Indiana Law Journal Indiana Law Journal

Volume 95 Issue 4 Article 5

Fall 2000

The Death of the Income Tax (or, The Rise of America’s Universal The Death of the Income Tax (or, The Rise of America’s Universal

Wage Tax) Wage Tax)

Edward J. McCaffery

University of Southern California;California Institute of Tecnology

, emccaffery@law.usc.edu

Follow this and additional works at: https://www.repository.law.indiana.edu/ilj

Part of the Estates and Trusts Commons, Law and Economics Commons, Taxation-Federal Commons,

Taxation-Federal Estate and Gift Commons, Taxation-State and Local Commons, and the Tax Law

Commons

Recommended Citation Recommended Citation

McCaffery, Edward J. (2000) "The Death of the Income Tax (or, The Rise of America’s Universal Wage

Tax),"

Indiana Law Journal

: Vol. 95: Iss. 4, Article 5.

Available at: https://www.repository.law.indiana.edu/ilj/vol95/iss4/5

This Article is brought to you for free and open access by

the Maurer Law Journals at Digital Repository @ Maurer

Law. It has been accepted for inclusion in Indiana Law

Journal by an authorized editor of Digital Repository @

Maurer Law. For more information, please contact

The Death of the Income Tax

(or, The Rise of America’s Universal Wage Tax)

EDWARD J. MCCAFFERY

*

I. LOOMINGS

When Representative Alexandria Ocasio-Cortez, just weeks into her tenure as

America’s youngest member of Congress, floated the idea of a sixty or seventy

percent top marginal tax rate on incomes over ten million dollars, she was met with

a predictable mixture of shock, scorn, and support.

1

Yet there was nothing new in the

idea. AOC, as Representative Ocasio-Cortez is popularly known, was making a

suggestion with sound historical precedent: the top marginal income tax rate in

America had exceeded ninety percent during World War II, and stayed at least as

high as seventy percent until Ronald Reagan took office in 1981.

2

And there is an

even deeper sense in which AOC’s proposal was not as radical as it may have seemed

at first. For whether one likes, loves, hates, or fears it, one brute fact stands out about

AOC’s tax gambit: it would do nothing at all to change the tax burdens facing many

of America’s wealthiest billionaires who pay no federal income tax. Two you may

have heard of? How about President Donald J. Trump

3

or his son-in-law, Jared

Kushner.

4

How can this be? How can progressive efforts to make the wealthy pay a fairer

share of the overall tax burden be doomed from the start? The answer lies in a

surprising, and surprisingly hidden, fact: the individual income tax, as it was intended

to be, is dead. Out of its ashes, a new colossus has arisen: a universal wage tax that

*

Robert C Packard Trustee Chair in Law, Economics and Political Science, University

of Southern California; BA, Yale; JD, Harvard Law School; MA (Economics), USC. I thank

James Alm, Scott Altman, David Gamage and Austin Weinstein for comments and Eric

Nyman and David Sorenson for research assistance.

1. See Paul Krugman, The Economics of Soaking the Rich, N.Y. TIMES (Jan. 5, 2019),

https://www.nytimes.com/2019/01/05/opinion/alexandria-ocasio-cortez-tax-policy-dance

.html [https://perma.cc/HN3E-YZSN]; Aaron Rupar, The Conservative Response to Ocasio-

Cortez’s Tax Proposal Has Been Embarrassingly Deceptive: What Conservatives Are Getting

Wrong About Marginal Tax Rates, VOX (Jan. 7, 2019, 10:40 AM), https://www.vox

.com/policy-and-politics/2019/1/7/18171803/ocasio-cortez-70-percent-marginal-tax-rate-scal

ise-norquist-spin [https://perma.cc/8XKJ-4C4N]; Emmanuel Saez & Gabriel Zucman,

Alexandria Ocasio-Cortez’s Tax Hike Idea Is Not About Soaking the Rich, N.Y. TIMES (Jan.

22, 2019), https://www.nytimes.com/2019/01/22/opinion/ocasio-cortez-taxes.html

[https://perma.cc/526T-8TUN].

2. See Niall McCarthy, Alexandria Ocasio-Cortez’s Tax Plan Isn’t Unprecedented

Historically, FORBES (Jan. 24, 2019), https://www.forbes.com/sites/niallmccarthy/2019/01/24

/alexandria-ocasio-cortezs-tax-plan-isnt-unprecedented-historically-infographic/#35e7b3835

4dc [https://perma.cc/X8X2-4J2V].

3. Steve Eder & Megan Twohey, Donald Trump Acknowledges Not Paying Federal

Income Tax for Years, N.Y. TIMES (Oct. 10, 2016), https://www.nytimes.com/2016/10/10/us

/politics/donald-trump-taxes.html [https://perma.cc/ZV87-QD3Z].

4. Jesse Drucker & Emily Flitter, Jared Kushner Paid No Federal Income Tax for Years,

Documents Suggest, N.Y. TIMES (Oct. 13, 2018), https://www.nytimes.com/2018/10/13

/business/jared-kushner-taxes.html [https://perma.cc/E7HE-GFN9].

1234 IN DIANA LA W J OU RNA L [Vol. 95:1233

is simple, formless, onerous, and inescapable. America taxes wages, not wealth.

Those few who have significant wealth can easily find ways to live off it, well and

tax-free. America’s many workers have no such choice. AOC’s increased tax rate

would fall on a few working millionaires

5

but not on the many billionaires, like

President Trump and Kushner, who have no reportable “income” under current law

on which AOC or anyone else can tax them.

The killing of the income tax has not been open and notorious: such is not the

style of contemporary politics. As with other markers of progressive social policy—

the promises of universal health care, Obamacare, come to mind

6

—the income tax is

dying a death by stealth, albeit stealth played out in plain view. The plot lines of the

tragedy are apparent. The individual “income” tax has been split in two. One tax, for

the masses, is a simple, increasingly formless wage tax. This wage/income tax adds

higher brackets onto the payroll tax, the model toward which the wage/income tax

aims, to form a single “universal wage tax” providing the vast bulk of the

government’s revenue. A second tax, which I shall call the “ur-income tax,” persists

only for the wealthiest top 1%–5% of the population. This tax, the relics of a true

income tax, still nominally taxes wealth—that is, income from capital—in addition

to wages, as an “income” tax must in order to be an income tax. But this taxation of

wealth as opposed to wages is so porous that it is largely symbolic. Structural features

of the tax—loopholes—allow the wealthy to avoid its sting. Congress and the

executive branch continue to add rules and regulations to help the wealthy avoid tax.

Indeed, a cynic might suggest that the ur-income tax, the original and future tax that

applies to America’s wealthiest, persists only to feed the Wall Street financiers who

help their clients avoid paying it and the politicians and lobbyists who benefit

whenever tax reform specifically for the wealthy is on the legislative table.

7

For the

rest of us, the income tax has died, and we are paying a painful price for its killing.

The fate of the income tax correlates closely with an economic-class structure in

America that many have begun to notice.

8

For the very top, the 0.1% or so, tax is

essentially voluntary due to basic tax planning available for those living off capital

alone. For the next tier, what Matthew Stewart has taken to calling the new American

aristocracy,

9

the ur-income tax continues to apply, as these citizens have a mix of

capital and labor with which to play tax-planning games. For the bottom 90%–95%

of the economic scale, however, the income tax is dead, replaced by the formidable

and inescapable universal wage tax. This is the tale told in the pages ahead.

5. See William Gale, Ocasio-Cortez’s Tax on the Super Rich Won’t Happen. Here’s a

Better Way to Do It, CNN BUS. (Jan. 22, 2019), https://www.cnn.com/2019/01/22/perspect

ives/alexandria-ocasio-cortez-tax-plan-alternative/index.html [https://perma.cc/5VH4

-E73U].

6. Joanne Kenen, The Stealth Repeal of Obamacare, POLITICO (Dec. 19, 2017, 5:54 PM),

https://www.politico.com/story/2017/12/19/obamacare-repeal-tax-bill-trump-243912

[https://perma.cc/4KVH-X3E8].

7. Edward J. McCaffery & Linda R. Cohen, Shakedown at Gucci Gulch: The New Logic

of Collective Action, 84 N.C. L. REV. 1159 (2006).

8. See, e.g., Matthew Stewart, The 9.9 Percent Is the New American Aristocracy,

ATLANTIC (June 2018), https://www.theatlantic.com/magazine/archive/2018/06/the-birth-of

-a-new-american-aristocracy/559130/ [https://perma.cc/SD4F-TGA5].

9. See id.

2020] DEA TH OF TH E INCOME TA X 1235

A. The Trump Tax Cut, in Context

The recent “major overhaul” of the income tax under President Donald J. Trump

in fact continued a decades-long trend to transform the individual income tax into a

flat, or flattened, wage tax for the masses.

10

There is barely a need for most

Americans even to fill out forms to pay it. It has already long been the case that just

over one-half of Americans even pay the individual income tax;

11

around 150 million

individuals file returns each year.

12

Before the Tax Cuts and Jobs Act of 2017

(TCJA), only approximately 30% of those who filed had been taking “itemized”

deductions—meaning, among other things, the need to fill out longer forms and a

greater likelihood of being audited by the IRS.

13

Under the changes effected by the

TCJA, with an increased “standard deduction” and a continued assault on personal,

itemized deductions, the percentage of itemizers is expected to plunge to around 10%

of income taxpayers.

14

This means that ninety-five percent of Americans either will

not need to fill out an income tax return at all or will be approaching the possibility

of a “postcard” return,

15

or even more simply, having the government fill out tax

forms for them.

16

For most of these taxpayers the overwhelming component of their

income will be wages reported to the government by their employers. There will not

be any personal deductions to keep track of or show on a return. The typical

household will simply add up its wages as reflected on W-2s, subtract the standard

deduction, and look up the amount owed—most of which will already have been paid

through wage-withholding in paychecks. Indeed, millions of Americans will be

happy to get tax refunds on account of their overwithholding.

17

10. See Edward J. McCaffery, Taxing Wealth Seriously, 70 TAX L. REV. 305 (2017).

11. Catey Hill, 44% of Americans Won’t Pay Any Federal Income Tax, MONEYISH (Apr.

17, 2017), https://moneyish.com/hoard/44-of-americans-wont-pay-any-federal-income-tax/

[https://perma.cc/WD7Z-U3F5].

12. Brett Collins, Projections of Federal Tax Return Filings: Calendar Years 2011–2018,

31 STAT. INCOME BULL. 189, 182 fig.A (2012), https://www.irs.gov/pub/irs-soi/12rswin

bulreturnfilings.pdf [https://perma.cc/Y4M2-CQF4].

13. Scott Greenberg, Who Itemizes Deductions?, TAX FOUND. (Feb. 22, 2016),

https://taxfoundation.org/who-itemizes-deductions/ [https://perma.cc/XHZ5-9TXP].

14. Gary Strauss, Higher Standard Deduction Means Fewer Taxpayers to Itemize, AARP

MONEY (Jan. 22, 2018), https://www.aarp.org/money/taxes/info-2018/new-standard-deduct

ion-fd.html [https://perma.cc/8X4B-9TTR]; Erica York, Nearly 90 Percent of Taxpayers Are

Projected to Take the TCJA’s Expanded Standard Deduction, TAX FOUND. (Sept. 26, 2018),

https://taxfoundation.org/90-percent-taxpayers-projected-tcja-expanded-standard-deduction/

[https://perma.cc/9BW4-96RC].

15. Howard Gleckman, The New Tax Law’s Really, Really Big Postcard, FORBES (Jan.

29, 2018, 1:57 PM), https://www.forbes.com/sites/beltway/2018/01/29/tax-new-tax-bills-real

ly-really-big-postcard/#7a1dfe1a7bbc [https://perma.cc/73EH-BT85].

16. See Joseph Bankman, Using Technology to Simplify Individual Tax Filing, 61 NAT’L

TAX J. 773, 773 (2008) (describing California’s attempt to reform individual tax filing through

its “ReadyReturns” program, which provided a “pro-forma or tentative” tax return to

taxpayers with simple returns).

17. Kathy Frankovic, Americans Are Looking Forward to Their Tax Refunds, YOUGOV

(Apr. 16, 2018), https://today.yougov.com/topics/politics/articles-reports/2018/04/16/ameri

cans-are-happy-looking-forward-their-tax-refu [https://perma.cc/LBW5-WM3L].

1236 IN DIANA LA W J OU RNA L [Vol. 95:1233

This is a tax with few or no forms to fill out, little or no variation among taxpayers,

falling only on wages, and automatically collected from paychecks. What should this

remind us of? For ninety percent or more of Americans, the individual income tax is

morphing into the second part of a universal wage tax system that simply adds higher

rate brackets onto the federal payroll tax. The payroll tax has long been a flat-rate

wage tax on the vast majority of American workers, kicking in on the first dollar of

wage income—that is, having no deductions, standard or otherwise. And this payroll

tax already is, for more than three out of four American workers, the major tax they

pay (more than one out of four Americans only pay payroll taxes)

18

—though they do

not know it.

19

Most Americans never fill out any form to pay payroll taxes or pay

any planners to avoid them, students almost never study the tax, the IRS does not

much trouble regular citizens about it, and politicians almost never talk about it. Only

once in its eighty-year history has the payroll tax ever been cut, and that cut—

President Barack Obama’s payroll tax holiday—was undone after two years, when

the government needed to resolve a fiscal crisis of its own making, mainly on account

of reckless cuts to the individual income tax, as we shall consider further below.

20

The payroll tax as it is and always has been is a pure wage tax—one that makes

no effort at all to tax income from wealth. It is not an income tax. The more the

“income” tax looks like a payroll tax, the less it is in fact an income tax. President

Trump’s tax cuts dealt a further death blow to what an income tax is supposed to be.

For most Americans, the income tax is dead.

B. The Seeds Planted

The plan radically to transform the income tax into a wage tax in drag, like the

entire history of the payroll tax, has been hidden in plain sight all along, at least since

Grover Norquist published a seminal editorial piece, Step-by-Step Tax Reform, in

2003.

21

Conservatives have been surprisingly explicit about their goals of achieving

a tax system with “a single-rate tax, which taxes income one time,” as Norquist put

it.

22

Increasingly, since Norquist first set out the plan in simple written form, the “one

time” that “income” gets taxed is as it is earned from labor, just like the payroll tax.

Norquist’s plan was to incrementally bring the “income” tax into synch with the

holy grail of a flat tax, as championed by such conservative luminaries as Steve

Forbes, Richard Armey, Robert Hall, and Alvin Rabushka.

23

One can see the plot in

18. Roberton C. Williams, Most Americans Pay More Payroll Tax Than Income Tax, TAX

POL’Y CTR. (Sept. 6, 2016), https://www.taxpolicycenter.org/taxvox/most-americans-pay-

more-payroll-tax-income-tax [https://perma.cc/8XFP-HK9F].

19. Edward J. McCaffery, Cognitive Theory and Tax, 41 UCLA L. REV. 1861 (1994).

20. Edward J. McCaffery, Distracted from Distraction by Distraction: Reimagining

Estate Tax Reform, 40 PEPP. L. REV. 1235 (2013).

21. Grover Norquist, Step-by-Step Tax Reform, WASH. POST (June 9, 2003),

https://www.washingtonpost.com/archive/opinions/2003/06/09/step-by-step-tax-reform/f200

f59d-7370-42f6-837b-265501dc3701/?noredirect=on&utm_term=.fde6850c3203 [https://per

ma.cc/3ARN-63NZ].

22. Id.

23. See, e.g., ROBERT E. HALL & ALVIN RABUSHKA, THE FLAT TAX (2d ed. 2007);

Lawrence Zelenak, The Selling of the Flat Tax: The Dubious Link Between Rate and Base, 2

2020] DEA TH OF TH E INCOME TA X 1237

the details, such as in the conservative predilection for “Roth-style” treatment of

savings under the “income” tax—going so far as to label the movement

“Rothification” of the income tax.

24

Under the Roth model, income is taxed once, as

earned, and never again. This is also true of the payroll tax: income is taxed as earned,

from wages, but the system makes no attempt whatsoever to track income from

wealth or savings. The simple reason for the parallelism is that an “income” tax with

Roth-style treatment of savings is a payroll tax—one that taxes wages and ignores

savings. Such a universal wage tax, of course, wildly favors those who do not actually

have to work for wages to support their lifestyles: those like America’s ever-growing

list of billionaires (well over 500 as I write)

25

and ever-growing number of “dynasty-

trust babies,” who can live off their wealth, not wages.

26

Each of Norquist’s five steps (in his own words; I have added just the numbers to

track the text better) is already well on its way to becoming reality: “[1] [a]bolish the

death tax, [2] abolish the capital gains tax, [3] expand IRAs so that all savings are

tax-free, [4] move to full expensing of business investment rather than long

depreciation schedules and [5] abolish the alternative minimum tax.”

27

Each step has

proceeded incrementally, just as Norquist’s global strategy was meant to proceed

incrementally. In particular, the TCJA severely weakened the “death” tax (step 1)

28

as well as the alternative minimum tax (step 5),

29

while moving towards expensing

of business investment (step 4).

30

And as ordinary American wage earners continued

CHAP. L. REV. 197 (1999); Steve Forbes, The Tax Code: Make It Flat, FORBES (Mar. 7, 2014),

https://www.forbes.com/sites/steveforbes/2014/03/07/the-tax-code-make-it-flat/#31880e2a7

e0e [https://perma.cc/HYG8-9QNE]; Daniel Mitchell & William Beach, How the Armey-

Shelby Flat Tax Would Affect the Middle Class, HERITAGE FOUND. (Mar. 12, 1996),

https://www.heritage.org/taxes/report/how-the-armey-shelby-flat-tax-would-affect-the-mid

dle-class [https://perma.cc/W36R-TSCH].

24. Bill Bischoff, How the New Tax Law Created a ‘Perfect Storm’ for Roth IRA

Conversions in 2019, MARKETWATCH (Feb. 24, 2019), https://www.marketwatch.com

/story/how-the-new-tax-law-creates-a-perfect-storm-for-roth-ira-conversions-2018-03-26

[https://perma.cc/4XRW-PX2A]; Amir El-Sibaie, What Rothification Means for Tax Reform,

TAX FOUND. (Sept. 12, 2017), https://taxfoundation.org/what-rothification-means-for-tax-

reform/ [https://perma.cc/9KAS-JRCG].

25. Katie Sola & Emily Canal, Here Are the States with the Most Billionaires, FORBES

(Mar. 5, 2016), https://www.forbes.com/sites/katiesola/2016/03/05/here-are-the-states-with-

the-most-billionaires/#13fb2cfc101e [https://perma.cc/2E38-V48G].

26. Edward J. McCaffery, Wealth Not Wages: The Fundamental Trick of Tax Policy,

HUFFINGTON POST, https://www.huffingtonpost.com/entry/wealth-not-wages-the-fundament

al-trick-of-tax-policy_us_59ea5fd1e4b034105edd4e79 [https://perma.cc/XS72-2ZYF]

(updated Oct. 20, 2017, 5:27 PM).

27. Norquist, supra note 21.

28. Howard Gleckman, Only 1,700 Estates Would Owe Estate Tax in 2018 Under the

TCJA, TAX POL’Y CTR. (Dec. 6, 2017), https://www.taxpolicycenter.org/taxvox/only-1700-

estates-would-owe-estate-tax-2018-under-tcja [https://perma.cc/3GWA-RN6Y].

29. Bill Bischoff, Meet the New, Friendlier Alternative Minimum Tax, MARKETWATCH

(Feb. 26, 2018), https://www.marketwatch.com/story/meet-the-new-friendlier-alternative

-minimum-tax-2018-02-26 [https://perma.cc/RMZ8-TUFC].

30. John Ohannessian & Stefanie Levit, Tax Reform: Enhanced Fixed Asset Expensing

Under the Tax Cuts and Jobs Act, MAZARS (Feb. 9, 2018), https://mazarsledger.com/enhanced

-fixed-asset-expensing-under-the-tax-cuts-and-jobs-act/ [https://perma.cc/3PD2-4KKW].

1238 IN DIANA LA W J OU RNA L [Vol. 95:1233

to search for the $4000 of benefits that Trump promised them from Tax Cuts 1.0,

31

talk of Tax Cuts 2.0 featured reductions to the capital-gains rate, even by executive

regulatory action (step 2),

32

and an expansion of IRAs—along the Roth model (step

3).

33

At the end of this line, when all five of Norquist’s steps have been taken in full,

there will be no income tax as we know it, or one that can properly be called an

“income” tax: we will have arrived at a universal wage tax.

C. The Normative Stakes at Issue

To be clear, much has been gained as the death of the income tax plays out. The

simplifications to the tax system are popular, the administrative efficiencies of a

simpler tax are real, and so forth. This Article is not about parsing out blame for the

status quo, but it is worth noting, in passing at least, that it is not just conservatives

bent on a flat wage tax driving the policy changes. Liberals and progressives have

been especially wont to use the income tax as a vehicle for advancing social and

political ends—noble causes, perhaps, but ones that helped to make the income tax

unpopular and unwieldy.

34

Whatever the causes or benefits of the income tax’s

demise, some very important things have been lost in its passing: in particular, the

very possibilities for politics and progressivity.

The payroll tax is again the guide—it rarely features as an issue in electoral

politics and is not, and never has been, meaningfully redistributive. Indeed, there are

compelling reasons, in both theory and practice, why a wage tax ought not to be too

progressive or feature overly high marginal tax rates on the upper income: this is a

lesson both of the late Nobel Laureate James Mirrlees, of optimal income tax fame,

35

and of the academic and political advisor Arthur Laffer, of the “Laffer Curve” and

recent Presidential Medal of Honor fame.

36

Thus AOC’s proposal to raise marginal

31. Heather Long, The Average American Family Will Get $4,000 from Tax Cuts, Trump

Team Claims, WASH. POST (Oct. 16, 2017), https://www.washingtonpost.com/news/wonk

/wp/2017/10/16/the-average-american-family-will-get-4000-from-tax-cuts-trump-team-

claims/?utm_term=.488f058e7357 [https://perma.cc/6DQQ-YP6X].

32. Newt Gingrich, Why THIS Must Happen Next in Trump’s Economic Revolution, FOX

NEWS (Aug. 8, 2018), http://www.foxnews.com/opinion/2018/08/08/newt-gingrich-why-this-

must-happen-next-in-trump-s-economic-revolution.html [https://perma.cc/XD5A-72P9].

33. Laura Davison, In New Round of Tax Cuts, Retirement Changes Seen as Most Likely

to Pass, BLOOMBERG (July 18, 2018, 3:46 PM), https://www.bloomberg.com/news/articles

/2018-07-18/in-tax-cuts-2-0-retirement-changes-seen-as-most-likely-to-pass [https://perma

.cc/T5QQ-9764].

34. See generally Edward J. McCaffery, The Missing Links in Tax Reform, 2 CHAP. L.

REV. 233 (1999).

35. See J. A. Mirrlees, An Exploration in the Theory of Optimum Income Taxation, 38

REV. ECON. STUD. 175 (1971); Sam Roberts, James Mirrlees, Whose Tax Model Earned a

Nobel, Dies at 82, N.Y. TIMES (Sept. 4, 2018), https://www.nytimes.com/2018/09/04

/obituaries/james-mirrlees-dead.html [https://perma.cc/U42T-WZNX].

36. Arthur Laffer, The Laffer Curve: Past, Present, and Future, HERITAGE FOUND. (June

1, 2004), https://www.heritage.org/taxes/report/the-laffer-curve-past-present-and-future

[https://perma.cc/442Y-HVWH]; Ian Schwartz, President Trump Presents the Presidential

Medal of Freedom to Arthur Laffer, REALCLEARPOLITICS (June 20, 2019),

https://www.realclearpolitics.com/video/2019/06/20/president_trump_presents_the_presiden

2020] DEA TH OF TH E INCOME TA X 1239

tax rates faces a plausible objection that it will deter high-end labor effort, while

doing nothing at all for those who are already wealthy and do not have to work for

wages in the first place.

The death of the income tax as an income tax—as a tax that is meant to fall on

wealth as well as on wages—means a deep, structural, and likely long-lasting loss to

America. To its advocates such as Grover Norquist, the death will be the crowning

glory in the systematic disarmament of the state’s tools of redistribution. Once cut,

complex, progressive taxes on capital and the rich will be hard to raise.

37

Taxes on

wages, in contrast, are easy to collect and raise—their broad base means modest rate

increases raise massive revenues, and their largely hidden structures keep the people

from complaining too much about seemingly small increases to them. We saw this

dynamic play out rather precisely under President Obama’s “fiscal cliff fix,” in 2012,

when the restoration of a temporary, two percent payroll tax cut brought in the bulk

of the revenues (specifically, $1 trillion over a ten year period) to close a fiscal gap

created in large part due to President George W. Bush’s reckless income tax cuts.

38

As this all plays out, wealth will be systematically left off the hook for paying any of

the price of whatever civilization endures.

The income tax is not completely dead, yet. And it might never fully, literally die.

Like the story of the gift and estate, or so-called “death,” tax

39

or like the slashing of

the corporate income tax—two taxes meant to fall on wealth not wages—the ur-

income tax may persist largely as a fig leaf giving cover to a tax system

fundamentally set up to tax wages, not wealth. It will be more symbolic than real and

more fodder for keeping money—lots of money—in politics. Meantime, ninety to

ninety-five percent of Americans will be facing a flattened and inescapable wage tax.

Tax will continue to be a deep part of the problem of exacerbating wealth inequality

in America and not any part of its solution. Meaningful possibilities for getting the

wealthy to pay a fair share into the collective will be dead in all but name.

We are almost at the funeral stage, though hope continues to spring eternal. New

ideas, such as AOC’s marginal-rate increase, Senator Elizabeth Warren’s recent

proposal for a federal wealth tax on fortunes in excess of $50 million

40

and former

Vice President Biden’s proposal to repeal the “stepped-up basis” on death rule of

I.R.C. § 1014,

41

bear promise of different things to come—of a real attempt to get

the wealthy to pay a fair share of tax. But for progress to obtain and endure, it is best

to understand the failures of past and present tax policy. These recent progressive

tial_medal_of_freedom_to_arthur_laffer.html [https://perma.cc/N3R2-J5EK].

37. Robert J. Shiller, Once Cut, Corporate Income Taxes Are Hard to Restore, N.Y. TIMES

(June 22, 2018), https://www.nytimes.com/2018/06/22/business/big-war-to-raise-the-corp

orate-income-tax.html [https://perma.cc/795Y-GAE5].

38. See McCaffery, supra note 10, at 343–44.

39. This is discussed later in this Article in greater depth. See infra Section IV.B.3.

40. Sahil Kapur & Joe Weisenthal, Warren Faults ‘Captalism Without Rules’ in Pushing

Wealth Tax, BLOOMBERG (Jan. 30, 2019), https://www.bloomberg.com/news/articles/2019-

01-30/warren-faults-capitalism-without-rules-in-pushing-wealth-tax [https://perma.cc/A3JV

-PBTY].

41. The RS Politics 2020 Democratic Primary Policy Guide, ROLLINGSTONE (July 31,

2019), https://www.rollingstone.com/politics/politics-lists/2020-democratic-candidates-iss

ues-policy-positions-820811/ [https://perma.cc/XZJ6-8LZK].

1240 IN DIANA LA W J OU RNA L [Vol. 95:1233

proposals all work within an existing paradigm of taxing income-plus-wealth that

has existed on the books in America for over a century. It is not working, as this

Article argues. Sometimes paradigms must shift, and new tools need to be crafted for

old and intransigent problems. Furthering this intellectual project along is a main

goal of this Article.

This is an important political and legal story. Let us go through it step by step, as

they say.

II. THE SCRIPT

To fully understand the death of the income tax, we need some background in

diverse disciplines including political economy, history, and, not least, tax law and

theory. The complexities of the subject matter help obscure its basic and profound

truths—a major part of the reason that the murder can take place in broad daylight. I

will keep the main discussion as simple and welcoming as possible, for the technical

details tend to obscure the basic truths. More complexity can be found by following

sources in the footnotes.

A. The Producers: Wealth and Wages

There are two major forces at work throughout our story: capital and labor, the

two great factors of production in a modern capitalist economy. All wealth comes,

ultimately, from one’s labor or from one’s capital: people earn wealth either by

working for it or by using their assets (money, machines, land, buildings, intellectual

property, and so forth), for which they are paid rents or profits.

Political economists from John Stuart Mill to Karl Marx and beyond have used

this vocabulary.

42

The contemporary French economist Thomas Piketty recently

published a major work, Capital in the 21st Century, collecting vast reams of data to

paint a picture of the state of capital and labor today.

43

The quick bottom line: capital

is winning. The world has more capital than ever, more unequally held. The Western

world is at, and is soon to exceed, levels of capital accumulation and inequality not

seen since the Gilded Age of the early twentieth century—a moment in time that

boded ill for Western civilization. Labor, meantime, has been losing: wages have

been stagnating for some time, and labor’s share of the national income has been in

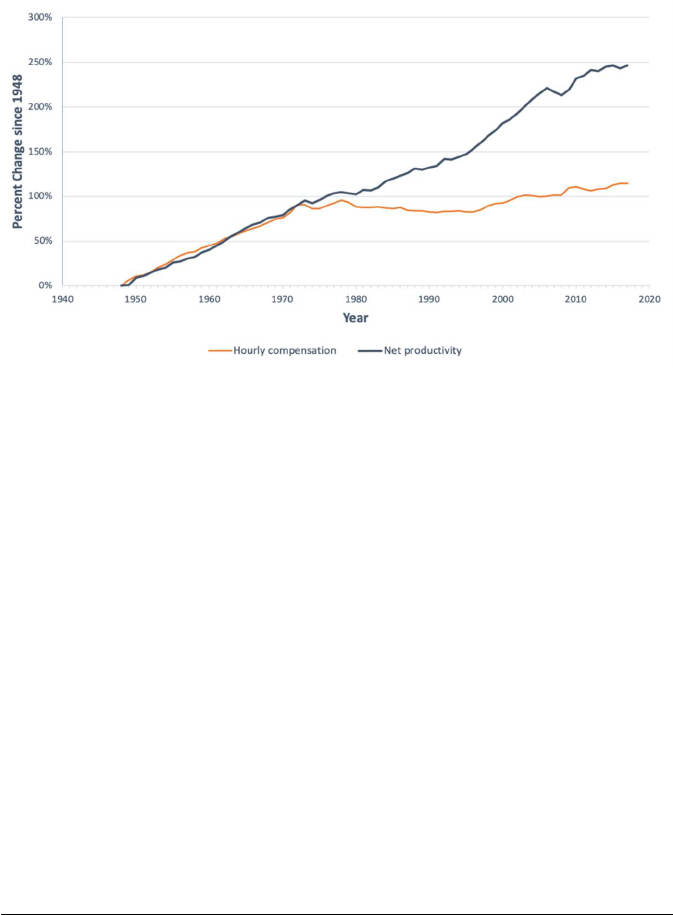

steady decline for decades, as Figure 1 illustrates.

44

42. See generally KARL MARX, DAS KAPITAL (1848); JOHN STUART MILL, PRINCIPLES OF

POLITICAL ECONOMY (1848).

43. THOMAS PIKETTY, CAPITAL IN THE TWENTY-FIRST CENTURY (2013); accord EDWARD

J. MCCAFFERY, THE MEANING OF CAPITAL IN THE 21ST CENTURY (2016).

44. Jonathan Rothwell, Make Elite Compete: Why the 1% Earn So Much and What to Do

About It, BROOKINGS (Mar. 25, 2016), https://www.brookings.edu/research/make-elites-com

pete-why-the-1-earn-so-much-and-what-to-do-about-it/ [https://perma.cc/J76H-AMW8].

2020] DEA TH OF TH E INCOME TA X 1241

Figure 1: Labor Share of the National Income, 1948–2018

45

Wage and Salary Employee Compensation as a Share of the Gross

Domestic Income

In part because “capital” and “labor” have connotations of Marxism and

unpleasant undergraduate lectures, I will generally use the simpler, more colloquial

terms of wealth and wages. “Wealth” refers to the value of all of one’s assets, minus

debts or liabilities; “wages” refer to paychecks, income from labor. In 2017, the

average American worker received wages of just under $45,000 per year.

46

The

average income (from capital and labor, combined) of the top one percent of

households in America was about $430,000, while the average wealth of the top one

percent was over $10,300,000.

47

Wealth inequality, in other words, is far more severe

than wage inequality. To have some real examples in mind, Warren Buffett has a net

worth, a wealth, of $85 billion ($85,000,000,000) as I write;

48

his salary as the chief

executive officer of Berkshire Hathaway is $100,000.

49

The late Steve Jobs, who died

45. Shares of Gross Domestic Income: Compensation of Employees, Paid: Wage and

Salary Accruals: Disbursements: To Persons, FED. RESERVE BANK OF ST. LOUIS,

https://fred.stlouisfed.org/series/W270RE1A156NBEA [https://perma.cc/FLW8-KVY2] (last

updated Aug. 29, 2019).

46. Alison Doyle, Average Salary Information for US Workers, BALANCE CAREERS,

https://www.thebalancecareers.com/average-salary-information-for-us-workers-2060808

[https://perma.cc/SBZ3-MGK5] (last updated May 10, 2019).

47. PK, Who Are the One Percent in the United States by Income and Net Worth?,

DQYDJ, https://dqydj.com/who-are-the-one-percent-united-states/ [https://perma.cc/BU3P

-YFWL] (last updated Oct. 10, 2019).

48. Tanza Loudenback, 24 Mind-Blowing Facts About Warren Buffett and His $84.7

Billion Fortune, BUS. INSIDER (Aug. 30, 2018), http://www.businessinsider.com/facts-about

-warren-buffett-2016-12 [https://perma.cc/SPW8-2BZ6].

49. Sarah Berger, Warren Buffett Has Been Making the Same Salary for Decades—and

It’s Surprisingly Low, CNBC (Mar. 19, 2018), https://www.cnbc.com/2018/03/19/warren

-buffetts-berkshire-hathaway-salary.html [https://perma.cc/3LC4-J2TD].

1242 IN DIANA LA W J OU RNA L [Vol. 95:1233

in 2011 with a wealth of $10 billion,

50

did Buffett one hundred thousand better:

Jobs’s annual wages from Apple, the company he founded, were $1.

51

Wealth and wages are the producers in a capitalist economy, and they are the

dueling players in the tax saga that will end in the income tax’s death. It is important

to understand that this is not a battle between “rich” and “poor,” but rather a battle

between a specific type of “rich”—those that have wealth and do not need wages—

and everyone else. Most significantly, it is not a battle between “upper” income and

“lower” income. There is much confusion here, as anti-income tax advocates like to

point to statistics showing that upper-income persons pay most of the income tax and

that the income tax is therefore, if anything, too progressive.

52

As often in the public political presentation of tax, there are fiscal optical illusions

at work. What we see is not the full story. The income tax system appears progressive

on its face, as those with higher incomes pay higher income taxes. But there are

illusions at both ends of the income scale. On the low end, the usual claim ignores

the payroll tax, which falls on wages beginning with the first dollar of them. On the

high end, where the wealthy live, looking at “income” fails to capture the hugely

significant unrealized appreciation of the wealthy, who do not have to report their

true economic income as “income” on any tax form, as we shall discuss below.

53

Under the universal wage tax, as we shall see, Americans who work regular jobs for

a living face a flattened and inescapable wage tax. The payroll tax provides the lower

brackets, the wage/income tax the higher brackets: when combined, these rates

flatten out considerably (see Figures 13 and 14, below, if you want to peek ahead).

Meantime, those with wealth, who do not depend on wages for their lifestyle, can

avoid all tax—and do not show up in the picture at all.

The reorientation involved in looking at matters of tax through the lens of wealth

and wages, capital and labor, is Copernican. It answers the paradox confronting

AOC: raising rates on millionaires does nothing to billionaires. The new focus allows

us to see a universal wage tax structure that is surprisingly flat and virtually

inescapable. This is what labor faces. All workers are taxed, and rather heavily. This

stands in contrast to all taxes on wealth (the corporate income, gift and estate, and

ur-income taxes), the coproducer of the economy. These taxes are low, when they

fall at all, and are virtually voluntary all of the time.

50. Andrew Beattie, Steve Jobs and the Apple Story, INVESTOPEDIA (Jun 30, 2019),

https://www.investopedia.com/university/steve-jobs-biography/steve-jobs-net-worth.asp

[https://perma.cc/L6S9-6J8A].

51. Why Did Steve Jobs Only Make $1 a Year? (and What Can You Learn From It),

MOTLEY FOOL (Mar. 7, 2017), https://www.fool.com/personal-finance/2014/02/01/why-did-

steve-jobs-only-make-1-a-year-and-what-you.aspx [https://perma.cc/Z8F7-9CCL]. Jobs was

far from alone. See, e.g., Robert W. Wood, Tax-Smart Billionaires Who Work for $1, FORBES

(Apr. 5, 2014), https://www.forbes.com/sites/robertwood/2014/04/05/tax-smart-billionaires

-who-work-for-1/#77894ad6dfee [https://perma.cc/4GHN-VMMC].

52. Laura Saunders, Top 20% of Americans Will Pay 87% of Income Tax, WALL ST. J.

(Apr. 6, 2018), https://www.wsj.com/articles/top-20-of-americans-will-pay-87-of-income

-tax-1523007001 [https://perma.cc/ET2W-B4EN].

53

See infra Section III.B.

2020] DEA TH OF TH E INCOME TA X 1243

Thus the wealth-wage distinction allows us to see the fatal problem with

Democratic or liberal tax policy in the post-World War II (“post-War”) era: because

taxes fall primarily on wages, redistribution, if any, has to occur from more highly

paid to lower paid workers or to the nonworking poor. The middle class is pitted

against the lower class while the upper class sits on the sidelines. This is not a recipe

for social stability.

Wealth and wages have often been on separate paths throughout history, but the

present trajectories point to pressing and looming social, political, and economic

perils. In short and in sum, while wealth is still winning, wages are now losing. As

Piketty and others have abundantly documented, the rich are getting richer as capital

takes a greater share of the social economic pie. Global forces such as free trade and,

more importantly, automation bring pressure on wages or eliminate the need for

human workers altogether while benefiting capital. While the rich have been getting

richer, wages have been stagnating.

1. A Quick Flashback

It has not always been as it is now between wealth and wages. There have been

periods of history when capital and labor moved in tandem, sharing equally in

society’s productive gains. This is not the world that Figure 1 points to for the

present. Figure 1 shows that labor’s share of GDP has been falling steadily in the

post-War era, falling from over 50% in the late 1960s to just over 40% more recently.

This means that some 10% of the annual national income—more than $2 trillion in

2018, given a GDP of $20.5 trillion

54

—has shifted from labor to capital over this

time period.

Now this could be so because the national income was growing so fast that labor,

despite its smaller share of the pie, was better off: that is, it could be the case that

50% of the 2010 pie is a better deal than 60% of the 1970 one. Were this so, the

wealthy would still be getting much wealthier—after all, their 50% of the (larger)

2010 social pie is clearly better than their 40% of the (smaller) 1970 pie. But perhaps

labor is gaining, too, just not as quickly.

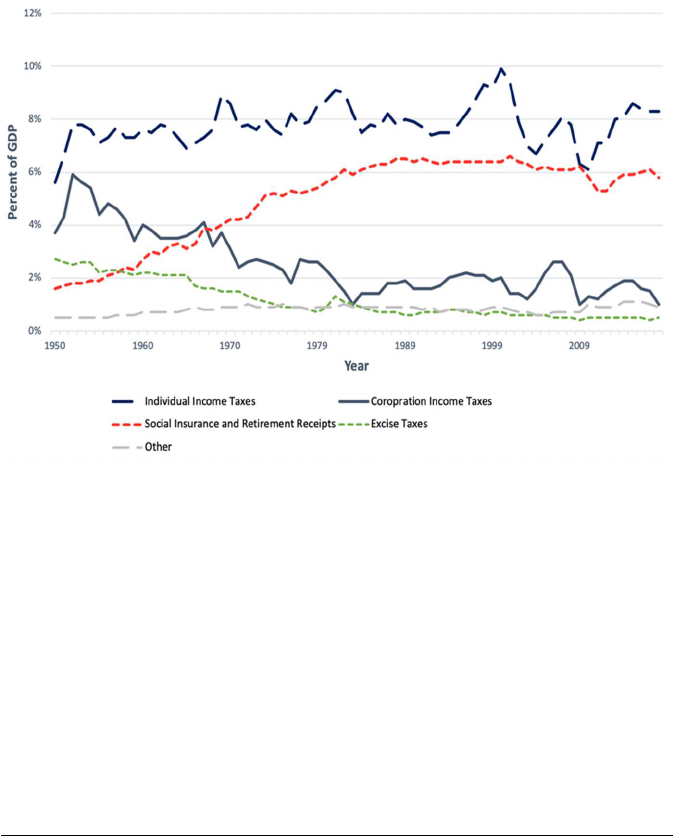

Figure 2 casts considerable doubt on that happy tale. This Figure, prepared by the

nonpartisan Economic Policy Institute, shows the average hourly wage growth,

adjusted for inflation, for ordinary (nonsupervisory) workers on one line and national

productivity on the other, for the period from 1948–2011. The chart is helpfully

divided in two at the year 1973. For the period from 1948–1973, wealth and wages

were in virtual lockstep. These were rebuilding years, with plenty of need for labor

and capital as America emerged from the cataclysms of economic depression and

war. Things changed starting around 1973. Wages essentially flattened, while overall

productivity continued its skyrocketing trajectory. That means that these years, of

internet booms and automation and global marketplaces, were very good overall, but

ordinary labor—wages—was not going along on the ride. The rich were getting

richer, in other words, without pulling workers along with them. Capital and labor,

54. Gross Domestic Product, Fourth Quarter and Annual 2018 (Initial Estimate),

BEAGOV (Feb. 28, 2019), https://www.bea.gov/news/2019/initial-gross-domestic-product

-4th-quarter-and-annual-2018 [https://perma.cc/475D-7X88].

1244 IN DIANA LA W J OU RNA L [Vol. 95:1233

happily married during the immediate post-War phase, have been divorced for some

time now.

Figure 2: Wage Growth and Productivity, 1948–2017

55

Gap Between Productivity and a Typical Worker’s Compensation

from 1948–2017

Figure 3 confirms this sense, focusing on the impacts of inflation. Since the 1960s,

American wages have essentially been flat in constant-dollar (here, in 2019) terms.

55. The Productivity—Pay Gap, ECON. POLICY INST., https://www.epi.org/productivity

-pay-gap/ [https://perma.cc/47G9-EKG8] (last updated July 2019).

2020] DEA TH OF TH E INCOME TA X 1245

Figure 3: Hourly Wages for Production and Nonsupervisory Employees, Nominally

and Adjusted for Inflation

56

HOURLY WAGES FOR PRODUCTION AND NONSUPERVISORY EMPLOYEES

2. Back to Tax

Tax, which could and arguably should be addressing and correcting for the

growing gap between wealth and wages—by taxing wealth more and wages less—

has been doing precisely the opposite. Taxes are falling more heavily on wages, less

heavily on wealth, even in the face of macroeconomic forces vastly favoring wealth.

Our central story, of the slow death of the income tax as an income tax, is a leading

cause of this perversity.

B. The Staging: All About the Base

Any tax consists of a simple product of a “rate,” or how much is being taxed,

times a “base,” or what is being taxed. The bifurcation of political issues between

base and rates is key to our tale. The income tax has always depended on a series of

progressive marginal rates that have contributed to its complexity and unpopularity:

AOC waded into this thicket. But our story of the income tax’s death turns on the

base, or the “what” of taxation, in the first instance. Norquist’s dream in five easy

56. Databases, Tables & Calculators by Subject, U.S. BUREAU OF LABOR STATISTICS,

https://data.bls.gov/timeseries/CES0500000008 [https://perma.cc/2EPG-83CT] (last modified

May 14, 2020, 7:41 PM), converted through CPI Inflation Calculator, U.S. BUREAU OF LABOR

STATISTICS, https://data.bls.gov/cgi-bin/cpicalc.pl [https://perma.cc/EF5T-YKP4].

1246 IN DIANA LA W J OU RNA L [Vol. 95:1233

pieces is about changing the base of the income tax into a wage one.

57

The question

of rates will be dealt with separately, using another bifurcation—between the payroll

and “income” taxes—to effect a significant optical illusion. We will get to that after

the main tale.

Back to the base. There are three major choices of base for a comprehensive tax—

one meant to apply to wide ranges of individuals and to collect significant revenues.

These taxes fall on the flow of funds into and out of households, as opposed to those

taxes, such as property or pure “wealth” taxes, that fall on assets or on static stocks

of wealth—for example, Senator Warren has announced plans for an annual wealth

tax on fortunes in excess of fifty million dollars.

58

In the flow of funds, money comes

into a household from wages and/or the returns on wealth. What comes in goes out,

in the form of either spending or savings. In the traditional language of tax policy:

Capital + Labor → Income = Consumption + Savings.

59

In words, the returns to capital (wealth) and labor (wages) come into a household and

thus constitute “income.” Whatever comes in is either spent (consumption) or not

(savings): the two categories of outputs from a household.

An income tax, by definition and in theory, is supposed to tax both wealth and

wages, capital and labor, the two sources of income on the left-hand side of the above

relation. As the Supreme Court put it in the seminal case of Eisner v. Macomber,

decided in 1920, “[i]ncome may be defined as the gain derived from capital, from

labor, or from both combined.”

60

In choosing to tax both wealth and wages, income taxes have long been criticized

for being a so-called double tax, going back at least as far as John Stuart Mill in

1848.

61

The reason is simple to understand. Consider two taxpayers, Ant and

Grasshopper, each of whom earn $100 from a day at work, in wages. Grasshopper

spends all of his money before he goes to sleep, as is his wont. Ant, on the other

hand, saves a portion of her wealth, as is her wont. When Ant’s savings yield a

return—interest, rent, dividends—she has a point in complaining that she is being

harmed by her thrift under an income tax. Why should she pay tax twice, when she

and Grasshopper have each earned the same amount initially, and Ant is only earning

more money on account of her thrift?

The criticism of the income tax as a “double tax” on savings has led economists

and others to advocate for “single” taxes, which apply only once in the flow of a

57. See supra text accompanying note 27.

58. Naomi Jagoda, Warren Stakes out 2020 Ground with Wealth-Tax Proposal, THE HILL

(Jan. 27, 2019), https://thehill.com/policy/finance/427075-warren-courts-progressives-with

-wealth-tax-proposal [https://perma.cc/4NUX-RTZP].

59. HENRY C. SIMONS, PERSONAL INCOME TAXATION: THE DEFINITION OF INCOME AS A

PROBLEM OF FISCAL POLICY 50 (1938).

60. 252 U.S. 189, 207 (1920) (internal quotation marks and citations omitted).

61. See generally MILL, supra note 42.

2020] DEA TH OF TH E INCOME TA X 1247

household’s funds.

62

This is Norquist and company’s quest for a tax “which taxes

income one time.”

63

There are two major choices of single taxes, each of which can properly be called

a “consumption” tax. One tax applies when income is first earned, and never again.

This type of tax has been called a “prepaid” consumption tax, but we can call it by a

simpler name: a “wage tax.” The second type of consumption tax falls when, and

only when, an individual spends money on herself. This type of tax has been called

a “postpaid” consumption or a “consumed income” tax, but again we can use a

simpler term: a “spending tax.”

Much ink has been spent explaining the similarities and differences among

income and consumption taxes.

64

In theory, prepaid and postpaid, or wage and

spending, taxes lead to the same place under certain conditions. But this is not an

article about tax theory or about the intellectual history of tax.

65

This Article concerns

practical politics and the possibilities for the sharing of government burdens between

capital and labor, wealth and wages. Consider how the different taxes affect wealth

and wages. As a practical matter, there is no doubt that an income tax, in theory and

by definition, is meant to fall on both wealth and wages. There is also no doubt that

a wage tax falls only on wages, never on wealth. A spending tax, in contrast, can fall

on wealth, when wealth is used to finance consumption.

66

Consider our friend Grasshopper again. Grasshopper earns his $100 of wages and,

just before he has spent his last cent, he buys a lottery ticket. He gets lucky, and the

ticket pays off $10,000. How do the three taxes affect him? Suppose all taxes have a

flat 30% rate, just to illustrate (and to foreshadow a bit). An income tax falls first on

Grasshopper’s wages, taking 30%, or $30, from his $100. Then, when Grasshopper’s

lottery ticket hits, the income tax taxes him again, taking 30%, or $3000, of his

$10,000 winnings, leaving him with $7000 to consume. A wage tax taxes

Grasshopper’s wages, taking $30 from his $100, but then ignores the lottery

winnings, so Grasshopper gets to keep his full $10,000. Finally, a spending tax would

not tax Grasshopper’s wages, so he gets to keep his full initial $100 of pay, until he

spends them and pays his $30. But when Grasshopper goes to spend his $10,000

lottery winnings, he also must pay a 30% tax, or $3000, leaving him with $7000 of

personal spending.

In sum: the wage tax, and the wage tax alone, allows Grasshopper to keep and

spend his entire “windfall” from his “investment” in the lottery ticket.

67

This simple example shows that the single taxes of wage and spending taxes are

different, because they fall at different times. Wage taxes completely ignore savings:

savings are irrelevant to how much payroll taxes one pays, for example. Spending

taxes, in contrast, do fall on “windfalls” from capital: what is irrelevant under a

62. See generally Jeffrey L. Kwall, The uncertain case against the double taxation of

corporate income, 68 N.C. L. REV. 613 (1990).

63. Norquist, supra note 21.

64. See, e.g., Edward J. McCaffery, A New Understanding of Tax, 103 MICH. L. REV.

807 (2005).

65. C.f. id.

66. See id. at 822.

67. See McCaffery, supra note 10, at 327–28 (discussing windfalls).

1248 IN DIANA LA W J OU RNA L [Vol. 95:1233

spending tax is where the money to spend came from (wealth, wages, gift, loan, or

otherwise).

68

With just this small taste of tax theory behind us, it should come as no surprise

that conservatives have aimed to transform the “income” tax—a tax which is meant

to fall on both wealth and wages, to the extent of “double” taxing savings—into a

“single” tax. Nor should it be a surprise that the preferred single tax has emerged to

be the wage-tax model—recall that an “income” tax with unlimited Roth-style

treatment of savings is a wage tax.

69

This is the death of the income tax. The end of

days for the income tax lies with a universal wage tax.

This is why our main story is all about the base. It turns on the relatively quiet,

hidden transformation of the “income” tax into a wage tax. This proceeds along

Norquist’s charted course, starting with wages. We systematically eliminate all

additions to wages by allowing for tax-free savings and no capital-gains tax, and we

also eliminate all subtractions, or deductions, from wages by limiting business

deductions and repealing the personal ones. We wake up with an “income” tax that

has only wages in its base, and then we discover a flattened rate structure on labor

under the universal wage tax.

C. The Players: The Big Three of Taxes

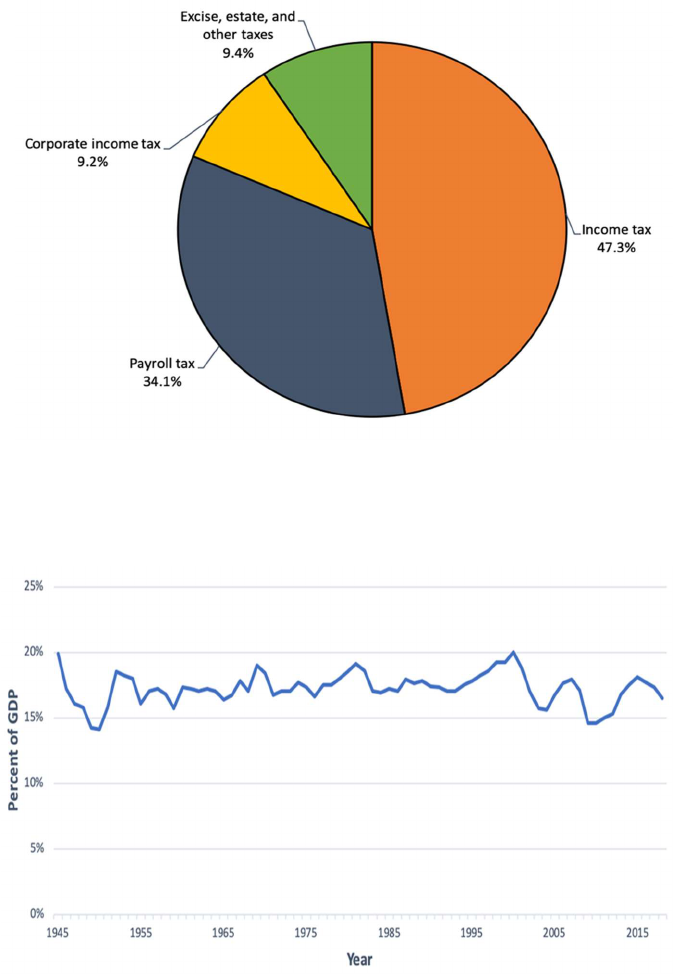

Figure 4, below, taken from official government data, shows the history of the

principal sources of federal revenues normalized as a percentage of gross domestic

product (GDP) from 1950 to 2016. Figure 5 puts into a pie chart the data from the

single year 2016. Both charts clearly show that there are and have long been three

major taxes financing the federal government: the individual income, the payroll, and

the corporate income taxes. In 2016, for example, these three taxes accounted for

more than 90% of the government’s revenues; the other portion in the pie chart

consists of “excise, estate, and other taxes,” which specifically includes sales of

government assets—a large residual category. In sum, the “Big Three” of individual

income, payroll, and corporate income taxes warrant our primary focus, although we

comment a bit on the estate, or so-called “death,” tax, below.

68. Id.

69. See supra text accompanying notes 24–25.

2020] DEA TH OF TH E INCOME TA X 1249

Figure 4: Major Sources of Federal Revenue as Percentages of GDP, 1950–2018

70

Federal Tax Receipts by Source as a Share of National GDP, 1950–2018

To dispense with a concern that some readers might have upfront, payroll taxes

are indeed “taxes,” as their revenues are available for general government purposes.

Payroll taxes are not, that is, set aside in any special account dedicated for specific

workers to use in their old age or retirement.

71

The government both collects

revenues and spends them, and the two sides of fiscal politics are not necessarily

connected.

Another common misunderstanding of payroll taxes is that the employee only

pays, or “contributes” (payroll taxes tend to be called social security and Medicare

“contributions” under the Federal Insurance Contribution Act (FICA)),

72

one-half of

the total. The employee’s “share” of social security taxes is 6.2% of her wages, up to

a ceiling of $128,000 in 2018; her share of Medicare taxes is 1.45%, with no cap, for

a total employee share of 7.65%.

73

The employer pays a matching “share,” another

7.65%.

74

But economists attribute all 15.3% to the employee, for the simple reason

that when an employer pays a worker $100 in wages, he must also pay the

70. Historical Tables, OFFICE OF MGMT. & BUDGET, https://www.whitehouse.gov

/omb/historical-tables/ [https://perma.cc/P92H-VE9C] (Table 2.3).

71. See John Olson, What Are Payroll Taxes and Who Pays Them?, TAX FOUND. (July

25, 2016) (citing Federal Insurance Contribution Act (FICA), ch. 531, 49 Stat. 620 (1935)

(codified as amended in scattered sections of 42 U.S.C.)), https://taxfoundation.org/what-are-

payroll-taxes-and-who-pays-them/ [https://perma.cc/89LQ-C7AB].

72. Topic No. 751 Social Security and Medicare Withholding Rates, IRS, https://www.irs

.gov/taxtopics/tc751 [https://perma.cc/L7B2-GS3B] (last updated Feb. 14, 2020).

73. See Olson, supra note 71.

74. Id.

1250 IN DIANA LA W J OU RNA L [Vol. 95:1233

government $7.65 in the employer’s share—and that is money owed on account of

the employee’s working, which could otherwise be given straight to the worker.

75

The federal government now, rather to its credit, simply reports the entire 15.3%

burden as part of the payroll tax, as Figure 4 does, and as we shall use throughout.

76

We can learn much from Figure 4. By starting in 1950, Figure 4 considers only

the modern post-War economy and government. Before this time, as we shall discuss

briefly below, the overall tax burden was much smaller, and the individual income

tax in particular was, during the period before World War II, far less significant.

Since 1950, on the other hand, the overall federal tax burden as a percentage of GDP

has remained remarkably constant, moving within a band of 15%–20% of the

economy (as shown in Figure 6). What changes—and what is a focus of the analysis

in this Article—is the composition of the total, the relative shares of the Big Three.

75. Id.

76. Technically, an adjustment needs to be made to keep the tax rates constant between

the amount of wages earned and payroll taxes, as both bases are tax inclusive. If Ant earns

$100 in wages, it is true that her employer will have to remit $15.30 in payroll taxes. But only

$7.65, one-half of this total, comes out of the $100. The other $7.65 is a shadow wage of sorts.

So Ant “really” got $107.65 in pay, $15.30 of which was paid to the government for payroll

taxes. This would make Ant’s payroll tax rate 14.2% on a tax-inclusive basis (where the tax

itself is included in the denominator, that is, $15.3/$107.65). The text uses the more common

15.3% for simplicity.

2020] DEA TH OF TH E INCOME TA X 1251

Figure 5: Sources of Federal Tax Revenue, 2016

77

Sources of Federal Tax Revenue, 2016

Figure 6: Federal Tax Receipts (Total) as Percentage of GDP, 1945–2018

78

Federal Tax Receipts as a Percentage of GDP, 1945–2018

1252 IN DIANA LA W J OU RNA L [Vol. 95:1233

D. The Plot: Towards a Universal Wage Tax

Before we look at trends over time, consider how the Big Three taxes fit into the

prior brief discussion of tax bases. The individual income tax is in theory meant to

fall on both wealth and wages, all income derived “from labor or from capital or from

both combined,” as Macomber put it.

79

The payroll tax is, of course, a tax only on

wages and the model for what the income tax is becoming. Finally, the corporate

income tax, although its ultimate incidence is unclear,

80

is a tax on wealth or capital

in the first instance. This is because the corporate income tax is a tax on all of the

corporation’s income minus the wages it pays, which are subtractions from income

under I.R.C. § 162.

81

Just as the payroll tax is a wage tax, the corporate income tax

is a nonwage tax.

Now focus on what happens to the Big Three taxes over the time period reflected

in Figure 4. Compare in particular the two years 1952 and 2016. In 1952, the Big

Three’s shares, listed as Individual Income/Corporate Income/Payroll, were 7.8%,

5.9%, and 1.8%, respectively, for a total tax burden of 15.5% of GDP. In 2016, those

same shares were 8.4%, 1.6% and 6.0%, for a total of 16% of GDP. The total reflects

a modest increase in the aggregate tax burden from these three taxes; as Figure 6

shows, the aggregate tax burden of all federal taxes has been fairly constant since the

dawn of the post-War period. (In fact, “Hauser’s Law,” named after the investment

analyst William Hauser, holds that federal tax revenues since World War II are

always approximately 19.5% of GDP, regardless of marginal rates.)

82

But the

dramatic story is the near total inversion of the corporate income and payroll tax

shares, from 5.9% and 1.8% in 1952, to 1.6% and 6.0% by 2016. In sum, the share

of the pure wage tax increased over these decades by 4.2% of GDP, while the share

of the corporate income tax, the pure nonwage tax, fell by 4.3% of GDP—a nearly

perfect swap from nonwage to wage taxation.

Figure 4 shows that this inversion is not an artifact of choosing two particular

years, 1952 and 2016. The trends are quite pronounced. The corporate income tax

steadily falls throughout the decades shown in Figure 4, and the payroll tax steadily

rises. Among the Big Three taxes, the marginal rates under the payroll tax alone have

never been cut, except for the two-year period of President Obama’s payroll tax

holiday in 2011 and 2012 (as seen in Figure 7).

These trends help show how the United States could emerge with a wage-tax

system, given where we started in 1950: we completely inverted the relative roles of

the corporate income and payroll taxes during this time period. This then leaves the

77. Historical Tables, supra note 70 (Table 2.3).

78. Id. (Table 2.3).

79. 252 U.S. 189, 207 (1920) (internal quotation marks omitted) (citation omitted).

80. Edward McCaffery, The Uneasy Case for Capital Taxation, TAX

NETWORK (Mar. 1, 2012), https://tax.network/emccaffery/the-uneasy-case-for-capital-taxat

ion/ [https://perma.cc/2MN5-EPDZ].

81. I.R.C. § 162 (2018).

82. W. Kurt Hauser, There’s No Escaping Hauser’s Law, WALL ST. J. (Nov. 26, 2010),

https://www.wsj.com/articles/SB10001424052748703514904575602943209741952

[https://perma.cc/MZ29-XNU].

2020] DEA TH OF TH E INCOME TA X 1253

individual income tax, which has remained notably steady during this post-War

period as a percentage of GDP, as Figure 4 shows.

Figure 7: Payroll Tax Rate History, 1937–2017

83

Payroll Tax Rate History, 1937–2017

Figure 8: Highest Marginal Rate Under Income Tax, 1913–2018

84

Highest Marginal Tax Rate, 1913–2018

The yield of the income tax hovers around 8% of GDP; any significant rise above

that level, as we saw in the 1970s (partly due to inflation) or in the 1990s (partly due

to the Internet and stock market booms), is followed by tax cuts, as we saw in the

1980s under President Ronald Reagan or in the early 2000s under President George

W. Bush. Unlike the virtually monotonic increase in rates and overall burdens under

83. Payroll Tax Rates, TAX POLICY CTR. (July 18, 2019), https://www.taxpolicy

center.org/statistics/payroll-tax-rates [https://perma.cc/MZ3A-FDTC].

84. Historical Highest Marginal Income Tax Rates, TAX POLICY CTR. (Feb. 4, 2020),

https://www.taxpolicycenter.org/statistics/historical-highest-marginal-income-tax-rates

[https://perma.cc/3W8M-DCCT].

1254 IN DIANA LA W J OU RNA L [Vol. 95:1233

the payroll tax, rates under the individual income tax have frequently been cut and

occasionally been raised over the post-War period, as Figure 8 illustrates: the income

tax, unlike the payroll tax, has been a political “football” during the decades, kicked

around by lawmakers, lobbyists, and their paying patrons.

The individual income tax accounted for about one-half of all federal revenues

from the Big Three during this post-War period. Whereas we have just commented

on the switch from corporate income to payroll taxes—a movement strengthened by

the TCJA, which steeply cut corporate income taxes

85

—the individual income tax’s

role in the story follows a different path. The individual income tax is too big to fail

or simply to be eliminated. Instead, the story of the death of the individual income

tax is a story of the steady erosion of its base and of its transformation into a wage

tax: Norquist’s quest.

Once again, the income tax is supposed to fall on both wealth and wages. But it

has never been all that serious about falling on wealth, and this trend has accelerated

as of late.

86

This is the death of which we write—the death of the tax as a true income

tax, falling equally on capital and labor. The income tax will still be called an

“income” tax. Why not? Old taxes are good taxes as they say.

87

But there will be two

distinct regimes within the “income” tax. For the vast majority of Americans, some

ninety-five percent, mainly wage earners, the tax will be simple to pay but impossible

to avoid. For a growing minority of America’s rich capable of living off wealth alone,

the ur-income tax, just like the lingering death tax, will still have its formal

complexities. But it will not have many substantive teeth. Taxation for the wealthy

will be complex but avoidable.

With the corporate income tax reduced to a bare fraction of its past load, with the

payroll tax bolstered and here to stay, and with the individual income tax stripped of

its abilities to tax wealth but not wages, the work of the conservative assault on the

tools of redistribution will be at its natural end. The Big Three taxes will become

cover for a burdensome and inescapable wage tax.

E. A Short Before the Feature: The Near Death of the Death Tax

Before moving on to the feature story—the transformation of the income tax into

a wage tax—we take a few moments to consider a smaller story playing out on rather

precisely parallel tracks. This is the tale of the U.S. wealth transfer tax system, also

known as the gift, estate, and generation-skipping tax system, or, more colloquially,

as the “death tax.” The careful reader will recall that killing the death tax was one of

Norquist’s five easy pieces towards a flat wage tax.

88

The gift, estate, and generation-skipping tax system was intended to fall on the

gratuitous transfer of wealth, whether that be during life (the gift tax) or after a death

(the estate tax). The taxes fall only on wealth at the moment of its passing. Thus, just

as with the corporate income tax, another nonwage tax, we would predict estate taxes

to be declining in significance as the wider American tax system becomes a wage-

85. See infra Section V.B.2.

86. See McCaffery, supra note 10, at 328.

87. See generally ADAM SMITH, THE WEALTH OF NATIONS (1776).

88. See supra notes 27–30 and accompanying text.

2020] DEA TH OF TH E INCOME TA X 1255

based one. And so they are. Figure 9 shows estate and gift tax revenues as a

percentage of total federal revenues—not GDP—demonstrating both that revenues

have been declining in the post-War era and that they are hardly significant today.

Figure 9: Estate and Gift Tax Revenue as a Percentage of Federal Receipts

1940–2018

89

Estate and Gift Tax Revenue as a Percentage of Government

Receipts, 1940–2018

It is clear that the wealth transfer tax system has never been a major source of

revenue. Nor are many even subject to it, as Figure 10 shows.

Figure 10: Taxable Estate Tax Returns as Percentage of Adult Deaths, 1934–2013

90

Percentage of Adult Deaths with a Taxable Estate

89. Historical Tables, supra note 70 (Tables 2.1 and 2.5).

90. Fiscal Facts, TAX POLICY CTR. (July 10, 2017), https://www.taxpolicycenter.org

/fiscal-fact/historical-returns-percentage-deaths [https://perma.cc/3PQ5-RPN9].

1256 IN DIANA LA W J OU RNA L [Vol. 95:1233

Strikingly, neither Figures 9 nor 10 reflect the changes enacted under the TCJA,

which raised the exemption, or “zero bracket” of the gift and estate tax, to over $11

million for individuals and over $22 million for married couples, indexed for

inflation. Under these levels, some 99.8% of Americans do not even have to worry

about their successors’ needing to fill out forms for the death tax.

It is past time to give a shout out to two academic commentators on the estate tax

saga, Michael J. Graetz and Ian Shapiro, who published the book Death by a

Thousand Cuts: The Fight over Taxing Inherited Wealth in 2005,

91

very much

anticipating this present Article. Graetz and Shapiro chronicled well the steady

erosion of the wealth-transfer tax system—another hallmark of progressive politics,

another attempt to tax wealth, not wages. The tax has long been considered a

“voluntary tax,”

92

because the wealthy and sophisticated can readily avoid it with

complex planning. The casino magnate and conservative financier Sheldon Adelson,

for example, was able to get $8 billion out of his taxable estate at a time when the

official exemption level was about $1 million;

93

President Trump’s then chief

economic advisor, Gary Cohen, candidly stated his view that only “morons” pay the

estate tax as the TCJA was coming into form.

94

Graetz and Shapiro expertly chronicle decades of legislative, regulatory, and

judicial decisions and actions that continually struck blows at the integrity of the

wealth-transfer tax system.

95

The authors were technically wrong, or at least

premature, to herald the “death” of the death tax.

96

Significantly, even the TCJA,

while rendering the wealth-transfer tax system moot for all but a small fraction of the

top one percent of Americans, did not literally kill the tax. But this minor semantic

detail only helps to underscore the relevance of Graetz and Shapiro’s important

account to our present effort, for the script on the death tax is strikingly parallel to

the story of the killing of the income tax. In the more than a decade since Death by a

Thousand Cuts was published, the tax has continued to be cut—its exemption levels

going up under President Obama and then again, and dramatically, under President

Trump and the TCJA. The tax, while alive, is on life support. The tax is also unlikely

to ever come back in anything like its original intended role: the exemption level

91. MICHAEL J. GRAETZ & IAN SHAPIRO, DEATH BY A THOUSAND CUTS: THE FIGHT OVER

TAXING INHERITED WEALTH (2005).

92. See generally GEORGE COOPER, A VOLUNTARY TAX? NEW PERSPECTIVES ON

SOPHISTICATED ESTATE TAX AVOIDANCE (1979); George Cooper, A Voluntary Tax? New

Perspectives on Sophisticated Estate Tax Avoidance, 77 COLUM. L. REV. 161 (1977); Edward

McCaffery, A Voluntary Tax? Revisited, 93 NAT’L TAX ASS’N PROC. 268 (2000).

93. Zachary R. Mider, Accidental Tax Break Saves Wealthiest American $100 Billion,

BLOOMBERG (Dec. 17, 2013), https://www.bloomberg.com/news/articles/2013-12-17/acci

dental-tax-break-saves-wealthiest-americans-100-billion [https://perma.cc/KFU2-Y8LY].

94. Robert Frank, ‘Only Morons Pay the Estate Tax,’ Says White House’s Gary Cohn,

CNBC (Aug. 29, 2017), https://www.cnbc.com/2017/08/29/only-morons-pay-the-estate-tax-

says-white-houses-gary-cohn.html [https://perma.cc/MVU3-CKEK]; see also Edward

McCaffery, Tax Breaks for Multi-Millionaire Morons, HUFFINGTON POST (Nov. 2, 2017),

https://www.huffpost.com/entry/tax-breaks-for-multi-millionaire-morons_b_59f9f06ae4b0b7

f0915f635d [https://perma.cc/WKZ7-A4PG].

95. See generally GRAETZ & SHAPIRO, supra note 91.

96. Id. at 3–4.

2020] DEA TH OF TH E INCOME TA X 1257

under the estate tax has never been lowered, except for a slight technical adjustment

in 1933 to coordinate the gift and estate tax levels.

97

This is a harbinger of the death of the income tax, too. The death tax has not and

will not formally die. But the tax is irrelevant for the vast majority of Americans and

easily avoidable by the handful still potentially subject to it who are willing to pay

to play tax-avoidance games.

Why keep the much-reviled death tax hanging around at all? Aside from the

symbolism of the government’s maintaining the appearance of being serious about

taxing wealth, the persistence of the death tax does an important service: it provides

cover to the perpetuation of a key provision in the individual income tax, the

“stepped-up basis” on death rule of I.R.C. § 1014 (this is the provision that Vice

President Biden has pledged to repeal if elected).

98

We shall consider this provision,

wittily dubbed the “Angel of Death” law,

99

further below: it provides the third step

in the three-step guide to avoiding all income tax on wealth, Buy/Borrow/Die.

Stepped-up basis for assets acquired from a decedent has long been justified as being

fair in a world where wealthy decedents pay an estate tax.

100

Today, 99.8% of

decedents do not have to worry about their estates paying a tax. Yet 100% of heirs

will get stepped-up basis on the assets that they inherit.

The estate tax story is just a warm-up, a trial balloon. It perfectly foreshadows the

income tax tale. The near death of the death tax is, in itself, an important element of

the wider central story, because, like the decline of the corporate income tax, it is

about the fall of a tax on wealth. As we consider the individual income tax, we should

be under no illusion that there is some magical tax offstage, such as the estate or

corporate income taxes, to miraculously solve all of our problems, to address the

failures to tax wealth more vigorously.

101

The forces favoring wealth have already

killed the estate tax for all intents and purposes, leaving just the good part (the

stepped-up basis) and not much else, except employment for financiers of dynasty

trusts and lobbyists. We will see the same techniques emerging under the reform of

the income tax. One, create a simple wage/income tax for the masses, providing most

of the federal revenue and allowing a smaller tax on the rich, the ur-income tax, to

emerge as a separate matter. Then, two, continually make changes to the smaller,

weaker tax that only applies to the wealthiest few—a tax where changes can go

unnoticed except by lobbyists and those who pay them, because the revenue effects

are modest and the number of taxpayer targets is limited. This ur-income tax will be

ripe for the killing by a thousand cuts. There will be no reason to formally announce

its death and there will be plenty of reasons to keep the tax hanging around on life

97. See Julie Garber, Federal Estate Tax Exemptions 1997 Through 2019, THE BALANCE

(Feb. 29, 2020), https://www.thebalance.com/exemption-from-federal-estate-taxes-3505630

[https://perma.cc/WD6Y-T8R6].

98. The RS Politics 2020 Democratic Primary Policy Guide, supra note 41.

99. McCaffery, supra note 10, at 320.

100. Scott Eastman, The Trade-offs of Repealing Step-Up in Basis, TAX FOUNDATION (Mar.

13, 2019), https://taxfoundation.org/step-up-in-basis/ [https://perma.cc/LLB5-MF7B];

Stephen J. Entin, The President Proposes a Second Tax on Estates, TAX FOUNDATION (Jan.

23, 2015), https://taxfoundation.org/president-proposes-second-tax-estates/ [https://perma.cc

/E58Z-GHEP].

101. See id. at 311.

1258 IN DIANA LA W J OU RNA L [Vol. 95:1233

support—to serve the ends of politicians, financiers, and the wealthy who pay them

both.

Now on with the show.

III. ACT ONE: ORIGIN STORIES, FEATURING ACHILLES’ HEELS

Figure 4 and the analysis above took off in the post-World War II period, starting

around 1950. The individual income tax’s contribution to federal revenues has been

fairly stable throughout this post-War period, always taking home the gold as the

single most important tax of the Big Three even as the corporate income and payroll

taxes switched places for the silver and bronze medals. It was not always so. As we

go through the story of the individual income tax’s transformation into a wage tax,

we start at the beginning, and we follow the story of taxes on wealth and wages.

A. The Income Tax Comes of Age

The income tax was conceived as a modest tax on wealth and the wealthy. When

times called for more revenue—much more revenue by World War II—the still

young “class” income tax got married to the masses of wage earners, becoming,

largely, a wage tax.

1. Baby Steps: The Sixteenth Amendment and a Modest Tax on Wealth

The modern income tax was born in 1913 following the ratification of the

Sixteenth Amendment to the U.S. Constitution.

102

America had used an income tax

during the Civil War under President Abraham Lincoln and then again in the

Progressive Era of the 1890s. But the latter tax was struck down, precisely because

it fell on capital (without apportionment) as well as on wages—it was the capital part

that the Supreme Court found unconstitutional.

103

Thus, the movement to ratify the

Sixteenth Amendment was specifically and intentionally a movement to tax wealth.

The sponsors of the law were well aware of Mill’s criticism of an income tax as a

“double tax” on income that was saved. They wanted that.

104

But they did not want much of that. Although the individual income tax was

enabled by the ratification of the Sixteenth Amendment, Congress actually enacted

the income tax in the Revenue Act of 1913, also known as the Tariff Act.

105

The

law’s cuts to tariffs or excise taxes were its most politically and economically

significant provisions. The income tax went into effect with a top marginal rate of

1%, albeit with “surcharges” for higher incomes that created a top marginal rate

bracket of 7% for households reporting over $500,000 in income.

106

To put these

102. U.S. CONST. amend. XVI.

103. Pollock v. Farmers’ Loan & Tr. Co., 157 U.S. 429, 583 (1895).

104. See SHELDON D. POLLACK, THE FAILURE OF U.S. TAX POLICY: REVENUE AND POLITICS

45–53 (1996); ROBERT STANLEY, DIMENSIONS OF LAW IN THE SERVICE OF ORDER: ORIGINS OF

THE FEDERAL INCOME TAX 1861–1913 (1993); McCaffery, supra note 64, at 810.

105. Revenue Act of 1913, ch. 16, 38 Stat. 114 (codified as amended in scattered sections

of 26 U.S.C.).

106. Id. § 2, 38 Stat. at 166–67.

2020] DEA TH OF TH E INCOME TA X 1259

numbers in contemporary terms, $500,000 in 1913 is equivalent to over $13.1 million

($13,161,785) in 2020 dollars, according to the government’s inflation calculator.

107

The 7% marginal rate applying to such people, if any existed, is less than the state

and local sales tax rate in some twenty states today.

108

All in, less than one percent

(1%) of Americans paid individual income taxes in 1913,

109

and the tax was a trivial

component of government revenues.

This original modern income tax did not tax much, but it did tax wealth.

Government statistics going back to 1913 fail to specifically report “wages and