NREL is a national laboratory of the U.S. Department of Energy, Office of Energy

Efficiency & Renewable Energy, operated by the Alliance for Sustainable Energy, LLC.

Contract No. DE-AC36-08GO28308

Methodology for Calculating

Cost per Mile for Current and

Future Vehicle Powertrain

Technologies, with Projections

to 2024

Preprint

M. Ruth

National Renewable Energy Laboratory

T.A. Timbario, T.J.Timbario, and M. Laffen

Alliance Technical Services, Inc.

To be presented at SAE 2011 World Congress

Detroit, Michigan

April 12-14, 2011

Conference Paper

NREL/CP-6A10-49231

January 2011

NOTICE

The submitted manuscript has been offered by an employee of the Alliance for Sustainable Energy, LLC

(Alliance), a contractor of the US Government under Contract No. DE-AC36-08GO28308. Accordingly, the US

Government and Alliance retain a nonexclusive royalty-free license to publish or reproduce the published form of

this contribution, or allow others to do so, for US Government purposes.

This report was prepared as an account of work sponsored by an agency of the United States government.

Neither the United States government nor any agency thereof, nor any of their employees, makes any warranty,

express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of

any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately

owned rights. Reference herein to any specific commercial product, process, or service by trade name,

trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation,

or favoring by the United States government or any agency thereof. The views and opinions of authors

expressed herein do not necessarily state or reflect those of the United States government or any agency thereof.

Available electronically at

http://www.osti.gov/bridge

Available for a processing fee to U.S. Department of Energy

and its contractors, in paper, from:

U.S. Department of Energy

Office of Scientific and Technical Information

P.O. Box 62

Oak Ridge, TN 37831-0062

phone: 865.576.8401

fax: 865.576.5728

email:

mailto:reports@adonis.osti.gov

Available for sale to the public, in paper, from:

U.S. Department of Commerce

National Technical Information Service

5285 Port Royal Road

Springfield, VA 22161

phone: 800.553.6847

fax: 703.605.6900

email:

[email protected]world.gov

online ordering:

http://www.ntis.gov/help/ordermethods.aspx

Cover Photos: (left to right) PIX 16416, PIX 17423, PIX 16560, PIX 17613, PIX 17436, PIX 17721

Printed on paper containing at least 50% wastepaper, including 10% post consumer waste.

1

11PFL-0226

Methodology for Calculating Cost-per-Mile for Current and Future

Vehicle Powertrain Technologies, with Projections to 2024

Mark Ruth

National Renewable Energy Laboratory

Thomas A. Timbario, Thomas J. Timbario, Melissa Laffen

Alliance Technical Services, Inc.

ABSTRACT

Currently, several cost-per-mile calculators exist that can provide estimates of acquisition and operating costs for consumers and

fleets. However, these calculators are limited in their ability to determine the difference in cost per mile for consumer versus fleet

ownership, to calculate the costs beyond one ownership period, to show the sensitivity of the cost per mile to the annual vehicle miles

traveled (VMT), and to estimate future increases in operating and ownership costs. Oftentimes, these tools apply a constant

percentage increase over the time period of vehicle operation, or in some cases, no increase in direct costs at all over time. A more

accurate cost-per-mile calculator has been developed that allows the user to analyze these costs for both consumers and fleets.

Operating costs included in the calculation tool include fuel, maintenance, tires, and repairs; ownership costs include insurance,

registration, taxes and fees, depreciation, financing, and tax credits. The calculator was developed to allow simultaneous comparisons

of conventional light-duty internal combustion engine (ICE) vehicles, mild and full hybrid electric vehicles (HEVs), and fuel cell

vehicles (FCVs). Additionally, multiple periods of operation, as well as three different annual VMT values for both the consumer

case and fleets can be investigated to the year 2024. These capabilities were included since today’s “cost to own” calculators typically

include the ability to evaluate only one VMT value and are limited to current model year vehicles. The calculator allows the user to

select between default values or user-defined values for certain inputs including fuel cost, vehicle fuel economy, manufacturer’s

suggested retail price (MSRP) or invoice price, depreciation and financing rates.

INTRODUCTION

As advanced vehicle technology development programs are undertaken, it is useful to have an understanding of the ownership and

operating costs. Advanced ICE technologies and hybrid propulsion systems have been in the market for a few years, to the point

where acquisition and operating costs can be identified with a high degree of accuracy. For several years, the U.S. Department of

Energy (DOE) and other global government agencies have sponsored the development of FCV propulsion systems. A number of

worldwide automotive manufacturers are developing FCV systems with the expectation that limited production quantities will be

offered in the 2013-2015 timeframe. Having a calculation tool that can assess the various elements of vehicle acquisition and

operating costs and compare them among competing technologies is useful to identify those cost elements that contribute the most (or

least) to cost competitiveness and provide insight on where further development efforts can be applied to achieve greater cost

competitiveness.

This paper is a summary of the development by the authors of a more accurate cost-per-mile calculator that allows the user to analyze

vehicle acquisition and operating costs for both consumers and fleets. Two scenarios were chosen for this study: one defines a mature,

market-ready FCV technology and hydrogen fueling infrastructure in 2010; the other examines a “market introduction” case with

FCVs as an emerging technology in the 2013-2015 timeframe with an immature hydrogen fueling infrastructure. Cost-per-mile results

are reported only for consumer-operated vehicles travelling 15,000 miles per year and for fleet vehicles travelling 25,000 miles per

year.

2

METHODOLGY FOR CALCULATING FUTURE VEHICLE ATTRIBUTES

CONVENTIONAL ICE VEHICLE

Original equipment manufacturer (OEM) data beginning with model year 1993 (when available) were obtained for six mid-size class

sedans

1

The vehicle attributes mentioned above were averaged together for each model year. For example, wheelbase data for a 2002

Chevrolet Malibu, Honda Accord, Nissan Altima and Toyota Camry were averaged together to get a generic 2002 mid-size sedan

wheelbase. Again, not all seven models were used in the averaging due to class change or vehicle model availability in that model

year. The process was repeated for each vehicle attribute for model years 1993-2010. The resulting averaged attributes were used to

define a generic mid-size conventional ICE vehicle for each model year. Model years with similar attributes were grouped together,

forming the generic mid-size conventional ICE vehicle generations. Since 1993, this generic mid-size vehicle has gone through four

generations with the attributes listed in Table 1.

: the Chevrolet Malibu, Ford Fusion, Honda Accord, Nissan Altima, Saturn Aura, and Toyota Camry. These vehicles were

specifically chosen because each has or had a hybrid electric variant. In addition, manufacturer's data for the Ford Taurus (which was

discontinued in 2006 and subsequently reintroduced in 2008) were also collected to help fill in early 1990s data because vehicles like

the Fusion and Aura are both relatively new models. Selected vehicle attributes, i.e., fuel economy, exterior dimensions and interior

volumes, weight, performance, and pricing (MSRP and invoice), were collected for each of the seven models through model year

2010 [1]. Vehicle design refresh cycles for each model were also analyzed. The available data suggest that OEMs update their

individual vehicle models approximately every five years (or one vehicle generation). Therefore, starting with 2010, a vehicle will

likely be refreshed in 2015, 2020, 2025, and so on. While researching vehicle attributes for the chosen vehicle models, care was taken

to determine if the vehicle class changed during the course of the refresh cycle; when an updated model fell outside of the mid-size

class, the data for those attributes were disregarded. For example, the newest generation of the Honda Accord is classified as a large

car although the Accord was classified as a mid-size vehicle between 1998 and 2007. Therefore, Honda Accord data for model years

2008-2010 and prior to 1998 were not included in determining future vehicle attributes.

Table 1 – Generic Conventional ICE Mid-Size Sedan Past and Current Attributes

GENERATION

1

2

3

4

MODEL YEAR

1993-

1996

1997-

2001

2002-

2007

2008-

2010

Fuel Economy (mpg)

City

Highway

Combined

18

26

21

19

27

22

20

29

24

22

31

25

Range

a

(mi)

City

Highway

Combined

315

457

365

316

455

369

363

516

420

387

544

447

Dimensions &

Capacities

Length (in)

Width (in)

Wheelbase (in)

Curb weight (lb)

Luggage (ft

3

)

Fuel tank (gal)

190.6

70.6

104.9

3052

16.2

17.5

191.1

70.6

106.8

3070

15.3

16.7

190.0

70.7

108.0

3124

15.5

17.7

190.4

71.1

109.9

3307

15.3

17.7

Performance

Horsepower

Acceleration,

0-60 mph (sec)

Drag coefficient

Power-to-weight

134

N/A

N/A

0.0440

144

N/A

0.30

0.0467

162

8.4

0.30

0.0520

168

7.9

0.32

0.0508

Pricing (nominal$)

MSRP

Invoice

N/A

N/A

$16,641

$15,047

$17,623

$16,338

$19,926

$18,748

a

Range is calculated by multiplying fuel economy by fuel tank volume; N/A - not available

1

Mid-size is defined as interior volume greater than or equal to 110 cubic feet but less than 120 cubic feet (Code of Federal

Regulations, Title 40, Section 600.315-08, Classes of comparable automobiles).

3

Generally, the generic conventional ICE mid-size sedan has grown in size and weight through each generation while becoming more

fuel efficient with increasing horsepower.

Two methods were utilized to forecast the generic conventional ICE vehicle's 2015 and 2020 attributes (generations 5 and 6). Method

1 employs the same technique that was used to group the generic mid-size sedan’s attributes. OEM data for each model year (1993-

2010) for the Chevrolet Malibu were grouped together to form vehicle generations. The process was repeated for the Fusion, Altima,

and Camry. (Data for the Taurus and Accord were not utilized for this method because the Taurus was discontinued in 2006 and the

Accord is now classified as a large car). This method could not be applied to the Aura since it has been available for only one

generation. Each individual generational attribute was plotted with a best fit curve for each vehicle, and the curve was used to project

the value of that attribute for the next two vehicle generations. The projected 2015 (generation 5) attributes for the four vehicles were

averaged together in a similar fashion as for each of the generation 1, 2, 3 and 4 attributes in Table 1; the process was repeated for

2020 (generation 6). It should be noted that this process was not applied for vehicle pricing. Both MSRP and invoice price, which

were provided in current dollars for 1993-2010, were converted to 2009 constant dollars using the Consumer Price Index for All

Urban Consumers (CPI-U) for New Cars [2]. MSRP and invoice were plotted in 2009 constant dollars and projected using a best fit

curve to obtain future vehicle pricing.

Method 2 also uses a best fit curve projection to determine generation 5 and 6 attributes. However, the data used in the projection are

that of the generic mid-size vehicle generations as seen in Table 1. MSRP and invoice pricing were forecasted using the same process

as was used in Method 1. Both methods yielded very similar results (see Table 2). Method 1 and Method 2 were then averaged

together, yielding the final 2015 and 2020 conventional ICE vehicle attributes used as default assumptions in the calculation tool.

Again, the general trend is increasing vehicle size and weight with higher fuel efficiency and horsepower.

Table 2 – Generic Conventional ICE Vehicle Future Attributes

GENERATION

5

6

MODEL YEAR

2015

2020

METHOD 1 2 1 2

Fuel Economy (mpg)

City

Highway

Combined

24

33

27

24

33

27

25

35

28

25

35

29

Range (mi)

City

Highway

Combined

421

585

478

419

581

479

448

617

503

457

623

514

Dimensions &

Capacities

Length (in)

Width (in)

Wheelbase (in)

Curb weight (lb)

Luggage (ft

3

)

Fuel tank (gal)

191.0

71.8

109.8

3371

15.7

17.8

190.1

71.7

110.3

3345

15.8

17.8

192.1

72.5

110.5

3482

15.8

17.7

190.0

72.6

110.9

3432

16.5

18.0

Performance

Horsepower

Power-to-weight

187

0.0555

185

0.0553

208

0.0598

200

0.0583

Pricing (2009$)

MSRP

Invoice

$22,346

$21,198

$21,891

$21,076

$24,788

$23,672

$24,044

$23,591

The 2015 and 2020 future attributes were compared to those identified in existing literature. Several sources [3-16] were identified

that projected future fuel economy of conventional ICE vehicles as well as some other vehicle attributes, namely range, curb weight,

engine horsepower, power-to-weight ratio, and MSRP. The projections in several of these references reflect expectations that

advanced technologies will be implemented in the vehicle fleet and are expressed as a percent increase over current vehicle fuel

economy. Examples of future technologies include:

• Drag reduction

• Low rolling resistance tires

• Variable compression ratio

• Camless valve actuation

4

• Lean burn gasoline direct injection

• Gasoline homogeneous charge compression ignition dual mode

• Low friction lubricants

• Engine friction reduction

• Advanced continuously variable transmission

Fuel economy forecasts from the present study, as described above, were compared to fuel economy projections in the references.

The forecasts in the cited sources were averaged together for each attribute and compared to the forecasts from this study. A

comparison between the two methods was generally favorable (see Table 3).

Table 3 – Comparison of Projected Conventional ICE Attributes

GENERATION

5

6

MODEL YEAR

2015

2020

SOURCE

This

Study

Ref

b

This

Study

Ref

b

Fuel Economy (mpg)

City

Highway

Combined

24

33

27

24

33

29

25

35

28

27

37

31

Range (mi)

Highway

583

598

620

634

Dimensions &

Capacities

Curb weight (lbs)

3358

3254

3457

3222

Performance

Horsepower

Power-to-weight

186

0.0554

166

0.0502

204

0.0591

167

0.0474

Pricing (2009$)

MSRP

$22,119

$21,978

$24,416

$24,538

b

References [3-16]

HYBRID ELECTRIC VEHICLES

The authors examined two different HEV powertrains: mild and full. A mild HEV can be defined as basically a conventional ICE

vehicle with a motor/generator that allows for engine shut-down in various situations, i.e. braking, coasting, etc. Mild HEVs do not

posses an independent hybrid drivetrain, like the full HEV, and therefore cannot run solely on the electric motor. When compared to

full HEVs, mild HEVs have relatively small electric motors, small battery capacity, and small increases in fuel economy. However,

both mild and full HEVs typically employ regenerative braking and engine assist.

OEM data for 2005-2010 conventional and hybrid electric versions of the Chevrolet Malibu, Ford Fusion, Honda Accord, Nissan

Altima, Saturn Aura and Toyota Camry were compiled [1]. As was done with the conventional ICE vehicles, attributes of each HEV

were averaged together to determine generic HEV attributes for each model year. Once the averaging process was complete, the

model years with similar attributes were grouped together to form vehicle generations. It was determined that one mild HEV

generation has existed. Neither Method 1 nor Method 2, which was used for the conventional ICE vehicle, could be used to project

future mild HEV attributes due to the lack of historical generational data. Instead, a new method was utilized that compared the

attributes of each mild HEV (i.e., increases in fuel economy, curb weight, etc.) with those of its conventional ICE counterpart. The

differences in each attribute, including MSRP and invoice pricing, were then forecasted using a best fit curve to project the 2015

(generation 2) and 2020 (generation 3) mild HEV attributes. For MSRP and invoice pricing, these results were used as a check against

prices projected using the same methodology that was used in Method 2 for the conventional ICE vehicle. The forecasted mild HEV

attributes were compared to projections from literature sources. Several sources [7,10,13,17,18] that provided projections of HEV

attributes were identified; the projections were averaged together and used to verify the results of the best fit curve projections. The

comparison between the future mild HEV attributes projected as described above and those of the referenced sources can be seen in

Table 4.

Mild HEVs

5

Table 4 – Comparison of Projected Mild HEV Attributes

GENERATION

2

3

MODEL YEAR

2015

2020

SOURCE

This

Study

Ref

c

This

Study

Ref

c

Fuel Economy (mpg)

City

Highway

Combined

41

33

38

40

34

42

50

35

42

42

36

48

Range (mi)

Highway

721

711

855

775

Dimensions &

Capacities

Curb Weight (lb)

3473

3391

3530

3491

Performance

Horsepower

Power-to-weight

156

0.0448

133

0.0391

158

0.0448

146

0.0417

Pricing (2009$)

MSRP

$30,426

$26,190

$34,176

$31,042

c

References [7,10,13,17,18]

The only commercially available mid-size class full HEV is the Toyota Prius, now in its third generation. OEM data beginning with

the Prius's introduction in the United States in 2001 were obtained [1]. Method 1, as explained in the Conventional ICE Vehicle

section above, was utilized to determine the future full HEV attributes. These future attributes were compared to the average

attributes of the references [4,5,7,8,13,14,18-20] from a literature survey. The comparison can be seen in Table 5.

Full HEV

Table 5 – Comparison of Projected Full HEV Attributes

GENERATION

4

5

MODEL YEAR 2015 2020

SOURCE Authors

Ref

d

Authors

Ref

d

Fuel Economy

(mpg)

City

Highway

Combined

54

50

52

50

N/A

54

55

51

54

52

N/A

59

Range (mi)

Highway

637

767

660

837

Dimensions &

Capacities

Curb weight (lb)

3183

3169

3322

3206

Performance

Horsepower

Power-to-weight

113

0.0354

118

0.0355

133

0.0401

129

0.0378

Pricing (2009$)

MSRP

$26,755

$27,269

$29,947

$28,369

d

References [4,5,7,8,13,14,18-20]

FUEL CELL VEHICLE

Currently, there is only one commercial mid-size FCV, the Honda FCX Clarity. Although available to the public, this limited

production vehicle is for lease only in three California markets (Torrance, Santa Monica and Irvine), with no option to buy. The $600

per month, three-year lease covers maintenance costs and collision insurance [21]. Although a limited production vehicle, the FCX

Clarity provides a good baseline for mid-size FCV attributes and represents the first generation of FCVs for this study. Since no

historical information exists for mid-size FCVs, published studies and DOE goals/targets were used to envision what the next two

generations of FCV attributes may be.

The authors examined two FCV scenarios. The Target FCV Scenario assumes the FCV is a mature technology in 2010, fully

competitive with conventional ICE vehicles and HEVs and manufactured in production volumes similar to today's rates, achieving all

6

DOE cost goals/targets; the Current FCV Scenario looks at a "market introduction" case with FCVs as an emerging technology

entering the market in 2013 and using today's cost estimates for its subsystems.

To determine MSRP in the Target FCV Scenario, the FCV subsystem costs were calculated relative to a conventional ICE vehicle.

Cost estimates and DOE cost goals were taken from Plotkin et al. [14]. Table 6 and Table 7 list those subsystem components and

accompanying costs for the FCV and conventional ICE vehicle. Intermediate costs for years not provided in Tables 6 and 7 were

obtained by plotting each subsystem with a best fit curve. Fuel cell size and hydrogen storage potential were assumed to be the same

as the Honda FCX Clarity, 100 kW and 3.92 kg H

2

at 350 bar, respectively. The conventional ICE vehicle subsystem costs were then

subtracted from the FCV subsystem costs to obtain the incremental subsystem costs of the FCV. As outlined in Plotkin et al. [14], the

costs in Tables 6 and 7 are manufacturing costs and are not representative of MSRP. Therefore, Plotkin et al. [14] multiplied these

manufacturing costs by 1.5 to obtain the retail price equivalent (RPE). The incremental RPE of the FCV over the conventional ICE

vehicle was obtained by summing the incremental subsystem costs and multiplying by 1.5. This increment was then added to the

conventional ICE vehicle MSRP to obtain the FCV MSRP (see Table 8). The historical percent difference between MSRP and

invoice was compared for the vehicles outlined in the Conventional ICE Vehicle section. Analysis determined that the difference is

slowly decreasing with each vehicle generation, with the invoice price being 95% of MSRP for the 2015 model year and 96% of

MSRP in 2020. FCV invoice pricing was calculated using these percentages of MSRP.

The Current FCV Scenario uses the current manufacturing cost estimates listed in Plotkin et al. [14] to determine FCV MSRP (see

Table 9). A similar analysis to that of the Target FCV Scenario was utilized: the difference in subsystem costs between the FCV and

conventional ICE vehicle was determined. The incremental cost of the FCV was multiplied by 1.5, as used in Plotkin et al. [14] to

obtain the RPE and then added to the conventional ICE vehicle MSRP for 2013. The subsequent years then follow the same declining

MSRP trend as is used in the Annual Energy Outlook [5]. The resulting MSRP agrees favorably with comments by manufacturers

about future FCVs. Toyota expects to price its FCV at $50,000 in 2015; Hyundai-Kia is confident that its price will be lower [22].

Table 6 – FCV Subsystem Costs (2009$)

SCENARIO

Target

Current

YEAR

2010

2015

2020

2010

Fuel cell system

$4,500

$4,500

$3,833

$10,800

Hydrogen storage $521 $263 $263 $1,956

Motor

$1,110

$700

$574

$1,300

Battery

$1,000

$1,000

$910

$2,400

Transmission $100 $100 $100 $100

Electronics

$790

$500

$22

$1,200

Exhaust

$0

$0

$0

$0

Table 7 – Conventional ICE Subsystem Costs (2009$)

YEAR

2010

2015

2020

Engine

$1,700

$1,805

$1,882

Hydrogen storage $0 $0 $0

Motor

$0

$0

$0

Battery

$0

$0

$0

Transmission

$100

$100

$0

Electronics

$0

$0

$0

Exhaust

$400

$400

$400

After a review of literature [14,21,23-25], it was determined that the only other vehicle attribute that could be projected over the next

two generations of FCVs is fuel economy. The average of the projections in the literature is provided in Tables 8 and 9.

Table 8 – Current and Projected FCV Attributes, Target FCV Scenario

SOURCE Ref [21]

Ref

e

Ref

e

GENERATION 1 2 3

MODEL YEAR

2010

2015

2020

Fuel Economy (mpg)

City

Highway

Combined

60

60

60

68

68

68

73

73

73

7

Range (mi)

240

N/A

N/A

Dimensions &

Capacities

Length (in)

Width (in)

Wheelbase (in)

Curb weight (lb)

Luggage (ft

3

)

Fuel tank (kg)

190.3

72.7

110.2

3582

13.1

3.92 @ 350 bar

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

N/A

Performance

Fuel cell (kW)

100

N/A

N/A

Pricing (2009$)

MSRP

$28,917

$30,107

$32,992

e

References [14,23-25]

Table 9 – Current and Projected FCV Attributes, Current FCV Scenario

SOURCE N/A Ref [21]

Ref

f

GENERATION

N/A

1

2

MODEL YEAR 2010 2015 2020

Fuel Economy (mpg)

City

Highway

Combined

N/A

N/A

N/A

60

60

60

68

68

68

Range

(mi) N/A 240 N/A

Dimensions &

Capacities

Length (in)

Width (in)

Wheelbase (in)

Curb weight (lb)

Luggage (ft

3

)

Fuel tank (kg)

N/A

N/A

N/A

N/A

N/A

N/A

190.3

72.7

110.2

3582

13.1

3.92 @ 350 bar

N/A

N/A

N/A

N/A

N/A

N/A

Performance

Fuel cell (kW)

N/A

100

N/A

Pricing (2009$)

MSRP

N/A

$43,280

$40,801

f

References [14,23-25]

DIRECT COSTS

OPERATING COSTS

Four gasoline price projection data sets from the Energy Information Administration are included in the cost-per-mile calculation tool.

Two are from the Annual Energy Outlook 2009 [11,26]: the high price case (default for the tool for both the Target FCV Scenario and

the Current FCV Scenario) and the updated reference case, both converted to 2009 dollars. The third and fourth are from the Annual

Energy Outlook 2010 [19,27] which includes a high oil price case and a reference case, both of which are also converted to 2009

dollars. Fuel costs were calculated as follows:

Gasoline

Fuel Cost

20XX

= Fuel Price

20XX

× VMT ÷ MPG

y

(1)

where 20XX denotes the year, VMT is vehicle miles traveled, mpg is the EPA adjusted combined fuel economy in miles per gallon

gasoline equivalent and Y is the vehicle generation.

Future hydrogen prices were determined using projections from the study Transitions to Alternative Transportation: A Focus on

Hydrogen [23]. The hydrogen price projections (in dollars per gasoline gallon equivalent) to the year 2050 from the hydrogen success

case (Case 1) were used as illustrated in Figure 1. The historical CPI-U [28] was used to convert the hydrogen prices to 2009 dollars

Hydrogen

8

and the fuel cost for each specific year was generated from Equation 1. Just as the Target FCV Scenario assumes a fully mature FCV

technology, so does it assume a fully integrated hydrogen fueling station infrastructure. Therefore, the starting point on the hydrogen

price curve presented in the study was shifted to that of 2019 to represent a lower hydrogen cost in 2010 for the Target FCV Scenario

($3.85 in 2009$). In effect, the 2019 price becomes the 2010 price, the 2020 price becomes the 2011 price, and so on for the out years

in the Target FCV Scenario. This price corresponds to the latest H2A forecourt production analysis price of $3.50 in 2005 dollars

($3.83 in 2009 dollars) utilizing steam methane reforming of natural gas [29]. (The H2A production model is an Excel-based tool that

performs a discounted cash flow analysis over a time period based on user inputs and economic assumptions to calculate the cost of

hydrogen.)

Figure 1 – Hydrogen Fuel Prices, Scenarios 1 and 2 [23]

For the consumer portion of the calculation tool, scheduled maintenance information for the Chevrolet Malibu, Ford Fusion, Nissan

Altima, Toyota Camry (conventional ICE and mild HEV), and Toyota Prius (full HEV) was obtained from OEM owner’s manuals and

maintenance guides; the Saturn Aura was excluded since that model was discontinued in 2009. Details such as manufacturer’s

recommended service intervals for each vehicle as well as specific maintenance items performed at those intervals were obtained. The

estimated expense to maintain these mid-size sedans was calculated using the RepairPrice Estimator [30] in 2009 dollars.

Maintenance costs over a five-year period were calculated and included all scheduled maintenance. These costs included an averaged

labor cost (the average of expected labor cost at the dealer and expected labor cost at a private shop) as well as an averaged parts cost

(high and low). Ten cities, including Boston, Chicago, Cleveland, Denver, Houston, Los Angeles, Miami, New York, San Francisco,

and Seattle, were used to determine a “national” average. This 10-city average became the baseline for maintenance costs. Future

maintenance costs were estimated using the historical CPI-U for Maintenance and Repairs [31] by fitting a curve to the data and using

the curve to forecast increases in maintenance costs. FCV maintenance costs were adjusted from the conventional ICE vehicle

maintenance costs by the ratios used in the National Energy Modeling System (NEMS) model [25] for FCVs. Years not provided in

the NEMS inputs were interpolated by using a best fit curve.

Maintenance

For fleet vehicles, Vincentric’s Vinbase Online for Fleets [32] was used to calculate maintenance costs in 2009 dollars. The same

make and model vehicles and the same 10 cities were considered as were used for the consumer vehicles. However, a three-year

ownership period was used instead of the five-year period that was used for consumer ownership. Again, the same projected CPI-U

for Maintenance and Repairs [31] that was used in the consumer portion of the calculation tool was applied to the fleet portion to

project future maintenance costs. Fleet FCV maintenance costs were adjusted from the fleet conventional ICE vehicle maintenance

costs using the NEMS input ratios for FCV maintenance [25].

It was assumed that a set of long-life radial tires would last 60,000 miles prior to needing replacement [33] for a conventional ICE

vehicle. However, a switch to low rolling resistance (LRR) tires will more than likely be necessary to help OEMs meet the new

Corporate Average Fuel Economy (CAFE) standards due to be instituted in 2016. These LRR tires typically have a tread wear life of

30,000 to 50,000 miles [34-36]. For the purposes of this study, it was assumed that the average LRR tire would need to be replaced

after 40,000 miles. OEMs already equip mild and full HEVs with LRR tires to help improve vehicle fuel economy; it was assumed

Tires

9

that FCVs would likewise be equipped with LRR tires. The cost to replace one set of tires was estimated with data from the detailed

maintenance information from IntelliChoice’s cost of ownership estimator [37] in 2009 dollars. The average tire replacement cost was

determined for the Chevrolet Malibu, Ford Fusion, Nissan Altima, Toyota Camry (conventional ICE, mild HEV, and FCV), and

Toyota Prius (full HEV). Future replacement tire costs were estimated using projections developed from the historical CPI-U for

Tires [38]. As was done with the maintenance data, a best fit curve was used with the CPI-U tire data to project future increases for

tire costs.

For the consumer case, the expense to repair a vehicle for an item that is not covered under the manufacturer’s warranty was

calculated using the National Automobile Dealers Association’s (NADA’s) 5-Year Car Cost of Ownership [39] estimator. Repair

costs for the five-year ownership period of a Chevrolet Malibu, Ford Fusion, Nissan Altima, Toyota Camry, and Toyota Prius were

investigated. As with the maintenance data, the costs in the same 10 cities were used and averaged together to form a “national”

average. The 10-city average served as the baseline for repair costs. The best fit curve from the historical CPI-U data for

Maintenance and Repairs [31] previously used in the maintenance calculation was again utilized to determine future increases to repair

costs. The authors compared the powertrain components of the Honda FCX Clarity (i.e. powerplant power, battery pack voltage,

motor power) to that of the mild and full HEVs in this study. It was determined that the Honda FCX Clarity’s powertrain components

more closely match the mild HEV than the full HEV. Therefore, it was assumed that the FCV would have similar repair costs to those

of mild HEVs.

Repairs

For fleet vehicles, Vincentric’s Vinbase for Fleets [32] was used to calculate repair costs in 2009 dollars. The same make/model

vehicles and the same 10 cities were considered as were used for the consumer vehicles. However, a three-year ownership period

(typical for fleets) was investigated instead of the five-year period that was used for consumer ownership. Again, the same projected

CPI-U for Maintenance and Repairs [31] that was used in the consumer portion of the calculation tool was applied to the fleet portion

to project future repair costs.

OWNERSHIP COSTS

For consumers of conventional ICE vehicles and mild and full HEVs, the countrywide average for combined (liability,

comprehensive, and collision) auto insurance premiums was estimated using the National Association of Insurance Commissioners

Auto Insurance Databases [40]. The data were then used to develop a best fit curve to project future premium costs. Insurance costs

for the natural gas Honda Civic GX were investigated and compared to those of its conventional Honda Civic EX counterpart. The

percentage increase in insurance premiums from the conventional Honda Civic to the natural gas Civic was then applied to the

conventional ICE vehicle’s insurance premiums (calculated as described above) to estimate the insurance premiums for FCV owners.

Insurance

Fleet vehicle insurance costs were calculated using Vinbase Online for Fleets [32] for the conventional ICE vehicle and both mild and

full HEVs. As was done with the consumer portion of the calculation tool, the percentage increase from the conventional Honda Civic

to the natural gas Civic was applied to the Vincentric data for calculating future FCV insurance costs. Future insurance rates were

projected using the historical CPI-U for Motor Vehicle Insurance [41] because historical data on fleet vehicle insurance costs were not

available.

This expense consists of the yearly registration costs charged by states, titling fees, as well as the state and local sales tax on the

purchase of a vehicle. IntelliChoice’s State Fees Chart [42] was used as the basis to determine a national average for all 50 states.

The chart was updated to account for recent changes to state sales taxes; a calculated combined tax rate was added if both state and

local taxes were levied on the purchase of a new vehicle. The combined tax rate was then averaged together for all 50 states.

Likewise, state titling fees and registration costs were averaged to determine a national average. These taxes and fees were assumed

to be constant through all the ownership periods. Taxes were calculated in the first year of consumer vehicle ownership using the

following equation:

State Registration, Taxes, and Fees

Tax

CONSUMER

= MSRP

20XX

× R (2)

10

Where MSRP is in 2009 dollars, 20XX is the year and R is the average national tax rate. Fleet ownership taxes were calculated in a

similar manner:

Tax

FLEET

= Invoice

20XX

× R (3)

Where Invoice is in 2009 dollars, 20XX is the year and R is the average national tax rate. Fleet pricing is generally calculated as

invoice plus destination charge minus a fleet incentive; the authors have assumed that the destination charge and fleet incentive are

equal.

The consumer portion of the calculation tool contains NADA resale values [39] for the Chevrolet Malibu, Ford Fusion, Nissan Altima,

Toyota Camry, and Toyota Prius. The vehicles' resale values as a percentage of retained MSRP were averaged together (Malibu,

Fusion, Altima, and Camry for conventional ICE vehicle and mild HEV; Prius for full HEV). These resale values assume that the

vehicle is in a clean, reconditioned state when sold. It was assumed that the 2015 and 2020 vehicles would retain the same percentage

of their original MSRP as did the 2010 model year vehicle when sold after five years. The FCV depreciation is calculated using the

difference in depreciation percentage between the conventional Honda Civic and the natural gas Civic. This difference is then applied

to the conventional ICE vehicle depreciation to calculate the FCV depreciation as a percentage of retained MSRP.

Vehicle Depreciation

Depreciation, as a percentage of invoice price, for fleet vehicles (conventional ICE and mild and full HEV) was calculated using the

Vincentric data [32]. Again, the difference between the conventional and natural gas Honda Civic depreciation was applied to the

conventional ICE vehicle Vincentric data to estimate the FCV depreciation. Although FCVs may experience higher rates of

depreciation when first introduced to the market in the 2013-2015 timeframe in the Current FCV Scenario, no data were available to

determine to determine how depreciation rates may vary as function of market maturity. Therefore, the same depreciation rates were

used in both the Target FCV Scenario and the Current FCV Scenario.

The expense of the interest on a consumer vehicle loan was calculated from consumer credit data [43] and bank prime rates [44] from

the Federal Reserve. Historical interest rates for new car loans at auto finance companies were listed as well as average maturity and

loan-to-value ratios. A graph of these historical interest rates versus the historical prime rate was developed using a best fit curve to

determine the relationship between new car loan rates and the prime rate. A prime rate forecast [45] was then obtained and used to

project future new car loan interest rates. The Federal Reserve data [43] indicated that the historical (1993-2009) average new car

loan maturity was 57.52 months with an average loan-to-value ratio of 91.77. Therefore, the average consumer puts down 8.23% on a

new car loan.

Financing

The interest on a fleet vehicle was determined in a similar manner. However, interest rates for 3-month commercial paper [46] were

used instead of interest rates from auto finance companies. A similar relationship between the historical prime rate and the 3-month

commercial paper rate was established. The forecasted prime rate [45] then was used to predict future 3-month commercial paper

rates from the best fit curve. A loan-to-value ratio of 100 was assumed (no money down on the loan).

Section 1341 of the Energy Policy Act of 2005 (Pub. L. 109-58) provides for the Alternative Fuel Motor Vehicle Credit and includes

separate tax credits for four categories of light, medium, and heavy-duty vehicles: hybrids, FCVs, alternative fuel vehicles (dedicated

natural gas and propane), and lean-burn diesel vehicles. The credit amount differs by the type of vehicle and is subtracted directly

from the total amount of federal tax owed. It covers 50% of the incremental cost of the vehicle, plus an additional 30% of the

incremental cost for vehicles meeting super ultra low emissions vehicle (SULEV) and Bin 2 emission standards, and is capped at

$5,000 for vehicles with gross vehicle weight ratings (GVWRs) of 8,500 lb or less. The cost per mile calculation tool assumes mild

HEVs will qualify for the 50% incremental cost, while full HEVs and FCVs will get the full 80% of the incremental cost covered until

the tax credit expires on December 31, 2010.

Tax Credit

CALCULATING THE COST PER MILE

The cost-per-mile calculation tool described in this paper assumes that the vehicle is kept for five (consumer) or three (fleet) years

[47,48] and then is sold in a clean, reconditioned state. Model years 2015 and 2020 represent new generations of vehicles with the

11

attributes outlined in the Methodology for Calculating Future Vehicle Attributes section. All of the direct costs were calculated in

2009 dollars. However, the calculation tool contains the ability to convert this 2009 dollar amount into any nominal dollar year by

using forecasts for the CPI-U [49,50]. To obtain the total annual cost-per-mile for each vehicle type, all of the operating and

ownership costs for each of the three- or five-year periods were summed and divided by the annual VMT (which was kept constant).

It should be noted that indirect costs were neglected in the calculations of this tool. These may include but are not limited to costs for

compliance with vehicle inspection and maintenance programs, accident repairs, congestion, roadway maintenance/construction,

parking, and tolls.

RESULTS

Cost-per-mile results are reported only for consumer-operated vehicles travelling 15,000 miles per year [51] and for fleet vehicles

travelling 25,000 miles per year [48], though the calculation tool can also be used to assess consumer-operated vehicles travelling

10,000 or 20,000 miles per year and fleet vehicles travelling 20,000 or 30,000 miles per year. Overall results using the tool's default

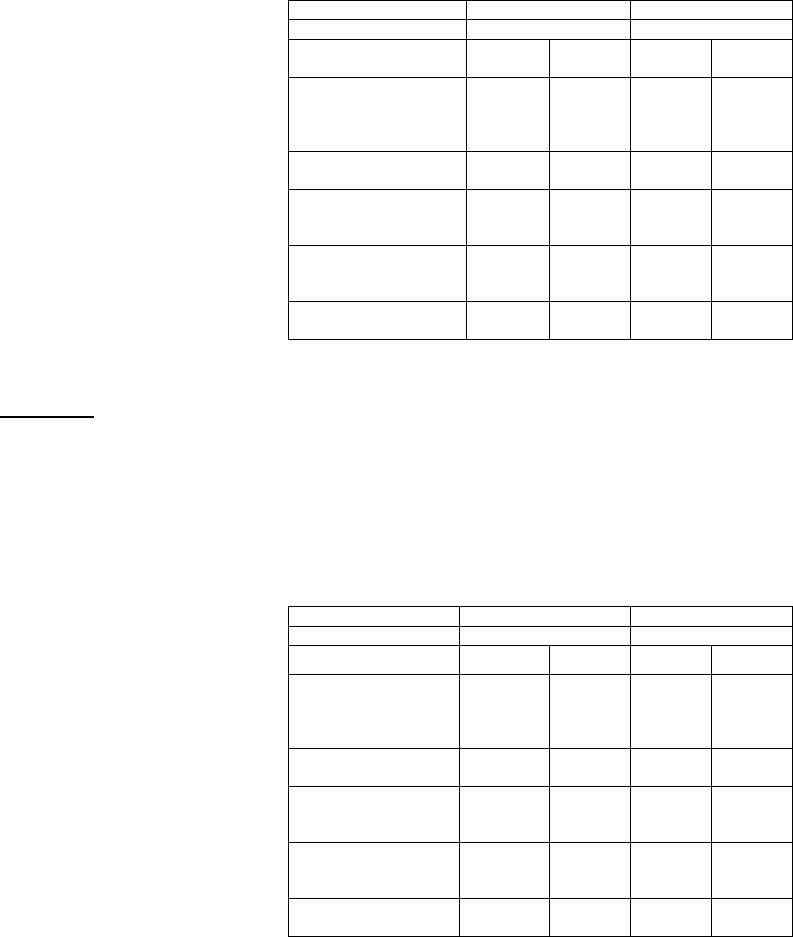

values for the Target FCV Scenario are shown in Figures A1 and A2 (all figures are included in the Appendix). Both figures show

that FCVs can be competitive with conventional ICE vehicles as well as full HEVs if DOE cost targets are met, even without

federally-mandated tax credits that are applied only in the first ownership period for both consumers (2010-2014) and fleets (2010-

2012) in this analysis. This analysis validates that the DOE targets/goals must be achieved for FCVs to be commercially competitive

with other vehicle powertrains. Detailed results for each powertrain and ownership type are shown in Figures A3-A10. These results

show that FCVs may be more competitive on a cents-per-mile basis than mild HEVs if the DOE targets are achieved. Mild HEVs

cannot compete with the other powertrains in this scenario due to their: 1) high MSRP (large financing expenditures); 2) high

depreciation rate (low residual value); and 3) lower fuel economy relative to full HEVs and FCVs (high fuel costs). Across all

powertrains, depreciation is the largest contributor to direct costs in calculating the cost per mile.

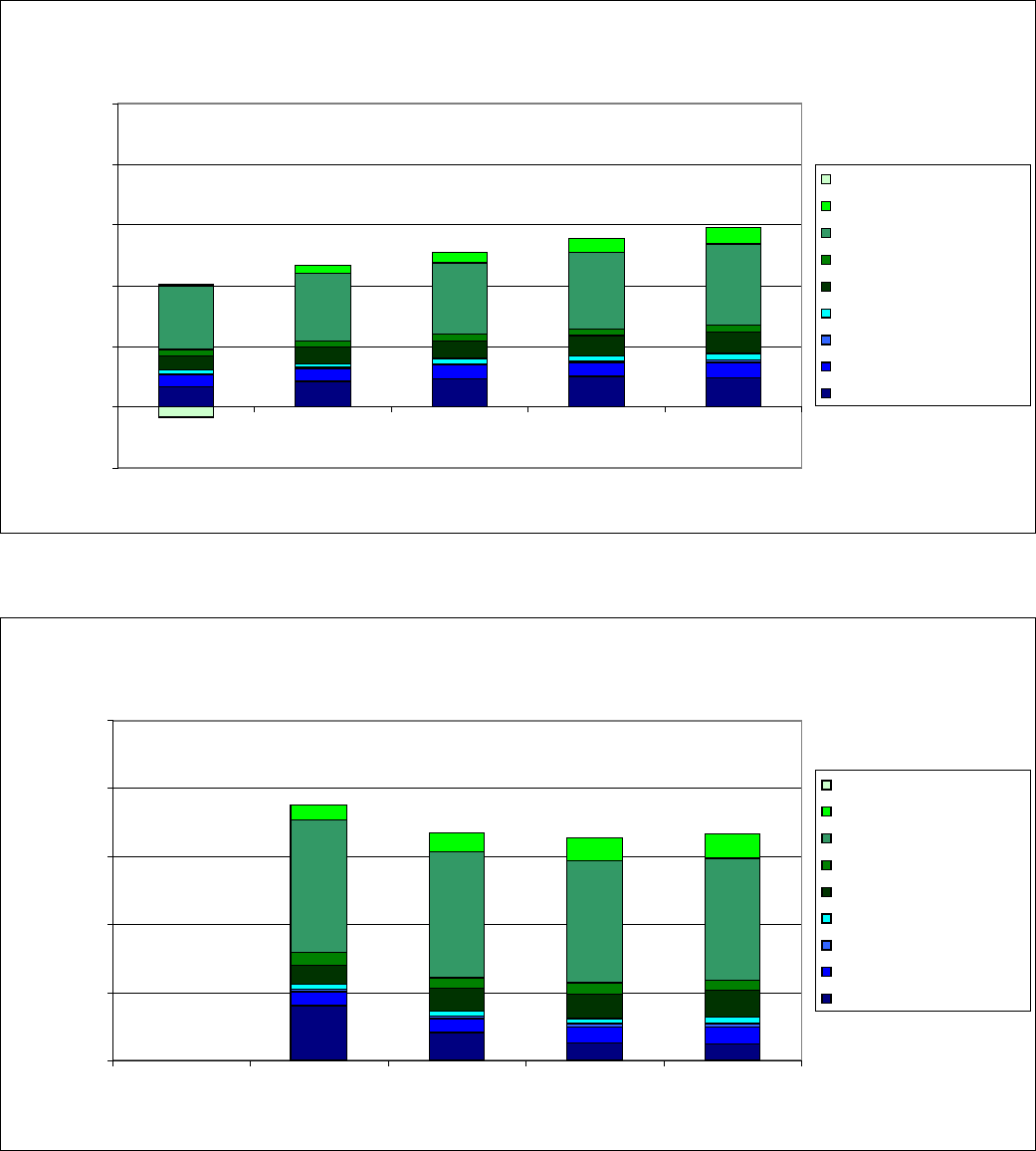

The Current FCV Scenario overall results for consumer and fleet ownership are shown in Figures A11 and A12, respectively. Note

that there are no results for FCVs in the first ownership period for both consumer and fleets as FCVs do not enter the market until

2013 in this scenario. Contrasting with the Target FCV Scenario, the Current FCV Scenario shows that to be competitive with

conventional ICE vehicles and HEVs during the early stages of commercial implementation, FCVs will need tax credits or other forms

of subsidies. The detailed results for the Current FCV Scenario (Figures A13-A20) again show depreciation and financing

expenditures as the major costs for the FCV. High FCV MSRP is likely to be a market barrier at least initially when FCVs are

introduced. However, if the DOE cost targets can be met for all FCV subsystem components, the cost-per-mile differential compared

to other vehicle powertrain technologies will be kept to a minimum.

SUMMARY/CONCLUSIONS

The authors have created a new cost-per-mile calculator that allows for comparison among several advanced powertrains, including a

conventional ICE vehicle, mild and full HEV, and FCV. This flexible tool contains default data sets for both consumer and fleet

ownership and includes the ability to analyze the cost-per-mile over several ownership periods, which today’s calculators do not

provide. Two scenarios were chosen for analysis: one defines a mature, market-ready FCV technology and hydrogen fueling

infrastructure in 2010; the other examines a “market introduction” case with FCVs as an emerging technology in the 2013-2015

timeframe with an immature hydrogen fueling infrastructure. In both scenarios, the largest contributor to the total cost-per-mile is

vehicle depreciation. If uncertainties in factors such as fuel cell stack durability and hydrogen fuel availability can be eliminated, the

depreciation differential between the FCV and its gasoline counterparts could be reduced.

While Toyota and Hyundai-Kia intend to bring FCVs to the future market, several manufacturers are either producing plug-in HEVs

(PHEVs) or are in the process of readying them for the market. Since PHEVs will be openly competing against the powertrains

presented in this study, the authors intend to add this technology to a future iteration of the cost-per-mile calculator.

REFERENCES

1. Cars.com, “Research,” http://www.cars.com, 2009.

2. Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers,” New Cars, 2009.

3. Committee on Science, “Improving the Nation's Energy Security: Can Cars and Trucks be Made More Fuel Efficient?,” Written

Statement of Mr. K.G. Duleep, 2005.

4. Greene, D. and DeCicco, J., “Engineering-Economic Analysis of Automotive Fuel Economy Potential in the United States,”

ORNL/TM-2000/26, 2000.

12

5. Energy Information Administration, “Supplemental Tables to the Annual Energy Outlook 2009 with Projections to 2030,” Tables

61, 69, 70 and 71, 2009.

6. Transportation Research Board, “Effectiveness and Impact of Corporate Average Fuel Economy (CAFE) Standards,” 2002.

7. DeCicco, J., An, F. & Ross, M., “Technical Options for Improving the Fuel Economy of U.S. Cars and Light Trucks by 2010-

2015,” 2001.

8. Bandivadekar, A. et al., “On the Road in 2035: Reducing Transportation's Petroleum Consumption and GHG Emissions,” 2008.

9. Energy Information Administration, “Assumptions to the Annual Energy Outlook 2009,” Table 7.1, DOE/EIA-0554(2009), 2009.

10. Energy Information Administration, “The National Energy Modeling System: An Overview 2009,” DOE/EIA-0581(2009), 2009.

11. Energy Information Administration, “Annual Energy Outlook 2009 with Projections to 2030,” Updated Annual Energy Outlook

2009 Reference Case with ARRA Table 12, Petroleum Product Prices, DOE/EIA-0383(2009), 2009.

12. National Highway Traffic Safety Administration, “Corporate Average Fuel Economy for MY 2011-2015 Passenger Cars and

Light Trucks,” Preliminary Regulatory Impact Analysis, 2008.

13. Freidman, D., “A New Road: The Technology Potential of Hybrid Vehicles,” 2003.

14. Plotkin, S. et al., “Multi-Path Transportation Futures Study: Vehicle Characterization and Scenario Analyses,” ANL/ESD/09-5,

2009.

15. Environmental Protection Agency, “Interim Report: New Powertrain Technologies and Their Projected Costs,” EPA420-S-05-

013, 2005.

16. Bureau of Labor Statistics, “Producer Price Index for Passenger Cars,” 1997-2009, 2009.

17. Duvall, M., “Comparing the Benefits and Impacts of Hybrid Electric Vehicle Options for Compact Sedan and Sport Utility

Vehicles,” 1006892, 2002.

18. Greene, D., Duleep, K.G. & McManus, W., “Future Potential of Hybrid and Diesel Powertrains in the U.S. Light-Duty Vehicle

Market,” ORNL/TM-2004/181, 2004.

19. Energy Information Administration, “Annual Energy Outlook 2010,” Reference Case Table 12, Petroleum Product Prices,

DOE/EIA-0383(2010), 2010.

20. Simpson, A., “Cost-Benefit Analysis of Plug-In Hybrid Electric Vehicle Technology,” Conference Paper, NREL/CP-540-40485,

2006.

21. Honda Motor Company, “Honda FCX Clarity - Frequently Asked Questions,” http://automobiles.honda.com/fcx-clarity/faq.aspx,

2009.

22. Saunders, M., “Hyundai-Kia's Fuel Cell Push,” http://www.autocar.co.uk/News/NewsArticle/AllCars/250265/, 2010.

23. Board on Energy and Environmental Systems, “Transitions to Alternative Transportation Technologies – A Focus on Hydrogen,”

2008.

24. Energy Information Administration, “The Impact of Increased Use of Hydrogen on Petroleum Consumption and Carbon Dioxide

Emissions,” SR/OIAF-CNEAF/2008-04, 2008.

25. National Renewable Energy Laboratory, “Projected Benefits of Federal Energy Efficiency and Renewable Energy Programs: FY

2008 Budget Request,” NREL/TP-640-41347 2007.

26. Energy Information Administration, “Annual Energy Outlook 2009 with Projections to 2030,” High Price Case Tables, Table 12,

DOE/EIA-0383(2009), 2009.

27. Energy Information Administration, “Annual Energy Outlook 2010,” High Oil Price Case Table 12, Petroleum Product Prices,

DOE/EIA-0383(2010), 2010.

28. Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers,” Purchasing power of the consumer dollar (1982-

84=$1.00), 2009.

29. James, B.D., Current (2005) Steam Methane Reformer (SMR) at Forecourt 1500kg/day, Computer Software, Directed

Technologies, Inc., Arlington, VA, 2008.

30. RepairPal, “RepairPrice Estimator,” http://repairpal.com, 2009

31. Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers,” Maintenance and Repairs, 2009.

32. Vincentric, “Vinbase Online for Fleets,” http://www.vincentric.com, 2009

33. T

ire Rack, “Tire Tech Information/General Tire Information,” Tire Aging - Part #1, http://www.tirerack.com/tires, 2009.

34. Green Seal, “Choose Green Report: Low Rolling Resistance Tires,” 2003.

35. New Mexico Climate Change Advisory Group, “Low Rolling Resistance Tires,” Teleconference Call #9 of TLU TWG,

http://www.nmclimatechange.us/template.cfm?FrontID=4701, 2006.

36. Practical Environmentalist, “Boost Gas Mileage with LRR Tires,” http://www.practicalenvironmentalist.com/travel/how-to-

improve-your-gas-mileage-with-low-rolling-resistance-tires.htm, 2009.

37. IntelliChoice, “Cost of Ownership,” Detailed Maintenance Information, http://www.intellichoice.com, 2009.

38. Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers,” Tires, 2009.

39. NADA, “5-Year Car Cost of Ownership,” http://www.nadaguides.com, 2009.

40. National Association of Insurance Commissioners, “Auto Insurance Database,” 2009.

41. Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers,” Motor Vehicle Insurance, 2009.

42. IntelliChoice, “Cost of Ownership,” State Fees Chart, http://www.intellichoice.com, 2009.

13

43. Federal Reserve, “Consumer Credit,” Terms of Credit at Commercial Banks and Finance Companies,

http://www.federalreserve.gov, 2009.

44. Federal Reserve, “Selected Interest Rates,” Bank Prime Loan,” http://www.federalreserve.gov, 2009.

45. Mortgage-X, “Prime Rate Forecast,” http://mortgage-x.com, 2009.

46. Federal Reserve “Selected Interest Rates,” Commercial Paper, Nonfinancial 3-month, http://www.federalreserve.gov, 2009.

47. R.L. Polk and Company, “The Changing U.S. Auto Industry - Consumer Sentiment During Challenging Times,” 2009

48. Automotive Fleet, “2010 Automotive Fleet Fact Book Stats, Operating Costs, Intermediate Cars,” 2009.

49. Congressional Budget Office, “The Budget and Economic Outlook: Fiscal Years 2010 to 2020,” 2010.

50. Office of Management and Budget, “Mid-Session Review: Budget of the U.S. Government,” 2009.

51. U.S. Department of Transportation, Federal Highway Administration, “Our Nation’s Highways: 2010,” 2010.

CONTACT INFORMATION

Alliance Technical Services, Inc.

10816 Town Center Blvd., Suite 232

Dunkirk, MD 20754

www.alliance-technicalservices.com

ACKNOWLEDGMENTS

The authors would like to thank the National Renewable Energy Laboratory (NREL) for the opportunity to perform this analysis under

NREL subcontract no. LCI-8-88606-01.

DEFINITIONS/ABBREVIATIONS

BLS

Bureau of Labor Statistics

CAFE

Corporate Average Fuel Economy

CPI-U

Consumer Price Index, All Urban

DOE

Department of Energy

EPA

Environmental Protection Agency

FCV

fuel cell vehicle

GVWR

gross vehicle weight restriction

H2A

Hydrogen Analysis

HEV

hybrid electric vehicle

ICE

internal combustion engine

kg

kilogram(s)

kW

kilowatt(s)

kWh

kilowatt-hour(s)

lb

pound(s)

LRR

low rolling resistance

mpg

miles per gallon

MSRP

manufacture’s suggested retail

OEM

original equipment manufacturer

NADA

National Automobile Dealers

RPE

retail price equivalent

SULEV

super ultra low emissions vehicle

VMT

vehicle miles traveled

14

APPENDIX

Consumer Results

$0.49

$0.59

$0.64

$0.50

$0.66

$0.73

$0.42

$0.56

$0.63

$0.45

$0.57

$0.63

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

ICE Mild HEV Full HEV FCV

15,000

VMT

Figure A1 – Target FCV Scenario Overall Results for Consumer-Owned Vehicles

Fleet Results

$0.43

$0.51

$0.55

$0.60

$0.63

$0.43

$0.56

$0.60

$0.65

$0.69

$0.37

$0.47

$0.51

$0.56

$0.59

$0.38

$0.48

$0.51

$0.55

$0.59

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

ICE Mild HEV Full HEV FCV

25,000

VMT

Figure A2 – Target FCV Scenario Overall Results for Fleet-Owned Vehicles

15

Consumer Conventional ICE Vehicle

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.49

$0.59

$0.64

Figure A3 – Target FCV Scenario Detailed Results for a Consumer Owned-Conventional ICE Vehicle

Consumer Mild HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.50

$0.66

$0.73

Figure A4 – Target FCV Scenario Detailed Results for a Consumer-Owned Mild HEV

16

Consumer Full HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.42

$0.56

$0.63

Figure A5 – Target FCV Scenario Detailed Results for a Consumer-Owned Full HEV

Consumer FCV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.45

$0.57

$0.63

Figure A6 – Target FCV Scenario Detailed Results for a Consumer-Owned FCV

17

Fleet Conventional ICE Vehicle

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.43

$0.51

$0.55

$0.60

$0.63

Figure A7 – Target FCV Scenario Detailed Results for a Fleet-Owned Conventional ICE Vehicle

Fleet Mild HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.43

$0.56

$0.60

$0.65

$0.69

Figure A8 – Target FCV Scenario Detailed Results for a Fleet-Owned Mild HEV

18

Fleet Full HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.37

$0.47

$0.51

$0.56

$0.59

Figure A9 – Target FCV Scenario Detailed Results for a Fleet-Owned Full HEV

Fleet FCV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.38

$0.48

$0.51

$0.55

$0.59

Figure A10 – Target FCV Scenario Detailed Results for a Fleet-Owned FCV

19

Consumer Results

$0.49

$0.59

$0.64

$0.50

$0.66

$0.73

$0.42

$0.56

$0.63

$0.77

$0.73

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

ICE Mild HEV

Full HEV

FCV

15,000

VMT

Figure A11 – Current FCV Scenario Overall Results for Consumer-Owned Vehicles

Fleet Results

$0.43

$0.51

$0.55

$0.60

$0.63

$0.43

$0.56

$0.60

$0.65

$0.69

$0.37

$0.47

$0.51

$0.56

$0.59

$0.75

$0.67

$0.65

$0.67

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

ICE Mild HEV Full HEV FCV

25,000

VMT

Figure A12 – Current FCV Scenario Overall Results for Fleet-Owned Vehicles

20

Consumer Conventional ICE Vehicle

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.49

$0.59

$0.64

Figure A13 – Current FCV Scenario Detailed Results for Consumer Owned-Conventional ICE Vehicle

Consumer Mild HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.50

$0.66

$0.73

Figure A14 – Current FCV Scenario Detailed Results for Consumer-Owned Mild HEV

21

Consumer Full HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.42

$0.56

$0.63

Figure A15 – Current FCV Scenario Detailed Results for Consumer-Owned Full HEV

Consumer FCV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2014 2015-2019 2020-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

15,000

VMT

$0.77

$0.73

Figure A16 – Current FCV Scenario Detailed Results for Consumer-Owned FCV

22

Fleet Conventional ICE Vehicle

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.43

$0.51

$0.55

$0.60

$0.63

Figure A17 – Current FCV Scenario Detailed Results for Fleet-Owned Conventional ICE Vehicle

Fleet Mild HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.43

$0.56

$0.60

$0.65

$0.69

Figure A18 – Current FCV Scenario Detailed Results for Fleet-Owned Mild HEV

23

Fleet Full HEV

($0.20)

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.37

$0.47

$0.51

$0.56

$0.59

Figure A19 – Current FCV Scenario Detailed Results for Fleet-Owned Full HEV

Fleet FCV

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

2010-2012 2013-2015 2016-2018 2019-2021 2022-2024

Ownership Period

Total Cost Per Mile (2009$)

Tax credit

Financing

Depreciation

Registration, taxes & fees

Insurance

Repairs

Tires

Maintenance

Fuel

25,000

VMT

$0.75

$0.67

$0.65

$0.67

Figure A20 – Current FCV Scenario Detailed Results for Fleet-Owned FCV

F1147-E(10/2008)

REPORT DOCUMENTATION PAGE

Form Approved

OMB No. 0704-0188

The public reporting burden for this collection of information is estimated to average 1 hour per response, including the time for reviewing instructions, searching existing data sources,

gathering and maintaining the data needed, and completing and reviewing the collection of information. Send comments regardin

g this burden estimate or any other aspect of this

collection of information, including suggestions for reducing the burden, to Department of Defense, Executive Services and Communications Directorate (0704-

0188). Respondents

should be aware that notwithstanding any other provision of law, no person shall be subject to any penalty for failing to comply with a collection of information if it does not display a

currently valid OMB control number.

PLEASE DO NOT RETURN YOUR FORM TO THE ABOVE ORGANIZATION.

1. REPORT DATE (DD-MM-YYYY)

January 2011

2. REPORT TYPE

Conference Paper

3. DATES COVERED (From - To)

4. TITLE AND SUBTITLE

Methodology for Calculating Cost per Mile for Current and Future

Vehicle Powertrain Technologies, with Projections to 2024: Preprint

5a. CONTRACT NUMBER

DE-AC36-08GO28308

5b. GRANT NUMBER

5c. PROGRAM ELEMENT NUMBER

6. AUTHOR(S)

M. Ruth, T.A. Timbario, T.J. Timbario, and M. Laffen

5d. PROJECT NUMBER

NREL/CP-6A10-49231

5e. TASK NUMBER

HS07.1002

5f. WORK UNIT NUMBER

7. PERFORMING ORGANIZATION NAME(S) AND ADDRESS(ES)

National Renewable Energy Laboratory

1617 Cole Blvd.

Golden, CO 80401-3393

8. PERFORMING ORGANIZATION

REPORT NUMBER

NREL/CP-6A10-49231

9. SPONSORING/MONITORING AGENCY NAME(S) AND ADDRESS(ES)

10. SPONSOR/MONITOR'S ACRONYM(S)

NREL

11. SPONSORING/MONITORING

AGENCY REPORT NUMBER

12. DISTRIBUTION AVAILABILITY STATEMENT

National Technical Information Service

U.S. Department of Commerce

5285 Port Royal Road

Springfield, VA 22161

13. SUPPLEMENTARY NOTES

14. ABSTRACT (Maximum 200 Words)

Currently, several cost-per-mile calculators exist that can provide estimates of acquisition and operating costs for

consumers and fleets. However, these calculators are limited in their ability to determine the difference in cost per

mile for consumer versus fleet ownership, to calculat

e the costs beyond one ownership period, to show the sensitivity

of the cost per mile to the annual vehicle miles traveled (VMT), and to estimate future increases in operating and

ownership costs. Oftentimes, these tools apply a constant percentage increase over the time period of vehicle

operation, or in some cases, no increase in direct costs at all over time. A more accurate cost-per-

mile calculator has

been developed that allows the user to analyze these costs for both consumers and fleets. The calculator was

developed to allow simultaneous comparisons of conventional light-duty internal combustion engine (ICE) vehicles,

mild and full hybrid electric vehicles (HEVs), and fuel cell vehicles (FCVs). This paper is a summary of the

development by the authors of a more accurate cost-per-mile calculator that allows the user to analyze vehicle

acquisition and operating costs for both consumer and fleets. Cost-per-mile results are reported for consumer-

operated vehicles travelling 15,000 miles per year and for fleets travelling 25,000 miles per year.

15. SUBJECT TERMS

Cost-per-mile; Cost-per-mile calculator; Vehicle Powertrain Technologies; hybrid electric vehicles; HEV; fuel cell

vehicles; FCV; internal combustion engine vehicle; ICE; vehicle fleet

16. SECURITY CLASSIFICATION OF:

17. LIMITATION

OF ABSTRACT

UL

18. NUMBER

OF PAGES

19a. NAME OF RESPONSIBLE PERSON

a. REPORT

Unclassified

b. ABSTRACT

Unclassified

c. THIS PAGE

Unclassified

19b. TELEPHONE NUMBER (Include area code)

Standard Form 298 (Rev. 8/98)

Prescribed by ANSI Std. Z39.18