Revised 4/14/22 Page 1 of 7

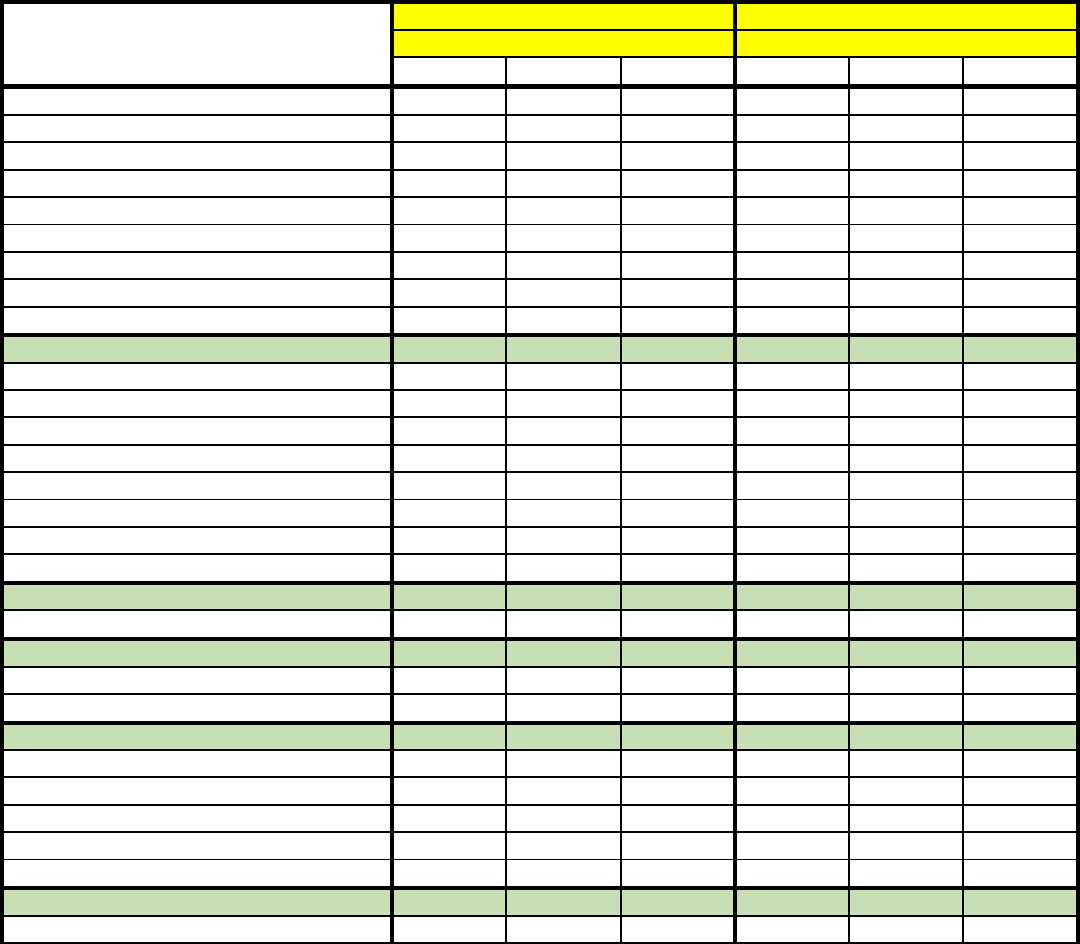

County

and

Municipality Real Personal Utility Real Personal Utility

Allegany County 0.9750 2.4375 2.4375

Barton 0.2050 0.5800 0.5800 0.9094 2.2734 2.2734

Cumberland 1.0595 2.6480 2.6480 0.8315 2.0788 2.0788

Frostburg 0.7000 1.5000 1.5000 0.8627 2.1567 2.1567

Lonaconing 0.3408 0.8179 0.8179 0.8773 2.1932 2.1932

Luke 1.2500 0.9500 0.9500 0.8753 2.1882 2.1882

Midland 0.2800 0.7000 0.7000 0.9094 2.2734 2.2734

Westernport 0.6000 1.5000 1.5000 0.9094 2.2734 2.2734

Anne Arundel County 0.9330 2.3320 2.3320

Annapolis 0.7380 1.9400 1.9400 0.5590 1.3970 1.3970

Highland Beach 0.1505 0.3762 0.3762 0.9030 2.2570 2.2570

Baltimore City 2.2480 5.6200 5.6200

Baltimore County 1.1000 2.7500 0.0000

Calvert County 0.9270 2.2300

2.2300

Chesapeake Beach 0.3233 0.0000 0.0000 0.5910 1.3900

1.3900

North Beach 0.6034 0.0000 1.8000 0.5910 1.3900

1.3900

Caroline County 0.9800 2.4500

2.4500

Denton 0.7600 1.5000 1.7000 0.9200 2.4500

2.4500

Federalsburg 0.8800 1.6500 1.6500 0.9000 2.4500

2.4500

Greensboro 0.7200 1.5130 1.4000 0.9200 2.4500

2.4500

Hillsboro 0.1600 0.4000 0.4000 0.9800 2.4500

2.4500

Marydel 0.3000 0.8300 0.8300 0.9800 2.4500

2.4500

Preston 0.3600 0.7000 0.7000 0.9700 2.4500

2.4500

Ridgely 0.5329 1.2750 1.2750 0.9300 2.4500

2.4500

Goldsboro 0.4600 1.0000 1.0000 0.9800 2.4500

2.4500

Henderson 0.4800 0.8400 0.8400 0.9800 2.4500

2.4500

Templeville 0.3600 0.7200 0.7200 0.9800 2.4500

2.4500

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

Revised 4/14/22 Page 2 of 7

County

and

Municipality Real Personal Utility Real Personal Utility

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

Carroll County 1.0180 2.5150

2.5150

Taneytown 0.3700 0.8000 0.8000 1.0180 2.5150

2.5150

Sykesville 0.3300 0.8750 0.8750 1.0180 2.5150

2.5150

Manchester 0.2160 0.4600 0.4600 1.0180 2.5150

2.5150

Westminster 0.5600 1.1000 1.4000 1.0180 2.5150

2.5150

Hampstead 0.2200 0.5500 0.5500 1.0180 2.5150

2.5150

New Windsor 0.2615 0.4000 0.4000 1.0180 2.5150

2.5150

Union Bridge 0.3500 0.7500 0.7500 1.0180 2.5150

2.5150

Mount Airy 0.1662 0.4100 0.4100 1.0180 2.5150

2.5150

Cecil County 1.0279 2.5697 2.5697

Cecilton 0.2284 0.0080 0.0080 1.0279 2.5697

2.5697

Chesapeake City 0.4688 1.1800 1.1800 1.0279 2.5697

2.5697

Elkton 0.6356 1.2100 1.2100 1.0279 2.5697

2.5697

North East 0.4800 0.0000 1.2000 1.0279 2.5697

2.5697

Charlestown 0.3334 0.8000 0.8000 1.0279 2.5697

2.5697

Rising Sun 0.4600 0.9000 0.9000 1.0279 2.5697

2.5697

Port Deposit 0.5452 0.0000 2.2000 1.0279 2.5697

2.5697

Perryville 0.3597 0.9400 0.9400 1.0279 2.5697

2.5697

Charles County 1.1410 2.8525 2.8525

Indian Head 0.3000 0.8000 0.8000 1.1020 2.8525 2.8525

La Plata 0.3200 0.7500 2.5000 0.9990 2.8525 2.8525

Port Tobacco 0.0400 0.0400 0.0400 1.1410 2.8525 2.8525

Dorchester County 1.0000 2.4400 2.4400

Secretary 0.2989 0.8000 0.8000 1.0000 2.4400 2.4400

East New Market 0.7109 1.6000 1.6000 1.0000 2.4400 2.4400

Cambridge 0.8301 1.6900 1.6900 0.9267 2.4400 2.4400

Hurlock 0.8237 1.4000 1.4000 0.9179 2.4400 2.4400

Vienna 0.4787 1.0800 1.0800 1.0000 2.4400 2.4400

Church Creek 0.1700 0.3500 0.3500 1.0000 2.4400 2.4400

Galestown 0.3091 0.6500 0.6500 1.0000 2.4400 2.4400

Brookview 0.3000 0.5800 0.5800 1.0000 2.4400 2.4400

Revised 4/14/22 Page 3 of 7

County

and

Municipality Real Personal Utility Real Personal Utility

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

Eldorado 0.1900 0.4000 0.4000 1.0000 2.4400 2.4400

Frederick County 1.0600 0.0000 2.6500

Brunswick 0.4100 0.0000 2.6500 1.0600 0.0000 2.6500

Burkittsville 0.1900 0.0000 0.0000 1.0600 0.0000 2.6500

Emmitsburg 0.3464 0.9000 0.0000 1.0600 0.0000 2.6500

Frederick 0.7305 1.5500 1.5500 0.9505 0.0000 2.6500

Middletown 0.2320 0.5800 0.0000 1.0600 0.0000 2.6500

Mt. Airy 0.1662 0.4100 0.4100 1.0600 0.0000 2.6500

Myersville 0.3460 0.0000 1.1730 0.9407 0.0000 2.6500

New Market 0.1200 0.4500 0.4500 1.0600 0.0000 2.6500

Rosemont 0.0400 0.0000 0.0000 1.0600 0.0000 2.6500

Thurmont 0.2992 0.6200 0.6200 1.0600 0.0000 2.6500

Walkersville 0.1400 0.4400 0.4400 1.0600 0.0000 2.6500

Woodsboro 0.1389 0.0000 0.0000 1.0600 0.0000 2.6500

Garrett County 1.0560 0.0000 2.6400

Accident 0.3045 0.6100 0.6100 1.0560 0.0000 2.6400

Deer Park 0.3000 0.7500 0.7500 1.0560 0.0000 2.6400

Friendsville 0.4100 0.5600 1.6400 1.0560 0.0000 2.6400

Grantsville 0.1941 0.0000 0.5000 1.0560 0.0000 2.6400

Kitzmiller 0.3600 0.0000 1.2000 1.0560 0.0000 2.6400

Loch Lynn Heights 0.3200 0.5300 1.0000 1.0560 0.0000 2.6400

Mt. Lake Park 0.4137 0.0000 1.2000 0.9916 0.0000 2.4790

Oakland 0.4720 1.2000 1.2000 1.0560 0.0000 2.6400

Harford County 1.0279 2.5698 2.5698

Aberdeen 0.6400 1.7000 1.7000 0.8913 2.2283 2.2283

Bel Air 0.5400 1.2000 1.2000 0.8913 2.2283 2.2283

Havere de Grace 0.5650 1.7050 1.7050 0.8913 2.2283 2.2283

Howard County 1.0140 2.5350 2.5350

Kent County 1.0120 0.0000 0.0000

Betterton 0.3200 0.8000 0.0000 1.0120 0.0000 0.0000

Chestertown 0.4332 0.0000 0.0000 1.0120 0.0000 0.0000

Revised 4/14/22 Page 4 of 7

County

and

Municipality Real Personal Utility Real Personal Utility

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

Galena 0.2355 0.0000 0.0000 1.0120 0.0000 0.0000

Millington 0.2909 0.0000 0.0000 1.0120 0.0000 0.0000

Rock Hall 0.3800 0.0000 0.0000 1.0120 0.0000 0.0000

Montgomery County 0.7178 1.7945 0.0000

Friendship Heights 0.0400 0.0400 0.0000 0.7178 1.7945 0.0000

Drummond 0.0480 0.1200 0.0000 0.7178 1.7945 0.0000

Oakmont 0.0400 0.1000 0.0000 0.7178 1.7945 0.0000

Chevy Chase Village 0.0773 0.6600 0.0000 0.7178 1.7945 0.0000

Sec. 3 Village of Chevy Chase 0.0200 0.0500 0.0000 0.7178 1.7945 0.0000

Town of Chevy Chase 0.0098 0.0000 0.6600 0.7178 1.7945 0.0000

Sec. 5 Village of Chevy Chase 0.0000 0.0000 0.0000 0.7178 1.7945 0.0000

Village of Martins Addition 0.0050 0.5000 1.4500 0.7178 1.7945 0.0000

North Chevy Chase 0.0450 0.1300 0.0000 0.7178 1.7945 0.0000

Chevy Chase View 0.0200 0.0000 1.0000 0.7178 1.7945 0.0000

Battery Park 0.0400 0.1000 0.0000 0.7178 1.7945 0.0000

City of Rockville - Class 1 0.6220 0.0000 0.0000 0.7178 1.7945 0.0000

City of Rockville - Class 4 0.2920 0.0000 0.0000 0.7178 1.7945 0.0000

City of Rockville - Class 5 0.2920 0.0000 0.0000 0.7178 1.7945 0.0000

City of Rockville - Class 50 0.2920 0.8050 0.0000 0.7178 1.7945 0.0000

City of Gaithersburg 0.2620 0.5300 0.0000 0.7178 1.7945 0.0000

Town of Barnesville 0.0514 0.2000 0.0000 0.7178 1.7945 0.0000

Town of Laytonsville 0.0900 0.3000 0.0000 0.7178 1.7945 0.0000

Town of Poolesville 0.1781 0.6000 0.0000

0.7178 1.7945 0.0000

Town of Garrett Park 0.2045 1.0000 0.0000 0.7178 1.7945 0.0000

Town of Glen Echo 0.1500 0.8000 1.5000 0.7178 1.7945 0.0000

Town of Sommerset 0.1000 1.0000 0.0000 0.7178 1.7945 0.0000

Town of Brookeville 0.1500 0.4500 0.0000 0.7178 1.7945 0.0000

Town of Washington Grove 0.2479 0.7000 0.0000 0.7178 1.7945 0.0000

Town of Kensington 0.1312 0.8000 5.0000 0.7178 1.7945 0.0000

City of Takoma Park 0.5397 1.5500 1.5700 0.7178 1.7945 0.0000

Bethesda 0.0120 0.0300 0.0000 0.7178 1.7945 0.0000

Revised 4/14/22 Page 5 of 7

County

and

Municipality Real Personal Utility Real Personal Utility

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

Silver Spring 0.0240 0.0600 0.0000 0.7178 1.7945 0.0000

Wheaton 0.0300 0.0750 0.0000 0.7178 1.7945 0.0000

Kingsview Village Center 0.0000 0.0000 0.0000 0.7178 1.7945 0.0000

West Germantown 0.1560 0.0000 0.0000 0.7178 1.7945 0.0000

White Flint

0.1103 0.0000 0.0000 0.7178 1.7945 0.0000

Prince George's County 1.0000 2.5000 0.0000

New Carrollton 0.6391 1.6000 0.0000 0.8620 2.1230 0.0000

Eagle Harbor 0.4727 0.0000 0.0000 0.9980 2.4950 0.0000

Greenbelt 0.8275 1.7225 0.0000 0.8470 2.0830 0.0000

Berwyn Heights 0.5450 0.0000 0.0000 0.8580 2.1120 0.0000

Bladensburg 0.7400 2.0900 0.0000 0.8560 2.1090 0.0000

Bowie 0.4000 1.0000 0.0000 0.8480 2.0870 0.0000

Brentwood 0.3792 1.7500 2.0000 0.9140 2.2650 0.0000

Capitol Heights 0.4200 2.5000 2.5000 0.8610 2.1200 0.0000

Cheverly 0.4899 1.1000 0.0000 0.8610 2.1210 0.0000

Cheverly - Apartments 0.6600 1.1000 0.0000 0.8610 2.1210 0.0000

College Park 0.3131 0.8380 0.0000 0.9650 2.4040 0.0000

Colmar Manor - Non Commercial 0.9235 1.6500 0.0000 0.8730 2.1540 0.0000

Colmar Manor - Commercial 0.8636 1.6500 0.0000 0.8730 2.1540 0.0000

Cottage City - Non Commercial 0.5409 0.0000 0.0000 0.9060 2.2420 0.0000

Cottage City - Commercial 0.7431 0.0000 0.0000 0.9060 2.2420 0.0000

District Heights 0.7333 1.5000 2.0000 0.8590 2.1150 0.0000

Edmonston 0.5264 1.5000 0.0000 0.8970 2.2190 0.0000

Fairmount Heights 0.4300 0.0000 0.0000 0.9190 2.2790 0.0000

Glenarden 0.3481 0.8800 0.0000

0.8880 2.1950 0.0000

Hyattsville 0.6300 1.1500 0.0000 0.8430 2.0710 0.0000

Landover Hills 0.5200 1.2500 0.0000 0.9130 2.2650 0.0000

Laurel 0.7100 0.0000 0.0000 0.8150 1.9950 0.0000

Mount Rainier 0.7900 0.9900 2.7500 0.8550 2.1040 0.0000

Mount Rainier - Apartments 0.8600 0.9900 2.7500 0.8550 2.1040 0.0000

North Brentwwod - Non Commercial 0.4400 0.0150 0.0200 0.9960 2.4900 0.0000

Revised 4/14/22 Page 6 of 7

County

and

Municipality Real Personal Utility Real Personal Utility

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

North Brentwwod - Commercial 0.5857 0.0150 0.0200 0.9960 2.4900 0.0000

Riverdale Park 0.6540 2.0000 2.0000 0.8700 2.1480 0.0000

Seat Pleasant 0.5800 15.0000 0.0000 0.8740 2.1570 0.0000

University Park 0.5386 2.2500 0.0000 0.8600 2.1170 0.0000

Upper Marlboro - Non Commercial 0.3000 0.5000 1.5000 0.9440 2.3490 0.0000

Upper Marlboro - Commercial 0.5400 0.5000 1.5000 0.9440 2.3490 0.0000

Morningside 0.7800 2.0000 0.0000 0.9160 2.2720 0.0000

Forest Heights - Non Commercial 0.5076 1.7500 0.0000 0.8900 2.1980 0.0000

Forest Heights - Commercial 0.5878 1.7500 0.0000 0.8900 2.1980 0.0000

Queen Anne's County 0.8471 0.0000 2.1180

Sudlersville 0.1670 0.4700 0.0000 0.8471 0.0000 2.1180

Church Hill 0.3400 0.8500 0.8500 0.8471 0.0000 2.1180

Centreville 0.5350 0.0000 13.0000 0.7171 0.0000 2.1180

Queenstown 0.2026 0.5100 0.0000 0.8471 0.0000 2.1180

Queen Anne 0.1800 0.4500 0.0000 0.8471 0.0000 2.1180

Templeville 0.3600 0.7200 0.7200 0.8471 0.0000 2.1180

Barclay 0.2000 0.2000 0.2000 0.8471 0.0000 2.1180

Millington 0.2909 0.7000 0.0000 0.7621 0.0000 2.1180

St. Mary's County 0.8478 2.1195 2.1195

Leonardtown 0.1266 0.0000 0.3165 0.8478 2.1195 2.1195

Somerset County 1.0000 2.5000 2.5000

Crisfield 0.8700 1.7500 1.7500 1.0000 2.5000 2.5000

Princess Anne 1.0300 2.2500 2.2500 1.0000 2.5000 2.5000

Talbot County 0.6565 0.0000 1.6413

Easton 0.5200 1.3000 1.3000 0.5235 0.0000 1.3088

St. Michaels 0.4900 0.0000 1.6000 0.5295 0.0000 1.3238

Trappe 0.3300 0.5400 0.5400 0.5585 0.0000 1.3963

Oxford 0.3187 0.0000 0.0000 0.5385 0.0000 1.3463

Queen Anne 0.1800 0.4500 0.4500 0.5964 0.0000 1.4910

Washington County 0.9480 2.3700 2.3700

Sharpsburg 0.3500 0.8750 0.8750 0.8230 2.3700 2.3700

Revised 4/14/22 Page 7 of 7

County

and

Municipality Real Personal Utility Real Personal Utility

2021-2022 COUNTY & MUNICIPALITY TAX RATES

Municipal/Special Taxing

County

District Tax Rate

Tax Rate

Williamsport 0.4850 0.0121 0.0121 0.8230 2.3700 2.3700

Hagerstown 1.0020 2.5050 0.2800 0.8230 2.3700 2.3700

Hagerstown - Apartments 1.0320 0.0000 0.0000 0.8230 2.3700 2.3700

Clear Spring 0.3200 0.7000 0.7000 0.8230 2.3700 2.3700

Hancock 0.5200 0.9500 0.9500 0.8230 2.3700 2.3700

Boonsboro 0.3591 0.8700 0.8700 0.8230 2.3700 2.3700

Smithsburg 0.3500 0.8750 0.8750 0.8230 2.3700 2.3700

Funkstown 0.3700 0.8750 0.8750 0.8230 2.3700 2.3700

Keedysville 0.1800 0.4500 0.4500 0.8230 2.3700 2.3700

Wicomico County 0.9195 2.1715 2.1715

Salisbury 0.9832 2.4000 3.5100 0.9195 2.1715 2.1715

Mardela Springs 0.2300 0.5000 0.5000 0.9195 2.1715 2.1715

Pittsville 0.2800 0.9000 0.9000 0.9195 2.1715 2.1715

Sharptown 0.6000 1.5500 1.5500 0.9195 2.1715 2.1715

Delmar 0.6622 2.5000 3.0000 0.9195 2.1715 2.1715

Willards 0.5100 1.1500 1.1500 0.9195 2.1715 2.1715

Hebron 0.4450 1.0000 1.0000 0.9195 2.1715 2.1715

Fruitland 0.9200 1.9200 1.9200 0.9195 2.1715 2.1715

Worcester 0.8450 2.1125 2.1125

Pocomoke City N 1.1311 2.0000 2.4000 0.8450 2.1125 2.1125

Pocomoke City H 0.9375 0.0000 0.0000 0.8450 2.1125 2.1125

Snow Hill 0.8600 1.8200 0.0000 0.8450 2.1125 2.1125

Berlin 0.8150 1.7000 0.0000 0.8450 2.1125 2.1125

Ocean City 0.4561 1.1400 0.0000 0.8450 2.1125 2.1125

MARYLAND STATE TAX RATE 0.112 0.280

There is no Personal Property Tax Rate for State of Maryland

The Department of Assessments and Taxation does its best to ensure that this

document is complete and accurate, but this information is compiled and made

available to the public as a courtesy. Please contact the local governments for

verification before using any information in this document.

Real Property

Utility Tax Rate