Table of Contents

Page

Report of Independent Auditors 1

Financial Statements

Consolidated Balance Sheets 4

Consolidated Statements of Income 5

Consolidated Statements of Comprehensive Income (Loss) 6

Consolidated Statements of Changes in Equity 7

Consolidated Statements of Cash Flows 8

Notes to Financial Statements 10

1

Report of Independent Auditors

The Board of Directors

Evergreen Federal Bank and Subsidiary

Report on the Audit of the Financial Statements

Opinion

We have audited the consolidated financial statements of Evergreen Federal Bank and Subsidiary,

which comprise the consolidated balance sheets as of September 30, 2023 and 2022, and the related

consolidated statements of income, comprehensive income (loss), changes in equity, and cash flows

for the years then ended, and the related notes to the consolidated financial statements.

In our opinion, the accompanying consolidated financial statements present fairly, in all material

respects, the financial position of Evergreen Federal Bank and Subsidiary as of September 30, 2023

and 2022 and the results of its operations and its cash flows for the years then ended in accordance

with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audit in accordance with auditing standards generally accepted in the United

States of America (GAAS). Our responsibilities under those standards are further described in the

Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are

required to be independent of Evergreen Federal Bank and Subsidiary and to meet our other ethical

responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe

that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit

opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the consolidated financial

statements in accordance with accounting principles generally accepted in the United States of

America, and for the design, implementation, and maintenance of internal control relevant to the

preparation and fair presentation of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are

conditions or events, considered in the aggregate, that raise substantial doubt about Evergreen

Federal Bank and Subsidiary’s ability to continue as a going concern within one year after the date

that the financial statements are available to be issued.

2

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial

statements as a whole are free from material misstatement, whether due to fraud or error, and to

issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance

but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance

with GAAS will always detect a material misstatement when it exists. The risk of not detecting a

material misstatement resulting from fraud is higher than for one resulting from error, as fraud may

involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal

control. Misstatements are considered material if there is a substantial likelihood that, individually or

in the aggregate, they would influence the judgment made by a reasonable user based on the

consolidated financial statements.

In performing an audit in accordance with GAAS, we:

• Exercise professional judgment and maintain professional skepticism throughout the audit.

• Identify and assess the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error, and design and perform audit procedures responsive to those risks.

Such procedures include examining, on a test basis, evidence regarding the amounts and

disclosures in the consolidated financial statements.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of Evergreen Federal Bank and Subsidiary’s internal control.

Accordingly, no such opinion is expressed.

• Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluate the overall presentation of the

consolidated financial statements.

• Conclude whether, in our judgment, there are conditions or events, considered in the aggregate,

that raise substantial doubt about Evergreen Federal Bank and Subsidiary’s ability to continue as

a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other

matters, the planned scope and timing of the audit, significant audit findings, and certain internal

control–related matters that we identified during the audit.

Portland, Oregon

December 6, 2023

Financial Statements

Evergreen Federal Bank and Subsidiary

See accompanying notes.

4

Consolidated Balance Sheets

September 30, 2023 and 2022

2023 2022

Cash 27,377,060$ 56,637,248$

Due from banks 457,200 612,204

Interest-bearing deposits with banks 1,681,743 1,721,224

Total cash and cash equivalents 29,516,003 58,970,676

Investment securities available-for-sale, at fair value 66,952,770 131,665,850

Restricted equity securities (FHLB) 760,800 737,800

Loans held-for-sale, net of deferred loan fees - 273,377

Loans receivable, net of deferred loan fees

and allowance for loan losses 455,975,501 412,435,397

Accrued interest receivable 1,736,314 1,525,784

Property and equipment, net of accumulated depreciation 23,113,576 19,875,985

Bank-owned life insurance, net of surrender charges 17,757,871 17,350,631

Net deferred tax assets 3,299,204 4,204,703

Other assets 1,353,461 1,472,255

Total assets 600,465,500$ 648,512,458$

Deposits 524,380,931$ 578,000,780$

Advance payments by borrowers for taxes and insurance 4,936,635 3,802,368

Accrued expenses and other liabilities 2,470,620 2,981,445

Note payable 600,000 800,000

Total liabilities 532,388,186 585,584,593

COMMITMENTS AND CONTINGENCIES (Note 13)

EQUITY

Retained income 73,944,816 71,267,829

Accumulated other comprehensive income (loss), net of tax (5,867,502) (8,339,964)

Total equity 68,077,314 62,927,865

Total liabilities and equity 600,465,500$ 648,512,458$

LIABILITIES

ASSETS

Evergreen Federal Bank and Subsidiary

See accompanying notes.

5

Consolidated Statements of Income

Years ended September 30, 2023 and 2022

2023 2022

INTEREST INCOME

Loan fees and interest 20,682,119$ 16,423,627$

Cash and investment securities 2,503,987 2,135,303

Restricted equity security dividends (FHLB) 28,710 21,190

Total interest income 23,214,816 18,580,121

INTEREST EXPENSE

Deposits 2,908,505 555,427

Borrowings 189,133 34,374

Total interest expense 3,097,638 589,801

Net interest income before (recapture of) provision

for loan losses 20,117,178 17,990,320

(RECAPTURE OF) PROVISION FOR LOAN LOSSES (271,000) (300,200)

Net interest income after (recapture of) provision

for loan losses 20,388,178 18,290,520

NONINTEREST INCOME

Service charges on deposit accounts 736,707 750,336

Gain on sale of loans 36,558 407,591

Service charges on loan accounts 413,575 443,452

Increase in cash surrender value of life insurance 310,117 262,538

Other income 385,494 362,068

Total noninterest income 1,882,451 2,225,985

NONINTEREST EXPENSE

Salaries and employee benefits 9,594,256 8,985,764

Occupancy 2,606,505 2,170,098

Data processing 1,111,787 1,065,203

Advertising, marketing, and promotional costs 753,710 614,462

Net loss on sale of investments 2,538,174 -

Other expense 2,129,278 2,106,380

Total noninterest expense 18,733,710 14,941,907

INCOME BEFORE PROVISION FOR INCOME TAXES 3,536,919 5,574,597

PROVISION FOR INCOME TAXES 859,932 1,452,481

NET INCOME 2,676,987$ 4,122,117$

Evergreen Federal Bank and Subsidiary

See accompanying notes.

6

Consolidated Statements of Comprehensive Income (Loss)

Years Ended September 30, 2023 and 2022

2023 2022

NET INCOME 2,676,987$ 4,122,117$

Other comprehensive income (loss), net of income taxes

Unrealized holding gains (losses) on available-for-sale

investment securities 839,788 (11,501,710)

Reclassification for net gain on available-for-sale

investment securities recognized in earnings 2,538,174 -

Income tax effects (905,500) 3,083,160

Total other comprehensive income (loss),

net of taxes

2,472,462 (8,418,550)

COMPREHENSIVE INCOME (LOSS) 5,149,449$ (4,296,433)$

Evergreen Federal Bank and Subsidiary

See accompanying notes.

7

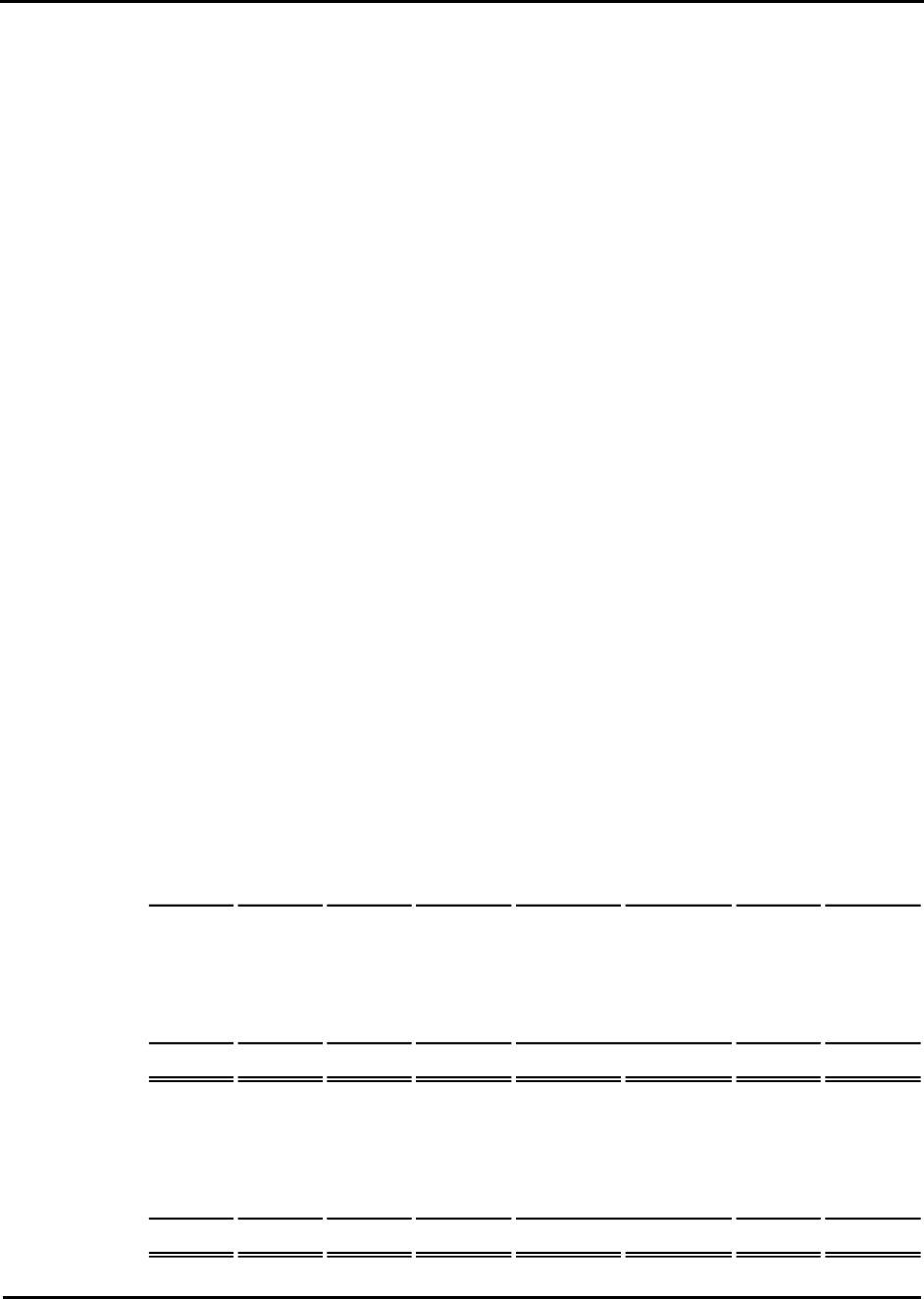

Consolidated Statements of Changes in Equity

Years Ended September 30, 2023 and 2022

Retained Income

Total Equity

BALANCE, September 30, 2021 67,145,712$ 78,586$

67,224,298$

Net income 4,122,117 -

4,122,117

Other comprehensive income (loss), net of taxes - (8,418,550)

(8,418,550)

BALANCE, September 30, 2022 71,267,829 (8,339,964) 62,927,865

Net income 2,676,987 -

2,676,987

Other comprehensive income (loss), net of taxes - 2,472,462

2,472,462

BALANCE, September 30, 2023 73,944,816$ (5,867,502)$ 68,077,314$

Accumulated Other

Comprehensive

Income (Loss)

Evergreen Federal Bank and Subsidiary

See accompanying notes.

8

Consolidated Statements of Cash Flows

Years Ended September 30, 2023 and 2022

2023 2022

CASH FLOWS FROM OPERATING ACTIVITIES

Net income 2,676,987$ 4,122,117$

Adjustments to reconcile net income to net cash

from operating activities

Net accretion of discounts and amortization of

premiums on investment securities 88,147 160,436

(Recapture of) provision for loan losses (271,000) (300,200)

Depreciation of property and equipment 1,057,581 907,529

Amortization of promotional assets 176,975 144,389

Amortization of mortgage servicing asset 170,630 295,055

Origination of loans held for sale (1,722,500) (14,205,778)

Proceeds from sales of loans held for sale 2,032,435 15,233,442

Gain on sale of loans held for sale (36,558) (407,591)

Increase in the cash surrender value of bank-owned

life insurance (310,117) (352,692)

Loss from sale of investment securities 2,538,174 -

Change in deferred taxes - 246,700

Changes in other assets and liabilities

Accrued interest receivable and other assets (686,057) (670,078)

Accrued expenses and other liabilities (361,232) (870,311)

Net cash from operating activities 5,353,465 4,303,018

CASH FLOWS FROM INVESTING ACTIVITIES

Purchase of investment securities (932,500) (92,804,036)

Proceeds from sales of investment securities 66,397,220 -

Proceeds from investment maturities - 11,000,000

Purchase of restricted equities (FHLB) (23,000) (42,500)

Loans made to customers, net (43,269,104) (51,068,288)

Purchase of bank-owned life insurance - (1,475,837)

Purchases of property and equipment (4,295,172) (1,604,260)

Net cash from investing activities 17,877,444$ (135,994,921)$

Evergreen Federal Bank and Subsidiary

Consolidated Statements of Cash Flows (continued)

Years Ended September 30, 2023 and 2022

See accompanying notes.

9

2023 2022

CASH FLOWS FROM FINANCING ACTIVITIES

Net increase (decrease) in deposits (53,619,849)$ 34,570,823$

Payments on long term borrowings (200,000) (200,000)

Increase (decrease) in advance payments by

borrowers for taxes and insurance 1,134,267 (271,520)

Net cash from financing activities (52,685,582) 34,099,303

NET CHANGE IN CASH AND CASH EQUIVALENTS (29,454,673) (97,592,600)

CASH AND CASH EQUIVALENTS, beginning of year 58,970,676 156,563,276

CASH AND CASH EQUIVALENTS, end of year 29,516,003$ 58,970,676$

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION

Interest paid 2,206,909$ 589,801$

Income taxes paid 748,000$ 1,454,000$

SUPPLEMENTAL DISCLOSURE OF NON-CASH

INVESTING ACTIVITIES

Change in fair value of investment securities

available-for-sale, net of taxes 2,472,462$ (8,418,550)$

Evergreen Federal Bank and Subsidiary

10

Notes to Financial Statements

Note 1 – Organization and Summary of Significant Accounting Policies

Description of business – Evergreen Federal Bank (the Bank) is a mutual institution that focuses on

traditional banking functions and community building activities. The Bank, chartered in 1934 and serving

Josephine, Jackson, and Curry Counties in Oregon, is headquartered in Grants Pass, Oregon and

operates branches in Grants Pass as well as in Ashland, Brookings, Rogue River, and Medford, Oregon.

The Bank is primarily engaged in the business of granting residential and commercial real estate loans

and provides a wide range of banking as well as other financial services primarily to individual customers.

Basis of consolidation – The consolidated financial statements include the accounts of the Bank and its

wholly-owned subsidiary, Affordable Housing. All material intercompany balances and transactions have

been eliminated in consolidation.

Use of estimates – The consolidated financial statements have been prepared in accordance with

generally accepted accounting principles in the United States of America and reporting practices

applicable to the banking industry. In preparing the consolidated financial statements, management is

required to make estimates and assumptions that affect the reported amount of assets and liabilities as of

the date of the consolidated balance sheets, revenues and expenses for the reporting period, and

disclosures of contingent assets and liabilities. Actual results could differ significantly from those

estimates.

Significant estimates are necessary in determining the fair value of financial instruments, the recorded

value of the allowance for loan losses, the valuation of the mortgage servicing asset, deferred tax assets

and liabilities, and the amount of impairment, if any, on investment securities and other real estate owned.

Management believes the assumptions used in arriving at these estimates are reasonable.

Cash and cash equivalents – For the purposes of the consolidated statements of cash flows, the Bank

considers all highly-liquid debt instruments purchased with an original maturity of three months or less to

be cash equivalents, including amounts due from banks and interest-bearing deposits with banks.

Investment securities – Investment securities are classified into one of two categories: (1) held‐to‐

maturity or (2) available‐for‐sale. The Bank does not purchase investment securities for trading purposes.

Investment securities that management has the positive intent and ability to hold until maturity are

classified as held-to-maturity and are carried at their remaining unpaid principal balance, net of

unamortized premiums or unaccreted discounts. Premiums are amortized and discounts are accreted

using the interest method over the period remaining until maturity.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

11

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

Securities classified as available‐for‐sale are those debt securities that the Bank intends to hold for an

indefinite period of time, but not necessarily to maturity. Any decision to sell a security classified as

available‐for‐sale would be based on various factors, including significant movements in interest rates,

changes in the maturity mix of the Bank’s assets and liabilities, liquidity needs, regulatory capital

considerations, and similar factors. Securities available‐for‐sale are carried at fair value. Unrealized gains

or losses, net of the related deferred tax effect, are reported as accumulated other comprehensive

income (loss) within equity. Realized gains and losses on sales of securities are recognized in earnings at

the time of sale and are determined by the specific identification method. Purchase premiums and

discounts are recognized in interest income using the interest method over the term to maturity of the

securities.

The Bank assesses other-than-temporary impairment (OTTI) or permanent impairment of its investment

securities based on whether it intends to sell a security or if it is likely that it would be required to sell the

security before recovery of the amortized cost basis of the investment, which may be maturity. For debt

securities, if the Bank intends to sell the security or it is likely that it will be required to sell the security

before recovering its cost basis, the entire impairment loss must be recognized in earnings as an OTTI. If

the Bank does not intend to sell the security and it is not likely that it will be required to sell the security,

but the Bank does not expect to recover the entire amortized cost basis of the security, only the portion of

the impairment loss representing credit losses would be recognized in earnings. The credit loss on a

security is measured as the difference between the amortized cost basis and the present value of the

cash flows expected to be collected. Projected cash flows are discounted by the original or current

effective interest rate depending on the nature of the security being measured for OTTI.

Restricted equity securities (FHLB) – The Bank’s investment in Federal Home Loan Bank of Des

Moines (FHLB) stock is a restricted equity security carried at cost ($100 per share) which approximates

fair value. As a member of the FHLB system, the Bank is required to maintain a minimum level of

investment in FHLB stock based on its asset size and outstanding FHLB advances. The Bank may

request redemption of any stock in excess of the amount required. Stock redemptions are made at the

discretion of the FHLB.

FHLB stock is generally viewed as a long-term investment. Accordingly, when evaluating FHLB stock for

impairment, its value is determined based on the ultimate recoverability of the par value rather than by

recognizing temporary declines in value. The Bank has concluded its FHLB stock investment is not

impaired as of September 30, 2023 and 2022.

Loans held-for-sale – Mortgage loans held-for-sale are reported at the lower of cost or market value.

Gains or losses on sales of loans that are held-for-sale are recognized at the time of sale and determined

by the difference between net sale proceeds and the net book value of the loans.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

12

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

Loans receivable – Loans receivable that management has the intent and ability to hold for the

foreseeable future or until maturity are reported at the outstanding principal balance adjusted for the

allowance for loan losses, any net deferred fees or costs on originated loans and unamortized premiums

or unaccreted discounts on purchased loans. Loan origination fees, net of certain direct origination costs,

are deferred and amortized as an adjustment of the yield on the related loan using the interest method.

Interest on loans is calculated using the simple-interest method on daily balances of the principal amount

outstanding.

Allowance for loan losses – The allowance for loan losses represents management’s recognition of the

assumed risks of extending credit and its evaluation of the quality of the loan portfolio. The allowance is

maintained at a level considered adequate to provide for potential loan losses based on management’s

assessment of various factors affecting the loan portfolio, including a review of problem loans, business

conditions, loss experience, and an overall evaluation of the quality of the portfolio. The allowance is

increased or decreased by provisions charged to operations and reduced by loans charged-off, net of

recoveries. Regulatory examiners may require the Bank to recognize additions to or reductions of the

allowance based upon their judgment about information available to them at the time of their

examinations.

Uncollectible interest on loans is charged-off or an allowance is established by a charge to income equal

to all interest previously accrued. Interest is subsequently recognized only to the extent cash payments

are received until delinquent interest is paid in full and, in management’s judgment, the borrower’s ability

to make periodic interest and principal payments is probable, in which case the loan and loan interest is

returned to accrual status.

Impaired loans and related income – A loan is considered impaired when management determines that

it is probable that all contractual amounts of principal and interest will not be paid as scheduled in the loan

agreement. These loans often include loans on nonaccrual status that are past due 90 days or more,

nonaccrual status loans which have been restructured, and other loans that management considers to be

impaired. The recorded net investment in impaired loans, including accrued interest, is limited to the

present value of the expected cash flows of the impaired loan, the observable fair market value of the

loan, or the fair value of the loan’s collateral, if the loan is collateral dependent.

Loans are reported as troubled debt restructurings when the Bank, for economic or legal reasons related

to the borrower’s financial difficulties, grants significant concessions to a borrower that it would not

otherwise consider. The concessions may be granted in various forms, including reduction in the stated

interest rate, reduction in the loan balance or accrued interest, and extension of the maturity date. As a

result of these concessions, restructured loans are impaired as the Bank will not collect all amounts due,

both principal and interest, in accordance with the terms of the original loan agreement. Impairment

reserves on non-collateral dependent restructured loans are measured by comparing the present value of

expected future cash flows on the restructured loans, discounted at the interest rate of the original loan

agreement, to the loan’s carrying value. These impairment reserves are recognized as a specific

component to be provided for in the allowance for loan losses.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

13

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

When a loan is placed on nonaccrual status, all interest previously accrued but not collected is reversed

and charged against interest income. Income on nonaccrual loans is then recognized only when the loan

is brought current or when, in the opinion of management, the borrower has demonstrated the ability to

resume payments of principal and interest. Interest income on restructured loans is recognized pursuant

to the terms of new loan agreements. Interest income on other impaired loans is monitored and is based

upon the terms of the underlying loan agreement.

Mortgage loan transactions and servicing – When loans are sold with the servicing rights retained, the

Bank recognizes mortgage servicing rights based on estimated fair value. Fair values are calculated by

the Bank based on the size of the loan, its contractual and expected maturity and servicing value factors

from the Federal Home Loan Mortgage Corporation fee quote tables as well as data provided by third-

party vendors. Impairment of mortgage servicing rights is measured based upon the characteristics of the

individual loans, including note rate, term, underlying collateral, current market conditions, and estimates

of net servicing income. The Bank accounts for its recorded value and possible impairment of mortgage

servicing rights on a loan-by-loan basis. The book value allocated to mortgage servicing rights is recorded

among “other assets” and amortized in proportion to, and over the period of, estimated net servicing

income.

Property and equipment – Property and equipment are stated at cost less accumulated depreciation.

The cost of property and equipment is depreciated using the straight-line method over the estimated

useful lives of the related assets, ranging typically from 3 to 39 years.

Bank-owned life insurance – Bank-owned life insurance is carried at the cash surrender value and

reflects the Banks’s investment in the recorded asset, net of surrender charges. Changes in the cash

surrender value of the contracts are included in earnings as gains or losses in the period they arise.

Income taxes – Income taxes are accounted for using an asset and liability approach that requires the

recognition of deferred tax assets and liabilities for the expected future tax consequences of temporary

differences between the financial statement and tax basis of assets and liabilities at the applicable

enacted tax rates. A valuation allowance is provided when it is more likely than not that some portion or

all of the deferred tax assets will not be realized. The Bank evaluates the realizability of its deferred tax

assets by assessing its valuation allowance and by adjusting the amount of such allowance, if necessary.

The factors used to assess the likelihood of realization include the Bank’s forecast of future taxable

income and available tax planning strategies that could be implemented to realize the net deferred tax

assets. Failure to achieve forecasted taxable income in applicable tax jurisdictions could affect the

ultimate realization of deferred tax assets and could result in an increase in the Bank’s effective tax rate

on future earnings.

The Bank recognizes the tax benefit from uncertain tax positions only if it is more likely than not that the

tax positions will be sustained on examination by the taxing authorities, based on the technical merits of

the position. A tax benefit is measured based on the largest benefit that has a greater than 50% likelihood

of being realized upon ultimate settlement. The Bank recognizes interest and penalties related to income

tax matters in “other expense”. The Bank does not anticipate that the amount of unrecognized tax

benefits will significantly increase or decrease in the next 12 months.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

14

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

Advertising, marketing, and promotional costs – The Bank expenses most advertising and marketing

costs as they are incurred. Advertising, marketing and promotional costs of $753,710 and $614,462 were

recorded for the years ended September 30, 2023 and 2022, respectively, which includes both costs that

are expensed as incurred and the amortization of prepaid costs, as described below.

The Bank capitalizes amounts as prepaid costs for such expenditures that benefit future periods. Prepaid

costs are included in other assets and amortized over the period the Bank receives a benefit, which was

estimated to be three to ten years as of September 30, 2023. For the years ended September 30, 2023

and 2022, the Bank capitalized $55,000 and $283,668, respectively, as prepaid costs and recognized

$176,975 and $144,389, respectively, in amortization expense, included in advertising, marketing and

promotional costs.

As of September 30, 2023 and 2022, prepaid costs were $449,349 and $571,324, net of accumulated

amortization, respectively, which are recorded within “other assets.”

Off-balance sheet financial instruments – The Bank holds no derivative financial instruments.

However, in the ordinary course of business, the Bank has entered into off-balance sheet financial

instruments consisting of commitments to fund loans and extend credit and to acquire investment

securities. These financial instruments are recorded in the financial statements when they are funded or

related fees are incurred or received.

Fair value measurements – The Bank uses fair value measurements to define fair value. Fair value is

defined as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly

transaction between market participants at the measurement date.

The Bank determines fair value based upon quoted prices when available or through the use of

alternative approaches, such as matrix or model pricing, when market quotes are not readily accessible

or available. The valuation techniques used are based on observable and unobservable inputs.

Observable inputs reflect market data obtained from independent sources, while unobservable inputs

reflect the Bank’s market assumptions.

These two types of inputs create the following fair value hierarchy:

Level 1 inputs – Unadjusted quoted prices in active markets for identical assets or liabilities that the

entity has the ability to access at the measurement date.

Level 2 inputs – Inputs other than quoted prices included in Level 1 that are observable for the asset

or liability, either directly or indirectly. These might include quoted prices for similar assets and

liabilities in active markets and inputs other than quoted prices that are observable for the asset or

liability, such as interest rates and yield curves that are observable at commonly quoted intervals.

Level 3 inputs – Unobservable inputs for determining the fair values of assets or liabilities that reflect

an entity’s own assumptions about the assumptions that market participants would use in pricing the

assets or liabilities.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

15

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

The following methods and assumptions were used by the Bank in estimating fair values of assets and

liabilities for disclosure purposes:

Cash and cash equivalents – The carrying amounts of short-term instruments approximate their fair value.

Investment securities available-for-sale – Fair values for investment securities are based on quoted

market prices or the market values for comparable securities.

Restricted equity securities (FHLB) – The fair value of FHLB stock approximates redemption value.

Loans receivable and loans held-for-sale – Fair values are estimated by stratifying the loan portfolio into

groups of loans with similar financial characteristics. Loans are segregated by type, such as real estate,

commercial, and consumer, with each category further segmented into fixed and adjustable rate interest

terms.

The fair value of fixed rate loans is calculated by discounting scheduled cash flows through the

anticipated maturities adjusted for prepayment estimates. For mortgage loans held-for-sale, the Bank

uses secondary market rates in effect for loans of similar size to discount cash flows. For other fixed rate

loans, cash flows are discounted at rates currently offered for similar maturities. Adjustable interest rate

loans are assumed to approximate fair value because they generally reprice within the short-term.

Fair values are adjusted for credit risk based on assessment of risk identified with specific loans and risk

adjustments on the remaining portfolio based on credit loss experience. Assumptions regarding credit risk

are judgmentally determined using specific borrower information, internal credit quality analysis, and

historical information on segmented loan categories for nonspecific borrowers.

Bank-owned life insurance – The carrying amount approximates fair value.

Deposits – The fair value of deposits with no stated maturity, such as checking, passbook savings, and

money market accounts, is equal to the amount payable on demand. The fair value of certificates of

deposit is based on the discounted value of contractual cash flows. The discount rate is estimated using

the rates currently offered for deposits of similar maturities.

Off-balance sheet instruments – The Bank’s off-balance sheet instruments include unfunded

commitments to extend credit and borrowing facilities available to the Bank. The fair value of these

instruments is not considered practicable to estimate because of the lack of quoted market prices and the

inability to estimate fair value without incurring excessive costs.

Limitations – Fair value estimates are made at a specific point in time, based on relevant market

information and information about the financial instrument. These estimates do not reflect any premium or

discount that could result from offering for sale at one time the Bank’s entire holdings of a particular

financial instrument.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

16

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

Reclassifications – Certain account reclassifications have been made to the financial statements, when

necessary, to conform to current year presentation. These reclassifications did not affect previously

reported net income or members’ equity.

Comprehensive income (loss) – Recognized revenue, expenses, gains and losses are included in net

income (loss). Certain changes in assets and liabilities, such as unrealized gains and losses on available-

for-sale securities, are reported on a cumulative basis, net of tax effects, as a separate component of

equity on the Consolidated Balance Sheet. Changes in such items, along with net income (loss), are

components of comprehensive income (loss).

Revenue Recognition – The Bank applies Accounting Standards Codification Topic 606 (“ASC 606”) to

account for revenue from contracts with customers, which (i) creates a single framework for recognizing

revenue from contracts with customers that fall within its scope and (ii) revises when it is appropriate to

recognize a gain (loss) from the transfer of nonfinancial assets, such as OREO. The majority of the

Bank’s revenues come from interest income and other sources, including loans and investments that are

outside the scope of ASC 606. The Bank’s services that fall within the scope of ASC 606 are presented

within non-interest income and are recognized as revenue as the Bank satisfies its obligation to the

customer. Services within the scope of ASC 606 include: service charges on deposit and loan accounts.

The following revenue streams are within scope of ASC 606, while the remainder of non-interest streams

are generally out of scope.

Service charges on deposit accounts – The Bank earns fees from its members for deposit related account

maintenance and transaction-based activity. Account maintenance fees consist primarily of account fees

and analyzed account fees charged on deposit accounts on a monthly basis. The performance obligation

is satisfied and the fees are recognized on a monthly basis as the service period is completed.

Transaction-based fees are charged for specific services provided including non-sufficient funds,

overdraft transfers, and wire services. The performance obligation is satisfied as the transaction

completes resulting in the immediate recognition of the income. This also includes interchange income,

which is earned when a debit card issued by the Bank is used to purchase goods or services at a

merchant. The income earned on each transaction is determined by a combination of the transaction

amount, merchant type, and other factors. The performance obligation is satisfied and the resulting

income is earned when the transaction completes and is charged to the cardholders’ card. Accordingly,

the income is recognized in the period in which the performance obligation is satisfied.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

17

Note 1 – Organization and Summary of Significant Accounting Policies (continued)

Service charges on loan accounts – The Bank earns fees from its members for loan related account

maintenance and transaction-based activity. The bank earns various fees related to the servicing of loans

such as late payments and lines of credit fees. Loan related fees are earned as the maintenance of the

loan occurs and the actual fee is paid by the member. The performance obligation is satisfied as the

transaction completes resulting in the immediate recognition of the income. The Bank earns servicing

fees for collecting loan and escrow payments for loans that were sold to Federal Home Loan Mortgage

Corporation. The servicing fees are earned as the servicing occurs.

Subsequent events – Subsequent events are events or transactions that occur after the balance sheet

date but before the consolidated financial statements are available to be issued. The Bank recognizes in

the consolidated financial statements the effects of all subsequent events that provide additional evidence

about conditions that existed at the balance sheet date, including the estimates inherent in the process of

preparing the consolidated financial statements. The Bank’s consolidated financial statements do not

recognize subsequent events that provide evidence about conditions that did not exist at the balance

sheet date, but arose after that date and before the consolidated financial statements were available to be

issued. The Bank has evaluated subsequent events through December 6, 2023, which is the date the

consolidated financial statements became available for issuance.

Note 2 – Investment Securities

The amortized cost, gross unrealized gains and losses, and estimated fair value of available-for-sale

investment securities at September 30, 2023 are summarized below:

Gross Gross

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

U.S. Treasury securities 71,014,215$ -$ (7,316,685)$ 63,697,530$

U.S. Government agency securities 3,954,938 - (699,698) 3,255,240

74,969,153$ -$ (8,016,383)$ 66,952,770$

The amortized cost, gross unrealized gains and losses, and estimated fair value of available-for-sale

investment securities at September 30, 2022 are summarized below:

Gross Gross

Amortized Unrealized Unrealized Estimated

Cost Gains Losses Fair Value

U.S. Treasury securities 139,112,497$ -$ (10,711,927)$ 128,400,570$

U.S. Government agency securities 3,947,697 - (682,417) 3,265,280

143,060,194$ -$ (11,394,344)$ 131,665,850$

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

18

Note 2 – Investment Securities (continued)

The following table presents the gross unrealized losses and fair value of the Bank’s investment

securities, aggregated by investment category and length of time that individual securities have been in a

continuous unrealized loss position, at September 30, 2023:

Gross Gross Gross

Estimated Unrealized Estimated Unrealized Estimated Unrealized

Fair Value Losses Fair Value Losses Fair Value Losses

U.S. Treasury Securities 923,560$ (10,567)$ 62,773,970$ (7,306,118)$ 63,697,530$ (7,316,685)$

U.S. Government agency

securities - - 3,255,240 (699,698) 3,255,240 (699,698)

Totals 923,560$ (10,567)$ 66,029,210$ (8,005,816)$ 66,952,770$ (8,016,383)$

Less than 12 Months

12 Months or Greater

Totals

At September 30, 2023, 36 securities held by the Bank have unrealized losses and are considered to be

temporarily impaired investments. Temporary impairment of these securities is due to interest rate risk

associated with fixed-rate obligations. Management believes that, while actual fluctuations in unrealized

losses may occur over the life of investment securities, the temporary impairment of each investment

security in an unrealized loss position at September 30, 2023, will reverse as the individual investment

security approaches its contractual maturity date.

The following table presents the gross unrealized losses and fair value of the Bank’s investment

securities, aggregated by investment category and length of time that individual securities have been in a

continuous unrealized loss position, at September 30, 2022:

Gross Gross Gross

Estimated Unrealized Estimated Unrealized Estimated Unrealized

Fair Value Losses Fair Value Losses Fair Value Losses

U.S. Treasury securities 102,741,270$ (7,094,294)$ 25,659,300$ (3,617,633)$ 128,400,570$ (10,711,927)$

U.S. Government agency

securities - - 3,265,280 (682,417) 3,265,280 (682,417)

102,741,270$ (7,094,294)$ 28,924,580$ (4,300,050)$ 131,665,850$ (11,394,344)$

Less than 12 Months

12 Months or Greater

Totals

At September 30, 2022, 59 securities held by the Bank had unrealized losses and were considered to be

temporarily impaired investments.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

19

Note 2 – Investment Securities (continued)

The amortized cost and estimated fair value of available-for-sale investment securities by expected

maturity at September 30, 2023, are as described in the following table.

Amortized Estimated

Cost Fair Value

Due one year or less 3,017,725$ 2,885,850$

Due after one to five years 61,507,146 55,375,000

Due after five to 10 years 10,444,282 8,691,920

74,969,153$ 66,952,770$

During the year ended September 30, 2023, the Bank sold investment securities for proceeds of

$66,397,220 that resulted in gross realized losses of $2,538,174.

The Bank pledged three securities as of September 30, 2023, with an amortized cost of $7,751,686 to

secure customer deposits greater than $250,000.

Note 3 – Restricted Equity Securities (FHLB)

As a member of the FHLB system, the Bank is required to maintain a minimum level of investment in

FHLB stock based on asset size and specific percentage of its outstanding FHLB advances. As of

September 30, 2023 and 2022, the minimum stock requirements were $760,800 and $737,800,

respectively.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

20

Note 4 – Loans Receivable, Deferred Loan Fees, and Allowance for Loan Losses

The composition of loan balances at September 30 is summarized as follows:

2023 2022

Loans

Residential 1–4 family 187,169,330$ 170,154,396$

Commercial 269,923,242 244,253,584

Home equity 5,261,750 4,855,838

Consumer 1,128,638 861,084

Other 42,574 47,239

Total loans 463,525,534 420,172,140

Less

Allowance for loan losses (6,560,866) (6,867,199)

Deferred loan fees, net of costs (989,167) (869,544)

Total loans receivable, net of deferred loan fees and

allowance for loan losses 455,975,501$ 412,435,397$

The following table summarizes activity related to the allowance for loan losses by significant segments of

the loan portfolio as of and for the years ended September 30, 2023 and 2022:

Residential

1-4 Family Commercial Home Equity Consumer Other Total

Allowance

Beginning balance

2,464,170$ 4,295,878$ 53,109$ 53,355$ 687$

6,867,199$

Charge-offs - (35,333) - - - (35,333)

Recoveries - - - - - -

Provision (recapture) 177,646 (455,021) (4,617) 11,079 (88) (271,000)

Ending balance

2,641,816$ 3,805,525$ 48,492$ 64,434$ 599$ 6,560,866$

Ending balance individually

evaluated for impairment

-$ -$ -$ -$ -$ -$

Ending balance collectively

evaluated for impairment

2,641,816$ 3,805,525$ 48,492$ 64,434$ 599$ 6,560,866$

Loans

Total loans 187,169,330$ 269,923,242$ 5,261,750$ 1,128,638$ 42,574$ 463,525,534$

Ending loan balance: individually

evaluated for impairment

335,146$ 1,452,311$ -$ -$ -$ 1,787,457$

Ending loan balance: collectively

evaluated for impairment

186,834,184$ 268,470,931$ 5,261,750$ 1,128,638$ 42,574$ 461,738,077$

2023

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

21

Note 4 – Loans Receivable, Deferred Loan Fees, and Allowance for Loan Losses (continued)

Residential

1-4 Family Commercial Home Equity Consumer Other Total

Allowance

Beginning balance 2,351,247$ 4,720,466$ 48,752$ 43,515$ 3,419$ 7,167,399$

Charge-offs - - - - - -

Recoveries - - - - - -

Provision (recapture) 112,923 (424,588) 4,357 9,840 (2,732) (300,200)

Ending balance

2,464,170$ 4,295,878$ 53,109$ 53,355$ 687$ 6,867,199$

Ending balance individually

evaluated for impairment

-$ -$ -$ -$ -$ -$

Ending balance collectively

evaluated for impairment

2,464,170$ 4,295,878$ 53,109$ 53,355$ 687$ 6,867,199$

Loans

Total loans 170,154,396$ 244,253,584$ 4,855,838$ 861,084$ 47,239$ 420,172,140$

Ending loan balance: individually

evaluated for impairment

351,539$ 1,173,172$ -$ -$ -$ 1,524,711$

Ending loan balance: collectively

evaluated for impairment

169,802,857$ 243,080,412$ 4,855,838$ 861,084$ 47,239$ 418,647,429$

2022

The following table presents the loan portfolio by loan classification and credit quality indicator as of

September 30:

2023 2022 2023 2022 2023 2022

Grade

Pass 186,908,589$ 169,642,530$ 259,580,637$ 243,181,431$ 5,261,750$ 4,855,838$

Special Mention - - 8,937,560 - - -

Substandard 260,741 511,866 1,405,045 1,072,153 - -

Doubtful - - - - -

Loss - - - - - -

Total 187,169,330$ 170,154,396$ 269,923,242$ 244,253,584$ 5,261,750$ 4,855,838$

2023 2022 2023 2022 2023 2022

Grade

Pass 1,128,638$ 861,084$ 42,574$ 47,239$ 452,922,188$ 418,588,122$

Special Mention - - - - 8,937,560 -

Substandard - - - - 1,665,786 1,584,019

Doubtful - - - - - -

Loss - - - - - -

Total 1,128,638$ 861,084$ 42,574$ 47,239$ 463,525,534$ 420,172,140$

Total

Home Equity

Consumer

Residential 1-4 Family

Commercial

Other

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

22

Note 4 – Loans Receivable, Deferred Loan Fees, and Allowance for Loan Losses (continued)

The following describes the criteria by which loans are categorized by credit quality indicator:

Pass – Pass assets are well protected by the current net worth and paying capacity of the obligor or

guarantors, if any, or by the fair value, less costs to acquire and sell any underlying collateral in a timely

manner.

Special mention – A special mention asset has potential weaknesses that deserve management’s close

attention. If left uncorrected, these potential weaknesses may result in deterioration of the repayment

prospects for the asset or in the institution’s credit position at some future date. Special mention assets

are not adversely classified and do not expose an institution to sufficient risk to warrant adverse

classification.

Substandard – A substandard asset is inadequately protected by the current sound worth and paying

capacity of the obligor or by the collateral pledged, if any. Assets so classified must have a well-defined

weakness, or weaknesses that jeopardize the liquidation of the debt. They are characterized by the

distinct possibility that the institution will sustain some loss if the deficiencies are not corrected.

Doubtful – An asset classified as doubtful has all the weaknesses inherent in one classified substandard

with the added characteristic that the weaknesses make collection or liquidation in full, on the basis of

currently known facts, conditions, and values, highly questionable and improbable.

Loss – An asset, or portion thereof, classified as loss is considered uncollectible and of such little value

that its continuance on the Bank’s books as an asset, without establishment of a specific valuation

allowance or charge-off, is not warranted. This classification does not necessarily mean that an asset has

no recovery or salvage value; but rather, there is much doubt about whether, how much, or when the

recovery would occur. As such, it is not practical or desirable to defer the write off.

The following table provides an aging analysis of the Bank’s loans as of September 30:

Recorded

Greater Loans on Investment >

30-59 Days 60-89 Days Than Total Past

Nonaccrual

90 Days and

Past Due Past Due 90 Days Due Current Total Status Accruing

Residential 1-4 family 39,693$ -$ -$ 39,693$

187,129,637$

187,169,330$

260,741$

-$

Commercial - - 120,367 120,367

269,802,875

269,923,242

331,160

-

Home equity - - - -

5,261,750

5,261,750

-

-

Consumer - - - -

1,128,638

1,128,638

-

-

Other - - - -

42,574

42,574

-

-

Total 39,693$ -$ 120,367$ 160,060$ 463,365,474$ 463,525,534$ 591,901$ -$

Residential 1-4 family -$ 46,012$ -$ 46,012$

170,108,384$

170,154,396$

511,866$

-$

Commercial - - - -

244,253,584

244,253,584

-

-

Home equity - - - -

4,855,838

4,855,838

-

-

Consumer - - - -

861,084

861,084

-

-

Other - - - -

47,239

47,239

-

-

Total -$ 46,012$ -$ 46,012$ 420,126,129$ 420,172,140$ 511,866$ -$

2023

2022

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

23

Note 4 – Loans Receivable, Deferred Loan Fees, and Allowance for Loan Losses (continued)

The following table summarizes impaired loan information by significant segment of the loan portfolio as

of and for the years ended September 30, 2023 and 2022:

Unpaid Average Interest

Recorded Principal Related Recorded Income

Investment Balance Allowance Investment Recognized

With no related allowance recorded

Residential 1-4 family 335,146$ 342,258$ -$ 341,035$ 15,786$

Commercial 1,452,311 1,532,279 - 1,519,838 77,137

Total impaired loans

Residential 1-4 family 335,146 342,258 - 341,035 15,786

Commercial 1,452,311 1,532,279 - 1,519,838 77,137

Total

1,787,457$ 1,874,537$ -$ 1,860,873$ 92,923$

With no related allowance recorded

Residential 1-4 family 351,539$ 358,282$ -$ 355,825$ 15,887$

Commercial 1,173,172 1,235,667 - 1,191,436 75,184

Total impaired loans

Residential 1-4 family 351,539 358,282 - 355,825 14,887

Commercial 1,173,172 1,235,667 - 1,191,436 75,184

Total

1,524,711$ 1,593,949$ -$ 1,547,261$ 90,071$

2023

2022

The Bank offers a variety of modifications to borrowers as troubled debt restructurings. The modification

categories offered can generally be described in the following categories:

Rate modification – A modification in which the interest rate is changed.

Term modification – A modification in which the maturity date, timing of payments, or frequency of

payments is changed.

Interest only modification – A modification in which the loan is converted to interest only payments for a

period of time.

Payment modification – A modification in which the dollar amount of the payment is changed, other than

an interest only modification described above.

Combination modification – Any other type of modification, including the use of multiple categories above.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

24

Note 4 – Loans Receivable, Deferred Loan Fees, and Allowance for Loan Losses (continued)

There was one troubled debt restructuring during the year ended September 30, 2023.The following table

presents the troubled debt restructured by type of modification that occurred during the year ended

September 30, 2023 and 2022:

Number of Pre Post Number of Pre Post

Contracts Modification Modification Contracts Modification Modification

Payment modification

Residential 1 212,969 212,969 1 239,365 239,365

1 212,969 212,969 1 239,365 239,365

2023

2022

Troubled debt restructurings that are on accrual and nonaccrual status as of September 30, 2023 and

2022 were as follows:

Accrual Nonaccrual

Status Status

Residential 1-4 family 335,967$ -$

Commercial 1,121,453 210,792

1,457,420$ 210,792$

Residential 1-4 family 112,174$ 239,365$

Commercial 1,173,172 -

1,285,346$ 239,365$

2023

2022

During the years ended September 30, 2023 and 2022, there were no troubled debt restructured loans for

which there was a payment default within a period of 12 months following the restructure.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

25

Note 5 – Mortgage Loans Serviced for Others

Mortgage loans serviced for others are not included in the accompanying consolidated balance sheets.

The unpaid principal balances of these loans at September 30 are summarized as follows:

2023 2022

Mortgage loan portfolios serviced for

Federal Home Loan Mortgage Corporation 146,953,705$ 158,334,892$

Assets, liabilities, revenues, and expenses recognized by the Bank that relate to loans serviced for others

as of and for the years ended September 30, include the following:

2023 2022

Mortgage servicing asset (included in "other assets") 231,461$ 397,512$

Mortgage servicing revenues (included in "service charges

on loan accounts") 381,886 418,132

Mortgage servicing asset amortization expense (included in

"other expense") 170,630 295,054

Custodial escrow balances held for others (included in

"advance payments by borrowers for taxes and

insurance") 1,581,048 1,434,971

Note 6 – Property and Equipment

Property and equipment at September 30 are summarized as follows:

2023 2022

Land 9,417,819$ 9,417,819$

Buildings and improvements 27,124,327 21,919,629

Equipment and furniture 3,445,377 3,049,250

39,987,523 34,386,698

Less accumulated depreciation (16,881,136) (15,859,705)

23,106,387 18,526,993

Construction in progress 7,189 1,348,992

Property and equipment, net of accumulated

depreciation 23,113,576$ 19,875,985$

Depreciation expense of $1,057,581 and $907,529 was recognized for the years ended September 30,

2023 and 2022, respectively.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

26

Note 7 – Deposits

Deposit accounts at September 30 consist of the following:

Total Weighted Average Total Weighted Average

Deposits Interest Rate Deposits Interest Rate

Savings accounts 179,625,377$ 0.18% 237,841,126$ 0.04%

Interest-bearing demand 170,417,551 0.60% 200,018,814 0.21%

Time certificates 91,750,589 3.18% 43,977,705 0.82%

Noninterest-bearing demand 53,684,670 - 61,357,355 -

Money market accounts 28,902,744 0.87% 34,805,780 0.07%

Total deposits 524,380,931$ 578,000,780$

2023

2022

As of September 30, 2023, the scheduled maturities of time certificates of deposit were as follows:

2024 82,966,404$

2025 5,875,449

2026 876,112

2027 489,110

2028 242,171

Thereafter 1,301,343

91,750,589$

Years ending September 30,

Time certificates of deposit of $250,000 or more aggregated to $26,283,130 and $8,098,391 at

September 30, 2023 and 2022, respectively.

Interest expense on all deposit accounts is summarized as follows for the years ended September 30:

2023 2022

Time certificates 1,622,013$ 373,889$

Savings accounts 215,957 41,066

Demand deposits 872,437 121,262

Money market accounts 198,098 19,210

Total interest expense on deposits 2,908,505$ 555,427$

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

27

Note 8 – Borrowing Facilities and Note Payable

As a member of the FHLB, the Bank has entered into an “Advances, Security and Deposit Agreement”

which provides for a credit arrangement. Borrowings under the credit arrangement are collateralized by

the Bank’s FHLB stock, the Bank’s deposits at the FHLB, and other instruments, which may be pledged.

The Bank had a blanket pledge of loans collateralizing its FHLB borrowing arrangement totaling

$387,248,215 at September 30, 2023. Term and overnight advances under the FHLB agreement are

limited to 45% of the Bank’s assets. The maximum total borrowing available from the FHLB was

$234,701,675 at September 30, 2023.

The Bank also maintains an overnight line of credit facility with the Federal Reserve Bank of San

Francisco. Advances are secured by commercial real estate loans. Interest is charged daily on advances

at an amount set by the Federal Reserve Bank’s Board of Governors (5.50% at September 30, 2023).

The Bank also has an unsecured overnight line of credit with US Bank. Available borrowing capacity for

overnight line of credit accounts was $12,281,931 at September 30, 2023. No borrowings were

outstanding under these facilities at September 30, 2023.

During fiscal 2017, the Bank purchased a building and land with a down payment of $200,000 and an

installment note payable of $1,800,000. The note requires payments of $200,000 on the first business

day of January each year and matures January 1, 2026. The interest rate was 4.00% per annum for the

first five years. The note had a one-time rate adjustment on June 1, 2022 which was below the floor of

4.00% so the interest rate will remain at 4.00% per annum for the remaining term of the note. The note

payable is collateralized by the building, and may be prepaid at any time by the agreement of both parties

and is callable by the lender by giving the Bank a 30-day advance notice. The outstanding balance on the

note payable was $600,000 and $800,000 at September 30, 2023 and 2022, respectively.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

28

Note 9 – Income Taxes

The following is a summary of income tax expense:

2023 2022

Current taxes

Federal expense 700,764$ 881,880$

State expense 159,168 323,901

859,932 1,205,781

Deferred taxes

Federal (benefit) (37,400) 223,300

State (benefit) 37,400 23,400

- 246,700

Provision for income taxes 859,932$ 1,452,481$

The nature and components of deferred tax assets and liabilities as of September 30 are as follows:

2023 2022

Deferred tax assets

Allowance for loan loss 1,865,088$ 1,808,316$

Unrealized losses on investment securities 2,148,879 3,054,379

Non-accrual interest 2,214 477

Deferred compensation 213,374 205,720

Other 4,183 12,362

Total deferred tax assets 4,233,738 5,081,254

Deferred tax liabilities

Accumulated depreciation (750,565) (683,443)

Stock dividends (101,698) (101,698)

Prepaids and other (58,905) (69,652)

Loan fees (23,366) (21,758)

Total deferred tax liabilities (934,534) (876,551)

Net deferred tax assets 3,299,204$ 4,204,703$

There were no valuation allowances offsetting deferred tax assets as of September 30, 2023 and 2022,

because management believes that it is more likely than not that the Bank’s deferred tax assets will be

realized by offsetting future taxable income with reversing taxable differences and through anticipated

future operating income.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

29

Note 9 – Income Taxes (continued)

An analysis of the variations from the expected statutory tax rates and the effective tax rates is as follows:

Amount Percent Amount Percent

Tax expense at federal

statutory rate 742,753$ 21.00% 1,170,471$ 21.00%

State tax, net of federal

tax benefit 218,488 6.18 339,317 6.09

Bank-owned life insurance (78,764) (2.23) (68,214) (1.22)

Other (22,545) (0.64) 10,907 0.06

Income tax expense 859,932$ 26.07% 1,452,481$ 26.29%

2023

2022

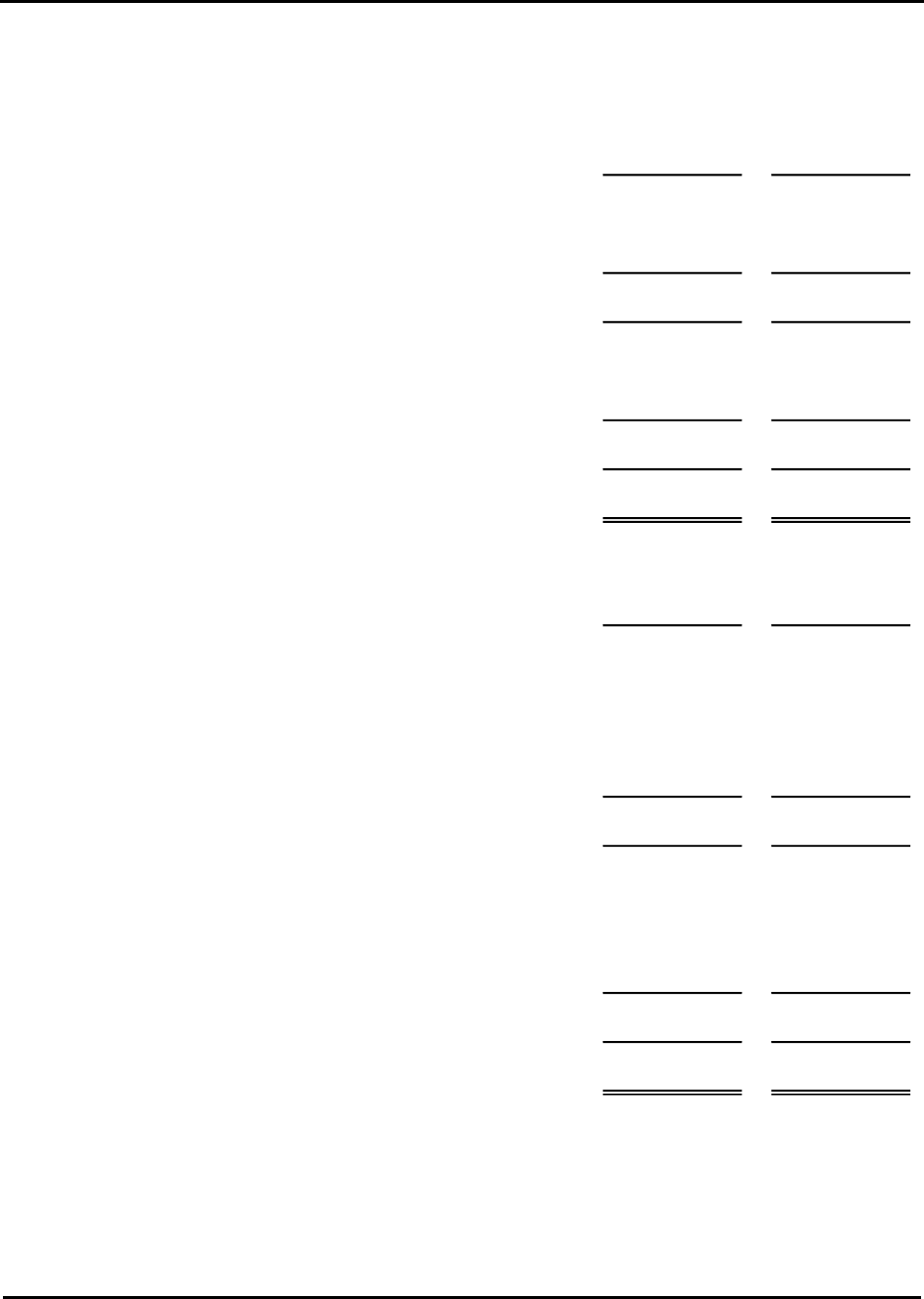

Note 10 – Regulatory Capital Requirements

The Bank is subject to various regulatory capital requirements administered by federal banking agencies.

Failure to meet minimum capital requirements can initiate certain mandatory – and possibly additional

discretionary – actions by regulators that, if undertaken, could have a direct material effect on the Bank’s

consolidated financial statements. Under capital adequacy guidelines and the regulatory framework for

prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative

measures of its assets, liabilities, and certain off-balance sheet items as calculated under regulatory

accounting practices. The Bank’s capital amounts and classifications are also subject to qualitative

judgments by the regulators about components, risk weightings, and other factors.

The federal banking agencies issued the Community Bank Leverage Ratio (CBLR) Framework which

allows qualified institutions to opt into the CBLR framework in place of the risk-based capital guidelines.

The CBLR framework provides a simple measure of capital adequacy for certain qualifying community

banking organizations. Evergreen opted into CBLR framework effective January 1, 2020. Management

believes, as of September 30, 2023 and 2022 that the Bank meets all capital adequacy requirements to

which it is subject.

The most recent notification from the Office of the Comptroller of the Currency categorized the Bank as

well-capitalized under the regulatory framework for prompt corrective action. Management believes that

the Bank continues to maintain its well-capitalized status as of September 30, 2023.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

30

Note 10 – Regulatory Capital Requirements (continued)

Actual

Amount Ratio Amount Ratio

As of September 30, 2023

(dollars in thousands)

Community Bank 73,945$ 12.14% 54,813$ >9.0 %

Leverage Ratio

Core Capital 73,945$ 12.14% 54,813$ >9.0 %

As of September 30, 2022

(dollars in thousands)

Community Bank 71,268$ 10.96% 58,527$ >9.0%

Leverage Ratio

Core Capital 71,268$ 10.96% 58,527$ >9.0%

Framework

Well-Capitalized

under the CBLR

Note 11 – Retirement and Incentive Compensation Plans

The Bank contributes to a simplified employee pension plan with individual participant accounts for each

employee who meets certain criteria relative to age and length of service. Contributions, which are at the

discretion of the Board of Directors, are for amounts of up to 15% of includable compensation for eligible

participants. Contributions to the plan were $878,288 and $899,649 for the years ended September 30,

2023 and 2022, respectively.

The Bank also has incentive compensation plans established by the Board of Directors for executives and

employees. Under these plans, incentive compensation is established and allocated to eligible employees

based on certain performance criteria. At the Board’s discretion, key executives are also granted one-time

bonuses based upon performance. During the years ended September 30, 2023 and 2022, $242,651 and

$553,183, respectively, were charged to expense pursuant to these incentive compensation plans.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

31

Note 11 – Retirement and Incentive Compensation Plans (continued)

The Bank has purchased bank-owned life insurance (BOLI) to support split-dollar life insurance

arrangements it has made with certain key employees. Some of these arrangements provide for death

benefits only during employment, to be split between the Bank and an employee’s named beneficiaries,

and some of these arrangements provide for death benefits to be made available to an employee’s

named beneficiaries continuing after retirement. For those arrangements that provide for a post-

retirement death benefit, the Bank recognizes current service cost and accrues an obligation on its

balance sheet within accrued expenses and other liabilities. As of September 30, 2023 and 2022, the

Bank accrued $97,123 and $90,155 respectively, for this obligation.

Note 12 – Other Expenses

Other expenses included in noninterest expense included the following for the years ended

September 30:

2023 2022

Deposit Insurance Fund Assessment 254,239$ 168,230$

EFT/ATM expense 180,817 264,248

Mortgage servicing rights amortization 170,630 295,054

Postage and shipping expense 152,349 149,098

Audit and accounting services 136,540 142,500

Mortgage loan and appraisal expense 135,889 182,078

Donations 111,268 116,401

Assessment expenses 104,132 131,415

Checking and savings administrative costs 99,171 79,282

Stationary, printing, and office supplies 80,109 66,935

Other expenses 704,135 511,138

2,129,278$ 2,106,380$

Note 13 – Commitments and Contingencies

Financial instruments with off-balance sheet risk – The Bank is a party to financial instruments with

off-balance sheet risk in the normal course of business to meet the financing needs of its customers.

These financial instruments include commitments to fund loans, commitments to extend credit and

acquire investment securities, construction loans in progress, and the issuance of letters of credit. These

instruments involve, to varying degrees, elements of credit and interest rate risk which have not been

recognized in the consolidated balance sheets. All financial instruments held or issued by the Bank are

held or issued for purposes other than trading.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

32

Note 13 – Commitments and Contingencies (continued)

The Bank’s exposure to credit loss in the event of nonperformance by the other party to the financial

instrument for commitments to fund loans, commitments to extend credit and acquire investment

securities, construction loans in progress, and letters of credit written is represented by the contractual

notional amount of those instruments. The Bank uses the same credit policies in making commitments

and conditional obligations as it does for on-balance sheet instruments. Management does not anticipate

any material loss as a result of these transactions.

The following summarizes the Bank’s off-balance sheet commitments as of September 30, 2023:

Contract or

Notional Amount

Financial instruments whose contract amounts

contain credit risk

Commitments to fund other loans 12,551,800$

Commitment to fund unused lines of credit 20,377,988

Commitments to extend credit on construction loans 28,975,970

Standby letters of credit 930,011

62,835,769$

Commitments to fund loans, commitments to extend credit, and construction loans in progress are

agreements to lend to a customer as long as there is no violation of any condition established in the loan

contract or agreement. Commitments generally have fixed expiration dates or other termination clauses

and may require payment of a fee. Since many of the commitments are expected to expire without being

drawn upon, total commitment amounts do not necessarily represent future cash requirements. The Bank

evaluates each customer’s creditworthiness on a case-by-case basis. The amount of collateral obtained,

if deemed necessary by the Bank upon funding of loans or extensions of credit, is based on

management’s credit evaluation of the customer. Collateral held varies but consists primarily of real

estate.

Letters of credit written are conditional commitments issued by the Bank to guarantee the performance of

a customer to a third party. Those guarantees are primarily issued to support public and private borrowing

arrangements, including commercial papers, bond financing, and similar transactions. The credit risk

involved in issuing letters of credit is essentially the same as that involved in extending loan facilities to

customers. The Bank holds cash, marketable securities, or real estate as collateral supporting those

commitments for which collateral is deemed necessary.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

33

Note 13 – Commitments and Contingencies (continued)

Operating lease commitments – The Bank leases certain property to a non-related third party under a

non-cancellable lease agreement. The lease, which was set to expire March 6, 2019, allows for the tenant

to exercise a renewal option for four successive terms of five years and requires a base monthly payment

calculated at the greater of $10,000 or 6% of net sales. The Bank has renewed the lease for an additional

term through March 2024. Minimum total future rental income expected from this commitment is as

follows:

Years ending September 30, 2024 51,935$

Total minimum payment to be received 51,935$

Employment Agreements – The Bank has entered into employment agreements with certain members

of executive management that require payments in the event of certain contingencies. Until such events

occur, no accrual of such amounts is required.

Legal contingencies – The Bank may become a defendant in certain claims and legal actions arising in

the ordinary course of business. In the opinion of management, after consultation with legal counsel,

there are no matters presently known to the Bank that are expected to have a material adverse effect on

the consolidated financial condition of the Bank.

Note 14 – Fair Value Measurements

Assets measured on a nonrecurring basis are assets that, due to an event or circumstance, were required

to be re‐measured at fair value after initial recognition in the financial statements at some time during the

reporting period. There were no assets measured on a nonrecurring basis that were re-measured for the

years ended September 30, 2023 and 2022, respectively.

The following disclosures are made of fair value information about financial instruments where it is

practicable to estimate that value. In cases where quoted market values are not available, the Bank

primarily uses present value techniques to estimate the fair values of its financial instruments. Valuation

methods require considerable judgment, and the resulting estimates of fair value can be significantly

affected by the assumptions made and methods used. Accordingly, the estimates provided herein do not

necessarily indicate amounts which could be realized in a current market exchange.

In addition, as the Bank normally intends to hold the majority of its financial instruments until maturity, it

does not expect to realize many of the estimated amounts disclosed. The disclosures also do not include

estimated fair value amounts for items which are not defined as financial instruments but which have

significant value.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

34

Note 14 – Fair Value Measurements (continued)

The following fair value measurements exclude certain financial instruments and all non-financial

instruments. Any aggregation of the fair value amounts presented in the following table would not

represent the underlying value of the Bank. The carrying amount and estimated fair value of financial

instruments as of September 30 is summarized as follows (in thousands):

Carrying Fair Carrying Fair

Amount Value Amount Value

Financial assets

Cash and cash equivalents 29,516,003$ 29,516,003$ 58,970,676$ 58,970,676$

Investment securities 66,952,770 66,952,770 131,665,850 131,665,850

Restricted equity securities 760,800 760,800 737,800 737,800

Loans held-for-sale - - 273,377 273,377

Loans receivable 463,525,534 374,020,000 420,172,140 395,989,000

Financial liabilities

Checking, savings, and money

market accounts 432,630,342 432,630,342 534,023,075 534,023,000

Time certificates of deposit 91,750,589 91,026,000 43,977,705 42,464,000

2023

2022

Note 15 – Concentrations of Credit Risk

Most of the Bank’s lending activity is with customers located within the markets it serves in southern

Oregon. The majority of such customers are also depositors of the Bank. The Bank originates first

mortgage, home equity, consumer, and commercial loans. The distribution of commitments to extend

credit approximates the distribution of loans outstanding. Generally, loans are secured by real estate,

personal property, and deposit accounts. Rights to collateral vary and are legally documented and

enforceable to the extent practicable. Although the Bank has a diversified loan portfolio, local economic

conditions may affect borrowers’ ability to meet the stated repayment terms.

The Bank maintains balances in correspondent bank accounts that at times may exceed federally insured

limits. Management believes that its risk of loss associated with such balances is minimal due to the

financial strength of the correspondent banks.

Evergreen Federal Bank and Subsidiary

Notes to Financial Statements

35

Note 16 – Related-Party Transactions

The Bank has purchased various products and services owned by various directors. Total amounts paid

were $87,078 and $74,318 for the years ended September 30, 2023 and 2022, respectively.

Certain directors and executive officers are also customers of and have had banking transactions with the

Bank in the ordinary course of business, and the Bank expects to have such transactions in the future. All

loans and commitments to loan included in such transactions are made in compliance with applicable

laws on substantially the same terms (including interest rates and collateral) as those prevailing at the

time for comparable transactions with other persons, and in the opinion of the management of the Bank,

do not involve more than the normal risk of collection or present any other unfavorable features. The

amount of loans outstanding to directors, executive officers, and companies with which they are

associated was as follows:

2023 2022

BALANCE, beginning of year 490,934$ 178,279$

Loans made 10,646 406,885

Loans repaid (72,159) (94,230)

BALANCE, end of year 429,421$ 490,934$

Directors’ and senior officers’ deposit accounts at September 30, 2023 and 2022 were $7,076,148 and

$5,410,971, respectively.

The amount of loan commitments outstanding to directors, executive officers, and companies with which

they are associated was $100,000 and $92,100 at September 30, 2023 and 2022.