1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

UNITED STATES DISTRICT COURT

FOR THE CENTRAL DISTRICT OF CALIFORNIA

June 2023 Grand Jury

UNITED STATES OF AMERICA,

Plaintiff,

v.

ROGER KEITH VER,

Defendant.

CR No.

I N D I C T M E N T

[18 U.S.C. § 1341: Mail Fraud; 26

U.S.C. § 7201: Attempt to Evade

and Defeat Tax; 26 U.S.C. §

7206(1): Subscription to a False

Tax Return]

The Grand Jury charges:

COUNTS ONE THROUGH THREE

[18 U.S.C. § 1341]

A. INTRODUCTORY ALLEGATIONS

At times relevant to this Indictment:

Defendant VER and His Companies

1. Defendant ROGER KEITH VER, who was born in San Jose,

California, resided in Tokyo, Japan, and Saint Kitts and Nevis (“St.

Kitts”). Defendant VER was in a long-term relationship with a

Japanese citizen (“partner”).

2. Defendant VER was the sole owner and Chief Executive

Officer (“CEO”) of MemoryDealers.com, Inc., and Agilestar.com, Inc.,

2:24-cr-00103-MWF

2/15/2024

CDO

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 1 of 26 Page ID #:1

2

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

two businesses that were based in Santa Clara, California, and sold

computer and networking equipment. MemoryDealers and Agilestar were

small business corporations (“S-Corporations”) until March 3, 2014,

when by operation of law they were automatically converted to C-

Corporations.

Bitcoins

3. Bitcoins were a cryptocurrency circulated over the

internet. Bitcoins were not issued by any government, bank, or

company, but rather were controlled through computer software

operating via a decentralized, peer-to-peer network. Bitcoins were

sent to and received from bitcoin addresses, which were analogous to

bank account numbers and consisted of strings of case-sensitive

letters and numbers, each 26 or more characters long. Each bitcoin

address was controlled through the use of a private key that was the

equivalent of a password or PIN and was necessary to access the

bitcoins associated with the bitcoin address.

4. Bitcoin transactions were recorded on the bitcoin

blockchain. The bitcoin blockchain was a decentralized public ledger

on which were recorded all bitcoin transactions in which a bitcoin

address sent or received bitcoins. The bitcoin blockchain was updated

approximately six times per hour. All records on the bitcoin

blockchain were publicly available.

5. Generally, a bitcoin wallet was an application that allowed

bitcoin users to easily send and receive bitcoins and store their

private keys. Users typically acquired bitcoins by purchasing them

through a cryptocurrency exchange.

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 2 of 26 Page ID #:2

3

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

Defendant VER’s and His Companies’ Acquisition of Bitcoins

6.

Defendant VER began acquiring bitcoins no later than April

2011. Defendant VER also avidly promoted bitcoins, even obtaining the

moniker “Bitcoin Jesus.”

7.

Defendant VER opened accounts on MemoryDealers’ behalf at

several cryptocurrency exchanges. He wired and caused to be wired

funds from MemoryDealers’ and Agilestar’s bank accounts to those

exchanges to purchase bitcoins for them. For example:

a. In April 2011, defendant VER opened an account in

MemoryDealers’ name at Mt. Gox, a cryptocurrency exchange, using his

own MemoryDealers’ e-mail address. Defendant VER repeatedly wired and

caused to be wired funds from MemoryDealers’ and Agilestar’s bank

accounts to the Mt. Gox account to purchase bitcoins. Defendant VER

transferred MemoryDealers’ and Agilestar’s bitcoins from Mt. Gox to

bitcoin wallets that defendant VER controlled on their behalf.

b. In June 2012, defendant VER also opened an account on

MemoryDealers’ behalf at Bitstamp, another cryptocurrency exchange.

When he opened the account, defendant VER provided MemoryDealers’

articles of incorporation and indicated he was MemoryDealers’ sole

owner. He also provided a copy of a recent MemoryDealers’ bank

statement. Defendant VER repeatedly wired and caused to be wired

funds from MemoryDealers’ bank account to Bitstamp to purchase

bitcoins. Defendant VER transferred MemoryDealers’ bitcoins from

Bitstamp to bitcoin wallets that defendant VER controlled on

MemoryDealers’ behalf.

8. Defendant VER also caused MemoryDealers to acquire bitcoins

by using MemoryDealers’ money to purchase them directly from sellers.

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 3 of 26 Page ID #:3

4

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

9.

MemoryDealers used bitcoins to conduct its business.

Beginning in or around October 2011, and continuing until at least on

or about June 18, 2017, MemoryDealers paid certain vendors in

bitcoins. MemoryDealers received payments from customers in bitcoins

through September 2017. On or about November 1, 2012, MemoryDealers

launched Bitcoinstore.com. MemoryDealers, doing business as

Bitcoinstore.com, accepted payment in bitcoins for products it sold

on the internet. Bitcoinstore.com operated until approximately July

31, 2014.

10. Defendant VER also used his own funds to purchase bitcoins.

For example, on or about July 23, 2012, defendant VER opened an

account in his own name at Coinbase, another cryptocurrency exchange.

11. On or about November 30, 2013, defendant VER donated 1,000

of his personally held bitcoins, valued at $1,065,145, to a charity

qualified under section 501(c)(3) of the Internal Revenue Code. On or

about November 6, 2014, defendant VER filed an Amended U.S.

Individual Income Tax Return (Form 1040X) for tax year 2013 on which

he claimed a deduction for this donation.

Defendant VER’s Expatriation

12. United States citizens could renounce their U.S.

citizenship, a process known as expatriation.

13. Under the Internal Revenue Code (“IRC”), expatriation from

the United States by a person who qualified as a “covered expatriate”

had tax implications. Specifically, all of a covered expatriate’s

property was treated as having been sold on the day before the

expatriation date for its fair market value—referred to as a

“constructive sale”—and any gain arising from that constructive sale

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 4 of 26 Page ID #:4

5

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

was required to be taken into account for that taxable year and was

subject to tax, which was referred to as an “exit tax.”

14.

Under the IRC, covered expatriates were also required to

file an Initial and Annual Expatriation Statement (Form 8854) with

the Internal Revenue Service (“IRS”). Covered expatriates were

required to certify on their Forms 8854 that they had complied with

their tax obligations in the five years before expatriation and,

among other things, provide information about their net worth,

income, assets, and liabilities as of the date of their expatriation.

15. In August 2012, defendant VER hired Law Firm 1 to advise

him about expatriating and later hired Law Firm 1 to assist with his

expatriation and prepare his 2014 U.S. Nonresident Alien Income Tax

Return (Form 1040NR) and Initial and Annual Expatriation Statement

(Form 8854) (collectively the “expatriation-related tax returns”).

16. Law Firm 1 also advised defendant VER to hire an appraiser

to value MemoryDealers and Agilestar. As described below, defendant

VER hired two different appraisers to do so. Appraiser 1 was a large,

international accounting firm that defendant VER retained in 2012;

Appraiser 2 was a solo practitioner that defendant VER retained in

2015.

17. On February 4, 2014, defendant VER became a St. Kitts

citizen. On March 3, 2014, defendant VER furnished to the United

States Consulate in Barbados a signed Request for a Determination of

Possible Loss of Citizenship (Form DS-4079), which included in Part

II, a separately signed Statement of Voluntary Relinquishment of U.S.

Citizenship. The U.S. Department of State subsequently issued him a

Certificate of Loss of Nationality of the United States (Form DS-

4083) that said defendant VER expatriated as of February 4, 2014.

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 5 of 26 Page ID #:5

6

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

18.

Under the IRC, however, a U.S. citizen is determined to

have expatriated for the purposes of computing the exit tax and

preparing the Form 8854 on the earliest of four events. The earliest

of those four events applicable to defendant VER was the furnishing

of his Statement of Voluntary Relinquishment of U.S. Citizenship to

the U.S. Consulate on March 3, 2014.

19. Defendant VER was a covered expatriate because his net

worth on that day was at least $2,000,000. As such, defendant VER was

required to prepare and file a Form 8854 and to pay an exit tax on

any gain from the constructive sale of his worldwide assets as of

March 2, 2014, and to report his worldwide assets on a Form 8854 as

of March 3, 2014.

20. However, Law Firm 1 erroneously advised him, based on the

date referenced in the U.S. Department of State’s Certificate of Loss

of Nationality, that he expatriated for tax purposes on February 4,

2014, and had to pay the exit tax based on the constructive sale of

his worldwide assets as of February 3, 2014.

21. Law Firm 1 prepared and defendant VER signed and filed his

expatriation-related tax returns incorrectly using February 4, 2014,

as the date of his expatriation.

Clustering Analysis

22. Clustering analysis, described below, combined with other

attribution evidence, establishes that on February 3, 2014, defendant

VER owned approximately 131,000 bitcoins either directly or through

his companies.

23. The clustering analysis used information from the

blockchain to group bitcoin addresses together into clusters based on

co-spending. Co-spending occurred when multiple bitcoin addresses

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 6 of 26 Page ID #:6

7

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

sent bitcoins in a single transaction, indicating that a single owner

held the private keys for all those addresses. A cluster could be

labeled based on its root address, namely, the earliest existing

bitcoin address in the cluster.

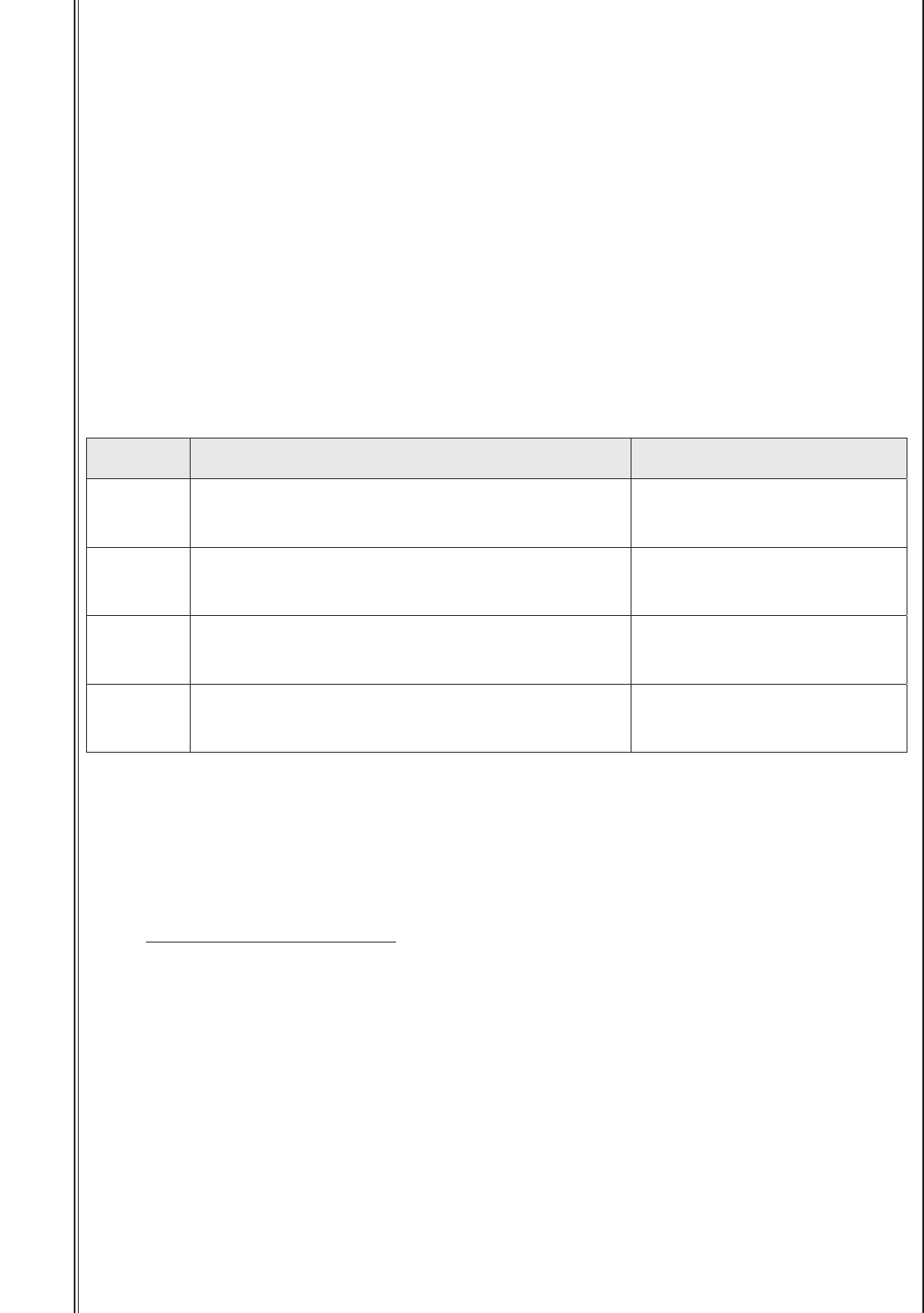

24.

The clustering analysis establishes that the bitcoins

referenced in paragraph 22 above were contained within at least four

clusters of bitcoin addresses. These four clusters held bitcoins on

February 3, 2014, as follows:

Cluster Root Address Bitcoins on 2/3/2014

1 1E6mijNx2xKzRt6KXiqZncUmybgYN4cn2X

(“Cluster 1E6mij”)

110,000.0491

2 1JKPkpDFruDNjFKQ5upDkB2CbstbR3RtE7

(“Cluster 1JKPkp”)

2,000.9710

3 1LXrSb67EaH1LGc6d6kWHq8rgv4ZBQAcpU

(“Cluster 1LXrSb”)

4,037.8632

4 1LDWDufjU5ATbozDZY3uChb7oPAbDaiB7K

(“Cluster 1LDWDu”)

15,000.0005

25. Clustering analysis also establishes that on March 2, 2014,

defendant VER owned either directly or through his companies nearly

the same number of bitcoins contained in at least the same four

clusters.

B. THE SCHEME TO DEFRAUD

26. Beginning no later than in or about October 2012, and

continuing through at least in or about December 2018, in Los Angeles

County, within the Central District of California, and elsewhere,

defendant VER knowingly and with the intent to defraud, devised,

participated in, and executed a scheme to defraud the United States

Department of the Treasury as to material matters, and to obtain

money and property by means of materially false and fraudulent

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 7 of 26 Page ID #:7

8

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

pretenses, representations, and promises, and the concealment of

material facts, regarding the number and value of bitcoins he owned

and controlled both personally and through his companies.

27.

The scheme to defraud operated, in substance, as follows:

a.

In August 2012, Defendant VER hired Law Firm 1 to

assist with his potential expatriation, including estimating any

potential exit tax. Law Firm 1 told defendant VER that to estimate

his exit tax, he should “pretend” to sell all of his assets on the

day before his anticipated expatriation and calculate a tax on any

gain from those pretend sales above $651,000.

b. After defendant VER was so advised, but before he was

able to expatriate in 2014, he concealed and provided false

information to his various advisors regarding the number and value of

bitcoins he owned and controlled both personally and through his

companies. For example:

i. In October 2012, defendant VER provided to Law

Firm 1 a purported list of his assets and proposed exit tax

calculation. The list of assets did not include any bitcoins.

ii. Defendant VER engaged Appraiser 1 in August 2012.

During the course of Appraiser 1’s engagement, Appraiser 1 prepared

multiple draft valuations of MemoryDealers and Agilestar. Appraiser 1

repeatedly advised defendant VER that the bitcoins listed as assets

on MemoryDealers’ and Agilestar’s financial records should be valued

at their current market price and asked defendant VER for the number

of bitcoins held by the companies.

iii. In response, defendant VER did not provide

Appraiser 1 with the total number of bitcoins the companies held and

instead purported to provide the total number of bitcoins in his

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 8 of 26 Page ID #:8

9

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

possession. But the figures he provided were substantially lower than

the number of bitcoins attributable to him and his companies. For

example, on or about April 12, 2013, defendant VER told Appraiser 1

that he controlled 25,000 bitcoins, when approximately 117,000

bitcoins were attributable to him and his companies on that date,

with approximately 70,000 held by defendant VER’s companies.

iv. Appraiser 1 did not finalize its valuations

because on or about May 15, 2013, defendant VER informed Appraiser 1

that he was not going to be able to expatriate soon and requested

that Appraiser 1 indefinitely delay its work.

v. Throughout this time, Defendant VER sought advice

from Appraiser 1, Law Firm 1, and MemoryDealers’ and Agilestar’s

outside return preparers about whether the best way to minimize his

exit tax and post-expatriation tax liabilities would be to distribute

MemoryDealers’ and Agilestar’s bitcoins to himself.

vi. Also throughout this time, defendant VER

continued to acquire bitcoins for his companies and to invest

bitcoins in, or to loan bitcoins to, bitcoin-related startups.

c. After failing to obtain citizenship in several other

countries, in early December 2013, defendant VER told Law Firm 1 that

he believed he would be able to obtain citizenship from St. Kitts and

renounce his U.S. citizenship by the end of the year.

d. Law Firm 1 warned defendant VER that “doing so will

mean (tax-wise) that you are diving off the high dive into the pool

without checking how much water is in the pool. Meaning—when you

renounce you have committed yourself and whatever the tax results

are, they are. No adjustments are possible.”

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 9 of 26 Page ID #:9

10

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

e.

After defendant VER retained Law Firm 1 in January

2014 to assist with his expatriation, including calculating his

estimated exit tax payment, and while Law Firm 1 prepared and filed

his expatriation-related tax returns, defendant VER continued to

conceal and provide false information to his advisors regarding the

number and value of bitcoins he owned and controlled both personally

and through his companies. For example:

i. On February 3, 2014, the day Law Firm 1 advised

defendant VER to use when calculating his exit tax, he had

approximately 131,000 bitcoins that could be attributed to him and

his companies. Based on an analysis of their financial records, about

73,000 of these bitcoins could be attributed to MemoryDealers and

Agilestar. Bitcoins traded on February 3, 2014, between $782 and $960

across several large bitcoin exchanges. From April 2011 to January 1,

2013, when defendant VER and his companies acquired most of their

bitcoins, bitcoins traded at no more than about $32.00 across several

large bitcoin exchanges.

ii. In or around April 2014, Law Firm 1 attempted to

estimate defendant VER’s exit tax so that defendant VER could make an

estimated tax payment for 2014. On or about April 5, 2014, Return

Preparer 1, an employee at Law Firm 1, sent defendant VER an

estimation of defendant VER’s exit tax of $3,990,000. A few days

later, Return Preparer 1 updated it, reducing the estimated exit tax

to $3,400,000. The spreadsheet Return Preparer 1 used to compute that

figure listed a total value of only $3,000,000 for “[b]itcoins held

in personal wallets,” listed defendant VER as the 100% owner of the

bitcoins, and noted that defendant VER had provided the estimate of

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 10 of 26 Page ID #:10

11

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

the bitcoins’ value. The spreadsheet did not list how many bitcoins

defendant VER personally owned.

iii.

Defendant VER did not make any estimated tax

payments for 2014.

iv.

A year later, when Law Firm 1 was preparing

defendant VER’s expatriation-related tax returns, Return Preparer 1

e-mailed defendant VER on or about April 10, 2015, requesting

additional information about defendant VER’s assets. Return Preparer

1 asked defendant VER how many bitcoins defendant VER owned and what

he had paid for them. When he responded a few days later, defendant

VER did not provide the requested information and instead discussed

various aspects of the bitcoin market.

v. On or about August 3, 2015, Return Preparer 1 e-

mailed defendant VER and proposed using an $800 per bitcoin value for

defendant VER’s personally held bitcoins. Defendant VER rejected

Return Preparer 1’s proposal as unreasonable, claiming that he had so

many bitcoins that if he had had to sell them all on a single day in

February 2014 it would have crashed the market. Defendant VER did not

specify how many bitcoins he had but suggested a value of his

personal bitcoin holdings of $9,200,000.

vi. A few weeks later, Return Preparer 1 told

defendant VER that Lawyer 1, another employee of Law Firm 1, had

determined that they had to use the $800 per bitcoin value and again

asked defendant VER how many bitcoins defendant VER personally held.

Defendant VER withheld the requested information once more, and

instead said that using the $800 per bitcoin value was “impossible

and unreasonable.” Lawyer 1 later told defendant VER that they were

legally required to use the $800 per bitcoin value.

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 11 of 26 Page ID #:11

12

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

vii.

In August 2015, Lawyer 1 also asked defendant VER

about his personal bitcoin holdings, specifically about how he had

come to own bitcoins through bitcoinstore.com. Defendant VER

responded that MemoryDealers “kept as many of the bitcoins as

possible.” In response to Lawyer 1’s follow-up questions, defendant

VER remarked that bitcoin wallets “were not registered to any name or

associated with a tax id, and that no one, including the IRS, can

freeze ones [sic] bitcoin accounts or seize ones [sic] bitcoins.”

Defendant VER also asserted that all the bitcoins obtained from

“MemoryDealers / Bitcoinstore were held in bitcoin wallets that only

[he was] able to access.” Defendant VER stated that he believed a

“smart tax strategy would be for [the bitcoins] to have been

transferred to [his] personal ownership whenever it would have been

cheapest to have done so from a tax perspective.”

viii. While Law Firm 1 was preparing defendant

VER’s expatriation-related tax returns, it reminded defendant VER of

his need to obtain valuations of MemoryDealers and Agilestar. Instead

of returning to Appraiser 1, who had already prepared draft

valuations, in June 2015 defendant VER retained Appraiser 2 to start

the process anew.

ix. In August 2015, Appraiser 2 prepared valuations

of MemoryDealers and Agilestar based in large part on the companies’

financial records and tax returns using a valuation date of February

4, 2014.

x. On or about August 4, 2015, Appraiser 2 sent

draft valuations to Employee 1, a MemoryDealers’ employee. Appraiser

2 valued MemoryDealers at $2,250,000, which included bitcoins valued

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 12 of 26 Page ID #:12

13

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

at $1,304,054, and valued Agilestar at $4,310,000, which included

bitcoins valued at $113,582.

xi.

Employee 1 forwarded the draft valuations to

Return Preparer 2, one of MemoryDealers’ and Agilestar’s outside

return preparers, and requested Return Preparer 2’s input. Return

Preparer 2 responded by e-mail, questioning the valuation of the

companies’ bitcoins, and told Employee 1 to ask Appraiser 2 “if the

Bitcoin values are market value on the dates of valuation.” Return

Preparer 2 explained that the “value should be: total Bitcoins x

Average Market Price on Date of Valuation (2/3/14). If the value

shown is that value, no problem; otherwise, an adjustment should be

made, up or down, to show [Fair Market Value] of Bitcoins on that

date.”

xii. Employee 1 forwarded Return Preparer 2’s e-mail

to defendant VER.

xiii. On or about August 13, 2015, Employee 1

confirmed with Appraiser 2 that the previously provided draft

valuations were the final versions. No adjustments had been made in

response to Return Preparer 2’s concern.

xiv. Employee 1 then forwarded the valuations to Law

Firm 1, which subsequently incorporated them into defendant VER’s

expatriation-related tax returns. At no time did defendant VER object

to the incorrect valuations prepared by Appraiser 2, which defendant

VER then knew would be incorporated into his expatriation-related tax

returns.

xv. As part of the return preparation process, on or

about October 14, 2015, Return Preparer 1 e-mailed defendant VER a

list of his bank and trading accounts of which Return Preparer 1 was

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 13 of 26 Page ID #:13

14

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

aware. Return Preparer 1 requested defendant VER provide any

additional accounts not listed. Defendant VER responded, identifying

an additional trading account but failed to disclose his account at

Coinbase, which held some of defendant VER’s bitcoins on February 4,

2014. And a few weeks before this e-mail, defendant VER had sent

Lawyer 2, at Law Firm 2, who was also assisting defendant VER with

his expatriation, bitcoins from his Coinbase account. Defendant VER’s

Coinbase account had bitcoins on March 3, 2014, as well.

xvi. Also on or about October 14, 2015, Return

Preparer 1 e-mailed defendant VER and requested once again that he

provide the total number of bitcoins he owned on February 4, 2014.

Return Preparer 1 copied Lawyer 1 on the e-mail. Yet again, defendant

VER did not tell them how many bitcoins he had. He instead asked,

“[c]ompletely hypothetically speaking, what would the ramifications

be if I were to have had 200,000 [bitcoins] at the time of my

renunciation?”

xvii. Lawyer 1 replied and advised defendant VER

to obtain an appraisal of his personally held bitcoins from a “third

party who [had] no personal interest in the tax implications of the

appraisal.”

xviii. A week later, defendant VER asked Appraiser

2 if Appraiser 2 could provide a valuation for “an amount of Bitcoins

as of Feb 4th 2014 in an illiquid market?”

xix. In a follow-up e-mail, defendant VER asked if

Appraiser 2 could assist, stating “I actually have all the

information you need to make it super easy for you. I would just need

to explain it all, and then you would affix your name to it.”

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 14 of 26 Page ID #:14

15

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

xx.

Approximately two weeks later, Appraiser 2

responded to defendant VER, indicating he would take a look at the

information. Appraiser 2 requested that defendant VER “state how many

bitcoins are subject to appraisal....”

xxi.

Instead of providing the requested information,

defendant VER responded by discussing the state of the bitcoin market

at the time of his expatriation. He also asked Appraiser 2 to opine

on how Appraiser 2 would hypothetically value someone’s bitcoins if

the number of bitcoins was substantially more than the total number

traded on that day.

xxii. Instead of addressing defendant VER’s

hypothetical, Appraiser 2 wrote back and only said “What was your

BitCoins [sic] holding as of February 4, 2014.” Despite having

previously said that he had all the information for Appraiser 2,

defendant VER responded and said that he was not sure how many

bitcoins he had and asked another hypothetical about how Appraiser 2

would approach valuing 20,000 bitcoins.

xxiii. In response to defendant VER’s hypothetical,

Appraiser 2 said that the value per bitcoin could be between $100 to

$800. Defendant VER then paid Appraiser 2 to prepare a valuation of

his personally held bitcoin.

xxiv. On or about November 24, 2015, Lawyer 1

responded to an email from defendant VER. Despite having final

appraisals of MemoryDealers and Agilestar for several months,

defendant VER had raised a concern with Lawyer 1 about “figuring out”

which bitcoins were his and which were MemoryDealers’. In response,

Lawyer 1 told defendant VER that the appraisal for MemoryDealers

included bitcoins valued at $1.3 million based on the company’s

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 15 of 26 Page ID #:15

16

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

financial records but that Lawyer 1 did not know how many bitcoins

this corresponded to or how that value was calculated. Lawyer 1

advised defendant VER not to include MemoryDealers bitcoins as part

of the valuation of his personally held ones. Lawyer 1 also requested

that if defendant VER was uncertain about how the bitcoins were

allocated between himself and MemoryDealers to let Lawyer 1 know so

they could reevaluate. Over the next several weeks, Lawyer 1 followed

up with defendant VER on this issue, but defendant VER did not

respond.

xxv. On or about December 3, 2015, defendant VER

formally requested that Appraiser 2 prepare a valuation of 25,000

bitcoins and confirmed that he held those bitcoins personally. Around

the same time, defendant VER told Lawyer 1 that the issue of how many

bitcoins he personally owned had been taken care of and that he had

provided Appraiser 2 with his best estimate.

xxvi. After some back and forth between defendant

VER and Lawyer 1, and defendant VER and Appraiser 2 about whether the

bitcoins were held by defendant VER, his partner, or his company, on

or about December 7, 2015, defendant VER once again confirmed that

the 25,000 bitcoins were held by him personally “and [did] not

include any other bitcoins that [he] may have been holding

custodially for others.”

xxvii. On or about January 11, 2016, Appraiser 2

told defendant VER that it would make a significant difference in the

valuation if he owned the bitcoins personally or if a company owned

them.

xxviii. A few days later, defendant VER wrote in an

e-mail to Lawyer 1 and others that “reading between the lines of what

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 16 of 26 Page ID #:16

17

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

[Appraiser 2] said, it [sounded] like the appraisal will be MUCH

lower if the bitcoins are owned by a corporate entity rather than

myself personally.” Defendant VER further stated, “[p]erhaps it will

be easier for tax reporting requirements if I gave all my bitcoins to

my partner (not legally married wife) in Japan?”

xxix.

Defendant VER caused Law Firm 1 to prepare

and mail on or about April 28, 2016, a United States Gift (and

Generation-Skipping Transfer) Tax Return (Form 709), falsely claiming

that defendant VER had gifted 25,000 bitcoins to his partner on

November 15, 2011. Defendant VER signed the Form 709 under penalties

of perjury on or about April 15, 2016. The IRS received the Form 709

on or about May 4, 2016.

f. Defendant VER caused Law Firm 1 to prepare and mail on

or about May 4, 2016, defendant VER’s 2014 U.S. Nonresident Alien

Income Tax Return (Form 1040NR). This Form 1040NR failed to report

any gain from the constructive sale of any bitcoins that defendant

VER personally owned and substantially underreported gains from the

constructive sales of MemoryDealers and Agilestar, which were based

on Appraiser 2’s August 2015 valuations discussed in paragraph 27(e),

above. The return listed a total tax due of $1,032,845. Defendant VER

signed the Form 1040NR under penalties of perjury on or about April

15, 2016. The IRS received the Form 1040NR on or about May 10, 2016.

g. Defendant VER also caused Law Firm 1 to prepare and

mail on or about May 4, 2016, defendant VER’s 2014 Initial and Annual

Expatriation Statement (Form 8854) that failed to report personally

owned bitcoins and underreported the fair market values of

MemoryDealers and Agilestar. Defendant VER signed the Form 8854 under

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 17 of 26 Page ID #:17

18

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

penalties of perjury on or about April 15, 2016. The IRS received the

Form 8854 on or about May 10, 2016.

h.

On or about July 13, 2016, Return Preparer 1 was

erroneously informed that the IRS had not received the 2014 Form

1040NR and Form 8854 that were mailed on or about May 4, 2016. On or

about July 14, 2016, defendant VER re-signed those returns, and on or

about July 19, 2016, Law Firm 1 mailed them to the IRS. The IRS

received these returns on or about July 22, 2016.

i. As further part of his scheme, defendant VER also

fraudulently misrepresented and concealed income he received in 2017

from the distributions of MemoryDealers’ and Agilestar’s bitcoins to

him. For example:

i. On or about March 17, 2016, defendant VER learned

from Return Preparer 3, another one of MemoryDealers’ and Agilestar’s

outside return preparers, that upon his expatriation when

MemoryDealers and Agilestar became C-Corporations, all of

MemoryDealers’ and Agilestar’s assets “rolled into” them.

ii. After defendant VER expatriated and continuing

through June 2017, MemoryDealers continued to acquire and/or spend

bitcoins, and Agilestar continued to own bitcoins.

iii. By 2017, defendant VER had opened personal

accounts at several other cryptocurrency exchanges such as Kraken,

Bitfinex, Bittrex, and Poloniex.

iv. On or about June 19, 2017, after paying an

invoice issued to MemoryDealers with bitcoins, defendant VER

instructed Employee 1 to “close out” the bitcoin balance, which

resulted in the removal of all bitcoins as assets from the financial

records of MemoryDealers and Agilestar. On that date, MemoryDealers’

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 18 of 26 Page ID #:18

19

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

financial records showed that it had approximately 58,000 bitcoins;

Agilestar’s financial records showed it had approximately 12,000.

v.

In the two weeks before defendant VER instructed

Employee 1 to remove the bitcoins from MemoryDealers’ financial

records, defendant VER had transferred nearly 3,000 bitcoins—worth

over $7 million—from Cluster 1JKPkp to defendant VER’s personal

account at Poloniex.

vi. In November 2017, defendant VER transferred tens

of thousands of bitcoins from Cluster 1E6mij and Cluster 1LDWDu to

exchange accounts in his name and then sold them for United States

dollars. He then transferred approximately $240 million from those

exchange accounts to bank accounts either in his name or under his

control in the Bahamas.

vii. Defendant VER retained Law Firm 1 to prepare his

2017 Form 1040NR. On or about July 26, 2018, Return Preparer 1 asked

defendant VER if he had received any income or distributions from

MemoryDealers or Agilestar during 2017. Defendant VER said that he

had not. Defendant VER also did not tell Return Preparer 1 that he

had received hundreds of millions of dollars from the sale of

bitcoins in 2017.

viii. As a result of defendant VER’s concealment

of the distributions of MemoryDealers’ and Agilestar’s bitcoins to

him in 2017, the 2017 Form 1040NR that defendant VER caused Return

Preparer 1 to prepare and mail on or about December 15, 2018, did not

report any gain or pay any tax related to those distributions.

j. The false and fraudulent statements and

representations and material omissions on the 2014 Form 1040NR, 2014

Form 8854, and the 2017 Form 1040NR that defendant VER caused to be

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 19 of 26 Page ID #:19

20

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

prepared and mailed to the IRS collectively deprived the IRS of taxes

rightfully due in the amount of approximately $48 million.

C.

USE OF THE MAILS

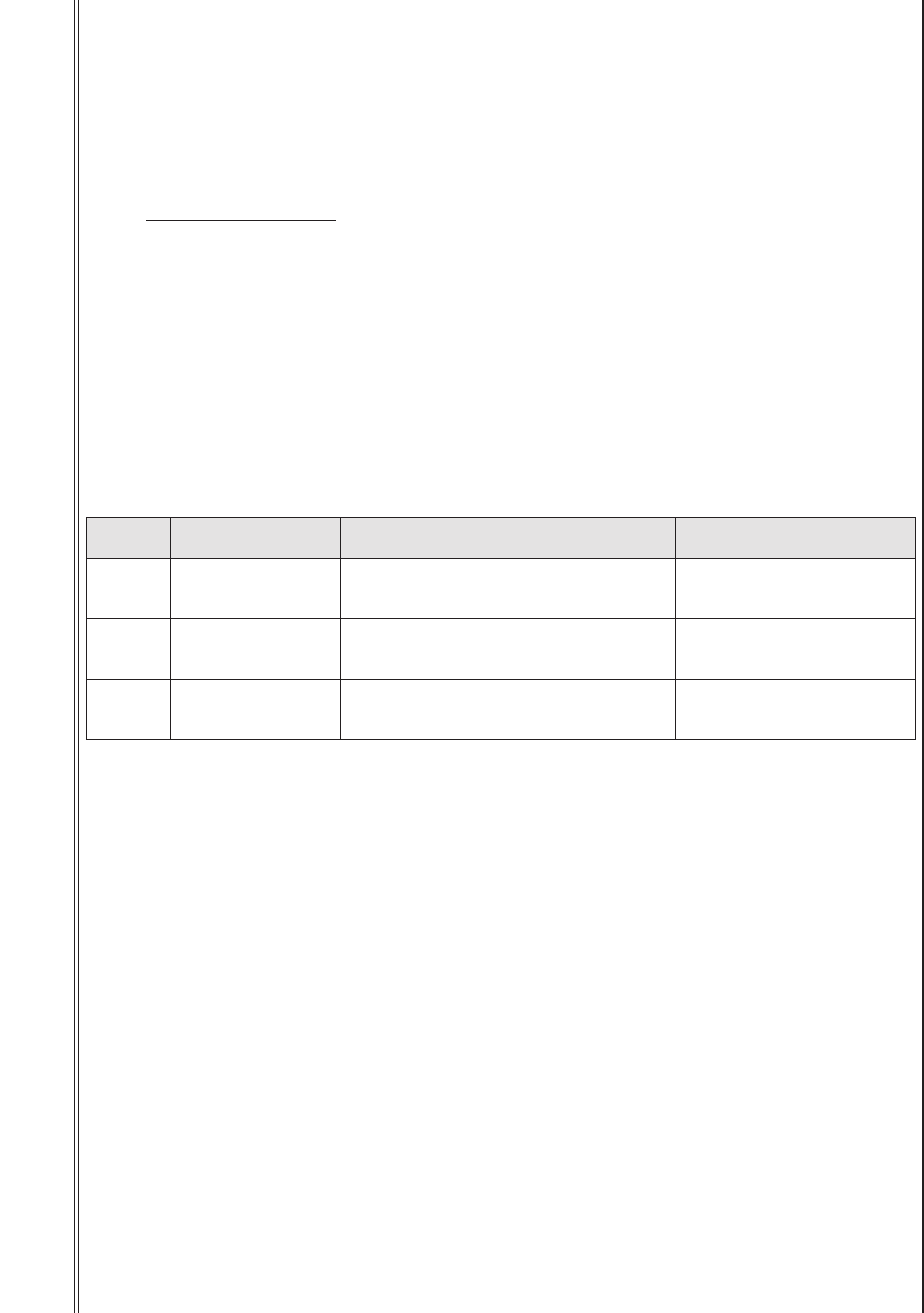

28.

On or about the dates set forth below, in Los Angeles

County, within the Central District of California, and elsewhere,

defendant VER, for the purpose of executing the above-described

scheme to defraud, knowingly caused the following items to be placed

in a post office and authorized depository for mail matter to be sent

and delivered by the United States Postal Service according to the

directions thereon:

COUNT DATE ADDRESS MAIL MATTER

ONE May 4, 2016 Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

Defendant VER’s

false 2014 Forms

1040NR and 8854

TWO July 19,

2016

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

Defendant VER’s

false 2014 Forms

1040NR and 8854

THREE December 15,

2018

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

Defendant VER’s

false 2017 Form

1040NR

COUNT FOUR

[26 U.S.C. § 7201]

29. The Grand Jury realleges paragraphs 1 through 25 and 27 of

this Indictment here.

30. Beginning no later than on or about January 1, 2014, and

continuing through on or about December 18, 2018, in Los Angeles

County, within the Central District of California, and elsewhere,

defendant VER willfully attempted to evade and defeat income tax due

and owing by him to the United States of America, for the calendar

year 2014, by committing the following affirmative acts, among

others, on or about the following dates:

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 20 of 26 Page ID #:20

21

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

a.

preparing and causing to be prepared, signing and

causing to be signed, and filing and causing to be filed with the IRS

on May 10, 2016, a false 2014 U.S. Nonresident Alien Income Tax

Return (Form 1040NR) that failed to report gain from the constructive

sale of personally owned bitcoins and substantially underreported

gains from the constructive sales of MemoryDealers and Agilestar;

b. preparing and causing to be prepared, signing and

causing to be signed, and filing and causing to be filed with the IRS

on May 10, 2016, a false 2014 Initial and Annual Expatriation

Statement (Form 8854) that failed to report personally owned bitcoins

and underreported the fair market values of MemoryDealers and

Agilestar;

c. preparing and causing to be prepared, signing and

causing to be signed, and filing and causing to be filed with the IRS

on July 22, 2016, a false 2014 U.S. Nonresident Alien Income Tax

Return (Form 1040NR) that failed to report gain from the constructive

sale of personally owned bitcoins and substantially underreported

gains from the constructive sales of MemoryDealers and Agilestar;

d. preparing and causing to be prepared, signing and

causing to be signed, and filing and causing to be filed with the IRS

on May 4, 2016, a false 2011 United States Gift (and Generation-

Skipping Transfer) Tax Return (Form 709) that falsely claimed

defendant VER had gifted 25,000 bitcoins on November 15, 2011, to his

partner;

e. on June 19, 2017, instructing Employee 1 to “close

out” the bitcoin balance, which resulted in the removal of all

bitcoins as assets from the financial records of MemoryDealers and

Agilestar; and

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 21 of 26 Page ID #:21

22

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

f.

preparing and causing to be prepared, signing and

causing to be signed, and filing and causing to be filed with the IRS

on December 18, 2018, a false 2017 U.S. Nonresident Alien Income Tax

Return (Form 1040NR) that failed to report income from the

distributions of bitcoins to defendant VER from MemoryDealers and

Agilestar.

COUNT FIVE

[26 U.S.C. § 7201]

31. The Grand Jury realleges paragraphs 1 through 25 and 27 of

this Indictment here.

32. From on or about January 1, 2017, through on or about

December 18, 2018, in Los Angeles County, within the Central District

of California, and elsewhere, defendant VER willfully attempted to

evade and defeat income tax due and owing by him to the United States

of America, for the calendar year 2017, by committing the following

affirmative acts, among others, on or about the following dates:

a. on June 19, 2017, instructing Employee 1 to “close

out” the bitcoin balance, which resulted in the removal of all

bitcoins as assets from the financial records of MemoryDealers and

Agilestar;

b. on July 26, 2018, falsely stating to Return Preparer 1

that he did not receive any distributions or other payments from

MemoryDealers in 2017;

c. on July 26, 2018, falsely stating to Return Preparer 1

that he did not receive any distributions or other payments from

Agilestar in 2017; and

d. preparing and causing to be prepared, signing and

causing to be signed, and filing and causing to be filed with the IRS

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 22 of 26 Page ID #:22

23

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

on December 18, 2018, a false 2017 U.S. Nonresident Alien Income Tax

Return (Form 1040NR) that failed to report income from the

distributions of bitcoins to defendant VER from MemoryDealers and

Agilestar.

COUNT SIX

[26 U.S.C. § 7206(1)]

33. The Grand Jury realleges paragraphs 1 through 25 and 27 of

this Indictment here.

34. On or about May 10, 2016, in Los Angeles County, within the

Central District of California, and elsewhere, defendant VER

willfully made and subscribed, and filed and caused to be filed with

the IRS, a false 2014 U.S. Nonresident Alien Income Tax Return (Form

1040NR), which was verified by a written declaration that it was made

under penalties of perjury and which defendant VER did not believe to

be true and correct as to every material matter. The Form 1040NR was

not true and correct as follows:

a. on the Sales and Other Dispositions of Capital Assets

(Form 8849), included with the Form 1040NR, defendant VER:

i. failed to report gain from the constructive sale

of personally owned bitcoins, whereas defendant VER then knew he

personally owned bitcoins and was required to report gain from their

constructive sales;

ii. falsely reported proceeds of $2,250,000 and gain

of $2,064,268 from the constructive sale of MemoryDealers, whereas

defendant VER then knew the proceeds and gain from the constructive

sale of this company were substantially greater than the amounts he

reported; and

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 23 of 26 Page ID #:23

24

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

iii.

falsely reported proceeds of $4,310,000 and gain

of $3,954,220 from the constructive sale of Agilestar, whereas

defendant VER then knew the proceeds and gain from the constructive

sale of this company were substantially greater than the amounts he

reported;

b.

on Line 14, Cap Gain or (Loss), defendant VER falsely

reported capital gain of $6,085,116, whereas defendant VER then knew

the amount of capital gain he was required to report was

substantially greater than this amount; and

c. on Line 75, Amount you owe, defendant VER falsely

reported $1,034,357, whereas defendant VER then knew that he owed

substantially more than this amount.

COUNT SEVEN

[26 U.S.C. § 7206(1)]

35. The Grand Jury realleges paragraphs 1 through 25 and 27 of

this Indictment here.

36. On or about May 10, 2016, in Los Angeles County, within the

Central District of California, and elsewhere, defendant VER

willfully made and subscribed, and filed and caused to be filed with

the IRS, a false 2014 Initial and Annual Expatriation Statement (Form

8854), which was verified by a written declaration that it was made

under penalties of perjury and which defendant VER did not believe to

be true and correct as to every material matter. The Form 8854 was

not true and correct as follows:

a. defendant VER falsely reported on Part IV, Section A,

Line 2 that his net worth was $18,669,174.42, whereas he then knew

his net worth was substantially greater than this amount;

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 24 of 26 Page ID #:24

25

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

b.

defendant VER failed to report on Part IV, Section B,

Line 8 and attachment that he personally owned any bitcoins, whereas

he then knew he personally owned bitcoins;

c.

defendant VER failed to report on Part IV, Section B,

Line 8 and attachment that he had an account at Coinbase that held

bitcoins, whereas he then knew he had an account at Coinbase that

held bitcoins;

d. defendant VER falsely reported on Part IV, Section B,

Line 8 and attachment the fair market value of MemoryDealers as

$2,250,000, whereas he then knew the fair market value of the company

was substantially greater than this amount; and

e. defendant VER falsely reported on Part IV, Section B,

Line 8 and attachment the fair market value of Agilestar as

$4,310,000, whereas he then knew the fair market value of the company

was substantially greater than this amount.

COUNT EIGHT

[26 U.S.C. § 7206(1)]

37. The Grand Jury realleges paragraphs 1 through 25 and 27 of

this Indictment here.

38. On or about December 18, 2018, in Los Angeles County,

within the Central District of California, and elsewhere, defendant

VER willfully made and subscribed, and filed and caused to be filed

with the IRS, a false 2017 U.S. Nonresident Alien Income Tax Return

(Form 1040NR), which was verified by a written declaration that it

was made under penalties of perjury and which defendant VER did not

believe to be true and correct as to every material matter. The Form

1040NR was not true and correct as follows:

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 25 of 26 Page ID #:25

26

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

a.

on Line 61, total tax, defendant VER falsely reported

$583,281, whereas he then knew that his total tax was substantially

more than this amount because it did not include any tax from the

distributions of bitcoins from MemoryDealers and Agilestar he

received that year; and

b.

on Line 75, Amount you owe, defendant VER falsely

reported $333,025, whereas defendant VER then knew that he owed

substantially more than this amount.

A TRUE BILL

/s/

Foreperson

E. MARTIN ESTRADA

United States Attorney

MACK E. JENKINS

Assistant United States Attorney

Chief, Criminal Division

RANEE A. KATZENSTEIN

Assistant United States Attorney

Chief, Major Frauds Section

MATTHEW J. KLUGE

Assistant Chief, Tax Division

United States Department of Justice

PETER J. ANTHONY

Trial Attorney, Tax Division

United States Department of Justice

JAMES C. HUGHES

Assistant United States Attorney

Ma

j

or Frauds Section

Case 2:24-cr-00103-MWF Document 1 Filed 02/15/24 Page 26 of 26 Page ID #:26