United States Department of State

Bureau for International Narcotics and Law

Enforcement Affairs

Money Laundering and

Financial Crimes

Country Database

June 2016

INCSR 2016 Volume II Country Database

i

Table of Contents

Money Laundering/Financial Crimes Countries/Jurisdictions ....................................... 2

Countries and Jurisdictions Table ................................................................................. 3

Comparative Table Key .................................................................................................. 4

Glossary of Terms .......................................................................................................................... 4

Comparative Table ......................................................................................................... 7

All Money Laundering and Financial Crimes Countries/Jurisdictions ................................ 18

Afghanistan ......................................................................................................................................... 18

Albania ................................................................................................................................................ 21

Algeria ................................................................................................................................................. 24

Andorra ................................................................................................................................................ 25

Angola ................................................................................................................................................. 27

Anguilla ................................................................................................................................................ 29

Antigua and Barbuda .......................................................................................................................... 31

Argentina ............................................................................................................................................. 33

Armenia ............................................................................................................................................... 36

Aruba ................................................................................................................................................... 38

Australia .............................................................................................................................................. 40

Austria ................................................................................................................................................. 43

Azerbaijan ........................................................................................................................................... 45

Bahamas ............................................................................................................................................. 47

Bahrain ................................................................................................................................................ 50

Bangladesh ......................................................................................................................................... 51

Barbados ............................................................................................................................................. 53

Belarus ................................................................................................................................................ 55

Belgium ............................................................................................................................................... 58

Belize ................................................................................................................................................... 60

Benin ................................................................................................................................................... 63

Bermuda .............................................................................................................................................. 65

Bolivia .................................................................................................................................................. 67

Bosnia and Herzegovina ..................................................................................................................... 69

Botswana ............................................................................................................................................. 71

Brazil ................................................................................................................................................... 73

British Virgin Islands ............................................................................................................................ 76

Brunei Darussalam .............................................................................................................................. 78

Bulgaria ............................................................................................................................................... 80

Burkina Faso ....................................................................................................................................... 83

Burma .................................................................................................................................................. 85

Burundi ................................................................................................................................................ 89

Cabo Verde ......................................................................................................................................... 91

Cambodia ............................................................................................................................................ 92

Cameroon ............................................................................................................................................ 95

Canada ................................................................................................................................................ 97

Cayman Islands ................................................................................................................................ 100

Central African Republic ................................................................................................................... 102

Chad .................................................................................................................................................. 104

Chile .................................................................................................................................................. 106

China, People’s Republic of .............................................................................................................. 109

Colombia ........................................................................................................................................... 112

Comoros ............................................................................................................................................ 115

Congo, Democratic Republic of the .................................................................................................. 116

INCSR 2016 Volume II Country Database

ii

Congo, Republic of the ...................................................................................................................... 118

Cook Islands...................................................................................................................................... 120

Costa Rica ......................................................................................................................................... 121

Cote d’Ivoire ...................................................................................................................................... 124

Croatia ............................................................................................................................................... 127

Cuba .................................................................................................................................................. 128

Curacao ............................................................................................................................................. 131

Cyprus ............................................................................................................................................... 133

Czech Republic ................................................................................................................................. 138

Denmark ............................................................................................................................................ 141

Djibouti .............................................................................................................................................. 143

Dominica ........................................................................................................................................... 145

Dominican Republic .......................................................................................................................... 147

Ecuador ............................................................................................................................................. 149

Egypt ................................................................................................................................................. 152

El Salvador ........................................................................................................................................ 154

Equatorial Guinea ............................................................................................................................. 156

Eritrea ................................................................................................................................................ 159

Estonia .............................................................................................................................................. 161

Ethiopia ............................................................................................................................................. 163

Fiji ...................................................................................................................................................... 165

Finland ............................................................................................................................................... 166

France ............................................................................................................................................... 168

Gabon ................................................................................................................................................ 171

Gambia .............................................................................................................................................. 173

Georgia .............................................................................................................................................. 175

Germany ............................................................................................................................................ 177

Ghana ................................................................................................................................................ 180

Gibraltar ............................................................................................................................................. 182

Greece ............................................................................................................................................... 184

Grenada ............................................................................................................................................ 186

Guatemala ......................................................................................................................................... 188

Guernsey ........................................................................................................................................... 191

Guinea ............................................................................................................................................... 193

Guinea-Bissau ................................................................................................................................... 196

Guyana .............................................................................................................................................. 199

Haiti ................................................................................................................................................... 201

Holy See (Vatican City) ..................................................................................................................... 203

Honduras ........................................................................................................................................... 205

Hong Kong ........................................................................................................................................ 208

Hungary ............................................................................................................................................. 210

Iceland ............................................................................................................................................... 212

India ................................................................................................................................................... 214

Indonesia ........................................................................................................................................... 217

Iran .................................................................................................................................................... 219

Iraq .................................................................................................................................................... 222

Ireland ............................................................................................................................................... 225

Isle of Man ......................................................................................................................................... 227

Israel .................................................................................................................................................. 229

Italy .................................................................................................................................................... 231

Jamaica ............................................................................................................................................. 234

Japan ................................................................................................................................................. 236

Jersey ................................................................................................................................................ 237

Jordan ............................................................................................................................................... 241

Kazakhstan ........................................................................................................................................ 243

Kenya ................................................................................................................................................ 245

INCSR 2016 Volume II Country Database

iii

Korea, Democratic People’s Republic of .......................................................................................... 249

Korea, Republic of ............................................................................................................................. 251

Kosovo .............................................................................................................................................. 253

Kuwait ................................................................................................................................................ 254

Kyrgyz Republic ................................................................................................................................ 257

Laos ................................................................................................................................................... 259

Latvia ................................................................................................................................................. 261

Lebanon ............................................................................................................................................ 264

Lesotho .............................................................................................................................................. 267

Liberia ................................................................................................................................................ 269

Libya .................................................................................................................................................. 272

Liechtenstein ..................................................................................................................................... 274

Lithuania ............................................................................................................................................ 276

Luxembourg ...................................................................................................................................... 277

Macau ................................................................................................................................................ 280

Macedonia ......................................................................................................................................... 282

Madagascar....................................................................................................................................... 285

Malawi ............................................................................................................................................... 287

Malaysia ............................................................................................................................................ 289

Maldives ............................................................................................................................................ 292

Mali .................................................................................................................................................... 294

Malta .................................................................................................................................................. 297

Marshall Islands ................................................................................................................................ 299

Mauritania .......................................................................................................................................... 301

Mauritius ............................................................................................................................................ 304

Mexico ............................................................................................................................................... 306

Micronesia, Federated States of ....................................................................................................... 308

Moldova ............................................................................................................................................. 310

Monaco .............................................................................................................................................. 312

Mongolia ............................................................................................................................................ 314

Montenegro ....................................................................................................................................... 315

Montserrat ......................................................................................................................................... 320

Morocco ............................................................................................................................................. 322

Mozambique ...................................................................................................................................... 324

Namibia ............................................................................................................................................. 326

Nauru ................................................................................................................................................. 328

Nepal ................................................................................................................................................. 329

Netherlands ....................................................................................................................................... 331

New Zealand ..................................................................................................................................... 333

Nicaragua .......................................................................................................................................... 336

Niger .................................................................................................................................................. 338

Nigeria ............................................................................................................................................... 340

Niue ................................................................................................................................................... 343

Norway .............................................................................................................................................. 345

Oman ................................................................................................................................................. 347

Pakistan ............................................................................................................................................. 349

Palau ................................................................................................................................................. 351

Panama ............................................................................................................................................. 353

Papua New Guinea ........................................................................................................................... 356

Paraguay ........................................................................................................................................... 358

Peru ................................................................................................................................................... 362

Philippines ......................................................................................................................................... 365

Poland ............................................................................................................................................... 368

Portugal ............................................................................................................................................. 370

Qatar ................................................................................................................................................. 372

Romania ............................................................................................................................................ 374

INCSR 2016 Volume II Country Database

iv

Russia ............................................................................................................................................... 376

Rwanda ............................................................................................................................................. 380

Samoa ............................................................................................................................................... 382

San Marino ........................................................................................................................................ 384

Sao Tome & Principe ........................................................................................................................ 385

Saudi Arabia ...................................................................................................................................... 387

Senegal ............................................................................................................................................. 389

Serbia ................................................................................................................................................ 391

Seychelles ......................................................................................................................................... 394

Sierra Leone ...................................................................................................................................... 396

Singapore .......................................................................................................................................... 398

Sint Maarten ...................................................................................................................................... 400

Slovak Republic ................................................................................................................................ 402

Slovenia ............................................................................................................................................. 404

Solomon Islands ................................................................................................................................ 406

Somalia ............................................................................................................................................. 407

South Africa ....................................................................................................................................... 410

South Sudan...................................................................................................................................... 413

Spain ................................................................................................................................................. 415

Sri Lanka ........................................................................................................................................... 418

St. Kitts and Nevis ............................................................................................................................. 420

St. Lucia ............................................................................................................................................ 423

St. Vincent and the Grenadines ........................................................................................................ 425

Sudan ................................................................................................................................................ 427

Suriname ........................................................................................................................................... 429

Swaziland .......................................................................................................................................... 432

Sweden ............................................................................................................................................. 434

Switzerland ........................................................................................................................................ 435

Syria .................................................................................................................................................. 438

Taiwan ............................................................................................................................................... 441

Tajikistan ........................................................................................................................................... 443

Tanzania ............................................................................................................................................ 445

Thailand ............................................................................................................................................. 447

Timor-Leste ....................................................................................................................................... 449

Togo .................................................................................................................................................. 451

Tonga ................................................................................................................................................ 453

Trinidad and Tobago ......................................................................................................................... 455

Tunisia ............................................................................................................................................... 457

Turkey ............................................................................................................................................... 459

Turkmenistan..................................................................................................................................... 462

Turks and Caicos .............................................................................................................................. 464

Uganda .............................................................................................................................................. 466

Ukraine .............................................................................................................................................. 468

United Arab Emirates ........................................................................................................................ 470

United Kingdom ................................................................................................................................. 473

Uruguay ............................................................................................................................................. 475

Uzbekistan ......................................................................................................................................... 479

Vanuatu ............................................................................................................................................. 481

Venezuela ......................................................................................................................................... 483

Vietnam ............................................................................................................................................. 486

West Bank and Gaza ........................................................................................................................ 488

Yemen ............................................................................................................................................... 491

Zambia .............................................................................................................................................. 493

Zimbabwe .......................................................................................................................................... 495

INCSR 2011 Volume II Country Database

1

INCSR 2016 Volume II Country Database

2

Money Laundering/Financial Crimes

Countries/Jurisdictions

Money Laundering and Financial Crimes

3

Countries and Jurisdictions Table

Countries/Jurisdictions of Primary

Concern

Countries/Jurisdictions of

Concern

Other Countries/Jurisdictions

Monitored

Afghanistan

Latvia

Albania

Malaysia

Andorra

Mali

Antigua and Barbuda

Lebanon

Algeria

Marshall Islands

Anguilla

Malta

Argentina

Liechtenstein

Angola

Moldova

Armenia

Mauritania

Australia

Luxembourg

Aruba

Monaco

Bermuda

Mauritius

Austria

Macau

Azerbaijan

Mongolia

Botswana

Micronesia FS

Bahamas

Mexico

Bahrain

Montenegro

Brunei

Montserrat

Belize

Netherlands

Bangladesh

Morocco

Burkina Faso

Mozambique

Bolivia

Nigeria

Barbados

Nicaragua

Burundi

Namibia

Brazil

Pakistan

Belarus

Peru

Cabo Verde

Nauru

British Virgin Islands

Panama

Belgium

Poland

Cameroon

Nepal

Burma

Paraguay

Benin

Portugal

Central African

Republic

New Zealand

Cambodia

Philippines

Bosnia and

Herzegovina

Qatar

Chad

Niger

Canada

Russia

Bulgaria

Romania

Congo, Dem Rep of

Niue

Cayman Islands

Singapore

Chile

Saudi Arabia

Congo, Rep of

Norway

China, People Rep

Sint Maarten

Comoros

Senegal

Croatia

Oman

Colombia

Somalia

Cook Islands

Serbia

Cuba

Palau

Costa Rica

Spain

Cote d’Ivoire

Seychelles

Denmark

Papua New Guinea

Curacao

Switzerland

Czech Republic

Sierra Leone

Dominica

Rwanda

Cyprus

Taiwan

Djibouti

Slovakia

Equatorial Guinea

Samoa

Dominican Republic

Thailand

Ecuador

South Africa

Eritrea

San Marino

France

Turkey

Egypt

St. Kitts and

Nevis

Estonia

Sao Tome & Principe

Germany

Ukraine

El Salvador

St. Lucia

Ethiopia

Slovenia

Greece

United Arab Emirates

Ghana

St. Vincent

Fiji

Solomon Islands

Guatemala

United Kingdom

Gibraltar

Suriname

Finland

South Sudan

Guernsey

United States

Grenada

Syria

Gabon

Sri Lanka

Guinea Bissau

Uruguay

Guyana

Tanzania

Gambia

Sudan

Haiti

Venezuela

Holy See

Trinidad and Tobago

Georgia

Swaziland

Hong Kong

West Bank & Gaza

Honduras

Turks and Caicos

Guinea

Sweden

India

Zimbabwe

Hungary

Vanuatu

Iceland

Tajikistan

Indonesia

Ireland

Vietnam

Kyrgyz Republic

Timor

-Leste

Iran

Jamaica

Yemen

Lesotho

Togo

Iraq

Jordan

Liberia

Tonga

Isle of Man

Kazakhstan

Libya

Tunisia

Israel

Korea, North

Lithuania

Turkmenistan

Italy

Korea, South

Macedonia

Uganda

Japan

Kosovo

Madagascar

Uzbekistan

Jersey

Kuwait

Malawi

Zambia

Kenya

Laos

Maldives

INCSR 2016 Volume II Country Database

4

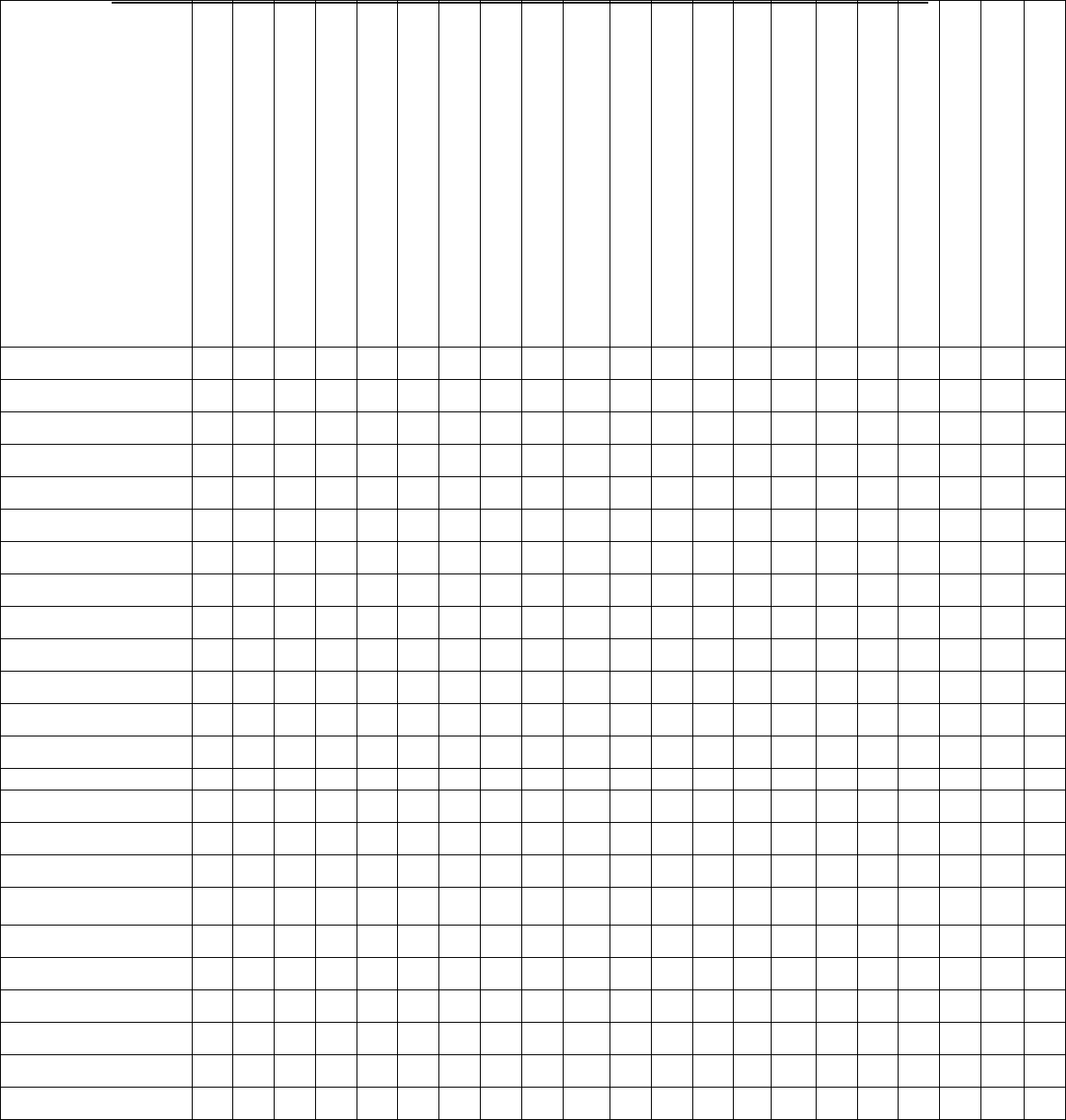

Comparative Table Key

The comparative table that follows the Glossary of Terms below identifies the broad range of

actions, effective as of December 31, 2015, that jurisdictions have, or have not, taken to combat

money laundering. This reference table provides a comparison of elements that include

legislative activity and other identifying characteristics that can have a relationship to a

jurisdiction’s money laundering vulnerability. With the exception of number 5, all items should

be answered “Y” (yes) or “N” (no). “Y” is meant to indicate that legislation has been enacted

to address the captioned items. It does not imply full compliance with international

standards. All answers indicating deficiencies within the country’s/jurisdiction’s AML/CFT

regime should be explained in the “Enforcement and implementation issues and comments”

section of the template, as should any responses that differ from last year’s answers.

Glossary of Terms

• 1. “Criminalized Drug Money Laundering”: The jurisdiction has enacted laws

criminalizing the offense of money laundering related to the drug trade.

• 2. “Criminalized Beyond Drugs”: The jurisdiction has enacted laws criminalizing the

offense of money laundering related to crimes other than those related to the drug trade.

• 3. “Know-Your-Customer Provisions”: By law or regulation, the government requires

banks and/or other covered entities to adopt and implement Know-Your-

Customer/Customer Due Diligence programs for their customers or clientele.

• 4. “Report Large Transactions”: By law or regulation, banks and/or other covered

entities are required to report large transactions in currency or other monetary instruments

to designated authorities. (CTRs)

• 5. “Report Suspicious Transactions”: By law or regulation, banks and/or other covered

entities are required to report suspicious or unusual transactions to designated authorities.

On the Comparative Table the letter “Y” signifies mandatory reporting; “P” signifies

reporting is not required but rather is permissible or optional; “N” signifies no reporting

regime. (STRs)

• 6. “Maintain Records over Time”: By law or regulation, banks and/or other covered

entities are required to keep records, especially of large or unusual transactions, for a

specified period of time, e.g., five years.

• 7. “Disclosure Protection - ‘Safe Harbor’”: By law, the jurisdiction provides a “safe

harbor” defense against civil and criminal liability to banks and/or other covered entities

and their employees who provide otherwise confidential banking data to authorities in

pursuit of authorized investigations.

• 8. “Criminalize ‘Tipping Off’”: By law, disclosure of the reporting of suspicious or

unusual activity to an individual who is the subject of such a report, or to a third party, is

a criminal offense.

Money Laundering and Financial Crimes

5

• 9. “Financial Intelligence Unit”: The jurisdiction has established an operative central,

national agency responsible for receiving (and, as permitted, requesting), analyzing, and

disseminating to the competent authorities disclosures of financial information in order to

counter money laundering. An asterisk (*) reflects those jurisdictions whose FIUs are not

members of the Egmont Group of FIUs.

• 10. “Cross-Border Transportation of Currency”: By law or regulation, the jurisdiction

has established a declaration or disclosure system for persons transiting the jurisdiction’s

borders, either inbound or outbound, and carrying currency or monetary instruments

above a specified threshold.

• 11. “International Law Enforcement Cooperation”: No known legal impediments to

international cooperation exist in current law. Jurisdiction cooperates with authorized

investigations involving or initiated by third party jurisdictions, including sharing of

records or other financial data, upon request.

• 12. “System for Identifying and Forfeiting Assets”: The jurisdiction has established a

legally authorized system for the tracing, freezing, seizure, and forfeiture of assets

identified as relating to or generated by money laundering activities.

• 13. “Arrangements for Asset Sharing”: By law, regulation, or bilateral agreement, the

jurisdiction permits sharing of seized assets with foreign jurisdictions that assisted in the

conduct of the underlying investigation. No known legal impediments to sharing assets

with other jurisdictions exist in current law.

• 14. “Criminalized the Financing of Terrorism”: The jurisdiction has criminalized the

provision of material support to terrorists, terrorist activities, and/or terrorist

organizations.

• 15. “Report Suspected Terrorist Financing”: By law or regulation, banks and/or other

covered entities are required to record and report to designated authorities transactions

suspected to relate to the financing of terrorists, terrorist groups, or terrorist activities.

• 16. “Ability to Freeze Terrorist Assets w/o Delay”: The government has an independent

national system and mechanism for freezing terrorist assets in a timely manner (including

but not limited to bank accounts, other financial assets, airplanes, autos, residences,

and/or other property belonging to terrorists or terrorist organizations).

• 17. “States Party to 1988 UN Drug Convention”: States party to the 1988 United

Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic

Substances, or a territorial entity to which the application of the Convention has been

extended by a party to the Convention.

• 18. “States Party to the UN International Convention for the Suppression of the

Financing of Terrorism”: States party to the International Convention for the

Suppression of the Financing of Terrorism, or a territorial entity to which the application

of the Convention has been extended by a party to the Convention.

• 19. “States Party to the UN Convention against Transnational Organized Crime”: States

party to the United Nations Convention against Transnational Organized Crime

(UNTOC), or a territorial entity to which the application of the Convention has been

extended by a party to the Convention.

INCSR 2016 Volume II Country Database

6

• 20. “States Party to the UN Convention against Corruption”: States party to the United

Nations Convention against Corruption (UNCAC), or a territorial entity to which the

application of the Convention has been extended by a party to the Convention.

• 21. “U.S. or International Sanctions/Penalties”: The United States, another jurisdiction

and/or an international organization, e.g., the UN or FATF, has imposed sanctions or

penalties against the jurisdiction. A country’s inclusion in the FATF’s International

Cooperation Review Group exercise is not considered a sanction or penalty unless the

FATF recommended countermeasures against the country/jurisdiction.

Money Laundering and Financial Crimes

7

Comparative Table

“Y” is meant to indicate that legislation has been enacted to address the captioned items. It does not imply

full compliance with international standards. Please see the individual country reports for information on

any deficiencies in the adopted laws/regulations.

1

The UK extended its application of the 1988 UN Drug Convention to Anguilla, Bermuda, British Virgin Islands, Cayman

Islands, Gibraltar, Guernsey, Isle of Man, Jersey, Montserrat, and Turks and Caicos. The International Convention for the

Suppression of the Financing of Terrorism has been extended to Anguilla, Bermuda, the British Virgin Islands, Guernsey,

Isle of Man, and Jersey. The UNCAC has been extended to British Virgin Islands, Guernsey, Isle of Man, and Jersey. The

UNTOC has been extended to Anguilla, Bermuda, the British Virgin Islands, Cayman Islands, Gibraltar, Guernsey, the Isle

of Man, Jersey, and the Turks and Caicos Islands.

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know

-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection

- “Safe Harbor”

Criminalize “Tipping Off”

Cross

-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report

Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Afghanistan

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y N Y Y Y Y N

Albania

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Algeria

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Andorra

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Angola

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y N Y Y Y Y N

Anguilla

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Antigua and

Barbuda

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Argentina

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Armenia

Y Y Y Y Y Y Y N Y Y Y Y N Y Y Y Y Y Y Y N

INCSR 2016 Volume II Country Database

8

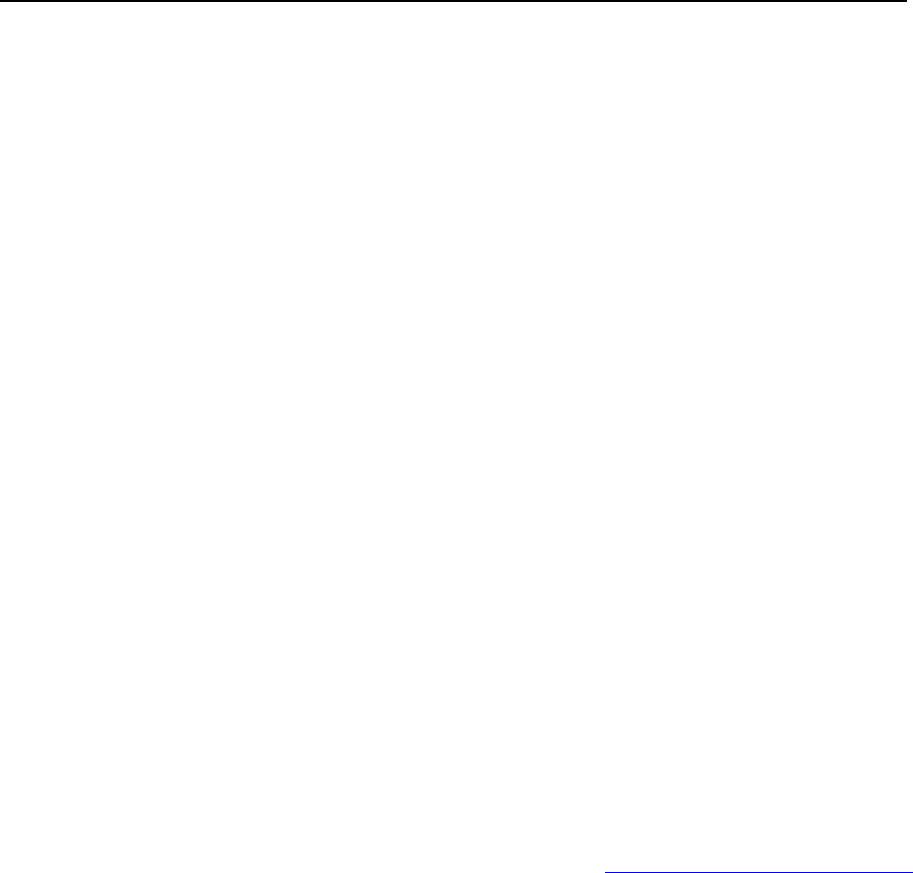

2

The Netherlands extended its application of the 1988 UN Drug Convention, the International Convention for the

Suppression of Terrorism Financing, and the UN Convention against Transnational Organized Crime to Aruba, Curacao,

and St. Maarten.

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Aruba

2

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Australia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Austria

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Azerbaijan

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Bahamas

Y Y Y N Y Y Y Y N Y Y Y Y Y Y Y Y Y Y Y N

Bahrain

Y Y Y N Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y N

Bangladesh

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Barbados

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Belarus

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Belgium

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Belize

Y

Y

Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Benin

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Bermuda

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Bolivia

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Bosnia &

Herzegovina

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Botswana

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Brazil

Y Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y N

British Virgin

Islands

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Brunei

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Money Laundering and Financial Crimes

9

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Bulgaria

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Burkina Faso

Y Y Y Y Y Y Y Y N Y Y N N Y Y N Y Y Y Y N

Burma

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y Y

Burundi

Y Y Y Y Y Y N N N N Y Y N Y Y N Y N Y Y N

Cabo Verde

Y Y Y Y Y Y Y N Y Y* Y Y N Y Y N Y Y Y Y N

Cambodia

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Cameroon

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Canada

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Cayman Islands

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y N Y N N

Central African

Rep.

Y Y Y N Y Y Y Y N N Y N N Y Y Y Y Y Y Y N

Chad

Y Y Y N Y Y Y Y Y Y Y N N Y Y N Y Y Y N N

Chile

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

China

Y Y Y Y Y Y Y Y Y Y* N Y N Y Y N Y Y Y Y N

Colombia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Comoros

Y Y N N Y N Y Y Y Y* Y N N Y Y N Y Y Y Y N

Congo, Dem Rep. of

Y Y Y Y Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y Y Y

Congo, Rep. of

Y Y Y Y Y Y Y Y Y Y* Y N N Y Y Y Y Y N Y N

Cook Islands

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Costa Rica

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

N

Y

Y

Y

Y

Y

Y

Y

N

Cote d’Ivoire

Y Y Y Y Y Y N Y Y Y Y Y N Y Y Y Y Y Y Y Y

Croatia

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Cuba

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y Y

INCSR 2016 Volume II Country Database

10

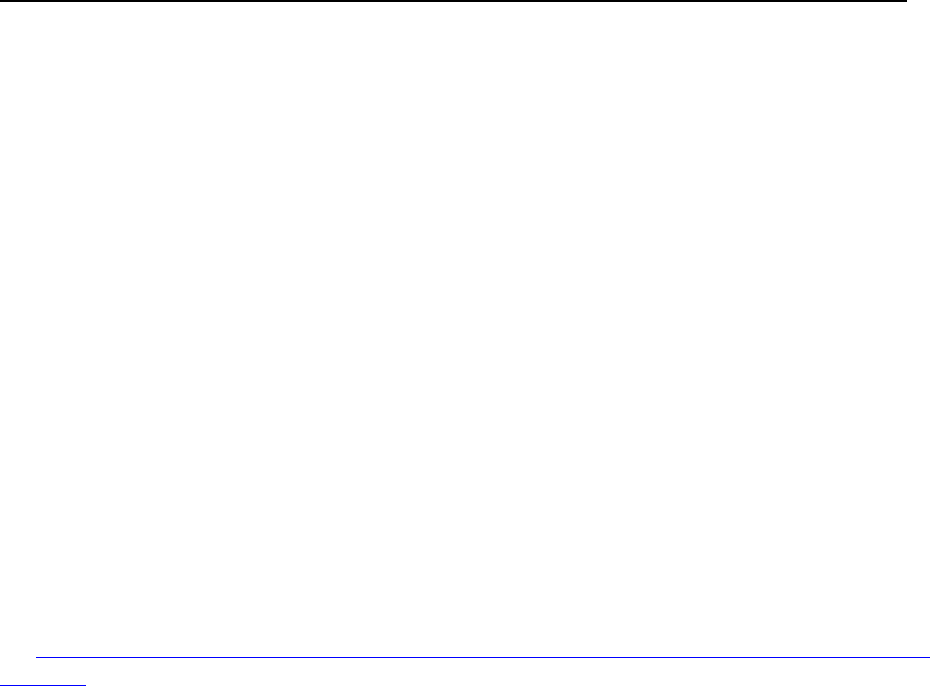

3

Area administered by

Turkish Cypriots

Y Y Y Y Y Y N N Y Y* N Y N Y Y Y N/

A

N/

A

N/

A

N/

A

N

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Curacao

2

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Cyprus

3

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Czech Republic

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Denmark

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Djibouti

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Dominica

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Dominican

Republic

Y Y Y Y Y Y N N Y Y* Y Y Y Y Y Y Y Y Y Y N

Ecuador

Y Y Y Y Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y Y N

Egypt

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

El Salvador

Y Y Y Y Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y N

Equatorial Guinea

Y Y Y Y Y Y Y Y N Y* Y Y N N N N N Y Y N N

Eritrea

N N Y Y Y Y N N Y Y* N N N N N N Y N Y N Y

Estonia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Ethiopia

Y Y Y Y Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y Y N

Fiji

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y N Y N

Finland

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

France

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Gabon

Y Y Y Y Y Y N N N Y Y N N Y Y N Y Y Y Y N

Money Laundering and Financial Crimes

11

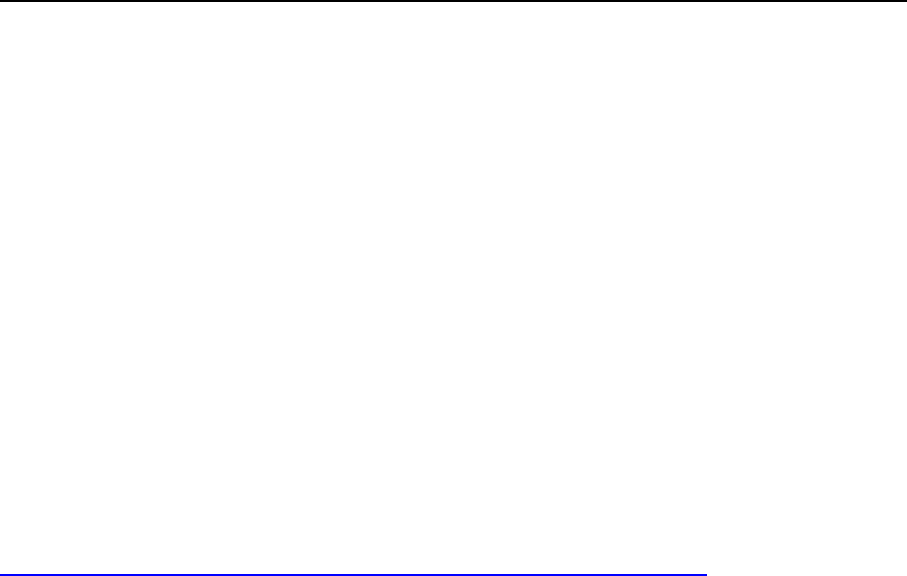

4

The People’s Republic of China extended the 1988 UN Drug Convention, the International Convention for the Suppression

of Terrorism Financing, the UNTOC and the UNCAC to the special administrative regions of Hong Kong and Macau.

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know

-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection

- “Safe Harbor”

Criminalize “Tipping Off”

Cross

-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized

Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanction

s/Penalties

Govt/Jurisdiction

Gambia

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Georgia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Germany

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Ghana

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Gibraltar

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y N N Y N N

Greece

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Grenada

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Guatemala

Y Y Y Y Y Y N N Y Y Y Y N Y Y Y Y Y Y Y N

Guernsey

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Guinea

Y Y Y N Y Y Y Y Y Y* Y N N Y N N Y Y Y Y N

Guinea-Bissau

Y Y Y N Y Y Y N N Y* Y Y Y Y N N Y Y Y Y Y

Guyana

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Haiti

Y Y Y Y Y Y Y Y N Y* Y Y Y Y Y Y Y Y Y Y N

Holy See

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Honduras

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Hong Kong

4

Y Y Y N Y Y Y Y N Y Y Y Y Y Y Y Y Y Y Y N

Hungary

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Iceland

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

India

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Indonesia

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Iran

Y Y Y N Y Y N N N Y* N N N N N N Y N N Y Y

INCSR 2016 Volume II Country Database

12

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Iraq

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y N Y Y Y Y N

Ireland

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Isle of Man

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Israel

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Italy

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Jamaica

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Japan

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y N N N

Jersey

1

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Jordan

Y Y Y N Y Y Y Y Y Y Y N N Y Y Y Y Y Y Y N

Kazakhstan

Y Y Y Y Y Y Y N Y Y Y Y N Y Y N Y Y Y Y N

Kenya

Y Y Y Y Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y Y N

Korea, North

Y Y N/

A

N/

A

N/

A

N/

A

N/

A

N/

A

N/

A

N/

A

N N/

A

N/

A

N/

A

N/

A

N/

A

Y Y N N Y

Korea, South

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N Y N

Kosovo

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y N N N N N

Kuwait

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Kyrgyz Republic

Y Y Y Y Y Y Y Y Y Y Y N N Y Y Y Y Y Y Y N

Laos

Y Y Y N Y N N Y Y Y* Y N N N N N Y Y Y Y N

Latvia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Lebanon

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y N Y Y N

Money Laundering and Financial Crimes

13

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Lesotho

Y Y Y Y Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y Y N

Liberia

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y N Y Y Y Y N

Libya

Y Y Y N Y Y N N N Y* N N N N N N Y Y Y Y Y

Liechtenstein

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Lithuania

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Luxembourg

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Macau

4

Y Y Y N Y Y Y Y N Y Y Y Y Y Y Y Y Y Y Y N

Macedonia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Madagascar

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Malawi

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Malaysia

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

N

Y

Y

Y

Y

Y

Y

Y

N

Maldives

Y Y Y Y Y N Y N Y Y* Y Y N Y Y N Y Y Y Y N

Mali

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Malta

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Marshall Islands

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Mauritania

Y Y Y Y Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y Y N

Mauritius

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Mexico

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Micronesia, FS

Y Y Y N Y Y Y Y Y Y* Y Y N N N Y Y Y Y Y N

Moldova

Y Y Y Y Y Y Y N Y Y Y Y N Y Y Y Y Y Y Y N

Monaco

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Mongolia

Y Y Y Y Y Y Y N Y Y Y Y N Y Y N Y Y Y Y N

Montenegro

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

INCSR 2016 Volume II Country Database

14

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Montserrat

1

Y Y Y N Y Y Y Y Y Y* Y Y Y Y Y Y Y N N N N

Morocco

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Mozambique

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Namibia

Y Y Y Y Y Y Y Y N Y Y Y N Y Y Y Y Y Y Y N

Nauru

Y N Y Y Y Y Y Y Y Y* N Y N Y Y Y Y Y Y Y N

Nepal

Y Y Y Y Y Y N Y Y Y N Y N Y Y Y Y Y Y Y N

Netherlands

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

New Zealand

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Nicaragua

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Niger

Y Y Y N Y Y N Y Y Y* Y Y N Y Y N Y Y Y Y N

Nigeria

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Niue

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y N Y Y Y N N

Norway

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

N

Oman

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Pakistan

Y Y Y Y Y Y Y Y Y Y* Y N N Y Y Y Y Y Y Y N

Palau

Y Y Y Y Y Y Y Y Y Y* Y N N Y Y Y N Y N Y N

Panama

Y Y Y Y Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y N

Papua New Guinea

Y Y Y Y Y Y Y Y Y Y* Y Y N Y N N N Y N Y N

Paraguay

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Peru

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Philippines

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Poland

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Portugal

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Money Laundering and Financial Crimes

15

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Qatar

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Romania

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Russia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Rwanda

Y Y Y Y Y Y N Y Y Y* Y Y N Y Y N Y Y Y Y N

St. Kitts and Nevis

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

St. Lucia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

St. Vincent and

the Grenadines

Y Y Y Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y N N

Samoa

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

San Marino

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Sao Tome and

Principe

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y N Y Y Y Y N

Saudi Arabia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Senegal

Y

Y

Y

N

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

N

Serbia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Seychelles

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Sierra Leone

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y N Y Y Y Y N

Singapore

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Sint Maarten

2

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N

Slovak Republic

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Slovenia

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Solomon Islands

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y N N Y N Y N

Somalia

N

N

N

N

N

N

N

N

N

N

N

N

N

N

N

N

N

N

N

N

Y

South Africa

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

N

INCSR 2016 Volume II Country Database

16

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

South Sudan

Y Y N N N N N N N N N N N N N N N N N Y N

Spain

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Sri Lanka

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Sudan

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y*

Y

Y

N

Y

Y

Y

Y

Y

Y

Y

Y

Suriname

Y Y Y N Y Y Y Y Y Y* Y Y Y Y Y Y Y Y Y N N

Swaziland

Y Y Y Y Y Y Y Y N Y* Y N N Y Y Y Y Y Y Y N

Sweden

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Switzerland

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Syria

Y Y Y Y Y Y Y Y Y Y* N Y N Y Y Y Y Y Y N Y

Taiwan

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N N N N N N

Tajikistan

Y

Y

Y

Y

Y

Y

Y

N

Y

Y

Y

Y

N

Y

Y

Y

Y

Y

Y

Y

N

Tanzania

Y Y Y N Y Y Y Y N Y Y Y N Y Y Y Y Y Y Y N

Thailand

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Timor-Leste

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Togo

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Tonga

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y N N

Trinidad and

Tobago

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Tunisia

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Turkey

Y Y Y N Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Turkmenistan

Y Y Y Y Y Y Y Y Y Y* Y Y N Y Y Y Y Y Y Y N

Turks and Caicos

1

Y

Y

Y

N

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

Y

N

Y

N

N

Uganda

Y Y Y Y Y Y N Y Y Y* Y Y Y Y Y N Y Y Y Y N

Money Laundering and Financial Crimes

17

Actions by Governments

Criminalized Drug Money Laundering

Criminalized ML Beyond Drugs

Know-Your-Customer Provisions

Report Large Transactions

Report Suspicious Transactions (YPN)

Maintain Records Over Time

Disclosure Protection - “Safe Harbor”

Criminalize “Tipping Off”

Cross-Border Transportation of Currency

Financial Intelligence Unit (*)

Intl Law Enforcement Cooperation

System for Identifying/Forfeiting Assets

Arrangements for Asset Sharing

Criminalized Financing of Terrorism

Report Suspected Terrorist Financing

Ability to Freeze Terrorist Assets w/o Delay

States Party to 1988 UN Drug Convention

States Party to Intl. Terror Finance Conv.

States Party to UNTOC

States Party to UNCAC

US or Intl Org Sanctions/Penalties

Govt/Jurisdiction

Ukraine

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

UAE

Y Y Y Y Y Y Y N Y Y Y Y N Y Y Y Y Y Y Y N

United Kingdom

Y Y Y N Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Uruguay

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Uzbekistan

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y Y Y Y Y Y N

Vanuatu

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Venezuela

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y N

Vietnam

Y Y Y Y Y Y Y N Y Y* Y Y N Y Y N Y Y Y Y N

West Bank and

Gaza

Y Y Y Y Y Y Y Y N Y* Y Y N N N N N N N Y N

Yemen

Y Y Y N Y Y Y Y Y Y* Y Y N Y Y N Y Y Y Y N

Zambia

Y Y Y N Y Y Y Y Y Y* Y Y Y Y Y Y Y N Y Y N

Zimbabwe

Y Y Y N Y Y Y Y Y Y* Y Y Y Y Y N Y Y Y Y Y

INCSR 2016 Volume II Country Database

18

All Money Laundering and Financial

Crimes Countries/Jurisdictions

Afghanistan

The Islamic Republic of Afghanistan is not a regional or offshore financial center. Terrorist and

insurgent financing, money laundering, bulk cash smuggling, abuse of informal value transfer

systems, and other illicit activities designed to finance organized criminal activity continue to

pose serious threats to the security and development of Afghanistan. Afghanistan remains a

major narcotics trafficking and producing country, and is the world’s largest opium producer and

exporter. The narcotics trade, corruption, and contract fraud are major sources of illicit revenue

and laundered funds. Corruption permeates all levels of Afghan government and society.

Afghanistan has a small banking sector, and the government has implemented management

reforms over the past year. Traditional payment systems, particularly hawala networks, remain

significant in their reach and scale. Less than 10 percent of the Afghan population uses banks,

depending instead on the traditional hawala system, which provides a range of financial and non-

financial business services in local, regional, and international markets. Approximately 90

percent of financial transactions run through the hawala system, including foreign exchange

transactions, funds transfers, trade and microfinance, as well as some deposit-taking activities.

Corruption and weaknesses in the banking sector incentivize the use of informal mechanisms and

exacerbate the difficulty of developing a transparent formal financial sector in Afghanistan. The

unlicensed and unregulated hawaladars in major drug areas, such as Helmand, likely account for

a substantial portion of the illicit proceeds being moved in the financial system. Afghan business

consortiums that control both hawaladars and banks allow criminal elements within these

consortiums to manipulate domestic and international financial networks to send, receive, and

launder illicitly-derived monies or funds intended for criminal, insurgent, or terrorism activities.

For additional information focusing on terrorist financing, please refer to the Department of

State’s Country Reports on Terrorism, which can be found at: http://www.state.gov/j/ct/rls/crt/

DO FINANCIAL INSTITUTIONS ENGAGE IN CURRENCY TRANSACTIONS RELATED

TO INTERNATIONAL NARCOTICS TRAFFICKING THAT INCLUDE SIGNIFICANT

AMOUNTS OF US CURRENCY; CURRENCY DERIVED FROM ILLEGAL SALES IN

THE U.S.; OR ILLEGAL DRUG SALES THAT OTHERWISE SIGNIFICANTLY AFFECT

THE U.S.: YES

CRIMINALIZATION OF MONEY LAUNDERING:

“All serious crimes” approach or “list” approach to predicate crimes: All serious crimes

Are legal persons covered: criminally: YES civilly: NO

KNOW-YOUR-CUSTOMER (KYC) RULES:

Enhanced due diligence procedures for PEPs: Foreign: YES Domestic: YES

Money Laundering and Financial Crimes

19

KYC covered entities: Banks (public and private), money service businesses (MSBs),

hawaladars, lawyers, real estate agents, trust companies, securities dealers, independent legal

professionals, insurance companies, and dealers of bullion, precious metals, and stones

REPORTING REQUIREMENTS:

Number of STRs received and time frame: 342 in 2014

Number of CTR received and time frame: 1,908,610 in 2014

STR covered entities: Banks (public and private), MSBs, hawaladars, lawyers, real estate

agents, trust companies, securities dealers, independent legal professionals, insurance

companies, and dealers of bullion, precious metals, and stones

MONEY LAUNDERING CRIMINAL PROSECUTIONS/CONVICTIONS:

Prosecutions: 4 in 2014

Convictions: 4 in 2014

RECORDS EXCHANGE MECHANISM:

With U.S.: MLAT: NO Other mechanism: YES

With other governments/jurisdictions: YES

Afghanistan is a member of the Asia/Pacific Group on Money Laundering (APG), a FATF-style

regional body. Its most recent mutual evaluation can be found at:

http://www.apgml.org/members-and-observers/members/member-

documents.aspx?m=69810087-f8c2-47b2-b027-63ad5f6470c1

ENFORCEMENT AND IMPLEMENTATION ISSUES AND COMMENTS:

The Government of Afghanistan’s ability to enforce relevant laws and regulate institutions is

hampered by corruption. Limited resources and lack of technical expertise and infrastructure

also hamper effective regulatory oversight. Afghanistan has made progress with the enactment

of its July 2014 AML and CFT laws. Significant provisions include the creation of an adequate

legal basis to criminalize money laundering; and the authority to confiscate funds or real

property derived from criminal activity, sell property, and hold the proceeds in an asset

recovery/sharing fund. In addition, in mid-2015, Afghanistan enacted a comprehensive banking

law to enhance reporting and the governance of private and state-owned banks. The law, which

also includes criteria for fit and proper determinations and a regime for declaring cross-border

transportation of cash and bearer negotiable instruments, will go into effect in early 2016.

Despite making some regulatory progress on banking, no clear division exists between the

hawala system and the small formal financial sector. Hawaladars often keep accounts at banks

and use wire transfer services to settle their balances with other hawaladars abroad. Due to

limited bank branch networks, banks occasionally use hawaladars to transmit funds to hard-to-

reach areas within Afghanistan. Afghanistan’s financial intelligence unit, FinTRACA, reports

that no MSBs or hawaladars have ever submitted suspicious transaction reports (STRs), as

compared to the 10 to 15 STRs FinTRACA receives daily from traditional financial institutions.

Insurance companies and securities dealers are also technically under the regulatory regime and

are required to file STRs, but the government does not enforce this requirement. Precious metals

and stones dealers, lawyers, accountants, and real estate agents are not supervised in

Afghanistan.

INCSR 2016 Volume II Country Database

20

Border security continues to be a major challenge throughout Afghanistan, with the country’s 14

official border crossings under central government control. Afghanistan’s cross-border reporting

requirement applies to those entering or exiting the country with an amount of more than