The Economics of Long-Term Care in Canada

Kevin Milligan, University of British Columbia and NBER

Tammy Schirle, Wilfrid Laurier University

July 2023

This paper is written for the NBER international comparison project on long-term care. We

thank the organizers and other participants in the project for helpful suggestions, and

Moyosoreoluwa Sogaolu for research assistance. Some of the research was conducted at the

SWORD Research Data Centre under contract 21-MAPA-SWO-7104. Statistics Canada is not

responsible for the results presented in this paper.

1

Introduction

The Covid-19 pandemic brought the current state of long-term care into broad public focus as

many people in Canada and other countries wondered about the available quality of care. Going

forward, these concerns about the quality of long-term care will grow more acute by the aging of

the population. The first Canadians born in the baby-boom generation are now approaching their

80s, an age range where the use of long-term care grows rapidly. So, with increased demand for

higher-quality care and an increase in the demographic demand for care, the pressures on the

long-term care sector are set to increase.

This paper contributes a broad overview of the Canadian long-term care system. Taking an

economist’s viewpoint, we bring together supply and demand factors to provide an economic

analysis of the current and future path for long-term care. Canada’s situation shares similarities

with other countries, but also embodies unique structural characteristics.

The two key similarities of the Canadian situation with most other OECD countries are the

demographic pressures and the focus on residential care. Because of the aging of the baby boom

population the share of Canadians over age 65 will more than double from 11 percent of the

population in 1990 to a forecast of 24 percent in 2050. For those over age 85, the population

share is projected to go from 1 percent in 1990 to over 5 percent by 2050. These trends are

broadly aligned with other OECD countries. The other main similarity is the focus of the system

on residential care. While there has been increasing attention paid to home and community non-

residential care, the majority of public expenditures still go to residential care in nursing homes.

2

The main difference of the Canadian case with other OECD countries is the mix of public and

private care. There is large variance across countries in the public share of long-term care

spending, and Canada is overall in the middle of the pack. The Canadian private long-term care

insurance market is small; and shrinking further in recent years. The biggest difference from

other countries is the dispersion of the public-private mix within Canada, as other countries have

more uniform country-wide systems. Long-term care in Canada is regulated provincially and the

public systems are designed and funded provincially. The result is that different provinces have

very different systems. Quebec’s long-term care is largely in a unified public system, while New

Brunswick’s system is dominated by private not-for-profits and Ontario’s has a majority of

private for-profit facilities.

The analysis below aims to provide an introduction to and overview of the economics of long-

term care in Canada in the context of international comparison. We are somewhat constrained in

this comparison by lack of a large survey like the Health and Retirement Study in the United

States, or the SHARE data in many European countries. For this reason, we lack data on some

key metrics used to compare across countries, such as standardized measures of activities of

daily living. In addition, there is not one national system to describe but instead a plethora of

subnational systems, each with its own administrative information and design features.

The paper begins with background information on the demographics, wellbeing, health and

living arrangements of Canadian seniors. We then provide information on caregiving, focusing

both on the receivers and givers of care in institutional settings, as well as formal and informal

home-based settings. We then describe the structure of the long-term care system in Canada,

3

including public and private components. Finally, we offer calculations estimating the total cost

of long-term care of the elderly in Canada, including implicit costs for informal home care.

Part I: Demographics, Well-Being, Health, and Living Arrangements

This section provides background context to the discussion of caregiving for Canadian seniors.

We begin with statistics on demographic trends. We then provide an overview of the health of

Canadian seniors, their economic wellbeing, and their living arrangements.

I.A. Demographic facts and trends

The Canadian population is aging and is expected to age further over the next few decades. The

figures discussed in this section illustrate this trend. For women, life expectancy at birth (Figure

1) increased from 80.6 years in 1990 to 84.3 years in 2019. Our projections suggest women’s life

expectancy will increase further, reaching 87 years by 2050.

1

For men, life expectancy at birth

was 74.3 years in 1990, increasing to 80.2 by 2019 and expected to increase to 84.7 by 2050.

Life expectancy at age 65 shows similar trends (in Figure 2). In 1990, women aged 65 could

expect to live an additional 19.4 years and are project to see that increase to 24 years by 2050.

Men have seen greater improvements in old-age mortality, as men in 1990s expected to live

another 15.4 years after age 65, while men are projected to live another 22.2 years after age 65 in

the year 2050.

1

We use a simple Lee-Carter method for projecting mortality rates, estimating Canada-wide mortality separately for

men and women, using single-age mortality rates from 1981-2019 to form projections. We made use of the leecarter

command in Stata in developing these estimates, and the general time trend component is projected as a random

walk with drift process (using ARIMA in Stata). Projections are sensitive to the time period used in estimates and

these projections appear to underestimate life expectancy. See Bohnert et al. (2015) for information on the methods

used by Statistics Canada, which are more involved than what is used here.

4

Figure 1: Life Expectancy at Birth

Source: Authors’ tabulations using Canadian Human Mortality Database (2022) mortality rates.

Our projections based on Lee-Carter methods.

Overall, these projections indicate a large and sustained increase in lifespans, on average. In

Milligan and Schirle (2021) these average lifespan changes are disaggregated by splitting people

into quantile groups using earnings from ages 50-54. That paper finds that longevity is greater

for high earners than low earners, but that the gains in longevity over time have been almost

uniform across the earnings distribution.

5

Figure 2: Life Expectancy at Age 65

Source: Authors’ tabulations using Canadian Human Mortality Database (2022) mortality rates.

Our projections are based on Lee-Carter methods.

Alongside general reductions in fertility rates in Canada, the increase in life expectancy is a key

reason why older individuals now represent a larger share of the population. The share of the

population that is over the age of 65 (shown in Figure 3) rose from 11 percent in 1990 to nearly

18 percent in 2019. The trend is expected to slow after 2030 as the Baby Boom generation ages,

with the share age 65 and over reaching 24 percent by 2050.

6

Figure 3: Population over Age 65

Source: Authors’ tabulations based on Statistics Canada Tables 1700005 and 1700057.

For the population share age 85 or older, the Baby Boom generation again dominates the trends.

In Figure 4, the rapid increase in the population age 85 and older begins around 2030, 85 years

after the war’s end in 1945. The 85 and older population share will go from about 1 percent in

1990 to almost 6 percent by 2050. Correspondingly, those over 85 represent an increasingly

larger share of the older population after 2030 (Figure 5). So, the elderly population will grow to

have a much heavier share of the oldest old. These demographic trends underlie projections for

the increase and timing of an upswing in the demand for long-term care in the coming decades.

7

Figure 4: Population over Age 85

Source: Authors’ tabulations based on Statistics Canada Tables 1700005 and 1700057.

8

Figure 5: Share of Age 65+ population age 85+

Source: Authors’ tabulations based on Statistics Canada Tables 1700005 and 1700057.

I.B. Health measures

In Canada, we do not have the standard Activities of Daily Life (ADL) measure available in the

datasets we use for this paper. Instead, we focus on questions that report whether the respondent

needs “help” with an activity. Needing help is potentially a distinct concept from having a

limitation. When comparing our results to other countries, this difference should be kept in mind.

From pooling years in the Canadian Community Health Survey for those living in private homes,

we find that 22 percent of the population aged 65 or older, and 59 percent of the population aged

9

85 or older, report requiring help with at least one daily activity due to a long-term health

condition or aging.

2

In Table 1 we present both the types of help needed and the count for the

number of items with which help is needed, for the 65 and older and 85 and older populations.

Table 1: Proportion of Older Population Needing Help with Activity

Activity

65+

85+

Total

65+

85+

Meals

0.080

0.261

0

0.777

0.408

Errands

0.156

0.481

1

0.086

0.159

Housework

0.157

0.423

2

0.046

0.119

Finances

0.083

0.291

3

0.033

0.107

Basic

4

0.021

0.070

Personal care

0.057

0.201

5

0.019

0.075

Moving

0.033

0.093

6

0.019

0.063

Note: Canadian Community Health Survey master file tabulations, years 2009, 2010, 2013 and

2014. Individuals report whether they require help with each activity. Total indicates how many

of these activities an individual has reported needing help with.

It appears common for people to need support with tasks required for independent living (as 48

percent of seniors aged 85 or over need help running errands). However, a significant portion

also requires help with basic activities of daily living: 6 percent of those 65 and older, and 20

percent of those 85 and older, required help with personal care (which includes washing,

dressing, eating, or taking medications). The increase in need between the 65 and older and 85

and older population is striking. For many categories in Table 1 the need increases by a factor of

more than three between the two age categories. This finding emphasizes the very steep gradient

of need for help with the activities of life as Canadians age.

2

This number can be inferred from Table 4; by taking one minus the proportion needing help with zero activities in

the right-hand panel.

10

The greater need for help with daily activities seen above reflects a general deterioration in

health. In Table 2, we see older individuals are less likely to report good (or better) health than

younger individuals aged 18-64. Among older individuals, however, there is a large gap between

those who report needing help with personal care and the general elderly population. For

example, while 77 percent those 65 and older report good health, only 36 percent of those 65 and

older who require help with personal care also report good health. Those requiring personal care

are also less likely to report good mental health, although the gap between them and the general

population is not as large (81 percent vs. 94 percent among those 65 and older). Life satisfaction,

however, appears to decline with age and is quite low among those requiring help with personal

care. For those aged 65 and older who require help, 42 percent are satisfied with life. For ages 85

and older, this proportion drops slightly to 37 percent.

Table 2: Health and Wellbeing of Individuals

18-64

65+

85+

All

All

Personal

care

All

Personal

care

Good health

0.904

0.773

0.364

0.666

0.419

Good mental

health

0.940

0.944

0.810

0.916

0.831

Satisfied

0.908

0.820

0.419

0.651

0.372

Note: Canadian Community Health Survey master file tabulations, years 2009, 2010, 2013 and

2014. Personal care refers to anyone who reports needing help with personal care needs due to a

long-term health condition or aging. Good health indicates good, very good or excellent self-

reported health. Satisfied indicates that on a scale of 1 to 10 the respondent rates satisfaction with

life as 6 or higher.

In Table 3, we describe the income position of seniors who require help with personal care or

housework. We split the population of seniors by their position relative to the median income,

where the median income line is drawn using the incomes of all families with main income

11

earner age 18 and older. From our tabulations here, we find nearly 30 percent of people aged 65

and over have a household income that is less than half the median income of the broader

population. When restricted to the subset of seniors requiring help with personal care or

housework, there are fewer seniors in the middle-income groups, and more in the lowest income

groups. Among those needing help with personal care, 36.4 percent have less than half the

median income, a higher share than for the full age 65 and older population.

Table 3: Distribution of Household Income

No Personal Care

All 65+

Personal care

Housework

No

Housework

<50% median

0.295

0.364

.334

.285

50-100% median

0.305

0.256

.293

.310

100-150% median

0.122

0.096

.097

.128

150-200% median

0.045

0.027

.032

.048

200% + median

0.232

0.258

.241

.229

Note: Canadian Community Health Survey master file tabulations, years 2009, 2010, 2013 and

2014. Household income (normalized for family size) is compared to the median (normalized)

household income for respondents age 18 and over. The second column restricts the sample to

those reporting need for help with personal care.

I.C. Economic Well-being

We now describe the financial situation of Canadian seniors as context to the affordability of

care among older Canadians. The surveys we use here for assessing the economic well-being of

Canadians exclude from the sampling frame those who live in congregate living facilities. So, the

results are representative only for those who live in private dwellings. We return to this

discussion when assessing living arrangements below.

In Table 4, we report the income distribution of older families (age 65 and over) relative to the

income distribution of younger families (aged 18-64). To account for differences between the

12

two groups in terms of average family size, the lower panel (B) in Table 4 offers estimates based

on normalized income. When considering the incomes of those 65 and older to those age 18-64,

the high ratio at the 5

th

percentile of each distribution clearly stands out: the 5

th

percentile of

after-tax normalized income among older families and individuals is 1.65 times the income of

younger families. This largely reflects the relative generosity of Canada’s retirement income

system to the supports available to the non-elderly at the lowest part of the income distribution

(where child benefits are relatively generous but minimal supports are available to childless non-

elderly families).

For middle- and higher-income seniors, the numbers reported in Table 4 suggest seniors have

incomes that are lower than among younger families. Seniors at the 75

th

percentile of the

normalized after-tax income distribution have incomes that are 85 percent of the incomes of

younger families at the 75

th

percentile. It is worth noting the ratio of normalized before tax

incomes among seniors to younger families is magnitude similar to the earnings replacement

rates of retired couples in the upper half of the income distribution described in Ostrovsky and

Schellenberg (2010). The overall picture that emerges is a more compressed income distribution

for seniors than for younger Canadians. This finding is consistent with more detailed (but earlier)

research in Baker and Milligan (2009).

13

Table 4: Income Distribution

After-tax income

Before-tax income

18-64

65+

Ratio

18-64

65+

Ratio

A. Total

5th

14319

20696

1.45

14477

20798

1.44

10th

23703

21970

0.93

24544

22046

0.90

25th

45857

31834

0.69

50286

32649

0.65

50th

79016

48431

0.61

90786

51612

0.57

75th

121350

73490

0.61

145787

82655

0.57

90th

169658

104498

0.62

209811

124480

0.59

95th

208547

132187

0.63

265705

162991

0.61

Mean

91302

59293

0.65

109814

67660

0.62

B. Normalized

5th

11291

18606

1.65

11469

18831

1.64

10th

15901

20330

1.28

16162

20492

1.27

25th

25332

23313

0.92

27118

23478

0.87

50th

38501

32246

0.84

44220

34378

0.78

75th

54592

46254

0.85

65898

53058

0.81

90th

74224

64024

0.86

92750

77481

0.84

95th

90160

79196

0.88

116184

98814

0.85

Mean

43151

39081

0.91

51844

44552

0.86

Note: Incomes presented in 2019 Canadian dollars, using the 2018 Canadian Income Survey,

representing income of a census family, authors’ tabulations. For the bottom panel, income is

‘normalized’ using the OECD equivalence scale to account for the number and age of census

family members.

As older individuals may use their assets to finance consumption in retirement, we also consider

the wealth available to older and younger families (in Table 5). We categorize families by the

age of the major income earner within the family. At the 10

th

percentile, the net worth of seniors

is more than 8 times that of younger families (18-64). At the median, however, this ratio falls to

just over two. Both groups’ distributions are highly skewed, with seniors at the 95

th

percentile

holding 1.18 times the assets of younger families at the 95

th

percentile (worth 1.8 million in 2019

for younger families and 2.1 million for senior families).

14

Table 5: Wealth Distribution

Percentile

18-64

65+

Ratio

10th

1075

9000

8.37

25th

25950

103075

3.97

50th

192000

385000

2.01

75th

573350

850000

1.48

90th

1177005

1551050

1.32

95th

1812505

2147500

1.18

Mean

445891

642207

1.44

Note: Canadian dollars, 2019, Survey of Financial Security. Net worth of an economic family

excluding employer pensions.

Tables 4 and 5 then suggest the flow of income may be most important for judging the financial

well-being of lower-income seniors while net worth is more important for seniors in the middle

or upper end of the distribution. In Table 6 we consider the distribution of consumption

expenditures more directly. Across the distributions, the ratio of expenditures among seniors is

lower than among younger households. The normalized income estimates are important to

highlight—consumption at the lowest end of the distribution is nearly identical among seniors

(65+) and younger households (18-64), with a ratio of 0.91 at the 5

th

percentile.

Note the middle of these normalized expenditure distributions is where there appears the greatest

difference (0.80), however this is much larger a ratio than what was observed in Table 4 with

respect to income measures. This suggests that consumption of seniors is less different than

younger families than income. The difference is explained by more seniors having the ability to

draw down savings to fund current expenditures. These differences in younger and older family

consumption patterns are explored in detail in Milligan (2008).

15

Table 6: Consumption Distribution

A. Total

B. Normalized

18-64

65+

Ratio

18-64

65+

Ratio

5th

13186

10432

0.79

8929

8159

0.91

10th

17941

12477

0.70

11418

9733

0.85

25th

28021

17889

0.64

16122

12860

0.80

50th

45051

28298

0.63

23644

18834

0.80

75th

68289

45776

0.67

34970

28316

0.81

90th

96514

68738

0.71

49690

41673

0.84

95th

121288

87047

0.72

62922

53115

0.84

Mean

53002

35925

0.68

28192

23084

0.82

Note: Canadian 2019 dollars, using the 2017 Survey of Household Spending. Total consumption

of a household is presented here. Normalized amount adjusts household spending to account for

the number of household members and whether members are adults or children using available

information about household size and type and the OECD equivalence scales.

I.D. Living Arrangements

The well-being of individuals also depends on their living arrangements. Living with others is an

important determinant of opportunities to share income or receive care from family or friends.

In Table 7 we provide counts of Canadians in 2021 by the type of dwelling they lived in. The

vast majority of Canadians aged 65 or older (94 percent) live in private dwellings (whether

owned or rented). The remaining 6 percent of Canadians aged 65 or older live in ‘collective’

dwellings, which for the most part are the long-term care facilities—nursing homes and seniors’

residences—that provide care. A larger portion of those aged 85 and older (27 percent) live in

these collective dwellings. Later in the paper (in Part II.B) we return to discussing the situation

of seniors in long-term care facilities.

16

Table 7: Dwelling Type by Age Group, 2021

All ages

Age 65+

Age 85+

(1000s)

(%)

(1000s)

(%)

(1000s)

(%)

All

36986

100%

7021

100%

861

100%

Private dwellings:

Single detached

21496

58.12%

3948

56.23%

322

37.39%

Other

14832

40.10%

2639

37.58%

301

35.00%

Collective dwellings:

Health care facility

485

1.31%

408

5.82%

233

27.07%

Hospitals

11

0.03%

8

0.11%

4

0.44%

Nursing homes

185

0.50%

172

2.45%

100

11.62%

Seniors residence

160

0.43%

151

2.15%

89

10.33%

Nursing+res.

68

0.18%

65

0.92%

38

4.46%

Other

234

0.63%

39

0.56%

7

0.76%

Source: tabulations based on 2021 Census tables 98100046 and 98100045.

As mentioned earlier, survey-based data on income, consumption, and wealth are limited by the

sampling frame which includes only those in private dwellings. This means that for the older (85

and older) population, the 27 percent in nursing homes and seniors’ residences are not included

in those data.

The types of family Canadians live in changes over the lifecycle. In Figure 6 we consider the

living arrangements of individuals in private dwellings in 2016 using the Census. The figure

describes the likelihood of couples or single individuals to live independently (without others).

We see that at ages 65-74 and over age 75, most people are living independently (82 and 81

percent, respectively). A small share has older family members in their household (6 percent and

7 percent respectively) but are less likely than younger individuals to have older family living

with them. A slightly larger share of seniors over 65 are the oldest members of their household,

with younger family present (11 percent).

17

Figure 6: Living Arrangements of Individuals in Private Dwellings

In order to understand how living arrangements vary by health status, we turn back to a pooled

sample from the Canadian Community Health Survey. Tabulations presented in Table 8 indicate

that the seniors living with younger members may be able to rely on those younger members for

some care. The seniors (65 and older) needing help with personal care appear more likely to live

with one of their children (13 percent) than the broader sample of seniors (8.5 percent). Those

needing care are also slightly less likely to live alone.

18

Table 8: Living Arrangements of Older Individuals in Private Dwellings

65+

85+

All

Personal

care

All

Personal

care

Living arrangements

With spouse

0.587

0.447

0.313

0.260

With child

0.085

0.130

0.118

0.164

Alone

0.286

0.264

0.469

0.317

other

0.092

0.199

0.124

0.274

Homeowner

0.779

0.692

0.654

0.655

Note: Canadian Community Health Survey master file tabulations, years 2009, 2010, 2013 and

2014. Personal care refers to anyone who reports needing help with personal care needs due to a

long-term health condition or aging.

The analysis in this section shows that contemporary Canadian seniors are, overall, in a solid

economic situation with higher wealth and less low-income incidence than younger Canadians.

Most live in a home they own with their spouse. However, when looking at the age 85 and older

compared to the age 65 and older group, more live with their child or alone and fewer live in

their own house. These patterns are driven in part by deteriorating health at older ages, with

incidence of the need for help more than triple in the 85 and older population what is seen in the

age 65 and older population. Because the age 85 and older population is set to grow

substantially, the patterns among the older seniors we document in this section should attract

particular attention by policy makers.

Part II: Receipt and Provision of Care

After the broad overview of the demographic and economic situation of Canadian seniors in the

previous section, we now turn to the use and provision of care for Canadian seniors. We begin

with the receipt of care, looking at how institutional residential care and home-based care is

19

provided. We then focus on the labor market for caregivers, with analysis of the number of

workers and their wages.

II. A. Receipt of Care

In Canada, the vast majority of individuals over age 65 live in private dwellings—either

independently or with extended family, as described earlier in part I.D. As individuals age and

require more care, they are more likely to rely on institutional care—in nursing homes,

residential care facilities or facilities that combine the two (see Table 7 in the previous section).

In this section, we describe the extent to which elderly Canadians are receiving care in each

setting and the types of care they receive.

Institutional care

In 2021, there were 408 thousand individuals aged 65 or older living in seniors’ homes, nursing

homes, and health care facilities according to the Census. (See Table 7 in the previous section).

According to an institutional accounting provided by the Canadian Institute for Health

Information that we analyze in this section, the number of formal long-term care beds is just

under 200,000. This is consistent with the Census count if one considers that many of those who

identify as living in a “seniors’ home” may live in a facility that does not meet the technical

definition for a “long-term care bed.”

20

Table 9: Number of Beds and Facilities

Beds

Facilities

Jurisdiction

Number

of LTC

beds

Beds per

1000

persons

age 65+

Number

of LTC

homes

Share

Public

Share

private /

for profit

Share

private

/ NFP

Newfoundland and

Labrador

3014

26

40

98%

2%

0%

Prince Edward Island

1244

39

19

47%

47%

6%

Nova Scotia

6842

33

84

14%

44%

42%

New Brunswick

4925

29

70

0%

14%

86%

Quebec

40823

24

440

88%

12%

0%

Ontario

78902

30

627

16%

57%

27%

Manitoba

9765

44

125

57%

14%

29%

Saskatchewan

8924

47

161

74%

5%

21%

Alberta

15762

26

186

46%

27%

27%

British Columbia

27478

28

308

35%

37%

28%

Yukon

312

56

4

100%

0%

0%

Northwest Territories

201

51

9

100%

0%

0%

Nunavut

28

18

3

100%

0%

0%

Canada total

198220

29

2076

46%

31%

23%

Source: National Health Expenditure Database, Canadian Institute for Health Information, 2021.

The Canadian Institute for Health Information assembles the National Health Expenditure

Database, part of which focuses on long-term care. The database is assembled from the national

income and product accounts, provincial administrative records, and a number of different

surveys.

3

We use these data to report the overall counts of beds and facilities, along with the

breakdown by who owns the facility – publicly owned, owned by private for-profit organizations

or owned by private not-for-profit organizations.

3

See Canadian Institute for Health Information (2021). See also Grignon and Spencer (2018) for refinements and

criticisms of the measures used in the database.

21

The first column of Table 9 shows the number of beds in each province and territory, and the

second column normalizes the beds by the population age 65 and older. There is a large spread in

the number of beds per capita, ranging from 18 per 1,000 in Nunavut Territory to 56 per 1,000 in

Yukon Territory. The patterns defy easy description, with different mixes of political culture,

rural-urban differences, and incomes being contributing factors.

The right-hand panel of Table 9 shows facilities counts and how they break down into the share

owned by public, private for-profit, and private not-for-profit organizations. There is a wide

range. The systems in the territories are fully public, and Quebec is almost fully public. On the

other end, New Brunswick has no publicly owned homes, but an 86 percent share for private not-

for-profit. Ontario has the largest for-profit share, at 57 percent. British Columbia has an even

mix of the three types.

The main explanation for this cross-provincial difference is the constitutional assignment of

responsibilities to federal and provincial governments. Long-term care facilities are regulated

provincially. As long-term care facilities-based care is not publicly insured as part of federal-

provincial agreements, standards of care and staffing are set by provincial governments under

provincial statutes and regulations. For example, Ontario’s (recently rewritten) legislation is

called the “Fixing Long-Term Care Homes Act, 2021” (Statutes of Ontario Chapter 39). To be

granted a licence, there must be an infection prevention and control program, a policy to prevent

abuse and neglect, and a procedure for reporting and complaints, among other rules. For staffing,

the regulations require that personal support workers complete a program that meets established

22

standards, including 600 hours of class time and practical time. Other provinces have similar

types of legislation and regulations, but the scope and level of regulation varies across provinces.

Non-institutional care

In 2021, there were 6.6 million Canadians aged 65 or older living outside of institutions, often

independently but also in private homes with other family members. (See Table 7 and Figure 6 in

the previous section.) A substantial portion of this group requires help with personal care and

other daily activities in their own homes.

Figure 7: Older Individuals Receiving Help, Paid and Unpaid

Source: GSS Cycles 32 (2018) and 26 (2012) tabulations by authors. Respondents are asked

about the hours of care or help received in an average week.

In Figure 7 we describe how often older individuals (65 or older and 85 or older) indicate

receiving help, and whether they paid for the help they received. Among those aged 85 or older,

23

56 percent did not receive any care or help. Only 3 percent relied exclusively on paid help, 16

percent relied exclusively on unpaid help, and a larger group (25 percent) relied on both paid and

unpaid help.

Table 10: Hours of Care Received by Older Individuals

65+

85+

Unpaid

Paid

Unpaid

Paid

Average

22

8

26

13

25th percentile

2

1

3

1

Median

7

2

10

3

75th percentile

21

6

24

8

Source: GSS Cycles 32 (2018) and 26 (2012) tabulations by authors. Respondents are asked

about the hours of care or help received in an average week.

We can also examine the intensity of care by looking at the number of hours of care received.

Table 10 reports the distribution of hours of care received of both unpaid and paid types. There is

stronger reliance on unpaid care than paid care. Comparing the medians to the means, it appears

the distribution of hours is highly skewed. The mean of unpaid hours at age 65 and older, for

example, is 22 hours but the median is only 7 hours and the 75

th

percentile only reaches 21

hours. The average number of hours rises with age, but only by 30 percent on average across the

two age groups shown. This contrasts with the extensive margin (any care being received) in

Figure 7 which showed the proportion using any care at all more than doubled from ages 65 and

older to ages 85 and older. So while there are age gradients in both the intensive margin (Table

10) and the extensive margin (Figure 7), it is the extensive margin that shows the stronger age

gradient as more seniors find they need at least some care at older ages.

24

Reliance on paid home care services

In Table 11 we provide further information on the types of home care services individuals

receive. (We note that Figure 7 and Table 11 are based on different sources and that the former

suggests only a slightly different percentage of seniors relying on paid care.) Among the services

people pay for, it is most common for the elderly to require nursing care (11 percent of those age

85 or over) and personal or home support (23 percent of those age 85 or over). Both of these

categories also exhibit very strong growth from the younger (age 65 and older) to the older (age

85 and older) groups.

Table 11: Use of Paid Home Care Services, by Type of Service

Portion who report use

Type of home care used

65+

85+

Nursing care

0.038

0.114

Other health care

0.015

0.038

Medical equipment and

supplies

0.019

0.050

Personal or home support

0.055

0.234

Other services

0.013

0.051

Any Care

0.092

0.313

Source: CCHS tabulations, years 2015, 2016, 2018, 2019.

In Table 12, we describe the length of time people over age 65 have used different types of home

care services. It appears most types of home supports reflect a need for longer-term care: 42

percent of those using nursing care have been receiving help for more than one year and 67

percent of those receiving personal and home supports have received the help for more than one

year. Reliance on other health care services appears a bit more short-term, which includes

services such as physiotherapy. This pattern of shorter-term care may arise from recovery from

specific acute health events like a broken bone or a heart attack.

25

Table 12: Duration of Home Care Services Used, by Type of Service (Age 65+)

Duration of Care

Nursing

Other health

Med.

Equip

Support

Other

Less than 1 month

0.203

0.233

0.125

0.076

0.115

1-less than 3 months

0.152

0.199

0.167

0.076

0.094

3-less than 6 months

0.089

0.098

0.118

0.067

0.078

6 months - less than 1 year

0.135

0.141

0.114

0.110

0.133

1-3 years

0.220

0.168

0.224

0.311

0.285

More than 3 years

0.202

0.161

0.252

0.361

0.296

Source: CCHS tabulations, years 2015, 2016, 2018, 2019. Each column sums to 1.

When home care services are paid, it is not necessarily the care recipients paying for these

services directly. Similar to long-term care facilities-based care, home care services are not

publicly insured as part of federal-provincial agreements. As such, the standards for assessing

home care needs and the out-of-pocket costs to recipients vary by province. For example, in

Quebec a needs assessment determines whether individuals qualify for home care services (such

as nursing or personal support) and if approved there is no payment required by individuals. For

domestic help services (such as housekeeping) in Quebec, those needing assistance can receive a

subsidy (up to $18.65 per hour) depending on age, income, and family situation. In British

Columbia, a needs assessment also determines eligibility for home care services but payment for

services depends on income. BC individuals with low income (eg. such as those receiving the

Guaranteed Income Supplement) are not required to pay anything, but those with a modest

income will be charged up to $300 per month for support.

4

Overall, a large part of home care services is paid for by provincial governments (as discussed in

more detail in the next section). In Table 13 we see that most people receiving nursing care

services did not typically pay anything at all (as 87 percent of those aged 65 and over who used

4

A measure of annual income is multiplied by 0.00138889 to define a daily rate.

26

nursing services report spending $0). Only 6 percent of seniors who use nursing services paid

$200 or more in a typical month for the help received. People are more likely to pay for personal

and home support (which includes things like housekeeping) and other supports (such as meal

delivery). In a typical month, 18 percent of those relying on personal and home supports spend

$200 or more.

Table 13: Amounts Paid for Home Care Services Used, by Type of Service (Age 65+)

Amount paid (typical month)

Nursing

Other health

Med.

Equip

Support

Other

$0

0.87

0.83

0.66

0.51

0.35

$1-less than $50

0.04

0.05

0.08

0.11

0.22

$50-less than $100

0.02

0.03

0.05

0.11

0.17

$100-less than $200

0.01

0.03

0.06

0.10

0.10

$200 or more

0.06

0.06

0.14

0.18

0.16

Source: CCHS tabulations, years 2015, 2016, 2018, 2019. Each column sums to 1.

Reliance on informal or unpaid care

Our tabulations presented earlier in Figure 7 and Table 11 suggest 17 percent of individuals aged

65 or older, and 41 percent of individuals aged 85 or older, rely heavily on unpaid care or help.

We provide more granular detail on informal care provision at the end of the next subsection.

Total use of care

Combining our information on help received at home in Figure 7 with the information on the

proportion of people living in collective dwellings in Table 7 allows some insight into the overall

distribution of types of care. In Figure 8 we combine these data for those using care (either at

home or because they live in a nursing home or hospital) into one chart for each of the two age

27

groups.

5

These data come from different sources but are useful to gain a rough sense of how the

types of care are distributed. Among those using some type of care, the share in a nursing home

or hospital rises from 17 percent in the age 65 and older population to 28 percent in the age 85

and older population. A smaller proportion uses only unpaid help at age 85 and older than at

younger ages. The pattern here can be characterized as showing an increase in the use of

professional care types at older ages.

Figure 8: Distribution of Types of Care

Source: Combined data from Figure 7 and Table 7; see the sources indicated there. Each pie

segment shows the proportion needing the indicated care type, among the population using any

type of care for each age group.

II.B Care providers

The care sector is labor intensive, but that labor is employed through various occupations spread

across multiple sectors. There is also paid and unpaid work performed in this sector, with various

degrees of skill, both with and without formal training. This subsection looks at the types and

5

For this calculation, we exclude the residents of ‘seniors residences’ reported in Table 7 since these are not care

facilities. We do include the category of facilities that combine seniors’ residence and nursing home services, since

those facilities do provide care.

40%

35%

8%

17%

Age 65+

41%

27%

5%

28%

Age 85+

Both types of

help

Unpaid help

only

Paid help only

Nursing home

or hospital

28

characteristics of the workers providing the care, then moves onto wages and understanding

those who work without pay.

Institutional care workers

A wide range of occupations are involved in providing care to elderly individuals in institutions.

We describe those care workers who report working in the “nursing and residential care

facilities” industry (NAICS code 623) in Table 14 and Figure 9.

Table 14: Individuals Working in Nursing Homes and Residential Care, 2016

Occupations

NOCs

(4-digit)

Number

Female (%)

Canadian born

(%)

Registered Nurses,

Supervisors

3011-3012

32,240

92.3

64.1

Licensed Nurses

3233

23,095

91.2

64.4

Nurses aides, orderlies

3413

131,030

90.3

62.5

Total

NA

186,375

90.7

63.0

Source: Tabulations using Census 2016 master files. Sample of individuals working in NAICS

6230.

From Census data in Table 14, we see that in 2016 there were more than 186 thousand people

working in institutional care as care workers. Nurse aides and orderlies were the most common

occupation in this industry (131 thousand workers) and 55 thousand licensed and registered

nurses worked in these facilities. These jobs are predominantly filled by women (90.7 percent

overall). We note that while nursing occupations are more than 90 percent female, management

positions (not listed here) are more likely filled by men than other occupations (being 71 percent

female). The industry also tends to have fewer Canadian-born workers than the broader labor

29

force.

6

This is particularly true among those working as nurses’ aides and orderlies, where only

62.5 percent of workers are Canadian born.

Figure 9 Education of Workers in Nursing Homes and Residential Care, 2016:

Source: Tabulations using Census 2016 master files. Sample of individuals working in NAICS

6230 within select occupations. See Table 14 for occupation classifications.

Looking at education levels, there are very few nurses who have only completed high school, as

most positions require formal training in a college or university program.

7

Education standards

are part of regulations for long-term care facilities, and the precise details of the standards vary

across provinces. Those working as nurse aides and orderlies are more likely to have lower levels

of education, while 78 percent have completed college or university.

6

Using Statistics Canada Table 14-10-0085-01, Canadian born individuals represented 76 percent of the labor force

in 2016.

7

Given the small sample sizes within some professions at the lowest education levels, we have grouped high school

graduates with those having less than high school to meet confidentiality requirements associated with using the

Census master files.

0% 20% 40% 60% 80% 100%

Nurse aides, orderlies

Reg. Nurses

Licensed Nurses

High school or less College BA or more

30

Formal home care workers

In Table 15 and Table 16 we describe individuals who report working as home care workers

(NOC 4412) in 2016. These data are also drawn from the Census.

Table 15: Number of Home Care Workers in Canada by NAICS

Home Care Workers (NOC 4412)

NAICS:

Number of

workers

Portion

Home health care (6216)

18490

0.19

Nursing homes and res. Care (6230)

10190

0.11

Individual and family services (6241)

28630

0.30

Private Households (8141)

15050

0.16

All other NAICS

23650

0.25

Total

96010

1

Source: Census 2016 tabulations

In Table 15 we see these workers describe themselves as working in a range of industries—

including home health care, nursing homes, individual and family services and private

households. Like nurses and nurses’ aides in institutional care, home care workers (in Table 16)

are predominantly female (89 percent) and less likely than the broader labor force to be Canadian

born (63 percent). Home care workers are also less educated, on average, than those working in

institutional care with 37 percent having completed high school or less.

Table 16: Select Characteristics of Home Care Workers

Portion

Female

0.894

Canadian Born

0.634

Education

Less than high school

0.128

High school

0.247

College

0.482

University (BA+)

0.144

Source: Census 2016 tabulations

31

Wages of paid care workers

For many individuals providing paid care, occupation-specific skills are transferable between

industries. As such, we consider the usual hourly wages with select occupations without

restricting to specific industries. These wage data are presented in Table 17 (for April 2019) and

broader trends in nominal wages are presented in Figure 10.

Table 17: Usual Hourly Wages of Workers in Select Occupations, April 2019

April 2019 wages

Relative to Median Wages of

NOC

Average

Median

All workers

High School or less

Nurse

Supervisors

3011

40.27

43.00

1.68

2.39

Registered

Nurses

3012

37.63

39.00

1.57

2.17

Aides,

Orderlies

3413

20.76

20.35

0.86

1.13

Home Care

Support

4412

18.45

17.00

0.77

0.94

Source: Average and median wages by NOC are provided by the Labour Market Information

Council, using LFS master files. The median wage of all workers ($26.92) and those whose

highest degree is high school or less ($20) is found using the LFS April 2019 PUMF. All dollar

amounts are in nominal terms.

Given the higher education requirements for nurses, it is not surprising their average and median

wages are relatively high. In Table 17, we see that the median wage of registered nurses is 1.57

times the median wage of all workers. Aides and orderlies, who are less educated than nurses

(Figure 10) are paid roughly half as much as nurses and are paid slightly more than the average

worker with high school or less. Home care support workers are paid less than aides and

orderlies, with wages more in line with other workers with high school or less.

32

Figure 10: Wages of Care Workers

Source: Custom tabulations provided by the Labour Market Information Council, using LFS

master files.

In Figure 10 we see that wages of home care support workers have been catching up to those of

nurses’ aides and orderlies. Some of these workers are covered by centralized bargaining and

union contracts in some provinces. For example, Ontario nurses have contracts with hospitals

and nursing homes, using templates that are then tailored to specific workplaces.

Unpaid caregivers

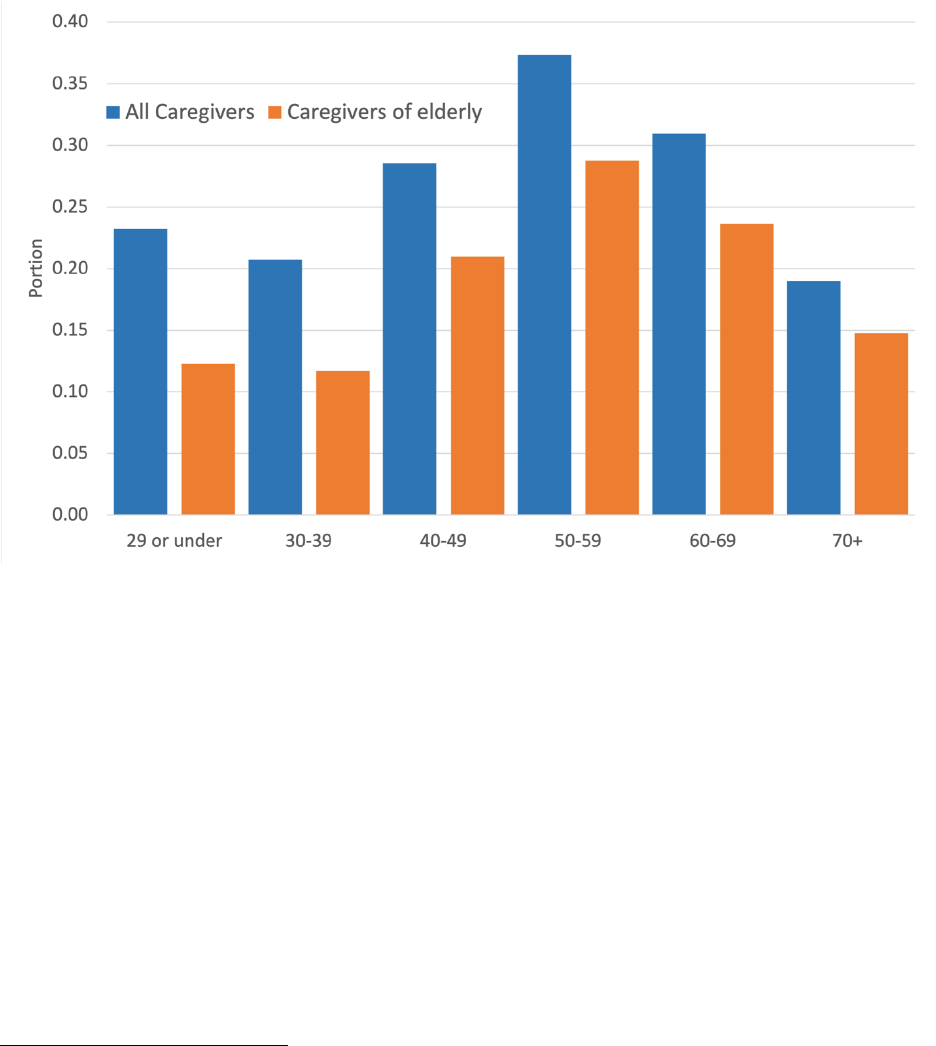

As shown in Figure 7, many seniors rely on unpaid care and help. In Figure 11, we describe the

portion of individuals (by age group) that reports providing informal unpaid care to someone

because of a long-term health condition or aging. We see a significant portion of the population

provides such care, with the largest share among those aged 50-59 (37 percent). We also see that

33

older individuals are more likely to be the caregivers of elderly recipients compared to a broader

sample of all caregivers.

Figure 11: Provision of Care by Age

Source: GSS Cycles 32 (2018) and 26 (2012) tabulations by authors. All caregivers represent

individuals who indicate they provide care to someone because of a long-term health condition

or aging. Caregivers of the elderly represents the subset of individuals who provide care to at

least one person age 65 or older.

The characteristics of caregivers are reported in Table 18. We see that caregivers are distributed

across all age groups, although those caring for at least one elderly person (age 65 or older) are

more likely from older age groups themselves. Caregivers are slightly more likely to be female

(54 percent) and their education levels closely resemble those of the broader population.

8

8

The education levels presented in Table 18 are similar to 2018 levels found using LFS PUMFs, where for example

26 percent of all individuals have a BA or more and 15 percent have less than high school.

34

Table 18: Characteristics of Informal Care Providers

All caregivers

Care for elderly

person

Age group

29 or under

0.205

0.158

30-39

0.128

0.105

40-49

0.176

0.188

50-59

0.243

0.272

60-69

0.159

0.177

70+

0.089

0.101

Female

0.540

0.540

Education

Less than High

School

0.129

0.113

High School Grad.

0.268

0.256

Trades/College

0.334

0.339

BA+

0.270

0.291

Source: GSS Cycles 32 (2018) and 26 (2012) tabulations by authors.

Sample of individuals who report being caregivers, providing care to family or

friends due to a long-term health condition or aging. Caregivers for an elderly

person are the subset of caregivers who provide care to at least one person age 65

or older.

We now turn to the question of who is providing informal care. In Table 19, the data shows that

spouses provide a lot of informal care, as 35.7 percent of care recipients reported their spouse as

the primary caregiver.

9

As one might expect given the age distribution of caregivers in Table 18,

the elderly often rely on their children for care. Daughters are commonly a person’s primary

caregiver (30.5 percent), while sons and in-laws are less likely to be the primary caregiver (15.3

percent and 3.4 percent respectively).

9

We note that when caregivers are asked who their primary care recipient is, only 8 percent of those caring for at

least one elderly person reports their spouse as the primary recipient. This suggests many caregivers are many

individuals’ primary caregiver.

35

Table 19: Primary Caregiver Relationship to Elderly Recipients

Relationship to care recipient

Portion

Spouse

0.357

Son

0.153

Daughter

0.305

Son/Daughter in law

0.034

Other relatives

0.073

Non-relative

0.079

Source: GSS Cycles 32 (2018) and 26 (2012) tabulations by authors.

Sample represents individuals aged 65 or older who receive informal care;

relationship characterizes who their primary caregiver is. Caregivers provide care

to family or friends due to a long-term health condition or aging.

The elderly will also rely on relatives other than their children and spouses. We also see in Table

19 that 7 percent of elderly care recipients report their primary caregiver is another relative—

such as an aunt or cousin. A sizeable group of elderly individuals rely on caregivers who are not

their relatives.

Table 20: Hours of Informal Care Provided per Week

Hours of care

All caregivers

Care for elderly

person

Mean

12

11

25th percentile

2

1

Median

4

3

75th percentile

10

10

Source: GSS Cycles 32 (2018) and 26 (2012) tabulations by authors.

Caregivers provide care to family or friends due to a long-term health condition or

aging. Caregivers for an elderly person are the subset of caregivers who provide

care to at least one person age 65 or older.

Finally, we turn to the hours of care provided by informal caregivers, in Table 20. Many

individuals provide care (as in Figure 11), but most provide only a few hours of care every week.

Typically, caregivers who provide care to at least one elderly person are providing only 3 hours

of care every week (median). The distribution of hours of care, however, is clearly skewed, with

36

an average hours of care that is higher than the 75

th

percentile. Worth noting, the hours of care

among caregivers of the elderly is not higher than the hours of care among all caregivers.

Part III: Canada’s Long-Term Care System

Long-term care in Canada is financed by public and private sources. In this section, we describe

the general structure of the public funding programs and the features of the private long-term

care insurance market. We close the section with a summary of the shares of spending from

different sources.

III.A. Public Systems

Each province and territory operates its own long-term care system. There are publicly owned

long-term care homes and also public subsidies for lower-income people. In many provinces the

public subsidies can be used at private facilities. Access to public facilities is by application, with

the criteria generally including citizenship, residency, age, and health. For example, in British

Columbia an applicant needs to be a Canadian citizen or permanent resident, have lived in

British Columbia for at least 3 months, be 19 years of age or older, and “be unable to function

independently because of chronic, health-related problems…”

10

Needs are assessed, and the

appropriate care facility type is offered.

10

See https://www2.gov.bc.ca/gov/content/health/accessing-health-care/home-community-care/are-you-eligible.

37

For public subsidies, each province has its own formula.

11

Typically, there is a minimum

contribution required which is generally aligned closely with the value of federal Old Age

Security and Guaranteed Income Supplement payments (designed to set a minimum personal

allowance for the person receiving care). For income higher than these federal pensions, the

provincial subsidy is typically clawed back. There are also asset tests in Quebec and in

Newfoundland and Labrador.

The public subsidy formula’s minimum personal allowance (or minimum contribution) and

clawback rates differ across provinces. For example, in Quebec (in 2022) the personal allowance

was set at $290 per month. Every dollar of income over that allowance is clawed back to pay for

the individual’s long-term care fees (at $2,019 per month). In British Columbia, a minimum

allowance of $325 is set aside, and 80 percent of additional income is clawed back (with a

maximum rate of $3,847.20 in 2023). In Saskatchewan, the personal allowance (for 2023) was

set at $466 per month (as the difference between their minimum fee and a first income threshold

defined at $1,759), and income is then clawed back at a rate of 57.5 percent (with a maximum

rate of $3,218).

III. B. Private Long-Term Care Insurance

Health insurance in Canada is dominated by provincial public health insurance programs that list

a wide range of insurable services. Many employers offer supplemental health insurance to cover

services not insured by the public plans, most notably pharmaceuticals, dental, and vision care.

Those on public income assistance have access to public coverage for these supplemental needs,

11

See Blomqvist and Busby (2012) for a description of the system and details on each province. Library of

Parliament (2020) provides an update.

38

but some Canadians have no supplemental health coverage. For long-term care insurance, few

employer-sponsored supplemental plans cover long-term care risks.

Beyond the group insurance market, there is a small and shrinking market for individual private

long-term care insurance. The available policies typically require two or more ADLs to trigger a

payment under the policy. The policies are priced by age and sex. These long-term care

insurance policies are not often bundled with other insurance products on the private market, but

instead sold as a standalone product. (Boyer et al. 2020, p. 139) This might make these products

more difficult to sell because of the increased marketing costs. Several providers have fallen out

of the market, with few options left on the market.

12

Table 21: Features of Long-Term Care Insurance Market

Age

Has

LTCI

Average

Premium

Average

Benefit

50-54

0.154

83

2307

55-59

0.113

173

1693

60-64

0.089

117

2310

65-70

0.054

120

2155

Source: Retirement Savings Institute, HEC Montreal survey RSI-01. See Boyer et

al. (2020).

A 2016 survey of Quebec and Ontario residents ages 50-70 found that 10.5 percent had

purchased a long-term care insurance policy. The average premium was $116 and the average

insured benefit was $2,467.

13

The age pattern of these characteristics is shown in Table 21. There

is a clear downward gradient in long-term care insurance uptake from 15.4 percent at ages 50-54

to 5.4 percent at ages 65-70. The premium and the benefit, however, do not have clear trends

12

For example, in 2021 Sun

Life (a major insurer) raised their long-term care insurance policy premiums for

existing customers and closed the product to new sales. SunLife now offers a new product that requires a 1 to 2

year waiting period for any benefit

https://www.sunlife.ca/en/health/long-term-care-insurance/clarica-and-sun-

long-term-care-insurance-policyowners/

13

See Boyer et al. (2020) for details.

39

across ages. As the number of firms offering such insurance has continued to shrink since 2016,

the proportions with a policy are likely even lower today.

III. C

. Summary of Financing Shares

Taking the different financing sources together, we can depict the different financing shares as a

percent of the total. The data from the OECD used here include all types of long-term care

(institutional, community care, and home care) for care recipients of any age. Later in the paper,

we focus more closely on those age 65 and older. Figure 12 shows that public financing

represents 78.4 percent of spending, with private spending making up the residual 21.6 percent.

The strong majority of the private financing comes from out-of-pocket spending, with insurance

payments making up only 3.3 percent of the total.

Figure 12: Long-Term Care Financing by Source

Source: OECD Health Expenditure and Financing database.

III.D. Long-term Care as Share of Economy

Public

78.4%

Private,

insurance

3.3%

Private, out

of pocket

18.3%

40

In Figure 13 we put these costs in context by comparing them to GDP. This comparison is useful

both to understand the impact of the long-term care system on the Canadian economy and also to

facilitate international comparisons. Again, we use the OECD data that include spending on all

types of long-term care and at all ages. Over the 31 years from 1990 to 2021, the share of GDP

going to long-term care rose from under 1 percent of GDP in 1990 to more than 2 percent by

2021. In constant 2019 Canadian dollars, this represents an increase from $11 billion in 1990 to

$52 billion in 2021.

14

The nominal value in current dollars for 2021 is $54 billion.

Figure 13: Share of GDP Spent on Long-Term Care

Source: OECD Health Expenditure and Financing database.

Part IV: Total Cost of Long-Term Care

In this section we bring together elements of the data presented in this paper to produce an

estimate of the total cost of care. We now narrow our focus to those age 65 and older. We aim

14

See Grignon and Spencer (2018) for a discussion of the shortcomings of the OECD long-term care estimates.

0.00

0.50

1.00

1.50

2.00

2.50

1990 1995 2000 2005 2010 2015 2020

41

our calculations for 2019, reported in 2019 Canadian dollars. For each of three line items

(residential long-term care, home care, informal care) we present an estimate of the number of

users and total spending. We then calculate a cost per user for each of the three line items. We

begin by going through the source of each element of the calculation for each line item, then

bring it together in a final calculation at the end of the section.

IV.A Residential long-term care

We have different sources to draw on for the total number of people in care and the total cost.

We describe the sources and our choices for the total cost calculation here.

For the count of people, our Census counts reported in Table 7 show 172,000 in nursing homes,

151,000 in seniors’ residence, and another 65,000 in combined nursing homes and seniors’

residences. So, a narrow definition of just “nursing homes” would yield 237,000 people. In Table

9, we report the National Health Expenditure Database count of beds in long-term care

residences, which is 198,220. For the total cost calculation, we use the Census count of nursing

homes: 237,000 people.

For costs, we rely primarily on data from the OECD Health Statistics Database OECD (2022),

supplemented with information from the National Health Expenditure Database (Canadian

Institute for Health Information 2021). The differences between these data sources are

documented and explored in Grignon and Spencer (2018), who find the OECD measures too

broad in most cases compared to their preferred measure. For residential long-term care, we

begin with the OECD estimates for “in-patient long-term care.” This includes individuals of any

age. To produce an estimate for ages 65 and older, we use the age-based breakdown from the

42

National Health Expenditures Database which finds for 2019 that those age 65 and older

represent 78.7 percent of total residential long-term care expenditures.

15

Our estimate for residential long-term care expenditures using this method is $27.9 billion for

2019. This is split between $19.6 billion in public spending and $8.3 billion in private spending,

for roughly a 70/30 percent public/private split. Our estimates are in line with other estimates,

including the results presented in National Institute on Ageing (2019).

IV.B Paid Home Care

We now turn to formal, paid home care. In Table 11 we use the Canadian Community Health

Survey and find that for those age 65 and older, the proportion who report paid care is 9.2

percent. In Figure 7 we employ the General Social Survey, where the percent who report using

any paid care is 11 percent. For our calculations, we use the number from the GSS: 11 percent.

There were 6.6 million Canadians ages 65 and older in 2019, so we estimate 726,000 are users of

formal paid home care.

For costs, we again rely on data from the OECD Health Statistics database (OECD 2022), which

provides a total cost of home care for the public sector. Grignon and Spencer (2018) note that the

OECD does not provide estimates for private home care, but instead allocates those expenditures

elsewhere in its health accounts. Alternatively, Grignon and Spencer (2018) present a method to

estimate private expenditures, finding for the period up to 2014 the average share of private

15

We use Series E3, Table E.3.24.1. The category “other institutions” is mainly residential long-term care facilities.

43

spending is about 28 percent. We use this number to interpolate a private expenditure for home

care, by applying the 28 percent share to the dollar value provided by the OECD.

The OECD public home care estimate (across all ages) is $11.5 billion. To adjust for the

proportion of these expenditures associated with those age 65 or higher, we draw on a data

source from the Canadian Institute for Health Information which reports the age splits for clients

in a subset of provinces.

16

This source has 87 percent of clients age 65+. Of course, the services

provided across ages may differ so this division is perhaps rough. We apply this 87 percent then

multiply by (0.28/0.72=0.3888) to find the associated private sector home care spending amount.

We arrive at an estimate of $10 billion for public homecare and $3.9 billion for private

homecare. This is larger than found by National Institute on Ageing (2019), who report only $4

billion in public and $2 billion in home care expenditures. However, our public homecare

estimate is in line with the National Health Expenditures Database reported total for 2019 of

$10.2 billion for the public sector across all ages.

IV.C Unpaid Home Care

To estimate the cost of unpaid home care, we first derive an estimate for the number of hours of

care that is used by recipients. Since those hours of care are not contracted in a market, there is

no wage to observe. The person providing the care does have a value for their time, either

because those hours could potentially be sold to the market (if the caregiving person is working)

or because those hours must come out of leisure time that could otherwise be maintained by

16

We use tables from the 2021 Home Care Reporting System data provided by the Canadian Institute for Health

Information.

44

paying for care. Below, we explain two different methods of valuing these hours provided to

caregiving that incorporate these opportunity costs of time in different ways.

For someone who has a job, hours spent caregiving might come out of hours that could be sold to

their employer. If the labor market is competitive and flexible, then we can value that time at the

observed market wage for those individuals. We do so by taking the average hourly wages in the

2019 Labour Force Survey by age-gender-education group. Then, we use the age-gender-

education information in Table 18 to develop a composite wage that corresponds to the typical

demographics of caregivers. The average wage calculated in this way for 2019 is $27.34/hour.

This estimate of a caregiver’s opportunity cost is how we value foregone potential work hours

that are devoted to informal caregiving. Below, we refer to this as

.

For someone without a job, the hours spent caregiving can be valued in different ways,

depending on how we think about leisure. At one extreme, hours taken out of leisure could be

valued at zero. At the other extreme, the hours could be valued at the potential cost of market

care—the observed hourly wage of homecare workers. Our estimate for this wage comes from

Table 17. For home-care support workers, the average hourly wage is $18.45/hour. Below we

refer to this as

.

We combine this information into a single estimate by using the composite wage for workers to

value time for those who have a job, and two different estimates ($0 and $18.45) for valuing the

time of those without a job. Using the comparable age-education-gender groups in the Labour

Force Survey we find the proportion of people in each group who are working and use this

45

proportion and the implicit wage information to form the estimate. The proportion working using

this cell-average strategy in 2019 is 0.584.

The ‘low’ valuation assigns no value to leisure:

(

)

×

+ 1

(

)

× 0.

The ‘high’ valuation incorporates the value of leisure at the cost of hiring a paid caregiver:

(

)

×

+ 1

(

)

×

.

In each valuation case, we multiply the resulting implicit cost by the total number of hours of

unpaid caregiving in Canada. To find this number, we start with Table 10Table 10 where we

report that the average number of hours per week of informal care, among those receiving care is

22. Figure 7, using data from the Canadian Community Health Survey, finds that the proportion

using any unpaid help is 17 percent. With 6.6 million Canadians ages 65 and older, that is

1,122,000 recipients of unpaid help. At an average of 22 hours per week and 1,144 hours per

year, the total number of hours per year comes to 1,284 million hours.

We summarize these valuation calculations in Table 22 below. The left column shows the ‘low’

valuation described above, while the right column shows the ‘high’ valuation.

Table 22: Valuation of Informal Care

Low

High

Valuation (billions)

20.5

30.4

Total hours unpaid work

(millions)

1,284 1,284

prob(employed)

0.584

0.584

Wages/hour if employed

$27.34

$27.34

46

Wages/hour of caregiver

0

$18.45

Valuation per hour

$15.97

$23.64

Source: authors’ calculations, as described in the text. Dollar values are in 2019 Canadian

dollars.

IV.D Total Cost of Care

We aggregate the estimates discussed above for residential long-term care, formal home care,

and informal care in Table 23 below. The first two columns are drawn directly from the

discussion above. The third column provides a comparison in terms of GDP, and the last column

shows a per capita amount for each category. These estimates are for Canadians ages 65 and

older, and the estimates are centered around 2019 so we report in 2019 Canadian dollars. We

provide both public and private sector estimates for residential long-term care and formal home

care, along with a total. The informal care cost considers the two cases with the low valuation

(zero value of leisure) and the high valuation (leisure funded by paying for market-wage

homecare).

47

Table 23: Estimates of Total Cost of Care

Number

of users

Total

Spending

GDP

Share

Spending per

user

Residential Long-term care

Public

19.6

0.85%

Private

8.3

0.36%

Total

237,000

27.9

1.21%

$117,865

Formal home care

Public

10.0

0.43%

Private

3.9

0.17%

Total

726,000

13.9

0.60%

$19,150

Informal care

Low valuation

1,122,000

20.5

0.89%

$18,270

High valuation

1,122,000

30.4

1.31%

$27,000

62.3

Total (low valuation)

2.69%

Total (high valuation)

72.2

3.12%

Source: authors’ calculations, as described in the text. Dollar values are in 2019 Canadian

dollars; shares are the share of 2019 GDP.

Summed across these three types, the total cost of care is $62.3 billion for the low valuation, and

$72.2 billion for the high valuation. Nominal GDP in 2019 for Canada was $2.31 trillion, so in

the second last column we restate all the total cost information as a share of GDP to provide

better context for the overall fiscal bite and for international comparisons. Using the low

valuation, long-term care costs 2.69% of 2019 GDP; using the high valuation it is 3.12%.

Finally, in the last column we express the cost per user. Residential long-term care is much more

expensive, at nearly $118,000 per year per resident. Formal home care is about $19,000 per year

on average, with informal care in the range of $18,000 to $27,000.

48

Conclusions

This paper has provided a broad overview of long-term care for older Canadians, looking at the

economics of both the demand and supply sides of caregiving. Like other OECD countries, the

coming demographic wave of older baby boomers will put tremendous stress on the existing

financial, organizational, and physical structures of the long-term care system. Unlike other

OECD countries, Canada’s system is organized almost entirely at the subnational level, with

provinces and territories having by far the largest role in financing and regulating long-term care.

The unique federal structure of long-term care in Canada presents challenges and opportunities.

The greater ease of the federal government to tax and borrow could provide extra revenue to

fund necessary investments in bricks and mortar infrastructure or in ongoing annual

expenditures. However, whatever financial role the federal government may play, the

opportunity of decentralized experimentation (in the “federalism as a laboratory” spirit of Justice

Brandeis) should not be dismissed.

17