Other Income

About Other Income

• Additional resources listed in L< “References” tab

• Review all tips and cautions in the lesson

• Read all examples and sample interviews

• We will review answers to each exercise

2

Other Income

Objectives – Other Income

Determine:

• Other types of income and how to report them

• Determine the requirements for the cancellation of debt on

no

nbusiness credit card debt when preparing tax returns

• Determine when canceled credit card debt is included in gross inco

me

on

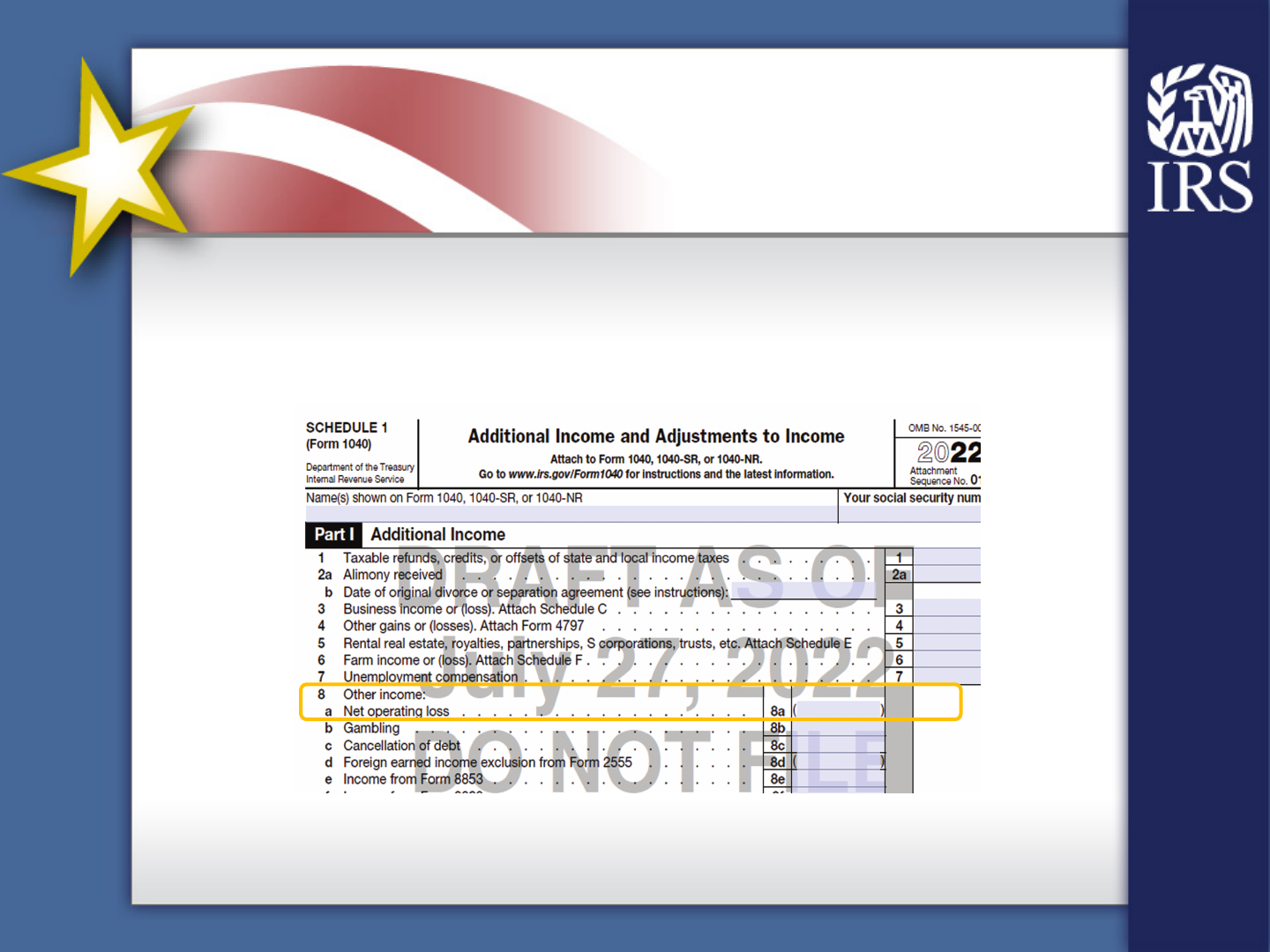

Form 1040, Schedule 1

• How to properly report income earned from worldwide sources

• Who is eligible for the foreign earned income exclusion

• How to calculate the excludible amount using Form 2555, Foreign

E

arned Income

• Time Required: 30 minutes

Other Income

3

Topics

• Other Income

• Nonbusiness Credit Card Debt

• Worldwide Income

• Foreign Earned Income Exclusion

• Period of Stay

• Qualifying Income

• Reporting Other Income

4

Other Income

Key Terms

Definitions are always available in the L< online Glossary.

• Blocked Income

• Bona Fide Residence Test

• Coverdell ESA

• Foreign Earned Income Exclusion

• Foreign Tax Credit

• Period of Stay

• Physical Presence Test

• Medicaid Waiver Payments

• Regular Place of Abode

• Tax Home

• Worldwide Income

5

Other Income

Other Income

6

Other Income

What are some examples?

• Prizes and awards

• Gambling winnings

(including lotteries and raffles)

• Cash for Keys

• Jury duty pay

• Alaska Permanent Fund dividends

• Nonbusiness credit card debt

Cancellation

Other Income

See Publication 4491 for details on these types of other income:

• Health Savings Account distributions

• Qualified Medicaid Waiver Payments

• Distributions from ABLE accounts

• Coverdell ESA and a 529 plan

Other examples of other income are:

• Gambling Winnings, Cash for Keys, Penal Income,

7

Other Income

Cancellation of Debt – Nonbusiness Credit Card Debt

8

Other Income

• If a taxpayer receives Form 1099-C for canceled credit card debt and

was solvent, all the canceled debt will be included on Form 1040, Other

Income line.

• Generally, taxpayers must include all canceled amounts (even if less

than $600) on the Other Income line of Form 1040

• Review the

Insolvency Determination Worksheet

Worldwide Income

9

Other Income

• For U.S. citizens and resident aliens, income earned outside the U.S. is

subject to the same taxes and filing requirements as U.S. income.

• Amounts reported on a U.S. return must be converted to U.S. dollars.

What exchange rate do you use?

• Use the rate in effect when the income was received.

• The average annual exchange rate can be used if:

• Foreign income was received evenly throughout the year, and

• The foreign exchange rate was relatively stable during the year

• Monthly exchange rates can be used for foreign income earned evenly

for one or more months, but not the whole year.

Foreign Earned Income Exclusion

• Allows qualified taxpayers to voluntarily exclude foreign earnings from

taxable income – amount is indexed to inflation, updated yearly

• Does not apply to members of Armed Forces or U.S. governmen

t

e

mployees

• Taxpayers cannot claim the earned income credit or foreign tax credi

t

if

using this exclusion

• The term “foreign country” does n

ot

i

nclude U.S. territories or possessions –

see Chapter 4 of

Pub 54 for details

• Claimed using

Form 2555

10

Other Income

Current year not available

Foreign Earned Income Exclusion

• To be eligible, the taxpayer must:

• Demonstrate that his or her tax home is in a foreign country

• Meet a period of stay requirement – either the bona fide residence

test or the physical presence test

• Have income that qualifies as foreign earned income

• Married couples – requirements must be met separately for each

person

• Taxpayers whose “regular place of abode” is in the U.S. cannot be

considered to have a foreign tax home and would not qualify for the

exclusion – see

Pub 54 for details

11

Other Income

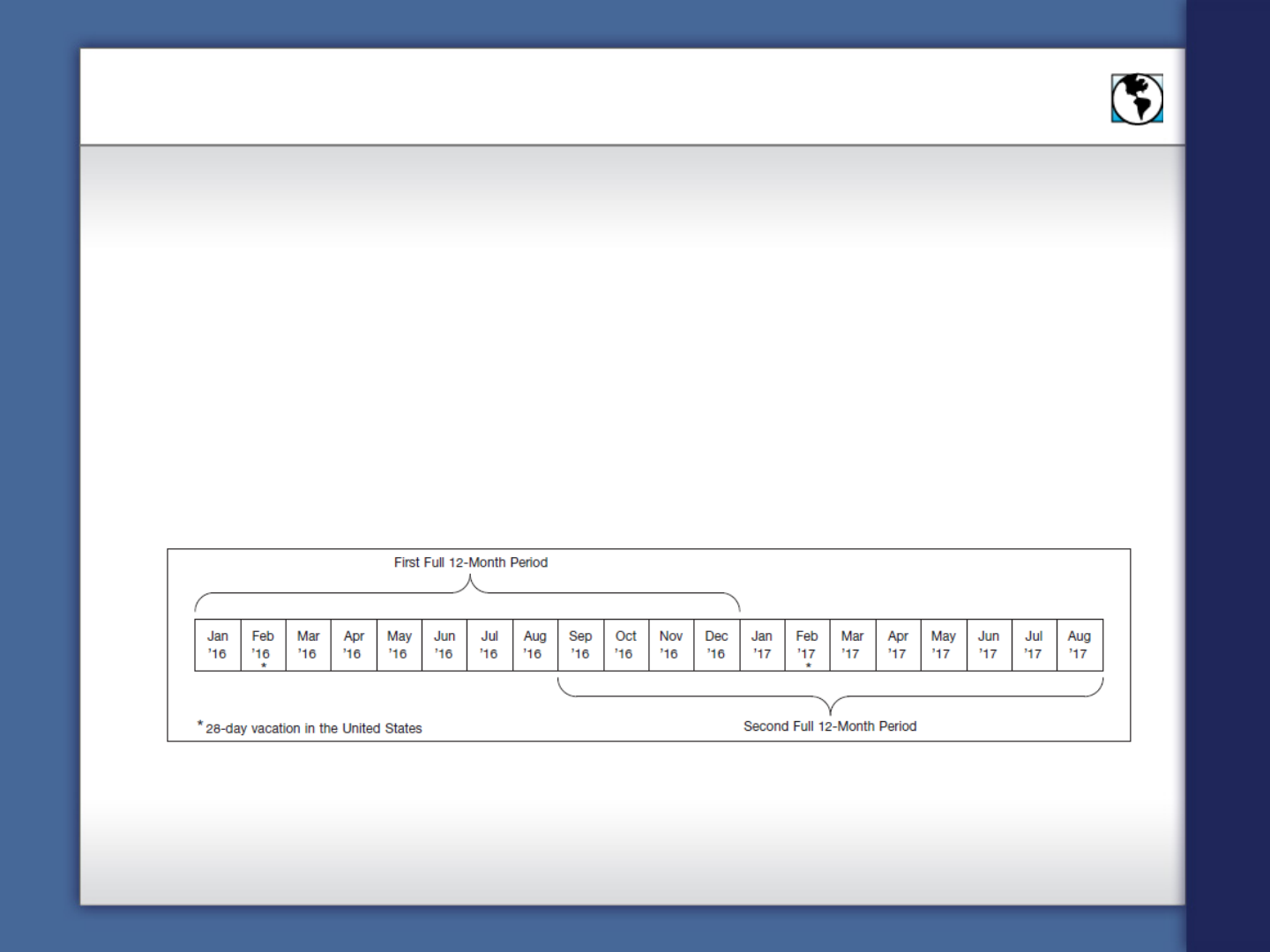

Period of Stay

• What is required to meet the period of stay requirement?

• Bona fide residence test – taxpayer must have set up permanent

quarters in a foreign country for an entire, uninterrupted tax year.

• Physical presence test – taxpayers must be physically present in a

foreign country 330 full days in 12 consecutive months

12

Other Income

Qualifying Income

• Must be earned income for services (other than military or U.S.

government) performed in a foreign country

• Salaries

• Wages

• Commissions

• Professional fees

• Self-employment income

• What types of income would not qualify?

• Dividends, interest, capital gains, alimony, social security benefits,

pensions, annuities

13

Other Income

Reporting Other Income

• Reporting on Form 2555 using TaxSlayer

• Link to Form 2555

• The exclusion amount is calculated by TaxSlayer and entered as a

negative number on Form 1040, Other Income line.

14

Other Income

Out of Scope for this Lesson:

• Distributions from an ABLE account in which the funds were not fully

used for qualified disability expenses

• Distributions from Educational Savings Accounts in which the:

• Funds were not used for qualified education expenses, or

• Distribution was more than the amount of the qualified expenses

• Taxpayers who are insolvent and had debt canceled

15

Other Income

Summary

• Other Income includes any taxable income for which there is not a

specific line identified on Form 1040. This income is reported on Form

1040, Schedule1.

• U.S. citizens and resident aliens are taxed on worldwide income, and

must file a U.S. tax return even if all the income is from foreign sources,

and even if they paid (or will pay) taxes to another country.

• Amounts received in foreign currency must be converted to U.S. dollars

for reporting on the return. Use the exchange rate prevailing when the

taxpayer receives the pay.

• If the taxpayer is eligible to exclude some or all of foreign earned

income, complete Forms 2555. The excludible amount will be entered

as a negative number on Schedule 1.

16

Other Income