November 17, 2022

Introduction

A priority of the Ontario Securities Commission (the OSC or we) is improving the investor experience

and expanding investor protection through a range of initiatives

1

. Included in this are initiatives to

support behavioural insights and policy testing capabilities. Reflecting this commitment, the Investor

Office examined gamification and other behavioural techniques that are currently being used or may

be used in the future by Order Execution Only or self-directed investment platforms as part of their

digital engagement practices (DEPs). The report arising from this work (the Report) examines how the

different gamification and other behavioural techniques may influence retail investors behaviours—

both positively and negatively. The Report is appended to this staff notice (this Notice).

Purpose

A wave of digital, mobile-friendly investing platforms has created new options for retail investors in

Canada and around the world. While these platforms have expanded market participation, there is

growing interest in some of the DEPs that they and, to a lesser extent, more traditional retail

investment platforms use and how these may raise investor protection concerns. These tactics,

sometimes referred to broadly as “gamification,” use insights from behavioural science to influence

investor behaviour.

Regulators have faced some challenges in understanding and responding to these developments,

including: a lack of common terminology and definitions currently in use; an absence of a regulatory

inventory of practices currently employed by Canadian (and US) dealers in the marketplace; and,

limited direct testing and data as to effects of DEPs on shaping investor behaviour.

To respond to the above, the Investor Office undertook a behavioural science study on gamification

and other behavioural techniques under the DEPs umbrella. The Report, which is appended to this

Notice, is a result of this work and provides:

(i) a taxonomy of gamification and other behavioural techniques that are currently being

used or may be used by online brokerages in the future and their likely impact on

retail investor behaviour—both positively and negatively; and

(ii) the results of an online randomized controlled trial (RCT) experiment that examines

the use of points and top traded lists to determine their impact on trading frequency.

The goal of this work is to assist the OSC, other regulators and stakeholders in understanding these

new developments. In responding to the developments, we encourage taking an evidence-informed

1

Ontario Securities Commission Business Plan for the fiscal years ending 2023-2025, available online at

https://www.osc.ca/sites/default/files/2022-04/pub_20220426_osc-2023-2025-business-plan.pdf at p. 23.

OSC Staff Notice 11-796

Digital Engagement Practices in Retail Investing:

Gamification and Other Behavioural Techniques

2

approach, using behavioural insights to facilitate the use of DEPs in a manner that supports good

investor outcomes.

Research findings

Gamification refers to a variety of behavioural techniques that integrate game-related elements into

non-gaming contexts and applications, with the purpose of improving user experience and

engagement. We use the term other behavioural techniques to refer to DEPs that use insights from

behavioural science in ways that can influence investor behaviour but do not meet the definition of

gamification. DEPs themselves are “the tools including behavioural techniques, differential marketing,

gamification, design elements or design features that intentionally or unintentionally engage with

retail investors on digital platforms as well as the analytical and technological tools and methods.”

2

This definition highlights a range of potential tools, such as behavioural techniques, differential

marketing, gamification, design elements, design features, and data analytics, that increase user

engagement. There are other DEP tools beyond this definition as well, such as artificial intelligence

and dark patterns.

The Report

examines five gamification techniques used on self-directed investor platforms:

1. Ga

mblification: Techniques derived from gambling, which most prominently include the use

of variable rewards. Variable rewards are economic benefits (e.g., cash payouts) where the

size, timing, or likelihood of the benefit is unpredictable to the user. Beyond variable rewards,

the gamblification category might also include language and imagery that evokes gambling

(e.g., reference to “jackpots” or scratch cards).

2. Leaderboards: Public displays of ranked information about application users’ performance.

Leaderboards enable and encourage social comparison and competition.

3. Rew

ards (negligible or non-economic rewards such as points, badges, scores): Providing

rewards for performing tasks or accomplishing goals within an online application. Our

definition includes rewards with either no economic value or with nominal economic value

that should not materially influence investor behaviour under a purely rational economic

decision-making model.

4. Goal and

Progress Framing: Design elements that i) help users set and visualize their goals,

and/or ii) strategically frame users’ performance and progress with respect to these goals to

stimulate greater levels of engagement.

5. Feedback: T

he provision of information about a user's performance on a task in (near) real-

time, including both continuous progress feedback and immediate success feedback.

The Report also examines four other behavioural techniques:

2

This definition is consistent with that of the U.S. Securities and Exchange Commission (SEC)’s definition found

in Release Nos. 34-92766 Request for Information and Comments on Broker-Dealer and Investment Adviser

Digital Engagement Practices, Related Tools and Methods, and Regulatory Considerations and Potential

Approaches; Information and Comments on Investment Adviser Use of Technology to Develop and Provide

Investment Advice at page 1, available online at https://www.sec.gov/rules/other/2021/34-92766.pdf.

3

1. Salience / Attention-inducing Prompts: Information is more likely to influence people’s

behaviour if it attracts their attention.

2. Sim

plification and Selective Deployment of Friction Costs: The design of the user experience

that reduces or introduces small barriers across the user journey, influencing the likelihood

and manner in which a user completes a specific task. We use “simplification” to refer to

reductions in small barriers and “friction costs” to refer to increases in small barriers.

3. Soci

al Interactions: Design elements that enable platform users to interact with other users

by i) generating, sharing, viewing, and reacting to content, and ii) engaging in direct

messaging.

4. Social Norms: Design features which signal social norms (i.e., information about how others

think and behave).

These techniques could be employed in a manner that has positive influences on retail investors such

as:

• encouraging deposits to investment accounts,

• encouraging greater participation and learning of investor education modules on digital

platforms,

• improving diversification of the investor’s portfolio, and

• setting and monitoring progress towards long-term retirement savings goals.

However, these techniques also could have negative influences on investor behaviour such as:

• increasing risk taking by overweighting small probabilities,

• creating habit forming behaviours,

• invoking a psychological “hot” state that influences a user’s subsequent behaviour such as

the “hot hand” fallacy, making a person more likely to gamble with a windfall or unexpected

bonus,

• increase trading frequency and risk-taking,

• inc

reasing focus on shorter-term outcomes or trading activity that reduces longer term

returns and/or undermines investment goals, and

• increasing investor’s (over)confidence, negatively impacting investor performance.

We

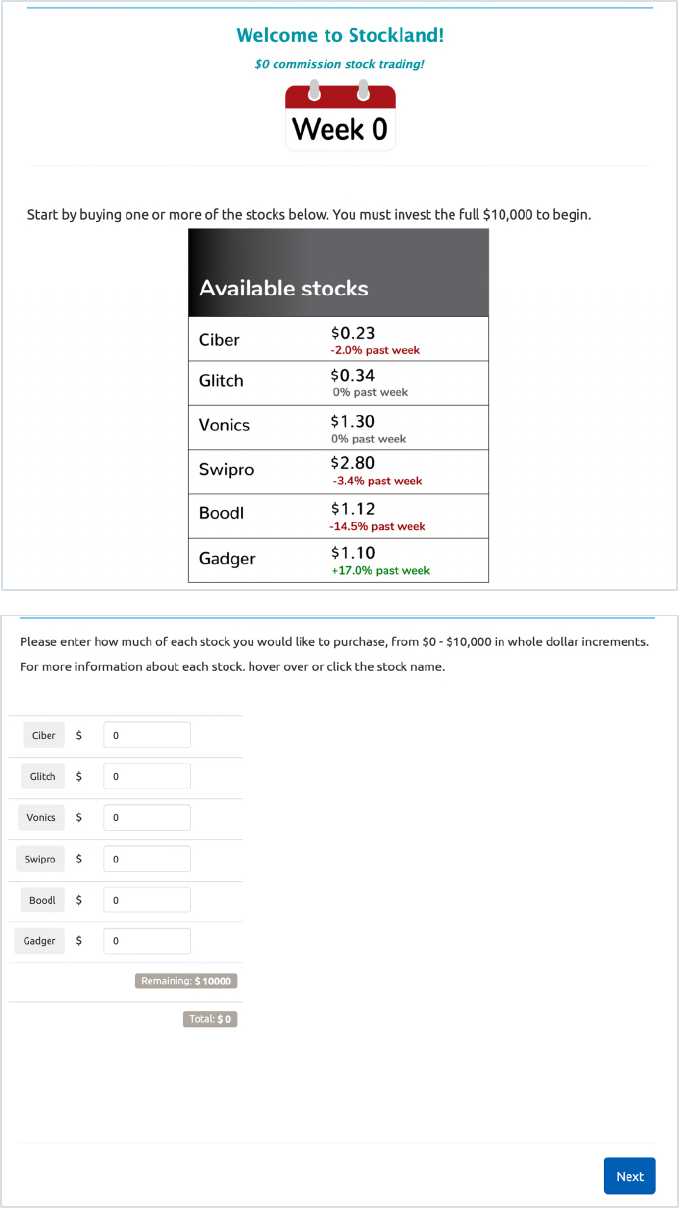

tested some of the techniques identified in the Report in a RCT. We conducted an online RCT with

2,430 Canadians to assess the impact of two techniques of interest on investing behaviours in a

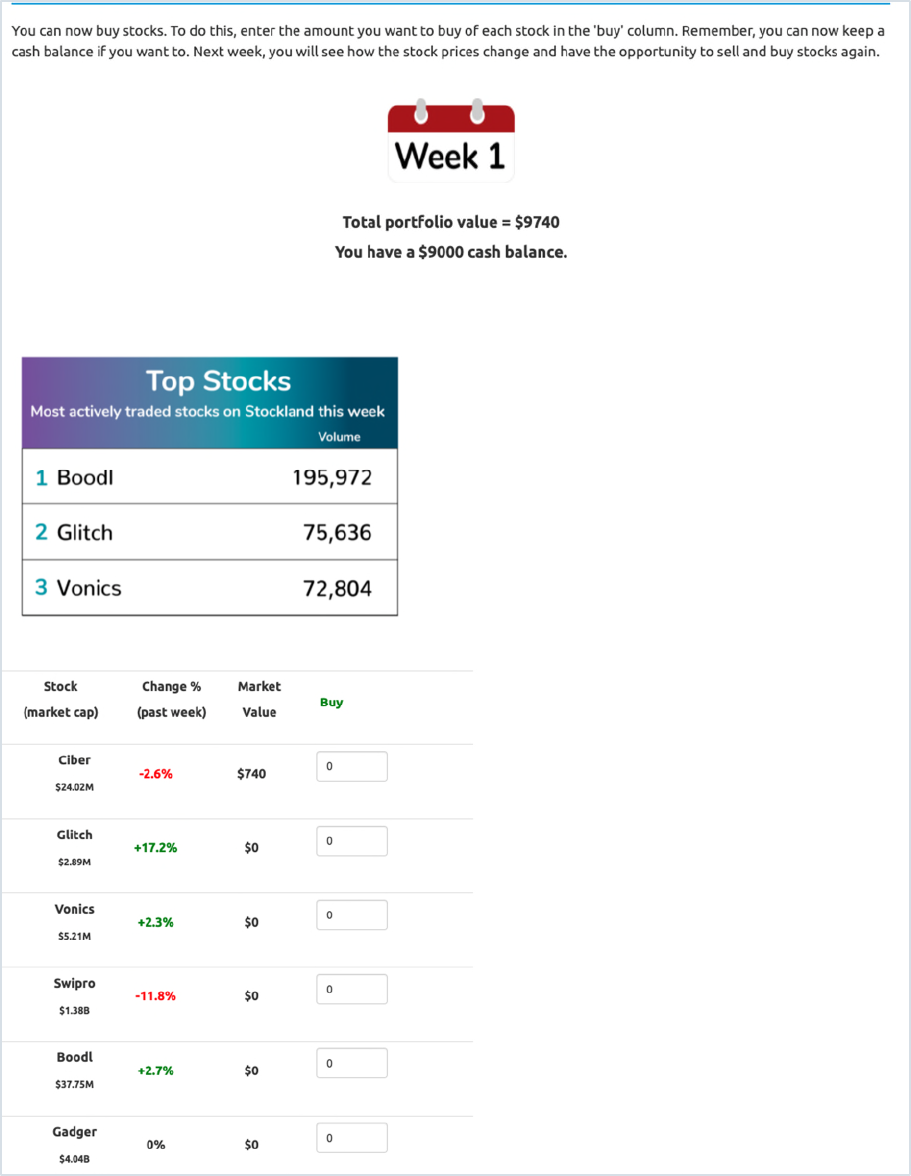

simulated trading environment: (1) giving investors “points” with negligible economic value for buying

or selling stocks—a form of reward, and (2) showing investors a “top traded list”—a combination of

attention-inducing prompts and social norms. The experiment was conducted online in a simulated

real-world trading environment with Canadians aged 18-65 engaging through mobile, tablet or

desktop devices.

Research participants received $10,000 in simulated “money” to invest in up to six different

fictitiously-named stocks. After their initial allocation of funds, they were taken through seven

4

simulated weeks of stock price movements, with an option to buy and/or sell stocks during each week.

At the end of the experiment all participants received a fixed amount of compensation for

participating in the experiment. They also earned additional compensation based on their balance at

the end of the experiment. Participants were aware that the larger the value of their portfolio at the

end of the experiment, the more they would earn. This created an incentive for participants to trade

thoughtfully and to try to maximize their returns.

Importantly, participants who were rewarded with points made 39% more trades than participants in

the control group (i.e., those who were exposed to the same trading simulation but without any

gamification or other behavioural techniques). This statistically significant difference was found

despite the fact that the points had negligible value. This is an important finding given that there is a

strong negative impact of increased trading volume on investors’ returns (on average)

3

, and in light of

the material benefit that may be gained by digital trading platforms from increased trading volume.

Showing research participants a top traded list did not increase their trading frequency.

Furthermore, participants who saw the top traded lists were 14% more likely than participants in the

control group to buy and sell those top listed stocks. This finding suggests that showing participants a

top traded lists can affect their trading decisions, nudging them towards buying and selling the stocks

listed as top traded, which is herding. There were no differences between the points group and the

control group in terms of the buying and selling the top traded stocks.

Conclusion

These findings reinforce the importance of using behavioural science as a policy tool by regulators.

Given the statistically significant findings derived from the RCT, the Report recommends that

regulators consider the implications of the findings, including whether any of the gamification and

other behavioural techniques examined have attributes similar to recommendations and/or result in

investor behaviour that is (on average) detrimental to investor outcomes, and if so, consider possible

responses.

The Report also recommends:

1. collecting more data to see the impact of gamification and other behavioural tactics through

leveraging data collected by digital trading platforms, or through other experiments,

2. collecting evidence and data on strategies to mitigate negative impacts of DEPs to determine

if mitigation approaches are effective (e.g., adding friction points), and

3. ex

ploring positive impacts of gamification and other behavioural techniques to increase

investing knowledge and level of expertise.

W

e encourage registrants to review the findings of the Report and consider the influence that their

DEPs may have on their clients so that negative investor behaviours are not encouraged (whether

inadvertently or otherwise), and to focus their use of DEPs in a manner that supports good investor

outcomes.

3

Barber, B. M., & Odean, T. (2000). Trading is hazardous to your wealth: The common stock investment performance of individual

investors. Journal of Finance, 55(2), 773-806.

5

We look forward to engaging with investors, registrants, and other stakeholders with respect to the

Report’s findings and our broader work to improve the investor experience and expand investor

protection.

Que

stions

If you have any questions or comments about this Notice or the Report, please contact:

Tyler Fleming

Director

Investor Office

20 Queen Street West, 22nd Floor

Toronto, ON M5H 3S8

Email: [email protected]

Marian

Passmore

Senior Advisor, Policy

Investor Office

20 Queen Street West, 22nd Floor

Toronto, ON M5H 3S8

Email: mpassmor[email protected]ov.on.ca

Ma

tthew Kan

Senior Advisor, Behavioural Insights

Investor Office

20 Queen Street West, 22nd Floor

Toronto, ON M5H 3S8

Email: mkan@osc.gov.on.ca

Research Report

November 2022

Digital Engagement

Practices in Retail Investing:

Gamifcation &

Other Behavioural

Techniques

Prepared by the Behavioural Insights Team (BIT) in Collaboration with the Investor Office

Research and Behavioural Insights Team (IORBIT) of the Ontario Securities Commission

2

Table of Contents

Table of Contents...................................................................................................................2

Executive Summary ...............................................................................................................3

Key Findings.......................................................................................................................5

Introduction ............................................................................................................................7

Overview of Project Approach..............................................................................................10

Key limitations ..................................................................................................................11

Exploratory Research...........................................................................................................12

Exploratory Research Methodology..................................................................................12

Exploratory Research Findings: Taxonomy of Gamification and Other Behavioural

Techniques.......................................................................................................................15

Experimental Research........................................................................................................ 36

Experimental Research Methodology ............................................................................... 36

Experimental Research Findings ......................................................................................... 44

Conclusion: Considerations for Regulators .......................................................................... 48

Appendix A: Use of Gamification and Other Tactics on Trading Platforms ...........................50

Appendix B: Detailed Experimental Research Findings........................................................52

Appendix C: Experimental Research Analysis Technical Details..........................................62

Appendix D: Experimental Research Screens......................................................................66

Appendix E: Bibliography .....................................................................................................79

3

Executive Summary

A wave of digital, mobile-friendly investing platforms has created new options for retail

investors in Canada and around the world. While these platforms have expanded market

participation, there is growing interest in some of the digital engagement practices (DEPs)

that they and, to a lesser extent, more traditional retail investment platforms use and how

these may raise investor protection concerns. These tactics, sometimes referred to broadly

as “gamification,” use insights from behavioural science to influence investor behaviour.

Broadly, investing platforms use a wide range of DEPs to increase user engagement. They

do this for a variety of business objectives (e.g., customer acquisition and retention, revenue,

profitability) and not necessarily to improve long-term outcomes for their retail investors.

Various regulators around the world have expressed concerns that some of these tactics

may negatively impact investor outcomes. For example, the United States Securities and

Exchange Commission (SEC) has flagged concerns that these features may encourage

investors to trade more often, invest in different products, or change their investment strategy

in inappropriate ways.

1

The goal of this research report is to support the Ontario Securities Commission (OSC) and

other regulators and stakeholders in understanding and responding to these new

developments. This report aims to help chart an effective, evidence-informed path forward in

the months and years ahead as digital trading platforms continue to evolve and grow.

The Behavioural Insights Team was engaged by the OSC’s Investor Office to:

1. Generate a taxonomy of gamification and other behavioural techniques by conducting

literature and environmental scans; and,

2. Conduct an experiment that examines the effects of gamification and other related

behavioural techniques on retail investor behaviours.

We worked in close partnership with the Investor Office Research and Behavioural Insights

Team (IORBIT) to develop the research parameters for the taxonomy, design and conduct

an experiment using a randomized controlled trial (RCT), analyze the experimental data, and

prepare this report. IORBIT’s insights, advice, and feedback were critical to this project’s

success.

In this report, we examine gamification and other behavioural techniques to see how they

affect investor behaviour—both positively and negatively. We outline a taxonomy of

gamification and other behavioural techniques currently employed or with high relevance to

retail investing, and their potential implications for investor behaviour. The five gamification

techniques examined were: (1) gamblification, (2) leaderboards, (3) rewards (negligible or

non-economic rewards such as points, badges, scores), (4) goal and progress framing, and

(5) feedback. The four other behavioural techniques examined were: (1) salience / attention-

inducing prompts, (2) simplification and selective deployment of friction costs, (3) social

interactions, and (4) social norms. We also discuss the results of an experiment (an RCT)

1

U.S. Securities and Exchange Commission (2021, Aug. 27). SEC Requests Information and Comment on Broker-Dealer and

Investment Adviser Digital Engagement Practices, Related Tools and Methods, and Regulatory Considerations and Potential

Approaches; Information and Comments on Investment Adviser Use of Technology. Retrieved from:

https://www.sec.gov/news/press-release/2021-167.

4

with 2,430 investors that simulated a real-world trading environment, in which we measured

the effects of two digital engagement practices, points and top traded lists, on trading

behaviour (e.g., trading frequency).

As the use of the terms digital engagement practices, behavioural techniques, and

gamification have become increasingly popular, it is imperative for regulators to have a clear

and common definition of these terms to allow for rigorous research and potential regulatory

action. To navigate the DEP landscape, we have used the SEC’s definition of DEPs (see Key

Definitions, below) as a foundation. This definition highlights a range of potential tools, such

as behavioural techniques, differential marketing, gamification, design elements, design

features, and data analytics, that increase user engagement. There are other DEP tools

beyond this definition as well, such as artificial intelligence and dark patterns. This report

does not examine all such tools; it focuses on gamification and other behavioural techniques

used in self-directed digital trading platforms. Figure 1 illustrates the relationship among

DEPs, behavioural techniques, and gamification. Gamification techniques are a subset of

behavioural techniques, which are in turn a subset of DEPs.

Key Definitions

For the purposes of this report:

Digital Engagement Practices (DEPs) are defined, consistent with the U.S.

Securities and Exchange Commission, as “the tools including behavioural

techniques, differential marketing, gamification, design elements or design

features that intentionally or unintentionally engage with retail investors on

digital platforms as well as the analytical and technological tools and methods.”

Gamification refers to a variety of behavioural techniques that integrate game-

related elements into non-gaming contexts and applications, with the purpose of

improving user experience and engagement.

We use the term other behavioural techniques to refer to DEPs that use

insights from behavioural science in ways that can influence investor behaviour

but do not meet the definition of gamification.

Digital trading platforms are websites, portals, and applications for trading

securities that are available to retail investors through their phones, computers,

tablets.

5

Key Findings

The Experiment

We conducted an online RCT to assess the impact of two gamification techniques of interest

on investing behaviours in a simulated trading environment: (1) giving investors “points” with

negligible economic value for buying or selling stocks, a form of reward, and (2) showing

investors a “top traded list”, a combination of attention-inducing prompts and social norms.

Participants who were rewarded with points made almost 40% more trades than

participants in the control group (i.e., those who were exposed to the same trading

simulation but without any gamification or other behavioural techniques). This is despite the

fact that the points had negligible value. This is a striking finding given the strong negative

impact of increased trading volume on investors’ returns (on average) and the benefit of

increased volume that may exist for digital trading platforms. The “top traded list” did not

2

increase trading frequency in our experiment.

In addition, participants who saw the top traded lists were 14% more likely than

participants in the control group to buy and sell those top listed stocks. This finding

suggests that showing participants a top traded lists can affect their trading decisions,

nudging them towards buying and selling the stocks listed as top traded. There were no

2

Barber, B. M., & Odean, T. (2000). Trading is hazardous to your wealth: The common stock investment performance of

individual investors. Journal of Finance, 55(2), 773-806.

Figure 1: The relationship between DEPs, gamification, and other behavioural

techniques. This illustration is a simplification as some overlap between these

categories is not depicted.

6

differences between the points group and the control group in terms of the buying and selling

the top traded stocks.

Implications

Based on our findings, we recommend that regulators consider the implications for retail

investors when digital trading platforms offer points for trading activity, as well as display top

traded lists. More broadly, we encourage regulators to consider whether any of the

gamification and behavioural techniques examined have attributes similar to

recommendations and/or result in investor behaviour that is (on average) detrimental to

investor outcomes. If so, then possible responses to these techniques should be considered.

Furthermore, we encourage regulators to close the major gaps in empirical evidence by

collecting more data. Such data can be generated by conducting more experimental studies

using simulated investing platforms, and by reviewing the data from digital trading platforms

that have implemented gamification or other behavioural techniques. These actions will

enable the OSC and other regulators to set new empirically-driven regulatory strategies and

approaches.

7

Introduction

A wave of digital, mobile-friendly investing platforms has created new options for retail

investors in Canada and around the world. While these platforms can increase access and

expand market participation, there is growing regulatory interest in some of the digital

engagement practices (DEPs) that they and, to a lesser extent, more traditional retail

investment platforms use and how these may raise investor protection concerns. These

tactics, sometimes referred to broadly as “gamification,” use insights from behavioural

science to influence user (investor) behaviour. Regulators are concerned that some of these

tactics may negatively impact investor outcomes. For example, the United States Securities

and Exchange Commission, (the “SEC”) has flagged concerns that these features may

encourage investors to trade more often, invest in different products, or change their

investment strategy.

3

Broadly, investing platforms use a wide range of Digital Engagement Practices (DEPs) to

increase user engagement. They do this for a variety of business objectives (e.g., customer

acquisition and retention, revenue, profitability) and not necessarily to improve long-term

outcomes for their retail investors. Various regulators around the world have expressed

concerns that some of these tactics may negatively impact investor outcomes. For example,

the United States Securities and Exchange Commission (SEC) has flagged concerns that

these features may encourage investors to trade more often, invest in different products, or

change their investment strategy in inappropriate ways.

4

The goal of this research report is to support the Ontario Securities Commission (OSC) and

other regulators and stakeholders in understanding and responding to these new

developments. This report aims to help chart an effective, evidence-informed path forward in

the months and years ahead as digital trading platforms continue to evolve and grow.

While there is significant interest surrounding the use of gamification and other behavioural

techniques, they are recent developments in the investing context, and there is little research

into how they are affecting investor behaviour and decision-making. In this context, the

Ontario Securities Commission (OSC) engaged the Behavioural Insights Team (BIT) to:

1. Generate a taxonomy of gamification and behavioural techniques by conducting

literature and environmental scans of:

a. Relevant research into how gamification and other behavioural techniques

can be used to influence retail investor behaviour, as well as key gaps in that

research;

b. How firms serving retail investors are currently using these techniques in

Canada and in select international markets; and

c. Other ways that firms may use gamification and other behavioural techniques

in the future, given the approaches being used in other industries.

3

U.S. Securities and Exchange Commission (2021, Aug. 27). SEC Requests Information and Comment on Broker-Dealer and

Investment Adviser Digital Engagement Practices, Related Tools and Methods, and Regulatory Considerations and Potential

Approaches; Information and Comments on Investment Adviser Use of Technology. Retrieved from:

https://www.sec.gov/news/press-release/2021-167.

4

U.S. Securities and Exchange Commission (2021, Aug. 27). SEC Requests Information and Comment on Broker-Dealer and

Investment Adviser Digital Engagement Practices, Related Tools and Methods, and Regulatory Considerations and Potential

Approaches; Information and Comments on Investment Adviser Use of Technology. Retrieved from:

https://www.sec.gov/news/press-release/2021-167.

8

2. Conduct an experiment that examines the effects of gamification and other related

behavioural techniques on retail investor behaviours.

We worked in close partnership with the Investor Office Research and Behavioural Insights

Team (IORBIT) to develop the research parameters for the taxonomy, design and conduct

an experiment using a randomized controlled trial (RCT), analyse the experimental data, as

well as prepare this report. IORBIT’s insights, advice, and feedback were critical to this

project’s success.

In this report, we examine gamification and other behavioural techniques to see how they

affect investor behaviour—both positively and negatively. We outline a taxonomy of

gamification and other behavioural techniques with high relevance to retail investing, and

their potential implications for investor behaviour. We also discuss the results of an

experiment (an RCT) with 2,430 investors that simulated a real-world trading environment, in

which we measured the effects of two digital engagement practices (i.e., points and top

traded lists) on trading behaviour (i.e., trading frequency).

As the use of the terms digital engagement practices, behavioural techniques, and

gamification have become increasingly popular, it is imperative for regulators to have a clear

and common definition of these terms to allow for rigorous research and potential regulatory

action. To navigate the DEP landscape, we use the SEC’s definition of DEPs (see Key

Definitions, below) as a foundation. This definition highlights a range of potential tools for

increasing user engagement. This report does not examine all such tools. For example, we

do not examine the use of predictive data analytics, dark patterns, or artificial intelligence.

Reflecting our expertise in behavioural science, this research focuses on gamification and

other behavioural techniques used in self-directed digital trading platforms. Figure 2

illustrates the relationship between DEPs, behavioural techniques, and gamification.

Gamification techniques are a subset of behavioural techniques, which are in turn a subset of

DEPs.

9

Key Definitions

For the purposes of this report:

Digital Engagement Practices (DEPs) are defined, following the U.S. Securities

and Exchange Commission, as “the tools including behavioural techniques,

differential marketing, gamification, design elements or design features that

intentionally or unintentionally engage with retail investors on digital platforms as

well as the analytical and technological tools and methods.”

Gamification refers to a variety of behavioural techniques that integrate game-

related elements into non-gaming contexts and applications, with the purpose of

improving user experience and engagement.

We use the term other behavioural techniques to refer to DEPs that use

insights from behavioural science in ways that can influence investor behaviour

but do not meet the definition of gamification.

Digital trading platforms are websites, portals, and applications for trading

securities that are available to retail investors through their phones, computers,

tablets, or other technology.

The image below represents the relationship between DEPs, gamification, and other

behavioural techniques, all of which can be implemented in digital platforms.

Figure 2: The relationship between DEPs, gamification, and other behavioural

techniques. This illustration is a simplification as some overlap between these categories

is not depicted.

10

Overview of Project Approach

This project was conducted in two main phases: exploratory research and experimental

research, as illustrated in the diagram below.

For the exploratory research, we conducted a scan and synthesis of relevant behavioural

science to understand how gamification and other behavioural techniques may influence

retail investor behaviour, in ways that both support and may negatively impact investor

outcomes. We also reviewed select retail investor platforms, news articles, and various

regulators’ statements and reports to understand how firms in Canada and other select

markets are currently using these approaches. Our exploratory research was summarized in

a taxonomy that listed each current or potential technique being employed, their known or

potential impact on investor behaviour, and their current use on investment platforms we

reviewed.

In the second phase, we ran an experiment to empirically test the impact of two selected

techniques on key investor behaviours. This experiment was designed to address key gaps

in the existing evidence base.

As a final step in our process, we developed a set of considerations for regulators informed

by both streams of research.

Figure 3: Overview of the exploratory and experimental research approaches

Overview of Project Approach

11

Key limitations

This section summarizes the most important limitations of this research report. Following

sections provide more detailed accounts of limitations related to each research methodology.

1. This report is not exhaustive in identifying how gamification and other behavioural

techniques are being used on investment platforms today. The proliferation of

platforms, limitations in access to platforms and ability to engage in trading activity,

and the bounded timelines for this review prevent an exhaustive report. However, we

believe it reflects a reasonable cross-section of the techniques being used by self-

directed investing platforms.

2. While we have tried to identify likely uses for gamification and other behavioural

techniques beyond what we found in our review, operators of digital trading platforms

are likely to identify further applications that this report does not consider.

3. There are a vast number of unanswered empirical questions about how DEPs

influence investor behaviour. Our experiment had to select a limited number of

techniques to test and behaviours to measure. Further, our experiment was

conducted in a controlled environment, an investing simulation. Participants in the

experiment did not use real funds and traded in fictitious equities. However, the use

of a robust experimental method (i.e., an RCT) provides us with confidence in terms

of the validity of our findings and our ability to generalize them to real-world trading. In

addition, research participants were compensated based on their returns, and other

aspects of the simulation were carefully designed to enhance its generalizability.

12

Exploratory Research

This section summarizes the methodology and findings from our exploratory research, which

included a literature scan and environmental scan.

Exploratory Research Methodology

We applied a mixed-methods approach to address two exploratory research questions:

1. How do gamification and other behavioural techniques influence investor decision-

making?

2. How are firms serving retail investors currently using or planning to use these

techniques?

Methods included a literature scan and environmental scan. The literature scan provided a

theoretical foundation by identifying and summarizing 31 items of relevant behavioural

science and economic literature related to gamification, other behavioural techniques, and

retail investing. The environmental scan conducted September 7 - October 1, 2021, provided

context on the extent to which firms serving self-directed retail investors are applying these

techniques. It included a direct observation of 12 self-directed retail investor platforms (which

have been anonymized and numbered Platforms 1 to 12 for the purposes of this report), and

a further review of 16 news articles and statements. Both methods informed the development

of a taxonomy of gamification and other behavioural techniques for retail investing platforms.

This taxonomy summarized each current identified technique, their known or potential impact

on investor behaviour, and their current use on the investing platforms we reviewed. More

information on each part of our exploratory research method is captured in the table below:

Exploratory Research Activities: Overview of Methodology

Literature Scan

● The literature scan began by conducting research database

searches for key terms (e.g., investing, gamification), then used a

“snowball method”, whereby we reviewed the sources cited by

relevant papers. The search was also expanded to identify non-peer

reviewed (grey literature), internal BIT resources, and sources

recommended by the OSC.

● Key methodological considerations for the literature scan included:

○ Defining gamification: Gamification is an umbrella term

used to describe the integration of game-related elements

into non-gaming contexts and applications, with the

purpose of improving user experience and engagement.

5

Gamification has become an increasingly popular design

component of applications that do not constitute games,

such as apps aimed at helping users keep track of their

5

Deterding, S., Dixon, D., Khaled, R., & Nacke, L. (2011, September). From game design elements to gamefulness: defining"

gamification". In Proceedings of the 15th international academic MindTrek conference: Envisioning future media environments

(pp. 9-15).

13

weight loss goals, learn new languages, or trade

securities. It is used broadly to increase engagement with

digital applications and to increase the behaviours

encouraged by those applications (e.g., studying,

exercising).

○

Exploring gamification research: Published academic

research on gamification is concentrated in two sectors,

education and health. While this may reflect greater use of

gamification in these sectors, it may also be that

researchers are more likely to conduct experiments and

receive data in these domains. While our literature scan

prioritized the more limited research related to investor

behaviour, we integrated findings from other fields where

we believed it would be relevant across user contexts.

Environmental

Scan

● To conduct the environmental scan, we collaboratively identified 12

self-directed retail investing platforms of interest (both Canadian and

international) with the OSC and went through the process of

registering for an account, keeping a record of gamification and other

behavioural techniques identified throughout the user experience

within each platform. Where it was not possible to register for

accounts with platforms based outside of Canada, we reviewed

videos on YouTube highlighting the features of each of these apps

and how to use them. We did not execute any trades on these

platforms.

● We also reviewed a range of other sources, including news articles

and statements by regulators for further information on how these

platforms may be using (or planning to use) gamification and other

behavioural techniques.

● Our scan excluded banking and financial management platforms that

do not enable trading in securities.

●

See Appendix A for a table summarizing which gamification and

other behavioural techniques were observed on each platform

reviewed.

Taxonomy of

Gamification

and Other

Behavioural

Techniques

● Synthesizing the findings from the literature and environmental

scans, we developed a taxonomy of gamification and other

behavioural techniques that outlines how each technique has been

shown to (or plausibly might) impact specific retail investor

behaviours or choices. Investor behaviours of interest included

enrolling in the platform, engagement with the platform, deposits,

and a wide range of trading-related behaviours like trading frequency

and risk-taking.

● As noted above, there is no authoritative list or common

understanding of what constitutes a gamification technique in the

context of investing platforms. The most widely accepted definition of

gamification, “the use of game-design elements in non-gaming

contexts”, is broad and does not clearly identify what counts as a

14

gamification technique. Systematic reviews of gamification

techniques employ varying taxonomies. Securities regulators tend to

understand gamification very widely, including concepts from

behavioural science (e.g., attention-inducing prompts like

notifications) that are not generally understood to be part of

gamification. To address these challenges, we developed our own

taxonomy of gamification and other behavioural techniques that are

most relevant to retail investing platforms.

● We developed an initial list (i.e., taxonomy) of gamification

techniques based on three widely cited meta-analyses / systematic

reviews of gamification.

, ,

This initial taxonomy was further refined

876

after conducting our environmental scan; we eliminated certain

techniques that did not appear to be relevant to investing platforms

(such as chatbots, avatars, or fantasy themes). Our environmental

scan also revealed that certain other behavioural techniques that do

not meet the traditional definition of gamification are often discussed

alongside gamification tactics and used widely on investing

platforms. We included those techniques, like attention-inducing

prompts, in a separate section of our taxonomy and define them as

other behavioural techniques.

● The widespread use of gamification on investing platforms is a new

phenomenon that is rapidly escalating and shifting. We believe that

new techniques are likely to be deployed by firms operating

platforms. Given the overall purpose of this report in supporting

regulatory strategy, we did not want to constrain our taxonomy and

considerations solely to techniques that have already been

implemented. Where we speculate on further potential use cases,

we clearly note that such approaches are not yet in effect. We draw

conclusions on the potential impact of both current and potential

approaches based on our theoretical and empirical findings. Given

the importance of specific implementation features and context, we

cannot draw definitive conclusions on how gamification techniques

are likely to affect investor behaviour across platforms. As supported

by the existing research and our own experiment (see section

below), we draw inferences on the likely impacts of these techniques

on trading frequency, risk appetite, and other aspects of investing

behaviour.

6

Hamari, J., Koivisto, J., & Sarsa, H. (2014, January). Does gamification work?--a literature review of empirical studies on

gamification. In 2014 47th Hawaii international conference on system sciences (pp. 3025-3034).

7

Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J., Edney, S., & Maher, C. (2017). Does gamification increase engagement with

online programs? A systematic review. PloS one, 12(3), e0173403.

8

Johnson, D., Deterding, S., Kuhn, K. A., Staneva, A., Stoyanov, S., & Hides, L. (2016). Gamification for health and wellbeing:

A systematic review of the literature. Internet Interventions, 6, 89-106.

15

Exploratory Research Findings: Taxonomy of

Gamification and Other Behavioural Techniques

The following taxonomy includes nine techniques informed by behavioural science that are

relevant to investing platforms. For each technique we provide: (1) a definition, (2) a

summary of how it is being used across industries and its general impact on user behaviour,

and (3) description of how it is being used in investing platforms and its impact on investor

behaviour and/or how it might be used and affect investor behaviour.

Gamification Techniques

Gamification refers to a variety of behavioural techniques that integrate game-related

elements into non-gaming contexts and applications, with the purpose of improving user

experience and engagement. Gamification techniques represent a subset of behavioural

techniques, which are a subset of (DEPs).

Gamblification

Definition: Gamblification refers to techniques derived from

gambling, which most prominently include the use of variable

rewards. Variable rewards are economic benefits (e.g., cash

payouts) where the size, timing, or likelihood of the benefit is

unpredictable to the user. Beyond variable rewards, the

gamblification category might also include language and

imagery that evokes gambling (e.g., reference to “jackpots,”

scratch cards).

9

General use and impact on behaviour: Gamblification has

been used to encourage a broad set of behaviours ranging

from user-platform engagement to vaccination . For

11

10

instance, Google Pay gives users virtual scratch cards worth

up to $10 in cash rewards as a variable reward for using this

payment option. In Canada, Tim Hortons’ “Roll Up the Rim”

contest is a famous example of a retailer leveraging variable

rewards to motivate purchasing behaviour.

Lotteries and other variable reward interventions can be potent

drivers of behaviour for three main reasons:

9

The overall relationship between trading and gambling is outside the scope of this research. While trading is distinct from

gambling insofar as investors pursue long-term strategies (and invest in productive assets), there is a relationship between

gambling and investing. Some traders are motivated by the thrill of potential short-term returns and treat trading as gambling. In

their paper “Trading as Gambling,” Dorn, Dorn and Sengmueller (2015) provide evidence for this, showing that when there are

large lotteries, trading activity declines as people substitute lottery entries for trading.

10

Grieve, R. & Lowe-Calverley, E. (2016, Jul 16). The power of rewards and why we seek them out. The Conversation.

11

Jacobson, L. & Tamakloe, K. S. (2021, Aug 19). “Have vaccine lotteries worked? Studies so far show mixed results”.

Politifact.

Figure 4: A modified version

of Platform 7’s rewards,

which give “surprise stocks”

with variable value to first-

time users when they sign up

for an account and to users

who refer a friend

16

1. Their combination of high-impact rewards and generally low win probabilities taps into

our tendency to disproportionately focus on reward magnitude and overweight small

12

probabilities.

13

2. The inherent uncertainty of variable rewards is habit-forming. Decades of research

have found that animals trained to perform behaviours such as pressing levers or

14

seeking drugs using variable rewards learn these behaviours much more readily

15

than those trained with consistent reward schedules. Such animals are also known to

be particularly resistant to so-called behavioural extinction

,

, meaning that they

1716

continue performing their conditioned behaviours long after they are no longer being

reinforced. Indeed, variable reward schedules are often used to simulate and study

addiction in research settings, and are thought to be responsible for the

18

addictiveness of gambling.

19

3. Variable rewards and other incentives couched in language reminiscent of gambling

can invoke a psychological “hot” state that influences a user’s subsequent behaviour.

For instance, when an investment is framed as a “jackpot” entry, our decision-making

becomes dominated by considerations of reward magnitude and less sensitive to

realistic chances. The results of a gamble can further distort our judgements, with

20

one study showing that winning on a gamble makes us 80% likely to continue with the

next gamble, compared to 20% after a loss. This behaviour is thought to stem from

21

a flawed assumption that a win signals a streak where future positive outcomes are

more likely than before (also known as the hot hand fallacy).

22

Current use on digital trading platforms and impact on behaviour: Gamblification

strategies are present on several digital trading platforms. Platform 7 gives “surprise stocks”

with variable value to first-time users when they sign up for an account and to users who

refer a friend. Notably, the free stocks are presented in the form of a scratch card, where

users are presented with an option of three scratch-off tickets and must choose one to

“scratch” their fingers across the phone screen to see what they’ve won. Platform 10 users

have to click on a virtual present to reveal the prize that they have “won” for referring a friend,

the value of which also varies. The platform then presents users with a list of three potential

stocks for them to invest in with the referral bonus. This list of three stocks makes it more

likely the user will choose one of those stocks instead of other securities that could be more

12

Griffiths, M., & Wood, R. (2001). The psychology of lottery gambling. International Gambling Studies, 1(1), 27-45.

13

Burns, Z., Chiu, A., & Wu, G. (2010). Overweighting of small probabilities. In Wiley Encyclopedia of Operations Research and

Management Science (pp. 1-8). Hoboken, NJ, USA: John Wiley & Sons.

14

Skinner, B.F. (1969). Contingencies of reinforcement: A theoretical analysis. Meredith Corporation.

15

Lagorio, C. H., & Winger, G. (2014). Random-ratio schedules produce greater demand for iv drug administration than fixed-

16

Miltenberger, R. G. (2008). “Behavioral Modification: Principles and Procedures”. Florida, Thomson.

17

Shull, R. L., & Grimes, J. A. (2006). Resistance to extinction following variable‐interval reinforcement: Reinforcer rate and

amount. Journal of the Experimental Analysis of Behavior, 85(1), 23-

39.

18

Egli, M., Schaal, D. W., Thompson, T., & Cleary, J. (1992). Opioid-induced response-rate decrements in pigeons responding

under variable-interval schedules: reinforcement mechanisms. Behavioural Pharmacology.

19

Haw, J. (2008). Random-ratio schedules of reinforcement: The role of early wins and unreinforced trials. Journal of

Gambling Issues, (21), 56-

67.

20

Chaudhry, S., & Kulkarni, C. (2021, June). Design Patterns of Investing Apps and Their Effects on Investing Behaviors. In

Designing Interactive Systems Conference 2021 (pp. 777-788).

21

Croson, R., & Sundali, J. (2005). The gambler’s fallacy and the hot hand: Empirical data from casinos. Journal of Risk and

Uncertainty, 30(3), 195-209.

22

Ayton, P., & Fischer, I. (2004). The hot hand fallacy and the gambler’s fallacy: Two faces of subjective randomness?. Memory

& cognition, 32(8), 1369-1378.

ratio schedules in rhesus monkeys. Psychopharmacology, 231(15), 2981-2988.

17

suitable, given the increased salience and reduced friction of purchasing them. Users do not

have to invest the referral bonus in these three stocks, but the approach increases the

likelihood that they will. Platform 10 also uses variable rewards for new users, offering the

cash equivalent of a stock worth up to $4500. The free stock bonus has a value between $5

and $4500 with an average of $

15.

23

Given the evidence on variable rewards more broadly, we expect that these approaches are

likely to increase platform sign-ups by offering a large potential bonus and increase the

frequency of referrals. We also believe that these experiences may increase the likelihood of

ongoing use of the application.

Beyond the immediate behaviour being rewarded, there are reasons to believe that

gamblification tactics can change subsequent financial decisions as well. We are significantly

more likely to gamble on money that feels like a windfall or unexpected bonus,

24,25

like a

large variable reward. These rewards may increase retail investor risk taking after receiving

the bonus, especially where the bonus is unexpectedly large. There are two underlying

effects. First, the “house money” effect describes how gamblers are less concerned about

losing their winnings than losing their own money, their pre-existing stake.

26

Second, those

who receive an unexpectedly large award may be influenced by the “hot hand fallacy”,

27

the

feeling that one is on a “hot streak” and that things are going to continue going well. This

might motivate higher levels of trading activity than users might otherwise engage in.

Potential use on digital trading platforms and impact on behaviour: In the future, digital

trading platforms may provide variable rewards for other behaviours, including deposits and

trading (e.g., based on the volume or type of trades made). For example, users might be

awarded an additional entry into a high-stakes lottery for every trade they carry out. If

implemented, the evidence on variable rewards suggests this could have an outsized effect

on trading frequency, surpassing the value of a fixed incentive per trade. Trading frequency

or volume is a critical behaviour of interest, given the strong negative correlation with investor

returns

28

and the incentives platforms can have to see higher trading volume. In terms of

deposits, variable rewards would likely result in increased deposit behaviours within a

specific account.

Leaderboards

Definition: A public display of ranked information about application users’ performance.

Leaderboards enable and encourage social comparison and competition.

General use and impact on behaviour: Leaderboards are one of the most common

gamification tactics across digital platforms and apps in a variety of industries.

29

By offering

23

Footnote source deleted re: Platform 10

24

Kellner, C., Reinstein, D., & Riener, G. (2019). Ex-ante commitments to “give if you win” exceed donations after a win. Journal

of Public Economics, 169, 109-127.

25

Adam, M., Roethke, K., & Benlian, A. (2021). Gamblified digital product offerings: an experimental study of loot box menu

designs. Electronic Markets, 1-16.

26

Thaler, R. & Johnson, E. (1990), Gambling with the house money and trying to break even: The effects of prior outcomes to

risky choice. Management Science, 36, (6), 643-660.

27

Croson, R., & Sundali, J. (2005). The gambler’s fallacy and the hot hand: Empirical data from casinos. Journal of Risk and

Uncertainty, 30(3), 195-209.

28

Odean, T. (1999). Do investors trade too much? American economic review, 89(5), 1279-1298.

29

Johnson, D., Deterding, S., Kuhn, K. A., Staneva, A., Stoyanov, S., & Hides, L. (2016). Gamification for health and wellbeing:

A systematic review of the literature. Internet Interventions, 6, 89-106. Also: Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J.,

18

users the opportunity to see and show their peer groups where they stand relative to others,

leaderboards tap into our desire for recognition and innate tendency for social comparison

and competition.

30,31

A 2017 meta-analysis (a statistical analysis that combines the

results of multiple scientific studies that address the same

question and increases the confidence in the results)

indicates that leaderboards are among the most effective

gamification tactics, often outperforming other approaches

like points and badges and generating small-to-medium-size

effects compared to control conditions.

32

In one study

focused on educational outcomes, researchers found that

gamifying an online learning platform with leaderboards

(alongside several other tactics), resulted in a 25% increase

in student retention, as well as 23% higher average test

scores compared to those produced by control conditions.

33

Another study found that leaderboards alone led to

approximately 40% higher levels of user activity in a gamified

image annotation task compared to control conditions, which

was approximately 4% and 16% more than researchers were

able to achieve with levels and points, respectively.

34

Indeed, commercial platforms frequently use leaderboards to

enhance user participation, with particular prevalence within

the fitness app industry, where platforms such as Strava and

Nike+ track and rank users based on running mileage and

other parameters of performance. It is worth noting, however,

that inducing a competitive spirit may not have the same

effects on everyone and may in fact disadvantage the performance of individuals who are

intrinsically less competitive.

35

Current use on digital trading platforms and impact on behaviour: Leaderboards are a

relatively rare feature of digital trading platforms. US-based Platform 8 offers the option to

enable social investing, allowing users to compare how they are doing with their peers by

featuring on a leaderboard where users are ranked based on returns weighted within a

certain time frame. Users must meet certain criteria to feature on the leaderboard, including

owning at least a minimum number of holdings worth at least a certain combined valued to

Edney, S., & Maher, C. (2017). Does gamification increase engagement with online programs? A systematic review. PloS one,

12(3), e0173403.

30

Leibbrandt, A., Gneezy, U., & List, J. A. (2013). Rise and fall of competitiveness in individualistic and collectivistic societies.

Proceedings of the National Academy of Sciences, 110(23), 9305-9308.

31

Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J., Edney, S., & Maher, C. (2017). Does gamification increase engagement with

online programs? A systematic review. PloS one, 12(3), e0173403.

32

Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J., Edney, S., & Maher, C. (2017). Does gamification increase engagement with

online programs? A systematic review. PloS one, 12(3), e0173403.

33

Krause, M. Mogalle, M., Pohl, H. & Williams, J. J. (2015). “A playful game changer: fostering student retention in online

education with social gamification”. In Proceedings of the Second ACM Conference on Learning@Scale.

34

Mekler, E. D., Brühlmann, F., Opwis, K., & Tuch, A. N. (2013, October). Do points, levels and leaderboards harm intrinsic

motivation? An empirical analysis of common gamification elements. In Proceedings of the First International Conference on

gameful design, research, and applications (pp. 66-73).

35

Song, H., Kim, J., Tenzek, K. E., & Lee, K. M. (2010, June). The effects of competition on intrinsic motivation in exergames

and the conditional indirect effects of presence. In Annual conference of the International Communication Association,

Singapore.

Figure 5: A modified version

of Platform 8's social

investing features, which

rank users on a leaderboard

based on weighted returns

within a certain time frame.

19

dissuade members from copying deceptive results from other users (e.g., a massive return

solely from one penny stock).

Platform 2 features multiple types of leaderboards. As an example, users have access to an

“Editors’ choice” leaderboard of investors to follow and copy, as well as a leaderboard of the

most copied investors on the platform. Users are also invited to try joining the Platform 2’s

“Popular Investor Program” which allows successful joiners to generate an income from

being copied by other users. As of September 2021, we did not identify any Canadian

platforms using leaderboards.

Leaderboards have not been evaluated in a trading context in the academic literature.

However, the studies conducted in other contexts, mentioned in the section above, suggest

that leaderboards can be expected to increase user engagement with digital trading

platforms. This may increase trading frequency and risk-taking, particularly in users who are

more motivated by social comparisons

36

and competition than their longer-term financial

goals. Leaderboards may also implicitly signal a social norm (see section below) around

striving for and celebrating high financial performance. Here, frequently changing leader

names may be viewed as the culmination of an ongoing competition, and a sign that this

contest is desirable and popular. The impact of this is likely to depend on the salience of the

leaderboard, whether economic or non-economic rewards are tied to leaderboard

performance, and the type of returns or activity that the leaderboard represents.

Leaderboards that focus on shorter-term returns, like Platform 2’s 12-month returns, may

increase myopic, speculative trading. Traders with a ranking on the leaderboards may also

experience increased (over)confidence, which negatively impacts returns from trading.

37

Potential use on digital trading platforms and impact on behaviour: In the future, digital

trading platforms could implement additional leaderboards for other types of investor

behaviour, such as trading frequency or even social interactions like “posts” or “likes” (see

following section). Displaying a leaderboard that measures activity could clearly increase the

frequency of trading. As described further below, even leaderboards for social interactions

may be deceptively risky, given how strong an influence on behaviour social feedback and

recognition can be. On the other hand, leaderboards for completing investor education

modules, where offered by digital platforms, could encourage greater participation and

learning.

Rewards (e.g., points, badges, scores)

Definition: Providing rewards for performing tasks or accomplishing goals within an online

application. Our definition includes rewards with either no economic value (e.g., badges,

scores, animations) or with nominal economic value (e.g., points that can be redeemed for

an insignificant financial value) that should not materially influence investor behaviour under

a purely rational economic decision-making model. This category excludes larger financial

36

For further discussion of social comparison, see the section on Social Interactions, below.

37

Biais, B., Hilton, D., Mazurier, K., & Pouget, S. (2005). Judgemental overconfidence, self-monitoring, and trading performance

in an experimental financial market. The Review of Economic Studies, 72(2), 287-312.

20

rewards (e.g., cash bonuses or points that can be redeemed for significant financial value),

as they constitute a traditional incentive, not a “behavioural” intervention.

General use and impact on behaviour: Providing

rewards like points, badges and scores are among the

most commonly used gamification tactics.

38

While these

rewards can have little or no economic value, they can still

have a significant effect on consumer / user behaviour,

promoting engagement in online programs

39

and

influencing consumer behaviour.

40

For example, the Nike+

app awards “NikeFuel points” for completing physical

activity tasks. These techniques motivate behaviour

through social comparison (see Leaderboards, above) and

our intrinsic desire to make progress, even if the measure

is arbitrary.

Badges, in particular, are popular features of apps and

online programs. They act as publicly visible signs of status

within the network of application users. Amazon marks

individuals as “top reviewers” when enough other users

mark their reviews as helpful. A “pre and post” evaluation of

the web platform “Sharetribe” found that badges increased

user posts, page views, and transactions.

41

In a commercial

context, retailers have long offered loyalty points and

programs. While these points can generally be redeemed

for goods and can be considered a traditional economic

reward, their impact on behaviour outstrips their pure economic value as people tend to

overvalue points they collect.

42

Not only are they overvalued, the mere decision to redeem a

reward significantly increases purchase behaviour before and after the redemption event.

43

However, studies examining the effect of badges exclusively on engagement with online

programs have found only small effect sizes.

44

Current use on digital trading platforms and impact on behaviour: An American

financial platform, Platform 8, uses points to reward users. Platform 8 is differentiated from

other investing platforms by providing a wide range of financial products and services on one

platform, including investing options, credit cards, loans, insurance, bank accounts, credit

score information, budgeting tools, etc. While points are not given for investing behaviours,

users can earn “Platform 8 points” for actions like spending money with the credit card or

38

Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J., Edney, S., & Maher, C. (2017). Does gamification increase engagement with

online programs? A systematic review. PloS one, 12(3), e0173403.

39

Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J., Edney, S., & Maher, C. (2017). Does gamification increase engagement with

online programs? A systematic review. PloS one, 12(3), e0173403.

40

Tobon, S., Ruiz-Alba, J. L., & García-Madariaga, J. (2020). Gamification and online consumer decisions: Is the game over?.

Decision Support Systems, 128, 113167.

41

Hamari, J. (2017). Do badges increase user activity? A field experiment on the effects of gamification. Computers in Human

Behavior, 71, 469-478.

42

Van Osselaer, S. M., Alba, J. W., & Manchanda, P. (2004). Irrelevant information and mediated intertemporal choice. Journal

of Consumer Psychology, 14(3), 257-270.

43

Dorotic, M., Verhoef, P. C., Fok, D., & Bijmolt, T. H. (2014). Reward redemption effects in a loyalty program when customers

choose how much and when to redeem. International Journal of Research in Marketing, 31(4), 339-355.

44

Looyestyn, J., Kernot, J., Boshoff, K., Ryan, J., Edney, S., & Maher, C. (2017). Does gamification increase engagement with

online programs? A systematic review. PloS one, 12(3), e0173403.

Figure 6: A modified version of

Platform 8’s rewards program,

which rewards users with points

for completing various in-app

actions, such as checking your

credit score

21

signing into the app on a daily basis and on consecutive days. The economic value of the

Platform 8 points is quite limited. For example, users are rewarded with 1 point for a daily

app login, and each Platform 8 point is worth $0.01. The earned points then can be

converted into fractional shares of stocks within the investing component of Platform 8’s

digital platform, converted into cryptocurrency within the digital assets component of the

platform, turned into cash, used towards loans, or used as credit towards the Platform 8

credit card. Enabling users to apply their points on traditional securities or crypto investments

may be a particularly effective way to get non-investors to use these components of the

Platform 8 digital platform.

45

It leverages the concept of ‘mental accounting’, which describes

how people tend to treat money differently based on subjective criteria, such as its source.

They may, for example, be more willing to take on risk with “bonus money” than money from

other sources (e.g., employment income).

Another US-based personal finance app has taken a slightly different approach. They reward

users with a percentage of their debit card purchases back in stock. For example, when a

user spends money at Walmart, Amazon, or Starbucks, they earn fractional shares in these

companies. When they spend at a smaller business, such as a local restaurant, they earn an

investment of their choosing, either a stock or an ETF. The app’s company’s analysis

suggests that one-third of customers using this reward card go on to make a follow up

investment in the given stock or fund.

46

While offering users automated investments in the

market is not negative for investors, this type of reward system may reduce diversification.

In a much simpler use of rewards, Platform 7 previously showered users’ screens with digital

animations to celebrate certain actions like placing a first trade or successfully referring

friends. A 2021 experiment tested how gamification techniques, including confetti bursts,

achievement badges, and messages of encouragement influence users’ risk taking when

trading. Participants in the experiment were assigned to trade virtual assets on either a

simple experimental platform that mimics a retail investing app or a gamified version.

47

In

each round, participants were given a virtual asset that they can sell at any time. Every two

seconds, the asset price either increased by a random amount or, with a small probability

that varied each round, crashed to zero. Users who traded on the gamified version of the

platform took on significantly more risk. For example, they waited 14% longer to sell in the

gamified version. The impact of gamification was stronger for high-risk environments (i.e., for

assets that had a higher probability of crashing). Increasing the probability of a crash from

2% to 5% led to a 246% stronger impact of gamification on risk taking. In addition, the effect

was stronger for inexperienced traders with lower financial literacy; a one standard deviation

increase in a financial literacy score reduced the impact of gamification by 56%.

Potential use on digital trading platforms and impact on behaviour: Trading platforms

could introduce points / scores or badges as a way to potentially motivate a wide range of

investor behaviours. For example, badges could be awarded for purchasing different types of

securities (e.g., options) or points could be awarded on a per-trade basis. Digital platforms

might consider enabling users to “cash in” these points for small rewards (e.g., fractions of

stocks, gift certificates, etc.) or keep them purely nominal. Small rewards are likely to have a

45

Footnote source deleted re: Platform 8

46

Footnote source deleted re: a US-based platform

47

Chapkovski, P., Khapko, M., & Zoican, M. (2021). Does gamified trading stimulate risk taking?. SSRN 3971868.

22

larger impact on investor behaviour, given that they could be overvalued as being

economically significant, and would have some financial cost to the digital platforms.

There may also be opportunities for investing platforms to deploy trading-related rewards in

ways that are more likely to benefit users. For example, they could award points for

improving the diversification of the investor’s portfolio (e.g., across asset classes or sectors).

Goal and progress framing

Definition: Design elements that i) help users set and visualize their goals, and/or ii)

strategically frame users’ performance and progress with respect to these goals to stimulate

greater levels of engagement.

General use and impact on behaviour: Diverse goal and progress framing tactics are

being used across industries (e.g., air travel, food & drink, health apps) to motivate two

primary types of engagement behaviours: i) purchasing

and consumption, and ii) work and productivity. For

example, flight miles programs motivate consumption by

strategically framing their customers’ flight histories as

progress towards a particular goal. One study has found

that reminding customers of how close they are to

unlocking rewards associated with hitting an arbitrary

points target can make them 55% relatively more willing to

agree to receive marketing content in exchange for bonus

miles, compared to when they are further from that

threshold.

48

In a practice that has attracted some controversy, Uber

uses goal framing tactics to nudge their workers to keep

driving beyond their desired log-off times.

49

When drivers

are about to log off for the day, the app alerts them to how

close they are to their daily income target (or a target

which the company took the liberty to set for them) and

encourages them to continue working. Although an

absence of publicly available data from these interventions

makes it difficult for us to specify the magnitude of the

behavioural effect, the aggregate evidence suggests that

goals (even arbitrary ones), influence behaviour across a

range of activities.

How companies or apps choose to present an individual’s

progress toward a goal is also impactful. First, the closer we think we are to a goal, the more

effort we are willing to expend to achieve it, a concept called the goal-gradient hypothesis.

Our perceived proximity to a goal can be manipulated through “endowed progress.” People

getting a “Buy 12 coffees, get 1 free” card, with two of these coffees already pre-stamped

48

Kivetz, R., Urminsky, O., & Zheng, Y. (2006). The goal-gradient hypothesis resurrected: Purchase acceleration, illusionary

goal progress, and customer retention. Journal of Marketing Research, 43(1), 39-58.

49

Scheiber, N. (2017). How Uber uses psychological tricks to push its drivers’ buttons. New York Times.

Figure 7: Uber has used

progress framing to encourage

drivers to continue driving

23

buy more coffee than those getting a “Buy 10 coffees, get 1 free” card even though the actual

proximity to the goal, buy 10 more coffees, is the same.

50

Second, a theory known as the small area hypothesis states that “individuals in pursuit of a

goal exhibit stronger motivation when they focus on whichever is smaller in size: the area of

their completed actions or their remaining actions needed to reach a goal.”

51

This means that

if a user is 10% of the way to a goal, it’s more motivating to focus their attention on the 10%

they have accomplished than the 90% they haven’t. Conversely, if they are 90% of the way

to a goal, it is more motivating to focus on the 10% remaining than the 90% complete. One

study of the behaviours of over 90,000 members of an online Q&A community has found that

small-area progress framing accounted for a minimum of 78% increase in user activity and

engagement after the platform was restructured.

52

“Streaks” are another popular tactic used to frame progress. Derived from the concept of

“winning streaks” in sports, they are used as a measurement of how consistently a user

completes a specific action. For example, Duolingo refers to streaks in their language-

learning platform, where users grow their streak for each day in a row they complete a

lesson. An analysis of this feature has revealed that the streaks help increase users’

attention to their learning purpose when the challenges increase and improves motivation.

53

Winning streaks were also shown to increase in perceived attractiveness with greater length.

The effectiveness of this feature has been noted by other industries: mobility service

providers such as Uber and Lyft distribute so-called “streak” or “consecutive ride” bonuses to

motivate their driver employees.

54

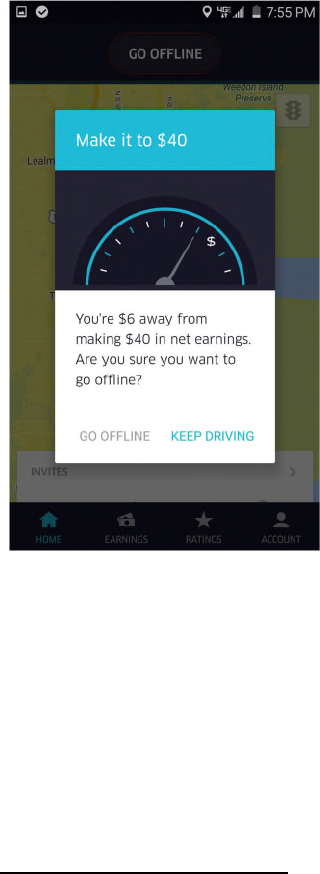

Current use on digital trading platforms and impact on behaviour: Our environmental