Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 1 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

1. Product Description Associated Bank’s Non-Conforming ARM Program allows Associated to offer customized underwriting solutions based on the

borrower’s individual credit with Associated Bank and other lenders; their current capacity to make the monthly payments; and the

collateral that the loan is secured on.

Borrower Benefits:

Competitive Rates

Loan Amounts up to $1.5 million

Amortization 120 to 360 months

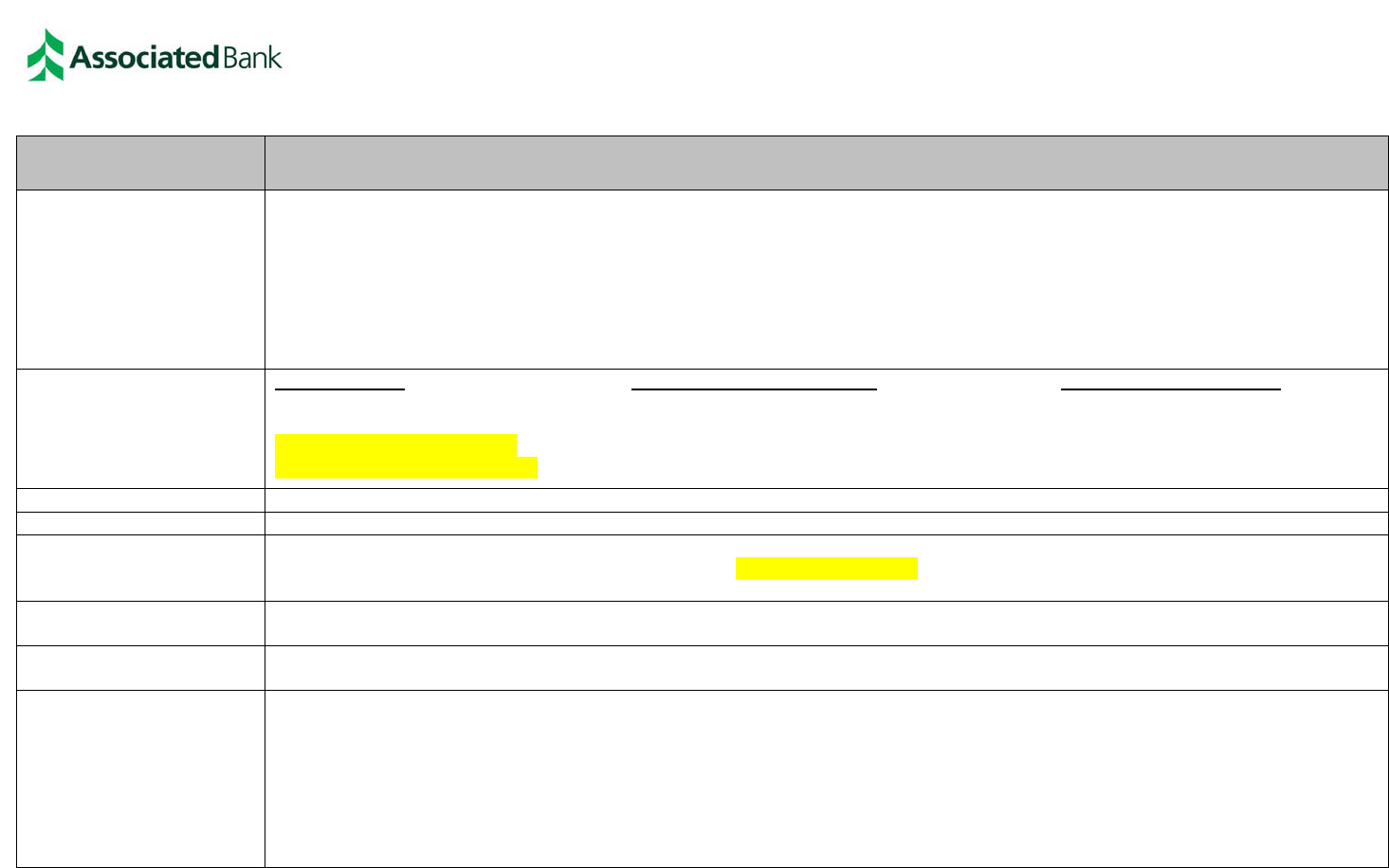

2. Product Codes

Product Code Note/Rider Form Reference ARM Product Plan in DU

p3lib225 – 3/1 Portfolio ARM 3528/3187 FM GENERIC, 3 YR

p5lib225 – 5/1 Portfolio ARM 3528/3187 FM GENERIC, 5 YR

p7lib525 – 7/1 Portfolio ARM 3528/3187 FM GENERIC, 7 YR

p10lib525 – 10/1 Portfolio ARM 3528/3187 FM GENERIC, 10 YR

3. Index

1 Yr LIBOR

4. Margin 2.25

5. Initial Adjustment

Cap

3/1 & 5/1 ARM - 2%

7/1 & 10/1 ARM – 5%

6. Annual Adjustment

Cap

2%

7. Lifetime

Adjustment Cap

5%

8. Rate at Adjustment

The first adjustment on month 37 (61 months for a 5/1 ARM, etc.), is equal to the margin plus the index rounded to the nearest

0.125, and is capped at the Initial Adjustment Cap.

o 3/1 ARM – Rate adjusts at 36 months (3-years) and then every year after that.

o 5/1 ARM – Rate adjusts at 60 months (5-years) and then every year after that.

o 7/1 ARM – Rate adjusts at 84 months (7-years) and then every year after that.

o 10/1 ARM – Rate adjusts at 120 months (10-years) and then every year after that.

Subsequent adjustments are made annually and are limited to the Annual Adjustment Cap and Lifetime Adjustment Cap.

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 2 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

9. Conversion Option N/A

10. Temporary Buy

downs

Not Eligible

11. Qualifying Rate

3/1 & 5/1 ARM – Greater of the Fully Indexed Rate or Note Rate + 2%

7/1 & 10/1 ARM - Greater of the Fully Indexed Rate or Note Rate

12. Qualifying Ratios

3 & 5 year ARM ratios of 37 (front-end) and 47 (back-end)

7 & 10 year ARM ratios of 37 (front-end) and 45 (back-end)

All ratios are based on documented and verified income

Property taxes for new construction to be calculated using appraised value through www.tax-rates.org

Income, assets and liabilities will be considered for all borrowers when using a non-occupant co-borrower.

13. Purpose of Loan

Purchase

Limited Cashout Refinance

o Existing 2nd liens being paid off must be seasoned for 12 months and cannot have more than $2,000 in draws over the

past year.

Cashout Refinance

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 3 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

14.

Loan Amount and

LTV/CLTV Limits

Purchase and Limited Cashout Refinance Mortgages

2

Cashout Refinance Mortgages

3 4 5

Property

Type

Max. Loan Amt Max. LTV

Max.

HCLTV

1

FICO

Property

Type

Max. Loan Amt

Max.

LTV

Max.

HCLTV

FICO

1 unit O/O

$453,101-$650,000 90% 90% 700

1 unit O/O

$453,101-$650,000 80% 80% 700

$453,101-$650,000

95%

6

n/a 700 $1,000,000 75% 75% 700

$850,000

90%

6

n/a 700 $1,500,000 65% 70% 700

$999,999 80% 85% 700 2 unit O/O $580,151-$650,000 70% 70% 740

$1,000,000

90%

6

n/a 740

1 unit 2nd

$453,101-$650,000 75% 75% 700

$1,500,000 70% 75% 700 $1,000,000 65% 65% 700

2 unit O/O $580,151-$650,000 75% 75% 700

$1,500,000 60% 60% 700

1 unit 2nd

$453,101-$650,000 80% 80% 700

$1,000,000 70% 70% 700

$1,500,000 65% 65% 700

1

The CLTV/HCLTV for a combined Associated Bank first and second mortgage cannot exceed the lesser of the matrix or 90%. Except for HELP DPA, wholesale loans are not eligible for Associated Bank secondary

financing.

2

When combining a 1

st

& a 2

nd

lien into one loan the 2

nd

lien must be seasoned to qualify the transaction as a Limited Cash Out Refinance. A 2

nd

lien is considered seasoned when the borrower is able to document via a

Closing Disclosure that the entire drawn amount was used for the home purchase. Payoff of a non-purchase second lien can be considered a Limited Cash-out refinance provided the second lien is seasoned for 12

months. HELOC mortgages must document that the loan has had no draws in excess of $2,000 in the past 12 months.

3

Maximum cash out amount of $200,000 with HCLTV > 80%.

4

Maximum cash out amount of $350,000 with HCLTV <80%.

5

Properties cannot have been listed for sale in the past six months.

6

Limited to 5/1, 7/1, & 10/1 ARM’s only that require Mortgage Insurance (minimum LTV available is 80.01%). Must obtain Mortgage Insurance for these loan buckets structured as a single transaction. In some cases,

Mortgage Insurance guidelines may be more restrictive than Associated Bank guidelines.

15. Secondary

Financing

Refer to #14. Loan Amount and LTV/TLTV Limits

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 4 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

16. Property Types

Single Family Detached

Townhouse

Condo (Refer to Third Party Originator Condo Guides)

PUD Attached

PUD Detached

1 – 4 Family

Manufactured Home

17.

Occupancy Types

Primary Residence

Second Home

o Resort/Recreation area

o Borrower may not enter into any rental agreements that require the property to be rented.

o The borrower must live in the property for some portion of the year.

18. Geographic

Locations

/Restrictions

Associated Mortgage will accept loans from the following states:

Illinois

Indiana

Iowa

Kansas

1

Kentucky

2

Michigan

Minnesota

Missouri

Ohio

Wisconsin

1

Metropolitan Kansas City (property must be in one of the following counties: Johnson, Wyandotte, Leavenworth, Miami, Douglas)

2

Counties of Kenton, Campbell, and Boone

19. Assumable No

20. Escrows

Loans greater than 80% LTV must escrow taxes and insurance.

21. Prepayment

Penalty

N/A

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 5 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

22.

Underwriting

Alimony/maintenance may be deducted from the borrower’s gross income instead of treating it as a liability. This does not

apply to child support. A divorce decree confirming the amount is required.

Asset depletion is allowed to qualify a borrower as long as asset depletion represents at least 51% of total income. Assets

used for the calculation of the monthly income stream must be owned by the borrower as an individual. If joint accounts are

used, the co-owner of the account must be a borrower on the loan. Trust assets are acceptable as long as our borrower is the

sole beneficiary to the trust funds. IRA, 401K, and Annuity accounts may be considered income at 60% of the vested balance,

less any outstanding loans. If borrower is able to access IRA, 401K, and Annuity accounts without penalty, you may use 70% of

the vested balance, less any outstanding loans. Investment accounts, (stocks, bonds, mutual funds, etc.) will be used at 70% of

the current statement balance. Balances must be verified to support a five (5) year continuance of the income used to qualify

for the loan. For example, $1 million eligible asset account reduced to 60% = $600,000 divided by 60 (months) = $10,000 of

income for qualifying purpose.

o The following accounts are examples of assets that are not eligible for asset depletion: 529 college funds, accounts

under UTMA, checking accounts, savings accounts, CDs, cash value of life insurance policies, lump-sum inheritance,

or divorce proceeds and pledged accounts.

Rental Income

o Rental income is allowed if it can be verified with at least one year of the most recent tax returns. If the most recent tax

return does not show a full 12 months of rental income due to the length of time the property has been rented, 75% of

rent due on a signed lease may be used instead as rental income.

Business Loss

o All business losses must be considered in income calculation.

23.

Borrower/Co-

Borrower Eligibility

U.S. Citizen

Documented Permanent Resident Alien

1

Documented Non-Permanent Resident Alien

1

Loans to LLC’s (Limited Liability Companies) and Trusts are not allowed however; loans to individuals may be considered when

collateral is vested to an LLC or a Revocable Trust.

1

Lender must obtain verification that a non-U.S. Citizen is legally present in the United States. The lender should make a determination of the non-U.S. citizen’s status based on the individual’s case using the

appropriate documentation. If the documentation provided is called into question, then Associated Bank’s Underwriter will determine if the documentation is deemed appropriate documentation per the individual case.

24. Co-Signer

A co-signed loan may be acceptable, however; the mortgage may not be cosigned by a party that has an interest in the

property sales transaction -- such as property seller, the builder, the real estate broker, etc. The primary borrower (the primary

wage earner) must qualify for the credit individually. A co-signer applicant must also qualify for the credit individually. A co-

signer is used only to mitigate limited credit history of the borrower. Co-signers cannot be used to mitigate poor credit history.

See Box 12 for additional information on non-occupant co-borrowers.

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 6 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

25.

Credit

A minimum number of 4 trade lines for 12 months must be present in the credit report. One must be a mortgage or rental

verification.

Qualifying Credit Score

o When three credit scores are present the middle score will be the borrower’s score.

o If only two credit scores are given the lower of the two scores will be the borrower’s score.

o If only one credit score is given, then this will be the borrower’s score.

o If more than one borrower has applied for the loan, the lowest score of all the applicable credit scores is the representative

credit score of the file.

Bankruptcies are required to be fully discharged for a minimum of 4 years, measured from discharge/dismissal date to

disbursement date of new loan, and borrower has re-established credit depth to include a minimum of 4 trade lines with a

recent 12 month history of use and no derogatory credit in the last 24 months. One trade must be housing. These trade lines

must have been opened after the discharge of the bankruptcy.

Foreclosures are required to be settled for a minimum of 7 years, measured from sale/execution date to disbursement date of

new loan, and borrower has re-established credit depth to include a minimum of 4 trade lines with a recent 12 month history of

use and no derogatory credit in the last 24 months. One trade must be housing. These trade lines must have been opened

after the date of sale/execution.

Short Sales/Deeds in Lieu are required to be settled a minimum of 4 years, measured from sale/execution/transfer date to

disbursement date of new loan, and borrower has re-established credit depth to include a minimum of 4 trade lines with a

recent 12 month history of use and no derogatory credit in the last 24 months. One trade must be housing. These trade lines

must have been opened after the date of sale/execution/transfer.

All delinquent credit obligations should be paid prior to closing with no serious trend in credit delinquencies in the previous

o 12 months, defined as

1x30 on mortgage or 2x30 on other trades

o 24 months, defined as

1x60 on any debt.

Medical collection may be waived if there is documentation proving the collection item is currently in process for insurance

reimbursement.

Disputed Accounts do not need to be resolved if the balance is zero and the accounts are at least 6 months old. All other credit

must meet posted guidelines.

The maximum age of all credit documents is 120 days. The age is determined from the date the Note is signed. A one-time

extension of 120 days can be granted by an Underwriter, if notified within 2 business days of the Loan Acceptance Letter

expiration date.

Student loan payments must be included in the borrower’s total debt obligation (whether deferred or not). The credit report

payment will be used if present. If a payment is not reflected on the credit report an account statement may be provided. If no

statement is available, then a monthly payment of 1% of the outstanding balance will be used for qualifying the borrower.

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 7 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

25.

Credit (cont’d)

Installment and revolving debt may be paid off to qualify. The borrower may either:

o Have the debt paid off and closed through the loan closing proceeds or;

o Pay off the debt prior to closing, with proof of funds used to satisfy debts (showing the account is closed and paid off).

26.

Funds for Closing

Borrower Investment

5% minimum down payment from their own funds unless they receive a gift of at least 20%. Gifts may only be used on

Principal residence and second home properties.

Seller Contributions

Primary Residence & Second Home

3% for LTV/TLTV >90% & < 95%

6% for LTV/TLTV > 75% & < 90%

9% for LTV/TLTV < 75%

Gift Funds

Gift funds must be from an eligible source: relative, domestic partner, fiancé, church, municipality, or nonprofit organization.

The name, address, phone number, amount of the gift, and relationship of the donor must be disclosed.

When the Gift Funds reduces the LTV/CLTV to 80% or less, then the 5% Borrower Investment is waived.

Business Funds

Borrower must own the business asset

Minimum 3 months business statements evidencing sufficient ending balances month-over-month to support withdrawal must

be provided

Example: Borrower wishes to use $30,000 business funds for down payment. 3 most recent bank statements must show an

ending balance each month of at least $30,000 to use these funds

27.

Reserves

401K’s, IRA’s, Annuities will be used at 60% of the vested balance, less any outstanding loans. Stocks, bonds and mutual

funds will be used at 70% of the current statement balance.

Business funds are not an acceptable source of funds for reserves.

Primary Residence and Second Home reserve requirements are calculated using all outstanding liens on the subject property

only.

Loan Amount PITI Reserve Requirements (months)

Up to $650K 3

Over $650K to $1 million 4

Over $1 million 8

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 8 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

28. Appraiser

Requirements

Appraisers must be selected following Associated Bank’s appraisal policy.

29.

Appraisal

Requirements

The property must be livable and marketable.

The Maximum is 20 acres, with the appraisal containing comparables of similar size acreage. Residences over 10 acres are not

allowed if the value of the land is worth more than 50% of the total appraised value.

Dome and earth homes are not acceptable.

Appraisals must be completed on a current Uniform Residential Appraisal Report and comply with the Uniform Appraisal

Dataset (UAD).

Loans must have an interior and exterior appraisal performed on the Uniform Residential Appraisal Report (1004/1073/1025).

Properties that have an unusual feature such as design or location must include comparable sales to address the concerns.

30.

Mortgage

Insurance

Mortgage insurance is required on all loans with an LTV greater than 80%.

Borrower Paid Monthly, Borrower Paid Single, Split Paid Premium, and Lender Paid Mortgage Insurance options available.

Acceptable Companies (MI pricing will vary based on company and credit score)

o Arch Mortgage Insurance Company

o Essent Guaranty Mortgage Insurance

o Genworth Financial

o Mortgage Guaranty Insurance Corporation (MGIC)

o National Mortgage Insurance – split paid is not available

o Radian

Lower Cost MI is not available

All ARMs

Standard

Coverage

80.01 - 85.00% 12%

85.01 - 90.00% 25%

90.01 - 95.00% 30%

Associated Non-Conforming Adjustable Rate Mortgage Program

TPO Originations

08/03/18 Page 9 of 9

3/1, 5/1, 7/1 & 10/1 ARMs

31. Documentation

Type

Full

Documentation requirements are as follows:

o Current paystub dated within 30 days of the application that contains at least 30 days of year-to-date earnings

o 2-years W-2 Statements

o 2-years federal income returns; 2-years business returns and YTD Profit & Loss statement, if applicable

1,2

o 2-months of most recent asset statements.

Loan Amounts > $1 million require a TROY Report for borrowers with no established Associated Bank relationship

1

.

Loan Amounts > $1 million require a personal financial statement that is fully completed and executed by all borrowers. The

personal financial statement must be dated within twelve months of the date of the credit application.

Self-employed persons must provide two years tax returns showing income from self-employment. A borrower is self-employed

if they own 25% interest or greater in a business and they must be self-employed for a minimum of two years before the income

can be considered for qualifying.

1

An established customer to Associated Bank is defined as follows:

Has an active loan account with Associated Bank for the past 12 months with no delinquent payments OR

Has an active deposit account or relationship for the past 12 months

2

Transcripts are required on all new borrowers. Also, tax returns may be required in the following instances, but not limited to: jumbo loan amounts, self-employed

borrowers, truck drivers, seasonal workers, construction workers, borrowers with tip income, all commissioned workers, borrowers with potential job expenses,

regional or area managers, owners of rental properties, interest, or dividend income, borrowers who work for family members, and sole proprietors or if a borrower’s

interest in a partnership, S-Corp or corporation is 25% or greater.