LOUISIANA INSURANCE FRAUD TASK FORCE

2019 Annual Report

© Photo by Michelle Cloud

2

The Louisiana Insurance Fraud Task Force is a statutorily mandated partnership between three state

agencies created to collectively investigate and deter acts of insurance fraud and auto theft in Louisiana.

The following three agencies are members of the Task Force:

Louisiana State Police

Insurance Fraud / Auto Theft Program

Office of the Attorney General

Insurance Fraud Support Unit

Louisiana Department of Insurance

Insurance Fraud Section

Louisiana Automobile Theft and Insurance Fraud Prevention Authority

Insurance fraud is any fr audulent act, knowingly and willfully committed by any per son in an attempt to

injure, defraud, or deceive an insurance company. In Louisiana, insurance fraud is a felony, and when

convicted, penalties could include jail time, fines, community service, probation and/or restitution.

2019 Annual Report

3

Table of Contents

2019 Annual Report

Letter From Louisiana State Police Superintendent

4

Louisiana State Police Insurance Fraud / Auto Theft Program

5

Program Notes 6

Referral Information 7

Investigations and Arrests 9

Criminal Investigations by Type 10

Judicial Actions 11

Budget Expenditures 12

Investigative Highlights 13

Law Enforcement Training and Auto Theft 16

Personnel Movement and Highlights 17

Office of the Attorney General / Insurance Fraud Support Unit

18

Basic Information 19

Statutory Authority 20

Purpose and Expenditures 21

Statistical Information and Other Accomplishments 22

Department of Insurance / Insurance Fraud Section & LATIFPA

23

Claims Fraud / Crime Categories and Charges 24

Producer, Claims Adjuster and Company Fraud Actions 25

Background Investigations / LATIFPA 25

2019 Expenditures / LATIFPA Budget 26

How to Report Fraud

27

4

January 29, 2020

Honorable John Bel Edwards

Office of the Governor

State Capital

Baton Rouge, Louisiana

Dear Governor Edwards:

As you know, the Louisiana Insurance Fraud Task Force is a tri-member coalition comprised of the Louisiana

State Police Insurance Fraud and Auto Theft Program, the Louisiana Department of Insurance, and the

Louisiana Attorney General’s Office. Together, the members provide a portal for suspected insurance fraud

complaint submission, investigation, and prosecution.

In 2019, the Task Force strived to make a difference in the fight against insurance fraud and auto theft

perpetrated against the citizens of Louisiana, and the insurance companies who do business in this fair state.

The Task Force filled investigator vacancies, re-domiciled personnel for full-state coverage, incorporated new

training opportunities, added new technologies, and strengthened lines of communication with the insurance

industry and anti-fraud partners. The Task Force recommitted itself to the Coalition Against Insurance Fraud,

representing the State of Louisiana on the Coalition’s Board of Directors.

Because of these organizational strategies and actions, the Task Force has once again succeeded in providing

a professional work product to its customers. The Task Force remains a driving force in the combat of

insurance fraud.

As a reflection of the tireless efforts of the men and women of the Louisiana Insurance Fraud and Auto Theft

Task Force, I present to you the 2019 Annual Report.

Sincerely,

Colonel Kevin W. Reeves

Deputy Secretary, Public Safety Services

Superintendent, Louisiana State Police

2019 Annual Report

Letter From The Superintendent

KEVIN REEVES, COLONEL

DEPUTY SECRETARY

State of Louisiana

Department of Public Safety and Corrections

Public Safety Services

5

2019 Annual Report

Louisiana State Police

Insurance Fraud / Auto Theft Program

6

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

The Program

The Insurance Fraud / Auto Theft Program is a statutorily

mandated criminal investigative unit within the Louisiana

State Police Bureau of Investigations, Criminal

Investigations Division. The Program is dedicated to

seeking justice on behalf of the citizens of the state of

Louisiana and industry stakeholders by the execution of

superior, professional, and effective investigations.

A Sergeant within each field office directly supervises

Troopers and Criminal Investigators tasked with

investigating criminal referrals from the Louisiana

Department of Insurance, and complaints of auto theft and

insurance fraud received from the public. Each field

office is commanded by a Lieutenant and each region is

under the command of a Captain.

The statewide program coordinator is a lieutenant, tasked to work with State Police supervisors and staff,

industry representatives, and governmental partners to ensure the success of the Program mission. In

December of 2019, there were thirteen State Police Troopers and five Criminal Investigators assigned to the

Program throughout the state.

Bossier City (Troop G)

Sgt. Michael Wilkerson

4185 Viking Dr

Bossier City, LA 71111

(318) 741-2726

Monroe (Troop F)

Sgt. Sanikka Williams

3420 Medical Plaza Dr, Ste 10

Monroe, LA 71203

(318) 362-4588

Alexandria (Troop E)

Sgt. Larry Zeller

5903 Coliseum Blvd

Alexandria, LA 71302

(318) 484-2104

Field Office Contacts

Baton Rouge (Troop A)

Sgt. Eric Adams

7919 Independence Blvd

Baton Rouge, LA 70896

(225) 925-3850

New Orleans (Troop B)

Sgt. Joe Cuccia

1450 Poydras St, Ste 1300

New Orleans, LA 70112

(504) 310-7064

Covington (Troop L)

Sgt. Oliver Jackson

109 New Camilia Blvd, Ste 102

Covington, LA 70433

(985) 543-4158

REGION I REGION III REGION II

Houma (Troop C)

Sgt. Justin Rice

103 Melissa Ln

Houma, LA

(985) 876-8834

Breaux Bridge (Troop I)

Sgt. Dale Latham

437 West Mills Rd

Breaux Bridge, LA 70517

(337) 332-8080

Lake Charles (Troop D)

Sgt. Kent Pevoto

One Lakeshore Dr, Ste 970

Lake Charles, LA 70629

(337) 491-2906

Coordinator: Lt. David Stelly (337) 332-8063 Support: Helena Graham (225) 925-3536

A

B

C

D

E

F

G

I

L

7

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

Referrals Received...

The Insurance Fraud and Auto Theft Program receives insurance fraud referrals from the Louisiana

Department of Insurance on a monthly basis. In 2019, the Program received 1,090 referrals from the

Department of Insurance. Of the referrals received, the Program accepted 281 and declined 809 referrals.

In addition to the referrals received from the Louisiana Department of Insurance, the Insurance Fraud / Auto

Theft Program also accepted 155 criminal complaints related to insurance fraud, vehicle theft, and other

crimes, which were received from various entities, including Program generated operations, other law

enforcement agencies, citizens, etc.

Referrals Received from LDI 1090

LDI Referrals Accepted 281

LDI Referrals Rejected 809

Non-LDI Investigations 155

Total Referrals 1245

2019 Referral Information

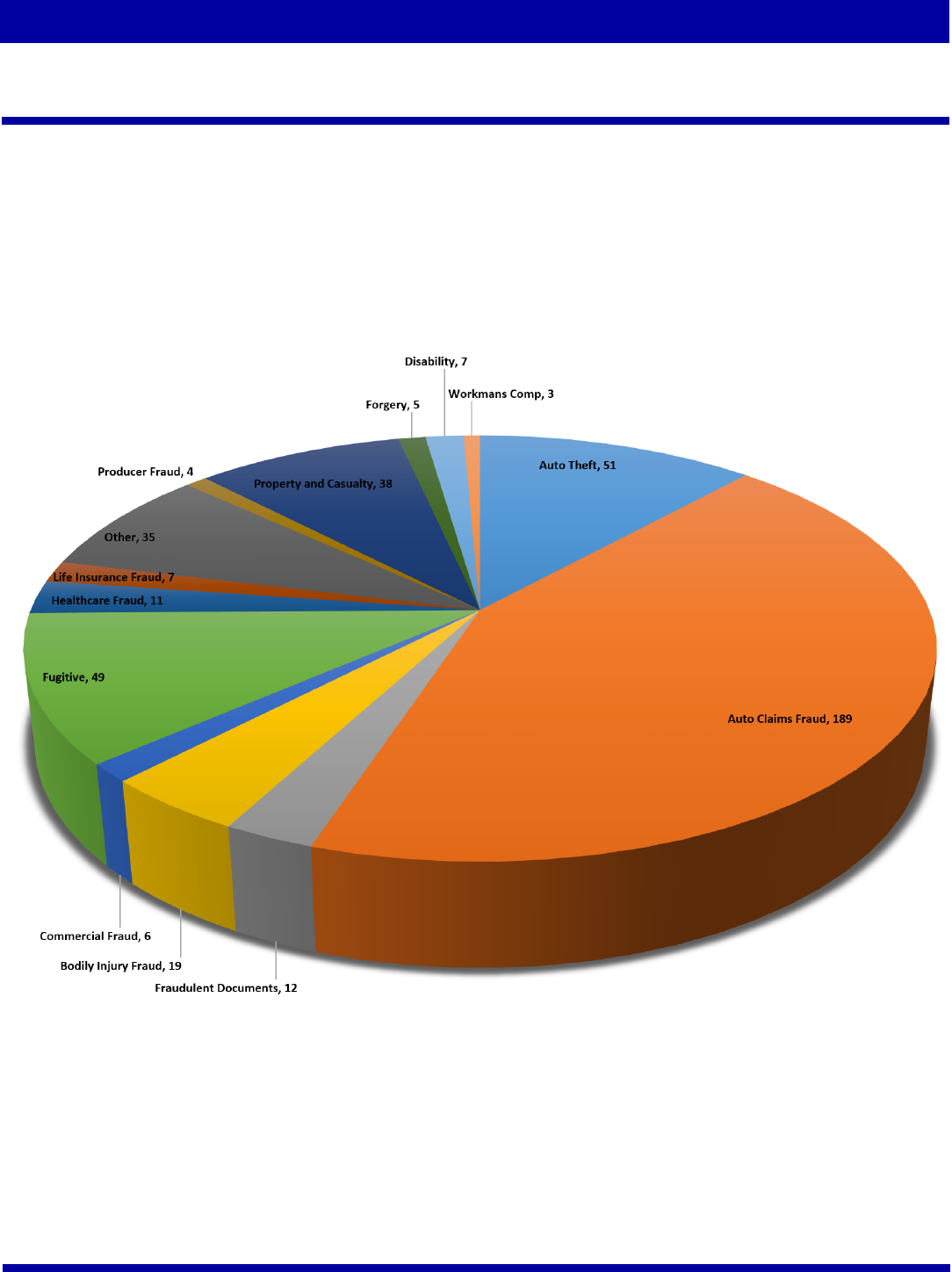

In 2019, 72% of the referrals received from the

Department of Insurance were

related to auto claims fraud, followed by

property & casualty fraud at 10%, healthcare

fraud at 5%, and bodily injury fraud at 5%.

The remaining types listed in the table to the

right make up the remaining 8%.

2019 LDI Referrals & Non-LDI Referrals Received

Type of Invesgaon… LDI Non-LDI

Auto Claims Fraud 788 12

Auto The 1 50

Bodily Injury Fraud 50 1

Catastrophe Fraud 1 0

Commercial Policy Fraud 12 0

Disability Fraud 15 0

Forgery 7 2

Fraudulent Ins. Documents 13 4

Fugive 0 49

Healthcare Fraud 57 0

Life Insurance Fraud 17 0

Other 3 35

Producer Fraud 10 0

Property & Casualty Fraud 112 2

Worker's Compensaon Fraud 4 0

8

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

2019 Referrals Accepted by Type...

9

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

2019 Investigations and Arrests...

Investigations & Incidents Opened 391

Investigations & Incidents Closed 365

Arrests 287

2019 Case Information

Three Year Statistical Profile...

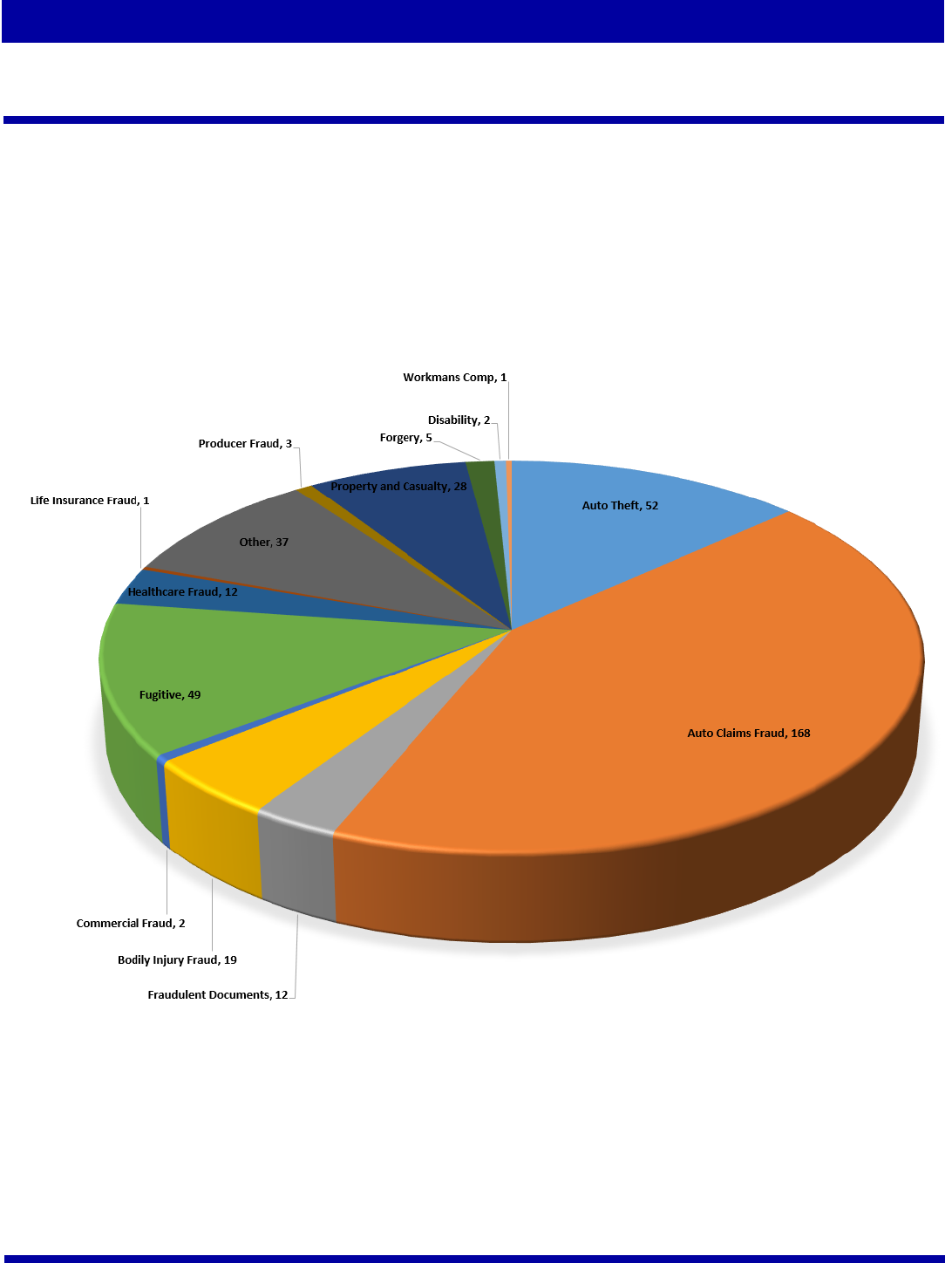

In 2019, the Insurance Fraud and Auto Theft Program opened 391 criminal investigations and closed 365.

Region 1 (Baton Rouge, Covington, New Orleans) accounted for 216 of those investigations, Region 2

(Houma, Lafayette, Lake Charles) recorded 62 investigations opened, and Region 3 (Alexandria, Monroe,

Bossier) initiated 113 investigations. Of the 365 investigations closed, 222 or 61% were closed by arrest.

In 2019, the Program arrested a total of 287 persons throughout the state. Statewide 52% of the arrests

were in Region 1, 16% were in Region 2, and 32% were in Region 3.

The Program opened 44% more investigations in 2019 than in 2018, and the number of investigations

closed increased by 25%. The number of arrests increased by 25% from 2018. A fair portion of the

increase in production can be attributed to the support afforded to the Program by State Police Criminal

Detectives Squads, who were cross-trained to assist with reducing the case backlog. In all, the Criminal

Detectives accounted for 24% of the 44% increase in investigations opened, 17% of the 25% increase in

investigations closed, and 10% of the 25% increase in the number of criminal arrests.

10

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

2019 LSP Investigations Conducted by Type...

11

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

2019 Judicial Actions...

The total number of people adjudicated in 2019

surpassed each of the previous three years. Between

2016 and 2018, the average number of persons

convicted of crimes investigated by the Program was

87 and the average number of people entering a

pretrial intervention program was 20. The number of

convictions in 2019 was 16% higher than the previous

three year average. Persons entering a pretrial

intervention program was 30% higher than the

previous three year average. In 2019, there was a

28% reduction in the amount of prison time ordered

per conviction as compared to the previous three year

average, and a 12% reduction in the amount of

probation time ordered per conviction based on the

three year average.

Convictions 101

Jail Time Ordered 83 years 7 months

Probation Ordered 99 years 8 months

Community Service 506 hours

Pre-Trial Intervention 34 entries

Restitution $105,424

Court Fines $24,361

2019 Judicial Actions

In 2019, the Program had 21.8% of their convictions

declared in Orleans Parish, 11.9% in Caddo Parish,

followed by 9.9% in East Baton Rouge Parish. The

remaining convictions were spread throughout 28

other parishes. The table to the right shows all

convictions and pretrial interventions by parish.

Parish Convictions

Pretrial

Interventions

Acadia 1 0

Ascension 1 2

Assumption 3 2

Bienville 0 1

Bossier 1 0

Caddo 12 0

Calcasieu 3 3

Desoto 1 0

E Baton Rouge 10 4

E Feliciana 2 0

Evangeline 4 4

Franklin 2 0

Jefferson 6 5

Lafayette 4 2

Lincoln 3 0

Morehouse 1 1

Orleans 22 2

Ouachita 2 1

Plaquemines 1 0

Rapides 1 0

Richland 1 0

St. Bernard 2 1

St. Charles 0 1

St. James 1

0

St. Landry 1

0

St. Martin 1

1

St. Mary 2

0

St. Tammany 1

1

Tangipahoa 3

2

Terrebonne

0 1

Union 1

0

Vermillion 5

0

Webster 2

0

W Feliciana 1

0

12

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Unit

2019 Budget Expenditures...

13

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

Region 1 Investigative Highlights

Auto Theft

In August of 2019, Louisiana State Police

received information from the National Insurance

Crime Bureau concerning numerous vehicles with

cloned identities in Baton Rouge and surrounding

areas. State Police teamed up with sheriff’s

offices from East Baton Rouge Parish, East

Feliciana Parish and Forrest County in

Mississippi. On October 30, 2019, multiple

search warrants were served in Louisiana and

Mississippi. Three arrests were made and 18

stolen vehicles were recovered estimated to be

valued at $717,000.

Healthcare Fraud

In January of 2019, Louisiana State Police began

an investigation into allegations of healthcare

fraud regarding Whylithia and Richard Robinson.

A State Police investigation determined Whylithia

and Richard submitted fraudulent and forged

medical invoices and documentation supporting

fictitious claims. The claims were submitted for

both of them, as well as their two minor children.

The loss to the insurance company was

$31,107.34. On September 11, 2019, Whylithia

and Richard Robinson were both charged in

Iberville Parish for Insurance Fraud, Forgery, and

Theft.

Claims Adjuster Fraud

In August of 2019, Louisiana State Police

received a criminal referral alleging criminal

activity by Michelle Lusk, a licensed insurance

agent in Louisiana. Michelle Lusk was employed

to handle workman’s compensation claims for

Louisiana State University. A State Police

investigation determined that Lusk was

fraudulently generating paperwork to justify the

issuance of payments from the university’s

workman’s compensation account. The

investigation also determined that Samantha

Zayak assisted Lusk with the fraud. State Police

obtained warrants in East Baton Rouge Parish

charging Lusk with Theft, Insurance Fraud, and

Forgery. Zayak was charged with Theft. Both

were arrested and booked. The Louisiana

Department of Insurance served Lusk with a

Cease and Desist Order.

Staged Vehicle Crash

In October 2016, Cadja Bourda reported a claim

with a Louisiana insurance company in reference

to an alleged automobile crash. Bourda told the

insurance company she was struck in the rear of

her vehicle by Ann Grant. After the alleged

accident, Cadja Bourda, Shardae Folse, and

Megan Matthews reported claims to the insurance

company. All parties involved indicated that no

one knew any other person in the opposing

vehicle. State Police determined persons in the

opposing vehicles were in communication prior to

the alleged crash. The investigation concluded

that the crash was staged. All three subjects were

arrested for Insurance Fraud in Jefferson Parish,

Louisiana.

Auto Theft

In September 2019, three people carrying candy

boxes stole a 2015 Mercedes-Benz and a 2018

Dodge Charger that were parked in a casino

parking garage in New Orleans. That same day,

officers detained Ditalion Thomas, carrying a

similar candy box, for trespassing on the casino

property. State Police confronted Thomas, who

admitted to being involved in the vehicle thefts

and identified the other two parties as Lataijal

McNeal and Xavier Glaspie. McNeal, Glaspie,

and both stolen vehicles were found by law

enforcement in Tennessee. All three have been

charged with Auto theft in Orleans Parish.

Disability Fraud

In September 2019, Haydee Santana of

Covington, Louisiana, was indicted by a federal

grand jury for Theft of Government Funds.

According to the indictment, Santana applied for

Social Security Supplemental Security Income

disability payments. Santana’s SSI application

allegedly concealed assets. In total, Santana

fraudulently obtained over $31,000.00 in

disability benefits. The U.S. Attorney’s Office

praised the work of the Social Security

Administration, Office of Inspector General, and

the Louisiana State Police.

All persons are presumed innocent until proven guilty.

14

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

Region 2 Investigative Highlights

second time, and the driver fled again. The team

of officers from Abbeville, Kaplan, and State

Police pooled their resources; serving search

warrants for documentary evidence, submitting

evidence for DNA analysis, and conducting

interviews. The officers were able to determine

that one of the occupants of the stolen truck was

Antonio Gilbert. At the conclusion of the

investigation in 2019, State Police arrested

Plowden, Mitchell, and Gilbert on charges ranging

from Criminal Mischief, Simple Obstruction of a

Roadway, Possession of Stolen Property, Reckless

Operation, Filing a False Public Record, and

Insurance Fraud. Since their arrests, Gilbert was

sentenced to five years in prison and three years of

probation, Mitchell was sentenced to two years in

prison and two years of probation; Plowden’s

charges are still pending.

Staged Rental Vehicle Crash

On June 28, 2018, Louisiana State Police received

a criminal complaint concerning allegations of

insurance fraud. The complainant believed a

group of people in Terrebonne Parish staged a

vehicle crash. A State Police investigation

determined that in May of 2018, Heather

Thibodaux, Bonnie Brien, Ashley Burnett,

Fredericka Burnett, and Germaine Johnson

conspired and participated in a staged vehicle.

The crash involved a privately owned vehicle and

a U-Haul rental truck. At the conclusion of the

investigation, all were arrested by State Police, on

charging ranging from Insurance Fraud to Injuring

Public Records.

All persons are presumed innocent until proven guilty.

Vehicle Crash Jump-ins

In 2018, Louisiana State Police received a

complaint concerning a suspicious two-vehicle

crash, which reportedly occurred in Acadia Parish.

The State Police investigation determined that a

crash between vehicles driven by Harris Gobar

and Lonnie Lambert did occur. After, and for

differing reasons, Gobar and Lambert recruited

replacement drivers and additional passengers.

Upon the arrival of law enforcement, the group

falsely identified the drivers and passengers of the

two vehicles. The new drivers were identified as

Jaclin Trahan and Jernai Campbell; additional

passengers included Temesha Lambert and

Belinda Hebert. Lonnie Lambert claimed to be a

passenger rather than a driver. Lonnie and Jernai

claimed to have been injured in the crash; Jernai

even opted to be transported to a hospital for her

injuries. Upon completion of the investigation,

State Police arrested Jernai Campbell, Lonnie

Lambert, Temesha Lambert, Belinda Hebert,

Harris Gobar, and Jaclin Trahan on criminal

charges ranging from Filing a False Police Report

to Insurance Fraud.

Stolen Vehicle and Staged Vehicle Crash

In 2017, Louisiana State Police received a request

for assistance from the Abbeville Police

Department. According to the complaint, the

Abbeville Police Department was called to

investigate a two-vehicle hit and run crash

involving a Nissan passenger car driven by

Shandrea Plowden and occupied by Jordan

Mitchell, and a City of Kaplan truck, which was

later determined to be the subject of a theft. In

speaking with law enforcement from Abbeville

and from the City of Kaplan, Investigators learned

that the crash was captured on a surveillance

camera and that one of the occupants of the stolen

truck had left footwear at the scene. A review of

the surveillance video showed the two vehicles

prior to the crash. The Nissan slowed as the

stolen truck approached from the rear and struck

it. After the strike, the driver and occupant

abandon the stolen truck. Mitchell got their

attention, and one of the occupants returned to the

stolen truck. The stolen truck struck the Nissan a

15

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

Region 3 Investigative Highlights

Life Insurance Application Fraud

On August 14, 2018, Louisiana State Police

received a complaint from the Grant Parish

Sheriff’s Department. The complaint originated

with the death of Keelien Lewis, where Daniel

Aikens attempted to collect $250,000.00 in life

insurance benefits pursuant to a policy Aikens had

taken out on Lewis. A State Police investigation

determined that in October of 2017, Aikens

submitted life insurance applications to Colonial

Insurance for himself, Keelien Lewis, Jonathan

Sanders, and Jason Miles. Aikens, Sanders,

Lewis, and Miles falsely reported themselves as

part owners of a business. The policy required the

insureds to be owners of the business and have at

least ten employees, inclusive of the owners. The

fraudulent applications submitted indicated there

were four equal owners of the business

partnership, and that the business had an

additional six employees. The policies were

issued. In January of 2019, Jonathan Sanders and

Aikens were arrested on State Police warrants

charging them with Insurance Fraud in Rapides.

An additional arrest is expected.

Watercraft Insurance Fraud

On September 5, 2019, Louisiana State Police was

contacted by the Louisiana Department of

Wildlife and Fisheries. Wildlife and Fisheries

agents believed they had credible information

concerning insurance fraud, which they obtained

during the investigation of an alleged boat crash.

A joint State Police and Wildlife and Fisheries

investigation determined that Troy Sproles

reported to Wildlife and Fisheries that he was

involved in a boat crash in Union Parish. After

the loss, Sproles reported to his insurance

company that he lost 16 rods and reels, valued at

approximately $10,000.00. Later that same

evening, Wildlife and Fisheries agents confronted

Sproles and found him to be in possession of the

fishing equipment he reported lost to the insurance

company. At the conclusion of the investigation,

State Police arrested Sproles, charging him with

Insurance Fraud.

Automobile Insurance Fraud

On October 11, 2016, Louisiana State Police

received a criminal referral from the Louisiana

Department of Insurance on behalf of an insurance

company. The complaint alleged Diedra Michelle

Lee intentionally caused injury to her child

following a collision between a City of Shreveport

bus and a privately owned vehicle. Following the

incident, Lee filed fraudulent bodily injury claims

for her daughter and herself. A State Police

investigation determined Lee and her daughter

were passengers on a Shreveport city bus when it

was involved in a crash with another vehicle.

After the crash, Lee caused her daughter’s head to

strike the seat forward of their position. Lee then

made fraudulent insurance claims indicating her

daughter and she sustained injuries in the crash.

On August 7, 2019, Lee was arrested by State

Police and charged with Cruelty to a Juvenile and

two counts of Insurance Fraud. She was booked

into the Caddo Parish Correctional Center.

Healthcare Fraud

In 2019, Louisiana State Police began an

investigation into allegations of healthcare fraud

against Dr. Mary Beth Jones, a licensed

professional counselor. The complainant, an

insurance company doing business in Louisiana,

alleged that Dr. Jones billed an insurance

company for excessive dates of services in

relation to healthcare services she reportedly

rendered to three patients in Bossier Parish in

2017. The State Police investigation concluded

Jones did commit insurance fraud by billing the

insurance company for an inflated amount of

healthcare services in contrast to what services

were actually administered. As a direct result of

her actions, Dr. Jones was paid approximately

$26,261.55 by the insurance company for which

she was not entitled. On August 23, 2019, Dr.

Jones voluntarily surrendered to Bossier Parish

Sheriff Deputies on a State Police warrant

charging her with two counts of Insurance Fraud.

She was booked into the Bossier Parish Jail.

All persons are presumed innocent until proven guilty.

16

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

LAW ENFORCEMENT

TRAINING

One of the ancillary duties of the Louisiana State

Police Insurance Fraud and Auto Theft Program is

to provide education and instruction to State

Police members and local law enforcement to

raise awareness of insurance fraud and auto theft.

To achieve this, the Program offered two

standardized training products: an Auto Theft

Investigations Class and Certification on the

Affidavit of Physical Inspection. These training

modules helped the officers gain confidence in the

investigation of auto theft, in identifying false

claims of auto theft, and in confirming the identity

of a motor vehicle by vehicle identification

number. In 2019, members of the Program

conducted 21 training sessions with a combined

attendance of 395 law enforcement officers.

This year, the Program implemented two new

training strategies. The Program, in conjunction

with the National Insurance Crime Bureau, hosted

a three day Insurance Fraud and Auto Theft

Summit. The training was made available and

free of charge to all Louisiana law enforcement,

and was attended by 41 officers. The Program

also conducted a one day Insurance Fraud and

Auto Theft Program in-service. The in-service

was designed to review criminal statutes

associated with the investigation of insurance

fraud and auto theft, and provide a platform for

officers to present summaries on significant

investigations for discussion. The in-service was

attended by members assigned to the program as

well as select members of the State Police

Criminal Investigations Division.

State Police sent Sergeants Michael Wilkerson

and William Latham to the 2019 National

Coalition Against Insurance Fraud annual meeting

in Washington DC. Their presence gave State

Police the opportunity to learn about current

national legal developments in the fight against

fraud, show State Police’s support of the

Coalition’s efforts to combat insurance fraud, and

to showcase our Program, processes, and results.

AUTO THEFT

The investigation of vehicle theft is a core mission

of the Insurance Fraud and Auto Theft Program.

The Program has made investments to enhance

State Police’s ability to identify and recover stolen

vehicles, and to capture persons stealing and

possessing these vehicles.

As in years past, the National Insurance Crime

Bureau has been a tried and true supporter of our

vehicle theft mission.

2019 IFAT Program Results

Stolen Vehicles Recovered 197

Value of Recoveries $3,408,149.00

17

LOUISIANA STATE POLICE 2019 Annual Report

Insurance Fraud / Auto Theft Program

Additions

Trooper First Class Daniel Graf transferred to the

New Orleans Field Office from Troop B Patrol in

the spring of 2019.

Senior Trooper Cedric Skinner transferred to the

New Orleans Field Office from Troop B Patrol in

the spring of 2019.

Trooper First Class Leander Journee transferred

from the Criminal Intelligence Unit to the New

Orleans Field Office.

Departures

Senior Trooper Cedric Skinner was promoted to

Sergeant and assigned to Troop N Patrol.

Criminal Investigator Edward Smith transferred

from the Insurance Fraud Squad to the Criminal

Detectives Squad within the Breaux Bridge Field

Office.

Criminal Investigator Nicholas O’Connor

transferred from the New Orleans Field Office to

the Criminal Intelligence Unit.

Team Member

Spotlights

Trooper First Class Jeffrey Theriot is a member

of the Louisiana State Police Insurance Fraud/Auto

Theft Program in New Orleans. Prior to coming to

the Louisiana State Police, Trooper Theriot was a

member of the Slidell Police Department in

Louisiana, where he served for 10 years. During

his assignment at the Slidell Police Department,

Trooper Theriot was awarded Officer of the Year.

He was accepted to attend the Louisiana State

Police Academy and graduated in April 2015;

afterwards, being assigned to Troop L as a

patrolman. In the fall of 2018, Trooper Theriot

transferred to his current assignment as an auto

theft and insurance fraud investigator in the New

Orleans Field Office. In 2019, Trooper Theriot

initiated 46 criminal investigations, recovered 47

stolen vehicles, and arrested 40 people for

insurance fraud, auto theft, and other criminal

offenses.

One of Trooper Theriot’s investigations disrupted

an international criminal organization that was

utilizing stolen or synthetic identities to

fraudulently purchase vehicles for international

export. Trooper Theriot’s investigation fostered

close working relationships with local and federal

partners, as well as affected companies in the

insurance and automotive industries. In the near

future, he plans to continue fostering partnerships

and implement additional measures such as the

use of computer driven evidence, both of which

are intended to build better criminal cases for

prosecution.

Investigator Edward Smith was hired by

Louisiana State Police in August of 2015 and

assigned to the Insurance Fraud and Auto Theft

Program. He was assigned to the Breaux Bridge

Field Office. Investigator Smith previously

worked for the Opelousas Police Department and

for the St. Landry Parish Sheriff’s Office; gaining

seven years of experience in all facets of criminal

investigations. In addition to his Program

assigned investigations, Investigator Smith

assisted the Breaux Bridge CID office by

responding to aid criminal detectives, criminal

intelligence agents, and narcotics officers in their

assigned duties and responsibilities.

Investigator Smith served as an instructor for local

P.O.S.T. academies, leaning on his experience to

provide education on the topics of auto theft

investigations and physical inspection

certifications. Investigator Smith’s thoroughness,

attention to detail, team-oriented disposition, and

tireless efforts made substantial contributions to

the Program and the Breaux Bridge Field Office.

In light of his efforts and professionalism,

Investigator Smith was awarded the Louisiana

State Police Meritorious Service Award in 2019.

Investigator Smith will be missed, having

transferred from the Program in September of

2019.

18

OFFICE OF THE ATTORNEY GENERAL 2019 Annual Report

Louisiana Attorney General

Jeff Landry’s Criminal Division

INSURANCE FRAUD SUPPORT UNIT

2019 ANNUAL REPORT

19

OFFICE OF THE ATTORNEY GENERAL 2019Annual Report

Insurance Fraud Support Unit

Louisiana Attorney

General Jeff Landry

is proud of the

efforts of his

Insurance Fraud

Support Unit (the

Unit). Through

prosecutions and the

recovery of hundreds

of thousands of

dollars in restitution,

the unit is a valuable

asset in the fight

against criminals

who defraud the

State and its taxpayers. The Unit operates as part

of a tri-agency task force created by the

Legislature and dedicated solely to fighting

insurance fraud in Louisiana.

The Unit fulfills three primary responsibilities:

providing legal advice and consultation in

insurance fraud matters to the other two task force

agencies – the Louisiana State Police (LSP) and

the Louisiana Department of Insurance (LADOI);

prosecuting individuals statewide charged with

insurance fraud; and presenting insurance fraud

information and training to the insurance industry

along with state and federal agencies.

The primary objective of the Unit is to provide

superior legal representation to the LADOI and

LSP in insurance fraud investigations and

prosecutions. Assistant Attorneys General

assigned to the Unit prosecute violations of

Louisiana’s criminal laws under Titles 14, 22, 23,

and 47 by conducting – or assisting in – criminal

prosecutions upon the recusal or assistance

request of local district attorneys and by providing

legal support to law enforcement agencies

investigating criminal insurance fraud.

The Unit also works closely with the Louisiana

Department of Revenue (LDR). History shows

that if criminals are defrauding insurance

companies, then those same criminals are likely

defrauding the State when it comes time to pay

their taxes. This is why the Unit entered into an

agreement with LDR to investigate and assist in

the prosecution of all tax-related fraud in

Louisiana. These prosecutions are of tax

preparers, who receive a fee for preparing

Louisiana state tax returns for others, and

individuals who commit tax evasion and/or fraud

through the filing of their personal Louisiana state

tax returns.

The Unit may handle insurance fraud cases that

begin with a complaint made directly to the

Attorney General’s Office. Additionally, the Unit

may consult with – and provide legal support to –

all local and state law enforcement agencies

regarding insurance fraud matters and questions.

This includes, but is not limited to, reviewing

drafts of arrest and search warrants; conducting

legal research; and evaluating cases from a

prosecutor’s perspective (i.e., whether there is

sufficient evidence to satisfy legal burdens of

proof). Due to the complex nature of some of the

cases handled – the local district attorney may be

consulted while the investigation is still ongoing

to obtain the necessary authority to offer a plea

agreement, immunity to a target of the

investigation to secure his cooperation concerning

other targets, or request to prosecute the case

outright.

The Unit’s attorneys attend regularly scheduled

intelligence-sharing meetings hosted by LSP in

Baton Rouge. These meetings are attended by

members of special investigative units from many

insurance companies that do business in

Louisiana. Under a statutory grant of immunity

from civil liability, these personnel share

information with law enforcement regarding fraud

trends and specific cases being worked. This level

of information sharing allows all participants in

the Louisiana Insurance Fraud Task force to stay

abreast of the constantly evolving methods that

offenders employ to commit fraud, and has

resulted in the successful prosecutions of several

staged accident rings, producer fraud cases, health

care provider fraud cases, and theft of equipment

and automobiles.

The Unit’s section chief has given presentations

on insurance fraud prosecution issues before

20

OFFICE OF THE ATTORNEY GENERAL 2019Annual Report

Insurance Fraud Support Unit

organizations such as the National White Collar

Crime Center, the Louisiana Association of Self

Insured Employers, the Orleans Parish District

Attorney’s Economic Crimes Unit, the

Insurance Security Association, the American

Council of Life Insurers, the National Insurance

Crime Bureau (NICB), the Louisiana District

Attorneys’ Association, the LADOI, and the

Louisiana Claims Association.

All of the Unit’s attorneys attend continuing

legal education training from various sources,

including the National Association of Insurance

Commissioners (NAIC) and other NICB or

NAIC sponsored training. Moreover, the Unit is

connected with the Homeland Security

Information Network – enabling attorneys to

track insurance fraud cases from start to finish.

This network allows everyone involved with the

cases to have access to relevant information at

all times. The Unit’s section chief also serves on

the board of the Louisiana Auto Theft and

Insurance Fraud Prevention Authority

(LATIFPA).

As part of our ongoing commitment to working

with insurers operating in Louisiana, as well as

fostering the professional development and

expertise of our individual Assistant Attorneys

General – the Unit attended a law enforcement

summit event hosted by Blue Cross/Blue Shield

on November 7, 2019. Participation in this day-

long meeting offered special training to law

enforcement in insurance and healthcare fraud-

related issues.

All Assistant Attorneys General assigned to the

Unit are expected to handle opinion requests.

When opinions are assigned, work is done with

law clerks to research and draft accurate

responses to the requests.

BASIC INFORMATION

ABOUT THE UNIT

Statutory Authority for Operations

La. Const. Art. IV, Section 8 provides, in pertinent

part:

As necessary for the assertion or protection of any

right or interest of the state, the attorney general

shall have authority

…….

(2) upon the written request of a district

attorney, to advise and assist in the prosecution

of any criminal case; and

(3) for cause, when authorized by the court

which would have original jurisdiction and

subject to judicial review, (a) to institute,

prosecute, or intervene in any criminal action

or proceedings, or (b) to supersede any

attorney representing the state in any civil or

criminal action.

La. Code of Criminal Procedure Article 682 provides,

in pertinent part:

When a district attorney is recused…it shall be

the duty of the Attorney General to appoint a

member of his staff…to act in the place of the

recused district attorney.

La. R. S. 36:702(E) provides:

There shall be within the Department of

Justice a criminal division. It shall be

responsible for criminal appeals, amicus curiae

briefs in criminal prosecutions, habeas corpus

defense, assistance to district attorneys in

criminal cases, criminal prosecution, public

corruption, institutional and insurance fraud

cases, and extraditions, in accordance with

Article IV, Section 8 of the Constitution of

Louisiana.

21

OFFICE OF THE ATTORNEY GENERAL 2019Annual Report

Insurance Fraud Support Unit

Additional Statutory Authority

for Insurance Fraud Support

Unit Operations

La. R. S. 40:1421 et seq.

Primary Purpose of Insurance Fraud

Support Unit

To provide superior legal representation to LADOI

and LSP in insurance fraud investigations and

prosecutions.

To attend LADOI and LSP meetings to screen

insurance fraud referrals.

To prosecute tax fraud cases pursuant to contract with

LDR.

Insurance Fraud Expenditures

January 2019 to December 2019

Salaries $498,244.00

Related Benefits $245,233.00

Travel $15,694.00

Operating Services $17,216.00

Supplies $1,253.00

Other Charges $57.00

Acquisitions $2,628.00

IAT Charges $45,877.00

TOTAL $826,202.00

22

OFFICE OF THE ATTORNEY GENERAL 2019Annual Report

Insurance Fraud Support Unit

STATISTICAL

INFORMATION FOR THE

UNIT

A strategic objective for the Unit is to provide

legal support to law enforcement agencies

investigating criminal insurance fraud referrals

by responding to requests for legal

consultation within two working days and by

attending 90% of intelligence-sharing meetings

hosted by the LSP Insurance Fraud Unit. In

2019, the Unit’s attorneys attended all

intelligence sharing meetings with the LADOI

and the LSP fraud units.

During the 2019 calendar year, the Unit not

only reached the standard of 95% percent of

requests for legal consultation responded to

within 2 working days; but also exceeded this

goal in handling 100% of all requests for legal

consultation within two working days.

During the 2019 calendar year, 391 new fraud

cases were opened through the operation of the

multi-agency Insurance Fraud Task Force. 365

cases were closed as either a conviction, a

pretrial agreement, or a consult. As of

December 31, 2019, the Task Force was

working 87 active open cases of fraud.

The Unit meets the State goal for Crime and

Safety Reform of bringing security to all

Louisiana citizens by protecting our taxpayers

from insurance related fraud. LADOI estimates

that there are over $500 million dollars lost

annually in Louisiana to insurance fraud, as it

pertains to casualty and property claims. This

does not include healthcare fraud which is

estimated to be about $1.5 billion in Louisiana

alone. The typical Louisiana household pays

almost $1,000 a year in fraud-related charges

passed on to them as consumers.

OTHER 2019

ACCOMPLISHMENTS

During the 2018 calendar year, the Unit entered into a

prosecution assistance agreement with the 19th

Judicial District Attorney’s Office – allowing

Assistant Attorneys General to prosecute all insurance

fraud cases occurring in East Baton Rouge Parish (or

where East Baton Rouge Parish is a proper

jurisdiction). This agreement has resulted in 19 active

prosecutions of Task Force cases in 2019. These new

cases represent actual and potential fraud amounts of

well over a million dollars. Six different Assistant

Attorneys General are currently prosecuting Task

Force cases, allowing the development of experience

and expertise in insurance fraud cases on a broader

level in the Criminal Division of the Attorney

General’s Office.

Finally, the Unit was successful last year in recovering

restitution of over a hundred thousand dollars to

various victims – including individuals, insurance

companies, and LDR.

The Unit continues its work of protecting consumers

and insurers in Louisiana by actively working with its

partners in the State Insurance Fraud Task Force, and

by fostering relationships with insurers to ensure that

their interests in deterring and prosecuting fraud are

fully represented in the justice system.

23

2019 Annual Report

Louisiana Department of Insurance

Division of Insurance Fraud

24

LOUISIANA DEPARTMENT OF INSURANCE 2018 Annual Report

Insurance Fraud Support Unit

Claims Fraud...

The Division of Insurance Fraud received 2,330 reports of suspected

fraudulent claims during 2019. The majority were from insurance companies

in accordance with La. R.S. 22:1926. Since its inception in 2007, the

Division of Insurance Fraud database has accumulated 37,934 entries of

suspected fraudulent claims.

During 2019, the LDI Division of Insurance Fraud referred 1090 claim fraud

investigations to the State Police. There were 171 arrests resulting in 302

charges for numerous crimes as a result of criminal referrals related to

suspected fraudulent insurance claims.

*An arrest may include multiple charges.

Charges Against Claimants or Licensees

Resulting from Referrals by Category

Category

Number of

Charges*

Percent of

Crimes

Insurance Fraud 142 47%

Automobile Insurance Fraud 60 19.9%

Forgery 43 14.2%

Filing False Public Records 17 5.6%

Theft 14 4.6%

Injuring Public Records 10 3.3%

Criminal Conspiracy 6 2.0%

Contributing to the Delinquency of a Juveniles 3 1.0%

False Auto Theft Affidavit 1 .5%

Accessories After the Fact 1 .5%

Criminal Damage to Property with Intent to Defraud 1 .5%

Cruelty to Juveniles 1 .5%

Improper Lane Usage 1 .5%

25

LOUISIANA DEPARTMENT OF INSURANCE 2019 Annual Report

Insurance Fraud Support Unit

2019 Producer, Adjuster and Company Fraud Actions...

Background Investigations…

The Division of Insurance Fraud investigates the backgrounds of companies, officers, directors, utilization

review organizations, claims adjusters and other entities applying to conduct the business of insurance in

Louisiana. This includes changes of officers and directors of domestic companies currently authorized to do

business in the state.

Louisiana Automobile Theft and Insurance Fraud Prevention Authority...

In 2010, legislation was passed to provide a portion of these funds to LATIFPA, a public agency within the

Department of Insurance. La. R.S. 22:2131 established LATIFPA, for the purpose of combating motor

vehicle insurance fraud, including fraud by theft and other criminal acts. La. R.S. 22:2134 and La. R.S.

40:1428, amended in 2010, authorized the Commissioner of Insurance to withhold $187,000 each fiscal year

from the insurance fraud assessment to provide funding for LATIFPA. This allocation was used for conducting

educational and public awareness programs designed to inform the citizens of the state about methods of

preventing motor vehicle theft and combating insurance fraud. During Calendar Year 2019, LATIFPA

expended $189,197.00, to raise public awareness about insurance fraud and vehicle theft and to raise

awareness among teen drivers about the consequences of vehicle theft and vehicle theft prevention.

For more information on the Fraud Division and LATIFPA, please refer to the 2018—2019 Louisiana

Department of Insurance Annual Report.

Action Number

Number of Investigations Opened 148

Fines 8

License Revocations 11

License Suspensions 3

Cease and Desist Orders Served 5

Criminal Referrals to Law Enforcement 8

Arrests Made as a Result of Criminal Referrals 2

Action Number

Company Applications Received 115

Company Applications Approved 115

Company Biographical Affidavits Received 966

Company Biographical Affidavits Approved 954

26

LOUISIANA DEPARTMENT OF INSURANCE 2019 Annual Report

Insurance Fraud Support Unit

Calendar Year 2019 Budget Expenditures...

Note: This amount does not include the $189,197.00 shown

above for the LA Automobile Theft Insurance Prevention Au-

thority.

Expenditure Category Amount

Salaries Classified—Regular 594,227.11

Salaries Classified—Termination 787.54

Salaries Unclassified—Regular 137,074.17

Salaries Unclassified—Overtime 0.00

Wages 7,908.00

Wages—Overtime 420.00

Retirement Contr—State Emp 287,681.22

Post Retirement Benefits 3,754.80

FICA Tax 516.34

Medicare Tax 10,019.08

Group Insurance 67,216.46

Total Personal Services $1,109,604.72

In-State Travel—Administrative 0.00

In-State Travel—Conf, Conv 1,340.00

In-State Travel—Field 582.00

Out-of-State Travel—Admin 1,172.64

Out-of-State Travel—Conf, Conv 3,615.51

Total Travel $6,710.15

Printing 55.00

Rentals—Buildings 1,532.56

Rentals—Others 31.88

Dues and Subscriptions 4,206.00

Mail, Delivery, and Postage 6,862.39

Operating Services—Misc 10.50

Total Operating Services $12,698.33

Operating Supplies—Computers 719.98

Operating Supplies—Auto 347.91

Operating Supplies—Other 96.87

Total Supplies $1,164.76

IAT—Printing 480.00

IAT—Postage 152.11

Total IAT $832.44

TOTAL DIVISION OF INSUR-

ANCE FRAUD EXPENDITURES

$1,130,810.40

DIVISION OF INSURANCE FRAUD

Total Expenditures $1,130,810.40

Means of Financing

Insurance Fraud Invesgaon Fund $624,168.00

LDI Self-Generated Funds $506,642.40

Total Means of Financing $1,130,810.40

LA AUTOMOBILE THEFT AND INSURANCE FRAUD

PREVENTION AUTHORITY

Amount Expended of the $227,000 Appropriaon

LATIFPA Fund $189,197.00

27

2019 Annual Report

Report Insurance Fraud to the

Louisiana Department of Insurance

Insurance Fraud is ANY intentional misrepresentation

to profit from an insurance entity.

Report Fraud Online:

http://www.ldi.la.gov/consumers/insurance-fraud/report-insurance-fraud

By Phone:

(225) 342-4956 or (800) 259-5300

By Mail:

P.O. Box 3096, Baton Rouge, La 70821

Physical Address:

1702 N. Third Street, Baton Rouge, La 70802

Referrals are vetted through the Louisiana Department of Insurance (LDI). When criminal activity is

suspected LDI submits the referral to the Louisiana State Police Insurance Fraud and Auto Theft Unit for

further investigation and possible arrest(s). The Louisiana Attorney General’s Office is notified when a

referral is submitted to Louisiana State Police.

HELP LOUISIANA BOOT OUT FRAUD!

LOUISIANA INSURANCE FRAUD TASK FORCE

LOUISIANA STATE POLICE

Insurance Fraud & Auto Theft Program

7919 Independence Blvd., A-19, Baton Rouge, LA 70806

(225) 925-3536

www.lsp.org

LOUISIANA OFFICE OF THE ATTORNEY GENERAL

Insurance Fraud Support Unit

1885 N. Third Street, Baton Rouge, LA 70802

(225) 326-6000

www.ag.state.la.us

LOUISIANA DEPARTMENT OF INSURANCE

Insurance Fraud Section

Louisiana Auto Theft and Insurance Fraud Prevention Authority

1702 N. Third Street, Baton Rouge, LA 70802

(225) 342-4956

www.ldi.la.gov

This public document was published at a total cost of $361.19 One-hundred (100) copies of this public document were published in this first printing at a cost of

$361.19 The total cost of all printings of this document, including reprints is $361.19 This document was published by OTS-Production Support Services, 627

North 4th St., Baton Rouge, LA 70802 for the Louisiana State Police, Criminal Investigations Division, 7919 Independence Blvd., Baton Rouge, LA, 70806 to meet

the requirement for an annual report of activities for the Insurance Fraud Task Force under the authority of L.R.S. 40:1427. This material was printed in accord-

ance with the standards for printing by state agencies established in R.S. 43:31. Printing of this material was purchased in accordance with the provisions of Title

43 of the Louisiana Revised Statutes.

© Photo by Michelle Cloud