MOD IV

USER MANUAL

Property Administration

Division of Taxation – Department of the Treasury

State of New Jersey

Trenton, New Jersey

October 2018

MOD IV Manual Updates

2017 - CHAPTER IV & REFERENCE F

Subfield Qualification Codes – page 15: Parking Space Unit Qualifier.

Exempt Statute Number – pages 54: Condominium Common Element Statue.

Exempt Property Listing Code – pages 59, 61, 62: Condominium Common Element.

2018 - CHAPTER IV

Subfield Qualification Codes – page 15: Distinct Unit Qualifier.

2023 – Reference B

Class 4 Use Code – page 48: Cannabis retail and warehouse

2024 – Reference E & F

Exempt Statute Number – pages 54, 55: Assessed in Adjoining Municipality & Unknown Owners

Exempt Property Listing Code – pages 59 - 63: Temple, Mosque, Unknown Owners, and Assessed in

Adjoining Municipality.

1

MOD-IV USER MANUAL

TABLE OF CONTENTS

HISTORY OF MOD-IV - THE NEW JERSEY PROPERTY TAX SYSTEM.……..………4

CHAPTER I ........................................................................................................... 5

PURPOSE OF MOD-IV ............................................................................................................ 5

ROLE OF THE DIVISION OF TAXATION ...................................................................................... 5

ROLE OF THE COUNTY BOARDS OF TAXATION .......................................................................... 5

ROLE OF TAX COLLECTOR ....................................................................................................... 6

ROLE OF ASSESSORS' OFFICES AND STAFF ............................................................................... 6

ROLE OF THE DATA CENTERS .................................................................................................. 6

CHAPTER II ......................................................................................................... 8

AN OVERVIEW OF THE NEW JERSEY PROPERTY TAX SYSTEM MOD-IV ...................................... 8

CHAPTER III ...................................................................................................... 12

ON-LINE GUIDE LINES .......................................................................................................... 12

CHAPTER IV ...................................................................................................... 13

PROPERTY RECORD CHANGES ............................................................................................... 13

GENERAL INSTRUCTIONS ....................................................................................................... 13

OWNER DATA ....................................................................................................................... 16

PROPERTY DESCRIPTION DATA.............................................................................................. 18

EXEMPT PROPERTY DATA ..................................................................................................... 20

CHANGING PROPERTY IDENTIFICATION ................................................................................. 24

TAX SECTION - DATA FIELDS ................................................................................................. 25

SUPPLEMENTARY DATA FIELDS ............................................................................................. 26

CHAPTER V ........................................................................................................ 31

ADDED AND OMITTED-ADDED ASSESSMENTS ......................................................................... 31

CHAPTER VI ............................................................................................................. 33

2

OMITTED AND ROLL BACK ASSESSMENT ................................................................................ 33

CHAPTER VII ........................................................................................................ 35

ADDED/OMITTED ASSESSMENT DATA FIELDS ......................................................................... 35

PROPERTY DESCRIPTION SECTION ......................................................................................... 35

CHAPTER VIII ................................................................................................... 37

SYSTEM MAINTENANCE ......................................................................................................... 37

WARNING AND ERROR MESSAGES .......................................................................................... 37

CHAPTER IX ...................................................................................................... 41

GENERAL MOD-IV POLICIES / REQUIREMENTS ..................................................................... 41

HOW TO BECOME A CERTIFIED MOD-IV DATA CENTER ......................................................... 42

TYPES OF MOD-IV CERTIFICATION ....................................................................................... 42

MOD-IV DATA CENTER REQUIREMENTS ............................................................................... 42

ON-LINE GUIDE LINES .......................................................................................................... 43

CHAPTER X ........................................................................................................ 44

PROPERTY TAX YEAR STATUTORY CALENDAR .......................................................................... 44

REFERENCES ................................................................................................... 45

REFERENCE A .................................................................................................. 46

FORMAT FOR ADDITIONAL LOTS ............................................................................................. 46

REFERENCE B .................................................................................................. 48

CLASS 4 CODES ..................................................................................................................... 48

REFERENCE C .................................................................................................. 50

SR-1A NON-USABLE CODES ................................................................................................. 50

REFERENCE D .................................................................................................. 53

USING THE "X" QUALIFIER .................................................................................................... 53

REFERENCE E .................................................................................................. 54

3

STATUTES UNDER WHICH EXEMPTIONS ARE CLAIMED ............................................................... 54

REFERENCE F .................................................................................................. 56

EXEMPT PROPERTY CLASSIFICATION CODES .......................................................................... 56

OWNERSHIP OF TAX EXEMPT PROPERTY BY NAME, PART 1 ...................................................... 57

PRINCIPLE USE OR PURPOSE, PART 2 .................................................................................... 58

EXEMPT PROPERTY - SPECIFIC PROPERTY DESCRIPTION, PART 3 NUMERIC ............................. 60

EXEMPT PROPERTY - SPECIFIC PROPERTY DESCRIPTION PART 3 ALPHABETICAL .................... 62

EXHIBITS….....………………...…………………………………….……...64

EXHIBIT 1………..…………….………..….…………………………....……65

MOD-IV FIELDS DESCRIPTIONS (NUMERIC SEQUENCE) ......................................................... 65

EXHIBIT 2…………………………....……………….…………..…….......…75

REQUIRED POPULATION OF MOD-IV FIELDS 18 AND 23…………...........…........……....….…75

APPENDIX ............................................................................................................ 76

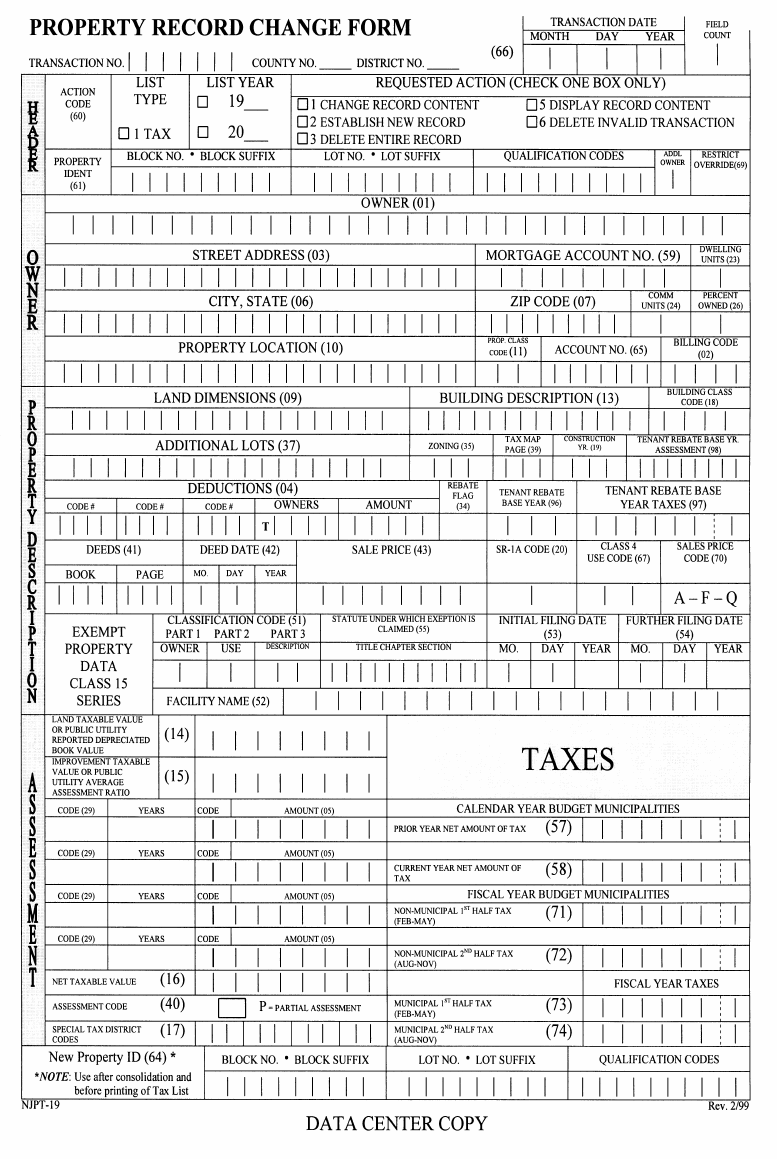

P

ROPERTY RECORD CHANGE FORM ..................................................................... 77

A

DDED/OMITTED ASSESSMENT CHANGE FORM .................................................... 78

P

ROPERTY RECORD SUPPLEMENTRY CHANGE FORM ............................................ 79

T

HE PROPERTY RECORD CHANGE FORM FIELDS ................................................. 80

A

DDED/OMITTED ASSESSMENT CHANGE FORM FIELDS ........................................ 85

INDEX ................................................................................................................. 89

4

History of MOD-IV - The New Jersey Property Tax System

The New Jersey Property Tax System was developed by an outside vendor under contract in

1966 and was written in COBOL (Common Business-Oriented Language). The system was

referred to as the N.J.P.T.S. 3- Line System because the output displayed property information

on 3 lines. The system provided for standard and uniformly printed tax lists and tax bills.

In 1971 fields were added and procedures were implemented for the expansion and storage of

data. Exempt property information fields were expanded, and qualification codes were added.

The expansion allowed for an additional line of print. The 3- Line System was converted to the

4-Line system, referenced as the N.J.P.T.S. 4-Line System. (The use of the 3- Line system was

phased out by 1974).

The last upgrade to the New Jersey Property Tax System was in 1980. The number of fields was

increased to include the recording of several property characteristics, and programming was

implemented to provide for the production of the county equalization table and the abstract of

ratables. The upgrade was written to state specification by an outside vendor under contract to

the state and released for use in 1982. This upgrade and expansion of the N.J.P.T.S. 4-Line

System (modernization of the 4-line system) is the current MOD IV.

In 1993 the Office of Information Technology assumed responsibility for all changes and

maintenance to the MOD IV programming.

Shown in the Appendix (Page 76) are the change forms and field descriptions available at the

time of the 1982 release of MOD IV.

5

CHAPTER I

Purpose of the New Jersey Property Tax System/MOD-IV

The New Jersey Property Tax System, known as MOD-IV, provides for the uniform preparation,

maintenance, presentation and storage of the property tax information required by the

Constitution of the State of New Jersey, the New Jersey Statutes, and the rules promulgated by

the Director of the Division of Taxation (N.J.A.C 18:12-2 and 3). MOD-IV is the property of the

State of New Jersey.

Role of the Division of Taxation

The Division of Taxation through Property Administration and the New Jersey State Treasury

Office of Information Technology (OIT) are responsible for modifications and program changes

to MOD-IV. If a new law is passed or an existing law is revised, MOD-IV must be modified to

conform to legislative or judicial intent.

The Division serves as the contracting agency for the use of MOD-IV by county, municipal, and

private data processing centers. Property Administration certifies data centers and periodically

tests certified data centers to ensure uniform treatment of data, uniform applications of MOD-IV

programs and procedures, and compliance with regulations. Coordination, and distribution of

MOD-IV programming and instructions to Data Processing Centers, County Boards of Taxation

and assessors are also handled by the Division.

The Division assists County Tax Boards in establishing schedules to insure an orderly flow of

MOD-IV maintenance throughout the tax year. [The staff is also available to provide

explanations of the edits and error messages contained in MOD-IV.]

Role of the County Boards of Taxation

The County Boards of Taxation have jurisdiction over the municipal assessors and serve as the

central administrative agency for the coordination of assessment function. The County Tax

Administrator prepares a calendar of events (N.J.S.A. 54:3-14) for assessors, collectors and data

centers in order to effectively supervise the orderly flow of data pertinent to the successful

administration of MOD-IV. In addition, the County Board of Taxation should review all MOD-

IV data changes as part of their supervision of assessors (N.J.S.A. 54:3-16) and review of the

assessment process (N.J.S.A. 54:4-46).

A County Board of Taxation may contract with a Data Center for the production of the county

equalization table and the abstract of ratables. (NOTE: The contracted Data Center must have a

Master File for every district in the county to use the programs.) Front load programs have been

developed by MOD-IV vendors to automate many functions of the county tax board. Some of

those programs currently include SR-1A programs, tax appeal programs, tax appeal account

programs and a communication system.

6

Role of Tax Collector

The tax collector is responsible for specific fields of information maintained in the New Jersey

Property Tax System. Tax dollar fields, billing codes, and tenant rebate fields are the

responsibility of the tax collector even if data entry is through the assessor's office. Numeric

bank billing codes are available from the Division of Local Government Services.

http://www.nj.gov/dca/divisions/dlgs/programs/tax_collector.html

The tax collector is provided with an Intermediate Tax Duplicate. (Historically, tax collectors

who posted their displays manually were provided with hand posting forms.) After the tax rate

has been struck, the collector is provided with an Extended Tax Duplicate which will contain the

third and fourth quarter payments on the current year's taxes and the following year's preliminary

taxes broken down into first and second quarter payments. Tenant Rebate Notices are produced

from the extended tax duplicate file.

In fiscal towns the tax collector is provided with an Audit Trail for the first and second quarter

payments calculated on a percentage adopted by the municipality. After the tax rate is struck, the

tax collector receives an Extended Tax Duplicate containing the reconciled third and fourth

quarter payments for the current tax year.

In both fiscal and calendar billing, if a tax rate has not been certified, an option for an estimated

third quarter billing is available.

Preliminary Tax Bills for line items which had added assessments in the prior year are calculated

as follows: one half of the taxes levied under the regular Tax Bill last year plus one half of the

added assessment tax amount projected to twelve months.

Role of Assessors' Offices and Staff

The assessor is responsible for valuing all property within the municipality and maintaining each

line item. Current information includes value and all other descriptive data. System maintenance

is usually accomplished through a MOD IV online system. (The online system automates the

original Property Record Change form maintenance process.) Proper maintenance enables the

assessor to produce the statutorily required lists, notices, and reports. These include: Tax Lists

and Assessment Notices produced from the tax list file; Extended Tax Duplicate with the most

current owners of record; and the Added and Omitted Assessment List with additional value and

most current owner of record.

Role of the Data Centers

A certified MOD-IV data center provides the County Boards of Taxation, the assessors and tax

collectors with the support necessary to produce the Tax List, Extended Tax Duplicate, Audit

Trail-Fiscal and estimated Billing quarters 1, 2, & 3, Table of Aggregates, County Equalization

Table, County Abstract of Ratables, Added Assessment Tax List, Omitted Assessment Tax List,

Omitted-Added Assessment Tax List, Roll-Back Assessment Tax List, and other reports.

These other reports include:

1. Tax Bills, Calendar and Fiscal

7

2. Added and Omitted Assessment Bills

3. Assessment Notices

4. Tenant Rebate Notices

5. Proof Book

6. Limited Exemption Audit Trails

7. Chapter 441 and UEZ Exempt Property Listing

8. Added and Omitted Billing Audit Trail

9. Over Billed Report

10. Property Identification Cross-Reference Report

(old to new and new to old)

11. Acreage Calculation Report

12. Revaluation Comparison Report

Tax bills must be created from the corresponding Extended Tax Duplicate file. All reports

should be created using certified MOD IV programs.

Although updates of the master file generally occur immediately or overnight, the county tax

administrator sets the schedule for the final production of statutorily required lists and reports.

All MOD-IV data centers must supply the Division of Taxation with a Master File for all clients.

At a minimum the Master File must be provided after the production of the:

• Tax List

• Extended Tax Duplicate

• Input to Consolidation

• Upon request

Additionally, a list of override changes must be submitted with the Extended Tax Duplicate

submission.

MOD-IV data centers must keep the Division of Taxation apprised of their clients. When adding

or deleting a client, such information must be submitted either in writing or via email

notification. Data centers must also notify the Division of Taxation of any changes to their

hardware/software configuration as this might necessitate a re-certification. For notifications,

please use the following email: TAXATION.PROPADMI[email protected]ov

The data center must have the ability to implement authorized modifications to MOD-IV which

are supplied by the Division of Taxation. MOD IV vendors serve as a central processing unit for

their clients. At a minimum the vendor provides a method for entry of MOD IV changes and

provides service including a complete property tax data management system with municipal

and/or county networking through the vendor central communication system. The vendor is

responsible for program implementation, printed output on promulgated forms, programming for

vendor developed enhancement programs, education of their clients and timely delivery of

output. The vendor is also responsible for the security, integrity and back-up of all data.

8

CHAPTER II

An Overview of the New Jersey Property Tax System MOD-IV

MOD-IV is the mechanism to maintain and update all assessment records (MOD-IV Master File)

and produce all statutorily required Tax Lists. The Tax List is filed with the County Board of

Taxation on or before January 10th of each year. This list displays all parcels of real property as

delineated and identified on the municipality's official Tax Map, as well as taxable values and

descriptive data for each parcel. MOD-IV produces the following components to be filed with

the Tax List, Tax Collector’s Duplicate, and Assessor’s Field Book:

◊ New Jersey Property Tax System Legend: Defines qualification codes, building

description codes, property class codes, limited exemption codes, deduction codes,

special tax districts codes and exempt property identification codes used on the Tax

List.

◊ Alphabetical Index by Owner: Indicates on which page the item appears, along with

block and lot number, account number, deed book and page number, property class

and property location. An Alphabetical Index of this type is also produced for the

Railroad Real Property Tax List, the Public Utilities Personal Property Tax List and

the Exempt Property List.

◊ Alphabetical Index by Street Name for Property Location: Displays similar

information as described above. This index is produced for the Real Property Tax

List, the Railroad Real Property Tax List, the Public Utilities Personal Property Tax

List and the Exempt Property Tax List.

◊ Real Property Tax List: Displays all taxable and exempt real property with assessed

values. The values of exempt properties are not included in the totals at the bottom of

each page as the word “exempt” appears in the net value field.

◊ Railroad Real Property Tax List: Displays Classes 5A and 5B railroad properties.

These properties are assessed by the State of New Jersey and are for informational

purposes only.

◊ Public Utility Personal Property Tax List (Telephone & Pipelines): Displays

Classes 6A and 6B properties.

◊ Exempt Property Tax List: Displays Classes 15A, 15B, 15C, 15D, 15E and 15F.

◊ Page Totals Report: For each portion of the list are as follows:

a) Tax List Page Totals Report

b) Railroad Real Property Tax List Page Totals Report

c) Public Utility Personal Property Page Totals Report

d) Exempt Property List Page Totals Report

9

◊ District Summary Report SR-3A: Displays a value summary by property class, the

total number and dollar amount of deductions and limited exemptions.

◊ Table of Aggregates: Displays a summary report of assessment and budget

information certified by the local assessor and County Board of Taxation. The report

breaks out the following information:

a) Total assessment of taxable land and improvements excluding 2nd class

railroad property

b) Limited exemptions and abatements by amount and statute

c) Number and type of deductions allowed

d) Total assessment of exempt property

e) Apportionment of taxes, budget information and tax rates

f) Assessment breakdown of taxable property by class

After the tax rate is struck, an Extended Tax Duplicate is produced complete with indices, page

total reports and summaries similar to those accompanying the Tax List. The Extended Tax

Duplicate for towns operating on a calendar year budget displays the billed first half taxes and

second half taxes broken down into quarterly payments.

For municipalities operating on a fiscal year budget, an audit trail is produced for 1

st

and 2

nd

quarter bills. The taxes are calculated using a billing percentage for non-municipal and municipal

revenue required. An Extended Tax Duplicate is produced for 3rd and 4th quarter bills based

on the tax rate.

The owner name, address, billing code and account number can be updated after the Tax List is

produced so the most current ownership and billing information is reflected on the Extended Tax

Duplicate.

On or before October 1st, of the tax year, MOD-IV will produce the following lists:

◊ Current Year Added Assessment List: Displays all new construction, added

improvements to existing structures and any exempt properties that have become

taxable between January 1st and September 30th of the current tax year.

◊ Prior Year Added Assessment List: Displays any new construction, added

improvements to existing structures and any exempt properties that have become

taxable between October 1

st

and December 31

st

of the pre-tax year. The list

accommodates one or two months of prior year added assessments.

◊ Omitted-Added Assessment List: Displays any added assessments in the prior year

that were completed before October 1st and not included on that year's Added

Assessment List. The list accommodates three to twelve months of prior year omitted-

added assessments.

◊ Current Year Omitted Assessment List (Current Year): Displays any parcels

omitted from the current year Tax List.

10

◊ Prior Year Omitted Assessment List (One-Year Prior): Displays parcels omitted

from the prior year Tax List.

◊ Roll-Back Assessment List: Displays Roll-Back taxes on Class 3B farmland that is

no longer eligible for the farmland assessment. Lists may be produced for:

• Current Year

• One Year Prior

• Two Year Prior

• Three Years Prior - This is to be used only when a change of use has occurred

between October 1st and December 31st of the pre-tax year and the farmland

application has not been denied by the assessor or County Board of Taxation. An

added assessment will be applied to the current tax year and Roll-Back taxes can

go back three years prior.

Note: Roll-Back assessment lists present the information from a Roll-Back memorandum

of judgment issued subsequent to a Roll-Back hearing.

In addition the system produces the following:

◊ Extended Tax Duplicate: Displays the reconciled extension of the assessment

multiplied by the tax rate for tax dollars due for municipalities operating under either

a fiscal or a calendar budget.

◊ Tenant Rebate Notice: Acknowledgement for rebate of taxes for certain qualified

rental properties of five (5) or more residential units.

◊ Audit Trail for Fiscal Billing Quarters 1 and 2: Displays estimated billing for

fiscal municipalities with tax dollars calculated on a percentage of municipal and non-

municipal revenue amounts needed to operate for the two tax quarters.

◊ Audit Trail for Estimated 3

rd

Quarter Billing: Displays estimated 3

rd

quarter

billing only when a tax rate is not available.

◊ Tax Bills:

• Regular Calendar bill is created for an annual tax amount reconciled with the

estimated billing for quarters one and two. Bill displays the annual tax amount

reconciled for quarters three and four of the current year and estimated amount for

quarters one and two for the subsequent years.

• Fiscal Bills are created at minimum twice a year. Fiscal quarters three and four

are based on a tax rate extended less previous amount billed. Fiscal quarters 1

and 2 are based on a percentage of municipal and non-municipal amounts of

revenue needed to finance the two tax quarters.

• In compliance with the law, a single quarter estimated bill may be produced.

11

• Added and Omitted Assessment Bills are produced based on the specific list types

created and generated.

• School Tax Overage billing. School budget billing that occurs after the

November election following taxpayer voting approval.

◊ Assessment Notice: Created from the Tax List file for every taxable property in the

municipality to notify each owner of the current and prior year assessments, property

class, prior year taxes billed, and appeal information.

◊ Proof Book: A copy of the body of the ratable portion of the tax list, including the

date of the last update for each item.

◊ Limited Exemption Audit Trails: Produced for limited exemption/abatements of 1-

5 years and designated by codes G, I, J, K, L, N, O and U.

◊ Chapter 441 and UEZ Exempt Property Listing: Produced from the Exempt

Property List Codes 24-16-994 and 24-17-994.

◊ Over Billed Report: Produced when quarters one and two exceed total levy

calculated for quarters three and four.

◊ Tax Billing Audit Trail: Total of all four quarters billed and subsequent year bill.

◊ Property Identification Cross-Reference Report: This report is generated when

property identifications within an entire municipality are changed. It displays the

current and prior block, lot, and qualification code, property location, property class,

and tax map page. Two formats; one sorted by prior to current and the other sorted by

current to prior are produced.

◊ Acreage Calculation Report: Displays the calculated information in Field (09), land

dimension, into acres or part of an acre. This acreage calculation will be retained in

the "Calculated Acreage Field" and will print on the Tax List. Manual entries cannot

be made to this field.

MOD-IV is also capable of producing the County Equalization Table and County Abstract of

Ratables.

12

CHAPTER III

On-Line Guide Lines

Certified data centers have developed on-line transaction creation systems. With an on-line

transaction system the assessor is able to data enter transactions on-line.

The on-line transaction system must include all actions realized with the “Property Record

Change Form” and “Added/Omitted Assessment Change Form.” It is advisable that screens for

“Tax List Changes” be separate from screens for “Added and Omitted Changes.”

The following guidelines have been set forth by the Division of Taxation in regard to on-line

transaction creation systems:

1. All MOD-IV programs, all output listings and reports must be run at the certified MOD-IV

data centers location and on the hardware certified at the site. Transactions may be conveyed

from the on-line transaction system site to the MOD-IV certified site.

2. The on-line transaction creation system must generate transactions in the “3 card format.” IT

MUST NEVER UPDATE THE MASTER FILE DIRECTLY. The system should contain

the same edits as the MOD-IV maintenance programs. This will insure that only clean data

is accepted into the maintenance cycle. The transaction created must then be run through the

MOD-IV maintenance programs. The output is the “Accepted Transaction Listing.” This

report should be provided to the assessor and county board.

3. After each maintenance, the on-line Master File should be updated so that the user always

has the latest information available.

4. On-line transaction systems can be integrated with the following:

• Tax Collection System

• SR-1A System

• CAMA System

• Tax Appeal System

• Equalization System

• Abstract of Ratables System

• Forms promulgated by the Division may be populated from the MOD-IV database

Each certified MOD-IV vendor should supply specific instructions to their clients concerning

their on-line programs.

13

CHAPTER IV

Property Record Changes

A description of the processing actions and information entered in MOD-IV is provided here for

the user. Specific use of the on-line transaction creation system is available through the vendor.

MOD-IV only accepts certain characters. These characters are the ten numeric characters 0

through 9, the twenty-six letters of the alphabet and the following punctuation marks:

Period .

Comma ,

Dash

-

Colon :

Ampersand &

The character limit for each field must be observed. For example, there are thirty-five positions

for Owner Field (01). If the owner's name is more than thirty-five characters counting each

letter, space, number and punctuation mark it must be shortened or abbreviated to thirty-five

characters so that it will fit in the space provided.

Note: Use of a field for an alternate purpose will contaminate the Master File. Each field is

designed for specific information with a defined number of characters.

General Instructions

Introduction: MOD IV is a record of all real property assessed in every municipality in New

Jersey. The municipal assessor is charged with maintaining the records to accurately provide for

the assessment and taxation of locally assessed property. The records so maintained are used to

produce an annual Tax List filed on January 10 of each year.

The on-line vendor developed systems provide the means to access, change, add and delete

records. A record is accessed by defining the location of the record, county and municipality, and

requesting the record through the property identification, street address, or owner’s name. After

the record is accessed, the record is either viewed or changed. New records may be added and

existing records deleted. A description of the terms, actions, and process are provided below.

Header: The Header displays the information necessary to locate, identify the line item, and

define the action. The Header displays the action code Field (60), property identification Field

(61), restrict override Field (69), and numeric codes representing the County and District of the

property location.

Transaction number - six numeric characters: created in the on-line system to group the

changes.

County Number (County Code) - two numeric characters: representing the code number of the

county for which the transaction is being prepared. Fill in leading zero where applicable.

14

District Number (District Code) - two numeric characters: representing the code number of the

taxing district for which the transaction is being prepared. Fill in leading zero where applicable.

Transaction Date and Field Count Field (66) - six numeric characters (Transaction Date) two

numeric characters (Field Count): Transaction Date (date the action is initiated) and Field County

are created and controlled by the on-line system.

Fields used in MOD-IV are further described in Exhibit 1.

When a property is accessed, it may be for “View Only” or there are three specific operations

(Actions) which can be initiated:

1. CHANGE RECORD CONTENT: Used to alter information for a line item which exists on the

MOD-IV Master File. This action will alter only the information in the field(s) for which

data has been entered.

2. ESTABLISH NEW RECORD: Used to add a new line item to the Master File. The property

identification entered in Field (61) (Block, Lot, and Qualification Code if necessary), is the

first field completed. The requested property identification must not match that of any item

currently on the Master File. These following mandatory fields must be completed.

Field (01) Owner Name

Field (03) Street Address

Field (06) City, State

Field (07) Zip Code

Field (09) Land Description

Field (10) Property Location

Field (11) Property Class Code

Field (14) Land Taxable Value

Field (15) Improvement Taxable Value, if not class 1 or 3B

Field (16) Net Taxable Value

Field (18) Building Class Code*: mandatory when establishing a Class 2 or 3A line item.

Field (23) Dwelling Units*: mandatory when establishing a Class 2 or 3A line item.

Field (51) Exempt Property Classification Code: mandatory when establishing an exempt

line item.

*Effective for 2016 Tax List (in support of Homestead Rebate Verification)

3. DELETE ENTIRE RECORD: Used to remove an entire line item from the Master File. The

property identification entered in Field (61) Block, Lot plus Qualification Code must match

exactly the property identification of the item to be deleted.

Property Identification Field (61) - twenty-nine alpha numeric characters composed of three

subfields: This field is the key to the Master File for all lists.

Subfield Block - -nine numeric characters: layout is 5 characters plus 4 characters suffix with an

assumed decimal point separating the suffix.

Subfield Lot - nine numeric characters: layout is 5 characters plus 4 characters suffix with an

assumed decimal point separating the suffix.

Subfield Qualification Codes - 11 alpha numeric characters: Each code is assigned a specific

position within the field. Five characters are the standard for view or print on a tax list unless a

condominium is an exempt portion of a ratable. In that case the qualification code “X” will print

in the sixth position on the tax list.

The only codes that may be used are listed below:

• X - Indicates the line item is an exempt portion of a ratable parcel, the taxable portion of

which is listed immediately preceding. (See Reference D)

• T - Cell Tower - followed by a two-digit number from 01 to 99 indicating the cell tower

number within the municipality.

• B - Billboard - followed by a two-digit number from 01 - 99 indicating the billboard number

within the municipality.

• Y - Renewable energy.

• QFARM - Designates qualified farmland.

• LOT - Indicates the land, separately assessed from the building.

• BLDG - Indicates the building, separately assessed from the land.

• CXXXX - Indicates a condominium unit. (Substitute the unit number for the X's).*

• PXXXX - Indicates a parking space unit. (Substitute the unit number for the X's).*

• DX

XXX - Indicates a distinct unit. (Substitute the unit number for the X's).*

*Note: A unit number may be numeric, alpha or alpha/numeric. If more than one qualification code is to be used,

they are not to be separated by commas or characters.

Qualification codes may be used to make the property identification unique among others with the same

block and lot designation. I.e. condominiums may be differentiated by using the same block and lot

and a qualification code “C” followed by four numeric characters. Leading zeros are required in the

qualification subfield to maintain numeric sequence: Block 1 Lot 1 C0001

• MXXXX - Indicates a mobile home. (Substitute the unit number for the X's).

• FP - Indicates that the line item is the portion of a plot or parcel that lies within the Flood

Plain.

• HL - Indicates the line item is the portion of a plot or parcel that lies within the Highlands

under Ch. 120, P.L. 2004.

• HM - Indicates the line item is located within the jurisdiction of the Hackensack

Meadowlands Development Commission.

• PL - Indicates the line item is the portion of a plot or parcel that lies within the Pinelands.

• Z - Indicates that the line item is the portion of a plot or parcel that lies within the Coastal

Zone.

• L - Indicates the line item is the portion of a plot or parcel that lies within the Wetlands.

• W - Ward - followed by a two-digit number from 01 to 99 indicating the ward in which the

property is located.

• S - Sector - followed by a two-digit number from 01 to 99 indicating the sector in which the

property is located.

Restrict Override Field (69): When the Tax Lists are filed with the County Board of Taxation,

the Master File is "restricted." No changes may be made to the Tax Lists for the current year

without the authorization of the County Board of Taxation. Upon application from the assessor or

by its own authority the County Board of Taxation may override the restriction of specific

changes from the date the Tax Lists are filed (January 10

th

) to the promulgation of the County

Equalization Table. After the production of the Table, no changes may be made to the current

year Tax List without a formal appeal.

The regulations of the County Boards of Taxation define how errors may be corrected.

15

rev:

October 2018

17

Owner Data

Owner Field (01) - thirty five alpha/numeric characters including punctuation: This field will be

shown on the Tax List exactly as it is entered. Last name should be placed first so that the

Alphabetical Index will sequence on the last names. This field accepts alpha characters, numeric

characters, characters and punctuation marks. Do not exceed thirty-five characters including

characters and punctuation.

Tip: "Care of" should be written as three characters, "C/O." Corporate names should not begin

with "The" if they are to be sequenced properly in the index. Abbreviations may be used.

Tip: Line items not assessed locally may carry the phrase "assessed in ,” The

mandatory fields should be completed as follows:

(Field 01) Owner enter "Assessed"

(Field 03) Street Address enter "in"

(Field 06) City/State enter "district name"

Enter zeros in the taxable value, and five zeros in the Zip Code Field (07). Supply the correct

data for the Land Dimension Field (09) and Property Location Field (10).

Billing Code Field (02) - five numeric characters: Used for an assigned code from a lending

institution.

Tip: The billing code may be found in the Bank Billing Book List provided by the Department of

Community Affairs. Letters of authorization are sent to the Tax Collector.

Street Address Field (03) - twenty five alpha-numeric characters: This field is mandatory and

should reflect the property owner's mailing address.

Mortgage Account Number Field (59) - ten alpha-numeric characters:

Tip: The information in this field would be provided by the Tax Collector’s Office.

City, State Field (06) - twenty-five alpha-numeric characters: Enter the city and state portion of

the owner's mailing address.

Zip Code Field (07) – nine alpha-numeric characters: Enter the zip code number of the owner's

mailing address.

Dwelling Units Field (23) – two numeric characters: A leading zero is required for a single

character entry. The number of dwelling units on the property.

Property Location Field (10) - twenty five alpha-numeric characters: This is the physical

location of the property.

18

Property Class Field (11) - three alpha-numeric characters: The class should be entered exactly

as it is listed below. If it is less than three characters, leading zeros should not be used.

Each line item must carry one of the property class codes listed below.

For the classification of taxable real property, the following codes are applicable:

1 Vacant Land

2 Residential (four families or less)

3A

Farm (Regular)

3B Farm (Qualified)

4A

Commercial

4B Industrial

4C Apartment

For the classification of railroad property, the following codes are applicable:

5A Class I Railroad Property

5B Class II Railroad Property

For the classification of tangible personal property of public utilities and oil refineries, the

following codes are applicable:

6A

Personal Property Telephone

6B Machinery, Apparatus or Equipment of Petroleum Refineries

For all Class 1 (Vacant Land) properties and Class 3B (Farmland-Qualified) properties, land only

is assessed. Any farm buildings, such as silos, barns or other accessory farm buildings are

assessed within the 3A classification in the improvement column.

For the classification of exempt property line items, the following codes are applicable:

15A Public School Property

15B Other School Property

15C Public Property

15D Church and Charitable Property

15E Cemeteries and Graveyards

15F Other Exempt properties not included in the above classifications

Class 15 properties will appear twice; once in the ratable section of the Tax List in block and lot

order with the word “Exempt” in the net taxable value, and again in the exempt section of the

Tax List.

Account Number Field (65) - eight alpha-numeric characters: Utilized by districts whose

collectors have assigned account numbers to be printed on the Tax List and Tax Bill. An account

number should be unique.

18

Property Description Data

Land Dimension Field (09) - Twenty alpha-numeric characters: Accepted formats include:

150x351

52658SF (square feet)

1.211 AC

7.5 Acres

If the size is entered as dimensions or in square feet, MOD-IV will calculate the acreage and

print it in the "Calculated Acreage" field on the Tax List.

Tip: If “IR or IR. or IRR or IRR.” are entered, acreage calculation is not performed.

Building Description Field (13) - fifteen alpha-numeric characters: The information in a

description should be listed in the following order: stories, exterior structural material, style,

number of stalls, and type of garage. The listed codes may be supplemented according to need.

The building description codes are listed below:

STORIES:

S Prefix S with number of stories

STRUCTURE:

AL

B

CB

F

M

Aluminum siding

Brick

Concrete Block

Frame

Metal

RC

S

SS

ST

W

Reinforced concrete

Stucco

Structured Steel

Stone

Wood

STYLE:

A

B

C

D

E

L

M

Commercial

Industrial

Apartments

Dutch Colonial

English Tudor

Colonial

Mobile Home

S

T

W

X

Z

O

2

Split Level

Twin

Row home

Duplex

Raised Rancher

Other

Bi-Level

R

Rancher

3

Tri-level

GARAGE:

AG Attached Garage UG Unattached Garage

Tip: Number of cars is prefixed to code.

Example: 1.5SSTL2AG means: 1 1/2 story stone colonial with a 2 car attached garage

19

Building Class Code Field (18) - five alpha-numeric characters: The Building Class from the

Appraisal Manual for New Jersey Assessors is required in this field, and may be used in a

program for comparing similar properties or in a mass appraisal. This field is mandatory when

establishing a Class 2 or 3A line item as of 2015. (See Exhibit 2 - Memorandum)

Additional Lot Field (37) - twenty alpha-numeric characters: Only a primary block and lot may

be entered for identification purposes in Field (61). This field is provided for the display of any

additional contiguous lots that were assessed with the primary. Proceed with the first additional

lot followed by a comma to separate the lot numbers. (See Reference A)

Zoning Field (35) - four alpha-numeric characters: Municipal zoning designations are reflected

in this field.

Tax Map Page Field (39) - four alpha-numeric characters: Enter the page of the Tax Map which

corresponds to the property location.

Construction Year Field (19) - Four numeric characters.

Deductions Field (04) - fourteen alpha-numeric characters: The deduction field accepts five

types of deductions. The number of owners, the deductions to which they are entitled, and the

total dollar amount of the deductions is entered. Only the codes listed below are acceptable:

V Veteran

S Senior Citizen

W Widow of a Veteran

D Disabled Person

R Surviving Spouse

Under "Code," enter the applicable deduction code and under "#," the number of deductions of

that type the owner is eligible to receive. Multiple types of deductions may be shown by

repeating the previous instructions. In the sub-field entitled "Owners," enter the total number of

owners of the property. Four characters, numeric, leading zeros are required.

In the sub-field "Amount," enter the total of all deductions to which the owner(s) may be

entitled. This must be in whole dollars and if less than 100, a leading zero is required. Upon

removal of a deduction where multiple deductions exist, the entire field must be re-entered.

Rebate Flag Field (34) - one alpha character: Field that will accept either "Y" or "N." A "Y"

indicates that the tenant is eligible for a rebate and that a tenant rebate notice should be generated.

An "N" indicates the tenant is not eligible for a rebate and that a tenant rebate notice should not

be generated.

Tenant Rebate Base Year: Field (96) - four numeric characters: Displays the base year for the

Tenant Rebate.

Tenant Rebate Base Year Taxes Field (97) - Nine numeric characters: The decimal point is

assumed. This field displays the tax dollar amount for the tenant rebate base year in Field (96).

20

Tenant Rebate Base Year Assessment Field (98) - Nine numeric characters: Use whole

numbers and right justify. This field displays the total assessment of the property for the Tenant

Rebate Base Year Field (96).

Deed Field (41) – ten alpha-numeric characters: Five are for book number information, followed

by five for page number information. Also used for the county recording systems based on

instrument numbers

Deed Date Field (42) - six numeric characters: The Date of the deed is entered in this field.

MMDDYY leading zeros required.

Sales Price Field (43) - nine numeric characters: The selling price of the property should be

entered in whole dollars. A nominal consideration sale of one dollar should be entered as 1. A

maximum of five sales will be retained on the Master File.

SR-1A Non-Usable Code Field (20) - two numeric characters: Certain deed transactions are not

usable in determining the assessment sales ratio. The field accepts non-usable codes 01-33. A list

of non-usable codes is found in Reference C and on the Division website:

http://www.state.nj.us/treasury/taxation/

Class 4 Use Code Field (67) - three numeric characters: Describes the specific use of a

commercial property. The field accepts the commercial use codes found in Reference B.

Sales Price Code Field (70) - one alpha character: This is a field to show the method used in

verifying the sales price and will accept the following codes:

A Actual (from the deed)

F Field checked

Q Checked by Questionnaire

Exempt Property Data

Classification Code Field (51) - seven numeric characters: Comprised of three sub-fields: Owner,

Purpose or Use and Specific Description. Code numbers are obtained from Reference F or the

Tax List Legend. This is a mandatory field when establishing exempt properties.

Exempt Statute Number Field (55) – twelve alpha-numeric characters: The statute number

entered on the Initial Statement by the applicant for the exemption or, if owned by a public body,

the statute pertaining to the level of government and/or the use of the property should be entered

in this field. A list of statutes and acceptable format is presented in Reference E.

Initial Filing Date Field (53) - six numeric characters: Enter the date the Initial Statement was

filed with the assessor. (MMDDYY) Leading zeros must be entered.

Tip: Enter the date of acquisition for Class 15C - Public Property, date of exemption for Totally

Disabled Veterans, and beginning date for an in-lieu tax payment

21

Further Filing Date Field (54) - six numeric characters: When a Further Statement is filed

(every third year), the filing date is entered in this field. (MMDDYY) leading zeros must be

entered)

Tip: This field is not applicable for Public Property and Totally Disabled Veterans. Ending date

of in-lieu tax payments should be entered.

Facility Name Field (52) - twenty alpha-numeric characters: Displays the name or a distinctive

term by which the exempt property is known. In the absence of a assessor's entry, the applicable

description from Part III of the Exempt Property Tax System Legend will be printed. alpha-

numeric

Land Taxable Value Field (14) - nine numeric characters: Enter the assessed value of the land

in this field. Use whole numbers and right justify. If the property class is 6A or 6B enter the

reported depreciated book value of Public Utility Tangible Personal Property.

Improvement Taxable Value Field (15) - nine numeric characters: Enter the assessed value of

the improvement in this field. Nine-space, numeric field. Use whole numbers and right justify.

If the property class is 6A or 6B enter the applicable ratio of assessed to true value of real

property promulgated by the Director of the Division of Taxation on October 1

st

of the pre-tax

year or 100%. The ratio may be up to five characters with the decimal point assumed. Do not

enter the decimal point. i.e. 45% enter as 4500, 68.69% enter as 6869, 100% enter as 10000.

Limited Exemption Amount Code and Amount Field (05) - one alpha character (exemption

amount code) and eight numeric characters (exemption amount): A property may be eligible for

a special or limited exemption (one that does not exempt the entire property). Enter the letter

code and the amount, in even dollars, in the remaining characters. The sub-field should be right

justified. In all instances Field (29) must accompany the submission of a Field (05).

Limited Exemptions:

E

Fire Suppression System

F Fallout Shelter

P Pollution Control

W Water Supply Control

Y Renewable Energy

Rehabilitation & Redevelopment Limited Exemptions & Abatements:

G Commercial Industrial Exemption

I Dwelling Exemption

J Dwelling Abatement

K New Dwelling/Conversion Exemption

L New Dwelling/Conversion Abatement

N Multiple Dwelling Exemption

O Multiple Dwelling Abatement

U Urban Enterprise Zone Abatement

22

It is possible for a property to be eligible for more than one limited exemption. However, the

total dollar amount of the exemptions may not exceed the taxable value of the property. MOD-

IV will accommodate a maximum of four exemptions. When deleting an expired portion of a

multiple exemption, the entire field must be re-entered along with a corresponding Field (29).

When adding an exemption/abatement where one already exists, both the original and the newly

added exemption/abatement must be entered in Field (05) along with a corresponding Field (29).

Limited Exemption Code and Term: Field (29) - two alpha-numeric characters: the first

character accepting a limited exemption/abatement code letter and the second character

accepting numerals 1,2,3,4,5, or 9.

For exemption codes E, F, P, W, and Y, the second character should always be 9 indicating that

the exemption is ongoing.

For exemption/abatement code letters G, I, J, K, L, N, O, and U, the second character should be

1, 2, 3, 4, or 5 designating the term in number of years for the exemption/abatement being

submitted.

Field (29) and Field (05) are dependent fields and programming will not allow a transaction to be

accepted if both fields are not completed. An audit trail for exemption/abatement codes G, I, J,

K, L, N, O, and U is produced at consolidation. The audit trail shows the expiration date of the

exemption/abatement. The assessor must use the added assessment process to return the property

to taxable status and manually delete the limited exemption/abatement information from the tax

list. The taxable value must also be corrected.

Net Taxable Value Field (16) - nine numeric characters: For real property, the net taxable value

equals the sum of the assessed value of the land plus the assessed value of the improvement

minus any limited exemptions. When there are one or more changes to the assessment the net

taxable value must be recalculated, and if the new figure(s) are incorrect, the change(s) will be

rejected. (No cents assumed, right justified.)

For personal property of public utilities (Classes 6A or 6B), the net taxable value equals the

product of the reported depreciated book value multiplied by the average assessment ratio.

These calculations are not checked by MOD-IV.

Assessment Code Field (40) - one alpha character: If a "P" is entered in this box, the word

"partial" will appear under the improvement assessed value on the Tax List and on the Tax Bill

next to the net taxable value. This is used to indicate that the improvement was not completed

prior to October 1

st.

When the improvement is completed and is included in the assessment for

the following year, remove the "partial" indicator.

Special Tax District Codes Field (17) - three alpha-numeric characters: The acceptable codes

are listed below:

D Revenue Allocation District

F Fire

G Garbage/Solid Waste

S Special Improvement

23

W Water

L

Light

The first space is for the alpha code listed above. The second and third characters are for the

number (01 through 99) specifying the district. MOD-IV allows for four special tax districts.

24

Changing Property Identification

NOTE: Contact your MOD-IV Data Center before using Field (64).

New Property Identification Field (64) - twenty-nine alpha-numeric characters: This field is

used to change a block, lot, and qualification code without having to delete and re-establish an

entire line item. Using field (64) allows for the property history to transfer with the property ID

change.

Note:

1. Two maintenance runs are required to accomplish a Field (64) change. No changes may be

made to the old or new block and lot description until the two maintenance runs are completed.

2. The new block and lot designation must be unique to the existing MOD-IV Master File.

3. All Field (64) changes are to be completed after consolidation and prior to the production of

the official Tax List.

25

Tax Data Fields

Prior Year - Net Amount of Tax Field (57) - nine numeric characters: The total amount of net

taxes billed for the previous tax year. It is a field for dollars and cents, with an assumed decimal.

Do not enter the decimal point. One-half of the amount in this field is stored as "Taxes Billed

First Half." This field is to be used from October 1

st

, of the pre-tax year until the time the current

year's tax rate is struck and the Extended Tax Duplicate is produced. Decimal point is assumed.

Current Year - Net Amount of Tax Field (58) - nine numeric characters: Total amount of net

taxes billed for the current year. Data entry rules are the same as for Field (57). After the

Extended Tax Duplicate is run, data may be entered in this field until the Added and Omitted

Assessment Lists are produced. Decimal point is assumed.

Non-Municipal 1

st

Half Tax Field (71) - nine numeric characters: State Fiscal Year total

amount of net taxes billed for the first half of the tax year, for non-municipal purposes in a

municipality on a fiscal year budget. This amount would include county, school, library taxes,

etc. Decimal point is assumed.

Non-Municipal 2

nd

Half Tax Field (72) - nine numeric characters: State Fiscal Year amount of

net taxes billed for the second half of the tax year, for non-municipal purposes in a municipality

on a fiscal year budget. Decimal point assumed.

Municipal 1

st

Half Tax Field (73) - nine numeric characters: State Fiscal Year total amount of

net taxes billed for the first half of the tax year, for local municipal purposes in a municipality on

a fiscal year budget. Decimal point assumed.

Municipal 2

nd

Half Tax Field (74) - nine numeric characters: State Fiscal Year total amount of

net taxes billed for the second half of the tax year, for local municipal purposes in a municipality

on a fiscal year budget. Decimal point assumed.

26

Supplementary Data Fields

MOD-IV has fields to record descriptive and appraisal data. The use of these fields is not

mandatory and these fields do not print on the tax list.

Optional fields should be addressed by their appropriate field number. For on-line methods of

entry of these fields, contact your MOD-IV data center for specific instructions.

All optional fields are listed below along with descriptive information and formatting

instructions.

The Additional Owner portion of Field (61) - two numeric characters: allows for a numeric

count of owners above and beyond those that will fit in Field (01) Owner. Although street

address Field (03), city and state Field (06) and zip code Field (07) can be submitted along with

the owners name for each additional owner only the owners name will appear and only in the

alphabetical index. (Fields 03, 06, and 07) will be retained on the MOD-IV Master File and can

be extracted for other purposes. i.e. Mailing labels.

Claimant Social Security Number Field (21) - eleven numeric characters: This field is no

longer used.

School Tax Overage Amount Field (22) - eleven numeric characters: (Formerly Co-Claimant

Social Security Number) Decimal point assumed.

Commercial Units Field (24) - two numeric characters: The number of commercial units on the

property. Leading zeros required.

Multiple Occupancy Code Field (25) - one numeric character: indicates the portion of a multiple

unit dwelling the owner occupies. The following codes are acceptable:

1 = 1/4

2 = 1/3

3 = 1/2

4 = 2/3

5 = 3/4

6 = All

Percent Owned Field (26) - two numeric characters: Percentage of ownership for the property.

If this field is blank, it indicates 100% ownership.

Delinquent Tax Code Field (28) - one alpha character: Accepts the letter "S." An "S" in this

field indicates that the owner is delinquent on paying their local property taxes (per the Tax

Collector.)

Additional Lots 2 Field (38) - twenty alpha-numeric characters: The same rules apply as to

Field (37). This field should not be used for purposes other than additional lots exceeding the

size of Field (37). (Reference A)

27

Previous Sales Dates 1 Field (44) - twenty four numeric characters: This field is comprised of

three sub-fields. The assessor may list the previous sale data, previous sale price in whole

dollars and the previous assessment in this field. The first six positions are for a sale date. The

sales price and assessment are both nine characters.

Tip: Prior sale (history) is generated by MOD-IV by saving existing sales data before applying

the new sale data Field (41) and (43). This field allows the user to modify sale history generated

by the system.

Previous Sales Dates 2 Field (45): See Field (44).

Previous Sales Dates 3 Field (46): See Field (44).

Previous Sales Dates 4 Field (47): See Field (44).

Previous Sales Dates 5 Field (48): See Field (44).

Census Tract Field (49) - five alpha-numeric characters: Displays the census tract number for

the property location. Census tract information may be obtained from the US Census Bureau.

Census Block Field (50) - four alpha-numeric characters: Contains the census block number for

the property location. Census tract information may be obtained from the US Census Bureau.

Number of Rooms Field (75) - four numeric characters: The number of rooms in the principle

dwelling is placed in this field.

Number of Baths Field (76) - four numeric characters: The number of bathrooms in the principle

dwelling is placed in this field.

Number of Apartments Field (77) - four numeric characters: Used for Class 4C properties, the

number of apartments on a particular line item.

Number of Buildings Field (78) - four numeric characters: The number of buildings on a

particular line item containing more than one building.

Building Cubic Feet Field (79) - seven numeric characters: The total cubic feet of building

space on a particular line item.

Building Square Feet Field (80) - six numeric characters: The total floor square footage of a

particular line item.

Depreciation Field (81) - two numeric characters: A depreciation factor is placed in this field.

Basement Codes Field (82) - four alpha characters: Describes the basement of the building on a

particular line item. From left to right, the first character describes basement area and accepts:

A = 1/4

B = 1/2C = 3/4

D = Full

E = None

28

The second character describes the portion of the basement that is finished and accepts:

F = 1/4

G = 1/2

H = 3/4

I = Full

J = None

The third character describes the basement wall type and accepts:

K = Dry Wall

L = Plaster

M = Wood Panel

N = Dirt

The fourth character describes the basement floor type and accepts:

O = Concrete

P = Tile

Q = Dirt

Lot Dimensions Field (83) - thirteen numeric characters: Decimal point assumed. From left to

right, the first four characters are reserved for the front footage (or average), the second four

characters are reserved for the depth in feet (or average) and the last five characters are reserved

for the unit price with cents.

Lot Area Field (84) - nine numeric characters: From left to right, the first two characters are

reserved for the percent of the lot covered by the building and the last seven characters are

reserved for the price per unit per acre.

Standard Depth Field (85) - three numeric characters: Field is always in whole feet.

Depth Factor Field (86) - three numeric characters.

Utilities Field (87) - six alpha characters: A descriptive field where the characters from left to

right are as follows:

1. The first character describes the type of water in the property and accepts:

A = Water

B = City Water

C = None

2. The second character describes the type of sewerage and accepts:

D = Septic Tank

E = Sewers

F = None

3. The third character describes the type of heat in the property and accepts:

G = Gas

H = Electric

I = Oil

J = Steam

29

K = Coal

L = None

4. The fourth character describes the type air conditioning in the property and accepts:

M = Gas

N = Electric

O = Window

P = None

5. The fifth character indicates whether or not the property has electricity and accepts:

Q = Yes

R = No

6. The sixth character indicates whether or not the property has natural gas and accepts

the letters S & T where

S = Yes

T = No

Streets Field (88) - six alpha-numeric characters.

1. The first character indicates whether or not there are streets contiguous to the

property and accepts:

A = Yes

B = No

2. The second character indicates the type of street surface and accepts:

C = Dirt

D = Gravel

E = Paved

3. The third character indicates whether or not there are sidewalks on the property and

accepts:

F = Yes

G = No

4. The fourth character indicates whether or not there is curbing on the property and

accepts:

H = Yes

I = No

5. The fifth character indicates whether or not there is a driveway and what type of

surface it is when there is a driveway and accepts:

J = There is no driveway

K = Dirt driveway

L = Paved driveway

6. The sixth character accepts the numerals 1-9 indicating the number of streets

bordering the property.

30

Topography Field (89) - four alpha-numeric characters: describes the contour of the land

portion of the line item. The first character is alpha and accepts:

H = High

L = Low

E = Level

S = Swamp

R = Riparian

The last three characters are numeric for the percentage of this terrain. The percentage should be

expressed in whole numbers only using all three positions when 100%.

Main Building Purpose Field (90) - four alpha-numeric characters: The acceptable codes for

this field are as follows:

1. RFM - This code is for Residential Family Dwelling and the three-character code

should be left justified. The remaining characters to the far right accept the numerals

1 - 4 indicating the number of family units in the property.

2. APTS - Apartments - Should be Class 4C with 5 units or more.

3. COMM - Commercial

4. INDH - Heavy Industry

5. INDL - Light Industry

6. OFFS - Offices

7. RMHS - Rooming House

8. UNOC - Unoccupied

Number of Lots Field (91): two numeric characters.

Value Map Page Number Field (92) - four alpha-numeric characters.

Last Appraisal Field (93) - six numeric characters: date field indicating the date on which the

subject line item was last appraised. (MMDDYY)

Land Location Codes Field (94) - five alpha-numeric characters: The acceptable codes from left

to right are follows:

1. The first two characters describe the condition of the land are as follows:

GD = Good

PR = Poor

FR = Fair

2. The three remaining characters describing the location of the land and are as follows:

URB = Urban

RUR = Rural

RUB = Rurban

SUB = Suburban

Building Cost Conversion Group Field (95) - three alpha-numeric characters: A building cost

conversion number as per the NJ Assessor's Appraisal Manual.

31

CHAPTER V

Added and Omitted-Added Assessments

This chapter describes Added Assessment processing in the MOD-IV system. The on-line

transaction system provides for the processing of added assessments for current year, prior year

and omitted added assessments.

Two types of changes are covered by the added assessment law. Added assessments are structural

changes that occur after the assessment date, and the added assessment procedure is used to

return a formerly exempt or partially exempt property to taxable status.

First, an added assessment will only be accepted by the system for an existing line item on the

current or following year's Master File. For example, when an assessor discovers a new home or

an addition to a structure subject to an added assessment, a line item must be on the current or

following year's Tax List. If no line item exists, it must first be created (established) before an

added assessment can be entered.

(Current Year): When establishing the current year Added Assessment List the assessor has the

option of either incrementing the value or not incrementing the value to the following year's Tax

List. When the added assessment is not incremented the record is created for only the added

assessment billing. When the added assessment value is incremented the following actions occur:

1. The added assessment item will be established on the current year Added Assessment List for

the current tax year indicated.

2. A property class change will be indicated on the following year's Tax List. (if necessary)

3. The building description of the current year added assessment will be transferred to the

subsequent year's Tax List when the transfer indicator, Field (31), has been used.

4. The subsequent year's property values will be increased by the value of the full added

assessment.

There are mandatory fields for all added assessments that must be completed when establishing

an added assessment line item for the current year. They are:

1. Choose List Type:

a) Added

or Added with increment. (option)

For an added assessment for an exempt item that became taxable, do NOT increment

b) List Year - must be current tax year

2. Property Class Code Field (11)

3. Building Description Field (13)

4. Building Description Transfer Indicator Field (31) - optional

5. Land Taxable Value Field (14): Complete only for exempt to ratable situations.

6. Improvement Taxable Value Field (15) (full assessment amount)

7. Net Taxable Value Field (16) (full assessment amount)

8. Completion Date Field (36): This field is important, as it becomes part of the block and lot

identification. This information is used to differentiate between multiple added assessments

on the same property.

32

Prior Year Added Assessments: If an improvement was completed or an exempt property

became taxable between October 1

st

and November 30

th

of the prior tax year, this item may be

entered on the Prior Year Added Assessment List. The mandatory fields for a prior year added

assessment are the same as those for a current year added assessment with the following

exceptions:

1. List Type Prior Year Added Assessment List is selected. There is no increment.

2. Completion Date must be any date between October 1

st

and November 30

th

inclusive. This

list only accommodates a 1 or 2 month time period.

NOTE: Do NOT use the Building Description Transfer Indicator Field (31).

Omitted-Added Assessments: An omitted added assessment is used to tax an added assessment

for three to twelve months of the prior year. This list is used in two situations when an added

assessment was applicable in the prior year:

If the added assessment was applicable for three to twelve months of the prior year and the added

value was not included in the current year’s assessment, then

• An omitted added is created for the prior year for the applicable number of months and a

twelve month current year added is created.

If the added assessment was applicable for three to twelve months of the prior year and the added

value is included in the current year’s assessment, then

• An omitted added is created for the prior year for the applicable number of months.

1. Choose List Type:

a) Omitted – Added - There is no increment.

b) List Year - must be prior tax year.

2. Property Class Code Field (11)

3. Building Description Field (13)

4. Land Taxable Value Field (14): Complete only if the omitted-added item was an exempt

property that became a ratable.

5. Improvement Taxable Value Field (15) (full assessment amount)

6. Net Taxable Value Field (16) (full assessment amount)

7. Completion Date Field (36)

Added, prior year added and omitted-added records may be changed or deleted once established.

To access the record enter the following:

1. Property Identification Field (61)

2. Original Completion Date Field (36): This field must be entered since it becomes part of the

property identification and is necessary to identify and access the item.

Enter the modifications/changes necessary; however if the original requested action included

the increment feature, the increment process cannot be changed in the added process. After

consolidation, adjustments must be made to the subsequent year's Tax List to readjust the

assessments and/or property class that were incremented. Other changes may also be

completed at this time.

33

CHAPTER VI

Omitted and Rollback Assessment

This chapter describes how Omitted Assessments are entered in the MOD-IV system. The on-

line transaction system provides for the processing of omitted and rollback omitted assessments.

Omitted Assessments: Omitted assessments are taxable property that should have been included

on the current year's Tax List. By statute, an omitted assessment is to be valued and taxed for the

current year and the prior year.

First: To process an omitted assessment for the current year, establish the line item for the

subsequent year's Tax List. The fields listed below are mandatory to establish the current year

omitted assessment line item.

Choose List Type:

a) Omitted.

b) List Year - must be current year.

2. Property Class Code Field (11)

3. Building Description Field (13)

4. Land Taxable Value Field (14)

5. Improvement Taxable Value Field (15) if applicable.

6. Net Taxable Value Field (16)

7. Months Assessed Field (12) or 12 months will be assumed by the system.

Note: A completion date is never used on an omitted assessment.

If a prior year omitted assessment is necessary, the same fields as listed above are completed

with one exception. In the List Year Field (60), the prior year will be entered instead of the

current year.

Rollback Assessment Lists: MOD-IV will accept Roll-Back assessment items for the current

year and three years prior. The assessment amount to be entered is the difference between what

appeared on the Tax List for the applicable years under the Farmland Assessment and what the

item would have been assessed were it Class 1 (vacant land). A separate entry is made for each

year involved. The following fields should be entered:

Choose List Type

a) Omitted.

b) List Year - either current year or first, second or third year prior.

2. Property Class Code Field (11): Always 3B.

3. Building Description Field (13): Enter “Roll-Back taxes”

4. Assessment Code Field (40): "R" = Rollback Assessment. Use of this field produces a

separate Rollback Assessment List complete with index, page totals and a District Summary.

5. Land Taxable Value Field (14): The difference between the assessment under the Farmland

Assessment Act as QFARM and the assessment as Class 1, vacant land.

6. Net Taxable Value Field (16): Should be the same value that is in Field (14).

34

Omitted assessments and Rollback assessments may be changed or deleted. To access the record

enter the following:

1. Property Identification Field (61)

2. List Type

Modify other omitted or rollback fields as necessary. Values on the Rollback Assessment List

should be the same as the values on the Rollback Memorandum of Judgement.

35

CHAPTER VII

Added/Omitted Assessment Data Fields

MOD-IV stores multiple years of tax data to allow for the process and production of the added

and omitted assessments. The system carries the following: 2 years for the omitted-assessment