Page 1 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

2019 MISSISSIPPI WORKERS’ COMPENSATION CLAIMS GUIDE

This Guide, now in its fifth edition, represents a collaborative effort by

representatives of the Mississippi Workers’ Compensation community who serve

on the Board of Directors of the Mississippi Workers’ Compensation Educational

Association, Inc.

The MWCEA Board members responsible for the 2019 revisions of this

Guide were:

James M. Anderson, Anderson Crawley & Burke, pllc

TG Bolen, Markow Walker, P.A.

Andre Ducote, Morgan and Morgan

Steve Funderburg, Funderburg Sessums & Peterson, PLLC

Gary Jones, Daniel Coker Horton and Bell, P.A.

Michael Traylor, Schwartz & Associates, P.A.

The Guide was designed to provide those responsible for claims decisions

with information that will facilitate appropriate claims handling. It is intended to

only be a summary that includes the basic provisions of the Mississippi Workers’

Compensation Law, and it does not attempt to cover every issue that might be

encountered in the handling of claims or to be a substitute for competent legal

advice. This guide is not an official publication of the Mississippi Workers’

Compensation Commission and since cases are usually fact intensive and the law

is continually evolving, it should not be construed as the Commission’s official

pronouncement of the law on any issue.

Page 2 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Mississippi Workers’ Compensation Educational Association, Inc.

Board of Directors, July 2019

Andre F. Ducote*

President

(601) 949-3388

aducote@forthepeople.com

T. G. Bolen, Jr.*

Vice President

(601) 853-1911

tgbolen@markowwalker.com

Tina O’Keefe*

Immediate Past President

(662) 357-1185

TOkeefe@goldstrike.com

Barbara Oltremari

Board Member

(601) 720-8091

barbaraoltremari@gmail.com

Steven H. Funderburg

Past President

(601) 355-5200

sfunderburg@jfsplawfirm.com

Molly Staley

Board Member

(601) 987-8200

mstaley@capitalortho.com

*Executive Committee

Page 3 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

MISSISSIPPI WORKERS’ COMPENSATION CLAIMS GUIDE

Guide Overview 1

1. MWCEA Board of Directors 2

2. Table of Contents 3

Chapter 1—The Basics 7

1. What is Workers’ Compensation? 7

2. Administration of Mississippi Workers’ Compensation 7

3. Who pays Workers’ Compensation Claims? 8

4. What are an Adjuster’s Responsibilities? 9

5. Adjuster Licensing 9

6. Adjuster Canons of Ethics 10

Chapter 2—Coverage 11

1. Employers Covered by the Act 11

2. What Happens if an Employer Refuses to Get Coverage? 11

3. Insurance Coverage 12

a. Standard Workers’ Compensation Insurance Policy 12

b. Employers’ Liability Insurance Coverage 13

c. Cancelling and Non-Renewing Coverage 13

4. Self-Insurance and Group Self-Insurance 14

5. Assigned Risk Coverage 14

6. Notice of Coverage 14

Chapter 3—Jurisdiction 16

1. Mississippi Jurisdiction 16

2. Injuries Outside of Mississippi 16

3. Non-Residents of Mississippi Injured in Mississippi 16

4. Concurrent Jurisdiction 17

Chapter 4—Exclusive Remedy 18

1. What is Exclusive Remedy? 18

2. Exceptions to the Exclusive Remedy Doctrine 18

Chapter 5—Compensability 20

1. Burden of Proof 20

2. Injury Defined 21

a. Arising Out of and In Course of Employment 22

b. Untoward Event 24

c. Contributed to, Aggravated, or Accelerated by Employment 24

d. Presumption in Death Cases 25

e. Willful Act of Third Person/Assaults 25

Page 4 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

f. Occupational Diseases 27

3. Hernia Claims 27

4. Going to and Coming from Work 28

5. Mental Injuries 29

6. Cumulative and Repetitive Injuries 30

7. Last Injurious Exposure 31

8. Multiple Carriers in Compensability Dispute 31

9. Idiopathic Falls 32

Chapter 6—Defenses to Claims 33

1. Employee Status 33

a. Undocumented Workers/Aliens 34

2. Pre-existing Conditions 35

a. Second Injury Fund 35

b. Apportionment 36

37

3. Statute of Limitations 37

a. Where No Indemnity Benefits are Paid 37

b. Where Indemnity Benefits are Paid 38

4. Intervening Cause of Disability 39

5. Intoxication 40

40

6. Willful Intention to Injure Self or Another 41

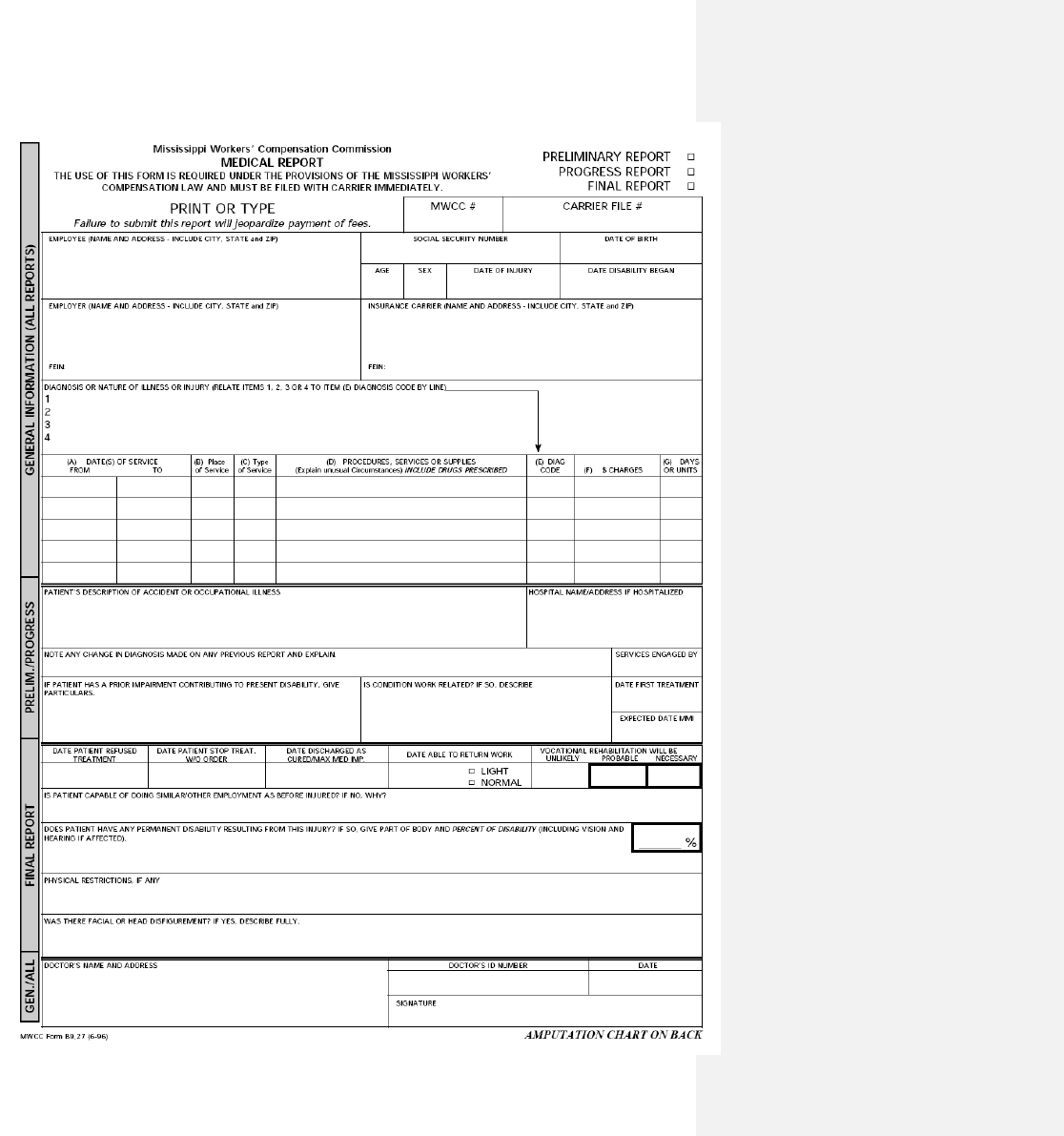

Chapter 7—Commission Forms 43

1. Address for Form Filing 43

2. A Forms 43

a. A-16, Notice of Coverage 43

b. A-24, Proof of Coverage 44

3. B Forms 44

a. IAIABC IA-1, (replaces the B-3), First Report of Injury 44

b. B-18, Notice of Payment 45

Practice Point: Possible admission of liability 45 c. B-19, Application for Lump Sum Payment

c. B-19, Application for Lump Sum Payment 45

d. B-9, 27, Medical Report 46

e. B-31, Notice of Final Payment 46

Practice Point: Completing B-31 for 5, 6, 7 days lost time 47

Practice Point: C-1 Issue 47

f. B-52, Employer’s Notice of Controversion 48

g. B-5, 11 and B-5, 22, Petition to Controvert and Answer 49

4. R Forms 49

a. R-1, Early Notification of Severe Injury 49

b. R-2, Referral for Rehabilitation and Initial Report 49

Page 5 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Chapter 8—Average Weekly Wage 50

1. Three Formulas 50

2. Partial Weeks Worked 51

3. Employed for Short Time Before Injury 51

4. Gratuities/Tips 52

5. Sick Pay and Vacation Pay 52

6. Part Time Employees 53

7. Claimant with More Than One Job at Time of Injury 53

Chapter 9—Disability Benefits 54

1. Maximum and Minimum Weekly Amounts 54

2. Waiting Period 54

3. Non-Consecutive Lost Time Days 55

4. Daily Compensation Rate 55

5. Maximum Recovery 55

6. Penalties for Late Payments 56

7. Overpayments 56

8. Child Support Liens 57

a. Obligations in the event of a settlement 58

Chapter 10—Categories of Disability 59

1. Temporary Total Disability 59

Practice Point: Salary in Lieu of Compensation 61

2. Temporary Partial Disability 61

3. Permanent Partial Disability 62

a. Scheduled Member Injuries 63

1) Use of AMA Guidelines 63

b. Body as a Whole Injuries 66

c. Serious Head or Facial Disfigurement 68

4. Permanent Total Disability 68

Chapter 11—Death Benefits 70

1. Immediate Lump Sum Payment 70

2. Funeral Allowance 70

3. Weekly Benefits to Dependents 70

a. Death Claims Involving Undocumented Workers (Aliens) 72

4. Payment to Second Injury Fund 73

Chapter 12—Medical Benefits 74

1. Choice of Physician 74

a. Selection of DME Vendor, Pharmacy Vendor 75

b. Selection of Diagnostic Testing Facilities 75

2. Travel Expense 76

3. Employer’s Medical Exam (EME) 76

4. Independent Medical Exam (IME) 77

Page 6 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

5. Ex parte Communications with Medical Providers 78

6. HIPAA Compliant Medical Authorization 79

7. Treatment by VA Hospital or Paid for by Government 79

8. Medical Payments by Health Insurance Providers 80

9. Mississippi Workers’ Compensation Fee Schedule 80

a. Where to Obtain Fee Schedule 80

b. Issues Addressed in Fee Schedule 81

c. Pre-Certification 81

d. Appeals for Denials of Pre-Certification 83

e. Retrospective Review 84

f. Provider’s Responsibilities 84

g. Fees for Copy Expenses 85

h. Payer’s Responsibilities 86

i. Facility Fee Issues 86

j. Explanation of Review 86

k. Request for Reconsideration 87

l. Dispute Resolution 87

Chapter 13—Vocational Rehabilitation 89

1. Use of Vocational Rehabilitation Professionals 89

Chapter 14—General Issues 90

1. Settlements 90

2. Lump Sum Payments 92

3. Subrogation/Claims Against Third Parties 92

4. Medicare’s Interests 94

5. Medicaid’s Interests 95

6. Social Security Offsets 96

7. Fraud 96

8. Claimant’s Attorney Fees 97

2012 Amendment Regarding Attorney Fees 97

Chapter 15—Litigation Procedures 98

Chapter 16—Mediation 101

Chapter 17—Bad Faith Claims 102

1. What is Bad Faith? 102

2. Suggestions for Avoiding Bad Faith 104

Chapter 18 – 2012 Legislative Changes 105

Epilogue 108

MWCEA Board of Directors 109

Page 7 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

2019 MISSISSIPPI WORKERS’ COMPENSATION CLAIMS GUIDE

Chapter 1

THE BASICS

1.1. WHAT IS WORKERS’ COMPENSATION?

Workers’ compensation is a social program that is designed to provide

wage replacement and medical benefits to workers who are injured on the job.

Although the roots of workers’ compensation can be found in Germany in the

1800’s, it was not until 1911 that the first workers’ compensation law that

sustained constitutional challenges was enacted in this country. Now virtually

every state in the United States has a workers’ compensation law and there are

also federal workers’ compensation laws applicable to certain employees.

Mississippi adopted its workers’ compensation law in 1948 with the law becoming

effective January 1, 1949. The Mississippi Workers’ Compensation Law is

codified at Miss. Code Ann. §71-3-1, et. seq. (1972, as amended). Numerous

Commission Rules have also been adopted that explain and assist in the

implementation of the law. Those are available on the Commission Web site at

http://www.mwcc.state.ms.us/pdf/gen&proRules.pdf.

1.2. ADMINISTRATION OF MISSISSIPPI WORKERS’

COMPENSATION

In Mississippi, the Mississippi Workers’ Compensation Commission

administers the workers’ compensation law. See Miss. Code Ann. §71-3-85

(1972, as amended). The Commission is comprised of three individuals

appointed by the Mississippi Governor with approval of the Mississippi Senate.

Each appointment is for a six-year term and the appointments are staggered so

that an appointment comes up every two years. One Commissioner is designated

as Chairman who is the administrative head of the agency. One of the members

of the Commission must be a licensed Mississippi attorney, another is appointed

Page 8 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

to represent business interests and the other is chosen to represent employee

interests.

In Mississippi, litigated cases are tried before an Administrative Judge

(often referred to as an AJ or ALJ) who is an employee of the Commission. All of

the Administrative Judges are licensed Mississippi attorneys. See Miss. Code

Ann. §71-3-93 (1972, as amended). There are up to 8 Administrative Judges

who are hired by the Commission with the approval of the Governor, and their

appointments are not for any specific amount of time. The Commission employs

a staff to carry out the Commission’s statutory responsibilities. When an

Administrative Judge’s decision is appealed to the full Commission, the

Commission considers the appeal based on the record made before the

Administrative Judge. The Commission appellate review is not a new trial.

The Mississippi Workers’ Compensation Commission is located at 1428

Lakeland Drive, Jackson, Mississippi 39216. The Mailing address is P. O. Box

5300, Jackson, Mississippi 39296-5300. The telephone number is 601 987 4200

or toll free, 866 473 6922.

1.3. WHO PAYS WORKERS’ COMPENSATION CLAIMS?

Although some employers are exempt from the application of the law (as

discussed more fully in subsequent sections), all other employers are required to

protect their liability for the payment of workers’ compensation benefits by either

purchasing a workers’ compensation insurance policy, qualifying as a self-insurer

before the Mississippi Workers’ Compensation Commission, or participating in a

group self-insurance fund which is regulated by the Mississippi Workers’

Compensation Commission. The Commission does not pay claims. Some

employers might self-administer their workers’ compensation programs and pay

the claims themselves, but most employers utilize an insurance company or

third-party administrator to pay their claims. Miss. Code Ann. §71-3-75 (1972,

as amended).

Page 9 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

1.4. WHAT ARE AN ADJUSTER’S RESPONSIBILITIES?

The primary duties of a workers’ compensation adjuster, whether that

person is working for an employer, an insurance company or a third-party

administrator, are very similar. Those responsibilities begin with completing a

prompt and thorough investigation of every claim so that an informed and

timely decision may be made regarding the payment of benefits as is appropriate

under the facts of each claim. Talking with employers, claimants, and co-

employees to determine facts; obtaining and evaluating medical documentation

concerning the medical problems which are a part of each claim; evaluating

disability information from the medical providers; and timely paying

compensation, medical and rehabilitation benefits, as appropriate under the law

and the circumstances of each claim, are all a part of the claims professional’s

job. Those responsibilities require effective written and oral communication skills

and the ability to interact with employers, claimants, witnesses, the medical

community, attorneys, and the Commission staff regarding decisions made and

the reasons for those decisions and actions.

1.5. ADJUSTER LICENSING

Adjusters must obtain a Property and Casualty license from the Mississippi

Department of Insurance unless that adjuster only handles claims for the

insurance company by whom he or she is employed. (To explain, adjusters

employed by an insurance company and only handling claims for that insurance

company do not have to have a Mississippi adjuster license, while adjusters for a

third-party administrator do have to obtain a license.) Effective July 1, 2016

there is a separate insurance adjuster license applicable only to workers’

compensation claims, although a general adjuster’s license such as is required to

handle all other kinds of claims may be utilized instead of the specific workers’

compensation adjuster’s license. The applicant is required to attend training as

Page 10 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

dictated by the Mississippi Department of Insurance and pass a test. However, a

test is not required for one who is licensed as an adjuster in another state with

which the Mississippi Department of Insurance has entered into a Reciprocity

Agreement. For licensing requirements, see Miss. Code Ann. §83-17-417 (1972,

as amended) or details on the Mississippi Department of Insurance’s website,

http://www.mid.ms.gov/licensing/adjuster-licensing.aspx.

1.6. ADJUSTER CANONS OF ETHICS

Although there are no officially adopted canons of ethics applicable to

Mississippi workers’ compensation adjusters, the law indicates that an adjuster is

in a position of fiduciary responsibility and is responsible for making sure that

legitimate claims are paid timely. Many see the adjuster’s job as one that

includes responsibility for the maintenance of the integrity of the workers’

compensation system consistent with the social purposes of the legislation so as

to promote public confidence and trust in the system. Others urge that care

should be taken not to violate laws or regulations applicable to a situation and

argue that a sense of urgency to do the job promptly should be paramount.

Nearly everyone would agree that being courteous and sensitive to the issues is

a part of maintaining professionalism expected by the workers’ compensation

system. Just as the adjuster should strive to avoid unnecessary litigation and

delays, it is argued that the adjuster should also support efforts to prevent fraud

within the system. Common sense suggests that care must be taken by the

adjuster to avoid a conflict of interest and to make decisions free from personal

prejudices or other form of illegal discrimination.

The current adjuster continuing education hour requirements are 24 CEU

credits every two years and 3 ethics hours.

Page 11 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Chapter 2

COVERAGE

2.1. EMPLOYERS COVERED BY THE ACT

The Mississippi Workers’ Compensation Act requires coverage if an

employer “has in service five or more workmen or operatives regularly in the

same business or establishment under any contract of hire, express or implied.”

See Miss. Code Ann. §71-3-5 (1972, as amended). Often, the number of workers

employed may fluctuate above and below five and the employer and/or carrier

may be left wondering whether coverage is necessary. The test is generally one

of the size of the operation and whether five or more employees are “regularly”

used to carry it on (even if all 5 employees are not employed at the same time).

If the answer is “yes,” then coverage is necessary, and if in doubt, the employer

is encouraged to obtain coverage. There are certain categories of employers who

are not subject to the coverage requirements of the Act, regardless of the

number of workers employed. The list of exempted employers includes nonprofit

charitable organizations, fraternal, cultural, religious corporations or associations.

2.2. WHAT HAPPENS IF AN EMPLOYER REFUSES TO GET COVERAGE?

An employer who fails to secure workers’ compensation payments under

the Act, when required to do so, faces statutory criminal and civil penalties. See

Miss. Code Ann. §71-3-83 (1972, as amended). In addition, an employee injured

in the course and scope of his employment has the choice of either suing the

employer in tort or proceeding against the employer under the Act. See Miss.

Code Ann. §71-3-9 (1972, as amended). If suit is filed against the uninsured

employer, the employer may not plead as a defense that the injury was caused

by the negligence of a fellow servant, nor that the employee assumed the risk of

his employment, nor that the injury was due to the contributory negligence of

the employee.

Page 12 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

2.3. INSURANCE COVERAGE

Employers may discharge their duty to provide workers’ compensation

coverage for their employees in several different ways. See Miss. Code Ann. §71-

3-75 (1972, as amended). The first method is by securing coverage with a third-

party insurer. According to the Act, once coverage is secured, the insurer’s

liability is coextensive with the employer’s, meaning that the insurer is obligated

to pay all workers’ compensation liability of the insured employer, despite any

limitations which the contract for insurance may contain which purports to limit

the insurer’s liability. See Miss. Code Ann. §71-3-77 (1972, as amended).

Nearly every insurance company utilizes the same basic workers’

compensation insurance policy form, and it is a policy form that has been in use

since the 1950’s with some revisions over the years. The National Council of

Compensation Insurance (NCCI) owns the copyright to the policy form. There

are endorsements to the policy form that can be used to modify or explain some

of the coverage details.

Details as to how to search for who has coverage for an employer on a

specific date of injury can be found at https://www.ewccv.com/cvs/.

2.3.a. STANDARD WORKERS’ COMPENSATION INSURANCE POLICY

The standard workers’ compensation policy form includes two coverage

parts. The first part of the policy requires the insurance company to pay on

behalf of its insured employer the workers’ compensation benefits owed by the

employer to its employees. Each policy has an “Information Page” that defines

the extent of the coverage by listing the States covered by the policy. The

workers’ compensation part of the policy does not have policy limits and requires

the carrier to pay the insured employer’s liability under the specified workers’

compensation law.

Page 13 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

2.3.b. EMPLOYER’S LIABILITY INSURANCE COVERAGE

The second part of the policy form is an Employers’ Liability Insurance

Policy which was originally included in the policy form at a time when some kinds

of injuries, such as occupational diseases, were not covered by workers’

compensation systems. Because the law evolved over the years to include all

kinds of injuries and occupational diseases, this part of the policy form was

basically dormant and inactive in most jurisdictions for many years. With

increasing efforts to avoid the exclusive remedy doctrine (the thrust of which is

that workers’ compensation is intended to be the only remedy a claimant has

against his employer for a workplace injury—See Chapter 4 herein), the policy

has started being considered more frequently in recent years. It is written as a

more traditional kind of insurance policy with policy limits, exclusions, and other

specific provisions. In its simplest form, the policy imposes a contractual

obligation on an insurance carrier to indemnify and defend the insured employer

for those claims by employees against the employer for injuries arising out of

and occurring in the course of employment that are not covered by the workers’

compensation law. A careful coverage analysis will be required in the event a

claim is made which might fall under the terms of that policy.

2.3.c. CANCELLING AND NON-RENEWING COVERAGE

Cancellation and non-renewal of a workers’ compensation insurance policy

must be done in specific conformity with the law or the coverage could be

extended beyond the intent of the carrier. In an effort to provide a claimant with

a source to get his claim paid, coverage is going to be found to remain in effect

unless the carrier has precisely complied with the law regarding notice to the

insured and the Commission when cancelling or non-renewing the coverage. For

specific details, see Miss. Code Ann. §71-3-77 (1972, as amended) and MWCC

Rule 1.5.

Page 14 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

2.4. SELF-INSURANCE AND GROUP SELF-INSURANCE

A company which wishes to be exempt from insuring its liability under the

Act may make application with the Mississippi Workers’ Compensation

Commission to be considered a “self-insurer.” The application must, among

other things, demonstrate the company’s financial ability to pay all compensation

required by the Act. The Act also provides for the pooling of liabilities by two or

more employers for the purpose of establishing a self-insured group. All

employers who wish to establish such a group must be comprised of members of

the same bona fide trade association or trade group, and all must be domiciled in

the State of Mississippi. See Miss. Code Ann. §71-3-75 (1972, as amended) and

Commission Rule 1.7.

2.5. ASSIGNED RISK COVERAGE

Finally, the Act provides for a “Mississippi Workers’ Compensation

Assigned Risk Plan” to be administered by the Mississippi Commissioner of

Insurance. See Miss. Code Ann. §71-3-111 (1972, as amended). These policies

are “for the assignment of risks which in good faith are entitled to insurance

under this chapter but which, because of unusual conditions and circumstances,

are unable to obtain such insurance.” In order to effectuate this provision, the

Commissioner of Insurance is authorized to advertise and contract with carriers

doing business in Mississippi to be servicing carriers for the Plan.

2.6. NOTICE OF COVERAGE

An employer is required to post a Notice of Coverage form on its premises

revealing details as to its coverage under Miss. Code Ann. §71-3-81 (1972, as

amended) and Commission Rule 1.8. Also, under Rule 1.3, each employer must

provide proof of its coverage to the Commission, but this reporting is handled

electronically. See additional provisions regarding these requirements on the

Page 16 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Chapter 3

JURISDICTION

3.1. MISSISSIPPI JURISDICTION

Most work-related accidents that fall within the Act are easy to identify as

such. The typical scenario involves a Mississippi resident working for a

Mississippi employer who has a work accident in Mississippi. Generally, coverage

exists if 1) the injury occurred in Mississippi, 2) the claimant was regularly

employed in Mississippi, or 3) the claimant was hired in Mississippi. The

Commission has exclusive jurisdiction over those cases covered by the Act. See

Miss. Code Ann. §71-3-47 (1972, as amended).

3.2. INJURIES OUTSIDE OF MISSISSIPPI

Questions arise, however, in situations where Mississippi workers are

injured outside of this State. For coverage to exist where an employee is injured

outside of Mississippi, the employee must have been hired or regularly employed

in Mississippi, and his work outside of the state must be temporary (generally

less than six months absent an election to extend coverage). In determining

coverage, the place of the claimant’s residence or domicile is not relevant.

Instead, the question is one of whether the work assignment outside the State is

temporary or permanent and not necessarily whether the worker’s departure

from the State was temporary or permanent. The Act does not apply if the work

assignment outside of the State is permanent (which includes work in a foreign

country.) See Miss. Code Ann. §71-3-109 (1972, as amended).

3.3. NON-RESIDENTS OF MISSISSIPPI INJURED IN MISSISSIPPI

When employees who were hired and/or regularly employed in another

state are injured in Mississippi while on a temporary job assignment, Mississippi

Page 17 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

law might not apply. However, in these situations, generally Mississippi law

applies unless all three of the following requirements are met: 1) the employer

has provided coverage under the laws of another state which cover the employee

for his work in Mississippi; 2) the other state recognizes the extraterritorial

provisions of the Act; and 3) the workers’ compensation law of the other state

must exempt Mississippi claimants and employers from its application. See Miss.

Code Ann. §71-3-109 (1972, as amended). The practical effect is that either

Mississippi law or the applicable law of the other State will cover a foreign worker

injured in Mississippi.

3.4. CONCURRENT JURISDICTION

One additional point to be made regarding jurisdictional issues relates to

successive awards: the Mississippi Workers’ Compensation Act does not bar a

claimant from filing a claim in Mississippi if benefits were awarded under the laws

of another State. The problem typically arises where an employee who was hired

and/or regularly employed in Mississippi is injured while on a temporary work

assignment in another state. It is possible that the employee would be covered

for that injury by the laws of the State in which he was injured. At the same

time, the claimant could also be entitled to coverage by the Mississippi Act. If

the employee is awarded benefits in the State where he was injured, he would

not be barred from filing a claim in Mississippi; however, the employer would be

entitled to credit for any award made in the foreign State against any liability

under the Mississippi Workers’ Compensation Law. (However, a denial of a claim

in the foreign jurisdiction will in some instances be construed to be res judicata

of the same issues if it is subsequently filed in Mississippi). Whether or not the

other involved State would have jurisdiction of the claim in addition to Mississippi

will depend entirely on the applicable provisions of the other State. The claims

professional should seek advice of counsel in the State where the other claim is

filed to fully evaluate those issues.

Page 18 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Chapter 4

EXCLUSIVE REMEDY

4.1. WHAT IS EXCLUSIVE REMEDY?

The Mississippi Workers’ Compensation Law is the exclusive or only remedy

available to a claimant for an injury arising out of and occurring in the course and

scope of employment. See Miss. Code Ann. §71-3-9 (1972, as amended). Stated

differently, the employer cannot be sued by an employee for a compensable

injury pursuant to common law for work related injuries based on a negligence

theory.

4.2. EXCEPTIONS TO THE EXCLUSIVE REMEDY DOCTRINE

There are exceptions to the rule that workers’ compensation is the only

remedy a claimant has against his employer. The first exception is where the

employer has not “secured payment of compensation”, which means that the

employer has failed to have a workers’ compensation insurance policy in effect or

failed to qualify as a self-insurer pursuant to procedures set forth in the Act. If

the employer does not have workers’ compensation coverage in effect, or is not a

qualified self-insurer, the employee is free to sue the employer outside the

confines of the workers’ compensation system and pursue remedies he has at

common law, and in that contingency, the employer loses certain defenses it

would otherwise have available. See Miss. Code Ann. §71-3-9 (1972, as

amended).

Another exception to the exclusive remedy rule involves claims for which

the Mississippi Workers’ Compensation Law does not provide a remedy. This is

best illustrated by the case of Miller v. McRae’s, 444 So.2d 368 (1984), in which

an employee was “falsely imprisoned” by a co-worker while in the course and

scope of employment. The co-employee detained the employee to question her

regarding a missing sum of money. The claimant filed a tort suit against the

Page 19 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

employer claiming that as a result of the false imprisonment, she suffered great

humiliation, loss of reputation, and physical illness. The Supreme Court held that

the exclusive remedy provisions in the Mississippi Workers’ Compensation Act did

not bar the employee’s false imprisonment claim since there was no “injury” as

defined by the Act for which a remedy would be available to the employee.

Still another area where the exclusive remedy provision does not apply is

where the employer intentionally injures the employee. In Franklin Furniture v.

Tedford, 18 So.3d 215 (Miss. 2009), the Mississippi Supreme Court held that

where acts committed by the employer are “substantially certain” to cause injury

to an employee, if there is actual intent to injure the employee, such actions fall

outside the exclusivity of the Act and the employee will be allowed to pursue

damages at common law.

As examined more fully in Chapter 17 herein, another type of claim that is

often discussed as an exception to the exclusive remedy doctrine is a claim in

tort by the employee against his employer, carrier, and others based on

allegations of “bad faith” claims handling. The details of issues involving those

claims are very important, and the claims professional is encouraged to read that

chapter closely.

Page 20 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Chapter 5

COMPENSABILITY

The premise of the Mississippi workers' compensation system is to provide

an injured employee a recovery for injuries that arise out of (referring to a causal

connection to the employment) and occur in the course of his employment

(involving an analysis of the time, place, and situation of the injury).

Compensability is established even if the employee caused or contributed to his

own injuries. Miss. Code Ann. §71-3-7. In exchange for imposing that liability on

an employer without determining who is at fault in causing the injury, the law

imposes a limit on the amount of money and type of benefits that can be

recovered by the injured employee. The system has survived constitutional

challenges over the years, but the fact that a claimant gives up an unlimited

recovery historically resulted in the workers' compensation system being liberally

interpreted in favor of the claimant. This means that disputed or doubtful cases

were resolved in favor of awarding compensation and the claimant was given the

benefit of the doubt in resolving issues or disputes. Legislative amendment in

2012 has potentially altered this historic interpretation as discussed below but

the trend toward resolving doubtful cases in favor of awarding benefits

continues.

Miss. Code Ann. §71-3-7 (1972, as amended) provides that a claim must

arise out of and occur in the course of employment and that medical causation

be established in order to receive compensation for an injury. Although both

tests must be met to establish compensability, practically the two are often

considered collectively so that compensability is found if “arising out of” is high

and “course of employment” is low, or vice versa. Some call such analysis the

“unitary test of work connection” or the “quantum theory of compensability.”

5.1. BURDEN OF PROOF

The claimant bears the burden of proving every element in his claim

Page 21 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

essential to a recovery, and that includes the fact of an injury that arose out of

and in the course of employment, that the medical problem in question is

causally related to the injury in question, and that claimant’s disability is

supported by medical findings. In meeting that burden, however, claimant has

traditionally been given the benefit of the doubt, and there is much case law

providing that “doubtful cases are to be resolved in favor of compensation” or

“the beneficent purposes of the Act” require a liberal interpretation of the

evidence in favor of claimant. The prior requirement that doubtful cases were to

be resolved in favor of compensability made it easier for a claimant to meet his

burden of proof with the burden then shifting to the employer/carrier to establish

that claimant’s story was inherently improbable of that the greater weight of the

evidence did not support claimant’s claim.

For injuries on or after July 1, 2012, the law is to be impartially construed

so as to favor neither the claimant nor employer/carrier, and the workers’

compensation laws are not to be liberally construed in order to fulfill any

beneficent purposes. That said, most workers’ compensation professionals

believe that close cases will probably result in awarding compensation even if

“liberal construction” is no longer mandated or mentioned in the MWCC Order.

5.2. INJURY DEFINED

The Act includes a definition of the term “injury” at Miss. Code Ann. §71-3-

3 (b) (1972, as amended). The complete definition is pasted below, and the

claims professional is encouraged to review the details when analyzing a

compensability issue. Some of the key phrases within the definition have been

bolded for emphasis and are further discussed in the following sections.

“Injury" means accidental injury or accidental death arising out of

and in the course of employment without regard to fault which

results from an untoward event or events, if contributed to or

aggravated or accelerated by the employment in a

significant manner. Untoward event includes events causing

Page 22 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

unexpected results. An untoward event or events shall not be

presumed to have arisen out of and in the course of

employment, except in the case of an employee found dead

in the course of employment. This definition includes injuries to

artificial members, and also includes an injury caused by the

willful act of a third person directed against an employee

because of his employment while so employed and working on

the job, and disability or death due to exposure to ionizing

radiation from any process in employment involving the use of or

direct contact with radium or radioactive substances with the use of

or direct exposure to roentgen (X-rays) or ionizing radiation. In

radiation cases only, the date of disablement shall be treated as

the date of the accident. Occupational diseases, or the

aggravation thereof, are excluded from the term "injury,"

provided that, except as otherwise specified, all provisions

of this chapter apply equally to occupational diseases as

well as injury.

PRACTICE NOTE: The determination of compensability requires a thorough

analysis of facts and the application of law to those facts. Although this guide

attempts to address many of the concepts encountered in this analysis, it does

not attempt to address every conceivable situation. The claims professional is

encouraged to not rely solely on this representative summary of decisions in

making decisions regarding compensability. These examples are intended to be

instructive in the analysis of whether a claim is compensable, but cases are

uniquely fact intensive, and every case must be considered on its own merits.

The claims professional is encouraged to seek advice of counsel to analyze

compensability before issuing a denial. As emphasized in this Guide, the reliance

upon the advice of counsel can shield the decision of the claims professional from

a punitive damage claim even if the claim decision is later claimed to have been

made in “bad faith.”

5.2.a. ARISING OUT OF AND IN THE COURSE OF EMPLOYMENT

Compensability analysis begins with a look at the issues of “arising out of

and in the course of employment”. In its simplest form, the “arising out of”

Page 23 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

requirement refers to the causal origin of the injury. The question focuses on

whether it is connected to the employment. Mississippi has adopted the

“positional risk test” in analyzing the issue which means that the injury would not

have occurred but for the fact that the employment placed a claimant in a

position where he was injured. As an example, in Wiggins v. Knox Glass, Inc.,

219 So. 2d 154 (Miss. 1969), the Court ruled that an injury from an act of nature

arises out of and in the course of employment so long as the worker is injured at

a place where he was required to be by the conditions of the employment.

The “course of employment” component of compensability generally refers

to the time, place and circumstances of the accident in relation to the

employment. If the claimant is generally doing his job at a time and place he is

supposed to be doing his job, the requirement is met.

Compensability is broadly construed and can still be found if there is a

sufficient work contribution present. As an example, there is no requirement that

the injury actually occur during work hours or on the employer’s premises. In

Mississippi Research and Development Center v. Dependents of Shults, 287 So.

2d 273 (Miss. 1973), the employee died in his kitchen at home, but

compensability was found on the premise that workplace stress had contributed

to a heart attack. Another illustration of the rule is one where the employee

manifested symptoms of a brain hemorrhage one evening at work and the acute

event actually did not occur until the next morning at home. Walker Mfg. Co. v.

Pickens, 206 So. 2d 639 (Miss. 1968).

Just because something occurs at work, however, does not make it

compensable. When the workplace is merely the place where the injury occurs,

it might not be compensable even though it occurs during the time of and at the

place of employment. It still has to arise from a risk incidental to the

employment. In Mathis v. Nelson’s Foodland, Inc., 606 So. 2d 101 (Miss. 1992),

the claimant was injured when he lit a firecracker at work but the injury was not

compensable because the lighting of the firecracker has no relationship to the

employment.

Page 24 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

PRACTICE NOTE: The “arising out of” and “in the course of” requirements

for compensability are captured in all workers’ compensation systems, but the

concepts have evolved uniquely in the different workers’ compensation systems,

and the conclusions reached on similar fact scenarios vary widely across the

United States. For that reason, a claims professional should not assume that a

fact scenario found compensable in one jurisdiction automatically translates to

the same conclusion in any other jurisdiction.

5.2.b. UNTOWARD EVENT

Note that the definition of “Injury” in section 5.2 above includes a

requirement for an “untoward event” as a part of the analysis of compensability.

Except in the case of a “Mental/Mental” injury discussed in section 5.5 of this

Guide, the significance of that phrase is hard to find in existing case law. An

incident can apparently meet the requirement of “untoward event” quite easily as

illustrated by the case of Beverly Healthcare v. Hare, 50 So.3

rd

1003 (Miss.

2011). That case involved an elderly employee with a significant history of pre-

existing problems with her leg (4 different identified injuries). She “pivoted” and

a bone in her leg snapped. Those facts were interpreted as representing a

compensable injury in spite of the significant pre-existing problems and

apparently minor work incident giving rise to the claim.

5.2.c. CONTRIBUTED TO, AGGRAVATED, OR ACCELERATED BY EMPLOYMENT

Compensability is found when the employment, or some component of

the employment, combines with pre-existing medical problems or congenital

defects to create disability. The employment need not be the sole cause of

problem, and it is sufficient to meet the definition of injury by showing that

the employment “contributes” to the disability, “aggravates” dormant or

active medical problems so as to create disability, or “accelerates”,

“exacerbates” or “lights up” an underlying medical problem so as to make it

Page 25 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

symptomatic. Cases abound finding an employment connection, and therefore

a compensable injury, when medical problems such as heart attacks, strokes,

hypertension, dermatological problems, cancer, arthritis, hemorrhoids,

pulmonary problems, and other conditions have been aggravated or

accelerated by the employment or injury.

In Quitman Knitting Mill v Smith, 540, So. 2d 623 (Miss. 1989) a

claimant purchased a cold tablet from her employer’s first aid station, and

that tablet was found to have contributed to the onset of the claimant’s

essential tremors. The Court reasoned that the employer benefited from

selling such items by lessening absenteeism as a part of the basis for finding

the claim compensable.

5.2.d. PRESUMPTION IN DEATH CASES

There is a presumption of compensability if a worker is found dead at a

time and place he was reasonably supposed to be during the performance of his

job. See e.g., Road Maintenance Supply, Inc. v. Dependents of Maxwell, 493 So.

2d 318 (Miss 1986).

The “found dead” presumption is contained within the definition of “injury”

in Chapter 5.2 above. It should be noted that the presumption is rebuttable and

after it has made its appearance, the employer/carrier have the burden of

proving that the claim is not compensable.

Also, where an employee falls dead in front of witnesses as opposed to

being “found dead” where no one witnessed the death, there is no presumption

of compensability. See In Re Dependents of Harbin, 958 So. 2d 1620 (Miss.

App., 2007).

5.2.e. WILLFUL ACT OF A THIRD PERSON/ASSAULTS

When a claimant is assaulted while on the job, compensability analysis

focuses on the one who committed the assault to the extent necessary to

Page 26 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

determine whether the assailant is connected to the employment, such as a co-

employee, or whether the assailant is a “third party” to the employment

relationship, such as a criminal.

If an assault causes injury between co-employees, it should be determined

whether the dispute between the co-employees that results in the injury is

rooted in personal, non-employment activity. If the assault is due to a personal

issue between the parties and not over an employment related issue, the injury

may not be compensable even if it happens on the job site. Sanderson Farms,

Inc. v. Jackson, 911 So. 2d 958 (Miss. Ct. App. 2005).

Conversely, if a claimant is injured from the intentional act of another

person who is a stranger to the employment relationship, compensability analysis

shifts to a determination as to whether there is a connection between the

employment and the assault. Stated differently, those injuries are compensable

only if the assault was committed “because of” the employment. Miss. Code

Ann. §71-3-3(b) (1972, as amended). For example, where an assault was

committed by a stranded motorist the claimant had stopped to help, the

“because of the employment” test was met because the employer benefitted by

having its employees attempt to provide “Good Samaritan” assistance to the

public. Big “2” Engine Rebuilders, v Freeman, 379 So. 2d 888 (Miss. 1980)

If the intentional assault has no connection to the employment, the claim

may not be found compensable. In Ellis v. Rose Oil Co. of Dixie, 190 So. 2d 450

(Miss. 1966), a claim involving a worker who was killed by his paramour’s

vengeful husband, the claim was not compensable since it was the worker’s

personal activity that created the risk of harm.

PRACTICE NOTE: If there is a work injury to an employee flowing from an

assault, the employer might be confronted with a suit under tort law such as

those causes of action discussed in Section 4.2 of this Guide. Such a claim might

require a focus on whether or not the loss is covered by the Employer’s Liability

Insurance Policy as mentioned in Section 2.3.b. of this Guide.

Page 27 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

5.2.f. OCCUPATIONAL DISEASES

Occupational diseases can be compensable and the analysis is usually

focused on the medical proof as to whether or not the job caused the alleged

occupational disease or contributed to the development of the disease/injury in a

significant manner. Cases have supported a finding of compensability involving

allegations of increased blood pressure, cardiac problems, strokes, and many

other medical problems. Cases are all unique and require a clear understanding

of the allegations, the job in question, and the medical opinions addressing

causation.

5.3. HERNIA CLAIMS

Hernia claims are treated specially under the Mississippi Workers’

Compensation Act with specific tests to prove compensability and limitations on

the amounts payable. See Miss Code Ann. 71-3-23 (1972, as amended). The

statute lists 5 requirements for a compensable hernia paraphrased as follows:

1. The hernia immediately follows sudden effort.

2. There was severe pain in the area of the hernia.

3. There had not been a descent or protrusion in that area before this

hernia.

4. That the problem was noticed immediately and reported to the

employer within a reasonable time.

5. That the problem was such to have required medical treatment within

five days after the injury.

These “requirements” have not always been strictly enforced and many

cases have found compensability despite one or more of the statutory elements

being unfulfilled. In Lindsey v. Ingalls Shipbuilding Corp., 219 Miss 437, 442

(1954), the claimant clearly did not have treatment within five days, but the

Page 28 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

court said that the “statute does not require that the claimant prove that he was

actually attended by a physician or surgeon within five days after the injury. The

statute only requires that the claimant prove that the physical distress following

the descent of the hernia was such as to require the attendance of a physician or

surgeon within five days.” Id.

It is also noteworthy that the statute provides that a post-operative hernia

is considered an “original” hernia. That means that a hernia that occurs in the

same area, which was earlier repaired surgically, will still be compensable if the

five requirements are otherwise met.

PRACTICE NOTE: There is a statutory limitation on the number of weeks

an employer must pay compensation benefits related to a hernia. The benefits

for temporary total disability cannot exceed twenty-six (26) weeks when the

claimant has surgery to repair the hernia but only thirteen (13) weeks when he

or she undergoes conservative treatment instead of surgery.

5.4. GOING TO AND COMING FROM WORK

Generally, an injury that occurs while the employee is travelling to and

from work is not compensable. King v. Norrell Services, Inc., 820 So.2d 692

(Miss. Ct. App. 2000); Miller Transporters, Inc. v. Seay’s Dependents, 350 So.2d

689 (Miss. 1977). There are important exceptions to that generality, however,

many of which are tied to unique circumstances of the work in question.

Examples of such exceptions include: (1) where the employer furnishes the

means of transportation, or remunerates the employee for the travel; (2) where

the employee performs some duty in connection with his employment at home;

(3) where the employee is injured by some hazard or danger which is inherent in

the conditions along the route necessarily used by the employee; (4) where the

employer furnishes a hazardous route (5) where the injury results from a

hazardous parking lot furnished by the employer; (6) where the place of injury,

although owned by one other than the employer, is in such close proximity to the

Page 29 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

premises owned by the employer as to be, in effect, a part of such premises; or

(7) when the employee is on a special mission or errand for his employer, or

where the employee is accommodating his employer in an emergency situation.

PRACTICE NOTE: Claim denials based on the “going to and coming from”

work general rule against compensability should almost always be supported by

legal advice of counsel that none of the “exceptions” apply.

5.5. MENTAL INJURIES

When mental stress leads to mental injury without a physical injury, the

claim could be compensable, but the claimant has a heightened burden of proof.

For a “mental-mental” injury to be compensable, the claimant bears the burden

of proving, by clear and convincing evidence, that the mental injury resulted

from “more than the ordinary incidents of employment” and that there was an

“untoward event or unusual occurrence” that contributed to the mental or

emotional injury. The claimant’s burden of proof is greater than that

encountered in proving compensability in a physical injury situation, and all of

the cases are factually intensive.

Illustrations of cases found compensable for a mental-mental injury are

Brown & Root Construction v. Duckworth, 475 So. 2d 813 (Miss. 1985)

(psychological symptoms resembling a stroke after not getting a promised

promotion); Borden, Inc v. Eskridge, 604 So. 2d 1071 (Miss. 1991) (work

harassment and demotions caused depression); Mid-Delta Home Health, Inc v.

Robertson, 749 So. 2d 379 (Miss. App. 1999) (TTD awarded due to emotional

disorder stemming from being overworked and harassed); Kemper National

Insurance Co. v. Coleman, 812 So.2d 1119 (Miss. App. 2002) (a workers’

compensation adjuster was treated for depression as the result being passed

over for a promotion and being harassed by his supervisor).

Illustrations of cases found non-compensable for a mental-mental injury

are Smith and Sanders, Inc. v. Peery, 473 So. 2d 423 (Miss. 1985) (claimant

Page 30 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

experienced a psychological problem after being laid off due to a decline in

business); Smith v. City of Jackson, 792 So. 2d 335 (Miss. App. 2001) (claimant

had anxiety [a “nervous breakdown”] due to overwork; Radford v. CCA-Delta

Correctional Facility, 5 So. 3d 1158 (Miss. App. 2009) (claimant had depression

and post-traumatic stress disorder after being reassigned to another supervisor).

PRACTICE NOTE: All of the reported decisions illustrate a fact intensive

analysis, and no conclusions as to compensability or non-compensability should

be drawn from a scenario such as “overwork means it is compensable or not

compensable.” Most cases involving an individual who had been treated for pre-

existing psychological problems were ultimately denied, but that does not mean

that all of those cases are automatically denied. The claims professional should

thoroughly investigate every claim of this nature and would be well served to

seek advice of counsel in developing the correct position to take on each matter.

When an employee has emotional stress from work activity that leads to an

ailment with physical manifestations, the physical injury could be compensable.

Berry v. Universal Mfg. Co., 597 So. 2d 623 (Miss. 1992) was a compensable

claim where job stress contributed to hypertension.

Sometimes a mental injury causes another physical injury. In

Weyerhaeuser Co. v. Ratliff, 197 So. 2d 231 (Miss. 1967), a worker lacerated

three fingers in a work-connected injury and had stress and anxiety over the

finger injury which aggravated a chronic duodenal ulcer requiring surgery. An

award of benefits related to the surgery to repair the ulcer was approved.

Also, mental injury stemming from the physical injury (e.g. pain related

depression or Post Traumatic Stress Disorder from an accident) are not subject

to the heightened burden that applies to pure mental injuries. This is also true

for physical injuries that manifest from mental ailments.

5.6. CUMULATIVE AND REPETITIVE INJURIES

A compensable claim does not have to be tied to a single incident. A

Page 31 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

compensable disability can flow from a series of events or repetitive motion, the

cumulative effect of which can qualify as a compensable injury. Carpal tunnel

claims are illustrative of this rule of law. Compensable results have also been

found in other kinds of cumulative injury claims such as spine ailments caused or

aggravated by the work activity. See, e.g. Smith v. Masonite Corp., 48 So.3d

656 (Miss. Ct. App. 2010).

PRACTICE NOTE: Compensability of cumulative or repetitive injury claims

is heavily dependent upon medical opinions from the providers as to how the

work did or did not contribute to the injury.

5.7. LAST INJURIOUS EXPOSURE

Mississippi has adopted the “last injurious exposure” rule that is applicable

in cases where the exposure occurs over an extended period of time. In its

simplest form, that rule is that if a claimant has a series of employers (or

different carriers for the same employer) and the work activities ultimately cause

the claimant to be disabled, the last employer (or carrier) in that series of events

is responsible for the entire claim. See Thyer Mfg. Co. v. Mooney, 173 So. 2d

652 (Miss. 1965) (claimant worked for a manufacturer through three successive

carriers, and the last carrier was the one that bore the responsibility for the

claim).

Cases of this nature are always factually intensive, however, and the

claims professional is encouraged to thoroughly investigate the facts, analyze the

medical opinions, and seek advice of counsel if the correct response to the claim

is not apparent.

5.8. MULTIPLE CARRIERS IN COMPENSABILITY DISPUTE

Sometimes, in the cases involving a cumulative impact or repetitive motion

injury, progressive occupational disease, or multiple consecutive injuries, it is not

readily apparent which of the various employers and/or carriers might ultimately

Page 32 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

be responsible for a claimant’s injuries and medical treatment. Miss. Code Ann.

§71-3-37(13) (1972, as amended) provides a solution so that the claimant is not

left without treatment and benefits while the process for determining

responsibility evolves. The Commission can order the disputing parties to

provide the benefits equally until it is determined which party is solely liable, and

at that determination, the liable employer/carrier must reimburse the non-liable

employer/carrier for the benefits paid by the non-liable employer/carrier, with

interest.

PRACTICE NOTE: If confronted with this situation, the parties are

encouraged to get an Order from the Commission as contemplated by the

referenced code section. A volunteer who makes a payment that it doesn’t owe

might not have a remedy to recover payments which are ultimately not found to

be its responsibility unless the payments are done pursuant to the statute.

5.9. IDIOPATHIC FALLS

Sometimes the claimant is suffering from a medical condition that is not

caused by the job but the medical condition causes claimant to fall at work and

sustain other injuries. For example, if a claimant with epilepsy suffers a seizure

and is injured in a fall, the employer/carrier would not owe benefits for the

treatment of the epilepsy, but would owe benefits for the injuries caused by

striking the employer’s floor, or table or equipment. In Chapman, Dependents of

v. Hanson Scale Co., 495 So. 2d 1357 (Miss. 1986), the Mississippi Supreme

Court said:

We consider exposure to falls upon a concrete floor a sufficient risk

attendant upon employment so that an injury caused in part thereby

is compensable. Larry Ray Chapman, while at his usual place of

work, fell and struck his head upon just such a floor and as a result

died. His death arose out of and within the course and scope of his

employment.

Page 33 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

Chapter 6

DEFENSES TO CLAIMS

6.1. EMPLOYEE STATUS

It is important to remember that only claims by employees of the employer

are payable. Often times questions center on whether or not someone is an

employee as opposed to a volunteer or an independent contractor.

In its simplest form, an employee is a person under a contract of hire,

expressed or implied. An independent contractor, on the other hand, is not an

employee who is entitled to benefits. The individual might be doing work for or

on behalf of the employer, but that alone is not enough to make that person an

employee. A variety of things are analyzed to determine whether a person is an

independent contractor as opposed to an employee, and among those things are

whether or not the employer has the right to control the work activities of the

person in question. Remember that the right to control is not the same thing as

actually exercising that control, however. Generally speaking, if an employer

specifies the time that an individual comes to work, when they leave, how the

work is supposed to be done, provides the tools necessary to do the job, etc., the

person will be considered an employee.

Sometimes the right of control question is not very clear and the Court

has, in those circumstances, then looked at whether or not the work being

performed is an integral part of the employer’s business enterprise. When

analyzing the nature of the work in question to address this issue, an

employee/employer relationship is found when the work performed is an integral

part of the employer’s business. As an example, trucking companies will

sometimes enter into a contract with a truck driver and that contract could

actually call the driver an “independent contractor”. However, in analyzing the

relative nature of the work test, the Court might find that trucking companies are

hired to deliver products in a truck from Point A to Point B and the only way they

Page 34 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

can do that is by having truck drivers. As a consequence, the truck driving

activity is an integral part of the trucking business’ operations, and the injured

worker driving the truck is therefore an employee. Conversely, however, if there

is a refrigerator in the office of a trucking company that breaks and someone is

called to the office to fix that refrigerator, that person is likely not doing

something that is an integral part of the employer’s business operation.

Accordingly, he will probably not be considered an employee for workers’

compensation purposes.

A “volunteer” is a person who is not hired to do the work of the employer

but just shows up and starts working. Under those circumstances he will

probably not be considered an employee, but the analysis is usually fact

intensive. That concept should not to be confused with a volunteer fireman, as an

example, because a volunteer fireman is actually doing the activities of the

employer entity as specifically agreed by the parties and he would therefore be

an employee.

A “statutory employee” is a concept generally tied to the issue involving an

employee of an uninsured subcontractor. As a simple illustration, if the employer

contracts to build a house and he then subcontracts to a roofing contractor to put

on the roof of that house, and one of the employees of that roofing subcontractor

is injured, the injured employee will have a claim against his subcontracting

employer, but if his employer does not have workers’ compensation insurance

coverage, he would also have a viable claim against the general contractor as the

general contractor’s “statutory employee”.

6.1.a UNDOCUMENTED WORKERS/ALIENS

Undocumented workers, or those who are not citizens of the United States

or who do not have legal documentation permitting them to be in the United

States, can be employees for workers’ compensation purposes. The Mississippi

Workers’ Compensation Law makes no special provisions regarding “aliens” other

Page 35 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

than to say that if they have an injury and return to their home country, any

permanent disability benefits due can be paid in a lump sum rather than bi-

weekly. Miss. Code Ann §71-3-27 (1972, as amended). (As stated in Chapter

10.3.a, herein, that code section also limits the death beneficiaries entitled to

benefits in claims involving undocumented workers.)

6.2. PRE-EXISITING CONDITIONS

It is important to remember that the aggravation of a pre-existing

condition is still a compensable injury. Cases have variously described the issue

as one involving the aggravation, exacerbation, acceleration, or lighting up of the

pre-existing condition. All of that together or singularly can constitute a

compensable injury if the pre-existing condition was aggravated in a significant

manner. Stated differently, the employment or work injury does not have to be

the sole cause of a medical problem in order for it to be compensable.

Where there is a pre-existing condition, however, two possibilities can be

considered in limiting the indemnity benefits payable, the second Injury Fund

and Apportionment, both of which are discussed below. Neither has any effect

on medical benefits.

6.2.a. SECOND INJURY FUND

Mississippi has a very limited Second Injury Fund that is rarely applicable.

One of the definitions of permanent total disability is dismemberment or loss of

use of both arms, legs, hands, feet, eyes or any combination of those five

scheduled members. To illustrate, the loss of a hand and an eye is permanent

and total disability.

If, at the time of the accident in question, the claimant had already lost

one of those scheduled members and in the accident in question loses another of

those scheduled members, the claimant is permanently and totally disabled. The

Mississippi Workers’ Compensation Commission’s Second Injury Fund is

Page 36 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

applicable in those very limited circumstances. In such a case, the

employer/carrier must pay claimant’s temporary total disability benefits related

to the injury in question and the permanent partial disability benefits for the loss

of the scheduled member lost in the compensable accident; the Commission’s

Second Injury Fund will pay the balance of indemnity benefits for permanent

total disability. To illustrate, if the injury involves the loss of use of an arm and

the injury in question involves twenty weeks of temporary total, the

employer/carrier would pay twenty weeks of temporary total, two hundred weeks

for loss of the arm, and the Commission Second Injury Fund would pay the

remaining two hundred thirty weeks so that the claimant recovers the full four

hundred fifty week benefit for permanent total disability.

The Second Injury Fund has no application in any other circumstances

such as a back injury or other “body as a whole” cases.

6.2.b. APPORTIONMENT

Where the claimant is suffering from a pre-existing condition that is a

material contributing factor to his permanent disability or death, then permanent

disability or death benefits may be reduced by the proportion to which the pre-

existing condition contributes to the disability or death. The burden of proof for

apportionment is on the employer/carrier and case law requires that the

employer/carrier prove that, from a medical standpoint, the pre-existing

condition is a material contributing factor to the disability. The pre-existing

condition does not have to be occupationally disabling for apportionment to

apply. To receive an apportionment of benefits, the injury must involve the

same part of the body.

The amount of apportionment or reduction of an award due to the pre-

existing condition is not limited to the medical estimate regarding the degree of

contribution. In other words, the Administrative Judge, after considering all the

testimony, could apportion (or reduce) the award by more or less than the fifty

Page 37 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

percent medical estimate.

6.3. STATUTE OF LIMITATIONS

There are two separate and distinct statutes of limitations with which to be

concerned. The first applies where compensation benefits have not been paid

and the second applies where compensation benefits have been paid.

6.3.a. WHERE NO INDEMNITY BENEFITS ARE PAID

In those cases where no indemnity or compensation benefits are paid to a

claimant, there is a two-year statute of limitations beginning on the date of

injury. Miss. Code Ann §71-3-35 (1972, as amended). Once the statute of

limitations has run, the claim for both indemnity and medical benefits is barred.

Speed Mechanical, Inc. v Taylor, 342 So. 2d 317 (Miss. 1977).

The claimant can toll or stop the running of the statute of limitations by

filing a Petition to Controvert. Also, if indemnity benefits are paid or if the

employer pays salary in lieu of compensation benefits, the statute of limitations

is no longer applicable.

There are some cases indicating that if the claim is a “lost time” claim but

the employer/carrier never filed the First Report of Injury with the Commission,

the statute of limitations does not begin to run.

There can be issues involving a latent injury or one in which the effects of

the injury do not show up until a later time. These cases are always factually

intensive, but in general terms, the statute of limitations begins to run on the

date that the claimant, as a reasonable person, recognizes the nature,

seriousness and probable compensable character of his injury or illness.

6.3.b. WHERE INDEMNITY BENEFITS ARE PAID

Page 38 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

If compensation benefits are paid, the two-year statute of limitations is not

applicable. In those cases where compensation or indemnity benefits are paid, a

claimant has one year from the date that Commission Form B-31, Notice of Final

Payment, is properly filed with the Mississippi Workers’ Compensation

Commission. The one-year statute of limitations is technically a jurisdictional

issue taken from the combined reading of Miss. Code Ann §§71-3-37(7), 71-3-53

(1972, as amended), and Commission Rule 2.17. A combined analysis of those

sections indicates that the Commission loses jurisdiction of the case one year

after the proper filing of a B-31, and if the Commission loses jurisdiction of a

case, no one has jurisdiction over the claim since workers’ compensation issues

are exclusively reserved for determination by the Commission. The net result is

still a one-year limitation after the filing of a B-31.

A change to MWCC Rule 2.17 effective January 18, 2018, is significant as it

relates to the B-31. Under the new rule, filing the B-31 starts the running of the

one-year limitation provided notice of the filing is given to Claimant or Claimant’s

attorney. Notice may be given by any means which acknowledges delivery of the

B-31. Claimant’s signature is no longer required on the form, but if Claimant

does sign it, that signature constitutes an acknowledged delivery of the B-31 to

Claimant.

If additional benefits are paid or treatment authorized after the filing of

form B-31, the running of the one-year statute of limitations is tolled (or

stopped), and an amended B-31 showing the new payment totals is required.

The same notice of the filing as outlined above must be followed when filing the

amended form B-31.

Sometimes, after the B-31 has been filed, additional medical bills will be

paid that concern treatment rendered before the date of the B-31 filing, and

arguably, payments for those items would not toll the statute requiring a new

form B-31 to be filed.

6.4. INTERVENING CAUSE OF DISABILITY

Page 39 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

The employer/carrier are responsible for compensation and medical

benefits that are related to the claim in question. Sometimes an issue will arise

which challenges whether or not the current medical problem, treatment and/or

disability is related to the accident in question as opposed to an intervening

cause. As with all affirmative defenses, the employer/carrier bear the burden of

proving that the continuing disability and medical treatment should not be their

responsibility.

There is a presumption under the law that disability, once it is shown to

exist, continues to be causally related to the accident. The presumption is not

that the disability in fact continues, but if it does continue, the presumption is in

favor of a continued causal connection.

The burden is on the employer/carrier to prove that the effects of the

original injury have subsided and that disability is now only the result of the new

or intervening accident. Medart Division of Jackes-Evans Manufacturing

Company, Inc. v. Adams, 344 So.2d 141 (Miss. 1977). It is not enough that the

new incident or medical problem simply combines with the original injury to

create disability. Rathborne, Hair & Ridgeway Box Company v. Green, 115

So.2d 674 (Miss. 1959).

6.5. INTOXICATION

Miss. Code Ann. §71-3-7 (1972, as amended) provides as follows: “No

compensation shall be payable if the intoxication of the employee was the

proximate cause of the injury….” That simple statement has struggled for

viability as a defense under Mississippi law over the years. In 2012, Mississippi

law was amended in such a way that the intoxication defense has a new life,

although it has yet to be thoroughly vetted. For injuries on or after July 1, 2012,

the intoxication defense was revised with changes to Miss. Code Ann §71-3-7,

Miss. Code Ann. §71-3-121, and Miss. Code Ann. §71-7-5 (1972, as amended).

The changes are intended to make the defense work in such a way that the

Page 40 of 109

A publication of the Mississippi Workers’ Compensation Educational Association, Inc.

©2019

burden of proof is passed to the claimant when alcohol, improperly used

prescription drugs, or illegal drugs are involved in a claim. The basic provisions

include the following:

• No compensation will be payable if the use of alcohol, illegal drugs, or a

prescription drug taken inconsistent with the prescribing physician’s

instructions is the proximate cause of the injury.

• The Employer has the right to request that a claimant undergo a drug or

alcohol test following an on-the-job injury.

• A rebuttable presumption is created that the use of alcohol/drugs was the

proximate cause of the injury in the event of a positive test for:

o A blood alcohol content of .08% or greater;

o An illegally used drug; or

o A prescription drug taken contrary to the prescribing physician’s

orders.

• If the Claimant refuses the drug test, it is presumed that one of the above

three reasons was the proximate cause of the injury.