Renter (claimant)

Rent Certificate

2006

Wisconsin Department of Revenue

NOTE: Alterations on lines 1 to 13 or the signature line (whiteouts, erasures, etc.) will void this

rent certificate. A rent certificate with an error should be discarded and a new one completed.

NEED HELP?

Contact any Department of Revenue office. Check your

phone book for local listing.

You may also call:

(608) 266-8641 (Madison)

(414) 227-4000 (Milwaukee)

REMINDERS FOR RENTERS:

• If line 11d above is 2 or more and each occupant did

not pay an equal share of the rent, see instructions for

Shared Living Expenses Schedule.

• Schedule H or H-EZ must be completed and filed with

this rent certificate.

1 Name

2 Social security number

3 Address of rental property (property must be in Wisconsin)

4 Time you actually lived here in 2006

From (mo/day) To (mo/day)

5 If your landlord will not sign your rent certificate, complete lines 6 to 13,

attach rent verification (see instructions), and check this box. ¤

/ / 2006/ / 2006

Complete lines 1 to 5. Then have your

landlord fill in lines 6 to 13 and sign.

Landlord Fill in lines 6 to 13 and sign.

10a Is this rent certificate for rent of:

A mobile home? Yes No

A mobile home site? Yes No

b Mobile home taxes or parking permit fees, or municipal fees

you collected from this renter for 2006. $

6 Name

7 Address

8 Telephone number

9a Is the rental property (line 3) subject to property taxes?

Yes No

b If 9a is “No” and you are a sec. 66.1201 municipal housing

authority that makes payments in lieu of taxes, check this box. ¤

Signature (by hand) of landlord or authorized representative Date

I certify that the information shown on this rent certificate is true,

correct, and complete to the best of my knowledge.

Sign

here

11 Fill in lines 11a to 11e based on the period of time this rental unit was

occupied by this renter. Use the additional columns on lines 11a and

11b only if rent rates changed during the year (see instructions). Do not

include amounts received directly from a governmental agency.

a Rent collected per

month for this rental

unit for 2006. $ $ $ $

b Number of months this

rental unit was rented

to this renter in 2006.

c Total rent collected for this

rental unit for 2006. $

d Number of occupants in this rental unit –

do not count spouse or children under 18.

e This renter’s share of total 2006 rent. $

12 Value of food and services provided

by landlord (this renter’s share). $

13a Rent paid for occupancy only –

Subtract line 12 from line 11e. $

b Was heat included in the rent? Yes No

c If a long-term care facility/CBRF/nursing home,

check the method used to compute line 13a:

Standard rate ($100 per week).

Percentage formula (fill in percentage) %.

Other method approved by Department of Revenue.

I-017

Shared Living Expenses Schedule

Step 1: List name(s) of other occupants:

Step 2: List the total amount (not the monthly amount) of all shared

living expenses (rent, food, utilities, and other) paid by all occupants

and the amount that you paid:

Shared Living

Expenses

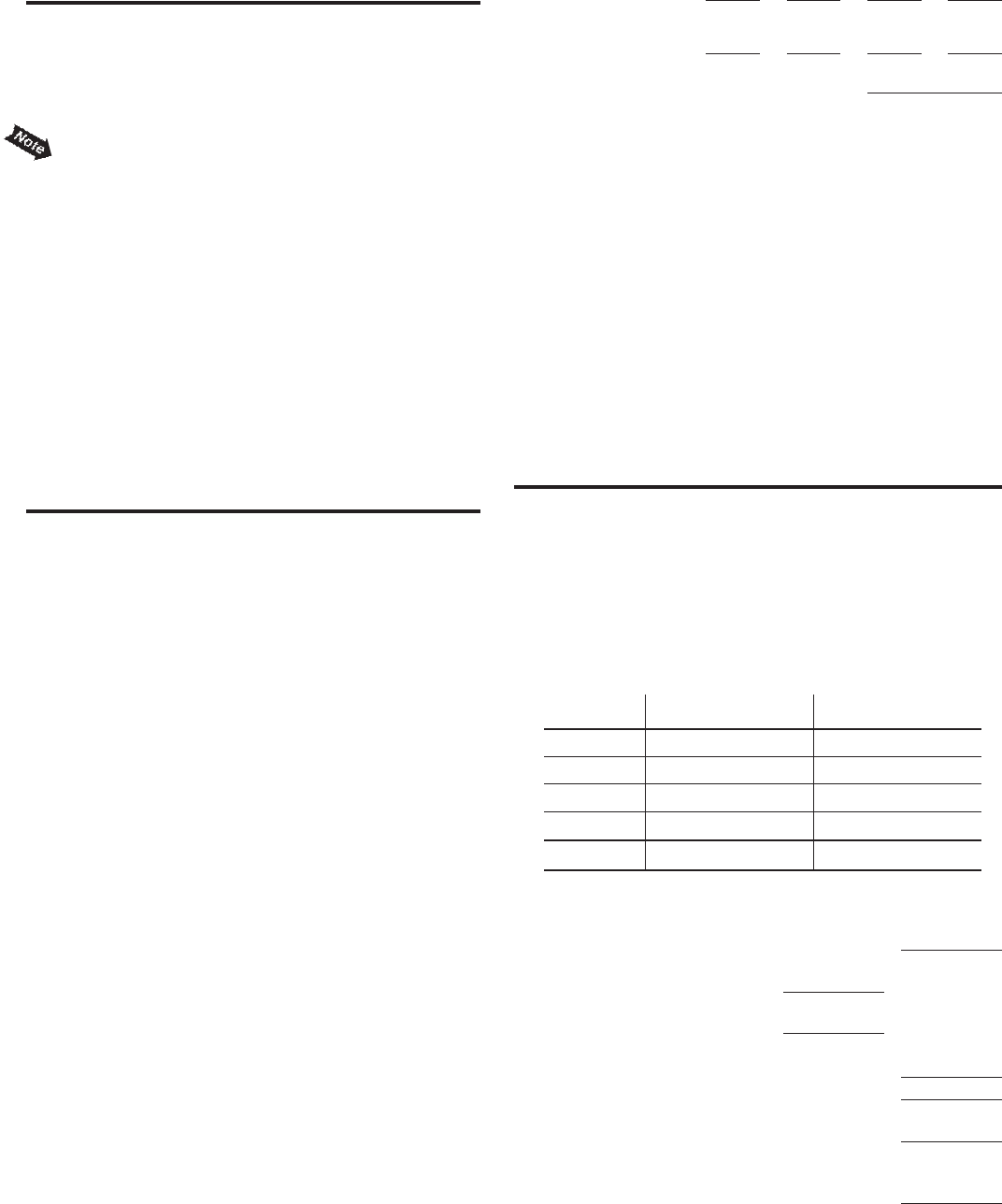

Rent 1a) 1b)

Food 2a) 2b)

Utilities 3a) 3b)

Other 4a) 4b)

Total 5a) 5b)

Amount

You Paid

Total Paid by

All Occupants

Step 3: Using the amounts listed in Step 2, compute your allowable

rent paid for occupancy only:

1 Total rent paid (line 1a) . . . . . . . . . . . . . . . . . . . . 1

2 Shared living expenses

you paid (line 5b) . . . . . . . . . 2

3 Total shared living

expenses (line 5a) . . . . . . . . 3

4 Divide line 2 by line 3. Fill

in decimal amount. . . . . . . . . . . . . . . . . . . . . . . . . 4 X

.

5 Multiply line 1 by line 4 . . . . . . . . . . . . . . . . . . . . 5

6 Value of food and services provided by

landlord (line 12 above). . . . . . . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5. This is your allowable

rent. Fill in here and on line 14a or 14c of

Schedule H (line 9a or 9c of Schedule H-EZ) . . . 7

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or Enter.

Print

Clear

Tab to navigate within form. Use mouse to

check applicable boxes, press spacebar or

Enter.

Print

Clear

A rent certificate is used to verify the rent paid to occupy a

Wisconsin "homestead" in 2006. A homestead could be a

room, apartment, mobile home, house, farm, or nursing home

room.

Instructions for Renter (Claimant)

Complete lines 1 to 5. Then give the rent certificate to your

landlord to complete lines 6 to 13 and sign. A separate rent

certificate must be completed for each homestead you rented

in 2006 if used in computing your homestead credit.

If your landlord will not sign your rent certificate, check

the box on line 5. Complete lines 6 to 13, and attach copies

of each canceled check or money order receipt you have to

verify your rent. If you do not have verification of your rent,

contact the Department of Revenue at (608) 266-8641 for

additional instructions.

After you receive the completed rent certificate from your

landlord, fill in the allowable amounts from lines 10b and 13a

on lines 13, 14a, and 14c of Schedule H (lines 8, 9a, and 9c

of Schedule H-EZ), as appropriate. Note: If line 11d is 2 or

more, see “Renter Instructions for Shared Living Expenses

Schedule” in the next column.

Attach all rent certificates to one Schedule H or H-EZ. If you

claim less than 12 months of rent and/or property taxes, also

attach a note explaining where you lived for the balance of

2006.

Instructions for Landlord/Authorized Representative

Fill in a separate rent certificate for each renter (claimant)

requesting one for homestead credit. Fill in line 1 if it is not

already completed. Fill in lines 6 to 13, sign, and give the

completed rent certificate to the renter. Note: You may not

charge a fee for filling in a rent certificate.

Line 9b If you checked “No” on line 9a, do not complete the

rent certificate unless you are a sec. 66.1201 municipal

housing authority that makes payments in lieu of property

taxes. If this applies to you, check the box on line 9b.

Line 11a Fill in the rent you actually collected per month for

this rental unit (apartment, room, one-half of a duplex, etc.)

for 2006, for the time this renter occupied it in 2006. Include

in the monthly rate any separate amounts the renter paid to

you for items such as a garage, parking space, utilities, ap-

pliances, or furnishings. Do not include rent for a prior year

or amounts you received directly from a governmental agency

through a subsidy, voucher, grant, etc., for the unit (except

amounts an agency paid as a claimant’s representative

payee). If the monthly rent for this unit changed in 2006, use

the extra columns to fill in each monthly rate separately.

Line 11b Fill in the number of months (or partial months)

you rented the unit to this renter in 2006. If you filled in more

than one amount on line 11a, fill in the number of months or

partial months each rate applied. For partial months, fill in

the number of days rather than a fraction or a decimal.

Line 11c Fill in the total rent collected for this unit for the

period of time the unit was occupied by this renter in 2006

(generally, multiply line 11a by 11b).

Rent Certificate Instructions

Line 11d Fill in the total number of occupants in this rental unit

during the rental period. Note: Do not count the renter’s spouse

or children under age 18 as of December 31, 2006.

Line 11e Fill in this renter’s share of the total 2006 rent paid. Do

not include rent paid for other renters, or amounts you received

directly from a governmental agency (except amounts an agency

paid as a claimant’s representative payee).

Line 12 Fill in this renter’s share of the value of food, medical,

and other personal services, including laundry, transportation,

counseling, grooming, recreational, and therapeutic services, you

provided for this rental unit. Do not include utilities, furnishings, or

appliances. If you did not provide any of the items, fill in 0.

Signature Review the rent certificate to be sure that line 1 and

each of the lines 6 to 13b (and 13c, if applicable) has an entry.

Sign (by hand), date, and return the rent certificate to the renter.

Signature stamps, photocopied signatures, etc., are not acceptable.

Renter Instructions for Shared Living Expenses Schedule

Complete this schedule if line 11d shows more than one occupant

and each occupant did not pay an equal share of the rent. You

may claim only the portion of rent that reflects the percentage of

shared living expenses you paid.

Example: You and your roommate paid shared living expenses

as shown below. Your landlord provided services and filled in $300

as your share on line 12.

a Rent collected per

month for this rental

unit for 2006. $ $ $ $

b Number of months this

rental unit was rented

to this renter in 2006.

c Total rent collected for this

rental unit for 2006. $

300 325

75

3,725

Shared Living

Expenses

Rent 1a) 1b)

Food 2a) 2b)

Utilities 3a) 3b)

Other 4a) 4b)

Total 5a) 5b)

Amount

You Paid

Total Paid by

All Occupants

$4,800

2,400

600

200

$8,000

$4,800

1,200

-0-

-0-

$6,000

Example: You rented this unit for $300 per month for 7 months

and $325 per month for 5 months. Fill in lines 11a - 11c as follows:

Your allowable rent for occupancy only is $3,300, computed as

follows:

1 Total rent paid (line 1a). . . . . . . . . . . . . . . . . . . . . . 1

2 Shared living expenses

you paid (line 5b). . . . . . . . . . . 2

3 Total shared living

expenses (line 5a) . . . . . . . . . . 3

4 Divide line 2 by line 3. Fill

in decimal amount . . . . . . . . . . . . . . . . . . . . . . . . . . 4

X .

5 Multiply line 1 by line 4 . . . . . . . . . . . . . . . . . . . . . . 5

6 Value of food and services provided by

landlord (line 12 above) . . . . . . . . . . . . . . . . . . . . . 6

7 Subtract line 6 from line 5. This is your allowable

rent. Fill in here and on line 14a or 14c of

Schedule H (line 9a or 9c of Schedule H-EZ) . . . 7

$4,800

$6,000

75

$3,600

$ 300

$3,300

$8,000