1

www.ksrevenue.org

KANSAS

Exemption Certificates

This booklet is designed to help businesses properly use Kansas sales

and use tax exemption certificates as buyers and as sellers. It explains the

exemptions currently authorized by Kansas law and includes the exemption

certificates to use. Businesses with a general understanding of Kansas

sales tax rules and regulations can avoid costly errors.

As a registered retailer or consumer, you will receive updates from the

department when changes are made in the laws governing sales and use tax

exemptions. Keep these notices with this booklet for future reference. You

may also obtain the most current version of any exemption certificate or

publication from our web site.

Pub. KS-1520 (Rev. 10/09)

NOTE: Due to limited funding, the Department of

Revenue has discontinued the printing of this

publication. It is available only through our web site.

2

TABLE OF CONTENTS

RETAILER

RESPONSIBILITIES............................................... 3

The Cardinal Rule

What is an Exemption Certificate?

Accepting Exemption Certificates

Blanket Exemption Certificates

Record Keeping

BUYING YOUR INVENTORY ................................. 4

Resale Exemption Certificate Requirements

Kansas Sales Tax Account Numbers

Items Purchased Must Be For Resale

Sample Completed Resale Exemption Certificate

SALES TAX EXEMPTIONS ................................... 6

Exempt Buyers

Items Exempt from Sales Tax

Uses that are Exempt

The Utility Exemption

SPECIAL SITUATIONS .......................................... 10

Contractors

Project Exemption Certificates

Manufacturers and Processors

Wholesalers

Paying Tax on Personal Use of Inventory

When in Doubt…

RELATED TOPICS ................................................ 13

Audit Issues

Local Sales Tax

Out-of-State Sales

Compensating Use Taxes

If there is a conflict between the law and information found in this publication, the law remains the final authority.

Under no circumstances should the contents of this publication be used to set or sustain a technical legal position.

Exemption certificates are updated as laws change; consult our web site for current versions. A library of current

policy information is also available on our web site: www.ksrevenue.org

USING EXEMPTION CERTIFICATES .................... 15

Completing the Certificate

Penalties for Misuse

SAMPLE EXEMPT ENTITY CERTIFICATE............ 16

EXEMPTION CERTIFICATES

Agricultural (ST-28F) ............................................................... 18

Aircraft (ST-28L) ........................................................................ 19

Consumed in Production (ST-28C) ................................... 20

Direct Mail Sourcing (ST-31) ............................................... 21

Designated or Generic (ST-28)...........................................22

Dry Cleaning & Laundry Retailer (ST-28X) .................... 24

Ingredient or Component Part (ST-28D) ......................... 25

Integrated Production Machinery & Equipment

(ST-201) ............................................................................26

Interstate Common Carrier (ST-28J) ................................28

Multi-Jurisdiction (ST-28M) ................................................... 30

Project Exemption Request Exempt Entities

(PR-76) ............................................................................. 32

Project Exemption Request (Economic

Development Project (PR-70b) ................................ 34

Project Completion Certification (PR-77) .......................40

Railroad (ST-28R) ..................................................................... 41

Resale (ST-28A) ........................................................................42

Retailer/Contractor (ST-28W) ............................................... 43

Streamlined Sales Tax (PR-78SSTA)................................. 44

Tire Retailer (ST-28T) ............................................................. 46

U. S. Government (ST-28G) ................................................. 47

Utility (ST-28B) .......................................................................... 48

Vehicle Lease or Rental (ST-28VL) ................................... 50

Veterinarian (ST-28V) .............................................................. 51

Warehouse Machinery & Equipment (ST-203) ........... 52

3

RETAILER

RESPONSIBILITIES

THE CARDINAL RULE

Kansas retailers are responsible for collecting the full

amount of sales tax due on each sale to the final user or

consumer. All Kansas retailers should follow this cardinal

rule:

All retail sales of goods and enumerated

taxable services are considered taxable

unless specifically exempt.

Therefore, for every sale of merchandise or taxable service

in Kansas, the sales receipt, invoice, or bill MUST either:

• show that the total amount of sales tax due

was collected, or

• be accompanied by a Kansas exemption

certificate or Form PR-78SSTA.

WHAT IS AN EXEMPTION CERTIFICATE?

An exemption certificate is a document that a buyer

presents to a retailer to claim exemption from Kansas

sales or use tax. It shows why sales tax was not charged

on a retail sale of goods or taxable services. The buyer

completes and furnishes the exemption certificate, and

the seller keeps the certificate on file with other sales tax

records.

An exemption certificate must be completed in its

entirety, and by regulation K.A>R> 92-1925b must should:

• explain why the sale is exempt,

• be dated,

• describe the property being purchased unless

using Form PR-78SSTA, and

• contain the seller’s name and address and

the buyer’s name, address, and signature.

Some exemption certificates also require a buyer to

furnish the Kansas tax account number or request a

description of the buyer’s business. The exemption

certificates for nonprofit organizations require the exempt

entity’s tax ID number.

The Kansas exemption certificates, including Form PR-

78SSTA, beginning on page 19 meet these requirements.

When the appropriate certificate is used, and all the blanks

are accurately filled out, the certificate may be accepted

by a retailer.

ACCEPTING EXEMPTION CERTIFICATES

An exemption certificate relieves a seller from

collecting sales tax if it has obtained the required

identifying information as determined by the director and

the reason for claiming the exemption at the time of

purchase. A seller should:

1) verify the identity of the person or entity presenting

the exemption certificate; and

2) maintain the fully completed exemption certificate in

your sales tax records for at least three (3) years.

You should obtain the appropriate Kansas exemption

certificate from your customer at the time of the sale and

no later than the actual delivery of the taxable item or

service. 90 days subsequent to the date of sale.

However, some customers claim to be exempt only

after the goods or services have been delivered, and

deduct the tax from the bill. When this happens, you

are still responsible for obtaining an exemption certificate

from the customer. If you are unable to secure an

exemption certificate the sale is considered taxable, and

as the retailer, you will be liable for the tax.

BLANKET EXEMPTION CERTIFICATES

If you make recurring exempt sales of the same type to the

same customer, you are not expected to obtain an exemption

certificate for each transaction. Kansas law provides that a

seller is relieved of liability for the tax when he obtains a

blanket exemption certificate from a purchaser with which

the seller has a “recurring business relationship”. Such

certificate need not be renewed or updated when there is

a recurring business relationship between the buyer and

seller. A “recurring business relationship” exists when a

period of no more than 12 months elapses between sales.

All of the certificates in this booklet may be used as

blanket certificates.

All Tax-Exempt Entity Exemption Certificates (sample

on page 16) contain an expiration date. If a One Tax-

Exempt Entity Exemption Certificate is obtained by the

seller it can be used for all sales made prior to the

expiration date as provided on the certificate is sufficient.

No need for the seller to obtain multiple copies of this

Tax-Exempt Entity Certificate.

RECORD KEEPING

You must keep all sales tax records, including

exemption certificates, for your current year of business

and at least three prior years. DO NOT send exemption

certificates to the Department of Revenue with your sales

tax return.

4

BUYING

YOUR INVENTORY

Probably the most widely used sales tax exemption

is for the purchase of items intended for resale. When

buying your inventory from a wholesaler or another

retailer, or selling inventory items to another retailer,

you will use a Resale Exemption Certificate or Form PR-

78SSTA.

RESALE EXEMPTION CERTIFICATE

REQUIREMENTS

A resale exemption certificate has two

requirements.

1) The items purchased must be for resale

in the usual course of the buyer’s business.

2) The buyer must have a Kansas sales tax

account number, except in drop shipment

situations.

A retailer should make sure both requirements are met

provided before accepting a Resale Exemption Certificate

from the customer. The following discussion of these two

requirements will help you avoid costly errors.

ITEMS PURCHASED MUST BE FOR RESALE

When accepting A buyer can use a resale exemption

certificate from a buyer, you must verify only to purchase

the property that will be for resale and not for personal or

other nonexempt use by the buyer. The property being

purchased must be of the type normally sold at retail in

the usual course of the buyer’s business. For example,

a restaurant owner cannot use an exemption certificate

to buy tires or appliances since a restaurant does not

customarily sell these items.

KANSAS SALES TAX ACCOUNT NUMBERS

The Kansas Department of Revenue assigns a Kansas

sales tax account number to you after you complete the

Business Tax Application, Form CR-16. This number is

printed on your Retailers’ Sales Tax Registration Certificate

and is used to report and pay the sales tax you collect from

your customers to the department. It is also the number

that MUST be provided appear on a Resale Exemption

Certificate, Form ST-28A or Form PR-78SSTA.

CAUTION: DO NOT accept a photocopy of a

customer’s sales tax registration certificate

instead of a completed exemption certificate.

You cannot exempt a sale from tax simply because the

buyer is a registered retailer.

A common misconception is that a sales tax account

number is also a “tax-exempt” number. However, a sale

is not exempt simply because the buyer has a sales tax

number. A tax number only proves the customer is a

registered retailer; it does not certify that the item(s)

purchased are exempt (for resale or any other reason).

A completed exemption certificate must be obtained

from the customer before the sale is exempt.

Retailers from other states

As a general rule, wholesalers and buyers from other

states not registered in Kansas should use the Multi-

Jurisdiction Exemption Certificate, Form ST-28M or PR-

78SSTA, to purchase buy items for their resale inventory.

The Multi-Jurisdiction certificate or PR-78SSTA may also

used by wholesalers to buy their inventory. If the inventory

item purchased by an out-of-state retailer who has sales

tax nexus with Kansas is drop shipped to a Kansas

location, the out-of-state retailer may provide to the third

party vendor a Resale Exemption Certificate from any

state, or the Multi-Jurisdiction Exemption Certificate

showing registration for any state. They may also use

PR-78-SSTA exemption certificate. The law no longer

requires that they have a Kansas registration in order for

the sale to be exempt.

Sales Tax Account Number Format

The Kansas Department of Revenue changed the

format of a Kansas Sales tax account number in

September, 1999. Businesses registered prior to that

date received the new type of reporting number, but

were not issued a new Registration Certificate with

the new number format.

The following explanations will help you recognize the

two types of Kansas sales tax account numbers that

may appear on a Kansas Sales Tax Certificate of

Registration. Either type of number is acceptable on an

exemption certificate. However, you should obtain the

new tax account numbers from those customers who

are using blanket exemption certificates (see page 3). If

you have any questions about a sales tax account number

furnished by a customer, contact our office.

Current Format of Sales Tax Account Numbers

A Kansas Sales tax account number is a fifteen-

character number. There are three parts to your Kansas

Sales Tax Account Number:

Tax Type EIN, “A” or “K” number End code

004 4812345678F 01

004 K12345678F 01

004 A12345678F 01

5

The tax type prefix for sales tax is “004.” If you are

registered with the department for other taxes (withholding,

compensating use) the prefix will change to denote the

different tax type. For example, the prefix for withholding

tax is “036.”

Your account number is based on either your federal

Employer Identification Number (EIN), an “A” or a “K”

number assigned by the Kansas Department of Revenue

for those accounts that are not required to have an EIN.

All registration numbers end with the letter “F.”

The two-digit end code at the end of the number denotes

the number of registrations under this EIN, “A” or “K”

number. For most taxpayers it is “01.”

Sales Tax Account Numbers Before October, 1999

The registration number shown on Kansas Sales Tax

Registration Certificates issued before October, 1999 had

four parts (separated here by hyphens).

1-000-X000-X000

Part one is the tax type - “1” is for sales tax. Parts

two and three are the unique letter (X) and number (0)

combination assigned to the business. Part four is the

local tax code. Parts two and three were used on

exemption certificates, such as: 002-0000 or 2-0000.

The tax account numbers assigned by the department

for other tax types (such as tire excise and transient

guest tax) still follow this general format.

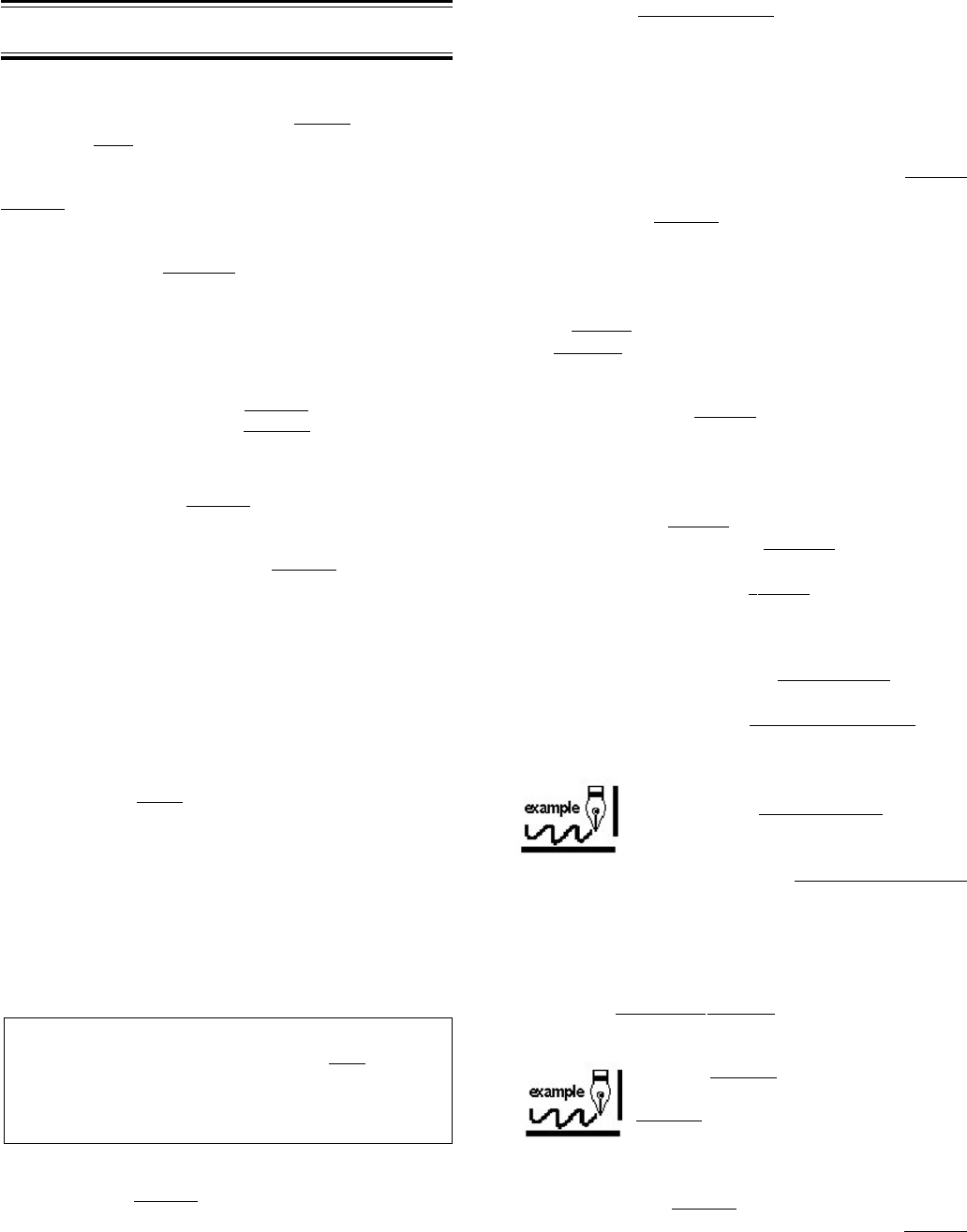

SAMPLE COMPLETED RESALE EXEMPTION

CERTIFICATE

All the blanks on an exemption certificate must

should

be completed before the exemption certificate may be

accepted by a retailer (page 15). Use the completed Resale

Exemption Certificate illustrated in the example below as a

guide. Also, the Form PR-78SSTA may be used.

James Adams owns a candy store in Topeka, and buys his inventory from Wholesale Candies and Snacks.

His sales tax account number is 004-740000000F-02. The Resale Exemption Certificate he completed for his

vendor is below. He also purchased display racks from this vendor, but since he is the final consumer of the

racks, they were invoiced separately and he paid the sales tax on them.

Kansas Department of Revenue

RESALE EXEMPTION CERTIFICATE

The undersigned Kansas retailer certifies that the tangible personal property or repair service purchased from:

Seller:

Address:

will be resold by me in the form of tangible personal property or repair service. I hereby certify that I hold valid Kansas sales tax registration number

, and I am in the business of selling

Description of tangible personal property or repair service purchased:

I understand and agree that if the items purchased with this certificate are used for any purpose other than retention, demonstration, or display while

being held for sale in the regular course of business, I am required to report and pay the sales tax, based upon the purchase price of the items.

Purchaser:

Address:

Signature: Date:

Business Name

Street, RR or P. O. Box City State Zip + 4

(May attach a copy of registration certificate)

(Description of product(s) sold - food, clothing, furniture, etc.)

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

TO CONSERVE SPACE ONLY THE

TOP

PORTION OF THE CERTIFICATE

IS

REPRODUCED HERE.

Wholesale Candies

123 Main Street Topeka KS 66612

004-740000000F-02 food, gasoline, and beverages

candy, gum, packaged snacks

James Adams Convenience Store

2171 Southwest Blvd Topeka, KS 66611

James Adams 4/28/09

6

SALES TAX EXEMPTIONS

The sales tax exemptions authorized by Kansas law

fall into three general categories. These are: entities

who are exempt, specific items that are exempt, and

uses of an item that makes it exempt. This section

explains each category with examples and exceptions

noted. Additional information about an exemption is part

of the certificate designed for it.

EXEMPT ENTITIES

All of the following entities are exempt from sales tax

when making a

direct purchase of goods. Most, but not

all of these entities, are also exempt when making a

direct purchase of a taxable service. You will want to

consult their exemption certificate to determine The Tax-

Exempt Entity Exemption Certificate issued by the

Department to the entity states whether its their

exemption is limited to just goods or whether the

exemption extends to services as well. A direct purchase

is one that is billed directly to the exempt buyer and paid

for by a check or voucher from the exempt buyer.

♦ The U.S. Government, its agencies and

instrumentalities

♦ The state of Kansas and Kansas political

subdivisions: school districts, counties, cities, etc.

♦ Elementary and secondary schools

♦ Noncommercial educational television and

radio stations

♦ Nonprofit blood, tissue and organ banks

♦ Nonprofit educational institutions

♦ Nonprofit 501(c)(3) historical societies

♦ Nonprofit hospitals

♦ Nonprofit 501(c)(3) museums

♦ Nonprofit 501(c)(3) primary care clinics

♦ Nonprofit 501(c)(3) religious organizations

♦ Nonprofit 501(c)(3) zoos

♦ Nonprofit youth development programs

♦ Parent-teacher organizations (PTA or PTO)

FOR A COMPLETE LIST OF

EXEMPT ENTITIES SEE PAGE 17.

The 501(c)(3) designation refers to the section of

the Internal Revenue Code under which a nonprofit entity

has been granted an exemption from federal (and state)

income tax. Although used to define who qualifies for

an exemption, a nonprofit 501(c)(3) designation does

not mean the organization is automatically exempt

from sales tax. Only the entities listed here are exempt

from paying Kansas sales tax on their direct purchases

when the appropriate exemption certificate is completed

and provided to the retailer.

Although exempt by law, these entities must still support

their exemption with a completed exemption certificate.

This booklet contains exemption certificates that can be

used for each of these exempt buyers with examples and

common pitfalls to avoid or, Form PR-78SSTA can be used.

There are special rules applicable to exempt entities

on purchases for certain construction projects and repair

work performed for some of these exempt entities. See

“Project Exemption Certificates” (found herein).

Exception: When the state of Kansas or nonprofit

hospital operates a taxable business (such as a

public cafeteria or gift shop), or when a political

subdivision sells or furnishes utilities, non-inventory items

purchased for use in these taxable businesses are taxable to

the otherwise exempt group.

A city’s gas utility must pay sales tax on office

equipment, pipe and vehicles used (even

partially) by it’s gas utility. A hospital must pay

sales tax on its restaurant equipment, furniture, fixtures and

reusable utensils purchased for its public cafeteria.

Credit Cards

Many government agencies are issuing credit cards to

their employees and agents who travel or make purchases

while on official business or on behalf of the agency. When

the agency is responsible for payment of any credit card

charges, purchases made by employees with said credit

card are exempt from Kansas sales or use tax as a direct

purchase. When someone other than the exempt entity is

responsible for payment of the credit card charge, the

purchase is not automatically exempt. The appropriate

exemption certificate must be obtained.

Purchases made by agents or employees of an

exempt buyer with their personal funds are taxable.

Exception: The rental of hotel rooms by

agents or employees of the U.S. Government

while on official business are exempt

regardless of the method of payment.

Buyers who are NOT exempt

A common misconception is that all nonprofit

organizations are exempt from sales tax. While a

nonprofit status for income tax purposes may be a

requirement for a Kansas sales tax exemption, nonprofit

organizations that have not been granted a specific sales

tax exemption must pay tax on their purchases. Groups

and organizations that are NOT EXEMPT from paying

Kansas sales tax include alumni associations, charitable

and benevolent organizations, clubs, labor unions, and

professional associations.

7

CERTIFICATES FOR TAX-EXEMPT ENTITIES

Kansas law requires all sales Tax-Exempt Entities to

obtain and utilize only exemption certificates issued by

the Department of Revenue or the SSTA exemption

certificate form PR-78SSTA. These certificates, an

example of which is on page 16, contains the exempt

entity’s NAME, ADDRESS, and TAX EXEMPTION

NUMBER issued by the Department of Revenue. Any

sales Tax-Exempt Entity that does not have an exemption

certificate may apply on-line at the department’s web

site.

The purpose of the tax-exempt exemption certificates

is to control fraudulent tax-exempt purchases and to assist

retailers, sales people and cashiers in identifying exempt

entities and easily determining whether a claim for

exemption is valid, based on the exempt entity’s status.

If one of the entities listed on page 17 requests an

exemption and they do not present the department-issued

certificate or Form PR-78SSTA, containing a Tax-Exempt

Identification Number or have it already on file with the

seller, the seller must deny the request. The department

asks that you advise the purchaser to contact the

department for guidance.

Please note that the Tax-Exempt Entity exemption

certificate does not apply to farmers, to purchases by the

federal government, or to the manufacturing and

processing related exemptions, or other use-based

exemptions. Also, the Tax-Exempt Identification Number

is separate and apart from a Kansas Sales Tax

Registration Number, format 004-XXXXXXXXXF-0X, required

of anyone (including exempt entities) making retail sales

of taxable goods, services or admissions in Kansas.

Sales to Exempt Entities not based in Kansas.

Many of the exemptions granted under K.S.A.

79-3606 and apply also to non-Kansas organizations.

While a Kansas-based organization must provide its

numbered certificate (or Form PR-78SSTA with the KDOR

issued identification number provided) to make an exempt

purchase of goods or taxable services in Kansas, many

non-Kansas exempt organizations will not have been

initially be issued an Exempt Entity ID#. While

encouraged to obtain a Kansas Exempt Entity ID# (visit

our web site to apply), a non-Kansas exempt entity (such

as a school located in another state) making a direct

purchase in Kansas will simply need to complete an

exemption certificate for the retailer. The Designated or

Generic Exemption Certificate, Form ST-28, has been

designed for this purpose. Also, the Form PR-78SSTA

may be used.

ITEMS EXEMPT FROM SALES TAX

These items are enumerated in the law as exempt

from sales tax:

Aircraft sales, parts, and repair services for carriers in

interstate or foreign commerce; and repair,

replacement & modification parts and service on all

aircraft

Broadcasting equipment purchased by over-the-air free

access radio and television stations to generate their

broadcast signals

Drill bits & explosives used in the exploration of oil & gas

Drugs and pharmaceuticals sold to veterinarians

Farm machinery and equipment

Food sold to groups providing meals to the elderly and

homebound, or sold by a nonprofit 501(c)(3)

organization under a food distribution program that

sells food below cost in exchange for community

service

Integrated production machinery and equipment

Materials purchased by a community action group to

repair or weatherize low-income housing

Medical supplies and equipment purchased by a

nonprofit nursing home

Public health educational materials purchased by a

nonprofit corporation for free distribution to the public

Railroad parts, materials, and services for railroad rolling

stock used in interstate or foreign commerce

Rolling stock (trucks, buses, tractor-trailers, etc.), repair

or replacement parts, and motor fuels purchased by

ICC carriers

Warehouse machinery and equipment

Other items not taxed in Kansas include food stamp

purchases, Child Nutrition Act (WIC) program purchases,

lottery tickets, prescription drugs and insulin, and

prosthetic and orthopedic appliances.

Prosthetic and Mobility Enhancing Equipment

A prosthetic or mobility enhancing equipment

purchased by the individual for whom it was prescribed in

writing by a licensed physician, chiropractor, optometrist,

dentist, or podiatrist is not taxed (K.S.A. 79-3606(r)).

Exempt devices and mobility enhancing equipment

include canes, crutches, eyeglasses, orthodontic braces,

prosthetic limbs and braces, wheelchairs, and accessories

attached to motor vehicles, such as wheelchair lifts and

specialized hand or foot controls. See NOTICE 04-05 for

information on hearing aids.

8

Repair and replacement parts for prosthetic or mobility

enhancing equipment are also exempt if you have the

original prescription order on file. However, charges for

labor services to repair them are taxable.

Sales of prosthetic and mobility enhancing equipment

to doctors for their inventory, display or use in the

performance of their duties are taxable.

NOTE: This exemption does not apply to hot tubs,

whirlpools, motor vehicles, or personal property which

when installed becomes a fixture to real property.

USES THAT ARE EXEMPT

Items may also be exempt from sales tax because of

how they are used. Items that are

ingredient or component

parts or are consumed in the production of property or

services that are later sold to the final consumer are

exempt. These two exemptions are applicable to many

types of businesses.

IMPORTANT: Contractors may NOT use the

Consumed in Production or the Ingredient or

Component Part exemptions to buy their materials.

Ingredient or Component Part

Items that become a part of a finished product to be sold

to the final consumer are exempt as ingredient or

component parts. In order to qualify the item must:

• be necessary and essential to the finished

product,

• be used in or on the finished product,

• become a physical part of the finished product,

and

• become an ingredient or compound part of

property or service for retail sale.

As a general rule, if the item leaves with the product and

is not returned for reuse by the manufacturer or retailer, it is

an ingredient part. Examples include, but are not limited

to:

• paper and ink for publishing newspapers and

magazines;

• containers, labels, shipping cases, twine, and

wrapping paper which are not returned to the

manufacturer;

• food that will be prepared and sold as meals;

• paper bags, drinking straws, and paper plates

used in food sales;

• feed for commercial livestock, and

• fertilizer used in the production of plants and plant

products produced for resale.

To use the Ingredient or Component Part Exemption

Certificate or Form PR-78SSTA, the buyer must have a

Kansas sales tax account number OR a Kansas

manufacturers’ or processors’ exemption number (see

Manufacturers and Processors herein).

Consumed in Production

Like ingredient or component parts, items that are

“consumed in production” must meet certain

qualifications to be exempt. The item must be:

• necessary and essential to the process,

• used in the actual process,

• consumed or dissipated by the process within one

year,

• used in the process of:

- producing, manufacturing, processing,

mining, drilling, refining or compounding of

tangible personal property,

- the treatment of by-products or wastes

from any such production process,

- the providing of services,

- the irrigation of crops, or

- the storage and processing of grain, and

• not reusable for such purposes.

Examples include utilities to power manufacturing

machinery, or fertilizers and insecticides used in growing

crops. Additional examples are in the Consumed in

Production Exemption Certificate, Form ST-28C.

Exempt Agricultural Uses

Since many items used in agriculture are exempt

either as ingredient or component parts or are

consumed in production, these two exemptions are part

of the Agricultural Exemption Certificate, Form ST-28F.

Form PR-78SSTA may also be used. Other exempt

agricultural uses are:

Agricultural animals (cattle, hogs, sheep, chickens,

ostriches, etc.) and aquatic animals and plants. These are

exempt when used in the production of food for human

consumption; the production of animal, dairy, poultry, or

aquatic plant and animal products, fiber, or fur; or the

production of offspring for the above purposes. The purchase

of pleasure animals or pets is taxable.

Agricultural Soil Erosion Prevention. Seeds, tree

seedlings, chemicals, and services purchased and used

for the purpose of producing plants to prevent soil erosion

on land devoted to agricultural use are exempt from sales

tax.

Propane for Agricultural Use. Propane used for an

agricultural purpose is exempt from sales tax. Examples

include propane to power farm implements or to provide heat

for brooder or farrowing houses. Propane for recreational

use, such as RVs and barbecue grills, is taxable.

9

THE UTILITY EXEMPTION

Utilities may be exempt from sales tax in much the same

way as goods or services — certain

buyers are exempt,

and certain

uses are exempt. As used here, “utilities” are

electricity, gas, water or heat.

Buyers Who Are Exempt

The exempt buyers listed on page 6 do not pay sales

tax on their utilities.

However, when the state of Kansas,

a political subdivision or a nonprofit hospital is also

engaged in a taxable business, utilities used in that

business are TAXABLE, unless the use itself qualifies for

exemption. Exempt and taxable uses for political

subdivisions and nonprofit hospitals are illustrated below.

City Electric Departments. Exempt: Utilities used to

generate the electricity. Taxable: Utilities used to

heat, cool and/or light the generating plant and/or

administrative offices.

Nonprofit Hospitals. Exempt: Utilities used to provide

medical services and nonprofit hospital

administration; electricity/gas to operate grills and

ovens in the public cafeteria. Taxable: Utilities used

by a gift shop; water to clean a cafeteria open to

the general public.

Nonprofit corporations who provide nursing or

foster care for children, the elderly, or disabled may also

be exempt from paying sales tax on their utilities. To

qualify, the Court of Tax Appeals (COTA) must first have

granted the nonprofit corporation an exemption from

real estate property tax.

Exempt Utility Uses

Electricity, gas, water and heat used in these

industries and ways are exempt from sales tax:

• Consumed in production

• Ingredient or component part

• Irrigation of crops

• Movement in interstate commerce

• Providing taxable services

• Severing of oil

NOTE: Agricultural and noncommercial residential use of

electricity, gas or heat are exempt from the

state sales tax,

but are subject to any applicable local (city and/or county)

sales tax in effect at the customer’s location. Agricultural and

noncommercial residential use of water is exempt from both

sale and local sales tax.

Use these general guidelines and illustrations to

determine if a portion of the utilities used by your

business is exempt. Unless part of an integrated

production operation, utilities used to light, heat, cool,

clean, or maintain equipment, buildings, or business

facilities are TAXABLE.

Agricultural. State Exemption: Gas and electricity use

related to farming or ranching, such as the electricity

needed to operate milking machines or to run a grain

auger. (Local sales tax applies). Water use related to

farming and ranching is exempt from both state and

local sales tax.

Consumed in Production. The utility use must meet the

consumed in production criteria on page 8.

Exempt:

Utilities used to operate tools and manufacturing

machinery. Taxable: Utilities to light, heat or cool a

nonproduction area.

Ingredient or Component Part. The utility use must meet

the definition of an ingredient or component part on page

8.

Exempt: Water to make soft drinks or other beverages.

Taxable: Water used to clean vats and brewing

equipment.

Irrigation of Crops.

Exempt: Electricity or other power

sources to run an irrigation pump or water applied to

growing crops.

Movement in Interstate Commerce by Railroad or

Public Utility.

Exempt: Electricity or gas used to pump

or push oil or gas through an interstate pipeline, provided

the pipeline is registered with the Federal Energy

Regulatory Commission. Taxable: Utilities used by non-

interstate pipelines. Utilities used to operate railroad

signal lights and switches;

Noncommercial Residential. State Exempt: Gas and

electricity used in your home for nonbusiness purposes.

(Local sales tax applies). State & Local Exempt: Water

used in your home for nonbusiness purposes.

CONDOMINIUMS AND APARTMENT

COMPLEXES. State Exempt: Gas and

electricity used in the apartment or

condominium for nonbusiness residential

purposes (local sales tax applies). State & Local Exempt:

Water used in the apartment or condominium for

nonbusiness residential purposes.

Providing Taxable Services. To qualify, the service must

be subject to sales tax. Utilities used by those who

provide nontaxable services, such as a doctor, lawyer,

accountant, or childcare center are TAXABLE.

HOTELS. Exempt: Utilities actually used in

the rooms occupied by hotel guests.

Taxable: Utilities for lobbies, conference

rooms, hallways, administrative offices,

swimming pools, and parking lots.

Severing of Oil. Exempt: Electricity or gas to power

pumps that remove oil or gas from the ground. Taxable:

Electricity or gas for lighting and other nonextraction

purposes at the pump station.

10

Obtaining a Utility Exemption

To request an exemption for electricity, gas or water used

in your business you must complete Form

ST-28B, Statement for Sales Tax Exemption on Electricity,

Gas or Water Furnished Through One Meter.

You will need to complete a form for each utility meter

on which you are requesting an exemption. Follow these

steps to obtain an exemption on your utility.

1) Using the instructions and examples that

accompany the form, determine your exempt

percentage. You may need the assistance of a

plumber or electrician to complete the formula.

2) Give the original completed form to your utility company

along with all the workpapers and documents used to

compute your “Exempt Percent.” Be sure to keep a

copy of the form and your work papers for your records.

3) The utility company may forward your exemption request

to KDOR for review before granting the exemption.

4) Once approved, the utility will grant the exemption.

IMPORTANT: When there is a change in your “Exempt

Percent,” it is your responsibility to immediately file

a revised utility exemption form with your utility provider.

SPECIAL SITUATIONS

CONTRACTORS

A contractor, subcontractor, or repairman (hereafter

referred to as “contractor”) is any person who agrees to

furnish and install parts or materials, or performs the labor

service of installing the parts or materials for a specified

price. Contractors are considered to be the final user or

consumer of their materials and must, therefore, pay sales

tax on them when purchased from their vendors.

A retailer/contractor is a contractor who maintains an

inventory of materials. Examples of retailer/contractors

are building, electrical, and plumbing supply houses that

not only sell to the final consumer but also perform

construction or installation work.

This distinction between a contractor and a retailer/

contractor only determines when sales tax is paid on

materials. Materials are always taxable unless purchased

with a Project Exemption Certificate (opposite column).

A contractor must pay sales tax on all supplies and materials

when buying them from the supplier. If the supplier is an out-of-

state retailer, a contractor will pay Consumers’ Compensating

Use Tax on the supplies and materials (see “Compensating Use

Taxes” herein). Contractors cannot use a Resale Exemption

Certificate to buy their materials and supplies without sales tax.

A retailer/contractor must either collect sales tax

when the merchandise is sold at retail or self-accrue the

tax due when materials are removed from its tax-exempt

resale inventory for a contract job. (See “Paying Tax on

Personal Use of Inventory” herein.) Retailer/Contractors

will use the Contractor-Retailer Exemption Certificate, Form

ST-28W, to purchase their inventory. Form PR-78SSTA

may also be used.

Labor Services

The services of installing, applying, servicing,

repairing, altering, or maintaining tangible personal

property are subject to sales tax. This includes work

performed on tangible personal property that, once

installed or applied, becomes a part of real property.

However, the labor services of “installing” or “applying”

are not taxable when performed in connection with the

“original construction” of a building or facility. “Original

construction” is defined as the:

♦ first or initial construction of a new building or facility,*

♦ addition of an entire room or floor to an existing building

or facility,

♦ construction, reconstruction, repair, replacement,

remodeling or renovation of a residence,**

♦ restoration, reconstruction, or replacement of a

building, facility or utility structure damaged or

destroyed by fire, flood, tornado, lightning,

explosion, windstorm, ice loading and attendant

winds, terrorism or earthquake***,

♦ completion of any unfinished portion of an existing

building or facility, or

♦ construction, reconstruction, restoration,

replacement, or repair of a bridge or highway.

* A facility is a mill, plant, or refinery; oil, gas, or water

well; feedlot; and a transmission and distribution line

owned by a REA or municipality.

**A residence includes all types of dwellings where

individuals customarily live — homes, apartments,

nursing homes, etc.

*** A utility structure shall mean transmission and distribution

lines owned by an independent transmission company

or cooperative, the Kansas electric transmission authority

or natural gas or electric public utility. A windstorm shall

mean straight line winds of at least 80 miles per hour as

determined by a recognized meteorological reporting

agency or organization.

When a subcontractor is performing taxable labor

services for a general contractor, the subcontractor

must charge sales tax to the general contractor. A

contractor may NOT use a Resale Exemption Certificate

to purchase the labor services of another contractor

without tax.

PROJECT EXEMPTION CERTIFICATES

A Project Exemption Certificate (PEC) is a numbered

document issued only by the Kansas Department of Revenue

or its authorized agent (See “Agent Status”, herein ).

11

As the name implies, a PEC exempts the entire project

— materials and labor — from sales tax. Two types of projects

may receive a project exemption. Projects for

entities who

are exempt, and

certain economic development projects.

The following exempt entities qualify to use Form

PR-76 to request a Project Exemption Certificate or apply

on-line for most construction, remodel, or repair projects:

• Kansas political subdivisions

• Nonprofit hospitals

• Nonprofit schools & educational institutions

• Nonprofit zoos

• Primary care clinics and health centers

• Religious organizations

• U. S. Government and its agencies

Form PR-78SSTA may also be used, however, the

purchaser must provide the Department issued Project

Exemption Certificate Number on that form.

CAUTION: The state of Kansas and its agencies

DO NOT qualify for Project Exemption Certificates

(except state of Kansas correctional institutions

including a privately constructed correctional institution

contracted for state use and ownership). Materials

purchased by contractors for a state of Kansas project are

taxable. Only direct purchases by the state of Kansas or its

agencies are sales tax exempt - using their KDOR issued

Tax-Exempt Entity Exemption Certificate (or Form PR-

78SSTA containing the Tax-Exempt Entity Identification

Number issued by the Department).

ECONOMIC DEVELOPMENT. A project may also qualify

for a Project Exemption Certificate because it is an economic

development project. The qualifications are outlined in the

request form PR-70b (found herein).

IMPORTANT: Project Exemption Certificates are

dated and are not retroactive. All materials purchased

and all taxable labor services performed prior to the effective

date of the Project Exemption Certificate or after the expiration

date are taxable. Project exemptions apply only to one specific

project and expire upon completion of that project.

Agent Status for Project Exemption Certificates

Certain exempt entities may request “Agent Status” when

applying on-line for Project Exemption Certificates (PEC).

“Agent Status”, once granted, will allow the following entities

to complete the application on-line and be immediately

approved for a PEC. The applicant can then print the PEC

and supply it to contractors working for them. This Agent

Status authority is limited to: State of Kansas Correctional

Institutions, Kansas Political Subdivisions, Nonprofit

Hospitals and Nonprofit Schools and Education Institutions.

Project Exemption Steps

The following chronological steps illustrate how a Project

Exemption Certificate is requested, issued and used by the

project’s owner, contractors and suppliers.

1) A qualifying entity (petitioner) completes a request

for project exemption by completing a paper

application (found herein) or by applying on-line at

www.ksrevenue.org. Agent Status PECs must be

completed on-line in order that the petitioning

authority be able to immediately print a PEC.

2) KDOR receives and approves or denies the request

(Agent Status on-line applications are approved

automatically).

3) If approved, KDOR issues a numbered Project

Exemption Certificate to the petitioner. Agent Status

– able to immediately print a PEC once the on-line

application is completed.

4) The petitioner furnishes the numbered Project

Exemption Certificate (or Form PR-78SSTA

containing the Project Exemption Certificate

Number issued by the Department) to the

contractors and subcontractors for the job.

5) Contractors and subcontractors furnish the

numbered certificate to their suppliers.

6) Suppliers should put the certificate number on all

project invoices to verify the sale of materials and/

or labor is exempt.

7) When the project is complete, contractor(s) must

furnish the Project Completion Certification (found

herein) to the petitioner with a copy to KDOR.

8) Contractor(s) keep all project invoices for five years.

MANUFACTURERS AND PROCESSORS

Manufacturers and processors are eligible to purchase

their raw materials or parts exempt from sales tax. However,

if they do not also sell to the final consumer and have a tax

account number, they will not be able to provide a Kansas

Retailers’ Sales tax account number that is required in order

to use the Ingredient or Component Part exemption certificate.

To remedy this situation, the department issues a

Manufacturers’ or Processors’ Sales Tax Exemption

Certificate Number to those manufacturers and processors

that never make a retail sale, and therefore do not have a sales

tax account number. To apply, complete Form ST-90,

Application for Manufacturers’ or Processors’ Sales Tax

Exemption Certificate Number, or apply on-line. Use this

number on the Ingredient or Component Part Exemption

Certificate or Form PR-78SSTA when buying raw materials.

CAUTION: Manufacturers and processors who

make sales to the final user or consumer must

be registered to collect sales tax on these sales.

Often these sales are to their employees – a the

sale of factory seconds or first-quality products at discount.

WHOLESALERS

A wholesaler is a company that sells only to other

wholesalers or to retailers registered for sales tax.

A wholesaler by definition never sells to the final consumer

(retail sale).

Kansas wholesalers are not required to register with the

Department of Revenue to collect sales tax.

However, an exemption certificate must accompany

12

wholesale sales. When a wholesaler sells to a Kansas

retailer for resale, the Resale Exemption Certificate, Form

ST-28A or PR-78SSTA should be used. The Multi-

Jurisdiction Exemption Certificate, Form ST-28M, is used

when a wholesaler is buying inventory, selling to another

wholesaler, or selling to a retailer from another state. Form

PR-78SSTA may be used for this as well.

A wholesale company that only occasionally makes

retail sales must still register to collect sales tax. To

simplify sales tax reporting in this situation, it is suggested

that a separate retail division be established within the

organization from which all retail sales are made.

PAYING TAX ON PERSONAL USE OF INVENTORY

All of the exemption certificates in this booklet have

this statement above the buyer’s signature:

“The undersigned purchaser understands and agrees that

if the property or services are used other than as stated

above or for any other purpose that is not exempt from

sales or compensating tax, the undersigned purchaser

becomes liable for the tax.”

When you remove merchandise from your inventory

to use personally or as a gift, you become the final

consumer or user of the item(s) and must pay the sales

tax due. The sales tax is based upon your cost for the

item, not its retail price.

To report and pay the tax on tax exempt inventory

used for a taxable purpose, use the line or column of

your sales tax return entitled “MERCHANDISE

CONSUMED.” This is illustrated by the sample return

above. Retailer/contractors will also use this line or

column to report the cost of materials removed from a

tax exempt inventory for use on a contract job.

WHEN IN DOUBT ...

When there is a question that is not answered in this

booklet, contact the Department of Revenue. DO NOT

GUESS. Prompt clarification of whether a sale is taxable

or exempt will save you time in dealing with the issue in

Sharon Jones

purchases the

inventory for her

clothing store

without tax using a Resale

Exemption Certificate. When

she takes a blouse out of

inventory for a gift and a suit

for herself, she reports her cost

in these items ($70.00) on line

2 of her sales tax return. The

amount becomes a part of the

net sales total on which sales

tax is due.

the future and could also save you money by avoiding

costly sales tax deficiencies.

Many questions can be answered by the customer

representatives in our office, or by consulting the

department’s Policy Information Library on our web site.

However, there are unique situations that may require an

interpretation or clarification based upon the law,

regulations, and specific facts of the case. When this

happens, document the problem or question in writing

and request a Private Letter Ruling or an Opinion Letter

from the department. Mail or fax your request to:

Office of Policy and Research

Kansas Department of Revenue

915 SW Harrison St., Room 230

Topeka, KS 66612-1588

Fax: 785-296-7928

You will receive a written ruling within 30 days after

your request (and any additional information necessary

for the ruling) is received.

IMPORTANT: Although they are published in

our Policy Information Library (see below)

Opinion Letters and Private Letter Rulings are limited

ONLY to the requesting taxpayer and that taxpayer’s

specific factual situation. They cannot be relied upon or

cited by any other person.

Policy Information Library

As a service to taxpayers our web site contains a

library of policy information for all taxes administered by

(Note: To conserve space, only the front of the return is shown here.)

13

entity’s tax identification number.

A resale exemption certificate was accepted

that does not show a Kansas sales tax

registration number.

A resale exemption certificate that is missing the

purchaser’s Kansas registration number is incomplete and,

therefore, not acceptable. Furthermore, a retailer cannot

accept an resale exemption certificate from a purchaser

who does not provide have

a Kansas sales tax registration

number except when the out-of-state purchaser for resale

is having the item drop shipped to a customer in Kansas.

Wholesalers and out-of-state retailers should use the Multi-

Jurisdiction Exemption Certificate, Form ST-28M or Form

PR-78SSTA, when buying their resale inventory in Kansas.

A nonspecific exemption certificate was

accepted for property not normally sold in the

customer’s business.

A retailer cannot accept a blanket exemption certificate

for items that a customer normally does not sell in its

business. A reasonable and prudent inquiry on the part of

the retailer is necessary. Each certificate must have a

specific description of the property purchased with that

certificate.

Tax-free sales are made to a buyer that provides

only a Kansas sales tax number.

A retailer cannot exempt a sale from tax simply because

the customer provides a Kansas sales tax number or a copy

of a certificate of registration. A completed resale exemption

certificate must also be obtained. (See page 4, “Resale

Exemption Certificate Requirements”).

A retailer fails to remit sales tax to the state

because the customer crossed the tax off the bill

without providing a completed exemption certificate.

A retailer is still responsible for obtaining an exemption

certificate even when the customer refuses to pay the tax.

In the absence of a completed exemption certificate, the

sale is taxable, and the sales tax is due.

Failure of contractors to pay tax on materials

used in a project for an other exempt entity (such

as a school, nonprofit hospital, religious

organization, the federal government) that did not

obtain a Project Exemption Certificate.

A contractor is responsible for paying the sales tax on

all materials used in performing labor services, unless

working under a Project Exemption Certificate issued by

the Department of Revenue or its authorized agents (see

pages 10-11). When the exempt entity has not obtained a

project exemption number, materials purchased or

furnished by its contractor(s) are taxable.

LOCAL SALES TAX

Each Kansas county or city has the authority to levy a

local sales tax. When levied, a local sales tax rate is added

the department. This policy library contains the Kansas

Statutes and Regulations, Revenue Notices, Revenue

Rulings and other written advice issued by the

department. Opinion Letters and Private Letter Rulings

are also included, but are “scrubbed” to protect the privacy

of the taxpayer — any information that would identify the

taxpayer, such as name, address, product, etc., is

blanked out.

Key Statutes and Regulations

The information in this guide is based on these statutes

and regulations and others cited are in the text. They

are a part of the policy library on our web site.

K.S.A. 79-3602 – Sales tax definitions

K.S.A. 79-3603 – Taxing statute

K.S.A. 79-3606 – Exempting statute

K.S.A. 79-3651 – Exemption certificates

K.A.R. 92-19-25b – Exemption certificates

K.A.R. 92-19-66e – Project Exemption certificates

RELATED TOPICS

AUDIT ISSUES

Your sales tax records, including exemption

certificates, are subject to audit by the Department of

Revenue. If your exemption certificates are found to be

missing or incomplete during an audit, you have only

120 days from notice by the Director of Taxation to obtain

completed exemption certificates for these sales. (K.S.A.

79-3609(a)).

Since our audits usually cover a three-year period, this

task can be very time-consuming. If you cannot locate

the customer or he refuses to comply, you may become

liable for the sales or use tax due on that sale, plus penalty

and interest.

Avoiding Common Errors. Here are some of the

most common exemption certificate errors we find

during an audit with tips on how to correct or avoid

making these mistakes.

An exemption certificate is incomplete.

Completing every blank on the certificate designed for

that exemption will help to avoid most errors of omission.

All exemption certificates must have the name of the seller,

the name and address of the purchaser, a description of the

item(s) purchased, the reason it is exempt, and be signed

and dated by the purchaser.

The resale, retailer/contractor, tire excise, and dry

cleaning exemption certificates must also show a Kansas

tax registration number for that tax type. Exemption

certificates for nonprofit organizations require the exempt

14

to the statewide sales tax. The resulting total is collected

from the consumer and then sent by the retailer to the

Kansas Department of Revenue. Unless otherwise noted,

a sales tax exemption exempts the sale from the state, city,

county and special taxing district sales taxes. A list of all

the combined state and local tax rates, Sales Tax

Jurisdiction Code Booklet, Pub. KS-1700, is available from

our web site.

OUT OF STATE SALES

Kansas sales tax law applies only within the boundaries

of Kansas. When goods or merchandise are shipped or

delivered outside of Kansas (and not returned to a point in

Kansas), Kansas sales tax is not due. Out-of-state delivery

may be made by the seller, a common carrier, or through

the mail.

Since these sales are a deduction on your sales tax

return like an exempt sale, your books and records must

show the merchandise was delivered outside Kansas.

Acceptable proof of an out-of-state sale is a:

• Waybill or bill of lading, showing delivery to another

state,

• Post office, insurance, or registry receipt,

• Trip sheet signed by the seller’s delivery agent,

showing the address and signature of the person

outside Kansas who received the merchandise.

When goods or merchandise are delivered to a buyer in

Kansas, Kansas sales tax is due even though the buyer

may later transport the property out of Kansas. See page

4 for a discussion of drop shipments.

NOTE: If you have established a physical presence or “nexus”

in another state, you may be required to register for that state’s

sales or use tax. See “What is Nexus?”

COMPENSATING USE TAXES

Sales tax exemption certificates may also be used

to claim exemption from compensating use tax.

Compensating use tax applies to purchases of goods

from businesses in other states. The purpose of use

tax is to protect Kansas businesses from unfair

competition from businesses in other states that may

not charge tax. The use tax rate is the same as the state

and local sales tax rate in effect where the item is used,

stored or consumed. There are two types of use tax:

Consumers’ Compensating Use Tax and Retailers’

Compensating Use Tax.

Consumers’ Compensating Use Tax

Consumers’ compensating use tax is due when goods

or merchandise are purchased outside Kansas for use,

storage, or consumption (not resale) in Kansas, and a sales

tax equal to the state and local sales tax rate in effect where

the item is used, stored or consumed, has not been paid.

The tax applies whether the item is shipped into Kansas or

purchased outside of Kansas and brought back into

Kansas. For Kansas businesses, use tax is due when

equipment, fixtures and supplies are purchased from

another state without tax. Consult Publication KS-1700,

Sales Tax Jurisdiction Code Booklet, for sales/

compensating tax rates by alphabetical listing of cities and

counties. Sales/compensating tax rates for specific

addresses may be obtained at the department’s on-line

sales/compensating use tax rate locator -

www.ksrevenue.org.

A Topeka Kansas hotel needs to replace its

worn out linens and room furniture. The hotel

buys them from a Texas company; sales

tax is not charged on the invoice. This hotel

would owe the compensating use tax rate in effect where

the hotel is located (Topeka) on the total delivered price

(including shipping, handling, freight or delivery charges)

of the linens and furniture.

Retailers’ Compensating Use Tax

Out-of-state retailers collect this use tax on merchandise

they deliver or ship to their Kansas customers. Retailers

in other states are required to register and collect the Kansas

Retailers’ Compensating Use tax from their Kansas

customers if they have a physical presence in Kansas or

have established “nexus.”

What is Nexus?

Nexus is defined as a “means of connection” or a “link;”

it means you have a business presence for tax purposes.

What constitutes nexus varies from situation to situation.

Some of the ways that a business may establish nexus in

Kansas are listed below.

• Kansas business location, including an office.

• The presence in Kansas of sales or service

representatives.

• Operation of mobile stores in Kansas (example:

trucks with driver salespersons).

• Stocking inventory in a Kansas warehouse or on

consignment.

• Providing tangible personal property for lease or

rental in Kansas.

• Delivering merchandise to Kansas customers using

company vehicles or contract carriers, rather than

interstate common carriers.

• Providing or contracting for installation, repair,

construction, or other services in Kansas.

(Maintenance contracts require a Kansas Retailers’

Sales tax registration).

If you are a retailer in another state, and any of the above

describes your business activity in Kansas or the activities

of your agents, you are required to register and collect the

appropriate Retailers’ Sales or Compensating Use Tax from

your Kansas customers.

A Kansas resident orders a personal

computer from a Illinois retailer, which is

shipped to him from its warehouse in St.

Louis. The Illinois retailer also maintains a

retail outlet in Kansas. This out-of-state retailer is

required

to collect and remit Kansas Retailers’ Compensating Use

tax on this sale.

15

A Kansas resident orders furniture from a

Nebraska retailer. The retailer delivers the

furniture to her home in Kansas using its own

delivery vehicle. This Nebraska retailer is required to

register with the Kansas Department of Revenue to collect

Kansas Retailers’ Compensating Use tax, since the delivery

of the furniture into Kansas with a company vehicle has

established nexus.

Similarly, a Kansas retailer may establish “nexus” in

another state in these same ways. If any of the “nexus”

activities listed on the previous page describe your business

activity in another state, you should contact that state to

register to collect the sales/use tax from your customers

in those states. If you fail to register in those states, you

may become liable for the taxes that were not collected

on your sales.

Additional information about Kansas use taxes,

including sample completed returns for individuals and

businesses is in our Publication KS-1510, Kansas Sales

and Compensating Use Tax. All retailers operating in

Kansas should obtain a copy of this booklet; it is available

from our office or web site.

USING EXEMPTION

CERTIFICATES

On the following pages in alphabetical order are the

exemption certificates currently provided by the

Department of Revenue for the specific exemptions in

Kansas sales tax law. The certificates are designed to

be reproduced directly from this book. They may also

be downloaded from our web site.

BEFORE ACCEPTING ANY CERTIFICATE, carefully

read the exemption statement and the accompanying

explanation and instructions. Most certificates contain

a restatement of the Kansas law (K.S.A. — Kansas

Statutes Annotated), or regulation (K.A.R. — Kansas

Administrative Regulations) that established the

exemption.

IMPORTANT: If your customer or the purchase

does not fit the definition or the exempt

examples given in the certificate, the sale is most likely

not exempt.

COMPLETING THE CERTIFICATE

Follow these three rules when completing any

exemption certificate.

1) Print or type all information, except for the

authorized signature.

The information on the certificate must be legible both

to you and to our auditors. Do not print a signature,

although it is often helpful to print or type the name

below the signature.

2) Fill in all the blanks.

A certificate is complete only when all the requested

information is provided. Addresses must include the

street or PO Box, city, state, and zip code.

An exemption certificate is also not complete unless

the customer supplies the appropriate tax account

numbers required by the certificate. On the resale

exemption certificate, the seller may demand request

a copy of the buyer’s sales tax certificate of registration

as a condition of honoring the certificate.

3) Give specific descriptions.

Be as precise as possible when describing the

property or services purchased. You may use an

itemized list, refer to an itemized invoice number, or

at the very least provide a general description of the

items. When describing a business activity, include

the principal product(s) sold or manufactured.

PENALTIES FOR MISUSE

A buyer who issues an exemption certificate in order to

unlawfully avoid payment of the sales tax for business or

personal gain is guilty of a misdemeanor, and upon conviction

may be fined up to $1,000 or imprisoned for up to a year, or

both. When a buyer is found to have used a Resale

Exemption Certificate to avoid payment of the tax, the

director may also increase any penalty due on the tax by

$250 or 10 times the tax due, whichever is greater, for each

transaction where the misuse of a Resale Exemption

Certificate occurred. (K.S.A. 79-3651(g)).