-Office of Insurance

Fraud), Sgt. David Jernigan (LSP-IFAT-Bossier City).

Sgt. Leander Journee (IFAT-New Orleans) poses for a

picture while attending the Coalition Against Insurance

Fraud’s mid year membership meeting in Orlando, FL, in

June 2023.

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

21

Per LRS 40:1422, all members of the Louisiana State Police Insurance Fraud /

Auto Theft Unit are required to obtain the certification of Fraud Claim Law

Specialist (FCLS) within two years of their assignment to the unit. The training

and certification is obtained by taking a correspondence-type course with the

American Educational Institute, commonly referred to as AEI.

The FCLS designation is recognized throughout the industry as the mark of

professional achievement. Through the AEI’s “Law of Claims Fraud and

Investigation Defense Program” detectives receive coursework in the following

six key areas: Recognizing Fraud, Special Investigation, Proving Fraud, Handling

Suspicious Claims, Avoiding Bad Faith & Civil Liability in Handling Suspicious

Claims, Advanced Legal Issues in Fraud Investigation and Defense, and Auto

Insurance Fraud.

Upon successfully completing the core courses, detectives receive their FCLS

designation and certification.

In 2023, the following Louisiana State Police detectives assigned to the Insurance

Fraud / Auto Theft Unit received their FCLS designation and certification through

AEI:

SGT Justin Morris (Monroe); SGT Rodney Owens, Trooper First Class Mary Neal

and Inv. Ronald Besson (Alexandria); Trooper First Class Lucas Burge and Inv.

Daryle Graham (Baton Rouge); Trooper First Class Ryan Beard (Breaux Bridge);

and Trooper Malachi Hull (New Orleans).

(aeiclaimslaw.com)

In December 2023, the Louisiana State Troopers Association, Troop F

Affiliate, selected Criminal Investigator Morgan Todd as the 2023 Investigator

of the Year for the LSP-BOI. (Picture: Inv. Morgan and Sgt Justin Morris of

the LSP-IFAT Monroe Field Office.)

CERTIFICATIONS

AWARDS

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

22

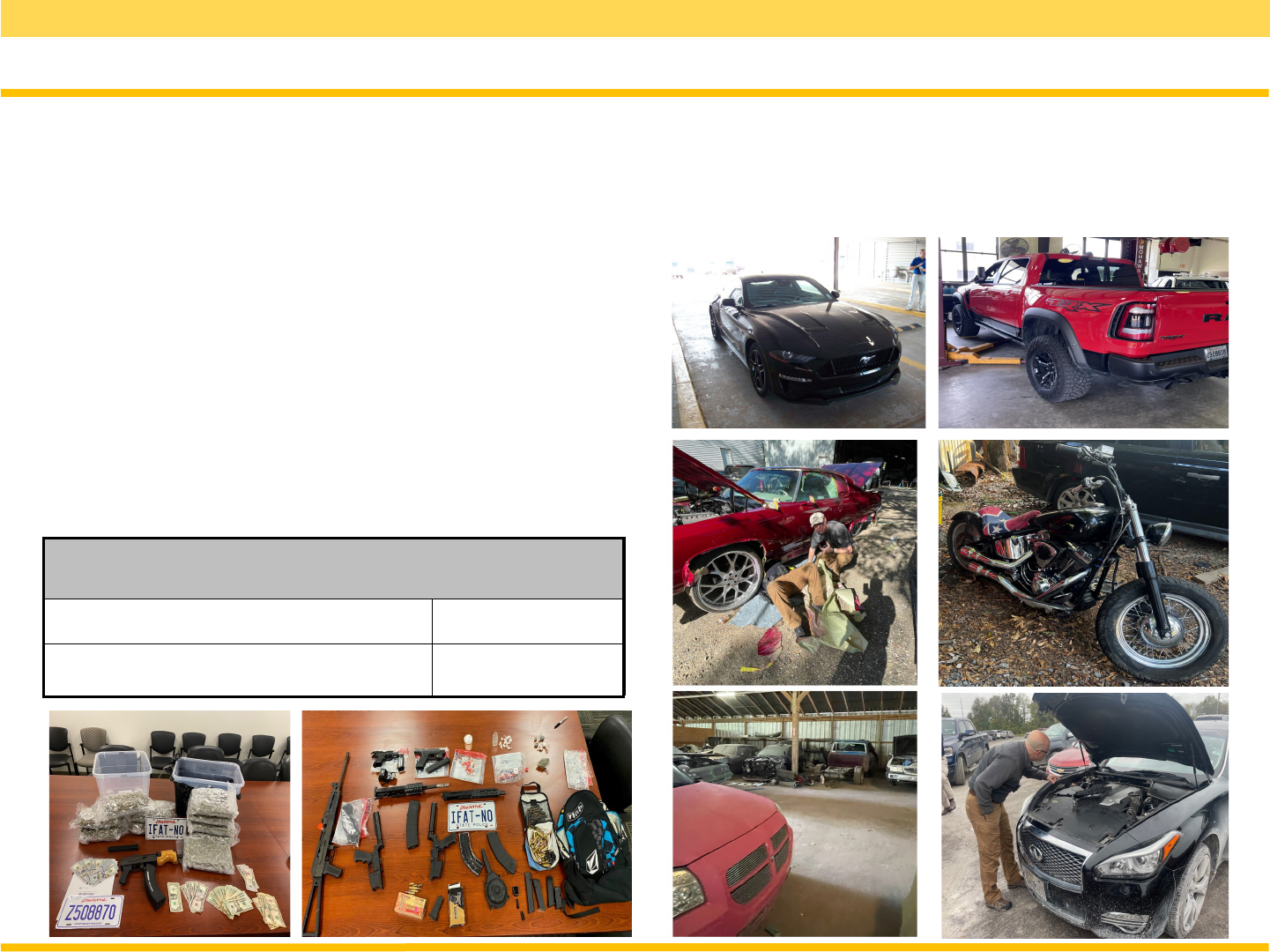

The Louisiana State Police - Insurance Fraud Auto Theft (LSP-IFAT) Unit plays a

pivotal role in combating auto thefts across the state. In addition to our role in

fighting insurance fraud, members are also dedicated to investigating and

preventing vehicle thefts. The unit consistently engages in the industry’s best

practices by utilizing the latest resources to track down and apprehend criminals

involved in auto theft and auto theft related activities. During 2023, unit personnel

recovered 270 vehicles across the state, with a cumulative value of approximately

$6.1M. Often times, while investigating auto theft crimes, detectives uncover the

spoils of other criminal activity such as illegal possession of CDS, illegal

possession of a firearm, etc.

On an ongoing basis, the LSP-IFAT Unit collaborates with the National Insurance

Crime Bureau (NICB), the Louisiana Department of Insurance - Louisiana Auto

Theft and Insurance Fraud Prevention Authority (LATIFPA), along with

numerous law enforcement agencies, insurance companies, and other stakeholders

to develop comprehensive strategies to keep the public informed and take a

proactive approach to tackle this criminal activity. Through relentless efforts and a

commitment to excellence, the unit will continually strive to safeguard the

community from the impact of auto thefts across the state.

Vehicle Thefts & Recoveries

2023 Vehicle Theft Recoveries by members of LSP-IFAT

Stolen Vehicles Recovered 270

Cumulative value of vehicles recovered $6,095,423.54

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

23

Retirements, Promotions, and Transfers

Retirements

February 2023

Master Trooper Kevin Dies (IFAT-Houma) retired with 28 years of

dedicated service.

Helena Graham (IFAT-Administrative Coordinator 3) retired with over 16

years of dedicated service.

LSP-IFAT extends its best wishes for a fulfilling retirement, expressing

gratitude for their dedicated service to both LSP and the residents of

Louisiana.

Promotions

April 2023

Senior Trooper Leander Journee of IFAT-New Orleans was promoted to

Sergeant in the Insurance Fraud / Auto Theft Unit’s New Orleans Field

Office.

August 2023

Trooper First Class Malachi Hull of IFAT-New Orleans was promoted to

Sergeant in the Crisis Response Unit.

Transfers

March 2023

Sgt. Nicole Barbe transferred from IFAT-New Orleans to the

Professional Standards and Compliance Unit.

August 2023

Trooper First Class Jacob Pucheu transferred from Troop B in New

Orleans, to the IFAT New Orleans Field Office.

Master Trooper Keith Bergeron transferred from IFAT New Orleans Field

Office to Troop B in Kenner.

Team Member Spotlights

(IFAT-Alexandria) - Investigator Ronnie Besson was born and raised in Central

Louisiana. In 1984, Inv. Besson joined the Alexandria Police Department (APD)

after graduating first in his class from the Alexandria Police Regional Training

Academy. During his career with the APD, Inv. Besson was assigned to the

Criminal Investigations Division and Crime Scene Unit. Additionally, he attended

the National Training Center for Polygraph Science and was certified as Polygraph

Examiner. In 2011, Inv. Besson retired from the APD with 27 years of service. He

has been employed as a Criminal Investigator with the Alexandria Field Office of

LSP since 2014. Inv. Besson has been married to his wife and best friend, Mary, for

36 years. According to Inv. Besson, he knew since a young boy in 4

th

grade that he

wanted to be a police officer. Today, he’s still living his dream!

(IFAT-Breaux Bridge) - Master Trooper Trent Hanks has been employed with the

Louisiana State Police for nearly 19 years. In December 2016, he transferred from

Troop I in Lafayette to the Insurance Fraud / Auto Theft Unit’s Breaux Bridge Field

Office. Before joining the Louisiana State Police, Master Trooper Hanks was a

United States Marine for 5 years, where he served during Operations Iraqi and

Enduring Freedom. He is married and has 2 children. In his spare time, MT Hanks

enjoys spending time with his family, exploring the great outdoors, and traveling.

(IFAT-Baton Rouge) - Investigator Jeff Cagle has been assigned to the

Insurance Fraud and Auto Theft Unit (IFAT) in Baton Rouge since 2018. Before

joining the IFAT unit, Inv. Cagle was a patrolman with the LA Dept of Public

Safety. Inv. Cagle began his 27 year law enforcement career as a dispatcher at

Louisiana State Police Headquarters in 1996. His service in Louisiana included

Louisiana State University (LSU) Police, LA DPS-Police and as a Louisiana State

Police Investigator - Capitol Detail. Additionally, he served several years as a

detective with the New Hampton Police Department in New Hampshire before

returning to the Louisiana State Police in 2017. Since joining the IFAT Unit, Inv.

Cagle has investigated a wide variety of insurance fraud and auto theft cases. His

investigations have resulted in the recovery of numerous stolen vehicles and

criminal convictions for insurance fraud and auto theft related crimes. Inv. Cagle is

an active member of the United States Secret Service Cyber Fraud Task Force,

which allows him to stay on the cutting edge of technological training and

advancements. He is the recipient of multiple Professional Excellence and Unit

Citation awards. Inv. Cagle is married to his wife of 22 years and has three

exceptional children. He enjoys long distance backpacking and wilderness survival

training.

LOUISIANA STATE POLICE 2023 ANNUAL REPORT

Insurance Fraud / Auto Theft Unit

24

PAGE INTENTIONALLY LEFT BLANK

25

LOUISIANA ATTORNEY GENERAL

JEFF LANDRY’S CRIMINAL DIVISION

INSURANCE FRAUD SUPPORT UNIT

2023 ANNUAL REPORT

OFFICE OF THE ATTORNEY GENERAL 2023 ANNUAL REPORT

26

Insurance Fraud Support Unit

Louisiana Attorney General Jeff Landry is proud of the efforts of his Insurance

Fraud Support Unit (the Unit). Through criminal prosecutions and the recovery of

restitution from insurance fraud offenders, the unit is a valuable asset in the fight

against criminals who defraud the State and its taxpayers. The Unit operates as

part of a tri-agency task force created by the Legislature and dedicated solely to

fighting insurance fraud in Louisiana.

The Unit fulfills three primary responsibilities: providing legal advice and

consultation in insurance fraud matters to the other two task force agencies – the

Louisiana State Police (LSP) and the Louisiana Department of Insurance

(LADOI); prosecuting individuals statewide charged with insurance fraud; and

presenting insurance fraud information and training to the insurance industry

along with state and federal agencies.

The primary objective of the Unit is to provide superior legal representation to the

LADOI and LSP in insurance fraud investigations and prosecutions. Assistant

Attorneys General assigned to the Unit prosecute violations of Louisiana’s

criminal laws under Titles 14, 22, 23, and 47 by conducting – or assisting in –

criminal prosecutions upon the recusal or assistance request of local district

attorneys and by providing legal support to law enforcement agencies

investigating criminal insurance fraud.

The Unit may handle insurance fraud cases that begin with a complaint made

directly to the Attorney General’s Office. Additionally, the Unit may consult with

– and provide legal support to – all local and state law enforcement agencies

regarding insurance fraud matters and questions. This includes, but is not limited

to, reviewing drafts of arrest and search warrants; conducting legal research; and

evaluating cases from a prosecutor’s perspective (i.e., whether there is sufficient

evidence to satisfy legal burdens of proof). Due to the complex nature of some of

the cases handled – the local district attorney may be consulted while the

investigation is still ongoing to obtain the necessary authority to offer a plea

agreement, immunity to a target of the investigation to secure his cooperation

concerning other targets, or request to prosecute the case outright.

The Unit’s attorneys attend regularly scheduled intelligence-sharing meetings

hosted by LSP in Baton Rouge. These meetings are attended by members of

special investigative units from many insurance companies that do business in

Louisiana. Under a statutory grant of immunity from civil liability, these personnel

share information with law enforcement regarding fraud trends and specific active

investigations. This level of information sharing allows all participants in the

Louisiana Insurance Fraud Task force to stay abreast of the constantly

evolving methods that offenders employ to commit fraud, and has resulted in

the successful prosecutions of several staged accident rings, producer fraud

cases, health care provider fraud cases, and theft of equipment and

automobiles.

The Unit’s section chief has given presentations on insurance fraud

prosecution issues before organizations such as the National White Collar

Crime Center, the Louisiana Association of Self Insured Employers, the

Orleans Parish District Attorney’s Economic Crimes Unit, the Insurance

Security Association, the American Council of Life Insurers, the National

Insurance Crime Bureau (NICB), the Louisiana District Attorneys’

Association, the LADOI, and the Louisiana Claims Association. All of the

Unit’s attorneys attend continuing legal education training from various

sources, including the National Association of Insurance Commissioners

(NAIC) and other NICB or NAIC sponsored training. Moreover, the Unit is

connected with the Homeland Security Information Network – enabling

attorneys to track insurance fraud cases from start to finish. This network

allows everyone involved with the cases to have access to relevant information

at all times. The Unit’s section chief also serves on the board of the Louisiana

Auto Theft and Insurance Fraud Prevention Authority (LATIFPA).

The Unit continues its work of protecting consumers and insurers in Louisiana

by actively working with its partners in the State Insurance Fraud Task Force,

and by fostering relationships with insurers to ensure that their interests in

deterring and prosecuting fraud are fully represented in the criminal justice

system.

OFFICE OF THE ATTORNEY GENERAL 2023 ANNUAL REPORT

27

Insurance Fraud Support Unit

BASIC INFORMATION ABOUT THE UNIT

Statutory Authority for Operations

La. Const. Art. IV, Section 8 provides, in pertinent part:

As necessary for the assertion or protection of any right or interest of the

state, the attorney general shall have authority

…….

(2) upon the written request of a district attorney, to advise and

assist in the prosecution of any criminal case; and

(3) for cause, when authorized by the court which would have

original jurisdiction and subject to judicial review, (a) to

institute, prosecute, or intervene in any criminal action or

proceedings, or (b) to supersede any attorney representing the

state in any civil or criminal action.

La. Code of Criminal Procedure Article 682 provides, in pertinent part:

When a district attorney is recused…it shall be the duty of the Attorney

General to appoint a member of his staff…to act in the place of the

recused district attorney.

La. R. S. 36:702(E) provides:

There shall be within the Department of Justice a criminal division. It

shall be responsible for criminal appeals, amicus curiae briefs in criminal

prosecutions, habeas corpus defense, assistance to district attorneys in

criminal cases, criminal prosecution, public corruption, institutional and

insurance fraud cases, and extraditions, in accordance with Article IV,

Section 8 of the Constitution of Louisiana.

Additional Statutory Authority for Insurance Fraud Support

Unit Operations

La. R. S. 40:1421 et seq.

Primary Purpose

To provide superior legal representation to LADOI and LSP in insurance fraud

investigations and prosecutions.

To participate in LADOI and LSP meetings to screen insurance fraud referrals.

To assist local District Attorneys in prosecuting insurance fraud.

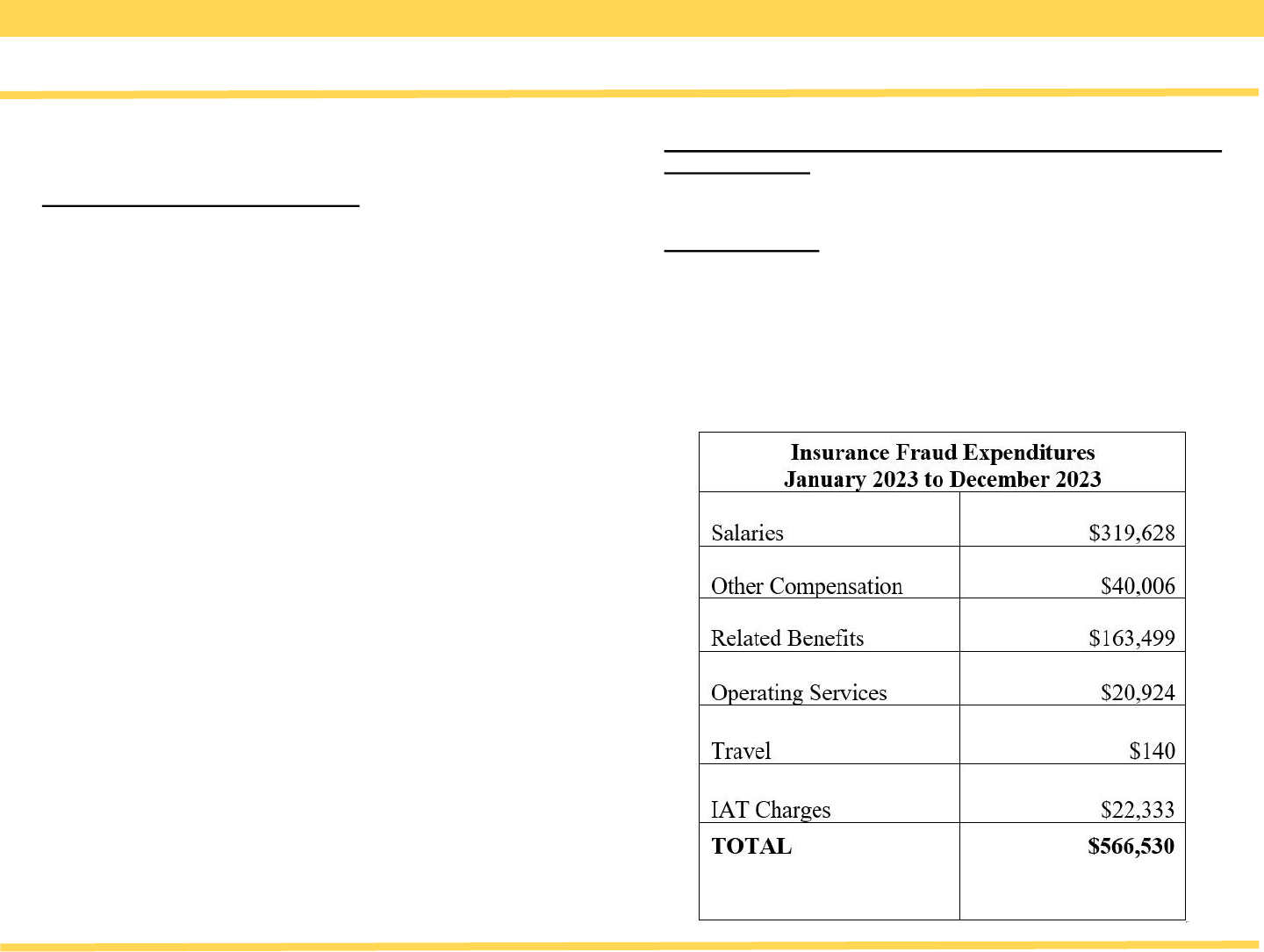

BUDGET FOR THE UNIT

OFFICE OF THE ATTORNEY GENERAL 2023 ANNUAL REPORT

28

Insurance Fraud Support Unit

STATISTICAL INFORMATION FOR THE UNIT

A strategic objective for the Unit is to provide legal support to law enforcement

agencies investigating criminal insurance fraud referrals by responding to requests

for legal consultation within two working days and by attending 90% of

intelligence-sharing meetings hosted by the LSP Insurance Fraud Unit. In 2023,

the Unit’s attorneys attended all six of the intelligence sharing meetings with the

LADOI and the LSP fraud units.

During the 2023 calendar year, the Unit not only reached the standard of 95%

percent of requests for legal consultation responded to within 2 working days; but

exceeded this goal by handling 100% of all requests for legal consultation within

two working days.

The Unit meets the State goal for Crime and Safety Reform of bringing security to

all Louisiana citizens by protecting our taxpayers from insurance related fraud.

LADOI estimates that there are over $500 million dollars lost annually in

Louisiana to insurance fraud, as it pertains to casualty and property claims. This

does not include healthcare fraud which is estimated to be about $1.5 billion in

Louisiana alone. The typical Louisiana household pays almost $1,000 a year in

fraud-related charges passed on to them as consumers.

OTHER 2023 ACCOMPLISHMENTS

OFFICE OF THE ATTORNEY GENERAL 2023 ANNUAL REPORT

During the 2018 calendar year, the Unit entered into a prosecution assistance

agreement with the 19th Judicial District Attorney’s Office – allowing Assis-

tant Attorneys General to prosecute all insurance fraud cases occurring in East

Baton Rouge Parish (or where East Baton Rouge Parish is a proper jurisdic-

tion). This agreement has resulted in 32 active pending prosecutions of Task

Force cases as of December 31, 2022. Nine different Assistant Attorneys Gen-

eral are currently prosecuting Task Force cases in various jurisdictions

throughout the State of Louisiana, allowing the development of experience and

expertise in insurance fraud cases on a broader level in the Criminal Division

of the Attorney General’s Office.

In 2023, the Unit instituted 42 new prosecutions of Insurance Fraud Task

Force cases. The Unit also resolved six Task Force cases by way of felony

guilty pleas in 2023. Included in that number is the conviction of Trampus

Wagoner for Felony Insurance Fraud (La RS 22:1924). He was ordered to pay

$248,909.16 in restitution to sixteen different victims. Wagoner was also sen-

tenced to five years DOC and three years of probation. Due to the efforts our

Task Force partners, the Attorney General’s office secured this restitution at

the same time as the conviction and the funds have been distributed to the vic-

tims.

The Unit continues to strive to increase its role in active prosecution of Task

Force cases statewide to ensure that taxpayers and insurers in Louisiana are

protected from fraud. In their role as prosecutors, Assistant Attorneys General

work to see justice done in each individual case, and to highlight the important

work done by its partners in combatting insurance fraud.

29

PAGE INTENTIONALLY LEFT BLANK

30

Office of Insurance Fraud

LOUISIANA DEPARTMENT OF INSURANCE 2023 ANNUAL REPORT

31

Office of Insurance Fraud

Claims

The LDI Office of Insurance Fraud received 2,789 reports of suspected fraudulent claims during 2023. The majority were from insurance companies in

accordance with La. R.S. 22:1926. Since its inception in 2007, the Office of Insurance Fraud database has accumulated 48,603 entries of suspected fraudulent

claims.

During 2023, the Office of Insurance Fraud referred 2,239 claim fraud investigations to Louisiana State Police. There were 98 arrests resulting in 203 charges for

numerous crimes as a result of criminal referrals related to suspected fraudulent insurance claims.

LOUISIANA DEPARTMENT OF INSURANCE 2023 ANNUAL REPORT

Charges Against Claimants or Licensees Resulting from Referrals by Category

Category

Number of

Charges*

Percent of

Crimes

Insurance Fraud 106 52.2%

Automobile Insurance Fraud 42 20.6%

Theft 20 9.9%

Forgery 12 5.9

Prohibited Actions and Sanctions—Insurance Producers 12 5.9%

Unfair Trade Practices 5 2.5

Identity Theft 2 1.0%

Criminal Conspiracy 1 .5%

Criminal Mischief 1 .5%

Filing False Public Documents 1 .5%

Obstruction of Justice 1 .5%

*An arrest may include multiple charges.

32

2023 Producer, Adjuster and Company Fraud Actions...

Background Investigations…

The Office of Insurance Fraud investigates the backgrounds of companies, officers, directors, utilization review organizations, claims adjusters and other entities applying to con-

duct the business of insurance in Louisiana. This includes changes of officers and directors of domestic companies currently authorized to do business in the state.

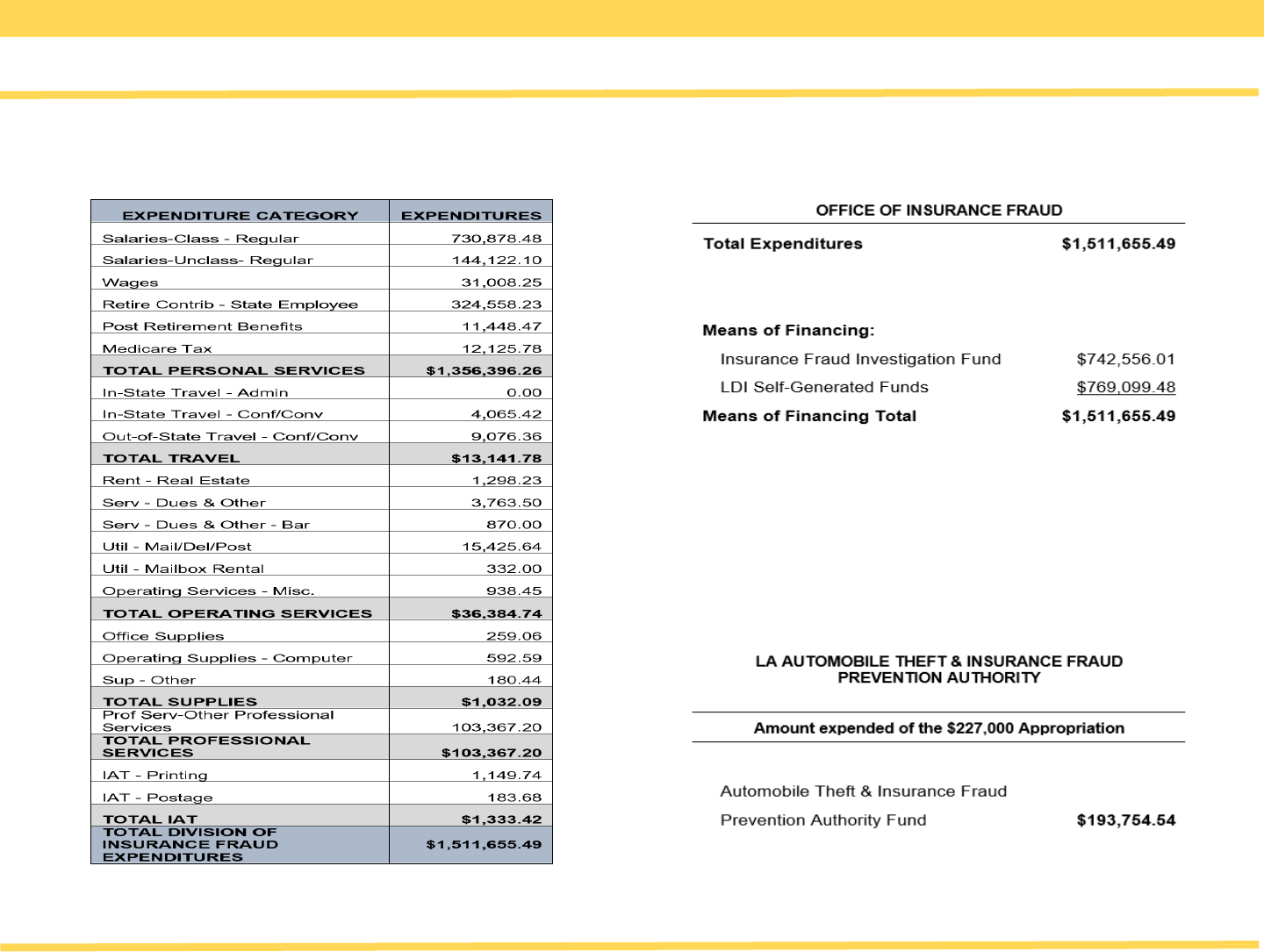

Louisiana Automobile Theft and Insurance Fraud Prevention Authority...

La. R.S. 22:2131 established the Louisiana Automobile Theft and Insurance Fraud Prevention Authority (“LATIFPA”) for the purpose of combating motor vehicle insurance

fraud, including fraud by theft and other criminal acts, property insurance fraud, workers’ compensation fraud, health insurance and healthcare fraud, and other forms of fraud

affecting the business of insurance. La. R.S. 40:1428 authorizes the Commissioner of Insurance to withhold $187,000 each fiscal year from the insurance fraud assessment to

provide funding for LATIFPA. This allocation is used to achieve the purposes and objectives of LATIFPA. During Calendar Year 2023, LATIFPA expended $193,754.54 to

accomplish its mission.

For more information on the Office of Insurance Fraud and LATIFPA, please refer to the 2022-2023 Louisiana Department of Insurance Annual Report.

Action Number

Number of Investigations Opened 293

Fines and Monetary Penalties 112

Consent Orders 4

License Revocations 53

License Suspensions 52

Cease and Desist Orders Served 39

Criminal Referrals to Law Enforcement 41

Arrests Made as a Result of Criminal Referrals 3

Action Number

Company Applications Received 100

Company Applications Approved 96

Company Biographical Affidavits Received 797

Company Biographical Affidavits Approved 818

LOUISIANA DEPARTMENT OF INSURANCE 2023 ANNUAL REPORT

Office of Insurance Fraud

33

Office of Insurance Fraud

LOUISIANA DEPARTMENT OF INSURANCE 2023 ANNUAL REPORT

Calendar Year 2023 Expenditures

34

Office of Insurance Fraud

Report Insurance Fraud to the

Louisiana Department of Insurance

Insurance Fraud is ANY intentional misrepresentation

to profit from an insurance entity.

Report Fraud Online:

http://www.ldi.la.gov/consumers/insurance-fraud/report-insurance-fraud

By Phone:

(225) 342-4956 or (800) 259-5300

By Mail:

P.O. Box 3096, Baton Rouge, LA 70821

Physical Address:

1702 N. Third Street, Baton Rouge, LA 70802

LOUISIANA DEPARTMENT OF INSURANCE 2023 ANNUAL REPORT

35

LOUISIANA STATE POLICE

Insurance Fraud & Auto Theft Unit

7919 Independence Blvd., A-19, Baton Rouge, LA 70806

(225) 925-3536

www.lsp.org

LOUISIANA OFFICE OF THE ATTORNEY GENERAL

Insurance Fraud Support Unit

1885 N. Third Street, Baton Rouge, LA 70802

(225) 326-6000

www.ag.state.la.us

LOUISIANA DEPARTMENT OF INSURANCE

Office of Insurance Fraud

Louisiana Auto Theft and Insurance Fraud Prevention Authority

1702 N. Third Street, Baton Rouge, LA 70802

(225) 342-4956

www.ldi.la.gov

36

This public document was published at a unit cost of $6.799. One hundred twenty (120) copies of this public document were published in this first printing at a total cost of $815.91. The total cost of all printings of this

document including reprints is $815.91. This document was published by OTS-Production Support Services, 627 North 4th Street, Baton Rouge, LA, 70802 for the Louisiana State Police, Insurance Fraud & Auto Theft

Unit, 7919 Independence Blvd., Baton Rouge, LA, 70806 to meet the requirement for an annual report of activities for the Louisiana Insurance Fraud Task Force under the authority of L.R.S. 40:1427. This material was

printed in accordance with the standards for printing by State Agencies established in R.S. 43:31. Printing of this material was purchased in accordance with the provisions of Title 43 of the Louisiana Revised Statutes.

HELP LOUISIANA BOOT OUT FRAUD!