National Standards

for

Personal Financial

Education

National Standards

for

Personal Financial

Education

Presented by

www.jumpstart.org

This publication was made possible through funding provided by the Jackson Charitable Foundation.

Copyright © 2021, Council for Economic Education, 122 East 42 Street, Suite 1012, New York, NY 10168; and Jump$tart Coalition

for Personal Financial Literacy, 1001 Connecticut Ave. NW, Suite 640, Washington, D.C. 20036. All rights reserved. The Standards

and Benchmarks in this document may be reproduced for noncommercial educational and research purposes. Notice of

copyright must appear on all pages. Printed in the United States of America.

ISBN: 978-1-7348096-2-6

2

National Standards for Personal Financial Education

Acknowledgments 3

Introduction 4

About the National Standards 5

Topic Summary of the Standards 7

I Earning Income 9

II Spending 15

III Saving 20

IV Investing 25

V Managing Credit 31

VI Managing Risk 36

Contents

3

National Standards for Personal Financial Education

Steering Committee

Christopher Caltabiano, Council for Economic

Education

Billy J Hensley, National Endowment for Financial

Education

Michael Staten, University of Arizona and Jump$tart

Coalition for Personal Financial Literacy

Project Director

Vickie Bajtelsmit, Colorado State University and

Jump$tart Coalition for Personal Financial Literacy

Writing Committee

Carlos Asarta, University of Delaware

Rachel Bi, Utah Valley University

Lori Myers, American Association of Family and

Consumer Sciences

Barbara O’Neill, Money Talk Financial Planning

Jacqueline Collins, Mansfield High School,

Massachusetts

Educator Review Committee

Holly Bosley, Highland Elementary, Colorado

Joel Chrisler, Sauk Prairie High School, Wisconsin

Josh Dalton, University of Delaware

Wade Haugen, Grafton Public Schools, North Dakota

Rachel Heitin, E.L. Haynes Public Charter School and

Tinkergarten, District of Columbia

Renay Mercer, Talley Middle School, Delaware

Tony Montgomery, City-As-School High School,

New York

Courtney Poquette, Winooski High School, Vermont

Expert Reviewers

Kari Arfstrom, National Association of State Treasurers

Rhonda Ashburn, AFSA Education Foundation

William Bosshardt, Florida Atlantic University

Elizabeth Kiss, Kansas State University

Meg Chapman, Junior Achievement

Amy Marty Conrad, National Endowment for Financial

Education

Dubis Correal, Consumer Financial Protection Bureau

Casey Cortese, Charles Schwab Foundation

Jared Davidove, Intuit

Dennis Duquette, Mass Mutual Foundation

Jessica Endlich, Next Gen Personal Finance

Rod Griin, Experian

Julie Heath, University of Cincinnati

Hilary Hunt, Financial Education Consulting

Rebecca Maxcy, University of Chicago Financial

Education Initiative

Tim Ranzetta, Next Gen Personal Finance

Luke Reynolds, Federal Deposit Insurance

Corporation

Danielle Robinson, Jackson Charitable Foundation

Mary Suiter, Federal Reserve Bank of St. Louis

Carly Urban, University of Montana

Gerri Walsh, FINRA Education Foundation

Rebecca Wiggins, Association for Financial

Counseling & Planning Education

®

(AFCPE

®

)

Equity Review

Great Lakes Equity Center

Acknowledgments

4

National Standards for Personal Financial Education

The Council for Economic Education (CEE) and the Jump$tart Coalition for Personal Financial

Literacy (Jump$tart) shared a vision: one set of national standards in personal finance education

that would unite and guide the diverse financial literacy community, including educators in many

subject areas, administrators, resource developers, researchers, supporters, and others We are

proud to present the National Standards for Personal Financial Education

These national standards identify knowledge, skills, and decision-making abilities that young people

should acquire during their K-12 education They provide a framework for a complete personal

finance curriculum that progresses through elementary, middle, and high school to prepare students

for their lives as smart consumers

While CEE and Jump$tart believe that learning about money management should begin at home,

we recognize that many children cannot get suicient guidance from their families alone and

that eective financial education in our nation’s classrooms is our best opportunity to provide all

students – regardless of background and circumstance – a wide-ranging financial education with

practical applicability

Research, such as the Global Financial Literacy Excellence Center’s April 2020 working paper,

Financial Education Aects Financial Knowledge and Downstream Behaviors, shows that financial

education has a positive causal eect on financial knowledge and, importantly, financial behaviors

Jump$tart’s 2020 Student Impact Study demonstrates the eectiveness of financial education when

teachers receive comprehensive professional development, with the greatest potential benefit

among economically disadvantaged students and students of color

Through hard work and an unwavering commitment, we are making progress CEE’s biennial Survey

of the States shows that as of 2020, 45 states include personal finance in their education standards,

24 states require that a personal finance course be oered in high school, and six of those states

require a dedicated course for high school graduation We have a lot to be proud of, but there is still

much more to do We oer the National Standards for Personal Financial Education as a tool to help

ensure that students receive a comprehensive financial education that, when coupled with financial

access and opportunities, consumer protections, good products, ethical services, and fair public

policies, will lead to a lifetime of financial well-being

Together, CEE and Jump$tart thank this project’s Steering Committee for its wisdom and oversight;

project lead, Dr Vickie Bajtelsmit and the Writing Committee for their talent and tireless eorts; the

Educator Review Committee for their practical insights; and to the diverse group of stakeholders

who submitted comments that not only strengthened the final product, but helped to make it a truly

collaborative endeavor We thank the Jackson Charitable Foundation for its generous support and,

finally, our own sta, contractors, and service providers who have made the National Standards for

Personal Financial Education a reality

Nan J. Morrison Laura Levine

President and CEO President and CEO

Council for Economic Education Jump$tart Coalition for Personal Financial Literacy

Introduction

5

National Standards for Personal Financial Education

The Writing Committee began with a draft based on the best elements of the National Standards

for Financial Literacy (CEE, 2013) and the National Standards in K-12 Personal Finance Education

(Jump$tart, 2015) The Educator Review Committee, made up of experienced elementary, middle,

and high school teachers, provided feedback and suggested missing topics, and weighed in on the

age-appropriateness of the benchmarks and activities After additional revisions, the draft was sent

to a broad cross-section of experts for review and comment, and then the final draft underwent an

equity and bias review by an independent consulting firm

Educational resources and curriculum outlines that relied on the most recent national standards

published by CEE and/or Jump$tart will not require significant revisions to be consistent with the

new standards The content of this publication is substantially similar to both, with improvements

in style and focus, updates for newer finance concepts and terminology, and increased attention to

assessability and equity/inclusion issues

The National Standards for Personal Financial Education is organized around six Topics, with

Standards and Learning Outcomes expected by the end of the 4th, 8th, and 12th grades The Topics

are:

I Earning Income

II Spending

III Saving

IV Investing

V Managing Credit

VI Managing Risk

Topics need not be addressed in a particular order and Standards covered in earlier grade levels

are not repeated unless there is an expectation for a higher level of learning or need to cover more

advanced elements within the Topic

Standards identify specific information that a student should understand at the completion of the

given grade level These Standards complete the phrase, “Students will know that”

Each Standard includes two to four measurable Learning Outcomes, representing ways that

students can demonstrate mastery of the Standard, including comprehension of the content as

well as application to financial decision making These Learning Outcomes complete the phrase,

“Students will use this knowledge to”

• Numbering Conventions: The new standards are numbered using the six Topics

Each Standard is numbered by grade level (Example: 4-1 to indicate the first Standard

for 4th grade students) Corresponding Learning Outcomes are lettered (Example:

4-1a, 4-1b)

• Topics and Order: The six major Topics are similar to CEE’s National Standards for

Financial Literacy and not wholly dierent from Jump$tart’s National Standards in

K-12 Personal Finance Education, except that Jump$tart’s Financial Decision-Making

Category has been incorporated into all six Topics The six Topics are numbered

for simplicity and reference, but do not indicate the order in which they should be

addressed in a resource or course

About the National Standards

6

National Standards for Personal Financial Education

• Cumulative Grade Level Knowledge: The National Standards for Personal Financial

Education specify the knowledge and decision-making skills that students should

have by the time they finish their primary (4th grade), middle (8th grade), and high

school (12th grade) levels This organization does not assume that all learning will

occur during the 4th, 8th, and 12th grade years but, rather, outlines the cumulative

result of learning that may have taken place in previous years

• Decision-making Focus: Decision-making is integrated throughout the standards

Factual content is presented as Standards, while the Learning Outcomes include a

progression of learning levels designed to encourage critical thinking and application

of the knowledge content to specific age-appropriate decisions

• Updated Topics: The new standards include current topics such as behavioral

finance, higher education financial planning, identity theft, financial technology,

mobile payments, cryptocurrency, and alternative financial services that were not

prevalent when earlier standards were published

• Avoidance of Definitions and Over-specificity: Eort was made to establish

standards that focus on how the content would be used to make good financial

decisions rather than standards that are merely terminology definitions Similarly, the

new standards focus on concepts and principles over specific products, laws, and

regulations, which are subject to continual change

• Focus on Knowledge and Skills: The new standards are presented in terms of

knowledge and decision-making skills rather than specific activities Because there

are many ways to teach each concept and the ideal method may dier based on

the student audience, this allows teachers greater flexibility in materials, teaching

methods, and lesson plans

• Assessability: Student assessment is critical to the educational process Learning

Outcomes were written with the objective of making them assessable

• Equity and Inclusion: Financial education is for all students and language used

throughout the National Standards for Personal Financial Education is purposefully

equitable and inclusive Situations presented in these standards are intentionally free

from bias

About the National Standards

7

National Standards for Personal Financial Education

I. Earning Income

Most people earn wage and salary income in return for working, and they can also earn income

from interest, dividends, rents, entrepreneurship, business profits, or increases in the value of

investments Employee compensation may also include access to employee benefits such as

retirement plans and health insurance Employers generally pay higher wages and salaries to

more educated, skilled, and productive workers The decision to invest in additional education or

training can be made by weighing the benefit of increased income-earning and career potential

against the opportunity costs in the form of time, eort, and money Spendable income is lower

than gross income due to taxes assessed on income by federal, state, and local governments

II. Spending

A budget is a plan for allocating a person’s spendable income to necessary and desired goods

and services When there is suicient money in their budget, people may decide to give money

to others, save, or invest to achieve future goals People can often improve their financial well-

being by making well-informed spending decisions, which includes critical evaluation of price,

quality, product information, and method of payment Individual spending decisions may be

influenced by financial constraints, personal preferences, unique needs, peers, and advertising

III. Saving

People who have suicient income can choose to save some of it for future uses such as

emergencies or later purchases Savings decisions depend on individual preferences and

circumstances Funds needed for transactions, bill-paying, or purchases, are commonly held in

federally insured checking or savings accounts at financial institutions because these accounts

oer easy access to their money and low risk Interest rates, fees, and other account features

vary by type of account and among financial institutions, with higher rates resulting in greater

compound interest earned by savers

IV. Investing

People can choose to invest some of their money in financial assets to achieve long-term

financial goals, such as buying a house, funding future education, or securing retirement income

Investors receive a return on their investment in the form of income and/or growth in value of

their investment over time People can more easily achieve their financial goals by investing

steadily over many years, reinvesting dividends, and capital gains to compound their returns

Investors have many choices of investments that dier in expected rates of return and risk

Riskier investments tend to earn higher long-run rates of return than lower-risk investments

Investors select investments that are consistent with their risk tolerance, and they diversify

across a number of dierent investment choices to reduce investment risk

Topic Summary of

the Standards

8

National Standards for Personal Financial Education

V. Managing Credit

Credit allows people to purchase and enjoy goods and services today, while agreeing to pay

for them in the future, usually with interest There are many choices for borrowing money, and

lenders charge higher interest and fees for riskier loans or riskier borrowers Lenders evaluate

creditworthiness of a borrower based on the type of credit, past credit history, and expected

ability to repay the loan in the future Credit reports compile information on a person’s credit

history, and lenders use credit scores to assess a potential borrower’s creditworthiness A low

credit score can result in a lender denying credit to someone they perceive as having a low level

of creditworthiness Common types of credit include credit cards, auto loans, home mortgage

loans, and student loans The cost of post-secondary education can be financed through a

combination of grants, scholarships, work-study, savings, and federal or private student loans

VI. Managing Risk

People are exposed to personal risks that can result in lost income, assets, health, life, or

identity They can choose to manage those risks by accepting, reducing, or transferring them

to others When people transfer risk by buying insurance, they pay money now in return for the

insurer covering some or all financial losses that may occur in the future Common types of

insurance include health insurance, life insurance, and homeowner’s or renter’s insurance The

cost of insurance is related to the size of the potential loss, the likelihood that the loss event

will happen, and the risk characteristics of the asset or person being insured Identity theft is

a growing concern for consumers and businesses Stolen personal information can result in

financial losses and fraudulent credit charges The risk of identity theft can be minimized by

carefully guarding personal financial information

Topic Summary of the Standards

9

National Standards for Personal Financial Education

I. Earning Income

Most people earn wage and salary

income in return for working, and they

can also earn income from interest,

dividends, rents, entrepreneurship,

business profits, or increases in

the value of investments Employee

compensation may also include

access to employee benefits such as

retirement plans and health insurance

Employers generally pay higher wages

and salaries to more educated, skilled,

and productive workers The decision

to invest in additional education or

training can be made by weighing the

benefit of increased income-earning

and career potential against the

opportunity costs in the form of time,

eort, and money Spendable income

is lower than gross income due to

taxes assessed on income by federal,

state, and local governments

Concept Progression

This topic focuses on income earned or

received by people and the various taxes

that are assessed on income. The 4th

grade standards focus on the dierent

ways that people earn income, methods

of payment, and how income is taxed by

government to pay for community services.

In 8th grade, these concepts are further

developed by having students consider

the benefits and opportunity costs of

investments in education and skills, and

the types of taxes on earnings. Students

also are introduced to the benefits and

costs of entrepreneurship at the 8th grade

level. By the 12th grade, students explore

each of these concepts in more depth. The

emphasis is on making career decisions

by better understanding career paths,

wage and salary compensation versus

employee benefits, factors to consider in

deciding whether to invest in additional

education/training, and the eect of

market conditions and technological

advances on labor market opportunities.

The National Standards for

Personal Financial Education

10

National Standards for Personal Financial Education

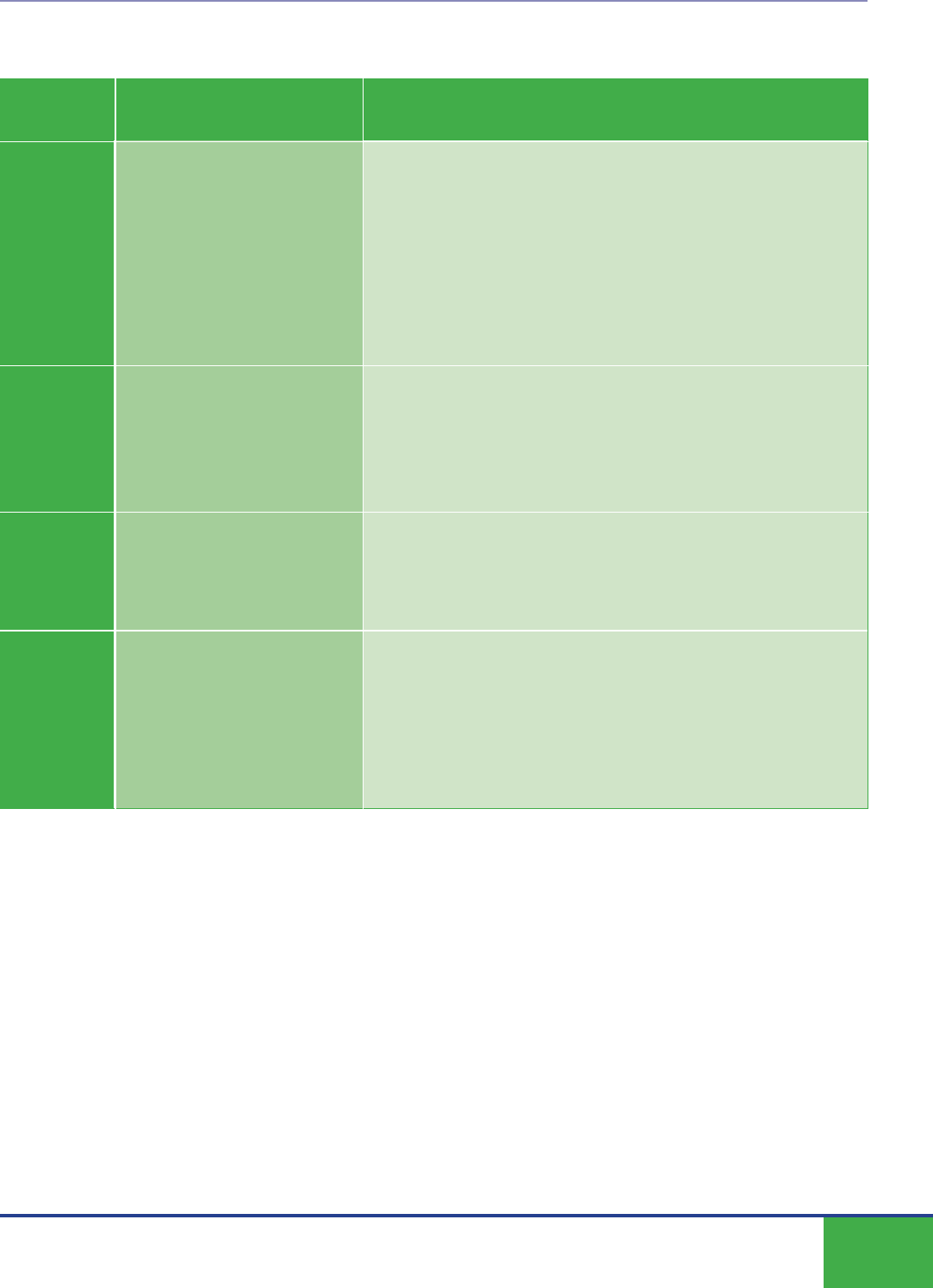

Grade 4

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Earning

Income 4-1

Earning

Income 4-2

Earning

Income 4-3

Earning

Income 4-4

Earning

Income 4-5

Earning

Income 4-6

Earning

Income 4-7

People have dierent job

choices depending on their

knowledge, skills, interests,

and experience

People may be able to

improve their ability to

earn income by gaining

new knowledge, skills, and

experience

There are dierent ways

to be paid for labor,

including wages, salaries,

commissions, and tips

People can earn income by

starting a new business as an

entrepreneur or by owning a

business

People can earn income by

lending money or by renting

their property to others

Income can be received as

gifts or as an allowance for

which no specified work may

be required

Most income is taxed by

the government to pay for

government-provided goods

and services

4-1a List dierent types of jobs

4-1b Discuss the types of knowledge, skills, interests, and

experience required for dierent types of jobs

4-2a Give examples of how an individual’s knowledge, skills,

and experience could aect their ability to earn income

4-2b Brainstorm ways to improve one’s ability to earn income

4-3a Explain why employers pay people for their labor

4-3b Describe the dierence between wages, salaries,

commissions, and tips

4-3c Compare how the following individuals are typically paid:

food server, teacher, and realtor

4-4a List several businesses they would be interested in

owning as an entrepreneur

4-4b Name several famous entrepreneurs and their

businesses, and hypothesize why they succeeded or

failed

4-4c Estimate how much income could be earned from a

business operated by children (such as a lawn service or

lemonade stand)

4-5a List several examples of ways in which people can

earn income by lending their money or by renting their

property to others

4-5b Identify dierent types of property that can be used

by owners to earn rental income (such as apartments,

automobiles, or tools)

4-6a Explain the possible reasons for gifting money to others

4-6b Discuss the pros and cons of families/caregivers paying

their children a weekly allowance

4-7a Describe examples of government-provided goods and

services that are paid for with taxes

4-7b Explain why citizens are required to contribute to the cost

of fire protection, police, public libraries, and schools

Earning Income

11

National Standards for Personal Financial Education

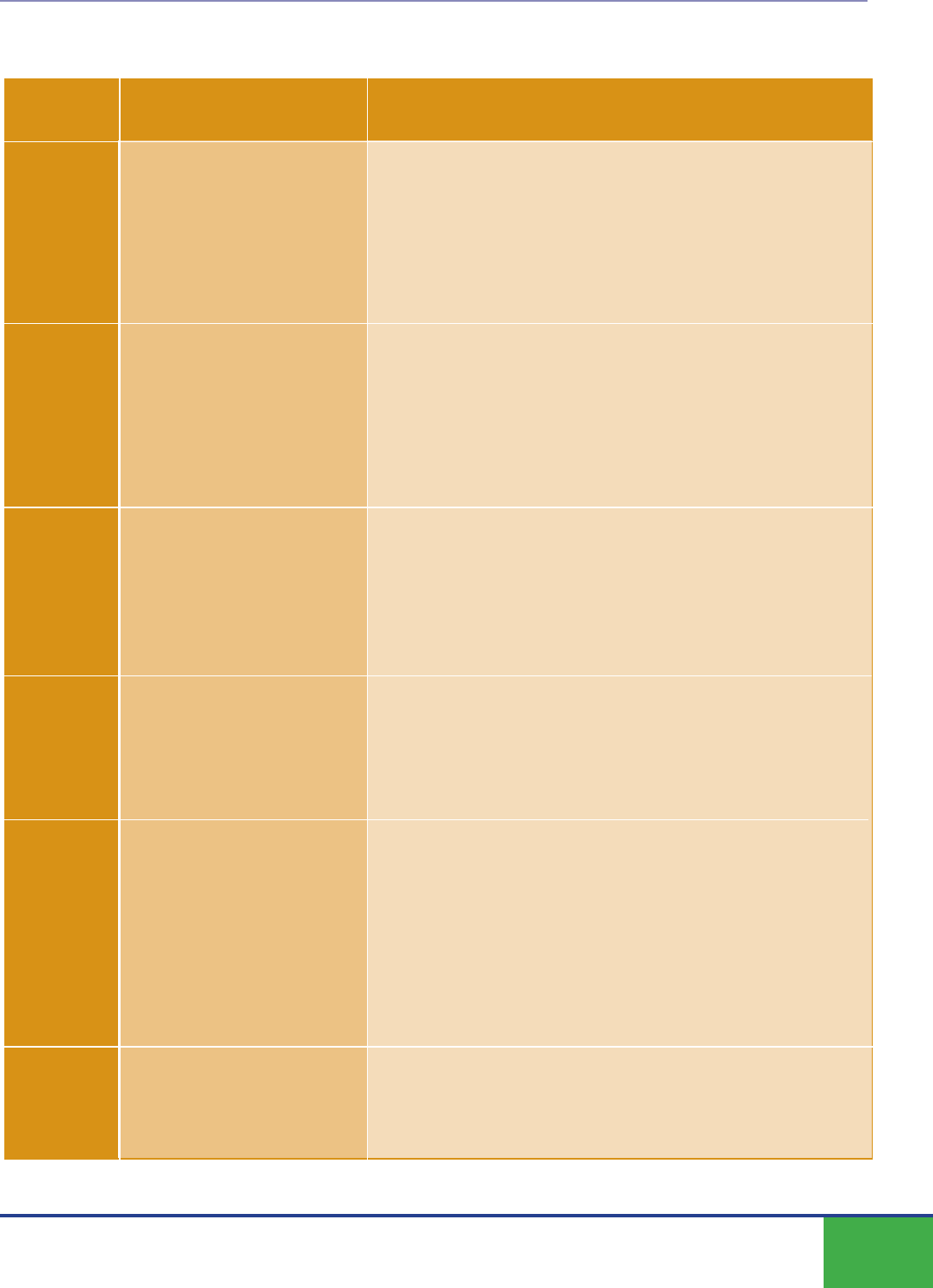

Grade 8

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Earning

Income 8-1

Earning

Income 8-2

Earning

Income 8-3

Earning

Income 8-4

Earning

Income 8-5

Careers are based on

working at jobs in the same

occupation or profession for

many years Careers vary in

their education and training

requirements

People make many decisions

over a lifetime about their

education, jobs, and careers

that aect their incomes and

opportunities

Getting more education,

training, and experience can

increase a person’s human

capital, productivity, and

income-earning potential

Education, training, and

development of job skills

have opportunity costs in

the form of time, eort, and

money

Net income (take-home pay)

is the amount left from wages

and salaries after taxes and

payroll deductions

8-1a Discuss the advantages and disadvantages of working in

the same occupation or profession for many years

8-1b Compare the education and training requirements for at

least two careers

8-1c Interview a person who is in a career of interest and

create a timeline that shows the progression of their

education, training, and job experiences

8-2a Compare the education and training requirements,

income potential, and primary duties of at least two jobs

available to high school students

8-2b Conduct research on a specific career field Describe the

education, job, or career decisions individuals in this field

might make over their lifetime and explain how this could

aect their income potential and opportunities

8-2c Assess personal skills and interests and match them to

various career options

8-3a Investigate training opportunities that can increase a

person’s ability to obtain higher paid employment during

high school

8-3b Explain why adults with a college education may earn

more than adults with no education beyond high school

8-3c Discuss how specific skills training can improve a young

person’s human capital, productivity, and income-earning

potential

8-3d Gather data on the average wage or salary for dierent

jobs and explain how they dier by the level of education,

job skill, or years of experience

8-4a Describe the opportunity costs of attending a training

course on babysitting, lifeguarding, or first aid

8-4b Compare the costs of post-secondary education with the

potential increase in income for a career of choice

8-4c Explain why families/caregivers might choose to help pay

for education and training of younger family members

8-5a Dierentiate between gross and net income

8-5b Identify common types of payroll deductions

8-5c Explain how taxes impact take-home pay

Earning Income

12

National Standards for Personal Financial Education

Grade 8 (cont’d)

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Earning

Income 8-6

Earning

Income 8-7

Earning

Income 8-8

Earning

Income 8-9

Social Security is a federal

government program that

taxes workers and employers

to provide retirement,

disability, and survivor

income benefits for workers

or their dependents

People are required to pay

taxes on most types of

income, including wages,

salaries, commissions, tips,

earnings on investments, and

self-employment income

The government provides

income support and

assistance for people who

qualify based on low income

or other criteria

Entrepreneurs gain

satisfaction from working

for themselves and expect

to earn profits that will

compensate for the risks

associated with new

business ventures

8-6a Identify the dierent groups of people who qualify for

Social Security benefits

8-6b Research the Social Security tax rate for someone who

is self-employed vs someone who is working for an

employer

8-6c Given information on a worker’s income and today’s

Social Security tax rates, calculate what the worker and

the worker’s employer will pay in Social Security taxes

8-6d Investigate Social Security benefits for people of dierent

income levels at their full retirement age

8-7a Illustrate the relationship between income level and

income tax paid

8-7b Describe how taxes are paid on tip income

8-7c Research the consequences of failing to pay income

taxes

8-8a Explain the financial situation addressed by Medicaid and

SNAP (Supplemental Nutrition Assistance Program)

8-8b Give several examples of personal circumstances that

qualify for government income support or assistance

8-9a Investigate the motivating factors to being self-employed

or working as an independent contractor in the “gig”

economy

8-9b Discuss why starting a new business could be riskier

than other career choices

8-9c Research common reasons for new business failures

Earning Income

13

National Standards for Personal Financial Education

Grade 12

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Earning

Income 12-1

Earning

Income 12-2

Earning

Income 12-3

Earning

Income 12-4

Earning

Income 12-5

Compensation for a job

or career can be in the

form of wages, salaries,

commissions, tips, or

bonuses, and may also

include contributions to

employee benefits, such as

health insurance, retirement

savings plans, and education

reimbursement programs

In addition to wages and paid

benefits, employees may

also value intangible (non-

cash) benefits, such as good

working conditions, flexible

work hours, telecommuting

privileges, and career

advancement potential

People vary in their

opportunity and willingness

to incur the present costs

of additional training and

education in exchange for

future benefits, such as

earning potential

Employers generally pay

higher wages or salaries to

more educated, skilled, and

productive workers than to

less educated, skilled, and

productive workers

Changes in economic

conditions, technology, or

the labor market can cause

changes in income, career

opportunities, or employment

status

12-1a Research potential income and employee benefit

packages that are likely to be oered to new employees

by various companies, government agencies, or not-for-

profit organizations

12-1b Explain why people should evaluate employee benefits in

addition to wages and salaries when choosing between

job and career opportunities

12-1c Dierentiate between contributory and non-contributory

employee benefits

12-1d Examine the benefits of participating in employer-

sponsored retirement savings plans and healthcare

savings plans

12-2a Give examples of intangible job benefits

12-2b Describe how intangible benefits can aect a worker’s

career choices and income

12-2c Evaluate the tradeos between income and non-income

factors when making career or job choices

12-3a Evaluate the costs and benefits of investing in additional

education or training

12-3b Explain how dierences in people’s life circumstances

can aect their opportunity and willingness to further

their education or training

12-3c Compare earnings and unemployment rates by level of

education and training

12-4a Identify dierent types of jobs and careers where wages

and salaries depend on a worker’s productivity and skills

12-4b Explain why wages or salaries vary among employees in

dierent types of jobs and among workers in the same

jobs

12-4c Discuss possible explanations for the persistence of race

and gender pay gaps

12-5a Discuss how economic and labor market conditions can

aect income, career opportunities, and employment

status

12-5b Evaluate the impact of technological advances on

employment and income

12-5c Discuss the eects of an economic downturn on

employment opportunities for people with dierent

characteristics, such as education, experience,

employment type, ethnicity, and gender

Earning Income

14

National Standards for Personal Financial Education

Grade 12 (cont’d)

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Earning

Income 12-6

Earning

Income 12-7

Earning

Income 12-8

Earning

Income 12-9

Earning

Income 12-10

Earning

Income 12-11

Federal, state, and local taxes

fund government-provided

goods, services, and transfer

payments to individuals

The major types of taxes are

income taxes, payroll taxes,

property taxes, and sales

taxes

The type and amount of taxes

people pay depend on their

sources of income, amount

of income, and amount and

type of spending

Interest, dividends, and

capital appreciation (gains)

are examples of unearned

income derived from financial

investments Capital gains

are subject to dierent tax

rates than earned income

Tax deductions and credits

reduce income tax liability

Retirement income

typically comes from some

combination of continued

employment earnings,

Social Security, employer-

sponsored retirement plans,

and personal investments

Owning a small business can

be a person’s primary career

or can supplement income

from other sources

12-6a Calculate the amount of taxes a person is likely to pay

when given information or data about the person’s

sources of income and amount of spending

12-6b Identify which level(s) of government typically receive(s)

the tax revenue for income taxes, payroll taxes, property

taxes, and sales taxes

12-6c Describe the benefits they receive, or may receive in the

future, from government-collected tax revenue

12-7a Investigate the federal and state tax rates applicable to

dierent sources of income

12-7b Compare sales tax rates paid on dierent types of goods

in their state and for online purchases

12-7c Dierentiate between gross, net, and taxable income

12-7d Explain why some income is reported on an IRS Form

W-2 and some is reported on an IRS Form 1099, and how

that could aect their taxes

12-8a Explain the dierence between earned and unearned

income

12-8b Compare the tax rates assessed on earned income,

interest income, and capital gains income

12-9a Complete IRS Form W-4

12-9b Explain the dierence between a tax credit and a tax

deduction

12-9c Identify several examples of tax credits, determining

whether they are refundable or non-refundable, and the

groups of people who benefit most from each type

12-10a Identify dierent potential sources of retirement income

12-10b Describe the importance of having multiple sources of

income in retirement, such as Social Security, employer-

sponsored retirement plans, and personal investments

12-10c Explain the importance of participating in employer-

sponsored retirement plans, when available, and

contributing enough to qualify for the maximum

employer match

12-10d Report the average benefit paid to a retiree living on

Social Security today

12-11a Evaluate the benefits and costs of gig employment, such

as driving for a cab or delivery service

12-11b Discuss the pros and cons of small business ownership

as their primary source of income

Earning Income

15

National Standards for Personal Financial Education

II. SPENDING

A budget is a plan for allocating

a person’s spendable income to

necessary and desired goods and

services When there is suicient money

in their budget, people may decide to

give money to others, save, or invest

to achieve future goals People can

often improve their financial well-being

by making well-informed spending

decisions, which includes critical

evaluation of price, quality, product

information, and method of payment

Individual spending decisions may be

influenced by financial constraints,

personal preferences, unique needs,

peers, and advertising

Concept Progression

This topic concerns choices that people

make to allocate their scarce resources

to necessary and desired goods and

services. The 4th grade standards introduce

the concepts of scarcity, preferences,

and trade-os that people make in their

spending decisions. Behavioral factors that

influence spending, such as peer pressure

and advertising, are also identified. These

concepts are expanded upon at later grade

levels. At the 8th grade level, students

learn about the basics of budgeting and

planning, and consider the factors that go

into making informed consumer decisions.

By the 12th grade, students are prepared to

make spending decisions consistent with

their budget, and with critical consideration

of product pricing, quality, and features.

Standards related to charitable giving and

consumer protection are also included at the

12th grade level.

16

National Standards for Personal Financial Education

Grade 4

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Spending

4-1

Spending

4-2

Spending

4-3

Spending

4-4

Spending

4-5

Spending

4-6

People dier in their

preferences, priorities,

and resources available

for consuming goods and

services

Money can be spent to

increase one’s own or

another individual’s personal

satisfaction or to share the

cost of goods and services

When people make a

decision to use money for a

particular purpose, they incur

an opportunity cost in that

they cannot use the money

for another purpose

Purchasing decisions have

costs and benefits that can

be dierent for dierent

people

Price, spending choices of

others, peer pressure, and

advertising about a product

or service can influence

purchase decisions

Payment methods for making

purchases include cash,

checks, debit cards, and

credit cards

4-1a Give examples of dierences in people’s preferences that

can influence their spending on goods and services

4-1b Brainstorm a personal list of goals for consumption of

goods and services

4-1c Prioritize future spending, taking resource limitations into

account

4-2a Describe ways that people in a community share the cost

of services available to everyone

4-2b Analyze how people dier in their values and attitudes

about spending money

4-2c Identify ways you spend your money to increase personal

satisfaction

4-3a Define the concept of opportunity cost

4-3b Provide examples of financial choices that have

opportunity costs

4-4a Compare the costs and benefits of purchasing an item for

people with dierent characteristics (eg age, income)

4-4b Explain the costs and benefits of trading goods and

services between family members and friends

4-5a Explain how peer pressure can aect purchasing

decisions

4-5b Share examples of how price, spending choices of others,

peer pressure, or advertising influence a purchase

decision

4-5c Identify reliable sources of information when comparing

products

4-6a Explain the similarities between paying for purchases

with cash, checks, and debit cards

4-6b Compare the eects of using debit versus credit cards to

make purchases

Spending

17

National Standards for Personal Financial Education

Grade 8

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Spending

8-1

Spending

8-2

Spending

8-3

Spending

8-4

Creating a budget can help

people make informed

choices about spending,

saving, and managing money

in order to achieve financial

goals

Making an informed purchase

decision requires a consumer

to critically evaluate price,

product claims, and quality

information from a variety of

sources

When evaluating information

about goods and services, a

consumer can better assess

the quality and usefulness

of the information by

understanding the incentives

of the information provider

Consumers weigh the costs

and benefits of dierent

payment methods to

determine the best option

for purchasing goods and

services

8-1a Identify personal goals for spending and saving

8-1b Create a budget that includes expenses and savings out

of a given amount of income

8-1c Explain why people with identical incomes make dierent

choices for spending, saving, and managing money

8-1d Discuss the budgeting challenges faced by people living

on minimum wage

8-2a Select an item and gather information from the

manufacturer’s website, retail websites, and consumer

review websites

8-2b Explain the types of information most helpful in making a

purchase decision

8-2c Identify misleading or deceptive information about

consumer goods or services found in online and print

sources

8-2d Discuss ways to verify a claim expressed in advertising

for an age-appropriate product

8-3a Evaluate information about goods and services based on

reliability and accuracy of the source

8-3b Assess strengths and weaknesses of various online and

printed sources of product information

8-3c Identify sources of product information that are less

useful for buying decisions due to incentive conflicts of

the information provider

8-4a Explain the dierence between a debit card and a credit

card

8-4b Explain how various payment methods are used to

purchase goods and services

8-4c Summarize the advantages, disadvantages, risks, and

protections of various payment methods

8-4d Choose and justify a preferred payment method for

purchases of at least three dierent types of goods and

services

Spending

18

National Standards for Personal Financial Education

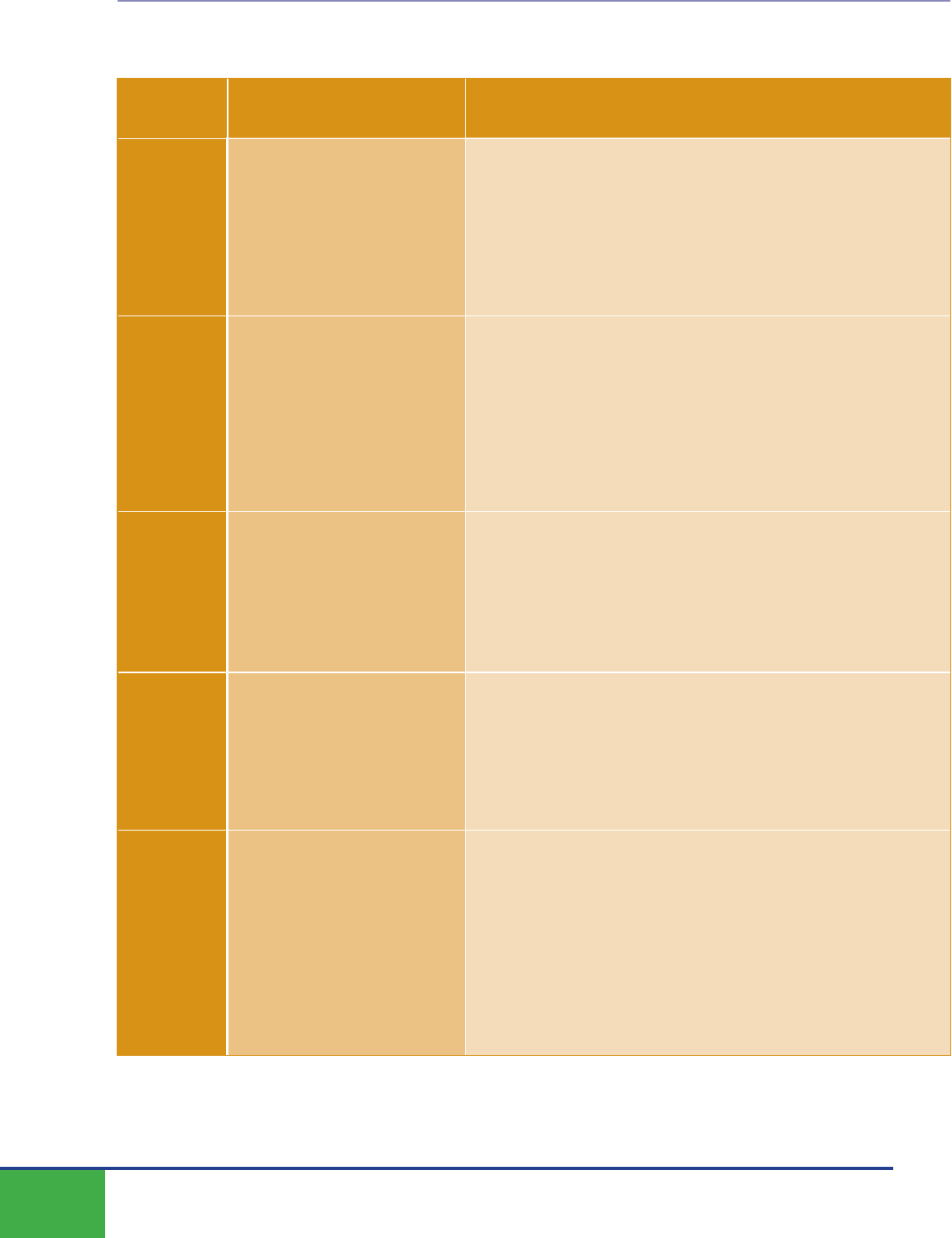

Grade 12

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Spending

12-1

Spending

12-2

Spending

12-3

Spending

12-4

Spending

12-5

A budget helps people

achieve their financial

goals by allocating income

to necessary and desired

spending, saving, and

philanthropy

Consumer decisions are

influenced by the price of

products or services, the

price of alternatives, the

consumer’s budget and

preferences, and potential

impact on the environment,

society, and economy

When purchasing a good

that is expected to be used

for a long time, consumers

consider the product’s

durability, maintenance costs,

and various product features

Consumers may be

influenced by how prices

of goods and services are

advertised, and whether

prices are fixed or negotiable

Consumers incur costs

and realize benefits when

searching for information

related to the purchase of

goods and services

12-1a Identify their short-term and long-term financial goals

12-1b Develop a budget to allocate current income to

necessary and desired spending, including estimates for

both fixed and variable expenses

12-1c Explain methods for adjusting a budget for unexpected

expenses or emergencies

12-1d Evaluate the advantages of using budgeting tools, such

as spreadsheets or apps

12-2a Select a product or service and describe the various

factors that may influence a consumer’s purchase

decision

12-2b Describe a process for making an informed consumer

decision

12-2c List the positive and negative eects of a recent

consumer decision on the environment, society, and the

economy

12-3a Explain the factors to evaluate when buying a durable

good

12-3b Analyze the cost and features of three competing

products or services

12-3c Compare product choices based on their impacts on the

environment or society

12-4a List dierent ways retailers advertise the prices of their

products

12-4b Describe how inflation aects purchase decisions and

the price of goods and services

12-4c Summarize how negotiation aects consumer decisions

and the price of goods and services

12-5a Explain how pre-purchase research encourages

consumers to avoid impulse buying

12-5b Brainstorm consumer research strategies and resources

to use when making purchase decisions

12-5c Analyze social media marketing and advertising

techniques designed to encourage spending

Spending

19

National Standards for Personal Financial Education

Grade 12 (cont’d)

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Spending

12-6

Spending

12-7

Spending

12-8

Spending

12-9

Housing decisions depend

on individual preferences,

circumstances, and costs,

and can impact personal

satisfaction and financial

well-being

People donate money, items,

or time to charitable and non-

profit organizations because

they value the services

provided by the organization

and/or gain satisfaction from

giving

Federal and state laws,

regulations, and consumer

protection agencies (eg,

Federal Trade Commission,

Consumer Aairs oice,

and Consumer Financial

Protection Bureau) can help

individuals avoid unsafe

products, unfair practices,

and marketplace fraud

Having an organized system

for keeping track of spending,

saving, and investing makes

it easier to make financial

decisions

12-6a Identify financial and personal reasons that younger

adults often choose to rent a home instead of buying

12-6b Compare the short-term and long-term costs and

benefits of renting versus buying a home in their city of

residence

12-6c Define key rental contract terminology, including lease

term, security deposit, grace period, and eviction

12-7a Discuss the motivations for and benefits of donating

money, items, or time

12-7b Develop a list of charitable organizations and provide a

possible reason that a donor might want to give money

to each organization

12-7c Identify specific steps one should take when researching

charitable and other not-for-profit organizations

12-8a Describe the roles and responsibilities of government

agencies that help protect consumers from fraud

12-8b Identify state and federal consumer protection laws

based on the issues they address and the safeguards

they provide

12-8c Investigate common types of consumer fraud and unfair

or deceptive business practices, including online scams,

phone solicitations, and redlining

12-8d Make recommendations for sources of help for

consumers who have experienced fraud

12-9a Explain how having a system for financial record-keeping

can make it easier to make financial decisions

12-9b Develop a system for keeping track of spending, saving,

and investing

12-9c Research financial technology options for financial

record-keeping

Spending

20

National Standards for Personal Financial Education

III. Saving

People who have suicient income

can choose to save some of it for

future uses such as emergencies or

later purchases Savings decisions

depend on individual preferences

and circumstances Funds needed

for transactions, bill-paying, or

purchases, are commonly held

in federally insured checking or

savings accounts at financial

institutions because these accounts

oer easy access to their money

and low risk Interest rates, fees,

and other account features vary

by type of account and among

financial institutions, with higher

rates resulting in greater compound

interest earned by savers

Concept Progression

Because there are obvious overlaps

between the Saving and Investing

topics, these two are designed to work

together. The Saving standards focus

on how people save money, where they

save money, and why they save money.

Saving plans and choices that are most

appropriate for short-term goals and

emergency funds are covered in this

topic, whereas longer-term and riskier

investment choices are covered in the

Investing topic. At the 4th grade level,

students learn that saving is a choice

between current and future spending,

people dier in their attitudes about

saving, and that savers can earn

interest on savings. Students in 8th

grade consider saving decisions in the

context of personal circumstances and

goals. The mathematics of compound

interest, the role of financial institutions

as intermediaries between savers and

borrowers, and the advantages of federal

deposit insurance are also addressed.

At the 12th grade level, students are

introduced to more complex concepts

and decisions, such as the erosion

of savings from inflation, real versus

nominal interest rates, the role of

markets in determining interest rates, the

choice of savings account type, financial

regulation, tax incentives for saving, and

behavioral factors that can aect saving

decisions.

21

National Standards for Personal Financial Education

Grade 4

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Saving

4-1

Saving

4-2

Saving

4-3

Saving

4-4

Saving

4-5

When people save money,

they are choosing not to

spend money today to be

able to buy something in the

future

A savings plan is a plan for

setting aside money to pay

for a future need, goal, or

emergency

People dier in their values

and attitudes about saving

Safety and ease of access

are factors to consider when

deciding where to keep

savings

Financial institutions often

pay interest on deposit

accounts to attract customers

to deposit money in their

institution

4-1a Explain why it is often harder to save than to spend

money

4-1b Give an example of buying something now versus saving

money for the future and explain how they would make

that decision

4-1c Find an example of an advertisement (in a newspaper,

magazine, on TV, social media, or online) that is designed

to influence people to spend money right away instead of

saving their money

4-2a Map out a savings plan designed to achieve a future

purchase objective

4-2b Give an example to illustrate the importance of having

some money set aside for emergencies

4-2c Describe ways that people can decrease expenses to save

more of their money

4-3a Discuss how life circumstances and experiences can

cause people to dier in their values and attitudes about

saving and their ability to save

4-3b Explain how a person’s friends and family can influence

their values and attitudes about saving

4-4a Describe the advantages of saving money in an account

at a financial institution rather than keeping the money at

home

44b Identify safe places for people to keep their money

45a Explain why financial institutions, such as banks and

credit unions, pay interest to depositors

4-5b Compare the interest rates on savings accounts at two

financial institutions

Saving

22

National Standards for Personal Financial Education

Grade 8

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Saving

8-1

Saving

8-2

Saving

8-3

Saving

8-4

Saving

8-5

Saving

8-6

People save money for many

dierent purposes, including

large purchases such as cars

and homes, education costs,

retirement, and emergencies

Savings decisions depend

on individual preferences

and circumstances, and can

impact personal satisfaction

and financial well-being

Financial institutions pay

interest to depositors and

loan out the money to

borrowers who pay interest

on their loans

Interest earned on savings is

the interest rate multiplied by

the balance in the account,

which includes the original

amount saved (principal) and

previously earned interest

Compound interest is

interest on both the original

principal and previously

earned interest, as compared

to simple interest which is

only interest on the original

principal

Checking and saving deposit

accounts in many financial

institutions are insured up to

certain limits by the federal

government

8-1a Identify the most common reasons that people save

money for the future

8-1b Create a savings plan that will allow someone to make a

large purchase in one year, 5 years, and 10 years

8-2a Compare personal attitudes toward saving to those of a

friend or relative

8-2b Explain how a person’s personality type might aect their

willingness to save or to stick to a savings plan

8-2c Identify life situations that can make it diicult for a

person to save or to stick to a savings plan

8-2d Discuss how savings decisions can aect financial well-

being

8-3a Compare and contrast dierent types of financial

institutions and their products and services

8-3b Compare the interest rate paid by a financial institution

on savings accounts to the interest charged by the same

institution on loans

8-3c Explain how financial institutions get the money to pay

interest to their customers who deposit money in savings

accounts

8-4a Dierentiate between principal and interest

8-4b Demonstrate how earning a higher interest rate on money

in a savings account will help a person to reach their

savings goal sooner

8-4c Use the Rule of 72 to approximate how many years it will

take for savings to double in value at dierent rates of

interest

8-5a Explain the benefit of compound interest as compared

with simple interest

8-5b Demonstrate how annual interest earned increases over

time when both the original principal and earned interest

are left in a savings account

8-6a Explain the importance of federal deposit insurance

8-6b Compare Federal Deposit Insurance Corporation (FDIC)

and National Credit Union Administration (NCUA)

insurance coverage limits for checking and savings

accounts oered at financial institutions

8-6c Identify types of accounts that do not oer deposit

insurance

Saving

23

National Standards for Personal Financial Education

Grade 12

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Saving

12-1

Saving

12-2

Saving

12-3

Saving

12-4

Saving

12-5

Financial institutions oer

several types of savings

accounts, including regular

savings, money market

accounts, and certificates of

deposit (CDs), that dier in

minimum deposits, rates, and

deposit insurance coverage

Deposit account interest

rates and fees vary between

financial institutions and

depend on market conditions

and competition

Unless oered by insured

financial institutions, mobile

payment accounts and

cryptocurrency accounts

are not federally insured and

usually do not pay interest to

depositors

Inflation can erode the value

of savings if the interest rate

earned on a savings account

is less than the inflation rate

Government agencies such

as the Federal Reserve, the

FDIC, and the NCUA, along

with their counterparts in

state government, supervise

and regulate financial

institutions to improve

financial solvency, legal

compliance, and consumer

protection

12-1a Compare the features of regular savings accounts, money

market accounts, and CDs

12-1b Explain why CDs typically pay higher interest rates than

regular savings accounts or interest-bearing checking

accounts

12-2a Select a preferred location for a savings account based

on comparison of interest rates and fees at dierent

types of financial institutions

122b Explain why an increase in the number of people who

want to borrow money might result in banks paying

higher rates on deposits

12-2c Discuss types of market conditions that could result

in financial institutions paying lower rates on savings

accounts

12-3a Research mobile payment account alternatives

12-3b Compare and contrast the features of mobile payment

accounts, cryptocurrency accounts, and checking/

savings accounts

12-3c Explain why storing money in a mobile payment account

can reduce the ability to grow savings

12-4a Explain why savers typically earn a higher nominal rate

of interest when inflation is high

12-4b Illustrate how inflation can reduce the purchasing power

of savings over time if the nominal interest rate is lower

than the inflation rate

12-4c Investigate how federal I bonds provide inflation

protection for savers

12-5a Investigate the areas of financial institution operations

that are subject to state and/or federal regulation and

supervision

12-5b Identify the state agency responsible for regulating

financial institutions where they live

12-5c Explain the importance of solvency regulation for

financial institutions

Saving

24

National Standards for Personal Financial Education

Grade 12 (cont’d)

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Saving

12-6

Saving

12-7

Saving

12-8

Saving

12-9

Tax policies that allow people

to save pretax earnings or

to reduce or defer taxes

on interest earned provide

incentives for people to save

Employer defined

contribution retirement plans

and health savings accounts

can provide incentives for

employees to save

People can reduce the

potential for future financial

strife with a partner or

spouse by sharing personal

financial information, goals,

and values prior to combining

finances

There are many strategies

that can help people manage

psychological, emotional, and

external obstacles to saving,

including automated savings

plans, employer matches,

and avoiding personal

triggers

12-6a Explain how traditional IRAs (individual retirement

accounts), Roth IRAs, and education savings accounts

provide incentives for people to save

12-6b Compare the tax advantages of traditional and Roth

IRAs

12-6c Compare the tax advantages of dierent types of

education savings accounts

12-7a Explain how an employer match of employee

contributions to its retirement plan provides an incentive

for employees to save

12-7b Compare the impact of employee “opt in” versus “opt

out” of employer retirement plans and explain why it

makes a dierence

12-7c Describe the pros and cons of saving through an

employer retirement plan as compared to saving outside

of an employer plan

12-7d Explain the benefits of saving money in a health savings

account for individuals with high-deductible health plans

12-8a Assess the value of sharing financial goals and personal

financial information with a partner before combining

finances

12-8b Discuss how personal financial decisions can aect

other people

12-9a Explain how external influences (eg peers, family, or

social media) can impact personal savings decisions

12-9b Identify strategies to manage psychological and

emotional obstacles to saving

12-9c Discuss strategies for avoiding personal triggers that

result in deviating from a savings plan

12-9d Explain how the saving strategy “pay yourself first” can

help people achieve their saving goals

Saving

25

National Standards for Personal Financial Education

IV. INVESTING

People can choose to invest some

of their money in financial assets to

achieve long-term financial goals,

such as buying a house, funding

future education, or securing

retirement income Investors receive

a return on their investment in the

form of income and/or growth in

value of their investment over time

People can more easily achieve their

financial goals by investing steadily

over many years, reinvesting

dividends, and capital gains to

compound their returns Investors

have many choices of investments

that dier in expected rates of

return and risk Riskier investments

tend to earn higher long-run rates of

return than lower-risk investments

Investors select investments

that are consistent with their risk

tolerance, and they diversify across

a number of dierent investment

choices to reduce investment

risk

Concept Progression

Because there are obvious overlaps

between the Saving and Investing

topics, these two are designed to work

together. The concepts of rate of return,

compound interest, and developing a

plan to set aside funds for future goals

are all introduced in the Saving topic,

but also apply to the Investing topic.

Whereas the Saving standards focus on

budgeting to save for short-term goals

and emergencies, with funds held in

low-risk deposit accounts, the Investing

standards focus on funds set aside for

future long-term goals, invested in riskier

financial assets with the expectation

of increasing future wealth or income.

Because investing is a more advanced

concept, the standards at the 4th grade

level only cover the basic distinction

between investing in riskier assets to

achieve long-term future goals versus

safer savings account choices for short-

term goals and emergency funds. At the

8th grade level, students are introduced

to the variety of possible financial

investments, types of income earned

from them, their relative riskiness, and

the benefits and mathematics of earning

compound interest over longer periods

of time. These concepts are expanded

on in the 12th grade standards, and

high school students also learn more

advanced investment concepts,

including the eect of individual risk

tolerance and behavioral biases on

investment choices, factors influencing

market prices of financial assets, the

benefits of portfolio diversification, how

financial markets are regulated, and the

benefits of financial technology.

26

National Standards for Personal Financial Education

Grade 4

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Investing

4-1

Investing

4-2

People invest their money

so that it can grow over time

and help them achieve their

long-term financial goals

Low-interest savings

accounts are commonly

used for short-term financial

goals and emergency funds

because they are low risk

When saving for longer-term

financial goals, people often

invest in riskier assets to earn

higher returns

4-1a Explain why people invest their money

4-1b Identify long-term financial goals that are most likely to be

achieved by people who regularly invest their money over

many years

4-2a Identify the similarities and dierences between saving

and investing

4-2b Provide examples of financial goals that are suited for

saving versus investing

Investing

27

National Standards for Personal Financial Education

Grade 8

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Investing

8-1

Investing

8-2

Investing

8-3

Investing

8-4

Investing

8-5

Investing

8-6

Investing

8-7

Investors in financial assets

expect an increase in value

over time (capital gain) and/

or receipt of regular income,

such as interest or dividends

Common types of financial

assets include certificates of

deposit (CDs), stocks, bonds,

mutual funds, and real estate

Investors who buy corporate

or government bonds are

lending money to the issuer

in exchange for regular

interest payments

Investors who buy corporate

stock become part-owners

of a business, benefit from

potential increases in the

value of their shares, and may

receive dividend income

Instead of buying individual

stocks and bonds, investors

can buy shares of pooled

investments such as mutual

funds and exchange-traded

funds (ETFs)

Dierent types of

investments expose investors

to dierent degrees of risk

The benefits of compounding

for building wealth are

greatest for people who

invest regularly over longer

periods of time

8-1a List the potential benefits of investing money in a financial

asset

8-1b Explain why some people might prefer to buy investments

that grow in value over time instead of investments that

pay regular income

8-2a Define common types of financial assets

8-2b Demonstrate how to find the current prices of stocks,

bonds, and mutual funds

8-2c Discuss how some financial assets can be harder to sell

quickly (eg stocks traded on an exchange versus real

estate)

8-3a Compare corporate and government bonds

8-3b Calculate the amount of annual interest income an

investor would receive from a corporate bond oering at a

given coupon interest rate

8-4a Select a stock and find the dividends it paid last year and

how much the price of the stock has changed over the

year

8-4b Explain the potential risks and rewards of investing in

corporate stock

8-5a Explain the concept of investment diversification both

within and among dierent asset classes

8-5b Discuss the advantages and disadvantages of investing in

a diversified stock or bond mutual fund versus individual

stocks and bonds

8-6a Compare rates of return on dierent types of investments

and order them by risk

8-6b Identify investments that would be most appropriate for

people who are uncomfortable with taking financial risk

8-7a Explain the concept of compounding

8-7b Estimate the future value of a lump sum invested today for

a specified period of time and rate of return

8-7c Estimate the future value of a regular series of equal

annual investments for a specified period of time and rate

of return

8-7d Demonstrate the dierence in wealth accumulation for a

person who begins to invest regularly at age 30 versus

someone who starts at age 40

Investing

28

National Standards for Personal Financial Education

Grade 12

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Investing

12-1

Investing

12-2

Investing

12-3

Investing

12-4

Investing

12-5

A person’s investment risk

tolerance depends on factors

such as personality, financial

resources, investment

experiences, and life

circumstances

Investors earn investment

returns from price changes

and annual cash flows (such

as interest, dividends or rent)

The nominal annual rate of

return is the annual total

dollar benefit as a percentage

of the beginning price

Investors expect to earn

higher rates of return when

they invest in riskier assets

Because inflation reduces

purchasing power over time,

the real return on a financial

asset is lower than its

nominal return

The prices of financial assets

change in response to market

conditions, interest rates,

company performance, new

information, and investor

demand

12-1a Give examples of factors that can influence a person’s

risk tolerance

12-1b Discuss how a person’s risk tolerance influences their

investment decisions

12-1c Assess their personal risk tolerance using an online tool

or worksheet

12-2a Describe the dierent types of annual cash flows that

can be received by investors

12-2b Compare nominal annual rates of return over time on

dierent types of investments, including cash flows and

price changes

12-2c Explain why assets that do not produce income or are

exposed to large price fluctuation (such as collectibles,

precious metals, and cryptocurrencies) are described as

speculative investments

12-3a Discuss the advantages and disadvantages of investing

in riskier assets

12-3b Investigate the long-run average rates of returns on

small-company stocks, large-company stocks, corporate

bonds, and Treasury bonds

12-3c Explain why the expected rate of return on a value stock

or mutual fund is likely to be lower than that of a growth

stock or mutual fund

12-3d Explain why bonds with longer maturities generally earn

a higher return than shorter-term bonds

12-4a Describe the impact of inflation on prices over time

12-4b Explain the relationship between nominal and real

returns

12-4c Find the current rate paid on CDs at a bank and calculate

the expected real rate after inflation

12-5a Describe factors that influence the prices of financial

assets

12-5b Predict what could happen to the price of a stock if

new information is reported about the company or its

products

12-5c Discuss how economic downturns that result in high

unemployment can aect the prices of financial assets

12-5d Explain why the market price of some assets, such as

bonds and real estate, increase when interest rates

decrease

Investing

29

National Standards for Personal Financial Education

Grade 12 (cont’d)

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Investing

12-6

Investing

12-7

Investing

12-8

Investing

12-9

Investing

12-10

Investing

12-11

When making diversification

and asset allocation

decisions, investors consider

their risk tolerance, goals,

and investing time horizon

Expenses of buying, selling,

and holding financial assets

decrease the rate of return

from an investment

Tax rules aect the rate

of return on dierent

investments, and can vary

by holding period, type of

income, and type of account

Common behavioral biases

can result in investors

making decisions that

adversely aect their

investment outcomes

Financial technology can

counterbalance negative

behavioral factors when

making investment decisions

Many investors buy and sell

financial assets through

discount brokerage firms

that provide inexpensive

investment services and

advice using financial

technology

12-6a Recommend portfolio allocation between major asset

classes for a short-term goal versus a long-term goal

12-6b Discuss the pros and cons of investing in a diversified

mutual fund versus investing in a small number of

individual stocks

12-6c Suggest an appropriate asset allocation for a very risk

averse person versus a very risk tolerant person

12-6d Explain how target date retirement funds reallocate

investments over time to meet their investment objective

12-7a Discuss how the expenses associated with buying

and selling investments can impact rates of return and

investment outcomes

12-7b Compare the expense ratios for several mutual funds

12-7c Explain why an actively managed mutual fund usually

has a higher expense ratio than an index fund

12-8a Compare tax rates paid on interest income versus short-

term and long-term capital gains

12-8b Describe the advantages of investing through a tax-

deferred account such as an IRA or 401(k) versus a

taxable account

12-8c Investigate the contribution limits and tax advantages of

a traditional IRA versus a Roth IRA

12-9a Identify several behavioral biases that can result in poor

investment decisions (eg loss aversion, investing in

employer stock, home bias, mental accounting)

12-9b Brainstorm methods for avoiding negative consequences

from behavioral biases

12-10a Explore common financial technologies used for

investing, including automated trading platforms

12-10b Explain how automating investment activities can help

people avoid making emotional investment decisions

12-11a Discuss how the development of financial technology

has made it easier for people of all income and

education levels to participate in financial markets

12-11b Choose a discount broker and research the minimum

starting account balance, minimum monthly investment,

and trading costs

12-11c Identify the advantages and disadvantages of robo-

advising and other investment-related financial

technologies

Investing

30

National Standards for Personal Financial Education

Grade 12 (cont’d)

Standard Learning Outcomes

Students will know that... Students will use this knowledge to...

Investing

12-12

Investing

12-13

Investing

12-14

Federal regulation of

financial markets is designed

to ensure that investors

have access to accurate

information about potential

investments and are

protected from fraud

Investors often compare

the performance of their

investments against a

benchmark, such as a

diversified stock or bond

index

Criteria for selecting financial

professionals for investment

advice include licensing,

certifications, education,

experience, and cost

12-12a Explain the role of federal regulators in financial

markets

12-12b Discuss why insider trading is illegal and harmful to

investment markets

12-12c Explain the importance of having access to full and

accurate information about potential investments

12-13a Explain why investors often compare portfolio

performance to a benchmark such as the S&P 500

Index

12-13b Research the composition of the most popular

benchmark indices and compare their recent

performance

12-13c Discuss the advantages of investing in an exchange-

traded fund (ETF) that tracks a market index rather than

investing in actively managed mutual funds or individual

stocks and bonds

12-14a Discuss reasons that a person might want to hire a

financial professional to manage their investments or

provide investment advice

12-14b Explain the importance of licensing, certifications,

education, and experience as criteria for selecting a

financial professional for investment management or

advice

12-14c Investigate where and how to find qualified financial

professionals

Investing

31

National Standards for Personal Financial Education

V. MANAGING CREDIT

Credit allows people to purchase and

enjoy goods and services today, while

agreeing to pay for them in the future,

usually with interest There are many

choices for borrowing money, and lenders

charge higher interest and fees for riskier

loans or riskier borrowers Lenders

evaluate creditworthiness of a borrower

based on the type of credit, past credit

history, and expected ability to repay the

loan in the future Credit reports compile

information on a person’s credit history,

and lenders use credit scores to assess

a potential borrower’s creditworthiness

A low credit score can result in a lender

denying credit to someone they perceive

as having a low level of creditworthiness