CAYMAN NATIONAL CORPORATION LTD.

FOR THE YEAR ENDED

SEPTEMBER 30, 2023

CONSOLIDATED FINANCIAL STATEMENTS

CAYMAN NATIONAL CORPORATION LTD.

CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED SEPTEMBER 30, 2023

C O N T E N T S

Page

3-9

10

-

11

12

13

Consolidated Statement of Changes in Equity 14

Consolidated Statement of Cash Flows 15-16

Notes to the Consolidated Financial Statements

1. Corporate information

2. Significant accounting policies 17-57

2.1 - Basis of preparation

2.2 - Basis of consolidation

2.3 - Changes in accounting policies

2.4 - Standards in issue not yet effective

2.5 - Improvements to International Financial Reporting Standards

2.6 - Summary of significant accounting policies

a) Cash and cash equivalents

b) Due from banks

c) Financial instruments - initial recognition

d) Financial assets and liabilities

e) Investment properties at fair value

f) Reclassification of financial assets and liabilities

g) Derecognition of financial assets and liabilities

h) Impairment of financial assets

i) Collateral valuation

j) Collateral repossessed

k) Write-offs

l) Accounts receivable and other assets

m) Leases

n) Premises and equipment

o) Impairment on non-financial assets

p) Business combinations and goodwill

q) Employee benefits

r) Taxation

s) Fiduciary assets

t) Earnings per share

u) Foreign currency translation

Independent Auditor's Report

Consolidated Statement of Financial Position

Consolidated Statement of Income

Consolidated Statement of Comprehensive Income

1

7

CAYMAN NATIONAL CORPORATION LTD.

CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED SEPTEMBER 30, 2023

C O N T E N T S (Continued)

Page

2. Significant accounting policies (continued)

v) Intangible assets

w) Revenue recognition

x) Fair value

y) Segment reporting

z) Customers’ liabilities under acceptances, guarantees and letters of credit

aa) Equity reserves

3. Significant accounting judgements, estimates and assumptions 58-60

4. Due from banks 61

5. Advances 61-63

6. Investment securities 64-65

7. Investment property 66

8. Premises and equipment 66-67

9. Right-of-use assets and Lease liabilities 68-69

10. Intangible assets 69

11. Other assets

70

12. Customers’ current, savings and deposit accounts 70

13. Other liabilities 70

14. Stated capital and share premium 71

15. Other reserves 72

16. Operating profit 73-75

17. Credit recovery/loss expense on financial assets 75

18. Taxation expense 75

19. Risk management 76-98

20. Related parties

9

8-100

21. Capital management

100

-101

22. Fair value 102-105

23. Segmental information 106-109

24. Maturity analysis of assets and liabilities 110-111

25. Dividends paid and proposed 112

26. Contingent liabilities 112

27. Structured entities 113

28. Discontinued operations 113-114

29. Subsidiary companies 115

30. Business combinations 116-117

31. Events after the reporting period 117

Ernst & Young Ltd.

62 Forum Lane

Camana Bay

P.O. Box 510

Grand Cayman KY1-1106

CAYMAN ISLANDS

Main tel: +1 345 949 8444

Fax: +1 345 949 8529

ey.com

A member firm of Ernst & Young Global Limited

Independent Auditor’s Report

The Board of Directors

Cayman National Corporation Ltd.

Report on the Audit of the Consolidated Financial Statements

Opinion

We have audited the consolidated financial statements of Cayman National Corporation Ltd. and its

subsidiaries (the Group), which comprise the consolidated statement of financial position as at

September 30, 2023, and the consolidated statement of income, consolidated statement of comprehensive

income, consolidated statement of changes in equity and consolidated statement of cash flows for the year

then ended, and notes to the consolidated financial statements, including a summary of significant

accounting policies.

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects,

the financial position of the Group as at September 30, 2023, and its financial performance and its cash

flows for the year then ended in accordance with International Financial Reporting Standards (IFRSs).

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our responsibilities

under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated

financial statements section of our report. We are independent of the Group in accordance with the

International Ethics Standards Board for Accountants’ International Code of Ethics for Professional

Accountants (including International Independence Standards) (IESBA Code) and we have fulfilled our

other ethical responsibilities in accordance with the IESBA Code. We believe that the audit evidence we

have obtained is sufficient and appropriate to provide a basis for our opinion.

Key Audit Matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our

audit of the consolidated financial statements of the current period. These matters were addressed in the

context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon,

and we do not provide a separate opinion on these matters. For each matter below, our description of how

our audit addressed the matter is provided in that context.

3

4

A member firm of Ernst & Young Global Limited

We have fulfilled the responsibilities described in the Auditor’s responsibilities for the audit of the

consolidated financial statements section of our report, including in relation to these matters. Accordingly,

our audit included the performance of procedures designed to respond to our assessment of the risks of

material misstatement of the consolidated financial statements. The results of our audit procedures,

including the procedures performed to address the matters below, provide the basis for our audit opinion

on the accompanying consolidated financial statements.

Key Audit Matter

How our Audit Addressed the Key Audit Matter

Allowance for Expected Credit Losses (ECL)

Refer to Notes 2.6, 5, 6 and 19.2.

IFRS 9: Financial Instruments requires the Group

to record an allowance for Expected Credit Losses

(ECLs) for all advances and other financial assets

not held at fair value through profit and loss

(FVPL), together with loan commitments and

financial guarantee contracts.

Advances (loans) and other financial assets held at

amortised cost comprise 97% of the Group’s total

assets. The provisions for ECLs consists of

financial assets that are individually evaluated for

impairment (stage 3), as well as losses inherent in

the financial assets portfolio that are not

specifically identified (stage 1 and stage 2). The

estimation of ECLs on financial assets is inherently

uncertain and is subject to significant judgment.

Identifying financial assets with significant

deterioration in credit quality may be challenging.

Models used to determine credit impairments are

complex, and certain inputs used are not fully

observable.

We assessed and tested the modelling techniques and

methodologies developed by the Group in order to

estimate ECLs.

We involved our EY valuation specialists to assess

the appropriateness of the models and assumptions

used by the Group.

We understood and evaluated the processes for

identifying significant deteriorations in credit

quality and assessed the reasonableness of

assumptions used to determine whether the Group

appropriately identified impairment events. We

tested the aging of the portfolios as a key input in to

the ECL Model.

We compared the completeness and accuracy of data

from underlying systems to the models used to

determine the ECLs. We considered the

methodologies applied in determining Probabilities

of Default (PDs) and the data used to estimate Loss

Given Defaults (LGDs) and tested the Exposures at

Default (EADs).

5

A member firm of Ernst & Young Global Limited

Key Audit Matter

How our Audit Addressed the Key Audit Matter

Allowance for Expected Credit Losses (ECL) (continued)

Key areas of judgment included:

• the identification of exposures with

significant deterioration in credit quality.

• the assumptions applied, which can be

highly subjective, to reflect current or

future external factors that are not

appropriately captured by the ECL model.

• the assumptions used in the ECL model

such as the financial condition of the

counterparty or valuation of security.

• the interpretation of the requirements to

determine impairment under the

application of IFRS 9, which is reflected in

the Group’s ECL models; and

• the application of assumptions where there

was limited or incomplete data.

These factors, individually and collectively, result

in a higher judgmental risk and thus are considered

a significant matter in the context of the

consolidated financial statements.

For ECLs calculated on an individual basis we tested

the factors underlying the impairment identification

and quantification including forecasts of the amount

and timing of future cash flows, valuation of

assigned collateral and estimates of recovery on

default.

We assessed the disclosure in the consolidated

financial statements considering whether it satisfies

the requirements of IFRS.

6

A member firm of Ernst & Young Global Limited

Key Audit Matter

How our Audit Addressed the Key Audit Matter

Goodwill impairment assessment

Refer to Notes 2.6, and 10

The Group has recorded goodwill of $4.17 million

in its consolidated statement of financial position.

Goodwill impairment assessment is very subjective

as it requires the use of projected financial

information and judgemental assumptions and is

considered a key audit risk.

As required by IAS 36: Impairment of Assets,

management performs an annual impairment

assessment on goodwill.

Management conducted the impairment test using

sensitivity analyses, including a range of growth

rates, interest rates, recovery assumptions, macro-

economic outlooks and discount rates in arriving at

an expected cashflow projection.

The purpose of the impairment review is to test that

goodwill is not carried at an amount greater than its

recoverable amount. The recoverable amount is

compared with the carrying value of the cash-

generating unit (CGU) to determine if the asset is

impaired.

Recoverable amount is defined as the higher of fair

value less costs of disposal (FVLCD) and value in

use (VIU); the underlying concept being that the

CGU should not be carried at more than the amount

it could raise, either from selling it now or from

using it.

We evaluated and tested the Group’s process for

goodwill impairment assessment.

We involved our EY valuation specialists team to

assist us in the review of the key assumptions, cash

flows and discount rate used to assess if they are

reasonable.

We analysed Management’s judgements used in its

assessments, including growth assumptions, by

applying our own sensitivity analyses to account for

market volatility.

We also assessed whether appropriate and complete

disclosures have been included in the consolidated

financial statements consistent with the

requirements of IAS 36.

7

A member firm of Ernst & Young Global Limited

Responsibilities of Management and the Board of Directors for the Consolidated Financial

Statements

Management is responsible for the preparation and fair presentation of the consolidated financial statements

in accordance with IFRSs, and for such internal control as management determines is necessary to enable

the preparation of consolidated financial statements that are free from material misstatement, whether due

to fraud or error.

In preparing the consolidated financial statements, management is responsible for assessing the Group’s

ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using

the going concern basis of accounting unless management either intends to liquidate the Group or to cease

operations, or has no realistic alternative but to do so.

The Board of Directors are responsible for overseeing the Group’s financial reporting process.

Auditor’s Responsibilities for the Audit of the Consolidated Financial Statements

This report is made solely to the Board of Directors, as a body. Our audit work has been undertaken so that

we might state to the Board of Directors those matters we are required to state to them in an auditor’s report

and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility

to anyone other than the Group and the Board of Directors as a body, for our audit work, for this report, or

for the opinions we have formed.

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a

whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report

that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an

audit conducted in accordance with ISAs will always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate,

they could reasonably be expected to influence the economic decisions of users taken on the basis of these

consolidated financial statements.

8

A member firm of Ernst & Young Global Limited

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain professional

skepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the consolidated financial statements,

whether due to fraud or error, design and perform audit procedures responsive to those risks, and

obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk

of not detecting a material misstatement resulting from fraud is higher than for one resulting from

error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the

override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit procedures

that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the

effectiveness of the Group’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting

estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of accounting

and, based on the audit evidence obtained, whether a material uncertainty exists related to events

or conditions that may cast significant doubt on the Group’s ability to continue as a going concern.

If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s

report to the related disclosures in the consolidated financial statements or, if such disclosures are

inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to

the date of our auditor’s report. However, future events or conditions may cause the Group to cease

to continue as a going concern.

• Evaluate the overall presentation, structure and content of the consolidated financial statements,

including the disclosures, and whether the consolidated financial statements represent the

underlying transactions and events in a manner that achieves fair presentation.

• Obtain sufficient appropriate audit evidence regarding the financial information of the entities or

business activities within the Group to express an opinion on the consolidated financial statements.

We are responsible for the direction, supervision and performance of the group audit. We remain

solely responsible for our audit opinion.

We communicate with the Board of Directors regarding, among other matters, the planned scope and timing

of the audit and significant audit findings, including any significant deficiencies in internal control that we

identify during our audit.

9

A member firm of Ernst & Young Global Limited

We also provide the Board of Directors with a statement that we have complied with relevant ethical

requirements regarding independence, and to communicate with them all relationships and other matters

that may reasonably be thought to bear on our independence, and where applicable, related actions taken to

eliminate threats or safeguards applied.

From the matters communicated with the Board of Directors, we determine those matters that were of most

significance in the audit of the consolidated financial statements of the current period and are therefore the

key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes

public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter

should not be communicated in our report because the adverse consequences of doing so would reasonably

be expected to outweigh the public interest benefits of such communication.

The partner in charge of the audit resulting in this independent auditor’s report is Baron Jacob.

Grand Cayman, Cayman Islands

November 14, 2023

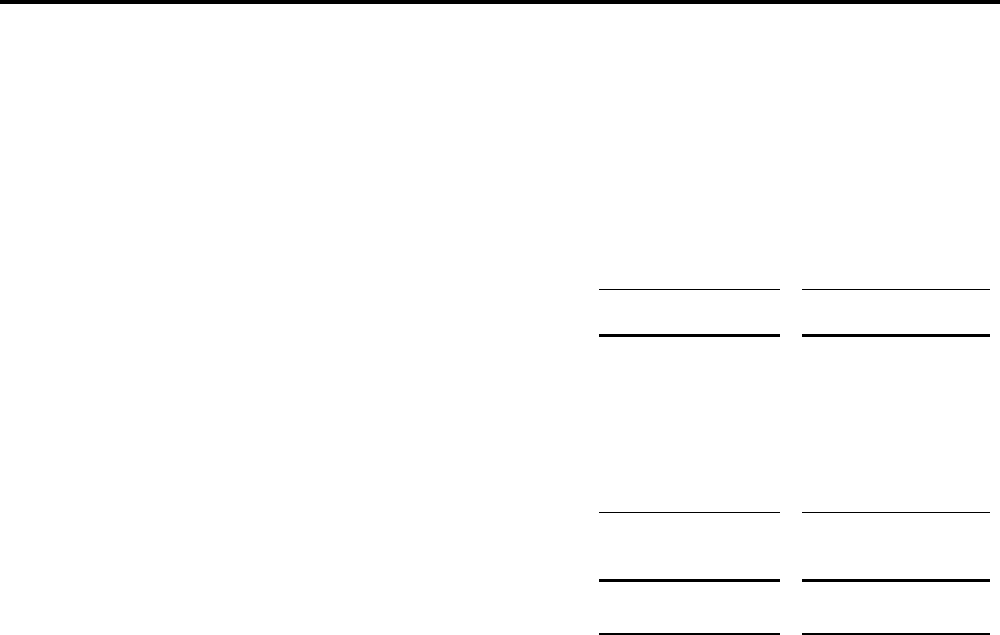

Notes 2023 2022

ASSETS

Cash on hand 11,540 13,600

Due from banks 4 179,096 179,526

Advances 5 934,678 891,387

Investment securities 6 655,963 424,112

Investment interest receivable 5,396 2,443

Investment property 7 98 60

Premises and equipment 8 23,315 21,963

Right-of-use assets 9 (a) 11,554 2,046

Intangible assets 10 4,172 -

Other assets 11 4,833 3,501

TOTAL ASSETS

1,830,645

1,538,638

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

CAYMAN NATIONAL CORPORATION LTD.

AS AT SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000)

The accompanying notes form an integral part of these consolidated financial statements.

Page 10

Notes 2023 2022

LIABILITIES & EQUITY

LIABILITIES

Customers' current, savings and deposit accounts 12 1,582,005 1,349,815

Accrued interest payable 5,955 833

Lease liabilities 9 (b) 11,943 2,143

Other liabilities 13 9,270 10,278

TOTAL LIABILITIES 1,609,173 1,363,069

EQUITY

Stated capital and Share premium 14 47,397 47,397

Other reserves 15 5,209 4,522

Retained earnings 168,866 123,650

TOTAL EQUITY 221,472 175,569

TOTAL LIABILITIES & EQUITY 1,830,645 1,538,638

Janet Hislop, Director

Nigel Wardle,

Director

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT SEPTEMBER 30, 2023

The accompanying notes form an integral part of these consolidated financial statements.

These consolidated financial statements were approved by

the Board of Directors on November 14,

2023 and signed on its behalf by:

Expressed in thousands of Cayman Islands dollars ($’000) (Continued)

CAYMAN NATIONAL CORPORATION LTD.

Page 11

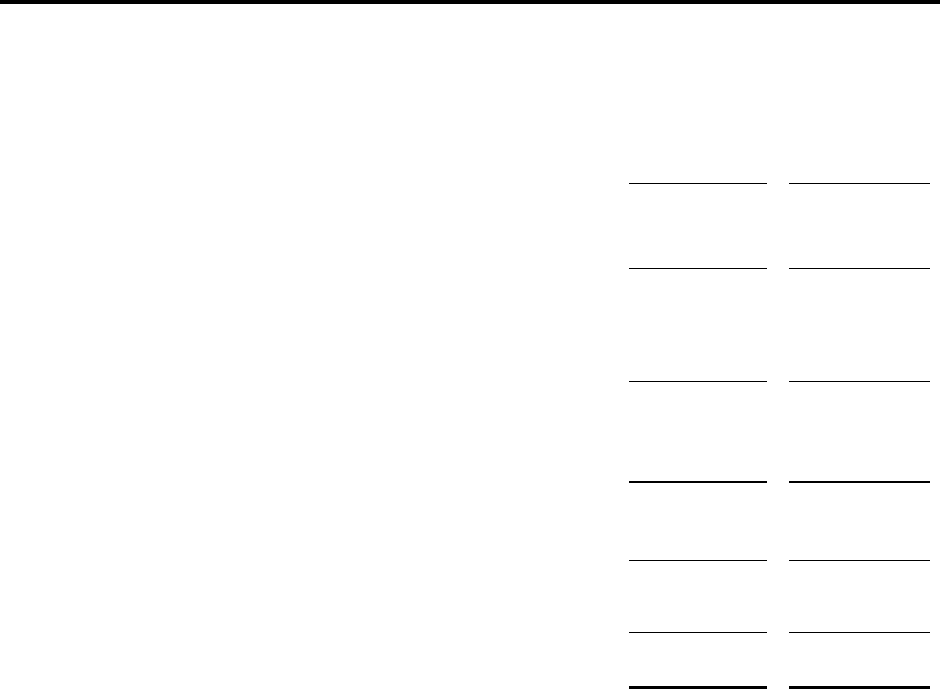

Notes 2023 2022

Interest income 16 (a) 94,633 49,618

Interest expense 16 (b) (14,867) (1,807)

Net interest income 79,766 47,811

Other income 16 (c)

31,307 28,583

111,073 76,394

Operating expenses 16 (d) (59,707) (51,005)

Operating profit

51,366 25,389

Credit loss (expense)/recovery on financial assets 17 (1,110) 14

Net profit before taxation 50,256 25,403

Taxation (expense)/income 18 (136) 1

Net Income from Continuing Operations 50,120 25,404

Net income/(loss) from discontinued operations 28 178 (71)

Net Incom

e

50,298 25,333

Earnings per share (expressed in $ per share)

Basic

$1.19 $0.60

Diluted

$1.18 $0.60

Weighted average number of shares (’000)

Basic 14 42,351 42,351

Diluted 14 42,351 42,351

The accompanying notes form an integral part of these consolidated financial statements.

CAYMAN NATIONAL CORPORATION LTD.

CONSOLIDATED STATEMENT OF INCOME

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($'000) except where otherwise stated

Page 12

2023 2022

Net Income 50,298 25,333

Other comprehensive income:

Change in fair value of available-for-sale financial assets

38 -

38 -

Foreign currency translation differences

649 (1,299)

649 (1,299)

Other comprehensive income for the year, net of tax

687

(1,299)

Total comprehensive income for the year, net of ta

x

50,985 24,034

Other comprehensive income that will not be reclassified to the

consolidated statement of income in subsequent periods:

Total items that will not be reclassified to the consolidated

statement of income in subsequent periods

CAYMAN NATIONAL CORPORATION LTD.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Expressed in thousands of Cayman Islands dollars ($’000)

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Other comprehensive income that will be reclassified to the

consolidated statement of income in subsequent periods:

Total items that will be reclassified to the consolidated statement

of income in subsequent periods

Page 13

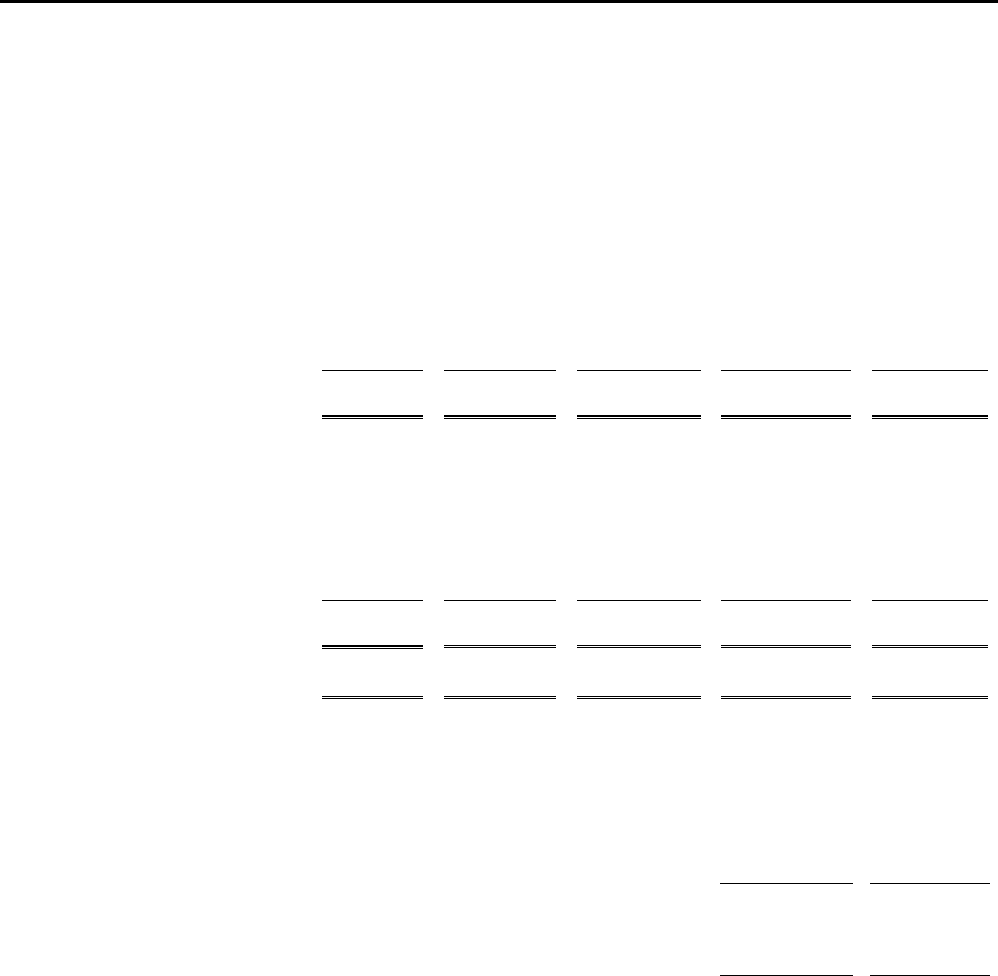

Other

Stated Share reserves Retained Total

capital premium (Note 15) earnings equity

Balance at October 1, 2021

42,351 5,046 5,821 103,399 156,617

Net income for the year

– – – 25,333 25,333

Other comprehensive income

–

– (1,299) – (1,299)

Total comprehensive income for the year

–

– (1,299) 25,333 24,034

Dividends (Note 25)

– – – (5,082) (5,082)

Othe

r

– – – – –

Balance at September 30, 2022

42,351

5,046 4,522 123,650 175,569

Balance at October 1, 2022

42,351 5,046 4,522 123,650 175,569

Net income for the year

– – – 50,298 50,298

Other comprehensive income

–

– 687 – 687

Total comprehensive income for the year

–

– 687 50,298 50,985

Dividends (Note 25)

–

– – (5,082) (5,082)

Balance at September 30, 2023 42,351

5,046 5,209 168,866 221,472

The accompanying notes form an integral part of these consolidated financial statements.

CAYMAN NATIONAL CORPORATION LTD.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000)

Page 14

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Notes 2023 2022

Operating activities

Net Income 50,298 25,333

Adjustments for:

Depreciation of premises and equipment and right-of-use assets 8 & 9 (a) 4,853 4,926

Credit loss expense/(recovery) on financial assets 17 1,110 (14)

Amortization (discount) / premium (2,311) 365

Translation difference (1,999) 1,434

Loss on sale of premises and equipment 795 274

Gain on remeasurement of right-of-use assets and lease liabilities (1)

(196)

Realised (gain)/loss on investment securities (64) 13

Increase in advances (44,305) (66,836)

Increase/(Decrease) in customers’ deposits 232,190 (33,174)

(Increase)/Decrease in other assets and investment interest receivable (4,373) 488

Increase/(Decrease) in other liabilities and accrued interest payable 4,114 (981)

Taxes paid, net of refund 88

1

Cash provided by / (used in) operating activities

240,395

(68,367)

Investin

g

activities

Purchase of investment securities (663,891) (743,434)

Proceeds from investment securities 436,969 760,378

Acquired goodwill (4,172) –

Additions to premises and equipment

8 (5,658) (3,645)

Proceeds from sale of premises and equipment 34

–

Cash (used in) / provided by investing activities

(236,718)

13,299

CAYMAN NATIONAL CORPORATION LTD.

The accompanying notes form an integral part of these consolidated financial statements.

Expressed in thousands of Cayman Islands dollars ($’000)

Page 15

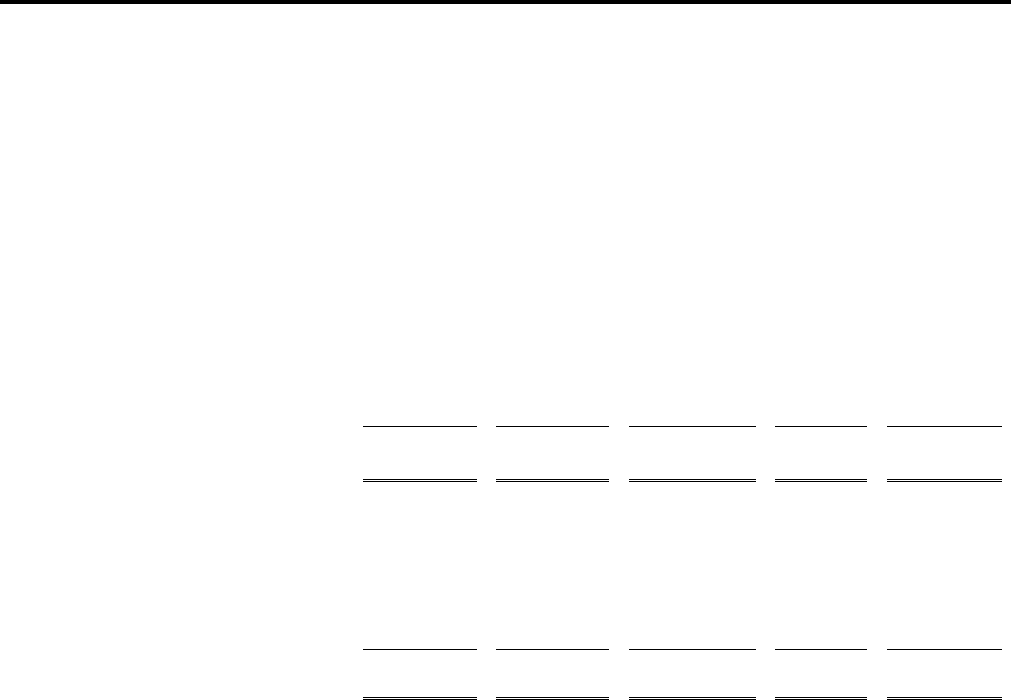

CAYMAN NATIONAL CORPORATION LTD.

Notes 2023 2022

Financing activities

Repayment of principal portion of lease liabilities 9 (b) (1,085) (1,752)

Dividends paid to shareholders 25 (5,082)

(5,082)

Cash used in financing activities

(6,167)

(6,834)

Net decrease in cash and cash equivalents

(2,490) (61,902)

Net forei

g

n exchan

g

e difference

–

(38)

Cash and cash equivalents at beginning of year

193,126

255,066

Cash and cash equivalents at end of year

190,636

193,126

Cash and cash equivalents at end of year are

represented by:

Cash on hand 11,540 13,600

Due from banks 4 179,096

179,526

190,636

193,126

Supplemental information:

Interest received during the year 88,649 48,949

Interest paid during the year 9,745 1,161

Dividends received 5

8

T

he accompanying notes form an integral part of these consolidated financial statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000)

Page 16

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except

where otherwise stated (Continued)

1.

Corporate information

2. Significant accounting policies

The Corporation is a holding company for the companies referred to in Note 29 (collectively, the "Group"),

all of which are incorporated in the Cayman Islands except where otherwise indicated. Through these

companies the Corporation conducts full service banking, company and trust management, mutual fund

administration, and stock brokering in the Cayman Islands and t

he Isle of Man.

Cayman

National Corporation Ltd (the "Corporation" or "CNC") was incorporated on October 4, 1976 and

operates subject to the provisions of the Companies Act of the Cayman Islands. The Company is partially

owned (74.99%) by the Republic Bank Trinidad and Tobago (Barbados) Limited (“RBTTBL”), no other

single owner exceeds 5%. The principal place of business for the Corporation is 200 Elgin Avenue, George

Town, Grand Cayman, Cayman Islands.

The Corporation is not liable for taxation in the Cayman Islands as there are currently no income, profits or

capital gains taxes in the Cayman Islands. Only two (2022: two) of the Corporation's subsidiaries are liable

for taxation which are those in the Isle of Man and which is reflected in these consolidated financial

statements.

The principal accounting policies applied in the preparation of these consolidated financial statements are set

out below. These policies have been consistently applied across the Group.

These financial statements provide information on the accounting estimates and judgements made by the

Group. These estimates and judgements are reviewed on an ongoing bases. Given the continued impact of

global economic uncertainty exacerbated by high inflation and rising interest rates, the Group has maintained

its estimation uncertainty in the preparation of these consolidated financial statements. The estimation

uncertainty is associated with the extent and duration of the expected economic downturn in the economy in

which we operate. This includes forecasts for economic growth,

unemployment, interest rates and inflation.

The

Group has formed estimates based on information available on September 30, 2023, which was deemed

to be reasonable in forming these estimates. The actual economic conditions may be different from estimates

used and this may result in differences between the accounting estimates applied and the actual results of the

Group for the future periods.

The shares of the Corporation are listed and its shares trade on the Cayman Islands Stock Exchange.

Page 17

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except

where otherwise stated (Continued)

2. Significant accounting policies (continued)

2.1

2.2 Basis of consolidation

• The contractual arrangement with the other vote holders of the investee

• Rights arising from other contractual arrangements

• The Group’s voting rights and potential voting rights

Basis of preparation

The consolidated financial statements of the Group are prepared in accordance with International

Financial Reporting Standards (IFRS), and are stated in Cayman Islands dollars. These consolidated

financial statements have been prepared on a historical cost basis, except for financial instruments

measured at fair value through profit or loss. The preparation of consolidated financial statements in

conformity with IFRS requires management to make estimates and assumptions. The financial

statements are prepared on an accrual basis. Actual results could differ from those estimates.

Significant accounting judgements and estimates in applying the Group’s accounting policies have

been described in Note 3.

All intercompany balances and transactions, including unrealized profits arising from intra-group

transactions have been eliminated in full. Unrealized losses are eliminated unless costs cannot be

recovered.

When the Group has less than a majority of the voting or similar rights of an investee, the Group

considers all relevant facts and circumstances in assessing whether it has power over an investee,

including:

Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are

de-consolidated from the date that control ceases and any resultant gain or loss is recognized in the

consolidated statement of income. Any investment retained is recognized at fair value.

A change in the ownership interest of a subsidiary, without a loss of control, is accounted for as an

equity transaction.

The Group re-assesses whether or not it controls an investee if facts and circumstances indicate that

there are changes to one or more of the three elements of control.

The financial statements have been prepared on the basis that the company is able to continue as a

going concern, including to meet its obligations in the ordinary course of business.

The consolidated financial statements comprise the financial statements of Cayman National

Corporation Limited and its subsidiaries as at September 30, each year. The financial statements of

subsidiaries are prepared for the same reporting year as the parent company using consistent

accounting policies.

Subsidiaries are all entities over which the Group has the power to direct the relevant activities, have

exposure or rights to the variable returns and the ability to use its power to affect the returns of the

investee, generally accompanying a shareholding of more than 50% of the voting rights.

Page 18

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except

where otherwise stated (Continued)

2. Significant accounting policies (continued)

2.3 Changes in accounting policies

New accounting policies/improvements adopted

The accounting policies adopted in the preparation of the consolidated financial statements are

consistent with those followed in the preparation of the Group’s annual financial statements for the

year ended September 30, 2022, except for the adoption of new standards and interpretations below.

The amendments must be applied prospectively. Earlier application is permitted if, at the same time or

earlier, an entity also applies all of the amendments contained in the Amendments to References to the

Conceptual Framework in IFRS Standards (March 2018).

The amendments are intended to update a reference to the Conceptual Framework without significantly

changing requirements of IFRS 3. The amendments will promote consistency in financial reporting and

avoid potential confusion from having more than one version of the Conceptual Framework in use.

These amendments had no impact on the consolidated financial statements of the Group.

IFRS 3 Business Combinations - Amendments to IFRS 3 (effective January 1, 2022)

The amendments add an exception to the recognition principle of IFRS 3 to avoid the issue of potential

‘day 2’ gains or losses arising for liabilities and contingent liabilities that would be within the scope of

IAS 37 Provisions, Contingent Liabilities and Contingent Assets or IFRIC 21 Levies, if incurred

separately. The exception requires entities to apply the criteria in IAS 37 or IFRIC 21, respectively,

instead of the Conceptual Framework, to determine whether a present obligation exists at the

ac

q

uisition date.

At the same time, the amendments add a new paragraph to IFRS 3 to clarify that contingent assets do

not qualify for recognition at the acquisition date.

Several amendments and interpretations apply for the first time in 2023, but do not have any impact on

the consolidated financial statements of the Group. These are also described in more detail below. The

Group has not early adopted any standards, interpretations or amendments that have been issued but

are not yet effective.

The amendments are intended to replace a reference to a previous version of the IASB’s Conceptual

Framework (the 1989 Framework) with a reference to the current version issued in March 2018 (the

Conceptual Framework) without significantly changing its requirements.

Page 19

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except

where otherwise stated (Continued)

2. Significant accounting policies (continued)

2.3 Changes in accounting policies (continued)

IAS 16 Property, Plant and Equipment - Amendments to IAS 16 (effective January 1, 2022)

The amendment prohibits entities from deducting from the cost of an item of property, plant and

equipment (PP&E), any proceeds of the sale of items produced while bringing that asset to the location

and condition necessary for it to be capable of operating in the manner intended by management.

Instead, an entity recognizes the proceeds from selling such items, and the costs of producing those

items, in profit or loss.

The amendment must be applied retrospectively only to items of PP&E made available for use on or

after the beginning of the earliest period presented when the entity first applies the amendment.

IAS 37 Provisions, Contingent Liabilities and Contingent Assets - Amendments to IAS 37 (effective

January 1, 2022)

The amendments apply a ‘directly related cost approach’. The costs that relate directly to a contract to

provide goods or services include both incremental costs (e.g., the costs of direct labour and materials)

and an allocation of costs directly related to contract activities (e.g., depreciation of equipment used to

fulfil the contract as well as costs of contract management and supervision). General and

administrative costs do not relate directly to a contract and are excluded unless they are explicitly

chargeable to the counterparty under the contract.

The amendments must be applied prospectively to contracts for which an entity has not yet fulfilled all

of its obligations at the beginning of the annual reporting period in which it first applies the

amendments (the date of initial application). Earlier application is permitted and must be disclosed.

The amendments are intended to provide clarity and help ensure consistent application of the standard.

Entities that previously applied the incremental cost approach will see provisions increase to reflect the

inclusion of costs related directly to contract activities, whilst entities that previously recognized

contract loss provisions using the guidance from the former standard, IAS 11 Construction Contracts,

will be required to exclude the allocation of indirect overheads from their provisions. Judgement will

be required in determining which costs are 'directly related to contract activities', but we believe that

guidance in IFRS 15 Revenue from Contracts with Customers will be relevant.

These amendments had no impact on the consolidated financial statements of the Group.

Page 20

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except

where otherwise stated (Continued)

2. Significant accounting policies (continued)

2.3 Changes in accounting policies (continued)

Improvements to International Financial Reporting Standards

IFRS Subject of Amendment

IFRS 1 -

IFRS 9 -

IAS 41 -

The annual improvements process of the International Accounting Standards Board deals with non-

urgent but necessary clarifications and amendments to IFRS. The following amendments are applicable

to annual periods beginning on or after January 1, 2022:

First-time Adoption of International Financial Reporting Standards – Subsidiary as a first-

time adopter (effective January 1, 2022)

Financial Instruments – Fees in the '10 per cent' test for derecognition of financial liabilities

(effective January 1, 2022)

Agriculture – Taxation in fair value measurements (effective January 1, 2022)

Page 21

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.4 Standards in issue not yet effective

The following is a list of standards and interpretations that are not yet effective up to the date of

issuance of the Group's consolidated financial statements. These standards and interpretations will

be applicable to the Group at a future date and will be adopted when they become effective. The

Group is currently assessing the impact of adopting these standards and interpretations.

The amended standard clarifies that the effects on an accounting estimate of a change in an input

or a change in a measurement technique are changes in accounting estimates if they do not result

from the correction of prior period errors. The previous definition of a change in accounting

estimate specified that changes in accounting estimates may result from new information or new

developments. Therefore, such changes are not corrections of errors. This aspect of the definition

was retained by the IASB.

The amendments are intended to provide preparers of financial statements with greater clarity as to

the definition of accounting estimates, particularly in terms of the difference between accounting

estimates and accounting policies. Although the amendments are not expected to have a material

impact on entities’ financial statements, they should provide helpful guidance for entities in

determining whether changes are to be treated as changes in estimates, changes in policies, or

errors.

The amendments clarify that where payments that settle a liability are deductible for tax purposes,

it is a matter of judgement (having considered the applicable tax law) whether such deductions are

attributable for tax purposes to the liability recognized in the financial statements (and interest

expense) or to the related asset component (and interest expense). This judgement is important in

determining whether any temporary differences exist on initial recognition of the asset and

liability.

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors - Amendments to IAS

8 (effective January 1, 2023)

The amendments clarify the distinction between changes in accounting estimates and changes in

accounting policies and the correction of errors. Also, they clarify how entities use measurement

techniques and inputs to develop accounting estimates.

IAS 12 Income Taxes - Amendments to IAS 12 - Deferred Tax related to Assets and Liabilities

arising from a Single Transaction (effective January 1, 2023)

The amendments to IAS 12, which narrow the scope of the initial recognition exception under IAS

12, so that it no longer applies to transactions that give rise to equal taxable and deductible

temporary differences.

Page 22

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.4 Standards in issue not yet effective (continued)

Under the amendments, the initial recognition exception does not apply to transactions that, on

initial recognition, give rise to equal taxable and deductible temporary differences. It only applies

if the recognition of a lease asset and lease liability (or decommissioning liability and

decommissioning asset component) give rise to taxable and deductible temporary differences that

are not e

q

ual.

IAS 12 Income Taxes - Amendments to IAS 12 - Deferred Tax related to Assets and Liabilities

arising from a Single Transaction (effective January 1, 2023) (continued)

Nevertheless, it is possible that the resulting deferred tax assets and liabilities are not equal (e.g., if

the entity is unable to benefit from the tax deductions or if different tax rates apply to the taxable

and deductible temporary differences). In such cases, which the Board expects to occur

infrequently, an entity would need to account for the difference between the deferred tax asset and

liability in profit or loss.

An entity should apply the amendments to transactions that occur on or after the beginning of the

earliest comparative period presented. In addition, at the beginning of the earliest comparative

period presented, it should also recognize a deferred tax asset (provided that sufficient taxable

profit is available) and a deferred tax liability for all deductible and taxable temporary differences

associated with leases and decommissioning obligations.

IAS 12 Income Taxes - Amendments to IAS 12 - International Tax Reform – Pillar Two Model

Rules (effective January 1, 2023)

The amendments to IAS 12, introduce a mandatory exception in IAS 12 from recognizing and

disclosing deferred tax assets and liabilities related to Pillar Two income taxes.

The amendments clarify that IAS 12 applies to income taxes arising from tax law enacted or

substantively enacted to implement the Pillar Two Model Rules published by the Organization for

Economic Cooperation and Development (OECD), including tax law that implements qualified

domestic minimum top-up taxes. Such tax legislation, and the income taxes arising from it, are

referred to as ‘Pillar Two legislation’ and ‘Pillar Two income taxes’, respectively.

The amendments require an entity to disclose that it has applied the exception to recognizing and

disclosing information about deferred tax assets and liabilities related to Pillar Two income taxes.

An entity is required to separately disclose its current tax expense (income) related to Pillar Two

income taxes, in the periods when the legislation is effective.

Page 23

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.4 Standards in issue not yet effective (continued)

•

•

IAS 12 Income Taxes - Amendments to IAS 12 - International Tax Reform – Pillar Two Model

Rules (effective January 1, 2023) (continued)

The temporary exception from recognition and disclosure of information about deferred taxes and

the requirement to disclose the application of the exception, apply immediately and retrospectively

upon issue of the amendments.

The amendments require, for periods in which Pillar Two legislation is (substantively) enacted but

not yet effective, disclosure of known or reasonably estimable information that helps users of

financial statements understand the entity’s exposure arising from Pillar Two income taxes. To

comply with these requirements, an entity is required to disclose qualitative and quantitative

information about its exposure to Pillar Two income taxes at the end of the reporting period.

The disclosure of the current tax expense related to Pillar Two income taxes and the disclosures in

relation to periods before the legislation is effective are required for annual reporting periods

beginning on or after 1 January 2023, but are not required for any interim period ending on or

before 31 December 2023.

IAS 1 Presentation of Financial Statements and IFRS Practice Statement 2 - Amendments to

IAS 1 - Disclosure of Accounting Policies (effective January 1, 2023)

The IASB issued amendments to provide guidance and examples to help entities apply materiality

judgements to accounting policy disclosures..

The amendments aim to help entities provide accounting policy disclosures that are more useful

by:

The amendments provide guidance and examples to help entities apply materiality judgements to

accounting policy disclosures. The amendments aim to help entities provide accounting policy

disclosures that are more useful by replacing the requirement for entities to disclose their

‘significant’ accounting policies with a requirement to disclose their ‘material’ accounting policies

and adding guidance on how entities apply the concept of materiality in making decisions about

accounting policy disclosures.

Replacing the requirement for entities to disclose their ‘significant’ accounting policies with

a requirement to disclose their ‘material’ accounting policies

Adding guidance on how entities apply the concept of materiality in making decisions about

accounting policy disclosures

Page 24

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.4 Standards in issue not yet effective (continued)

•

•

•

• That only if an embedded derivative in a convertible liability is itself an equity instrument,

would the terms of a liability not impact its classification

IAS 1 Presentation of Financial Statements and IFRS Practice Statement 2 - Amendments to

IAS 1 - Classification of Liabilities as Current or Non-current (effective January 1, 2024)

The amendments clarify:

The IASB issued amendments to paragraphs 69 to 76 of IAS 1 Presentation of Financial

Statements to specify the requirements for classifying liabilities as current or non-current.

What is meant by a right to defer settlement

That a right to defer must exist at the end of the reporting period

That classification is unaffected by the likelihood that an entity will exercise its deferral right

A seller-lessee applies the amendment to annual reporting periods beginning on or after 1 January

2024. Earlier application is permitted and that fact must be disclosed.

IFRS 16 Leases - Amendments to IFRS 16 (effective January 1, 2024)

The amendment specifies the requirements that a seller-lessee uses in measuring the lease liability

arising in a sale and leaseback transaction, to ensure the seller-lessee does not recognize any

amount of the gain or loss that relates to the right of use it retains.

After the commencement date in a sale and leaseback transaction, the seller-lessee applies

paragraphs 29 to 35 of IFRS 16 to the right-of-use asset arising from the leaseback and paragraphs

36 to 46 of IFRS 16 to the lease liability arising from the leaseback. In applying paragraphs 36 to

46, the seller-lessee determines ‘lease payments’ or ‘revised lease payments’ in such a way that

the seller-lessee would not recognize any amount of the gain or loss that relates to the right of use

retained by the seller-lessee. Applying these requirements does not prevent the seller-lessee from

recognizing, in profit or loss, any gain or loss relating to the partial or full termination of a lease,

as required by IFRS 16.

The amendment does not prescribe specific measurement requirements for lease liabilities arising

from a leaseback. The initial measurement of the lease liability arising from a leaseback may result

in a seller-lessee determining ‘lease payments’ that are different from the general definition of

lease payments in Appendix A of IFRS 16. The seller-lessee will need to develop and apply an

accounting policy that results in information that is relevant and reliable in accordance with IAS 8.

Page 25

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.4 Standards in issue not yet effective (continued)

2.5 Improvements to International Financial Reporting Standards

2.6 Summary of significant accounting policies

a) Cash and cash equivalents

b) Due from banks

Within due from banks are short term placements with original maturities of three months or less

from date of placement and cash at bank. Placements with original maturities greater than three

months are classified as investment securities.

The annual improvements process of the International Accounting Standards Board deals with non

-

urgent but necessary clarifications and amendments to IFRS. There were no amendments

applicable to annual periods beginning on or after January 1, 2023.

For the purposes of presentation in the consolidated statement of cash flows, cash and cash

equivalents consist of highly liquid investments, cash on hand and at bank. Cash at bank consists

of cash balances maintained at other banks.

A seller-lessee applies the amendment retrospectively in accordance with IAS 8 to sale and

leaseback transactions entered into after the date of initial application (i.e., the amendment does

not apply to sale and leaseback transactions entered into prior to the date of initial application).

The date of initial application is the beginning of the annual reporting period in which an entity

first applied IFRS 16.

IFRS 16 Leases - Amendments to IFRS 16 (effective January 1, 2024) (continued)

Page 26

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

c) Financial instruments - initial recognition

i) Date of recognition

ii) Initial measurement of financial instruments

iii) Measurement categories of financial assets and liabilities

Financial liabilities, other than loan commitments and financial guarantees are measured at

amortized cost.

The Group classifies all of its financial assets based on the business model for managing the assets

and the assets' contractual terms, measured at either:

• Amortized cost, as explained in Note 2.6 d (i)

• FVPL, as explained in Note 2.6 d (ii)

Financial assets and liabilities, with the exception of loans and advances to customers and

balances due to customers, are initially recognized on the trade date, i.e., the date that the Group

becomes a party to the contractual provisions of the instrument. This includes regular way trades:

purchases or sales of financial assets that require delivery of assets within the time frame generally

established by regulation or convention in the market place. Loans and advances to customers are

recognized when funds are transferred to the customers’ accounts. The Group recognizes balances

due to customers when funds are transferred to the Group.

The classification of financial instruments at initial recognition depends on their contractual terms

and the business model for managing the instruments, as described in Note 2.6e. Financial

instruments are initially measured at their fair value, except in the case of financial assets recorded

at Fair Value through the Profit or Loss (FVPL), transaction costs are added to, or subtracted from,

this amount.

Page 27

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

d) Financial assets and liabilities

i)

•

•

The most significant elements of interest within a lending arrangement are typically the

consideration for the time value of money and credit risk. To make the SPPI assessment, the

Group applies judgement and considers relevant factors such as the currency in which the

financial asset is denominated, and the period for which the interest rate is set.

In contrast, contractual terms that introduce a more than de minimis exposure to risks or

volatility in the contractual cash flows that are unrelated to a basic lending arrangement do

not give rise to contractual cash flows that are solely payments of principal and interest on

the amount outstanding. In such cases, the financial asset is required to be measured at

FVPL or Fair Value through Other Comprehensive Income (FVOCI) without recycling.

‘Principal’ for the purpose of this test is defined as the fair value of the financial asset at

initial recognition and may change over the life of the financial asset (for example, if there

are repayments of principal or amortization of the premium / discount).

The SPPI test

The contractual terms of the financial asset give rise on specified dates to cash flows

that are solely payments of principal and interest (SPPI) on the principal amount

outstanding and

The details of these conditions are outlined below.

The Group only measures Due from banks, Advances to customers and Investment securities

at amortized cost if both of the following conditions are met:

The financial asset is held within a business model with the objective to hold financial

assets in order to collect contractual cash flows.

For the first step of its classification process, the Group assesses the contractual terms of

financial assets to identify whether they meet the SPPI test.

Due from banks, Advances and Investment securities

Page 28

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

d) Financial assets and liabilities (continued)

i)

•

•

•

The Group determines its business model at the level that best reflects how it manages

groups of financial assets to achieve its business objective.

Business model assessment

The Group's business model is not assessed on an instrument-by-instrument basis, but at a

higher level of aggregated portfolios and is based on observable factors such as:

The risks that affect the performance of the business model (and the financial assets

held within that business model) and, in particular, the way those risks are managed.

The business model assessment is based on reasonably expected scenarios without taking

'worst case' or 'stress case' scenarios into account. If cash flows after initial recognition are

realized in a way that is different from the Group's original expectations, the Group does not

change the classification of the remaining financial assets held in that business model, but

incorporates such information when assessing newly originated or newly purchased financial

assets going forward.

Due from banks, Advances and Investment securities (continued)

How the performance of the business model and the financial assets held within that

business model are evaluated and reported to the entity's key management personnel.

The expected frequency, value and timing of sales are also important aspects of the

Group’s assessment.

Page 29

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

d) Financial assets and liabilities (continued)

ii) Financial assets at fair value through profit or loss

iii) Undrawn loan commitments

The designation eliminates, or significantly reduces, the inconsistent treatment that would

otherwise arise from measuring the assets or recognizing gains or losses on them on a

different basis.

Financial assets in this category are those that are designated by management upon initial

recognition or are mandatorily required to be measured at fair value under IFRS 9.

Management only designates an instrument at FVPL upon initial recognition.

Financial assets at FVPL are recorded in the consolidated statement of financial position at

fair value. Interest earned or incurred on instruments designated at FVPL is accrued in

interest income, using the Effective Interest Rate (EIR), taking into account any

discount/premium and qualifying transaction costs being an integral part of the instrument.

Dividend income from equity instruments measured at FVPL is recorded in profit or loss as

other income when the right to the payment has been established.

Undrawn loan commitments and letters of credit are commitments under which, over the

duration of the commitment, the Group is required to provide a loan with pre-specified terms

to the customer. These contracts are in the scope of the expected credit loss (ECL)

requirements but ECL was not determined based on the historical observation of defaults,

since there is not history of default.

The nominal contractual value of undrawn loan commitments are not recorded in the

consolidated statement of financial position. The nominal values of this instrument and the

corresponding ECLs are disclosed in Note 19.2.1 and Note 19.2.4 respectively.

Page 30

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

e) Investment properties at fair value

Investment properties are measured initially at cost, including related transaction costs. The

carrying amount includes the cost of replacing parts of an existing investment property provided

the recognition criteria are met and excludes the costs of the servicing an investment property.

Subsequently, investment properties are carried at fair value, which reflects market conditions as

of the date of the consolidated statement of financial position. Gains or losses arising from

changes in fair value of investment properties are included in the consolidated statement of

comprehensive income in the year in which they arise. All repairs and maintenance costs are

charged to the consolidated statement of comprehensive income during the financial period in

which they are incurred.

Investment properties that are not occupied by the Group and are held for long term rental yields

or capital appreciation or both are classified as investment property. Investment property

comprises principally of rental property and land.

Recognition of investment properties takes place only when it is probable that the future economic

benefits that are associated with the investment properties will flow to the Group and the cost can

be reliably measured; generally the date when all risks are transferred. The Group derecognizes the

asset when the Group enters into a revocable sales agreement or has executed a sale of the

property.

Page 31

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

f) Reclassification of financial assets and liabilities

g) Derecognition of financial assets and liabilities

•

•

The Group does not reclassify its financial assets subsequent to their initial recognition, apart from

the exceptional circumstances in which the Group acquires, disposes of, or terminates a business

line. Financial liabilities are never reclassified. The Group did not reclassify any of its financial

assets or liabilities in 2023.

Change in counterparty

The Group derecognizes a financial asset, such as a loan to a customer, to facilitate changes to the

original loan agreement or arrangement due to weaknesses in the borrower’s financial position

and/or non-repayment of the debt as arranged and terms and conditions have been restructured to

the extent that, substantially, it becomes a new loan, with the difference recognized as an

impairment loss. The newly recognized loans are classified as Stage 2 for ECL measurement

purposes.

Derecognition due to substantial modification of terms and conditions

When assessing whether or not to derecognize a loan to a customer, amongst others, the Group

considers the following factors:

Financial assets

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar

financial assets) is derecognized when the rights to receive cash flows from the financial asset

have expired. The Group also derecognizes the financial asset if it has both transferred the

financial asset and the transfer qualifies for derecognition.

If the modification is such that the instrument would no longer meet the SPPI criterion

If the modification does not result in cash flows that are substantially different, the modification

does not result in derecognition. Based on the change in cash flows discounted at the original rate,

the Group records a modification gain or loss, to the extent that an impairment loss has not already

been recorded.

Derecognition other than for substantial modification of terms and conditions

Page 32

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

g) Derecognition of financial assets and liabilities (continued)

•

•

•

•

•

•

•

A transfer only qualifies for derecognition if either:

The Group has no obligation to pay amounts to the eventual recipients unless it has collected

equivalent amounts from the original asset, excluding short-term advances with the right to

full recovery of the amount lent plus accrued interest at market rates

The Group has neither transferred nor retained substantially all the risks and rewards of the

asset, but has transferred control of the asset.

It retains the rights to the cash flows, but has assumed an obligation to pay the received cash

flows in full without material delay to a third party under a ‘pass-through’ arrangement.

Pass-through arrangements are transactions whereby the Group retains the contractual rights to

receive the cash flows of a financial asset (the 'original asset'), but assumes a contractual

obligation to pay those cash flows to one or more entities (the 'eventual recipients'), when all of

the following three conditions are met:

Financial assets (continued)

The Group has transferred its contractual rights to receive cash flows from the financial

asset, or

The Group has transferred substantially all the risks and rewards of the asset, or

The Group has transferred the financial asset if, and only if, either:

The Group has to remit any cash flows it collects on behalf of the eventual recipients

without material delay. In addition, the Group is not entitled to reinvest such cash flows,

except for investments in cash or cash equivalents including interest earned, during the

period between the collection date and the date of required remittance to the eventual

recipients.

Derecognition other than for substantial modification of terms and conditions (continued)

The Group cannot sell or pledge the original asset other than as security to the eventual

recipients

Page 33

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

g) Derecognition of financial assets and liabilities (continued)

A financial liability is derecognized when the obligation under the liability is discharged, cancelled

or expires. Where an existing financial liability is replaced by another from the same lender on

substantially different terms, or the terms of an existing liability are substantially modified, such

an exchange or modification is treated as a derecognition of the original liability and the

recognition of a new liability. The difference between the carrying value of the original financial

liability and the consideration paid is recognized in profit or loss.

Continuing involvement that takes the form of a guarantee over the transferred asset is measured at

the lower of the original carrying amount of the asset and the maximum amount of consideration

the Group could be required to pay.

Financial liabilities

When the Group has neither transferred nor retained substantially all the risks and rewards and has

retained control of the asset, the asset continues to be recognized only to the extent of the Group’s

continuing involvement, in which case, the Group also recognizes an associated liability. The

transferred asset and the associated liability are measured on a basis that reflects the rights and

obligations that the Group has retained.

Financial assets (continued)

Derecognition other than for substantial modification of terms and conditions (continued)

The Group considers control to be transferred if and only if, the transferee has the practical ability

to sell the asset in its entirety to an unrelated third party and is able to exercise that ability

unilaterally and without imposing additional restrictions on the transfer.

Page 34

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

h) Impairment of financial assets

i)

Overview of the ECL principles

Both LTECLs and 12mECLs are calculated on either an individual basis or a collective

basis, depending on the size and nature of the underlying portfolio of financial instruments.

The Group’s policy for grouping financial instruments measured on a collective basis is

explained in Note 19.2.6.

The 12mECL is the portion of LTECLs that represent the ECLs that result from default

events on a financial instrument that are possible within the 12 months after the reporting

date.

Based on the above process, the Group classifies its financial instruments into Stage 1, Stage

2 and Stage 3, as described below:

The ECL allowance is based on the credit losses expected to arise over the life of the asset

(the lifetime expected credit loss or LTECL), unless there has been no significant increase in

credit risk since origination, in which case, the allowance is based on the 12 months’

expected credit loss (12mECL). The Group’s policies for determining if there has been a

significant increase in credit risk are set out in Note 19.2.5.

The Group has established a policy to perform an assessment, at the end of each quarter, of

whether a financial instruments credit risk has increased significantly since initial

recognition, by considering the change in the risk of default occurring over the remaining

life of the financial instrument.

The Group has been recording the allowance for expected credit losses for all loans and

other debt financial assets not held at FVPL, together with loan commitments, letters of

credits and financial guarantee contracts, in this section all referred to as 'financial

instruments'. Equity instruments are not subject to impairment under IFRS 9.

Page 35

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

h) Impairment of financial assets (continued)

i)

Overview of the ECL principles (continued)

Stage 1

Stage 2

Stage 3

Financial assets considered credit-impaired (as outlined in Note 19.2.3). The Group records

an allowance for the LTECLs.

When a financial instrument has shown a significant increase in credit risk since origination,

the Group records an allowance for the LTECLs. Stage 2 financial instruments also include

facilities where the credit risk has improved and the financial asset has been reclassified

from Stage 3.

When financial instruments are first recognized and continue to perform in accordance with

the contractual terms and conditions after initial recognition, the Group recognizes an

allowance based on 12mECLs. Stage 1 financial assets also include facilities where the

credit risk has improved and the financial instrument has been reclassified from Stage 2.

For financial assets for which the Group has no reasonable expectations of recovering either

the entire outstanding amount, or a proportion thereof, the gross carrying amount of the

financial asset is reduced. This is considered a (partial) derecognition of the financial asset.

Page 36

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

h) Impairment of financial assets (continued)

ii) The calculation of ECLs

PD -

EAD -

LGD -

The Exposure at Default is an estimate of the exposure at a future default date, taking into

account expected changes in the exposure after the reporting date, including repayments of

principal and interest, whether scheduled by contract or otherwise, expected drawdowns on

committed facilities, and accrued interest from missed payments.

Each financial instrument is associated with different PDs, EADs and LGDs. When relevant,

it also incorporates how defaulted financial assets are expected to be recovered, including

the value of collateral or the amount that might be received for selling the asset.

The Probability of Default is an estimate of the likelihood of default over a given period of

time. A default may only happen at a certain time over the assessed period, if the facility has

not been previously derecognized and is still in the portfolio. The concept of PDs is further

explained in Note 19.2.4.

The mechanics of the ECL calculations are outlined below and the key elements are as

follows:

The Loss Given Default is an estimate of the loss arising in the case where a default occurs

at a given time. It is based on the difference between the contractual cash flows due and

those that the lender would expect to receive, including from the realization of any collateral.

It is usually expressed as a percentage of the EAD.

In addition to the historical measure of cash shortfalls, a cash shortfall is the difference

between the cash flows that are due to an entity in accordance with the contract and the cash

flows that the entity expects to receive.

The Group discounts expected credit losses using nominal interest rate as an approximation

of effective interest rate considering specific characteristics of the product.

Page 37

CAYMAN NATIONAL CORPORATION LTD.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED SEPTEMBER 30, 2023

Expressed in thousands of Cayman Islands dollars ($’000) except where otherwise state

d

(Continued)

2. Significant accounting policies (continued)

2.6 Summary of significant accounting policies (continued)

h) Impairment of financial assets (continued)

ii)

The calculation of ECLs (continued)

Stage 1

Stage 2

Impairment losses and recoveries are accounted for and disclosed separately.

With the exception of credit cards, overdrafts and other revolving facilities, for which the