Small Business Health Options Program Guide 2024

|

Congressional Plan Options

|

Washington, D.C.

Your guide to understanding

your 2024 plan options

Plans available to members of Congress,

staff and dependents

1

1

How to choose health

care coverage

Narrow down your plan options

To help narrow down plan options, consider what is most important to you and your dependents.

Choice Plus Insurance Plans

Broad, national access to physicians and hospitals, out-of-network coverage and no referrals needed to

see a specialist.

Choice Insurance Plans

Broad, national access to physicians and hospitals, network-only coverage and no referrals needed to see

a specialist.

Optimum Choice, Inc. (OCI) HMO Plans

Local access only to physician and hospitals, network-only coverage and a primary care physician (PCP)

to coordinate care and refer specialist services.

Core Essential Plans

Tailored local access only to physicians and hospitals, network-only coverage and no referrals needed to

see a specialist.

UnitedHealthcare Navigate® HMO Plans

Tailored local access only to physicians and hospitals, network-only coverage and a primary care

physician (PCP) to coordinate care and refer specialist services.

Choose plan features

With many plans to choose from, you have the control to pick the deductible, health savings account

(HSA) compatibility and cost-share levels that are right for you. Coverage also includes:

UnitedHealthcare Rewards is available on all of our plans. You can earn dollars for completing certain

healthy actions like tracking your daily steps, active minutes and sleep, and by completing one-time

reward activities like biometric screenings.

Care Cash® is a program that puts cash in members’ hands. Just by signing up for the plan, you get a

pre-paid debit card of $200 (individuals) or $500 (families) to help pay toward cost sharing for certain

eligible network health care expenses. Care Cash is available on all non-HSA and non-HRA plans.

$0 Kid’s Copay is a plan feature available on all non-HSA and non-HRA plans. With this feature, there is

no copay for network primary care office visits for children under 19.

2

How to choose health care coverage

1 2 3

Additional considerations

Essential coverage in every plan

These plans cover 10 essential benefits, preventive care services

like annual wellness exams and flu vaccinations, and pre-existing

conditions, and they include prescriptions and lab services.

Easy access to care

Access to doctors, clinics and hospitals with all of our health

plans. If you have a question or need advice, you can call

the toll-free number on your health plan ID card to talk with

registered nurses 24/7.

24/7 Virtual Visits

Access to Behavioral and Medical health care providers from

a computer, mobile device* and over the telephone. Simply

log in to myuhc.com®, select a participating 24/7 Virtual Visits

provider, and out-of-pocket costs will be $0 when covered by

both HSA and non-HSA plans.

Tools to manage health and costs

Through online resources, mobile apps and myuhc.com, you

have access to:

• Apps, tools and programs

to manage your health

• Estimated health care costs

• Health care provider search

• 24/7 access to

benefit information

UnitedHealth Premium Program

The UnitedHealth Premium® program can help you find doctors who are right for you and your family.

Find quality, cost-efficient care. For over 15 years, physicians in the UnitedHealth Premium® program have been measured

against criteria for providing quality and cost-efficient care. The Premium designation makes it easy for you to find doctors

who meet national standards for quality and local market benchmarks for cost efficiency. The UnitedHealth Premium program

evaluates physicians in various specialties using evidence-based medicine and national standardized measures to help you

locate quality and cost-efficient doctors. It’s easy to find a UnitedHealth Premium Care Physician. Just go to myuhc.com

Find a Provider. Choose smart. Look for blue hearts.

>

Premium Care Physician

The physician meets the

UnitedHealth Premium

program quality and cost-

efficient care criteria.

Quality Care Physician

This physician meets the

UnitedHealth Premium

program quality care

criteria but does not meet

the program’s criteria for

cost-efficient care.

Does Not Meet Premium

Quality Criteria

The physician does not meet

the UnitedHealth Premium

program quality criteria, so

the physician is not eligible

for a Premium designation.

Not Evaluated for Premium Care

The physician’s specialty is not

evaluated in the UnitedHealth

Premium program, the physician

does not have enough claims

data for program evaluation or the

physician’s program evaluation is

in process.

*Data rates may apply.

3

How to choose health care coverage

1 2 3

UnitedHealth Premium Program specialties

Allergy

• Allergy

• Allergy and immunology

Cardiology

•

Cardiac diagnostic

• Cardiology

• Cardiovascular disease

• Clinical cardiac

electrophysiology

• Interventional cardiology

Ear, nose and throat

•

Head and neck surgery

• Laryngology

• Otolaryngology

• Otology

• Pediatric otolaryngology

• Rhinology

Endocrinology

• Endocrinology, diabetes

and metabolism

Family medicine

•

Family practice

• General practice

• Preventive medicine

Gastroenterology

•

Digestive diseases

• Gastroenterology

• Hepatology — liver disease

General surgery

•

Abdominal surgery

• Colon and rectal surgery

• Proctology

• Surgery

Int

ernal medicine

• Geriatric medicine

• Internal medicine

• Pediatric internal medicine

Nephrology

•

Nephrology

Neurology

•

Neurology

• Neurology and psychiatry

• Neuromuscular disease

Neurosurgery, orthopedics

and spine

•

Back and spine surgery

• Hand surgery

• Knee surgery

• Neurology surgery

• Orthopedic surgery

• Shoulder surgery

• Sports medicine

Ob

stetrics and gynecology

• Gynecology

• Obstetrics

• Obstetrics and gynecology

Pediatrics

•

Adolescent medicine

• Pediatric adolescent

• Pediatrics

Pulmonology

•

Pulmonary medicine

Rheumatology

•

Rheumatology

Urology

•

Urology

Designated Diagnostic Providers

Designated Diagnostic Providers (DDP) are laboratory and imaging service

providers that meet certain quality and efficiency requirements. With your DDP

benefit, you’ll have the highest level of coverage — and likely save money — when

you use a DDP for outpatient lab and imaging services. If you don’t use a DDP,

your services may receive a lower level of coverage and you may be responsible

for a higher out-of-pocket cost.

Just look for the green check mark

To find a lower-cost DDP near you, go to myuhc.com > Find Care & Costs

Medical Directory Places.

>

>

Choose whether you’d like lab or imaging services and then look for the green

check

0

to confirm DDP status.

ABC

Laboratory

Laboratory

1234

Any

Street

Any City, State 12345

(123) 456-7890

PHONE

5.9 Miles Aw

ay

Get Directions I [!!

0 Designated Diagnostic Provider

DDP outpatient lab

and imaging services

Using a DDP may help you

save money on many

services, including:

Lab services

• Blood draws

• Blood glucose tests

• Metabolic tests/panels

• Rapid strep tests

Imaging services

• CT and PET scans

• MRI/MRAs

• Nuclear medicine scans

4

How to choose health care coverage

1 2 3

Why choose a health plan with a health savings account (HSA)?

Your premium costs may be lower

• You will have a higher deductible but usually pay less in

plan premiums

• This can add up to big savings, depending on your usage

You own the HSA

The HSA is a personal bank account, which means:

• There is no “use-it-or-lose-it” rule

• If you leave your employer or change plans, you can take

your HSA with you

The HSA helps you pay less in taxes*

You won’t have to pay federal income tax on:

• Deposits you or others make to your HSA

• Money you spend from your HSA on qualified expenses

• Interest earned on the HSA

Use the HSA for medical and pharmacy expenses, and more

When you have qualifying medical expenses, like a doctor visit or prescription, you can pay for them using

the money in your HSA. Or, you can save the money for a future medical need — even into retirement. It’s

your choice. Plus, you can use the money for expenses not covered by your plan such as dental and vision.

How a plan with HSA works

Eligible preventive care received in the network is covered 100%, and you won’t have any out-of-pocket costs.

Your deductible — You pay out-of-pocket until you reach the deductible. When you have an eligible

expense, such as a doctor visit, the entire cost of the visit will apply to your deductible. You will pay the full

cost of your health care expenses until you meet your deductible. You can choose to pay for care from your

HSA or you can choose to pay another way (i.e., cash, credit card) and let your HSA grow. It’s your money.

It’s your choice.

Your coverage — Your plan pays a percentage of your expenses. Once the deductible is paid, your health

plan may have cost-share. With cost-share, the plan shares the cost of expenses with you. The plan will pay a

percentage of each eligible expense, and you will pay the rest. For example, if your plan pays 80% of the cost,

you will be responsible for paying the remaining 20%. After the deductible, your plan may have a copayment

for certain services, such as prescriptions.

Your out-of-pocket limit — The out-of-pocket limit is the most you will have to pay in the plan year for

covered services. The plan will then pay 100% of all remaining covered expenses for the rest of the plan

year. Your deductible, coinsurance and even copayments will apply to your out-of-pocket limit.

If you have questions about Health Savings Accounts available through UnitedHealthcare plans, please call

Optum Bank HSA at 800-791-9361 or send an email to HSA[email protected].

* Subject to limits. Consult a tax advisor.

5

How to choose health care coverage

1 2 3

Behavioral health resources

UnitedHealthcare benefits include resources that offer support for many issues and concerns. Consider these behavioral

health resources when you or your family members need support.

AbleTo

®

(Telephonic/Video outreach)

AbleTo focuses on individuals with unmet

behavioral health needs coupled with chronic

medical conditions and/or major life events. This

evidence-based, structured therapy program helps

to strengthen medical recovery and self-care.

AbleTo provides virtual support for depression,

anxiety and stress that may accompany health

issues, such as cardiac conditions, diabetes,

chronic pain and cancer. Individuals who may

not take advantage of treatment on their own

are identified and contacted proactively. AbleTo

engages members in both behavioral coaching

and personalized therapy via phone or video twice

a week for up to 8 weeks.

Behavioral health in-person visits

Behavioral health care is a service for individuals

with specific diagnoses such as clinical

depression, bipolar disorder, etc. Substance use

disorder treatment benefits also fall under this

category. Behavioral health care, typically, is longer

term in nature.

The behavioral health benefit can help with

ongoing stressful situations, such as:

• Clinical depression

• Bipolar disorder

• Alcohol or drug

use disorders

• Domestic violence

• Eating disorders

• Compulsive disorders

• Medication

management

Behavioral health virtual visits: myuhc.com

Behavioral health care from the comfort of home

is now more accessible to help you and your

dependents stay healthier and more productive.

With UnitedHealthcare, members have access to

behavioral health providers, including sessions with

licensed psychiatrists, through our video-based

technology on our member website, myuhc.com.

Live and work well: liveandworkwell.com

Dedicated member portal with many resources and

online Cognitive Behavioral Therapy (CBT)

1

tools.

Members can connect via myuhc.com or access

directly using their HealthSafe ID

®

.

Psych Hub videos: liveandworkwell.com

(under Popular Tools section)

Educational video resources for understanding

behavioral health topics. With shame and stigma

often being reasons for non-treatment,

2

the Psych

Hub videos are meant to help educate members

on a variety of behavioral health topics, as well as

increase their understanding of care options and

support overall awareness.

Recovery Record

(available through the App Store®)

This app helps to promote recommended

treatment options to help engage and improve

outcomes for members with eating disorders.

Recovery Record provides members and providers

with a way to connect on provider-recommended

treatment plans and progress in between regularly

scheduled appointments to help improve member

engagement and outcomes.

Substance Use Disorder helpline and website:

855-780-5995 / liveandworkwell.com

Specialized substance use recovery advocates

are available by phone or online to help navigate

recovery options.

6

2

Compare plans

Choice Plus insurance plans

UnitedHealthcare Insurance Company

Choice Plus offers broad, national access to physicians, hospitals and

out-of-network coverage, and there are no referrals needed to see a specialist.

How does it work?

You have the choice to see any doctor or specialist without a referral, in or out

of the network. Although the insurance coverage will pay for out-of-network

services, it’s important to know that you save money when you use the network.

The Choice Plus Network

National access to over 1,713,250 physicians and health care professionals,

7,030 hospitals and 67,000 pharmacies.*

Members can

receive services

outside the

network, if they

choose, without

a referral.

* Network counts based on internal network analysis as of Q3 2023.

7

Compare plans

1 2 3

Choice Plus insurance plans

Plan Name

UnitedHealthcare Choice Plus Gold

0-2 500 750-2 1000 1500-1 1500-2 1500-3 1500-4

HSA

Plan Code DG-RP DI-AL DG-RC DG-RU DG-RH DG-Q5 DG-RF DG-QZ

Network

Individual

Deductible

$0 $500 $750 $1,000 $1,500 $1,500 $1,500 $1,500

Network

Family

Deductible

$0 $1,000 $1,500 $2,000 $3,000 $3,000 $3,000 $3,000

Network

Coinsurance

0% 20% 20% 0% 0% 20% 20% 20%

Network

Individual

Out-of-Pocket

Limit

$9,450 $5,800 $9,000 $7,500 $8,550 $8,550 $5,800 $8,550

Network Family

Out-of-Pocket

Limit

$18,900 $11,600 $18,000 $15,000 $17,100 $17,100 $11,600 $17,100

24/7 Virtual Visits $0 $0 $0 $0 $0 $0 $0 $0

PCP Office

Visit

$30 $25 $30 $20 $35 $0 $30 $10

Specialist

Office Visit

$60 $50

$60 (PD) $65

(non-PD)

$40 $70

$60 (PD) $120

(non-PD)

$60

$40 (PD) $80

(non-PD)

Urgent Care $60 $60 $60 $60 $60 $25 $60 $25

Emergency Room $500 $300

$400 after

deductible

$300 after

deductible

$350 after

deductible

$350 after

deductible

$350 after

deductible

40% after

deductible

Pharmacy

Pharmacy Code N09S N44 N09S K08S K08S K05S K08S K43S

Pharmacy

Deductible Type

$0 $0 $0

$250

Tier 2,3,4

$250

Tier 2,3,4

$250

Tier 2,3,4

$250

Tier 2,3,4

Combined

Tier 1 $15 $15 $15 $10 $10 $5 $10 $10

Tier 2 $40 $50 $40 $40 $40 $50 $40 $40

Tier 2 Specialty $40 N/A $40 $40 $40 $50 $40 $40

Tier 3 $75 $70 $75 $75 $75 $80 $75 $75

Tier 3 Specialty $100 N/A $100 $100 $100 $100 $100 $100

Tier 4 $125 $150 $125 $125 $125 $125 $125 $125

Tier 4 Specialty $150 N/A $150 $150 $150 $150 $150 $150

8

Choice Plus insurance plans

Plan Name

UnitedHealthcare Choice Plus Gold

HSA

HSA 1800 2000 2500-1 HSA 2500-1 3000

HSA HSA

Plan Code DG-QL DG-RA DG-Q2 DG-QQ DG-Q3

Network

Individual

Deductible

$1,800 $2,000 $2,500 $2,500 $3,000

Network

Family Deductible

$3,600 $4,000 $5,000 $5,000 $6,000

Network

Coinsurance

10% 0% 20% 10% 0%

Network

Individual Out-of-

Pocket Limit

$4,400 $7,000 $8,550 $4,350 $8,550

Network Family

Out-of-Pocket Limit

$8,800 $14,000 $17,100 $8,700 $17,100

24/7 Virtual Visits $0 $0 $0 $0 $0

PCP Office Visit 10% after deductible $30 $10 10% after deductible $0

Specialist Office

Visit

10% after deductible $60 after deductible $40 (PD) $80 (non-PD) 10% after deductible $50 (PD) $100 (non-PD)

Urgent Care 10% after deductible $60 $25 10% after deductible $25

Emergency Room 10% after deductible $350 after deductible 40% after deductible 10% after deductible $350 after deductible

Pharmacy

Pharmacy Code N09S K08S K43S K43S K05S

Pharmacy

Deductible Type

$0

$250

Tier 2,3,4

Combined Combined

$250

Tier 2,3,4

Tier 1 $15 $10 $10 $10 $5

Tier 2 $40 $40 $40 $40 $50

Tier 2 Specialty $40 $40 $40 $40 $50

Tier 3 $75 $75 $75 $75 $80

Tier 3 Specialty $100 $100 $100 $100 $100

Tier 4 $125 $125 $125 $125 $125

Tier 4 Specialty $150 $150 $150 $150 $150

9

Compare plans

1 2 3

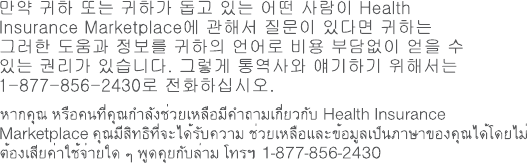

Choice Plus insurance rates

Rates displayed are full monthly premium rates based on a single policyholder.

Plan Name

UnitedHealthcare Choice Plus Gold

0-2 500 750-2 1000 1500-1 1500-2 1500-3 1500-4

Plan Code DG-RP DI-AL DG-RC DG-RU DG-RH DG-Q5 DG-RF DG-QZ

Age

0-14 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

15 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

16 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

17 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

18 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

19 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

20 $415.94 $413.46 $383.13 $413.51 $397.08 $379.04 $379.24 $366.53

21 $462.38 $459.62 $425.91 $459.68 $441.41 $421.36 $421.58 $407.45

22 $462.37 $459.61 $425.90 $459.67 $441.40 $421.35 $421.57 $407.44

23 $462.37 $459.61 $425.90 $459.67 $441.40 $421.35 $421.57 $407.44

24 $462.37 $459.61 $425.90 $459.67 $441.40 $421.35 $421.57 $407.44

25 $462.37 $459.61 $425.90 $459.67 $441.40 $421.35 $421.57 $407.44

26 $462.37 $459.61 $425.90 $459.67 $441.40 $421.35 $421.57 $407.44

27 $462.37 $459.61 $425.90 $459.67 $441.40 $421.35 $421.57 $407.44

28 $473.18 $470.36 $435.86 $470.42 $451.72 $431.20 $431.43 $416.97

29 $483.36 $480.47 $445.23 $480.53 $461.43 $440.47 $440.71 $425.93

30 $495.44 $492.48 $456.36 $492.55 $472.97 $451.49 $451.73 $436.58

31 $508.16 $505.13 $468.08 $505.19 $485.11 $463.08 $463.32 $447.79

32 $519.61 $516.51 $478.62 $516.57 $496.04 $473.51 $473.76 $457.88

33 $531.70 $528.52 $489.75 $528.59 $507.58 $484.52 $484.78 $468.53

34 $544.42 $541.16 $501.47 $541.23 $519.72 $496.11 $496.38 $479.74

35 $557.14 $553.81 $513.19 $553.88 $531.86 $507.70 $507.97 $490.95

36 $569.86 $566.45 $524.90 $566.52 $544.01 $519.29 $519.57 $502.15

37 $582.58 $579.10 $536.62 $579.17 $556.15 $530.89 $531.17 $513.36

38 $589.57 $586.05 $543.06 $586.12 $562.83 $537.26 $537.55 $519.53

39 $596.57 $593.00 $549.51 $593.08 $569.51 $543.64 $543.93 $525.69

40 $620.10 $616.40 $571.18 $616.47 $591.97 $565.08 $565.38 $546.43

41 $644.27 $640.42 $593.45 $640.50 $615.04 $587.10 $587.42 $567.73

42 $669.71 $665.71 $616.88 $665.79 $639.33 $610.29 $610.61 $590.14

43 $695.78 $691.63 $640.90 $691.71 $664.22 $634.05 $634.39 $613.12

44 $723.13 $718.81 $666.09 $718.90 $690.33 $658.97 $659.32 $637.22

45 $751.12 $746.63 $691.87 $746.72 $717.04 $684.47 $684.84 $661.88

(continued)

10

Compare plans

1 2 3

Choice Plus insurance rates

Rates displayed are full monthly premium rates based on a single policyholder.

(continued)

Plan Name

UnitedHealthcare Choice Plus Gold

HSA 1800 2000 2500-1 HSA 2500-1 3000

Plan Code DG-QL DG-RA DG-Q2 DG-QQ DG-Q3

Age

0-14 $401.87 $373.90 $357.40 $378.37 $383.62

15 $401.87 $373.90 $357.40 $378.37 $383.62

16 $401.87 $373.90 $357.40 $378.37 $383.62

17 $401.87 $373.90 $357.40 $378.37 $383.62

18 $401.87 $373.90 $357.40 $378.37 $383.62

19 $401.87 $373.90 $357.40 $378.37 $383.62

20 $401.87 $373.90 $357.40 $378.37 $383.62

21 $446.74 $415.64 $397.31 $420.62 $426.45

22 $446.73 $415.63 $397.30 $420.61 $426.44

23 $446.73 $415.63 $397.30 $420.61 $426.44

24 $446.73 $415.63 $397.30 $420.61 $426.44

25 $446.73 $415.63 $397.30 $420.61 $426.44

26 $446.73 $415.63 $397.30 $420.61 $426.44

27 $446.73 $415.63 $397.30 $420.61 $426.44

28 $457.17 $425.35 $406.59 $430.44 $436.42

29 $467.00 $434.50 $415.33 $439.70 $445.80

30 $478.68 $445.36 $425.72 $450.69 $456.95

31 $490.97 $456.80 $436.65 $462.26 $468.68

32 $502.03 $467.09 $446.48 $472.68 $479.24

33 $513.71 $477.95 $456.87 $483.67 $490.38

34 $525.99 $489.38 $467.80 $495.24 $502.11

35 $538.28 $500.82 $478.73 $506.81 $513.84

36 $550.57 $512.25 $489.66 $518.38 $525.58

37 $562.86 $523.69 $500.58 $529.95 $537.31

38 $569.62 $529.98 $506.60 $536.32 $543.76

39 $576.38 $536.26 $512.61 $542.68 $550.21

40 $599.12 $557.42 $532.83 $564.09 $571.92

41 $622.47 $579.14 $553.59 $586.07 $594.21

42 $647.05 $602.01 $575.45 $609.21 $617.67

43 $672.24 $625.45 $597.86 $632.93 $641.72

44 $698.66 $650.03 $621.36 $657.81 $666.94

45 $725.70 $675.19 $645.40 $683.27 $692.75

11

Compare plans

1 2 3

Choice Plus insurance rates

Rates displayed are full monthly premium rates based on a single policyholder.

Plan Name

UnitedHealthcare Choice Plus Gold

0-2 500 750-2 1000 1500-1 1500-2 1500-3 1500-4

Plan Code DG-RP DI-AL DG-RC DG-RU DG-RH DG-Q5 DG-RF DG-QZ

Age

46 $780.37 $775.71 $718.81 $775.81 $744.97 $711.13 $711.51 $687.66

47 $810.90 $806.06 $746.93 $806.16 $774.12 $738.95 $739.35 $714.56

48 $842.70 $837.67 $776.22 $837.77 $804.47 $767.93 $768.34 $742.58

49 $875.77 $870.54 $806.69 $870.65 $836.05 $798.07 $798.49 $771.73

50 $910.12 $904.68 $838.32 $904.79 $868.83 $829.36 $829.81 $801.99

51 $945.73 $940.08 $871.13 $940.20 $902.83 $861.82 $862.28 $833.37

52 $982.62 $976.75 $905.11 $976.87 $938.05 $895.44 $895.91 $865.88

53 $1,020.78 $1,014.68 $940.26 $1,014.81 $974.48 $930.21 $930.71 $899.51

54 $1,060.85 $1,054.51 $977.16 $1,054.64 $1,012.73 $966.72 $967.24 $934.81

55 $1,102.19 $1,095.60 $1,015.24 $1,095.74 $1,052.19 $1,004.39 $1,004.93 $971.24

56 $1,145.44 $1,138.59 $1,055.08 $1,138.74 $1,093.48 $1,043.81 $1,044.36 $1,009.35

57 $1,189.96 $1,182.85 $1,096.09 $1,183.00 $1,135.98 $1,084.38 $1,084.96 $1,048.58

58 $1,236.38 $1,229.00 $1,138.85 $1,229.15 $1,180.30 $1,126.68 $1,127.29 $1,089.50

59 $1,284.72 $1,277.04 $1,183.38 $1,277.21 $1,226.44 $1,170.73 $1,171.36 $1,132.09

60 $1,334.96 $1,326.99 $1,229.66 $1,327.16 $1,274.41 $1,216.52 $1,217.17 $1,176.36

61 $1,387.12 $1,378.83 $1,277.70 $1,379.00 $1,324.19 $1,264.04 $1,264.72 $1,222.32

62 $1,387.12 $1,378.83 $1,277.70 $1,379.00 $1,324.19 $1,264.04 $1,264.72 $1,222.32

63 $1,387.12 $1,378.83 $1,277.70 $1,379.00 $1,324.19 $1,264.04 $1,264.72 $1,222.32

64 and over $1,387.12 $1,378.83 $1,277.70 $1,379.00 $1,324.19 $1,264.04 $1,264.72 $1,222.32

(continued)

12

Compare plans

1 2 3

Choice Plus insurance rates

Rates displayed are full monthly premium rates based on a single policyholder.

Plan Name

UnitedHealthcare Choice Plus Gold

HSA Gold 1800 2000 2500-1 HSA Gold 2500-1 3000

Plan Code DG-QL DG-RA DG-Q2 DG-QQ DG-Q3

Age

46 $753.97 $701.49 $670.54 $709.88 $719.73

47 $783.46 $728.93 $696.77 $737.65 $747.89

48 $814.19 $757.52 $724.10 $766.58 $777.22

49 $846.14 $787.24 $752.52 $796.66 $807.72

50 $879.32 $818.12 $782.03 $827.91 $839.40

51 $913.73 $850.13 $812.63 $860.30 $872.24

52 $949.37 $883.29 $844.33 $893.86 $906.27

53 $986.24 $917.59 $877.12 $928.57 $941.46

54 $1,024.95 $953.61 $911.55 $965.02 $978.42

55 $1,064.89 $990.77 $947.07 $1,002.63 $1,016.54

56 $1,106.68 $1,029.65 $984.23 $1,041.97 $1,056.43

57 $1,149.69 $1,069.67 $1,022.48 $1,082.47 $1,097.49

58 $1,194.55 $1,111.40 $1,062.38 $1,124.70 $1,140.31

59 $1,241.25 $1,154.85 $1,103.91 $1,168.67 $1,184.89

60 $1,289.79 $1,200.02 $1,147.08 $1,214.38 $1,231.23

61 $1,340.18 $1,246.90 $1,191.89 $1,261.82 $1,279.33

62 $1,340.18 $1,246.90 $1,191.89 $1,261.82 $1,279.33

63 $1,340.18 $1,246.90 $1,191.89 $1,261.82 $1,279.33

64 and over $1,340.18 $1,246.90 $1,191.89 $1,261.82 $1,279.33

Valid for effective dates: Q1 2024.

Rates displayed are per employee rates by age for the Medical/Rx product.

Rates include employer and employee contribution — please contact your HR department for your employee contribution.

To calculate your total family rate (if applicable), add all rates by age for each member of the household. For all dependent children, ages 21 and over, individual rates apply.

For up to three dependent children under 21, add the 0–20 rate. Apply the employee contribution to this total to determine your monthly family premium.

13

Compare plans

1 2 3

Choice insurance plans

UnitedHealthcare Insurance Company

Choice offers broad, national access to physicians and hospitals with no

referrals needed to see a specialist.

How does it work?

You have the choice to see any doctor or specialist without a referral in the

network. The insurance coverage will only pay for visits to network providers,

so you will need to check your plan before visiting a doctor, clinic or hospital.

If you see an out-of-network provider for non-emergency services, you will

be responsible for all costs.

The Choice Network

Choice insurance plans offer national access to over 1,713,250 physicians and

health care professionals, 7,030 hospitals and 67,000 pharmacies.*

Members can

choose any

doctor/specialist

in the network.

Members will not

be covered if they

receive out-of-

network care.

* Network counts based on internal network analysis as of Q3 2023.

14

Compare plans

1 2 3

Choice insurance plans

Plan Name

UnitedHealthcare Choice Gold

0-1 750-1 1500-1 1500-3 1500-2 HSA 1800 2000 HSA 2500-1

HSA HSA HSA

Plan Code DG-RO DG-QM DG-RG DG-RE DG-Q4 DG-QK DG-Q9 DG-QP

Network

Individual

Deductible

$0 $750 $1,500 $1,500 $1,500 $1,800 $2,000 $2,500

Network Family

Deductible

$0 $1,500 $3,000 $3,000 $3,000 $3,600 $4,000 $5,000

Network

Coinsurance

0% 50% 0% 20% 20% 10% 0% 10%

Network

Individual Out-

of-Pocket Limit

$9,450 $6,100 $8,550 $5,800 $8,550 $4,400 $7,000 $4,350

Network Family

Out-of-Pocket

Limit

$18,900 $12,200 $17,100 $11,600 $17,100 $8,800 $14,000 $8,700

24/7 Virtual

Visits

$0 $0 $0 $0 0% $0 $0 $0

PCP Office Visit $30 $50 $35 $30 0%

10% after

deductible

$30

10% after

deductible

Specialist

Office Visit

$60 50% $70 $60

$60 (PD) $120

(non-PD)

10% after

deductible

$60 after

deductible

10% after

deductible

Urgent Care $60

50% after

deductible

$60 $60 $25

10% after

deductible

$60

10% after

deductible

Emergency

Room

$500

50% after

deductible

$350 after

deductible

$350 after

deductible

$350 after

deductible

10% after

deductible

$350 after

deductible

10% after

deductible

Pharmacy

Pharmacy Code N09S N42 K08S K08S K05S N09S K08S K43S

Pharmacy

Deductible

Type

$0 $0

$250

Tier 2,3,4

$250

Tier 2,3,4

$250

Tier 2,3,4

$0

$250

Tier 2,3,4

Combined

Tier 1 $15 $15 $10 $10 $5 $15 $10 $10

Tier 2 $40 $50 $40 $40 $50 $40 $40 $40

Tier 2 Specialty $40 N/A $40 $40 $50 $40 $40 $40

Tier 3 $75

50% up to

$150

$75 $75 $80 $75 $75 $75

Tier 3 Specialty $100 N/A $100 $100 $100 $100 $100 $100

Tier 4 $125

50% up to

$150

$125 $125 $125 $125 $125 $125

Tier 4 Specialty $150 N/A $150 $150 $150 $150 $150 $150

(continued)

15

Compare plans

1 2 3

Choice insurance rates

Rates displayed are full monthly premium rates based on a single policyholder.

Plan Name

UnitedHealthcare Choice Gold

0-1 750-1 1500-1 1500-3 1500-2 HSA 1800 2000 HSA 2500-1

Plan Code DG-RO DG-QM DG-RG DG-RE DG-Q4 DG-QK DG-Q9 DG-QP

Age

0-14 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

15 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

16 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

17 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

18 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

19 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

20 $411.55 $353.51 $392.06 $373.92 $374.16 $396.16 $369.08 $349.54

21 $457.50 $392.98 $435.83 $415.67 $415.93 $440.39 $410.29 $388.56

22 $457.49 $392.97 $435.82 $415.66 $415.92 $440.38 $410.28 $388.55

23 $457.49 $392.97 $435.82 $415.66 $415.92 $440.38 $410.28 $388.55

24 $457.49 $392.97 $435.82 $415.66 $415.92 $440.38 $410.28 $388.55

25 $457.49 $392.97 $435.82 $415.66 $415.92 $440.38 $410.28 $388.55

26 $457.49 $392.97 $435.82 $415.66 $415.92 $440.38 $410.28 $388.55

27 $457.49 $392.97 $435.82 $415.66 $415.92 $440.38 $410.28 $388.55

28 $468.18 $402.16 $446.01 $425.38 $425.65 $450.68 $419.88 $397.64

29 $478.25 $410.81 $455.60 $434.53 $434.80 $460.37 $428.91 $406.19

30 $490.21 $421.08 $466.99 $445.39 $445.67 $471.88 $439.63 $416.34

31 $502.79 $431.89 $478.98 $456.83 $457.12 $483.99 $450.92 $427.03

32 $514.12 $441.62 $489.78 $467.12 $467.41 $494.90 $461.07 $436.65

33 $526.08 $451.89 $501.17 $477.98 $478.28 $506.41 $471.80 $446.81

34 $538.66 $462.70 $513.15 $489.42 $489.73 $518.52 $483.08 $457.50

35 $551.25 $473.51 $525.14 $500.85 $501.17 $530.64 $494.37 $468.19

36 $563.83 $484.32 $537.13 $512.29 $512.61 $542.75 $505.66 $478.88

37 $576.42 $495.13 $549.12 $523.72 $524.05 $554.87 $516.94 $489.57

38 $583.34 $501.08 $555.72 $530.01 $530.35 $561.53 $523.15 $495.44

39 $590.26 $507.03 $562.31 $536.30 $536.64 $568.19 $529.36 $501.32

(continued)

16

1 2 3

Plan Name

UnitedHealthcare Choice Gold

0-1 750-1 1500-1 1500-3 1500-2 HSA 1800 2000 HSA 2500-1

Plan Code DG-RO DG-QM DG-RG DG-RE DG-Q4 DG-QK DG-Q9 DG-QP

Age

40 $613.55 $527.03 $584.49 $557.46 $557.81 $590.61 $550.24 $521.10

41 $637.46 $547.57 $607.27 $579.18 $579.55 $613.62 $571.69 $541.41

42 $662.63 $569.19 $631.25 $602.05 $602.43 $637.85 $594.26 $562.79

43 $688.43 $591.35 $655.83 $625.49 $625.89 $662.69 $617.40 $584.70

44 $715.49 $614.59 $681.61 $650.08 $650.49 $688.74 $641.67 $607.68

45 $743.18 $638.38 $707.99 $675.24 $675.66 $715.39 $666.50 $631.20

46 $772.13 $663.24 $735.56 $701.54 $701.98 $743.26 $692.46 $655.78

47 $802.33 $689.19 $764.34 $728.98 $729.44 $772.33 $719.55 $681.44

48 $833.80 $716.22 $794.31 $757.57 $758.05 $802.62 $747.76 $708.16

49 $866.52 $744.32 $825.48 $787.30 $787.80 $834.12 $777.11 $735.95

50 $900.50 $773.51 $857.86 $818.17 $818.69 $866.83 $807.58 $764.81

51 $935.74 $803.78 $891.43 $850.19 $850.73 $900.75 $839.19 $794.74

52 $972.24 $835.13 $926.20 $883.35 $883.91 $935.88 $871.92 $825.74

53 $1,009.99 $867.57 $962.17 $917.66 $918.24 $972.23 $905.78 $857.81

54 $1,049.64 $901.62 $999.93 $953.68 $954.28 $1,010.39 $941.34 $891.48

55 $1,090.54 $936.76 $1,038.90 $990.84 $991.47 $1,049.76 $978.02 $926.22

56 $1,133.33 $973.51 $1,079.66 $1,029.72 $1,030.37 $1,090.96 $1,016.39 $962.56

57 $1,177.38 $1,011.35 $1,121.63 $1,069.74 $1,070.42 $1,133.36 $1,055.90 $999.97

58 $1,223.32 $1,050.81 $1,165.39 $1,111.48 $1,112.18 $1,177.58 $1,097.10 $1,038.99

59 $1,271.15 $1,091.89 $1,210.95 $1,154.94 $1,155.66 $1,223.62 $1,139.99 $1,079.61

60 $1,320.86 $1,134.59 $1,258.31 $1,200.10 $1,200.86 $1,271.47 $1,184.57 $1,121.83

61 $1,372.46 $1,178.92 $1,307.47 $1,246.99 $1,247.77 $1,321.14 $1,230.85 $1,165.66

62 $1,372.46 $1,178.92 $1,307.47 $1,246.99 $1,247.77 $1,321.14 $1,230.85 $1,165.66

63 $1,372.46 $1,178.92 $1,307.47 $1,246.99 $1,247.77 $1,321.14 $1,230.85 $1,165.66

64 and over $1,372.46 $1,178.92 $1,307.47 $1,246.99 $1,247.77 $1,321.14 $1,230.85 $1,165.66

Choice insurance rates

Rates displayed are full monthly premium rates based on a single policyholder.

Compare plans

Valid for effective dates: Q1 2024.

Rates displayed are per employee rates by age for the Medical/Rx product.

Rates include employer and employee contribution — please contact your HR department for your employee contribution.

To calculate your total family rate (if applicable), add all rates by age for each member of the household. For all dependent children, ages 21 and over, individual rates apply.

For up to three dependent children under 21, add the 0–20 rate. Apply the employee contribution to this total to determine your monthly family premium.

17

1 2 3

OCI HMO plans

Optimum Choice, Inc. (OCI)

OCI HMO plans offer regional access to physicians and hospitals,

network-only coverage and a primary doctor to coordinate care and refer

specialist services.

How does it work?

You pick a primary care physician (PCP) to be your main doctor. Your

PCP gets to know you, helps manage your health care and refers you to

specialists (if needed). The health plan will only pay for visits to network

providers, so you will need to check your plan before visiting a doctor, clinic

or hospital. If you see an out-of-network provider for non-emergency

services, you will be responsible for all costs.

The OCI Network

With almost 32,000 health care providers, 235 hospitals and 3,500

pharmacies in D.C., Delaware, Maryland, Virginia and West Virginia, the OCI

network offers similar regional coverage as the Choice Plus network.

3

Members will need

to choose a PCP.

Members will not

be covered if they

receive out-of-

network care.

3

Compare plans

Network counts based on internal network analysis as of Q3 2023.

18

OCI HMO plans

Plan Name

UnitedHealthcare OCI Gold

500 1500-1 HSA 1800 2000-1 2500-3

HSA HSA

Plan Code DI-AS DG-QD DG-P5 DG-QA DQ-QE

Network

Individual

Deductible

$500 $1,500 $1,800 $2,000 $2,500

Network Family

Deductible

$1,000 $3,000 $3,600 $4,000 $5,000

Network

Coinsurance

20% 20% 10% 20% 20%

Network

Individual Out-of-

Pocket Limit

$5,800 $8,550 $4,400 $6,000 $8,550

Network Family

Out-of-Pocket

Limit

$11,600 $17,100 $8,800 $12,000 $17,100

24/7 Virtual

Visits

$0 $0 $0 $0 0%

PCP Office

Visit

$25 $0 10% after deductible $30 $10

Specialist

Office Visit

$50 $60 (PD) $120 (non-PD) 10% after deductible $60 $40 (PD) $80 (non-PD)

Urgent Care $60 $25 10% after deductible $60 $25

Emergency

Room

$300 $350 after deductible 10% after deductible $350 after deductible 60% after deductible

Pharmacy

Pharmacy Code N44 K05S N09S K08S K43S

Pharmacy

Deductible Type

$0 $250 Tier 2,3,4 $0 $250 Tier 2,3,4 Combined

Tier 1 $15 $5 $15 $10 $10

Tier 2 $50 $50 $40 $40 $40

Tier 2 Specialty N/A $50 $40 $40 $40

Tier 3 $70 $80 $75 $75 $75

Tier 3 Specialty N/A $100 $100 $100 $100

Tier 4 $150 $125 $125 $125 $125

Tier 4 Specialty N/A $150 $150 $150 $150

1 2 3

(continued)

Compare plans

19

1 2 3

OCI HMO rates

Rates displayed are full monthly premium rates based on a single policyholder.

Plan Name

UnitedHealthcare OCI Gold

500 1500-1 HSA 1800 2000-1 2500-3

Plan Code DI-AS DG-QD DG-P5 DG-QA DQ-QE

Age

0-14 $387.10 $357.70 $376.97 $352.52 $336.71

15 $387.10 $357.70 $376.97 $352.52 $336.71

16 $387.10 $357.70 $376.97 $352.52 $336.71

17 $387.10 $357.70 $376.97 $352.52 $336.71

18 $387.10 $357.70 $376.97 $352.52 $336.71

19 $387.10 $357.70 $376.97 $352.52 $336.71

20 $387.10 $357.70 $376.97 $352.52 $336.71

21 $430.31 $397.64 $419.05 $391.88 $374.31

22 $430.30 $397.63 $419.04 $391.87 $374.30

23 $430.30 $397.63 $419.04 $391.87 $374.30

24 $430.30 $397.63 $419.04 $391.87 $374.30

25 $430.30 $397.63 $419.04 $391.87 $374.30

26 $430.30 $397.63 $419.04 $391.87 $374.30

27 $430.30 $397.63 $419.04 $391.87 $374.30

28 $440.37 $406.92 $428.84 $401.03 $383.05

29 $449.84 $415.67 $438.06 $409.66 $391.29

30 $461.08 $426.07 $449.02 $419.90 $401.07

31 $472.92 $437.01 $460.54 $430.68 $411.37

32 $483.57 $446.85 $470.92 $440.38 $420.63

33 $494.82 $457.24 $481.87 $450.62 $430.41

34 $506.66 $468.18 $493.40 $461.40 $440.71

35 $518.50 $479.12 $504.93 $472.18 $451.01

36 $530.33 $490.06 $516.45 $482.96 $461.31

37 $542.17 $501.00 $527.98 $493.74 $471.60

38 $548.68 $507.01 $534.32 $499.67 $477.27

39 $555.19 $513.03 $540.66 $505.60 $482.93

(continued)

Compare plans

20

Plan Name

UnitedHealthcare OCI Gold

500 1500-1 HSA 1800 2000-1 2500-3

Plan Code DI-AS DG-QD DG-P5 DG-QA DQ-QE

Age

40 $577.09 $533.27 $561.99 $525.54 $501.98

41 $599.58 $554.05 $583.89 $546.03 $521.54

42 $623.26 $575.93 $606.95 $567.59 $542.14

43 $647.53 $598.35 $630.58 $589.69 $563.25

44 $672.98 $621.87 $655.37 $612.87 $585.38

45 $699.02 $645.94 $680.73 $636.58 $608.04

46 $726.25 $671.10 $707.24 $661.38 $631.72

47 $754.66 $697.35 $734.91 $687.25 $656.43

48 $784.25 $724.70 $763.73 $714.20 $682.18

49 $815.03 $753.14 $793.70 $742.23 $708.95

50 $846.99 $782.67 $824.83 $771.34 $736.75

51 $880.14 $813.30 $857.11 $801.52 $765.58

52 $914.47 $845.02 $890.54 $832.79 $795.44

53 $949.98 $877.84 $925.12 $865.13 $826.33

54 $987.27 $912.30 $961.44 $899.09 $858.77

55 $1,025.75 $947.85 $998.90 $934.12 $892.24

56 $1,065.99 $985.04 $1,038.10 $970.78 $927.24

57 $1,107.43 $1,023.32 $1,078.44 $1,008.51 $963.28

58 $1,150.63 $1,063.25 $1,120.52 $1,047.85 $1,000.87

59 $1,195.62 $1,104.82 $1,164.33 $1,088.82 $1,040.00

60 $1,242.38 $1,148.03 $1,209.86 $1,131.40 $1,080.67

61 $1,290.91 $1,192.88 $1,257.13 $1,175.60 $1,122.89

62 $1,290.91 $1,192.88 $1,257.13 $1,175.60 $1,122.89

63 $1,290.91 $1,192.88 $1,257.13 $1,175.60 $1,122.89

64 and over $1,290.91 $1,192.88 $1,257.13 $1,175.60 $1,122.89

OCI HMO rates

Rates displayed are full monthly premium rates based on a single policyholder.

Valid for effective dates: Q1 2024.

Rates displayed are per employee rates by age for the Medical/Rx product.

Rates include employer and employee contribution — please contact your HR department for your employee contribution.

To calculate your total family rate (if applicable), add all rates by age for each member of the household. For all dependent children, ages 21 and over, individual rates apply.

For up to three dependent children under 21, add the 0–20 rate. Apply the employee contribution to this total to determine your monthly family premium.

1 2 3

Compare plans

21

1 2 3

Core Essential plans

UnitedHealthcare of the Mid-Atlantic, Inc.

Core Essential plans offer tailored local access only to physicians and hospitals,

network-only coverage and no referrals needed to see a specialist.

Members can choose

any doctor/specialist

in the network.

How does it work?

You have the choice to see any doctor or specialist without a referral in the

tailored network. The health plan will only pay for visits to network providers,

so you will need to check your plan before visiting a doctor, clinic or hospital.

If you see an out-of-network provider for non-emergency services, you will be

responsible for all costs.

The Core Essential Network

The Core Essential network includes 24,880 providers and 87 hospitals in the

Mid-Atlantic region.

4

Information about pharmacy coverage for Core Essential plans:

Prescription drugs on all Core Essential plans are covered under a Prescription

Drug List that features a 4-tiered design to deliver clinical value and competitive

pricing. Tier 1 and Tier 2 medications have cost-share amounts that are lower

than Tier 3 and Tier 4. This helps encourage members to use these more cost-

effective options. Medications that aren’t listed are excluded from coverage.

Exclusions, while potentially disruptive, may help significantly reduce costs. By

covering only those drugs that offer both clinical value and competitive prices,

we are able to provide coverage for treatment options with lower total pharmacy

costs. Members who use an excluded medication have to meet criteria for

review and approval for coverage.

Core Essential plans also feature a tailored pharmacy network that includes

Walgreens, Walmart, Sam’s Club, Costco and Safeway.

To locate pharmacies in the Standard Select Network, visit myuhc.com. Start by

selecting Find a Pharmacy. On the Find a Network Pharmacy page, you can

search for pharmacies by name, ZIP code, city and state, or address.

A list of pharmacies will show at the end of the page. The network participation

status of each pharmacy is listed in the “Network participation” section after each

pharmacy. Be sure to confirm that “Standard Select with Walgreens” is listed.

4

Compare plans

Network counts based on internal network analysis as of Q3 2023

22

Core Essential plans

Plan Name UHC Core Essential Gold 500 UHC Core Essential Gold 750-2

Plan Code DI-AO DG-RD

Network Individual Deductible $500 $750

Network Family Deductible $1,000 $1,500

Network Coinsurance 20% 20%

Network Individual Out-of-Pocket Limit $5,800 $9,000

Network Family Out-of-Pocket Limit $11,600 $18,000

24/7 Virtual Visits $0 $0

PCP Office Visit $25 $30

Specialist Office Visit $50 $60 (PD) $65 (non-PD)

Urgent Care $60 $60

Emergency Room $300 $400 after deductible

Pharmacy

Pharmacy Code N44 N09S

Pharmacy Deductible Type $0 $0

Tier 1 $15 $15

Tier 2 $50 $40

T

ier 2 Specialty N/A $40

Tier 3 $70 $75

Tier 3 Specialty N/A $100

Tier 4 $150 $125

Tier 4 Specialty N/A $150

1 2 3

Compare plans

23

1 2 3

Plan Name

UHC Core Essential

Gold 500

UHC Core Essential

Gold 750-2

Age DI-AO DG-RD

Compare plans

Core Essential plans

Rates displayed are full monthly premium rates based on a single policyholder.

Plan Name

UHC Core Essential

Gold 500

UHC Core Essential

Gold 750-2

Age DI-AO DG-RD

0-14 $373.52 $345.80

15 $373.52 $345.80

16 $373.52 $345.80

17 $373.52 $345.80

18 $373.52 $345.80

19 $373.52 $345.80

20 $373.52 $345.80

21 $415.22 $384.40

22 $415.21 $384.39

23 $415.21 $384.39

24 $415.21 $384.39

25 $415.21 $384.39

26 $415.21 $384.39

27 $415.21 $384.39

28 $424.92 $393.38

29 $434.06 $401.84

30 $444.91 $411.89

31 $456.33 $422.46

32 $466.61 $431.98

33 $477.46 $442.03

34 $488.89 $452.60

35 $500.31 $463.18

36 $511.73 $473.75

37 $523.16 $484.33

38 $529.44 $490.14

39 $535.72 $495.96

40 $556.85 $515.52

41 $578.55 $535.61

42 $601.40 $556.76

43 $624.82 $578.44

44 $649.37 $601.18

45 $674.50 $624.44

46 $700.78 $648.76

47 $728.19 $674.14

48 $756.75 $700.58

49 $786.45 $728.07

50 $817.29 $756.63

51 $849.27 $786.24

52 $882.40 $816.90

53 $916.66 $848.63

54 $952.64 $881.94

55 $989.77 $916.31

56

$1,028.61 $952.26

57 $1,068.58 $989.27

58 $1,110.28 $1,027.87

59 $1,153.68 $1,068.05

60 $1,198.80 $1,109.83

61 $1,245.63 $1,153.18

62 $1,245.63 $1,153.18

63 $1,245.63 $1,153.18

64 and over $1,245.63 $1,153.18

Valid for effective dates: Q1 2023.

Rates displayed are per employee rates by age for the Medical/Rx product.

Rates include employer and employee contribution — please contact your HR department for your employee contribution.

To calculate your total family rate (if applicable), add all rates by age for each member of the household. For all dependent children, ages 21 and over, individual rates apply.

For up to three dependent children under 21, add the 0–20 rate. Apply the employee contribution to this total to determine your monthly family premium.

24

1 2 3

UnitedHealthcare Navigate® HMO plans

UnitedHealthcare of the Mid-Atlantic, Inc.

UnitedHealthcare Navigate® HMO plans offer tailored local access only to

physicians and hospitals, network-only coverage and a primary doctor to

coordinate care and refer specialist services.

How does it work?

You pick a primary care physician (PCP) to be your main doctor. Your PCP

gets to know you, helps manage your health care and refers you to specialists

(if needed). The health plan will only pay for visits to network providers, so

you will need to check your plan before visiting a doctor, clinic or hospital.

If you see an out-of-network provider for non-emergency services, you will

be responsible for all costs.

The Navigate Network

The Navigate network includes 24,880 providers and 87 hospitals in the

Mid-Atlantic region.

5

Members will need

to choose a PCP.

Members will not

be covered if they

receive out-of-

network care.

Compare plans

Information about pharmacy coverage for Navigate plans:

Prescription drugs on all available Navigate plans are covered under a

Prescription Drug List that features a 4-tiered design to deliver clinical value

and competitive pricing. Tier 1 and Tier 2 medications have cost-share

amounts that are lower than Tier 3 and Tier 4. This helps encourage members

to use these more cost-effective options. Medications that aren’t listed are

excluded from coverage. Exclusions, while potentially disruptive, may help

significantly to reduce costs. By covering only those drugs that offer both

clinical value and competitive prices, we are able to provide coverage for

treatment options with lower total pharmacy costs. Members who use an

excluded medication have to meet criteria for review and approval for coverage.

Navigate plans also feature a tailored pharmacy network that includes

Walgreens, Walmart, Sam’s Club, Costco and Safeway.

To locate pharmacies in the Standard Select Network visit myuhc.com. Start

by selecting Find a Pharmacy. On the Find a Network Pharmacy page, you

can search for pharmacies by name, ZIP code, city and state, or address.

A list of pharmacies will show at the end of the page. The network participation

status of each pharmacy is listed in the “Network participation” section after

each pharmacy. Be sure to confirm that “Standard Select with Walgreens”

is listed.

5

Network counts based on internal network analysis as of Q3 2023

25

1 2 3

UnitedHealthcare Navigate HMO plans

Plan Name UHC Navigate Gold 750

Plan Code DG-QY

Network Individual Deductible $750

Network Family Deductible $1,500

Network Coinsurance 20%

Network Individual Out-of-Pocket Limit $8,900

Network Family Out-of-Pocket Limit $17,800

24/7 Virtual Visits $0

PCP Office Visit $30

Specialist Office Visit $60

Urgent Care $60

Emergency Room $400 after deductible

Pharmacy

Pharmacy Code N09S

Pharmacy Deductible Type $0

Tier 1 $15

Tier 2 $40

Tier 2 Specialty $40

Tier 3 $75

Tier 3 Specialty $100

Tier 4 $125

Tier 4 Specialty $150

Compare plans

26

1 2 3

UHC Navigate Gold 750

Age DG-QY

Compare plans

UnitedHealthcare Navigate rates

Rates displayed are full monthly premium rates based on a single policyholder.

UHC Navigate Gold 750

Age DG-QY

0-14 $330.13

15 $330.13

16 $330.13

17 $330.13

18 $330.13

19 $330.13

20 $330.13

21 $366.99

22 $366.98

23 $366.98

24 $366.98

25 $366.98

26 $366.98

27 $366.98

28 $375.56

29 $383.64

30 $393.23

31 $403.33

32 $412.41

33 $422.00

34 $432.10

35 $442.20

36 $452.29

37 $462.39

38 $467.94

39 $473.49

40 $492.17

41 $511.35

42 $531.54

43 $552.24

44 $573.95

45 $596.16

46 $619.38

47 $643.61

48 $668.85

49 $695.10

50 $722.35

51 $750.62

52 $779.90

53 $810.19

54 $841.99

55 $874.80

56 $909.13

57 $944.46

58 $981.31

59 $1,019.68

60 $1,059.55

61 $1,100.95

62 $1,100.95

63 $1,100.95

64 and over $1,100.95

Valid for effective dates: Q1 2023.

Rates displayed are per employee rates by age for the Medical/Rx product.

Rates include employer and employee contribution — please contact your HR department for your employee contribution.

To calculate your total family rate (if applicable), add all rates by age for each member of the household. For all dependent children, ages 21 and over, individual rates apply.

For up to three dependent children under 21, add the 0–20 rate. Apply the employee contribution to this total to determine your monthly family premium.

27

3

Sign up

Find out what happens next

Check out the Members of Congress/Staff page at the Office of Personnel Management website.

• Visit: opm.gov/healthcare-insurance

• Click Changes in Health Coverage under the Insurance tab

• Click Eligibility & Enrollment in the left-hand column

• Click the Members of Congress/Staff tab

If you would like more information on UnitedHealthcare networks and to access sample policies, visit uhc.com/congress.

If you want more benefit information on all UnitedHealthcare plans available to you, and to sign up for coverage,

visit dchealthlink.com.

Exclusions and limitations:

*

• Charges in excess of Eligible

Expenses or in excess of any

specified limitation

• Pediatric dental and vision limited

to benefits as described in the

medical contract

• Outpatient prescription drug

products obtained from a non-

Network Pharmacy

• Coverage for prescription drug

products, which is less than or

exceeds the supply limit

• Prescription drug products dispensed

outside the United States, except as

required for emergency treatment

• Any product dispensed for the

purpose of appetite suppression

or weight loss

• Prescription drug products when

prescribed to treat infertility

• Certain prescription drug products

for smoking cessation

• Prescription drug products not

included on Prescription Drug List

• Compounded prescriptions

• Over-the-counter prescription drugs

unless we have designated the over-

the-counter medication as eligible

for coverage

• Growth hormone for children with

familial short stature

• Any medication that is used for the

treatment of erectile dysfunction or

sexual dysfunction

• A prescription drug product that

contains marijuana, including

medical marijuana

• Dental products including, but

not limited to, prescription

fluoride topicals

• Cosmetic procedures

and medications

• In-vitro fertilization

• Obesity surgery

• Services performed by a provider

who is a family member or shares

your same legal residence

• Physical, psychiatric or psychological

exams, testing, vaccinations,

immunizations or treatments that are

otherwise covered under this Policy

when required solely for purposes of

school, sports or camp, travel, career

or employment, insurance, marriage,

adoption, related to judicial or

administrative proceedings or orders,

conducted for purposes of medical

research, or are required to obtain or

maintain a license of any type.

• Services or supplies that are

experimental or investigational,

except routine costs associated

with qualifying clinical trials

* This list may not be all inclusive and is subject to change. Please refer to your plan coverage documents for a full list of exclusions and limitations.

28

If you, or someone you’re helping, has questions about the

Health Insurance Marketplace, you have the right to get help and

information in your language at no cost. To talk to an interpreter, call

1-877-856-2430.

Si usted, o alguien a quien usted está ayudando, tiene preguntas

acerc

a de Health Insurance Marketplace, tiene derecho a obtener

a

yuda e información en su idioma sin costo alguno. Para hablar con

un intérprete, llame al 1-877-856-2430.

እርስዎ፣ ወይም እርስዎ የሚያግዙት ግለሰብ፣ ስለ Health Insurance

Marke

tplace ጥያቄ ካላችሁ፣ ያለ ምንም ክፍያ በቋንቋዎ እርዳታና

የማግኘት መብት አላችሁ። ከአስተርጓሚ ጋር ለመነጋገር፣ 1-877-856-2430

ይደውሉ።

如果您,或是您正在協助的對象,有關於

Health Insurance

Marke

tplace 方面的問題,您有權利免費以您的母語得到幫助和訊

息。洽詢一位翻譯員,請撥電話1-877-856-2430。

S

i vous, ou une personne que vous aidez, av

ez des questions à

propos du Health Insurance Marketplace, vous avez le droit d’obtenir

grat

uitement de l’aide et des renseignements dans votre langue.

Pour parler à un interprète, appelez le 1-877-856-2430.

Kung ikaw, o ang iyong tinutulungan, a

y may mga katanungan

tungkol sa Health Insurance Marketplace, may karapatan kang

makakuha n

g tulong at impormasyon sa iyong wika nang walang

gastos. Upang makipag-usap sa isang tagasalin ng wika, tumawag

sa 1-877-856-2430.

Если у вас или лица, которому вы помогаете, имеются вопросы

по поводу

Health Insurance Marketplace, то вы имеете право

на бесплатное получение помощи и информации на ваше

м

языке. Для разговора с переводчиком позвоните по телефону

1-877-856-2430.

Se você, ou alguém a quem você está ajudando, tem per

guntas

sobre o Health Insurance Marketplace, você tem o direito de obter

ajuda e inf

ormação em seu idioma e sem custos. Para falar com um

intérprete, ligue para 1-877-856-2430.

Se tu o qualcuno che stai aiutando avete domande su Health

Insurance Mark

etplace, avete il diritto di ottenere aiuto e informazioni

nella v

ostra lingua gratuitamente. Per parlare con un interprete,

potete chiamare 1-877-856-2430.

Nếu quý vị, hay người mà quý vị đang giúp đỡ, có câu hỏi về Health

Insurance Marke

tplace, quý vị sẽ có quyền được giúp và c

ó thêm

thông n bằng ngôn ngữ của mình miễn phí. Để nói chuyện với một

thông dịch viên, xin gọi 1-877-856-2430.

I bale we, tole mut u ye hola, a gwee mbar

ga inyu Health Insurance

Marketplace, U gwee Kunde I kosna mahola ni biniiguene i hop

won

g nni nsaa wogui wo. I Nyu ipot ni mut a nla koblene we hop,

sebel 1-877-856-2430.

Ọ bụrụ gị, ma o bụ onye I na eyere-aka, nwere ajụjụ gbasara Health

Insur

ance Marketplace, I nwere ohere iwen

ta nye maka na ọmụma

na asụsụ gị na akwughi ụgwọ. I chọrọ I kwụrụ onye-ntapịa okwu, kpọ

1-877-856-2430.

Bí ìwọ, tàbí ẹnikẹni o n ranlọwọ, bá ní ibeere nípa Health Insurance

Marketplace

, o ní ẹtọ la gba iranwọ à

ìtónilé ní èdè rẹ láìsanwó.

Lá bá ongbufọ kan sọrọ, pè sórí 1-877-856-2430.

যদি আপনি, অথবা আপনি অন্য কাউকে সহায়তা করছেন, তাদের Health Insurance

Marketplace সম্পর্কে প্রশ্ন থাকলে, আপনার অধিকার আছে বিনা খরচে সাহায্য পাবার

, এবং আপনার নিজস্ব ভাষাতে তথ্য জানবার। অনুবাদকের সাথে কথা বলার জন্য, কল

করুন 1-877-856-2430.

ご本人您、またはお客您の身の回りの方でも、

Health Insurance

Marketplace についてご質問がございましたら、ご希望

の言語でサポ您トを受けたり、情報を入手したりすること

ができます。料金はかかりません。通您とお話される場

合、1-877-856-2430までお電話ください。

Falls Sie oder jemand, dem Sie helfen, Fragen zum Health

Insurance Marketplace haben, haben Sie das Recht, kostenlose

Hilfe und Infor

mationen in Ihrer Sprache zu erhalten. Um mit

einem Dolmetscher zu sprechen, rufen Sie bitte die Nummer

1-877-856-2430 an.

إذا كان لديك أو لدى شخص تساعده أسئلة بخصوص Health Insurance

Marke

tplace، فلديك الحق في الحصول على المساعدة والمعلومات

الضرورية بلغتك من دون أي تكلفة. للتحدث مع مترجم اتصل بـ

1-877-856-2430.

UnitedHealthcare Insurance Company, UnitedHealthcare of the

Mid-Atlantic and Optimum Choice Inc., and their affiliates do not treat

members differently because of sex, age, race, color, disability or

national origin.

If you think you were treated unfairly because of your sex, age, race,

color, dis

ability or national origin, you can send a complaint to:

Civil Rights Coordinator

United HealthCare Civil Rights Grievance

P.O. Box 30608

Salt Lake City, UT 84130

You must send the complaint within 60 days of when you found out

about it. A decision will be sent t

o you within 30 days. If you disagree

with the decision, you have 15 days to ask us to look at it again.

If you need help with your complaint, please call the toll-free member

phone number listed on y

our health plan ID card, TTY 711, Monday

through Friday, 8 a.m. to 8 p.m. You can also file a complaint with the

U.S. Dept. of Health and Human Services.

Online: https://ocrportal.hhs.gov/ocr/portal/lobby.jsf

Complaint forms are available at http://www.hhs.gov/ocr/office/file/

index.html.

P

hone: Toll-free 1-800-368-1019, 800-537-7697 (TDD)

Mail: U

.S. Dept. of Health and Human Services

. 200 Independence

Avenue, SW Room 509F, Hubert H. Humphrey Building, Washington,

D.C. 20201

We provide free language services. We provide free services to help

you communic

ate with us, such as letters in other languages or large

print. Or, you can ask for an interpreter. To ask for help, please call the

toll-free member phone number listed on your health plan ID card TTY

711, Monday through Friday, 8 a.m. to 8 p.m. ET.

Learn more

To learn more about UnitedHealthcare plans, visit uhc.com/congress or call 1-877-856-2430.

1

C

ognitive Behavioral Therapy (CBT) is a form of psychological treatment that has been demonstrated to be effective for a range of problems, including depression, anxiety disorders, alcohol and drug use problems,

marital problems, eating disorders and severe mental illness. apa.org/ptsd-guideline/patients-and-families/cognitive-behavioral. Accessed 09/30/2023.

2

bhsonline.com/ending-mental-health-stigma-in-the-workplace/. Accessed 09/30/2023.

App Store is a registered trademark of Apple, Inc. All trademarks are the property of their respective owners.

The AbleTo mobile application should not be used for urgent care needs. If you are experiencing a crisis or need emergency care, call 911 or go to the nearest emergency room. The Self Care information contained

in the AbleTo mobile application is for educational purposes only; it is not intended to diagnose problems or provide treatment and should not be used on its own as a substitute for care from a provider. AbleTo Self

Care is available to members ages 13+ at no additional cost as part of your benefit plan. Self Care is not available for all groups in District of Columbia, Maryland, New York, Pennsylvania, Virginia or West Virginia and is

subject to change. Refer to your plan documents for specific benefit coverage and limitations or call the toll-free member phone number on your health plan ID card. Participation in the program is voluntary and subject

to the terms of use contained in the mobile application.

The UnitedHealth Premium® designation program is a resource for informational purposes only. Designations are displayed in UnitedHealthcare online physician directories at myuhc.com®. You should always visit

myuhc.com for the most current information. Premium designations are a guide to choosing a physician and may be used as one of many factors you consider when choosing a physician. If you already

have a physician, you may also wish to confer with them for advice on selecting other physicians. Physician evaluations have a risk of error and should not be the sole basis for selecting a physician.

Please visit myuhc.com for detailed program information and methodologies.

Care Cash provides a pre-loaded debit card that can be used for certain health care expenses. If the card is used for ineligible 213(d) expenses, individuals may incur tax obligations and should consult an appropriate

tax professional to determine if they have such obligations. The information provided in connection with Care Cash is for general informational purposes only and is not intended to be nor should be construed as

medical advice. Individuals should consult an appropriate health care professional to determine what may be right for them.

24/7 Virtual Visits is a service available with a Designated Virtual Network Provider via video, or audio-only where permitted under state law. Unless otherwise required, benefits are available only when services are

delivered through a Designated Virtual Network Provider. 24/7 Virtual Visits are not intended to address emergency or life-threatening medical conditions and should not be used in those circumstances. Services may

not be available at all times, or in all locations, or for all members. Check your benefit plan to determine if these services are available.

Certain preventive care items and services, including immunizations, are provided as specified by applicable law, including the Patient Protection and Affordable Care Act (ACA), with no cost-sharing to you. These

services may be based on your age and other health factors. Other routine services may be covered under your plan, and some plans may require copayments, coinsurance or deductibles for these benefits. Always

review your benefit plan documents to determine your specific coverage details.

The UnitedHealthcare plan with Health Savings Account (HSA) is a qualifying high-deductible health plan (HDHP) that is designed to comply with IRS requirements so eligible enrollees may open a Health Savings

Account (HSA) with a bank of their choice or through Optum Bank®, Member FDIC. The HSA refers only and specifically to the Health Savings Account that is provided in conjunction with a particular bank, such as

Optum Bank, and not to the associated HDHP.

UnitedHealthcare Rewards is a voluntary program. The information provided under this program is for general informational purposes only and is not intended to be nor should be construed as medical advice.

You should consult an appropriate health care professional before beginning any exercise program and/or to determine what may be right for you. Receiving an activity tracker, certain credits and/or rewards and/

or purchasing an activity tracker with earnings may have tax implications. You should consult with an appropriate tax professional to determine if you have any tax obligations under this program, as applicable. If any

fraudulent activity is detected (e.g., misrepresented physical activity), you may be suspended and/or terminated from the program. If you are unable to meet a standard related to health factor to receive a reward under

this program, you might qualify for an opportunity to receive the reward by different means. You may call us toll-free at 1-866-230-2505 or at the number on your health plan ID card, and we will work with you (and, if

necessary, your doctor) to find another way for you to earn the same reward. Rewards may be limited due to incentive limits under applicable law. Components subject to change. This program is not available for fully

insured members in Hawaii, Vermont and Puerto Rico nor available to level funded members in District of Columbia, Hawaii, Vermont and Puerto Rico.

All UnitedHealthcare members can access a cost estimate online or on the mobile app. None of the cost estimates are intended to be a guarantee of your costs or benefits. Your actual costs may vary. When accessing

a cost estimate, please refer to the website or mobile application terms of use under Find Care & Costs section.

UnitedHealthcare policies may have exclusions or limitations or terms under which the policy may be continued in force or discontinued. For costs and complete details of the coverage, contact your broker, consultant

or UnitedHealthcare Representative.

Insurance coverage provided by or through UnitedHealthcare Insurance Company. Administrative services provided by United HealthCare Services, Inc. Health Plan coverage provided by or through Optimum Choice,

Inc. (and MAMSI Life and Health Insurance Company for out-of-network benefits). Health plan coverage provided by UnitedHealthcare of the Mid-Atlantic, Inc.

B2C EI232693256.0 10/23 © 2023 United HealthCare Services, Inc. All Rights Reserved. 23-2693850