Product Disclosure Statement

(PDS)

Household Insurance Policy

Preparation Date 12 April 2024

Welcome

What is this document?

This Product Disclosure Statement (PDS) is designed to assist you to understand what you need to know about

the product so you can make an informed choice before you purchase a policy. This PDS sets out the conditions

that apply to your policy including what we do and don’t cover, the exclusions that apply under your policy, and

what we pay when you make a claim. Unless we tell you otherwise, this PDS applies to any offers of renewal

we make to you, or to certain changes that you make to your policy which require us to send you a copy of this

PDS. This PDS, your Certificate of Insurance, and any Supplementary Product Disclosure Statement are very

important documents and you should read them carefully. If you don’t understand anything in them, you should

consider getting advice or call us so we may assist you. This PDS is up to date on the date it is prepared. If we

need to make changes to this PDS, we may issue a new PDS or a Supplementary Product Disclosure Statement.

For changes that are not materially adverse to you, we may notify you of the changes by making details of the

update available at aldiinsurance.com.au. You can also contact us to request a free copy of these changes by

calling us on 1300 407 021.

Who is this product for?

There are several types of cover which are disclosed within this PDS. To understand who this product has been

designed for, the different types of cover, and if the covers are likely to be consistent with your needs, objectives

and financial situation, you can review the Target Market Determination document which is available on our

website at aldiinsurance.com.au/documents or you can request a copy by calling us on 1300 407 021.

Who is the insurer?

The insurer of this product is RACQ Insurance Limited ABN 50 009 704 152, AFSL 233082 of 2649 Logan Road,

Eight Mile Plains, QLD 4113. RACQ Insurance Limited is responsible for managing all claims made under this

product.

Who is Honey Insurance?

Honey Insurance Pty Ltd ABN 52 643 672 628, AFSL 528244 (Honey Insurance) of PO Box 129, Surry Hills NSW,

2010 distributes and manages your insurance policy. RACQ may appoint Honey to manage all or some aspects

of your claim.

Who is ALDI Insurance?

ALDI Insurance Pty Ltd ABN 73 673 464 901 AR 1308867 (ALDI Insurance) promote and distribute the

insurance as authorised representative of Honey Insurance Pty Ltd.

We’re here to help

ALDI is smarter home insurance for the modern-day homeowner or renter. Our approach to home insurance

provides smart home technology to help you protect your home from common avoidable accidents that lead to

many claims. If you have any questions about our products or services or need help to make a claim, you can:

Call us on

1300 407 021

Visit us at

aldiinsurance.com.au

Snapshot of this PDS

This is a guide to the key sections of the Household Insurance policies we offer. Please read this PDS,

your Certificate of Insurance, any Supplementary Product Disclosure Statements for full details.

1. How your policy works p.12-14

Who is involved in this contract of insurance,

when the policy starts, and what happens if

you change your mind.

We also explain the important documents

that make up your policy.

The documents that make up your

policy are:

• Certificate of Insurance

• Product Disclosure Statement (PDS)

• Supplementary Product Disclosure

Statements

2. Smart Home Program p.15-17

Important information about the Smart

Home Program and the applicable premium

discount.

3. What your cover includes p.18-77

What we consider to be your home and your

contents and, what you are covered for.

The type of cover you have will depend on

your home and your contents and the level of

cover you have selected.

Specific exclusions apply to certain parts of

your cover. See the section that applies to

the type of cover you have selected for more

information.

The type of cover you have is shown on your

Certificate of Insurance.

This PDS is made up of 2 types of cover:

• Home Insurance

• Contents Insurance

4. What your cover does not include p.78-84

The general things we do not cover under

your policy. These are known as general

exclusions and they apply to all parts of your

cover, and all types of cover.

You should read these carefully to

understand what we will not cover as a part

of your policy.

These general exclusions apply in addition

to the specific exclusions found within the

‘What your cover includes’ section.

It is important that anyone that permanently

lives in your home is aware of these

exclusions as they apply to them also.

5. What you are responsible for p.85-91

The responsibilities you have, and conditions

that apply to your policy.

It is important for you to know about these

responsibilities and conditions.

If you don’t comply with any condition or

term of your policy, the law may allow us

to refuse or reduce a claim and/or cancel

your policy.

6. What you need to know about claiming p.92-105

What happens when you need to claim on

your policy, and the process that we will

follow with your claim.

This includes how to make a claim under your

policy, your responsibilities when making a

claim, how we will settle your claim, and what

excesses may apply to your claim.

7. Other information p.106-116

Other important information you should

know such as how we calculate your

premium, how your personal information

is handled, management of disputes or

complaints, and definitions for words that

have special meanings.

How to read this PDS

We have designed this PDS so it is easy for you to see what is covered, any limits that apply to your cover,

what is not covered, your responsibilities, and how making a claim works.

Coloured tabs to assist navigation

You can use the coloured tabs down the side of the page to help you navigate through the sections of this

PDS. These can be helpful when flicking between sections of the PDS.

To return to the contents page, click in the bottom left corner of the page.

Helpful tips and other information boxes

If there is information within the PDS that we feel needs to be brought to your attention, we utilise the below

highlighted boxes.

Words with special meanings used in this PDS

There are some words used in this PDS that have special meanings. To help you understand how we define

these words, see ‘Words with special meanings’ in the ‘Other information’ section on pages 112-116.

Helpful tips example

We use boxes like this one to highlight important and helpful information, or to help you

navigate around this PDS.

You and your

Refers to the policyholders shown on

the Certificate of Insurance and their

family who permanently live with

them at the insured address.

We, our or us

Refers to Honey Insurance and

RACQ as the product issuer.

Your Policy Your Cover Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Amounts shown

All policy limits and amounts shown in this PDS include any government statutory charges, levies, duties,

GST and other taxes that may apply.

Benefits that apply to your type of cover

Some benefits only apply to certain types of cover. We show this within each benefit. Below is an example

benefit and how we display which types of cover the benefit applies to.

Example included benefit

In the example above, the benefit is included for Building cover as well as Contents cover.

In the example below, the benefit is optional for Contents cover only and not available for Building cover.

Example optional benefit

The type of cover you have will be shown on your Certificate of Insurance.

Symbols with special meanings used in this PDS

There are symbols used in this PDS that have special meanings. To help you understand how we use symbols

within the ‘What your cover includes’ and ‘What your cover does not include’ sections we use the following:

This shows what you are covered for in the type of cover that you have chosen.

These are the limits that apply. Although we provide cover for you, there may be limitations to

how much cover you have or can claim on your policy.

This is what we don’t cover – known as exclusions.

You are not covered for these items, costs, circumstances or events.

You should read these exclusions carefully to ensure you understand what your policy doesn’t

cover you for.

This relates to additional important information about the cover you have chosen.

Included for:

Home Contents

Optional for:

Contents

1. How your policy works ...................................................................................................................... 12

Contract between you and us ................................................................................................................... 13

More than one policyholder

..................................................................................................................... 13

When your policy starts

............................................................................................................................ 13

Cooling off period

..................................................................................................................................... 13

Documents that make up your policy

...................................................................................................... 14

2. Smart Home Program ....................................................................................................................... 15

The Smart Home Program ......................................................................................................................... 16

Adding the Smart Home Program to your policy

...................................................................................... 16

Installing and activating the smart home sensor kit

................................................................................. 16

Premium discounts and repayments

......................................................................................................... 17

3. What your cover includes ............................................................................................................... 18

Types of cover you may choose ................................................................................................................ 19

Summary of cover under your policy

........................................................................................................ 19

What is your home

..................................................................................................................................... 21

Your home

.................................................................................................................................................. 21

Building types

..................................................................................................................................... 21

Other structures

.................................................................................................................................. 21

Building under construction

.............................................................................................................. 22

Outdoor items

..................................................................................................................................... 22

Indoor items

........................................................................................................................................ 23

Vehicles and accessories

................................................................................................................... 23

General limits on home items

............................................................................................................ 23

What is your contents

............................................................................................................................... 24

Your contents

............................................................................................................................................ 25

General contents

................................................................................................................................ 25

Jewellery, watches and other valuables

............................................................................................. 26

Sporting and recreational items

........................................................................................................ 26

Building, garden and tools

.................................................................................................................. 26

Mobility items

..................................................................................................................................... 27

For home unit owners

......................................................................................................................... 27

For tenants

.......................................................................................................................................... 27

Pets and livestock

............................................................................................................................... 27

Vehicles, caravan contents & spare parts

......................................................................................... 27

General limits on contents items

....................................................................................................... 28

Additional conditions

............................................................................................................................... 29

What we don’t cover when you’re renovating your home

................................................................. 29

Inside this PDS

If your home will be unoccupied for more than 60 days ................................................................... 29

Contents in open air

............................................................................................................................ 29

Insured events

........................................................................................................................................... 30

Making a claim – new for old contents

.............................................................................................. 30

Your sum insured

................................................................................................................................ 30

Summary of cover – insured events

.......................................................................................................... 31

Animal damage

................................................................................................................................... 32

Earthquake

.......................................................................................................................................... 32

Explosion

............................................................................................................................................. 33

Fire

....................................................................................................................................................... 33

Flood

.................................................................................................................................................... 34

Impact

................................................................................................................................................. 35

Leaks

................................................................................................................................................... 36

Lightning

............................................................................................................................................. 37

Riots

.................................................................................................................................................... 37

Storm

................................................................................................................................................... 38

Storm surge

....................................................................................................................................... 39

Theft

.................................................................................................................................................... 40

Tsunami

................................................................................................................................................ 41

Vandalism

............................................................................................................................................ 41

Included benefits

...................................................................................................................................... 42

Making a claim for an included benefit

.............................................................................................. 42

Summary of cover – benefits

.................................................................................................................... 43

Broken glass – Contents

..................................................................................................................... 45

Broken glass – Home

.......................................................................................................................... 46

Clean up cost

...................................................................................................................................... 47

Contents in a safe deposit box

........................................................................................................... 47

Contents in storage

............................................................................................................................ 48

Contents in transit

............................................................................................................................. 49

Counselling services

......................................................................................................................... 50

Credit card misuse

............................................................................................................................... 51

Demolition and removal of debris

...................................................................................................... 52

Design

................................................................................................................................................. 52

Emergency services damage

............................................................................................................. 53

Extra living expenses

.......................................................................................................................... 53

Food spoilage

..................................................................................................................................... 54

Funeral costs

....................................................................................................................................... 54

Gifts

..................................................................................................................................................... 55

Home modifications after a serious injury

......................................................................................... 55

Investigating leaks

............................................................................................................................... 56

Lifetime guarantee on repairs ............................................................................................................. 56

Locks

.................................................................................................................................................... 57

Redundancy premium waiver

............................................................................................................. 58

Replacing documents

......................................................................................................................... 59

Replacing trees, shrubs, plants and hedges

...................................................................................... 59

Security firm response

........................................................................................................................ 60

Storage costs after an event

............................................................................................................... 60

Temporary accommodation

................................................................................................................ 61

Temporary removal of contents

.......................................................................................................... 62

Visitor’s contents

................................................................................................................................. 63

Optional benefits

..................................................................................................................................... 64

Summary of cover

.................................................................................................................................... 64

Advanced cover – accidental damage & motor burnout

.................................................................. 65

Mobile phones

..................................................................................................................................... 66

Motor burnout

..................................................................................................................................... 67

Small business contents

..................................................................................................................... 68

Individual items at home

..................................................................................................................... 69

Items that can be insured away from home

....................................................................................... 70

Individual or grouped items away from home

..................................................................................... 71

Legal liability

............................................................................................................................................. 74

Home insurance

.................................................................................................................................. 75

Contents insurance

............................................................................................................................. 75

Legal liability exclusions

..................................................................................................................... 76

Owner-occupier

.................................................................................................................................. 76

Anyone

................................................................................................................................................ 76

4. What your cover does not include ............................................................................................... 78

General exclusions ................................................................................................................................... 79

Actions of the sea

................................................................................................................................ 79

Breaking the law

.................................................................................................................................. 79

Business

............................................................................................................................................... 79

Confiscation

......................................................................................................................................... 80

Computers and data

............................................................................................................................ 80

Defective or faulty workmanship

........................................................................................................ 80

Deliberate acts

..................................................................................................................................... 80

Disease

.................................................................................................................................................. 81

Erosion and landslide

........................................................................................................................... 81

Fraud

..................................................................................................................................................... 81

Further loss or damage

........................................................................................................................ 81

Indirect loss

......................................................................................................................................... 82

Loss not linked to an event ................................................................................................................. 82

Period of insurance

............................................................................................................................. 82

Pests and parasites

............................................................................................................................ 82

Radioactivity

....................................................................................................................................... 83

Roots and trees

................................................................................................................................... 83

Rust and mould

................................................................................................................................... 83

Seepage and pollution

........................................................................................................................ 83

Terrorism or war

.................................................................................................................................. 84

Watercraft

........................................................................................................................................... 84

Wear and tear

...................................................................................................................................... 84

Your responsibility

.............................................................................................................................. 84

5. What you are responsible for ......................................................................................................... 85

General conditions .................................................................................................................................. 86

What you should tell us and why

........................................................................................................ 86

Changes to your circumstances

........................................................................................................ 86

Your premium

..................................................................................................................................... 87

Managing or changing your policy

................................................................................................... 90

Cancelling your policy

......................................................................................................................... 91

6. What you need to know about claiming ..................................................................................... 92

Making a claim .......................................................................................................................................... 93

How to lodge your claim

..................................................................................................................... 93

Claim responsibilities

............................................................................................................................... 94

Our rights

.................................................................................................................................................. 95

When an incident occurs

.......................................................................................................................... 96

Lodging and assessing your claim

.......................................................................................................... 97

Settling your claim

................................................................................................................................... 98

Types of excesses

................................................................................................................................... 100

Paying your excess

........................................................................................................................... 100

Types of excesses that may apply

................................................................................................... 100

Reimbursing your excess

.................................................................................................................. 101

Claims that are less than your excess

............................................................................................... 101

Claims that we decline or you withdraw

........................................................................................... 101

Other claim considerations

.................................................................................................................... 102

Reductions we may apply

.................................................................................................................102

Salvage value

.....................................................................................................................................102

Repairing or replacing for uniform appearance

...............................................................................102

Pairs, sets and collections

.................................................................................................................105

Increase to your sum insured

........................................................................................................... 105

If you’re registered or required to be registered for GST

................................................................ 105

7. Other information ............................................................................................................................ 106

Dispute resolution process .....................................................................................................................107

Let us know about your complaint

..................................................................................................... 107

Reviewing your complaint

.................................................................................................................. 107

Refer to external dispute resolution

.................................................................................................. 107

Premium & discount guide

......................................................................................................................108

How we calculate your premium

...................................................................................................... 108

What discounts can be applied to your premium

............................................................................ 110

Personal information

................................................................................................................................ 111

Our Privacy Statement

....................................................................................................................... 111

General Insurance Code of Practice

........................................................................................................ 111

Financial Claims Scheme

......................................................................................................................... 111

Words with special meanings

..................................................................................................................112

1

How your policy works

This section explains who is involved in this contract of insurance, when the policy

starts, and what happens if you change your mind.

We also explain the important documents that make up your policy.

Your Policy Your Cover Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Contract between you and us

Your policy is a legal contract between you and us. We agree to give you the insurance set out in your policy

for the premium you pay us.

More than one policyholder

If more than one person is named as the policyholder on your Certificate of Insurance, then each person is

jointly responsible for:

• the completeness and accuracy of information in any application forms, statements, claims or

documents that are provided by any one of them to us,

• complying with the conditions of your policy, and

• the acts and omissions of all policyholders.

If more than one person is named as the policyholder on your Certificate of Insurance, then any one

policyholder will be taken to be authorised by all policyholders to transact on the policy (including to

change or cancel your policy, or make a claim under the policy).

When your policy starts

When you pay the annual premium or first monthly instalment, then your policy starts on the time and date

shown on your Certificate of Insurance.

If you renew your current policy, then your policy starts at midnight on your renewal date.

Cooling off period

When you take out a new policy or renew a current policy with us, we give you a cooling off period of 21 days.

The cooling off period starts from:

• the date and time we issue a new policy to you, or

• midnight on your renewal date.

If you want to cancel your policy during the cooling off period, you must tell us you want to do that. If you

cancel your policy during the cooling off period, we refund your premium in full (as long as you haven’t made

a claim).

Household Insurance Policy

|

Page 13

Your Policy Your Cover Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Documents that make up your policy

Your policy includes this Product Disclosure Statement (PDS), your Certificate of Insurance and any

Supplementary Product Disclosure Statements. These documents show the conditions that apply to your

policy. Please read the documents carefully and keep them in a safe place.

1. Product Disclosure Statement (PDS)

This PDS sets out the conditions that apply to your policy including what we do and don’t cover, the

exclusions that apply under your policy, and what we pay when you make a claim.

We give you a PDS with your Certificate of Insurance when you take out a new policy with us. You can

download a copy of our PDS from aldiinsurance.com.au/documents.

2. Certificate of Insurance

Your Certificate of Insurance shows the type of cover that applies to your policy and also shows any specific

details that apply to your policy.

For example, your policy number, home address, construction type, your period of insurance, the premium

for your policy, and any excesses that apply to your policy.

We give you a Certificate of Insurance when you take out a new policy, renew a current policy, or make a

change to your policy.

When you receive your Certificate of Insurance, you should check the details to make sure they are correct.

If the details are incorrect, please contact us.

3. Supplementary Product Disclosure Statement

If we need to make a change to the PDS conditions, we may issue a Supplementary Product Disclosure

Statement which sets out the change.

If we issue any Supplementary Product Disclosure Statements, we will give you a copy.

Sample documents

1. Product Disclosure

Statement (PDS)

2. Certificate of

Insurance

3. Supplementary Product

Disclosure Statement

Product Disclosure Statement

(PDS)

Household Insurance Policy

Preparation Date (TBC)

Household Certificate of

Insurance

Everything you need to know about your

ALDI Insurance policy

Supplementary Product Disclosure Statement

Page 1 of 5

Household Certificate of Insurance

ALDI Stores (A Limited Partnership) ABN 90 196 565 019 AR [AR Number]

aldiinsurance.com.au

1300 407 021

Supplementary Product Disclosure Statement

This Supplementary Product Disclosure Statement (SPDS) is issued by RACQ Insurance Limited

ABN 50 009 704 152 AFS Licence Number 233082 on 29 June 2020 incorporates and replaces the

information contained in the SPDS RHHB9.0719 dated 1 July 2019 and the SPDS RHHB9.1019 dated

29 October 2019.

This SPDS must be read in conjunction with the Household Insurance Policy Product Disclosure

Statement (PDS) RHHB2 03/17 dated 1 March 2017. These documents, together with your Certificate of

Insurance, form the basis of your insurance cover.

This SPDS makes the following important changes to the PDS:

• Introduction of The Australian Financial Complaints Authority (AFCA) in relation to disputes;

• Changes to the cover provided in relation to a storm event;

• Changes to the terms and conditions applicable to landlords;

• The removal of the optional benefit ‘Mortgagee’s interest in a home unit’; and

• Adding a general exclusion in relation to the transmission of diseases.

Date issued 22 May 2020

Household Insurance Policy

|

Page 14

2

Smart Home Program

This section provides an overview of the Smart Home Program.

Conditions apply to the Smart Home Program.

Your Certificate of Insurance will identify whether the Smart Home Program applies

to your policy.

Smart Home ProgramYour Policy Your Cover Not Covered Your Responsibilities Claiming Other information

The Smart Home Program

The Smart Home Program provides eligible policyholders the option to receive a smart home sensor

kit that can detect and alert you to common household risks when correctly installed, activated and

maintained in an operational state. If the Smart Home Program applies to your policy, you will be entitled to

a premium discount, subject to the terms of the Smart Home Program set out in this section.

Adding the Smart Home Program to your policy

If you agree to add the Smart Home Program to your policy, this will be set out in the Certificate of

Insurance.

If you did not elect to participate in the Smart Home Program before your policy started, you will not be able

to opt in to the Smart Home Program during the period of insurance. You may be entitled to add the Smart

Home Program to your policy at renewal.

Installing and activating the smart home sensor kit

If the Smart Home Program applies to your policy, a smart home sensor kit will be provided to you at no

additional cost. We will not use data from the smart home sensor kit in the claims process.

The smart home sensor kit will be delivered to the insured address. To be eligible for the Smart Home

Program discount described on page 16, you must install and activate the smart home sensor kit within

28 days of when you receive the smart home sensors, and keep the smart home sensor kit active for the

period of insurance.

Honey Insurance will notify you by email or SMS if sensors in the smart home sensor kit are detected to be

offline. If you identify that the smart home sensor kit is defective you must notify Honey Insurance within 7

business days on the contact details set out in this PDS.

Eligibility

If you are eligible, you will be presented with the option to participate in the Smart Home

Program before the start of your policy.

Household Insurance Policy

|

Page 16

Smart Home ProgramYour Policy Your Cover Not Covered Your Responsibilities Claiming Other information

Premium discounts and repayments

A Smart Home Program discount will be applied to your premium if you install and keep the smart home

sensor kit operational in accordance with the terms of the Smart Home Program set out in this section.

Your Certificate of Insurance will state that the Smart Home Program discount applies to your policy.

You will only be entitled to the full Smart Home Program discount if the smart home sensor kit has been

installed and activated in accordance with the requirements of this section.

When are you required to install the smart home sensor kit?

You must install and activate your smart home sensor kit within 28 days of when you receive the smart

home sensors.

If you don’t install the smart home sensor kit

If we detect that you have not activated the smart home sensor kit within 28 days of when you receive the

smart home sensors, or if the smart home sensor kit is detected to be offline at any time during the period

of insurance, we will try to contact you to confirm whether you intend to install (or re-install) and activate

the smart home sensor kit.

If we are unable to contact you, or you tell us you do not want the smart home sensor kit, we can end the

application of the Smart Home Program discount so that it no longer applies. If this occurs, you will not

be eligible for the Smart Home Program discount for the remainder of the period of insurance and your

premium will be adjusted accordingly.

If your Smart Home Program discount ends

If you pay your premium by the month and your Smart Home Program discount ends, we will adjust your

monthly premium payment to reflect the removal of the discount. This change will be applied to your

monthly direct debits from the start of the month following the end of the Smart Home Program discount.

If you pay your premium annually, then you must repay the Smart Home Program discount to us. You agree

to do this by paying the additional premium that applies to your policy. We will calculate this on a pro rata

basis from the start of the month following the end of the Smart Home Program discount for the remainder

of the period of insurance.

At no point will you need to repay any discount that applies for any part of the period of insurance before

the Smart Home Program discount ends.

You will not lose your eligibility for the discount if the smart home sensor kit is not operational because it is

defective and you notified Honey Insurance within 7 days after identifying the defect.

Household Insurance Policy

|

Page 17

3

What your cover includes

This section explains what we consider to be your home and contents, and what you

are covered for.

The type of cover you have will depend on your home and your contents, and the type

of cover you have selected.

Specific exclusions apply to certain parts of your cover. See the section that applies to

the type of cover you have selected for more information.

The type of cover you have is shown on your Certificate of Insurance.

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Types of cover you may choose

This PDS is made up of 2 different types of cover. The type of cover you have will depend on your home, or

your contents, and the type of cover that you have selected. The type of cover you have is shown on your

Certificate of Insurance.

The types of cover within the PDS are:

• Home Insurance

• Contents Insurance

Summary of cover under your policy

The table below summarises the cover we give you under the type of cover you have selected. For full details

about your cover, read the sections that apply to your policy within this document.

Summary of cover under your policy

Home

Contents

Loss or damage caused by certain events at the insured

address during the period of insurance.

Insured events

Events you are covered for.

Included benefits

Benefits we include as part of your cover. The number of

benefits available to you will depend on the occupancy

of your home, and the cover you have chosen.

Up to 14 benefits

Up to 20 benefits

Optional benefits

Benefits you can add to increase your cover.

The options available to you will depend on the

occupancy of your home, and the cover you have

chosen. You need to pay more for these benefits.

Up to 2 benefits

Up to 6 benefits

Legal liability

Your legal liability to pay compensation to someone for

loss or damage to their property or for death or bodily

injury which results from certain incidents during the

period of insurance which you are liable for.

Household Insurance Policy

|

Page 19

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

What is your home

Your home is made up of the building itself at the insured address shown on your Certificate of Insurance,

items that are fitted or fixed to that building as well as certain items that are within the boundary of your

property.

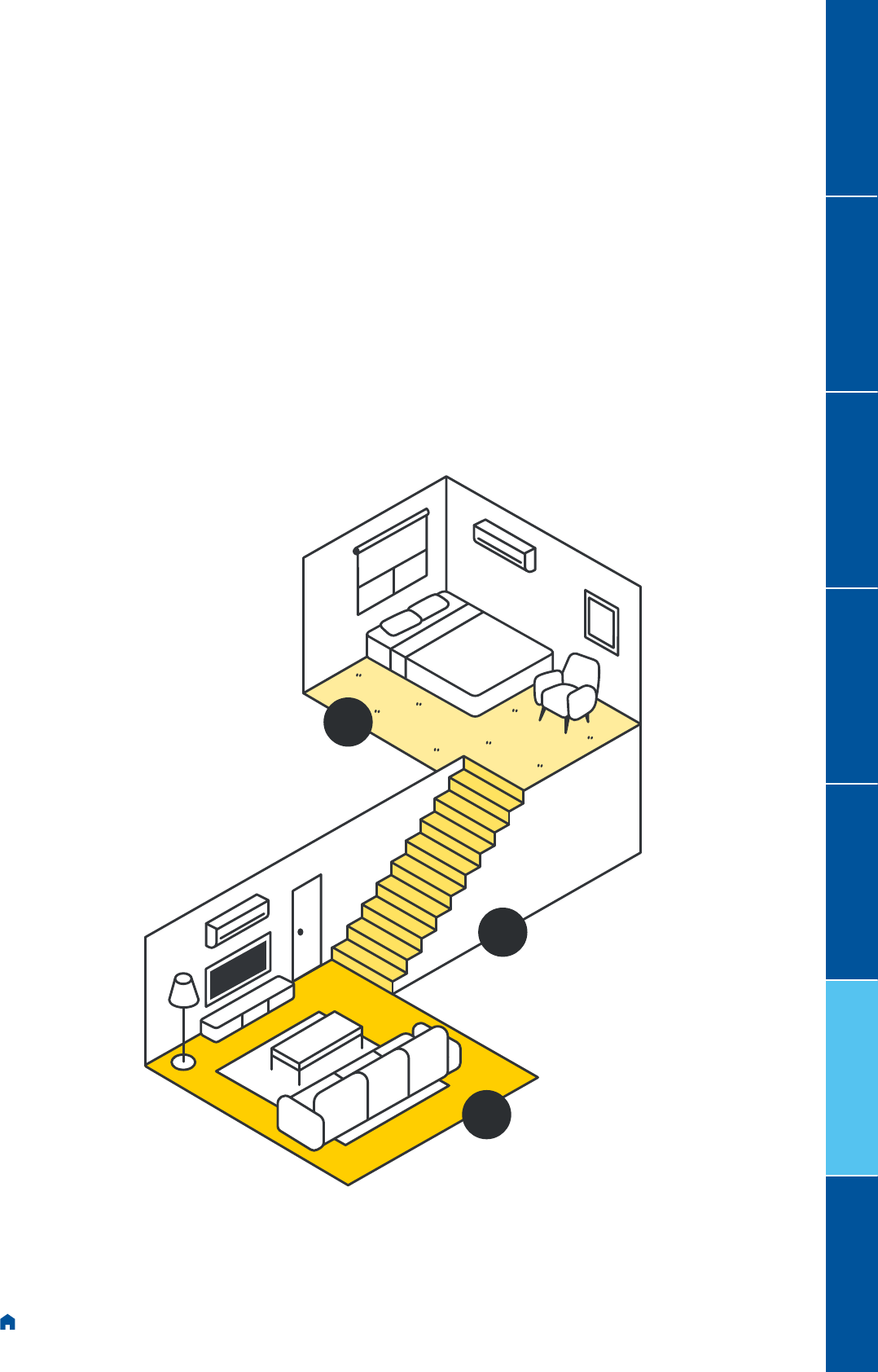

Examples of items that make up your home are shown in the graphic below and are shaded as blue. This is

explained in greater detail in the following section ‘Your home’ - see pages 21-23.

Household Insurance Policy

|

Page 20

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Your home

We cover your home at the insured address shown on your Certificate of Insurance. We also cover other

structures at that address. This section outlines what we cover and don’t cover as your home under your

policy.

Building types

You are covered for:

• The building you own and live in which is:

– A detached house; or

– A flat or home unit (including a duplex or semi-detached/attached home) which is your

main residence and is not part of a strata title.

• A transportable home that is fixed to foundations set into the ground and connected to all

services on the site.

You are not covered for:

• A hotel, motel, boarding house or barracks.

• Temporary homes or structures, caravans and mobile homes.

• A home unit which is part of a strata title.

• Any property you own which you do not live in and which is occupied by other people,

including tenants under a rental agreement with you.

Other structures

You are covered for:

• Other buildings that you use for domestic purposes which include garages, carports, sheds,

and pergolas.

You are not covered for:

• Temporary/unfixed swimming pools or spas (but we do cover temporary/unfixed swimming

pools or spas under Contents Insurance).

• Boat jetties, pontoons or wharves (unless shown on your Certificate of Insurance as being

insured as part of your home).

• Glasshouses or greenhouses (whether they are made mainly of glass or not).

• Retaining walls.

• Fences, sheds, stables or other structures you use for agricultural or other business

purposes.

Household Insurance Policy

|

Page 21

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Building under construction

You are covered for:

• Homes under renovation where there are changes to external walls, roof or flooring. We will

only cover you for 7 of the insured events - see page 29.

You are not covered for:

• Homes that are being built or rebuilt (but we do cover your home for some insured events

during renovations – see page 29).

Outdoor items

You are covered for:

• Fixed barbecues, clothes hoists, external blinds and awnings, shade sails, aerials and masts.

• Outdoor water and sullage pumps attached to service pipes or drains.

• Fixed swimming pools, spas or saunas, and their pumps, motors and filters.

• Fixed outdoor water tanks, solar appliances and solar panels.

• Sealed driveways, garden borders, bridges, paths, paving and playing surfaces, up to 500m

long in total.

• Fences, walls, and gates.

• Built-in furniture.

• Gas, water, electricity or other services that you own or are legally liable to repair or replace.

You are not covered for:

• Lawns, grass, trees, shrubs, plants and hedges (but we do cover trees, shrubs, plants

and hedges under the included benefit – replacing trees, shrubs, plants and hedges).

See page 59.

Household Insurance Policy

|

Page 22

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Indoor items

You are covered for:

• Fixed coverings on walls, ceilings, and floors (but not carpets – we cover carpets as part of

your contents).

• Equipment or appliances permanently fixed to the gas, plumbing or electrical systems

including fixed or built-in air conditioning units, ovens, stoves, range hoods, dishwashers,

and permanently fitted/fixed fish tanks.

• Ceiling fans and ceiling exhaust fans.

You are not covered for:

• Carpets (we cover carpets under Contents Insurance).

Vehicles and accessories

You are not covered for:

• A campervan, bus, semi-trailer, rail carriage, tram, watercraft or aircraft.

• A caravan or mobile home.

Home

Items Limit

Dividing fences, walls and gates on a shared boundary 50% of the total cost for up to 2km in total

Sealed driveways, garden borders, bridges, paths,

paving, and playing surfaces

The cost up to 500m long in total

Swimming pool and spa covers and liners that are up to

5 years old and are damaged by a storm

Up to $500

General limits on home items

There are general limits that apply to some home items, as shown in the table below.

Household Insurance Policy

|

Page 23

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

What are your contents

Your contents are items that are not fitted or fixed to your home. These items can be inside or outside your

home at the insured address. Please be aware some conditions apply to contents in the open air.

Examples of items that make up your contents are shown in the graphic below and are shaded as yellow.

This is explained in greater detail in the following section ‘Your contents’ - see page 25.

Household Insurance Policy

|

Page 24

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Your contents

We cover your contents at your home at the insured address shown on your Certificate of Insurance. This

section outlines what we cover and what we don’t cover as your contents under your policy.

General contents

You are covered for:

• Beds, lounges, tables, chairs, and wardrobes.

• Towels, bed sheets, blankets, and quilts.

• Internal blinds and curtains.

• Fixed and unfixed carpets.

• Unfixed light fittings.

• Furniture and furnishings in a home office.

• Clothing, shoes, bags and wallets.

• CDs, DVDs, Blu-ray discs and, records.

• Washing machines, refrigerators, freezers, dryers, and portable heaters.

• Home entertainment equipment like televisions and DVD players.

• Laptops, computers and tablet PCs.

• Computer game consoles and discs.

• Game software, music or other software that has been purchased or downloaded legally.

• Mobile phones.

• Cameras, video cameras, and their accessories.

• Portable music systems.

• Musical Instruments.

You are not covered for:

• Stock, property or materials used in a business (but we do cover tools of trade and

equipment and furnishings used in a home office). If you have the optional benefit of ‘Small

business contents’ shown on your Certificate of Insurance, we will cover office equipment

and stock that you keep at home.

Household Insurance Policy

|

Page 25

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Jewellery, watches and other valuables

You are covered for:

• Jewellery, watches, gold and silver artefacts.

You are not covered for:

• Precious metals in the form of bars or bullion and precious or semi-precious uncut or loose

gems.

• Credit, debit or any other type of financial transaction card.

• Tickets, coupons, lottery tickets, and competition entry forms.

• Registered securities.

Sporting and recreational items

You are covered for:

• Firearms that are legally registered and stored.

• Remote-controlled models, drones or toys.

• Sailboards, windsurfers, surfboards, canoes, kayaks, non-motorised surf skis, and water skis.

• Bicycles and scooters, including their accessories.

• Unregistered golf buggies.

Building, garden and tools

You are covered for:

• Household tools and tools of trade.

• Unregistered lawn and garden appliances.

• Temporary/unfixed swimming pools.

You are not covered for:

• Lawns, grass, trees, shrubs, plants, and hedges.

• Construction material for renovating your home.

• Equipment or appliances permanently fixed to gas, plumbing or electrical systems (we cover

fixed items under Home Insurance).

Household Insurance Policy

|

Page 26

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Mobility items

You are covered for:

• Motorised wheelchairs that are not required by law to be registered.

• Unmotorised wheelchairs.

For home unit owners

You are covered for:

• If you are an owner-occupier of a home unit, then your contents also include fixtures and

fittings that are not required by law to be insured by a body corporate.

For tenants

You are covered for:

• If you are a tenant, then your contents also include:

– landlord’s fixtures and fittings that you’re responsible for under the rental agreement, and

– fixtures and fittings you install with your landlord’s permission.

Pets and livestock

You are not covered for:

• Pets, livestock, fish or birds.

Vehicles, caravan contents & spare parts

You are not covered for:

• Registerable motor vehicles, motorcycles, scooters, trailers and caravans, and their tools,

parts, spare parts and accessories whether fitted or not.

• Trail and offroad motorbikes.

• Aircraft or watercraft, their tools, parts, spare parts and accessories whether fitted or not (but

we do cover sailboards, windsurfers, surfboards, canoes, kayaks, non-motorised surf skis,

and water skis).

• Golf buggies or motorised wheelchairs that are or should be registered.

• Anything that is in a caravan or mobile home.

Household Insurance Policy

|

Page 27

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

General limits on contents items

There are general limits that apply to some contents items as shown in the table below. You can choose to

increase the limit for specific items under the following optional benefits:

• ‘Individual items at home’ for cover only when they are at your home – see page 69.

• ‘Individual or grouped items away from home’ for cover when they are anywhere in Australia and

New Zealand – see page 71.

Contents items

Items Limit

Cameras and their accessories Up to $2,000

Cash, gift cards, cheques, and travellers cheques Up to $300

CDs and DVDs, Blu-ray discs, records, computer and

game consoles, computer and game software, discs

and music

Up to $5,000

Collections, medals or memorabilia Up to $2,000

Hand woven rugs and mats Up to $1,000 for each item

Movie or video cameras and their equipment Up to $2,000

Office equipment Up to $20,000

Stamp collections and collectors unnegotiable currency Up to $2,000

Tools of trade Up to $2,000

Watches, jewellery, and gold or silver artefacts

(but not bullion)

Up to $2,000 per item and $6,000 in total

Works of art, figurines, moulded objects, vases or curios

(except for jewellery, gold or silver artefacts)

Up to $2,000 per item and $12,000 in total

Household Insurance Policy

|

Page 28

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Additional conditions

There are additional conditions that may apply to your Home Insurance and your Contents Insurance.

These conditions and when they will apply are shown below.

What we cover when you’re renovating your home

If you are renovating your home, cover for any loss or damage to your home (and building materials) or your

contents only applies where the loss or damage is caused by one or more of the insured events below:

• Earthquake

• Explosion

• Fire

• Impact

• Storm (limited to loss or damage caused by very strong winds)

• Lightning

• Riots

Once your home is structurally secure with all external walls, roof and floors in place, this limitation won’t

apply and you will be covered for all insured events.

If your home will be unoccupied for more than 60 days

Your home is unoccupied if no one has been living in it for more than 60 consecutive days. Your home is

also unoccupied if someone stays there on average for less than one night a week during the 60 day period.

If your home is unoccupied, the Unoccupied Home excess (see page 101) will apply.

Contents in open air

Your contents are in the open air if they are anywhere at the insured address that is not fully lockable and

enclosed by weatherproof walls, flooring, and roof. For example, on your uncovered balcony or deck at

your home.

If loss or damage happens to your contents when they are in the open air, then:

• under the insured event ‘Impact’, we don’t cover them at all,

• under the insured event ‘Theft’, we only pay up to 5% of your contents sum insured,

• under the Optional benefit ‘Advanced cover’, we only pay up to 5% of your contents sum insured.

Household Insurance Policy

|

Page 29

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Insured events

We cover loss or damage to your home or your contents that is caused by certain events. These events are

set out in table ‘Summary of cover – insured events’ on page 31.

For us to cover you for loss or damage, the insured event must happen:

• at the insured address, and

• during the period of insurance.

The general exclusions shown on pages 79-84 apply to all insured events.

Making a claim – new for old contents

If you make a claim and it is settled by replacing your damaged or lost contents, then you will be given

new items to replace your old items – no matter how old your items are. However, the as new value of the

following contents items will be reduced for age, wear and tear:

• floor carpets that are over 10 years old,

• clothing.

Your sum insured

Your sum insured is the amount you choose to cover your home or your contents up to. It’s important for

you to choose a sum insured amount that is enough to cover the cost to rebuild your home and replace

your contents items if they are totally destroyed by an insured event – for example, a fire.

When you set your sum insured for your home you should look at:

• the cost to rebuild your home based on materials and labour, not just your home’s market value, and

• any additional costs to rebuild your home to comply with current building laws – this may increase the

total building costs.

When you set your sum insured for your contents you should look at:

• the costs to replace your items at today’s prices, and

• all your contents within each room of your house, for example clothing, linen, and furniture.

When we send you an offer to renew your policy, we will increase your sum insured by the uplift rate, which

helps to protect your sum insured against the effects of increasing costs. Even though we offer you that

increase, you don’t have to accept it.

Monitoring your sum insured

You can ask us to change your sum insured

at any time. It’s your responsibility to

regularly review your sum insured to make

sure it provides the right amount of cover

for your home and your contents.

Help to calculate your sum insured

If you need help to calculate

your sum insured, you can

use the calculator at

aldiinsurance.com.au

Household Insurance Policy

|

Page 30

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Summary of cover – insured events

The table below provides a brief summary of the insured events that we give you cover for. For full details

about your cover and the exclusions and limits that apply, see the relevant pages shown in the last column.

Insured events

Limit

Home

Contents

Page

Animal damage

Up to the sum

insured. General

limits apply for

some home and

contents items

covered.

32

Earthquake 32

Explosion 33

Fire 33

Flood 34

Impact 35

Leaks 36

Lightning 37

Riots 37

Storm 38

Storm surge 39

Theft 40

Tsunami 41

Vandalism 41

Household Insurance Policy

|

Page 31

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Animal damage

You are covered for:

Loss or damage to your home or your contents caused by an animal. For example, we cover

you if a gecko causes your air conditioning unit to malfunction.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by:

• your pets or other animals that you or a person who permanently lives at the home, keep at

your home,

• pests or parasites,

• birds (but we do cover some bird damage under the included benefit ‘Broken glass – home’

see page 46).

Earthquake

You are covered for:

Loss or damage to your home or your contents caused by an earthquake. An earthquake

excess applies on top of your basic excess – see page 100.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

Included for:

Home Contents

Included for:

Home Contents

Household Insurance Policy

|

Page 32

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Explosion

You are covered for:

If an item, device or substance explodes and causes loss or damage to your home or your contents.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage to an item or device that explodes.

Fire

You are covered for:

Loss or damage to your home or your contents caused by a fire, bushfire, or grassfire.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by smoke or heat (e.g. melting or scorching) when your home or your

contents did not catch fire (but we do cover you if the loss or damage is caused by a fire that is

within 100 metres of your home).

Loss or damage caused by a bushfire that happens during the first 72 hours from when we first

cover your home or your contents (but we do cover you if you take out your policy when you sign

a contract to buy your home or we replace another insurance policy).

Included for:

Home Contents

Included for:

Home Contents

Household Insurance Policy

|

Page 33

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Flood

You are covered for:

Loss or damage to your home or your contents caused by flood or water runoff.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by:

• water being absorbed through floors or external or internal walls of your home (including

rising damp) and any resulting loss or damage to your contents, including carpets,

• hydrostatic pressure building up below or behind any part of your home including a

swimming pool, spa, or tank,

• a power surge (but we may cover you if another insured event at your home causes the power surge).

Loss or damage caused by erosion, landslide, subsidence, vibration, earth shrinkage or

expansion or any other earth movement no matter how it is caused.

But we do cover damage caused by a landslide or subsidence that:

• occurs within 72 hours of the first loss or damage to your home or your contents caused by

the flood or water runoff, and

• is solely caused by the flood or water runoff (that is, not caused by or contributed to by

erosion over time, structural or design fault, or any other factor).

Loss or damage to:

• lawns or grass,

• swimming pools and spas, and their covers and liners,

• the water in swimming pools and spas,

• shade or sail cloth and fabric awnings.

Loss or damage caused by flood or water runoff that happens during the first 72 hours from when we

first cover your home or your contents (but we do cover you if you take out your policy when you sign a

contract to buy your home or we replace another insurance policy that covers flood or water runoff).

Water runoff from an item or device we cover under the insured event ‘Leaks’.

Included for:

Home Contents

Household Insurance Policy

|

Page 34

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Impact

You are covered for:

Loss or damage to your home or your contents caused by impact of these items:

• a motor vehicle or watercraft,

• a tree or tree branch,

• an aircraft, space debris, or debris from a rocket or satellite,

• a satellite dish, solar hot water tank, or aerial.

The costs to remove and dispose of a tree or branch that causes the impact.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by tree lopping or felling by:

• you or anyone who permanently lives with you,

• any person who has your consent or the consent of a person who permanently lives with you.

Loss or damage to underground services caused by a motor vehicle or watercraft.

The cost to remove the tree stump of a tree that causes the impact.

Included for:

Home Contents

Household Insurance Policy

|

Page 35

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Leaks

You are covered for:

Loss or damage to your home or your contents caused by liquids that are leaking, bursting,

discharging, or overflowing from these items or devices:

• dish and clothes washing machines,

• water catchment trays in refrigerators, freezers, and evaporative air conditioners,

• waterbeds,

• pipes, gutters and drains which are fixed or connected to your home,

• fixed domestic items which include water tanks, lavatory cisterns and pans, baths, basins,

and sinks,

• water mains.

We may also cover some other costs under the included benefit ‘Investigating leaks’ – see page 56.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by leaks:

• from shower recesses or cubicles,

• that you knew about but did not fix before they caused loss or damage to your

home or your contents,

• from fish tanks.

Loss or damage caused by gradual and ongoing leaks. But we do cover you if you can show:

• for your home, that the loss or damage started after you took out Home Insurance with us,

• for your contents, that the loss or damage started after you took out Contents Insurance with us,

• you did not know or could not have reasonably been expected to know about the leak before

it caused loss or damage to your home or your contents.

Loss or damage to the item or device which leaked.

The cost to replace the escaped liquid.

Included for:

Home Contents

Household Insurance Policy

|

Page 36

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Lightning

You are covered for:

Loss or damage to your home or your contents caused by a lightning strike.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage if there is no evidence that lightning was the cause of the loss or damage.

For example, power surges or fluctuations caused by an electricity provider or impact to

power lines.

Riots

You are covered for:

Loss or damage to your home or your contents caused by a riot and the action that legal

authorities take to control a riot.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

Included for:

Home Contents

Included for:

Home Contents

Household Insurance Policy

|

Page 37

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Storm

You are covered for:

Loss or damage to your home or your contents caused by a storm. For example, a cyclone.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by:

• a power surge (but we may cover you if another insured event at your home causes the

power surge),

• rain, hail or snow after it reaches the ground (but we may cover that under the insured

event ‘Flood’ as flood or water runoff).

Loss or damage caused by a storm that happens during the first 72 hours from when we first

cover your home or your contents (but we do cover you if you take out your policy when you sign

a contract to buy your home or we replace another insurance policy).

Loss or damage to:

• lawns or grass,

• swimming pool and spa covers and liners that are more than 5 years old,

• free standing walls,

• paintwork or coatings if that is the only building damage caused by the storm.

Included for:

Home Contents

Household Insurance Policy

|

Page 38

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Storm surge

You are covered for:

Loss or damage to your home or your contents caused by a storm surge.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.

The general limits for your home and your contents shown on pages 23 and 28 respectively.

You are not covered for:

Loss or damage caused by:

• water being absorbed through floors or external or internal walls of your home (including

rising damp) and any resulting loss or damage to contents, including carpets,

• hydrostatic pressure building up below or behind any part of your home including

a swimming pool, spa or tank,

• a power surge (but we may cover you if another insured event at your home causes the

power surge).

Loss or damage to:

• lawns or grass,

• swimming pools and spas and their covers and liners,

• the water in swimming pools and spas,

• shade and sail cloth or fabric awnings.

Loss or damage caused by a storm surge that happens during the first 72 hours from when we

first cover your home or your contents (but we do cover you if you take out your policy when you

sign a contract to buy your home or we replace another insurance policy).

Included for:

Home Contents

Household Insurance Policy

|

Page 39

Your CoverYour Policy Not Covered Your Responsibilities Claiming Other informationSmart Home Program

Theft

You are covered for:

Loss or damage to your home or your contents caused by theft or attempted theft by

someone who enters your home without your consent.

Limit:

Up to the sum insured for your home or your contents shown on your Certificate of Insurance.