LONG-TERM DISABILITY

INSURANCE HANDBOOK

Coverage Available to Eligible Employees

LONG-TERM DISABILITY

INSURANCE HANDBOOK

Coverage Available to Eligible Employees

December 2023

This handbook provides a description of your long-term disability insurance benets pursuant to Chapter 104 of the

Missouri Revised Statutes, and The Standard Group Insurance Policy Number 604201 or successors thereto, issued to

the Trustees of the Missouri State Employees’ Retirement System (MOSERS). If there is any discrepancy between this

handbook and the statutes or insurance policy, the statutes or insurance policy will prevail.

2

LTD INSURANCE BENEFITS

We Are Here to Help

Benet counselors are a valuable source

of information regarding your benets

and are available to assist you.

Schedule an Appointment

Speak with a benet counselor by phone

or make an appointment to visit our

oce. Our phones tend to be least busy

between 8:00 am and 9:00 am.

Call Center Hours

Monday−Friday

8:00 am–12:00 pm

1:00 pm–4:30 pm

Contact Us

Toll Free: (800) 827-1063

In Jeerson City: (573) 632-6100

Fax: (573) 632-6103

Visit Us

907 Wildwood Dr

Jeerson City, MO

Mailing Address

PO Box 209

Jeerson City, MO 65102-0209

Website

www.mosers.org

Log in to myMOSERS to access your

personal information, submit forms,

and more.

Connect with Us on Social Media

Be sure to follow us on social media. It’s a great

way to stay informed and learn about your MOSERS

benets. Invite your coworkers to join us, too!

The Group Policy

Provided by The Standard Insurance Company

The MOSERS long-term disability (LTD) program is provided

under Group Policy Number 604201, issued by The Standard

Insurance Company to the Trustees of the Missouri State

Employees’ Retirement System (MOSERS). The Standard

Insurance Company hereby certies that you will be insured

under the terms of the group policy during the time, in the

manner, and for the amount(s) set forth in the group policy,

provided you meet the eligibility requirements that have been

established for participation in the plan.

If you become disabled while insured under this group policy,

The Standard Insurance Company will pay LTD benets

according to the terms of the group policy after they receive

satisfactory proof of loss.

Certicate of Insurance

Group Policy Number

604201

Name and Address of Insurance Carrier

The Standard Insurance Company

Group Benets Department

P. O. Box 2800 • Portland, OR 97208-2800

(844) 505-6026

Name and Address of Policyholder

Board of Trustees

Missouri State Employees’ Retirement System (MOSERS)

907 Wildwood Drive • Jeerson City, MO 65109

(573) 632-6100 or (800) 827-1063

The group policy is held by MOSERS.

All claims must be led through MOSERS.

Claims are subject to the terms of the group policy.

As long as you meet the eligibility requirements

set forth in group policy number 604201,

you will have long-term disability coverage through MOSERS.

Eective date January 1, 2023

3

LTD INSURANCE BENEFITS

If you are viewing a PDF of this handbook,

use the links provided in blue to quickly

locate relevant or additional information

about a topic. Click on any topic in the table

of contents to go directly to that page.

For information about eligibility for

MOSERS long-term disability insurance,

see page 5.

Easily locate information by topic or

review denitions of the terminology

used by referring to the

glossary and index in the

back of this handbook.

Table of Contents

Summary of LTD Insurance Benets

Provisions .................................................................................................4

LTD Insurance Coverage

Eligibility for Coverage ........................................................................ 5

Enrollment & Premiums .....................................................................5

Exclusions & Limitations ...................................................................6

Social Security Benets ......................................................................6

Benets Upon Becoming Disabled

Income Replacement .........................................................................7

Applying for LTD Benets

The Claims Process ............................................................................ 10

The Approval Process ....................................................................... 11

Denial, Suspension, or

Termination of an LTD Claim ......................................................... 11

Maintaining Your Benets............................................................... 11

Career & Life Events That May

Aect LTD Insurance Benets

Approved Leave of Absence or Layo ....................................... 13

Death and Your LTD Benets ......................................................... 13

Temporary Recovery ......................................................................... 13

New Disabilities .................................................................................. 14

Life Insurance ..................................................................................... 14

Medical Benets ................................................................................. 14

Retirement ............................................................................................ 14

Return to Work

Return-to-Work Responsibility ..................................................... 15

Return-to-Work Incentive ............................................................... 15

Workplace Possibilities Program .................................................. 16

Glossary

Terms ....................................................................................................... 18

Index

Topics ...................................................................................................... 18

4

LTD INSURANCE BENEFITS

Summary of LTD Insurance Benets

The following summary highlights the major provisions of

your long-term disability (LTD) insurance benets. For more

information on a particular provision, please refer the to

index located in the back of this handbook.

Provisions

• Coverage Cost ‒ There is no cost to you for LTD

insurance. Your employer pays your premiums as long

as you are an active employee (unless on a leave of

absence).

• Income Replacement ‒ LTD benets can replace

up to 60% of your pre-disability earnings less any

deductible income.

• Creditable Service ‒ You will continue to earn creditable

service toward your retirement for each month you

receive disability benets.

• Waiver of Premium ‒ If you become disabled, you may

be eligible to continue your life insurance coverage and

not pay the premium.

• Workplace Possibilities Program ‒ The ability to perform

your work duties can be dicult if you have a medical

condition. The Workplace Possibilities Program provides

accommodations or services as an alternative to LTD.

• Survivor Benets ‒ Your spouse or child(ren) may

qualify for survivor benets if you die while receiving

LTD benets.

• Waiting Period ‒ Your LTD benet payments will begin at

the end of the benet waiting period—90 days after your

last day on the job or the period of sick leave you are

entitled to through your employer’s sick leave program,

whichever is longer.

• Taxes ‒ Your LTD benet may be subject to certain federal

and state taxes.

• Return to Work Incentive ‒ If eligible, the return to work

incentive allows you to work and still receive LTD benets

with some limitations.

• Own Occupation ‒ Disability benets will end if

you are able to work in your own occupation, or

any other reasonable occupation, but do not accept

available employment.

• Retirement ‒ LTD benet payments will end when you

begin receiving early retirement benets from MOSERS

or when you become eligible for normal retirement.

5

LTD INSURANCE BENEFITS

LTD Insurance Coverage

People insure their lives, health, homes, and other

possessions, but often overlook their most important

asset—their ability to earn an income. If you face a lengthy

illness or suer from an accident that leaves you unable to

work, you have resources. LTD insurance provides partial

income replacement if you are unable to work for an

extended period. This benet also includes a program that

may assist in making workplace changes so you can avoid

going or staying on LTD.

Eligibility for Coverage

Eligible Employees

You are eligible for MOSERS LTD insurance coverage

if you are:

• Working in a permanent position normally requiring at

least 1,040 hours per year as an employee of the state of

Missouri, and you are a member of any of the following

plans:

– Missouri State Employees’ Plan (MSEP, MSEP 2000,

and MSEP 2011)

– Judicial Plan (Judicial Plan and Judicial Plan 2011)

– Administrative Law Judges and Legal Advisors’ Plan

(ALJLAP)

• An active member of the General Assembly who is a

member of MOSERS.

• A member of the Public School and Education Employee

Retirement System of Missouri (PSRS/PEERS) who is

employed full-time by a state agency, and is a citizen or

resident of the United States or Canada.

• A member working in an MSEP, MSEP 2000, or MSEP

2011 position at Lincoln University or State Technical

College of Missouri.

• A uniformed water patrol ocer electing MOSERS

benets under the provisions of House Bill 1868.

RSMo 104.410.6

Non-eligible Employees

Certain groups of MOSERS members are not eligible to

participate in the LTD plan. These include the following:

• Uniformed water patrol ocers who have qualied, or

who qualify, for receiving other disability benets or

retirement benets due to disability, under the statutory

occupational disability plan.

• Members of MOSERS who have another disability plan

provided by their employer (i.e. universities not listed in

the proceeding section).

• A member of the College and University Retirement Plan

(CURP).

• Members eligible for normal (unreduced) retirement

from MOSERS.

• Missouri State Highway Patrol employees (except

uniformed water patrol ocers electing MOSERS benets

under the provisions of House Bill 1868).

• A retired member of the MoDOT and Patrol Employees’

Retirement System (MPERS) reemployed in a benet-

eligible position covered by MOSERS.

Enrollment & Premiums

Enrollment

As a new employee, LTD insurance coverage is automatic.

Your coverage begins on the rst day you become a state

employee and meet the active-work requirement.

Premiums

Your employer pays your monthly LTD insurance premiums,

unless you are on a leave of absence (see page 13).

6

LTD INSURANCE BENEFITS

Exclusions & Limitations

Exclusions

Your LTD benet is subject to certain exclusions and

limitations. You are not covered for a disability caused or

contributed to by:

• A pre-existing condition or the medical or surgical

treatment of a pre-existing condition, unless, on the date

you become disabled, you:

– have been continuously insured by The Standard

Insurance Company for 12 months (exclusion period),

and

– have been actively at work for at least one full day

after the end of those 12 months.

• An intentionally self-inicted injury, while sane or insane.

• War, or any act of war.

• Loss of license or certication.

• A disability caused or contributed to by your committing

or attempting to commit an assault or felony, or active

participation in a violent disorder or riot.

Additionally, if you received a refund of employee

contributions or a lump-sum payment equal to a

percentage of the present value of your deferred annuity at

the time of such refund or payment (e.g. a buyout), you are

not eligible to begin receiving or continue receiving long-

term disability benets.

The payment of benets is limited to 12 months for each

period of continuous disability while you reside outside the

United States or Canada.

Limitations

LTD benets are not payable for:

• Any period of disability when you are not under the

continuous care of a physician in the appropriate

specialty as determined by The Standard Insurance

Company.

• More than 24 months during your lifetime for a disability

caused or contributed to by use of alcohol, alcoholism,

use of any drug, including hallucinogens, or drug

addiction.

• Foreign residency beyond 12 months.

• Electing not to work when you are able to do so (see

Return to Work Responsibility on page 15).

• Any period of disability when you are not participating in

good faith in a rehabilitation program, medical treatment,

or vocational training approved by The Standard

Insurance Company unless your disability prevents you

from participating.

Social Security Benets

Generally, if your application for Social Security Disability

Insurance (SSDI) is approved, you must wait ve months

before you can receive your rst SSDI benet payment. This

means you would receive your rst payment in the sixth full

month after the date The Standard determined that your

disability began.

• Example: Your disability began on June 15, 2023 and

you applied on July 1, 2023. Your rst SSDI benet would

be paid for the month of December 2023, the sixth full

month of disability.*

Social Security cost-of-living adjustments (COLAs) will not

reduce the amount of your MOSERS LTD benet.

* Social Security Administration | Publication No. 05-10153 | April 2021

What You Need to Know When You Get Social Security Disability Benets

www.ssa.gov/pubs/EN-05-10153.pdf

MOSERS’ LTD benets and Social Security benets are

independent of each other. Approval for one does not guarantee

approval of the other.

7

LTD INSURANCE BENEFITS

Benets Upon Becoming Disabled

Income Replacement

Monthly Disability Benet

If you are disabled, have been approved for LTD by The

Standard Insurance Company, and have completed the

benet waiting period, your monthly disability benet will

equal 60% of: (1) your monthly salary on your last full day

of active work, or (2) the average monthly salary for your

highest consecutive 36 months of employment (whichever

amount is greater).

LTD insurance is intended to replace a percentage of

your income lost as a result of disability. In replacing the

percentage of lost wages, The Standard Insurance Company

also takes into account certain other sources of income

you may be eligible to receive as a result of your disability.

These other sources of income are called “deductible

income” because they are deducted from your LTD benet.

Your LTD benet will be reduced by the following types of

deductible income:

• Primary Social Security benets paid because of your

retirement or disability (Social Security cost-of-living

adjustments [COLAs] will not reduce the amount of your

disability benet).

• Amounts received or amounts eligible to be received

from any workers compensation law as a result of

your disability.

• Any wages earned while employed on a part-time basis.

• Any other benets received under another group

disability insurance plan.

• Any sick leave or salary continuation received while

eligible for LTD benets.

There may be other types of deductible income; contact The

Standard for a complete list.

Minimum Disability Benet

The gross amount of your LTD benet payments will never

be less than $100 per month or 15% of the maximum

monthly LTD benet otherwise payable, whichever amount

is greater.

Monthly Disability Benet Calculation

Now that you’re familiar with the criteria that can determine

your maximum and minimum monthly LTD benet, let’s

look at an example of how an LTD benet payment is

calculated and how it can be impacted by potential sources

of deductible income. To determine your pre-disability

earnings, MOSERS will use the greater of (1) your current

monthly compensation, or (2) the average monthly

compensation for your highest 36 consecutive months to

determine your pre-disability earnings.

Example

For this example, all dollar amounts are pre-tax (gross) and

the following assumptions have been made:

Pre-disability Earnings (current monthly

compensation was greater) ....................... $2,000 per month

LTD Replacement ...................................................................60% (.60)

Deductible Income (Social Security) .................$625 per month

Maximum Disability Benet Calculation

Your LTD plan provides a benet equal to 60% of your

pre-disability earnings (oset by deductible earnings)

Pre-disability Earnings $2,000

x

LTD Replacement .60

=

Maximum Monthly Disability Benet $1,200

Deductible Income Calculation

The next step is to determine any sources of deductible

income and calculate the reduction. See above for sources

of deductible income.

Maximum Disability Benets $1,200

-

Deductible Income $625

=

Monthly Disability Benet $575

Cost-of-Living Adjustments

Your LTD benet is NOT eligible for cost-of-living

adjustments. Once the amount of your disability benet

is determined, it will not increase. However, when you

become eligible to retire, the calculation of your benet will

include annual cost-of-living adjustments applied to your

monthly salary, as of your date of disability through your

retirement date.

RSMo 104.410.6, 104.1042

8

LTD INSURANCE BENEFITS

Dual Employment Provision

If you work at more than one full-time position for the state

of Missouri and become disabled, the following will apply:

• If you are disabled from all your positions, your pre-

disability earnings will be based on your earnings for all

your positions.

• If you are disabled from one of your positions and you

continue to work in the others, your work earnings will be

considered deductible income as described in the Return

to Work Incentive section (see page 15).

• If you are disabled from one of your positions and

you elect not to work in the others, your pre-disability

earnings will be based only on your earnings for the

position from which you are disabled.

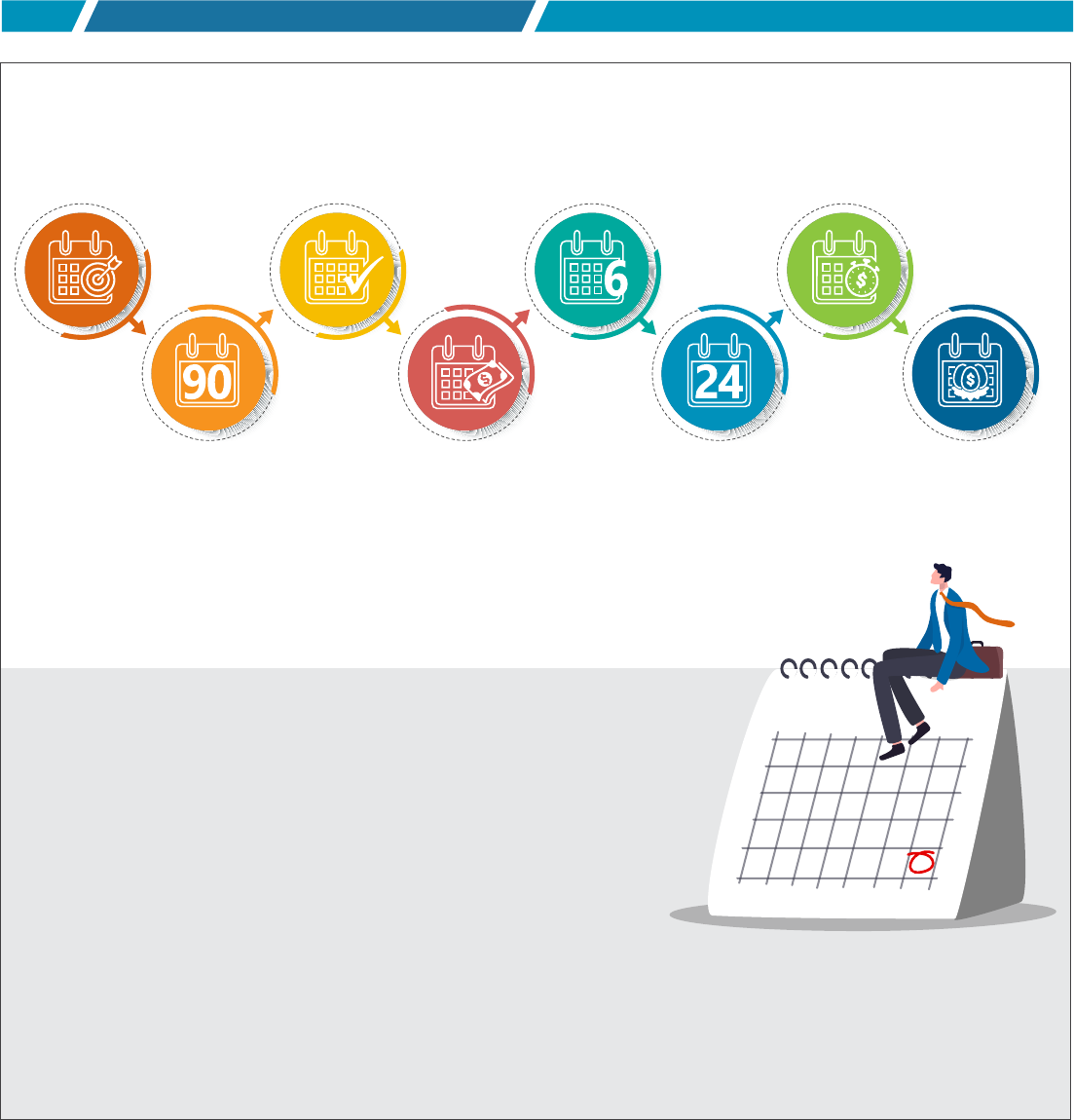

When Your Monthly Benet Payments Will Begin

Your LTD benet payments will begin at the end of the

benet waiting period—90 days after your last day on the

job or the period of sick leave you are entitled to through

your employer’s sick leave program, whichever is longer.

LTD benets will be issued on the rst day of the month

after your approval date. For example, if your approval date

is March 19, your rst benet payment would be issued

on April 1. All future benet payments will be made on the

rst day of each month. See Notable LTD Dates graphic

on page 12.

Once you begin receiving benets, your employer may

terminate your employment with the state. Contact a

MOSERS benet counselor and your employer to get

details about how terminations are administered in

your agency.

When Monthly Benet Payments Will End

LTD monthly benet payments will end when any one of the

following occurs. You:

• Are no longer disabled.

• Begin receiving early (reduced) retirement benets.

• Are eligible to receive normal (unreduced) retirement

benets.

• Begin receiving benets under any other group long-

term disability policy.

• Return to full-time active employment.

• Are able to work, but do not accept available

employment.

• Die.

Legislators and Statewide Elected Ocials ‒ In addition to

any of the preceding reasons listed, LTD monthly benets

will end when the total credited service you have accrued

as a legislator or a statewide elected ocial, through active

employment and while on long-term disability, equals the

corresponding constitutional service limitation (i.e. term

limit).

Overpayment of Benets

To provide you with an income as soon as possible, monthly

disability benets may be paid before a Social Security or

workers’ compensation monthly benet is determined.

This may result in an overpayment. You must notify The

Standard Insurance Company at (844) 505-6026 if you

begin receiving benets from workers’ compensation or

Social Security (including any retroactive payments) while

receiving your LTD benets. The Standard may reduce or

withhold future benets until the overpayment has been

repaid.

9

LTD INSURANCE BENEFITS

Duty to Pursue and Report Deductible Income

According to the terms of the policy, you may be asked to

pursue deductible income for which you may be eligible,

including Social Security and workers’ compensation

benets. The Standard Insurance Company may ask you

to provide written documentation that you are actively

pursuing these or other applicable benets.

You are also required to report other deductible income. To

report additional income such as Social Security disability,

worker’s compensation, or part-time employment, submit

a copy of your Social Security notication letter, workers’

compensation settlement, or current pay stub to The

Standard Insurance Company.

Taxes

Your LTD benet is an employer-paid benet, and is

considered to be income similar to receiving a wage or

salary. Therefore, your LTD benet is subject to certain

federal and state taxes. Medicare and Social Security taxes

will also be deducted from your LTD benets. You may want

to consult a tax advisor to see how you may be aected.

If you wish to have taxes withheld from your monthly LTD

benet, The Standard Insurance Company will provide you

with the necessary forms. Each year, The Standard Insurance

Company will also send you a W-2 for use in preparing your

income tax return.

For more information regarding tax implications on

your LTD benet, please contact The Standard Insurance

Company at (844) 505-6026 or contact a local tax advisor.

10

LTD INSURANCE BENEFITS

Applying for LTD Benets

The Claims Process

The easiest and most preferred way to le a long-term

disability claim is by phone. Simply contact The Standard’s

Intake Service Center at (844) 505-6026.

You will be asked to provide the following information, in

addition to other questions about your absence:

• Employer name: Trustees of the Missouri State Employees’

Retirement System (MOSERS)

• Human resources (HR) contact: (Name/Phone Number)

• Group policy number: 604201

• Your name and Social Security number

• Last day you were at work

• Nature of claim/medical information

• Physician’s contact information: (name, address, phone

and fax number)

You may also le your claim at www.standard.com (click

File a Claim to begin the process) or call (844) 505-6026.

Employee’s Statement

– You, the member, are responsible for completing

this form.

• Employer’s Statement

– HR representative is responsible for completing

this form.

• Attending Physician’s Statement

– Part A: Member is responsible for completing

this form.

– Part B: Physician is responsible for completing

this form.

Once you have led for disability, notify your HR

representative right away. This notication will prompt HR

to submit information directly to The Standard Insurance

Company, which is necessary to review your claim.

For additional information, see Frequently Asked Questions

About Filing a Long-Term Disability Claim available on

our website.

Required Filing Dates

File a claim as soon as possible once you become disabled.

We also encourage you to report a claim as soon as you

believe you will be absent from work beyond 90 calendar

days. If you are uncertain about how long you will be absent

or whether you should le a claim or not, we suggest that

you le your claim. This oers you some peace of mind and

allows for The Standard Insurance Company to begin its

review and issue a timely payment if appropriate.

You must provide proof of loss to The Standard Insurance

Company within 90 days after the end of the benet waiting

period. If you cannot do so, you must provide it as soon as

reasonably possible, but not later than one year after that

90-day period. If you le proof of loss outside these time

limits, your claim will be denied. These time limits do not

apply if you legally lack the capacity to perform the ling

procedure.

Cost to Apply for Benets

You will be responsible for paying any costs associated with

the completion of the Attending Physician’s Statement.

If requested by The Standard Insurance Company, you may

be required to provide evidence of continuing disability

at your expense. In some cases, The Standard Insurance

Company may hire and pay for a physician to examine you

to determine disability.

11

LTD INSURANCE BENEFITS

The Approval Process

A disability analyst from The Standard Insurance

Company will begin reviewing your disability claim once

they have received all of the forms and authorizations

completed in the claims process. Based on the specic

nature of your case, your claim may also be evaluated by

additional experts.

Depending on your individual situation, the approval

process may take anywhere from one week to four months.

In some cases, The Standard Insurance Company may

require additional medical information in order to make a

determination. If additional information is necessary, you

will be informed in writing of what is needed, and why it is

relevant.

You will be notied in writing of the evaluation outcome,

and the reason for approval or denial of your claim. In some

cases, you may choose to receive text messages regarding

your claim status. Text STATUS to 53284 to enroll. The

frequency and number of message will vary based on the

claim. Message and data rates my apply. Please review Text

Message Terms and Conditions from The Standard on their

website. Text STOP to 53284 to unsubscribe.

Denial, Suspension, or

Termination of an LTD Claim

The Standard Insurance Company will notify you in writing

if your disability claim is denied, suspended, or terminated.

The company will outline the reason why, and refer to the

group policy provisions on which the denial, suspension, or

termination is based.

Appeal Procedures

You will be informed by The Standard Insurance Company

of the steps you can take to resubmit your claim for review

and reconsideration if your claim is denied, suspended,

or terminated.

You may ask for a review and submit any additional

information you think may be helpful in order to reevaluate

your claim if your claim is denied, suspended, or terminated

or if you disagree with the amount of LTD benets being

paid. You must make your request in writing to The

Standard Insurance Company within 180 days after you

receive notice. If additional information is needed to

process your appeal, it will be promptly requested.

The Standard Insurance Company will notify you in writing

of the decision on any review of your appeal. The reasons

for the decision will be fully explained, with reference to the

applicable provisions of the group policy.

Ordinarily, a decision on your appeal will be reached within

45 days after the receipt of your review request. However,

in special circumstances, an additional 45 days may be

necessary to reach a nal decision.

The obligation to provide disability benets is primarily that

of the insurance carrier (The Standard Insurance Company)

and secondarily that of the MOSERS Board of Trustees. If

you are denied disability benets after following the appeal

procedures listed above, you may appeal the decision by

ling a petition against the insurance carrier in a court of

law in your county of residence.

Neither MOSERS nor our Board of Trustees is liable for the

disability benets provided by the insurance carrier and not

subject to litigation with regard to disability benets unless

you obtain a judgement against the insurance carrier and it

is unable to satisfy your judgement.

Maintaining Your Benets

The Standard Insurance Company will periodically send you

information regarding the status of your disability claim.

During the rst 24 months of your disability benet (own

occupation disability period), your claim will be reviewed

to determine if you are disabled from any occupation

that ts within your education, training or experience. If a

determination is made that you are not disabled from any

occupation, your LTD claim will be terminated at the end of

your own occupation disability period. In addition, during

the own occupation disability period, The Standard Insurance

Company will continue to gather medical evidence in

support of your inability to perform your own occupation.

For payments to continue through the end of the rst

24-month period, the medical evidence must continue to

support your disability under the own occupation disability

period.

You may be eligible for certain rehabilitation programs as a

result of your disability. You may speak with your disability

analyst at The Standard Insurance Company regarding

possible rehabilitation programs suited for you.

12

LTD INSURANCE BENEFITS

* Working full-time or receiving full salary during the 90-day benefit waiting period could

delay payment of or eligibility for LTD benefits.

** An overpayment may exist if Social Security makes a lump-sum payment.

If this occurs, you are required to reimburse The Standard Insurance Company.

LTD benefit payments will start on the latter of:

• The end of the benefit waiting period

• When your sick leave expires

LTD benefit payments will stop when you:

• Are no longer disabled

• Begin receiving early (reduced) retirement benefits

• Are eligible to receive normal (unreduced) retirement benefits

• Begin receiving benefits under another group long-term disability policy

• Return to full-time active employment

• Are able to work, but do not accept available employment

• Die

NOTABLE LTD DATES

Legislators and Statewide Elected Officials ‒ In addition to any of the preceding reasons listed, LTD monthly

benefits will end when the total credited service you have accrued as a legislator or a statewide elected official,

either through active employment and/or while on long-term disability, equals the corresponding constitutional

service limitation (i.e. term limit).

Date of

Disability

90-Days or

When Sick Leave Ends

(whichever is later)

Benefit Waiting Period*

6-Months

Social Security Benefit

Waiting Period*

Approval

Date

Early

Retirement

Normal

Retirement

LTD Payments Begin

1st of Next Month

24 Months

Disability Changes

from Own Occupation

to Any Occupation

13

LTD INSURANCE BENEFITS

Career & Life Events That May

Aect LTD Insurance Benets

Approved Leave of Absence or Layo

As long as you remain in active pay status, your employer

will pay your LTD premiums.

If you take an approved leave of absence or are laid o

and wish to continue your LTD coverage, you may do so for

up to one year. At the end of the 12-month period, your

coverage will terminate.

If you choose to continue LTD coverage, we will transfer

premium payments electronically each month from a

checking or savings account you designate. To make this

designation, you must request an Autopay Authorization

form from a MOSERS benet counselor. You must sign,

date, and return the completed form to MOSERS along with

a voided check or a deposit slip. You may upload the form

and a scan or photo of your voided check or deposit slip on

myMOSERS.

We will deduct payments directly from your account on

the 14th of each month, or the next business day. Please

allow 10 business days for initial processing. Alternatively,

MOSERS can send you a monthly bill, which you may pay

by check.

If you choose to terminate your LTD coverage while on an

approved leave of absence, your coverage will begin again

on the date you return to work.

Death and Your LTD Benets

Death Before Approval of Disability Benets

Your long-term disability claim will continue through the

review process if you die after the benet waiting period,

but before approval or denial for disability. We will pay your

estate a lump-sum benet for the time between the end of

the benet waiting period and your date of death if you are

determined to have been disabled. Your surviving spouse

and/or eligible children may then be eligible to receive a

survivor benet from The Standard Insurance Company.

Survivor Benets

The Standard Insurance Company will pay a survivor benet

if you die while receiving LTD benets. This benet is a lump

sum equal to three times your monthly LTD benet without

reduction by deductible income. The survivor’s benet is

intended to meet a portion of your family’s nancial needs

in the event of your death. The benet will be paid to your

surviving spouse or your unmarried children younger than

age 25. If you are not survived by an eligible spouse or

child, no survivor benet will be paid.

In the event there is an overpayment outstanding to The

Standard Insurance Company at the time of your death, the

survivor benet will be applied toward the overpayment.

Temporary Recovery

If you temporarily recover from your disability for a period

of time, but later suer a relapse and become disabled

again from the same cause or causes, you may not have

to begin a new benet waiting period, depending on the

length of the period of temporary recovery. A new benet

waiting period is not required if:

• The temporary recovery occurs during the benet waiting

period and the period of recovery does not exceed 30

days.

• The period of recovery occurs during the maximum

benet period and does not exceed 180 days.

If your temporary recovery does not exceed the allowable

periods outlined above, the following provisions will apply:

• No LTD benets will be payable for the period of

temporary recovery.

• The temporary recovery period will not count toward

your benet waiting period, your maximum benet

period, or your own occupation disability period.

• The pre-disability earnings used to determine your LTD

benets will not change.

• No LTD benets will be paid after benets become

payable under any group long-term disability policy

during your temporary recovery period.

14

LTD INSURANCE BENEFITS

New Disabilities

If a period of disability is extended by a new cause while

LTD benets are payable, LTD benets will continue while

you remain disabled. However, LTD benets will not

continue beyond the end of the original maximum benet

period, and all other provisions of the group policy will

apply to the new cause of disability.

Life Insurance

If you have basic, optional, or dependent life insurance

and become disabled while actively employed, you may be

eligible to continue your life insurance without paying any

premium. Your application for LTD benets also serves as

the application for a waiver of your MOSERS life insurance

premiums.

To be eligible for a waiver of premiums you must meet the

following conditions:

• You are totally disabled due to sickness, accidental injury,

or pregnancy rendering you unable to perform the

material duties of any work for which you are reasonably

qualied by education, training, and experience, or you

are eligible to receive disability benets under a group

long-term disability policy issued by The Standard

Insurance Company to MOSERS.

• Your disability occurs prior to age 60.

• You have completed a 90-day waiting period beginning

on the date you become totally disabled.

• You agree The Standard may have you examined at

reasonable intervals by a specialist of their choice. Failure

to attend an examination or to cooperate with the

examiner may result in the denial or suspension of LTD

benets.

• You are not retired or eligible for normal retirement.

If you qualify for a waiver of premiums, all premiums will

be waived including those for spouse and/or child(ren)

coverage. The waiver for your coverage will cease upon

normal retirement eligibility or retirement; as will the waiver

for your dependents’ coverage. If you are not approved for

a waiver of life insurance premiums, and wish to maintain

coverage, MOSERS will send you a bill each month to cover

the cost of the premiums.

You may continue at least a portion of your optional

coverage into retirement at which time you will be

responsible for the premiums. You can nd more

information regarding the waiver of premiums in your

Basic & Optional Life Insurance Handbook.

Medical Benets

If eligible, your health insurance will continue to be

administered by the Missouri Consolidated Health Care

Plan (MCHCP). They will send you a bill each month for

the cost of the premium to maintain your coverage until

you retire or return to active employment. Employees of

the Department of Conservation, State Technical College

of Missouri, and Lincoln University should contact their

employer for information regarding medical insurance.

Retirement

For retirement purposes only, you will continue to accrue

service and salary credit while receiving disability benets

(as if you were still working). To calculate the salary credit,

your gross monthly salary on the date of your disability

will be adjusted (based on 80% of the percentage increase

in the Consumer Price Index) for each year that you were

receiving disability benets. This safeguards you from

being penalized for not actively working until retirement.

Even those MOSERS members employed by State Technical

College of Missouri and Lincoln University will continue to

earn credit for service accrued during disability.

RSMo 104.410.6, 104.1042

MOSERS will send you a notice of retirement eligibility

approximately 120 days prior to the latter of your date of

retirement or the date your LTD benet is scheduled to end.

15

LTD INSURANCE BENEFITS

Return to Work

Return-to-Work Responsibility

If you elect not to work when you are able to do so, your

disability benets will be discontinued. During the own

occupation disability period, The Standard Insurance

Company will not pay benets for any period in which you

are able to work in your own occupation and earn at least

20% of your indexed pre-disability earnings, but you elect

not to work. During the any occupation disability period,

The Standard Insurance Company will not pay benets for

any period when you are able to work in any occupation

and are able to earn at least 20% of your indexed pre-

disability earnings, but you elect not to work.

Return-to-Work Incentive

Providing incentives for disabled employees to return to

work is critical for any successful rehabilitation plan. During

the 24 months immediately after you rst return to work,

The Standard Insurance Company’s LTD benet will be

reduced by only the amount of work earnings which, when

added to your maximum LTD benet, cannot exceed 100%

of indexed pre-disability earnings. Following that period,

The Standard Insurance Company will deduct one-half of

work earnings while you remain disabled. Frequently, this

means that claimants who return to work will receive more

total income than those who do not.

Following are some examples of how return-to-work

incentives are calculated. The following assumptions have

been made for all of the examples presented.

Pre-disability Earnings (current monthly

compensation was greater) ....................... $2,000 per month

Maximum Disability Benet

(60% of pre-disability earnings) .............. .$1,200 per month

Return-to-Work Incentive Example: First 24 Months Back at

Work While Receiving LTD Benets

Your maximum disability benet plus your work earnings

cannot exceed your pre-disability earnings.

Work One-Quarter Time (25%)

Pre-disability Earnings $2,000

x

Work Percentage .25

=

Part-time Work Earnings $500

Maximum Disability Benet $1,200

+

Part-time Work Earnings $500

=

Total Earnings $1,700

Total earnings of $1,700 are less than pre-disability

earnings of $2,000; therefore, the disability benet is

not reduced.

Work Half-Time (50%)

Pre-disability Earnings $2,000

x

Work Percentage .50

=

Part-time Work Earnings $1,000

Maximum Disability Benet $1,200

+

Part-time Work Earnings $1,000

=

Total Earnings $2,200

Total earnings of $2,200 are greater than pre-disability

earnings of $2,000; therefore, the disability benet is

reduced by $200.

16

LTD INSURANCE BENEFITS

After Receiving 24 Months of the Return-to-Work Incentive

Work Half-Time (50%)

LTD will be reduced $1 for every $2 of work earnings.

Pre-disability Earnings $2,000

x

Work Percentage .50

=

Part-time Work Earnings $1,000

Maximum Disability Benet $1,200

-

Part-time Work Earnings $500

=

Disability Earnings $700

Part-time Work Earnings $1,000

+

Disability Earnings $700

=

Total Earnings $1,700

Workplace Possibilities Program

The Standard Insurance Company oers the Workplace

Possibilities Program to provide customized solutions to

help you stay at work or return to work sooner.

The program provides a Workplace Possibilities coordinator

to determine if the criteria for eligibility is met, i.e.

treatment for a medical condition that limits the ability to

perform essential job functions. The coordinator will then

ask a Workplace Possibilities consultant, a professional

case manager, to oer direct services to assist you if you

are having diculties at work that could be related to a

disability. The key objectives of the program are to:

• Assist you in resuming job duties after a disability;

• Assess your work station to provide and implement

accommodations to ensure you can perform your job

productively and safely;

• Remove barriers to your comfort, safety and ability to

perform your job eectively;

• Promotes open communication amount all parties,

including the employee, supervisor, human resources,

medical providers, and others.

This service is completely voluntary. You are responsible for

providing medical documentation required by the program.

The coordinator and consultant will be able to obtain

clarication regarding medical information if you have

signed an Authorization to Obtain and Release Information.

The coordinator and consultant will not share condential

information with your supervisor or other sta, e.g. details

related to a medical diagnosis or treatment. They will only

share information about work capacity, accommodations,

and return-to-work dates.

Your HR representative can provide you with information

explaining the Workplace Possibilities Program and

the related forms. Your HR representative will also

provide the Workplace Possibilities consultant with

your contact information so that initial contact can be

made to answer any additional questions and provide

assistance in completing the forms, if necessary. Visit

workplacepossibilities.com for more additional information.

Partial employment is

dependent on whether your

employer can accommodate a

part-time work schedule.

17

LTD INSURANCE BENEFITS

Reasonable Accommodations

Your disability policy includes a Reasonable Accommodation

Expense Benet, and a Rehabilitation Plan Provision, that

encompasses an array of possible vocational interventions.

These funds (up to $25,000) may allow The Standard

Insurance Company, at their discretion, to pay expenses

toward any necessary worksite modications that result in

a disabled employee’s return to work, as well as other types

of accommodations, such as training, job development

services, ergonomic evaluations, and occupational therapy,

among other possible vocational interventions. In most

cases, the Reasonable Accommodation Expense Benet will

be paid directly to your employer or the vendor providing

the modication. If paid directly to you, the benet will be

considered a taxable benet.

If you would like more information about this process, you

or your employer may contact The Standard Insurance

Company at 855 WPP-PROG (855-977-7764).

The Standard Insurance Company will partner with you in

your eorts to return to work. If you believe you would

benet from such assistance, please call so The Standard

Insurance Company can conduct an initial assessment and

then strategize possible return-to-work solutions.

Eligibility for LTD insurance ends when you

become eligible for normal retirement.

Therefore, the Workplace Possibilities Program

is not available to employees eligible for

normal retirement.

18

LTD INSURANCE BENEFITS

Glossary

Terms

A

Active Work

Active work refers to performing with reasonable continuity

the material duties of your own occupation at your

employer’s usual place of business. If you are incapable of

active work because of physical disease, injury, pregnancy

or mental disorder on the day before the scheduled

eective date of your insurance, your insurance will not

become eective until the day after you complete one full

day of active work as an eligible member.

You will also meet the active-work requirement if you were:

• Absent from active work because of a regularly scheduled

day o, holiday, or vacation day.

• Actively at work on your last scheduled work day before

the date of your absence.

• Capable of active work on the day before the scheduled

eective date of your insurance.

B

Benet Waiting Period

The benet waiting period is the time that must pass

before LTD insurance benets are payable to you. You

must be continuously disabled during this waiting period.

No LTD insurance benets will be paid during this period.

The benet waiting period begins on the date you rst

become disabled, as determined by The Standard Insurance

Company, and is normally the day after your last full day

on the job. The benet waiting period ends when sick leave

benets expire or the date you’ve been disabled for 90

days, whichever is later.

D

Date of Disability

The date on which you rst become disabled.

Deductible Income

Deductible income includes income considered by The

Standard Insurance Company that osets your LTD

insurance benets (i.e. Social Security disability, sick pay,

salary continuation, workers’ compensation for lost time,

work earnings, or any other benets received under another

group disability insurance plan).

M

Maximum Benet Period

The maximum benet period is the maximum amount

of time that LTD benets are payable for one period of

continuous disability. The maximum benet period ends on

the earlier of the following events:

• The date you rst become eligible to receive normal

(unreduced) retirement benets from MOSERS.

• The date you begin receiving reduced (early) retirement

benets from MOSERS.

P

Pre-disability Earnings

Pre-disability earnings are income used to determine

your disability payment. It is the greater of the following

amounts:

• The average of your highest 36 consecutive months

of pay.

• Your monthly earnings in eect on your last full day of

active work.

Pre-disability earnings do not include overtime or any other

extra compensation paid by your employer.

19

LTD INSURANCE BENEFITS

Pre-existing Condition

A pre-existing condition is a mental or physical condition

whether or not diagnosed or misdiagnosed for which you

have done any of the following at any time during the 90

days just before your disability insurance becomes eective:

• Consulted a physician or other licensed medical

professional

• Received medical treatment, services, or advice

• Taken prescription drugs or medicine

• Undergone diagnostic procedures

After you have been continuously insured under the group

policy for 12 months, you are no longer subject to the pre-

existing condition exclusion.

W

Work Earnings

Work earnings include not only your gross monthly

earnings from work performed while disabled, but also

earnings you could receive if you worked as much as

you are able, considering your disability, in work that is

reasonably available.

Work earnings include earnings from your employer, any

other employer, or self-employment. It also includes any

sick, vacation, annual, or personal leave pay, or other salary

continuation earned or accrued while working.

20

LTD INSURANCE BENEFITS

Index

Topics

A

Accommodations 4, 16, 17

Active pay status 13

Active-work requirement 5, 18

Appeal procedures 11

Approval process 11

B

Benet waiting period 4, 7, 8, 13, 18

Board of Trustees 2, 11

C

Claims process 10

College and University Retirement Plan 5

Cost-of-living adjustments 6, 7

Creditable service 4

D

Death 13

Deductible income 4, 7, 8, 9, 13, 18

Denial 11

Department of Conservation 14

Dual employment 8

E

Eligibility 5, 17

Exclusions 6

F

Foreign residency 6

H

House Bill 1868 5

I

Income replacement 4, 7

L

Layo 13

Leave of absence 5, 13

Life insurance 4, 14

Limitations 6

Lincoln University 5, 14

M

Maximum benet period 19

Medical benets 14

Minimum disability benet 7

Missouri Consolidated Health Care Plan 14

Missouri State Highway Patrol 5

MoDOT and Patrol Employees’ Retirement System 5

N

New disabilities 14

O

Overpayment of benets 8

Own occupation 4, 18

P

Pre-disability earnings 7, 15, 16, 19

Pre-existing condition 6, 19

Premiums 4, 5, 13, 14

PSRS/PEERS 5

R

Reasonable accommodation 17

Reasonable occupation 4

Rehabilitation plan provision 17

Retirement 4, 5, 7, 8, 14, 17, 19

Return to work 8, 13, 15, 16, 17, 18

RSMo 104.410.6 14

RSMo 105.691, 104.344 5, 7

S

Sick leave 4, 7, 8, 18

Social Security 6, 7, 8, 9, 18

State Technical College of Missouri 14

Survivor benet 13

Suspension 11

T

Taxes 4, 9

Termination 11

U

Uniformed water patrol ocer 5

W

Waiting period 4, 18

Waiver of premiums 14

Work earnings 19

Workers compensation 7

Workplace Possibilities Program 4, 17

PO Box 209 • Jeerson City, MO 65102

(573) 632-6100 • (800) 827-1063

Visit us at 907 Wildwood Drive or online at www.mosers.org.

Contact MOSERS if you need an alternative format of this publication.