Our Values

Our People

Our Future

Intact Financial Corporation

2018 Annual Report

Intact Financial Corporation 2018 Annual Report

Company Profile

Intact Financial Corporation is the largest provider of property and casualty insurance in Canada and a leading provider of specialty

insurance in North America, with over $10 billion in total annual premiums. We serve more than five million personal, business and

public sector clients through oces in Canada and the U.S. In Canada, Intact distributes insurance under the Intact Insurance brand

through a wide network of brokers, including its wholly owned subsidiary BrokerLink, and directly to consumers through belairdirect.

In the U.S., OneBeacon Insurance Group, a wholly owned subsidiary, provides specialty insurance products through independent

agencies, brokers, wholesalers and managing general agencies.

Table of contents

1 Our Values | Our People | Our Future

2 Financial highlights

4 CEO’s message

10 Chairman’s message

12 Board of Directors and Executive

Committee members

13 MD&A and financial statements

170 Glossary

172 Five-year financial history

173 Three-year quarterly financial history

174 Shareholder and corporate information

175 Social responsibility

DPW BY BUSINESS LINE

1

Personal auto _______________37%

Personal property ____________22%

Commercial lines – CAN _______26%

Commercial lines – US ________15%

Approximately14,000

EMPLOYEES

$10.1B

Certain statements made in this annual report are forward-looking statements. These statements include, without limitation, statements relating to the company’s strategy, new products and services, lines of business, revenue,

performance, profitability and growth projections, use of technology, data and artificial intelligence, funding of projects, position within the industry and markets where it operates, return on equity, net operating income per

share and improved cross-border eciencies, as well as the sharing economy, climate change and market conditions. All such forward-looking statements are made pursuant to the “safe harbour” provisions of applicable

Canadian securities laws.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events

could dier materially from our expectations expressed in or implied by such forward-looking statements as a result of various factors, including those discussed in the Company’s most recently filed Annual Information Form

and annual MD&A. As a result, we cannot guarantee that any forward-looking statement will materialize and we caution you against unduly relying on any of these forward-looking statements. Except as may be required by

Canadian securities laws, we do not undertake any obligation to update or revise any forward-looking statements contained in this annual report, whether as a result of new information, future events or otherwise. Please read

the cautionary note at the beginning of the annual MD&A.

Disclaimer:

®Intact Design and Intact Insurance Design are registered trademarks of Intact Financial Corporation.

TM

Intact Service Centre and Intact Centre on Climate Adaptation are trademarks of Intact Financial Corporation.

®belairdirect. & Design is a registered trademark of Belair Insurance Company Inc. used under license. ®BrokerLink & Design is a registered trademark of Canada Brokerlink Inc. used under license. OneBeacon is a trademark of

OneBeacon Insurance Group Holdings, Ltd. All other trademarks are properties of their respective owners. ©2019 Intact Financial Corporation. All rights reserved.

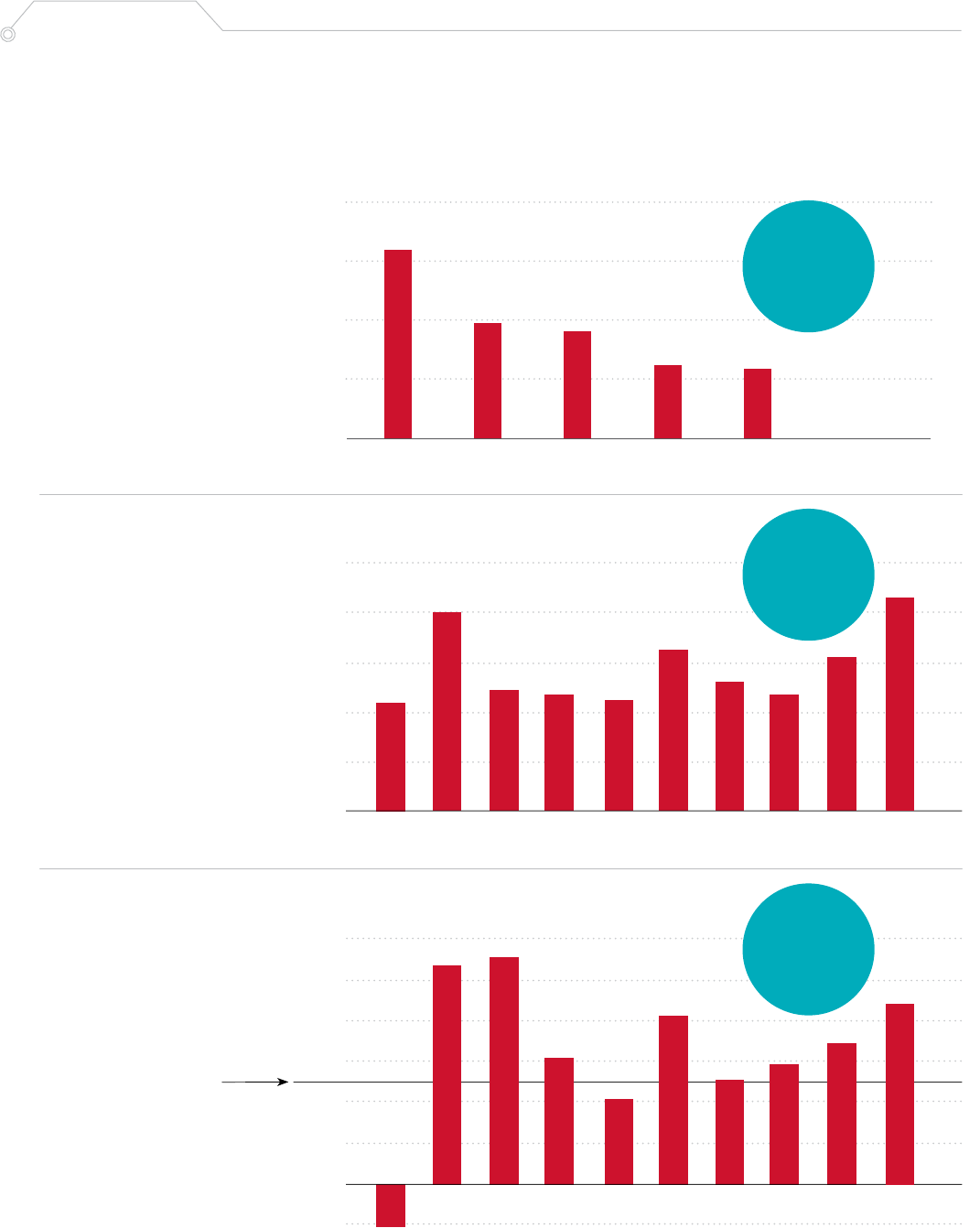

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

$3

$2

$1

$0

Annual dividend per common share

We are proud of our dividend growth track record,

including a CAGR of 9% since 2009.

350%

250%

150%

50%

-50%

Total shareholder return vs peers

On a total shareholder return basis (including dividends), our 15.3% CAGR over the past 10 years compares very favourably versus peers.

15%

9%

10-YEAR

CAGR

CAGR

YE2008 YE2009 YE2010 YE2011 YE2012 YE2013 YE2014 YE2015 YE2016 YE2017 YE2018

Intact Financial Corp. S&P/TSX Composite

S&P/TSX Banks

S&P/TSX Life Insurance

S&P/U.S. P&C Insurance

DPW BY BRAND

1

$10.1B

Intact Insurance _____________63%

belairdirect _________________14%

OneBeacon _________________15%

BrokerLink _________________ 8%

1 This is a non-IFRS financial measure. See glossary on page 170 for definition.

-50

50

150

250

350

Intact Financial Corporation 2018 Annual Report

1

Intact Financial Corporation 2018 Annual Report

1

OUR COMPANY IS ONE OF THE MOST RESPECTED

OUR VALUES | OUR PEOPLE | OUR FUTURE

Our Strategy

GROW

NOIPS

1

10% yearly

over time

EXCEED

industry ROE

by 5 points

LEAD

in data, AI, and

behavioural analytics

What we believe

Insurance is not about things. Insurance is about people.

OUR CUSTOMERS ARE

OUR ADVOCATES

•

Stay ahead of changing customer

expectations

•

Deliver experiences that are

second-to-none

•

Engage with our customers digitally

OUR PEOPLE

ARE ENGAGED

•

Be a best employer

•

Be a destination for top talent

and experts

•

Create an inspiring and

inclusive workplace

OUR SPECIALTY SOLUTIONS

BUSINESS IS A LEADER IN

NORTH AMERICA

•

Achieve a combined ratio

in the low 90s

•

Attract and retain the best expertise

•

Create $3 B in annual premiums

Our Values

Integrity | Respect | Customer driven | Excellence | Social responsibility

Why we are here

We are here to help people, businesses and society prosper

in good times and be resilient in bad times.

1 This is a non-IFRS financial measure. See glossary on page 170 for the definition.

Intact Financial Corporation 2018 Annual Report

2

Investment Portfolio

Financial Strength

FINANCIAL HIGHLIGHTS

2018 Financial Highlights

TOTAL INVESTMENTS

$16.9B

DPW

1

Underwriting income

1

Net investment income

NOIPS

1

OROE

1

Net distribution income

1

16%

$10.1B

2%

$474M

22%

$529M

11%

$146M

$5.74

3%

12.1%

0.8 pts

Fixed income ____________ 75%

Common shares __________ 13%

Preferred shares __________ 7%

Cash, cash equivalents,

short-term notes and loans __ 5%

Investment

mix

(net exposure)

Book value per share

$ 48.73

Debt-to-total capital ratio

22.0%

Total capital margin

$1.3B

95.2%

94.8%

Personal

auto

2018 2017

Personal

property

Commercial lines

Canada

Commercial lines

U.S.

99.5% 101.7% 89.1%88.3% 94.6% 86.5% 94.8%

Combined ratio by line of business

1

Underwriting Performance

Combined ratio by segment

1

95.1%

IFC

1 These are non-IFRS financial measures. See glossary on page 170 for definitions.

Intact Financial Corporation 2018 Annual Report

3

0

5

10

15

20

IFC #2 #3 #4 #5

20

15

10

5

0

Canadian Industry Outperformance

FINANCIAL HIGHLIGHTS

10

8

6

4

2

0

12

10

8

6

4

2

0

-2

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

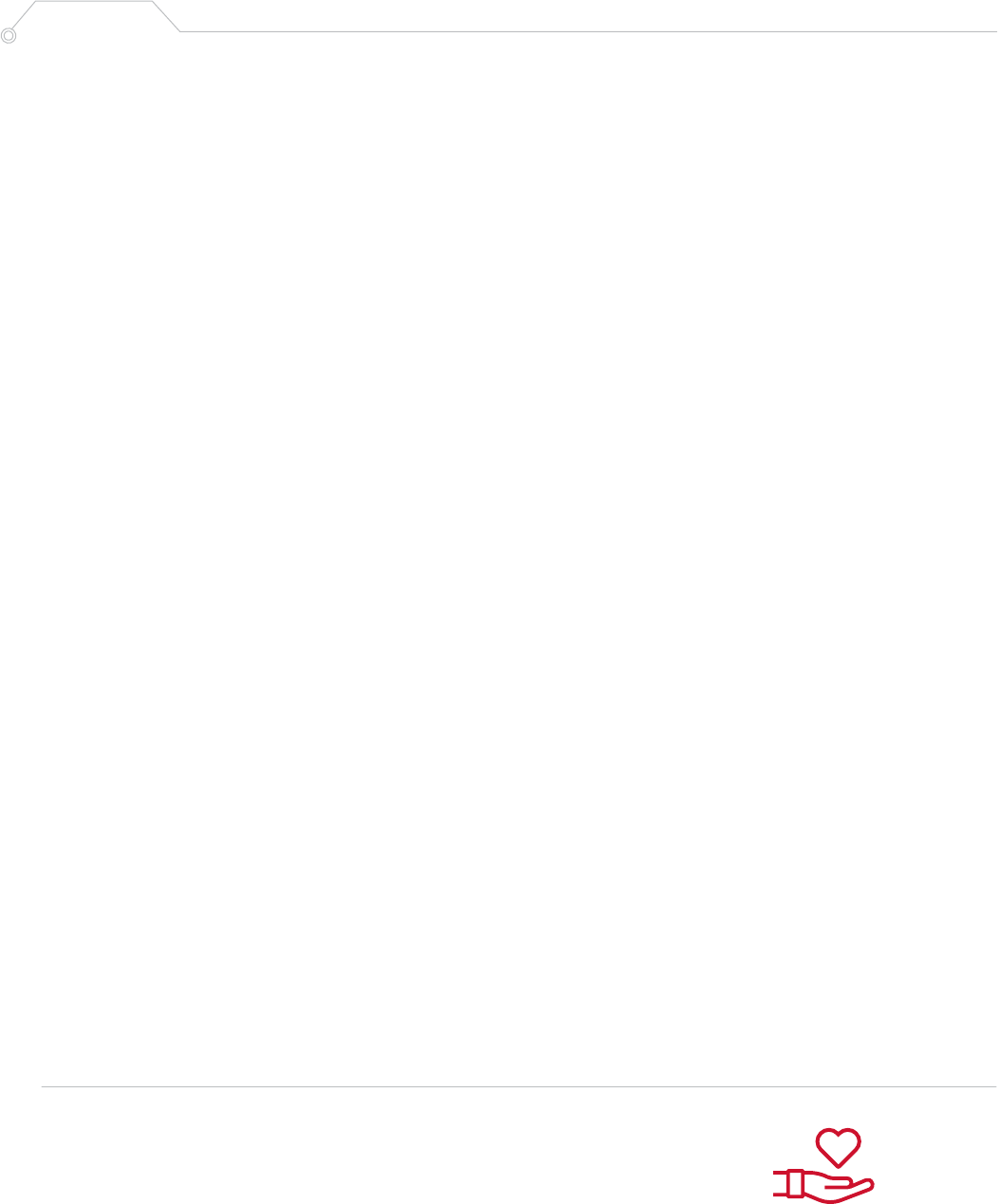

Market share by company (%)

1

With a market share of 16%,

we are 17 times the size of the

average P&C insurer in Canada.

Canadian combined ratio

outperformance (in pts)

1

Our sophisticated pricing,

underwriting discipline and

in-house claims expertise have

enabled us to outperform the

industry benchmark’s (top 20)

combined ratio.

Return on equity

outperformance (in pts)

1

Our superior underwriting results,

investment performance and

capital management have led to

a better ROE than the industry.

Target

outperformance

5 pts

16%

MARKET

SHARE

5.7 pts

10-YEAR AVG

outperformance

6.5 pts

10-YEAR AVG

outperformance

1 IFC’s ROE is the consolidated adjusted return on equity

(“AROE”), a non-IFRS financial measure. See glossary on

page170 for the definition.

1 Including MYA. Combined ratio is a non-IFRS financial

measure. See glossary on page 170 for the definition.

1 Market share data is based on the latest available data

from MSA Research Inc. (FY 2018).

Intact Financial Corporation 2018 Annual Report

4

CEO’S MESSAGE

Our values guide our decision making and are the foundation of our

success. They’re embraced by our people as they work to build a safe and

vibrant future for our customers, shareholders and communities.

In 2018, Intact Financial Corporation

(IFC) continued to grow, adapt and

innovate to define the future of

insurance, deliver second-to-none

experiences for our customers, and

help to build resilient communities.

Our success in 2018, and over the last

10 years, has been possible because

of the foundation it is built on and the

people who work here. As I write this

letter, we are celebrating our 10th

anniversary. I want to share with you

what has transpired in that time and

why it matters.

Ten years ago, with the support of

employees, brokers and the financial

markets, we raised $2.4 billion and

parted ways with our majority

shareholder ING. We brought the

leadership of property and casualty

(P&C) insurance industry back to

Canada – establishing IFC as an

independent, widely held company.

The financial crisis was at its peak – the

status quo was not an option and

we had to move with lightning speed.

The excitement was palpable, and it

worked – because we created a company

based on values and a belief that

insurance is about people, not things.

People needed to know who we were

and what we stood for. Within days of

the transaction we announced our name,

our colours and our values, and we used

those to transform the organization and

make it what it is today.

Our brands are now among the

most recognized insurance brands

in Canada – a testament to our focus

on getting customers back on track. We

have doubled the number of employees

to 14,000, become a best employer and

attracted a diverse and talented group

of people. Our strategy – to deliver

exceptional customer service, engage

our employees and earn the right to

be one of the most respected

companies – has delivered strong

returns for our shareholders.

Over the last decade, organic growth

and six major acquisitions have driven

a 10% CAGR in Direct Premiums

Written (DPW)

1

. With the acquisition of

OneBeacon, we have launched a new

growth pipeline in the U.S. We have

outperformed the P&C industry on

Return on Equity (ROE) by an average

of 650 basis points (bps). Our market

capitalization has quadrupled to

$14 billion, and we have delivered

an average annual total shareholder

return of over 15%, almost double

that of the TSX60.

Over the next 10 years, we will build

an unparalleled advantage in Canada by

transforming the customer experience

and extending our presence and

expertise in the U.S. As we focus on

excelling at the fundamentals, we will

continue to challenge ourselves to

stay ahead of changing consumer

expectations. We will lead in artificial

intelligence as the explosion of data and

technology advancements continue

rapidly. These big trends combined with

the impacts of climate change will have

Dear

shareholders,

1 This is a non-IFRS financial measure. See glossary on page 170 for the definition.

Intact Financial Corporation 2018 Annual Report

5

CEO’S MESSAGE

a profound eect on the kinds of

products we oer and the way we work.

Our values, purpose and strategy will

guide us as we tackle these trends,

serve our customers and communities,

and build a world-class P&C insurer.

2018 year in review

2018 was our first full year operating

in both Canada and the U.S.

DPW grew by 16%, driven by the

acquisition of OneBeacon and strong

growth in both commercial and specialty

lines in Canada. We saw improving

market conditions as the year progressed

and expect personal lines to be a greater

contributor to growth in 2019.

Net Operating Income Per Share

(NOIPS)

1

grew 3% to $5.74, with solid

underwriting performance in both

Canada and the U.S., and improved net

investment and distribution income.

Net investment income was up a strong

22% due to the growth resulting from

the integration of our Canadian and

U.S. investment portfolio, as well as

investment optimization initiatives

and higher yields.

The combined ratio

1

for Canada

was 95.2%, with continued strong

performance from personal property

and significant improvement in

personal auto. We are pleased with

the profitability trajectory in auto and

are focused on sustaining a mid-90s

combined ratio in 2019. Canadian

commercial lines experienced higher

large losses and higher CAT losses in

2018, but the underlying fundamentals

of the business remain strong.

OneBeacon, in its first full year,

produced a combined ratio of 94.8%.

We realized synergies in excess of

US $25 million in 2018, ahead of schedule.

OneBeacon business segments under

profit improvement plans are responding

positively and claims initiatives are

being rolled out and are gaining traction.

NOIPS accretion from OneBeacon was

roughly 6% in 2018 and we remain on

track for a sustainable low 90s combined

ratio by the end of 2020.

The Operating ROE (OROE)

1

was

12.1% in 2018, below our mid-teen

expectations and historical track record.

That being said, we outperformed the

industry on ROE by close to 900 bps,

a significant margin. We expect our

OROE to improve in 2019 given the

success of our profitability actions

and the improving market outlook.

Our balance sheet is strong, with

$1.3 billion of total capital margin

and debt-to-total capital of 22%.

This strength fuels the execution of

our strategy and gives us the flexibility

to take advantage of consolidation

opportunities in Canada moving

forward. Our balance sheet, combined

with good earnings momentum and

a favourable growth outlook, led us to

once again raise our quarterly dividend

this year by 9% to $0.76.

Favourable industry outlook

supportive of growth and

profitability initiatives

2018 was a challenging year for the

Canadian P&C industry with a combined

ratio of 102.1% and ROE of 2.8%.

Industry-wide actions including rate

increases have led to the firm conditions

we now see across all lines. We expect to

see at least mid single-digit premium

growth for the Canadian industry in 2019.

In personal auto and commercial lines,

profitability challenges are putting

upward pressure on rates, while in

personal property, companies continue

to adjust to changing weather patterns.

As industry rate increases catch up and

our competitive position improves, we

expect our growth in personal lines to

improve in 2019.

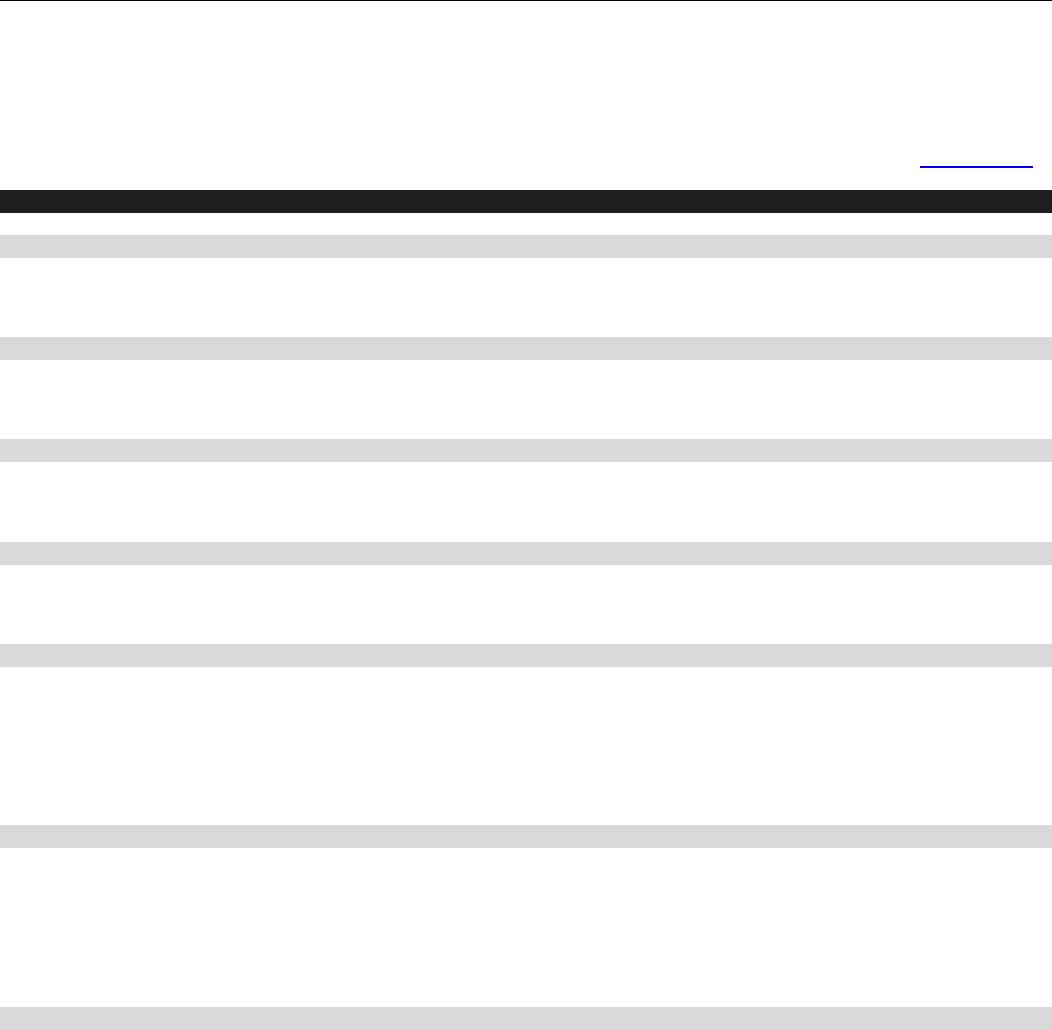

Direct premiums written Quarterly dividend per common share Total shareholder return

1

2009 2018

$4.3B

$10.1B

2009 2018

$2.35

$5.74

10.4

%

CAGR

10

%

CAGR

2009 2018

$0.32

$0.70

9

%

CAGR

0

5

10

15

20

S&P/TSX

Composite

IFC

15.3%

7.9%

2009 2018

$4.3B

$10.1B

2009 2018

$2.35

$5.74

10.4

%

CAGR

10

%

CAGR

2009 2018

$0.32

$0.70

9

%

CAGR

0

5

10

15

20

S&P/TSX

Composite

IFC

15.3%

7.9%

2009 2018

$4.3B

$10.1B

2009 2018

$2.35

$5.74

10.4

%

CAGR

10

%

CAGR

2009 2018

$0.32

$0.70

9

%

CAGR

0

5

10

15

20

S&P/TSX

Composite

IFC

15.3%

7.9%

1 Annualized, since December 31, 2008.

1 These are non-IFRS financial measures. See glossary on page 170 for definitions.

Intact Financial Corporation 2018 Annual Report

6

CEO’S MESSAGE

In U.S. Commercial, the pricing

environment is competitive but stable,

with modest upward pricing trends. We

expect low to mid single-digit industry

growth in the coming year, while our

strategies in U.S. Specialty position

us to do better than that.

Overall, we expect the industry’s ROE to

improve but remain below its long-term

average of 10% over the next 12 months.

While we maintain our 500 bps industry

outperformance objective, our strategies,

strong distribution networks and depth

of talent across the organization should

help us exceed this target and capture

improving growth opportunities in 2019.

Our strategy shapes

our success

In the medium term, we will continue

to excel at the fundamentals and

execute on our four strategic pillars

to solidify our position as Canada’s

number one P&C insurer and a leading

North American specialty insurer.

By 2020, we aim to have three out

of four customers as advocates by

delivering second-to-none experiences.

Through awareness and digital

adoption, we aim to have three out of

four people actively digitally engaged.

Our people are engaged

Our people are central to the success

of our customer driven transformation.

They are the ones who help customers

get back on track, develop new products,

and make it easier to do business with

us. We are a growing destination for

top talent as a company that invests in

the skills and tools of our employees,

provides an inspiring environment and

wants to be a force for good in society.

We are actively recruiting people with

a wide range of expertise, from those

focused on the front-line customer

service; to industry experts; to software

engineers, designers and data scientists.

We all share a common goal of wanting

to shape the future of insurance

and provide second-to-none

customer experiences.

Our customers are our advocates

This year, substantial investments

in technology, digital tools, design

expertise and artificial intelligence (AI)

helped us deliver industry-leading

platforms and provide more convenience

for customers. Our new Client Centre

self-service app makes it easier for

customers and brokers to do business

with us. And our recently launched mobile

Usage Based Insurance (UBI) 2.0 can

now detect distracted driving and

improve safety.

We are making things simpler for

small and mid-sized business customers

to get quotes through our new Quick

Quote tool for commercial lines – pre-

filling more than half the questions using

geomatics and external data sources.

Our claims service is a key dierentiator

and is at the heart of what we promise.

We continue to increase satisfaction by

providing customers with options to

tailor their experience – oering both

online self-service options as well as

face-to-face, full-service centres.

Our people are central to the success of our customer driven

transformation. They are the ones who help customers get back on track,

develop new products, and make it easier to do business with us.

Intact Financial Corporation 2018 Annual Report

7

CEO’S MESSAGE

A team that is engaged and inspired is

central to that future. As our company

grows and evolves, we continue to

have strong engagement. In 2018,

employees recognized our company

as being customer driven, for living our

values and for having leaders who care

for people, are open and honest, take

accountability and drive change. For

the 4th year in a row, we were named

one of Canada’s Top 100 Employers and

an Aon Best Employer –Canada 2019,

Platinum level. And for the first time, we

were named one of the 25 Best Places

to Work in Canada by Glassdoor, as

determined by those who know a

company best – employees.

Our specialty solutions business

is a leader in North America

Our Canadian specialty lines platform

has grown close to 50% over the past

five years. In 2017, we boosted our

ambitions in specialty lines with the

acquisition of OneBeacon. The

transition has gone very well – our

culture and values have been aligned

from the beginning. It feels like we've

been working together for a long time

and we are seeing positive results.

We continue to drive change, increase

broker satisfaction, and take customer

experience to the next level across

our personal and commercial

businesses while deepening our

strengths in pricing, risk selection,

claims and investments.

We have laid out clear performance

targets to earn respect including

exceeding industry ROE by 500 bps

in Canada and the U.S. and growing

NOIPS 10% yearly over time. We have

continued to perform well against those

targets. In 2018, we exceeded industry

ROE by close to 900 bps, taking average

annual outperformance on this metric

to 650 bps over the past decade. Since

becoming Intact Financial in 2009,

we’ve grown NOIPS at a compound

annual growth rate just north of 10%.

This outperformance allows us to invest

in transformation – including leveraging

AI to design relevant products and

services for customers. We aspire to

be the best insurance AI shop in the

world and we are building unique

partnerships with leading universities

in Canada to build a top talent pipeline

of actuaries and data scientists, and

to develop cutting-edge products.

Combined specialty lines premiums

grew to $2.3 billion in 2018, nearly a

quarter of IFC’s book of business.

We are on track to reach our goal of

$3 billion and achieve a sustainable

combined ratio in the low 90s in the

medium term.

Having the right people with the right

expertise is critical to the success of the

specialty business. We are now better

positioned to leverage the significant

opportunities we see in specialty lines

across North America including growing

our Canadian cross-border business,

expanding the most attractive

OneBeacon product oerings in both

the U.S. and Canada, and leveraging

our sharing economy expertise.

Our company is one of

the most respected

To be one of the most respected

companies we must, above all, live

our values in the marketplace every

day. That includes putting in place

strong governance and abiding by

the highest ethical standards. As our

Chairman notes in his letter, we have

consistently performed well in external

governance reviews.

Net operating income per share

2009 2018

$4.3B

$10.1B

2009 2018

$2.35

$5.74

10.4

%

CAGR

10

%

CAGR

2009 2018

$0.32

$0.70

9

%

CAGR

0

5

10

15

20

S&P/TSX

Composite

IFC

15.3%

7.9%

650 bps

10YEAR

AVERAGE ROE

OUTPERFORMANCE

Intact Financial Corporation 2018 Annual Report

8

CEO’S MESSAGE

Our team of data scientists and

actuaries at the Data Lab are rolling out

our latest rating algorithms. We see

strong evidence that our investments

in AI will drive eciencies, growth and

margin expansion in the years ahead

through more accurate pricing to better

reflect risk and a more personalized

product for customers.

Making a dierence

Making a dierence is in our DNA, and

it is reflected in our purpose and how

we live our values. Those values help

us make the right decisions whether we

are talking about financial performance

or supporting our communities.

Employees and customers are

increasingly looking to businesses to

take the lead on important societal

issues. We must challenge ourselves

over the next 10 years to have a greater

presence in our communities, and to

be more generous of our time, our

knowhow and our financial resources.

So how do we begin to raise the bar?

Over the last 10 years, we have donated

more than $37 million to charitable

causes, including more than $6 million in

2018 alone. Climate change adaptation,

addressing the root causes of child

poverty, and supporting employee

account for them. We also co-hosted

the Geneva Association Global Forum

on Pathways to Climate-Resilient Critical

Infrastructure in Toronto last September.

We will continue to use our knowledge,

experience and expertise in 2019 to

work with our partners to find solutions.

Child poverty is another serious issue

that needs immediate attention right

here in our own backyard. Today one

in five children in Canada lives in

poverty. This year, Intact’s donation

to the United Way was designated to

agencies that specifically address child

poverty issues. And we will continue

to build on our commitment in this

area of focus.

In 2018, we also supported the Roméo

Dallaire Child Soldiers Initiative to

establish a regional centre of training and

learning in Rwanda. These funds will help

the Dallaire Initiative establish a

permanent presence in Africa. This is a

cause that has been widely embraced

by our employees and I spent time in

Rwanda last spring with the Dallaire

Initiative and saw first-hand the

importance of their work. While the

problem of using children in wars is far

from resolved, the General's team is

moving the needle and making progress.

citizenship through our community

impact program are at the heart of

our giving.

Supporting climate change adaptation

initiatives has been, and will continue

to be, at the top of our list. We saw the

canary in the coal mine 10 years ago

and we’ve been helping our customers

manage the direct eects of increased

flooding, fire and other extreme weather

events ever since. We continue to see the

benefits in our investment in the Intact

Centre for Climate Adaptation at the

University of Waterloo. Dr. Blair Feltmate

and the team had outstanding success

this year working with government

partners to strengthen building codes

and flood standards and to give

homeowners practical tools and tips

to protect their homes from flooding.

We are working with other global

insurers, governments and non-

government organizations on climate

change. This year, we joined the United

Nations Environment Programme

Finance Initiative (UNEP FI) Task Force

on Climate-related Financial Disclosures

(TCFD) pilot, bringing together 16 of

the world's largest insurers to better

understand the impacts of climate

change on their business and how to

Climate change adaptation, addressing the root

causes of child poverty, and supporting employee

citizenship through our community impact program

are at the heart of our giving.

Over the last 10 years we

have donated more than

$37 million

to charitable causes

Intact Financial Corporation 2018 Annual Report

9

CEO’S MESSAGE

We will challenge ourselves to do better

in supporting climate change adaptation

and addressing the root causes of child

poverty in 2019 and beyond.

As beneficiaries of the power of AI,

we will also turn more of our attention

to the uncertainty this creates around

the future of work. People are

increasingly concerned about the

impact of technology on jobs and

whether they can continue to get

ahead. It is up to companies like Intact

to help our employees navigate this

uncertainty and gain new skills, and

for us to continue to grow and provide

good jobs in the future.

I would like to thank our shareholders

and brokers for their support over the

last 10 years and our world-class team

of employees across North America

for their dedication to our customers

and communities.

Conclusion

Our values, our people and our

strategy have been foundational to

our success over the last 10 years

and they will continue to underpin

our work over the next 10.

Our customer driven culture and our

care for our people during a period of

transformational change are what will

dierentiate us. We are confident that

this will fuel profitable growth and

another decade of outperformance on

our financial objectives as we establish

ourselves as a world-class P&C

insurance company.

Charles Brindamour

Chief Executive Ocer

•

Combined ratio of 93.0% in 2018

•

$2.3B of DPW in 2018

•

Steady improvement in

OneBeacon performance

•

NOIPS CAGR >10% since 2009

•

Track record of exceeding 500 bps

of ROE outperformance vs industry

•

Ranked #2 in Corporate Governance

out of all TSX listed companies

•

Invested in machine learning

and artificial intelligence

Our

Specialty

Solutions

business is

a leader

in N.A.

Our

company

is one of the

most

respected

•

Launched self-service app

•

Launched mobile UBI 2.0

•

Maintained #1 and #2 brand

consideration nationally for

Intact Insurance and belairdirect

•

Aon Best Employer

•

Canada’s Top 100 Employers

•

Canada’s Top Employers

for Young People

•

25 Best Places to Work (Glassdoor)

Our

customers

are our

advocates

Our

people

are

engaged

Our strategy

Intact Financial Corporation 2018 Annual Report

10

CHAIRMAN’S MESSAGE

Intact continues to accelerate its digital oerings, investing

in software engineering, machine learning and artificial

intelligence to design relevant products and provide options

for customers.

Intact is celebrating its 10-year

anniversary in 2019. It became an

independent and widely held company

in 2009 against the backdrop of the

global financial crisis. It was a bold move

that has consistently delivered strong

growth for you over the last 10 years.

In 2018, Intact delivered solid results

across underwriting, investments and

distribution, in both Canada and the

U.S. Net Operating Income Per Share

(NOIPS)

1

of $5.74 drove Operating

Return on Equity (OROE)

1

of 12.1%,

with over $1.3 billion of total capital

margin. In addition, the Company

announced a 9% increase in the

quarterly dividend for shareholders

to $0.76 per common share – the 14th

consecutive annual increase.

Under the leadership of Charles Brindamour

and his management team, the Company

continues to excel, outperform and deliver

value to you while staying grounded in its

founding values – integrity, respect,

customer driven, strive for excellence

and socially responsible.

Despite continued challenges with

extreme weather across North America,

personal auto in Canada and recent

market volatility, the Company is

well-positioned to outperform in a

changing environment, through

enhanced risk selection, better

segmentation and leveraging data

analytics.

Intact continues to accelerate its digital

oerings, investing in software

engineering, machine learning and

artificial intelligence to design relevant

products and provide options for

customers. With the successful

integration of OneBeacon in the U.S.

and close to $2.3 billion in combined

direct premiums written in 2018, Intact

is making good strides towards

achieving its goal of creating a leading

specialty insurer in North America.

10 years of

outperformance

Recognizing the significance of climate

change and the Company's expertise as

a risk manager, Intact is participating in

the United Nations Environment

Programme Finance Initiative (UNEP FI)

Task Force on Climate-related Financial

Disclosures (TCFD) pilot to help better

assess the intensifying impacts of

climate change on the business.

Built on strong governance principles,

and a high standard of compliance and

ethics, Intact is today one of the most

respected companies in Canada. The

Company was ranked first (tie) by the

Clarkson Centre for Board Eectiveness

in its Board Shareholder Confidence

Index 2018, for the third year running.

This index examines the quality of

corporate governance practices among

Canadian public companies. As well,

Intact maintained its second position

in The Globe and Mail’s 2018 Board

Games report card.

1 These are non-IFRS financial measures. See glossary on page 170 for definitions.

Intact Financial Corporation 2018 Annual Report

11

CHAIRMAN’S MESSAGE

The Company was one of three companies awarded with

Platinum Parity Certification by Women in Governance,

recognized for its ongoing focus and progress in developing

women in the workplace.

Claude Dussault

Chairman of the Board

Intact was also recognized by Brendan

Wood International (BWI) as one of

five 2018 Global TopGun insurance

companies for transparency and

financial reporting. Louis Marcotte

was also named a Global TopGun CFO

by BWI.

Having engaged employees is integral

to Intact’s success. Besides retaining

past awards – an Aon Best Employer in

Canada at the platinum level, one of

Canada's Top 100 Employers and

Greater Toronto’s Top Employers, and

one of Canada's Top Employers for

Young People, the Board is pleased

to note that Intact was voted for the

first time as one of the 25 Top-Rated

Workplaces in Canada by Indeed,

Canada's top job search site, as well

as one of the 25 best places to work

in Canada, by Glassdoor. Also,

the Company was one of three

companies awarded with Platinum

Parity Certification by Women in

Governance, recognized for its ongoing

focus and progress in developing

women in the workplace. These

accolades speak to the Company’s

commitment to talent development,

employee engagement and diversity.

I want to thank Louise Roy who retired

from the Board in 2018. Louise served

on the Board of the Company since

its IPO in 2004 and brought her

expertise to the Board’s Human

Resources and Corporate Governance

committees during her tenure.

Following Louise’s retirement, we

welcomed William L. Young, a director

with extensive public company board

and board leadership experience

gained at several U.S., Canadian and

European-based companies.

As Intact marks a decade of delivering

for customers and outperforming, l

want to pay tribute to the management

team and employees at Intact, who

deliver on the Company’s purpose

every day – helping people, businesses

and society prosper in good times

and be resilient in bad times. Your

dedication, passion and commitment

are most admirable and are what sets

the Company apart in the marketplace.

To shareholders, customers and

brokers, thank you for your trust and

support over the last decade. It is

with your continued trust that Intact

will continue to grow, outperform

and succeed in 2019, and for many

years to come.

Intact Financial Corporation 2018 Annual Report

12

GOVERNANCE

Claude Dussault

Chairman of the Board of Intact Financial

Corporation and President of ACVA Investing

Corporation

Charles Brindamour

Chief Executive Ocer

Robert W. Crispin

2,4

Corporate Director

Janet De Silva

2,3

President & CEO of Toronto Region Board of Trade

Robert G. Leary

1,4

CEO, Olayan Group

Eileen Mercier

1,4

Corporate Director

Sylvie Paquette

1,4

Corporate Director

Timothy H. Penner

2,3

Corporate Director

Frederick Singer

2,4

CEO of Echo360

Stephen G. Snyder

1,3

Corporate Director

Carol Stephenson

2,3

Corporate Director

William L. Young

1,3

Corporate Director

Charles Brindamour

Chief Executive Ocer

Louis Gagnon

President, Canadian Operations

T. Michael Miller

President, U.S. and Specialty Solutions

Patrick Barbeau

Senior Vice President, Claims

Martin Beaulieu

Senior Vice President and Chief Risk Ocer

Paul Brehm

Senior Vice President, Specialty Solutions

Sonya Côté

Senior Vice President and Chief Internal Auditor

Frédéric Cotnoir

Senior Vice President, Corporate and Legal Services

and Secretary

Debbie Coull-Cicchini

Executive Vice President, Intact Insurance

Dennis Crosby

Senior Vice President, Specialty Solutions (U.S.)*

Luisa Currie

Senior Vice President, Western Canada**

Joe D’Annunzio

Senior Vice President, BrokerLink

Jean-François Desautels

Senior Vice President, Québec and Digital

Distribution, Intact Insurance

Monika Federau

Senior Vice President and Chief Strategy Ocer

Anne Fortin

Senior Vice President, Direct Distribution and

Chief Marketing Ocer

Don Fox

Executive Vice President

Darren Godfrey

Senior Vice President, Personal Lines

Natalie Higgins

Senior Vice President, Atlantic Canada***

Karim Hirji

Senior Vice President, International and Ventures

Mathieu Lamy

Executive Vice President and Chief Operating Ocer

Alain Lessard

Senior Vice President, Commercial Lines

Louis Marcotte

Senior Vice President and Chief Financial Ocer

Lucie Martel

Senior Vice President and Chief Human Resources

Ocer

Benoit Morissette

Senior Vice President and Group Chief Actuary

Werner Muehlemann

Senior Vice President and Managing Director,

Intact Investment Management Inc.

Carla Smith

Senior Vice President, Corporate Development

Mark A. Tullis

Vice Chairman

Peter Weightman

Senior Vice President, Specialty Solutions and

Surety (Canada)

Notes:

1 Denotes member of the Audit Committee

2 Denotes member of the Compliance Review and Corporate Governance Committee

3 Denotes member of the Human Resources and Compensation Committee

4 Denotes member of the Risk Management Committee

Complete biographies of the members of the Board of Directors available on www.intactfc.com.

* As of January 1, 2019, transition to part-time status.

** Since June 1, 2018

*** Since April 2018

Board of Directors

Executive Committee Members

This page is

intentionally

left blank.

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

INTACT FINANCIAL CORPORATION 1

The following MD&A is the responsibility of management and has been reviewed and approved by the Board of Directors (or “Board”) for the year

ended December 31, 2018. This MD&A is intended to enable the reader to assess our results of operations and financial condition for the three-

and twelve-month periods ended December 31, 2018, compared to the corresponding periods in 2017. It should be read in conjunction with our

Consolidated financial statements for our fiscal year ended December 31, 2018. This MD&A is dated February 5, 2019.

“Intact”, the “Company”, “IFC”, “we” and “our” are terms used throughout the document to refer to Intact Financial Corporation and its subsidiaries.

Further information about Intact Financial Corporation, including the Annual Information Form, may be found online on SEDAR at www.sedar.com.

Table of contents

OVERVIEW ....................................................................................................................................................................... 5

Section 1 – About Intact Financial Corporation ............................................................................................................................................................ 5

Section 2 – Our performance at a glance..................................................................................................................................................................... 7

Section 3 – Consolidated performance ........................................................................................................................................................................ 8

SEGMENT PERFORMANCE .......................................................................................................................................... 10

Section 4 – Canada ................................................................................................................................................................................................... 10

Section 5 – U.S. ........................................................................................................................................................................................................ 16

Section 6 – Corporate and Other ............................................................................................................................................................................... 19

ENVIRONMENT & OUTLOOK ....................................................................................................................................... 22

Section 7 – Insurance industry at a glance ................................................................................................................................................................ 22

Section 8 – Operating environment ........................................................................................................................................................................... 23

Section 9 – Outlook ................................................................................................................................................................................................... 24

STRATEGY ..................................................................................................................................................................... 26

Section 10 – Strategy update .................................................................................................................................................................................... 26

Section 11 – Unique advantages ............................................................................................................................................................................... 31

Section 12 – Social responsibility .............................................................................................................................................................................. 33

FINANCIAL CONDITION ................................................................................................................................................ 36

Section 13 – Financial position .................................................................................................................................................................................. 36

Section 14 – Investments .......................................................................................................................................................................................... 37

Section 15 – Claims liabilities and reinsurance .......................................................................................................................................................... 40

Section 16 – Employee future benefit programs ........................................................................................................................................................ 43

Section 17 – Treasury management .......................................................................................................................................................................... 44

Section 18 – Capital management ............................................................................................................................................................................. 47

RISK MANAGEMENT ..................................................................................................................................................... 49

Section 19 – Overview ............................................................................................................................................................................................... 49

Section 20 – Risk management structure .................................................................................................................................................................. 49

Section 21 – Corporate governance and compliance program ................................................................................................................................... 51

Section 22 – Enterprise Risk Management ................................................................................................................................................................ 52

Section 23 – Off-balance sheet arrangements ........................................................................................................................................................... 67

Section 24 – Sensitivity analyses ............................................................................................................................................................................... 68

ADDITIONAL INFORMATION ........................................................................................................................................ 69

Section 25 – Financial KPIs and definitions ............................................................................................................................................................... 69

Section 26 – Non-operating results ............................................................................................................................................................................ 72

Section 27 – Non-IFRS financial measures ............................................................................................................................................................... 73

Section 28 – Accounting and disclosure matters........................................................................................................................................................ 76

Section 29 – Shareholder information ........................................................................................................................................................................ 78

Section 30 – Selected annual and quarterly information ............................................................................................................................................ 79

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

2 INTACT FINANCIAL CORPORATION

Non-IFRS financial measures

We use both IFRS and non-IFRS financial measures to assess our performance. Non-IFRS financial measures do not have any

standardized meaning prescribed by IFRS and are unlikely to be comparable to any similar measures presented by other

companies. The non-IFRS measures included in this MD&A are: direct premiums written (DPW), change or growth in constant

currency, net earned premiums (NEP), total net claims, underlying current year loss ratio, underwriting expenses, underwriting

income (loss), combined ratio, net distribution income, net operating income (NOI), net operating income per share (NOIPS),

operating return on equity (OROE), adjusted net income, adjusted net income per share (AEPS), adjusted return on equity (AROE)

and market based yield. See Section 27 – Non-IFRS financial measures for the definition and reconciliation to the most

comparable IFRS measures. These measures and other insurance-related terms used in this MD&A are defined in the glossary

available in the “Investors” section of our web site at www.intactfc.com.

Important notes

• Unless otherwise noted, DPW refer to DPW normalized for the effect of multi-year policies, excluding industry pools, fronting

and exited lines (referred to as “DPW” in this MD&A). DPW for 2017 were adjusted to exclude fronting from P&C Canada, to

enhance comparability with our current reporting. See Table 29 for details on exited lines and Table 31 for the

reconciliation to DPW, as reported under IFRS. All underwriting results and related ratios exclude the MYA and the results

of our U.S. Commercial exited lines, unless otherwise noted. The expense and general expense ratios are presented herein

net of other underwriting revenues.

• Catastrophe claims are any one claim, or group of claims, equal to or greater than $7.5 million for P&C Canada (US$5 million

for P&C U.S.) related to a single event (referred to as the “CAT threshold”), and can either be weather-related or not weather-

related (‘other than weather-related’). A non-catastrophe weather event is a group of claims, which is considered significant but

that is smaller than the CAT threshold, related to a single weather event.

• A large loss is defined as a single claim larger than $0.25 million for P&C Canada (US$0.25 million for P&C U.S.) but smaller

than the CAT threshold.

• When relevant, we present changes in constant currency, which exclude the impact of fluctuations in foreign exchange rates

from one period to the other, to enhance the analysis of our results with comparative periods. See Section 27 – Non-IFRS

financial measures.

• Regulatory Capital Ratios refer to MCT (as defined by OSFI and the AMF in Canada) and RBC (as defined by the NAIC in the

U.S.). All references to “total capital margin” in this MD&A include the aggregate of capital in excess of company action levels

in regulated entities (170% MCT, 200% RBC and other CALs in other jurisdictions) plus available cash in unregulated entities.

• Unless otherwise noted, market share and market related data for P&C Canada are based on the latest available data (YTD

Q3-2018) from MSA Research Inc. (“MSA”) and excludes LIoyd’s Underwriters Canada, Insurance Corporation of British

Columbia, Saskatchewan Government Insurance, Saskatchewan Auto Fund, Genworth Financial Mortgage Insurance

Company Canada and Canada Guaranty Mortgage Insurance Company. MSA data excludes certain Québec regulated

entities. Market share and market positioning reflect the impact of announced or completed acquisitions and are therefore

presented on a pro forma basis.

• Certain totals, subtotals and percentages may not agree due to rounding. Not meaningful (nm) is used to indicate that the

current and prior year figures are not comparable, not meaningful, or if the percentage change exceeds 1,000%.

Cautionary note regarding forward-looking statements

Certain of the statements included in this MD&A about the Company’s current and future plans, expectations and intentions,

results, levels of activity, performance, goals or achievements or any other future events or developments constitute forward-

looking statements. The words “may”, “will”, “would”, “should”, “could”, “expects”, “plans”, “intends”, “trends”, “indications”,

“anticipates”, “believes”, “estimates”, “predicts”, “likely”, “potential” or the negative or other variations of these words or other similar

or comparable words or phrases, are intended to identify forward-looking statements. Unless otherwise indicated, all forward-

looking statements in this MD&A are made as at December 31, 2018 and are subject to change after that date.

Forward-looking statements are based on estimates and assumptions made by management based on management’s experience

and perception of historical trends, current conditions and expected future developments, as well as other factors that management

believes are appropriate in the circumstances. Many factors could cause the Company’s actual results, performance or

achievements or future events or developments to differ materially from those expressed or implied by the forward-looking

statements, including, without limitation, the following factors:

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

INTACT FINANCIAL CORPORATION 3

• the Company’s ability to implement its strategy or operate

its business as management currently expects;

• its ability to accurately assess the risks associated with the

insurance policies that the Company writes;

• unfavourable capital market developments or other factors

which may affect the Company’s investments, floating rate

securities and funding obligations under its pension plans;

• the cyclical nature of the P&C insurance industry;

• management’s ability to accurately predict future claims

frequency and severity, including in the personal auto line of

business;

• government regulations designed to protect policyholders

and creditors rather than investors;

• litigation and regulatory actions; periodic negative publicity

regarding the insurance industry;

• intense competition;

• the Company’s reliance on brokers and third parties to sell

its products to clients and provide services to the Company;

• the Company’s ability to successfully pursue its acquisition

strategy; the Company’s ability to execute its business

strategy; the Company’s ability to successfully pursue its

acquisition strategy;

• the Company’s ability to execute its business strategy;

• the Company’s ability to achieve synergies arising from

successful integration plans relating to acquisitions;

• the Company’s profitability following the acquisition (the

“Acquisition”) of OneBeacon Insurance Group, Ltd.

(“OneBeacon”);

• the Company’s ability to improve its Combined Ratio in the

United States in relation to the Acquisition;

• the Company’s ability to retain business and key employees

in the United States in relation to the Acquisition;

• undisclosed liabilities in relation to the Acquisition;

• the Company’s participation in the Facility Association (a

mandatory pooling arrangement among all industry

participants) and similar mandated risk-sharing pools;

• terrorist attacks and ensuing events;

• the occurrence and frequency of catastrophe events,

including a major earthquake;

• catastrophe losses caused by severe weather and other

weather-related losses, as well as the impact of climate

change;

• the Company’s ability to maintain its financial strength and

issuer credit ratings; the Company’s access to debt and

equity financing;

• the Company's ability to compete for large commercial

business;

• the Company’s ability to alleviate risk through reinsurance;

• the Company’s ability to successfully manage credit risk

(including credit risk related to the financial health of

reinsurers);

• the Company’s ability to contain fraud and/or abuse; the

Company’s reliance on information technology and

telecommunications systems and potential failure of or

disruption to those systems, including in the context of

evolving cybersecurity risk;

• the impact of developments in technology and use of data

on the Company’s products and distribution;

• the Company’s dependence on and ability to retain key

employees;

• changes in laws or regulations;

• general economic, financial and political conditions;

• the Company’s dependence on the results of operations of

its subsidiaries and the ability of the Company’s subsidiaries

to pay dividends;

• the volatility of the stock market and other factors affecting

the trading prices of the Company’s securities;

• the Company’s ability to hedge exposures to fluctuations in

foreign exchange rates;

• future sales of a substantial number of its common shares;

• changes in applicable tax laws, tax treaties or tax

regulations or the interpretation or enforcement thereof.

All of the forward-looking statements included in this MD&A and the quarterly earnings press release dated February 5, 2019, are

qualified by these cautionary statements and those made in the section entitled Risk management (Sections 19-24) of our MD&A

for the year ended December 31, 2018. These factors are not intended to represent a complete list of the factors that could affect

the Company. These factors should, however, be considered carefully. Although the forward-looking statements are based upon

what management believes to be reasonable assumptions, the Company cannot assure investors that actual results will be

consistent with these forward-looking statements. When relying on forward-looking statements to make decisions, investors should

ensure the preceding information is carefully considered. Undue reliance should not be placed on forward-looking statements made

herein. The Company and management have no intention and undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise, except as required by law.

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

4 INTACT FINANCIAL CORPORATION

Glossary of abbreviations

Description

Description

AEPS

Adjusted EPS

MD&A

Management’s Discussion and Analysis

AFS

Available for sale

Moody’s

Moody’s Investor Service Inc.

AMF

Autorité des marchés financiers

MYA

Market yield adjustment

AOCI

Accumulated OCI

NAIC

National Association of Insurance Commissioners

AROE

Adjusted ROE

NCIB

Normal course issuer bid

BVPS

Book value per share

NEP

Net earned premiums

CAD

Canadian Dollar

NOI

Net operating income

CAGR

Compound annual growth rate

NOIPS

NOI per share

CAL

Company action level

OCI

Other comprehensive income

CAN

Canada

OROE

Operating ROE

CAT

Catastrophe

OSFI

Office of the Superintendent of Financial Institutions

DBRS

Dominion Bond Rating Services

P&C

Property & Casualty

DPW

Direct premiums written

PTOI

Pre-tax operating income

EPS

Earnings per share to common shareholders

PYD

Prior year claims development

Fitch

Fitch Ratings Inc.

RBC

Risk-based capital

FVTPL

Fair value through profit and loss

ROE

Return on equity

IFRS

International Financial Reporting Standards

S&P

Standard & Poor’s

KPI

Key performance indicator

U.S.

United States

MCT

Minimum capital test

USD

U.S. Dollar

This icon represents data relevant to environmental, social and governance (ESG) disclosure including its impact

on our results where applicable.

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

INTACT FINANCIAL CORPORATION 5

OVERVIEW

Section 1 – About Intact Financial Corporation

1.1 Who we are

• Largest provider of P&C insurance in Canada and a leading provider of specialty insurance in North America, with over

$10 billion in annual DPW.

• Approximately 14,000 full- and part-time employees who serve more than five million personal, business and public sector

customers through offices in Canada and the U.S.

• In Canada, we distribute insurance under the Intact Insurance brand through a wide network of brokers, including our wholly-

owned subsidiary BrokerLink, and directly to consumers through belairdirect. In the U.S., OneBeacon, a wholly-owned

subsidiary, provides specialty insurance products through independent agencies, brokers, wholesalers and managing general

agencies.

• We are a proven industry consolidator with a track record of 16 successful P&C acquisitions since 1988.

1.2 What we offer

With our comprehensive range of auto, home and business insurance products, we offer customers protection tailored to meet their

unique needs. Across Intact, we share the same goal: We are here to help people, businesses and society prosper in good times

and be resilient in bad times. Making a difference is important to us; it is our purpose.

2018 DPW

by business segment

2018 DPW

by line of business

2018 DPW

by brand

15%

85%

Canada Insurance

U.S. Insurance

22%

26%

15%

37%

Personal auto

Personal property

Commercial lines- Canada

Commercial lines- U.S.

8%

14%

15%

63%

Intact insurance BrokerLink

belairdirect OneBeacon

$8.6B

$1.5B

1

1

Represents Intact insurance premiums sold

through BrokerLink

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

6 INTACT FINANCIAL CORPORATION

1.3 Our business segments

We report our financial results under the business segments set out below. The composition of our segments is aligned with our

management structure and internal financial reporting based on geography and the nature of our activities.

Intact Financial Corporation

Canada

(CAN)

Comprised of underwriting (P&C Canada) and distribution activities in Canada

• Underwriting of automobile, home and business insurance contracts to individual and businesses in

Canada. Underwriting results in Canada are reported under three lines of business (see Section 4):

• Personal auto

• Personal property

• Commercial, which include Commercial auto and Commercial P&C

• Distribution operations, including the operating results of our wholly-owned broker, BrokerLink, as

well as our share of results of broker affiliates.

U.S.

Comprised of underwriting activities in the U.S. (P&C U.S.)

• Underwriting of specialty contracts mainly to small and midsize businesses in the U.S., which are

reported under:

• Commercial lines, which include the underwriting results of OneBeacon since September 28,

2017 (see Section 5).

Corporate

and Other

(Corporate)

Comprised of the following activities, which are managed at the Corporate level

• Investment management

• Treasury and capital management

• Other corporate activities, including internal reinsurance

Operating results include net investment income, finance costs, as well as other income and expenses

(including corporate expenses and ancillary income) (see Section 6).

We measure our consolidated performance mainly based on NOIPS and business segment performance based on pre-tax

operating income (PTOI).

Table 1 – Operating performance by segment

1

For the years ended Dec. 31,

2018

2017

CAN

U.S.

Corporate

Total

CAN

U.S.

Corporate

Total

DPW

8,601

1,489

-

10,090

8,423

307

-

8,730

NEP

8,332

1,380

3

9,715

8,204

326

-

8,530

Operating income

Underwriting income

400

71

3

474

478

8

-

486

Net investment income

-

-

529

529

-

-

432

432

Net distribution income

146

-

-

146

132

-

-

132

Finance costs

-

-

(103)

(103)

-

-

(82)

(82)

Other income (expense)

-

-

(18)

(18)

-

-

5

5

Pre-tax operating income (PTOI)

546

71

411

1,028

610

8

355

973

Net operating income (NOI)

839

771

NOIPS (in dollars)

5.74

5.60

1

Refer to Section 27 – Non-IFRS financial measures.

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

INTACT FINANCIAL CORPORATION 7

Section 2 – Our performance at a glance

Full year 2018 Highlights

DPW growth

NOIPS growth

OROE

Total capital

margin

BVPS

+16%

+3%

12.1%

$1.3 billion

+2%

• Net operating income per share up 19% to $1.93 in Q4-2018 driven by solid operating results

• Premiums grew 4% in the quarter and 16% for the full year fuelled by commercial lines across North America

• Combined ratio of 91.7% in Q4-2018 with significant improvement in personal auto

• Full year NOIPS of $5.74 drove Operating ROE of 12.1%, with over $1.3 billion of total capital margin

• Quarterly dividend increased by 9% to $0.76 per common share

DPW

Combined ratio

NOIPS (in dollars)

1,959

2,293

2,392

Q4

8,277

10,090

8,730

Annual

92.5%

91.7%

95.1%

95.3%

92.6%

94.3%

Q4 Annual

2016 2017 2018

1.58

1.93

1.63

Q4

4.88

5.60

5.74

Annual

EPS (in dollars)

Operating ROE

Total capital margin

1.27

1.67

1.60

Q4

3.97

5.75

4.79

Annual

12.0%

12.1%

12.9%

Annual

2016 2017 2018

970

1,333

1,135

Annual

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

8 INTACT FINANCIAL CORPORATION

Section 3 – Consolidated performance

Table 2 – Consolidated performance

1

Q4-2018

Q4-2017

Change

2018

2017

Change

DPW

2,392

2,293

4%

10,090

8,730

16%

NEP

2,509

2,400

5%

9,715

8,530

14%

Operating income

Underwriting income

210

178

32

474

486

(12)

Net investment income

140

121

19

529

432

97

Net distribution income

36

28

8

146

132

14

Finance costs

(27)

(25)

(2)

(103)

(82)

(21)

Other income (expense)

(6)

2

(8)

(18)

5

(23)

PTOI

353

304

49

1,028

973

55

NOI

281

236

19%

839

771

9%

Non-operating gains (losses)

(42)

(58)

16

(142)

(31)

(111)

Effective income tax rate

21.5%

5.9%

15.6 pts

20.2%

15.9%

4.3 pts

Net income

244

232

5 %

707

792

(11)%

Underwriting ratios

Claims ratio

62.7%

63.5%

(0.8) pts

65.3%

65.4%

(0.1) pts

Expense ratio

29.0%

29.1%

(0.1) pts

29.8%

28.9%

0.9 pts

Combined ratio

91.7%

92.6%

(0.9) pts

95.1%

94.3%

0.8 pts

Per share measures, basic and diluted

(in dollars)

NOIPS

1.93

1.63

19%

5.74

5.60

3%

EPS

1.67

1.60

4%

4.79

5.75

(17)%

BVPS

48.73

48.00

2%

Return on equity for the last 12 months

OROE

12.1%

12.9%

(0.8) pts

ROE

9.9%

12.8%

(2.9) pts

Total capital margin

1,333

1,135

198

Debt-to-total capital ratio

22.0%

23.1%

(1.1) pts

1

Refer to Section 27 – Non-IFRS financial measures.

Table 3 – Performance by business segment

1

Section

Q4-2018

Q4-2017

Change

2018

2017

Change

DPW growth in constant currency

Canada

4.4

2,067

1,986

4%

8,601

8,423

2%

U.S.

5.3

325

307

2%

1,489

307

nm

2,392

2,293

4%

10,090

8,730

16%

Combined ratio

Canada

4.4

90.8%

91.9%

(1.1) pts

95.2%

94.2%

1.0 pts

U.S.

5.3

96.7%

97.4%

(0.7) pts

94.8%

97.4%

nm

91.7%

92.6%

(0.9) pts

95.1%

94.3%

0.8 pts

PTOI

Canada

4.3

232

198

17%

546

610

(10)%

U.S.

5.3

13

8

63%

71

8

nm

Corporate and Other

6.4

108

98

10%

411

355

16%

353

304

16%

1,028

973

6%

1

Refer to Section 27 – Non-IFRS financial measures.

INTACT FINANCIAL CORPORATION

Management’s Discussion and Analysis for the year ended December 31, 2018

(in millions of Canadian dollars, except as otherwise noted)

INTACT FINANCIAL CORPORATION 9

Constant currency

With the acquisition of OneBeacon, approximately 15% of our premiums are written in USD. The impact of fluctuations in foreign exchange

rates was not material to our consolidated performance for the year ended December 31, 2018. See Section 5 – U.S. for the impact on our

U.S. results.

▪

Q4-2018 vs Q4-2017

2018 vs 2017

DPW growth

• Our premiums grew 4% in the quarter with strong

growth in commercial and specialty lines across

North America.

• Our premiums grew 16% for the full year, mainly

from the acquisition of OneBeacon which contributed

14% to our topline, and strong growth in both

commercial and speciality lines in Canada.

Underwriting

performance

• Overall combined ratio was solid at 91.7%, with

improved underlying performances in both Canada

and the U.S.

• Combined ratio for Canada was strong at 90.8%,

1.1 points better than last year, reflecting significant

improvement in personal auto, tempered by a

deterioration in commercial lines.

• Overall combined ratio of 95.1% with solid

underlying performances in both Canada and the

U.S.

• Combined ratio for Canada deteriorated by

one point to 95.2%, as the improvement in personal

auto was more than offset by higher large losses and

catastrophe losses in commercial lines.

• Combined ratio in the U.S. was 96.7%, as a

healthy underlying performance was offset by

5.9 points of CAT losses.

• Solid combined ratio in the U.S. of 94.8%, in line

with expectations for 2018, reflecting good progress

towards our goal of achieving a sustainable

combined ratio in the low-90s within 18-24 months.

Net investment

income

• Net investment income was up 16% from

investment optimization initiatives and higher yields.

• Net investment income was up 22%, due to the

growth in our investment portfolio following the

acquisition of OneBeacon, as well as investment

optimization initiatives and higher yields.

Net distribution

income

• Net distribution income was up 29% to

$36 million due to organic growth, improved

margins and broker acquisitions.

• Net distribution income was up 11% to

$146 million, reflecting the continued growth of our

broker network and improved profitability.

NOIPS

• NOIPS of $1.93 up 19%, due to improved

underwriting performance and strong growth in both

net investment income and net distribution income.

• NOIPS of $5.74 improved by 3%, largely driven by

the acquisition of OneBeacon, which delivered solid

underwriting results and drove the strong growth in

net investment income.

Effective

income tax rate

• Effective income tax rate of 21.5% for the quarter and 20.2% for the full year was largely in line with

expectations. In 2017, the effective income tax rate was unusually low as it included a one-time income tax

recovery related to the enactment of the U.S. Corporate tax reform as well as higher non-taxable gains.

Net income

• Net income of $244 million was up 5%, driven by

solid operating earnings.

• Net income of $707 million was down 11%,

despite higher operating earnings. In 2017, we had

benefited from one-time non-operating gains relating

to the acquisition of OneBeacon.

OROE

• Operating ROE for the 12 months ended December 31, 2018 was 12.1%, due to weak personal auto results

in the earlier part of 2018, as well as elevated large losses in commercial lines. Our OROE remains well above

the industry, though below our historical track record.

Financial

condition

• BVPS of $48.73 increased 2% from a year ago as our earnings, net of common share dividends, were offset