CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

1

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN Holdings Plc

Annual Report and Accounts 2018

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

2

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBNHoldings Group is an enduring institution with a rich heritage

woven into the fabric of society. Like a precious gem, our ability to

innovate, regenerate and transform makes us dynamic and ageless.

Over the years, the Group has remained resilient, overcoming

varying challenges to set the pace on many fronts across the

financial landscape. This unique attribute has engendered the

iconic brand to all stakeholders as a dominant and reliable

franchise.

As we commemorate the 125th anniversary of our flagship

business - FirstBank, the Group is geared to shape the future

more than ever before and deliver sustainable value.

TIMELESS

Timeless |/ˈtʌɪmləs/

Denition: Not aected by the passage of time.

Synonyms: Lasting, enduring, ageless

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

3

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

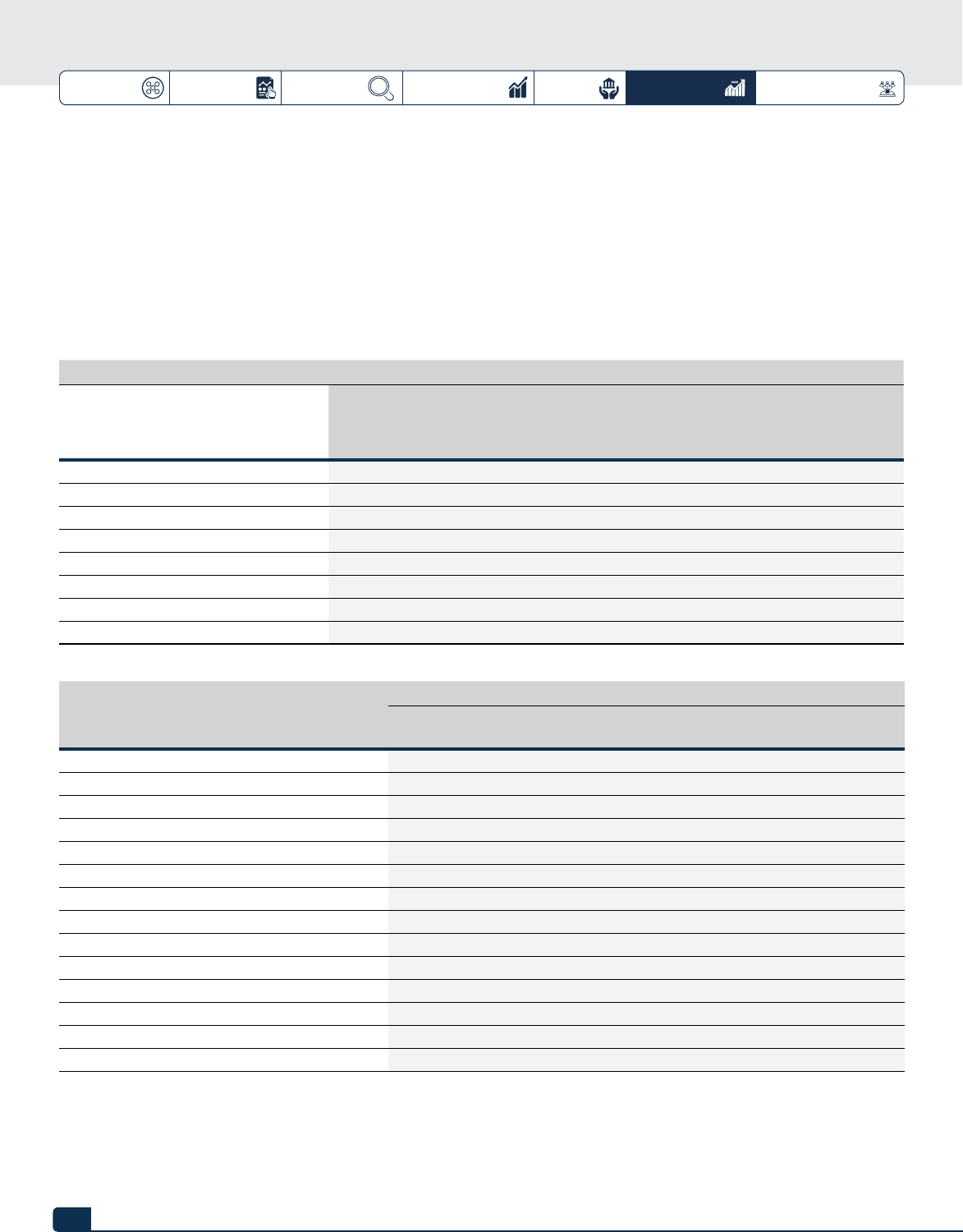

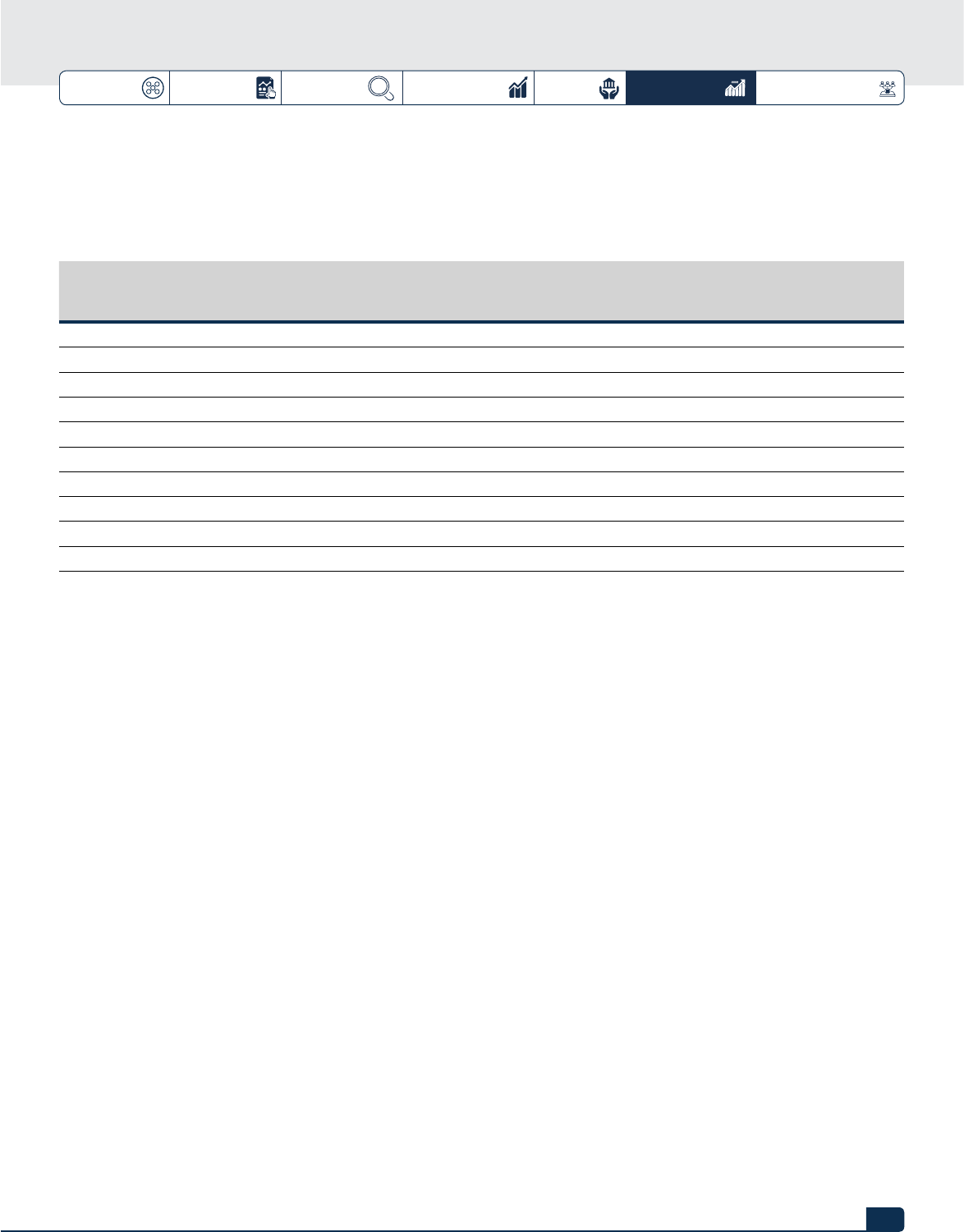

GROUP OVERVIEW

OUR PROFILE 8

OUR NETWORK 9

OUR STRUCTURE 10

FINANCIAL HIGHLIGHTS 12

NONFINANCIAL HIGHLIGHTS 14

RECOGNITION AND AWARDS 18

STRATEGIC REPORT

MACROECONOMIC REVIEW 23

GROUP CHAIRMAN’S STATEMENT 25

GROUP MANAGING DIRECTOR’S REVIEW 29

OUR BUSINESS MODEL 36

LEADERSHIP AND GOVERNANCE 40

RISK MANAGEMENT 44

COMPLAINTS HANDLING 65

FINANCIAL REVIEW

PERFORMANCE SUMMARY 68

GROUP PERFORMANCE 69

PERFORMANCE BY BUSINESS GROUPS 73

CORPORATE RESPONSIBILITY AND SUSTAINABILITY

OUR SOCIAL COMMITMENT 78

COMMUNITY DEVELOPMENT 80

SCORE CARD 87

STANDARDS AND CODES 89

STAKEHOLDER ENGAGEMENT 96

GOVERNANCE

BOARD OF DIRECTORS 99

ATTENDANCE AT BOARD MEETINGS 106

BOARD COMMITTEES 107

DIRECTORS’ REPORT 120

REPORT OF THE INDEPENDENT CONSULTANT 125

FINANCIAL STATEMENTS

RESPONSIBILITY FOR ANNUAL FINANCIAL STATEMENTS 128

REPORT OF THE AUDIT COMMITTEE 130

INDEPENDENT AUDITORS’ REPORT 131

INCOME STATEMENT 137

STATEMENT OF COMPREHENSIVE INCOME 138

STATEMENT OF FINANCIAL POSITION 139

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY 141

STATEMENT OF CASH FLOWS 143

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS 144

STATEMENT OF VALUE ADDED 313

FIVEYEAR FINANCIAL SUMMARYGROUP 315

FIVEYEAR FINANCIAL SUMMARYCOMPANY 317

SHAREHOLDER INFORMATION

SHAREHOLDER RESOURCES 319

NOTICE OF ANNUAL GENERAL MEETING 322

PROXY FORM 325

EPRODUCTS ACTIVATION FORM 327

EDIVIDEND MANDATE MANAGEMENT SYSTEM EDMMS 329

EBONUS FORM 331

SHAREHOLDERS DATA UPDATE FORM 333

GLOSSARY OF RATIOS 335

ABBREVIATIONS 337

APPENDIXCOMPLAINTS MANAGEMENT POLICY 339

CONTACT INFORMATION 343

CONTENT OUTLINE

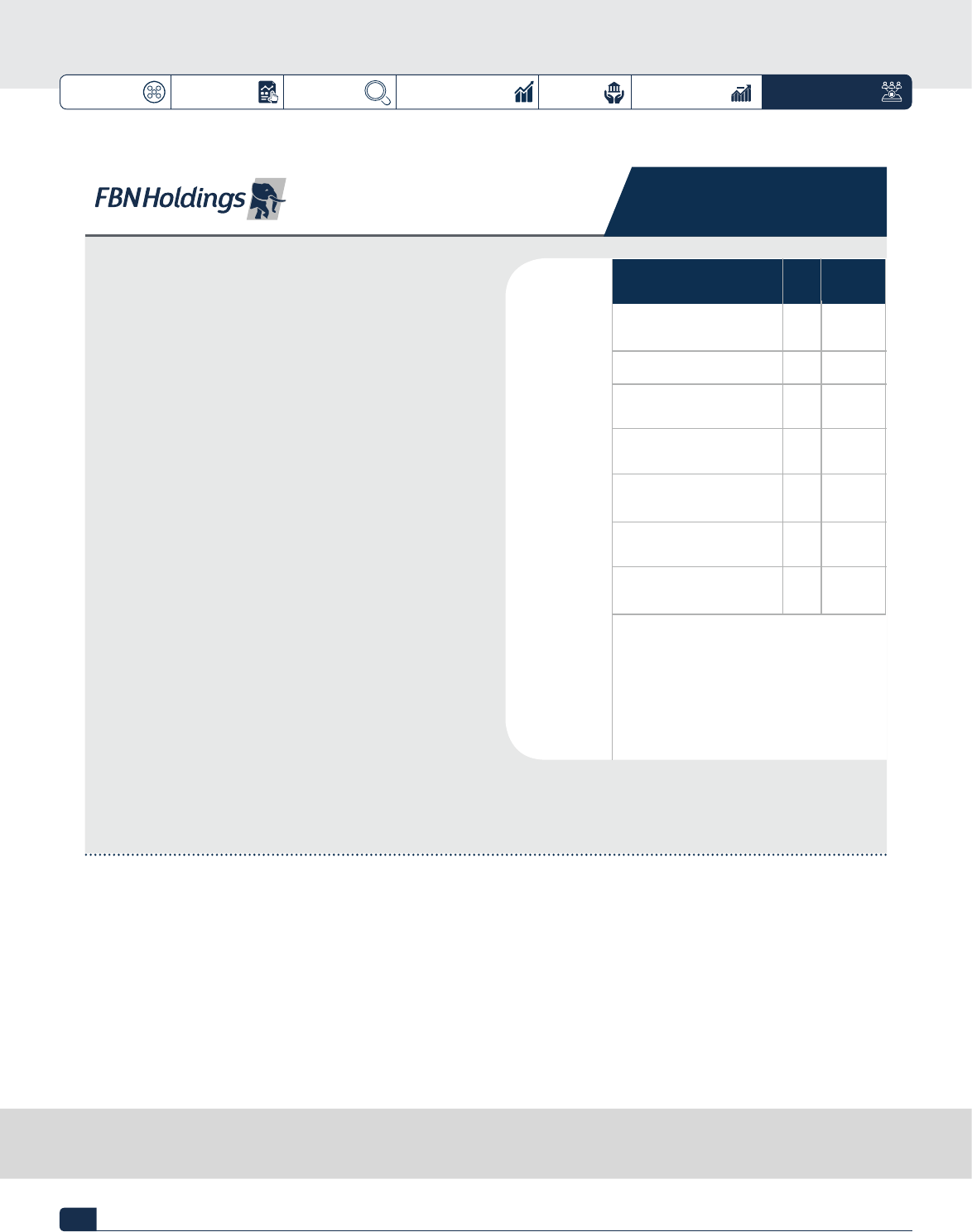

The term ‘FBN Holdings Plc’ or the ‘Group’ means

FBNHoldings together with its subsidiaries. FBN Holdings Plc

is a financial holding company incorporated in Nigeria on

14 October 2010. The Company was listed on the Nigerian

Stock Exchange under the ‘Other financial services’ sector

on 26 November 2012 and has issued and fully paid-up

share capital of 35,895,292,791 ordinary shares of 50

kobo each (N17,947,646,396). In this report, the

abbreviations ‘Nmn’, ‘Nbn’ and ‘Ntn’ represent millions,

billions and trillions of naira respectively.

FBN Holdings Plc is structured along the following business

groups, namely: Commercial Banking, Merchant Banking and

Asset Management, Insurance and Others.

The Commercial Banking business comprises

First Bank of Nigeria Ltd, FBNBank (UK) Ltd,

FBNBank DRC Ltd, FBNBank Ghana Ltd, FBNBank

The Gambia Ltd, FBNBank Guinea Ltd, FBNBank

Sierra Leone Ltd, FBNBank Senegal Ltd and First

Pension Custodian Nigeria Ltd. First Bank of

Nigeria Ltd is the lead entity of the Commercial

Banking business.

The Merchant Banking and Asset Management

business consists of FBNQuest Merchant Bank Ltd

and FBNQuest Capital Ltd. The subsidiaries of

FBNQuest Merchant Bank Ltd are: FBNQuest Asset

Management Ltd and FBNQuest Securities Ltd while

the subsidiaries of FBNQuest Capital Ltd are: FBNQuest

Trustees Ltd and FBNQuest Funds Ltd.

The Insurance business comprises FBN Insurance Ltd,

FBN General Insurance Ltd and FBN Insurance Brokers Ltd.

This report has been prepared under the International

Financial Reporting Standards (IFRS), and unless otherwise

stated, the income statement compares the 12 months to

December 2018 to the corresponding 12 months of 2017,

and the statement of financial position comparison relates

to the corresponding position at 31 December 2017. Except

as disclosed, all the balances and figures relate to continuous

operations. Relevant terms that are used in this document

but not defined under applicable regulatory guidance or the

IFRS are explained in the glossary or abbreviation section of

this report.

Shareholders will receive a compact disc (CD) containing

the Annual Report and Accounts of FBN Holdings Plc, as

well as information on outstanding dividend claims and a list

of all our business locations.

There will be an option to view a navigable PDF copy of the

FBNHoldings report as well as PDFs of certain subsidiary

reports at the annual report portal of the Investor Relations

section of the FBNHoldings website.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

4

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

We have deployed cutting-edge technology and

solutions to drive our digital and other product

oerings in an ecient manner to better serve

our customers.

SHAPING

THE FUTURE

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

5

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

We continually improve our processes, services and

people, deliberately reinforcing our solid foundation and

strengthening the fundamentals of our business towards

delivering sustainable value to our stakeholders.

DELIVERING

SUSTAINABLE

VALUE

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

6

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

As we reflect on our rich heritage and

ongoing transformation, we forge ahead

with the confidence of a brighter future.

BRIGHTER

FUTURE

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

7

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

Our Profile >> 8 Financial Highlights >> 12 Recognition and Awards >> 18

GROUP OVERVIEW

As at 31 December 2018, the Group closed with gross earnings of N583.5bn and

total assets of N5.6tn.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

8

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

OUR PROFILE

FBN Holdings Plc is one of Africa’s largest diversified non-operating financial holding company, oering

a broad range of services including commercial banking, merchant banking and asset management as

well as insurance to millions of customers. FBNHoldings through its subsidiaries oer innovative and

competitive financial solutions across Africa, Europe and Asia.

First Bank of Nigeria Ltd (FirstBank) is the largest

subsidiary of the FBNHoldings Group, oering

commercial banking services in 10 countries. FirstBank

also has a subsidiary that provides pension custody

services.

FBNQuest Merchant Bank Ltd and FBNQuest Capital Ltd

are subsidiaries of FBNHoldings, providing merchant

banking, asset management and investment banking

services. FBNQuest Merchant Bank Ltd is the parent

company to FBNQuest Asset Management Ltd and

FBNQuest Securities Ltd while the subsidiaries of

FBNQuest Capital Ltd are FBNQuest Funds Ltd and

FBNQuest Trustees Ltd.

FBNHoldings offers life insurance services through

FBN Insurance Ltd and general insurance through

its subsidiary, FBN General Insurance Ltd. The

business group also offers brokerage services

through FBN Insurance Brokers Ltd.

Notable milestones of the Group:

One of the largest financial institutions in Nigeria

The Commercial Banking subsidiary, FirstBank, was

founded in 1894

A rich history on the Nigerian Stock Exchange from

1971 and specifically as FBNHoldings since November

2012

Over 2 million active users on FirstMobile application

Over 15.7 million* customer accounts

888 business locations

2,895 ATMs and 9,771 POS terminals.

* Commercial Banking group

Customer Accounts:

15.7million*

Business Locations:

888

Total Assets:

N5.6tn

Gross Earnings:

N583.5bn

ATMs:

2,895

The

Strategic

Vision:

Our

Mission:

Our

Core

Values:

To become the

leading financial

services group

in Middle Africa,

providing

value to our

stakeholders.

To be the

undisputed leader

in every business

we choose to

participate in,

delivering superior

returns to our

shareholders.

Passion,

Partnership and

People underpin

everything we

do and apply to

everyone across

the Group.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

9

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

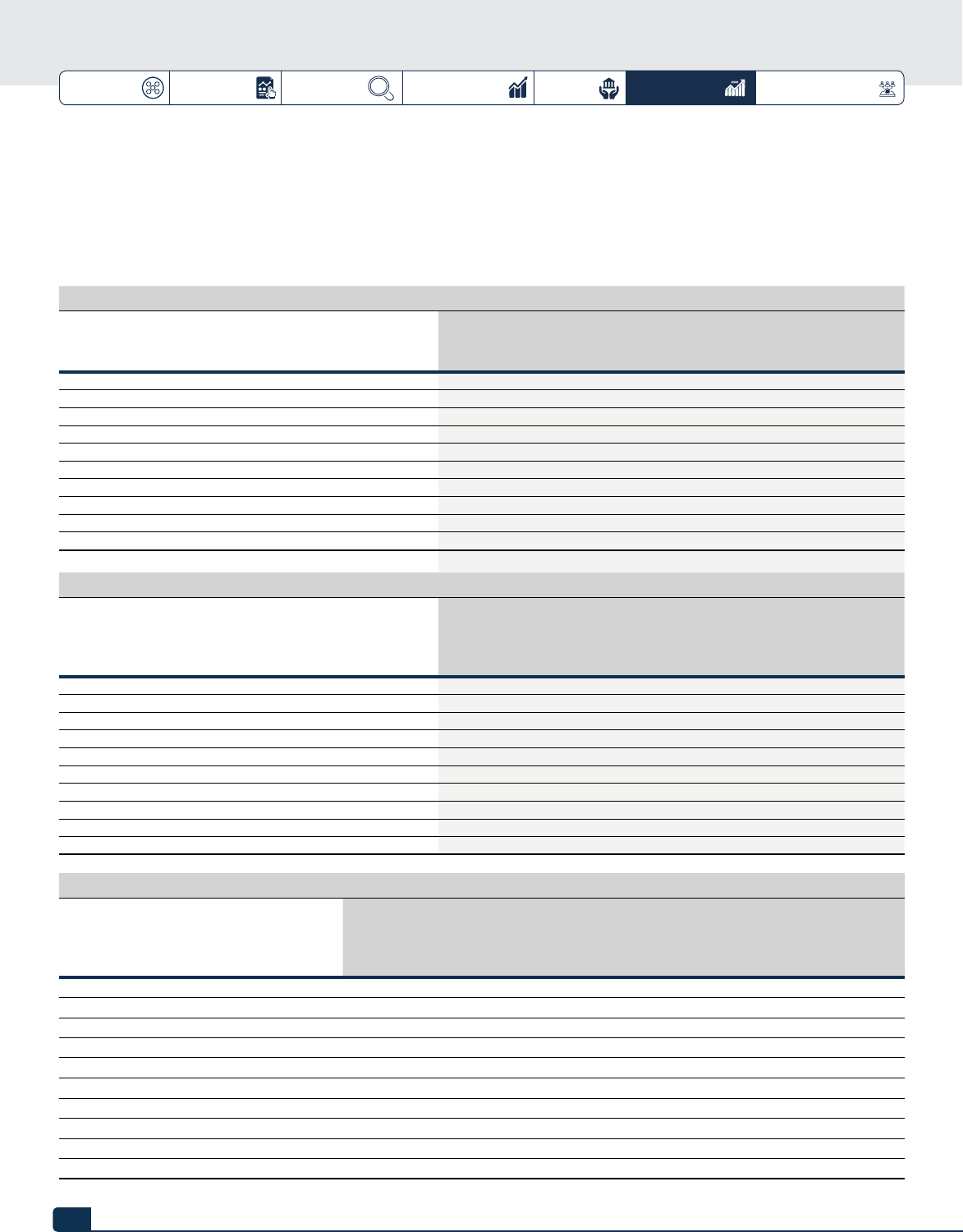

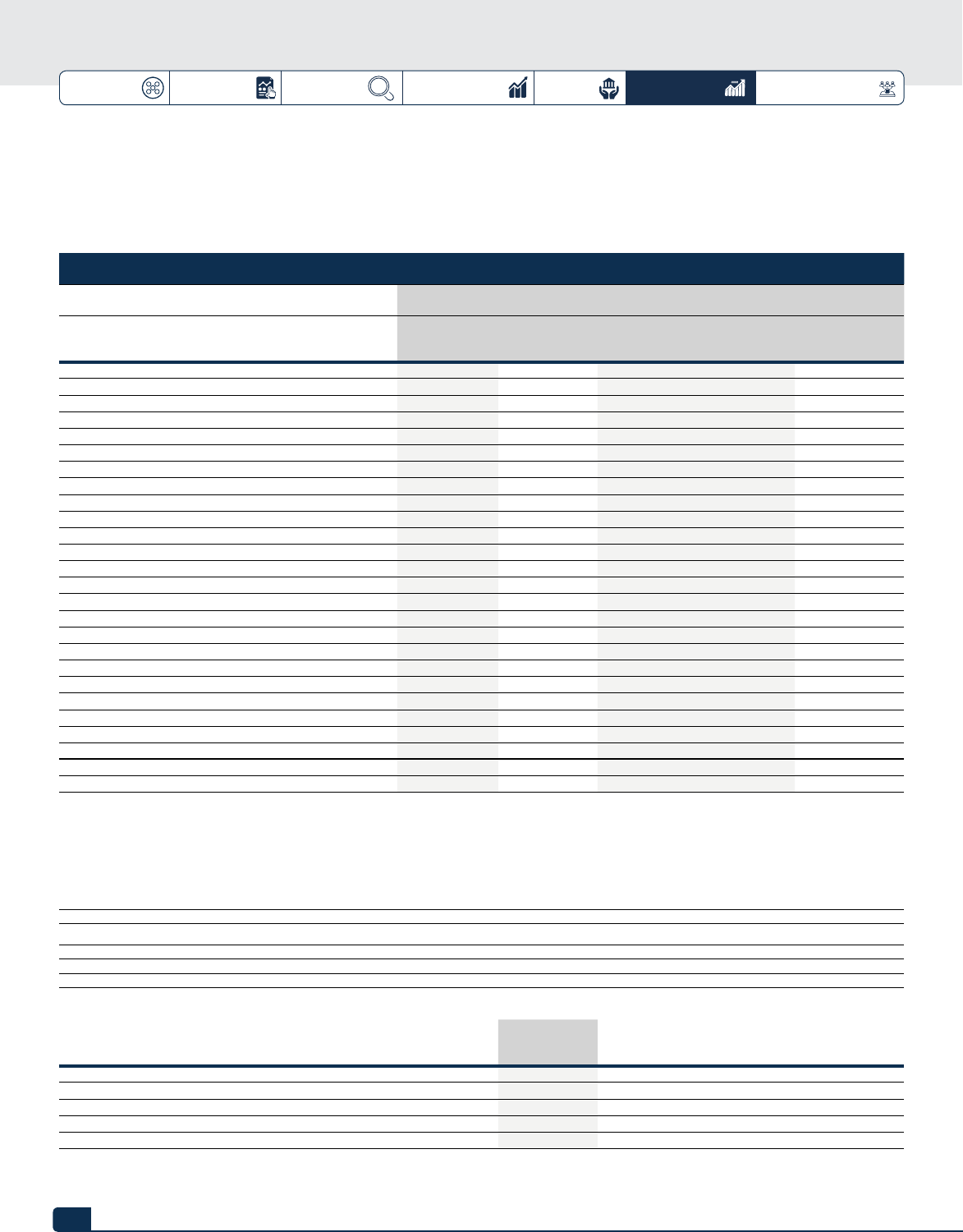

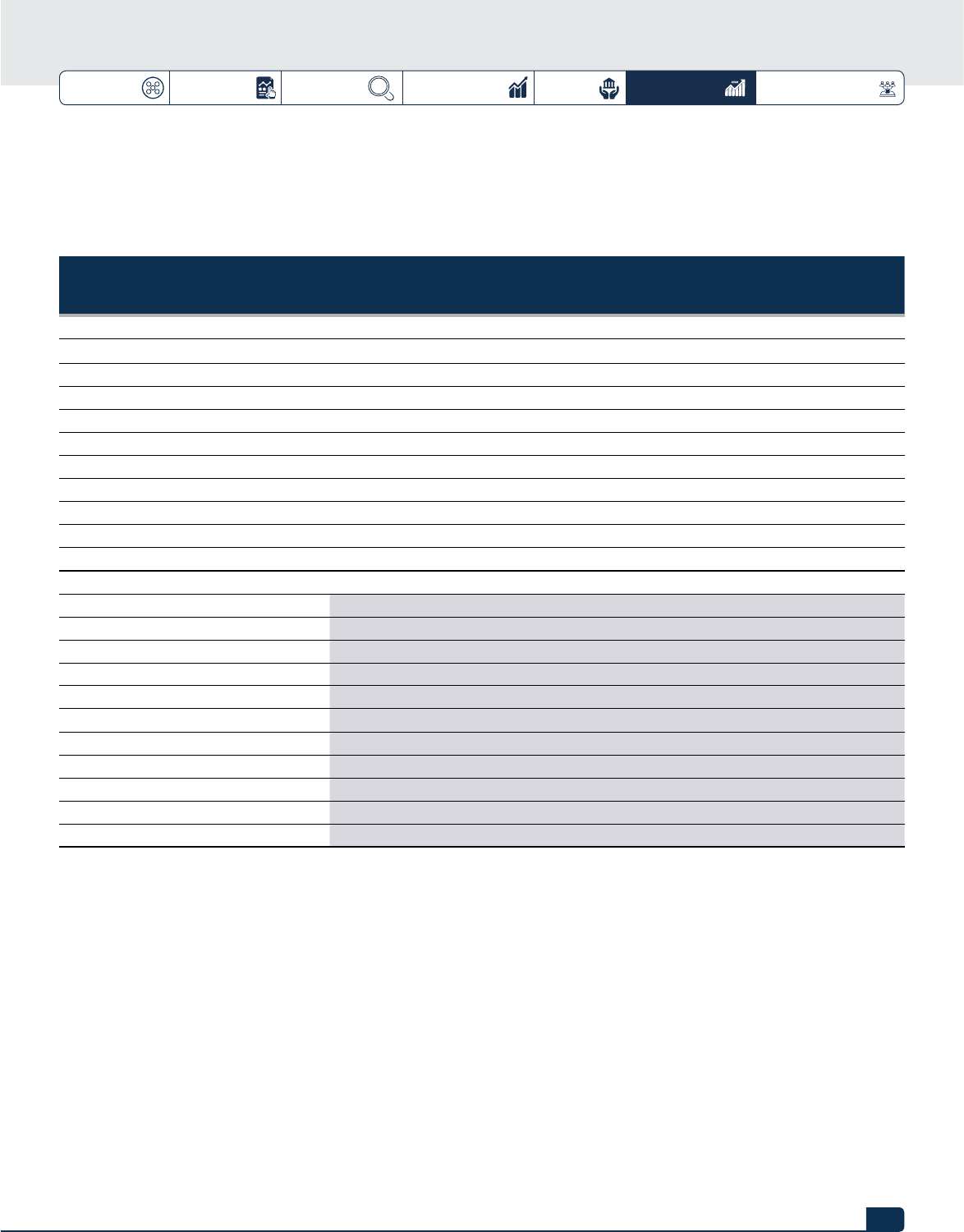

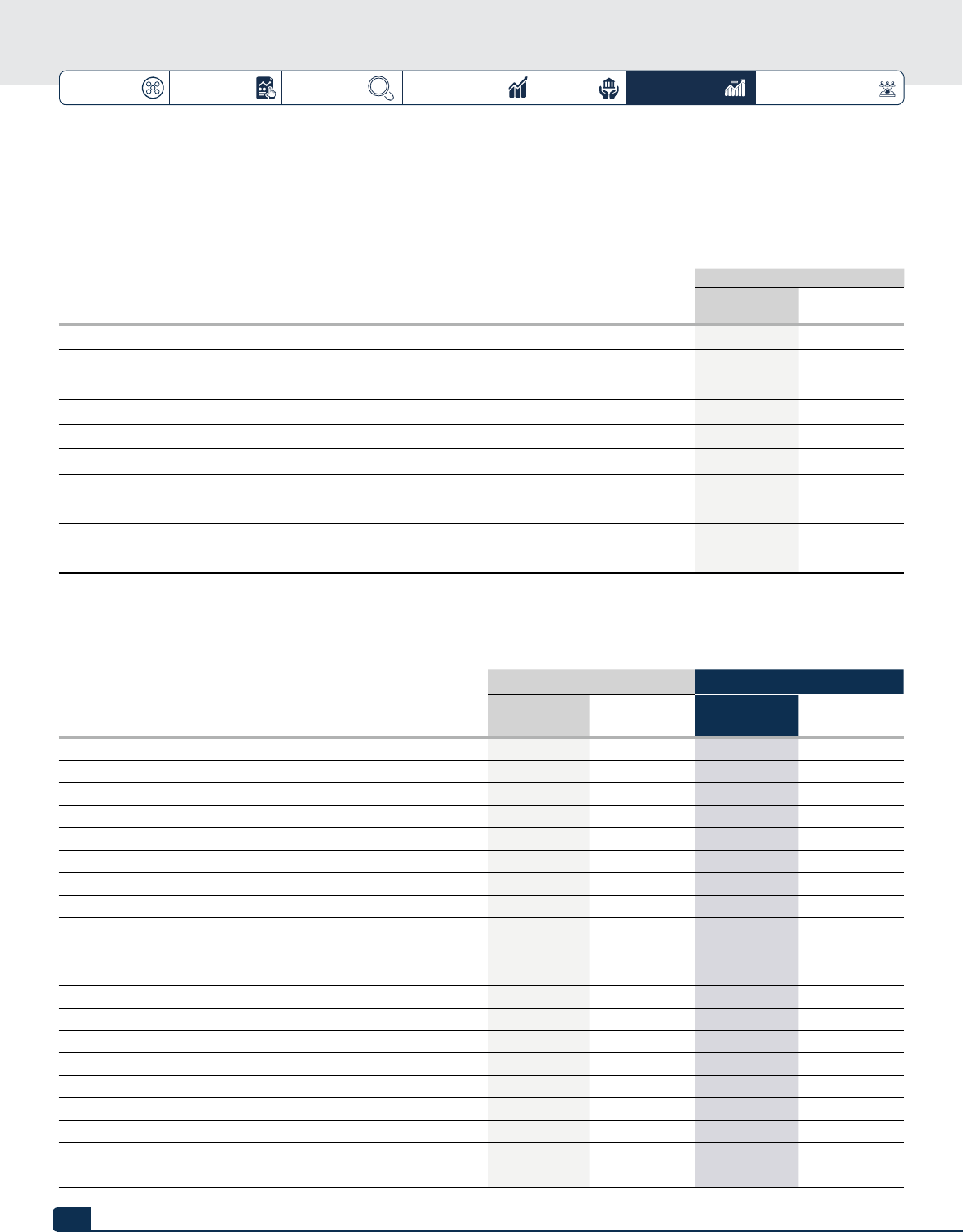

OUR NETWORK

UNITED KINGDOM (UK)

Name: FBNBank (UK) Ltd

Type: Licensed Bank

Founded: 2002

Products/Services: International Banking and Trade Services

DEMOCRATIC

REPUBLIC OF CONGO

Name: FBNBank DRC Ltd

Type: Licensed Bank

Founded: 1994

Products/Services: Commercial Banking

GHANA

Name: FBNBank Ghana Ltd

Type: Licensed Bank

Founded: 1996

Products/Services: Commercial Banking

REPRESENTATIVE OFFICE

Name: FBNBank China

Founded: 2009

Products/Services: Banking Services

NIGERIA

Name: FBN Holdings Plc

Type: Licensed Financial Holding Company

Founded: 2012

Products/Services: Commercial Banking, Merchant Banking

and Asset Management, Insurance

Name: FBNQuest Merchant Bank Ltd

Type: Licensed Bank

Founded: 1995

Products/Services: Merchant Banking and

Asset Management Services

Name: FBNQuest Capital Ltd

Type: Licensed Capital Market Operator

Founded: 2002

Products/Services: Private Advisory and Investments

NIGERIA

Name: First Bank of Nigeria Ltd

(Formerly First Bank of Nigeria Plc)

Type: Licensed Bank

Founded: 1894

Products/Services: Commercial Banking

Name: FBN Insurance Ltd

Type: Licensed Insurance company

Founded: 2010

Products/Services: Life Insurance Product and Services

Name: FBN Insurance Brokers Ltd

Type: Licensed Insurance Brokerage company

Founded: 2000

Products/Services: Insurance Brokerage Services

FRANCE

Name: FBNBank (UK) Ltd

Type: Bank Branch

Founded: 2008

Products/Services: Commercial Banking, International Banking

GUINEA

Name: FBNBank Guinea Ltd

Type: Licensed Bank

Founded: 1996

Products/Services: Commercial Banking

SIERRA LEONE

Name: FBNBank Sierra Leone Ltd

Type: Licensed Bank

Founded: 2004

Products/Services: Commercial Banking

THE GAMBIA

Name: FBNBank The Gambia Ltd

Type: Licensed Bank

Founded: 2004

Products/Services: Commercial Banking

SENEGAL

Name: FBNBank Senegal Ltd

Type: Licensed Bank

Founded: 2014

Products/Services: Commercial Banking

9

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

10

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

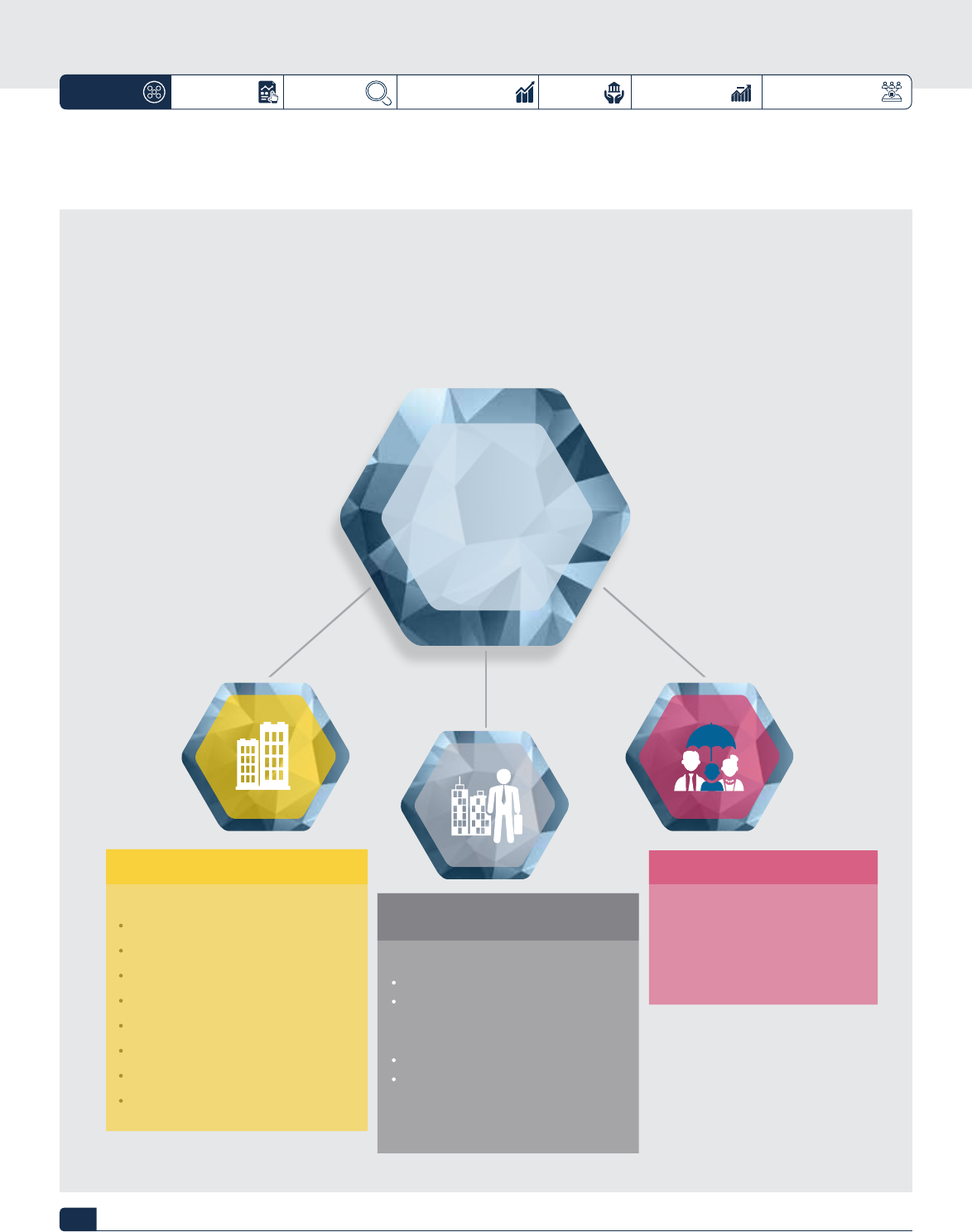

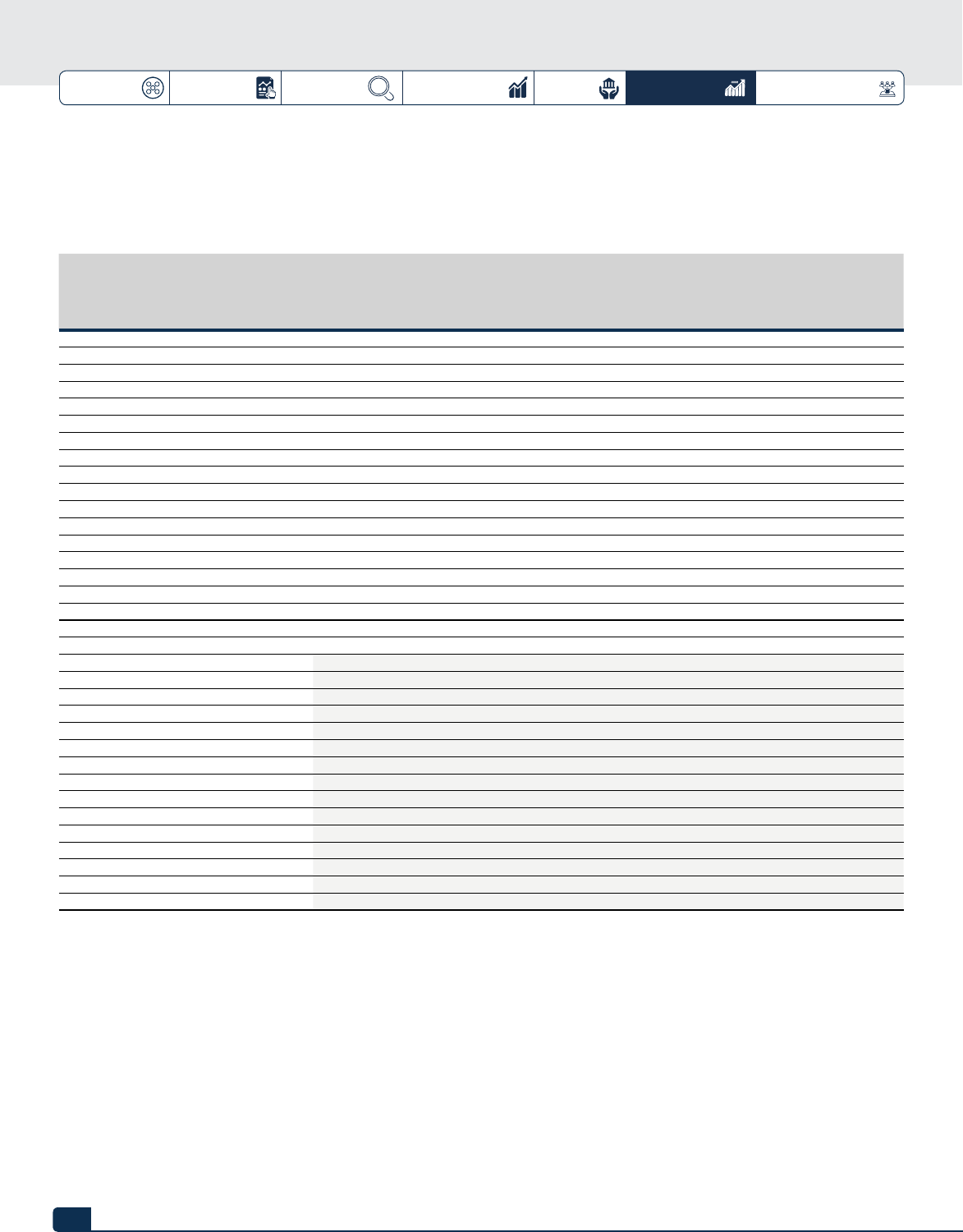

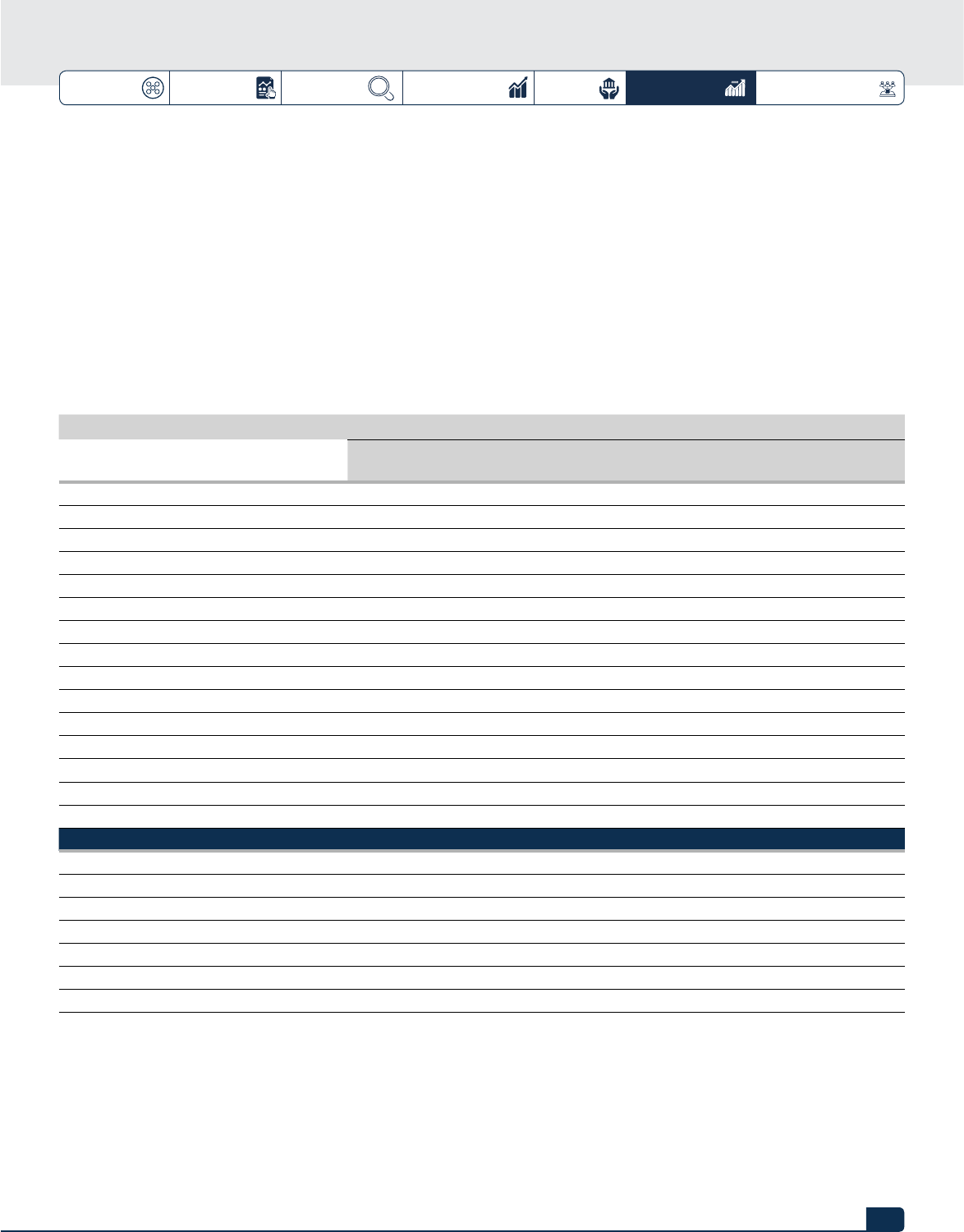

FBN HOLDINGS PLC

COMMERCIAL BANKING

First Bank of Nigeria Limited

• FBNBank(UK)Limited

• FBNBankDRCLimited

• FBNBankGhanaLimited

• FBNBankTheGambiaLimited

• FBNBankGuineaLimited

• FBNBankSierraLeoneLimited

• FBNBankSenegalLimited

• FirstPensionCustodianNigeriaLimited

MERCHANT BANKING AND

ASSET MANAGEMENT

FBNQuest Merchant Bank Limited

• FBNQuestAssetManagementLimited

• FBNQuestSecuritiesLimited

FBNQuest Capital Limited

• FBNQuestTrusteesLimited

• FBNQuestFundsLimited

FBN Insurance Limited

FBN General Insurance Limited

FBN Insurance Brokers Limited

INSURANCE

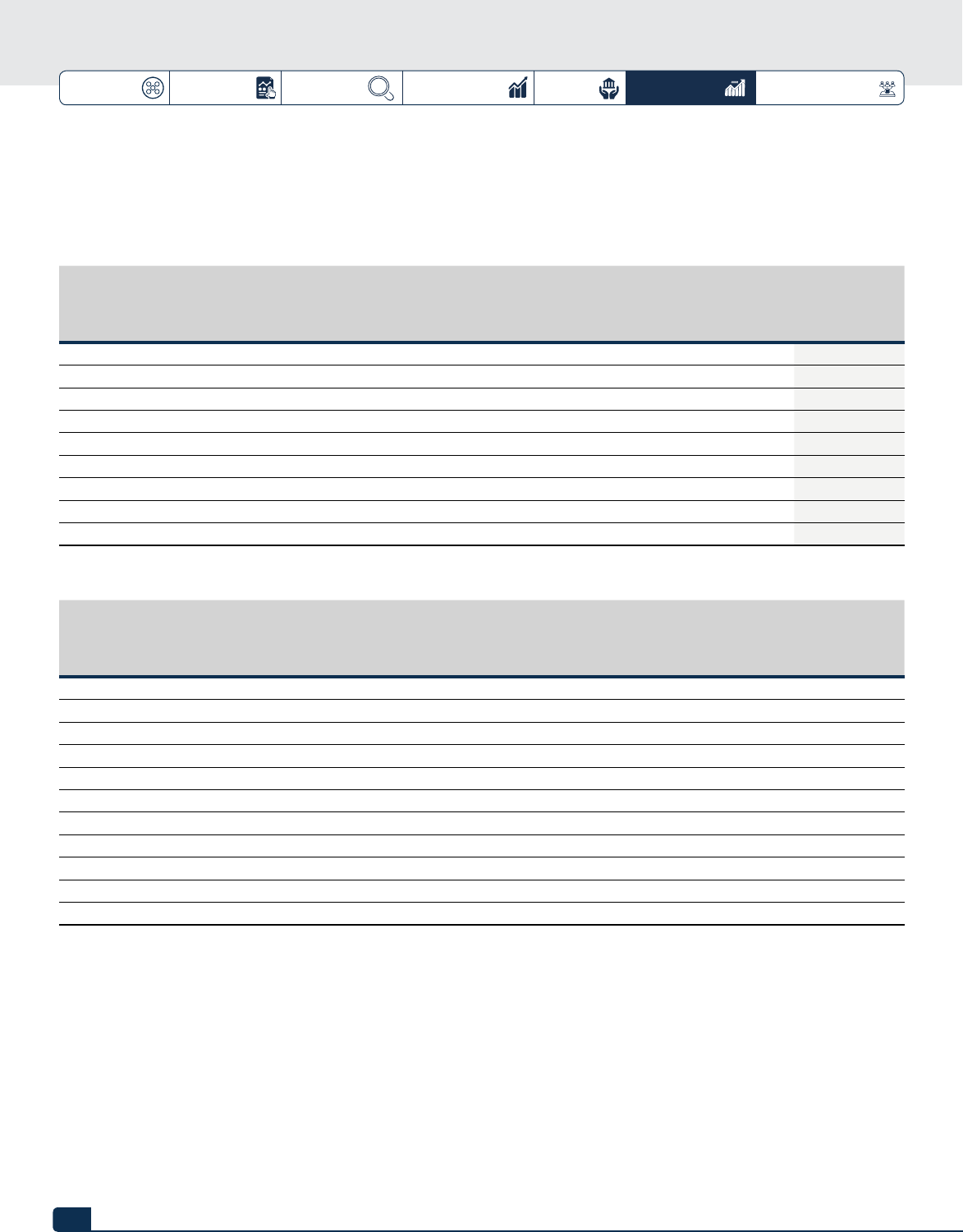

OUR STRUCTURE

Our business groups provide financial services to a variety of customers across commercial banking,

merchant banking and asset management and insurance.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

11

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

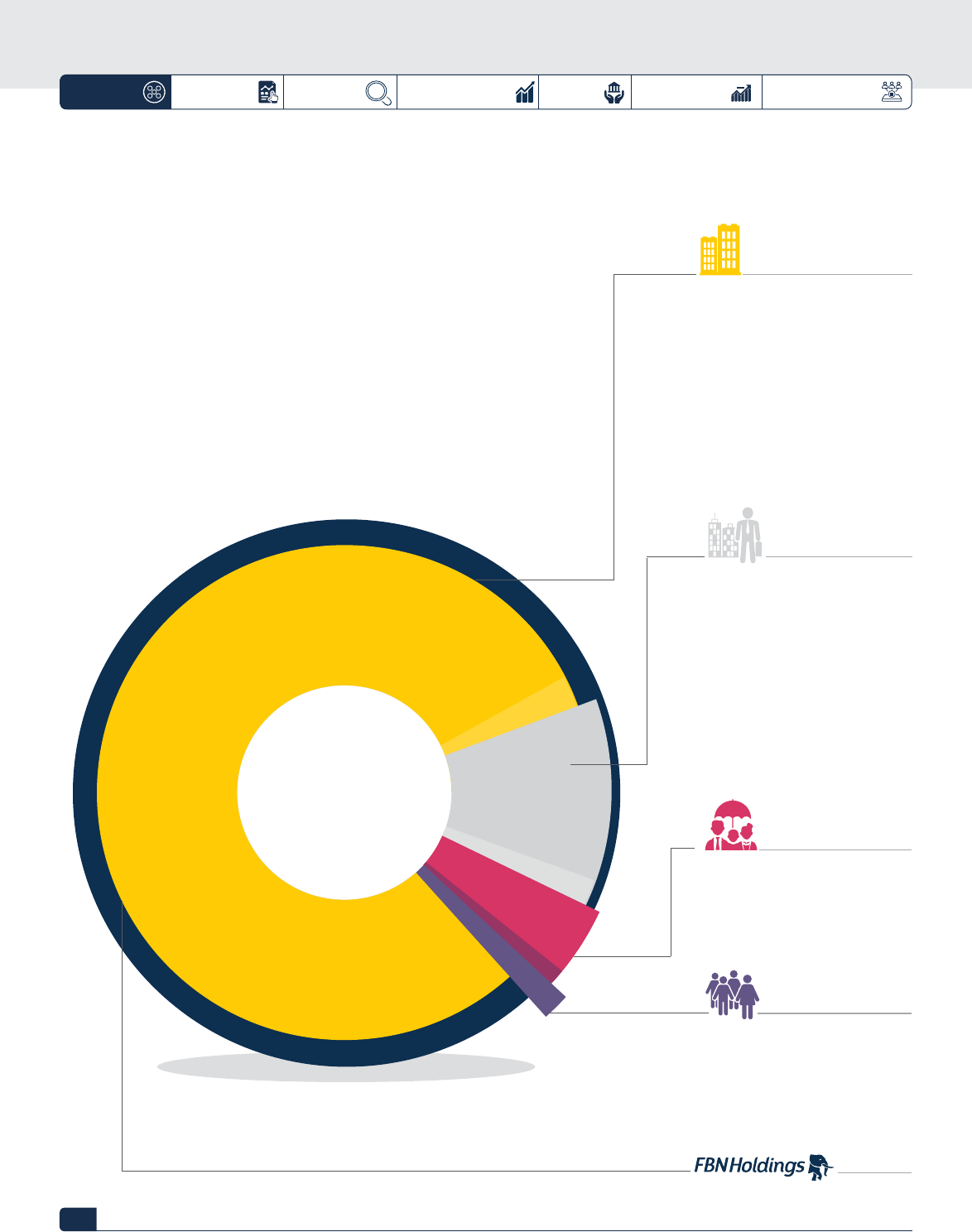

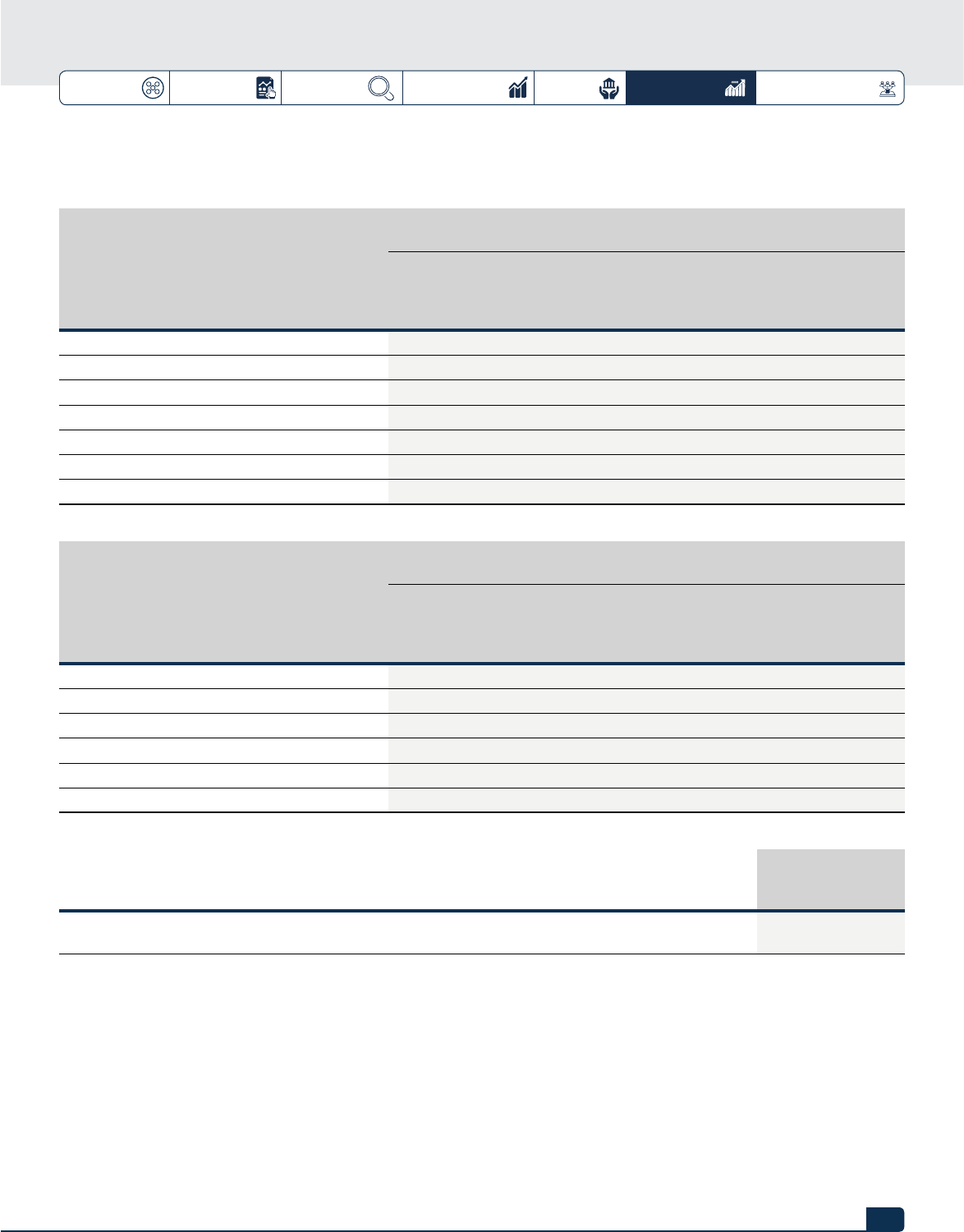

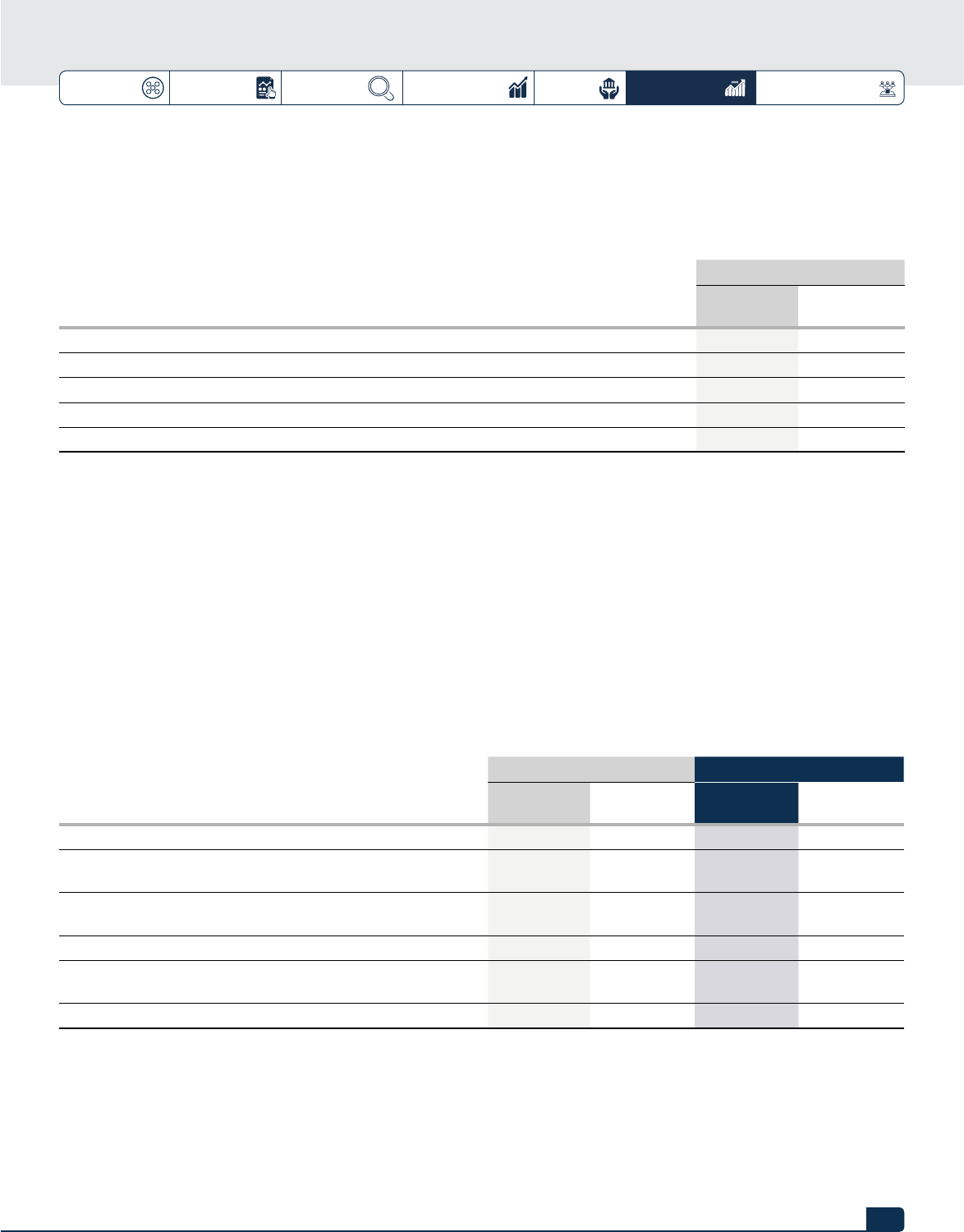

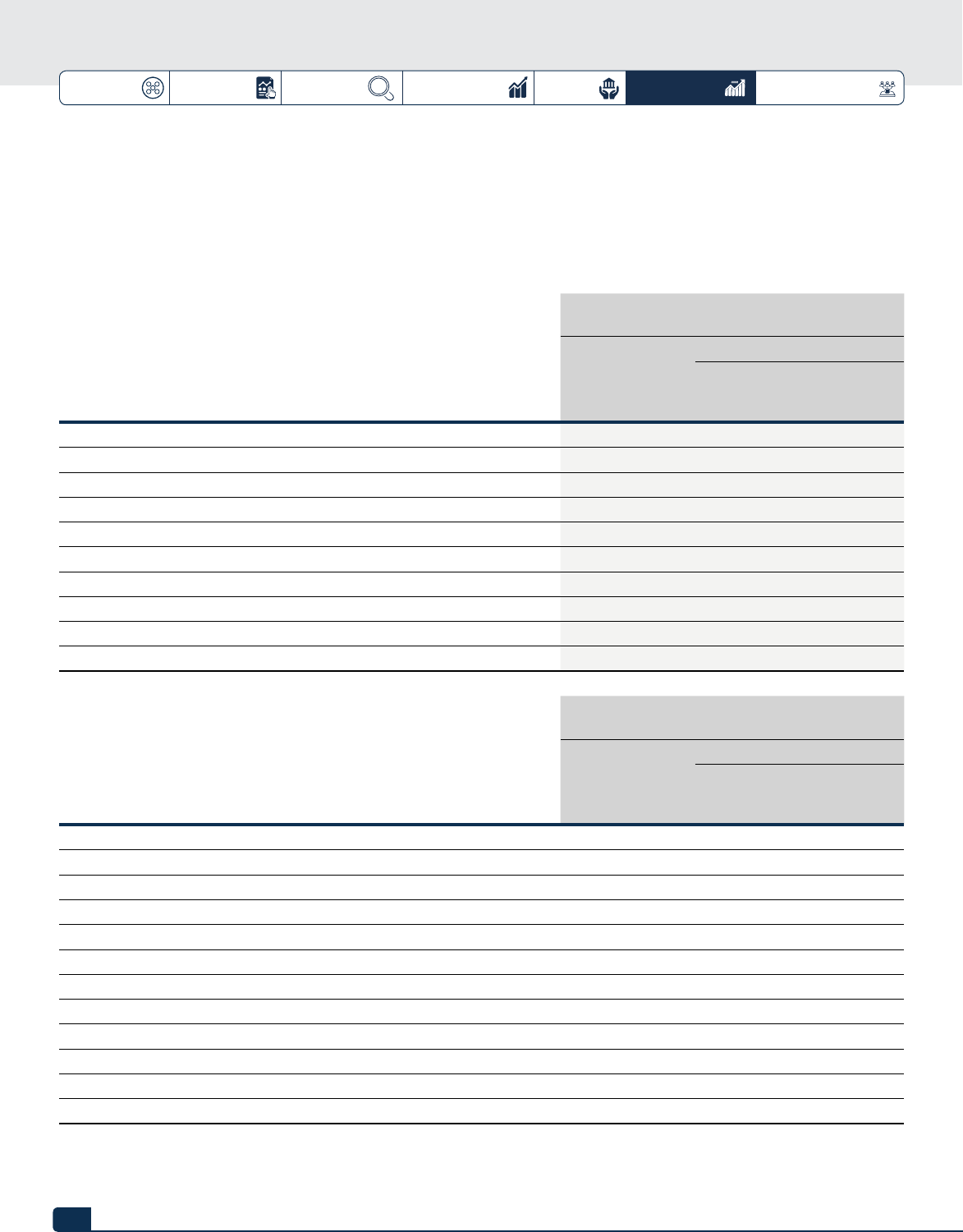

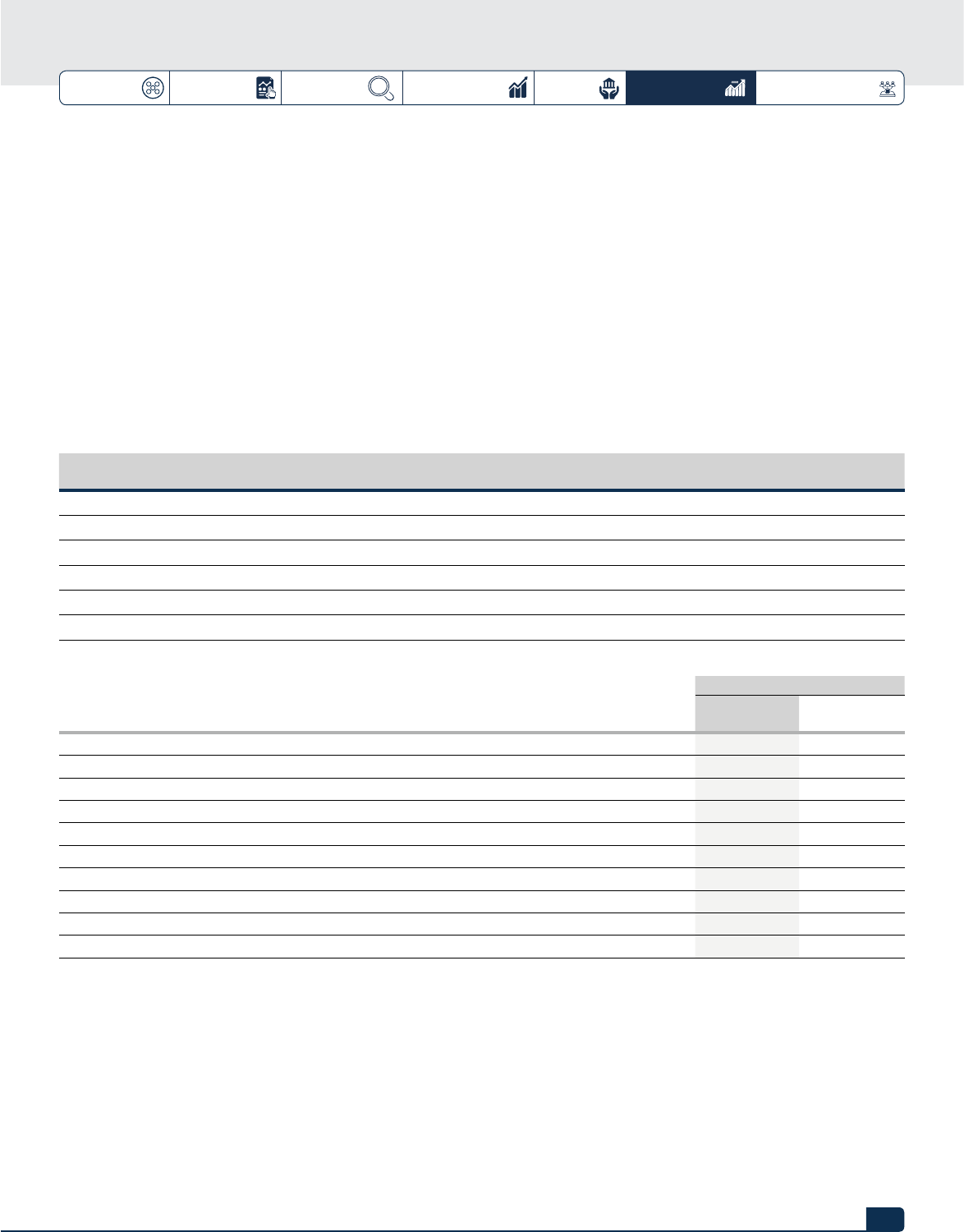

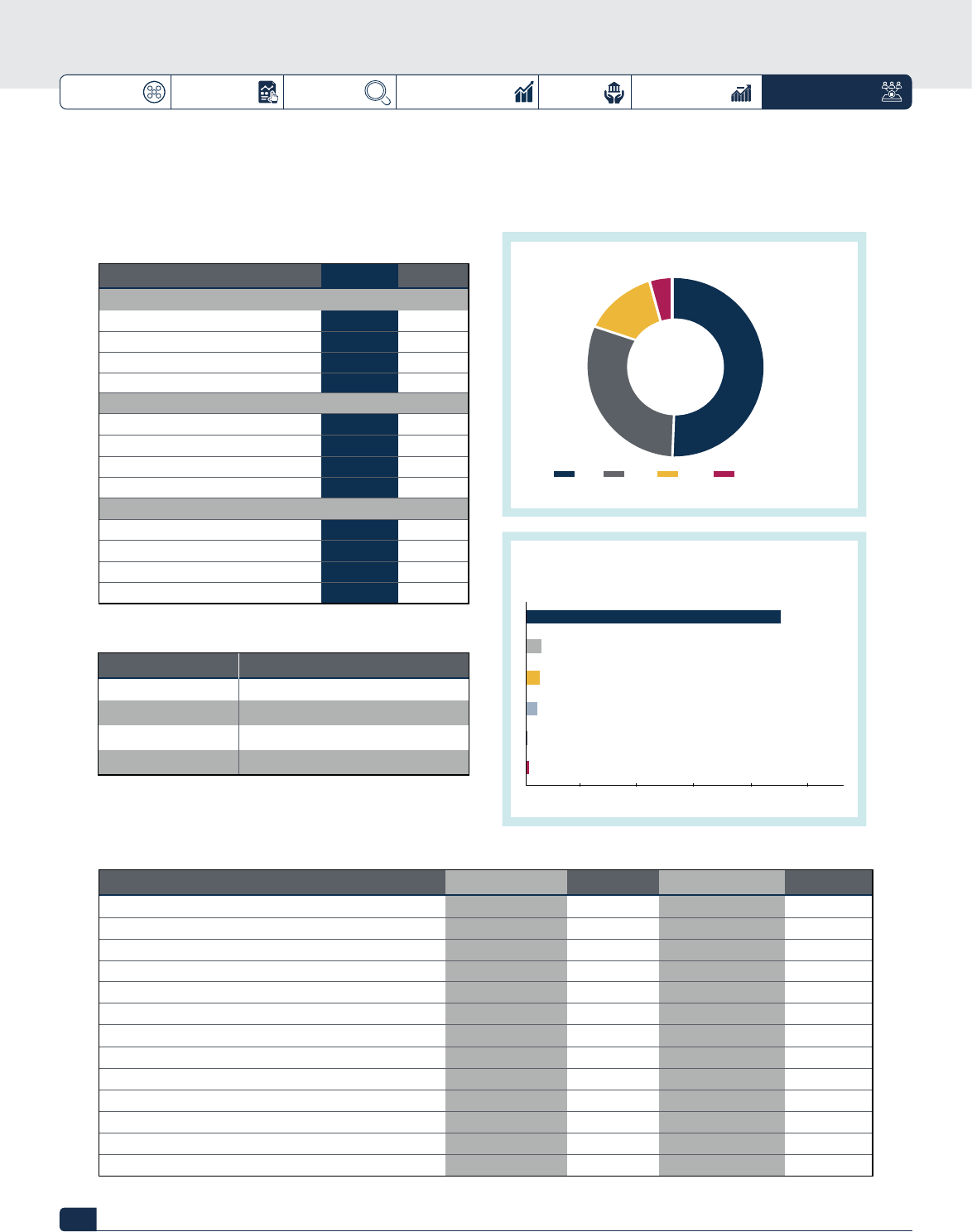

OUR STRUCTURE

Our products and services are designed to meet the requirements

of our customers.

Percentages represent

contribution to gross

earnings in 2018

COMMERCIAL BANKING

The Group’s core business is providing

financial services to individuals,

corporate and public sector customers.

This business segment includes

the Group’s local, international

and representative oces oering

commercial banking services.

88.2%

MERCHANT BANKING

AND ASSET MANAGEMENT

The Group’s key businesses comprise

Corporate Banking Investment Banking,

Wealth Management and Fixed Income

Securities Trading; as well as its subsidiary

businesses; Asset Management and

Equity Brokerage. The Group serves a

diverse customer base of corporates,

banks, public institutions, institutional

investors and high networth individuals.

7.7%

INSURANCE

This Group oers life, general

insurance and insurance brokerage

services.

OTHERS

3.8%

0.3%

100%

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

12

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

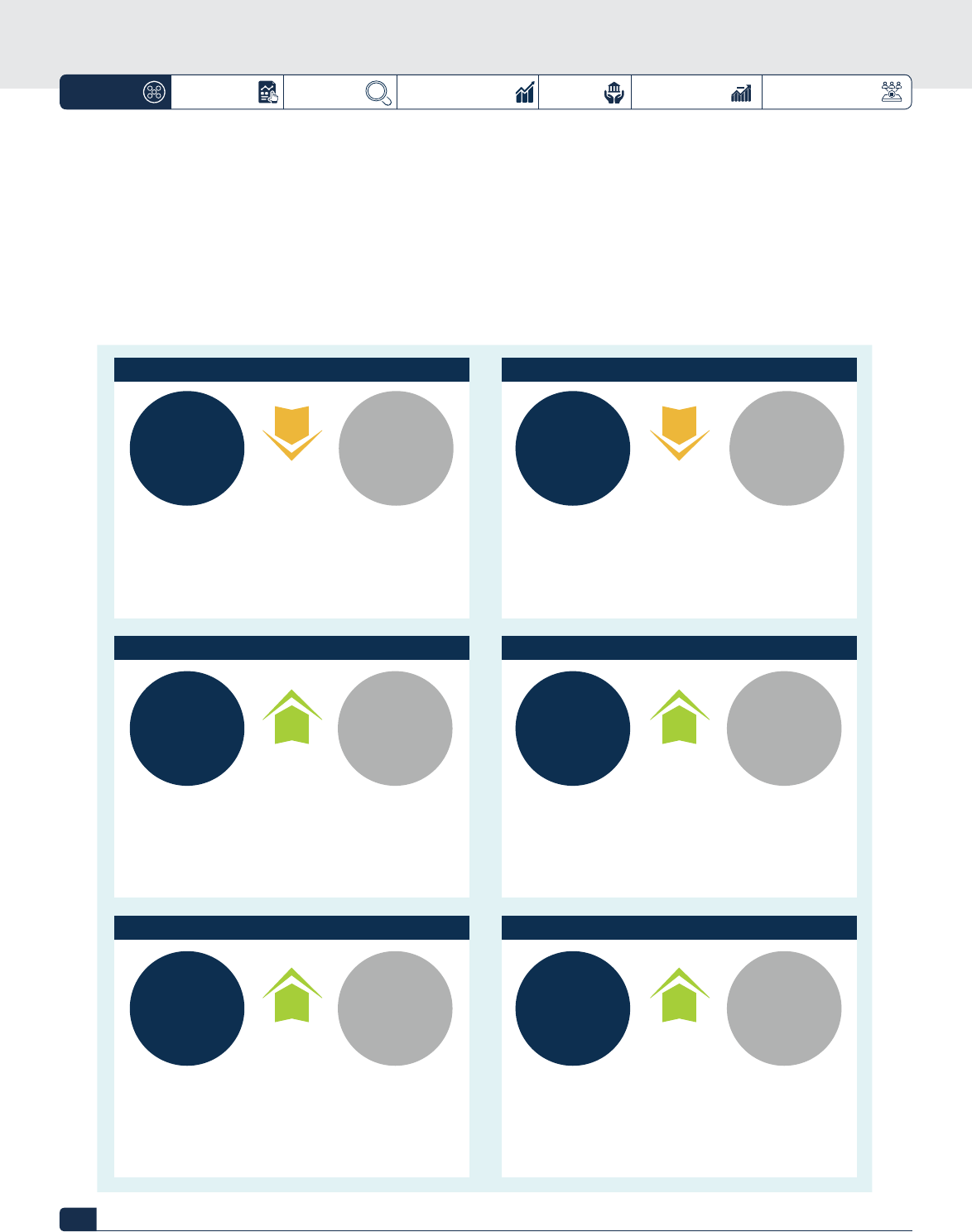

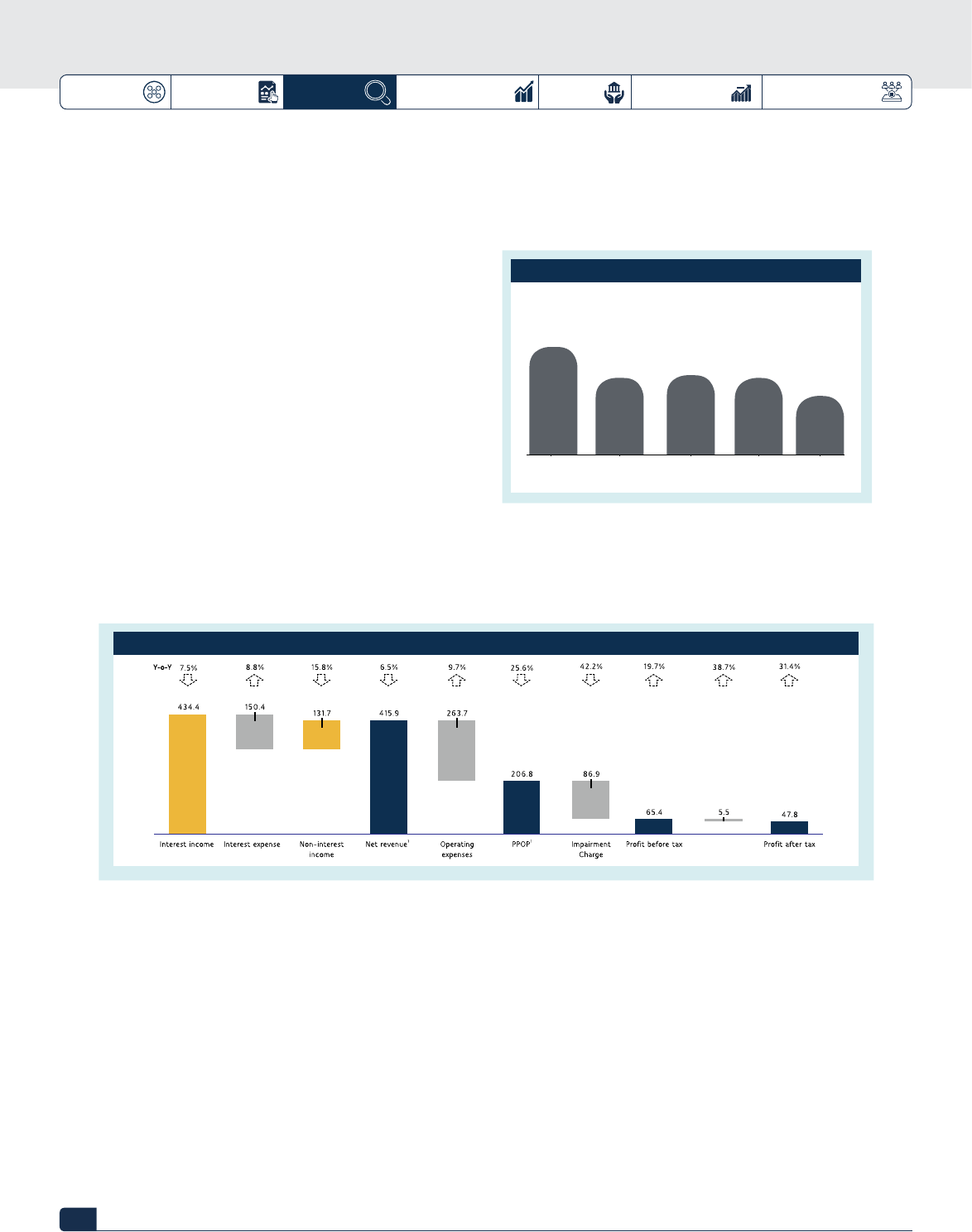

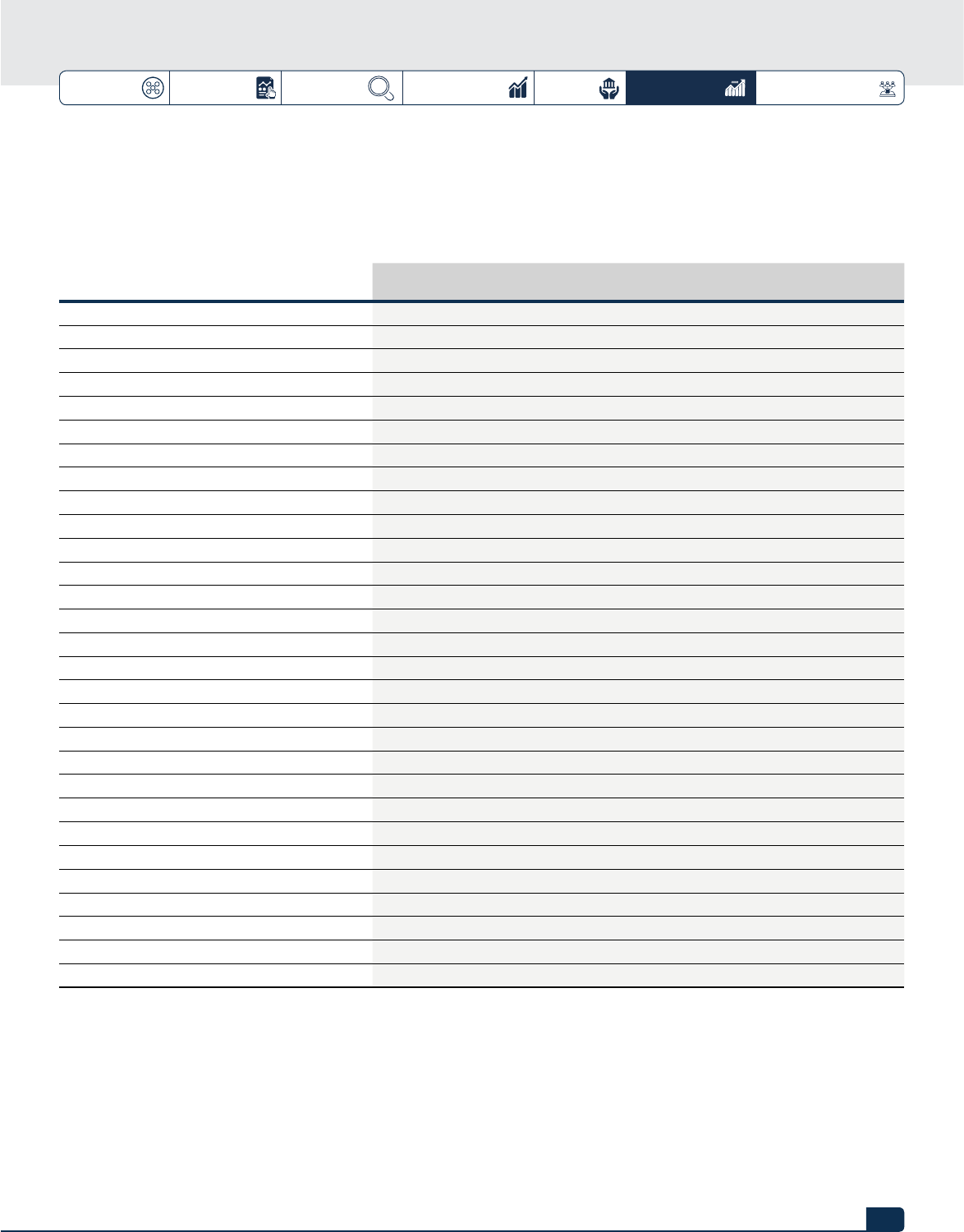

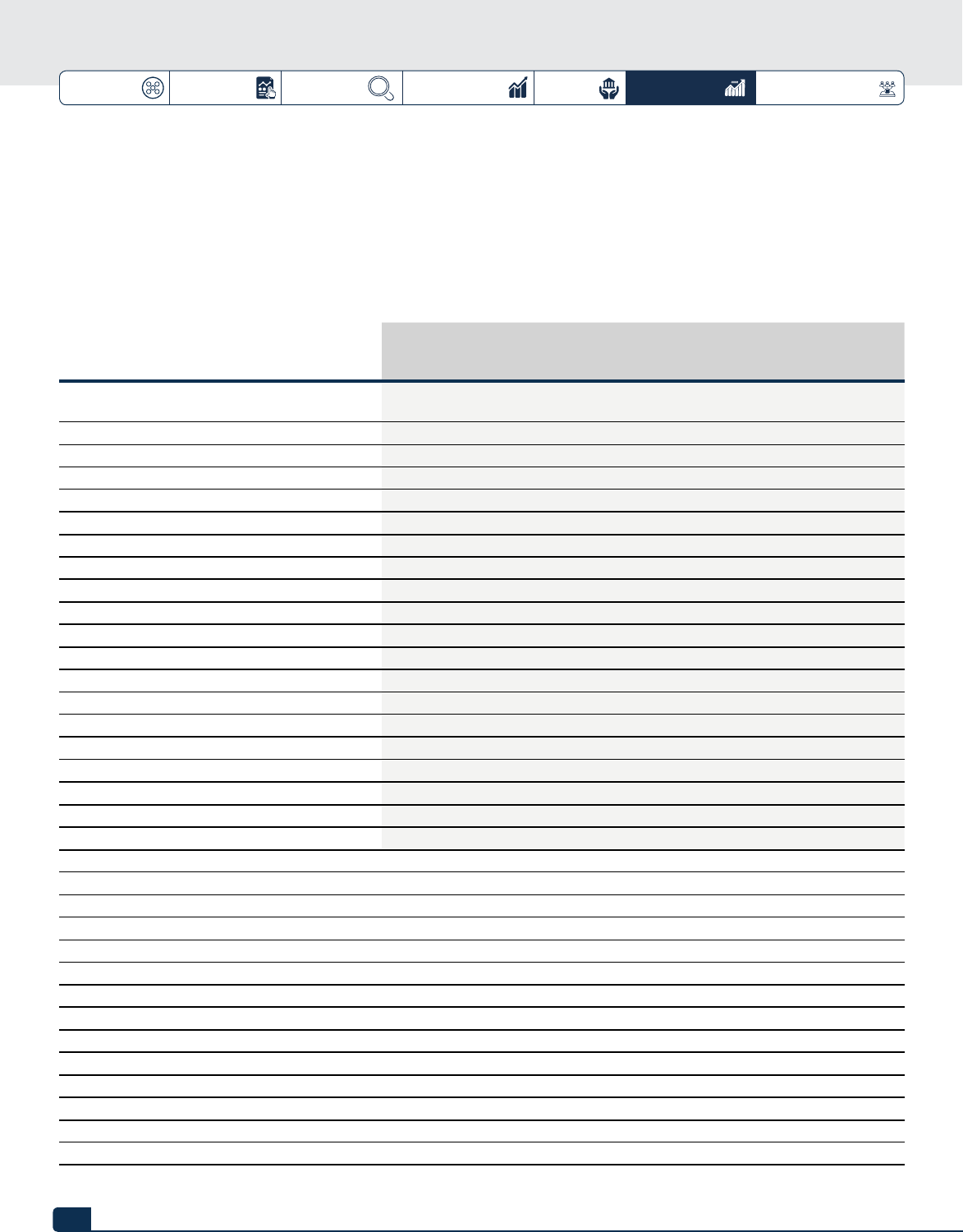

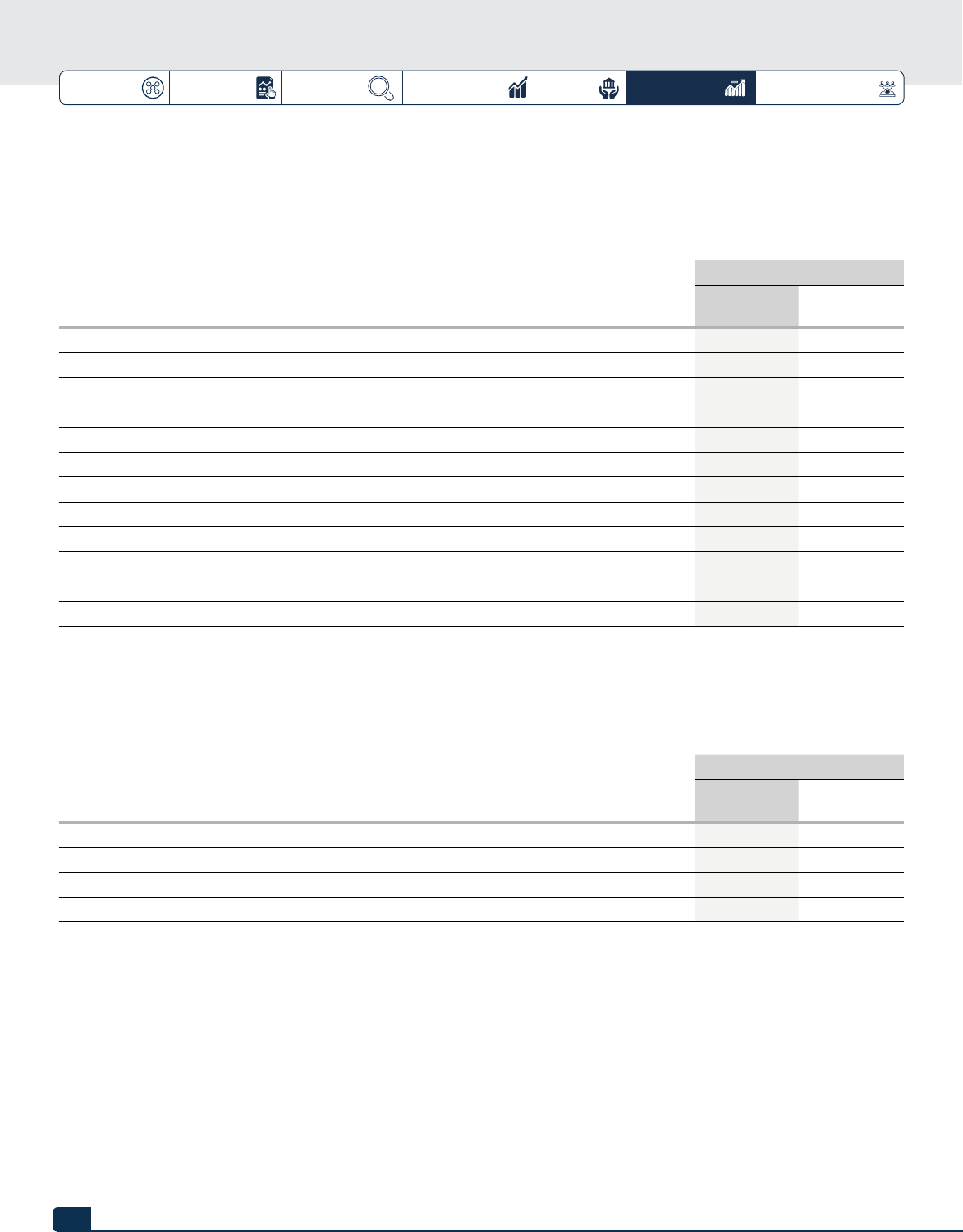

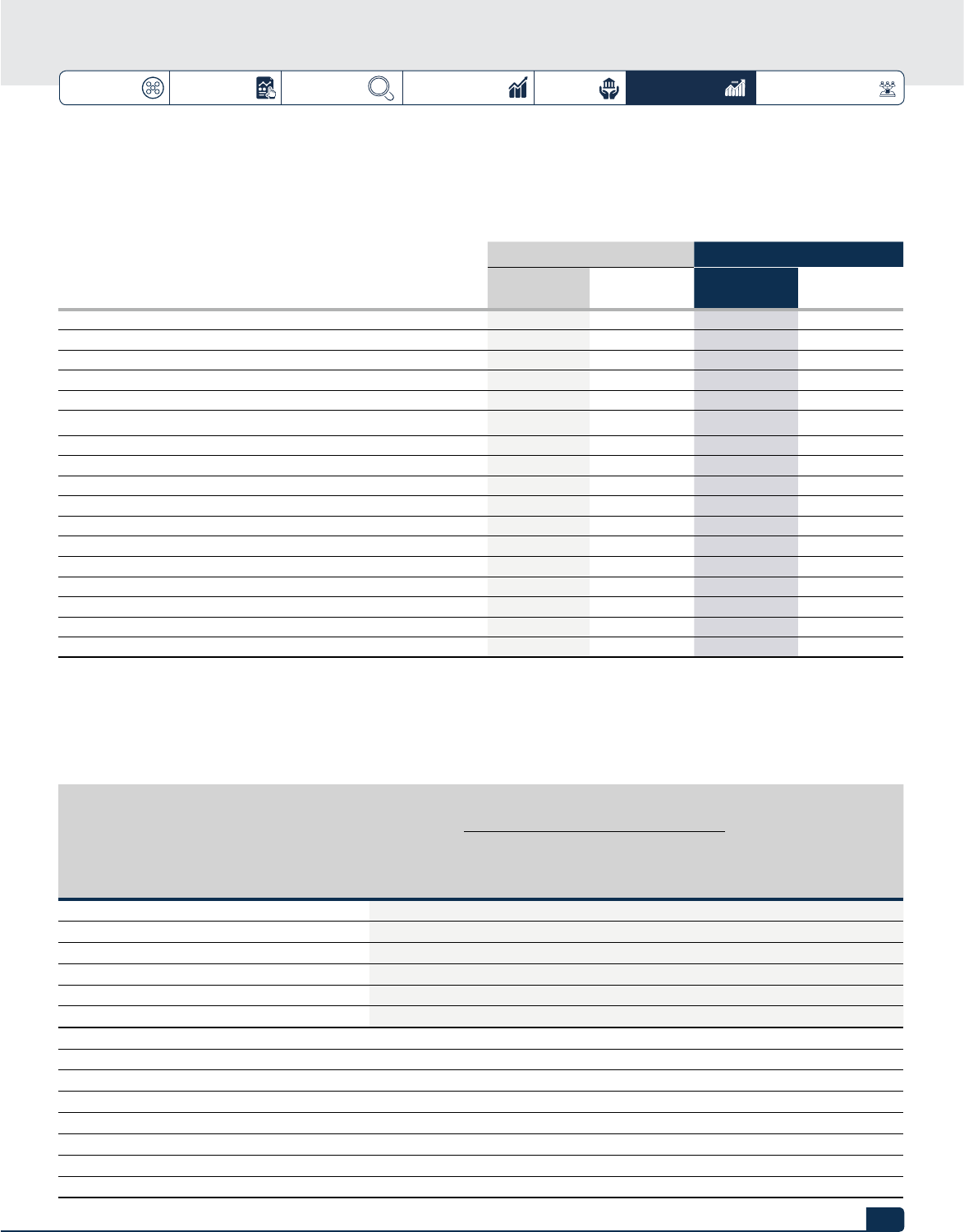

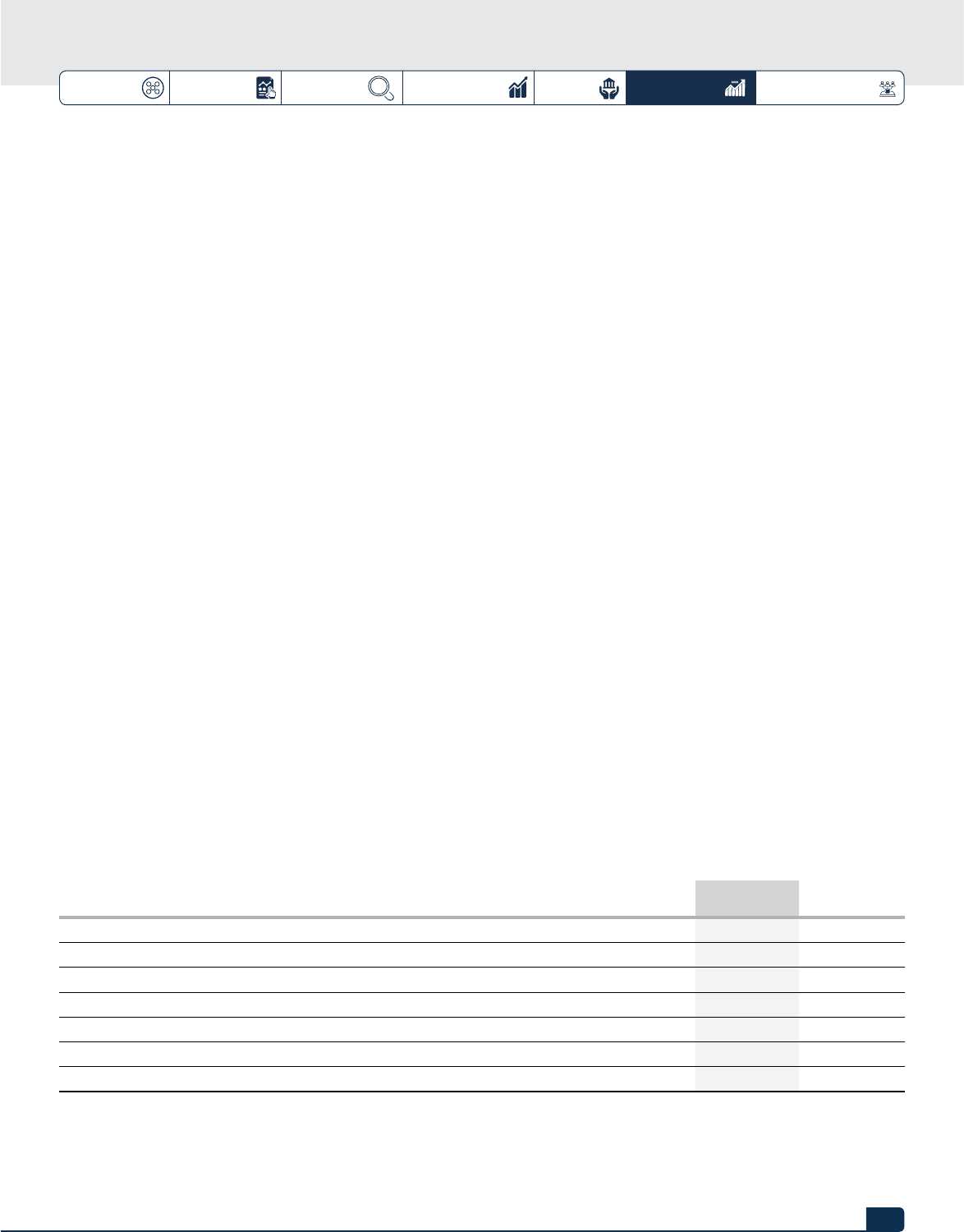

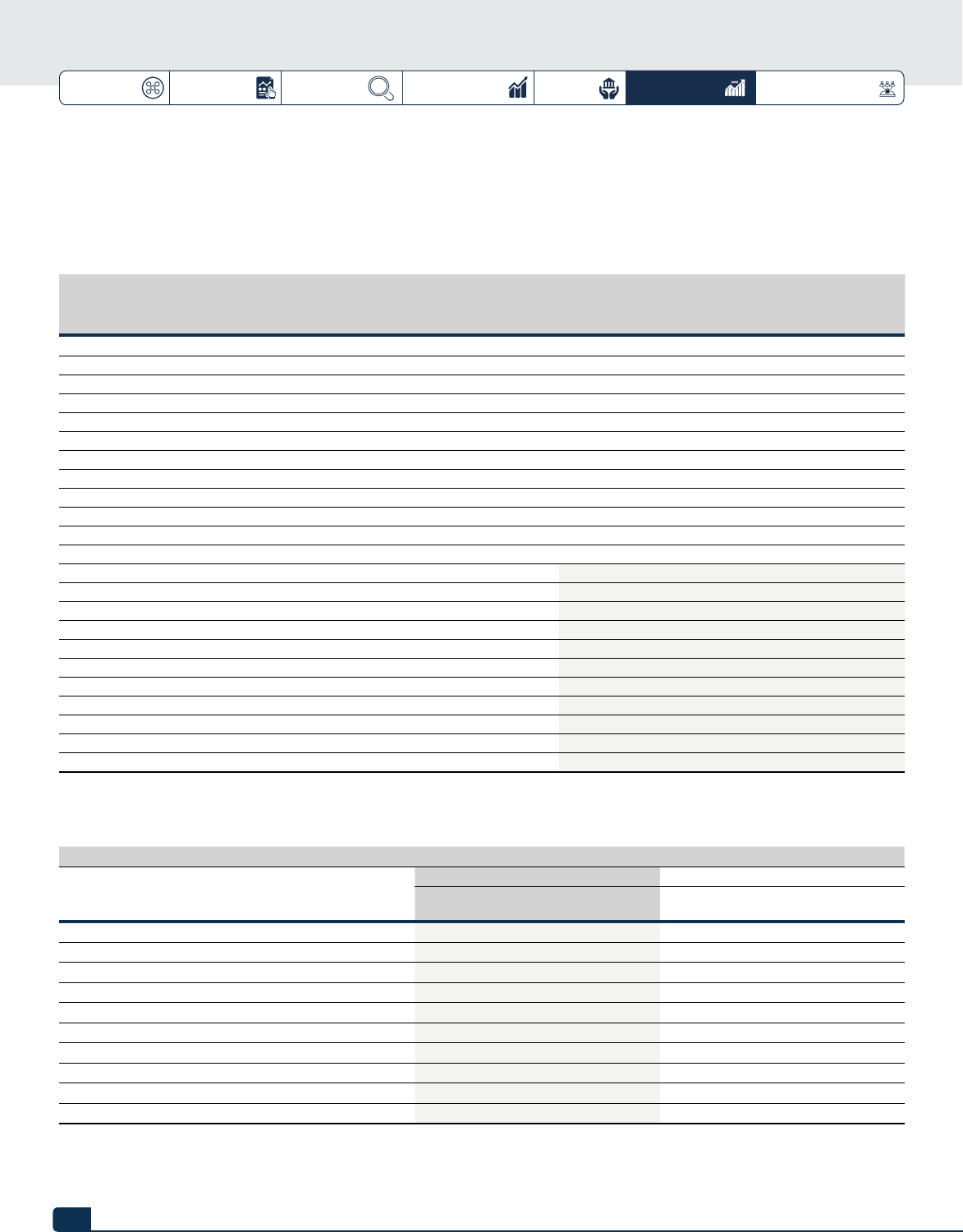

FINANCIAL HIGHLIGHTS

Gross earnings dropped due to a decline in interest income

on the back of a decrease in the loan book as well as the

depressed yield environment but partially oset by the

growth in non-interest income.

Increase in non-interest was driven by growth in fees and

commission income, on the back of growing contribution

from digital banking channels.

Sustained improvement in profit before tax on the back of

declining impairment charge on credit losses.

Net Interest income decreased largely on account of the

contraction in the loan book and the decline in investment

securities’ income, which were in part mitigated by an

increase in income from loans to banks.

The growth in operating expenses remained below the

headline inflation rate of 11.4%.

Increase in total customer deposits is driven by growth in

current and savings accounts.

N331.5bn

N240.3bn

N3,143.3bn

N595.4bn

N113.7bn

N54.5bn

2017

2017

2017

2017

2017

2017

N284.2bn

N263.7bn

N3,486.7bn

N583.5bn

N131.7bn

N65.3bn

2018

2018

2018

2018

2018

2018

GROSS EARNINGS NET INTEREST INCOME

14.3%

NONINTEREST INCOME OPERATING EXPENSES

15.8%

9.7%

PROFIT BEFORE TAX CUSTOMER DEPOSITS

19.7%

10.9%

2.0%

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

13

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

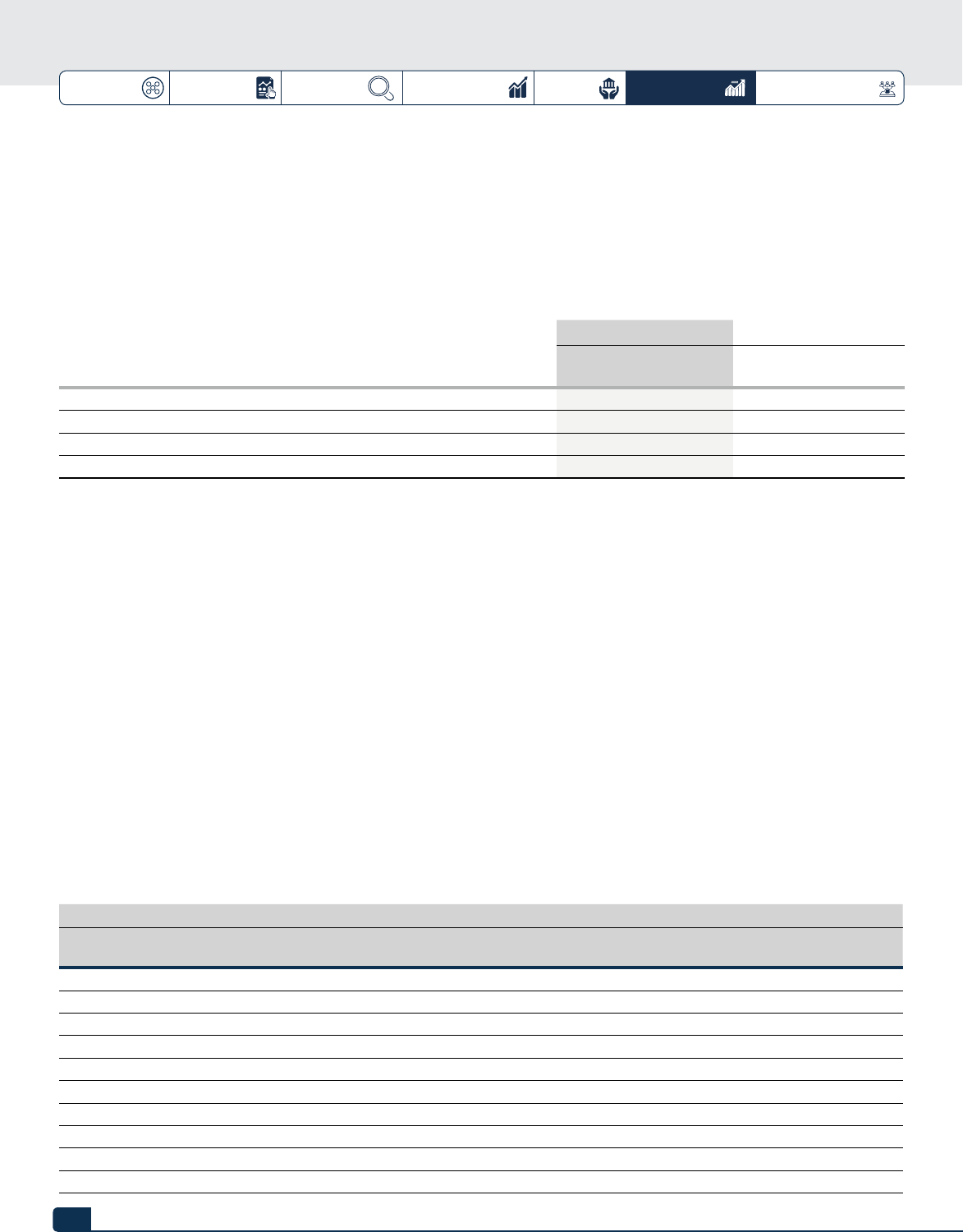

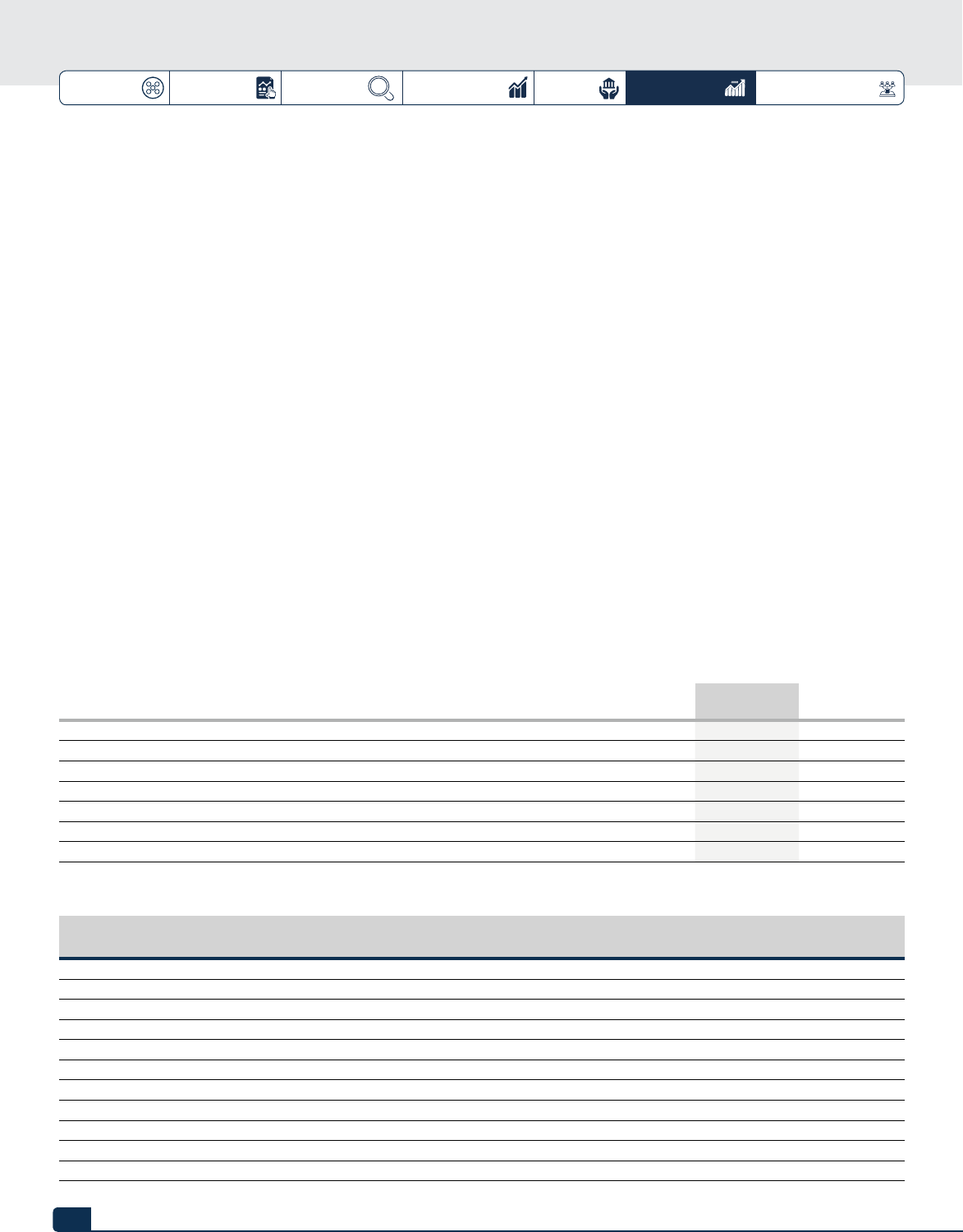

FINANCIAL HIGHLIGHTS

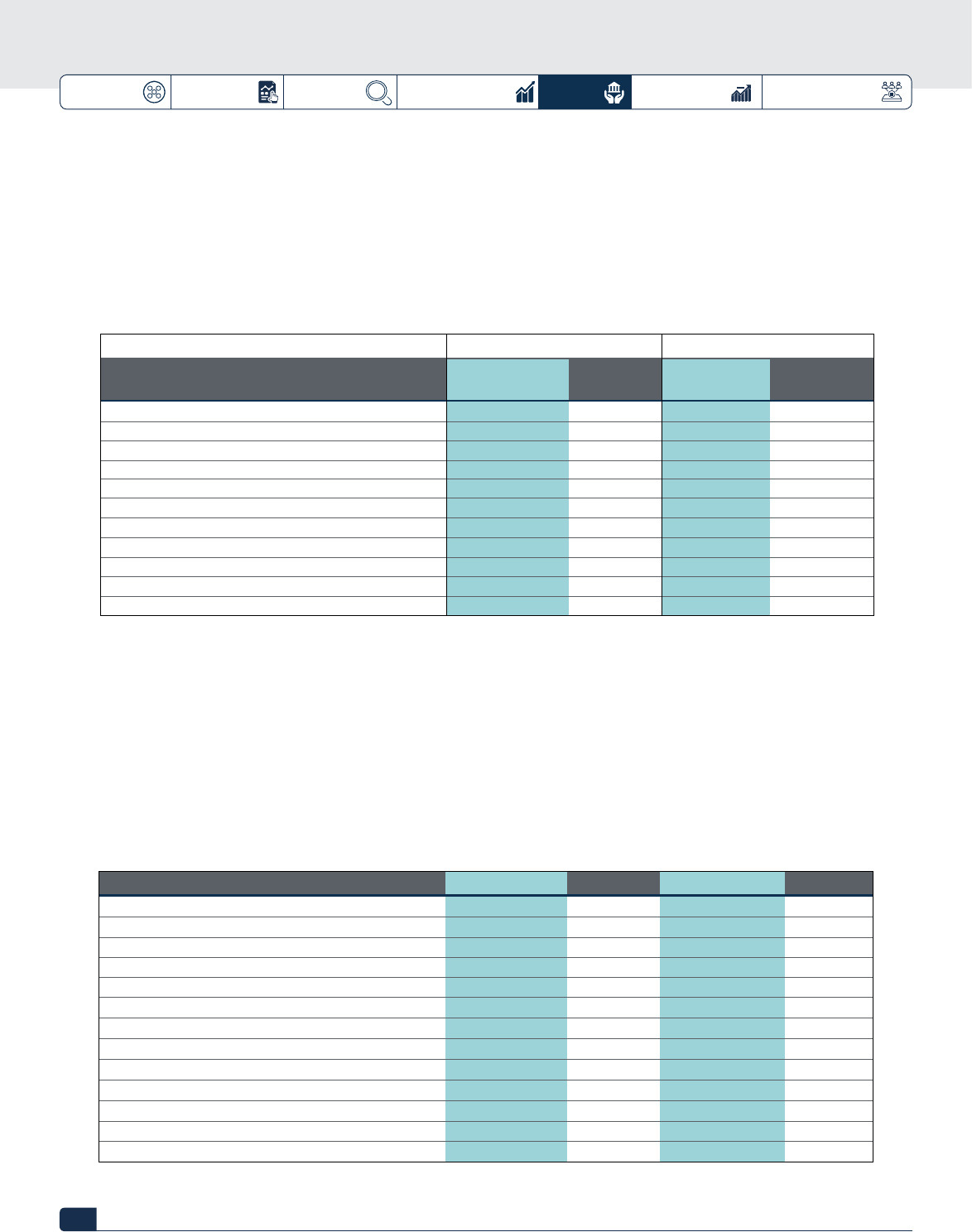

The decline in net customer loans and advances is reflective

of the weak macroeconomic environment that does not

support aggressive risk asset creation.

The improvement in return on average equity follows an

increase in profitability over equity.

The growth in earnings per share reflects improved

profitability.

Return on average assets for the year indicate improvement

in the financial performance.

N2,001.2bn

7.3%

N1.15

0.9%

2017

2017

2017

2017

N1.65

1.1%

N1,683.8bn

9.9%

2018

2018

2018

2018

CUSTOMER LOANS AND ADVANCES NET EARNINGS PER SHARE EPS

RETURN ON AVERAGE EQUITY RETURN ON AVERAGE ASSETS

15.9%

43.5%

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

14

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

NONFINANCIAL HIGHLIGHTS

STRENGTHENING TECHNOLOGY INFRASTRUCTURE

end-to-end technology platform for digital and business

growth, this has led to an increased volume of transactions

processed by the Bank. The Enterprise Resource Planning

(ERP) suite was also deployed and integrated across major

facets of our operations including human resources, finance,

procurement and general services functions. These

tools would drive eciency and productivity across

our processes and systems.

The Merchant Banking and Asset Management

business is at the tail end of the IT Transformation

project and has successfully articulated the

digital strategy to address current and future digital

capabilities.

Across the Group, sta were migrated to the Group-wide

Microsoft Oce 365 to ensure a single platform for

eective collaboration.

The Commercial Banking Subsidiary strengthened its

technology infrastructure, Information Technology (IT) risk

management, as well as IT security to drive automation,

increase sta productivity and transaction capacity.

In line with our digital and customer acquisition

drive, digital implementation in 2018 cut across

our various channels, products and services.

Pilot deployment of these applications are at

advanced stages while continuous enhancement

is underway. As part of the IT infrastructure

modernisation initiative, the enterprise IT

architecture design project was completed in

2018. The enterprise IT architecture provides the

blueprint for a modern IT infrastructure and operating

model that is appropriate for the Bank’s growth and digital

agenda. In addition, to leverage innovative technology

that would drive customer acquisition and retention, the

Bank implemented a robust, unified and rapidly scalable

ENHANCING DIGITAL BANKING OFFERING

The Group’s aspiration to drive a digitalised Bank would

be achieved through enhanced omni-channel capabilities,

automation, analytics and leveraging the Commercial Bank’s

existing brand and target digital customer segments. In 2018,

our service model for mass market was transformed

using the USSD and Agent Banking platforms.

FirstBank’s agents have been enabled to conduct

various transactions, such as funds transfers,

cash withdrawal, cash deposits, bills payments,

etc., for both FirstBank and non-FirstBank

customers. In addition, the Bank successfully

received the mandate for exclusive partnership

with National Union of Road Transport Workers to

activate agents in all motor parks in Nigeria.

There has been significant improvement in the total

number of subscribers on the USSD platform with

appreciable growth in transaction volume and value. Our

*894# quick banking application steadily grew to emerge

as the industry’s clear leader, having processed the highest

volume of transactions. In 2018, subscribers on our USSD

platform grew on a year-on-year basis from 4.1 million to

6.7 million bringing about a substantial growth in

revenue, transaction count and value processed.

Our digital channels were enhanced through

the incorporation of an account opening

feature. Non-FirstBank customers can now open

accounts via our USSD Banking, FirstMobile app,

ATMs, and Agent Banking channels. In 2018,

we had an impressive number of accounts opened

through our digital channels. Subsequently, our mobile and

online banking applications have recorded significant growth

in subscriber base and transaction value relative to prior

year.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

15

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

NONFINANCIAL HIGHLIGHTS

DRIVING INNOVATION

We commenced operations of our Digital Innovation

Laboratory (Lab) which has provided an eective

platform for engaging the Fintech community and

harnessing opportunities within the ecosystem. The Lab

hosted a hackathon with focus on innovative solutions to

challenges in the financial industry through the use of

Artificial Intelligence and Big Data. In addition, the Lab

implemented the innovative chat banking facility

on the Commercial Bank’s WhatsApp handle

which was launched in October 2018.

In line with our innovation drive, additional

value-added services were enabled on the

Commercial Bank’s e-channel platforms to

further enrich customer experience. For example,

the Visa card cash withdrawal capability on Agent

Banking; Foreign Currency limit increase on FirstMobile;

and mobile data vending services on USSD, were among

other ongoing enhancements.

The Commercial Bank deployed a Transaction Banking group

solution called FirstDirect. FirstDirect is a Trade finance

solution (Finastra) upgrade and integrated cash management

solution (Polaris).

Another critical component of the Bank’s strategic

plan is the First Shared Services, that involves the

centralisation and migration of repetitive non-core

back-oce processes. For example, the ATM funds

transfer dispute resolution process was automated using

workflow Business Process Management Solution. This

recorded progress with the Bank-wide migration of

automated payments across the branches.

Furthermore, the Group secured regulatory

approval to roll out the Group Shared Services

model to drive eciency and ultimately

improve cost-to-income ratio.

In addition, the Merchant Banking and Asset

Management business rolled out the FBN Edge app

to enhance operational eciency and improve customer

experience. FBN Edge was designed to simplify investing

by allowing users set-up mutual fund accounts, manage

their investments and track their progress on-the-go.

This way, users enjoy an edge in investing and can take

control and meet their financial goals sooner.

REVAMPED CUSTOMER VALUE PROPOSITION

In 2018, an online account opening process was

implemented for seamless account opening at any location

by potential customers. The instant account opening features

were deployed across all digital channels (USSD, ATM,

Web, Agent Banking). The Commercial Bank also

commenced a best-in-class enterprise CRM

framework to proactively manage and analyse

customer interactions and data throughout the

customer lifecycle. In addition, the upgrade and

digitalisation of customer onboarding process

and a revamp of customer value proposition

across various business segments were initiated

while a more ecient value chain model that takes an

enterprise-wide view of customers to extract more value,

unlock revenue pools, grow customer base and increase

profitability per customer was implemented.

The Merchant Banking and Asset Management

business have completed the integration to the

NIBSS platform and have registered with CSCS

to obtain the Legal Entity Identifier (LEI)

that enables clear and unique identification

of the Bank as a legal entity participating in

international financial transactions. Obtaining

the LEI has enhanced transactions by oshore

counterparties of the Fixed Income, Currencies

and Treasury as well as FBNQuest Securities.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

16

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

REVAMPED STRATEGIC FOCUS (PR1MUS)

The Group remains focused on driving its performance

through key strategic initiatives across its businesses.

Specifically, the Commercial Bank continues to

recalibrate its execution strategy by reviewing the

corporate strategic priorities. The recalibration is

focused on the execution of the seven corporate

strategic themes, realigned along six business

and functional work streams (Retail Banking,

Corporate Banking, Commercial Banking;

Public Sector, Cost Optimisation, Risk

Management, and Subsidiaries).

The work streams are supported by three key

enablers to achieve the strategic aspirations.

These include core IT infrastructure platforms to scale

and support business growth ambition, data and digital

tools to drive down cost, as well as talent and culture

management to improve performance. Consequently,

the strategic initiatives were consolidated into one

integrated transformation program, ‘PR1MUS’.

PR1MUS reflects the transformative path to

regaining industry leadership position. The

5-strategic pillars under the umbrella of PR1MUS

include Customer-led innovation, Safeguarding

our business, Re-igniting FirstBankers’ passion

and pride, Building a Digital Bank as well as

Reimagining and re-engineering the process.

Overall, PR1MUS is expected to improve stakeholder

engagements and accelerate both user adoption and

value realisation of our various initiatives.

PEOPLE AGENDA

The People Agenda is a critical element of our overall

goal towards entrenching a strong employee value

proposition (EVP) in line with our aspiration – ‘to develop

FBNHoldings into a hub for choice industry talent

anywhere’. As instituted, the People agenda is a means

of cultivating an innovative and high-performance work

environment through eective implementation of

group-wide synergistic initiatives around resourcing,

performance and reward management,

talent management, career development,

learning and leadership development, culture

transformation, employee engagement and

experience.

These initiatives are being implemented at the

group-level and customised to suit each operating

company with the objective of building and harnessing

the full potential of a robust and multi-skilled workforce

to consistently deliver on strategic objectives in the short,

mid and long-term.

Specifically, the Commercial Banking group reinvented

itself as a dynamic and customer-centric institution.

With this brand relaunch came a brand promise of ‘You

First’. To fulfil this promise, the Bank recognised the need

to make some critical changes to its culture. As such,

the Bank’s culture transformation initiative has been

redesigned to promote the internalisation of certain core

behaviours expected from FirstBank sta. This will also

facilitate various ways through which sta can develop

the identified behaviours within their roles and in

addition reinforce positive behaviours to sustain

the desired Group-wide transformation. The

activities around the culture transformation

initiatives include: Talent resourcing, leadership

development and continuous learning,

succession planning as well as improved

employee experience management.

On the other hand, the Merchant Banking and Asset

Management group also successfully embedded the

Corporate and Individual Performance Management

process during the year and launched the High Potential

(HiPo) initiative to identify and retain high performing and

high potential employees.

NONFINANCIAL HIGHLIGHTS

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

17

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

NONFINANCIAL HIGHLIGHTS

RENEWED APPROACH TO SYNERGY REALISATION

In line with our priority to extract value through synergy

and collaboration, we have seen significant results in

our revenue generation aspiration in 2018 relative to

the prior year. This remarkable achievement in synergy

revenues, reflects the execution of key synergy initiatives

to drive collaboration and cross-sell across all

operating companies. As a result, there has

been steady growth in the contribution to the

revenue pool of the Group, helping to further

diversify the revenue portfolio. Similarly, with

the approval to implement the Group Shared

Services, we expect to experience the benefits

of the cost synergies across our business.

To further deepen revenue synergies, our businesses

have continued to drive synergy growth by providing

complementary products and services, thereby

enhancing the overall value proposition of the Group.

These complementary products and services provide

a platform for complete financial solutions to our

large customer base in the quest to create wealth

and meet financial needs. Consequently, harnessing

the natural synergy that exists across our businesses

has progressively improved the deals’ pipeline thereby

enhancing revenue generation capabilities.

Considering the enormous potential of synergy

realisation in the Group’s overall strategy, the

synergy and collaboration initiatives have been

elevated to drive revenues from cross-sell across

the Group. We are not relenting our eorts,

and our ‘Think Group’ approach to synergy and

collaboration will further drive and unlock earnings

potential across the Group. We believe that our eorts to

integrate our oerings and provide end-to-end solutions

for our customers will create a competitive advantage in

our markets.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

18

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

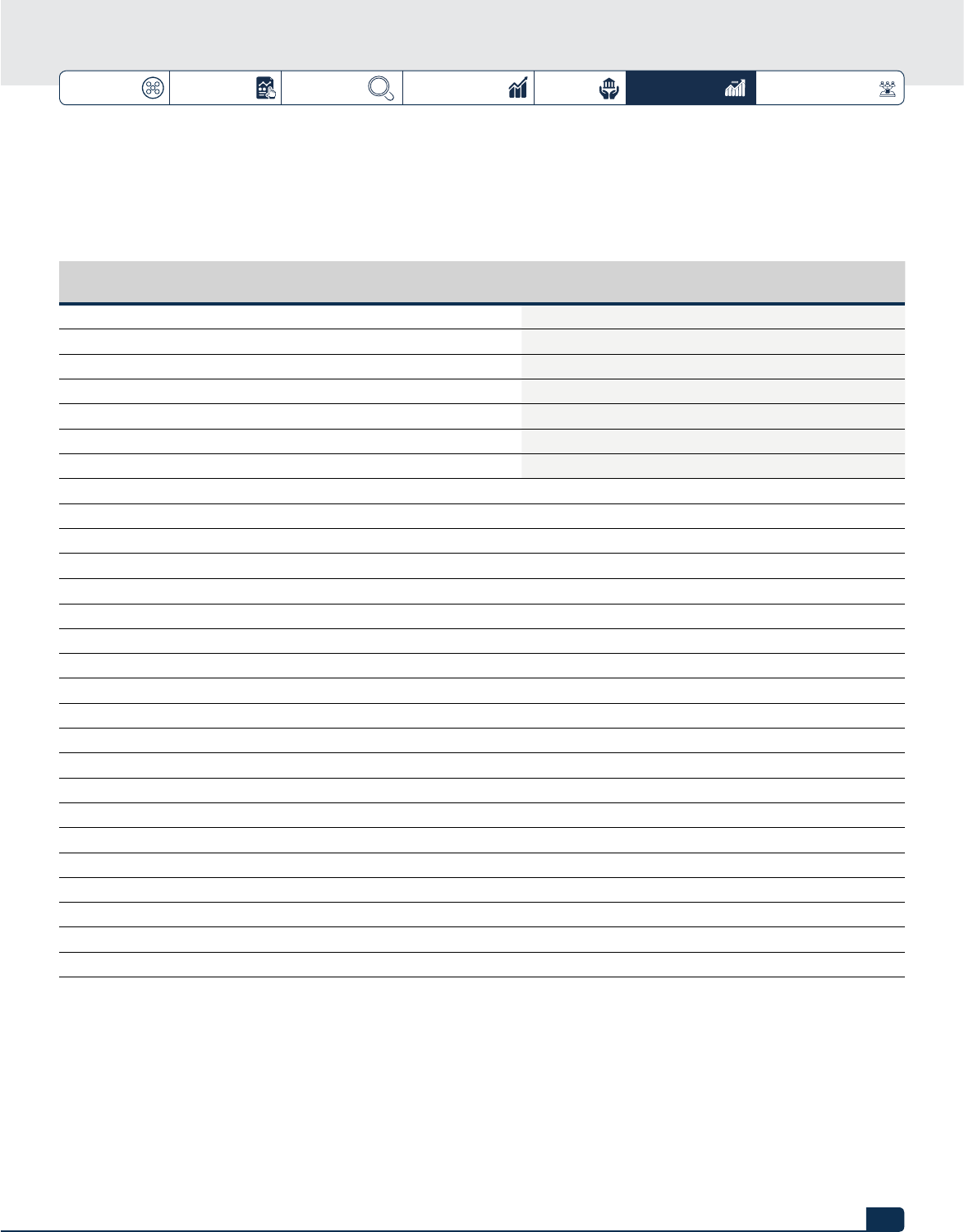

RECOGNITION AND AWARDS

BEST BANK IN NIGERIA

GLOBAL FINANCE MAGAZINE

FINANCIAL HOLDING COMPANY OF THE YEAR

BUSINESSDAY BANKING AND FINANCIAL INSTITUTIONS

FirstBank was rearmed the ‘Best

Bank in Nigeria’ for the 15th time. This

Award is in recognition of the Bank’s

consistent leadership role in enterprise

and innovative banking in Nigeria,

Middle Africa and beyond.

FBNHoldings won the ‘Financial

Holding Company of the Year’ Award

at the 5th BusinessDay Banking and

Financial Institutions Awards. This is in

recognition of its leadership role in the

financial services industry.

BEST RETAIL BANK IN NIGERIA

ASIAN BANKER INTERNATIONAL EXCELLENCE IN RETAIL

FINANCIAL SERVICES AWARDS

FirstBank won the ‘Best Retail Bank,

Nigeria’ Award for the seventh

consecutive year by the Asian Banker.

This Award is in recognition of the

Bank’s exceptional performance in the

nation’s retail market.

BEST RETAIL BANK BRAND

BRAND POWER GOLDEN ICON

FirstBank clinched the ‘Best Retail

Bank Brand’ Award for its lead role

in the revitalisation of the Nigerian

Industrial Brand for the development

and growth in a modern economy.

BANK OF THE DECADE

BUSINESS JOURNAL

FirstBank won the ‘Bank of the Decade’

Award in recognition of its performance

and consistent leadership in the

banking industry.

BEST PRIVATE BANK IN NIGERIA

GLOBAL FINANCE MAGAZINE

FirstBank was named the ‘Best Private

Bank, Nigeria’ for the Bank’s excellent

delivery of specialised service to high

networth individuals towards enhancing,

preserving and passing on their wealth.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

19

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

RECOGNITION AND AWARDS

OUTSTANDING FINANCIAL BRAND IN ICT

AND SOCIAL MEDIA DEPLOYMENT

MARKETING EDGE PUBLICATIONS LIMITED

FirstBank was named the ‘Outstanding

Financial Brand in ICT and Social Media

Deployment’. This Award is in recognition

of the Bank’s contribution to the growth,

development and continuing evolution of

the Nigerian Banking industry.

SECURITY CONSCIOUS BANK OF THE YEAR

NATIONAL CRIMEWATCH AWARDS

The ‘Security Conscious Bank of

the Year’ Award was conferred

on FirstBank in recognition of its

partnership against crime.

BEST BANK IN AGRICULTURE LENDING AND SUPPORT

BUSINESSDAY BANKING AND FINANCIAL INSTITUTIONS’

AWARDS

FirstBank clinched the ‘Best Bank in

Agriculture Lending and Support’ Award. This

is in recognition of the Bank’s leadership

in the Agricultural space and its valuable

contributions towards the development of

Agriculture at the Federal and State levels as

well as its support to private individuals and

organisations.

FMDQ MONEY MARKET LIQUIDITY PROVIDER

FMDQ OTC SECURITIES EXCHANGE

FirstBank was named ‘FMDQ Money

Market Liquidity Provider’ for its

promotion of operational excellence in

Nigerian financial markets.

BEST INVESTMENT BANK IN NIGERIA

GLOBAL FINANCE AWARDS

For the sixth consecutive year,

FBNQuest Merchant Bank received

the ‘Best Investment Bank in Nigeria’

Award. This is in recognition of its

leadership position in key business

areas.

BEST SOCIAL DEVELOPMENT BOND

EMEA FINANCE ACHIEVEMENT AWARDS

FBNQuest Merchant Bank was named

‘Best Social Development Bond’. This

Award is in recognition of its role in the

Mixta Real Estate transaction.

BEST LOCAL CURRENCY BOND HOUSE

EMEA FINANCE ACHIEVEMENT AWARDS

FBNQuest Merchant Bank received the

Award of ‘Best Local Currency Bond

House’. This is in recognition of the role

played by the Bank in the Mixta Real

Estate transaction.

BEST PRIVATE BANK IN NIGERIA

WORLD FINANCE MAGAZINE

FirstBank won the ‘Best Private Bank in

Nigeria’ Award for distinguishing itself

with its unique product oerings and

quality advisory services.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

20

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

RECOGNITION AND AWARDS

MOST INNOVATIVE BOND

EMEA FINANCE ACHIEVEMENT AWARDS

FBNQuest Merchant Bank clinched the

‘Most Innovative Bond’ Award. This is

in recognition of the Bank’s role as the

Nigerian Book runner to the Federal

Republic of Nigeria on the inaugural SEC-

Registered Diaspora Bond transaction.

BEST M&A DEAL AFRICA MIDMARKET

EMEA FINANCE ACHIEVEMENT AWARDS

FBNQuest Merchant Bank won the ‘Best

M&A Deal Africa (Mid-Market)’. This is

in recognition of the role played by the

Bank as the Joint Financial Advisers to

AMCON on the divestment of AMCON’s

100% shareholding in Keystone Bank

Limited.

DEAL OF THE YEAR AFRICA: ISLAMIC FINANCE

THE BANKER DEALS OF THE YEAR

FBNQuest Merchant Bank won the

‘Prestigious Deal of the Year in Africa’.

The Award recognises top financial

institutions in the world with sterling

performance. The Award was presented

to FBNQuest Merchant Bank on

account of the Debt Management

Oce of the Federal Government of

Nigeria on the seven-year inaugural

Sovereign Sukuk transaction.

DEAL OF THE YEAR DEBT

AFRICAN BANKER AWARDS

FBNQuest Merchant Bank received the

‘Deal of the Year – Debt’ Award. This is

in recognition of the role played by the

Bank in the Federal Republic of Nigeria

inaugural SEC-Registered Diaspora Bond

transaction.

BEST LOCAL INVESTMENT BANK IN NIGERIA

EMEA FINANCE AFRICAN BANKING AWARDS

FBNQuest Merchant Bank was

recognised as the ‘Best Local

Investment Bank in Nigeria’. The Award

is in recognition of the Bank’s leading

role in key transactions across various

sectors.

BEST NAIRA BOND

EMEA FINANCE ACHIEVEMENT AWARDS

FBNQuest Merchant Bank won the

‘Best Naira Bond’ Award. The Award

recognises the significant role played

by the Bank in the Debt Management

Oce of the Federal Government of

Nigeria on the seven-year inaugural

Sovereign Sukuk.

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

21

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

RECOGNITION AND AWARDS

ISSUING HOUSE WITH HIGHEST NUMBER OF

DEBT ISSUANCE

NIGERIAN STOCK EXCHANGE CEO AWARDS

FBNQuest Merchant Bank clinched the

‘Issuing House with the highest number

of Debt Issuance’ Award. This is in

recognition of the Bank’s continuous

delivery of increased value to its clients

on debt-related transactions.

BEST BROKER IN NIGERIA

EMEA FINANCE AFRICAN BANKING AWARDS

FBNQuest Securities won the ‘Best

Broker’ Award. This is in recognition

of its dealings on the Nigerian

Stock Exchange and Market Making

activities, including acting as the Lead

Stockbroker on the Notore Chemical

Industries transaction.

BEST ASSET MANAGER IN NIGERIA

EMEA FINANCE AFRICAN BANKING AWARDS

FBNQuest Asset Management won the

‘Best Asset Manager’ Award in Nigeria.

BEST ASSET MANAGER PANAFRICAN

EMEA FINANCE AFRICAN BANKING AWARDS

FBNQuest Asset Management won

the ‘Best Asset Manager’ (Pan-Africa)

Award. This is in recognition of the

sterling performance of its mutual funds

across all public funds and customised

portfolios over the last 12 months.

BOND FUND OF THE YEAR FBN NIGERIA

EUROBOND USD FUND

BUSINESSDAY: BANKING AND FINANCIAL INSTITUTIONS AWARDS

FBNQuest Asset Management won the

‘Bond Fund of the Year’ Award. This is in

recognition of its strong mutual funds’

performance across all public funds and

portfolios.

EQUITY FUND OF THE YEAR FBN NIGERIA SMART

BETA EQUITY FUND

BUSINESSDAY: BANKING AND FINANCIAL INSTITUTIONS AWARDS

AFRICA RE/AFRICAN INSURANCE ORGANISATION

INSURANCE COMPANY OF THE YEAR

FBNQuest Asset Management received

the ‘Equity Fund of the Year’ Award. The

FBN Nigeria Smart Beta Equity Fund

was the first of its kind in the Nigerian

market.

FBN Insurance won the prestigious

Insurance Company of the Year Award

at the 45th AfricaRe/African Insurance

Organisation conference in Accra, Ghana.

PRESIDENT’S AWARD

LAGOS BUSINESS SCHOOL ALUMNI

FBNQuest Merchant Bank received

the President’s Award from the Lagos

Business School for the significant role

played in the development of employees’

talent and for the promotion of

sustainable development.

22

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

Group Chairman’s Statement >> 25 Group Managing Director’s Review >> 29 Leadership and Governance >> 40

STRATEGIC REPORT

The thrust of our business is to build a fully-integrated financial institution. This

is reflected in the diversity of our business portfolio which enables us to provide

a range of financial products and services to our customers.

23

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

MACROECONOMIC REVIEW

The year 2018 was characterised by growing evidence of pass-throughs from a more protectionist global trade

regime, rising United States treasury yields, and a strengthening dollar which took their toll on stock markets around

the world. Furthermore, weak output performance in the 19-member Eurozone and Japan appeared even worse in the

context of the increasing uncertainty over the direction of Brexit in the United Kingdom.

The International Monetary Fund (IMF), World Bank, and the

Organisation for Economic Co-operation and Development

lowered their estimates of global growth for 2018 and

2019 during the last quarter of the year. Rising protectionist

sentiments around the world led by the United States and

the threat of a trade war between the United States and

China were the main downsides to the respective outlooks.

China remains critical to the short-to-medium-term global

economic outlook to the extent that China’s economic

growth engine is being refocused from exports to increased

domestic demand, a trend to serve as a major pull back on

the world trade.

Domestic Economy

In 2018, the economy was on a path to recovery. However, with

the third quarter output growth at 1.81% year-on-year relative

to 1.50% in the second quarter, there is only marginal room for

improvement. Crop production, trade, telecommunications

and information services were the main drivers of growth.

Concerned about the economy operating below its

potential, the IMF’s Article IV Consultation report on the

economy in 2018, suggested a number of policy changes

in the fiscal, monetary, foreign exchange, and banking

spaces to improve private sector supply responses.

By the middle of the second quarter, inflation had re-emerged

as a concern. The National Bureau of Statistics reported that

the consumer price index had risen by 11.44% year-on-year.

This increase was 0.16% above the rate recorded in November

2018 at 11.28% but 3.69% below the rate at which inflation

started the year at 15.13%. However, core inflation was largely

subdued in 2018.

In the third quarter, the country’s unemployment rate closed

at 23.1%, representing a major rise from 18.8% in 2017.

Underemployment rate on the other hand dropped to 20.1%

by the third quarter from 21.2% over the same period of

2017. The country’s labour force grew by 5.4million from

85.1million to 90.5million in the third quarter of 2017. In

addition, at N22.3tn, the country’s debt portfolio was about

20% of the country’s domestic output. The economy’s

medium-term prospects are modest without an increase in

domestic productivity. At 6% revenue to Gross Domestic

Product ratio, growth prospects are relatively modest,

although CBN data indicates that manufacturers Purchasing

Managers’ Index was at 56.2 index points in September

2018.

Concerns about the passing of the budget bill by the

National Assembly in the first quarter combined with

a soft global economy heightened fiscal vulnerability in

2018. However, in the first quarter of 2018, oil prices

recovered some of its losses as Russia and Saudi Arabia

agreed on production cuts. Oil market economists note

that a price below a benchmark of USD60 per barrel could

adversely aect Nigeria’s 2019 budget revenue projections

and widen the estimated 2019 fiscal deficit of N2.4tn.

Nigeria’s ranking on the World Bank’s 2018 ‘Doing Business’

Report fell one notch from the 145th position last year to

146th. According to the World Bank, among the reforms

embarked upon, ‘Nigeria made business start-up easier by

introducing an online platform for stamp duty payment’.

Furthermore, gaining access to electricity was easier by

requiring distribution companies to obtain the right of

way on behalf of their customers and by switching on the

electricity upon meter installation.

24

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

MACROECONOMIC REVIEW

Banking Industry

In 2018, reforms to the domestic financial services industry

architecture were pronounced. In an exposure draft, CBN

indicated its plan to set the minimum capital requirement

for Mortgage Guarantee Companies (MGC) at N6bn.

Licencing of MGCs was designed to deepen the mortgage

banking sub-sector by boosting access to mortgage

finance and establishing better risk management.

In the course of the year, CBN raised the minimum capital

requirement for Microfinance Banks (MFBs) to N5bn for

national MFBs (previously N2bn), N1bn for state MFBs

(previously N100mn), and N200mn for unit MFBs

(previously N20mn). During the year, the bank regulators

also appointed four domestic money banks as settlement

banks for the USD2.5bn bilateral currency swap. According

to CBN’s, recent Financial Stability Report, ‘only large

banks can withstand a further deterioration of their NPLs

by up to 50%’.

In 2018, the nation’s gross external reserves rose by 11%.

As at December 2018, the reserves were USD43.195bn

compared to USD38.912bn at the beginning of the year.

During the year, the balance on the reserves fluctuated

considerably as CBN continued to intervene in support of

the naira. The Federal Government’s 2018 USD5.36bn

Eurobond issue was crucial to the firming up of the

reserves. In addition, the healthy reserve position allowed

Standard and Poor’s (S&P) rearm its ‘B/B’ long and

short-term sovereign credit ratings for the economy, while

assigning the economy a ‘stable outlook’.

Outlook

In 2019, by broad consensus of global economic institutions,

the world economy will slow. However, the issue is where

and by how much. Reporting on this, the London-based

magazine, The Economist, noted that economists at

Investment Bank, JP Morgan developed their model based

only on the historical predictive power of the stock market,

credit spreads and the yield curve. This implies a probability

of a recession in the United States in 2019 which could be

as high as 91%.

The main drivers of global deceleration in 2019 are clear,

poor performance in China (down to a trend average

growth rate of 6% per annum from 10%, which the world

has become more familiar with), waning fiscal stimulus

(from recent tax reforms) which provided a boost to the

United States economy and an increased federal deficit

as well as the consequence of the tax breaks in 2018 are

all factors for considerations. The partial fiscal shut down

in the United States equally contribute to the concerns

resulting from the global economic growth decline.

In 2019, increased growth is expected from emerging

and frontier economies compared to 2018. However,

collectively, they lack the strength to compensate for

the decline in more advanced economies. A few of these

middle-income countries (Turkey, Argentina and Brazil to

some extent) face strong currency and external balance

of payment pressures (as yields rise in the United States

and the dollar strengthens). In countries like South Africa,

successful reforms will be crucial to sustaining momentum.

In Nigeria, a lot will depend on the condition of the

international oil market. If the global economy slumps,

oil prices will come under severe pressure and the rising

dollar would result in oil price decline. Furthermore, in an

election cycle, Nigeria’s fiscal and monetary policy may not

witness traction until the third quarter of 2019.

There are strong reasons to believe that monetary

conditions will tighten in the year as CBN seeks to rein

in liquidity. There are concerns that this might not be

adequate to refrain the naira from falling against major

foreign currencies.

Tighter liquidity may suggest that the banking sector will

aggressively defend current deposits while mobilising

new liabilities. It will become increasingly important for

the banking industry to mobilise retail deposits through

salary-type accounts and other self-liquidating, short-dated

instruments.

25

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

Distinguished Shareholders,

I am pleased to welcome you all to

the 7th Annual General Meeting of

our company, FBN Holdings Plc. I

will now present to you an overview

of the company’s performance and

outlook as we progress into the

final year of our current three-year

strategic planning cycle.

Dr Oba Otudeko,

CFR

Group Chairman

FBN Holdings Plc

GROUP

CHAIRMAN’S

STATEMENT

26

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

GROUP CHAIRMAN’S STATEMENT

securities reduced companies’ borrowing cost and made

financing expansion plans more aordable. These metrics

underscored renewed optimism in consumer and investor

confidence, resulting in a rally in the stock market at the

beginning of the year, as foreign portfolio investment flows

into the country grew substantially. Nigeria’s economy

grew by 1.95% in the first quarter of 2018 compared to

a contraction in the similar period of the previous year.

Conversely, by the end of 2018, bond yields were up

to 15.0% from 13.0% at the beginning of the year and

inflationary pressures led to a 16bps increase in inflation to

11.4% in the month of December. External Reserves which

had declined month-on-month since June, increased in

December following the Federal Government’s Eurobond

sale which raised over USD2.86billion but falling oil price

and drop in oil production allocation by Organisation of

Petroleum-Exporting Countries (OPEC) resulted in the year

ending on a more cautious note.

Operationalising Our Group Structure

Amidst the contrasting halves of the 2018 economy, our

businesses rose to the challenge to seek out new growth

opportunities through product innovations and new business

models. With a focus on financial inclusion and meeting the

varying and evolving financial needs of customers across

Nigeria, the Commercial Bank scaled up its Agent Banking

business to over 15,000 agents operating in 98% of

local government areas in Nigeria. Furthermore, to ensure

continuous product innovation, in the course of the year,

the Commercial Bank launched the FBN Digital Lab, and the

Chat Banking on WhatsApp with other innovations in the

pipeline to enhance the competitiveness of the business.

The benefits of these innovations are expected to be

realised in 2019 and beyond.

In line with our mandate as a holding company, FBNHoldings

continues to drive eciency in the management of risks and

allocation of capital across our financial services subsidiaries

in multiple geographies. As such, we recapitalized our Ghana

subsidiary, FBNBank Ghana, by increasing the paid-up capital

to GH¢400mn in line with the new capital regime of the

Bank of Ghana (BoG).

At the beginning of 2018, the global economy continued

on a synchronised upswing with investment, manufacturing

and trade showing strong signs of growth. However, trade

wars ensued, first initiated by the United States and

reciprocated by China, European Union, Canada, Mexico

and other economies. This dampened investor confidence

and impacted global economic growth significantly. Despite

the impact of the trade war, the United States’ economy

grew largely as a result of tax cuts for corporations and

associated increased spending. Consequently, the Federal

Reserve Bank intensified its tightening stance which

commenced in 2017, increasing the federal funds rate four

times in 2018 from 1.8% at the beginning of the year to

2.5% in December with a promise to further tighten to

circa 3.0% in 2019. In the same vein, the general stability

in the Euro zone resulted in the European Central Bank

ending its quantitative easing programme as it began

tapering its asset purchases in the second half of 2018.

In emerging markets, China’s economy expanded at the

slowest pace on the back of spillovers from financial

deleveraging and dampened economic sentiment resulting

from the trade war with the United States. Nevertheless,

the economy recorded a growth of 6.6% in 2018 as a result

of tax reforms and increased infrastructure spending. The

Sub-Saharan Africa region faced a challenging economic

environment; tightening financing conditions as external

borrowing costs increased and reversal of capital flow from

these markets to developed markets owing to attractive

rates in developed markets, particularly the United States.

Overall, the performance of this economic bloc was driven

by the largest economies with South Africa and Angola in

recession and Nigeria barely emerging from the negative

territory. Nevertheless, the rest of the region maintained

steady growth including Ghana and Kenya, which resulted in

a regional growth of 2.7% in 2018, a marginal improvement

from 2.6% in 2017.

In 2018, the Nigerian economy marginally benefitted

from increase in oil price and production, helping to

shore up foreign reserves which reached a five-year high

of USD48billion in June 2018. This enabled the Central

Bank maintain foreign exchange stability by intervening

in the markets. During the year under review, inflation

trended downwards, achieving 11.4% compared to 15.4%

in 2017. In addition, the decline in returns on government

27

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

GROUP CHAIRMAN’S STATEMENT

In 2018, the increased

group-wide collaboration

has resulted in a remarkable

achievement...

“

”

During the year, we took steps to maximise our investment

in innovation by ensuring that benefits from rolling out

new products, services and channels from the Digital Lab

are extended to other entities within the Group, thereby

harnessing the inherent cost reduction advantages of the

Group-structure. To achieve this, the Group coordination

and collaboration were improved, with the expectation of

more cost-eective and strategic interventions being rolled

out across the Group.

In 2018, the increased group-wide collaboration resulted in

a remarkable achievement of N20bn in synergy revenues,

representing three-year revenue synergy targets for the

Group between 2017 and 2019. The execution of key

synergy initiatives by employees to drive collaboration

and cross-sell across all operating companies, contributed

significantly to the achievement of this impressive result for

the Group. In furtherance of our cost synergy objective, we

recently secured approval of the Central Bank of Nigeria to

roll out our Group Shared Services model to drive eciency

and ultimately improve the cost-to-income ratio of the

Group.

Board Development and Corporate Governance

We continued our pursuit of high standards in corporate

governance during the year as our Board ensured provision

of strategic direction and dedicated oversight to our

businesses. Boards of our subsidiaries also remain strong

and well experienced to guide the respective businesses to

achieve their goals for 2019. The appointments of Moruf

Apampa and Festus Izevbizua, as Executive Directors in our

Life Insurance business, add wealth of experience to the

Board of FBN Insurance Limited and position the business

to sustain its strong performance as one of the leading life

insurance companies in Nigeria.

Looking into the Future

Established in 1894 as the Bank for British West Africa,

the Group has traversed an incredible journey of delivering

impeccable financial services to its customers and supporting

the building of a contemporary Nigeria and indeed, West

Africa. Consequently, we are celebrating 125 years of our

iconic institution in 2019. That is a major milestone for a

company of African heritage. Despite our long heritage, we

continue to evolve to meet our customer’s needs resulting

in local and international recognitions, as evidenced by the

numerous awards and accolades received in 2018. The

Holding Company was named the Best Financial Holding

Company in Nigeria by the BusinessDay Newspaper.

FirstBank was named the Best Bank by the prestigious

Global Finance magazine in the 2018 series of the World

Best Bank Awards. FBNQuest Merchant Bank, FBNQuest

Asset Management and FBNQuest Securities received

multiple awards including Best Local Investment Bank, Best

Asset Manager in Nigeria, Best Asset Manager Pan-Africa

and Best Broker in Nigeria at the EMEA Finance Awards

2018, and the Insurance group was crowned the Insurance

Company of the Year at the Africa Re Insurance Awards

in 2018. Our capacity to continually attract international

recognition is testament to the quality of service, talent and

infrastructure within our Group, and these are key pillars

that we will continue to build on as we progress in 2019.

The economic outlook for 2019 suggests a lethargic

expansion of the economy as the IMF recently revised its

economic growth forecast downwards from 2.3% to 2.0%.

The downside risk of fall in oil price and oil production could

lead to lower reserves and a weakened currency towards

the end of the year. Rising food prices from low harvests

as a result of the herdsmen conflict and severe floods in

2018, and the implementation of the new minimum wage

are expected to increase inflationary pressures during the

year which could lead to tighter monetary policy.

In addition, as we commence the final year of our 2017-2019

Strategic Planning Programme, we expect increased competition

and changing industry dynamics in the financial services space.

This is primarily due to the Central Bank’s published guidelines

on the licensing of Payment Service Banks in Nigeria, which

will allow non-financial institutions such as telecommunication

companies to provide basic financial services to customers for

the first time.

28

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

Nevertheless, we are resolute about delivering on our strategic

objectives for this year, as the Board and Management work

together to ensure that we create shareholder value and build

strong foundations for the future. We are not resting on our

laurels, and our renewed approach to synergy and innovation

will be major drivers to unlocking earnings potential for our

Group. We believe that our eorts to integrate our oerings

and provide end-to-end solutions for our customers will

create a competitive advantage in our markets.

Finally, on behalf of the Board of FBNHoldings, I would like

to express my sincere gratitude to our customers for their

continued patronage and trust in us; to our distinguished

shareholders for their support; and to the entire sta of the

FBNHoldings Group for their dedication and commitment to

the company.

Thank you and God bless you all.

Dr Oba Otudeko, CFR

Group Chairman

FBN Holdings Plc

GROUP CHAIRMAN’S STATEMENT

29

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

The Company delivered excellent

results despite volatile market

conditions and operating environment.

We made significant progress towards

our strategic targets and our goal of

being the custodian of first choice for

our customers.

We recorded increased underlying

profit, continued to improve the

eciency of the business and have

taken steps to further reinforce

a customer focused culture.

Considering the dynamism of the

global economy, we are convinced

that this focus provides the best

prospect to build a strong and

successful organisation that can

deliver sustainable shareholder

returns. We equally recognise that

technology is transforming the way

our customers interact with us,

and our core processes and our

UK Eke, MFR

Group Managing Director

TO BE UPDATED

U.K. Eke, MFR

Group Managing Director

FBN Holdings Plc

GROUP

MANAGING

DIRECTOR’S

REVIEW

Distinguished Shareholders,

It is my pleasure to present the

financial results of FBN Holdings Plc

for the year ended 31 December 2018.

30

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

2018 in Review

From the debilitating trade war between the United States

and China, concerns around rising rates in the United States

to the unfolding events as a result of Brexit and sustained

pressure on crude oil price, 2018 was characterised by

an uneven growth across markets and regions, a sharp

contrast to the synchronised global growth experienced

in 2017. These risks were heightened by the economic

implications of a spree of high profile elections in 2019,

which kept investors on edge in economies such as India,

South Africa, Argentina, Indonesia, Thailand, and Nigeria.

Consequently, the global economy is forecasted to have

grown by 3.1% in 2018, spurred by the 2.2% growth

recorded in the developed markets and a 4.5% growth

in emerging economies, driven by activities of major

commodity exporting countries recovering from the slump

in 2017.

As expected by the market, the Federal Reserve raised the

target range of the Federal Funds rate four times in 2018,

consistent with its tightening stance to rein in growing

consumer exuberance and avert economic bubble. Similarly,

during the year, the European Central Bank announced an

extension of its asset purchase program through the end of

the year, albeit a reduction in the monthly purchases from

€30bn to €15bn in October.

Consistent with global growth, the Nigeria economy continued

its recovery path in 2018 from the recent economic recession,

although at a slow rate, on the back of the recovery of crude-oil

price above the budget benchmark price of USD60pb which

peaked at USD81.2 in September 24, 2018, driving external

reserves to USD48bn, its highest in five years. Despite the

decent growth rate during the year, the economy remained

on the backfoot for the larger part of 2018 owing to the

numerous challenges including the escalated farmers/

herdsmen crisis, deteriorating state of key infrastructure and

increased political tension in the run-in to the general election

of 2019. The farmers/herdsmen crisis in the middle-belt

region impacted food outputs in 2018 and elevated prospect

for food inflation in the short-term as farmers abandoned

their farm settlements amid security challenges. In addition,

businesses dependent on importation suered significant

challenges in meeting raw material inputs as a result of the

gridlock at the two functional ports in the country, the Lagos

Apapa and Tin-Can Island Ports. Similarly, international trade,

haulage businesses and other ancillary business activities at

the Apapa corridor recorded muted growth during the year

The 2018 financial year was the penultimate year in the

current Strategic Planning Cycle for FBNHoldings which

runs between 2017-2019. This planning programme has

oered the Group the opportunity to take a critical look

at our businesses, review our processes and undertake

detailed evaluation of the market. This is to ensure our

Group is well-positioned to remain relevant in the evolving

financial services landscape whilst delivering quality returns

to our shareholders. The implementation of the initiatives

that emerged from this review process are at various stages

and our numbers have begun to justify the investment,

time and resources deployed to this process.

Whilst the strategic planning process is a vital part of our

operating model, the unique challenges encountered by the

Group in the last few years, the growing competition in the

financial services landscape, the regulatory dynamics and

the increasingly challenging macroeconomic environment

have ensured this planning cycle is approached dierently.

In summary, our priority over this period has been

three-pronged: strive to grow the topline by enhancing

the traditional income streams, developing new markets

through innovation and extracting value through synergy

and cross-sell; drive eciency in our processes by deploying

technology; and ensure ecient capital management to

retain value for shareholders.

Even though these initiatives are targeted at enhancing the

long-term fundamentals of the Group, there have been

short-term gains that have accrued to these dedicated

eorts. Recently, FBNHoldings was awarded the company

with the best corporate governance practices in Nigeria by

the prestigious World Finance Magazine. This is a testament

to the implementation of best-in-class governance

practices in all our operating companies. Similarly, in 2018,

we launched FBN Digital Lab in the heart of Yaba, Nigeria’s

‘Silicon Valley’. The Lab provides an excellent platform for

the Group, working with Fintechs, to drive its innovation

agenda, enhance its processes and open new markets for

subsidiaries within the Group. In terms of eciency, the

financial results are key leading indicators that the various

interventions including IT projects have started delivering

enhanced returns on investment.

GROUP MANAGING DIRECTOR’S REVIEW

31

FBN HOLDINGS PLC Annual Report and Accounts 2018

GOVERNANCE

SHAREHOLDER INFORMATION

FINANCIAL STATEMENTSGROUP OVERVIEW STRATEGIC REPORT

N

CORPORATE RESPONSIBILITY

AND SUSTAINABILITY

FINANCIAL REVIEW

N

as evidenced by the less-than-impressive readings from the

Purchasing Manager Indexes.

In 2018, Nigeria’s external reserves experienced wide

movement at two ends of the spectrum, enjoying the

benefit of oil price appreciation and suering from capital

flow reversals owing to increased yields in other developed

and emerging economies. In the first half of the year, the

external reserves rose by a significant sum of USD9bn,

peaking at USD48bn in July largely supported by stable

crude oil production, the issuance of the USD2.5bn

Eurobond and the rally in oil price. This gave the CBN the

needed war chest to pursue its defence of the Naira with

the convenience of being able to meet up to 10 months

of import bill. However, the second half of the year saw a

dwindling of the external reserves following exits of foreign

portfolio investors amid rising rates in the United States,

prompting increased foreign exchange intervention by the

CBN. The much-needed succour came with the successful

closure of the USD2.8bn Eurobond issuance in November

2018 allowing external reserves to close the year at a

healthy USD43.2bn.

Through 2018, the Monetary Policy Committee kept key

policy variables unchanged, retaining Monetary Policy Rate

(MPR) at 14.0%; Cash Reserve Ratio at 22.5%; Liquidity

Ratio at 30%; and the Asymmetric Window around the

MPR at +200/-500bps. Despite expectations of a less

hawkish stance in the early parts of 2018, the Committee

held rates unchanged due to sustained global uncertainties,

policy normalisation in the United States, fears of a stronger

United States Dollar, faltering output as well as anticipated

inflationary pressure as a result of political/election

spending. Consistent with the above, the CBN also sustained

its aggressive liquidity mop-up in the money market, driving

up average yield on short-term instruments to 13.0%, to

check excess liquidity in the system. Furthermore, the CBN

commenced the sale of Chinese Yuan in the second quarter

of 2018, following the currency swap agreement, worth

USD2.5bn, signed with the People’s Bank of China on April

27, 2018.

The Nigerian Stock Exchange All Share Index (ASI) fell

17.8% in 2018. The equity market started the year on a

high with the ASI reaching a 10-year peak of 45,092.83

in January 2018, emerging as the best performing bourse

in Africa. The ASI experienced a decline which began in

the second quarter of 2018 thereby ending the year in

red. During this period, foreign portfolio investments

outpaced domestic participation by 1.7%, accounting for

50.9% of total transactions in the market, while domestic

transactions accounted for 49.1%. The fixed income

market capitalisation increased by 11.8% to N10.17tn

from N9.10tn, recorded in 2017 and dominated by the

Federal Government with a capital raise of N1.16tn in a

bid to finance fiscal and infrastructure deficits. Similarly,

State Governments raised N125.59bn in new debt while

corporates raised a total of N31.47bn. The market also

witnessed the listing of a N100bn Federal Government of

Nigeria (FGN) Ijarah Sukuk designed to finance critical road

infrastructure across the country.

Headline inflation moderated considerably in 2018, touching

a low of 11.1% in July 2018, in contrast to the high regime

experienced in 2017 which continued into the first quarter

of 2018. The high inflation rate was largely due to the

base eect of the food inflation sub-index and sustained

liquidity in the foreign exchange market. Notwithstanding

the success in containing headline inflation, food inflation

pressure mounted due to incessant incidents of flooding

across food producing states, especially in the middle belt

region, complicated by the escalation of clashes between

farmers and herdsmen. Consequently, headline inflation