Greenbelt

Qualification

50-State Comparison

Outline

•Greenbelt Qualification:

• Eligibility Criteria Used by the States

• Plot/Land Size Criteria

• Income Production Criteria

• Prior Years’ Land Use Criteria

• Primary use

• Penalty for Change of Use

•Types of Tax Benefits for Agricultural Use

•Summary

Source

Significant Features of the Property Tax.

http://datatoolkits.lincolninst.edu/subcenters/significant-features-

property-tax/Report_Tax_Treatment_of_Agricultural_Property.aspx

Lincoln Institute of Land Policy and George Washington Institute of

Public Policy.

(Tax Treatment of Agricultural Property - 2014)

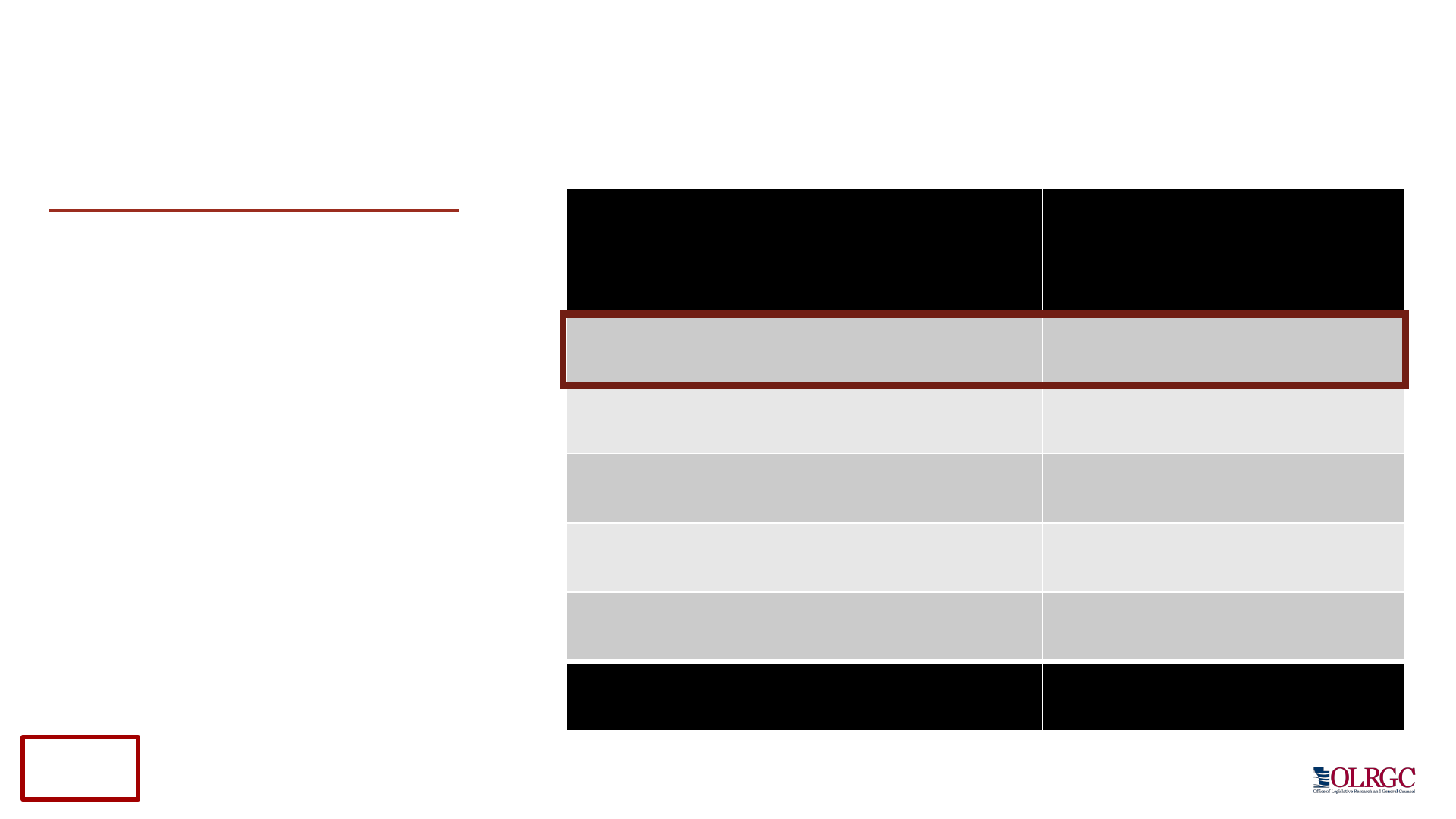

31

9

20

4

12

35

3

8

0 10 20 30 40

Income Production

Management Plan

Prior Years' Land Use

Location

Multi-Year Commitment

Plot/Land Size

Prerequisite Designation or Certification

No Criteria Other than Ag. Use

Number of States

Greenbelt Qualification:

Eligibility Criteria Used by the States

Utah

Criteria

Utah’s Plot/Land

Size Criteria

Qualifying farmland

must be at least 5

acres. If less than 5

acres of land,

property may qualify

if it is devoted to

agricultural use in

conjunction with

other eligible land

under same

ownership.

Plot/Land Size

Minimum

Number of

States

5 acres or less

18

6 to 10 acres

10

11 to 25 acres

3

Other

4

None

15

Total

50

Greenbelt Qualification: Plot/Land Size Criteria

Utah

Income Production Criteria

Number

of States

Based

on owner’s income

5

Based on

farm’s income

22

Expectation of profit

4

Based on crop production

1

None

19

Total*

51

Greenbelt Qualification: Income Production Criteria

Utah’s Income

Production Criteria

Land must produce

in excess of 50% of

the average

agricultural

production per acre

for the given type

and location of

land.*

*

Note: There are exceptions

for certain land uses

*Total greater than 50 because 1 state fits in multiple categories

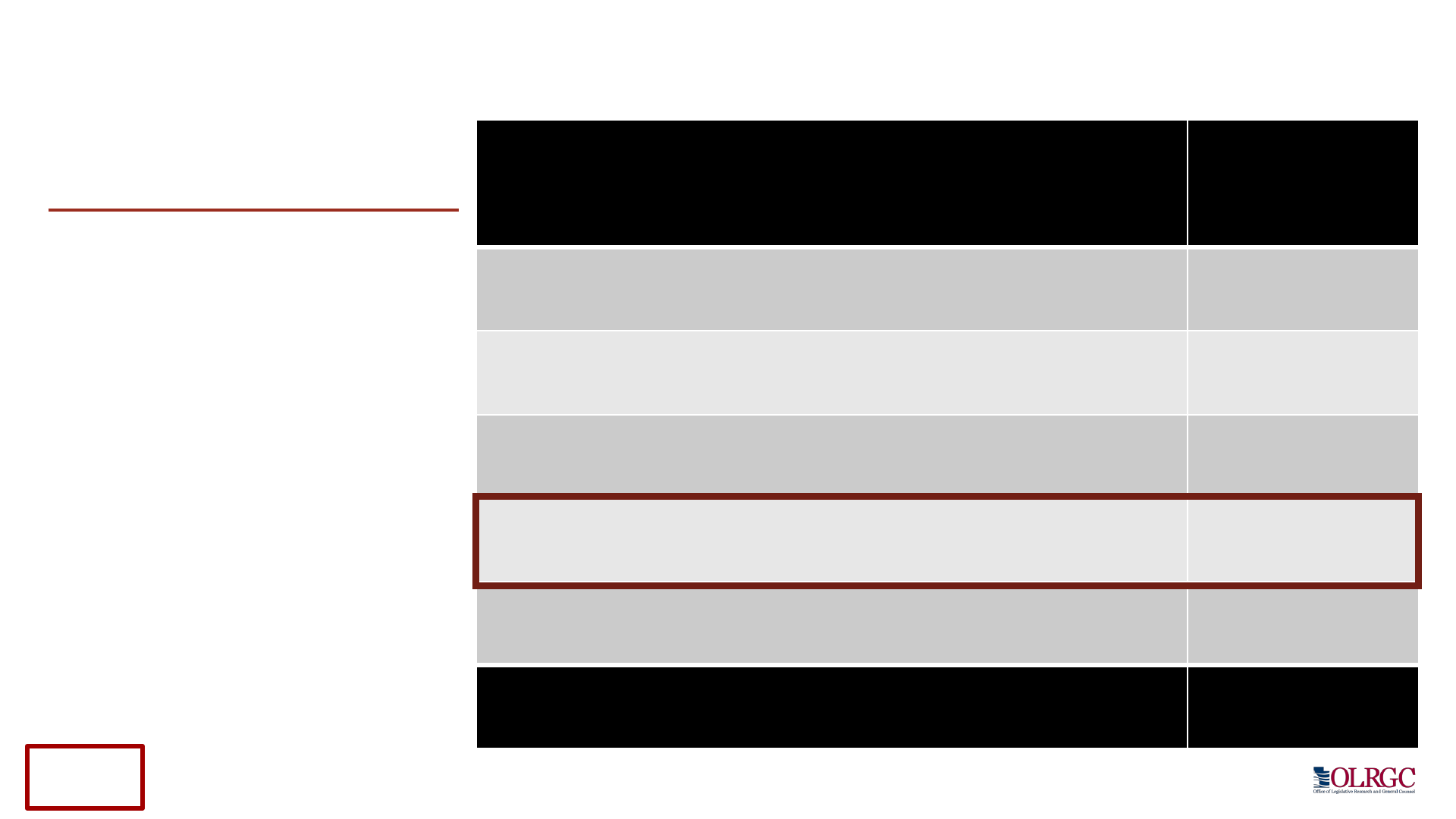

Utah

Greenbelt Qualification: Prior Years’ Land Use Criteria

Utah’s Prior Years’

Land Use Criteria

Land must have been

devoted to agricultural

use for at least 2

successive years

immediately preceding

the tax year in which

application is made

and meet the average

annual (per acre)

production

requirements.

Prior Years' Land Use

Criteria

Number of States

2 years or less

8

2 to 5 years

8

Other

4

None

30

Total

50

Utah

Greenbelt Qualification: Primary Use

Utah

“To be eligible for

FAA, it makes no

difference whether

agricultural use is

the primary or

secondary use of

a land parcel. As

long as other uses

do not hinder or

exclude the

agricultural use, a

parcel may receive

FAA assessment.”

Source: Farmland

Assessment Act

Standards of Practice,

Utah State Tax

Commission, May 2016

Ag. Land Use

10

Ag. use

may

be secondary

32

Ag. use

must

be primary

8

Unclear

1

No program

Greenbelt: Penalty for Change of Use?

32

18

0

10

20

30

40

50

Yes No

Number of States

Utah

Utah’s Penalty for

Change of Use

If the land becomes

ineligible, the owner

will be subject to a

rollback tax for up to

5 years. The tax

rate and market

value for each of the

years in question is

applied to determine

the tax amount.

Type of Tax Benefit for Agricultural Use

Number

of States

General

Agricultural Use Assessment

48

Specific Local

Option Farmland and Open

Space Program

10

Specific

Conservation Use Valuation

Assessment

3

Specific Urban

Agricultural Use Assessment

2

Other Specific Programs

11

Summary

• Utah is mostly similar to other states

• Differences include:

• Income qualification is based on crop

production (1/50 states)

• Not requiring that agricultural use be the

primary use of the land (10/50 states)

• Urban Farming Act (2/50 states)