1

CIRCULAR ECONOMY IN THE FURNITURE

INDUSTRY:

OVERVIEW OF CURRENT CHALLENGES AND

COMPETENCES NEEDS

2

CIRCULAR ECONOMY IN THE FURNITURE

INDUSTRY:

OVERVIEW OF CURRENT CHALLENGES AND

COMPETENCES NEEDS

This project has been funded with support from the European Commission

(Project 2017-1-BE01-KA202-024752)

This publication reflects the views only of the author, and the Commission cannot be held

responsible for any use which may be made of the information contained therein.

3

Contributors to the report.

Ecores (Belgium)

University of Vaasa (Finland)

CETEM ( Spain)

AMUEBLA (Spain)

CENFIM (Spain)

KIT (Germany)

The authors would like to warmly thank the representatives of the companies that were interviewed

during the preparation of this report.

• From Belgium: Nearly New Office Facilities, Raymonde, Recup Design, Studio Swelvet.

• From France: Extramuros, Extramuros association, Wood Stock Creation.

• From the Netherlands: Herso meubelfabriek.

• From Germany: Möbel Kiefer, Walter Knoll Company, Brühl, Löw Breidenbach Möbelbau

and Woodloops.

• From Italy: Arcadia and Kubedesign.

• From Finland: Martela, Artek 2nd cycle.

• From Sweden: Green Furniture Concept.

• From Spain: Beltá & Frajumar, Almacenes Maderas Sureste, Coolwood, Figueras

International Seating, Salpax, Grisverd, L´estoc, Mapay, Mobles 114, Nutcreatives, Puertas

Perciber, Sancal and Xuppin’s.

4

Table of Contents

Introduction .................................................................................................................................................... 5

1. The EU furniture industry in a nutshell ........................................................................................... 6

1.1 Production and Consumption ........................................................................................ 6

1.2 Waste generation and treatment .................................................................................... 6

2. Circular economy in the furniture industry: challenges and current issues ........................ 8

2.1 Circular economy in a nutshell ........................................................................................... 8

2.2 Existing challenges of the circular furniture industry ...................................................... 9

2.3 Opportunities to make the furniture industry more circular ........................................... 11

3. Circular business models in the furniture industry: key skills and competences............ 13

3.1 Backstage skills................................................................................................................. 16

3.2 Frontstage skills ................................................................................................................ 20

3.3 Transversal skills and competences ................................................................................ 23

3.4 Overview of skills and competences ............................................................................... 27

4. Examples of circular furniture cases ............................................................................................ 32

5. References ............................................................................................................................................ 51

5

Introduction

The European furniture industry is currently facing a variety of economic, regulatory and

environmental challenges. Increasing global competition with manufacturing growth in

emerging markets, improved logistics and declined tariffs on foreign trade puts increasing

pressure on EU-based companies. In the domestic market, increased demand for low-cost

items makes it difficult for companies focusing on long lasting and quality products to

compete. Moreover, increased raw material, labour and energy costs within the EU also

challenge business as usual practices. In order to face these existing threats, new practices

and out of the box thinking are needed to renew the sector and make it more sustainable.

The circular economy provides a promising avenue to create more value in the sector by

addressing simultaneously resource constraints, consumer value and profitability

challenges. The transition from linear to circular however requires significant changes at

micro, meso and macro levels, from innovation at business model and value chain level to

the introduction of supporting policy measures.

This report provides an overview on how the circular economy is currently being

implemented within the furniture sector. By focusing on existing practices, challenges and

opportunities at the micro-level, the main objective of this report is to identify the necessary

skills and competences needed to support the transformation of furniture companies

towards a circular economy.

This report was developed in the framework of FURN360 (www.furn360.eu), an Erasmus+

EU founded project aiming at developing a novel curriculum supporting companies from the

furniture industry to implement circular practices.

6

1. The EU furniture industry in a nutshell

This section provides an overview of the European furniture industry, highlighting figures of

production, consumption and waste generation.

1.1 Production and Consumption

EU Member States manufacture 28% of furniture sold worldwide – representing a €84 billion

market, employing approximately 1 million European workers. Most of the companies in the

sector are SMEs. Italy (€17.5 billion), Germany (€14.5 billion), UK (€8.8 billion) and Poland

(€7.1 billion) are the most significant furniture producers by value. The most significant

exporters are Germany (€9.5 billion), Italy (€9.2 billion) and Poland (€8.7 billion), whilst the

largest importers are Germany (€11.8 billion), UK (€6.6 billion) and France (€6.0 billion).

European Member States are major consumers of furniture, estimated at €68 billion per

year, with the EU28 being a net exporter. The largest consumers by value being Germany

(€16.8 billion), UK (€14.2 billion), Italy (€10.2 billion), France (€9.0 billion) and Spain (€4.4

billion). This equates to a EU28 consumption of ~10.5 million tonnes of furniture per annum.

A significant proportion of consumption includes wooden furniture, kitchen units and

mattresses. The domestic sector accounts for 82% of furniture consumption, with the

remaining 18% associated with B2B (business to business) consumption. Based on a total

EU28 consumption of €68 billion, and consumption of ~10.5 million tonnes of furniture per

annum this would be equivalent to: €55.8 billion and 8.6 million tonnes of domestic furniture

consumption p.a. and €12.2 billion and 1.9 million tonnes of business furniture consumption

p.a.

1.2 Waste generation and treatment

According to European Federation of Furniture Manufacturers (UEA) statistics, furniture

waste in the EU accounts for more than 4% of the total municipal solid waste (MSW) stream.

Waste arising from commercial sources is assumed to contribute 18% of total furniture waste

generation across the sector. Total annual EU28 furniture waste equates to 10.78 million

tonnes. According to European Federation of Furniture Manufacturers (UEA) statistics, 80%

to 90% of the EU furniture waste in MSW is incinerated or sent to landfill, with ~10%

recycled. Reuse activity in the sector is considered low. Where reuse does occur, it is mostly

through commercial second-hand shops, social enterprise companies or charities. Some

7

furniture items are also exchanged via free and paid exchange platforms (such as eBay),

though the number of items traded in this way is difficult to quantify. With respect to

remanufacturing, the size of the European sector is estimated to be €300 million turnover,

employing 3,400 European workers (less than 0.1% of the total furniture industry).

8

2. Circular economy in the furniture industry:

challenges and current issues

2.1 Circular economy in a nutshell

The model of a circular economy presents an alternative to this linear system of accelerating

waste production. It aims to conserve natural resources by substituting products with

services and designing things to be used again and again before the materials are

recovered.

Finally, materials are recovered and recycled back into new resources, reflecting

the cycling of elements in natural systems, in which the waste from one process is the food

for another.

The circular economy has been hailed by businesses, moreover, as a way to marry

environmental sustainability with profitability. McKinsey and the Ellen MacArthur Foundation

have suggested that a circular economy represents an economic opportunity of more than

$1 trillion globally.

The circular economy rests on three principles:

1. Preserve and enhance natural capital by, for example, selecting required natural

resources wisely and choosing, wherever possible, technologies and processes that

use renewable or better-performing resources.

2. Optimise resource yields, that is to say design for remanufacturing, refurbishing, and

recycling to keep components and materials circulating in, and contributing, to the

economy.

3. Foster system effectiveness by designing out “negative external impacts” such as

reducing damage to human utility, and managing externalities, such as land use, air,

water and noise pollution, release of toxic substances, and climate change.

9

6 key cycles can be highlighted to make furniture more circular:

o Maintain – using preventative maintenance to maximise product lifetime, e.g.

a chair remains a chair;

o Repair – corrective maintenance , e.g. a chair remains a chair;

o Reuse – redistributing products through a change in ownership, e.g. a chair

remains a chair;

o Refurbish – remanufacturing the product to optimize lifetime, e.g. by resizing

a desk or changing the appearance of a chair through re-upholstering to

extend ‘fashion’ service life, or resizing desks;

o Re-purpose – change functionality of the product, e.g a desk becomes a

table;

o Recycle – recovering the value of components and materials for feedstock

as secondary materials in new products.

2.2 Existing challenges of the circular furniture industry

European environment bureau has identified the main challenges faced by the sector to

move from a linear to a circular economy.

Materials and design challenges

o Lower quality materials and poor design – the move away from solid wood and

metal furniture to cheaper materials, which restricts the potential for a successful

second life. Weak product design and specification drivers – in relation to recycled

content, reuse of components, product durability, and design for

disassembly/reassembly, repair, reuse, remanufacture and recycling, the drivers for

improvement are weak or absent.

o REACH Regulation (on Registration, Evaluation, Authorisation and Restriction

of Chemicals) – legacy hazardous substances pose challenges and additional costs

for recyclers, together with a lack of information on chemicals contained in products

and on ways how to deal with them appropriately.

Demand-side challenges

10

o Poor consumer information consumers are rarely given guidance on how to

maintain and repair furniture, in order to prolong and extend the product lifespan.

o Availability of spares – A lack of availability of spare parts encourages the purchase

of new furniture over circular consumer patterns.

o Weak demand for second-hand furniture - the price differential between new

furniture against the cost of second-life furniture, is not significant enough to drive

more sustainable purchasing behaviour. This is coupled with poor awareness of the

availability and benefits of sustainable furniture options, for both domestic and

commercial purposes.

o Poor demand for recycled materials - end markets for recycled materials, post

deconstruction, are underdeveloped, and in some cases, already saturated, with

these associated market failures restricting further investment in recovery.

Closing the loop challenges

o Limited collection and reverse logistics infrastructure – currently there are weak

drivers and underinvestment in the collection and logistics for furniture take-back.

Producer responsibility mechanisms are not widely used in the furniture sector.

o High cost of repair and refurbishment – in many parts of the EU, transport and

labour costs are high, making any significant repair and refurbishment costly,

particularly where re-upholstery is required. In general, economies of scale and

economic incentives are needed to make repair and refurbishment viable.

Policy challenges

• Weak over-arching policy drivers – typically furniture is not managed in

accordance with the waste hierarchy, with reuse failing to be prioritised over

recycling, incineration and landfill. Underinvestment in reuse, repair and

11

remanufacturing infrastructure limits the potential for furniture being managed in

accordance with the principles of the waste hierarchy or the circular economy.

2.3 Opportunities to make the furniture industry more circular

Circular economy interventions have the potential to help counter the general challenges

identified in the sector, with repair, refurbishment and remanufacture allowing value

recovery, economic growth and job creation within the European furniture industry. Whilst

recycling rates in the EU have improved through the introduction of policy mechanisms such

as the Landfill Directive, there is minimal activity in higher-value circular resource flows, with

remanufacturing accounting for less than 2% of the EU manufacturing turnover.

In terms of furniture in particular, whilst reuse of furniture is common, this tends to be on a

small scale and with local social goals in mind rather than larger scale environmental and

economic ones.

In order to support the transition, different supporting mechanisms could be promoted. The

European furniture industries confederation EFIC supports a step-by-step approach, in

order to grant a gradual, sustainable and realistic transition to the circular economy

principles and where environmental sustainability principles are balanced with economically

sustainable criteria.

As most of the companies in the sector are SMEs, supporting measures should be adapted

to the size and scale of these companies. Educational (awareness of successful businesses

cases, focused training programmes) and economical support (e.g. financial innovative

projects, public incentives and technical assistance, circular tenders development) are key

in order to support the transformation of companies. More precisely:

o Production phase: supporting incentives measures aiming at increasing resource

efficiency through increased product life time, repairability, recyclability, efficient use

of material.

12

o Use phase: measures to promote information and awareness to support consumer

choices towards more responsible products, with a focus on materials sustainability

information.

o Disposal phase: harmonization of Extended Producers Responsability schemes that

promote incentives for producers to take into account environmental considerations

along the products' life, from the design phase to their end-of-life.

o Circular procurement: Public authorities at the National and European can boost

circular economy principle in practice through public tendering. Green and circular

criteria, as well as the promotion of novel business models (such as leasing of

furniture) should be promoted.

13

3. Circular business models in the furniture

industry: key skills and competences

As described before, supporting educational programmes are key to support companies on

their transformation to circular economy. New skills, competences and capabilities are

needed in order to implement circular business models. In the framework of the FURN360

project, we have identified throughout Europe 25 furniture companies active in the circular

economy. Interviews, held between March and May 2018 in Belgium, Finland, Germany,

Spain, France, The Netherlands, Italy and Sweden, allowed us to gather insights on the

necessary skills and competences needed to develop circular business models relevant for

the furniture industry. This section highlights the learnings of this research.

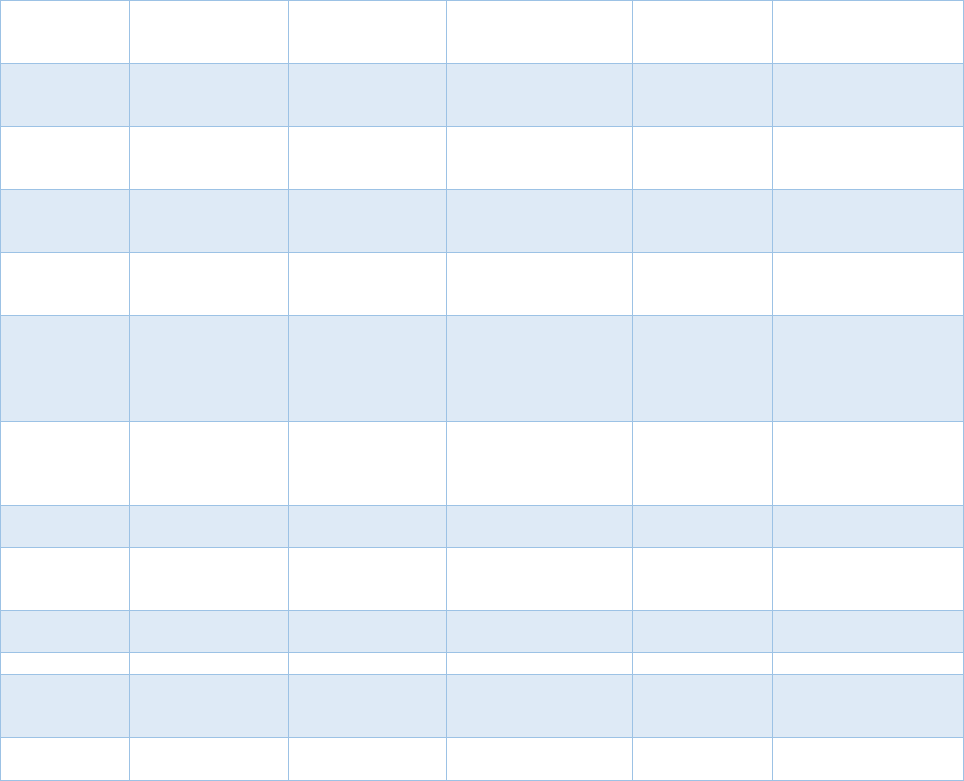

Table 1: Presentation of case studies

Code Country Circular business

model

Informant position Interview date brief description of

CBM

S1 Spain clean loop

/cascading loop

general manager 16-04-2018 FSC certified wooden

frames for upholstered

furniture, production of

pellets

S2

Spain

clean loop

Manager

19

-

04

-

2018

Certified wood

S3 Spain clean loop/short

loop

CEO 20-04-2018 Eco designed furniture,

transparency and

reparability

S4 Spain clean loop Product and marketing

manager

23-04-2018 Eco designed furniture

S5 Spain Director 18-04-2018 furniture design using

recycled material

S6 Spain long loop manager 16-04-2018 outdoor furniture

design manufacturer

S7 Spain clean loop quality manager 16-04-2018 fixed seats and

movable seating

solutions for public

spaces

S8 Spain clean loop Quality manager 18-04-2018 sustainable wooden

door manufacturing

S9 Spain long loop technical director 20-04-2018 manufacturer of leather

for the furniture

industry using pre-

consumer waste

S10 Spain long loop manager 13-04-2018 furniture manufacturer

made of recycled wood

S11 Spain clean loop head of Administrative

department

26-04-2018 manufacture of

upholstered furniture

B1 Belgium clean loop Founders 23-03-2018 furniture design using

unique reclaimed wood

B2 Belgium long loop project manager 11-03-2018 sustainable furniture

design using local old

furniture

B3

Belgium

long loop

coordinator

30

-

03

-

2018

B4 Belgium short loop CEO 11-04-2018- transformation of

workspace through

redesigned sustainable

furniture

14

F1 France long loop CEO 21-03-2018 and

3-04-2018

interior design of

spaces using reclaimed

wood material

F2 France long loop CEO 9-04-2018 high end furniture

designer made of

reclaimed wood

F3 France short and Long

loop

director 20-03-2018 Social purpose through

working with wood for

urban furniture

N1 Netherlands long loop and

access loop

CEO 5-04-2018 design of sustainable

furniture, leasing

service

Se1 Sweden clean loop, long

loop, access loop

Founder 11-04-2018 design of sustainable

furniture for public

spaces

It1 Italy clean loop, access

loop

CEO 9-04-2018 design of modular

sustainable furniture

De1 Germany long loop, clean

loop

manager 09.05.2018 Manufacturing of

seating solutions with a

focus on

ecofriendliness

De2 Germany long loop director 19.04.2018 Manufacturer of

furniture

De3 Germany clean loop long

loop

manager 09.05.2018 kitchen manufacturer

with environmental

concerns

De4 Germany clean loop manager 09.05.2018 Design of modular

furniture

De5

Germany

long loop

manager

09.05.2018

F

urniture manufacturer

Fi1 Finland Access loop and

short loop

sustainability Manager 21.05.2018 Furniture manufacturer

and service provider in

interior office solutions

FI2 Finland Short loop manager 25.05.2018 Retail of second hand

design furniture

15

In order to provide a clear overview of these skillsets, we have classified the competences

according to the various dimensions of the business model construct, using a

backstage/frontstage approach.

Figure 1: Business model construct

In the backstage side, we focus on the relevant skills necessary in the Resources, Activities

and partners dimensions of the circular business model.

In the frontstage site, we highlight skills and competences in Value proposition, customer

segments, customer relationships and channels.

Finally, we take a look at transversal competences that support both the frontstage and

backstage of business model innovation.

16

3.1 Backstage skills

Key resources

Key resources are the main inputs that a company uses to develop its value proposition,

service its customer segment and deliver the product to the customer. They are usually

based on a combination of tangible and intangible resources. These assets support the

creation of the end product and deal with the operational end of the business spectrum.

They highlight the type of materials needed, the equipment required and the type of

knowledge held by the staff employed. In the business models analyzed focusing on

companies applying circular economy principles in the furniture sector, the following

intangible resources were identified: 1) Knowledge and skills in sourcing the right material

and the right suppliers of ecological products, 2) Skills in acquiring new knowledge to

process reclaimed material.

Accessing the raw material (either reclaimed material collected locally or wood coming from

sustainably managed forests) is the most critical aspect in the new business model

development. This either requires knowledge and skills in developing a chain of custody

certification for FSC/PEFC wood – if the strategy is to focus on responsible sourcing, or

relevant skills in identifying and securing a stable source of reclaimed wood (either through

partnerships with waste handling companies or local public authorities) if the business model

focuses on reusing reclaimed materials. In the case of B4, the customer is also the provider

of the raw material, as the company offers integrated solutions for upcycling existing

furniture. Accessing this existing resource requires the implementation of a relevant logistics

routine (collection, sorting, cleaning processes) that is only possible if the company has the

right partners at hand. As they are driven by a strong ecological purpose, the circular

furniture companies strive to use more ecological products in their manufacturing process.

Finding substitutes to chemically processed glues, looking for alternatives to varnish by

using natural oil – the use of ecological options requires to adapt existing manufacturing

processes but also to search for the right eco-supplier.

Working with material which has previously been manufactured (in the furniture sector, the

majority of circular business cases make use of reclaimed wood) has consequences on the

way to handle and reprocess the resource: new skills need to be acquired throughout the

production cycle (from design to manufacture) as the type of wood that is supplied generally

comes in various batches and has different origins, different properties, and different

17

conditions. This needs to be analyzed, case by case. N1 manager, which has an extensive

experience in working with reprocessed wood highlights this competence: “Eight years ago

we were learning things and today we still learn other things because there is always another

type of wood coming up.”

Despite existing studies highlighting the importance of clean technologies supporting the

transformation to sustainable business models, technological novelties are often

disregarded as the main resources necessary to produce circular furniture. On the contrary,

working with reclaimed wood mainly requires manual work in order to put the wood back

into its initial condition. As F1 manager points out: “There is no need in technical innovation

but in vision and adaptation depending on the material that you have to work with”.

However, to make the transition successful, the staff needs to be aware of its limitations and

search for new knowledge. This is often done through trials and errors in a process that is

more timely than working with stable supplies. As B3 manager reflects, management has to

communicate the sustainability values that drive the company to work in such manner, to

make sure the staff understands and embraces this approach: “you have to make sure that

your co-workers want and can work in this way”.

Key activities

Transforming a linear business model into a circular one calls for a number of key activities

in order to operate successfully. Similarly to key resources, key activities are required to

create and offer a renewed value Proposition, reach markets, maintain customer

relationships, and earn revenues. Like key resources, key activities also differ depending on

the business model type. In the furniture manufacturing sector, the production part is the

main relevant set of activities. These activities relate to designing, manufacturing, and

delivering a product of superior quality. As a circular furniture products aim to deliver a

superior product with a minimum impact on resource use, adopting, mastering and

implementing eco-design skills (1) is perceived the most important distinctive key activity

along with Research and innovation along untapped material use (2).

Eco-design strategies are multiple and encompass various interventions throughout the life

cycles of a product/service. Strategies such as design for environment, design for

disassembly, design for modularity, design for recycling (design for material recovery),

design for reuse and remanufacturing (design for component recovery), design for reliability,

18

design for maintainability, and design for end-of-life allow the manufacturer to increase the

sustainability and circularity of their products to limit their impact on the environment in the

various life-cycle phases. Circular furniture companies highlight the importance of these

Design for X strategies. B4 manager for instance, stresses the significance of design for

remanufacture as a key aspect in eco-design process to facilitate the transformation of used

products into new ones. If most of the companies prioritize the use of eco-materials

(ecological glues for instance) in their manufacturing process, thinking of the next life of the

manufactured product seems to be more important to achieve a closed-loop process, as F1

founder discusses: ”we design our furniture in a way that we could easily assemble and

disassemble the material and reuse it after its life cycle”. Following a cradle-to-cradle

approach N1 founder combines Design for Environment with Design for Remanufacture:

“We are also developing a new glue that would be biodegradable on 18-20 years so that we

could reuse the wood when we get the tables back”. Specific to the circular furniture sector,

design skills are implemented once the resource (in this case the reclaimed wood) is

acquired. B3 manager for instance stresses the need to “readapt your design to the product

and to the material”. Eco-design skills however should not hide the need to develop products

whose value proposition relies first on aesthetic. As F1 director points out: “we think the

environmental approach will only be successful if we offer a beautiful product. Design is at

the service of the raw material, aesthetics at the service of ethics.”

Alongside eco-design capabilities, eco-innovation culture and environmental management

system strategy are also highlighted. Larger scale companies interviewed have

implemented environmental management systems to reduce their environmental impact.

Innovation in using untapped material is also recognized as a recurrent pattern in circular

furniture companies. Beyond product design and manufacture, circular companies in the

furniture sector may also innovate to maximize the value of their waste. In the case of

furniture manufacturer N1, the sawdust from the manufacturing process is sold to a local

partner which uses the glucose present in the wood and mixes it up with out of date biscuits

to make bio-alcohol. The pulp is used as filling for cat litter and compost, while a small part

of the wood waste is also used to warm up a local farming facility. This cascading use of the

various forms of wood by-products lead to close to zero-waste process, reinforcing both the

environmental purpose of the company while providing additional revenues.

19

Key partners/network

Alongside Key Activities and Key Resources, creating a relevant value network of suppliers

and partners is essential to make the business model effective. Opting for the right

partnership is instrumental in making a business success or a failure. Reasons for

partnership and collaboration may involve create new resource streams, access new skills

or competences, create new markets presence or pooling resources to offer an integrated

solution. If not all partnerships are key to the business, the capacity to identify key actors

and generate long-lasting collaboration (1) is an essential feature of a successful business

model innovation.

In order to close the loop or reinforce the sustainability of the final product/service offered to

the customer, collaboration skills and the ability to use external expertise are of high

importance. Belgian company B4 for instance, when not able to produce all the furniture

requested by the client, offered the customer Cradle to cradle certified products

manufactured by other companies as part of an integrated solution. The results led to an

increased overall sustainability of the final service provided.

Collaboration skills also provide access to new projects and resources. F1’s partnership with

a local authority gave the company entree to waste management facilities allowing the

company to access abundant and regular wood waste flows. In this win-win partnership, the

company provided the authorities with figures on the amount of diverted wood waste, thus

supporting the regional recycling/reusing targets. In the Netherlands, N1 developed a long

term partnership with a company recovering materials from buildings, allowing it to get

access to untapped wood material.

Long term commitment and trust in partnership development is also perceived as key. B4

has been developing its network of suppliers for 25 years and can count on the strength of

these relationships to deliver its services. The partnerships also extend to the clients side.

Long lasting relationships with clients provide the best word of mouth advertising. F2

developed a steady set of complementary partnerships to support its development. First,

with a French waste management company. The company located its offices on the waste

management site in order to directly access the wood waste collected by its partner. The

company also partnered with a used furniture collector. In order to increase its commercial

reach at European level, the company teamed up with one of their client (a large office

20

furniture brand) to distribute their production, giving it more credibility and an extended

customer outreach

3.2 Frontstage skills

Value proposition

The value proposition of a company provides a unique combination of products and services

which provide value to the customer by resulting in the solution of a problem the customer

is facing or providing value to the customer. In the furniture sector, if the conventional value

proposition is to provide access to high-quality, functional design furniture, the emotional

dimension of the product, translated in a strong responsible and sustainable ethos, is always

combined to the functional and aesthetic dimensions generally promoted in the sector. In

that respect, circular furniture manufacturers need to develop skills and competences

associated to the sustainable value (1) associated with their offerings, while responding to

their customer needs, through product customization (2) and product uniqueness (3)

features.

Product customization is a strong feature in circular value proposition of the furniture

industry. As Belgian company B3 coordinator states: “Everything is custom made”. Client

needs and preferences are clearly identified. A matching between existing wood in stock

and client preferences is being made. Similarly Italian furniture company It1 develops its

kid’s furniture design with a strong focus on product personalization. Clients are invited to

download tutorial on the company website to transform or upgrade the initial purchase,

allowing the client to give a personal and unique feel to the product. Associated with product

customization, product uniqueness is a common feature in circular furniture value

propositions. Belgian company B1 for instance doesn’t search for the perfect wood but sees

value in working with imperfect and unique trees with provides a sense of uniqueness to the

product and offers a story to the client on the origin of the tree used to develop the product.

Associated services are often included in the value proposition. Beyond selling furniture,

circular furniture companies often use their sustainability/circularity expertise as an added

value to reach customers in need for an improved sustainability impact. Swedish company

Se1 for instance, active in the B2B sector, highlights in its value proposition the increased

sustainability image of public clients purchasing their furniture. This results in a Brand

booster value proposition in which the client benefits from the sustainability value of the

21

furniture company. Similarly, French company F1 uses its communication skills combined

with sustainability expertise:”We make up a storytelling for our client so that it would also be

easier for them to communicate about their sustainability actions on their social media. We

provide the client with a communication strategy that is pre-established.”

Customer segments

Customer segments are the community of customers or businesses that a company is

aiming to sell its product or services to. In order to remain viable, the product or service

offerings must appeal to its target customer segment. In the circular furniture sector,

customer segments are generally perceived as a niche market. Niche market refers to a

customer segment with extremely defined characteristics and very particular needs. As a

consequence, this segment expects a highly tailored product, custom made, to suit their

needs. This in turn has a strong effect on the value propositions, distribution channels and

customer relationships, all closely defined according to the preferences of this particular

customer segment.

Companies applying circular economy principles in their business model and in their value

proposition therefore directly target consumer driven by high green and sustainable values.

In the B2C market, targeted segments are sensitive to the environmental and or social

dimensions of the products or services offered. In that respect, furniture companies offering

solutions fitting with circular economy principles do need to understand green consumption

motives and behaviors and adapt their value proposition accordingly. Green certifications

on one hand, or a compelling storytelling supports the customer in choosing a product close

to its values. As several circular businesses in the sector include a strong social dimension

(by employing staff with disabilities or facing employability challenges), the social purpose

of the company leads to focus on customer segments sensitive to these issues. In the B2B

market, targeted segments are often companies willing to improve their sustainability

credentials by using furniture or interior design solutions that can be easily associated with

a green image (through the purchase of products with a clear “recycled” look and feel).

22

Customer relationships

Customer relationships define the nature of the relationships that an organization develops

with its customer segments. The customer relationships that a company opts for are based

on their overall business model and directly impacts the customer experience. Companies

active in circular furniture tend to create and maintain a strong personal relationship with

their active clients. This has direct impact on customer acquisition, customer retention and

sales increase. These personal relationships development requires specific dedicated skills

which focus on engaging the customer through trust and transparency (1), personal

assistance (2) and community building (3).

Building trust and confidence requires a high level of transparency. “We always meet the

client before we create a product so that we can explain who we are, what we do and why

we do it.” tells B3 coordinator. “We invite people to see our workplace”.

Personal assistance is also highlighted. As ecological furniture may need special after-care

to keep its long-lasting properties, it is important to educate the client, provide resources

and information on how to maintain the product. Education the client goes beyond product

features: perception of reclaimed material is often perceived as a barrier to purchase from

a customer perspective. A remanufactured product is often compared to a second hand or

recycled product. Providing the client with the right communication is key to turn an initial

negative perception into a positive, value creating message. Belgian company B4 for

instance provides certificates to the clients showing the CO2 emissions reductions

associated to their use of service.

Customer relationships can also be maintained through Community-building strategies. As

an illustration, It1 created a community of users around their modular furniture products, with

the goal of exchanging ideas on how to upgrade or transform their initial kid’s tables and

chairs. Organization of workshops with clients is also a favored strategy to reinforce

community building. F2 regularly co-creation workshops where upcycling techniques are

taught.

23

3.3 Transversal skills and competences

Beyond the different dimensions of the business model innovation and the associated skills

analyzed in the previous section, it is possible to identify recurring skillsets that help shape

the circular business model of the companies interviewed. These transversal skills influence

and bridge several dimensions of the business models of these companies. Four transversal

competences are presented below: sustainability competences (1), entrepreneurial

competences (2), systems competences (3) and user-centered competences (4).

Sustainability competences: Translating personal sustainable values into a new

value proposition…

All informants are driven by strong personal values in relation to environmental challenges.

Belgian company B1 developed its value proposition based on its knowledge about the

finitude of resources and the need to apply a reuse principle in its business model. The

founders all understand the need to change the existing linear model to make a positive

impact. “We want to produce something that has no or little impact on the environment”

states the founder of French company F1. These values also extend beyond the awareness

of the environmental challenges. Translating a social purpose into a business model is what

drives the companies who have added a social component (professional reinsertion of

people with working disabilities) in their business model. These values are anchored in the

companies DNA from the start due to the personal conviction of their founders. Companies

with a longer business lifetime engaged in a transformation to realign their initial purpose

with their current values. Belgian company B4 for instance, after calculating its carbon

emissions footprint, realized it could do more by reusing used furniture/material in its

process. The strong will to reduce the impact of its activities on the environment and climate

is what drove the company to develop its circular services. Translating personal values into

a renewed business model comes from the capability to be future oriented and embrace a

long term orientation (Eccles et al, 2011):”If you are future oriented and if what you do makes

sense, you have to go for it. If not, do not start with it” states N1 CEO. “I’m not doing circular

economy for myself but for my child and for the future generations to have a brighter future.

This can only happen if we change things now.”

24

Entrepreneurial competences

Engaging in the circular economy does not come without bump. As the approach defies

current businesses practices in the sector, it is therefore necessary to adopt an

Entrepreneurial mindset to overcome all the unexpected challenges coming along, from the

building of new supply chains, the adoption of different manufacturing processes and the

utter complexity to convince consumers to purchase a product that might be perceived as

“not new”.

Before even grasping the challenges ahead, the idea leading to a renewed business model

comes from a strong sensing of opportunities, as B3 manager states: “In the beginning we

already used scaffolding wood. People came to us to buy this wood and then saw what we

could actually do for them. The opportunity appeared at the moment.” Seizing the

opportunity behind a circular business model however requires to understand the necessity

of a trial and error approach, a feature shared by the majority of informants. This mindset is

present in the young companies entering the market as completely circular, but also among

the companies who went to a gradual transformation. Belgian company B4, who has been

in active as a circular company for 10 years confirms: “We still work on trial and error. We

build our knowledge thanks to that and we still build knowledge”. The acquisition of new

skills often take time and patience, as N1 director points out:” I had to test a lot of methods,

do by trial and error to be able to reach the circular level that I have attained now. The more

we make mistakes, the better. We have to learn by trial and error. It is the best way to

improve oneself”

As part of the entrepreneurial mindset often comes a bricolage skillset. In this make-do

approach, often constrained to low investment and limited resources, time and personal

conviction are the driving force to try out new ways to work with the wood. “You have to

work a lot, develop new techniques, and acquire common sense. You continuously have to

ask yourself questions. You need to take time to try new methods” asserts N1 founder. B4

manager: “we search for solutions and try them out before you find the optimal solution.”

User-centered competences

User-centered design tries to optimize the product around how users can, want, or need to

use the product, rather than forcing the users to change their behavior to accommodate the

product. This skillset is translated in practice by engaging the customer in a co-creation

25

process, offering an integrated customer value creation process and meeting customer

needs.

In many customer-supplier relationships today, customers engage in dialog with suppliers

during each and every stage of product design and product delivery. In this interactive

process of learning together, firms and their customers have the opportunity to create value

through customized, co-produced offerings. This co-creation process can assist firms in

highlighting the customer’s point of view and in improving the front-end process of identifying

customers’ needs and wants. This pattern is preponderant in the circular business models

from the furniture industry. Given the resource versatility of reclaimed wood, the majority of

companies in the circular furniture sector are focusing on custom designs. They involve

customers from the first stage of the design process, inviting them to the facilities to look at

the available raw material and select the most suitable ones to meet their expectations. This

logic can often be extended to a stronger involvement of the customers, when for instance,

workshops are organized at the client facilities to co-build the renewed interior with recycled

wood materials.

Knowledge about customers’ value-creating processes should not be based solely on hard

data (such as customer satisfaction measures), but should incorporate a deep

understanding of customer experiences and processes.This requires to be able to take into

account the various dimensions inherent in the customer value creation process. Beyond

the functionality associated with the furniture itself, companies active in the circular furniture

business are able to engage the customer through highlighting other value dimensions:

Experiential and sensorial value, through the creation of a unique aesthetic furniture design,

but also symbolic value, by engaging the customer in experiencing the use of an ethical

product, free of chemicals and made of reclaimed waste.

Another key aspect of user-centered capabilities is to meet customer needs. In the pre-

purchase phase, it is important to support the client in making the right consumption choices.

Firms in the circular furniture business act as sustainability expert and can advise on the

right sustainable alternatives. Advice and support on taking care of the furniture in the post

purchase phase is also of high importance, to maintain the lifetime of the product purchased.

26

Systems competences

Sustainability challenges are complex and interconnected in their nature. However they are

often approached through single issue and technical dimensions rather than seeing it as a

systemic issue. In order to understand the challenges, taking a systems approach and

looking at these challenges in a holistic way, having a broad understanding of sustainability

whilst also using tools such as systems thinking and mapping can facilitate the

transformation of companies toward a circular economy. In that respect taking a systems

perspective can also strengthen the value proposition of the business model.

B4 for instance, has managed to integrate different strategic activities internally due to its

specific position in a holding group offering supporting complementary services, such as

removal and logistics services. The understanding of the advantageous position of the

company in its value net allowed the company to provide a holistic approach on the whole

value chain of the circular solution (access to used furniture, removal, transport, sorting,

storage and inventory, remanufacturing, interior design transformation services). Taking a

value network approach also reinforced the quality of products/service offered by the

company. “You have to include architects, designers, and consumers in the story of the

company, make it possible to think together and give advice to each other”.

27

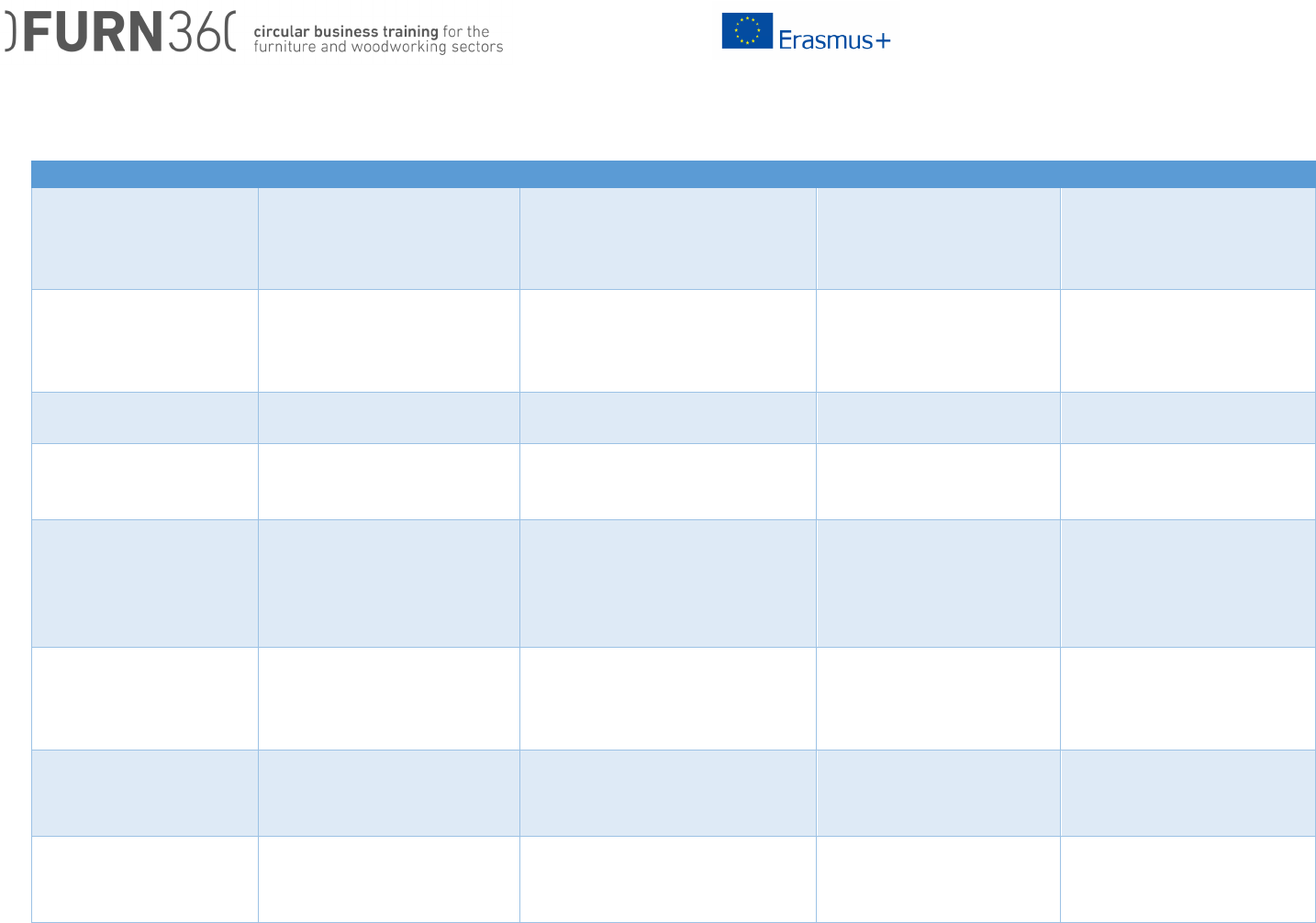

3.4 Overview of skills and competences

The table below provides an overview of identified skills and competences supporting the transformation to circular business models.

Business model block Key process/routine skills/competences Example Representative quote

Key Resources / key suppliers Sourcing Knowledge on accessing sustainably produced

or reclaimed material.

B1 assesses different options of wood

and resources based on its ecological

impact (location, certification, etc…).

”we need a clear understanding and

knowledge of the different resources

and raw materials” B1 founder.

Key Resources/ Network Sourcing Knowledge on identifying the right eco-

suppliers for material substitution.

B2 has identified the right eco-

supplier for ecological oils.

“We try to deal consciously with our

material. We try to find raw material as

close as possible to our production

place to promote short-circuits”B2

founder.

Key Resources / network Sourcing Skills in handling the customer as a provider. B4 uses the old furniture from its

clients as raw material for new

furniture

“our clients are important as we get

the raw material from them” B4 CEO

Key resources staff training Awareness of skills limitations and will to

extend knowledge.

B2 manager had to train himself and

work by trial and error.

“There are different types of wood. I

had to learn how to manufacture it and

develop my technical knowledge by

trial and error” B2 manager

Key resources staff training Ability to communicate values to staff. B3 founder stresses the importance of

communicating the values behind the

company to the workers

remanufacturing the furniture.

“You have to make sure that your co-

workers want and can work in this

way” B3 founder.

Key Activities Design Skills on design for X. B2 develops its product so that

material can easily be recycled at its

end of life.

“We use steel table legs that can be

completely recycled because we do not

mix the alloys”B2 manager.

Key Activities Research and innovation Innovation in untapped material use. B1 tries to innovate in using parts of

trees that would otherwise be used for

biomass energy

”We are also trying to develop design

techniques to reuse branch tree tops to

be able to upcycle” B1 founder.

Key Activities Waste management Knowledge on recycling and cascading use. N1 aims for zero waste processes by

taking a cascading approach to its

wood by products.

“We have no waste. Waste is just waste

because you call it that way, everything

is raw material but you need to find the

28

contacts that can helps you and use

it”N1 CEO

Network/key suppliers sourcing Collaboration and partnerships skills. B2 developed a strong alliance with a

local waste management organization

to access it bulky waste.

“Without the collect of the bulky waste

and its supply of wood, the project

could not have been conducted” B2

manager.

Network/key suppliers sourcing Networking skills. B1 has learnt to develop strategic

partnerships with regional waste

management authorities, to help them

source relevant untapped material.

key Resources/network strategic Pooling of complementarity skills. B2 identified the right partners to fit

with its existing competences.

“I had the marketing and production

skills while he had access to the

material and has a good network and

corporate skills” B2 manager

Value proposition Communication Building and communicating a sustainable

image.

B1 founders learnt about

sustainability in their education and

automatically translated it in their

brand identity

B2 highlights environmental,

aesthetic, local and social value in

their marketing

Value proposition design Product uniqueness development Company B1 highlights imperfection

from trees to create unique products

“We work with third choice wood

because it has imperfections such as

knots and cracks which is what we are

searching for” B1 founder.

Value proposition design Product customization B2 involves the client in selecting the

form of the end product

“we discuss with the clients about the

type of wood he wants, the dimension

and the finishing work of the furniture”

B2 manager

Customer segment Communication Knowledge on green consumption motives and

behaviours.

B3 develops its promotion mix to

attract green-minded consumers

“we target people that have a social and

ecological self-conscience” B3

coordinator

29

Customer relationships Manufacturing Transparency in product manufacturing company B1 invites clients to visit

their facilities to explain their

manufacturing process

”The fact that the people can see the

origin of their products begins to be

important again” B1 founder.

Customer relationships Communication Personal assistance: educating the client B1 informs their clients on the

ecological impact of their product

“We have the responsibility to

communicate the best choice to our

client” B1 founder

Customer relationships Communication Community-building B3 aims to implement workshops for

the clients to create a stronger sense

of community

“..organize some events when families

can come, have a drink, see the

workspace. We would like to bring

people together”. B3 coordinator.

30

Overview of transversal competences

Business model block Key process/routine skills/competences Example Representative quote

Value proposition, Key Resources Strategic vision Awareness and education on global

environmental challenges and the will to act

upon it.

Company B1 founders have received

trainings on the principle of circular

economy in their education

”the way we are consuming for the

moment is not sustainable so we try on

a small scale to go towards the good

direction”

Key Resource/Key activities Strategic vision Translating a social purpose into a business

model.

B2 redesigned his business model by

taking into account the social

motivations behing it.

“the cooperative wanted to enable

professional reintegration and to work

locally by using an abundant local

resource.” B2 manager

Key resources Strategic Entrepreneurial mindset. “You need the power and challenge to

work in such a way” B1 founder

Value proposition Strategic “Think outside the box” skills. B4 looks at space use inefficiency as

a driver to offer new value

proposition to its clients

“We try to motivate our clients to use

their space differently, to find the

optimal use of the workspace” B4

Key activities manufacturing ”Trial and error” approach to innovation. “We had to do a lot of things for the

first time so we were always

encountering problems. in the end we

learnt to deal with these problems” B1

founder

Key activities manufacturing “Bricolage” skills. B1 used reclaimed wood to begin

with because it was cheap and easily

accessible

“In the beginning the free material was

useful because we didn’t have the

capital to invest in other wood” B1

founder.

Value proposition/key

activities

design Cocreation with customers B1 offers “build your space”

workshops for its clients

“we bring our tools, material and

knowledge and we boost the

participants” B1 founder

Value proposition value creation Understanding of the various dimensions

of the customer value creation

F1 highlights aesthetic and

symbolic value beyond functional

value in its value proposition

”we work with enterprises that are

interested by our design and the

31

environmental message of our

products” F1 Founder

Value proposition value creation Responding to customer needs B3 starting designing upcycled

furniture to meet customer

demand.

“Our clients were asking for

furniture made of reclaimed

material. We wanted to do what our

clients like. the clients are part of

the story. B3 manager

key resources / key partners Strategic systems mapping and understanding B4 has created a systemic circular

solution based on its position in its

value net involving different

companies from the same group

“We have a real chain operation”

32

4. Examples of circular furniture cases

4.1 Green furniture – Sweden

Green Furniture Concept makes sustainable design for public interior areas. Configurably

winding, seamless seating and acoustic lighting from Green Furniture can be found in places

like Dublin Airport, Topanga Mall (LA) and Stockholm Central Station.

Green Furniture Concept was born out of a deep desire to be a leader in sustainable furniture

design and production. Sustainability has guided the development of the company and is

part of its soul as a company. From early on, the management has committed to integrating

environmental sustainability into its business processes and continuously improve its

environmental work.

Green furniture aims to be ecologically sound in all aspects: in its everyday mission and

through its products. The company strive to keep its products integrated in the natural cycle

or in a technical cycle free of waste. The Nordic Ecolabel is used as a base standard for

33

each product development. Those standards are exceeded by, for example, using natural

hard wax oil instead of varnish and upcycled instead of virgin materials.

“When I started making furniture I was shocked by how smelly furniture manufacturing was,

literally, with glues and coatings, and I decided to make a difference. The Green Furniture

brand was introduced at the Stockholm Furniture Fair in 2010, based on the idea of creating

sustainable modern classics. Furniture with heart and soul, pieces that say something about

both your taste and your sense of responsibility. Design that is better because it is made

according to sustainable principles, made to the highest standards of quality, so that your

piece can be with you for a long time. Furniture made using strong emotional language that

forges a relationship between the piece and people.” Johan Berhin, Founder.

Green furniture philosophy is that eco-friendliness should also make better furniture in terms

of function and aesthetics. Hard wax oil is not only equally resistant to varnish, it imbues the

wood surface with an utterly different feel and scratches can be easily touched up, just like

shoe polish, to keep your furniture always-like-new. Upcycled wooden planks not only

provide good solid wood, they carry a story of origins and the wise use of resources while

adding life and uniqueness to the design.

More info: www.greenfc.com

34

4.2 L’ESTOC - Spain

L’Estoc designs, produces, and sells furniture made from recycled materials and disused

objects. Its goal is to improve and dignify the life of people with intellectual disabilities,

fostering development through work. The combination of materials is the house trademark:

From wooden blinds the company makes benches or screens, a door can become a table,

and a crib is turned into a child desk.

A social lens to the circular economy

“We believe that a sustainable economy can be obtained not only from the environmental

point of view, but also from the social one. For this, we transform recoverable materials into

a valuable resource through a unique creative process that helps normalize the lives of

people with disabilities.’”

In Catalonia there are 378.000 registered people with disabilities, 10.6% of which are of the

intellectual type. Almost 55% of them are of working age, but only 78.000 actively work.

L'estoc offers a wide range of possibilities for labour integration. The worker gets involved

from the beginning in the whole process with a piece: Fixing, treating, polishing, painting,

35

and varnishing. The activity is stimulating, fosters creativity, and gives visibility to the skills

of people with disabilities.

L'estoc has been awarded the programs for Social Entrepreneurship of Momentum Project

by BBVA and Esade (2015), La Caixa Foundation (2012) and the Generalitat de Catalunya

(2011).

More info: http://lestoc.com/en/estoc/

36

4.3 ARCADIA DESIGN – Italy

“We embraced the circular economy principles because we believe that objects should

never be thrown away, but always transformed,” explains Massimo Germani., co founder

of Arcadia Design, an Italian innovative start up based in Central Italy.

The company designs EASYDiA + EASYoLo a set of modular chairs and tables for

children from 18 months up to 10 years, which offer space to customization and are designed

under circular economy principles. Their modular structure stimulate reuse,

transformation, customisation and imagination,that adults and children can share:

assembling the pieces when they get the pack, customising or replacing modules over time,

disassembling their chair or table when no longer needed and giving them a new beginning,

making one new suggested products or invent new ones.

“Rather than fix interiors, we prefer to conceive objects that you can modify and make of

them exactly what you want. So a chair and a table become a toy for children, a photo frame

for the family, an armchair for young people”.

37

The product is entirely made in Central Italy and based on a careful research on

sustainability criteria, partly in collaboration with University Milan Bicocca: all solid wood, a

limited edition in local chestnut again from Central Italy, to cut transports and support the

maintenance of local woods, finishings that are totally water-based, non-toxic and certified

for food contact.

More info: https://www.arcadiya.net

38

4.5 BRÜHL - Germany

With a durable, sustainably manufactured furniture made from eco-friendly materials, Brühl

is making a contribution to the conservation of our planet’s finite resources. The company

intend to make furniture “lighter” in terms of overall resource consumption and wants to

make sure that it “can be used for longer and in a better way”. All manufacturing steps

throughout the entire product life-cycle take ecological, sustainability and health-related

aspects into account. For example, values lie far below the legally permitted employee

exposure values for adhesives; in fact, they are almost below the detection threshold. All of

the materials used are also carefully examined with regard to their environmental

compatibility and durability to ensure that the furniture has a particularly long life-span. Some

of the designs are fully recyclable, and leftover materials are recycled. Brühl sources the

renewable resource wood from certified sustainably managed forests (FSC), and wherever

possible locally.

Leather suppliers use salt-free preservation techniques that save water. Oliva leather, for

example, consists of hides that have been tanned with the aid of plant-based methods and

therefore almost completely without the use of chemical substances. When it comes to the

textiles used, Brühl is also always on the lookout for even more environmentally-friendly

39

solutions in cooperation with sustainability-focused suppliers. All of the fabrics used comply

with the Oeko-Tex® standard or bear the EU-Flower eco-certificate. Due to the high quality

of the fabrics and the careful and precise finishing of the covers, the seating furniture is

exceptionally durable and has a particularly long life-cycle. Much of the furniture also

features removable covers, which essentially doubles its life-span.

In 2002, the company’s environmental commitment earned brühl the Bavarian Environment

Medal for special contributions towards environmental protection and regional development.

In 2009, brühl was the first furniture manufacturer in Germany to be awarded the “Blue

Angel” eco-label for particular eco-friendliness. brühl has also been a certified carbon neutral

manufacturer since 2017. As proof of their particular eco-friendliness brühl was the first

German seating furniture manufacturer to be entitled to use the ‘Blue Angel’ label in 2009.

More info: https://bruehl.com/

40

4.5 NNOF – Belgium

Nnof stands for 'nearly new office facilities': office furniture that is almost new. The Vilvoorde

company design offices with mostly recycled material, which usually comes from the

customer's previous interior. Chairs are re-upholstered, tables are given a new top layer,

cupboards are disassembled and transformed into new furniture. The end result does not

look like a thrift store, but simply as a new interior.

How did they get there? “Around the turn of the century I started to read a lot about climate

change, our handling of raw materials and all the problems that awaited us”, explains

managing director Didier Pierre. 'That was not fun. Our group already had a moving

company at that time, and another company that offered furniture management for offices.

We measured our climate impact and showed that we reduced our emissions every time we

repaired office furniture. It made us think: could we not go much further? We knew very well

how much office furniture was simply thrown away. Often we had to dispose of a whole

interior for the same customer with our moving company, and then to install brand new

furniture with our furniture management company. It was absurd. We decided to invest much

more in repairs. In the last two years we have also committed ourselves to re-working: we

41

now use tablets from old tables to make seating furniture, for example, or we design a rack

system made from used table bases. If customers leave us somewhat free, we can reuse a

very large part of their interior.

Why is it working so well? Nnof is more sustainable and cheaper. “That is surprising, but

actually it makes sense, because we do not buy raw materials, only for the final layer. And

I have no illusions: our customers choose us mainly because of the price advantage. But

they do agree that they choose sustainably. And that is good.”

More info: www.nnof.be

42

4.6 HERSO – The Netherlands

The Dutch wood working company Herso uses reclaimed wood to make new products, from

furniture to floors.

Herso uses wood from old floors, furniture, cut offs from carpenters and of course their own.

They select good pieces of wood, even small ones, to use in their designs. Iron pieces, such

as nails, are also reused, while sawdust is use to make bio-alcohol, cat litter, and compost.

In the rare case they need to use new wood, it is always FSC approved.

Rather than just selling their products, Herso has a sort of deposit money arrangement. In

essence, you rent the products. During its use, the product keeps a value that is determined

beforehand. At the end of use the product can be handed in, so that Herso can use it again

to make new furniture and floors. All Herso’s tables are solid and made by hand. They only

use biodegradable glue.

43

The company also takes on various projects, such as the no-waste floor of Circl, a circular

pavilion in the Netherlands. The floor is the size of a football field and made from wood from

all sorts of sources, such as a villa from the 50s, old furniture, a hardwood terras, window-

frames, and an old door. All this waste wood is turned into a beautiful wooden floor. And

Herso promises that when the pavilion is deconstructed in 25 years, that they will make new

products from the floor.

More info: www.herso.nl

44

4.7 Figueras International Seating - Spain

The Figueras Group is the global specialist in the design and manufacturing of high-end

fixed seating and movable seating solutions for public spaces, crafted through design,

innovation and engineering since 1929.

Figueras wants to make a significant contribution to improving the environment and believes

in eco-design and taking a sustainable approach to manufacturing. That’s why the company

has complied with ISO 14001, the global, officially-recognized, voluntary standard that

certifies Figueras’ exemplary environmental performance.

In 2017, Figueras Seating also obtained certification, in accordance with international

standard UNE-EN ISO 14006. This certification applies to product design and encompasses

environmental aspects such as the integration of product sustainable materials, eco-friendly

production processes, non-toxic materials use and. All considering the complete lifecycle of

the products.

More info: https://www.figueras.com

45

4.8 Mobles 114 - Spain

Mobles 114 editions specialises in producing contemporary furniture and fittings and is

based in Barcelona. The m114 brand, founded in 1973, is committed to improving the quality

of public places and homes with unique, timeless designs.

Mobles 114, an agent of change towards a sustainable model.

Aware that 70% of the environmental impact of products and services is determined during

the design stage, Mobles 114 sees design as a means of bringing about paradigmatic

changes towards a sustainable model.

Commited to better products, from the design stage through to manufacturing, distribution

and marketing, the company strives for environmental coherence in its final product.

Mobles 114 brings history and stories to life, turning them into good quality furniture, long-

lasting, sustainable and of great beauty. In many of its projects it collaborates with designers

who are sensitive towards the environmental issue, who look for functionality and aesthetics

using natural, local materials with a comprehensive view beyond the item of furniture itself.

The company applies various eco-design strategies in its production: 100% recycled and

recyclable materials; locally sourced or produced materials or natural materials; designs that

are easy to assemble and dismantle; products made from a single material whose

components can be recycled at the end of their life cycle, and minimal volumes to reduce

46

consumption as a result of transport; as well as a design that emphasises high quality and

durability in the final product.

Products that never go out of fashion, that last because they offer something more than just

a mere function, because they remain coherent in each phase of the process of design,

manufacture, distribution, use and useful life. These are well-designed items of furniture,

well-made and well-conceived from the beginning to the end.

Mobles 114 thereby becomes an agent of change towards a more sustainable and

responsible consumption, influencing its chain of suppliers and also its clients with a

sustainable, competitive proposal: a benchmark in finding eco-innovative solutions in the

furniture industry.

More info: http://mobles114.com

47

4.9 SANCAL - Spain

SANCAL, one of Spanish leaders on upholstery furniture, is dedicated to the production of

sofas, chairs and any upholstery furniture possible to be developed. Their products are well-

known for the effort and passion that the company put in the design procedure. For Sancal

design should be “a source of: Innovation, to develop new concepts and improve existing

products. Simplicity, to make our lives easier. Closeness, to make the new familiar.

Creativity, to thrill us”.

Quality and sustainability

“We reject the premise of the throw-away society, carefully designing pieces that will stand

the test of time”

Sancal have both the ISO 9001 and ISO 14001, yet its concern goes beyond the

requirements of any norm. Within its manufacturing process Sancal starts with wood from

renewable sources and carefully separate their residuals for recycling. In addition, solar

panels on their two factories with near 15.000 m

2

produce all the necessary electricity.

48

Design towards a circular economy

“Our premise is to design products which go forward with us, which bring value and allow

us to create personal, singular spaces.”

Sancal has a particular design far from the conventional and without the limitations of the

perfectly-matched environment; a contemporary style, timeless and eclectic with which it

evolves. Since the first steps all products are designed thinking in the future with an

environmental point of view, thinking in their efficiency, durability and reusability.

One of the best examples is the “rock” table. A

Life Cycle Analysis was done to re-design this

product with minor environmental impacts.

Thus, new environmental friendly materials

were introduced, as well as the materials used

for packaging. Due to this new “rock” table

design it has been optimized the use of raw

materials, decreased polluting waste, and improved the efficiency of product transport.

More info: https://sancal.com

49

4.10 Artek – 2

nd

cycle - Finland

Artek was founded in 1935 by four young idealists: Alvar and Aino Aalto, Maire Gullichsen,

and Nils-Gustav Hahl. Their initial goal was “to sell furniture and to promote a modern

culture of living by exhibitions and other educational means.” Today, the company

manufactures furniture, lighting, and accessories designed by Finnish masters and leading

international designers. It stands for clarity, functionality, and poetic simplicity.

Artek's current management believes that the values instilled by Aalto during the 1930s -

good quality, sourcing local materials and using them economically - tick many of the boxes

required of sustainable manufacturers today. "Aalto and his circle wouldn't have used the

word 'sustainability'," says Tom Dixon, the British furniture designer who became Artek's

creative director in 2004. "But if you look at what they did at Artek with modern eyes, it has

all of the underpinning characteristics."

In 2006, Artek began collecting used Aalto chairs and stools, searching them out from flea

markets and old factories, schools and shipyards. This led to the founding of the Artek

2nd Cycle initiative, which offers these re-discovered pieces for sale, beginning a second

50

cycle in their lives. Today, Artek 2nd Cycle is Artek’s platform for pre-loved furniture. The

brand offer re-discovered furniture and lighting for sale, beginning a second cycle in their

lives. Artek 2nd Cycle store, in the heart of Helsinki, is a meeting point connecting collectors,

customers, and designers. The store invites visitors to browse, buy a beautifully aged piece

of furniture, discover a rarity, or simply learn more from Artek experts. Artek 2nd Cycle not

only showcases the longevity of Artek furniture, it also promotes conscious consumption –

the idea that what we buy should be carefully chosen, cherished rather than disposed – and

seeks to honour the natural materials that have gone into producing these enduring designs.

As Alvar Aalto once said, “Nothing is ever reborn, but neither does it totally disappear. And

that which has once been, will always reappear in a new form.” Circular thinking?

More info: www.artek.fi/2ndcycle

51

5. References

• European Environment bureau, 2017. “Circular economy opportunities in the

furniture sector”

• Rebus, 2017. “REBUS Furniture Sector report”

• EFIC, 2017. “The Furniture Industry and The Circular Economy - Policy paper”