Robert W. Baird & Co. Incorporated. Baird does not provide tax advice. Contact your tax professional. Page 1 of 6

WEALTH SOLUTIONS GROUP

Purchasing bonds at a price above or below the

bond’s maturity value can lead to unique tax

consequences, but also provide investors some

opportunity for tax planning.

February 2023

When a bond is issued, it is assigned a maturity value, or “par value”. This is the amount the bond issuer agrees to

pay to the bond holder when the bond matures. A maturity value for a bond is typically $1,000, although the amount an

investor pays to purchase that bond is often something much different. Bonds can be bought under the following

circumstances:

• Original Issue Discount (OID) – If a bond is issued at a price that is less than its stated maturity value, the

bond is said to have Original Issue Discount, or OID. The amount of OID is the difference between what

the investor paid for the bond and its maturity value.

• Mar

ket Discount – If a bond is purchased in a secondary market for an amount less than its stated

maturity value, it is called a market discount bond. The amount of market discount is the difference

between what the investor paid for the bond and its maturity value.

There may be situations were a bond that was purchased on the secondary market at a discount

was also originally issued at a discount. This bond has both OID and market discount, and the

total discount for the bond is a combination of these two types.

• Market Premium – If a bond is purchased for more than its stated maturity value, either when originally

issued or later in a secondary market, it is called a premium bond. The amount of premium is the

difference between what the investor paid for the bond and its maturity value.

It is also possible that a bond that was issued with OID is later bought at a premium.

The tax rules in each of these situations can be fairly elaborate and often require an investor to make elections and

keep detailed records on the bond. In addition, the rules vary depending on the issuer of the bond (taxable bonds vs.

tax-exempt bonds). To further complicate matters, these rules have changed often over the years. While the rules

have been consistent for some time now, investors should note that the bond’s issue date and/or the purchase date will

dictate which tax rules apply. Below is a summary of the tax rules that are currently in effect for bonds purchased at a

discount or premium.

ORIGINAL ISSUE DISCOUNT (OID)

Investors purchasing a bond with OID are required to gradually recognize the difference between their purchase price

and the bond’s maturity value as ordinary income over the life of the bond. The amount of income to recognize is

determined annually by either the issuer of the bond or the broker that sold the bond to the investor and is reported on

Wealth Planning Department

Baird Private Wealth Management

Tax Treatment of Bond Premium and Discount

Buying bonds above or below par value creates a variety of tax issues

Tax Treatment of Bond and Discount, continued

Robert W. Baird & Co. Incorporated Page 2 of 6

Form 1099-OID. There are situations where the amount reported on the 1099 may need to be adjusted by the investor

– see the Adjustment to 1099-OID section below.

The process for calculating the amount of OID income to recognize each year is called accretion. As this OID is

accreted each year by the investor and recognized as ordinary income, it is also added to the investor’s cost basis in the

bond. This adjusted cost basis is also called the accreted value of the bond. If the bond is sold prior to maturity date,

any difference between the sales proceeds and accreted value is taxed as a capital gain or loss.

1

If the bond is held to

maturity, the OID would be fully accreted, resulting in the cost basis of the bond matching its maturity value, thereby

eliminating any capital gain.

Under the accretion rules, the amount of discount included in income is calculated using the constant interest rate

method. This method results in the amount of OID recognized annually to increase slightly each year, so that the

annual accretion is a constant percentage of the accreted value of the bond at the beginning of each year.

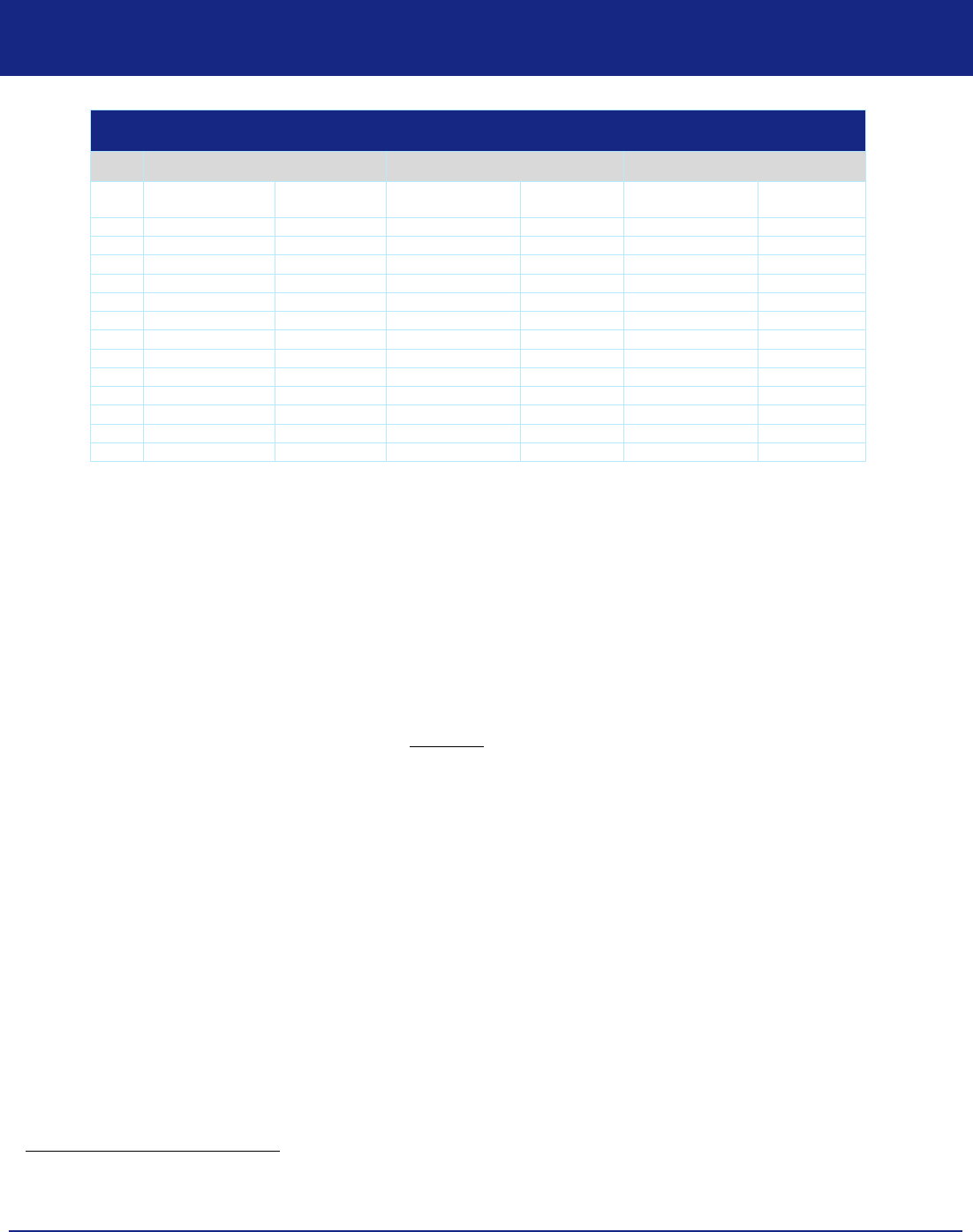

• Example 1: An investor purchases a newly-issued bond July 1, 2020 for $514. The bond will mature June 30, 2032

for $1,000. This bond has OID of $486 ($1,000 maturity value less $514 purchase price). Using the constant

interest rate method, the annual accretion amount is calculated to equal 5.70% of the bond’s accreted value each

year. The amount of OID recognized each year is shown below, along with the accreted value of the bond at the end

of each year.

Example 1: OID Accretion on Taxable Bond

Adjusted Basis/Accreted Value

at Beginning of the Year

Current Year

Accretion

Adjusted Basis/Accreted

Value at End of the Year

2020

$514.00

$14.64

$528.64

2021

528.64

30.11

558.75

2022

558.75

31.83

590.58

2023

590.58

33.64

624.22

2024

624.22

35.56

659.77

2025

659.77

37.58

697.35

2026

697.35

39.72

737.07

2027

737.07

41.98

779.06

2028

779.06

44.38

823.43

2029

823.43

46.90

870.34

2030

870.34

49.57

919.91

2031

919.91

52.40

972.31

2032

$972.31

$27.69

$1,000.00

In the example above, if this bond were sold or called any time during this period, the OID for that year would be

adjusted to reflect the actual period for which the bond was owned. If the bond were sold for more or less than its

accreted value, the investor would recognize a capital gain or loss.

These OID rules are generally applied to any bond that is issued at a discount. However, there are exceptions to those

rules:

• Tax-Exempt Bonds – Because the interest on these bonds is exempt from federal income tax, so is the OID that is

accreted each year. Therefore, there is no federal income tax impact during the year when the OID on a tax-exempt

bond is accreted. However, the cost basis of the bond is still adjusted upward for the annual OID, thereby allowing

investors in these bonds to minimize or eliminate any capital gain on the sale or maturity of the bond. Also, while this

accreted OID is not taxable for federal purposes, it may be taxable for state purposes. Investors should check their

state’s tax rules on the reporting of OID on federally tax-exempt bonds.

1

However, if any market discount or market premium applied to the bond, the tax treatment will vary.

Tax Treatment of Bond and Discount, continued

Robert W. Baird & Co. Incorporated Page 3 of 6

• U.S. Savings Bonds – Investors purchasing Series E, EE or I bonds issued by the U.S. Government do so at a

discount to their maturity value, just like investors in OID bonds. However, investors in Series E, EE or I bonds have

a choice on how to report this type of OID. Investors can accrete the OID into income (and increase their cost basis)

as illustrated in Example 1 above, or the entire OID amount can be recognized as income in the year the bond

matures or is disposed of. In either case, the accreted OID is taxed as US Government interest (not a capital gain),

meaning it is taxable for federal tax purposes but exempt from state income taxes.

• Short-Term Debt Instruments – Bonds that are issued with less than one year remaining until their maturity date

are not subject to the OID rules.

• Bonds issued before March 2, 1984 – OID bonds issued before this date are subject to a different set of tax rules.

MARKET DISCOUNT – TAXABLE BONDS

A bond is said to have been sold at a market discount when its value falls after it is originally issued, usually caused by

an increase in interest rates. This bond may have originally been issued as an OID bond, in which case the market

discount is equal to the accreted value of the bond just prior to purchase less the price paid for it.

• Example 2: Continuing with Example 1 above – At the end of 2026, this bond had an accreted value of $737.07. If

the bond was then sold to a new investor for $600, that new investor would now own a bond with a market discount

of $137.07 ($737.07 - $600) and remaining OID of $262.93 ($1,000 - $737.07).

Investors purchasing a bond with a market discount have two decisions to make regarding that discount.

1. To accrete or not to accrete – The first decision is whether to accrete the market discount into income each

year, or to report the entire market discount as ordinary income when the bond matures or is disposed of. This is

different than how OID is treated, which must be accreted into income annually.

If the investor chooses to not accrete the discount into income each year and then holds the bond to maturity, the

entire market discount is taxed as ordinary income at maturity. It is not taxed as a capital gain. If the bond is sold

prior to maturity, any gain due to un-accreted discount is taxed as ordinary income, and the balance is taxed as a

capital gain.

To elect to report the accreted market discount in income each year, a statement is attached to the tax return for the

first year in which the accreted discount is reported. This election then becomes permanent for all market discount

bonds acquired that year and any year thereafter. Investors can’t change back to the non-accretion method without

the consent of the IRS.

Choosing to accrete the interest results in recognizing income sooner than if it was not accreted. However, this

annual income amount is smaller than the lump-sum amount required to be recognized when the bond is disposed

of. Therefore, the cumulative tax cost may ultimately be less when accreting the market discount. Factors to

consider in this decision would be the amount of discount recognized annually versus the total discount recognized

when the bond is disposed of, as well as the investor’s current and projected future level of taxable income and tax

rates.

2. Accretion calculation method – If the investor chooses to accrete the discount, the second decision is how to

calculate the annual discount to be recognized. Market discount can be accreted using the constant interest rate

method (the same method that must be used for OID) or by using the ratable accrual method. Under this second

method, the accreted market discount is equal to the total discount divided by the number of days between the

investor’s purchase date and the bond’s maturity date.

• Example 3: An investor purchases a bond July 1, 2020 for $514, and that bond will mature June 30, 2032 for

$1,000. This bond was originally issued with no OID, so the bond has total market discount of $486 ($1,000

maturity value less $514 purchase price). The amount of market discount recognized each year under the three

accretion options is shown below.

Tax Treatment of Bond and Discount, continued

Robert W. Baird & Co. Incorporated Page 4 of 6

Example 3: Market Discount Accretion on Taxable Bond

Constant Interest Rate Method Ratable Accrual Method No Annual Accretion

Annual

Accretion/Income

Accreted

Value

Annual

Accretion/Income

Accreted

Value

Annual

Accretion/Income

Accreted

Value

2020

$14.64

$528.64

$20.25

$534.25

$0

$514.00

2021

30.11

558.75

40.50

574.75

0

514.00

2022

31.83

590.58

40.50

615.25

0

514.00

2023

33.64

624.22

40.50

655.75

0

514.00

2024

35.56

659.77

40.50

696.25

0

514.00

2025

37.58

697.35

40.50

736.75

0

514.00

2026

39.72

737.07

40.50

777.25

0

514.00

2027

41.98

779.06

40.50

817.75

0

514.00

2028

44.38

823.43

40.50

858.25

0

514.00

2029

46.90

870.34

40.50

898.75

0

514.00

2030

49.57

919.91

40.50

939.25

0

514.00

2031

52.40

972.31

40.50

979.75

0

514.00

2032

$27.69

$1,000.00

$20.25

$1,000.00

$486.00

$1,000.00

For investors accreting market discount, the ratable accrual method is assumed to be the default option. To choose the

constant interest rate method, the investor must attach a statement to their tax return identifying the applicable bond

and stating the accretion is calculated using that method. This election is effective beginning on the date the bond was

acquired.

MARKET DISCOUNT – TAX-EXEMPT BONDS

Tax-exempt bonds purchased with market discount after April 30, 1993 are subject to the same rules as taxable

discount bonds

2

. The investor has the option to accrete the market discount into income each year or recognize it all in

the year the bond is disposed of.

• If the discount is accreted each year – The accreted discount is treated as ordinary interest income and is subject

to federal income tax. This accreted discount is taxable despite the fact that the bond itself is considered a tax-

exempt bond.

• If the discount is not accreted annually – Any gain attributed to the market discount that was not accreted is

subject to federal tax as ordinary interest income when the bond is disposed of. Any gain beyond that amount is

taxed as a capital gain. If the bond is sold for less than the purchase price, there is no gain attributable to market

discount, and the entire loss is a capital loss.

DE MINIMIS RULE FOR BOND DISCOUNT

Bonds with OID or market discount deemed to be “de minimis”, meaning below a certain threshold, are exempt from the

accretion rules. For this test, a de minimis discount is one that is less than ¼ of 1% of the bond’s par value, multiplied

by the number of years until the bond matures. This rule applies to both taxable and tax-exempt bonds.

• Example 4: A taxable bond with a par value of $1,000 is issued and matures in 12 years. The de minimis OID

threshold for this bond is $30 (0.25% x 12 years = 3% x $1,000 par value). As long as the OID on this bond is less

than $30 (meaning its purchase price is more than $970), the OID does not have to be accreted into income each

year. When the bond matures, that discount will be taxed as a capital gain. If the OID is $30 or more, the discount

must be accreted into income each year as illustrated in Example 1.

2

Market discount on tax-exempt bonds purchased before May 1, 1993 must be recognized as income when the bond is disposed of only. There is no

option to accrete that discount.

Tax Treatment of Bond and Discount, continued

Robert W. Baird & Co. Incorporated Page 5 of 6

• Example 5: A 15-year tax-exempt bond is issued at a par value of $1,000. After 5 years, a new investor purchases

this bond on the open market for $925, which represents a market discount of $75. The de minimis market discount

threshold for this bond is $25 (0.25% x 10 years = 2.50% x $1,000 par value), so this discount will be treated as

ordinary income. The market discount would have to be less than $25 to be considered a capital gain.

PREMIUM – TAXABLE BONDS

For taxable bonds, the rules regarding bond premium are consistent regardless of whether the premium was paid when

the bond was originally issued or when the bond was later purchased in the secondary market. In both cases, the

investor has two options:

1. Deduction at time of sale – In this case, the premium is treated as part of the cost basis of the bond. When the

bond is sold, called or matures, this premium is then used to reduce the capital gain or increase the capital loss

realized by the investor. This option is the default treatment of taxable bond premium unless the investor elects the

second option.

2. Annual deduction – The premium could be used over the life of the bond to reduce the amount of interest

included in income. This process is called amortization.

When amortizing premium on taxable bonds issued after September 27, 1985, the amortization must be calculated

using the constant interest rate method. For bonds issued prior to that date, investors can use the ratable accrual

method or any other reasonable method.

To calculate the premium amortization, begin with the bond yield. This can be calculated by the investor or may be

provided by the broker. This yield amount is multiplied by the adjusted acquisition price of the bond, and the result is

subtracted from the interest paid on the bond. The adjusted acquisition price of the bond for the first period is the initial

purchase price of the bond. After that, the basis is decreased by the amortized premium amount.

• Example 6: An investor purchases a newly-issued bond July 1, 2020 for $1,350. The bond will mature June 30,

2032 for $1,000, and has a stated interest rate of 5% paid semi-annually. The broker states that the yield on this

bond is 1.74%. This bond has a premium of $350 ($1,350 purchase price less $1,000 maturity value). The amount

of premium realized (using the constant interest rate method) each year is shown below, along with the amortized

value of the bond at the end of each year:

Example 4: Premium Amortization on Taxable Bond

Adjusted Acq Price/Amortized

Value at Beginning of the Year

Current Year

Amortization

Adjusted Acq Price/Amortized

Value at End of the Year

2020

$1,350.00

$13.23

$1,336.77

2021

1,336.77

26.69

1,310.07

2022

1,310.07

27.16

1,282.91

2023

1,282.91

27.63

1,255.28

2024

1,255.28

28.12

1,227.16

2025

1,227.16

28.61

1,198.56

2026

1,198.56

29.10

1,169.45

2027

1,169.45

29.61

1,139.84

2028

1,139.84

30.13

1,109.71

2029

1,109.71

30.65

1,079.06

2030

1,079.06

31.19

1,047.87

2031

1,047.87

31.73

1,016.14

2032

$1,016.14

$16.14

$1,000.00

In the example above, if this bond were sold or called any time during this period, the premium for that year would be

adjusted to reflect the actual period for which the bond was owned. If the bond was sold for more or less than its

amortized value, the investor would recognize a capital gain or loss.

Tax Treatment of Bond and Discount, continued

Robert W. Baird & Co. Incorporated Page 6 of 6

If the investor chooses to amortize the bond premium, it is done by reporting the amortized premium on the tax return

for the first year this election applies. This amount is shown as a negative amount on Schedule B of the tax return and is

netted against any other interest income realized during the year. The investor should also attach a statement to that tax

return indicating they are making this election. Once the election is made, it applies to all taxable bonds owned in the

year of the election and those acquired in the future. The only way to change this election is with approval from the IRS.

By amortizing, the investor is able to reduce the amount of taxable interest income they report each year they own the

bond. If that bond is held to maturity, there is no capital gain or loss to report. By not amortizing, the investor must

report the full amount of interest paid on the bond as taxable income each year. The unamortized premium will

eventually result in a capital loss when the bond matures, which can generally only be used to offset a capital gain.

Therefore, the investor realizes two advantages by amortizing:

1. Offset ordinary income – The amortized premium offsets ordinary income, not capital gain. Ordinary income is

usually taxed at a higher rate than a capital gain, meaning the amortization creates a greater tax savings.

2. Annual tax savings – The tax savings from amortizing is realized each year, beginning the year the bond is

purchased, as opposed to waiting until the bond is sold or matures.

PREMIUM – TAX-EXEMPT BONDS

As with tax-exempt bonds with OID, investors do not have a choice on the tax treatment for the premium on tax-exempt

bonds. Investors are required to amortize the premium in these cases. However,

because the interest from the bond is

tax-exempt, the amortized premium does not create a current-year tax benefit for the investor (unlike with premium on a

taxable bond). Even though there is no tax benefit for amortizing this premium, the investor must still reduce their cost

basis in the bond for the amortized amount. If the tax-exempt bond is held to maturity, there is no deductible capital

loss.

The amortized premium for a tax-exempt bond is calculated the same way as it is when an investor elects to amortize

premium on a taxable bond. While there is no federal tax benefit to amortizing the premium on these bonds, there could

be state tax implications. Investors should check their state’s tax rules on the reporting of amortized premium on

federally tax-exempt bonds.

ADJUSTMENT TO 1099-OID

Even though a bond was originally issued at a discount, changes in interest rates or other factors could result in that

bond subsequently being purchased by an investor at a premium to the bond’s accreted value. In these situations, the

investor may be both accreting discount and amortizing premium on the same bond.

An investor in this situation will still receive a 1099-OID from the broker holding the bond showing the amount of OID

income to report for the year. This amount will then need to be adjusted to reflect the amortization of the premium the

investor paid when they purchased the bond (for taxable bonds, this would only apply if the investor chose to amortize

the premium). This adjustment is typically reported as a separate item on the tax return and is labeled “OID

Adjustment”, rather than being subtracted directly from the OID reported on the 1099.