Illinois Department of Revenue

Publication 122

Instructions for Farmland Assessments

January 2024

About this publication

Pub-122, Instructions for Farmland Assessments, is issued according to Section 10-115 of the

Property Tax Code which states, “The Department shall issue guidelines and recommendations for

the valuation of farmland to achieve equitable assessment within and between counties.”

Table of Contents

Definition of Land Use .......................................................................................... Page 2

How is farmland assessed? ........................................................................... Page 3

What are the adjustment factors? .................................................................. Page 3

What are the guidelines for alternative uses? ............................................... Pages 4-6

Other guidelines ................................................................................................... Pages 6-8

Assessment of Farmland ...................................................................................... Page 9

Individual soil weighting method .................................................................... Pages 9-13

Table 1 Certified Values for 2024 Farmland Assessments .................................. Page 14

Table 2 Productivity of Illinois Soils...................................................................... Pages 15-35

Table 3 Slope & Erosion Adjustment Table .......................................................... Page 36

Assessment of Farm Homesites and Rural Residential Land .............................. Page 37

Assessment of farm residences .................................................................... Page 37

Assessment of farm buildings ........................................................................ Pages 37-39

Farm building schedules....................................................................................... Pages 40-54

For information or forms

....................................................................................... Page 54

The information in this publication is current as of the date of the publication.

The contents of this publication are informational only and do not take

the place of statutes, rules, or court decisions. For many topics covered

in this publication, we have provided a reference to the Illinois Property

Tax Code for further clarification or more detail at 35 ILCS 200/1 et seq.

Get more information and

forms faster and easier at

tax.illinois.gov

Other Publications for Assessors:

Publication 123 Instructions for Residential Schedules

Publication 124 Construction Terminology

Publication 126 Instructions for Commercial and Industrial Cost Schedules

Publication 127 Component-in-Place Schedules

PUB-122 (R-01/24)

Page 2 of 54

Publication 122

Instructions for Farmland Assessments

Definition of Land Use

Section 10-125 of the Property Tax Code identifies cropland, permanent pasture, other farmland, and

wasteland as the four types of farmland and prescribes the method for assessing each. State law requires

cropland, permanent pasture, and other farmland to be defined according to US Bureau of Census

definitions. The following definitions comply with this requirement.

January 2024

Cropland includes all land from which crops were harvested or hay was cut; all land in orchards, citrus

groves, vineyards, and nursery greenhouse crops; land in rotational pasture, and grazing land that could

have been used for crops without additional improvements; land used for cover crops, legumes, and soil

improvement grasses, but not harvested and not pastured; land on which crops failed; land in cultivated

summer fallow; and idle cropland.

Permanent pasture includes any pastureland except woodland pasture and pasture qualifying under

the Bureau of Census’ cropland definition which includes rotational pasture and grazing land that could have

been used for crops without additional improvements.

Other farmland includes woodland pasture; woodland, including woodlots, timber tracts, cutover, and

deforested land; and farm building lots other than homesites.

Wasteland is that portion of a qualified farm tract that is not put into cropland, permanent pasture, or

other farmland as the result of soil limitations and not as the result of a management decision.

Acronyms used in this publication

AEV Agricultural economic value

CCAO Chief county assessment officer

CREP Conservation Reserve Enhancement Program

CRP Conservation Reserve Program

CV Contributory value

EAV Equalized assessed value

ICSS Illinois Cooperative Soil Survey

LF Linear foot

NRCS Natural Resources Conservation Service

oc On center

PI Productivity index

PRC Property record card

RCN Replacement cost new

REL Remaining economic life

SF Square foot

SFFA Square foot floor area

SWCD Soil and Water Conservation District

VFS Vegetative filter strip

Note: For definitions of common construction terms used in this

Publication, see Publication 124, Construction Terminology.

Printed by the authority of the state of Illinois, electronic only, one copy

PUB-122 (R-01/24)

Page 3 of 54

How is farmland assessed?

Cropland is assessed according to the equalized

assessed value (EAV) of its adjusted soil productivity

index (PI) as certified by the Department. Each year, the

Department supplies a table that shows the EAV of

cropland by PI.

See Page 14 for Certified Values for 2024

Farmland Assessments.

Cropland with a PI below the lowest PI certified by the

Department is assessed as follows:

Step 1 Subtract the EAV of the lowest certified PI

from the EAV for a PI that is five greater.

Step 2 Divide the result of Step 1 by 5.

Step 3 Find the difference between the lowest PI for

which the Department certified a cropland EAV

and the PI of the cropland being assessed.

Step 4 Multiply the result of Step 2 by the result of

Step 3.

Step 5 Subtract the result of Step 4 from the lowest

EAV for cropland certified by the Department.

Step 6 The EAV of the cropland being assessed will

either be the result of Step 5 or one-third of the

EAV of cropland for the lowest certified PI,

whichever is greater.

Permanent pasture is assessed at one-third of its

adjusted PI EAV as cropland. By statute, the EAV of

permanent pasture cannot be lower than one-third of the

EAV per acre of cropland of the lowest PI certified by the

Department.

Other farmland is assessed at one-sixth of its adjusted

PI EAV as cropland. By statute, the EAV of other

farmland cannot be lower than one-sixth of the EAV

per acre of cropland of the lowest PI certified by the

Department.

Wasteland is assessed according to its contributory

value to the farm parcel. In many instances, wasteland

contributes to the productivity of other types of farmland.

Some land may be more productive because wasteland

provides a path for water to run off or a place for water to

collect. Wasteland that has a contributory value should

be assessed at one-sixth of the EAV per acre of cropland

of the lowest PI certified by the Department. When

wasteland has no contributory value, a zero assessment

is recommended.

What are the adjustment factors?

Adjustment for slope and erosion. Use the Slope

and Erosion Adjustment Table on Page 36 to make

adjustments to the PI for slope and erosion.

Adjustment for flooding. Adjust the PI of the affected

acreage only, which suffers actual, not potential,

crop loss due to flooding as prescribed in Bulletin

810, published by the University of Illinois, College

of Agriculture, Cooperative Extension Service. The

following text is taken directly from Bulletin 810.

“Estimated yields and productivity indices

given in Table 2 apply to bottomland soils that

are protected from flooding or a prolonged

high water during the cropping season

because of high water in stream valleys. Soils

that are subject to flooding are less productive

than soils that are protected by levees. The

frequency and severity of flooding are often

governed by landscape characteristics and

management of the watershed in which a

soil occurs. For this reason, factors used to

adjust productivity indices for flooding must

be based on knowledge of the characteristics

and history of the specific site. Wide variation

in the flooding hazard, sometimes within short

distances in a given valley, require that each

situation be assessed locally.

If the history of flooding in a valley is known

to have caused 2 years of total crop failures

and 2 years of 50% crop losses out of ten

years, for example, the estimated yields

and productivity indices of the bottomland

soils could be reduced to 70% of those

given in Table 2. Estimated crop yields and

productivity indices for upland soils subject

to crop damage from long-duration ponding

have already been reduced accordingly in

Table 2.”

Flood adjustment procedures should

identify the actual acres affected by flooding;

determine, from yield data, the extent of crop loss

(in bushels) caused in each flood situation;

adjust the PI of the affected soils by a percentage

equal to the percentage of crop loss caused by each

flooding situation over a multi-year (preferably

ten-year) period; and

recompute the flood adjustments annually. The

continuous collection and analysis of yield data is

needed in order to identify and compensate for

changes in a parcel’s flooding history.

PUB-122 (R-01/24)

Page 4 of 54

Adjustment for drainage district assessments.

The EAV of farmland acreage that is subject to a

drainage district assessment must be adjusted. Divide

the amount equal to 33 1/3 percent of the per acre

drainage district assessment by the five-year Federal

Land Bank mortgage interest rate for that assessment

year. Subtract the result from the EAV. Since drainage

district assessments may vary greatly from year to year,

it is advisable to use a five-year average of per-acre

drainage district assessments when making this

adjustment.

Adjustments for soil inclusions, droughty soil and

ponding. Do not make an adjustment for soil inclusions,

droughty soil, or ponding. Long-term yield averages

taken at many locations already include these effects.

Only unusual conditions of large amounts of inclusions

with differing productivity potential would be likely to

affect the productivity of a local area.

When ponding consistently produces a crop loss,

make a flooding adjustment.

What are the guidelines for alternative

uses?

Roads. Do not assign a value to acreage in dedicated

roads unless a portion of the right-of-way is in a farm

use. In this case, assess this portion.

Creeks, streams, rivers, and drainage ditches.

Assess acreage in creeks, streams, rivers, and

drainage ditches that contribute to the productivity of

a farm as contributory wasteland. Assess acreage that

does not contribute to the productivity of a farm as

non-contributory wasteland.

Grass waterways and windbreaks. Assess acreage in

grass waterways and windbreaks as other farmland.

Ponds and borrow pits. Assess ponds and borrow pits

used for agricultural purposes as contributory wasteland.

If a pond or borrow pit is used as part of the homesite,

assess it with the homesite at 33 1/3 percent of market

value.

Power lines. Generally, no adjustment is made.

Lanes and non-dedicated roads. Assess acreage in

lanes and non-dedicated roads the same as the adjacent

land use. This could be as cropland, permanent pasture,

other farmland, or wasteland.

Assessment of land under an approved forestry

management plan. Land that is being managed under

the Illinois Forestry Development Act (FDA), as approved

by the Illinois Department of Natural Resources, is

considered “other farmland” for assessment purposes.

Land assessed under the FDA is excluded from both

the two-year and primary-use requirements. Any change

in assessed value resulting from a newly-approved

FDA plan begins on January 1 of the assessment year

immediately following the plan’s initial approval date

(whether or not trees have been planted). Changes

in assessed value resulting from amendments or

cancellations of existing plans also begin as of January 1

of the assessment year following the change. If the

effective date of an FDA plan is January 1, then that

plan would be eligible for an FDA assessment for that

assessment year. Once the chief county assessing

officer (CCAO) receives official notification that a tract

has been granted approved FDA status, this status

remains in effect until notified otherwise or until the

property is sold. For more information, see Publication

135, Preferential Assessments for Wooded Acreage.

Assessment of land in vegetative filter strips. Land

in all downstate counties that has been certified by the

Soil and Water Conservation District (SWCD) as being in

an approved vegetative filter strip (VFS) is eligible, upon

application, to be assessed at one-sixth of its soil PI EAV

as cropland. Land in Cook County that has been certified

by the SWCD as being in an approved VFS is eligible,

upon application, to be assessed according to Section

10-130 of the Property Tax Code. Land assessed as a

VFS is excluded from both the two-year and primary-use

requirements.

The effective date of the initial legislation that creates the

assessment provision for a VFS is January 1, 1997.

Assessment as a VFS begins in the first assessment

year after 1996, for which the property is in an approved

VFS use on the annual assessment date of January

1. For example, land that is in a VFS during a portion

of 2023, and is certified by the SWCD as being in an

approved status on January 1, 2024, is eligible for

assessment as a VFS for the 2024 assessment year.

Land in Christmas tree production. Land used for

growing Christmas trees is eligible for a farmland

assessment provided it has been in Christmas trees or

another qualified farm use for the previous two years

and that it is not part of a primarily residential parcel. If

Christmas trees are grown on land that either was being

cropped prior to tree plantings or land that ordinarily

would be cropped, then the cropland assessment should

apply until tree maturity prevents the land from being

cropped again without first having to undergo significant

improvements (e.g., clearing). At this point, the “other

farmland” assessment should apply. If Christmas trees

are grown on land that was neither in crop production

prior to tree planting nor would ordinarily be cropped,

then the “other farmland” assessment instantly applies.

Land in Conservation Reserve Program (CRP).

Land in the CRP is eligible for a farmland assessment

provided it has been in the CRP or another qualified

farm use for the previous two years and is not a part

of a primarily residential parcel. CRP land is assessed

according to its use. Land enrolled into the CRP can be

planted in grasses or trees. If grass is planted, this land

will be classified as cropland (according to the Bureau

of Census’ cropland definition). If trees are planted, then

PUB-122 (R-01/24)

Page 5 of 54

the cropland assessment should apply until tree

maturity prevents the land from being cropped again

without first having to undergo significant improvements

(e.g., clearing). At this point, the “other farmland”

assessment should apply.

Land in Conservation Reserve Enhancement

Program (CREP). Land in the CREP is eligible for a

farmland assessment provided it has been in the CREP

or another qualified farm use for the previous two years

and is not a part of a primarily residential parcel. Land

in an active CREP program is assessed the same as

CRP.

Horse boarding and training facilities. The boarding

and training of horses (regardless of the use for which

the horses are being raised) is generally considered to

meet the “keeping, raising, and feeding” provisions of

the farm definition pertaining to livestock. Therefore,

such a tract would be eligible for a farmland assessment

provided its sole use has been in this or another qualified

farm use for the previous two years; and, it is not part of

a primarily residential parcel.

Assessment of tree nurseries. Tree nurseries are

included in the statutory definition of a farm. Such a tract

would be eligible for a farmland assessment provided

its sole use has been in this or another qualified farm

use for the previous two years and it is not part of a

primarily residential parcel. If trees are grown on land

that either was being cropped prior to tree planting or

land that ordinarily would be cropped, then the cropland

assessment should apply until tree maturity prevents the

land from being cropped again without first having to

undergo significant improvements (e.g., clearing). At this

point, the “other farmland” assessment should apply. If

trees are grown on land that was neither in crop

production prior to tree planting nor would ordinarily be

cropped, then the “other farmland” assessment would

instantly apply.

Assessment of greenhouse property. Greenhouses

are included in the statutory definition of a farm. To

qualify as a greenhouse, a building must be used for

cultivating plants. A tract that qualifies as greenhouse

property is eligible for a farmland assessment provided

its sole use has been in this or another qualified farm

use for the previous two years and it is not part of a

primarily residential parcel. Greenhouses are assessed

according to their contributory value, and greenhouse

lots are assessed as “other farmland.”

Wildlife farming. Wildlife farming is included in the

statutory definition of a farm. To qualify for wildlife

farming, a tract must comply with the “keeping, raising,

and feeding” provisions of the farm definition. The

mere keeping of a wildlife habitat does not meet these

provisions. Hunting may be a component of wildlife

farming; but, hunting, in itself, does not constitute wildlife

farming. Neither is just the purchase and release of

adult game for hunting considered wildlife farming. Land

that is actively engaged in the farming of wildlife is

eligible for a farmland assessment provided its sole use

has been in this or another qualified farm use for the

previous two years and it is not part of a primarily

residential parcel. Any such land that was either

previously being cropped or ordinarily would be cropped,

would warrant a cropland assessment until additional

improvements (e.g., clearing) would be required before

the land could be cropped again. At this point, the other

farmland assessment would apply. Any such land that

neither was being cropped nor ordinarily would be

cropped, would warrant an “other farmland” assessment.

Fish farming. Fish farming is included in the statutory

definition of a farm. To qualify for fish farming, a tract

must comply with the “keeping, raising, and feeding”

provisions of the farm definition. Fishing may be a

component of fish farming; but, fishing, in itself, does not

constitute fish farming. Neither is just the purchase and

release of fish for fishing, a practice often referred to as

“put and take,” considered fish farming. Land that is

actively used for the farming of fish is eligible for a

farmland assessment provided its sole use has been in

this or another qualified farm use for the previous two

years and it is not part of a primarily residential parcel.

Compost sites. Composting, generally, does not meet

the farm definition. However, an on-farm composting site,

where the finished product is for on-farm use, does qualify

for the farmland assessment. If such a composting site is

situated on land that either was being cropped prior to the

composting activity or that ordinarily would be cropped,

then the cropland assessment applies until the

composting activity would prevent the land from being

cropped again without first having to undergo significant

improvements. At this point, the contributory wasteland

assessment should apply. If the composting site is

situated on land that was neither in crop production prior

to composting activity nor would ordinarily be cropped,

then the contributory wasteland assessment should

instantly apply.

Sewage sludge disposal sites. Determining the proper

assessment classification for farmland that is also used

as a sewage sludge disposal site depends upon

circumstances pertaining to the particular site, such as

the application rate of the sludge,

whether or not the application of the sludge interferes

with farming operations (sludge can be applied

before a crop is planted, directly to a crop, after a

crop is harvested, or in a manner so intensive as to

prohibit farming), or

whether or not the owner or operator of the site

receives financial payment.

PUB-122 (R-01/24)

Page 6 of 54

The overriding factor to determine whether such a

dually-used tract is eligible for a farmland assessment is

whether or not the sludge is being applied at agronomic

rates (i.e., rates which are suitable for the growth and

development of crops). If nonfarm sludge is applied to an

otherwise eligible farm tract at an agronomic rate, then

the farm classification applies. If, however, cessation

of farming occurs as a result of sludge being applied

at a nonagronomic rate, then the farm classification

may not apply. Even if application of nonfarm sludge at

a nonagronomic rate does not interfere with farming

operations, income generated from this nonfarm activity

may conflict with the law’s sole-use requirement.

The Illinois Environmental Protection Agency, Water

Pollution Control Division, should be contacted at

217 782-0610 for information pertaining to whether or

not nonfarm sludge is being applied at an agronomic

rate.

Other guidelines

“Idle land” is land that is not put into a qualified farm

use as the result of a management decision, including

neglect. Idle land differs from wasteland, which is

defined as “... that portion of a qualified farm tract which

is not put into cropland, permanent pasture, or other

farmland as the result of soil limitations and not as a

result of a management decision.”

How to assess idle land depends upon whether or not

the idle land

is part of a farm,

could be cropped without additional improvements,

and

is larger or smaller than the farmed portion of the

parcel or tract.

Guidelines for the assessment of idle land are as follows:

If idle land is not part of a farm or not qualified for

a special assessment (i.e., open space), treat it as

nonfarm and assess it at market value according to

its highest and best use.

If idle land is part of a farm, and could be cropped

without additional improvements, it may be assessed

as cropland if the idle portion of the parcel is smaller

than the farmed portion of the parcel.

If idle land is part of a farm but could not be cropped

without additional improvements, it may be assessed

as wasteland if the idle portion of the parcel is

smaller than the farmed portion of the parcel.

Generally, when the idle portion of the parcel is

larger than the farmed portion of the parcel, the idle

portion is assessed at market value according to

its highest and best use. However, when a farm tract

consists of multiple tax parcels, the cropland or

wasteland assessment may apply to the idle portion

of a predominantly (or exclusively) idle parcel if the

idle portion of the overall farm tract is smaller than

the farmed portion of the tract.

Distinguishing between idle land (that is not farmland) and

land that may qualify under the farm definition as “forestry”

may be difficult. However, to qualify as forestry, a wooded

tract must be systematically managed for the production of

timber.

Primary use provision of the farm definition. The

statutory farm definition (35 ILCS 200/1-60) states: “For

purposes of this Code, ‘farm’ does not include property

which is primarily used for residential purposes even

though some farm products may be grown or farm

animals bred or fed on the property incidental to its

primary use.” Because the farm definition prohibits

farmed portions of primarily residential parcels from

receiving a farmland assessment, assessors must make

primary-use determinations on parcels that contain both

farm and residential uses.

The determination of primary-use must have a rational

basis and be uniformly applied in the assessment

jurisdiction. This recommended guideline is intended to

supplement the assessor’s judgment and experience

and to provide advice and direction to assessors to

determine whether or not a parcel with both farm

and residential uses is used primarily for residential

purposes. This guideline does not apply to tracts

assessed under the forestry management or vegetative

filter strip provisions of the Property Tax Code, nor does

it apply to parcels that do not contain any residential

usage.

According to this guideline, the primary use of a parcel

containing only intensive farm and residential uses is

residential unless the intensively-farmed portion of

the parcel is larger than the residential portion of the

parcel. For purposes of this guideline, “intensive farm

use” refers to farm practices for which the per-acre

income and expenditures are significantly higher than

in conventional farm use. Intensive farm use is typically

more labor-intensive than conventional farm use.

According to this guideline, the primary use of a parcel

containing only conventional farm and residential uses

is residential unless the conventionally-farmed portion

of the parcel is larger than the residential portion of

the parcel. These presumptions may be rebutted by

evidence received that the primary use of the parcel

is not residential. For purposes of this guideline,

“conventional farm use” refers to the tending of all

major and minor Illinois field crops, pasturing, foresting,

livestock, and other activities associated with basic

agriculture.

If a parcel has a use combination of residential,

conventional farm, and intensive farm, the determination

of whether or not the primary use is residential must be

made by applying the criteria for each type of farm

use described in the preceding paragraphs and then

weighing the result of all farm uses against residential

use of the parcel.

PUB-122 (R-01/24)

Page 7 of 54

If a parcel has a use combination of residential,

nonresidential-nonfarm (e.g., commercial, industrial),

and any type of farm use, then the relative proportion of

all uses should be considered in determining whether the

primary use of the parcel is residential. For example, if

the primary use of the parcel is commercial, the primary

use of the parcel cannot be residential and any farmed

portion of the parcel meeting the two-year requirement is

entitled to a farmland assessment even though it may be

smaller than the portion of the parcel used for residential

purposes.

Alternative soil mapping guideline. The Department

has consistently advocated the use of Illinois

Cooperative Soil Survey (ICSS) soil mapping (mapping

prepared for county detailed soil surveys) for computing

farmland assessments. The ICSS soil maps contain the

level of accuracy needed to assure that soil productivity

indices and assessed values are accurate.

The Natural Resources Conservation Service (NRCS),

the agency responsible for directing the ICSS program,

is a producer of Order 2 soil surveys. Order 2 soil

mapping (mapping prepared at a scale of 1:12,000

to 1:20,000) is regarded by the Department as the

largest, feasibly-manageable scale for which to conduct

a reliable state mapping project. The ICSS does not

produce Order 1 (mapping produced at a scale usually

larger than 1:12,000) soil mapping for a county. Although

Order 1 soil mapping could provide a more detailed

account of the soils for a specific site than Order 2

mapping, its lack of national and state standards will

often cause it to be less accurate.

Landowners may, however, challenge ICSS soil data

(mapping) in a tax assessment complaint and submit

alternative soil mapping. Such soil mapping should be

prepared at the same scale or under the specifications

and standards as ICSS soil mapping. When a complaint

is filed, boards of review must decide whether evidence

supports replacing ICSS soil mapping with alternative

mapping. Evidence that supports substituting alternative

soil mapping for ICSS soil mapping is the acceptance of

such alternative mapping by the NRCS and a resulting

change in the official record copy of the soil map. An

official record copy soil map showing all approved soil

surveys is maintained by the NRCS. Board of review

decisions regarding the standing of alternative mapping

should not be made without considering the expert

opinion of the NRCS.

Through combined efforts of the Department, NRCS,

and the Office of Research in the College of Agricultural,

Consumer and Environmental Sciences at the

University of Illinois at Champaign-Urbana, the following

mechanism has been developed which will give boards

of review access to such expert opinion.

The CCAO should forward any alternative Order 2 soil

mapping received in a complaint to the local NRCS

field office. The NRCS field office will conduct an

initial evaluation of the alternative soil mapping, and,

as warranted, will forward the material to the NRCS

area and/or state level. The NRCS will determine if the

alternative mapping warrants a change in the official

record copy. Boards of review should give substantial

weight to NRCS decisions when settling complaints.

Since NRCS evaluations will only be performed on

alternative Order 2 soil mapping, according to this

guideline, board of review rules should be amended to

require that corresponding Order 2 soil mapping must

accompany any Order 1 soil mapping submitted in a

complaint. Boards of review can benefit greatly from an

NRCS evaluation of Order 2 soil mapping.

Since ICSS soil maps identify soils as they occur on the

landscape, boards of review should not replace ICSS soil

mapping with any alternative mapping for areas smaller

in size than a tax parcel. The entire tax parcel should be

evaluated and mapped if alternative soil mapping is done.

Use of a tract during the assessment year. Since real

property is valued according to its condition on January

1 of the assessment year, a time when most farmland

is idle, an assessor will often not know if a tract will no

longer be used for farming. Therefore, circumstances

occurring after January 1 may be taken into consideration

to determine a parcel’s tax status as farm or nonfarm. For

example, if a typically cropped tract previously assessed

as farmland has not been planted or used in any other

qualified farm use during the assessment year and

building construction has begun on the tract, the tract

should not be assessed as farmland.

Significance of primary use on a non-residential

parcel. The primary use of a non-residential parcel does

not have to be agricultural in order for a tract within the

parcel to be assessed as a farm. The farmed portion of

primarily commercial or industrial parcels is eligible for a

farm assessment provided it qualifies under the statutory

definition of farm and has qualified for the previous two

years. For example, if a small farmed tract on an 80-acre

industrial parcel meets the farm definition and has met

the definition for the previous two years, the small tract

should be assessed as farmland.

Two-year eligibility requirement. The statutory

requirement that land be in a farm use for the preceding

two years applies to nonfarm converted-to-farm tracts for

which there was no previous farming and not to tracts

converted for the purpose of adding to existing farmland.

For example, the two-year requirement would not apply

when the dwelling on a farmed parcel is demolished and

the land is farmed. The two-year requirement also does not

apply to tracts assessed under the Forestry Development

Act or land assessed as a vegetative filter strip.

Detailed soil mapping. Modern detailed soil maps,

prepared by the USDA Natural Resources Conservation

Service, are now complete in every county. Boards of

review are advised to consider such detailed soil mapping

when presented for appeal.

PUB-122 (R-01/24)

Page 8 of 54

Effect of commercial retailing of farm products on

preferential assessment status. Eligibility for receiving

the preferential farmland assessment depends solely

upon a tract’s conformity with the farm definition without

regard to the retailing methods of agricultural products

produced on the tract. For example, a pay-to-pick

strawberry patch is eligible for a preferential farmland

assessment provided its sole use has been in this or

another qualified farm use for the previous two years

and it is not part of a primarily residential parcel. Tracts

devoted to nonfarm uses (e.g., clubhouse, cabin), tracts

where the use is not solely agricultural (e.g., pasture also

used for commercial horseback riding or camping), or

tracts used for the sale of nonfarm products are not

eligible for preferential treatment.

Effects of gubernatorial proclamation — declaring

county as a State of Illinois disaster area. Unless

stipulated, there is no farmland assessment relief

associated with a disaster area proclamation. Any crop

damage caused by flooding from such a disaster,

should be compensated for through the county’s flood

adjustment procedure.

Use of ortho-photo base maps. Use of an ortho-photo

base map is neither mandated by statute nor required

by the Department. The Department recognizes certain

advantages associated with ortho-photography, but

is also aware of hardships the additional expense

of ortho-photography may impose on some local

governments. The benefits of ortho-photography

increase when the photo base map is used in a

computer-assisted mapping system or geographic

information system and increases further as the

steepness and diversity of the terrain increases. Before

deciding on a base map, a county should be sure that

it is accurate enough to allow for proper matching of

parcel boundaries and soil types. The law requires that

cropland, permanent pasture, and other farmland be

assessed according to its adjusted PI. This can only be

accomplished when soil types are adequately identified

and measured by land use.

Effect of a designated Ag area on farmland

assessments. The Agricultural Areas Conservation and

Protection Act, 505 ILCS 5/1 et seq., provides for the

establishment of agricultural conservation and protection

areas (commonly called “Ag Areas”). The establishment

of an Ag area provides the following benefits:

Landowners are protected from local laws or

ordinances that would restrict normal farming

practices, including nuisance ordinances.

Protection from special benefit assessments for

sewer, water, lights or nonfarm drainage (unless

landowners are benefited) is provided.

Land is protected from locally-initiated projects

that would lead to the conversion of that land to

other uses.

State agencies may consider the existence of Ag

Areas when selecting a site for a project; however,

the Act does not prohibit these agencies from

acquiring land in Ag Areas for development

purposes.

When determining farmland eligibility, no special

consideration is given to a tract due to its being located

within a designated Ag Area.

Comparing actual yields to formula yields when

determining flood adjustments. Sometimes the

yields of flood-affected farms and upland farms of

similar PIs are similar; but, once adjusted for flood,

the flood-affected farms carry a lower assessment. In

order to keep the PIs and assessments of flood-affected

soils and similar-producing upland soils consistent, a

proposal was presented for comparing actual yields

to formula yields and not assigning a flood adjustment

when the yield of a particular soil meets or exceeds the

average yield for the soil’s PI. The Department advises

against comparing actual yields to formula yields as a

way of determining if a flood adjustment is warranted.

The Farmland Assessment Law presupposes average

yield potential under an average level of management. It

would be inappropriate to penalize farmers who achieve

higher-than-average yields through the employment of

higher and costlier management practices. Refer to the

instructions for flood adjustment.

PUB-122 (R-01/24)

Page 9 of 54

Assessment of Farmland

The Farmland Assessment Law establishes capitalized net

income as the basis for the EAV of farmland. Each year, the

net income is determined for each PI of cropland. The net

income is then capitalized by the five-year Federal Land

Bank rate to determine an agricultural economic value (AEV)

for each PI. The AEV for each PI is then multiplied by 33

1/3

percent (.3333), the product of which is the EAV. A listing of

the 2024 EAVs of cropland by PI is given in Table 1. By law,

the EAV of permanent pasture should be at one-third and the

EAV of other farmland should be at one-sixth of these values.

To assess cropland, permanent pasture, or other farmland,

determine the PI of each soil type. Because wasteland is

assessed based on its contributory value as described in

the guidelines, it is not necessary to determine the PI of

wasteland in a farm parcel.

The degree of difficulty and accuracy in assessing farmland is

determined by the type of soil maps available. The easiest and

most accurate soil map to use is the detailed soil map prepared

by the USDA Natural Resources Conservation Service (NRCS)

for modern detailed soil surveys. A modern detailed soil map is

an aerial base map showing the delineation of each soil type

based on numerous soil samples and other field and laboratory

analyses. Currently, all 102 counties have been mapped.

Individual soil weighting method

Using a detailed soil survey

Procedural steps and example assessments for implementing

the individual soil weighting method using a detailed soil

survey are given in Steps 1 through 10.

Step 1 — Obtain adequate aerial base tax maps. This step

can be accomplished by acquiring or developing a set of aerial

base tax maps as outlined in the Tax Maps and Property Index

Number section of the Illinois Tax Mapping Manual.

Step 2 — Obtain detailed soil maps showing the distribution

of each soil type. Detailed maps are prepared by the NRCS,

in cooperation with the University of Illinois. These maps

provide an inventory of the soil types found in a specific area.

The various soil types are delineated on the soil map and are

numerically coded for identification.

Reproduce detailed soil maps as overlays and at the same

scale as the aerial base tax maps. This will allow the assessor

to easily identify soil types by land-use category. Make any

necessary corrections for map distortion.

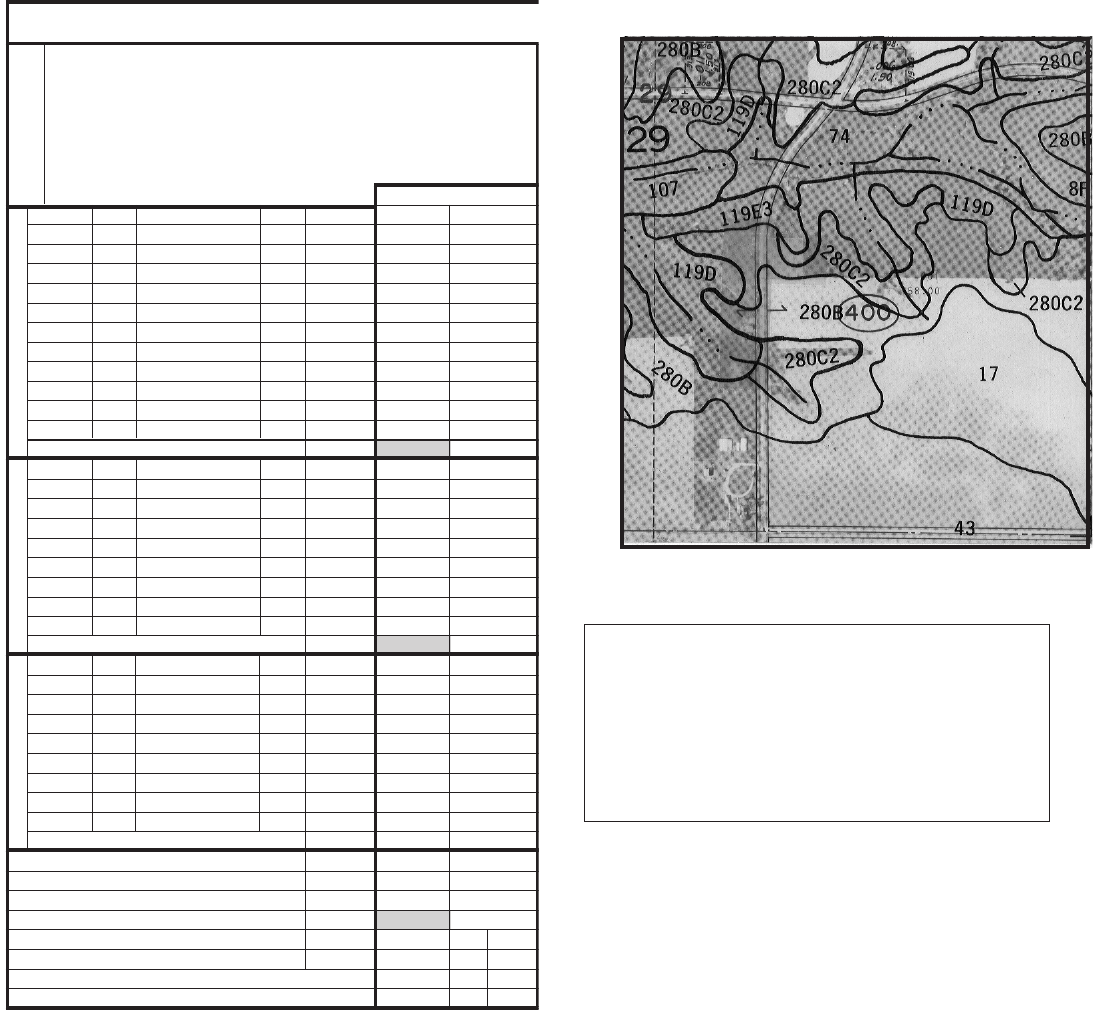

The aerial base tax map is shown as Figure 1. The parcel

used in this example is 01-29-400-001-0011. This parcel

consists of 158 acres, all the land in the SE ¼ of section 29

south of the center line of the road. An overlay of the detailed

soil survey map is shown on the aerial photograph.

Step 3 — Determine, from aerial photograph interpretation

and on-site inspection of the parcel, the portions of the tract to

be classified as cropland, permanent pasture, other farmland,

wasteland, road, and homesite. Cropland, permanent pasture,

and other farmland will each have an assessment based upon

soil productivity. Refer to the land use guidelines to determine

into which category a specific land use falls. Also determine

which portions of the wasteland contribute to the productivity

of the farm. Delineate all land-use categories on the aerial

photograph.

It was determined that the uses listed under Figure 1 were

present. As outlined in the guidelines, the farm building site

and the grass waterway will be assessed as other farmland

and the creek will be assessed as wasteland. The creek

contributes to the productivity of the farm by facilitating the

drainage of the entire parcel. The homesite is assessed based

upon the market value just as any other residential land.

Steps 4, 5, and 6 are illustrated in the example after Step 6.

Step 4 — Determine the acreage of each soil type within

each land use category that will be assessed by productivity.

The measurement may be made using a planimeter, grid,

electronic calculator, or computerized mapping system (GIS,

autocad, map info, etc.) whereby the various maps (soil,

aerial, tax) may be digitized or scanned-in as layers. For

noncomputerized mapping systems, outline the areas to be

measured when the detailed soil survey map is laid over the

aerial tax map. For this example, the acreage of each soil

type was measured using an electronic area calculator and

is shown under the headings ‘‘Soil I.D.’’ and ‘‘# Acres’’ on the

property record card (PRC).

Step 5 — Determine soil PI ratings for each soil type

identified. Table 2 lists the average management PI for soil

types mapped in Illinois. To use the table, locate a soil’s

identification number in the left-hand column and find its

corresponding PI in the right-hand column.

The PIs of the soil on this parcel listed below are also shown

under the heading ‘‘PI’’ on the PRC.

Soil ID PI Soil ID PI

8 81 107 123

17 105 119 99

43 126 280 108

74 120

For information on assigning PIs to soil complexes, refer

to the section titled “Soil complex adjustments”.

PUB-122 (R-01/24)

Page 10 of 54

Step 6 — Adjust the PIs for slope and erosion. The indexes

given in Table 2 are for 0 to 2 percent slopes and uneroded

conditions. Therefore, adjust these PIs for the negative

influence of actual slope and erosion conditions.

Table 3 shows percentage adjustments for common slope and

erosion conditions for favorable and unfavorable subsoil. Soil

types with unfavorable subsoils are indicated in Table 2 under

subsoil rooting. To use Table 3, select the proper subsoil type

and correlate the percentage slope on the left-hand side of

the table with the degree of erosion at the top of the table. The

number taken from this table is a percentage that is multiplied

by the PI taken from Table 2. The result is the PI under

average level management adjusted for slope and erosion.

Slope is indicated on a detailed soil survey map by the letter

following the soil number. In this particular soil survey, the

slopes are identified as follows:

Letter code % slope used % slope used in

Table 3

no letter or A 0-2% slope 1%

B 2-4% slope 3%

C 4-7% slope 6%

D 7-12% slope 10%

E 12-18% slope 15%

F 18-35% slope 27%

Letter codes and percentage of slope vary between

detailed soil surveys and between soil types within surveys.

Consult the soil survey for the correct percentage of

slope for each soil type.

Because Table 3 cannot be used with slope ranges, use a

central point of the slope ranges unless a better determinant

of slope is available. For the slope ranges used in the

example, the central points are given above.

Erosion is indicated on a detailed soil survey map by a

number following the letter indicating slope. Erosion is

indicated below.

No number or 1 uneroded

2 moderate erosion

3 severe erosion

Given the information above, the designation of a soil

as 280C2 indicates soil #280 with 4-7 percent slope and

moderate erosion.

Using Table 3 to find the percentage adjustment to the PI of

a soil designated as ‘‘C’’ slope ‘‘2’’ erosion, read down the

‘‘slope’’ column to 6 percent and across to the ‘‘moderate

erosion’’ column to find the number 93, or 93 percent

adjustment. Applying this 93 percent adjustment to the PI of

soil #280 given in Table 2 results in a PI adjustment for slope

and erosion of 100 for the 280C2 soil (108 x 93% = 100).

The designation of a soil as 8F indicates soil #8 with 18-35

percent slope and uneroded.

Using Table 3 to find the percentage adjustment to the PI of

a soil designated as ‘‘F’’ slope and uneroded, read down the

‘‘slope’’ column to 27 percent and across to the ‘‘uneroded’’

column to find the number 71 or 71 percent adjustment.

Applying this adjustment to the PI of soil #8 given in Table 2

results in an adjusted PI of 58 for the 8F soil (81 x 71% = 58).

PUB-122 (R-01/24)

Page 11 of 54

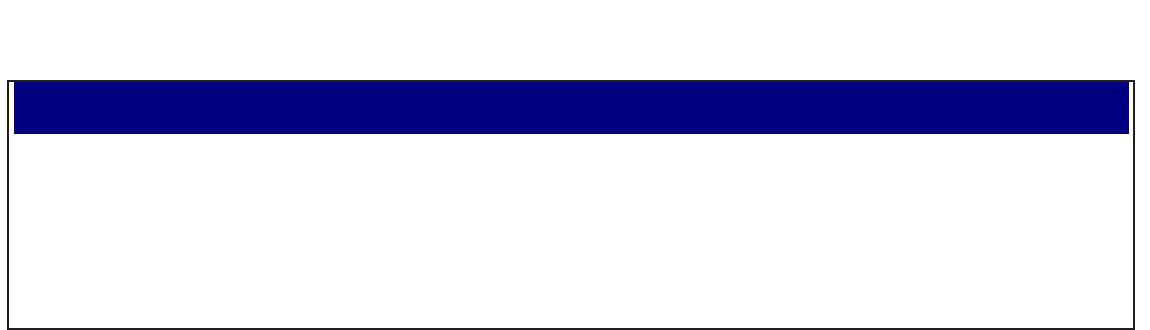

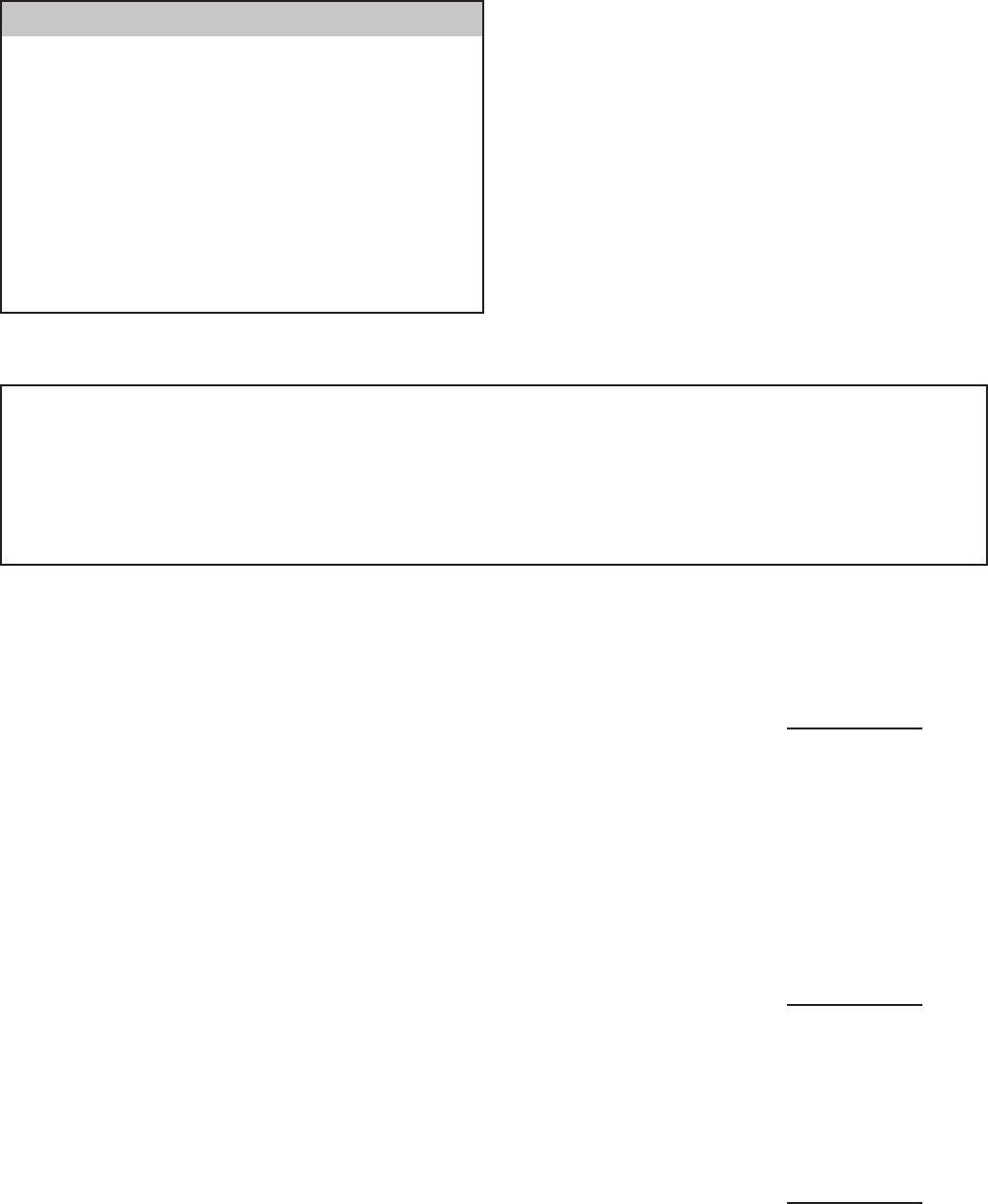

Steps 7 through 10 are illustrated on the PRC example

following Step 10.

Step 7 — Determine the EAV per acre of each soil type for

each land use category. To do this, locate the adjusted PI of

each soil type in Table 1. The EAV per acre for a soil type in

the cropland category is found directly from the table. For soil

types in the permanent pasture and other farmland categories,

determine the EAV per acre for each soil in the same manner

as for cropland; then, multiply this value times one-third for

permanent pasture and one-sixth for other farmland.

For example, soil #17 in the cropland category has an

adjusted PI of 105. By locating the PI of 105 in Table 1, the

EAV per acre is found to be $467.19. To determine the EAV

per acre for a soil included in the permanent pasture and

other farmland categories, multiply the value as cropland

by one-third (.3333) and one-sixth (.1667) respectively. Soil

119D in the permanent pasture category has an adjusted PI

of 93 which has a cropland value from Table 1 of $368.99.

After multiplying this value by 33

1/3 percent (.3333), the

EAV for this soil in the permanent pasture category is equal

to $122.98. The EAV per acre of a soil included in the other

farmland category is determined by multiplying its value as

cropland from Table 1 by one-sixth (.1667).

The six acres of creek are considered to contribute to the

productivity of the farm and are assessed as contributory

wasteland at one-sixth of the value of the lowest PI of

cropland certified by the Department. For 2023, the lowest PI

of cropland certified by the Department was 82. The EAV per

acre for cropland of PI 82 is $327.50. The EAV per acre of the

wasteland that is a creek is

$327.50 x

.1667

= $54.59 per acre.

An EAV per acre of zero is assigned to both the two acres of

non-contributory wasteland and the two acres of public road.

All EAVs by soil type are shown under the heading ‘‘Cert. Val.’’

the PRC.

Step 8 — Calculate the assessed value for each soil type

in each land-use category by multiplying the EAV per acre

(from Step 7) by the number of acres for each corresponding

soil type. For example, the assessed value for soil #43 in the

cropland category is 35 (acres) x $846.64/acre = $29,632.00.

These calculations are shown under the heading ‘‘Asmt.’’ on

the PRC.

Step 9 — Subtotal the number of acres and assessed values

of the soil types within each land-use category to obtain

the total number of acres and total EAVs for the cropland,

permanent pasture, and other farmland categories. In

the example, the total EAV for the 83 acres of cropland is

$51,946.00. These calculations are shown on the ‘‘Subtotal’’

line under their respective headings on PRC.

Step 10 — Determine the total EAV for farmland by adding

the previously determined subtotals for cropland, permanent

pasture, and other farmland to the assessed value of

wasteland.

The PI adjustments and the adjusted PIs of all soils in the

parcel are shown under the headings ‘‘Adj. Factor(s)’’ and

‘‘Adj. P.I.’’ on the PRC.

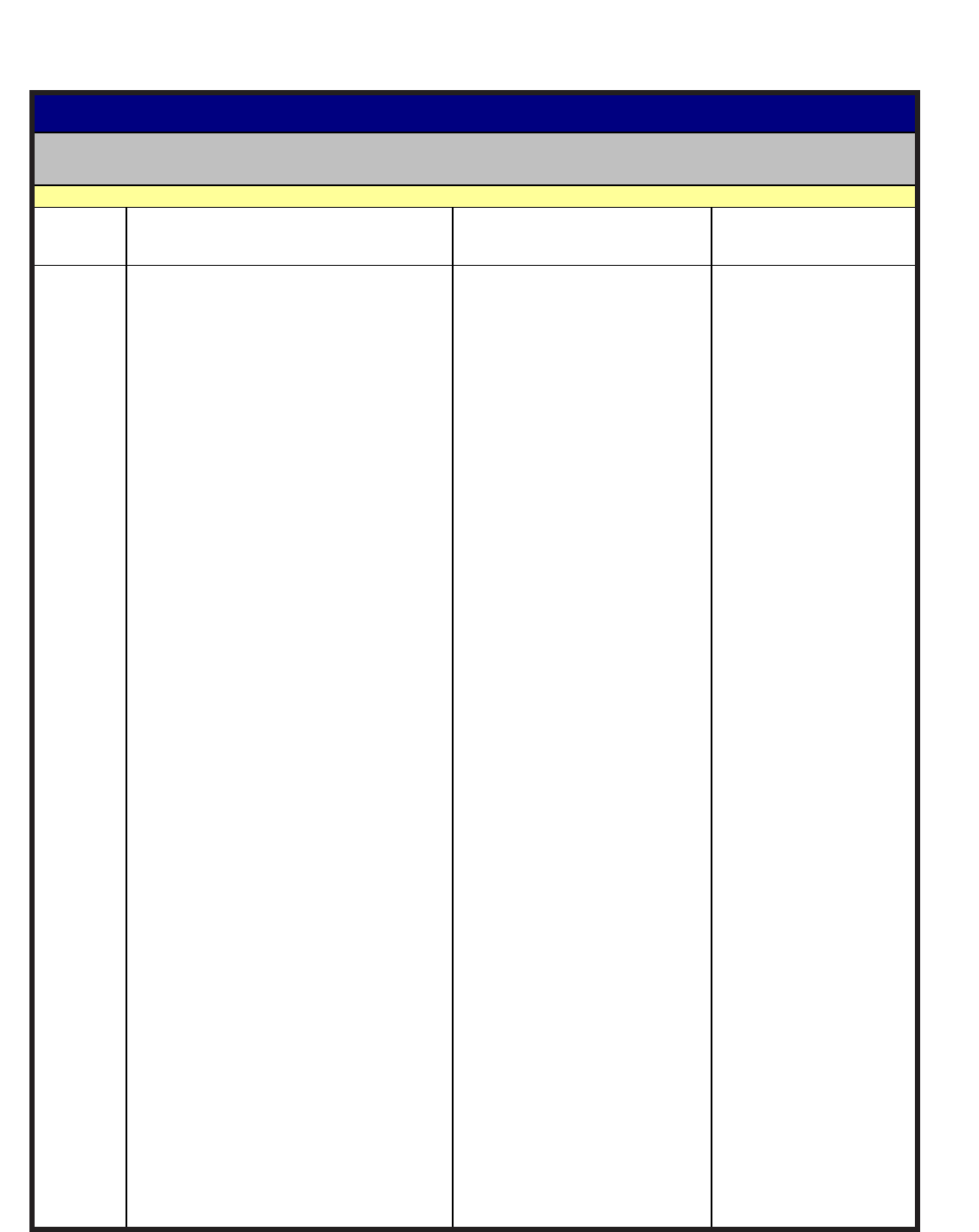

Example — Steps 4, 5, and 6

Property Record — Farm — Individual Soil Weighting Method

Zoning Card No. Township Vol. Tax Code Area Sect. Block Parcel Unit

—— of ——

Division Record of Ownership Date Deed Stamp Sale Pri ce

Year _______ Year _______ Year _______ Year _______ Year _______ Year _______

Soil ID PI Adj. Factor(s)

Adj . PI

No. Acres Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt.

Subtotal:

Subtotal:

Subtotal:

Contributory Wasteland 1/6 Lowest EAV

Non-Contributory Wasteland 000000000000

Dedicated Roads 000000000000

Total All Farmland

No. Acres Value Level Asmt. Value Level Asmt. Value Level Asmt. Value Level Asmt. Value Level Asmt. Value Level Asmt.

Homesite

Residential Bldgs.

Farm Bldgs.

33

1

/

3

33

1

/

3

33

1

/

3

33

1

/

3

33

1

/

3

33

1

/

3

PRC-1F (R-6/99) IL-492-1154

Cropland (Full EAV)Permanent Pasture (1/3 EAV)Other Farmland (1/6 EAV)

Ownership/Mailing Address

& Abbr. Legal

17 105 105 28

43 126 126 35

119D 99 0.94 (S) 93 1

280B 108 0.99(S) 107 14

280C2 108 0.93(S & E) 100 5

83

8F 81 0.71(S) 58 4

43 126 126 1

74 120 120 12

107 123 123 4

119D 99 0.94 (S) 93 17

119E3 99 0.75 (S & E) 74 4

280B 108 0.99 (S) 107 6

280C2 108 0.93 (S & E) 100 8

56

43 126 126 4

280C2 108 0.93 (S & E) 100 3

7

6

2

2

156

2024

PUB-122 (R-01/24)

Page 12 of 54

Use Acres Use Acres

Cropland 83 Grass Waterway 3

Permanent Pasture 56 Wasteland 2

Farm Building Site 4 Creek 6

Road 2

Figure 1

Property Record — Farm — Individual Soil Weighting Method

Zoning Card No. Township Vol. Tax Code Area Sect. Block Parcel Unit

—— of ——

Division Record of Ownership Date Deed Stamp Sale Pri ce

Year _______ Year _______ Year _______ Year _______ Year _______ Year _______

Soil ID PI Adj. Factor(s)

Adj . PI

No. Acres Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt. Cert. Value Asmt.

Subtotal:

Subtotal:

Subtotal:

Contributory Wasteland 1/6 Lowest EAV

Non-Contributory Wasteland 000000000000

Dedicated Roads 000000000000

Total All Farmland

No. Acres Value Level Asmt. Value Level Asmt. Value Level Asmt. Value Level Asmt. Value Level Asmt. Value Level Asmt.

Homesite

Residential Bldgs.

Farm Bldgs.

33

1

/

3

33

1

/

3

33

1

/

3

33

1

/

3

33

1

/

3

33

1

/

3

PRC-1F (R-6/99) IL-492-1154

Cropland (Full EAV)Permanent Pasture (1/3 EAV)Other Farmland (1/6 EAV)

Ownership/Mailing Address

& Abbr. Legal

467.19 13,081

846.64 29,632

368.99 369

483.90 6,775

417.79 2,089

51,946

109.16 437

282.19 282

220.81 2,650

242.87 971

122.98 2,091

109.16 437

161.28 968

139.25 1,114

8,950

141.14 565

69.65 209

774

328

54.59

61,998

2024

17 105 105 28

43 126 126 35

119D 99 0.94 (S) 93 1

280B 108 0.99(S) 107 14

280C2 108 0.93(S & E) 100 5

83

8F 81 0.71(S) 58 4

43 126 126 1

74 120 120 12

107 123 123 4

119D 99 0.94 (S) 93 17

119E3 99 0.75 (S & E) 74 4

280B 108 0.99 (S) 107 6

280C2 108 0.93 (S & E) 100 8

56

43 126 126 4

280C2 108 0.93 (S & E) 100 3

7

6

2

2

156

PUB-122 (R-01/24)

Page 13 of 54

Soil complex adjustments

Occasionally, two or more soils occur together in a pattern that

is too intricate for the individual soils to be delineated on the

soil map at the scale being used. These groups of soils are

called soil complexes. When this situation occurs, the PI of the

complex is calculated by weighting or averaging the individual

indexes of the soils in the complex. When the percentage of

each type of soil in the complex is known, a weighted PI is

calculated. The method for weighting is outlined below using

the Cisne-Huey complex for a county in which percentages

of each soil is known. If the percentages of each soil type

cannot be obtained, the PIs for the individual soil types may

be averaged to get a PI for the complex.

Cisne-Huey PI x percent = Contribution

Cisne (2) 97 x 60% = 58.2

Huey (120) 79 x 40% = 31.6

Total 100% = 89.8 = 90 = PI

PUB-122 (R-01/24)

Page 14 of 54

Table 1

4

Average Gross Non-Land Net Land Agricultural Equalized * 2024 Certifed

Management PI Income Production Costs Return Economic Value Assessed Value Value

82 $560.15 $441.19 $118.96 $2,314.41 $771.47 $327.50

83 $565.20 $443.24 $121.97 $2,372.89 $790.96 $329.11

84 $570.26 $445.28 $124.97 $2,431.37 $810.46 $330.72

85 $575.31 $447.33 $127.98 $2,489.84 $829.95 $332.39

86 $580.36 $449.37 $130.98 $2,548.32 $849.44 $334.07

87 $585.41 $451.42 $133.99 $2,606.80 $868.93 $335.68

88 $590.46 $453.46 $137.00 $2,665.28 $888.43 $337.18

89 $595.51 $455.51 $140.00 $2,723.76 $907.92 $343.38

90 $600.56 $457.55 $143.01 $2,782.23 $927.41 $349.78

91 $605.61 $459.60 $146.01 $2,840.71 $946.90 $356.19

92 $610.66 $461.64 $149.02 $2,899.19 $966.40 $362.59

93 $615.71 $463.69 $152.02 $2,957.67 $985.89 $368.99

94 $620.76 $465.73 $155.03 $3,016.14 $1,005.38 $375.41

95 $625.82 $467.78 $158.04 $3,074.62 $1,024.87 $381.81

96 $630.87 $469.83 $161.04 $3,133.10 $1,044.37 $388.21

97 $635.92 $471.87 $164.05 $3,191.58 $1,063.86 $394.61

98 $640.97 $473.92 $167.05 $3,250.05 $1,083.35 $401.00

99 $646.02 $475.96 $170.06 $3,308.53 $1,102.84 $408.11

100 $651.07 $478.01 $173.06 $3,367.01 $1,122.34 $417.79

101 $656.12 $480.05 $176.07 $3,425.49 $1,141.83 $428.03

102 $661.17 $482.10 $179.08 $3,483.96 $1,161.32 $438.56

103 $666.22 $484.14 $182.08 $3,542.44 $1,180.81 $449.19

104 $671.27 $486.19 $185.09 $3,600.92 $1,200.31 $458.91

105 $676.32 $488.23 $188.09 $3,659.40 $1,219.80 $467.19

106 $681.38 $490.28 $191.10 $3,717.88 $1,239.29 $475.58

107 $686.43 $492.32 $194.10 $3,776.35 $1,258.78 $483.90

108 $691.48 $494.37 $197.11 $3,834.83 $1,278.28 $491.39

109 $696.53 $496.41 $200.12 $3,893.31 $1,297.77 $498.74

110 $701.58 $498.46 $203.12 $3,951.79 $1,317.26 $506.17

111 $706.63 $500.50 $206.13 $4,010.26 $1,336.75 $515.56

112 $711.68 $502.55 $209.13 $4,068.74 $1,356.25 $526.04

113 $716.73 $504.59 $212.14 $4,127.22 $1,375.74 $536.70

114 $721.78 $506.64 $215.14 $4,185.70 $1,395.23 $547.55

115 $726.83 $508.68 $218.15 $4,244.17 $1,414.72 $558.55

116 $731.88 $510.73 $221.16 $4,302.65 $1,434.22 $569.77

117 $736.94 $512.77 $224.16 $4,361.13 $1,453.71 $581.14

118 $741.99 $514.82 $227.17 $4,419.61 $1,473.20 $592.65

119 $747.04 $516.86 $230.17 $4,478.09 $1,492.70 $604.38

120 $752.09 $518.91 $233.18 $4,536.56 $1,512.19 $622.49

121 $757.14 $520.95 $236.19 $4,595.04 $1,531.68 $669.24

122 $762.19 $523.00 $239.19 $4,653.56 $1,551.17 $713.52

123 $767.24 $525.04 $242.20 $4,712.00 $1,570.67 $728.69

124 $772.29 $527.09 $245.20 $4,770.47 $1,590.16 $750.53

125 $777.34 $529.14 $248.21 $4,828.95 $1,609.65 $797.93

126 $782.39 $531.18 $251.21 $4,887.43 $1,629.14 $846.64

127 $787.45 $533.23 $254.22 $4,945.91 $1,648.64 $896.67

128 $792.50 $535.27 $257.23 $5,004.38 $1,668.13 $917.74

129 $797.55 $537.32 $260.23 $5,062.86 $1,687.62 $937.85

130 $802.60 $539.36 $263.24 $5,121.34 $1,707.11 $958.18

10% Increase of 2023 certified value at PI 111 is $46.87

* These values reflect the Statutory changes to 35 ILCS 200/10-115e under Public Act 98-0109.

*Farmland values are as certified by the Farmland Assessment Technical Advisory Board. Any differences in calculations

are due to rounding at different stages of calculations.

Certified Values for Assessment Year 2024 ($ per acre)

The 5-year capitalization rate is 5.14 percent.

PUB-122 (R-01/24)

Page 15 of 54

Table 2 Information and Acknowledgement

This table replaces Table 2 in Bulletin 810. Duplicate IL Map Symbols are in bold typeface. Use the appropriate soil type name

to determine the proper productivity index.

Acknowledgement: Soil productivity indices and other required data for each Illinois soil were transferred to this website. From

1996 to present, the Illinois crop yields estimates and productivity indices by soil type were created by a University of Illinois

Urbana-Champaign, College of Agricultural, Consumer and Environmental Sciences task force of soil scientists, agronomists,

crop scientists and agricultural economists in the Department of NRES.

PUB-122 (R-01/24)

Page 16 of 54

Instructions for Farmland Assessments

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

2 Cisne silt loam Favorable 97

3 Hoyleton silt loam Favorable 96

4 Richview silt loam Favorable 98

5 Blair silt loam Unfavorable 92

6 Fishhook silt loam Unfavorable 86

7 Atlas silt loam Unfavorable 79

8 Hickory loam Favorable 81

9 Sandstone rock land Crop yield data not available

10 Plumfield silty clay loam Unfavorable 72

12 Wynoose silt loam Favorable 86

13 Bluford silt loam Favorable 90

14 Ava silt loam Unfavorable 89

15 Parke silt loam Favorable 97

16 Rushville silt loam Favorable 97

17 Keomah silt loam Favorable 105

18 Clinton silt loam Favorable 107

19 Sylvan silt loam Favorable 98

21 Pecatonica silt loam Favorable 100

22 Westville silt loam Favorable 100

23 Blount silt loam Favorable 93

24 Dodge silt loam Favorable 108

25 Hennepin loam Unfavorable 80

26 Wagner silt loam Favorable 96

27 Miami silt loam Favorable 99

28 Jules silt loam Favorable 108

29 Dubuque silt loam Unfavorable 85

30 Hamburg silt loam Favorable 95

31 Pierron silt loam Favorable 90

34 Tallula silt loam Favorable 116

35 Bold silt loam Favorable 97

36 Tama silt loam Favorable 123

37 Worthen silt loam Favorable 126

38 Rocher loam Favorable 96

40 Dodgeville silt loam

Favorable 92

41 Muscatine silt loam Favorable 130

42 Papineau fine sandy loam Favorable 91

43 Ipava silt loam Favorable 126

44

Pella silty clay loam, bedrock substratu

Favorable 100

45 Denny silt loam Favorable 105

46 Herrick silt loam Favorable 118

47 Virden silt loam Favorable 122

48 Ebbert silt loam Favorable 111

49 Watseka loamy fine sand Favorable 82

Revised January 1, 2012

IL map

symbol

Soil type name Subsoil rooting

PUB-122 (R-01/24)

Page 17 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

50 Virden silty clay loam Favorable 119

51 Muscatune silt loam Favorable 130

53 Bloomfield fine sand Favorable 75

54 Plainfield sand Favorable 67

55 Sidell silt loam Favorable 117

56 Dana silt loam Favorable 116

57 Montmorenci silt loam Favorable 103

59 Lisbon silt loam Favorable 121

60 La Rose silt loam Favorable 104

61 Atterberry silt loam Favorable 117

62 Herbert silt loam Favorable 116

63 Blown-out land Crop yield data not available

64 Parr fine sandy loam Favorable 95

67 Harpster silty clay loam Favorable 117

68 Sable silty clay loam Favorable 126

69 Milford silty clay loam Favorable 113

70 Beaucoup silty clay loam Favorable 116

71 Darwin silty clay Favorable 98

72 Sharon silt loam Favorable 108

73 Ross loam Favorable 119

74 Radford silt loam Favorable 120

75 Drury silt loam Favorable 112

76 Otter silt loam Favorable 123

77 Huntsville silt loam Favorable 127

78 Arenzville silt loam Favorable 115

79 Menfro silt loam Favorable 106

81 Littleton silt loam Favorable 126

82 Millington loam Favorable 111

83 Wabash silty clay Favorable 103

84 Okaw silt loam Favorable 85

85 Jacob clay Favorable 73

86 Osco silt loam Favorable 125

87 Dickinson sandy loam Favorable 92

88 Sparta loamy sand Favorable 81

89 Maumee fine sandy loam Favorable 83

90 Bethalto silt loam Favorable 118

91 Swygert silty clay loam Unfavorable 104

92 Sarpy sand Favorable 74

93 Rodman gravelly loam Unfavorable 74

94 Limestone rock land Crop yield data not available

95 Shale rock land Crop yield data not available

96 Eden silty clay loam Unfavorable 72

97 Houghton peat Favorable 107

98 Ade loamy fine sand Favorable 91

99

Sandstone and limestone rock land

Crop yield data not available

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil rooting

PUB-122 (R-01/24)

Page 18 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

100 Palms muck Favorable 104

101 Brenton silt loam, bedrock substratum Favorable 111

102 La Hogue loam Favorable 107

103 Houghton muck Favorable 115

104 Virgil silt loam Favorable 117

105 Batavia silt loam Favorable 114

106 Hitt sandy loam Favorable 100

107 Sawmill silty clay loam Favorable 123

108 Bonnie silt loam Favorable 98

109 Racoon silt loam Favorable 94

111 Rubio silt loam Favorable 101

112 Cowden silt loam Favorable 103

113 Oconee silt loam Favorable 105

114 O'Fallon silt loam Unfavorable 89

115 Dockery silt loam Favorable 114

116 Whitson silt loam Favorable 103

119 Elco silt loam Favorable 99

120 Huey silt loam Unfavorable 79

122 Colp silt loam Unfavorable 87

123 Riverwash Crop yield data not available

124 Beaucoup gravelly clay loam Favorable 116

125 Selma loam Favorable 114

126 Bonpas silt loam, overwash Favorable 117

127 Harrison silt loam Favorable 115

128 Douglas silt loam Favorable 112

131 Alvin fine sandy loam Favorable 98

132 Starks silt loam Favorable 106

134 Camden silt loam Favorable 106

136 Brooklyn silt loam Favorable 99

137 Clare silt loam, bedrock substratum Favorable 113

138 Shiloh silty clay loam Favorable 115

138+ Shiloh silt loam, overwash Favorable 111

141 Wesley fine sandy loam Favorable 100

142 Patton silty clay loam Favorable 117

145 Saybrook silt loam Favorable 117

146 Elliott silt loam Favorable 111

147 Clarence silty clay loam Unfavorable 95

148 Proctor silt loam Favorable 120

149 Brenton silt loam Favorable 125

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil rooting

PUB-122 (R-01/24)

Page 19 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

150 Onarga sandy loam Favorable 97

151 Ridgeville fine sandy loam Favorable 101

152 Drummer silty clay loam Favorable 127

153 Pella silty clay loam Favorable 120

154 Flanagan silt loam Favorable 127

155 Stockland loam Unfavorable 82

157 Symerton loam Favorable 114

159 Pillot silt loam Favorable 106

162 Gorham silty clay loam Favorable 115

164 Stoy silt loam Favorable 96

165 Weir silt loam Favorable 94

166 Cohoctah loam Favorable 118

167 Lukin silt loam Favorable 96

171 Catlin silt loam Favorable 122

172 Hoopeston sandy loam Favorable 97

173 McGary silt loam Unfavorable 89

174 Chaseburg silt loam Favorable 107

175 Lamont fine sandy loam Favorable 86

176 Marissa silt loam Favorable 109

178 Ruark fine sandy loam Favorable 88

179 Minneiska loam Favorable 92

180 Dupo silt loam Favorable 116

182 Peotone mucky silty clay loam, marl substratum Favorable 106

183 Shaffton loam Favorable 102

184 Roby fine sandy loam Favorable 98

188 Beardstown loam Favorable 100

189 Martinton silt loam Favorable 115

191 Knight silt loam Favorable 107

192 Del Rey silt loam Favorable 100

193 Mayville silt loam Favorable 98

194 Morley silt loam Favorable 92

197 Troxel silt loam Favorable 124

198 Elburn silt loam Favorable 127

199 Plano silt loam Favorable 126

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil rooting

PUB-122 (R-01/24)

Page 20 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

200 Orio sandy loam Favorable 97

201 Gilford fine sandy loam Favorable 98

204 Ayr sandy loam Favorable 96

205 Metea silt loam Favorable 86

206 Thorp silt loam Favorable 112

208 Sexton silt loam Favorable 102

210 Lena muck Favorable 111

212 Thebes silt loam Favorable 98

213 Normal silt loam Favorable 118

214 Hosmer silt loam Unfavorable 93

216 Stookey silt loam Favorable 102

217 Twomile silt loam Favorable 93

218 Newberry silt loam Favorable 101

219 Millbrook silt loam Favorable 114

221 Parr silt loam Favorable 105

223 Varna silt loam Favorable 103

224 Strawn silt loam Favorable 93

225 Holton silt loam Favorable 89

226 Wirt silt loam Favorable 94

227 Argyle silt loam Favorable 108

228 Nappanee silt loam Unfavorable 78

229 Monee silt loam Favorable 88

230 Rowe silty clay Favorable 98

231 Evansville silt loam Favorable 114

232 Ashkum silty clay loam Favorable 112

233 Birkbeck silt loam Favorable 108

234 Sunbury silt loam Favorable 116

235 Bryce silty clay Favorable 107

236 Sabina silt loam Favorable 108

238 Rantoul silty clay Favorable 96

239 Dorchester silt loam Favorable 113

240 Plattville silt loam Favorable 106

241 Chatsworth silt loam Unfavorable 69

242 Kendall silt loam Favorable 110

243 St. Charles silt loam Favorable 108

244 Hartsburg silty clay loam Favorable 119

248 McFain silty clay Favorable 105

249 Edinburg silty clay loam Favorable 112

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil

rooting

PUB-122 (R-01/24)

Page 21 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

250 Velma loam Favorable 100

252 Harvel silty clay loam Favorable 111

256 Pana silt loam Favorable 102

257 Clarksdale silt loam Favorable 114

258 Sicily silt loam Favorable 110

259 Assumption silt loam Favorable 106

261 Niota silt loam Favorable 87

262 Denrock silt loam Favorable 102

264 El Dara silt loam Favorable 89

265 Lomax loam Favorable 102

266 Disco sandy loam Favorable 96

267 Caseyville silt loam Favorable 112

268 Mt. Carroll silt loam Favorable 119

270 Stronghurst silt loam, sandy substratum Favorable 111

271 Timula silt loam Favorable 100

272 Edgington silt loam Favorable 109

274 Seaton silt loam Favorable 106

275 Joy silt loam Favorable 127

277 Port Byron silt loam Favorable 127

278 Stronghurst silt loam Favorable 111

279 Rozetta silt loam Favorable 106

280 Fayette silt loam Favorable 108

282 Chute fine sand Favorable 66

283 Downsouth silt loam Favorable 120

284 Tice silty clay loam Favorable 118

285 Carmi loam Favorable 95

286 Carmi sandy loam Favorable 94

287 Chauncey silt loam Favorable 105

288 Petrolia silty clay loam Favorable 103

290 Warsaw silt loam Favorable 105

291 Xenia silt loam Favorable 104

292 Wallkill silt loam Favorable 109

293 Andres silt loam Favorable 120

294 Symerton silt loam Favorable 116

295 Mokena silt loam Favorable 111

296 Washtenaw silt loam Favorable 116

297 Ringwood silt loam Favorable 115

298 Beecher silt loam Favorable 101

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil

rooting

PUB-122 (R-01/24)

Page 22 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

300 Westland clay loam Favorable 107

301 Grantsburg silt loam Unfavorable 90

302 Ambraw clay loam Favorable 101

304 Landes fine sandy loam Favorable 89

306 Allison silty clay loam Favorable 120

307 Iona silt loam Favorable 105

308 Alford silt loam Favorable 107

310 McHenry silt loam Favorable 101

311 Ritchey silt loam Unfavorable 74

312 Edwards muck Favorable 97

313 Rodman loam Unfavorable 74

314 Joliet silty clay loam Favorable 87

315 Channahon silt loam Unfavorable 71

316 Romeo silt loam Unfavorable 43

317 Millsdale silty clay loam Favorable 97

318 Lorenzo loam Unfavorable 93

319 Aurelius muck Favorable 85

320 Frankfort silt loam Unfavorable 90

321 Du Page silt loam Favorable 111

322 Russell silt loam Favorable 103

323 Casco silt loam Unfavorable 91

324 Ripon silt loam Favorable 98

325 Dresden silt loam Favorable 102

326 Homer silt loam Favorable 101

327 Fox silt loam Favorable 96

328 Holly silt loam Favorable 96

329 Will silty clay loam Favorable 115

330 Peotone silty clay loam Favorable 108

331 Haymond silt loam Favorable 117

332 Billett sandy loam Favorable 88

333 Wakeland silt loam Favorable 114

334 Birds silt loam Favorable 103

335 Robbs silt loam Favorable 92

336 Wilbur silt loam Favorable 113

337 Creal silt loam Favorable 98

338 Hurst silt loam Unfavorable 88

339 Wellston silt loam Unfavorable 80

340 Zanesville silt loam Unfavorable 84

341

Ambraw silty clay loam, sandy substratum

Favorable 101

342 Matherton silt loam Favorable 101

343 Kane silt loam Favorable 110

344 Harvard silt loam Favorable 111

345 Elvers silt loam Favorable 104

346 Dowagiac silt loam Favorable 99

347 Canisteo silt loam Favorable 111

348 Wingate silt loam Favorable 107

349 Zumbro sandy loam Favorable 87

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil rooting

PUB-122 (R-01/24)

Page 23 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity Index (PI)

Average management

350 Drummer silty clay loam, gravelly substratum Favorable 122

351 Elburn silt loam, gravelly substratum Favorable 120

352 Palms silty clay loam, overwash Favorable 112

353 Toronto silt loam Favorable 114

354 Hononegah loamy coarse sand Favorable 74

355 Binghampton sandy loam Favorable 93

356 Elpaso silty clay loam Favorable 127

357 Vanpetten loam Favorable 94

359 Fayette silt loam, till substratum Favorable 105

360 Slacwater silt loam Favorable 100

361 Kidder silt loam Favorable 91

362 Whitaker variant loam Favorable 105

363 Griswold loam Favorable 103

365 Aptakisic silt loam Favorable 102

366 Algansee fine sandy loam Favorable 83

367 Beach sand Crop yield data not available

368 Raveenwash silty clay loam Favorable 95

369 Waupecan silt loam Favorable 123

370 Saylesville silt loam Favorable 94

371 St. Charles silt loam, sandy substratum Favorable 100

372 Kendall silt loam, sandy substratum Favorable 104

373 Camden silt loam, sandy substratum Favorable 96

374 Proctor silt loam, sandy substratum Favorable 108

375 Rutland silt loam Favorable 118

376 Cisne silt loam, bench Favorable 97

377 Hoyleton silt loam, bench Favorable 96

378 Lanier fine sandy loam Favorable 72

379 Dakota silt loam Favorable 99

380 Fieldon silt loam Favorable 101

381 Craigmile sandy loam Favorable 102

382 Belknap silt loam Favorable 104

383 Newvienna silt loam Favorable 119

384 Edwardsville silt loam Favorable 124

385 Mascoutah silty clay loam Favorable 125

386 Downs silt loam Favorable 119

387 Ockley silt loam Favorable 102

388 Wenona silt loam Favorable 114

389 Hesch loamy sand, shallow variant Unfavorable 50

390 Hesch fine sandy loam Unfavorable 89

391 Blake silty clay loam Favorable 103

392 Urban land, loamy Orthents complex Crop yield data not available

393 Marseilles silt loam, gravelly substratum Unfavorable 96

394 Haynie silt loam Favorable 105

395 Ceresco loam Favorable 104

396 Vesser silt loam Favorable 109

397 Boone loamy fine sand Unfavorable 61

398 Wea silt loam Favorable 115

Revised January 1, 2012

IL map

symbol

Soil type name

Subsoil rooting

PUB-122 (R-01/24)

Page 24 of 54

Table 2

Productivity of Illinois Soils Under Average Management

Slightly Eroded, 0 to 2 Percent Slopes

B 810 Productivity

Index (PI)

Average management

400 Calco silty clay loam Favorable 121

401 Okaw silty clay loam Favorable 78

402 Colo silty clay loam Favorable 122

403 Elizabeth silt loam Unfavorable 54

404 Titus silty clay loam Favorable 104

405 Zook silty clay Favorable 103

406 Paxico silt loam Favorable 106

407 Udifluvents, loamy Crop yield data not available

408 Aquents, loamy Crop yield data not available