PJAEE, 17 (9) (2020)

4365

PERFORMANCE ANALYSIS OF PRIVATE AND PUBLIC SECTOR BANKS

OF OPEN- ENDED TAX SAVING MUTUAL FUND SCHEMES IN INDIA

K. Venkata Rami Reddy

1

, Prof. A. Sreeram

2

1

Research Scholar, Department of Financial Management, GITAM (Deemed to be University),

GITAM-HBS, Hyderabad Campus, India.

E-mail: [email protected]

2

Professor, Department of Financial Management, GITAM (Deemed to be University), GITAM-

HBS, Hyderabad Campus, India.

K. Venkata Rami Reddy, Prof. A. Sreeram: Performance Analysis Of Private And Public

Sector Banks Of Open- Ended Tax Saving Mutual Fund Schemes In India -- Palarch’s

Journal Of Archaeology Of Egypt/Egyptology 17(9). ISSN 1567-214x

Keywords: Equity Linked Savings Scheme (ELSS), Investor, Investment, Mutual Fund and

Performance.

ABSTRACT

This research study is an attempt to analyse the selected Equity Linked Savings Scheme

(ELSS) Mutual Fund schemes performance to see their growth trend on the investors

investments. In this research study 05 private sector banks and 05 public sector banks open

ended tax saving mutual fund schemes are considered as a sample and the banks was selected

based on their Corpus size. The risk-free limit adopted is 6.65%. To give increased return on

investor domestic investments and enhance investment allocation in different avenues, the scope

and needs of investors for mutual fund as an investment option has greatly increased. Mutual

fund investment contribution mostly from Tier 1 and Tier 2 cities only whereas rural and semi-

urban communities are less contrubution. One explanation for this is awareness levels in both

rural and semi-urban areas are very less. So, there is a great need for awareness-raising. Findings

of the study said that the Private Sector banks mutual fund schemes have recorded much better

performance when compared to Public Sector banks mutual fund schemes mainly due to better

allocation of funds, better management and Portfolio Manager's efficient performance. This

conclusion was obtained after the ratio of Sharpe, Treynor, beta, Jensen Alpha and Appraisal

ratio was measured and compared. The findings of the says that the ELSS funds have

outperformed the market index in terms of average returns. Axis Long Term Equity Fund is the

most reliable scheme in market. Moreover, all the funds have aggressive relationship with

PJAEE, 17 (9) (2020)

4366

market except Baroda ELSS 96 (Plan-B). This Study can be expanded further by taking other

specific mutual fund schemes to study how they are performing in trems of their benchmark

1. Introduction

Those investors who either lack large amounts of investment, or who do not

have the ability or time to study the market, but want their wealth to increase

mutual funds are suitable because fund manager will take care. The collected

money in the mutual funds is invested by qualified key fund managers

according to the stated goal of the schemeas well as investors. A minimal fee

that is reduced from the investment is charged by the fund house. The charged

fees by mutual funds are controlled and subject to certain limits laid down by

the Indian Securities and Exchange Board of India (SEBI). The savings rate by

individuals in India is one of the highest when compared to other countries.

This penchant for wealth creation implies that Indian investors need to look for

mutual funds beyond traditionally favoured Fixed Deposits (FDs) of banks and

purchasing of gold. Nevertheless, less awareness levels about mutual funds is

an investment avenue that is less preferred. Mutual funds have various

investment options for products across the financial continuum. The avenue

needed to achieve these goals often differ when savings goals vary, such as

(Old age) post-retirement expenses, children's for schooling or marriage,

purchasing of house, etc. The mutual fund industry in India offers a range of

schemes and provides for all forms of according to their needs.

For retail investors a great opportunity to get involved and gain benefits from

the upward trends in the mutual fund markets. While it can be advantageous to

invest in mutual funds, by choosing the right fund to invest according to their

needs. Therefore, investors should take due care of the fund and take account

of the risk-return trade-off and the time horizon, or consult with a professional

financial adviser. In addition, investors need to invest in different fund

categories, such as equity, debt and gold, in order to benefit from mutual fund

investments to the greatest extent possible. Although investors of all kinds are

capable of investing on their own in the securities market, but the better choice

is mutual fund for the sole reason that all benefits are included in a bundle.

UTI is India's oldest and largest mutual fund. Mutual funds were started by

several commercial banks and financial institutions. Corporate firms have also

launched mutual funds in the public sector and in the private sector. As at

December 31, 2019, the total number of accounts (or folios as per the parlance

of the mutual fund) stood at 8.71 crore (87.1 million), the Assets Under

Management (AUM) of the Indian MF Industry increased from about 6.65

trillion as at December 31, 2009 to about 26.54 trillion as at December 31,

2019, a four-fold increase over a 10-year period in both sectors. Several

taxpayers are searching for various options to save under income tax 80C,

1961. While there are many ways to save investments in tax-saving funds, one

of the attractive options is the Equity Linked Saving Scheme (ELSS). The lock-

in period of ELSS is much lower compared to traditional tax savings

PJAEE, 17 (9) (2020)

4367

instruments such as the Public Provident Fund (PPF), National Saving

Certificate (NSC) & bank deposits. ELSS is also an investment in equity

markets and investing in it can give you better long-term returns compared to

other asset classes. Investors invest in this scheme and receive tax advantages

under Sec 80C.

2. Literature Review

Kandpal, V., & Kavidayal, P. C. (2014)

1

, compared to the Public Sector

Mutual Funds in his study, the Private Sector Mutual Funds reported much

better performance, primarily due to better fund allocation, better management

and efficient performance of the portfolio manager. This outcome was achieved

after calculating and comparing the Sharpe, Treynor, beta and Jensen ratios.

Adhav, M. S. M., & Chauhan, P. M. (2015)

2

, their study concluded that

equity, debt and hybrid mutual funds performed better than their benchmarks

during the years 2009-10 to 2013-14 and generated sustainable returns for

investors in equity mutual funds compared to other schemes.Soni, S.,

Bankapue, D., & Bhutada, M. (2015)

3

, in their study it is concluded that the

both Kotak and HDFC mutual fund banks are well managed in terms of debt

schemes where as Kotak Mutual Fund schemes are more aggressive in Large

Cap Equity schemes, and HDFC Mutual Fund schemes in Mid Cap Equity

schemes are more aggressive. Bhagyasree, N., & Kishori, B. (2016)

4

, 14 out

of 30 mutual fund schemes in his research exceeded the benchmark return. The

results also showed that some of the schemes has failed, these schemes were

facing the problem of diversification. In the study, for all schemes which

showed that returns greater than the risk-free rate were provided by funds, the

Sharpe ratio was positive. The Jensen measure results showed that 19 of 30

schemes showed positive alpha, indicating superior performance of the scheme.

Suchitra, M. K., & Prashanta, A. (2017)

5

, in their study, the Indian Mutual

Funds scenario covers the gross mobilisation, gross redemption and net inflows

of mutual funds, the number of mutual funds and assets under management

(AUM) over the study period and the performance assessment of selected

companies. There was also a year-wise and sector-wise analysis of mutual

funds in India. Percentages, Averages, CAGR, and Standard Deviation are the

instruments used for the analysis of the data. The assessment of performance

was carried out by applying the Sharpe ratio. Compared to public sector mutual

funds, the performance of the majority of private sector mutual funds is

better.Thakuria, A., & Kashyap, S. (2017)

6

, his paper seeks to highlight the

comparative performance of mutual funds in the public and private sectors, as

well as to shed light on the scope of the fund market's existing potential in the

face of traditional investor risk aversion and the enormous increase in financial

assets. It has been noted that mutual funds in the private sector are taking more

risks and have also been able to achieve higher returns on average. Although

many of them have not been able to achieve better results over the long-term

horizon, some of them have done well in risk-return analysis, such as the

Reliance, Birla and Tata systems.Prakash, R.P., & Basanna, P. (2017)

7

, it is

shown in his study that public sector schemes have performed well compared

PJAEE, 17 (9) (2020)

4368

to private sector schemes and it is also found that most private sector schemes

have higher volatility measured in terms of standard deviation.

Raj, M., Verma, T., Bansal, S., & Jain, A. (2018)

8

, in his study, Public

Sector Mutual Funds reported much better performance than Private Sector

Mutual Funds, mainly due to better fund allocation, better management and

efficient performance of portfolio managers.

3. Problem Statement

From the Literature Review it is clear that no much work has been emphasized

on the open ended Equity Linked Savings Scheme (ELSS) of Mutual Funds.

ELSS scheme offering multiple benefits to investors like short duration, high

return than other tax saving schemes and dividend etc. Even though the

investor has multiple benefits but their growth was not satisfactory. When they

compare public sector banks mutual fund schemes and private sector banks

mutual fund schemes the performance of private sector funds is better than

public sector banks. Hence we would like to study the performance of public

and private sector banks mutual fund open ended tax saving schemes. With the

following objectives

1. To compare and evaluate the performance of various selected public and

private sector banks open ended tax-saving mutual fund schemes with Nifty 50

TRI.

2. To offer suggestions to decide where and when to invest in order to obtain

tax advantages and high returns.

4. Research Methodology

Methodology of science is a vital tool for achieving overall research objectives.

The purpose of this research paper is to analyse the performance of the various

schemes of public and private sector banks' mutual fund schemes (the open-

ended Equity Linked Saving Scheme with a statutory 3-year lock-in period and

tax benefits).

4.1 Sample selection

Top 10 Mutual funds schemes (direct growth) are considered for the current

study among the 44 mutual funds in the Association of Mutual Funds in India

(AMFI), of public and private sector banks.These banks has the share quarterly

average assets under management (QAAUM) as on December 2019 in crores

Rs. 15, 36,009.16.

PJAEE, 17 (9) (2020)

4369

Source:https://www.mutualfundindia.com/mf/Aum/details

4.2 Study Period

The timeline for the current research study is 1

st

April 2014 to 31

st

March

2019 i.e. five years.

4.3 Source of Data

Secondary data is the primary source for the current research work, where all

the Net Asset Value (NAV) information has been obtained from various

sources such as https://www.amfiindia.com and respective mutual fund bank

websites.

4.4 Tools and Techniques Used

Tools and techniques used to analysis in the current study are descriptive

statistics such as CAGR, mean, variability measures (such as standard

deviation (SD)) and coefficient of variance (CV) etc.,

1. CAGR= (Selling Price/Purchase Price)

1/n

-

1*100

2. Average (ȳ) = ∑y/n

3. SD (σ) = √∑ (y-ȳ)

2

/n

4. CV= σ/ȳ *100

5. Beta= Covariance (Ri, Rm)/Variance (Rm)

6. Sharpe Ratio= Rp – Rf/σ

7. Treynor Ratio= Rp – Rf/β

8. Jensen Alpha= Rp – (Rf + β (Rm – Rf))

4.5 Hypothesis of the Study

H

1

: There is a significance difference between Average Returns of Nifty 50TRI

and selected Private Sector Banks Mutual Fund Schemes.

5. Limitations

The limitations of this study are, the authors used the quantitative data for

analysis due to time constraints but unable to conduct qualitative analysis,

which could have taken the research a different direction. The researcher could

not explore investor’s perception on financial performance of mutual fund open

ended tax saving schemes by using qualitative research methodology. The

PJAEE, 17 (9) (2020)

4370

study is based on secondary data of selected banks open ended tax saving

schemes of (Public and Private Sector banks) NAV report.

6. Profile of Private and Public Sector Banks (Mutual Fund)

6.1 Baroda Mutual Fund

Bank of Baroda's wholly-owned subsidiary is Baroda Asset Management India

Ltd (BAML). The investment manager of the Baroda Mutual Fund ('Mutual

Fund'), Baroda Asset Management India Limited (AMC), is a wholly-owned

subsidiary of Bank of Baroda and is capable of serving the diverse asset

management needs of Indian investors through a range of offerings in equity,

debt and money markets, etc.

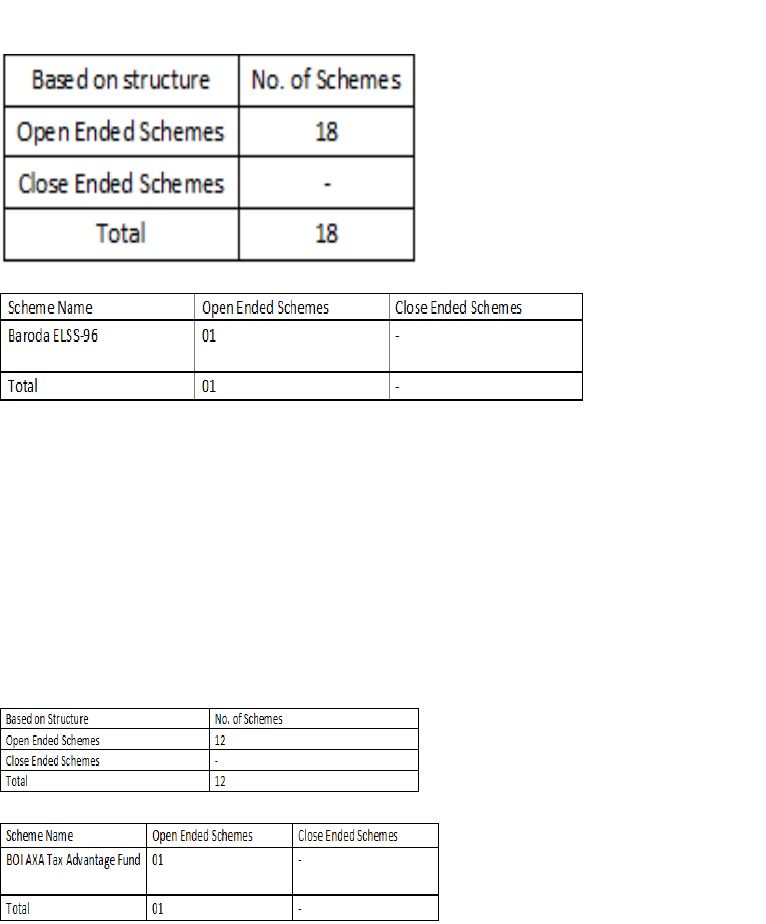

Different Schemes introduced by Baroda Asset Management India Limited as

under

Source:https://www.barodamf.com/Products/Pages/equity-schemes.aspx

Source:https://www.barodamf.com/Products/Pages/equity-schemes.aspx

A total of 18 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are two plans named as Plan-A and Plan-B. In Plan-A

there are three options known as growth, dividend and bonus and in Plan-B

there are three options known as growth, dividend and bonus.

6.2 BOI AXA Mutual Fund

BOI AXA Investment Managers Private Limited, part of the AXA Group, is a

joint venture between Bank of India and AXA Investment Managers, one of the

financial protection industry's largest players in the world.

Different Schemes introduced by BOI AXA Investment Managers Private Ltd

as under

Source: https://www.boiaxamf.com/product

Source: https://www.boiaxamf.com/product

PJAEE, 17 (9) (2020)

4371

A total of 12 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are three plans named as regular, direct and eco. In

regular plan there are two options known as growth and dividend and in direct

plan there are two options known as growth and dividend and in eco plan there

are two options known as growth and dividend.

6.3 Canara Robeco Mutual Fund

India's second oldest asset manager, Canara Bank, partnered with the Robeco

group through a joint venture, and the mutual fund was named Canara Robeco

Mutual Fund. This brings together the extensive experience of Canara Bank

with the global asset management experience of the Robeco group in the Indian

market.

Different Schemes introduced by Canara Robeco Asset Management Company

Ltd as under

Source: https://www.canararobeco.com/forms-downloads/forms-and-

information-documents/information-document/sid

Source:https://canararobeco.com/product/productlist#Equity

A total of 26 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan there

are two options known as growth and dividend.

6.4 SBI Mutual Fund

SBI Funds Management Pvt., with 30 years of rich fund management

experience. It has a strong and proud legacy that goes back to the State Bank,

India's biggest bank (SBI). Joint venture of one of the world's leading fund

management firms, SBI-AMUNDI (France).

It has a network throughout India of more than 222 acceptance points,

providing value and cultivating the trust of a vast and diverse investor

community.

Different schemes introduced by SBI Funds Management Pvt as under

Source: https://www.sbimf.com/en-us/navs

PJAEE, 17 (9) (2020)

4372

Source: https://www.sbimf.com/en-us/navs

A total of 248 schemes are available and of which 04 are tax savings schemes

i.e. ELSS. In ELSS there are two plans named as regular and direct. In regular

plan there are two options known as growth and dividend and in direct plan

also there are two options known as growth and dividend.

6.5 Union Mutual Fund

The Union Mutual Fund is a subsidiary of the Union Bank and holds 100% of

the shares of the Company's Mutual Fund.

Different Schemes introduced by Union Asset Management Company Private

Limited as under

Source: http://www.unionmf.com/Products.aspx

Source: http://www.unionmf.com/Products.aspx

A total of 16 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan also

there are two options known as growth and dividend.

6.6 HDFC Mutual Fund

HDFC Asset Management Company is the biggest and most profitable mutual

fund company in India with 3.7 trillion in assets under control. Housing

Development Finance Corporation Limited ('HDFC') and Standard Life

Investments Limited ('SLI') were set up as a joint venture starting in 1999.

There are currently over 80,000 empanelled distributors of HDFC Asset

Management Company from independent financial analysts, regional

distributors and banks. In over 200 cities, it has a network of 213 branches and

distribution partners.

Different Schemes introduced by HDFC Mutual Fund as under

Source:https://www.hdfcfund.com/ourproducts?fund_type=wealth-creation

PJAEE, 17 (9) (2020)

4373

Source:https://www.hdfcfund.com/ourproducts?fund_type=wealth-creation

A total of 44 schemes are available and of which 02 are tax saving scheme i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan there

are two options known as growth and dividend.

6.7 ICICI Mutual Fund

ICICI Prudential Asset Management Company Ltd. is a nationwide leading

asset management company (AMC) focusing on bridging the gap between

savings & investments and building long-term value through a variety of

simple and appropriate investment solutions for investors.

AMC is a joint venture between Prudential Plc, one of the largest financial

services companies in the United Kingdom, and ICICI Bank, a well known and

trusted financial services firm in India.

AMC has seen significant growth in scale from 2 locations and 6 employees at

the launch of the joint venture in 1998 to the current strength of 2062

employees covering more than 300 locations with an investor base of more

than 4 million investors (as of 30 June 2019).

Different Schemes introduced by ICICI Mutual Fund as under

Source: https://www.icicipruamc.com/downloads/sid

Source: https://www.icicipruamc.com/downloads/sid

A total of 100 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan there

are two options known as growth and dividend.

6.8 Kotak Mutual Fund

Kotak Mahindra Asset Management Company Limited (KMAMC), a Kotak

Mahindra Bank Limited wholly owned company (KMBL). KMAMC began

operations in December 1998 and has about 21 Lac shareholders in various

schemes. The corporation has 86 branches in 82 cities. KMMF provides

investors with varying risk-return profiles with catering schemes and was the

first fund house in the country to launch a dedicated gold scheme which only

invests in government securities.

Different Schemes introduced by Kotak Mutual Fund as under

PJAEE, 17 (9) (2020)

4374

Source: https://www.kotakmf.com/funds/equity-funds

Source: https://www.kotakmf.com/funds/equity-funds

A total of 40 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan there

are two options known as growth and dividend.

6.9 Axis Mutual Fund

Axis Mutual Fund started its first operations in October 2009 and has since

been growing strongly. It's operations on 3 founding principles-long-term

wealth creation, over 20 lac active investor accounts, and outside in (customer)

perspective and long-term relationship presence in over 90 cities.

Different schemes introduced by Axis Mutual Fund as under

Source: https://www.axismf.com/mutual-funds

Source: https://www.axismf.com/mutual-funds

A total of 33 schemes are available and of which 01 is tax savings schemes i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan also

there are two options known as growth and dividend.

7.0 IDFC Mutual Fund

IDFC Asset Management Company Ltd. was incorporated in 2000 and

manages more than 1 million investment folios with an AUM of more than One

Lakh Crore Crore representing leading institutions, corporations, family offices

and individual clients (USD 14bn). IDFC AMC is one of India's Top 10 Asset

Managers with a deep national presence on the ground and a seasoned

management team, promoted by the Government of India's IDFC Ltd., India's

leading infrastructure finance company. We provide and manage a diversified

range of funds across debt, equity and liquid alternatives asset classes and have

a distribution reach that covers 40 plus cities directly and has an indirect

presence in more than 280 plus cities across India.

Different Schemes introduced by IDFC Mutual Fund as under

PJAEE, 17 (9) (2020)

4375

Source: https://www.idfcmf.com/latest-navs.aspx

Source: https://www.idfcmf.com/latest-navs.aspx

A total of 55 schemes are available and of which 01 is tax saving scheme i.e.

ELSS. In ELSS there are two plans named as regular and direct. In regular plan

there are two options known as growth and dividend and in direct plan also

there are two options known as growth and dividend.

7. Performance evaluation

We analysed the performance of the public and private sector bank mutual

funds' open-ended tax saving schemes.

All the selected public and private sector banks open ended tax saving schemes

has two plans know as direct and regular plan

The direct plan is only for investors who purchase/subscribe units directly from

the Mutual Fund in a scheme. Whereas in Regular plan the investors invest

their investment through any distributer, both the plans have Growth &

Dividend Option.

Table 7.1 CAGR Values of selected ELSS funds and Nifty 50 TRI (%)

Source: Calculated from Secondary Data

PJAEE, 17 (9) (2020)

4376

Table 7.1 shows CAGR based on NAV of all banks and Nifty 50 TRI. From

the table it is clear that out of different direct-growth funds of private sector

banks giving high CAGR than public sector banks.

Table 7.2 Average Returns, Standard Deviation (SD) and Coefficient of

Variance (CV) of selected ELSS funds and Nifty 50 TRI

Source: Calculated from Secondary Data

Table 7.2 shows Average Returns, Standard Deviation (SD) and Coefficient

of variance (CV) of different funds. These values calculated by using CAGR.

From the table it is clear that the average returns of selected banks mutual

funds is more than the market index that is Nifty 50 TRI with moderate risk

and with moderate volatility. Among selected public sector banks, Canara

Robeco Equity Tax Saver Fund is giving high average return with moderate

risk and volatility is low. After Canara Robeco Equity Tax Saver Fund, BOI

AXA Tax Advantage Fund is giving high average return with high risk and

volatility is also moderate. After BOI AXA Tax Advantage Fund, SBI

Magnum Tax Gain Scheme is giving high average return with high risk and

volatility is also moderate. After SBI Magnum Tax Gain Scheme, Union

Long Term Equity Fund is giving moderate average return with low risk and

volatility is also moderate. After Union Long Term Equity Fund, Baroda

ELSS 96 (Plan-B) is giving low average return with less risk and volatility

also high. From the table it is clear that Canara Robeco Equity Tax Saver

Fund is providing high average returns (16.33 percent) with moderate risk

(17.52 percent) and low volatility (107.32 percent). Hence different funds of

selected banks are giving more returns to investors than market index except

Baroda ELSS 96 (Plan-B).

PJAEE, 17 (9) (2020)

4377

Among selected private sector banks, Axis Long Term Equity Fund is giving

high average return with high risk and volatility is moderate. After Axis

Long Term Equity Fund, Kotak Tax Saver Fund is giving high average

return with high risk and volatility is also high. After Kotak Tax Saver Fund,

IDFC Tax Advantage Fund is giving high average return with high risk and

volatility is also moderate. After IDFC Tax Advantage Fund, ICICI

Prudential Long Term Equity Fund is giving moderate average return with

low risk and volatility is also moderate. After ICICI Prudential Long Term

Equity Fund, HDFC Long Term Advantage Fund is giving low average

return with less risk and volatility also low. After HDFC Long Term

Advantage Fund, HDFC Tax Saver Fund is giving low average return with

moderate risk and volatility also high. From the table it is clear that Axis

Long Term Equity Fund is providing high average returns (20.80 percent)

with high risk (24.24 percent) and moderate volatility (116.53 percent).

Hence different funds of selected banks are giving more returns to investors

than market index.

Table 7.3 Beta Values of selected ELSS funds and Nifty 50 TRI

Source: Calculated from Secondary Data

Table 7.3 shows beta values of selected ELSS schemes and Nifty 50 TRI. The

value of beta shows performance of selected funds in correlation with market if

market. Beta value measures the change in the return of individual security in

response to unit change in market index. Hence it measures of systematic risk

of security. If beta value equal to 1 indicates proportionate change in return of

market index is equal to proportionate change in return of a fund. If beta

greater than 1 means the proportionate change in returns of a fund would be

more than market returns. If beta less than 1 indicates the returns of a fund

would be comparatively less the market index.

From the table it is clear that all the selected public sector funds has beta value

more than 1 except Baroda ELSS 96 (Plan-B) it means they are giving high

returns than market index. Among the selected public sector funds SBI

PJAEE, 17 (9) (2020)

4378

Magnum Tax Gain Scheme is giving higher returns than others later Canara

Robeco Equity Tax Saver Fund, BOI AXA Tax Advantage Fund and Union

Long Term Equity Fund are giving moderate returns and since beta value more

than 1 all funds are aggressive relationship with market index except Baroda

ELSS 96 (Plan-B).

From the table it is clear that all the selected private sector funds has beta value

more than 1 it means they are giving high returns than market index. Among

the selected private sector funds Kotak Tax Saver Fund is giving higher returns

than others later Axis Long Term Equity Fund, IDFC Tax Advantage, HDFC

Tax Saver Fund and ICICI Prudential Long Term Equity Fund are giving

moderate returns. Only HDFC Long Term Advantage Fund is giving less

return than other selected funds and since beta value more than 1 all funds are

aggressive relationship with market index.

Table 7.4 Sharpe Ratio values of selected ELSS funds

Source: Calculated from Secondary data

Table 7.4 Depicts the Sharpe ratio values of selected ELSS funds and Nifty 50

TRI. Sharpe value measures the returns earned over the risk free rate of return

relative to its standard deviation. Sharpe ratio of a fund with higher value is

considered superior relative to its peers. Form the table it is clear that among

selected public sector banks Canara Robeco Equity Tax Saver Fund has highest

Sharpe ratio when compared with other funds i.e., 15.95 which means gives

highest excess return over the risk free rate of return. Hence Canara Robeco

Equity Tax Saver Fund is best fund to invest.

Form the table it is clear that among selected private sector banks Axis Long

Term Equity Fund has highest Sharpe ratio when compared with other funds

i.e., 20.52 which means gives highest excess return over the risk free rate of

return. Hence Axis Long Term Equity Fund is best fund to invest.

PJAEE, 17 (9) (2020)

4379

Form the table it is clear that among selected public and private sector banks

Axis Long Term Equity Fund has highest Sharpe ratio when compared with

other funds i.e., 20.52 which means gives highest excess return over the risk

free rate of return. Hence Axis Long Term Equity Fund is best fund to invest.

Table 7.5 Treynor Ratio values of selected ELSS funds

Source: Calculated from Secondary data

Table 7.5 presents treynors ratio which is another risk adjusted return ratio but

it uses Beta (systematic) for risk measurement. Form the table it is clear that

the among selected public sector banks Canara Robeco Equity Tax Saver Fund

has a highest treynors ratio which is 11.35 means it gives best risk adjusted

return whereas, Baroda ELSS 96 (Plan-B) has a lowest treynors ratio that is -

4.85.

Form the table it is clear that the among selected private sector banks Axis

Long Term Equity Fund has a highest treynors ratio which is 16.65 means it

gives best risk adjusted return whereas, HDFC Long Term Equity Fund has a

lowest treynors ratio that is 10.45.

Form the table it is clear that among selected public and private sector banks

Axis Long Term Equity Fund has highest Sharpe ratio when compared with

other funds i.e., 16.65 which means gives highest excess return over the risk

free rate of return. Hence Axis Long Term Equity Fund is best fund to invest.

PJAEE, 17 (9) (2020)

4380

Table 7.6 Jensen’s Alpha values of selected ELSS funds

Source: Calculated from Secondary data

Table 7.6 presents Jensen’s alpha values which indicate whether the fund has

earned excess return over the benchmark return predicted through beta. Higher

the value of beta better is the fund. The data analysis shows that, among

selected public sector banks Canara Robeco Equity Tax Saver Fund has the

highest Jensen alpha of 0.97 whereas Baroda ELSS 96 (Plan-B) has a lowest

alpha that is -5.25. A closer look at the table shows that all the selected

schemes have a negative alpha except Canara Robeco Equity Tax Saver Fund

and BOI AXA Tax Advantage Fund which means they provide less return over

the expected return.

The data analysis shows that, among selected private sector banks Axis Long

Term Equity Fund has the highest Jensen alpha of 3.7 whereas HDFC Tax

Saver Fund has a lowest alpha that is -0.81. A closer look at the table shows

that all the selected schemes have a positive alpha except HDFC Tax Saver

Fund which means they provide excess return over the expected return.

Form the table it is clear that among selected public and private sector banks

Axis Long Term Equity Fund has highest Sharpe ratio when compared with

other funds i.e., 3.7 which means gives highest excess return over the risk free

rate of return. Hence Axis Long Term Equity Fund is best fund to invest.

Result of Hypothesis

H

10

: There is a significance difference between Average Returns of Nifty

50TRI and selected Public Sector Banks Mutual Fund Schemes.

PJAEE, 17 (9) (2020)

4381

Source: Calculated from Secondary data

The t stat value of 0.134 is less than t critical two tail value of 2.77, and the p

value of 0.89 is greater than the 0.05, indicating that there is no significant

difference in the average returns for Nifty 50 TRI and Public Sector banks

mutual fund schemes. Therefore, the null hypothesis is failed to reject.

H

20

: There is a significance difference between Average Returns of Nifty

50TRI and selected Private Sector Banks Mutual Fund Schemes.

Source: Calculated from Secondary data

The t stat value of 5.833 is greater than t critical two tail value of 2.57, and the

p value of 0.002 is less than the 0.05, indicating that there is a significant

difference in the average returns for Nifty 50 TRI and Public Sector banks

mutual fund schemes. Therefore, the null hypothesis is rejected and the

alternate hypothesis is accepted.

8. Suggestions

The following are Suggestions:

1. In general, the Canara Robeco Equity Tax Saver Fund generates higher

returns at low risk among public sector banks. Therefore an investor can invest

in the Equity Tax Saver Fund of Canara Robeco.

2. In general, the Axis Long Term Equity Fund generates more returns for low-

risk private sector banks. An investor will therefore be able to invest in the

Axis Long Term Equity Fund.

PJAEE, 17 (9) (2020)

4382

3. Employees who work in both the private and public sectors are eligible to

invest in private sector mutual funds because private sector mutual funds

provide high returns when compared to public sector mutual funds.

4. Compared with other public sector tax saving schemes under Section 80C,

such as PPF, NSC, EPF, Tax Saving Deposits, and so on, high returns are

provided by private sector mutual funds.

5. Each investor should analyse the mutual funds in terms of fund performance

before they make an investment decision. The schemes in the mutual fund

should be selected by the fund manager or portfolio manager on the basis of

investor profiling. Based on the market timing, the fund manager should

carefully select the scheme. In order for investors to easily understand the

company's performance, the portfolio manager should disclose all the

information related to the mutual fund and the company's performance to

investors. People who are interested in investing in mutual fund schemes may

invest in the mutual fund schemes of private sector banks.

6. Investors should choose long-term high-return equity schemes where they

are able to choose short-term minimum-risk constant-return debt schemes.

7. Since the last decade, the Indian Mutual Funds Industry has changed

completely for good and demonstrated significant growth and potential.

Although the Asset under Management and the number of schemes have

significantly increased, it has yet to be a household product and needs to

effectively cover the retail segment.

9. Conclusion

This study helped the investigator in understanding the different plans/options

of open ended tax saving mutual fund schemes and the best performing open

ended tax saving mutual fund schemes from a selected pool of mutual funds.

This enabled the researcher in suggesting the retail investor the best mutual

fund company to invest his or her money. The study is very relevant in today’s

financial market context and will form basis for the performance evaluation of

the mutual funds in future also. The mutual fund performance are measured by

different performance evaluation technique like CAGR, Average Return,

Standard Deviation, CV and Risk adjusted measures etc., and outcome from

evaluation will let the investor to invest in to the right categories of mutual

fund.

The study concludes that all ELSS funds have outperformed the market index

in terms of average returns. Axis Long Term Equity Fund is the most reliable

scheme in market. Moreover, all the funds have aggressive relationship with

market except Baroda ELSS 96 (Plan-B).

References

Kandpal, V., & Kavidayal, P. C. (2014). A Comparative Study of Selected

Public & Private Sector Equity Diversified Mutual Fund Schemes in

India. IOSR Journal of Business and Management, 16(1), 92-101.

PJAEE, 17 (9) (2020)

4383

Adhav, M. S. M., & Chauhan, P. M. (2015). Comparative Study of Mutual

Funds of Selected Indian Companies. International Journal of Science,

Technology and Management, 4(2), 44-51.

Soni, S., Bankapue, D., & Bhutada, M. (2015). Comparative Analysis of

Mutual Fund Schemes available at Kotak Mutual Fund and HDFC

Mutual Fund. International Journal of Research in Finance and

Marketing (IMPACT FACTOR–4.088), 5(4), 69-90.

Bhagyasree, N., & Kishori, B. (2016). A study on performance evaluation of

mutual funds schemes in India. International Journal for Innovative

Research in Science & Technology, 2(11), 812-816.

Suchitra, M. K., & Prashanta, A. (2017). Mutual Funds in India: A

Comparative Study of Select Public Sector and Private Sector

Companies. International Journal of Multidisciplinary Educational

Research, 7(12), 1-13.

Thakuria, A., & Kashyap, S. (2017). Comparative Performance Analysis of

Public Sector Sponsored and Private Sector Sponsored Mutual Funds in

India. European Journal of Economics and Business Studies, 3(1), 7-16.

Prakash, R.P., & Basanna, P. (2017). A COMPARATIVE ANALYSIS OF

PUBLIC AND PRIVATE SECTOR MUTUAL FUNDS IN INDIA.

Asia Pacific Journal of Research, I (XLVII),126-135.

Raj, M., Verma, T., Bansal, S., & Jain, A. (2018). Performance Of Mutual

Funds In India: A Comparative Analysis Of SBI Mutual Funds And

HDFC Mutual Funds. IOSR Journal of Business and Management,

20(10), 36-43.

Home corporate-profile. (n.d.). Retrieved from

https://www.barodamf.com/Pages/corporate-profile.aspx

About Us. (n.d.). Retrieved from https://www.boiaxamf.com/about-us

Canara RobecoCorporate Profile. (n.d.). Retrieved from

https://www.canararobeco.com/aboutus/corporate-profile

Corporate Profile Of SBI Funds Management Pvt. Ltd | SBI Mutual Fund.

(n.d.). Retrieved from https://www.sbimf.com/en-us/about-

us/corporate-profile

About us. (n.d.). Retrieved from

https://www.unionmf.com/companyProfile.aspx

Just a moment... (n.d.). Retrieved from https://www.hdfcfund.com/about-

us/corporate/overview

About Us. (n.d.). Retrieved from https://www.icicipruamc.com/about-us

About Us. (n.d.). Retrieved from https://assetmanagement.kotak.com/aboutus

About Us - Mutual Funds Company in India. (n.d.). Retrieved from

https://www.axismf.com/about-us

Riteverses. (2012, January 4). Financial Demand for World Class Infrastructure

Experts in India – IDFC. Retrieved from https://www.idfc.com/our-

firm/overview.htm

Asset Under Management. (n.d.). Retrieved from

https://www.mutualfundindia.com/mf/Aum/details

PJAEE, 17 (9) (2020)

4384

Mutual Funds India | Investment Plans | Tax Saving | Mutual Funds Nav. (n.d.).

Retrieved from https://www.amfiindia.com/

Research and Information - Aum Data | Average Aum | Folio Data. (n.d.).

Retrieved from https://www.amfiindia.com/research-information/aum-

data

Mutual Fund Definition. (2003, November 24). Retrieved from

https://www.investopedia.com/terms/m/mutualfund.asp