For a century, our mission hasFor a century, our mission has

been in absolute focus:been in absolute focus:

DECEMBER 31, 2022

Annual Report

Full Service Community Bank Since 1922

Celebrating 100 Years

Celebrating 100 YearsCelebrating 100 YearsCelebrating 100 Years

2022 ANNUAL REPORT CONTENTS

6 Helping People, Changing Lives

7 Financial Highlights

12 Selected Consolidated Financial & Other Data

14 Management’s Discussion and Analysis of Financial Condition

and Results of Operations

33 Report of Elliott Davis, LLC

35 Consolidated Balance Sheets

36 Consolidated Statements of Income

37 Consolidated Statements of Comprehensive (Loss) Income

38 Consolidated Statements of Changes in Shareholders’ Equity

39 Consolidated Statements of Cash Flows

41 Notes to Consolidated Financial Statements

76 Shareholders Information

77 Board of Directors

78 Bank Advisory Board

79 Management Team

80 Branch Locations

81 New Broad Street Branch

Security Federal Corporation (the “Company”), the holding company for Security

Federal Bank (the “Bank”), is pleased to announce earnings and nancial results

for the quarter and year ended December 31, 2022.

Quarterly net income increased $1.3 million, or 62.2%, to $3.3 million, or $1.01 per

common share, for the fourth quarter of 2022 compared to $2.0 million, or $0.62

per common share, for the fourth quarter of 2021. The increase in net earnings

was primarily attributable to an increase in net interest income, as the increase

in interest income exceeded the increase in interest expense. The increase in net

interest income was partially offset by a decrease in non-interest income.

Net income was $10.2 million, or $3.14 per common share, for 2022 compared to

$12.8 million, or $3.93 per common share, during the year ended December 31,

2021 (the “prior year”). The decrease in net income was primarily due to a decline

in non-interest income when compared to the prior year. Also contributing to

the decrease in net earnings was the release of $2.4 million in loan loss reserves

during 2021 following signi cantly higher loan loss provisions recorded in 2020

in response to the potential and unknown economic impact of the ongoing

COVID-19 pandemic.

Security Federal Corporation

Announces Fourth Quarter

and

Annual Earnings

Celebrating 100 Years

Celebrating 100 YearsCelebrating 100 YearsCelebrating 100 Years

On May 24, 2022, the Company entered into a Letter Agreement with the U.S. Department of Treasury under the Emergency

Capital Investment Program (“ECIP”). Established by the Consolidated Appropriations Act, 2021, the ECIP was created

to encourage low- and moderate-income community nancial institutions and minority depository institutions to provide

loans, grants, and forbearance for small businesses, minority-owned businesses, and consumers, especially low-income and

underserved communities, including persistent poverty counties, that may be disproportionately impacted by the economic

effect of the COVID-19 pandemic by providing direct and indirect capital investments in low- and moderate-income community

nancial institutions. Pursuant to the Agreement, the Company agreed to issue and sell 82,949 shares of the Company’s

Preferred Stock as Senior Non-Cumulative Perpetual Preferred Stock, Series ECIP (the “Preferred Stock”) for an aggregate

purchase price of $82.9 million in cash.

In light of our continued protability, Security Federal Corporation, parent company of Security Federal Bank, is pleased to

announce that a quarterly dividend of $0.13 per share was paid on or about March 15, 2023, to shareholders of record as of

February 28, 2023. This is the one hundred twenty-ninth consecutive quarterly dividend to shareholders since the Bank’s

conversion in October of 1987 from a mutual to a stock form of ownership. The dividend was declared as a result of the Bank’s

continued protability.

For additional information contact Darrell Rains, Chief Financial Ocer, at (803) 641-3000.

Balance Sheet Highlights

and Capital Management

>>

Total assets increased $80.2 million, or

6.2%, during the year to $1.4 billion at

December 31, 2022.

>>

Net loans receivable increased $50.4 million,

or 10.1%, during the year to $549.9 million

at December 31, 2022.

>>

Investment securities increased $11.2 million,

or 1.6%, during the year to $717.6 million.

>>

Total deposits decreased $5.9 million,

or 0.5%, during the year to $1.1 billion at

December 31, 2022.

>>

Common equity book value per share was

$23.76 at December 31, 2022, compared to

$35.51 at December 31, 2021. The decrease is

the result of a decrease in accumulated other

comprehensive income, net of tax, related to

the unrecognized loss in value of investment

securities during 2022.

4 | www.securityfederalbank.com 2022 Annual Report | 5

Timothy W. Simmons

CHAIRMAN

Roy G. Lindburg

PRESIDENT

Dollars in thousands

(except per share amounts)

Dec. 31, 2022 Sept. 30, 2022 Dec. 31, 2021

Total assets $1,381,366 $1,357,981 $1,301,214

Cash and cash equivalents 28,502 20,068 27,623

Total loans receivable, net * 549,917 523,094 499,497

Investment securities 717,586 729,519 706,356

Deposits 1,110,085 1,118,817 1,115,963

Borrowings 103,323 73,964 61,940

Total shareholders' equity 160,233 156,596 115,523

Common shareholders' equity 77,284 73,647 115,523

Common equity book value per share $23.76 $22.64 $35.51

Total risk based capital to risk

weighted assets

1

19.03% 19.11% 18.65%

CET1 capital to risk weighted assets

1

17.78% 17.86% 17.39%

Tier 1 leverage capital ratio

1

10.41% 10.32% 9.87%

* Includes PPP loans of $12,000 at 12/31/2022, $55,000 at 9/30/2022 and $9.8 million at 12/31/2021.

(1) - Ratio is calculated using Bank only information and not consolidated information

Fourth Quarter Comparative

Financial Highlights

>>

Net interest income increased $2.3 million,

or 25.9%, to $11.0 million.

>>

Total non-interest income decreased

$495,000, or 18.7%, to $2.1 million.

>>

Total non-interest expense decreased

$18,000, or 0.2%, to $8.9 million.

Quarter Ended

Year Ended

(Dollars in Thousands, except for Earnings per Share) December 31, 2022 December 31, 2021

Total interest income $13,197 $9,634

Total interest expense 2,231 924

Net interest income 10,966 8,710

Reversal of provision for loan losses - (134)

Net interest income after reversal of provision

for loan losses

10,966 8,844

Non-interest income 2,149 2,642

Non-interest expense 8,924 8,942

Income before income taxes 4,191 2,544

Provision for income taxes 902 516

Net income $3,289 $2,028

Earnings per common share (basic) $1.01 $0.62

Full Year Comparative

Financial Highlights

>>

Net interest income increased $4.3

million, or 12.8%, to $37.6 million

when compared to the prior year

primarily due to the increase in

interest income on investment

securities.

>>

Non-interest income decreased $3.0

million, or 23.9%, to $9.6 million

primarily due to decreases in gain on

sale of loans and grant income.

>>

Non-interest expense increased

$2.2 million or 6.8% to $34.2 million

primarily due to increases in salary

expense and other miscellaneous

non-interest expenses.

(Dollars in Thousands, except for Earnings per Share) December 31, 2022 December 31, 2021

Total interest income $42,578 $37,117

Total interest expense 5,028 3,824

Net interest income 37,550 33,293

Reversal of provision for loan losses - (2,404)

Net interest income after reversal of provision

for loan losses

37,550 35,697

Non-interest income 9,612 12,633

Non-interest expense 34,225 32,047

Income before income taxes 12,937 16,283

Provision for income taxes 2,709 3,509

Net income $10,228 $12,774

Earnings per common share (basic) $3.14 $3.93

Credit Quality Highlights

>>

The Bank recorded no provision for loan

losses during 2022 compared to a negative

provision of $2.4 million during 2021. The

negative provision in 2021 resulted from a

reduction in qualitative adjustment factors

due to the improvement in the economic and

business conditions at both the national and

regional levels as of December 31, 2021.

>>

Non-performing assets were $6.4 million, or

1.15% of gross loans, at December 31, 2022,

compared to $2.8 million, or 0.56% of gross

loans, at December 31, 2021.

>>

Allowance for loan losses as a percentage of

gross loans was 2.00% at December 31, 2022,

compared to 2.19% at December 31, 2021.

At Period End (Dollars in thousands)

Dec. 31, 2022 Sept. 30, 2022 Dec.31, 2021

Non-performing assets $6,421 $2,800 $2,813

Non-performing assets to gross loans 1.15% 0.53% 0.56%

Allowance for loan losses $11,178 $11,299 $11,087

Allowance to gross loans 2.00% 2.12% 2.19%

(Dollars in thousands)

Quarter Ended Year Ended

Dec. 31, 2022 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2021

Reversal of provision for loan losses $- $(134) $- $(2,404)

Net charge-offs (recoveries) $121 $(49) $(91) $(648)

We proudly celebrated our 100-year anniversary in 2022 marking a signi cant milestone for Security

Federal Bank. We were founded in 1922 as Aiken Building and Loan Association and grew slowly to

include several name changes—Security Federal Savings and Loan Association (1962), Security Federal

Savings Bank of South Carolina (1986), and Security Federal Bank (1996).

We began branching into other markets in 2000 with our rst branch in the Midlands. We opened our

rst Georgia branch in 2007. Our 18th branch was opened in Spring Valley (Columbia) in early 2022. We

will be opening our 19th branch in downtown Augusta in the spring of this year.

Our name changed several times and the bank has grown steadily, but our commitment to community

banking has remained constant. That commitment means helping people by “rolling up our sleeves”

and partnering with them to nd ways to meet their needs. We understand that many of their needs

require more than a one-time, transactional solution. Customers often need skilled professionals with

patience to work through the daily challenges of life. That culture of patience, understanding and

advocacy in overcoming hurdles has enabled Security Federal to steadily grow and build a reputation

that ts our tagline, Helping People…Changing Lives.

The Bank’s earnings were solid enabling us to increase our dividend this year. Notable for 2022 is the

award of approximately $83 million from the U.S. Treasury under its Emergency Capital Investment

Program to Security Federal to invest in underserved markets. The award complements our community

development programs that have helped our customers and communities over the years. We remain

especially proud of our Community Reinvestment Act (CRA) rating of Outstanding.

J. Chris Verenes

CHAIRMAN & CEO

SECURITY FEDERAL BANK

Philip R. Wahl, II

PRESIDENT

SECURITY FEDERAL BANK

2022 2021

TOTAL INTEREST INCOME

$42,578,000 $37,117,000

TOTAL INTEREST EXPENSE

5,028,000 3,824,000

NET INTEREST INCOME BEFORE

PROVISION FOR LOAN LOSSES

37,550,000 33,293,000

REVERSAL OF PROVISION

FOR LOAN LOSSES

- (2,404,000)

NET INTEREST INCOME AFTER

REVERSAL OF PROVISION FOR

LOAN LOSSES

37,550,000 35,697,000

NET INCOME AVAILABLE TO

COMMON SHAREHOLDERS

10,228,000 12,774,000

EARNINGS PER COMMON SHARE- BASIC

$3.14 $3.93

TOTAL BOOK VALUE PER

COMMON SHARE

$23.76 $35.51

AVERAGE INTEREST RATE SPREAD

2.89% 2.87%

NET INTEREST MARGIN

3.03% 2.97%

TOTAL LOANS ORIGINATED AND

RENEWED

557,075,000 518,396,000

FOR THE YEARS ENDED DECEMBER 31,

6 | www.securityfederalbank.com 2022 Annual Report | 7

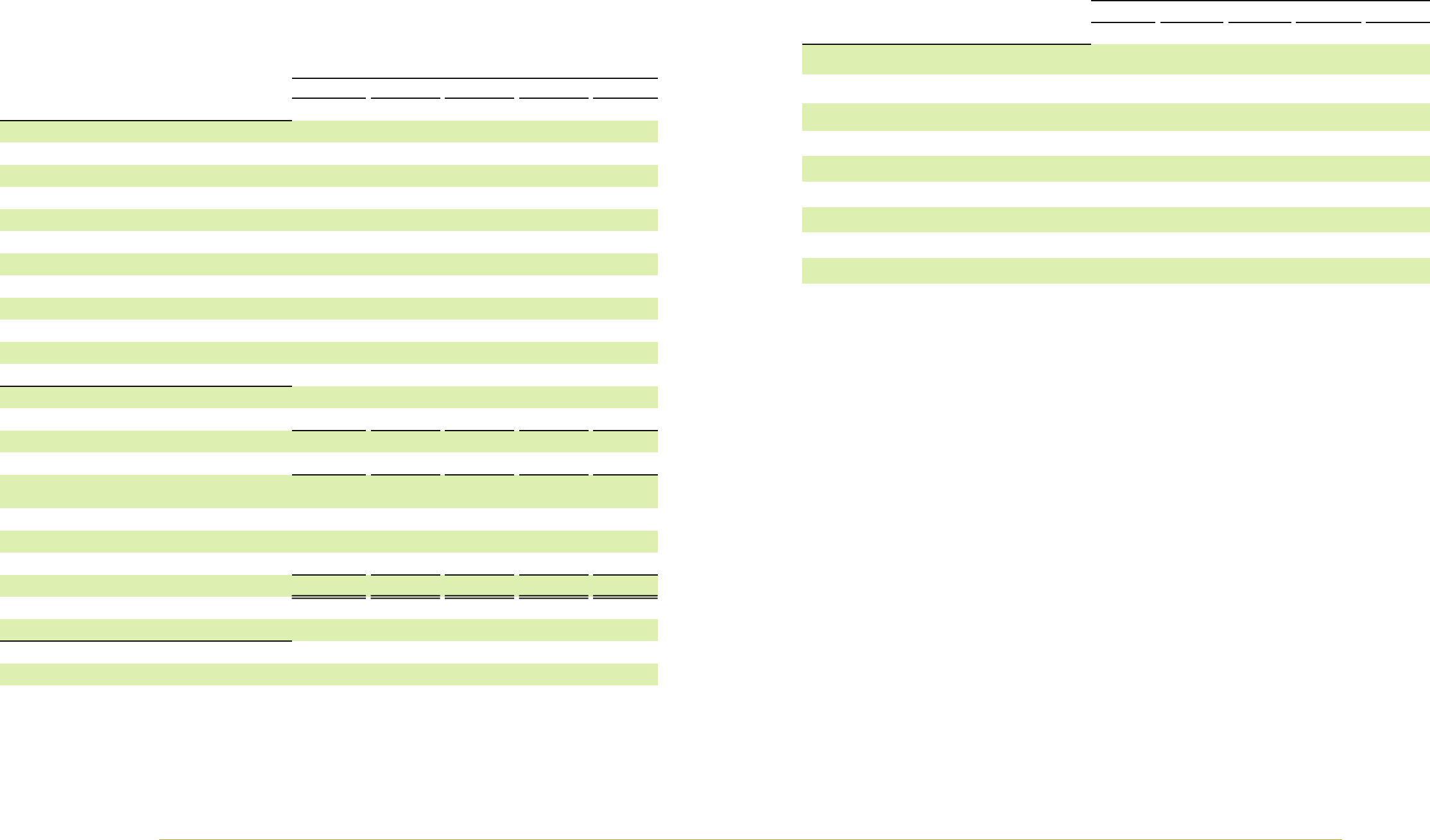

Financial Highlights

$7,051$7,207 $7,794

$1,172$913 $963

6.81%9.30% 8.90%

$12,774

$1,301

11.20%

2.19%2.64%

$10,228

$1,381

11.39%

2.00%2.10% 2.01%

$13,000

$12,000

$11,000

$10,000

$9,000

$8,000

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

Financial Highlights

For graphs related to earnings, all periods presented

are twelve month periods ending as of the dates indicated.

$12,000

$11,000

$10,000

$9,000

$8,000

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

8 | www.securityfederalbank.com 2022 Annual Report | 9

Net Income

Available

to Common

Shareholders

(IN THOUSANDS)

Total Assets

(IN MILLIONS)

Return

on Common

Equity

Allowances

for Loan

Losses

DEC. 2021DEC. 2018 DEC. 2019 DEC. 2020 DEC. 2022

DEC. 2021DEC. 2018 DEC. 2019 DEC. 2020 DEC. 2022

DEC. 2021DEC. 2018 DEC. 2019 DEC. 2020 DEC. 2022

DEC. 2021DEC. 2018 DEC. 2019 DEC. 2020 DEC. 2022

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

12%

10%

8%

6%

4%

2%

0%

3.5%

3.0%

2.5%

2.0%

1.5%

1.0%

0.5%

0.0%

$40

$35

$30

$25

$20

$15

$10

$5

$0

$25

$20

$15

$10

$5

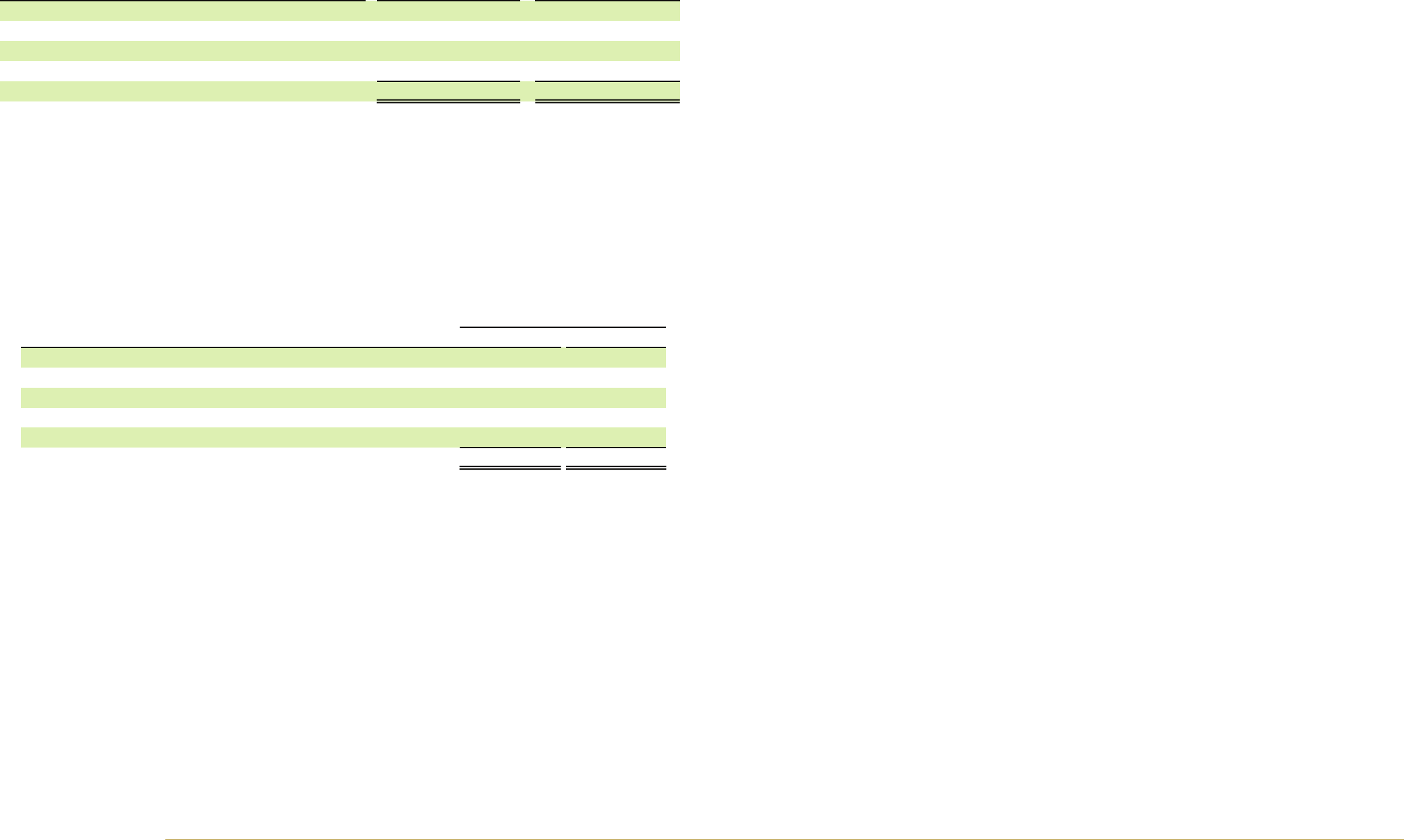

Book Value Per

Common Share

Earnings

Per Common

Share – Basic

Security

Federal

Corporation

Stock Prices

$21.67

$20.26

$21

$23

$24.25

$24.75

$23

$15.50

$9.86

$10.92

$9

$8.10

$11.75

$17.50

$21.25

$31.30

$28.30

$35

$30

$32

$25.45

$35

$35.51 $34.40 $23.76$27.26 $31.01

DEC. 2022DEC. 2021DEC. 2018 DEC. 2019 DEC. 2020

DEC. 2022DEC. 2021DEC. 2018 DEC. 2019 DEC. 2020

MARCH ‘02

MARCH ‘03

MARCH ‘04

MARCH ‘05

MARCH ‘06

MARCH ‘07

MARCH ‘08

MARCH ‘09

MARCH ‘10

MARCH ‘11

MARCH ‘12

DEC. ‘12

DEC. ‘13

DEC. ‘14

DEC. ‘15

DEC. ‘16

DEC. ‘17

DEC. ‘18

DEC. ‘19

DEC. ‘20

DEC. ‘21

DEC. ‘22

$3.93 $2.19 $3.14$2.44 $2.64

$4.00

$3.50

$3.00

$2.50

$2.00

$1.50

$1.00

$.50

$0

$35

$30

$25

$20

$15

$10

$5

$0

$3.9

$1.5

$0.8

$1.7

$13.0

$12.0

$11.0

$10.0

$9.0

$8.0

$7.0

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

0

$12.0

$11.0

$10.0

$9.0

$8.0

$7.0

$6.0

$5.0

$4.0

$3.0

$2.0

$1.0

Capital Ratios

Security

Federal Bank

20222021

$1.5

$0.7

$0.3

$1.3

$2.3

$1.0

$0.6

$1.8

$0.5

$0.7

$0.8

$1.1

$1.7

$2.5

$1.7

$0.5

$0.6

$3.5

$2.6

$1.1

$1.3

2018

10.4%

9.8%

9.9%

LEVERAGE

17.8%

18.6%

17.4%

TIER 1 RISK BASED

19.0%

19.9%

18.7%

TOTAL RISK BASED

2019 2020

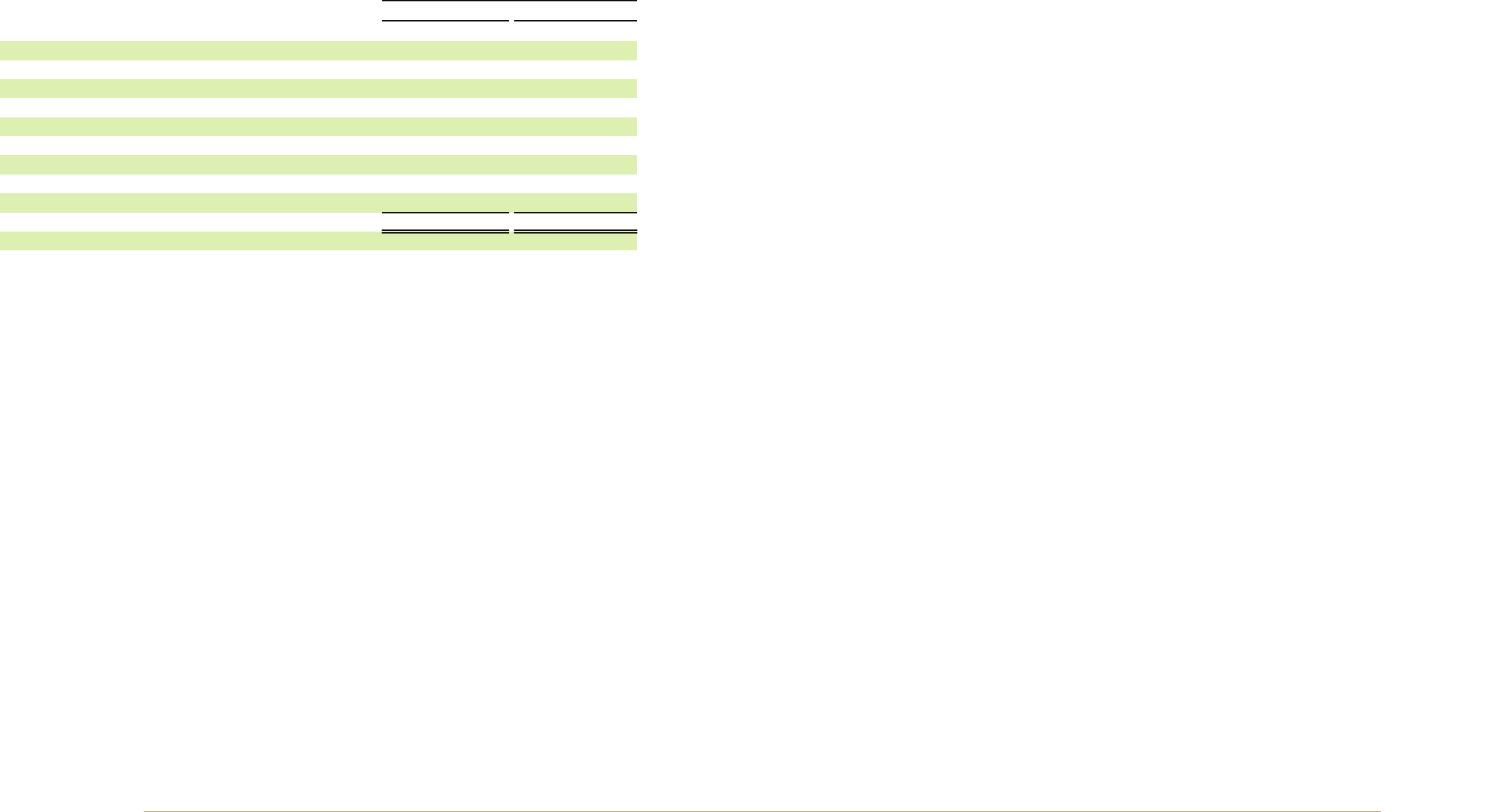

$600

$500

$400

$300

$200

$100

$0

$650

$600

$550

$500

$450

$400

$350

$300

$250

$200

$150

$100

$50

$0

$600

$500

$400

Total Loans

Held for

Investment

(IN MILLIONS)

Checking

and Savings

Deposits

(IN MILLIONS)

ALL OTHER LOANS

PERSONAL CHECKING

PPP LOANS

COMMERCIAL CHECKING

SAVINGS

2021

DEC. 2021

$441.0

$214.9

$157.2

$74.4

$47.1

2018

DEC. 2018

2019

DEC. 2019

2020

2021

2022

Non-Interest

Income

(IN MILLIONS)

GAIN ON SALE OF LOANS

DEPOSIT & CHECK CARD FEES

GAIN ON INVESTMENTS

TRUST FEES

INSURANCE AGENCY

GRANT INCOME

OTHER

$437.7

$92.7

$126.8

$48.4

$458.6 $549.9

$130.0

$130.1

$51.1

2020

DEC. 2020

2022

DEC. 2022

$499.9

$309.8 $309.0

$185.7 $202.0

$97.1 $108.2

$9.8

10 | www.securityfederalbank.com

$1.5 $1.5

$1.8

$0.2

$3.4

$1.4

$0.6

$3.8

2022 Annual Report | 11

20%

16%

12%

8%

4%

16%

12%

8%

Non-Interest Income 2018 2019 2020 2021 2022

GAIN ON SALE OF LOANS $1,250,530 $1,728,741 $3,508,397 $3,836,411 $1,704,904

DEPOSIT & CHECK CARD FEES 2,345,113 2,518,886 2,624,499 3,427,149 3,886,873

TRUST FEES 974,000 1,061,200 1,138,007 1,438,727 1,548,433

GAIN ON INVESTMENTS 573,266 819,053 1,332,666 - (2,211)

INSURANCE AGENCY 682,367 674,991 643,414 610,097 784,182

GRANT INCOME 343,078 478,049 519,712 1,826,265 170,699

OTHER 1,500,792 1,816,223 1,654,438 1,494,602 1,519,210

Financial Highlights

12 | www.securityfederalbank.com 2022 Annual Report | 13

The following tables provide selected consolidated financial and operating data of Security Federal Corporation at and for the

years indicated. In conjunction with the data provided in the following tables and in order to more fully understand our

historical consolidated financial and operating data, you should also read our “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” and our Consolidated Financial Statements and the accompanying notes

included in this report.

At and For the Year Ended December 31,

2022 2021 2020 2019 2018

Balance Sheet Data at End of Period

(Dollars in Thousands, Except Per Share Data)

Total Assets $ 1,381,366 $ 1,301,214 $ 1,171,710 $ 963,228 $ 912,614

Cash and Cash Equivalents 28,502 27,623 18,025 12,536 12,706

Certificates of Deposit with Other Banks 1,100 1,100 350 950 1,200

Investment Securities 717,586 706,356 607,579 433,892 409,894

Total Loans Receivable, Net

(1)

549,917 499,497 479,167 452,859 430,054

Deposits 1,110,085 1,115,963 918,096 771,407 767,497

Advances From Federal Home Loan Bank ("FHLB") — — 35,000 38,138 34,030

Borrowings from Federal Reserve Bank ("FRB") 44,080 — 48,700 — —

Total Shareholders' Equity 160,233 115,523 111,906 91,758 80,518

Common Shareholders' Equity 77,284 115,523 111,906 91,758 80,518

Income Data

Total Interest Income $ 42,578 $ 37,117 $ 37,096 $ 36,934 $ 33,072

Total Interest Expense 5,028 3,824 6,581 8,311 5,449

Net Interest Income 37,550 33,293 30,515 28,623 27,623

(Reversal of) Provision for Loan Losses — (2,404) 3,600 375 925

Net Interest Income After (Reversal of) Provision for

Loan Losses 37,550 35,697 26,915 28,248 26,698

Non-Interest Income 9,612 12,633 11,421 9,097 7,669

Non-Interest Expense 34,225 32,047 29,708 27,871 25,590

Income Taxes 2,709 3,509 1,577 1,680 1,570

Net Income $ 10,228 $ 12,774 $ 7,051 $ 7,794 $ 7,207

Per Common Share Data

Net Income Per Common Share (Basic) $ 3.14 $ 3.93 $ 2.19 $ 2.64 $ 2.44

Cash Dividends Per Share $ 0.76 $ 0.44 $ 0.40 $ 0.40 $ 0.36

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

1

Year Ended December 31,

2022 2021 2020 2019 2018

Other Data

Average Interest Rate Spread

2.89 %

2.87 % 2.91 % 3.10 % 3.27 %

Net Interest Margin

(Net Interest Income / Average Earning Assets)

3.03 %

2.97 % 3.04 % 3.26 % 3.38 %

Average Interest-Earning Assets to

Average Interest-Bearing Liabilities

134.63 %

128.62 % 120.99 % 116.83 % 116.01 %

Common Equity to Total Assets

5.59 %

8.88 % 9.55 % 9.53 % 8.82 %

Non-Performing Assets to Total Assets

(2)

0.46 %

0.22 % 0.31 % 0.43 % 0.85 %

Return on Assets

0.75 %

1.04 % 0.63 % 0.80 % 0.81 %

Return on Common Equity

11.39 %

11.20 % 6.81 % 8.90 % 9.30 %

Average Common Equity to Average Assets Ratio

6.63 %

9.27 % 9.32 % 9.05 % 8.69 %

Dividend Payout Ratio on Common Shares

(3)

24.17 %

11.20 % 18.46 % 14.41 % 14.76 %

Number of Full-Service Offices

18

17 17 17 16

(1) INCLUDES LOANS HELD FOR SALE

(2) NON-PERFORMING ASSETS CONSIST OF NON-ACCRUAL LOANS AND OTHER REAL ESTATE OWNED ("OREO")

(3) RATIO OF DIVIDENDS PAID ON COMMON SHARES TO NET INCOME AVAILABLE TO COMMON SHAREHOLDERS

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Selected Consolidated Financial and Other Data

2

14 | www.securityfederalbank.com 2022 Annual Report | 15

General

The following discussion and analysis is presented to provide the reader with an understanding of the financial condition and

the results of operations of Security Federal Corporation and its subsidiaries. The investment and other activities of the parent

company, Security Federal Corporation (the “Company”), have had no significant impact on the results of operations for the

periods presented in the Consolidated Financial Statements included herein. Because we conduct all of our material business

operations through Security Federal Bank (the "Bank"), a wholly owned subsidiary of the Company, the following discussion

of financial results are primarily indicative of the activities of the Bank. The Bank was founded in 1922 as a mutual building

and loan association. In 1987, the Bank converted to a federally chartered stock savings bank. On December 28, 2011, the Bank

completed a charter conversion from a federally chartered stock savings bank to a South Carolina chartered commercial bank.

In connection with this transaction, the Company reorganized from a savings and loan holding company into a bank holding

company.

The Bank has three wholly owned subsidiaries: Security Federal Investments, Inc. ("SFINV"), Security Federal Insurance, Inc.

(“SFINS”) and Security Financial Services Corporation (“SFSC”). SFINV was formed to hold investment securities and allow

for better management of the securities portfolio. SFINS is an insurance agency offering auto, business, and home

insurance. Effective April 30, 2022, Collier Jennings Financial Corporation, a wholly owned subsidiary of SFINS, and its

subsidiaries, Security Federal Auto Insurance, The Auto Insurance Store Inc., and Security Federal Premium Pay Plans Inc.

("SFPPP") and its wholly owned premium finance subsidiary were dissolved. SFPPP’s ownership interests in four other

premium finance subsidiaries were disposed of at an immaterial gain. Additionally, effective April 30, 2022, previously

inactive SFSC was dissolved.

In addition to the Bank, the Company has another wholly owned subsidiary, Security Federal Statutory Trust (the “Trust”),

which issued and sold fixed and floating rate capital securities of the Trust. Under current accounting guidance, however, the

Trust is not consolidated in the Company’s financial statements. Unless the context indicates otherwise, references to the

"Company," "we," "us," and "our" shall include Security Federal Corporation, the Bank and the Bank's subsidiaries.

The principal business of the Bank is accepting deposits from the general public and originating consumer and commercial

business loans as well as mortgage loans that enable borrowers to purchase or refinance one-to-four family residential real

estate. The Bank also originates construction loans on single-family residences, multi-family dwellings, and commercial real

estate, as well as loans for the acquisition, development and construction of residential subdivisions, and commercial projects.

The Bank also provides trust services and it offers property and casualty insurance products through its subsidiary, SFINS.

The Bank's net income depends primarily on its interest rate spread which is the difference between the average yield earned on

its loan and investment portfolios and the average rate paid on its deposits and borrowings. When the rate earned on interest-

earning assets equals or exceeds the rate paid on interest-bearing liabilities, this positive interest rate spread will generate net

interest income. The Bank’s interest spread is influenced by interest rates, deposit flows, and loan demands. Levels of non-

interest income and operating expense are also significant factors in earnings.

Forward-Looking Statements

This document, including information incorporated by reference herein, may contain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to our financial condition, results of

operations, plans, objectives, future performance or business. Forward-looking statements are not statements of historical fact,

are based on certain assumptions and are generally identified by use of the words "believes," "expects," "anticipates,"

"estimates," "forecasts," "intends," "plans," "targets," "potentially," "probably," "projects," "outlook" or similar expressions or

future or conditional verbs such as "may," "will," "should," "would" and "could." Forward-looking statements include

statements with respect to our beliefs, plans, objectives, goals, expectations, assumptions and statements about, among other

things, expectations of the business environment in which we operate, projections of future performance or financial items,

perceived opportunities in the market, potential future credit experience, and statements regarding our mission and vision.

These forward-looking statements are based upon current management expectations and may, therefore, involve risk and

uncertainties.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

14

Our actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-

looking statements as a result of a wide variety or range of factors, including, but not limited to:

• potential adverse impacts to economic conditions in our local market areas, other markets where the Company has lending

relationships, or other aspects of the Company's business operations or financial markets, generally, resulting from the

ongoing novel coronavirus of 2019 (“COVID-19”) and any governmental or societal responses thereto;

• the credit risks of lending activities, including changes in the level and trend of loan delinquencies and write-offs and

changes in our allowance for loan losses and provision for loan losses that may be affected by deterioration in the housing

and commercial real estate markets which may lead to increased losses and non-performing assets in our loan portfolio,

and may result in our allowance for loan losses not being adequate to cover actual losses, and require us to materially

increase our allowance for loan losses;

• changes in general economic conditions, either nationally or in our market areas;

• changes in the levels of general interest rates, and the relative differences between short and long term interest rates,

deposit interest rates, our net interest margin and funding sources;

• the transition away from London Interbank Offered Rate ("LIBOR") toward new interest rate benchmarks;

• fluctuations in the demand for loans, the number of unsold homes, land and other properties and fluctuations in real estate

values in our market areas;

• secondary market conditions for loans and our ability to originate and sell loans in the secondary market;

• results of examinations of the Company by the Board of Governors of the Federal Reserve System ("Federal Reserve")

and the Bank by the Federal Deposit Insurance Corporation ("FDIC") and the South Carolina State Board of Financial

Institutions, or other regulatory authorities, including the possibility that any such regulatory authority may, among other

things, require us to increase our reserve for loan losses, write-down assets, change our regulatory capital position or

affect our ability to borrow funds or maintain or increase deposits, or impose additional requirements or restrictions on us,

any of which could adversely affect our liquidity and earnings;

• legislative or regulatory changes that adversely affect our business, including changes in banking, securities and tax law,

and in regulatory policies and principles, or the interpretation of regulatory capital or other rules, and including changes as

a result of COVID-19;

• our ability to attract and retain deposits;

• our ability to control operating costs and expenses;

• our ability to implement our business strategies;

• the use of estimates in determining the fair value of certain of our assets, which estimates may prove to be incorrect and

result in significant declines in valuation;

• difficulties in reducing risks associated with the loans on our balance sheet;

• staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our workforce

and potential associated charges;

• disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information

technology systems or on the third-party vendors who perform several of our critical processing;

• our ability to retain key members of our senior management team;

• costs and effects of litigation, including settlements and judgments;

• our ability to manage loan delinquency rates;

• increased competitive pressures among financial services companies;

• changes in consumer spending, borrowing and savings habits;

• the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions;

• our ability to pay dividends on our common stock;

• adverse changes in the securities markets;

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

15

16 | www.securityfederalbank.com 2022 Annual Report | 17

• inability of key third-party providers to perform their obligations to us;

• changes in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the

Financial Accounting Standards Board ("FASB"), including additional guidance and interpretation on accounting issues

and details of the implementation of new accounting methods;

• other economic, competitive, governmental, regulatory, and technological factors affecting our operations, pricing,

products and services; and

• the other risks described elsewhere in this annual report to shareholders and in the Company's other filings with the

Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2022

("2022 Form 10-K").

Some of these and other factors are discussed in the 2022 Form 10-K under Item 1A, “Risk Factors.” Such developments could

have an adverse impact on our financial condition and results of operations.

Any of the forward-looking statements that we make may turn out to be inaccurate as a result of our beliefs and assumptions we

make in connection with the factors set forth above or because of other unidentified and unpredictable factors. Because of these

and other uncertainties, our actual future results may be materially different from the results indicated by these forward-looking

statements and you should not rely on such statements. The Company undertakes no obligation to publish revised forward-

looking statements to reflect the occurrence of unanticipated events or circumstances after the date hereof. These risks could

cause our actual results for 2023 and beyond to differ materially from those expressed in any forward-looking statements by or

on behalf of us, and could negatively affect the Company’s consolidated financial condition and consolidated results of

operations, liquidity and stock price performance.

Critical Accounting Estimates

We prepare our consolidated financial statements in accordance with GAAP. In doing so, we have to make estimates and

assumptions. Our critical accounting estimates are those estimates that involve a significant level of uncertainty at the time the

estimate was made, and changes in the estimate that are reasonably likely to occur from period to period, or use of different

estimates that we reasonably could have used in the current period, would have a material impact on our financial condition or

results of operations.

Accordingly, actual results could differ materially from our estimates. We base our estimates on past

experience and other assumptions that we believe are reasonable under the circumstances, and we evaluate these estimates on

an ongoing basis. We have reviewed our critical accounting estimates with the audit committee of our Board of Directors.

The significant accounting policies of the Company are described in Note 1 of the Notes to the Consolidated Financial

Statements included herein.

The Company believes the allowance for loan losses is a critical accounting policy that requires the most significant judgments,

estimates and assumptions used in preparation of the Consolidated Financial Statements. The impact of an unexpected large

loss could deplete the allowance and potentially require increased provisions to replenish the allowance, which would

negatively affect earnings. The Company provides for loan losses using the allowance method. Accordingly, all loan losses are

charged to the related allowance and all recoveries are credited to the allowance for loan losses. Additions to the allowance for

loan losses are provided by charges to operations based on various factors, which, in management’s judgment, deserve current

recognition in estimating possible losses. Such factors considered by management include the fair value of the underlying

collateral, stated guarantees by the borrower (if applicable), the borrower’s ability to repay from other economic resources,

growth and composition of the loan portfolio, the relationship of the allowance for loan losses to the outstanding loans, loss

experience, delinquency trends, and general economic conditions. Management evaluates the carrying value of the loan

portfolio monthly and adjusts the allowance accordingly. While management uses the best information available to make

evaluations, future adjustments may be necessary if economic conditions differ substantially from the assumptions used in

making these evaluations. The allowance for loan losses is subject to periodic evaluations by bank regulatory agencies that may

require adjustments to the allowance based upon the information that is available at the time of their examination. For a further

discussion of the Company’s estimation process and methodology related to the allowance for loan losses, see the discussion

under the section entitled “Financial Condition” and “Comparison of the Years Ended December 31, 2022 and 2021-Provision

for Loan Losses” included herein.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

16

The Company values an impaired loan at the loan’s fair value if it is probable that the Company will be unable to collect all

amounts due according to the contractual terms of the original loan agreement. Impaired loans are measured at the present value

of expected cash flows, the market price of the loan, if available, or the value of the underlying collateral. Expected cash flows

are required to be discounted at the loan’s effective interest rate. When the ultimate collectability of an impaired loan’s

principal is in doubt, wholly or partially, all payments received are applied to principal. Once the recorded principal balance

has been reduced to zero, any additional payments received are applied to interest income to the extent that any interest has

been foregone. Any additional payments received are recorded as recoveries of any amounts previously charged off. When the

repayment of the loan is not in doubt, payments are applied under the contractual terms of the loan agreement first to interest

and then to principal.

The Company uses assumptions and estimates in determining income taxes payable or refundable for the current year, deferred

income tax liabilities and assets for events recognized differently in its financial statements and income tax returns, and income

tax expense. Determining these amounts requires analysis of certain transactions and interpretation of tax laws and regulations.

The Company exercises considerable judgment in evaluating the amount and timing of recognition of the resulting tax liabilities

and assets. These judgments and estimates are reevaluated on a continual basis as regulatory and business factors change.

No assurance can be given that either the tax returns submitted by the Company or the income tax reported on the Consolidated

Financial Statements will not be adjusted by either adverse rulings by the United States Tax Court, changes in the tax code, or

assessments made by the Internal Revenue Service.

Asset and Liability Management

The objective of the Bank’s program of asset and liability management is to limit the Bank’s vulnerability to material and

prolonged increases or decreases in interest rates, or "interest rate risk." As a financial institution, interest rate risk is the Bank's

most significant market risk. The earnings and economic value of our shareholders’ equity varies in relation to changes in

interest rates and the corresponding impact on the market values of our assets and liabilities. The Bank has an Asset Liability

Management Committee (“ALCO”) who monitors the Bank’s asset liability strategy.

The asset/liability management process is designed to achieve relatively stable net interest margins and assure liquidity by

coordinating the volumes, maturities or re-pricing opportunities of interest-earning assets, deposits and borrowed funds. It is the

responsibility of the ALCO to determine and achieve the most appropriate volume and mix of interest-earning assets and

interest-bearing liabilities, as well as ensure an adequate level of liquidity and capital, within the context of corporate

performance goals. The ALCO meets regularly to review interest rate risk and liquidity in relation to present and potential

market conditions and evaluate funding and balance sheet management strategies to ensure the level of risk is consistent with

our asset/liability objectives.

Simulation is the principal tool used by the Bank in its ongoing effort to measure interest rate risk. Simulation involves the use

of a financial modeling system that provides reports showing the current and future impact of changes in interest rates and our

strategies and tactics. The Bank uses two dynamic methods: net interest income (“NII”) simulation and economic value of

equity (“EVE”) analysis. The NII simulation models the impact that changes in interest rates will have on our earnings while

EVE analysis models the impact those changes will have on the net present value of our asset and liability portfolios. These

models take into account our contractual agreements with regard to investments, loans, deposits and borrowings, and also

include assumptions surrounding market and customer behavior under different rate scenarios. The assumptions we use are

based upon a combination of proprietary and market data that reflect historical results and current market conditions. These

assumptions relate to interest rates, prepayments, deposit decay rates and the market value of certain assets and liabilities under

the various interest rate scenarios. We use market data to determine prepayments and maturities of loans, investments and

borrowings and use our own assumptions on deposit decay rates except for time deposits. Time deposits are modeled to reprice

to market rates upon their stated maturities. We also assume that non-maturity deposits can be maintained with rate adjustments

not directly proportionate to the change in market interest rates, based upon our historical deposit rates. We have demonstrated

in the past that the tiering structure of our deposit accounts during changing rate environments results in relatively lower

volatility and less than market rate changes in our interest expense for deposits. These assumptions are based upon our analysis

of our customer base, competitive factors and historical experience.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

17

18 | www.securityfederalbank.com 2022 Annual Report | 19

While these models are dependent on the accuracy of the assumptions that underlie the process, we believe that such modeling

provides a better illustration of our sensitivity to interest rate risk than does a traditional static gap analysis. These tools provide

our ALCO with the capability to estimate and manage the amount of earnings at risk in future periods and in selected interest

rate risk environments.

NII Simulation- The Bank’s primary focus is on NII simulation. Using NII simulation, the Bank measures earnings exposure

over both a 12 and 24 month period under multiple instantaneous rate shock scenarios. The Bank’s policy provides the

maximum acceptable negative impact on net interest income and return on assets ("ROA") over each time horizon associated

with each respective change in interest rates. Our ALCO monitors compliance with these policy limits and reports them to the

Board of Directors quarterly.

The following table indicates the NII simulation scenarios modeled and the applicable policy parameters.

Change in

Market Rates

Maximum Allowable Change in

NII Over

Maximum Allowable Change in

ROA Over

(in Basis Points) 12 Months 24 Months 12 Months 24 Months

400 (20)% (20)% (40)% (40)%

300 (15)% (15)% (30)% (30)%

200 (10)% (10)% (20)% (20)%

100 (7.5)% (7.5)% (10)% (10)%

— —% —% —% —%

(100) (7.5)% (7.5)% (10)% (10)%

(200) (10)% (10)% (20)% (20)%

(300) (15)% (15)% (30)% (30)%

(400) (20)% (20)% (40)% (40)%

The Bank performs a liquidity analysis, a component of managing liquidity risk and monitoring the Bank's asset liability

strategy. This analysis compares outstanding sources of liquidity to applicable policy parameters. The Bank was in compliance

with policy parameters as of December 31, 2022 and 2021. In addition, the Bank performs a Contingency Funding plan analysis

which incorporates various simulations in order to evaluate Bank's funding resources under stressed conditions. Both the

liquidity and Contingency Funding plan analysis are performed by the Bank's ALCO and presented to the Board of Directors

quarterly.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

18

EVE simulation- The EVE analysis serves as an indicator of the extent to which the present value of our capital could change,

given potential changes in interest rates. The difference represented by the present value of assets minus the present value of

liabilities is defined as the economic value of equity. This measure assumes a static balance sheet and does not incorporate any

growth assumptions, but does assume loan prepayments and certain other cash flows occur. It provides a measure of rate risk

extending beyond the 12 or 24 month time horizon contained in the NII simulation analyses.

While an instantaneous and severe shift in interest rates is used in this analysis to provide an estimate of exposure under an

extremely adverse scenario, a gradual shift in interest rates would have a much more modest impact. Since EVE measures the

discounted present value of cash flows over the estimated lives of instruments, the change in EVE does not directly correlate to

the degree that earnings would be impacted over a shorter time horizon, i.e., the next fiscal year. Further, EVE does not take

into account factors such as future balance sheet growth, changes in product mix, change in yield curve relationships, and

changing product spreads that could mitigate the adverse impact of changes in interest rates.

The following table indicates the EVE simulation scenarios modeled and the applicable policy parameters.

Change in Market Rates

(In Basis Points)

Maximum Change in

Economic Value of Equity

400 (40)%

300 (30)%

200 (20)%

100 (10)%

— —%

(100) (10)%

(200) (20)%

(300) (30)%

(400) (40)%

In evaluating the Bank's exposure to interest rate risk, certain shortcomings inherent in the method of analysis described above

are considered. No assurance can be given that changing economic conditions and other relevant factors impacting our net

interest income will not cause actual occurrences to differ from underlying assumptions. For example, loan repayment rates and

withdrawals of deposits will likely differ substantially from the assumptions used in the simulation models in the event of

significant changes in interest rates due to the option of borrowers to prepay their loans and the ability of depositors to

withdraw funds prior to maturity. In addition, this analysis does not consider any strategic changes to our balance sheet which

management may consider as a result of changes in market conditions.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

19

20 | www.securityfederalbank.com 2022 Annual Report | 21

Financial Condition - Assets

Total assets increased $80.2 million or 6.2% to $1.4 billion at December 31, 2022 from $1.3 billion at December 31,

2021. This increase was primarily due to increases in held to maturity ("HTM") investment securities, net loans receivable and,

to a lesser extent other assets, partially offset by a decrease in available for sale ("AFS") investment securities.

Cash and cash equivalents increased $879,000 or 3.2% to $28.5 million at December 31, 2022 compared to $27.6 million at

December 31, 2021. Total investment securities increased $11.2 million or 1.6% to $717.6 million at December 31, 2022 from

$706.4 million at December 31, 2021 as purchases of investments exceeded maturities, sales and principal paydowns during the

year. The Company purchased $210.3 million of investment securities during the year ended December 31, 2022 compared to

$217.6 million during the prior year and sold $22.4 million of AFS investment securities during the year ended December 31,

2022 compared to no sales during 2021.

Loans receivable, net, including loans held for sale, increased $50.4 million or 10.1% to $549.9 million at December 31, 2022

from $499.5 million at December 31, 2021 primarily due to increases in construction, residential mortgage and commercial real

estate loans. In addition, home equity lines of credit ("HELOCs") and other consumer loans also increased while commercial

and agricultural loans decreased during 2022 compared to 2021.

Construction loans increased $12.6 million or 12.6% to $112.8 million at December 31, 2022 from $100.2 million at

December 31, 2021. Residential mortgage loans held for investment increased $25.1 million or 29.5% to $110.1 million at

December 31, 2022 from $85.0 million at December 31, 2021. Commercial real estate loans increased $24.4 million or 10.7%

to $252.2 million at December 31, 2022 from $227.8 million at December 31, 2021.

Commercial and agricultural loans decreased $14.1 million or 31.4% to $30.6 million at December 31, 2022 from $44.7 million

at December 31, 2021.

HELOCs increased $3.1 million or 10.9% to $31.7 million at December 31, 2022 from $28.6 million at December 31, 2021.

Other consumer loans increased $2.2 million or 10.0% to $23.6 million at December 31, 2022 from $21.4 million at

December 31, 2021.

Loans held for sale, comprised of fixed rate residential loans, decreased $3.1 million or 77.4% to $913,000 at December 31,

2022 from $4.0 million at December 31, 2021. Typically, long term, newly originated fixed rate residential real estate loans are

not retained in the portfolio but are sold immediately in contrast to adjustable rate mortgage ("ARM") loans, which are

generally retained in the portfolio. The Bank sells all its fixed rate residential loans on a service-released basis. Fixed rate

residential loans sold to institutional investors, on a service-released basis totaled $48.5 million during the year ended

December 31, 2022, $112.9 million during the year ended December 31, 2021 and $111.1 million during the year ended

December 31, 2020.

Property and equipment, net increased $2.8 million or 10.8% to $28.0 million at December 31, 2022 from $25.2 million at

December 31, 2021 due to capital costs related to branch improvements and construction of the Bank's newest branch.

Other assets increased $14.0 million or 267.2% to $19.2 million at December 31, 2022 from $5.2 million at December 31,

2021. The increase was primarily the result of a $14.6 million increase in net deferred taxes, which was related to increased

unrealized losses in the AFS investment securities.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

20

Financial Condition - Non-Performing Assets

The Bank’s non-performing assets, which consist of non-accrual loans and OREO, increased $3.6 million or 127.3% to $6.4

million at December 31, 2022 from $2.8 million at December 31, 2021. Non-performing assets represented 0.5% and 0.2% of

total assets at December 31, 2022 and 2021, respectively.

At December 31, 2022 At December 31, 2021 $ %

(Dollars in thousands) Amount Percent

(1)

Amount Percent

(1)

Change Change

Non-Performing Loans:

Construction $ 115 0.02 % $ 21 — % $ 94 447.6 %

Residential Mortgage 1,545 0.28 1,389 0.28 156 11.2

Commercial Real Estate 4,282 0.76 1,057 0.21 3,225 305.1

Commercial and Agricultural 113 0.02 64 0.01 49 76.6

HELOC 189 0.03 142 0.03 47 33.1

Other Consumer 29 0.01 9 — 20 222.2

Total Non-Performing Loans 6,273 1.12 % 2,682 0.53 % 3,591 133.9 %

Other Non-Performing Assets:

OREO 120 0.02 % 130 0.03 % (10) (7.7) %

Total Non-Performing Assets

$ 6,393 1.14 % $ 2,812 0.56 % $ 3,581 127.3 %

Total Non-Performing Assets as a

Percentage of Total Assets 0.46 % 0.22 %

(1) PERCENT OF GROSS LOANS RECEIVABLE HELD FOR INVESTMENT, NET OF DEFERRED FEES AND LOANS IN PROCESS.

Non-performing loans increased in all loan categories during 2022 compared to 2021. The largest increase in non-performing

loans was in the commercial real estate loan category, which increased $3.2 million or 305.1% to $4.3 million at December 31,

2022 from $1.1 million at December 31, 2021. The balance in non-performing commercial real estate loans consisted of three

loans to three borrowers with an average loan balance of $1.1 million at December 31, 2022 compared to eight loans to six

borrowers with an average loan balance of $151,000 at December 31, 2021.

Non-performing residential loans, which represented the second largest category of non-performing loans, increased $156,000

or 11.2% to $1.5 million at December 31, 2022 from $1.4 million at December 31, 2021. Non-performing residential mortgage

loans at December 31, 2022 consisted of 16 loans to 16 borrowers with an average loan balance of $97,000, the largest of which

was $250,000, compared to 12 loans to 12 borrowers with an average loan balance of $116,000, the largest of which was

$274,000, at December 31, 2021.

Our strategy is to work with our borrowers to reach acceptable payment plans while protecting our interests in the underlying

collateral. In the event an acceptable arrangement cannot be reached, we may have to acquire these properties through

foreclosure or other means and subsequently sell, develop, or liquidate them.

The balance of loans classified as troubled debt restructurings ("TDRs") decreased $309,000 or 44.5% during the year ended

December 31, 2022. The Bank had two TDRs totaling $385,000 at December 31, 2022 compared to three TDRs

totaling $694,000 at December 31, 2021. At both December 31, 2022 and 2021, all TDRs were non-accruing. All TDRs are

reviewed for impairment loss and included in impaired loans until paid off. TDR loans can be classified as either accrual or

non-accrual. TDR loans are classified as non-accrual loans unless they have been performing in accordance with their modified

terms for a period of at least six months in which case they are placed on accrual status. At December 31, 2022, the Bank had

$5.6 million of impaired loans, including $385,000 in TDRs, compared to $2.3 million impaired loans, including $694,000 in

TDRs, at December 31, 2021.

OREO decreased $10,000 or 7.7% to $120,000 at December 31, 2022 from $130,000 at December 31, 2021. At December 31,

2022, the balance of OREO consisted of five acres of commercial land in Aiken, South Carolina.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

21

22 | www.securityfederalbank.com 2022 Annual Report | 23

The Bank reviews its loan portfolio and allowance for loan losses on a monthly basis. When determining the appropriate

allowance for loan losses during the years ended December 31, 2022 and 2021, management took into consideration such

factors as the national and state unemployment rates and related trends, national and state unemployment benefit claim levels

and related trends, the amount of and timing of financial assistance provided by the government, inflation, consumer spending

levels and trends, industries significantly impacted by the COVID-19 pandemic and a review of the Bank's largest commercial

loan relationships.

Effective January 1, 2023, the Bank adopted Accounting Standards Update (“ASU”) No. 2016-13, Financial Instruments -

Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, also known as CECL. CECL replaces the

incurred loss impairment framework in current GAAP. Adoption of this guidance resulted in a $2.0 million increase in the

allowance for credit losses, comprised of increases in the allowance for loan losses of $800,000 and the reserve for unfunded

commitments of $1.2 million. The cumulative effect adjustment to retained earnings was $1.6 million, net of tax. For additional

information, refer to “Recently Issued or Adopted Accounting Standards” in Note 1 of the Notes to Consolidated Financial

Statements included herein.

Management will continue to closely monitor economic conditions and will work with borrowers as necessary to assist them

through this challenging economic climate. Future additions to the Bank's allowance for loan losses are dependent on, among

other things, the performance of the Bank's loan portfolio, the economy, changes in real estate values, and interest rates. There

can be no assurance that additions to the allowance will not be required in future periods. The determination of the appropriate

level of the allowance for loan losses inherently involves a high degree of subjectivity and requires us to make significant

estimates of current credit risks and future trends, all of which may undergo material changes.

Deterioration in economic conditions affecting borrowers, new information regarding existing loans, identification of additional

problem loans and other factors, both within and outside of our control, may require an increase in the allowance for loan

losses. The ultimate impact will depend on future developments, which are highly uncertain and cannot be predicted. In

addition, bank regulatory agencies periodically review our allowance for loan losses and may require an increase in the

provision for possible loan losses or the recognition of further loan charge-offs, based on judgments different than those of

management. If charge-offs in future periods exceed the allowance for loan losses, we will need additional provisions to

increase the allowance for loan losses. Any increases in the allowance for loan losses will result in a decrease in net income

and, possibly, capital, and may have a material adverse effect on our financial condition and results of operations. Management

continually monitors its loan portfolio for the impact of local economic changes. The ratio of the allowance for loan losses to

total loans was 2.09% and 2.19% at December 31, 2022 and 2021, respectively.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

22

Financial Condition - Liabilities and Shareholders' Equity

Total deposits decreased $5.9 million or 0.5% to $1.11 billion at December 31, 2022 from $1.12 billion at December 31, 2021.

The majority of the Bank’s deposits are originated within the Bank’s immediate market area. The Bank had brokered time

deposits of $6.0 million and $10.0 million at December 31, 2022 and 2021, respectively. The Bank uses brokered time deposits

to manage interest rate risk because they are accessible in bulk at rates typically only slightly higher than those in our market

areas. A portion of these brokered time deposits give the Bank a call option that allows the Bank the choice to redeem them

early should rates change. In addition, the Bank had $5.0 million in other brokered deposits at December 31, 2022. Total

deposits at December 31, 2022, excluding brokered deposits, decreased $1.9 million or 0.2%. Brokered deposits were 1.0% and

1.3% of total deposits at December 31, 2022 and 2021, respectively.

Certificate of deposits that met or exceeded the FDIC insurance limit of $250,000 totaled $30.3 million and $39.4 million at

December 31, 2022 and 2021, respectively. The following table summarizes the maturity schedule of certificates of deposit

with a balance of $250,000 or more at December 31, 2022:

(In Thousands)

Within 3 Months $ 4,036

After 3 Months, Within 6 Months 3,741

After 6 Months, Within 12 Months 14,010

After 12 Months 8,485

$ 30,272

Total certificates of deposit scheduled to mature in one year or less totaled $96.2 million at December 31, 2022 compared to

$118.1 million at December 31, 2021.

Management’s policy is to maintain deposit rates at levels that are competitive with other local financial institutions. Based on

historical experience, we believe that a significant portion of maturing certificates of deposit will remain with the Bank.

The Bank had outstanding FHLB advances and borrowings from the "discount window" of the FRB of Atlanta totaling $0 and

$44.1 million at December 31, 2022, respectively, compared to no such advances or borrowings at December 31, 2021.

Depository institutions may borrow from the discount window for periods as long as 90 days, and borrowings are prepayable

and renewable by the borrower on a daily basis.

Other borrowings increased $803,000 or 3.0% to $27.6 million at December 31, 2022 from $26.8 million at December 31,

2021. These borrowings consist of short-term repurchase agreements with certain commercial demand deposit customers for

sweep accounts. The repurchase agreements typically mature within one to three days and the interest rate paid on these

borrowings floats monthly with money market type rates. The interest rate paid on the repurchase agreements was 0.75% and

0.15% at December 31, 2022 and 2021, respectively. The Bank had pledged as collateral for these repurchase agreements AFS

investment securities and HTM investment securities with amortized costs and fair values of $52.3 million and $49.8 million, at

December 31, 2022, and $45.3 million and $45.2 million, at December 31, 2021, respectively.

At both December 31, 2022 and 2021, the Company had $5.2 million in junior subordinated debentures outstanding. In

addition, the Company had $26.5 million and $30.0 million in subordinated debentures (“Notes”) outstanding at December 31,

2022 and 2021, respectively. During the year ended December 31, 2022, the Company repurchased $3.5 million in principal

amount of the Notes. For additional information, refer to Note 12 and Note 14 of the Notes to Consolidated Financial

Statements included herein.

Total shareholders' equity increased $44.7 million or 38.7% to $160.2 million at December 31, 2022 from $115.5 million at

December 31, 2021. The increase was primarily attributable to an $82.9 million issuance of Senior Non-Cumulative Perpetual

Preferred Stock, Series ECIP (the “Preferred Stock”) by the Company and net income of $10.2 million during 2022. These

increases were partially offset by $2.5 million in dividends paid to common shareholders and a $46.0 million decrease in

accumulated other comprehensive income, net of tax, related to the unrecognized loss in value of AFS investment securities

during the year ended December 31, 2022. Book value per common share was $23.76 at December 31, 2022 compared to

$35.51 at December 31, 2021.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

23

24 | www.securityfederalbank.com 2022 Annual Report | 25

Results of Operations

The following table presents the dollar amount of changes in interest income and interest expense for major components of

interest-earning assets and interest-bearing liabilities. The table also distinguishes between the changes related to higher or

lower outstanding balances and the changes related to the volatility of interest rates. For each category of interest-earning

assets and interest-bearing liabilities, information is provided on changes attributable to: (1) changes in rate (multiplied by prior

year volume); (2) changes in volume (multiplied by prior year rate); and (3) net change (the sum of the prior columns). For

purposes of this table, changes attributable to both rate and volume, which cannot be segregated, have been allocated

proportionately to the change attributable to volume and the change attributable to rate. Changes in income are calculated on a

tax equivalent basis using the effective tax rate for the period.

Years Ended December 31,

2022 vs. 2021 2021 vs. 2020

(Decrease) Increase Due to

Change in

(Decrease) Increase Due to

Change in

(Dollars in Thousands) Volume Rate Net Volume Rate Net

Interest-Earning Assets:

Loans:

(1)

$ 591 $ (2,150) $ (1,559) $ (2) $ 924 $ 922

Taxable Investment Securities 1,784 5,410 7,194 2,176 (2,948) (772)

Non-taxable Investment Securities

(2)

16 (395) (379) 283 (327) (44)

Deposits in Other Banks 34 154 188 (38) (31) (69)

Total Interest-Earning Assets $ 2,425 $ 3,019 $ 5,444 $ 2,419 $ (2,382) $ 37

Interest-Bearing Liabilities:

Deposits:

Certificate Accounts $ (133) $ (139) $ (272) $ (474) $ (1,414) $ (1,888)

Other Interest Bearing Deposits 103 1,449 1,552 209 (616) (407)

Total Deposits (30) 1,310 1,280 (265) (2,030) (2,295)

Borrowings (252) 176 (76) (125) (337) (462)

Total Interest-Bearing Liabilities (282) 1,486 1,204 (390) (2,367) (2,757)

Effect on Net Tax Equivalent Interest Income

(2)

$ 2,707 $ 1,533 $ 4,240 $ 2,809 $ (15) $ 2,794

(1) INTEREST ON NON-ACCRUAL LOANS IS NOT INCLUDED IN INCOME, ALTHOUGH THEIR LOAN BALANCES ARE INCLUDED IN AVERAGE LOANS OUTSTANDING.

(2) THE TAX-EQUIVALENT INTEREST INCOME ADJUSTMENT RELATES TO THE TAX EXEMPT MUNICIPAL BONDS

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

24

Average Balances, Interest Income and Expenses, and Average Yields and Rates

The following table compares detailed average balances, average yields on interest earning assets, and average costs of interest

bearing liabilities at December 31, 2022 and 2021. The average balances were derived from the daily balances throughout the

periods indicated. The average yields or costs were calculated by dividing the income or expense by the average balance of the

corresponding assets or liabilities. Nonaccrual loans are included in earning assets in the following tables. Loan yields have been

reduced to reflect the negative impact on our earnings of loans on nonaccrual status.

For the Year Ended December 31,

2022 2021

(Dollars in thousands)

Average

Balance Interest

Yield/

Rate

Average

Balance Interest

Yield/

Rate

Interest-Earning Assets:

Loans

(1)

$ 525,396 $ 25,637 4.88 % $ 513,987 $ 27,196 5.29 %

Taxable Investment Securities 695,960 16,145 2.32 % 591,387 8,952 1.51 %

Non-taxable Investments

(2)

23,651 846 3.58 % 23,351 1,225 5.25 %

Deposits in Other Banks 3,649 203 5.56 % 1,639 14 0.85 %

Total Interest-Earning Assets $ 1,248,656 $ 42,831 3.43 % $ 1,130,364 $ 37,387 3.31 %

Interest-Bearing Liabilities:

Checking, Savings and Money Market Accounts $ 703,914 $ 2,304 0.33 % $ 616,098 $ 752 0.12 %

Certificate Accounts 143,619 607 0.42 % 172,995 879 0.51 %

Total Interest-Bearing Deposits 847,533 2,911 0.34 % 789,093 1,631 0.21 %

Junior Subordinated Debt 5,155 180 3.49 % 5,155 97 1.88 %

Subordinated Debt 29,332 1,548 5.28 % 30,000 1,575 5.25 %

FHLB Advances and Other Borrowings

(3)

45,477 389 0.86 % 54,593 521 0.95 %

Total Interest-Bearing Liabilities $ 927,497 $ 5,028 0.54 % $ 878,841 $ 3,824 0.44 %

Net Interest Rate Spread 2.89 % 2.87 %

Tax Equivalent Net Interest Income/Margin

(2)

$ 37,803 3.03 % $ 33,563 2.97 %

Less: tax equivalent adjustment

(2)

253 270

Net Interest Income $ 37,550 $ 33,293

(1) INTEREST INCOME FROM OTHER LOANS INCLUDED IN THE TABLES ABOVE AND BELOW INCLUDES DEFERRED PPP LOAN FEES OF $441,000 AND $4.7 MILLION

RECOGNIZED DURING THE YEARS ENDED DECEMBER 31, 2022 AND 2021, RESPECTIVELY.

(2) TAX EQUIVALENT BASIS RECOGNIZES THE INCOME TAX SAVINGS WHEN COMPARING TAXABLE AND TAX-EXEMPT ASSETS AND WAS CALCULATED USING THE

EFFECTIVE TAX RATE IN PLACE FOR THE YEARS ENDED DECEMBER 31, 2022 AND 2021. THE TAX-EQUIVALENT INTEREST INCOME ADJUSTMENT RELATES TO

THE TAX EXEMPT MUNICIPAL BONDS INCLUDED IN OUR INVESTMENT PORTFOLIO DURING THE PERIODS INDICATED.

(3) INCLUDES FHLB ADVANCES, BORROWINGS FROM THE FRB AND REPURCHASE AGREEMENTS.

.

.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

25

26 | www.securityfederalbank.com 2022 Annual Report | 27

Comparison of the Years Ended December 31, 2022 and 2021

Net Income

Net income decreased $2.6 million or 19.9% to $10.2 million or $3.14 per basic and diluted common share for the year ended

December 31, 2022, compared to $12.8 million or $3.93 per basic and diluted common share for the year ended December 31,

2021. The decrease in net income during 2022 compared to the prior year was due to a decline in non-interest income and an

increase in non-interest expense, partially offset by an increase in net interest income. Also contributing to the decrease in net

income was a $2.4 million reversal of loan loss reserves during 2021 following significantly higher loan loss provisions

recorded in 2020 in response to the potential and unknown economic impact of the ongoing COVID-19 pandemic compared to

no provision for loan losses in 2022.

Net Interest Income

Net interest income increased $4.3 million or 12.8% to $37.6 million for the year ended December 31, 2022, compared to $33.3

million in 2021. The increase in net interest income was primarily due to higher interest income from investments, which was

partially offset by an increase in interest expense. The net interest margin on a tax-equivalent basis increased six basis points to

3.03% for the year ended December 31, 2022 from 2.97% for the year ended December 31, 2021.

Total average interest-earning assets increased $118.3 million or 10.5% to $1.25 billion for the year ended December 31, 2022

from $1.13 billion for the year ended December 31, 2021 with a 12 basis point increase in the average yield earned on these

assets. Average interest-bearing liabilities increased $48.7 million or 5.5% to $927.5 million for the year ended December 31,

2022 from $878.8 million for the year ended December 31, 2021 with an increase of 10 basis points in the average cost. The

interest rate spread on a tax-equivalent basis increased two basis points to 2.89% for the year ended December 31, 2022 from

2.87% in 2021.

Total interest income increased $5.5 million or 14.7% to $42.6 million for the year ended December 31, 2022, compared to

$37.1 million for the year ended December 31, 2021 as a result of increased interest income from taxable investments which

was partially offset by lower interest income from loans and tax-exempt investments.

Total tax-equivalent interest income on investments increased $6.8 million, or 67.0%, due to a $104.9 million, or 17.1%,

increase in the aggregate average balance of these interest-earning assets combined with an increase of 70 basis points in the

average yield earned on these assets during 2022 when compared to 2021.

Interest income from loans decreased $1.6 million or 5.7% to $25.6 million for the year ended December 31, 2022 compared to

$27.2 million for the year ended December 31, 2021. The decrease was primarily attributable to a decrease in deferred loan

fees on PPP loans recognized in 2022. The Bank recognized $441,000 and $4.7 million in deferred loan fees on PPP loans

during the years ended December 31, 2022 and 2021, respectively. There was no unamortized net deferred fees on PPP loans

remaining at December 31, 2022. This decrease was partially offset by an increase of $11.4 million in the average balance of

loans outstanding during the year ended December 31, 2022.

Total interest expense increased $1.2 million or 31.5% to $5.0 million for the year ended December 31, 2022, compared to $3.8

million for the year ended December 31, 2021 due to a 10 basis point increase in the average cost of interest-bearing liabilities

combined with an increase of $48.7 million, or 5.5%, in the average balance of these liabilities.

The largest increase was in interest expense on deposits, which increased $1.3 million or 78.4% to $2.9 million in 2022

compared to $1.6 million in 2021. Average interest-bearing deposits increased $58.4 million or 7.4% to $847.5 million during

the year ended December 31, 2022 compared to $789.1 million during 2021, while the average cost of those deposits increased

13 basis points to 0.34% during 2022 from 0.21% in 2021.

Interest expense on borrowings from the FRB and other borrowings decreased $132,000 or 25.3% to $389,000 during the year

ended December 31, 2022 from $521,000 during the prior year. The decrease was attributable to a $9.1 million, or 16.7%

decrease in the average balance of these liabilities combined with a decrease of nine basis points in the average cost to 0.86% in

2022 from 0.95% during 2021.

SECURITY FEDERAL CORPORATION AND SUBSIDIARIES

Management's Discussion and Analysis of Financial Condition and Results of Operations

26

Provision for Loan Losses

The Company recorded no provision for loan losses for the year ended December 31, 2022 compared to a $2.4 million reversal

of the provision for loan losses for the year ended December 31, 2021. The reversal of loan loss provision during 2021 was the

result of a reduction in historical loss and qualitative adjustment factors related to improvement in the economic and business

conditions at both the national and regional levels as of December 31, 2021. Non-performing assets increased $3.6 million, or

127.3%, to $6.4 million at December 31, 2022 from $2.8 million at December 31, 2021. Non-performing assets represented

0.46% and 0.22% of total assets at December 31, 2022 and 2021, respectively.

The amount of the provision is determined by management’s on-going monthly analysis of the loan portfolio and the adequacy

of the allowance for loan losses. The Company has established policies and procedures for evaluating and monitoring the credit

quality of the loan portfolio and for the timely identification of potential problem loans including internal and external loan

reviews. The adequacy of the allowance for loan losses is reviewed monthly by the Asset Classification Committee and

quarterly by the Board of Directors.

Management’s monthly review of the adequacy of the allowance includes three main components. The first component is an

analysis of loss potential in various homogeneous segments of the portfolio based on historical trends and the risk inherent in

each category. The historical loss periods used to calculate these ratios can range from one to ten years depending on which

period is deemed a more relevant indicator of future losses. Currently, management applies a ten-year historical loss ratio to

each loan category to estimate the inherent loss in these pooled loans.

The second component of management’s monthly analysis is the specific review and evaluation of significant problem credits

identified through the Company’s internal monitoring system, including but not limited to classified loans, non-accrual loans

and TDRs. These loans are evaluated for impairment and recorded in accordance with accounting guidance. All TDRs and

substantially all non-accrual loans are individually evaluated for impairment. In accordance with our policy, non-accrual

commercial loans with a balance less than $200,000 and non-accrual non-commercial (consumer, HELOC, residential

mortgage) loans with a balance less than $100,000 are deemed immaterial and therefore excluded from the individual

impairment review. For each loan deemed impaired, management calculates a specific reserve for the amount in which the

recorded investment in the loan exceeds the fair value. This estimate is based on a thorough analysis of the most probable

source of repayment, which is typically liquidation of the collateral.

The third component is an analysis of changes in qualitative factors that may affect the portfolio, including but not limited to:

relevant economic trends that could impact borrowers’ ability to repay, industry trends, changes in the volume and composition

of the portfolio, credit concentrations, or lending policies and the experience and ability of the staff and Board of Directors.

Management also reviews and incorporates certain ratios such as percentage of classified loans, average historical loan losses

by loan category, delinquency percentages, and the assignment of percentage targets of reserves in each loan category when

evaluating the allowance. Once the analysis is completed, the three components are combined and compared to the allowance

amount. Based on this, charges are made to the provision as needed.

Management believes the allowance for loan losses at December 31, 2022 is adequate based on its best estimates of the losses