Property Tax Reductions to

Diminish as Housing Market Improves

MAC TAYLOR • LEGISLATIVE ANALYST • MAY 5, 2014

Executive Summary

Property Tax Reductions for Millions of Properties Due to Real Estate Crisis. e real estate crisis

that unfolded during 2007 and 2008 aected millions of California property owners and thousands of

local governments. Alongside its broader economic eects, which included widespread foreclosures,

reduced construction activity, and diminished household wealth, the decline in property values resulted

in temporary property tax reductions for 3.2million properties—about 2.6million homes and 600,000

other properties. ese property tax reductions were required by Proposition8 (1978), which modied

the provisions of Proposition13 to explicitly allow for such reductions when property values fall.

Local Revenues Reduced by Billions of Dollars. For homes that received property tax reductions

in 2013-14, the average homeowner received a $1,600 reduction in his or her property tax payment. For

other properties that received property tax reductions—mainly apartments, commercial buildings,

industrial facilities, and agricultural land—the average owner received a $7,500 property tax reduction.

In total, temporary property tax reductions depressed local government property tax revenues by an

estimated $7billion in 2013-14, amounting to a 15percent reduction statewide.

Real Estate Market Recovery Means Large Property Tax Increases for Many. e state’s real estate

markets are recovering. Home values increased 12percent during 2012, yet property taxes for most

property owners were largely unaected. is is because state law limits property tax increases for most

properties to 2percent each year. However, taxes on properties with temporary tax reductions under

Proposition8 can increase faster than 2percent each year. Property taxes for these properties increase

based on the property’s market value because these properties are assessed at market value each year

that they receive a reduced assessment. Real estate improvements during 2012 resulted in property tax

increases ranging from 5percent to 20percent for many of these properties in 2013-14. Looking ahead,

property tax payments for many owners that received temporary property tax reductions during the real

estate crisis could increase by more than 10percent annually for the next several years. ese increases

likely will cause local property tax revenues to grow swily over the next several years as well.

Introduction

For many California taxpayers, the property

tax is one of the largest tax payments they make

each year. For thousands of California local

governments—K-12 schools, community colleges,

cities, counties, and special districts—property tax

revenues form the foundation of their budgets each

year. Despite the major role that property taxes

play in California nance, many issues related to

this system are complex and not well understood.

e purpose of this report is to highlight one

such issue—reduced assessment properties

under Proposition8 (1978). is report describes

California’s property tax assessment system and

details how it responded to the recent real estate

crisis. It also reviews how temporary property tax

reductions aected taxpayers, local governments,

and the state. Lastly, it highlights how this system is

responding to the recent and widespread recovery in

real estate prices.

Property Taxes Are a Major Revenue Source for

Local Governments. e property tax is California’s

second largest source of tax

revenue. About $50billion

in property taxes each year is

collected and distributed to

local governments—including

counties, cities, school and

community college districts

(schools), and special

districts. Figure1 shows how

property tax revenues were

distributed statewide to these

governments in 2012-13.

Property taxes are collected

by the county and distributed

to local governments within

that county. e share of

countywide property taxes

each type of local government

receives varies in each county.

Property Taxes Also Aect the State Budget.

Under the state’s education nance system, schools

receive a certain level of general purpose funding, as

specied in the annual budget act. Schools receive

this funding from a combination of local property

tax revenue and state General Fund revenues. If

a school’s property tax revenue is insucient to

achieve the specied funding level, the state provides

General Fund revenue to meet this requirement.

Local property taxes therefore aect the state budget

because increases in local property tax revenue

allocated to schools typically oset state spending on

education.

How Does California’s Property

Tax System Work?

Most Property Taxed Based on Its Purchase

Price. In California, owners of real property (land

and buildings) pay an annual one percent tax based

on their property’s taxable value, or “assessed value.”

Proposition13 (1978) established the process county

ocials use to determine the assessed value of real

How Are Property Taxes

Allocated Among Local Governments?

a

2012-13

Figure 1

a

Amounts shown reflect the percentage of total revenue from the 1 percent basic rate and

voter-approved debt rates.

Schools and

Community Colleges

Cities

Special Districts

Former

Redevelopment

Obligations

Counties

Graphic Sign Off

Secretary

Analyst

M PA

Deputy

ARTWORK #140251

Template_LAOReport_mid.ait

2 LegislativeAnalyst’sOfcewww.lao.ca.gov

AN LAO BRIEF

property. Under this system, when real property is

purchased, it gets an assessed value that is equal to

its purchase price, or “acquisition value.” Each year

thereaer, the property’s assessed value increases

by 2percent or the rate of ination, whichever is

lower. is process continues until the property is

sold, at which point it again is assessed to its most

recent acquisition value. In other words, a property’s

assessed value resets to market value each time it is

sold.

In most years under this assessment practice, a

property’s market value is greater than its assessed

value. is occurs because assessed values increase

by no more than 2percent per year, but market

values tend to increase faster. us, as long as the

property does not change ownership, its assessed

value increases predictably each year and is

unaected by faster increases in its market value.

For example, Figure2 shows how a hypothetical

property purchased in 1995 for $185,000 would be

assessed in 2012, aer having been sold in 2002

and reassessed at that time to its purchase price of

$300,000. In this example, the property is assessed at

its Proposition13 value each year.

What Happens When a Property’s Value Falls

Below its Proposition13 Value? When real estate

values decline, a property’s market value may fall

below its Proposition13 value, which is based on the

property’s most recent acquisition value. Without

an adjustment to its assessed value, the property

would be taxed based on an amount greater than

it is worth. In these events, county ocials reduce

the assessed value of a property by lowering it

from the property’s adjusted acquisition value

under Proposition13 to its current market value.

Properties that receive lower assessed values are

called Proposition8 “reduced assessment properties”

aer Proposition8, which explicitly allows for this

assessment reduction. Due to the recent downturn

in the state’s real estate markets, one-quarter of all

properties—about 3.2million—have assessment

reductions under Proposition8 in 2013-14.

Most Property Taxed Based on its Purchase Price

Figure 2

ARTWORK #140251

100,000

200,000

300,000

400,000

500,000

$600,000

1995 1997 1999 2001 2003 2005 2007 2009 2011

Property Purchased in 1995

Assessed at acquisition value

Property Sold in 2002

Reassessed to acquisition value, then

increases by up to 2 percent annually

Market Value

Increases or decreases based

on local real estate conditions

1996 1998 2000 2002 20122004 2006 2008 2010

Assessed Value

Proposition 13 Value

Increases by a maximum

of 2 percent each year

Graphic Sign Off

Secretary

Analyst

Director

Deputy

www.lao.ca.govLegislativeAnalyst’sOfce 3

AN LAO BRIEF

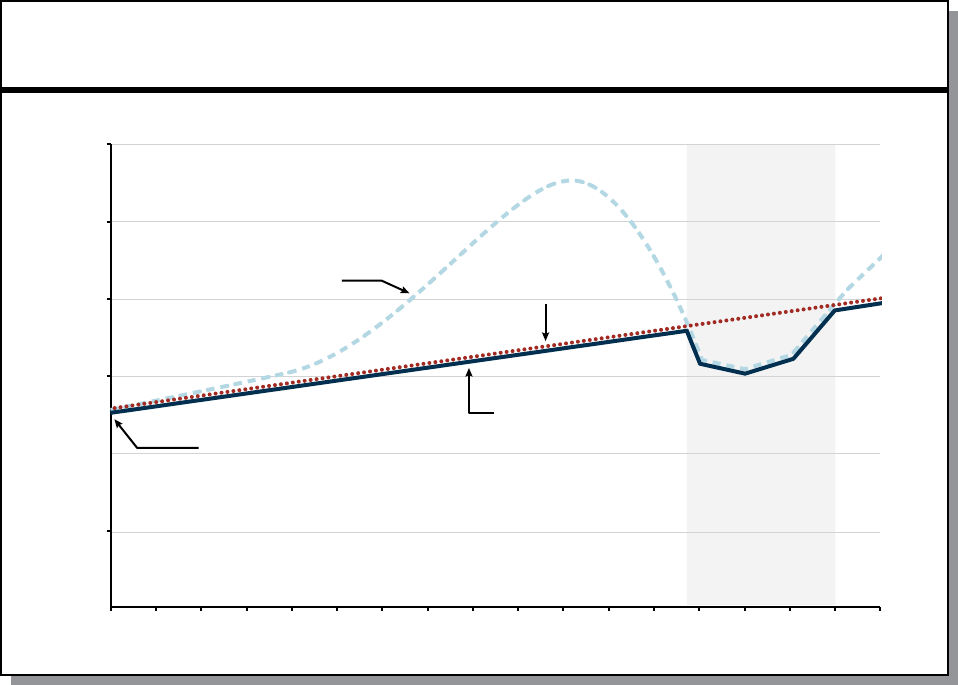

Figure3 illustrates the assessment of a

hypothetical Proposition8 reduced assessment

property over time. e market value of the

property purchased in 1995 stays above its

Proposition13 assessed value through 2007. en,

a signicant decline in its market value drops the

property’s market value below its Proposition13

assessed value. At this time, the property

receives a reduced assessment that is less than its

Proposition13 value. For three years, the property

is assessed at market value, which may increase or

decrease by any amount. By 2012, the property’s

market value has risen to what its assessed value

would have been under Proposition13. In later

years, the property’s assessed value is determined

by its original acquisition price adjusted upward

each year by as much as 2percent. In this example,

the property is assessed at its Proposition13 value

in some years and its market value in others.

Proposition8 During the Real Estate Crisis

Many Property Owners Purchased During

the Real Estate Boom. e recent real estate

crisis unfolded aer several years of pronounced

real estate activity during the mid-2000s.

Unprecedented new construction, home price

increases, and home sales levels characterized this

boom. Figure4 shows these trends for: (1)single-

family homes built, (2) existing single-family

homes sold, and (3) the median single-family home

sales price each year.

One important outcome of this housing

boom was that many Californians became recent

homeowners and most of them bought at or near

peak home prices. is interaction would have

signicant property tax consequences. As the

housing crisis hit in 2007, many homeowners,

especially recent buyers, had high acquisition

values for property tax purposes. Also, because

ARTWORK #140251

Property is Taxed at the Lower of Market Value or Proposition 13 Value

Figure 3

100,000

150,000

200,000

250,000

300,000

$350,000

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Market Value

Increases or decreases based

on local real estate conditions

Property Purchased

Assessed at acquisition value

Proposition 8

Reduced Assessment

Property assessed

at market value

Proposition 13 Value

Increases by a maximum of

2 percent each year

Assessed Value

Graphic Sign Off

Secretary

Analyst

Director

Deputy

4 LegislativeAnalyst’sOfcewww.lao.ca.gov

AN LAO BRIEF

Single-Family Homes Built

Existing Single-Family Homes Sold

Median Single-Family Home Sales Price

Unprecedented Housing Activity During Mid-2000s

Figure 4

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

180,000

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

100,000

200,000

300,000

400,000

500,000

600,000

700,000

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

100,000

200,000

300,000

400,000

500,000

$600,000

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

Graphic Sign Off

Secretary

Analyst

M PA

Deputy

ARTWORK #140251

Template_LAOReport_fullpage.ait

www.lao.ca.govLegislativeAnalyst’sOfce 5

AN LAO BRIEF

they purchased near the peak, market values

for these homes were similar to their assessed

values. Many of these newer owners would receive

Proposition8 reduced assessments as the real estate

crisis unfolded.

e Number of Proposition8 Properties

Increased Dramatically During the Crisis.

Figure5 shows the number of properties with

reduced assessments under Proposition8. During

the housing boom between 2002 and 2005, only

3percent of properties on average had reduced

assessment each year. As real estate values fell in

2007 and 2008, the share of properties with reduced

assessments increased tenfold. At its peak in

2012-13, about 3.7million properties, or one-third

of all properties, had reduced assessments.

Concentrated in Counties Hardest Hit

by Housing Crisis. Not surprisingly, reduced

assessment properties were concentrated in

counties hardest hit by the real estate crisis, where

price increases had been greatest during the

mid-2000s. Construction contractors, responding

to price signals at the time, built signicant new

commercial and residential developments in these

areas. Figure6 shows the relationship between

home price declines and the onset of reduced

assessments for counties with the highest shares

of reduced assessments. In particular, it shows (1)

the decline from peak to bottom for median single-

family home sales price and (2) the percentage of

properties in that county that received a reduced

assessment in 2013-14. Figure7 (see page 8), for

comparison, shows a statewide perspective of the

share of properties in each county that received a

reduced assessment in 2013-14.

Concentrated Among Single-Family Homes.

Most of the Proposition8 reduced assessment

properties are single-family homes. Homes and

condominiums make up about 80percent of

properties with reduced assessments. e rest

consists mainly of apartments, commercial

buildings, industrial facilities, and agricultural land.

Number of Proposition 8 Properties

Increased Dramatically During the Real Estate Crisis

Figure 5

Graphic Sign Off

Secretary

Analyst

M PA

Deputy

Template_LAOReport_large.ait

ARTWORK #140251

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

(In Millions)

94-95 95-96 96-97 97-98 98-99 99-00 00-01 01-02 02-03 03-04 04-05 05-06 06-07 07-08 08-09 09-10 10-11 11-12 12-13 13-14

6 LegislativeAnalyst’sOfcewww.lao.ca.gov

AN LAO BRIEF

Proposition 8 Properties Concentrated in Counties Hardest Hit by Housing Crisis

Figure 6

Median Single-Family Home Sales Price

Percentage of Properties With

Reduced Assessments in 2013-14

Stanislaus

Riverside

San Joaquin

Contra Costa

Placer

Fresno

El Dorado

$370K

$430K

$430K

$920K

$530K

$310K

$370K

Percentage Decline

(Peak to Bottom)

65%

60%

65%

48%

53%

58%

35%

51%

44%

43%

42%

40%

39%

38%

PEAK

$130K

$170K

$150K

$480K

$250K

$130K

$240K

BOTTOM

Graphic Sign Off

Secretary

Analyst

M PA

Deputy

ARTWORK #140251

www.lao.ca.govLegislativeAnalyst’sOfce 7

AN LAO BRIEF

Alameda

Stanislaus

San

Joaquin

Calaveras

Solano

Marin

San Francisco

San Mateo

Santa Cruz

Santa

Clara

Del

Norte

Siskiyou

Modoc

Trinity

Shasta

Lassen

Humboldt

Tehama

Plumas

Mendocino

Glenn

Butte

Sierra

Nevada

Yuba

Colusa

Lake

Placer

Yolo

Sonoma

Napa

El Dorado

Alpine

Tuolumne

Mariposa

Merced

Madera

Fresno

San

Benito

Monterey

Kings

Tulare

Inyo

San Luis

Obispo

Kern

Santa Barbara

Ventura

Los

Angeles

San Bernardino

Orange

Riverside

San Diego

Imperial

Contra

Costa

Mono

Sutter

Amador

Sacramento

Figure 7

Share of Properties With

Reduced Assessments

Reduced Assessments Are Widespread

Less Than 20%

20% to 30%

30% to 40%

More Than 40%

Trinity County data is unavailable.

Graphic Sign Off

Secretary

Analyst

M PA

Deputy

ARTWORK# 140251Template_CA_County Map.ait

8 LegislativeAnalyst’sOfcewww.lao.ca.gov

AN LAO BRIEF

How Did Proposition8 Aect

Property Owners During the Crisis?

How Much Were Taxable Values Reduced?

When owners receive a Proposition8 assessment

reduction, their property’s taxable value is reduced

temporarily to its market value, which is some

amount below its Proposition13 value. e size of

this reduction varies for each property depending

on (1) its initial acquisition value, (2) how much

that had increased over time under Proposition13,

and (3) how far below that value its market value

had fallen. We estimate that the average reduced

assessment for a single-family home under

Proposition8 was $140,000. is means that the

current market value for the average homeowner

with a reduced assessment is $140,000 lower than

what its Proposition13 value would otherwise have

been. On average, single-family homeowners with

reduced assessments received a $1,600 property

tax reduction for 2013-14. (In addition to the

1percent statewide property tax rate, some local

governments levy additional rates to repay voter-

approved infrastructure projects. us, property

tax reductions are somewhat greater than 1percent

of reduced taxable value under Proposition8.)

Commercial properties—mainly apartments,

retail stores, industrial facilities, and agricultural

land—tend to be larger and more valuable than

single-family homes. us, commercial properties

with Proposition8 reduced assessments received a

$650,000 reduction, on average, equal to a $7,500

reduction in property taxes. (ese estimates rely

on property tax information from Los Angeles,

Orange, Santa Clara, San Mateo, San Francisco,

and Riverside counties.)

How Do Proposition8 Properties Return

to eir Proposition13 Assessments? A

property under reduced assessment returns to

its Proposition13 value in one of two ways. First,

its market value increases faster than 2percent

each year until it exceeds the amount that its

assessment would have been had its market

value never declined. Each year thereaer, the

property’s Proposition13 value cannot increase

by more than 2percent each year. e second way

a property under reduced assessment returns to

its acquisition-based value is when it is sold. is

occurs because properties are assessed at their

acquisition value (purchase price) when they

change ownership. Of the 500,000 properties that

returned to their Proposition13 value assessment

in 2013-14, about 60percent did so due to market

value increases and 40percent did so aer being

sold.

How Did Proposition8 Aect

Governments During the Crisis?

In reducing property taxes for millions of

owners, reduced assessments also aected local

government nances. For many of California’s

4,000 local governments, property tax revenues

are the foundation of their annual budgets. Not

surprisingly, Proposition8 reduced assessments

have aected the services these governments have

been able to provide.

Proposition8 Properties Reduced Local

Property Taxes by About $7Billion. Based on

limited data, we estimate that the 3.2million

Proposition8 reduced assessments in 2013-14

lowered local property tax revenue by about

$7billion statewide. is amount is equal to

a 15percent reduction in total property taxes

collected in California. (As noted before, this

estimate is an extrapolation of data from six large

counties.)

Reduced Assessments Also Increased State

Spending on Education. About 40percent of

local property tax revenues go to schools. In most

cases, property tax revenues that go to schools and

community colleges oset required state spending

on education. As a result, most reductions in

school property taxes are made up by increases in

www.lao.ca.govLegislativeAnalyst’sOfce 9

AN LAO BRIEF

state resources for education. us, the 3.2million

Proposition8 reduced assessments, which lowered

total local property taxes by about $7billion,

likely increased state education spending by about

$3billion in 2013-14.

Proposition8 During the Real Estate Recovery

By ocial measures, the Great Recession ended

in 2009. California’s housing markets nevertheless

continued to struggle. In early 2012, however,

localized real estate improvements spread and

the housing recovery gained momentum. Home

values statewide climbed 12percent in 2012. Below,

we describe how this pronounced improvement

aected property owners with reduced assessments

and how it has aected local government revenues.

Number of Proposition8 Properties Declined

in 2013-14. For the rst time since 2006-07, the

number of Proposition8 reduced assessment

properties declined in 2013-14, from a peak of

3.7million in 2012-13 to 3.2million in 2013-14.

As mentioned earlier, about 60percent of this

decline resulted from price appreciation, where

the 2013-14 market value of reduced assessment

properties exceeded their original assessment

under Proposition13. Relatedly, because real estate

markets have been strengthening, it is unlikely that

many additional properties received Proposition8

reduced assessments in 2013-14.

Many Proposition8 Property Owners

Saw Increased Assessments in 2013-14. In

general, areas where real estate values have

increased recently have seen correspondingly

large assessment increases for properties under

Proposition8. In the near term, many of these

owners will experience increases in their property

taxes that are much larger in percentage terms

than increases for owners whose property did not

receive a reduced assessment. For example, single-

family homeowners with reduced assessments

in LosAngeles County saw average assessment

increases of 5percent in 2013-14. Commercial

properties with reduced assessments had their

assessments increased, on average, by 9percent.

In Santa Clara County, assessment increases in

2013-14 for single-family homeowners with reduced

assessments averaged 13percent. For condominium

owners, the average increase in assessed value was

much higher—20percent. In Sacramento County,

assessments for reduced assessment properties

increased on average by 6percent.

Proposition8 Properties Contributed to

Property Tax Growth in 2013-14. Proposition8

properties reduced local property tax revenues

during the real estate crises. As real estate markets

recover and these properties begin to see large

annual assessments increases, Proposition8 has

the opposite eect. is is because assessment

increases for these properties are not limited to

2percent; instead, they can increase or decrease by

any amount, based on local real estate conditions.

In particular, annual assessment increases above

2percent contribute to growth in local property

taxes because this growth exceeds what would

have occurred if the property’s assessment increase

remained limited under Proposition13. In many

counties, Proposition8 property assessments

increased in 2013-14 for the rst time since the

recession began.

In Los Angeles County, for example,

assessments for Proposition8 properties increased

by a total of $10billion in 2013-14, generating

additional property revenues of $120million for

local governments there.

Assessment Increases Expected to Continue

and Perhaps Accelerate. Real estate prices

improved in calendar year 2012. As a result,

2013-14 property tax assessments, based on

property values as of January 1, 2013, increased for

many reduced assessment properties. Most of the

recent home price gains, however, occurred aer

January 1, 2013, and therefore are not included

10 LegislativeAnalyst’sOfcewww.lao.ca.gov

AN LAO BRIEF

in the 2013-14 assessment determinations. In

particular, California home values increased

12percent in 2012 (included in the 2013-14

assessment determinations), but went on to increase

almost 20percent in 2013. For 2014-15, mindful of

this timing, we expect large assessment increases—

as much as 10 percent or 20 percent in many

cases—for properties that currently have reduced

assessments. Going forward, property tax increases

for owners that received temporary reductions

during the real estate crisis could exceed 10 percent

annually for several years. ese increases will

boost local property tax growth rates over the

next several years. At the same time, the number

of reduced assessment properties will decline as

assessment increases climb above their original

Proposition13 assessment value and reduced

assessment properties change ownership.

www.lao.ca.govLegislativeAnalyst’sOfce 11

AN LAO BRIEF

AN LAO B R I E F

12 LegislativeAnalyst’sOfcewww.lao.ca.gov

LAO Publications

This brief was prepared by Chas Alamo, and reviewed by Jason Sisney. The Legislative Analyst’s Ofce (LAO) is a

nonpartisan ofce that provides scal and policy information and advice to the Legislature.

To request publications call (916) 445-4656. This brief and others, as well as an e-mail subscription service,

are available on the LAO’s website at www.lao.ca.gov. The LAO is located at 925 L Street, Suite 1000,

Sacramento, CA 95814.