CRUISE LINES

INTERNATIONAL

ASSOCIATION

TRAVEL AGENT CRUISE

INDUSTRY OUTLOOK

NINTH EDITION | ECEMBERD 2018

CLIA IS GRATEFUL TO OUR SPONSOR FOR

SUPPORTING THIS REPORT

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

2

Posive trends are dominang cruise industry buzz, for good reason. Travel agents and

their customers are dishing on group and mulgeneraonal travel, river cruising, value,

luxury, the introducon of new ships and desnaons. Aside from these dominant areas,

no one theme stands out among the large swath of “signicant trends” reported by agents.

From a focus on experience and celebraon to small ships to adventure, travelers are

taking advantage of everything that cruises have to oer.

Meanwhile and pursuant to these posive vibes, travel agents are condent in their

views of favorable market condions moving into 2019—four of ve (83.5%) indicate

improvement in booking volume over last year, and a similar number (83.2%) ancipate

higher spending from clients. Of those who say bookings are down, most (3.7%) say

their business has declined just 1%-5%. Indeed, less than 1% say their cruise sales have

decreased more than 10% over the last year.

Summer/Fall

2018

Winter 2018

More than 10% Beer

1 to 5% Worse

6 to 10% Beer

6 to 10% Worse

1 to 5% Beer

More than 10% Worse

Remain Flat - No Change

39%

41%

26%

22% 17% 13%

5%

20% 11%

3%

1%

2%

2%

1%

Describe your agency's outlook regarding its cruise sales volume in the current year

compared to that of the previous year.

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

3

This posive business outlook has become a consistent trend since the incepon of

this quarterly report. Travel agents have seen increases in business compared to the

previous 52 weeks dependably for the last several years. This quarter’s results indicate

an improvement of 4 percentage points over just one year ago: 79.7% in Summer 2017

compared to 83.6% in Summer 2018, and most of the movement comes from those who

report that sales are 6% to 10% beer, from 13.5% to 25.5% (admiedly at the expense to

some in the greater than 10% range).

My cruise business has doubled this year,” reports Tobi

Tuobene of TAW Travel LLC. More and more people are

wanng to travel, and cruising gives them the best opportunity

to see more than one locaon. I feel that people are no longer

looking for the best deals. When thinking of a cruise, my clients

want a unique experience in ports they’ve never been to.

We are seeing more cruising business come into our

agency than ever before,” concurs Laurie Shuss of

Dream Vacaons. “There are so many promos right now from

all the cruise lines, that it is easy to nd the right product for

our clients. There has been more emphasis on river cruising

recently which brings more business to us than ever before.

Terms & Conditions: Offers are valid for new 2019 bookings made between November 1 – December 31, 2018. Offers and fares are capacity controlled and may be changed, cancelled or withdrawn at any

time. Free roundtrip economy air with a maximum value of $1,400 per person. Free roundtrip premium economy air available for Diamond Deck, Deluxe Balcony (BD), Junior Balcony (BJ, B1J) Suites on 11+

Day sailings with a maximum value of $2,100 per person. Scenic Savings are $1,000/pp for 8-10 Day sailings and $1,500/pp for 11+ Day sailings. Offers are based on number of cruise days, and exclude the

land portion of the trip. Scenic reserves the right to correct errors or omissions and to change any and all fares and promotions at any time. Availability is correct at the time of publishing but cannot be

guaranteed. A non-refundable initial deposit of $500 per person is required at the time of booking, with full payment required 90 days prior to departure. Flights must be booked through Scenic, on our

choice of airlines and are non-refundable once ticketed. A secondary deposit of $1500 per person is due upon airfare ticketing. These offers are combinable with past passenger offers, referral offers,

travel show & agent training vouchers and National Geographic departures. Not combinable with Groups or any other offers. For the most up-to-date pricing, availability and offers, please call Scenic

USA or your Travel Professional. Offers applicable for legal residents of the 50 United States of America.

BSP Job #: SCEN-18-K102_CLIA_NotSomeInclusive_DEC Client: SCENIC

Description: Scenic Ad

Trim: 8.5" x 11" Live: .375" from trim Bleed: .125" Issue: CLIA - FP DEC

Color: 4c Date: December 4, 2018 2:10 PM Mech Person: GU

To book your European cruise call us

at 1.855.337.1788 or visit scenicusa.com

On Scenic, there’s no nickel-and-diming: we include everything from bikes and

excursions to transfers and tips. Of course, there’s no compromising: we include

unique and customizable experiences on shore, and a butler and 5-star service

on board. Which all adds up to a truly special way to travel. #TheScenicRoute

GU

12.04.18 | 2:10PM

OR

FREE

ROUND-TRIP

AIRFARE

SAV E

UP TO $1,500

ALL

2019

EUROPEAN

RIVER

CRUISES

NOT “SOME-INCLUSIVE”

ALL-INCLUSIVE

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

5

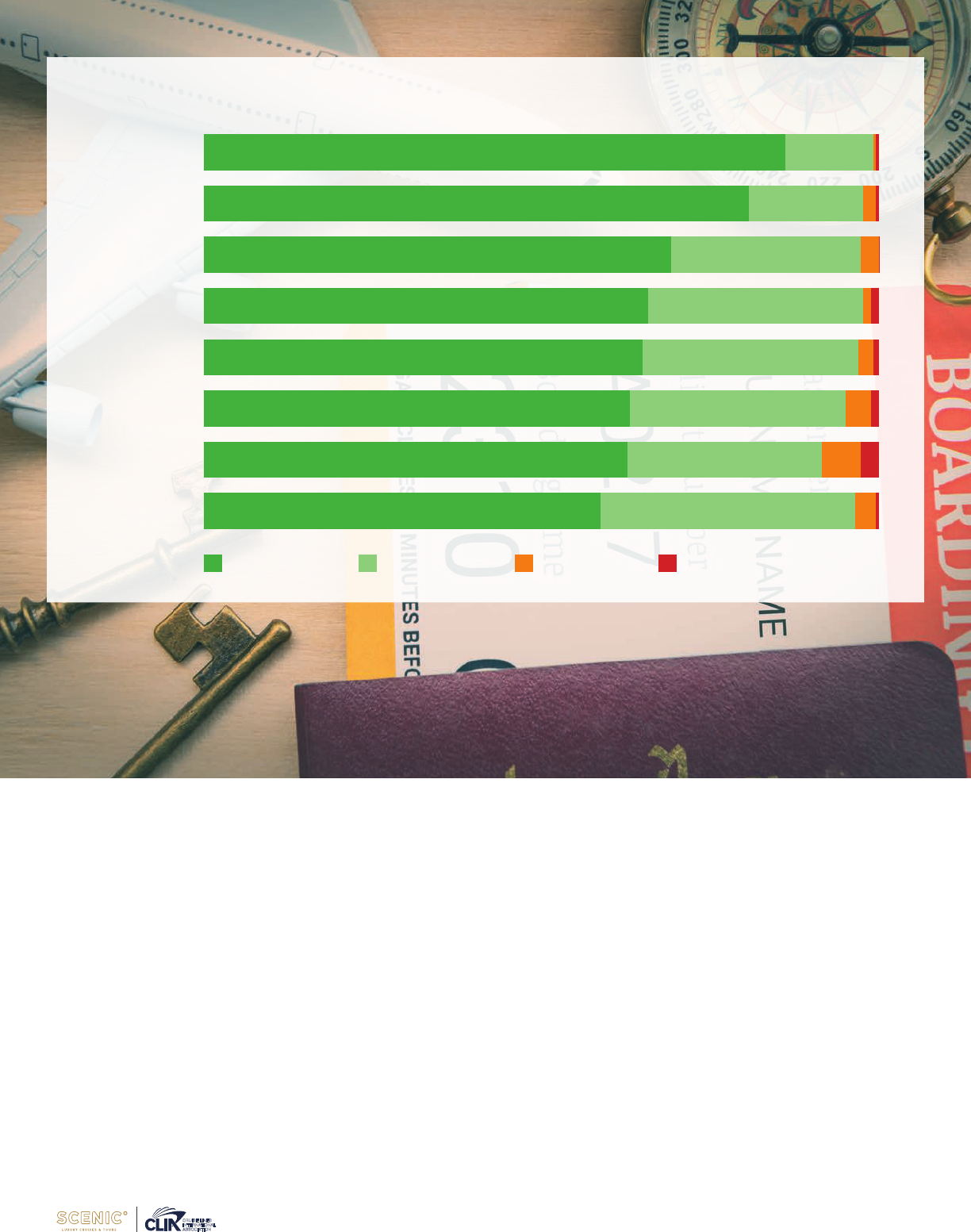

Travel agents report a greater degree of increased cruise spending since last year—from

77.9% in Summer 2017 to 83.2% in Summer 2018, a growth of 3.3 percentage points.

Interesngly, this report has seen posive cruise spending since its incepon—but the

current rate is the highest it has ever been, from a low of 67.2% in Spring 2016.

More than a quarter of agents (27.6%) say that their clients are spending greater than 10%

more than one year ago , and an addional 31% say that spend is 6% to 10% beer. Another

quarter (24.6%) say their cruisers are spending just a lile bit more with 1% to 5% increases.

As one travel agent reports: “People seem more inclined to spend the extra money to

travel to exoc places.” Another corroborates: “We are seeing clients willing to spend more

to go to new and interesng ports. They also like the idea of spending the night at a port,

allowing them to aend special acvies.”

INVESTING IN EXPERIENCES

Summer/Fall

2018

Summer 2017

More than 10% Beer

1 to 5% Worse

6 to 10% Beer

6 to 10% Worse

1 to 5% Beer

More than 10% Worse

Remain Flat - No Change

28%

23%

3.6%17%28%

31% 25% 12%

3.7%

27%

0.9%

0.8%

0.9%

0.4%

How would you esmate the cruise spending behavior of your clients in the

current year?

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

6

Alaska has been consistently the No. 1 growth desnaon for the last 3 years, and this

latest edion is no excepon. More than two-thirds of travel agents (67%) say they are

seeing increased interest in the Northern-most U.S. state. Indeed, Alaska has gained an

even wider margin than in the past.

“Alaska is selling like crazy right now,” reports Amy Madson of Cruise Inc. “Families are

liking the big ships in Alaska—Norwegian Bliss and Joy are bringing strong yields.”

But an interesng story is developing for those desnaons that follow. While interest in

the Caribbean remains consistent (up just 1 percentage point to 43% compared to one

year ago), other regions are seeing a greater upck in the amount of increased interest.

Consider Mediterranean Europe, where increased interest has jumped from 25% to 42%

(up 17 points) over the past year. South America has seen growth in increased interest

from just 9% last year to 20% today.

“More clients are requesng bucket list trips to Europe and Africa,” says one respondent.

“We have partnered with vendors that specialize in this area and I am compleng more

training on these desnaons.”

Similarly, growing interest in Hawaii is up 9 percentage points (24% to 33%), Panama Canal

up 9 points (23% to 32%), Canada / New England up 8 points (31% to 39%) and Northern

Europe up 7 points (25% to 32%).

Other, more distant, desnaons are also seeing growth in the increases of interest.

Australia / New Zealand marks a growth in increased interest of 6 percentage points

compared to one year ago (18% to 24%). In fact, one travel agent says this region has

become the majority of business: “It seems lately almost all of the cruises that I have

reserved are for Australia and New Zealand.”

FAVORITE DESTINATIONS

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

7

GROWTH STEADY DECLINE

Alaska

67% 4%29%

Caribbean/

Bermuda/Mexico

43% 11%46%

Europe

Medieranean

42% 48%

Canada/

New England

39% 50%

Hawaii

Panama Canal

Northern

Europe

Australia/New

Zealand

South America

Tahi And

South Pacic

California/

Pacic Coast

Trans-Atlanc

Asia

Africa

World Cruises

33%

32%

32%

24%

20%

20%

19%

17%

17%

9%

9%

52%

53%

53%

58%

53%

58%

62%

50%

55%

57%

54%

10%

14%

27%

33%

11%

16%

22%

37%

15%

18%

28%

20%

34%

In your view, are the following cruise desnaons experiencing growth, decline or

remaining steady in your bookings?

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

8

Travel agents say their most benecial asset (86.2%) is providing valuable experience and

product knowledge to their clients. They also enjoy being able to advocate for their clients

and leverage relaonships and experse if something goes wrong (80.7%).

“For any professional, educaon and training is key to their success. The same is true for

travel agents and these survey results prove it.” says Stephani McDow, MCC, Director

Membership & Professional Development at CLIA, “Those who invest in themselves

through professional development will not only provide their clients, customers and

partners with the best service and collaboraons; but will earn more. CLIA’s Career

Seascape is a one-stop shop for professional development designed to grow cruise sales

business, while CLIA’s Global Cruise Lines oer top-notch product training. “

THE VALUE OF THE TRAVEL AGENT

Time Savings

Access to Exclusive

Oers/Savings

Access to resources

not avaliable online

Provide

Round-the-clock

Support

Provide Valuable

Experse/Product

Knowledge

Free of charge

Provide Advocacy/

Leverage if something

goes wrong

Deliver Important

Nocaons

HIGH VALUE SOME VALUE NO VALUE NO VALUE AT ALL

69%

81%

66%

65%

63%

63%

86%

59%

28%

32%

17%

32%

13%

29%

32%

5.8%

38%

2.7%

0.4%

1.9%

1.2%

2.3%

3.8%

3.1%

0.4%

0.4%

1.2%

0.8%

1.1%

0.4%

2.7%

From the opons below, where do you feel you bring the highest amount of value?

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

9

Other values come from the me they save their customers (69.4%), access to exclusive

oers (66%), resources not available online (65.3%) and round-the-clock support (63.2%).

Two-thirds of agents (62.6%) say the fact that all of this comes free of charge connues to

bring client value, as well as the delivery of travel and other nocaons (59.0%).

“I educate the consumer that their price is no dierent if they use me, but the value and

quality of their vacaon will be beer,” says one agent.

The good news is that current clients seem fairly well educated in the power of using

a travel agent over self-booking, though further edicaon of the general public could

benet all travelers. Overall, there is at least some posive awareness among clients

around agent experse / knowledge (96%), advocacy (92%) and me savings (90%).

To a lesser extent, clients know about agents’ access to exclusive oers and resources

(87%), nocaons (86%) and round-the-clock support (85%). Free services at 83% are

the least known asset that travel agents oer.

Free of Charge

Time Savings

Provide

Round-the-clock

Support

Deliver Important

Nocaons

Provide Valuable

Experse/Product

Knowledge

Access to Exclusive

Oers/Savings

Provide Advocacy/

Leverage if something

goes wrong

Access to resources

not available online

VERY AWARE SOMEWHAT AWARE SOMEWHAT UNAWARE VERY UNAWARE

53% 5.8%

56%

51%

49%

47%

43%

72%

35% 5%

30% 11%

8.1%

12.6%

39%

36% 6.2%

12%

24%

36%

39%

12.7%44%

8.5%52%

3.4%

0.4%

1.9%

1.5%

2.3%

1.9%

From the opons below, to what extent do you feel your clients are aware of the

following services you provide?

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

10

The second-highest trend impacng the cruise marketplace is the river cruise, behind only

group and mulgeneraonal travel. Nearly four in ve travel agents (79%) say that river

cruising is, to some or great extent, a good way to introduce customers to cruising. Only

17% indicate that it isn’t.

The queson is why. Travel agents most frequently and overwhelmingly say their clients’

interest in river cruises comes from a desire to experience something new or dierent.

Trailing this substanally are requests for smaller ships, desnaon immersion, relaxed

entrée to Europe, less unpacking, more desnaons and reduced seasickness. Other

movaons for river cruisers include educaonal experiences, slower pace, inmate

sengs, luxury and trendiness.

The most popular river cruises showcase Europe, including 53% growth to eastern

waterways (Rhine, Moselle, Danube, Elbe), 30% growth to western channels (Soane, Seine,

Loire) and 24% growth to the south (Douro, Rhone, Dordogne, Garonne, Po).

THE RIVER CRUISE

TO A GREAT EXTENT OTHERTO SOME EXTENT TO NO EXTENT TO NO EXTENT AT ALL

23% 5%56% 12% 10%

To what extent to do you think river cruising is a great way to introduce

customers to cruising?

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

11

Nearly a quarter of agents (23%) see growth in U.S. river cruises, as well, parcularly on

the Columbia, Mississippi and Ohio rivers. Topping o river cruise desnaons with at least

20% growth is Asia at 21%, parcularly Vietnam and Myanmar (Mekong, Red, Irrawaddy and

Chindwin rivers).

GROWTH STEADY DECLINE

Europe, Central -

East - Rhine, Moselle,

Danube, Elbe

53% 7%40%

Europe,

Central - West:

Soane, Seine, Loire

30% 11%60%

Europe, South - Douro,

Rhone, Dordogne,

Garonne, Po

24% 14%62%

USA - Columbia

River, Mississippi,

Ohio River

23% 23%54%

Asia, Vietnam,

Myanmar - Mekong,

Red River, Irrawaddy

21% 28%51%

Asia, China (Yangtze)

15% 28%57%

Africa

8% 36%56%

South America

6% 27%67%

Asia, India -

Ganges River

5% 33%62%

In your view, are the following cruise desnaons experiencing growth, decline or

remaining steady in your river cruise bookings?

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

12

This increase in interest comes from all ages and generaonal cohorts—though the

greatest increase in demand constutes Baby Boomers (67%). But Generaons X and Y

aren’t to be tried with. Gen X has the second greatest growth in cruise bookings (42%),

followed by their immediate predecessors, Millennials, at 36%. Even the Silent Generaon

is upping its cruise ante, but to a lesser extent (31%).

GROWTH STEADY DECLINE

Silent Generaon/

Tradionalists

(Born before 1948)

31% 16%53%

Boomers

(1948-1966)

67% 3%29%

Gen X (1967-1981)

42% 7%51%

Gen Y/Millennials

(Born aer 1981)

36% 18%47%

The results of last quarter’s survey were no

surprise,” reports Rob Human, Vice President

Sales, USA, Scenic Group. “ We’ve seen tremendous

growth for both of our river cruise brands – Scenic and

Emerald Waterways – on the tradional European routes

like the Danube, as well as on newer routes like the Douro.

And it was because of our growth predicons in Asia that

we’re launching the new Emerald Harmony this spring. I

was also very happy to see the high awareness consumers

have of the knowledge and experse travel agents can

provide. It points to the importance of making sure that all

of us in the industry make sure our educaon programs are

updated regularly. I remain condent that in the coming

year we will connue to see even greater awareness of the

tremendous value travel agents have to oer.

In your view which of the following generaonal cohorts are experiencing growth,

decline or remaining steady in your river cruise bookings

CRUISE LINES

INTERNA

TIONAL

ASSOCIATION

13

To say the cruise marketplace is ourishing may be an understatement. Posive trends in

mulgeneraonal travel, river cruising, value and luxury and new ships and desnaons

are pushing more and more travelers into the cruise marketplace, and those travelers are

spending more than they have in the past. Four of ve travel agents (83.5%) say their

bookings are up since last year, and another 83.2% say spending is up, as well.

Alaska connues to be the desnaon with the greatest amount of growth in interest. But

other regions are seeing higher percentage increases in this area. Europe and South America

are seeing double-digit increases in interest over just one year ago. Hawaii, Panama Canal,

Canada / New England, Northern Europe and Australia / New Zealand are all experiencing

growth in interest from cruise clients.

The benets that travel agents bring to their clients, and the value of using a professional to

help book travel, are well known to cruisers. Clients understand that agents provide valuable

experience and product knowledge, advocacy and leverage, me savings, exclusive oers

and resources—all free of cost to the end consumer.

Aer group and mulgeneraonal travel, river cruises are the hoest trend in the

marketplace. Nearly four in ve travel agents (79%) say that it’s a great way to introduce

customers to cruising. It’s ideal for clients who desire new or dierent experiences, smaller

ships, desnaon immersion and relaxed entrée to Europe.

It’s a great me to be cruising.

CONCLUSIONS

1201 F STREET NW, SUITE 250

WASHINGTON, DC 20004

+1.202.759.9370

cruising.org

@CLIAGlobal

cruising.org

cruising.org

@CLIAGlobal