PSI Services LLC

3210 E Tropicana

Las Vegas, NV 89121

(888) 818-5822

E-mail: examschedule@psionline.com

https://home.psiexams.com/#/home

PENNSYLVANIA INSURANCE DEPARTMENT

LICENSING EXAMINATION

CANDIDATE INFORMATION BOOKLET

A Message from the Commissioner .......................... 2

The Licensure Process ........................................ 2

Fingerprint Requirements .................................... 4

Examination Payment and Scheduling Procedures ........ 4

Fees ................................................... 4

On-line Testing at a PSI test site ................. 5

Testing remotely .................................... 8

Rescheduling/Canceling an Examination ....... 9

Re-taking a Failed Examination .................. 9

Missed Appointment or Late Cancellation ....... 9

Exam Accommodations ............................. 9

English as a Second Language ..................... 9

Emergency Examination Site Closing ............. 9

Examination Site Location .................................... 9

Reporting to the Examination Site ......................... 10

Required Identification ........................... 10

Security Procedures ................................ 11

Taking the Examination by Computer ...................... 11

Identification Screen .............................. 11

Tutorial .............................................. 12

Test Question Screen .............................. 12

Remote Online Proctored Exam .................. 12

Examination Review ............................... 14

Score Reporting ............................................... 14

Duplicate Score Reports ........................... 14

Experimental Items ................................ 14

Tips for Preparing for your License Examination ......... 14

Obtaining your License ....................................... 14

Continuing Education ......................................... 15

Additional Licensing Information ........................... 15

Examination Content Outlines and Study Materials ...... 15

Exam Accommodations Request Form ...... End of Booklet

Please refer to our website to check for the most updated information at https://home.psiexams.com/#/home

Copyright © 2020 by PSI Services LLC Effective 7/1/2020

2

A MESSAGE FROM THE COMMISSIONER

This Candidate Information Booklet provides information about

the examination and application process for becoming licensed

to sell, solicit, negotiate or provide insurance or other services

and products in the Commonwealth of Pennsylvania.

Before being issued a license, you must pass an examination to

prove your knowledge of insurance statutes, regulations,

products and services. When you have successfully completed

your examination, you will be eligible to apply to the

Pennsylvania Insurance Department (the Department) for your

license.

The Department has contracted with PSI to conduct its

examination program. The Department and PSI work together to

ensure that examinations meet statutory requirements and

professional exam development standards.

Once a license is issued to an individual as an insurance

producer, the licensee may then secure insurer appointments to

represent the specific insurer if so desired. Please remember

that you may not engage in the business of insurance or viatical

settlements until the Department has issued to you one of the

various licenses explained in this Candidate Information

Booklet.

We wish you well in preparing for your examination and remind

you that Act 147 of 2002 requires all insurance producers to

complete 24 credit hours of continuing education courses each

biennial license cycle to be eligible to renew their license.

Any questions about the license examinations should be

directed to PSI. After you have successfully completed your

examination(s), questions regarding the application process to

obtain your license should be directed to the Department’s

Bureau of Licensing and Enforcement via e-mail at ra-in-

THE LICENSURE PROCESS

You must be licensed to sell, solicit or negotiate insurance in

the Commonwealth of Pennsylvania, or be appropriately

licensed to transact other insurance related functions such as

appraise physical damage to motor vehicles. To be licensed

there are various requirements you need to fulfill such as pre-

licensing education and testing requirements. The licensing

requirements are different, depending upon which license you

would like to apply for and your status as a resident or a non-

resident applicant.

To be licensed, you must:

Complete any necessary pre-licensing requirements;

Pass the required examination(s) for the type of

license you are applying for; and

After passing the examination use the kiosk at the PSI

test site to complete your license application online at

www.sircon.com/pennsylvania or www.nipr.com, or

you may apply using your own computer.

If required, submit applicable application materials

Note: Passing an examination does not guarantee that you will

be issued a license. You must submit your license application to

the Department within one year of passing the exam. Issuance

of a license depends on review and approval of all license

application materials.

For licensing information, please contact:

Pennsylvania Insurance Department

Bureau of Licensing and Enforcement

1209 Strawberry Square

Harrisburg, Pennsylvania 17120

Phone: 717.787.3840

Fax: 717.787.8553

Web site: www.insurance.pa.gov

E-mail: ra-in[email protected]

PRE-LICENSING EDUCATION REQUIREMENTS

Initial insurance producer applicants must first complete 24

hours of pre-licensing education credits. A list of approved

courses can be found at http://www.sircon.com/pennsylvania.

▪ Select Look up education courses or transcript.

▪ Select Approved Courses Inquiry.

▪ Choose Pennsylvania and select Submit.

▪ Change the Education Type to Pre-Licensing Education.

▪ Select your preferred instruction method or leave

blank and select Submit.

▪ By selecting the provider name, you will then be given

contact information and a link to available course

offerings for that particular provider.

▪ Once you have completed your pre-licensing education

credits, you will be issued a certificate of completion

and the provider will upload your course completion

information to Vertafore/SIRCON.

WAIVER OF EXAMINATION

Some initial insurance producer candidates may be exempt

from the pre-licensing education and examination requirement,

depending on the type of professional designation held and/or

the line of authority desired. The following classes of applicants

are exempt from pre-licensing and written examination

requirements:

▪ A business entity;

▪ A candidate who possesses the Professional Designation

CLU-Chartered Life Underwriter applying for Life or

Accident and Health Line;

▪ A candidate who has the Professional Designation

CPCU-Chartered Property and Casualty Underwriter

applying for Property, Casualty or Accident and Health

Line of Authority;

▪ A candidate who has the Professional Designation CIC-

Certified Insurance Counselor applying for Life,

Accident and Health or Property and Casualty Line of

Authority;

▪ A person who is licensed in another state as an

Insurance Producer for the same lines of authority for

which the person desires to be licensed in

Pennsylvania;

▪ A person who has a line of authority limited to Limited

Line Credit Insurance;

▪ A person who has a line of authority limited to a

Limited Line; and

▪ An individual whose line of authority will be restricted

to domestic mutual fire insurance and will be with a

company writing only coverage other than insurance

upon automobiles as authorized by Section 202(B)(1)

through (3) of the Act of May 17, 1921, known as the

Insurance Company Law of 1921.

3

Note: If you request an examination waiver, fingerprints are

still required before an initial resident insurance producer

license will be issued. See the Department’s Web site at

www.insurance.pa.gov for more information.

TYPES OF LICENSES

In accordance with Pennsylvania statutes and regulations, the

Department grants the licenses listed below.

Life and Health

Exam Series

Life Insurance, Annuities and Accident and

Health

16-01 and 16-02, or

16-03

Life Insurance and Annuities

16-01

Accident and Health

16-02

Variable Life & Variable Annuity

No exam (requires

FINRA registration)

Property

Exam Series

Fire and Allied Lines

16-04 or 16-06

Inland Marine and Motor Vehicle Physical

Damage

16-04 or 16-06

Domestic Mutual Fire (issued only to domestic

mutual fire companies)

No exam

Casualty

Exam Series

Casualty and Allied Lines

16-05 or 16-06

Accident and Health

16-02 or 16-03

Bonds: All Classes

16-05 or 16-06

Liability other than Motor Vehicle

16-05 or 16-06

Workers’ Compensation Insurance

16-05 or 16-06

Miscellaneous

Exam Series

Nonprofit Hospitalization

16-02 or 16-03

Title Insurance

16-10

Health Maintenance Organization

16-02 or 16-03

Nonresidents

See Page 3

Securities Investment Loss

16-05

Other Licenses

Exam Series

Surplus Lines Producer

16-09

Public Adjuster

16-19*

Motor Vehicle Physical Damage Appraiser

16-20 **

Personal Lines

16-16

Viatical Settlement Broker

16-17

*The examination content outline and more specific

information on taking this examination is available in the

Pennsylvania Public Adjuster Candidate Information Booklet

located online at https://home.psiexams.com/#/home.

**The examination content outline and more specific

information on taking this examination is available in the

Pennsylvania Motor Vehicle Physical Damage Appraiser

Candidate Information Booklet located online at

https://home.psiexams.com/#/home.

Combination examinations. A separate examination is given for

each major line of insurance. Combination Line examinations

(Life, Accident and Health; or Property and Casualty) combine

the content of the single-line examinations. You must pass the

overall examination to obtain a license in either line.

RESIDENT LICENSING REQUIREMENTS

Resident Insurance Producer

In order to qualify as a Pennsylvania resident insurance

producer, you must:

▪ Be at least 18 years of age;

▪ Maintain a primary residence or business location in

the Commonwealth of Pennsylvania;

▪ Possess the requisite professional competence, general

fitness and integrity of character;

▪ Be able to read and write English, with or without

visual or mechanical aids for the visually handicapped;

and

▪ Pass the appropriate examination(s) required by

statute 40 P.S. 310.5.

▪ Initial resident individual producer applicants are

required to be fingerprinted

Title Insurance Agent license

A title insurance agent means an authorized person, firm,

association, corporation or partnership, other than a bona fide

salaried employee of the title insurer who, on behalf of the

title insurer, performs the following acts, in conjunction with

the issuance of a title insurance report or policy:

▪ Determines insurability and issues title insurance

reports or policies or both; and

▪ Performs one or more of the following:

- Collects or disburses premiums, escrow or other

funds;

- Handles escrow, settlements or closings;

- Solicits or negotiates title insurance business; or

- Records closing documents.

An applicant for a Title Insurance Agent license is required to:

▪ Pass the Title Insurance Agent examination (applies to

both resident and nonresident applicants); and

▪ After passing the examination use the kiosk at the PSI

test site to complete your license application online at

www.sircon.com/pennsylvania or www.nipr.com, or

you may apply using your own computer.

▪ Fingerprints are required for both resident and non-

resident Title Insurance Agent applicants.

Surplus Lines license

A surplus lines producer is an individual, partnership or

corporation licensed by the Department to place insurance

coverage with an approved non-admitted company and who

may receive a commission for placing the coverage.

Under Article XVI of the Insurance Company Law (40 P.S.

Section 991.1601 et seq.), an applicant for a Resident Surplus

Lines Producer license shall:

▪ Be currently licensed in good standing as a resident

Pennsylvania Property and Casualty insurance

producer;

▪ Pass the Pennsylvania Surplus Lines examination—there

are no exemptions;

▪ After passing the examination use the kiosk at the PSI

test site to complete your license application online at

www.sircon.com/pennsylvania or www.nipr.com, or

you may apply using your own computer;

and

▪ If there is a partnership or corporation involved, a

separate business entity application must also be

submitted. Applicants can contact the Department for

the application and statement of regulations.

▪ Surplus Lines applicants do not require

fingerprinting.

4

NONRESIDENT LICENSING REQUIREMENTS

A nonresident holds a resident license in a U.S. state or

territory other than the Commonwealth of Pennsylvania. A

nonresident applicant for an insurance producer license shall

submit to the Department:

▪ As individuals: An application through

www.sircon.com/pennsylvania or www.nipr.com.

▪ As business entities: An application through

www.sircon.com/pennsylvania or www.nipr.com by

the designated licensee.

More information is available at www.insurance.pa.gov.

Reciprocal Agreements

Nonresident applicants shall be subject to the same burdens or

prohibitions placed upon Pennsylvania residents who apply for a

nonresident license in their home state.

Examinations for any lines of authority (other than Title

Insurance) will be waived for a nonresident insurance producer

license, provided that: 1) the application is for the same line of

authority held in the applicant’s “home” state; and 2) the

applicant’s home state grants a waiver of examination to

Pennsylvania resident insurance producers. See section 40 P.S.

310.10.

Note: Nonresident title insurance agent license applicants must

pass the Title Insurance Agent examination and submit

fingerprints.

Surplus Lines Producer license

A nonresident Surplus Lines Producer license may only be

obtained for the purpose of placing business on behalf of a

Pennsylvania resident with an eligible surplus lines insurer. An

applicant shall:

▪ Be currently licensed in Pennsylvania as a nonresident

property and casualty insurance producer, either pass

Pennsylvania’s surplus lines examination or hold

surplus lines authority in his/her home state and apply

under the reciprocity provision of Act 147 of 2002; and

▪ Submit an application online at

www.sircon.com/pennsylvania or www.nipr.com and

pay all fees by credit card. If there is a partnership or

corporation involved, a licensing application for the

business entity must also be submitted online at

www.sircon.com/pennsylvania or www.nipr.com.

FINGERPRINT REQUIREMENTS

Act 147 of 2002, 40 P.S. 310.5, requires initial resident

insurance producer applicants to provide fingerprint samples to

the Pennsylvania Insurance Department. The Department uses

this information to receive national criminal history background

information from the Federal Bureau of Investigation (FBI). This

applies to all initial applicants for a resident insurance producer

license and applicants for a nonresident insurance producer

license who do not qualify to apply for a license under

reciprocity.

Note Limited Lines applicants who do not need to take either

pre-examination education or an examination, still need to

submit fingerprint samples. Title agent applicants do need to

take an examination and submit fingerprint samples.

Fingerprints are not required for the following applicants:

Motor Vehicle Physical Damage Appraiser (MVPDA), Non-resident

Public Adjuster, Non-resident Producer, Viatical Settlement

Broker, Surplus Lines, Add qualification applicants (those

already licensed and wish to add a line of authority to your

existing license).

FINGERPRINT PROCESS

The following fingerprinting guidelines apply to applicants for a

new insurance producer license or title agent license:

▪ After passing the examination use the kiosk at the PSI test

site to complete your license application online at

www.sircon.com/pennsylvania or www.nipr.com, or you

may apply using your own computer.

▪ Fingerprinting is required of all applicants for a new

resident producer license and must be done at an IdentoGO

enrollment center. Applicants are required to register

online via the IdentoGO website at

https://uenroll.identogo.com or by telephone at 844-321-

2101 Monday through Friday, 8 A.M. to 6 P.M. EST.

Following registration, the applicant will be provided with

a registration number which they will take with them when

they go to the IdentoGO site for fingerprinting. Applicants

must be registered with IdentoGO prior to arriving at a

fingerprinting site. When registering online an applicant

must use the appropriate service code assigned to the

Insurance Department, which is 1KG8Q3. Using the correct

service code ensures the background check is processed for

the correct agency and submitted for the correct purpose.

▪ The total fingerprinting fee is $23.85. Payment is made at

the IdentoGO center after the applicant’s fingerprints have

been submitted. Credit card, debit card, certified check

or money order, are the only payment methods accepted.

No cash transactions or personal checks will be accepted.

▪ As a reminder, individuals should not register for a

fingerprinting appointment and submit their fingerprints

until after they have passed any examination

requirements and applied for licensure. Any fingerprint

results received without a corresponding license

application will be destroyed, and individuals will be

required to repay the fingerprinting fee and resubmit

their fingerprints at an IdentoGO center.

Fingerprint results will be returned to the Department from the

FBI. The Department will review and evaluate the results as

well as the license application to determine if all standards for

licensure have been met.

EXAMINATION PAYMENT AND SCHEDULING

PROCEDURES

It is your responsibility to contact PSI to pay and schedule for

an examination. There is no limit to the number of times you

may take an examination if you fail.

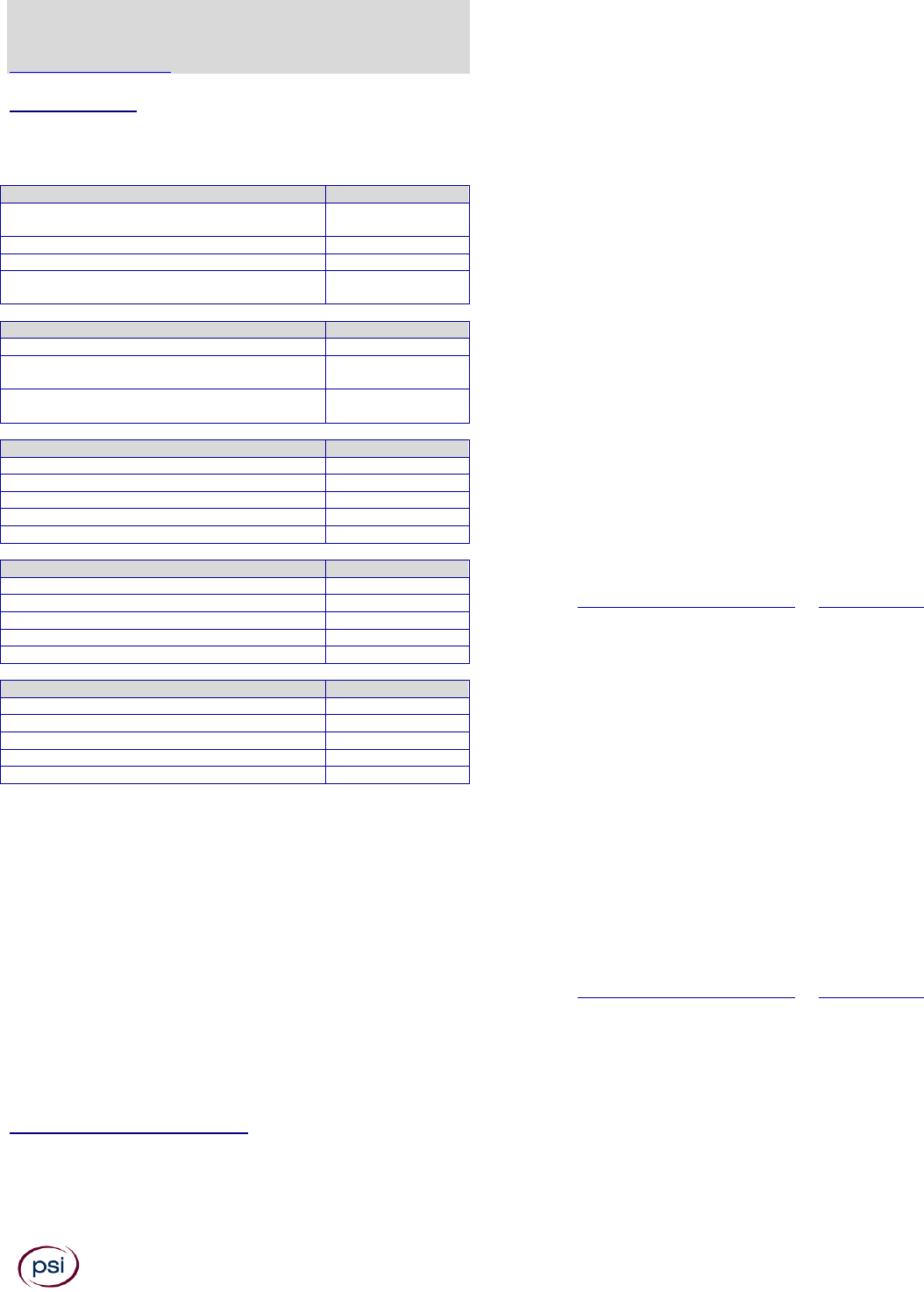

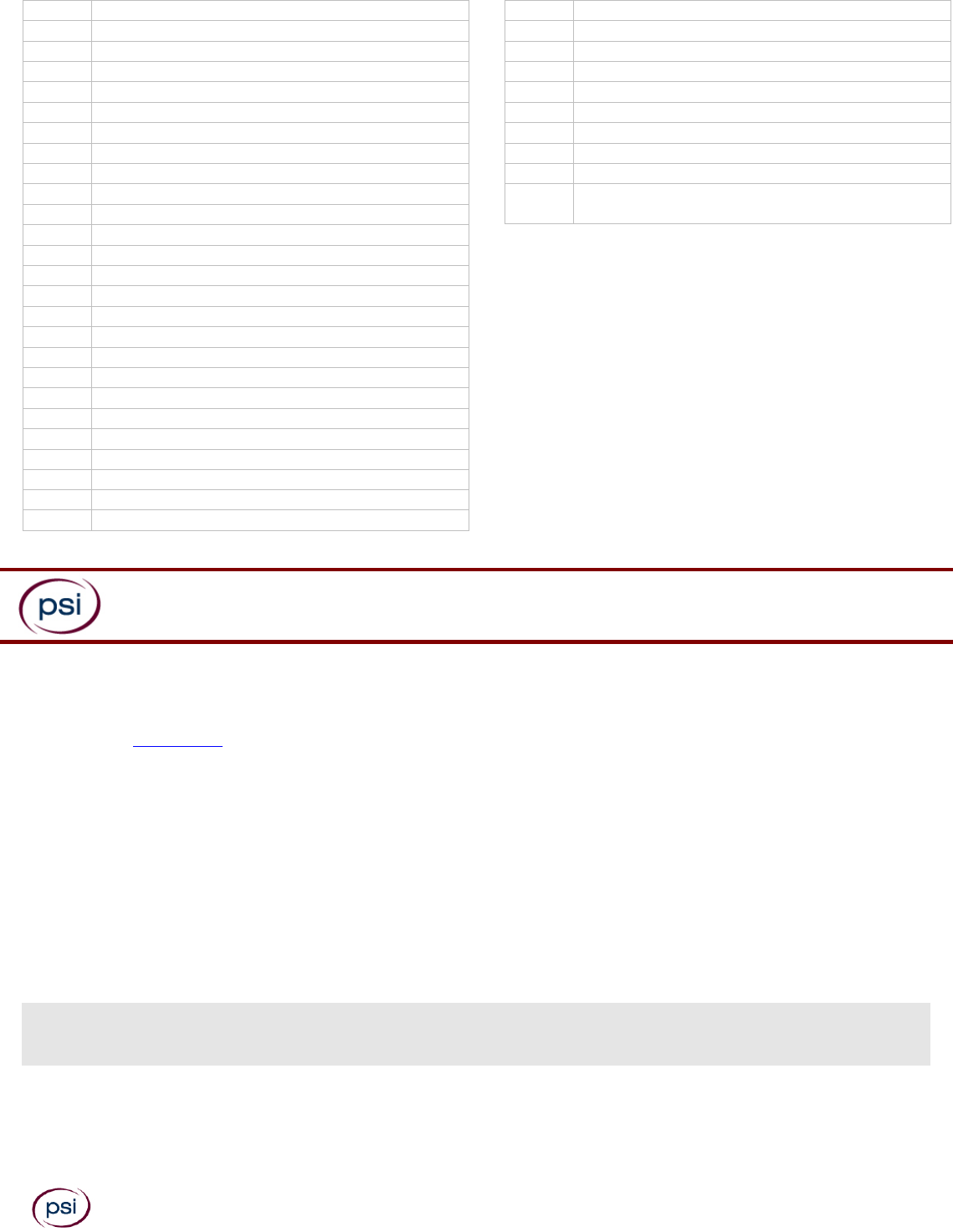

Examination

Examination

Series

Examination

Fees

Life Insurance

16-01

$43.00

Accident and Health

16-02

$43.00

Life, Accident and Health

16-03

$53.00

Property and Allied Lines

16-04

$43.00

Casualty and Allied Lines

16-05

$43.00

5

Property and Casualty

16-06

$53.00

Surplus Lines Producer

16-09

$43.00

Title Insurance Agent

16-10

$43.00

Personal Lines

16-16

$43.00

Viatical Settlement Broker

16-17

$43.00

ONLINE (https://home.psiexams.com/#/home)

For the fastest and most convenient examination scheduling process, register for your examinations online by accessing PSI’s

registration Website: Click Here

1. Select “SIGN UP” to create an account.

2. On a mobile phone, you need to select the icon on the top left corner. Then select “LOG IN” to create an account.

3. You will be prompted to create an account with PSI

IMPORTANT

You must enter your First and Last name

exactly as it is displayed on your government

issued ID.

6

4. After you submit the form, you will get a message that your account was created successfully. Click on “Login to Continue”.

Note: The username is the email address you entered when creating the

account.

5. You are now ready to schedule. Select the Jurisdiction, Account and the Test.

6. You will enter your personal information.

7

7. You will enter payment.

8. You will now select if you want to test at a PSI test site or Remotely proctored online from a computer at a remote location.

DELIVERY MODE TEST CENTER

1. Enter the “City or Postal Code” and select “Preferred Month” to take the Exam. Then select “Search Exam Center”.

8

2. Click on the preferred test site.

3. Then click on the date and time to make an appointment to take the Exam.

You are now scheduled and will receive an email confirmation.

DELIVERY MODE REMOTE ONLINE PROCTORED EXAM

1. Select Country and Time zone.

Select the date and time you will be taking the exam. DO NOT HIT CONTINUE. YOU MUST FIRST CHECK THE COMPATIBILTY OF

YOUR COMPUTER to include Audio/Video Check, Webcam Check and System Check. You must use Google Chrome Browser. Please

note that if your computer performs any system update (i.e. software, server, firewall, webcam, etc.) from the time you

schedule your exam to when you attempt to launch your exam, you may experience issues with your compatibility. It is best to

conduct another compatibility check on the machine that you will be taking your exam at least 24 hours prior to your scheduled

exam. You may also check your compatibility before or after registering for your exam by clicking here.

9

If you have any questions regarding your compatibility check, or if you experience issues launching your exam, you may contact our

remote proctoring technical support team at (844) 267-1017. You may also initiate a chat after you close the Secure Browser Software

by clicking here.

You are now scheduled and will receive an email confirmation.

RESCHEDULING/CANCELING AN EXAMINATION APPOINTMENT

You may cancel and reschedule an examination appointment

without forfeiting your fee if your cancellation notice is

received 2 days before the scheduled examination date. For

example, for a Monday appointment, the cancellation notice

would need to be received on the previous Saturday. You may

reschedule online at https://home.psiexams.com/#/home. or

call PSI at 888-818-5822.

Note: A voice mail or email message is not an acceptable

form of cancellation. Please use the PSI Website or call PSI

and speak directly to a Customer Service Representative.

RETAKING A FAILED EXAMINATION

It is not possible to make a new examination appointment on

the same day you have taken an examination; this is due to

processing and reporting scores. A candidate who tests

unsuccessfully on a Wednesday can call the next day, Thursday,

and retest as soon as Friday, depending upon space availability.

You may schedule online at

https://home.psiexams.com/#/home or call PSI at 888-818-

5822.

MISSED APPOINTMENT OR LATE CANCELLATION

If you miss your appointment, you will not be able to take the

examination as scheduled, further you will forfeit your

examination fee, if you:

▪ Do not cancel your appointment 2 days before the scheduled

examination date;

▪ Do not appear for your examination appointment;

▪ Arrive after examination start time;

▪ Do not present proper identification when you arrive for the

examination.

EXAM ACCOMMODATIONS

All PSI examination centers are equipped to provide access in

accordance with the Americans with Disabilities Act (ADA) of

1990, and exam accommodations will be made in meeting a

candidate's needs. A candidate with a disability or a candidate

who would otherwise have difficulty taking the examination

must follow the instructions on the Exam Accommodations

Request Form at the end of this Candidate Information Booklet.

ENGLISH AS A SECOND LANGUAGE

Upon receipt of a personal letter requesting the authorization and

a letter from your English instructor or sponsoring company (on

letterhead), certifying that English is not your primary language, a

candidate will be granted time and one-half to complete the

examination. Please use the Exam Accommodations Request

Form at the end of this Candidate Information Booklet to submit

your request and provide the required documents.

EXAMINATION SITE CLOSING FOR AN EMERGENCY

In the event that severe weather or another emergency forces

the closure of an examination site on a scheduled examination

date, your examination will be rescheduled. PSI personnel will

attempt to contact you in this situation. However, you may

check the status of your examination schedule by calling 888-

818-5822. Every effort will be made to reschedule your

examination at a convenient time as soon as possible. You will

not be penalized. You will be rescheduled at no additional

charge.

EXAMINATION SITE LOCATIONS

The following directions are generated from the most current

mapping services available. However, new road construction

and highway modifications may result in some discrepancies. If

you are not familiar with the specific area of the examination

site, please consult a reliable map prior to your examination

date.

Allentown

1620 Pond Road, Suite 50

Allentown, PA 18104

10

Take Route 22, exit Cedar Crest Blvd North. Turn Right on North Cedar

Crest Blvd. Turn left onto Winchester, then turn right onto Pond.

Bristol

1200 Veteran's Highway, Suite B4

Bristol, PA 19007

On I-95 toward Bristol Township, exit Bristol then turn right at the

stoplight. Office is the second building on the left. There are many

entrances, but use the entrance under the clock tower.

Cranberry Township

Cranberry Corporate Business Center

213 Executive Dr., Suite 150

Cranberry Township, PA 16066

From I-79 exit Cranberry-Mars Route 228, go West. Cross over Route 19

onto Freedom Road. Go three traffic lights then turn right onto

Executive Drive. Building is directly across from Hampton Inn.

Erie

2700 W. 21st Street, Suite 21 & 22

Erie, PA 16506

From Interstate 79 North, take the West 26th St., exit 182, or Rt. 20

West. Just after the 2nd light you'll see Bonnel Auto Sales on your right.

Lowell Ave runs along the side of the Bonnel Auto Sales, make a right

onto Lowell. Stay on Lowell until it intersects with West 21st St. Make

the left onto 21st and our building sits on that corner. The 2700 is

written across the front of the building.

From I 79 South coming from Erie proper same directions 26th St., exit

182 or Rt. 20 West right at Bonnel Auto Sales on Lowell. Stay on Lowell

until West 21st St intersects. The office at 2700 West 21st St. sits on the

left corner across the street from where you are now at the yield sign.

Greensburg

DiCesare Building

116 E. Pittsburgh St., Suite 101

Greensburg, PA 15601

From Route 30 East or West, exit Business 66 North (NB. NOT Turnpike

66.) Go about 1.5 miles into downtown Greensburg. Turn right in the

direction of Route 30 East at the lights between First Commonwealth

Bank and Citizen's Bank. Building will be about 500 feet on right, past the

YMCA but before Co Go's garage.

Harrisburg

2300 Vartan Way, Suite 245

Harrisburg, PA 17110

From 83 North towards Harrisburg, take 581 West. Take I-81 North, exit

Progress Avenue (exit 69) and turn left at the exit. Go approximately 1

mile to Vartan Way. Turn Right. Make immediate left into parking lot.

From I-81 South, exit Progress Avenue and turn left at the exit. Go

approximately 1 mile to Vartan Way. Turn Right. Make immediate left

into parking lot.

Note: 2300 Vartan Way faces Progress Avenue. PSI is in the building with

4 radio stations, including Hot 92 and Wink 104.

King of Prussia

601 South Henderson Road, Suite 205

King of Prussia, PA 19406

Going East: Take I-76 East and exit #330 toward Gulph Mills. Turn left at

the bottom of the ramp at the 1

st

traffic light (Gulph Road). Go North on

Gulph. Turn right at the 3

rd

traffic light (S Henderson Rd).

Going West: Take I-76 West and exit #330 toward Gulph Mills. Keep left

at the fork in the ramp. Turn slight left onto Balligomingo Road. Turn

right onto Trinity Lane and continue to follow Trinity. Turn slight left

onto Swedeland Rd. Turn slight right onto S. Gulph Road. Turn slight

right onto S. Henderson Rd.

Philadelphia (Bala Cynwyd)

One Bala Avenue, Suite 310

Bala Cynwyd, PA 19004

From I-76 exit City Line Avenue. Follow City Line Avenue South. The

building is on Bala and City Line (next to the Bala Cynwyd railroad

station). Note: This is NOT Bala Plaza.

Pittsburgh

Towne Center

1789 South Braddock Avenue, Suite 296

Pittsburgh, PA 15218

From I-376 East, go through Squirrel Hill tunnels. Exit #77 toward

Swissville. Turn slight left onto Monongahela Avenue. Turn right on

South Braddock Avenue (IN THE EDGEWOOD TOWNE CENTER OFFICE

BUILDING).

All candidates should report to the PSI office 30 minutes prior to the

published session time, and no earlier. If candidates wish to arrive

earlier, they must wait in the Security Office's designated areas on the

first floor, or outside of the building. The building management does not

allow candidates to wait in the hallways, and/or common areas of other

floors, including our own floor. Thank you for your cooperation.

Scranton

1125 Lackawanna Trail Rts 6&11

Clarks Summit, PA 18411

From I-81N take Exit 194 (Clarks Summit) and merge onto US6W/US/11N.

Continue on Routes 6 & 11 for approximately 3 miles until you see the

Agway building on the left side of the road. Just before the Agway

building, make a U-turn. After making the U turn you will see 2 houses

before you see the PSI parking lot. PSI is located in a long brown brick

building which is set back from the highway. There is a small red and

white sign located at the entrance to the parking lot.

(If approaching from the opposite direction (US6S/US11E) PSI is located

on the right, approximately 100 feet after the Agway building).

Additionally, PSI has examination centers in many other regions

across the United States. You may take the written

examination at any of these locations by following the

instructions on the Exam Accommodations Request Form found

at the end of this Booklet.

REPORTING TO THE EXAMINATION SITE

On the day of the examination, you should arrive 30 minutes

before your appointment. This extra time is for sign-in,

identification, and familiarizing you with the examination

process. If you arrive late, you may not be admitted to the

examination site and you will forfeit your examination

registration fee.

Person(s) accompanying an examination candidate may not wait

in the examination center, inside the building or on the

building's property. This applies to guests of any nature,

including drivers, children, friends, family, colleagues or

instructors.

REQUIRED IDENTIFICATION

Candidates must register for the exam with their LEGAL first

and last name as it appears on their government issued

identification. All required identification below must match the

first and last name under which the candidate is registered.

Candidates are required to bring one (1) form of valid (non-

expired) signature bearing identification to the test site. If the

candidate fails to bring proper identification or the candidate

names do not match, the candidate will not be allowed to test

and their examination fee will not be refunded.

• Primary Identification: All candidates must provide 1

form of identification. ID must contain candidate’s

photo, signature, and be valid and unexpired. Allowable

forms of identification are as follows:

- State issued driver’s license

- State issued identification card

11

- US Government Issued Passport

- US Government Issued Military Identification Card

- US Government Issued Alien Registration Card

- Canadian Government Issued ID

- US Employment Authorization Card

• Pre-licensing education certificate (applies only to

initial resident producer applicants):

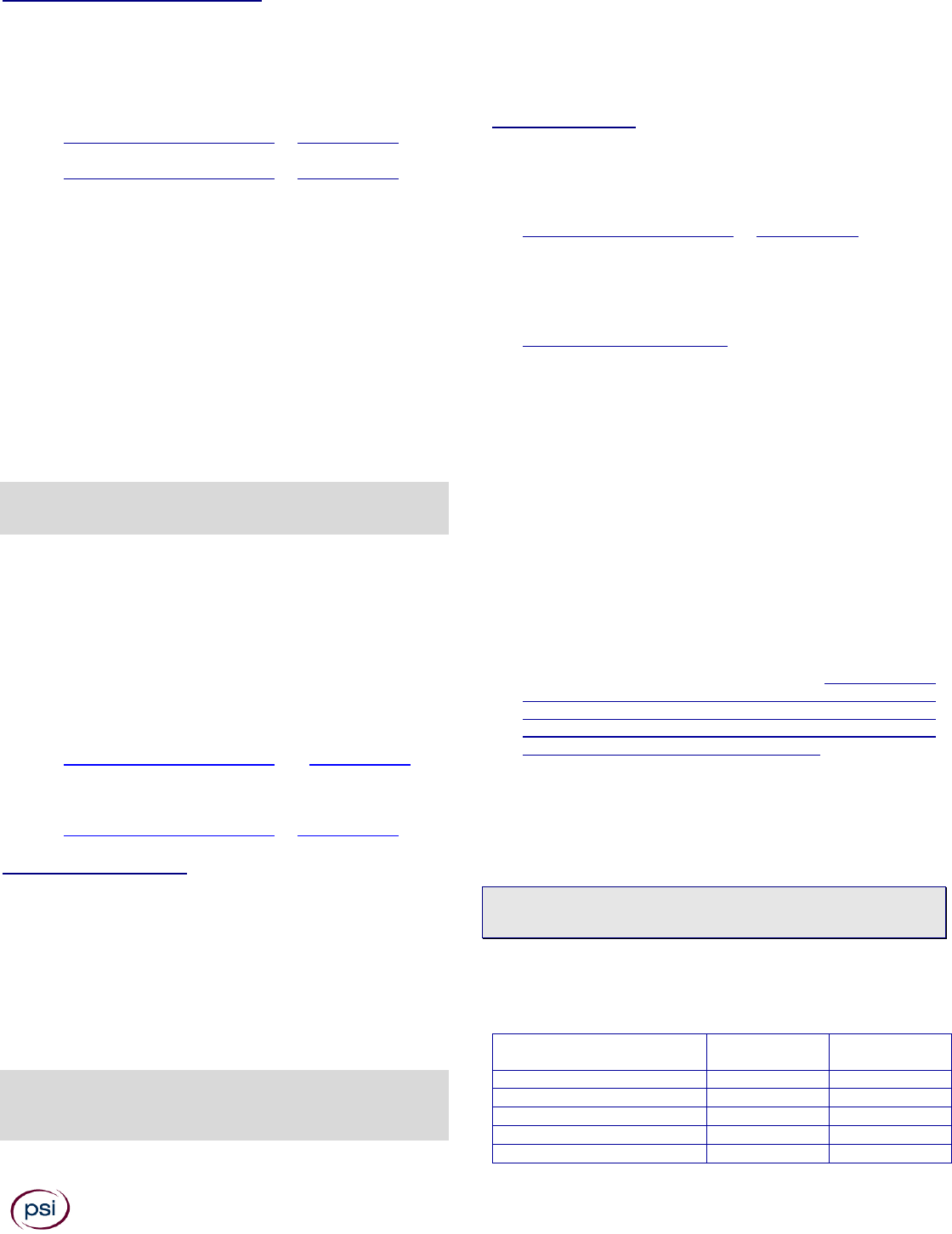

If the test is marked with a “Yes” in the chart below,

candidates must present their pre-licensing education

certificate or an education verification letter from the

Pennsylvania Insurance Department. If you fail, this

must be presented for every attempt thereafter.

Candidates will not be allowed to test without an

education certificate or an education verification letter.

A pre-licensing certificate is valid for one year from date

of completion; an education verification letter is valid

for one year from the date it was written). AN

ELECTRONIC VERSION OR HARD COPY WILL BE

ACCEPTED.

Examination

Examination

Series

*Prelicense

Certificate

Required?

Life Insurance

16-01

Yes

Accident and Health

16-02

Yes

Life, Accident and Health

16-03

Yes

Property and Allied Lines

16-04

Yes

Casualty and Allied Lines

16-05

Yes

Property and Casualty

16-06

Yes

Personal Lines

16-16

Yes

Viatical Settlement Broker

16-17

No

Motor Vehicle Physical Damage

Appraiser

16-20

No

Public Insurance Adjuster

16-19

No

Surplus Lines Producer

16-09

No

Title Insurance Agent

16-10

No

*Note: Candidates adding a Line of Authority must present their

current license instead of the pre-licensing education

certificate.

SECURITY PROCEDURES

The following security procedures apply during examinations

administered at a PSI examination site:

▪ All examination sites will provide ear plugs upon request

▪ Calculators provided by PSI are allowed.

▪ You will be given a piece of scratch paper and a pencil.

These will be returned to the proctor at the end of your

examination.

▪ All personal belongings of candidates should be placed in

the secure storage provided at each site prior to entering

the examination room. Personal belongings include, but

are not limited to, the following items:

- Electronic devices of any type, including cellular /

mobile phones, recording devices, electronic

watches, cameras, pagers, laptop computers, tablet

computers (e.g., iPads), music players (e.g., iPods),

smart watches, radios, or electronic games.

- Bulky or loose clothing or coats that could be used to

conceal recording devices or notes. For security

purposes outerwear such as, but not limited to: open

sweaters, cardigans, shawls, scarves, hoodies, vests,

jackets and coats are not permitted in the testing

room. In the event you are asked to remove the

outerwear, appropriate attire, such as a shirt or

blouse should be worn underneath.

- Hats or headgear not worn for religious reasons or as

religious apparel, including hats, baseball caps, or

visors.

- Other personal items, including purses, notebooks,

reference or reading material, briefcases, backpacks,

wallets, pens, pencils, other writing devices, food,

drinks, and good luck items.

▪ Although secure storage for personal items is provided at

the examination site for your convenience, PSI is not

responsible for any damage, loss, or theft of any personal

belongings or prohibited items brought to, stored at, or left

behind at the examination site. PSI assumes no duty of care

with respect to such items and makes no representation

that the secure storage provided will be effective in

protecting such items. If you leave any items at the

examination site after your examination and do not claim

them within 30 days, they will be disposed of or donated,

at PSI’s sole discretion.

▪ During the check in process, all candidates will be asked if

they possess any prohibited items. Candidates may also be

asked to empty their pockets and turn them out for the

proctor to ensure they are empty. The proctor may also ask

candidates to lift up the ends of their sleeves and the

bottoms of their pant legs to ensure that notes or recording

devices are not being hidden there.

▪ Proctors will also carefully inspect eyeglass frames, tie

tacks, or any other apparel that could be used to harbor a

recording device. Proctors will ask to inspect any such

items in candidates’ pockets.

▪ If prohibited items are found during check-in, candidates

shall put them in the provided secure storage or return

these items to their vehicle. PSI will not be responsible for

the security of any personal belongings or prohibited items.

▪ Any candidate possessing prohibited items in the

examination room shall immediately have his or her test

results invalidated, and PSI shall notify the examination

sponsor of the occurrence.

▪ Any candidate seen giving or receiving assistance on an

examination, found with unauthorized materials, or who

violates any security regulations will be asked to surrender

all examination materials and to leave the examination

center. All such instances will be reported to the

examination sponsor.

▪ Copying or communicating examination content is violation

of a candidate’s contract with PSI, and federal and state

law. Either may result in the disqualification of

examination results and may lead to legal action.

▪ Once candidates have been seated and the examination

begins, they may leave the examination room only to use

the restroom, and only after obtaining permission from the

proctor. Candidate will not receive extra time to complete

the examination.

TAKING THE EXAMINATION BY COMPUTER

The examination will be administered via computer. You will

be using a mouse and computer keyboard.

IDENTIFICATION SCREEN

You will be directed to a semiprivate testing station to take the

examination. When you are seated at the testing station, you

will be prompted to confirm your name, identification number,

and the examination for which you are registered.

12

TUTORIAL

Before you start your examination, an introductory tutorial is

provided on the computer screen. The time you spend on this

tutorial, up to 15 minutes, DOES NOT count as part of your

examination time. Sample questions are included following the

tutorial so that you may practice answering questions, and

reviewing your answers.

TEST QUESTION SCREEN

The “function bar” at the top of the test question screen

provides mouse-click access to the features available while

taking the examination.

One question appears on the screen at a time. During the

examination, minutes remaining will be displayed at the top of

the screen and updated as you record your answers.

IMPORTANT: After you have entered your responses, you will

later be able to return to any question(s) and change your

response, provided the examination time has not run out.

Question types. The questions in your licensing exam are

multiple choice. Each provides four options from which you

choose your answer.

Question formats. Three different multiple-choice formats are

used. Each format is showing in the following examples. An

asterisk (*) indicates the correct answer in each sample

question.

Format 1 – Incomplete Sentence:

Actual cash value is generally accepted to mean:

A. Original purchase price of the property

B. Market value at the time of the loss

C. Cost to replace at the time of loss plus appreciation

*D. Cost to replace at the time of loss, less depreciation

Format 2 – Direct Question:

Which one of the following is covered under the Liability

Coverage of the Business Auto Coverage Form?

A. Workers compensation

*B. Explosion

C. Expected injury

D. Pollution

Format 3 – All of the following except:

The Business Auto Coverage Form covers losses from all of the

following under comprehensive coverage EXCEPT:

A. Fire

B. Vandalism

*C. Freezing

D. Theft

REMOTE ONLINE PROCTORED EXAMINATION

Proctors for online testing will communicate with candidates on-screen during the test and pause the exam whenever unauthorized

persons or activity appear on video monitors or in audio recordings. The proctor will pause the exam whenever a candidate leaves the

testing station, or an interruption occurs. The proctor may end the test if an interruption is not corrected appropriately. Immediate on-

screen results will be displayed on your screen once you complete BOTH your exam AND the survey following the exam. Paper score

reports will not be available upon completion of the exam for this remotely proctored location. A military ID will not be accepted for a

remotely proctored exam, however, all other Identification noted above are acceptable for this delivery mode.

Before your exam begins, please be aware of the following testing rules:

✓ Please be reminded that earbuds, earphones, hats, caps, hood, shades or anything that can be placed on the head or

face is NOT allowed.

✓ Food, Drinks, or Breaks are not allowed. All personal items must be removed from the work area.

✓ Candidates are not allowed to have scratch paper.

✓ You are not allowed to leave the station during the exam. If you need to use the restroom before the exam begins,

please do so now.

✓ Please do your best to avoid covering your mouth for the whole duration of exam. Be aware that

talking/whispering/mouthing is not allowed during exam.

✓ You must keep both of your hands on or above the desktop during the exam.

✓ Also note that under no circumstances are you allowed to take a screenshot or photo of the exam or the exam results at

any time during or after the session.

Violating any of these rules will result in a warning and may result in exam termination.

13

BE SURE TO CHECK THE COMPATIBILTY OF YOUR COMPUTER to include Audio/Video Check, Webcam Check and System Check. Prior

to scheduling, click here. You must use Google Chrome Browser.

Please note that if your computer performs any system update (i.e. software, server, firewall, webcam, etc.) from the time you

schedule your exam to when you attempt to launch your exam, you may experience issues with your compatibility. It is best to

conduct another compatibility check on the machine that you will be taking your exam at least 24 hours prior to your scheduled

exam. You may also check your compatibility before or after registering for your exam by clicking here.

LAUNCHING THE EXAMINATION

You can launch the examination up to 30 minutes before the scheduled start time.

If you have any questions regarding your compatibility check, or if you experience issues launching your exam, you may contact our

remote proctoring technical support at (844) 267-1017. You may also initiate a chat after you close the Secure Browser Software by

clicking here.

14

EXAMINATION REVIEW

PSI, in cooperation with the Department, will be continually

evaluating the examinations being administered to ensure that

the examinations accurately measure competency in the

required knowledge areas. Comments may be entered on the

computer keyboard during the examination. Your comments

regarding the questions and the examinations are welcomed.

Comments will be analyzed by PSI examination development

staff. While PSI does not respond to individuals regarding these

comments, all substantive comments are reviewed. If a

discrepancy is found during the comment review, PSI and the

Department may re-evaluate candidates’ results and adjust

them accordingly. This is the only review of the examination

available to you.

SCORE REPORTING

Your score will be displayed on screen at the end of the

examination and a score report will be emailed to you. If you

fail, the emailed score report will include the diagnostic report

indicating your strengths and weaknesses by examination type.

Candidates taking a remotely proctored exam: Please note that

you must select to end both the exam portion and survey

portion of your test in order to receive your on-screen results

and emailed score report. If you do not receive your emailed

score report, you may reach out to [email protected].

You may request a duplicate score report after your

your name, candidate ID number and confirmation number.

Your candidate ID number and confirmation number is on your

exam confirmation email. Please allow up to 72 hours to

receive your duplicate score report.

EXPERIMENTAL ITEMS

In addition to the number of examination items specified in the

"Examination Content Outlines", a small number (5 to 10) of

"experimental" questions may be administered to candidates

during the examinations. These questions will not be scored and

sufficient time to answer them is included in the examination

time. The administration of such non-scored experimental

questions is an essential step in developing future licensing

examinations.

TIPS FOR PREPARING FOR YOUR LICENSE

EXAMINATION

The following suggestions will help you prepare for your

examination.

▪ Only consider the actual information given in the question,

do not read into the question by considering any

possibilities or exceptions.

▪ Planned preparation increases your likelihood of passing.

▪ Start with a current copy of this Candidate Information

Booklet and use the examination content outline as the

basis of your study.

▪ Read study materials that cover all the topics in the

content outline.

▪ Take notes on what you study. Putting information in

writing helps you commit it to memory and it is also an

excellent business practice.

▪ Discuss new terms or concepts as frequently as you can

with colleagues. This will test your understanding and

reinforce ideas.

▪ Your studies will be most effective if you study frequently,

for periods of about 45 to 60 minutes. Concentration tends

to wander when you study for longer periods of time.

OBTAINING YOUR LICENSE

Immediately after you pass your examination, use the kiosk at

the PSI test site to complete your license application online at

www.sircon.com/pennsylvania or www.nipr.com, or you may

apply using your own computer. If you are applying for a new

resident insurance producer license or title agent license, you

will also be required to provide fingerprints.

NOTE: You must provide fingerprints to permit the

Department to obtain a criminal history record report from

the FBI. See page 3 for details.

It is your responsibility to ensure that the application has been

properly completed and that the information is accurate.

Applications that are found to contain inaccurate or untruthful

responses may be denied. The Department strongly suggests

that you complete the paper application for an individual

resident insurance producer found online at

www.insurance.pa.gov and retain it as a reference to expedite

submitting your application electronically at the exam center.

STATUS OF LICENSE

After the Department has verified that you have passed the

required examination and that you have met all standards for

licensure, the Department will issue the appropriate license. The

license will list the line or lines of authority granted, if

applicable. You may view the status of your license application

on the Department’s Web site at www.insurance.pa.gov. Once

your license has been issued, you may print your license from the

web site. Please be advised that the Department no longer mails

licenses.

INITIAL INSURANCE PRODUCER FEES

▪ Resident insurance producer or title agent application fee =

$55

▪ Non-resident title agent application fee = $110

▪ Fingerprinting fee = $23.85 (paid at an IdentoGO enrollment

center upon fingerprint submission)

▪ Online service fees (if submitting your licensing application

electronically) will be charged and may vary – the

approximate fee is $12.50

PAPER APPLICATIONS

The option to apply using a paper application is only available if

you are unable to apply online. Be advised that the paper

licensing process will take considerably longer than the electronic

method. If you must apply via paper, an application can be

obtained from the Department’s web site at

www.insurance.pa.gov. You must include a cover letter

explaining why you are unable to apply online; otherwise, the

application will be returned along with a letter telling you to

apply online.

15

OTHER LICENSE APPLICATION FORMS

Different application forms are required for Partnerships or

Corporations, Surplus Lines Producers, Viatical Settlement

Brokers, Motor Vehicle Damage Appraisers and Public Adjusters.

All applications are available from the Department’s web site at

www.insurance.pa.gov. or upon request from the Department.

Again, to expedite review of your application, you should file

your application via Vertafore/SIRCON at

www.sircon.com/pennsylvania and pay appropriate fees with a

credit card.

The examination content outline and more specific information

on taking this examination is available in the Pennsylvania

Public Adjuster Candidate Information Booklet located online

at https://home.psiexams.com/#/home.

The examination content outline and more specific information

on taking this examination is available in the Pennsylvania

Motor Vehicle Physical Damage Appraiser Candidate

Information Booklet located online at

https://home.psiexams.com/#/home.

CONTINUING EDUCATION

Licensed insurance producers are required to complete a

minimum of 24 hours of continuing education credits to maintain

their license. Failure to complete the minimum 24-hour

requirement during your two-year licensing cycle will result in

the termination of your license. See www.insurance.pa.gov for

more information.

Insurance producers should not take any approved CE courses

until they receive their license as they will not receive credit for

any course taken before the issue date of their license.

Information on continuing education can be obtained from the

Department’s web site at www.insurance.pa.gov or by calling

717-787-3840.

ADDITIONAL LICENSING INFORMATION

Additional appointments. To obtain appointments with

additional companies, for powers for which you are already

qualified, you must enter into an agreement with the new

company regarding the additional appointment. The insurance

company is then responsible for reporting the appointment

information to the Department. Title agents must have an

appointment by a title insurer prior to transacting any business

(40 P.S. 910-24.1).

Amended license. An amended license consists of adding an

additional line of authority or status to an active license.

There is a $25 fee to amend an existing active license. An

amended licensing application can be submitted online at

www.sircon.com/pennsylvania. No pre-licensing education or

fingerprint submission is required to amend a license by adding a

line of authority to an existing active producer license.

Reporting requirements. All licensees are required to report

name or address changes as well as criminal charges and

convictions to the Department within 30 days.

Uniformity of licenses. A corporation or partnership must be

properly licensed. In order for a partnership or corporation to be

licensed, there must be a licensed individual designated as the

responsible licensee for the entity (corporation) and hold the

same line(s) of authority the entity is requesting.

Corporations. Business entities (corporations and partnerships)

should submit a licensing application online at

www.sircon.com/pennsylvania.

Fictitious Names. For any licensee, any assumed or fictitious

name, style or designation must be filed with the Department for

approval prior to using the alias or fictitious name. See

instructions for this process at www.insurance.pa.gov.

EXAMINATION CONTENT OUTLINES AND

STUDY MATERIALS

STUDY MATERIALS

In addition to any pre-licensing education that is required for

the examination you are taking, you are free to use materials of

your choice to prepare for the examination. Manuals have been

prepared by different publishers to assist candidates specifically

in preparing for license exams. Because of the number and the

diversity of approach of these publications, neither the

Department nor PSI reviews or approves study materials.

However, the following sources may be a starting point in your

search for study materials.

Pennsylvania Insurance Laws and Pennsylvania Insurance

Regulations, BHM Insurance Services, (302) 678-8795; (800) 543-

3635.

Purdon’s Pennsylvania Statutes Annotated, Titles 40 and 41:

Insurance, West, (800) 733-2889; http://www.westgroup.com

Pennsylvania statutes. The examinations contain a section on

Pennsylvania statutes. In addition to your study materials, you

may wish to consult a standard statute reference, such as those

available at most public or law libraries in Pennsylvania.

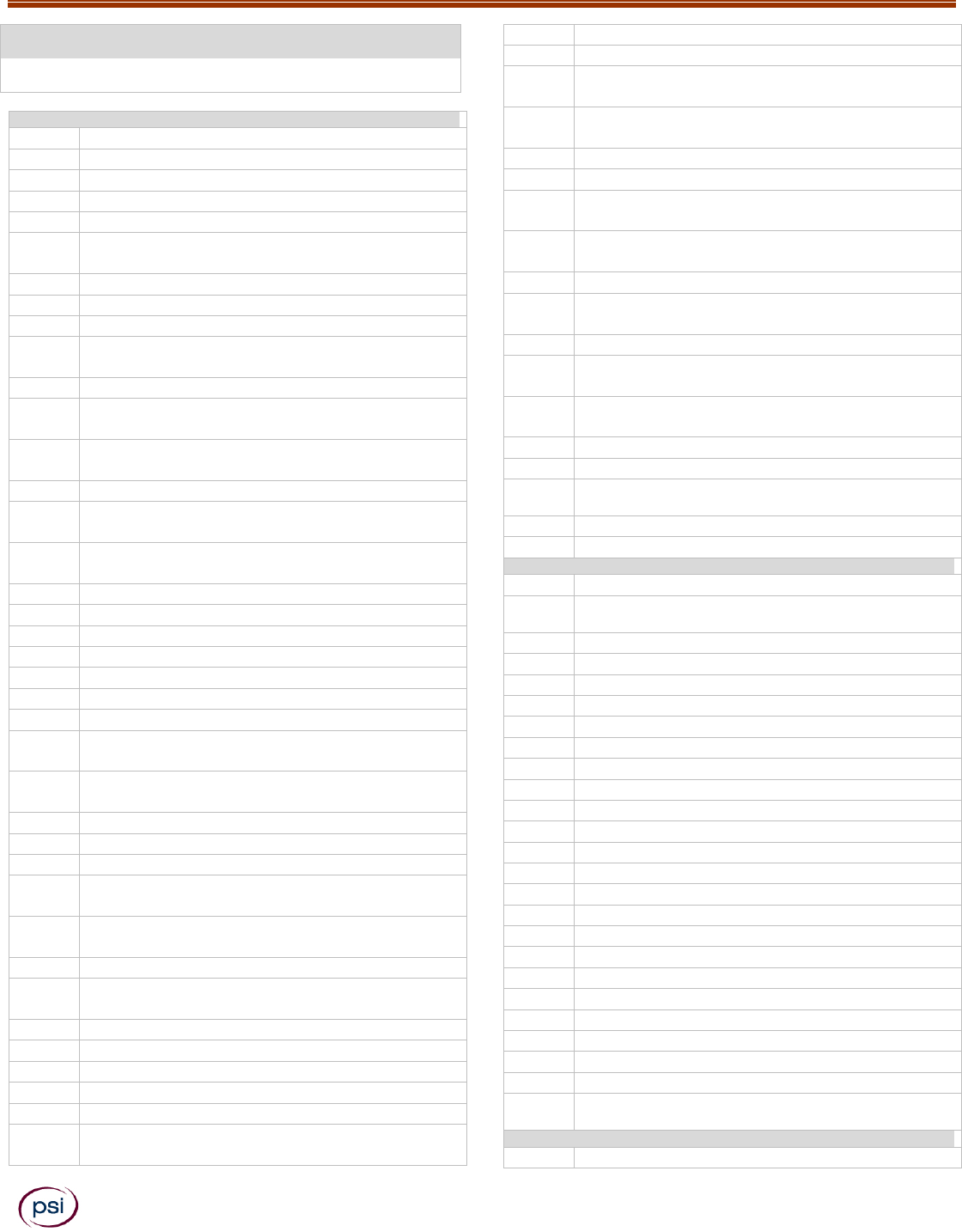

EXAMINATION CONTENT OUTLINES

Following are the individual examination content outlines

indicating the examination time limit, minimum score required

to pass, subject area and the number of items in each area.

These outlines are the basis of the examination. Each

examination will contain questions about the subjects in its

outline. In order to pass the examination, you must achieve a

minimum score of 70%.

16

PENNSYLVANIA PRODUCER’S EXAMINATION FOR LIFE INSURANCE

SERIES 16-01

100 Items – 120 Minutes

1.0 INSURANCE REGULATION (14%)

1.1

Licensing

Process and types

Requirements (40 P.S. § 310.1, 310.3-310.14)

Resident/nonresident (40 P.S. § 310.3–310.5, 310.10)

Temporary license (40 P.S. § 310.9)

Managers and exclusive general agents (40 P.S. §

310.1, 310.31)

Maintenance and duration

Change in address (40 P.S. § 310.11(19))

Renewal (40 P.S. § 310.8)

Duty to report administrative or criminal actions (40

P.S. § 310.78)

Assumed names (40 P.S. § 310.7)

Continuing education (40 P.S. § 310.8(b), 310.6(a), 31

Pa. Code Ch. 39a)

Inactivity due to military or extenuating circumstances

(40 P.S. § 310.8)

Disciplinary actions

License denial, nonrenewal, suspension, or revocation

(40 P.S. § 310.91, 310.11)

Penalties and fines for violations (40 P.S. §§ 310.12,

310.41a, 310.91, 1171.11)

Cease and desist order (40 P.S. §§ 310.91, 1171.9)

Civil

Criminal

Hearings

Consent agreement

1.2

State regulation

Acts constituting insurance transactions

Negotiate, sell, solicit (40 P.S. §§ 310.1, 310.3, 310.8,

310.11)

Commissioner's general duties and powers (40 P.S. §§

310.2, 1171.7)

Company regulation

Certificate of authority (40 P.S. §§ 47, 47a, 420)

Solvency (40 P.S. §§ 72, 112)

Policy forms and rates (40 P.S. §§ 510, 776.1–776.7,

1181–1199, 1221–1238)

Unfair claims settlement practices (40 P.S. §

1171.5(a)(10); 31 Pa. Code Ch. 146)

Producer regulation

Fiduciary responsibility (40 P.S. § 310.96; 31 Pa. Code

Ch. § 37.81)

Examination of books and records (40 P.S. § 323.3-4)

Producer disclosure requirements (40 P.S. § 310.71(b))

Commissions and fees (40 P.S. §§ 310.72–310.74)

Prohibited acts (40 P.S. § 310.11)

Appointment procedures

Producer appointment (40 P.S. § 310.71, 31 Pa Code

37.61)

Appointment termination (40 P.S. § 310.71a)

Unfair insurance practices (40 P.S. §§ 1171.1 1171.5)

Rebates and Inducements (40 P.S. §§

310.45, 310.46, 1171.5(a)(8))

Misrepresentation (40 P.S. §§ 310.47–.48,

1171.5(a)(1),(2))

Twisting (40 P.S. §§ 473)

False advertising (40 P.S. § 1171.5; 31 Pa. Code Ch. 51)

Defamation (40 P.S. § 1171.5(a)(3); 31 Pa. Code Ch.

51)

Boycott, coercion or intimidation (40 P.S. §

1171.5(a)(4))

Misappropriation of funds (40 P.S. §§ 310.11(4), 310.42)

Unfair discrimination (40 P.S. § 1171.5; 31 Pa. Code §

145.4)

Replacement (40 P.S. § 625, 31 Pa Code Ch. 81)

Privacy of consumer financial information (40 P.S. §

310.77(a); 31 Pa. Code §§ 146a.1–.44)

Insurance fraud regulation (40 P.S. §§ 325.1–325.62; 18

Pa. C.S. § 4117)

1.3

Federal Regulation

Fair Credit Reporting Act

Fraud and False Statements (18 USC Sections 1033 and

1034)

Privacy (Gramm-Leach-Bliley)

National Do Not Call List

2.0 GENERAL INSURANCE CONCEPTS (10%)

2.1

Risk

Methods of Handling Risk (e.g., Avoidance, Retention,

Sharing, Reduction, Transfer)

Elements of Insurable Risks

Definitions (e.g., Risk, Hazard, Peril, Loss)

2.2

Classifications of Insurers

Mutual, Stock

Admitted, Non-Admitted

Foreign, Domestic, Alien

2.3

Elements of a Contract

Consideration

Competent Parties

Legal Purpose

Offer

Acceptance

2.4

Authority and Powers of Producers

Express

Implied

Apparent

The Law of Agency

2.5

Legal Interpretations Affecting Contracts

Reasonable Expectations

Indemnity

Good Faith

Fraud

Warranties, Representations, Misrepresentations, and

Concealment

3.0 LIFE INSURANCE BASICS (20%)

3.1

Insurable Interest (40 P.S. § 512)

17

3.2

Personal Uses of Life Insurance

Survivor Protection

Estate Creation

Liquidity

Estate Conservation

Asset Protection

3.3

Determining Amount of Personal Life Insurance

Human Life Value Approach

Needs Approach

3.4

Business Uses of Life Insurance

Buy-Sell Funding

Key Person

Executive Compensation

3.5

Viatical and life settlements

Disclosure to consumers (40 P.S. § 626.7)

General rules (40 P.S. § 626.8)

Definitions (40 P.S. § 626.2)

3.6

Classes of life insurance policies

Group versus individual

Permanent versus term

Participating versus nonparticipating

Fixed versus variable life insurance

General account versus separate account (40 P.S. §

506.2; 31 Pa. Code Ch. 82.41-.51)

Regulation of variable life insurance (31 Pa. Code Ch.

82.1, .14, .81)

3.7

Factors in Premium Determination

Mortality

Interest

Expense

3.8

Premium Frequency

3.9

Producer responsibilities

Sales presentations

Advertising (31 Pa. Code Ch. 51.1–.36, .42)

Life and Health Insurance Guaranty Association (40 P.S. §

991.1717)

Life insurance disclosure statement (31 Pa. Code Ch. 83)

Illustrations (40 P.S. § 625.7–625.8)

Life insurance surrender comparison index disclosure (31

Pa. Code Ch. 83.51–.57)

3.10

Field Underwriting

Application Procedures

Warranties and Representations

3.11

Policy Delivery

Effective Date of Coverage

Premium Collection

Statement of Good Health

Delivery receipt requirement (40 P.S. § 625.4)

3.12

Company Underwriting

Sources of Information

Classifications of Risk (Preferred, Standard, Substandard,

Declined)

Selection criteria and unfair discrimination (40 P.S. §

477a)

3.13

Classification of Risks

Preferred

Standard

Substandard

4.0 TYPES OF LIFE INSURANCE POLICIES (17%)

4.1

Term Life Insurance

Level

Decreasing

Increasing Term

Renewable Term

4.2

Whole (Permanent, Ordinary) Life Insurance

Single Premium

Continuous Premium

Limited Payment Life

Adjustable Life

4.3

Universal Life

4.4

Index Whole Life

4.5

Specialized Policies

Joint Life

Survivorship Life

Juvenile

Return of Premium Term Insurance

4.6

Group Life Insurance

Eligible Groups

Characteristics of Group Life Insurance

Conversion to individual policy (40 P.S. § 532.7)

5.0 LIFE INSURANCE POLICY PROVISIONS, OPTIONS, AND RIDERS

(22%)

5.1

Standard Life Insurance Provisions (40 P.S. § 510)

Ownership

Assignment

Right to Examine (Free Look) (40 P.S. § 510C (a), (2), (3),

(b1))

Payment of Premiums (a)

Grace Period (b)

Misstatement of Age/Sex (e)

Incontestability (c)

Reinstatement (k)

Entire Contract (d)

Payment of claims (l)

Prohibited provisions including backdating (40 P.S. § 511)

5.2

Beneficiary Designation Options

Individuals

Classes

Estates

Minors

Trusts

5.3

Types of Beneficiaries

Revocable versus Irrevocable

Primary and Contingent

5.4

Beneficiary-Related Clauses

Common Disaster

Spendthrift

Effects of Divorce on Designation of Beneficiaries (20 Pa

C.S.A.§ 6111.2)

5.5

Settlement Options

Cash Payment (Lump Sum)

Interest Only

Life Income

Fixed-Period

Fixed-Amount Installments

Retained Asset Account

5.6

Nonforfeiture Options

18

Cash Surrender Value

Extended Term

Reduced Paid-Up Insurance

5.7

Policy Loan and Withdrawal Options

Loans

Automatic Premium Loans

Withdrawals Partial Surrenders

5.8

Dividend Options

Paid-Up Additions

Cash Payment (Lump Sum)

One Year Term

Reduction of Premium

Accumulation at Interest

5.9

Disability Riders

Waiver of Premium

Disability Income Benefit

Payor Benefit Life

5.10

Riders Covering Additional Insureds

Spouse

Children

Family

5.11

Riders Affecting Death Benefit Amount

Accidental Death

Guaranteed Insurability

Cost of Living

Return of Premium

Accelerated (Living) Benefit Provision Rider

Conditions for payment (31 Pa. Code Ch. 90f.3)

Effect on death benefit (31 Pa. Code Ch. 90f.3)

Exclusions and restrictions (31 Pa. Code Ch. 90f.4)

Long-Term Care Rider

5.12

Policy Exclusions

6.0 ANNUITIES (12%)

6.1

Annuity Principles and Concepts

Accumulation Period versus Annuity Period

Owner, Annuitant, and Beneficiary

Right to Examine (40 P.S. § 510D)

6.2

Immediate versus Deferred Annuities

6.3

Annuity (Benefit) Payment Options

Life Contingency Options

Annuities Certain

Pure Life versus Life with Guaranteed Minimum

Single Life versus Multiple Life

6.4

Annuity Products

Fixed Annuities

Equity Indexed Annuities

Immediate Annuities

Variable annuities

Assets in a separate account (31 Pa. Code Ch. 85.21–

.27)

Regulation of variable annuities (SEC, FINRA and

Pennsylvania) (31 Pa. Code Ch. 85.1–.4)

Suitability of annuities (Act 48 of 2018)

6.5

Uses of Annuities

Lump-Sum Settlements

Retirement Income

Education

7.0 FEDERAL TAX CONSIDERATIONS FOR LIFE INSURANCE (5%)

12a

Requirements of Life Insurance Qualified Plans

12b

Federal Tax Considerations for Qualified Plans

Withdrawals

Rollovers versus Transfers

12c

Qualified Plan Types, Characteristics, and Purchasers

Individual Retirement Accounts (IRAs; Traditional versus

Roth; Immediate Annuity)

401k

403b

12d

Taxation of Personal Life Insurance

Premiums

Dividends

Settlements

12e

Modified Endowment Contracts (MECs)

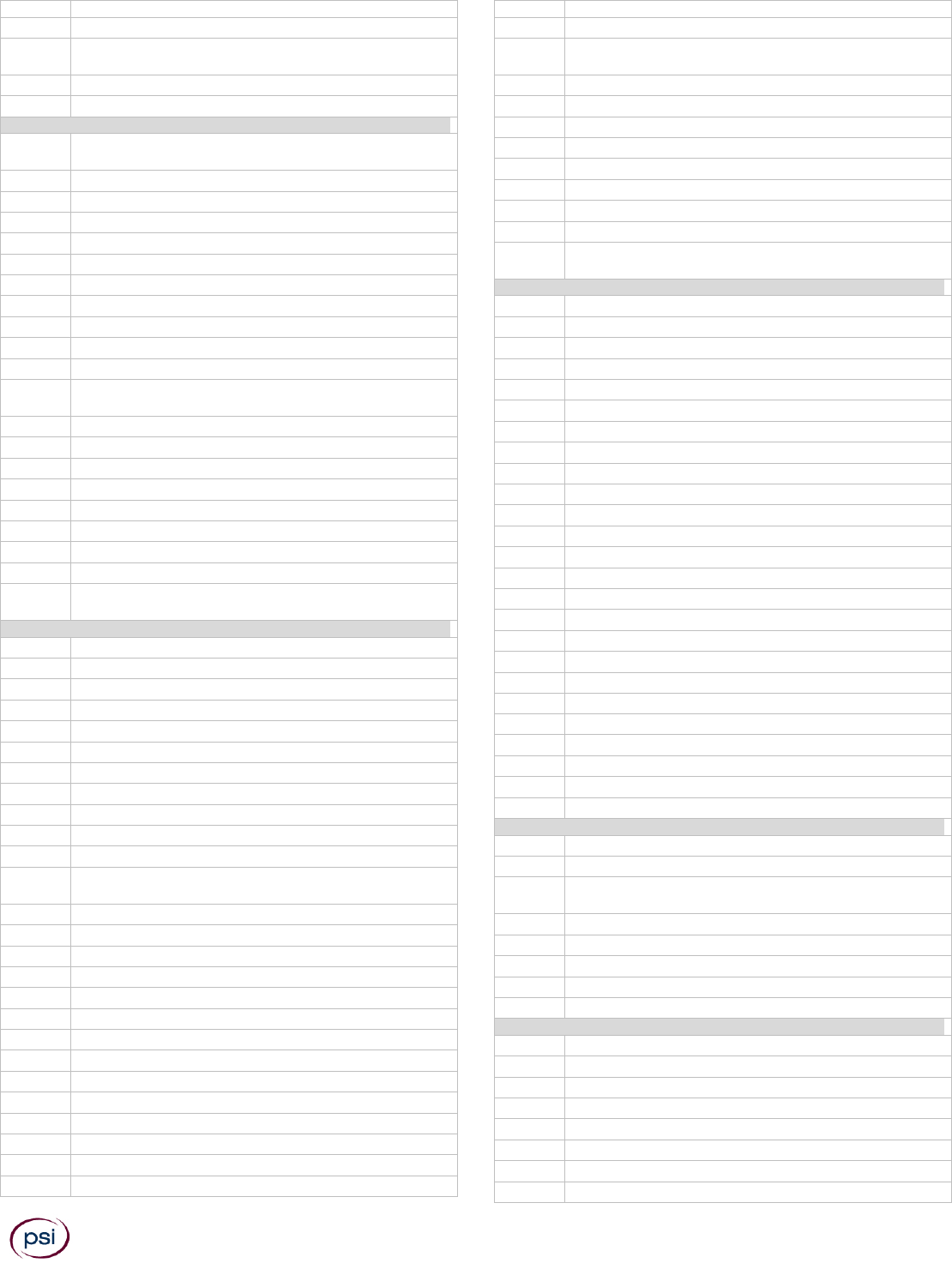

PENNSYLVANIA PRODUCER’S EXAMINATION FOR ACCIDENT AND

HEALTH INSURANCE

SERIES 16-02

100 Items – 120 Minutes

1.0 INSURANCE REGULATION (13%)

1.1

Licensing

Process and types

Requirements (40 P.S. § 310.1, 310.3-310.14)

Resident/nonresident (40 P.S. § 310.3–310.5, 310.10)

Temporary license (40 P.S. § 310.9)

Managers and exclusive general agents (40 P.S. §

310.1, 310.31)

Maintenance and duration

Change in address (40 P.S. § 310.11(19))

Renewal (40 P.S. § 310.8)

Duty to report administrative or criminal actions (40

P.S. § 310.78)

Assumed names (40 P.S. § 310.7)

Continuing education (40 P.S. § 310.8(b), 310.6(a), 31

Pa. Code Ch. 39a)

Waiver due to military or extenuating circumstances

(40 P.S. § 310.8)

Disciplinary actions

License denial, nonrenewal, suspension, or revocation

(40 P.S. § 310.91, 310.11)

Penalties and fines for violations (40 P.S. §§ 310.12,

310.41a, 310.91, 1171.11)

Cease and desist order (40 P.S. §§ 310.91, 1171.9)

Civil

Criminal

Hearings

Consent agreement

1.2

State regulation

Acts constituting insurance transactions

Negotiate, sell, solicit (40 P.S. §§ 310.1, 310.3, 310.8,

310.11)

Commissioner's general duties and powers (40 P.S. §§

310.2, 1171.7)

Company regulation

Certificate of authority (40 P.S. §§ 47, 47a, 420)

Solvency (40 P.S. §§ 72, 112)

19

Policy forms and rates (40 P.S. §§ 510, 776.1–776.7,

1181–1199, 1221–1238)

Unfair claims settlement practices (40 P.S. §

1171.5(a)(10); 31 Pa. Code Ch. 146)

Producer regulation

Fiduciary responsibility (40 P.S. § 310.96; 31 Pa. Code

Ch. § 37.81)

Examination of books and records (40 P.S. § 323.3-4)

Producer disclosure requirements (40 P.S. § 310.71(b))

Commissions and fees (40 P.S. §§ 310.72–310.74)

Prohibited acts (40 P.S. § 310.11)

Appointment procedures

Producer appointment (40 P.S. § 310.71, 31 Pa Code

37.61)

Appointment termination (40 P.S. § 310.71a)

Unfair insurance practices (40 P.S. §§ 1171.1 1171.5)

Rebates and Inducements (40 P.S. §§

310.45, 310.46, 1171.5(a)(8))

Misrepresentation (40 P.S. §§ 310.47–.48,

1171.5(a)(1),(2))

Twisting (40 P.S. §§ 473)

False advertising (40 P.S. § 1171.5; 31 Pa. Code Ch. 51)

Defamation (40 P.S. § 1171.5(a)(3); 31 Pa. Code Ch.

51)

Boycott, coercion or intimidation (40 P.S. §

1171.5(a)(4))

Misappropriation of funds (40 P.S. §§ 310.11(4), 310.42)

Unfair discrimination (40 P.S. § 1171.5; 31 Pa. Code §

145.4)

Replacement (40 P.S. § 625, 31 Pa Code Ch. 81)

Privacy of consumer financial information (40 P.S. §

310.77(a); 31 Pa. Code §§ 146a.1–.44)

Insurance fraud regulation (40 P.S. §§ 325.1–325.62; 18

Pa. C.S. § 4117)

1.3

Federal Regulation

Fair Credit Reporting Act

Fraud and False Statements (18 USC Sections 1033 and

1034)

Privacy (Gramm-Leach-Bliley)

National Do Not Call List

Affordable Care Act

2.0 GENERAL INSURANCE CONCEPTS (10%)

2.1

Risk

Methods of Handling Risk (e.g., Avoidance, Retention,

Sharing, Reduction, Transfer)

Elements of Insurable Risks

Definitions (e.g., Risk, Hazard, Peril, Loss)

2.2

Classifications of Insurers

Mutual, Stock

Admitted, Non-Admitted

Foreign, Domestic, Alien

2.3

Elements of a Contract

Consideration

Competent Parties

Legal Purpose

Offer

Acceptance

2.4

Authority and Powers of Producers

Express

Implied

Apparent

The Law of Agency

2.5

Legal Interpretations Affecting Contracts

Reasonable Expectations

Indemnity

Good Faith

Fraud

Warranties, Representations, Misrepresentations, and

Concealment

3.0 ACCIDENT AND HEALTH INSURANCE BASICS (10%)

3.1

Producer responsibilities

Sales presentations

Advertising (31 Pa. Code Ch. 51.1–.36, .42)

Life and Health Insurance Guaranty Association (40 P.S. §

991.1717)

Outline of coverage (40 P.S. § 991.1111; 31 Pa. Code Ch.

88.181)

3.2

Field Underwriting

Application Procedures

Warranties and Representations

3.3

Policy Delivery

Effective Date of Coverage

Premium Collection

Statement of Good Health

Delivery receipt requirement (40 P.S. § 625.4)

3.4

Company Underwriting

Sources of Information

Classifications of Risk (Preferred, Standard, Substandard,

Declined)

3.5

Definitions of Perils

Accidental Injury

Sickness

3.6

Types of Losses and Benefits

Loss of Income from Disability (Short-Term/Long-Term

Disability)

Medical Expense

Long-Term Care Expense

Prescriptions

3.7

Limited Health Insurance Policies

Accidental Death and Dismemberment

Hospital Indemnity

Critical Illness/Dread Disease (31 Pa. Code Ch. 88.169,

.193)

Vision Care

Hearing

Dental

3.8

Common exclusions from coverage (31 Pa. Code Ch.

88.84)

Pre-existing conditions (31 Pa. Code Ch. 88.51)

Intentionally self-inflicted injuries (1)(ii)

War or act of war (1)(i)

Elective cosmetic surgery (1)(vii)

Conditions covered by workers compensation (1)(iii)

Commission of or attempt to commit a felony

3.9

Classification of Risks

Preferred

Standard

20

Substandard

3.10

Considerations in replacing health insurance

Pre-existing conditions

Waiting periods

Benefits, limitations and exclusions

Underwriting requirements

Producer's liability for errors and omissions

Pennsylvania replacement requirements (31 Pa. Code

Ch. 88.101–.103)

4.0 INDIVIDUAL ACCIDENT AND HEALTH INSURANCE POLICY

PROVISIONS (13%)

4.1

Required Provisions (40 P.S. § 753(A))

Time Limit on Certain Defenses (2)

Grace Period (3)

Reinstatement (4)

Claim Forms (6)

Proof of Loss (7)

Time of Payment of Claims (8)

Physical Examinations and Autopsy (10)

Legal Actions (11)

Entire Contract (1)

Payment of Claims (9)

Change of Beneficiary (12)

Notice of Claim (5)

4.2

General Policy Provisions (40 P.S. § 753(B))

Change of Occupation (1)

Misstatement of Age/Sex (2)

Other insurance in this insurer (3)

Insurance with other insurers

Expense-incurred benefits (4)

Other benefits (5)

Unpaid premium (7)

Cancellation (8)

Conformity with state statutes (9)

Illegal Occupation (10)

Intoxicants, Narcotics, or Other Controlled Substances

(11)

4.3

Other General Provisions

Right to Examine/Free Look (40 P.S. § 752(A)(10); 31 Pa.

Code Ch. 89.73)

Insuring Clause

Consideration Clause

Renewability Clause

Coinsurance

Probationary Period

Elimination Period

Exclusions

5.0 DISABILITY INCOME AND RELATED INSURANCE (10%)

5.1

Benefits Determination for Disability

Indemnity

5.2

Qualifications of Disability

Total (Own Occupation, Any Occupation)

Partial (31 Pa. Code Ch. 88.138)

Permanent

Presumptive

Recurrent

Residual (31 Pa. Code Ch. 88.139)

Inability to Perform Duties (31 Pa. Code Ch. 88.137)

Occupational versus Non-Occupational

5.3

Individual Disability Income Insurance

Basic Total Disability Plan

Cost of Living Rider

Future Increase Option Rider

Change of Occupation

Other Cash Benefits

Refund Provisions

Exclusions

Waiver of Premium

Probationary Period

Elimination Period

Benefit Limits

Relation of earnings to insurance (40 P.S. § 753(B)(6))

Pennsylvania minimum benefit standards (31 Pa. Code Ch.

88.167)

5.4

Unique Aspects of Individual Disability Underwriting

Occupational Considerations

Benefit Limits

Policy Issuance Alternatives

5.5

Group Disability Income Insurance

Short-Term Disability

Long-Term Disability

Coordination of Benefits (Workers' Compensation Benefits

and Social Insurance) (77 P.S. § 511 et seq)

At-Work Benefits

5.6

Business Disability Insurance

Key Employee Disability Income

Disability Buy-Sell Policy

Business Overhead Expense

5.7

Social Security Disability

Qualification for Disability Benefits

Definition of Disability

Waiting Period

6.0 MEDICAL PLANS (14%)

6.1

Medical Plan Concepts

Fee-for-Service

Prepaid

Specified Coverage

Comprehensive Coverage

Dependent Coverage

6.2

Provisions and Clauses

Deductibles

Stop-Loss Provision

Impairment Rider

6.3

Types of Medical Plans

Basic Plans

Major Medical Insurance

Health Maintenance Organizations (HMOs)

Preferred Provider Organzations (PPOs)

Point-of-Service (POS) Plans

6.4

Cost Containment in Health Care Delivery

Managed Care

Preventive Care

Outpatient Benefits

Utilization Management

Preauthorization

Gatekeeper

21

6.5

Health Insurance Portability and Accountability Act

(HIPAA) (40 P.S. § 981-1)

Eligibility Requirements

Terms

Privacy

Portability

6.6

Pennsylvania mandated benefits (individual and group)

Postpartum coverage (40 P.S. § 1583)

Routine pap smears (40 P.S. § 1574(2))

Treatment for alcohol abuse and dependency (40 P.S. §§

908-1–908-8)

Serious mental illness (40 P.S. § 764g)

Annual gynecological examinations (40 P.S. § 1574(1))

Cancer therapy (40 P.S. § 764b)

Mammography coverage (40 P.S. § 764c)

Childhood immunizations (40 P.S. § 3503)

Dependent child age limit (31 Pa. Code Ch. 88.32)

Coverage of adopted children (40 P.S. § 775.1)

Newborn child coverage (40 P.S. §§ 771–775.2; 31 Pa.

Code Ch. 89.201–.209)

Physically handicapped/mentally retarded children (40

P.S. § 752(A)(9))

Medical foods (40 P.S. § 3901-3909)

Orally administered chemotherapy medication (Act 73 of

2016)

Mental health parity and addiction equity (40 P.S. § 908-

11-908-16)

7.0 GROUP HEALTH INSURANCE (9%)

7.1

Characteristics of Group Health Insurance

Group Contract

Certificate of Coverage

Eligible Groups