1

Application for Sales Tax

Exemption Certificates

KDOR (Kansas Department of Revenue) issues exemption

certificates containing exempt numbers. This publication explains

the use of Tax Exempt Entity Exemption Certificates, Project

Exemption Certificates, Enterprise Zone Project Exemption

Certificates and Manufacturer/Processor Exemption numbers.

It also explains how to use the on-line application process for a

quick, simple way to obtain your exemption certificate number(s).

Use this guide as a supplement to KDOR’s basic sales tax

guides: Publication KS-1510, Kansas Sales and Compensating

Use Tax, and Publication KS-1520, Kansas Exemption

Certificates.

Pub. KS-1528 (Rev. 6/11)

TABLE OF CONTENTS

INTRODUCTION ......................................................... 3

The Cardinal Rule

Exemption Certificates

Assigned Exemption Number(s)

TAX EXEMPT ENTITIES ............................................ 3

Purpose of the Tax Exempt Entity Exemption

Certificate

Tax Exempt Entities and Nonprofit

Organizations

Collecting Sales Tax on Sales made by the

Entity

Exemption Certificates without issued Exemption

Number(s)

Sales to Exempt Entities not based in

Kansas

PROJECT EXEMPTION CERTIFICATES (PEC) .......... 5

Purchases Exempt from Sales Tax when

using a PEC

Entities Qualifying for a Project Exemption

Certificate

Indirect Purchases not requiring a PEC

Agent Status

Entities Qualifying for Agent Status

ENTERPRISE ZONE PROJECT EXEMPTION

CERTIFICATES ..................................................... 6

Entities Qualifying for an Enterprise Zone Project

Exemption Certificate

Definitions

Additional Information

MANUFACTURER/PROCESSOR EXEMPTION

NUMBERS ............................................................. 8

Using the Manufacturer/Processor Exemption

Number

FREQUENTLY ASKED QUESTIONS ABOUT

PECs

and

EZPECs ................................................ 9

USER GUIDE – APPLYING FOR EXEMPTION

CERTIFICATES/NUMBERS ................................... 11

Setting up a KS WebTax Account .............. 11

Signing on to your KS WebTax Account ..... 12

Selecting an Exemption Type ..................... 13

Submitting a Request ................................. 14

Status Terms and Definitions ...................... 22

Functions ................................................... 23

TROUBLESHOOTING ................................................ 27

On-Line Exemption Application

KS WebTax

IMPORTANT NUMBERS AND INFORMATION ........... 26

If there is a conflict between the law and information found in this publication, the law remains the final authority. Under no

circumstances should the contents of this publication be used to set or sustain a technical legal position. A library of

current policy information is also available on our web site: www.ksrevenue.org

2

INTRODUCTION

THE CARDINAL RULE

Kansas retailers are responsible for collecting the

full amount of sales tax due on each sale to the final

user or consumer. Kansas retailers should follow this

cardinal rule:

All retail sales of goods and enumerated taxable

services are considered taxable unless specifically

exempt.

Therefore, for every sale of merchandise or taxable

service in Kansas, the sales receipt, invoice, or bill MUST

either 1) show that the total amount of sales tax due

was collected, or 2) be accompanied by a Kansas

exemption certificate.

EXEMPTION CERTIFICATES

An exemption certificate is a document that a buyer

presents to a retailer to claim exemption from Kansas

sales or use tax. It shows why sales tax was not charged

on a retail sale of goods or taxable services. The buyer

furnishes the exemption certificate and the seller keeps

the certificate on file with other sales tax records.

An exemption certificate must be completed in its

entirety and by regulation K.A.R. 92-19-25b must:

• explain why the sale is exempt,

• be dated,

• describe the property being purchased, and

• contain the seller’s name and address; and the

buyer’s name, address, and signature.

Some exemption certificates also require a buyer to

furnish the Kansas tax account number or a description

of the buyer’s business. The exemption certificates for

nonprofit organizations require the federal employers

ID number (EIN) of the organization.

ASSIGNED EXEMPTION NUMBER(S)

There are four types of exemption certificates that

have exemption numbers assigned and issued by the

Kansas Department of Revenue. They are:

• Tax Exempt Entity Exemption Certificate

• Project Exemption Certificate

• Enterprise Zone Project Exemption Certificate

• Manufacturer/Processor Exemption

There are several Kansas exemption certificates that

do not require an exemption number. These “fill-in”

exemption certificates are used for such exemptions as

agriculture, resale, ingredient/component part, etc. To

learn more about exemption certificates that do not have

assigned numbers, download publication KS-1520 from

our web site: ksrevenue.org

TAX EXEMPT ENTITIES

Since January 1, 2005, K.S.A. 79-3692 has required

that KDOR issue numbered exemption certificates to

exempt entities and organizations. The tax-entity

exemption application enables a qualified organization

to apply for, update, and print a sales and use tax

exemption certificate. The certificate is to be presented

by tax exempt entities to retailers to purchase goods

and/or services tax exempt from sales and use tax.

The following entities and organizations are exempt

and issued a Tax Exempt Entity Certificate from the

Kansas Department of Revenue:

• Booth Theatre Foundation K.S.A. 79-3606(xxx)

• Catholic Charities or Youthville K.S.A. 79-3606(sss)

• Community action groups weatherizing low-income

homes K.S.A. 79-3606(oo)

• Community-based mental health centers

K.S.A. 79-3606(jj)

• County Law Libraries K.S.A. 79-3606(rrr)

• Domestic violence shelters of the Kansas Coalition

Against Sexual and Domestic Violence (KCSDV)

K.S.A. 79-3606(hhh)

• Elementary and secondary schools and educational

institutions K.S.A. 79-3606(c)

• Food distributor to food distribution programs

K.S.A. 79-3606(iii)

• Free-Access Radio & TV Stations K.S.A. 79-3606(zz)

• Frontenac Education Foundation K.S.A. 79-3606(www)

• Habitat for Humanity organizations

K.S.A. 79-3606(ww)

• Homeless Shelters K.S.A. 79-3606(ppp)

• Hospitals, Blood, Tissue & Organ Banks, nonprofit

K.S.A. 79-3606(b)

• Jazz in the Woods K.S.A. 79-3606 (vvv)

• Kansas Academy of Science K.S.A. 79-3606(ggg)

• Kansas Bioscience Authority K.S.A. 74-99b12

• Kansas Chapters of Specific Nonprofit

Organizations K.S.A. 79-3606(vv):

- Alliance for the Mentally Ill

- Alzheimer’s Disease and Related Disorders

Associations

- American Cancer Society, Inc.

- American Diabetes Association

- American Heart Association

3

- American Lung Association

- Angel Babies Association

- Community Housing of Wyandotte County

(CHWC)

- Community Services of Shawnee, Inc.

- Cross-Lines Cooperative Council

- Cystic Fibrosis Foundation

- Dream Factory, Inc.

- Dreams Work, Inc.

- Heartstrings Community Foundation

- International Association of Lions Clubs

- Johnson County Young Matrons

- Kansas Specialty Dog Service (KSDS)

- Lyme Association of Greater Kansas City

- Mental Illness Awareness Council

- National Kidney Foundation

- Ottawa Suzuki Strings

- Parkinson’s Disease Association

- Spina Bifida Association

• Kansas Children’s Service League

K.S.A. 79-3606(uuu)

• Kansas groundwater management districts

K.S.A. 79-3606(s)

• Korean War Memorials organizations, nonprofit

K.S.A. 79-3606(tt)

• Marillac Center, Inc. K.S.A. 79-3606(mmm)

• Meals on Wheels organizations (must be

preparing the meals) K.S.A. 79-3606(v)

• Museums and historical societies, nonprofit

K.S.A. 79-3606(qq)

• Nonsectarian, comprehensive youth

development organizations, nonprofit (examples

include boy and girl scouts, 4-H clubs, child day

care centers) K.S.A. 79-3606(ii)

• Nursing homes, assisted living and interim care

homes, nonprofit K.S.A. 79-3606(hh)

• Port authority K.S.A. 79-3606(z)

• Primary care clinics & health centers serving the

medically underserved K.S.A. 79-3606(ccc)

• Public broadcasting radio & TV stations

K.S.A. 79-3606(ss)

• Public health corporations, nonprofit (limited to

preprinted materials) K.S.A. 79-3606(ll)

• Religious Organizations K.S.A. 79-3606(aaa)

• Rotary Club of Shawnee Foundation

K.S.A. 79-3606(zzz)

• Rural volunteer fire fighting organizations

K.S.A. 79-3606(uu)

• Sedgwick County-Sunrise Rotary Club &

Charitable Fund K.S.A. 79-3606(nnn)

• Special Olympics, Kansas K.S.A. 79-3606(lll)

• State of Kansas and Political Subdivisions of

Kansas K.S.A. 79-3606(b)

• TLC Charities Foundation K.S.A. 79-3606(yyy)

• TLC For Children and Families, Inc.

K.S.A. 79-3606(qqq)

• Victory in the Valley K.S.A. 79-3606(aaaa)

• Zoos, Nonprofit K.S.A. 79-3606(xx)

PURPOSE OF THE TAX EXEMPT ENTITY

EXEMPTION CERTIFICATE

The purpose for issuing Tax Exempt Entity Exemption

Certificates is to control fraudulent tax-exempt purchases

and to assist retailers, sales people and cashiers in

identifying exempt entities and determining whether a

claim for exemption is valid. If one of the entities listed

requests an exemption and does not present KDOR-

issued Tax Exempt Entity Exemption Certificate

containing its tax exempt entity number, the request

must be denied.

TAX EXEMPT ENTITIES AND NONPROFIT

ORGANIZATIONS

Nonprofit organizations are not automatically

considered to be tax exempt. The Kansas Legislature

determines by statute which organizations and entities

are exempt from sales tax on their purchases. Kansas

does not exempt all nonprofit organizations. If your

organization is not one of those on the provided list,

you are responsible for paying sales tax on your

purchases.

COLLECTING SALES TAX ON SALES MADE BY THE

ENTITY

If your organization is exempt from sales tax on your

purchases, it DOES NOT mean that goods or services

that you sell are also exempt from sales tax. Unless

specifically exempted by statute, when an organization

sells goods and services they must collect and remit

Kansas retailers’ sales tax.

NOTE: When purchasing items you intend to resale, you

do not pay tax at the time of purchase. See

Resale

Exemption Certificate

in Publication KS-1520.

EXEMPTION CERTIFICATE(S) WITHOUT ISSUED

EXEMPTION NUMBER(S)

Numbered exemption certificates are not issued for

the following situations:

• sales of resale transactions;

• agricultural exemption, manufacturing

machinery, equipment or consumed in

production transactions;

or

,

• agencies and instrumentalities of the federal

government.

For these transactions, a “fill-in” certificate is used

and a tax exempt number is not issued. The exemption

certificates for these situations and/or businesses are

discussed in Publication KS-1520, Kansas Exemption

Certificates, which is on our web site: ksrevenue.org

4

SALES TO EXEMPT ENTITIES NOT BASED IN

KANSAS

Kansas-based organizations must provide a KDOR-

issued Tax Exempt Entity Exemption Certificate to the

vendor in order to make a purchase exempt from Kansas

retailer’s sales or Kansas compensating use tax.

However, KDOR has not issued Tax Exempt Entity

Exemption Certificates to exempt entities located outside

of the state of Kansas. For example, Kansas law

exempts from sales/compensating tax all nonprofit

hospitals. Every nonprofit hospital located in Kansas

has been issued a Tax Exempt Entity Exemption

Certificate. A nonprofit hospital not located in Kansas

would complete a Designated or Generic Exemption

Certificate, Form ST-28, and present it to the Kansas

supplier in order for the Kansas sales/compensating

tax exemption to apply. Tax Exempt entities located

outside of Kansas, who do regular business in Kansas,

are encouraged to apply for a department issued Tax

Exempt Entity Exemption Certificate. For further

instructions on how to apply, refer to the

User Guide

section of this publication.

PROJECT EXEMPTION

CERTIFICATES (PECs)

A Project Exemption Certificate (PEC) is a numbered

certificate issued by KDOR or its authorized agent. A

PEC is issued to a qualifying entity for a specific project.

The PEC enables contractors and subcontractors to

purchase material and labor exempt on behalf of the

qualifying entity for that specific project. As the name

implies, a PEC exempts the entire project – materials,

supplies, construction equipment rental and labor

services – from sales tax.

PURCHASES EXEMPT FROM SALES TAX WHEN

USING A PEC

A PEC issued by KDOR, or its agents provides the

following benefits:

1) Allows contractors, subcontractors and repairmen

to purchase materials exempt from Kansas

retailers’ sales and compensating use taxes;

2) relieves contractors, subcontractors and

repairmen from charging their customers Kansas

retailers’ sales tax on the labor services they

perform to construct, reconstruct, remodel or

repair buildings or facilities;

and

,

3) exempts all of the machinery, equipment and

furnishings installed in the project from retailers

sales tax and compensating use tax.

In essence, when a PEC is issued for a project all of

the materials, labor, equipment, machinery and

furnishings which are incorporated into the project are

exempt from Kansas sales and compensating taxes.

ENTITIES QUALIFYING FOR A PROJECT

EXEMPTION CERTIFICATE

The following exempt entities qualify for a PEC.

K.S.A. 79-3606(b) and K.S.A. 79-3606(c)

• Booth Theatre Foundation

• Catholic Charities or Youthville

• Kansas Department of Corrections

• Elementary or secondary school or educational

institution

• Groundwater and rural water districts paying

clean drinking water fee

• Kansas Children’s Service League

• Museum within a designated qualified

hometown

• Non-profit food distribution center

• Non-profit zoo

501(c)(3)

• Political subdivisions of the state of Kansas

• Primary care clinic for medically underserved

501(c)(3)

• Public or private nonprofit hospital

• Religious Organization 501(c)(3)

• TLC for Children and Families, Inc.

• TLC Charities Foundation

• United States Government, its agencies or

instrumentalities

CAUTION: The state of Kansas and its agencies

DO NOT qualify for a Project Exemption

Certificate. Materials purchased by contractors

for a state of Kansas project are taxable. Exceptions to

this are: Department of Corrections, state educational

institutions and state owned hospitals.

INDIRECT PURCHASES NOT REQUIRING A PEC

Kansas statutes provide the ability for several entities

to purchase goods and services indirectly without

requiring the issuance of a PEC. Although KDOR would

recommend the entity obtain a PEC for their own record

keeping and to assist the contractor in making

purchases, a PEC is not required. Organizations that

are statutorily allowed indirect purchases without the

issuance of a PEC are:

• Domestic violence shelters of the Kansas

Coalition Against Sexual and Domestic Violence

(KCSDV)

• Frontenac Education Foundation

• Groundwater Management Districts

• Homeless Shelters

5

• Kansas Academy of Science

• Korean War Memorials organizations

• Marillac Center, Inc

• Port authority

• Rural and City Water Departments paying the

clean drinking water fee

• Rural volunteer fire fighting organizations

• Victory in the Valley

AGENT STATUS

Effective July 1, 1997, Kansas law authorized the

department to designate certain exempt entities as

agents of the state for the sole purpose of issuing Project

Exemption Certificates. The purpose of this designation

was to expedite the issuance of exemption certificates.

To apply for agent status, qualified entities must

submit an initial request through our on-line application.

For detailed instructions, see the

User Guide

section of

this publication. Once the initial request has been

reviewed and approved as an agent status, all

subsequent requests processed on-line will

automatically be approved and a certificate will be

available for printing immediately. There is one exception

to this rule, the request must be reviewed by the

department if the project is being funded with Industrial

Revenue Bonds (IRBs).

ENTITIES QUALIFYING FOR AGENT STATUS

The following exempt organizations/entities may apply

for and be granted Agent Status:

• Agency or Instrumentality of the United States

Government

• Political Subdivision of the State of Kansas

• Public or Private Elementary or Secondary

School

• Public or Private Nonprofit Educational Institution

• Public or Private Nonprofit Hospital

ENTERPRISE ZONE PROJECT

EXEMPTION CERTIFICATES

An Enterprise Zone Project Exemption Certificate

(EZ PEC) is a numbered certificate issued by KDOR which

exempts from sales tax all purchases of tangible personal

property or services purchased for the purpose of and

in conjunction with the construction, reconstruction,

expansion, or remodeling of a business or a retail

business. Machinery and equipment purchased and

installed at the business or retail business is also exempt

from sales tax.

ENTITIES QUALIFYING FOR AN ENTERPRISE ZONE

PROJECT EXEMPTION CERTIFICATE

The following types of businesses may qualify for an

enterprise zone project exemption certificate.

• Manufacturing business

• Nonmanufacturing business

• Retail business

• Lessor leasing to a manufacturer,

nonmanufacturer, retail or HPIP certified business

• HPIP certified business

MANUFACTURING BUSINESS

A manufacturing business is defined as all commercial

enterprises identified under the manufacturing standard

industrial classification (SIC) codes, major groups 20-

39. To qualify for the enterprise zone project exemption

certificate, a manufacturing business must:

• hire at least two additional full-time employees, and;

• receive approval from the Secretary of

Commerce if relocating to another city or county

within Kansas.

NONMANUFACTURING BUSINESS

A nonmanufacturing business is defined as any

commercial enterprise other than a manufacturing

business or a retail business. To qualify for the enterprise

zone project exemption certificate, a nonmanufacturing

business must:

• hire at least five additional full-time employees, and;

• receive approval from the Secretary of

Commerce if relocating to another city or county

within Kansas.

A nonmanufacturing business shall also include: the

business headquarters of an enterprise; ancillary

support operation of an enterprise; an enterprise

identified under the Standard Industrial Classification

code of 5961, Catalog and Mail-Order Houses; or an

enterprise identified under the Standard Industrial

Classification code of 7372, Prepackaged Software. To

qualify for the project exemption certificate, these types

of nonmanufacturing businesses must:

• hire at least twenty (20) additional full-time

employees; and,

• receive approval from the Secretary of

Commerce if relocating to another city or county

within Kansas.

RETAIL BUSINESS

A retail business is defined as:

• any commercial enterprise primarily engaged in

the sale at retail of goods or services taxable under

the Kansas retailers’ sales tax act;

• any service provider set forth in K.S.A. 17-2707,

and amendments thereto;

6

• any bank, savings and loan, or other lending

institution;

• any commercial enterprise whose primary business

activity includes the sale of insurance;

and

,

• any commercial enterprise deriving its revenues

directly from noncommercial customers in

exchange for personal services such as, but not

limited to, barber shops, beauty shops,

photographic studios and funeral services.

A retail business may qualify for the enterprise zone

project exemption certificate if the retail business:

• hires at least two additional full-time employees;

and

• locates or expands to a city with a population of

2,500 or less;

or

,

• locates or expands outside a city but in a county

with a population of 10,000 or less.

LESSOR LEASING TO A MANUFACTURER, NONMANUFACTURER,

RETAIL OR HIGH PERFORMANCE INCENTIVE PROGRAM (HPIP)

CERTIFIED BUSINESS

Any person constructing, remodeling or enlarging a

facility which is leased for a period of five years or more

to a business that would otherwise qualify for the sales

tax exemption if the business had constructed, remodeled

or enlarged its own facility qualifies for the enterprise

zone project exemption certificate. A copy of the 5 year

irrevocable lease must be attached to the lessor’s

application. The lessee must hire the minimum number

of employees as required.

HPIP CERTIFIED BUSINESS

An enterprise zone project exemption certificate is

available for select qualified businesses. A business

qualifies for an enterprise zone project exemption

certificate if it is certified as a qualified firm by the

Secretary of Commerce and is entitled to the training

and education tax credit or has participated during the

tax year in which the exemption is claimed in training

assistance by the Department of Commerce under the

Kansas industrial training (KIT), Kansas industrial

retraining (KIR) or State of Kansas investments in lifelong

learning (SKILL) program.

DEFINITIONS

FULL-TIME EMPLOYEES

A full-time employee is a person required to file a

Kansas income tax return and is employed by a business

or retail business to perform duties in connection with

the operation of the business or retail business on a:

• regular, full-time basis;

• part-time basis, provided the person is customarily

performing the duties at least 20 hours per week

throughout the taxable year; or

• seasonal basis, provided the person performs

duties for substantially all of the season customary

for the position in which the person is employed.

The number of full-time employees during any taxable

year is the sum of full-time employees on the last business

day of each month of the taxable year divided by 12. If

the business or retail business is in operation for less

than the entire taxable year, the number of full-time

employees is determined by dividing the sum of full-time

employees on the last business day of each full calendar

month during the portion of the taxable year during which

the business was in operation by the number of full

calendar months during the period.

BUSINESS HEADQUARTERS

Business headquarters is a facility where principal

officers of the business are housed and from which

direction, management or administrative support for

transactions is provided for a business or division of a

business or regional division of a business.

ANCILLARY SUPPORT

Ancillary support of an enterprise is a facility operated

by a business and whose function is to provide services

in support of the business, but is not directly engaged in

the business’ primary function.

CATALOG AND MAIL-ORDER HOUSES

Catalog and mail-order houses are primarily engaged

in the retail sale of products by catalog, mail-order, and

television.

PREPACKAGED SOFTWARE

Prepackaged software establishments are primarily

engaged in the design, development, and production of

prepackaged computer software.

CERTIFIED AS A QUALIFIED FIRM

The Secretary of Commerce will certify a business

as a qualified firm if the business is a for-profit

establishment subject to state income, sales or property

taxes AND one of the items under each of the following

sections apply:

Section One

• Identified under the standard industrial

classification codes major groups 20 through 39

(manufacturing);

or

• Identified under the standard industrial

classification codes major groups 40 through 49

(transportation, communications, electric, gas,

and sanitary services) 50 through 51 (wholesale

trade) or 60 through 89 (60-67, finance,

insurance and real estate: 70-89, services). At

least 51% of the sales made by these groups

must be to Kansas manufacturers and/or out of

state commercial governmental customers;

or

• Identified as a regional headquarters or back

office ancillary operation of a national or multi-

national corporation regardless of SIC codes;

7

Section Two

• The company pays above average wages

compared to other firms in its 2 digit SIC code;

or

• Is the only company in its 2 digit SIC category;

or

• Pays an average wage of a least 1.5 times the

average wage paid by other industries but

excluding compensation paid to owners with a

5% or more interest.

Section Three

• Received written approval from the Secretary of

Commerce for participation and has participated,

during the tax year for which the exemption is

claimed, in the Kansas industrial training (KIT),

Kansas industrial retraining (KIR) or the state of

Kansas investments in lifelong learning (SKILL)

program;

or

• Meets the qualifications for the tax credit under

K.S.A. 74-50,132 (the training tax credit)

ADDITIONAL INFORMATION

C

ITIES IN KANSAS WITH A POPULATION OF 2,500 OR LESS

For a table listing the cities in Kansas with a

population of 2,500 or less, visit the following KDOR

web site: ksrevenue.org/taxcredits-2500orless.htm

There are several cities located in two different

county boundaries. For these cities, the other county is

identified by the city name and the population

represents the total city population.

COUNTIES IN KANSAS WITH A POPULATION OF 10,000 OR LESS

A table listing the counties in Kansas with a population

of 10,000 or less, visit the following KDOR web site:

ksrevenue.org/taxcredits-10000orless.htm

KANSAS INDUSTRIAL TRAINING (KIT)

More information about the KIT program can be

found on the Kansas Department of Commerce web

site at kansascommerce.com

KANSAS INDUSTRIAL RETRAINING (KIR)

More information about the KIR program can be

found on the Kansas Department of Commerce web

site at kansascommerce.com

STATE OF KANSAS INVESTMENTS IN LIFELONG LEARNING (SKILL)

More information about the SKILL program can be

found on the Kansas Department of Commerce web

site at: kansascommerce.com

MANUFACTURING STANDARD INDUSTRIAL CLASSIFICATION (SIC)

CODES, MAJOR GROUP 20-39

A listing of the manufacturing SIC codes, major group

20-39 can be found on KDOR’s web site at:

ksrevenue.org/taxcredits-siccodes.htm

MANUFACTURER / PROCESSOR

EXEMPTION NUMBERS

Manufacturers and processors are eligible to purchase

their raw materials or parts exempt from sales tax.

Many exemption certificates presented to vendors

include the purchasers Kansas issued registration

number or another Kansas issued identification.

Manufacturers and processors, who do not also make

retail sales, are not issued Kansas registration numbers.

Therefore, manufacturers and processors may

experience some difficulty when purchasing their raw

materials or parts.

To remedy this situation, KDOR issues a

Manufacturers’ or Processors’ Sales Tax Exemption

Number to those manufacturers and processors that

never

make a retail sale, and therefore do not have a

sales tax account number.

CAUTION: Manufacturers and processors who

make sales to the final user or consumer must

be registered to collect sales tax on these

sales. This includes making sales to employees – the

sale of factory seconds or first-quality products at

discount. To apply for a Kansas sales tax registration

number, visit the KDOR web site using the following

address: ksrevenue.org/busregistration.htm

USING THE MANUFACTURER/PROCESSOR

EXEMPTION NUMBER

The Manufacturer/Processor exemption number can

be provided to sellers, if requested, when presenting

the following exemption certificates:

• Consumed in Production Exemption Certificate

(ST-28C)

• Ingredient or Component Part Exemption

Certificate (ST-28D)

• Integrated Production Machinery and Equipment

Exemption Certificate (ST-201)

Pub. KS-1520, Kansas Exemption Certificates,

provides copies of the above listed exemption

certificates. This publication can be found on the KDOR

web site at: ksrevenue.org

8

FREQUENTLY ASKED QUESTIONS

ABOUT PECs

and

EZPECs

How long does it take the Kansas

Department of Revenue (KDOR) to review

and provide a response back for project

exemption certificate requests submitted on-line?

KDOR will normally provide a response the same day

or next business day 75% of the time. However, if you

file by paper you can expect a minimum of 7 business

days for processing.

When should I apply for a PEC?

You should apply for a PEC prior to any purchases being

made for the project. By Kansas law, the effective date

of the PEC is the date your request is submitted to

KDOR. For requests that are:

– submitted on-line, the effective date is the date

you submit your request.

– mailed to KDOR, the effective date is the post

mark date.

– faxed to KDOR, the effective date is the fax date.

I forgot to apply for a PEC and the contractor

has begun purchasing materials. The

project is not completed; can I still apply

for a PEC?

Yes, you can still apply for a PEC; however, the taxes

must be paid for any purchases made prior to the

effective date of the exemption certificate (see refund

question). In the state of Kansas, the contractor is

considered to be the end user and is required to pay

taxes on the purchases of materials; unless they can

present a valid project exemption certificate at the time

of purchase.

I forgot to apply for a PEC and the project

is now complete; can I still apply for a PEC?

No, the taxes must be paid for the purchases made

(see refund question). In the state of Kansas, the

contractor is considered to be the end user and is

required to pay taxes on the purchases of materials;

unless they can present a valid project exemption

certificate at the time of purchase.

Yes, KDOR has a refund request form that you will need

to complete. Please keep in mind that you will be

required to provide invoices and receipts. The refund

forms to use are:

Petitioning Authority: ST-21PEC

Taxpayer: ST-21

Both forms can be downloaded from the KDOR web

site at ksrevenue.org

What is the Form PR-76?

The PR-76 is the paper form that had been used to

apply for a Project Exemption Certificate (PEC). KDOR

encourages applicants to submit their request on-line

at: ksrevenue.org/pecwelcome.htm. KDOR will accept

Form PR-76; however, the turn around time will be

longer. Processing a paper form requires at least of 7

business days.

What is the Form PR-74?

The PR-74 is the actual Project Exemption Certificate

(PEC) which will include the assigned project exemption

certificate number. Contractors and subcontractors will

need to present a copy of the valid project exemption

certificate to their vendors when making purchases of

materials to be used in the specified project.

What is the Form PR-70b?

The PR-70b is the paper form that had been used to

apply for an Enterprise Zone Project Exemption

Certificate (EZ PEC). KDOR encourages applicants to

submit their request on-line at: ksrevenue.org/

pecwelcome.htm. KDOR will accept Form PR-70b;

however, the turn around time will be longer. Processing

a paper form requires at least 7 business days.

What is the Form PR-71?

The PR-71 is the actual Enterprise Zone Project

Exemption Certificate (EZ PEC) which will include the

assigned project exemption certificate number.

Contractors and subcontractors will need to present a

copy of the valid project exemption certificate to their

vendors when making purchases of materials to be used

in the specified project.

What are the PR-77 and PR-77EZ forms?

Can the petitioning authority or taxpayer

Form PR-77 and PR-77EZ are the Project Completion

be refunded for taxes paid on a project that

Certificates. The project completion certificate is to be

would have qualified for a PEC?

signed by the contractor/subcontractor stating that all

9

the materials purchased with the project exemption

certificate were incorporated into that project. The

contractor should provide the signed project completion

certificate to the petitioning authority or taxpayer. The

petitioning authority or taxpayer should keep the

completion certificate on file for 4 years after the

completion of the project for Audit purposes.

Can the contractor fill out the application

for a PEC?

No. The petitioning authority must be the entity to submit

the request for a project exemption certificate.

Can contractors use a Kansas issued PEC

to purchase materials tax exempt from

another state?

KDOR does not have the authority to mandate whether

or not another state will accept a Kansas issued PEC. If

a contractor chooses to purchase materials in another

state, the other states tax laws apply to those

transactions.

I have several contractors and/or

subcontractors that will be involved in my

project. Whose contractor information

should I include on the application?

If you are applying on-line, you will have the option to

enter as many contractors as needed; however, you

are only required to provide the primary contractor’s

information. Should the contractor information change

at some point during the project, you can log back into

the on-line system and “request a change.” See the

User Guide that follows for detailed instructions.

Can I extend the expiration date on my PEC?

Yes, by following one of these instructions:

If you submitted your request on-line, log back into the

on-line application and click “request a change”. See

the User Guide that follows for detailed instructions.

If you faxed or mailed your request to KDOR, you will

need to fax or mail the department a written request to

extend the estimated completion date, including a

reason for the extension and the requested estimated

completion date.

10

USER GUIDE – APPLYING FOR

EXEMPTION CERTIFICATES / NUMBER

11

For your convenience, the Kansas Department of Revenue has an on-line application process to obtain

exemption certificates/numbers. You will need access to the internet to use the application – if you do not have

internet access, contact the department at (785) 296-3041 or (785) 296-3081 for assistance.

SETTING UP A KS WEBTAX ACCOUNT

NOTE: If you already use KS WebTax for

some other purpose, such as submitting

returns and/or payments, you can skip this

section and go to the section titled Sign In.

1. Launch your web browser (for example,

Internet Explorer)

2. Type www.ksrevenue.org

in the

Address Field, and press Enter.

3. Click the Exemption Certificates

Link

under the Your Business heading.

4. Click the KS WebTax

link under the

You will need to

heading and that will

lead you to the page displayed

on the

right:

5. Click the Continue on to the sign-

in

page

link, leading you to the page

shown on the right. NOTE: A security

information pop-up window

may display

stating

“This page contains both secure

and non-secure items. Do you

want to

display the non-secure items?”

Click

the Yes Button.

TIP: You may want to save this page to your

Favorites file for easy future access.

12

6.

Click the

Register Now

button, leading

you to the page displayed on the right.

7. Enter your info

rmation into the fields

on the Online Business Center

Registration form.

TIP: When the Exemption Certificates: Apply,

Modify, Print, and View radio button under the

Settings section is selected, you will be directed,

automatically, to the exemption certificate page each

time you log into this system.

8. When you have completed the on-

line

registration form, click the Continue

button.

9.

Verify your information (you may want

to print this screen for your records) and

click Register when you are finished.

10. Yo

ur registration has been saved; click

Continue

to be automatically logged in.

Skip the next section, Sign In.

SIGNING ON TO YOUR KS WEBTAX

ACCOUNT

1.

Launch your web browser (for example,

Internet Explorer).

2. Type www.ksrevenue.org

in the

address field, and press Enter.

3. Click the Exemption Certificates

link

under the Your Business heading.

13

4.

Click the

KS WebTax

link under the

You will need to

heading and that will

lead you to the page displayed on

the

right:

5. Click the Continue on to the sign-

In

page

link, leading you to the page

shown on the right. NOTE: A security

information pop-

up window may display

stating

“This page contains both secure

and non-

secure items. Do you want to

display the non-secure items?”

Click

the Yes Button.

TIP: You may want to save this page to your

Favorites file for easy future access.

6. Enter your User ID and Password

and

select the Sign In

button, leading you to

the page shown on the right. NOTE: If

yo

u are directed to a page different than

the one displayed here, select the

Exemption Certificates

button in the

navigation pane to the left of the

screen.

SELECTING AN EXEMPTION TYPE

1. Select the

Apply for a new Exemption

Certificate link.

2. Select the

radio button beside the

exemption type you want to request.

3. Select the Continue button.

14

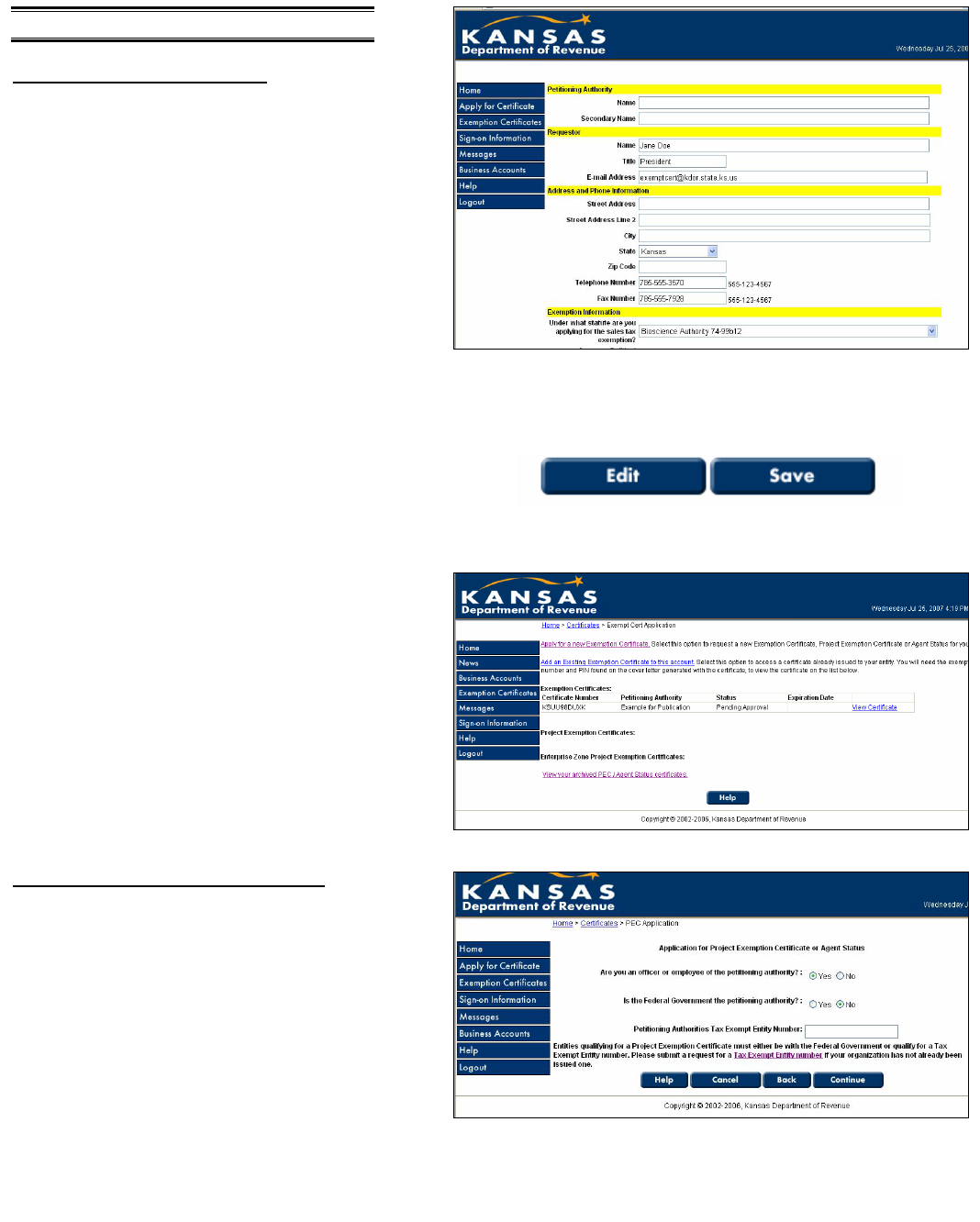

SUBMITTING A REQUEST

Tax Exempt Entity Certificate

If you selected the

Tax Exempt Entity

Cert radio button and clicked Continue

,

you will see a page as shown on the right:

1.

Complete each of the fields on the Tax

Exempt Entity request page.

Tip: The Requestor section of this page is pre-

filled with the information you entered when you

registered for KS WebTax. These fields can be edited

if necessary.

2. Click the Continue

button. You will see

a page that is complete with the

information you entered. Review the

information for accuracy.

3.

If you need to make corrections, click

the Edit

button. If all information is

correct, click the Save b

utton. NOTE:

Your request is not submitted until the

Save button is selected.

4. After you click the Save button, y

our

accounts page will display.

The

exemption certificate you applied for is

listed with a status of Pending Approval.

5. The Kansas Department

of Revenue

will review your request which takes

about 2 days, then yo

u may log back

into the system.

See section titled

Functions for further instructions.

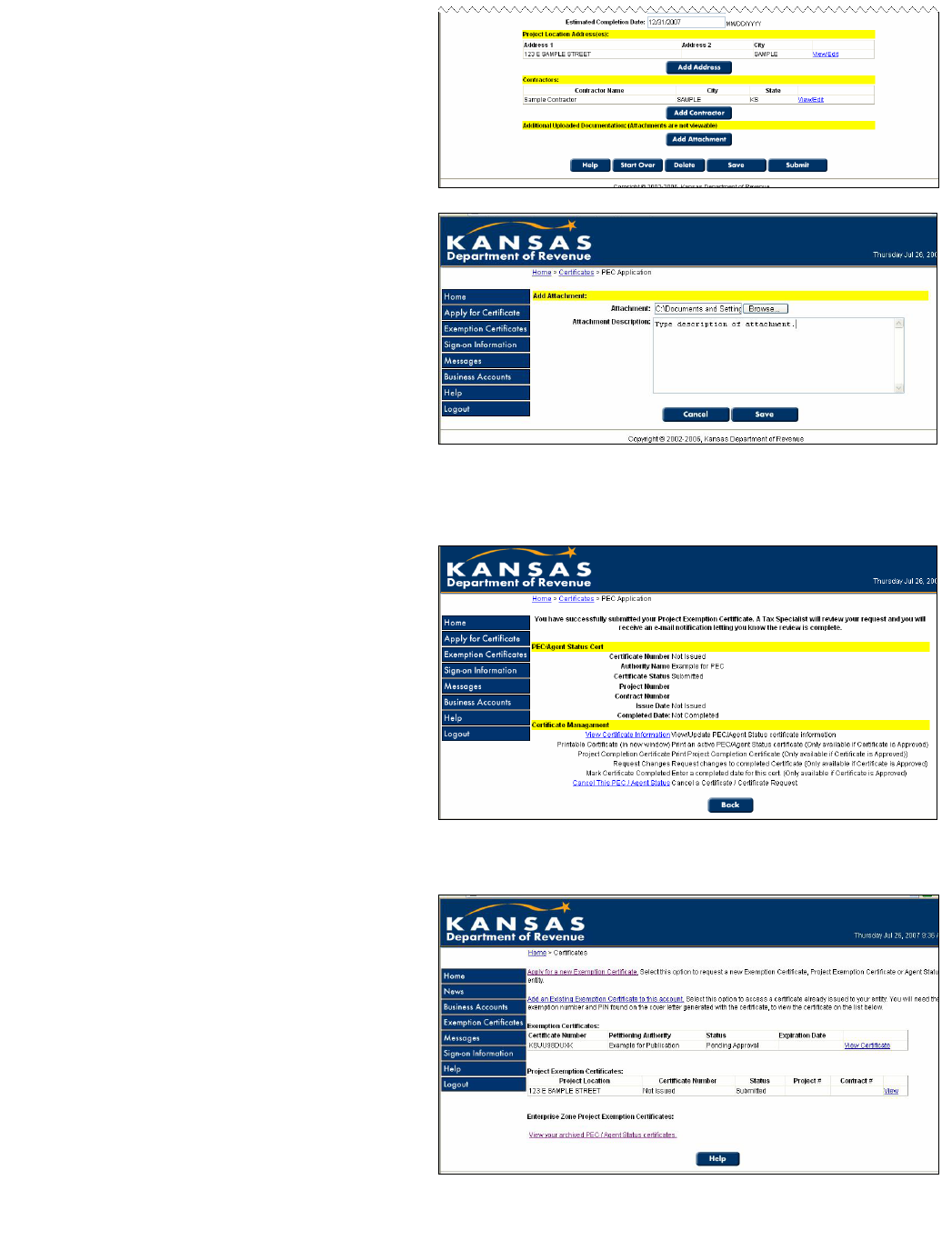

Project Exemption Certificate (PEC)

If you selected the

Project Exemption

Certificate (PEC) ra

dio button and clicked

Continue, you will see a page as shown

on

the right:

1. Answer Yes or No to the

questions

shown on the right.

NOTE: Most people

will answer Yes to the question

Are you

an officer or employee of the petitioning

authority? and No to the question

Is the

federal government the petitioning

authority?.

15

2.

Enter the

Petitioning Authorities Tax

Exempt Entity Number

. NOTE: This

entry field will appear only after the

first two questions have been

answered.

3. Click the Continue bu

tton, leading

you to the page that appears on the

right.

4. Complete the

Project Exemption

Certificate request page.

The

following fields are not required:

Project Number,

Contract Number

and Contract Date.

5. Complete the

Project Location

Address section by clicking the

Add

Address button. (See the following

TIP for adding multiple project location

addresses.)

6. Click the Save button.

7.

Complete the Contractors section by

clicking the Add Contractor

button.

(See the TIP below for adding multi

ple

contractors.)

8. Click the Save button.

16

TIP:

You can add multiple project location

addresses by selecting the Add Address button from

the main application page. (Only the first project

location address will appear on the printed certificate.)

TIP: You can add multiple contractors by

selecting the Add Contractor button from the main

application page.

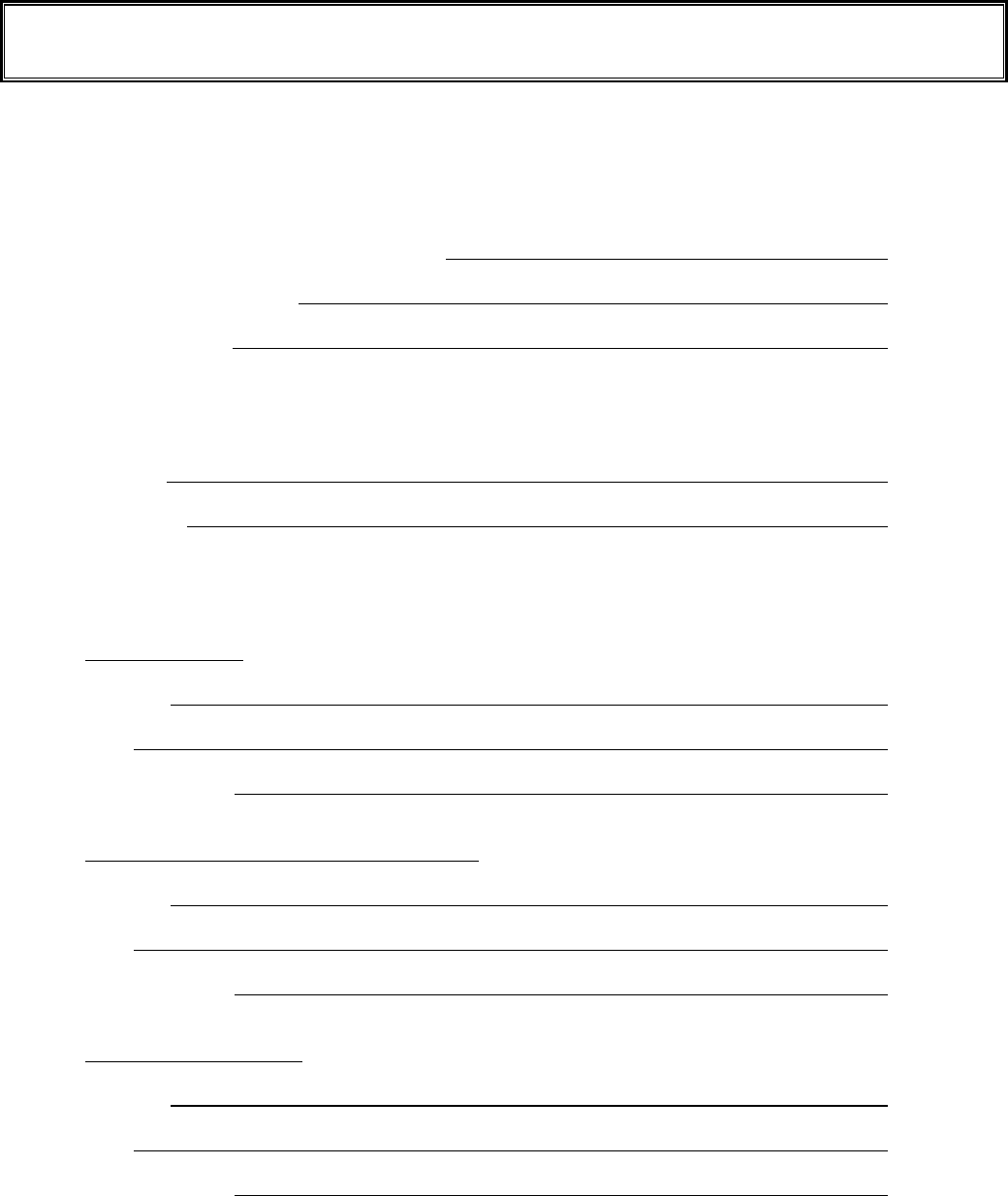

9. Complete the

Additional Upload

Documentation

section by clicking the

Add Attachment

button, leading you to

the page shown on the

right. NOTE:

This option is available if you have

additional information you need to

provide (for example, attaching a

spreadsheet listing several streets to be

repaved OR attaching an electronic

version of a signed agreement).

10. Click the Save button. NO

TE: You will

not be able to open the attachment.

However, once the request has been

submitted, the Department of Revenue

can open the attachment(s).

11. Click the Submit

button. You will see a

page similar to the one shown on

the

right, confirming that you

successfully

submitted your Project Exemption

Request.

12. Click the Back button.

13.

When the next page appears, click the

Logout

option on the left side of the

page.

After a Tax Specialist reviews your

request, you will receive an E-

mail

indicating t

here is a change to your account

and a request that you log back into the

system.

TIP: In most cases, your request will be reviewed

either the same day or next day. (See the Functions

section for further instructions.)

17

Generally speaking,

you will only be able

to see those exemption certificates that you

have entered.

TIP: If you want to see all the project exemption

certificates that have been entered by your organization,

you will need to add a copy of your organization’s Tax

Exempt Entity Exemption Certificate to your account.

(See Functions-Adding an exemption certificate/

number to your account.).

Agent Status

To apply for Agent

Status, select the

Agent Status Exempt Cert

radio button and

use the instructions for requesting a

Project

Exemption Certificate (page 14).

All projects, including requests from

Agents, funded with an Industrial Revenue

Bond (IRB), must be reviewed by the

Department of Revenue prior to approval.

TIP: The first request submitted under Agent Status

type must be reviewed and approved by the Department

of Revenue. Once approved, all subsequent requests

will be automatically approved and immediately available

to print and use.

Enterprise Zone Project Exemption

Certificate (EZPEC)

If you selected the

Enterprise Zone

Project Exemption Cert (EZPEC)

radio

button and clicked Continue

, you will see a

page as shown on the right.

1. Answer Yes or No to the question shown

on the right.

2. Click the Continue button

, leading you to

a page similar to the one shown on

the

right.

18

3.

Complete the

Taxpayer Information

and

Taxpayer Mailing Information

sections and click the Continue button.

4. Complete the Project Information

section and click the Continue button.

NOTE: The question “What will be the

average annual wage for new (non-

managerial) employees?”

is not a

required field.

5. Complete the

Estimated Project Costs

and Project Dates sections.

NOTE:

The Contractor Number and

Contract

Date under the

Contractor

Information

section are not required

fields.

6. Click the Add Contractor

button and

complete the Contractor Information

section.

TIP: You can add multiple contractors by

selecting the Add Another Contractor button from the

contractor page or selecting the Add Contractor

button from the main application page.

7. Click the Continue button.

8. Complete the Supporting Documen-

tation section by clicking the

Add

Attachment Button

, then click the

Continue

button. NOTE: This option is

available if

there is additional

info

rmation that you need to provide (for

example, attaching an electronic

version of a signed agreement OR

attaching an electronic version of

documents to describe the activities of

the business).

19

TIP:

You can attach multiple documents by

selecting the Add Another Attachment button from

the attachments page or selecting the Add

Attachment button from the main application page.

9. Click the Continue button.

10.

Review the information for accuracy,

click the Edit button if co

rrections need

to be made or click the Submit button

if

the information is correct. When

you

click the Submit

button, you will get a

page that looks like the one shown on

the right.

NOTE: Your request is not officially

submitted until the Submit button is

selected.

11. Click the View Printable Form

link at

the top of the page.

12.

Scroll to the bottom of the page and

click the Print button.

13. Click the Back

button at the bottom of

the page. This will take you to the

“Congratulations…” page as

shown in

the screen shot for step 10.

14. Click the View Accounts

link, leading

you to the page shown on the right.

15. Click the Logout button on

the left side

of your screen.

After the Kansas

Department of Revenue

reviews your

request, you will receive an e-

mail

indicat

ing there is a change to your

account and a request that you log back

into the system.

TIP: In most cases, your request will be reviewed

either the same day or next day. (See the Functions

section for further instructions.)

20

Manufacturer/Processor Exemption

Number (MPEC)

If you selected the

Manufacturer/

Processor Sales Tax Exemption Cert

(MPEC) radio button and clicked Continue

,

you will see a page as shown on the right.

1. Answer Yes or No

to the following

question:

Are y

ou an employee or officer to

the Manufacturer/Processor?

2. Click the Continue

button, leading you

to a page similar to the one shown on

the right.

3. Complete the Mailing Information

section and click the Continue button.

4. Complete the Manufacturer/Proc

essor

Location Information section.

5. Click the

Add Owner, Partner or

Officer button and complete the

Enter

Owner, Partner or Officer section.

TIP: You can add multiple owners, partners or

officers by selecting the Add Another Owner button

from the owner’s page or selecting the Add Owner,

Partner or Officer button from the main application

page.

6. Click the Continue button.

21

7.

Complete the

Add Attachment

section

by clicking the Add Attachment

button,

then click the Continue b

utton. NOTE:

This option is available if there is

additional information that you need to

provided (for example, attaching a

picture of the products you produce).

TIP: You can attach multiple documents by

selecting the Add Another Attachment button from

the attachments page or selecting the Add

Attachment button from the main application page.

8. Click the Continue button.

9.

Review the information for accuracy

click the Edit

button if corrections need

to be made or click the Submit

button if

the information is correct.

When you

click the Submit

button, you will get a

page that looks like the one shown on

the right.

10. Click the View Printable Form

link at

the top of the page.

11.

Scroll to the bottom of the page and

click the Print button.

12. Click the Back bu

tton at the bottom of

the page.

This will take you to the

“Congratulations…” page as shown in

the screen shot for step 10.

22

13.

Click the

View Accounts

link, leading

you to the page shown on the right.

14. Click the Logout button on

the left side

of your screen.

After the Kansas

Department of Revenue

reviews your

request, you will receive an e-

mail

indicating there is a change to your

account and a request that you log back

into the system.

STATUS TERMS AND DEFINITIONS

Li

sted here are terms that you may see

in the Status

column on your accounts

page.

Status Definition

Approved The request has been reviewed and

approved.

Approved As Agent Status The request was submitted by an Agent of

the department and was automatically

approved.

Canceled The request has been canceled.

Completed The project has been completed.

Declined The request has been reviewed and denied.

A Denial letter is available for printing.

Pending Approval The reviewer needs additional information

or documentation. A message will be

posted for the requester providing specific

directions.

Requested Changes A request to change either the Estimated

Completion Date, Estimated Project Cost or

Contractor information is pending review.

Saved The requester has entered information and

saved the request. Saved requests have

not been submitted to the department for

review.

Submitted The request has been submitted to the

department for review.

Waiting for Agreement The requester needs to provide a copy of a

signed agreement prior to the request being

approved.

23

FUNCTIONS

ADD EXEMPTION CERTIFICATE/NUMBER TO

YOUR ACCOUNT

This function applies to

the following

exemption types:

Tax Exempt Entity,

Enterprise Zone Project Exemption

Certificates, and Manufacturer/Processor.

1. Click the

Add an Existing Exemption

Certificate to this Account link.

2. Enter the

Tax Exempt Entity number

or the

Manufacturer/Processor

number, and the PIN.

Click the

Continue button.

TIP: The PIN (personal ID number) can be found

on the letter that you received from the Department of

Revenue. It is printed on the front page, in the upper

right corner. The Manufacturer/Processor PIN is in the

upper right corner of page 2.

VIEW

The View function

applies to all

exemption types.

1.

Click on the applicable link that is to the

far left of the Exemption Certificate that

you are interested in.

2. Click the Back

button at the bottom of

the page to take you back to your

accounts page.

ADD AN ATTACHMENT

This function applies to the follo

wing

exemption types

: Project Exemption Cert

(PEC), Agent Status Exemption Cert,

Enterprise Zone Project Exemption Cert

(EZPEC) and Manufacturer/

Processor

Exemption Numbers (MPEN).

1.

Click the view link next to the

Exemption Certificate/Number you want

to add an attachment.

2. Under the Certificate Management

heading, click the View Certificate/

Number Information link.

What will

appear is the Exemption Certificate/

Number Information.

24

ADD AN ATTACHMENT (CONT.)

3. Select the Add Attachment button at the

bottom of the page.

4. Select the Browse button and locate the

document you want to attach.

5. Enter a brief description of the document being

attached and select the Continue button.

VIEW CERTIFICATE/NUMBER INFORMATION

The View Certificate/Number Information

applies to all exemption types.

1. Click the view link next to the Exemption

Certificate you want to review.

2. Under the Certificate Management heading

click the View Certificate/Number Information

link. The Exemption Certificate/Number

Information will appear.

3. To go back to the View page, click the Back

button at the bottom of the page. NOTE: If the

status of the exemption you are viewing is

anything other than SAVED, you will not be able

to edit the request.

PRINT CERTIFICATE/NUMBER

The Print Certificate/Number applies to all

exemption types. NOTE: This function will not be

available to entities entering Enterprise Zone Project

Exemption Certificates (EZPECs) on the behalf of a

taxpayer.

1. Click the view link next to the Exemption

Certificate you want to print.

2. Under the Certificate Management heading

click the Printable Certificate (in new window)

link. The Exemption Certificate/letter will appear

in a new window.

3. Click the Print Form button at the top of the

page.

4. To go back to the View page, close the

Printable Certificate window.

PROJECT COMPLETION CERTIFICATE

The Project Completion Certificate applies to

the following exemption types: Project Exemption

Cert (PEC), Agent Status Exemption Cert and

Enterprise Zone Project Exemption Cert (EZPEC).

NOTE: This function will not be available to entities

entering Enterprise Zone Project Exemption

Certificates (EZPECs) on the behalf of a taxpayer.

1. Click the view link beside the Exemption for

which you want to print a Completion

Certificate.

2. Under the Certificate Management heading

click the Project Completion Certificate link.

The Completion Certificate will appear in a new

window.

3. Click the Print Form button at the top of the

page.

4. To go back to the View page, close the

Completion Certificate window.

REQUEST CHANGES

This function applies to the following exemption

types: Project Exemption Cert (PEC), Agent Status

Exemption Cert and Enterprise Zone Project

Exemption Cert (EZPEC).

1. Click the view link beside the exemption that you

need to request a change. You can request a

change for the following fields:

PECs: Estimated Completion Date,

Estimated Project Cost and Contractor

Information.

EZPECs: Estimated Completion Date and

Contractor Information.

2. Under the Certificate Management heading

click the Request Changes link.

3. The Certificate information will appear and the

above listed fields will be editable. Make the

necessary changes and click the Submit button.

You will be directed back to the View page.

4. Click the Back button at the bottom of the page

to take you to the accounts page. The status

has now changed to Requested Changes.

NOTE: Requests for changes must be reviewed

by the Department of Revenue, except for

requests associated with an approved Agent

Status certificate. Consequently, you will not be

able to perform any of the management

functions until your request has been approved.

You will receive an e-mail letting you know when

your request has been reviewed.

25

M

ARK

C

ERTIFICATE

C

OMPLETED

This function applies to th

ese

exemption types: Project Exemption Cert

(PEC), Agent Status Exemption Cert, and

Enterprise Zone Project Exemption Cert

(EZPEC).

1.

Click the view link beside the project

that is completed.

2. Under the Certificate Management

heading click the Mark Certific

ate

Completed link.

3.

Enter in the date that the project was

actually completed and click the

Mark

Completed

button. This will take you

back to the view page.

4. Click the Back

button to go to the

archive page and the Back to Active

button to go to the accounts page.

TIP: Notice that this exemption is no longer on

your active list. To go back to the exemption, click the

View your Archived Certificates link at the bottom of

your accounts page.

CANCEL CERTIFICATE

T

his function applies to all exemption

types.

1.

Click the view link beside the exemption

that you need to cancel.

2. Click the Cancel Certificate

link listed

under the Certificate Management

heading.

3.

Enter the reason for canceling the

request and click the Submit

button.

This will take you back

to the view

page.

4. Click the Back

button to go to the

archive page and the Back to Active

button to go to the accounts page.

NOTE: The exemption is no longer on

your active or archive lists and you will

not be able to access since it is marked

Canceled.

However, the department

can retrieve the information if

necessary.

26

U

PDATING

T

AX

E

XEMPTION

E

NTITY

INFORMATION

1. Click the View Certificate

link next to

your tax exempt entity certificate.

2. Click the View Certificate Informa

tion

link under the Certificate Management

heading.

3. Click the Update

button at the bottom

of the screen.

4.

Make the necessary corrections and

then select the Save

button at the

bottom of the screen.

TIP: You will not be able to change the

Petitioning Authority name. If the name of your

organization changes you will need to Cancel the

certificate using the incorrect name and submit a new

request.

UPDATING KS WEBTAX REGISTRATION

INFORMATION

1. Click the Sign-on Information

button in

the navigation pane

to the left of the

page.

2. Click the Edit button.

3.

Make the necessary updates and click

the Save button.

4. Click the Exemption Certificates

button in the navigation pane to go back

to your accounts page or the Logout

button in the navigation pane to log out

of the system.

27

TROUBLESHOOTING

ON-LINE EXEMPTION APPLICATION

I was entering my PEC request on-line and was called

away from my desk for awhile. When I returned, the

information I had entered was gone, why?

The system will time out if there is no activity for 20

minutes.

TIP: You are required to provide answers to all the questions

except for the following: Project Number, Contract Number and

Contract Date. You cannot SAVE the request if there are

unanswered questions. To get around this, enter place holder

information for each question and then SAVE the record – do not

select the Submit button. You can then reopen the request and

all the information you entered will still be there. Then, correct the

place holder information and select the Submit button.

I am trying to submit a request for a PEC and I have

entered my Tax Entity Exemption number. The

system won’t accept my number, what do I do?

The Kansas Tax Exempt Entity number is a 10-digit,

randomly selected, number that starts with the

letters KS and does not use the letter “O”

(KS1AA1A1AA). This field is case sensitive and

does not allow for spaces or punctuation.

If you are unable to locate this number, you can

contact our office at (785) 296-8460 or (785) 296-3081.

TIP: Be sure that you are using the number zero “0” and not

the letter “O”.

I selected the back button and I was kicked out

of the system, what did I do wrong?

Be sure to use the blue buttons, including the Back

button, at the bottom of each page. Using the Back

option in the tool bar at the top of your screen will, in

most cases, kick you out of the exemption certificate

application.

When I log onto the system I can only see the

PECs that I have entered. One of my coworkers

entered a PEC that I need to submit a request to

extend the estimated completion date, how do I

get this done?

By adding the Tax Exempt Entity certificate to your

account, you will be able to see all the PECs that have

been submitted by your entity (see the User Guide for

detailed instruction). You can then request a change

for the PEC that was entered by your coworker.

I have answered the questions and selected the

Submitted/Save button at the bottom of the

screen and nothing happens. Why won’t the

system take the information I entered?

In most cases, this means that either a question has

been left unanswered or the system does not like

what you have entered for a particular question. The

questions that are not being accepted are listed at the

top of your screen in red. If the question does not

have an answer entered, simply enter your response.

If you have entered a response, try removing any

special characters (i.e. #, @, etc.).

If you continue to have problems you can contact

our office at (785) 296-8460 or (785) 296-3081.

KS WEBTAX

I entered all the information to set up my account

for KS WebTax and it gives me a message that the

e-mail address is already being used, what do I do?

The message is telling you that an account already

exists for that email address. From the sign-on

page, select the Forgot your User ID/Password?

Link and follow the instructions. If you continue to

have problems you may contact our Electronic

Support Staff at 1-800-525-3901 or by e-mail at

eservices@kdor.ks.gov.

I am trying to create a password/UserID and I

keep getting error messages. Any suggestions?

Passwords must be at least 6 and no more than 12

characters in length and must include at least 1 number.

UserIDs must be at least 6 and no more than 12

characters in length. For security reasons you

should refrain from using the name of your business

as a part of the UserID.

If you continue to have problems you may contact

our Electronic Support Staff at 1-800-525-3901 or by

e-mail at es[email protected].gov

28

IMPORTANT NUMBERS AND INFORMATION

- KEEP THIS INFORMATION IN A SAFE LOCATION -

General Information

Organization Name/Petitioning Authority:

Representatives Name:

E-mail Address:

KS WebTax

User ID:

Password:

Exemption Number

Tax Exempt Entity

Number:

PIN:

Expiration Date:

Enterprise Zone Project Exemption Certificate

Number:

PIN:

Expiration Date:

Manufacturer / Processor

Number:

PIN:

Expiration Date:

29

State of Kansas

PRSRT STD

Department of Revenue

U.S. POSTAGE

915 SW Harrison

PAID

Topeka, KS 66612-1588

KANSAS DEPT.

OF REVENUE

⎡ ⎤

⎣ ⎦

TAXPAYER ASSISTANCE

This publication is a general guide and will not address every situation. If you have questions or need additional information, please

contact taxpayer assistance at the Kansas Department of Revenue (KDOR).

Taxpayer Assistance Center Phone: (785) 368-8222

Docking State Office Building - 1st floor Fax: (785) 291-3614

915 SW Harrison St. Web site: ksrevenue.org

Topeka, KS 66625-2007

Office hours are 8:00 a.m. to 4:45 p.m., Monday through Friday.

TAX FORMS

In addition to the publications listed below, KDOR’s web site contains a library of policy information, press releases, and other notices.

Due to limited state funding KDOR has discontinued the printing of these publications; however all are available from our web site.

• Publication KS-1216, Kansas Business Tax Application

• Publication KS-1500, North American Industry Classification System

• Publication KS-1510, Kansas Sales and Compensating Use Tax

• Publication KS-1515, Kansas Tax Calendar of Due Dates

• Publication KS-1520, Kansas Exemption Certificates

• Publication KS-1525, Kansas Sales and Use Tax for Contractors, Subcontractors and Repairmen

• Publication KS-1526, Kansas Sales and Use Tax for Motor Vehicle Transactions

• Publication KS-1527, Kansas Sales and Use Tax for Kansas Political Subdivisions

• Publication KS-1530, Kansas Tire Excise Tax

• Publication KS-1540, Kansas Business Taxes For Hotels, Motels and Restaurants

• Publication KS-1550, Kansas Sales and Use Tax for the Agricultural Industry

• Publication KS-1560, Kansas Tax Guide for Schools and Educational Institutions

• Publication KS-1700, Kansas Sales Tax Jurisdiction Code Booklet

• KW-100, Kansas Withholding Tax Guide

The following information guides are written for specific construction trades:

• EDU-26, Sales Tax Guidelines for Contractors and Contractor-Retailers

• EDU-27, Sales Tax Guidelines for Fabricators

• EDU-28, Sales Tax Guidelines for Businesses that Sell and Service Appliances and Electronic Products

• EDU-29, Sales Tax Guidelines for Contractor-Fabricators and Contractor-Manufacturers

• EDU-30, Sales Tax Guidelines for Lawn Care, Pest Control, Fertilizer Application and Landscaping

STATE SMALL BUSINESS WORKSHOPS

As part of our commitment to provide tax assistance to the business community, Tax Specialists within KDOR conduct small business

workshops on Kansas taxes at various locations throughout Kansas. Whether you are a new business owner, an existing business

owner, or an accountant, these workshops will give you the tools and understanding necessary to make Kansas taxes easier and less

time consuming for you. Topics covered include filing and reporting requirements and methods, what is taxable, what is exempt and how

to work with the department in collecting and remitting Kansas taxes.

For a schedule of our workshops, visit our web site. Pre-registration is required and a fee may be charged by the sponsoring Small

Business Development Center (SBDC).

Your suggestions and comments on this publication are important to us. Please address them to: Taxpayer Education,

Kansas Department of Revenue, 915 SW Harrison St., Topeka, KS 66625-1588 or call (785) 296-1048.