AMERICAN RESCUE PLAN ACT

WASHINGTON STATE

HOMEOWNER ASSISTANCE FUND

PLAN

VERSION 1.1 – MARCH 2022

Contents

PROPOSED PLAN OVERVIEW AND SUMMARY ............................................................................................. i

THE AMERICAN RESCUE PLAN ACT HOMEOWNER ASSISTANCE FUND OVERVIEW .............................. 1

HOMEOWNERSHIP ASSISTANCE NEEDS ..................................................................................................... 1

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN ................................................................ 2

THE MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM IS NEW, BUT SIMILAR PROGRAMS

HAVE BEEN DONE BEFORE. .......................................................................................................................... 4

THE MORTGAGE DEFAULT ASSISTANCE PROGRAM HAS A HISTORY OF SUCCESS ................................ 4

THIS PROPOSED WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN ADDRESSES CURRENT

AND FUTURE NEEDS .................................................................................................................................... 5

MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM COMPONENTS............................................ 6

MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM CONSIDERATIONS ..................................... 7

MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM ADMINISTRATIVE AND TECHNOLOGICAL

SUPPORT ....................................................................................................................................................... 8

MORTGAGE DEFAULT ASSISTANCE PROGRAM COMPONENTS ................................................................ 8

TREASURY REQUIRED PROGRAM TARGETING FOR HOMEOWNER ASSISTANCE ................................... 9

SOCIALLY DISADVANTAGED INDIVIDUALS .............................................................................................. 10

HAF PILOT PROGRAM .............................................................................................................................. 10

ELIGIBLE HAF OPPORTUNITIES NOT BEING IMPLEMENTED ................................................................ 11

OUTREACH ................................................................................................................................................. 11

ALLOCATION OF FUNDS FROM TREASURY .............................................................................................. 12

PERFORMANCE GOALS ............................................................................................................................. 12

PROGRAM IMPLEMENTATION TIMELINE ................................................................................................. 12

OTHER CONSIDERATIONS ......................................................................................................................... 13

CONCLUSION .............................................................................................................................................. 13

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN OVERVIEW AND SUMMARY– PAGE i

(VERSION 1.1 – MARCH 2022)

PROPOSED PLAN OVERVIEW AND SUMMARY

The Washington State Housing Finance Commission (Commission) intends to submit to the

United States Department of the Treasury (Treasury) a plan to comply with the requirements for

distribution of the allocation made to the State of Washington from the 2021 American Rescue

Plan Act, specifically the Homeowner Assistance Fund.

With Treasury’s approval, the Commission proposes to use the allocation to provide the

following services, set forth in more detail later in this document.

Mortgage Payment Financial Assistance Program. Dedicating approximately $120,000,000 to a

program that will provide homeowners in Washington state with potential financial assistance by

providing grants up to $60,000

1

for homeowners that meet the following qualifications:

• Has a household income of 100%—or less—of the Area Median Income (AMI) for the

county of residence. Please see the HUD FY 2021 Homeowner Assistance Fund Income

Limits.

• Has a demonstrable hardship caused by COVID-19 that began on or after January 20,

2020.

• Is the owner of the dwelling (up to four units) and it is the primary residence (owner-

occupied) of the applicant (this can include a manufactured/mobile home on rented

space).

For those meeting the qualifications above, the program can provide the following financial

assistance:

• To allow a homeowner to reinstate a mortgage or to pay other housing-related costs

related to a period of forbearance, delinquency, or default.

• For mortgage principal reduction, including with respect to a second mortgage provided

by a nonprofit or government entity.

• For facilitating mortgage interest rate reductions.

• To preserve a homeowner’s use of their “partial claim.”

In conjunction with at least one of the types of financial assistance above, the program can also

provide the following financial assistance:

• For homeowner’s insurance, flood insurance, and mortgage insurance.

• For homeowner’s association fees or liens, condominium association fees, or common

charges, and similar costs payable under a unit occupancy agreement by a resident

member/shareholder in a cooperative housing development.

• For down payment assistance loans provided by non-profit or government entities.

1

Grant limits and funding distribution set forth in further detail later in this document.

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN OVERVIEW AND SUMMARY– PAGE ii

(VERSION 1.1 – MARCH 2022)

The program will also provide for financial assistance for payment of delinquent property taxes

to cure default and for homeowner’s association fees or liens, condominium association fees, or

common charges, and similar costs payable under a unit occupancy agreement by a resident

member/shareholder in a cooperative housing development.

Mortgage Default Assistance Program. Dedicating approximately $15,000,000 to fund various

established support services that will allow all homeowners in the State of Washington,

regardless of income level

2

, to receive no-cost assistance working with their loan servicers by

funding default housing counseling services and related services. Also, a portion of these funds

will be used to fund Civil Legal Aid that can assist by providing no-cost legal assistance to

income-qualified homeowners.

Funds Retained. Approximately $10,000,000 of the funding received from Treasury will be

retained for future use. Uses for these retained funds could include:

• Supplemental funding for the uses set forth above.

• To establish other financial assistance programs. Such programs could include:

o Mortgage Payment Assistance (future mortgage payments)

o Home Repairs

o Other contemplated uses under Treasury’s guidelines

Program Timeline: Opportunities for public comment on this plan will be provided in the month

of March 2022. In addition, a Public Hearing on this plan will occur at the March Special

Meeting of the Washington State Housing Finance Commission. When this plan has been

approved by the Commissioners of the Washington State Housing Finance Commission, it will

be submitted to the U.S. Department of the Treasury for review and comment. When the plan

receives Treasury’s approval, it will be implemented.

Based upon our discussions with potential technology providers, the program then should be

operational within 30-60 days. Therefore, we would estimate a program start of April/May 2022.

2

The ability to provide counseling services to all homeowners throughout the state, regardless of household

income level, will be subject to approval by Treasury.

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 1

(VERSION 1.1 – MARCH 2022)

THE AMERICAN RESCUE PLAN ACT HOMEOWNER ASSISTANCE FUND OVERVIEW

On March 11, 2021, President Biden signed the historic American Rescue Plan Act that included

the Homeowner Assistance Fund. From the Homeowner Assistance Fund, the State of

Washington will receive $173,153,935.

The United States Department of the Treasury (Treasury) is administering these funds and

requires a Homeowner Assistance Fund Plan (HAF Plan) to be submitted to the Department of

the Treasury to access the full amount of the funding.

The Washington State Department of Commerce originally administered this program. All

aspects of the program were transferred to the Washington State Housing Finance Commission

on December 27, 2021.

Treasury has set forth the purpose of the Homeowner Assistance Funds:

The purpose of the Homeowner Assistance Fund (HAF) is to prevent mortgage

delinquencies and defaults, foreclosures, loss of utilities or home energy services, and

displacement of homeowners experiencing financial hardship after January 21, 2020.

Funds from the HAF may be used for assistance with mortgage payments, homeowner’s

insurance, utility payments, and other specified purposes. The law prioritizes funds for

homeowners who have experienced the greatest hardships, leveraging local and national

income indicators to maximize the impact.

This proposed Washington State Homeowner Assistance Fund Plan is subject to approval by the

United States Department of the Treasury before any additional distribution of funds received

from the Homeowner Assistance Fund can take place.

HOMEOWNERSHIP ASSISTANCE NEEDS

In May of 2021, the Consumer Financial Protection Bureau (CFPB) published a Special Issue

Brief: Characteristics of Mortgage Borrowers During the COVID-19 Pandemic. The report

made four significant findings:

1. Black and Hispanic borrowers, who together make up 18 percent of all mortgage

borrowers and 16 percent of current borrowers in our data, make up a significantly larger

share of borrowers who were in forbearance (33 percent) or delinquent (27 percent) as

reported through March 2021.

2. The share of loans with an LTV ratio above 60 percent was significantly larger for

borrowers in forbearance (50 percent) or delinquent (51 percent) compared to those who

were current (34 percent) as reported through March 2021. Borrowers with an LTV ratio

above 95 percent, who may be the most vulnerable to being underwater on their

mortgage, made up a significant share of those that were delinquent (5 percent),

compared to borrowers that were in forbearance (1 percent) or current (less than 1

percent).

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 2

(VERSION 1.1 – MARCH 2022)

3. Loans reported as in forbearance or delinquent in March 2021 were more likely

than current loans to be single-borrower loans and to have been 30+ days delinquent in

February 2020, and forbearance and delinquency were also associated with distress on

non-mortgage products. Among borrowers who were 30+ days delinquent in February of

2020, 18.6 percent were in forbearance and 15.4 percent were 60+ days delinquent as

reported through March 2021.

4. Considering borrowers based on their characteristics, forbearance and

delinquency were more common among borrowers who are Black or Hispanic, have a

higher LTV, or have other payment difficulties as reported through March 2021. Tract-

level characteristics also matter, with forbearance and delinquency being significantly

more likely in majority-minority census tracts and in tracts with lower relative income.

According to a report published in February of 2022, by the National Association of Realtors: A

Snapshot of Race and Home Buying in America, they calculate the homeownership rates for

Washington as follows:

Homeownership Rate

White

68%

Black

34%

Asian

62%

Hispanic

48%

(Cited with permission of the National Association of Realtors 3/9/2022).

Using various data sources (available both publicly as well as proprietary), it is calculated that

Washington state has between 1 million and 1.2 million mortgages. Recent reporting states that

approximately 3% of homeowners are not current on their mortgage (30,000 to 36,000

homeowners). In addition, recent reporting states that nearly 8,000 of the delinquent loans are

Federal Housing Administration (FHA) loans and that subset has a default rate of nearly 9%.

Based upon the CFPB’s Special Issue Brief cited above and the rates of delinquency for

Washington state, the Commission believes the program should focus on those earning less than

or equal to 100% Area Median Income (AMI) for the county of residence, and the outreach

should feature significant levels of targeting to reach homeowners in underserved communities

and those that have been significantly impacted by COVID-19.

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN

The intent of the Washington State Homeowner Assistance Fund Plan is to meet Treasury’s

guidelines by providing assistance targeting lower-income homeowners. This plan also intends to

maintain and increase the State’s existing network of foreclosure support for all residents

throughout the State of Washington.

As more fully set forth below, this plan proposes to use the allocation to achieve the following:

• Create a Mortgage Payment Financial Assistance Program to assist homeowners that are

at 100% of area median income (AMI), or below, for their county of residence with

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 3

(VERSION 1.1 – MARCH 2022)

financial assistance by providing grants up to $60,000. An eligible homeowner is one

that:

o Has a household income of 100%—or less—of the Area Median Income (AMI)

for the county of residence. Please see HUD FY 2021 Homeowner Assistance

Fund Income Limits.

o Has a demonstrable hardship caused by COVID-19 that began January 20, 2020

or after that date.

o Is the owner of the dwelling (up to four units) and it is the primary residence

(owner-occupied) of the applicant (this can include a manufactured/mobile home

on rented space).

For those meeting the qualifications above, the program can provide the following financial

assistance:

• To allow a homeowner to reinstate a mortgage or to pay other housing-related costs

related to a period of forbearance, delinquency, or default.

• For mortgage principal reduction, including with respect to a second mortgage provided

by a nonprofit or government entity.

• For facilitating mortgage interest rate reductions.

• To preserve a homeowner’s use of their “partial claim.”

In conjunction with at least one of the types of financial assistance set forth above, the program

can also provide the following financial assistance:

• For homeowner’s insurance, flood insurance, and mortgage insurance.

• For homeowner’s association fees or liens, condominium association fees, or common

charges, and similar costs payable under a unit occupancy agreement by a resident

member/shareholder in a cooperative housing development.

• For down payment assistance loans provided by non-profit or government entities.

The program will also provide for financial assistance for payment of delinquent property taxes

to cure default and for homeowner’s association fees or liens, condominium association fees, or

common charges, and similar costs payable under a unit occupancy agreement by a resident

member/shareholder in a cooperative housing development.

This plan also proposes to use the allocation to create a Mortgage Default Assistance Program to

achieve the following:

• Maintain and expand the statewide Homeownership Hotline. This proven “first-step”

allows any homeowner facing default to access the services related to mortgage default.

This trusted source of information is also instrumental in combatting predatory entities

that will undoubtably surface during this time of need.

• Maintain and expand the statewide Foreclosure Counseling Network by adding more

counselors, and where appropriate, counseling agencies, to the existing counseling

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 4

(VERSION 1.1 – MARCH 2022)

system. This will provide free counseling service to ANY Washington state homeowner

facing default.

• Maintain and expand the Civil Legal Aid Foreclosure Prevention Network by adding

more legal aid paralegals and attorneys to the system. This will ensure that low-income

homeowners can access legal services when needed to prevent foreclosure.

The Washington State Housing Finance Commission believes that this proposed Washington

State Homeowner Assistance Fund Plan provides equitable statewide service to homeowners of

any income level and throughout the entirety of the State of Washington. We believe it also

complies with the intent that lower-income homeowners, especially those who may have not

previously had access to services, receive targeted financial relief as specifically set forth in the

proposed Mortgage Payment Financial Assistance Program.

THE MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM IS NEW, BUT SIMILAR

PROGRAMS HAVE BEEN DONE BEFORE.

The Mortgage Payment Financial Assistance Program is a new program. However, for nearly a

decade, the Commission has used its network of partners to provide mortgage relief via grants

and loans:

• Under the 2012 National Mortgage Settlement, the Commission partnered with

HomeSight to design and implement a successful statewide mortgage rescue loan

program. This program used our network of counselors and legal aid to evaluate

homeowners’ eligibility and refer them into the program.

• In late 2020, the Commission partnered with HomeSight to administer Pierce County’s

COVID CARES mortgage grant program for lower-income homeowners in Pierce

County. This program also used our network of counselors to evaluate homeowners’

eligibility and refer them into the program. Again, this is similar to the program proposed

under this plan.

• Currently, the HAF PILOT Program—established January of 2022—offers support to

those that were/are currently facing imminent housing loss due to an active foreclosure or

judicial lien extinguishment action filed prior to December 31, 2021. The purpose of the

PILOT Program was to provide assistance to those that could lose their home while this

plan was being developed and approved. This program was funded from the initial 10%

allocation made by Treasury. The PILOT Program received $11,000,000 to provide

grants up to $60,000 for eligible homeowners facing imminent housing loss. More

information on this program can be found www.wshfc.org/foreclosure.

THE MORTGAGE DEFAULT ASSISTANCE PROGRAM HAS A HISTORY OF SUCCESS

The State of Washington is a “non-judicial foreclosure” state. In a non-judicial foreclosure a

third-party Trustee of a Deed of Trust (sometimes referred to as the “mortgage”), conducts the

foreclosure using statutory notice and sale procedures. Most mortgage foreclosures are

conducted this way and without court oversight. Exceptions include tax foreclosures and

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 5

(VERSION 1.1 – MARCH 2022)

homeowner’s association dues foreclosures, which must be foreclosed by filing an action with a

court.

Because so many foreclosures are conducted non-judicially, this allows Washington state to offer

non-attorney assistance in negotiating repayment plans or loan modifications with banks and

servicers that are proceeding with the mortgage foreclosures.

In 2010, the Washington State Legislature created the Foreclosure Fairness Act (FFA), assisted

by a group of the stakeholders represented in the non-judicial foreclosure process. This includes

homeowner advocates, civil legal aid, mediators, representatives of the banking/servicing

industry and representatives of the foreclosing trustees, among other parties in the real estate

industry. This group has continued to work together to fine-tune the FFA legislation, to achieve

the common goal of creating a system that prevents avoidable foreclosures without resorting to

the filing of legal actions.

The Foreclosure Fairness Act has been highly effective in helping homeowners, largely because

of its counseling and mediation components. Since the early 2010s, the Washington State

Department of Commerce (Commerce) and the Commission have jointly administered the

Foreclosure Fairness Program (FFP) which provides foreclosure counseling and other services to

all owner-occupied homeowners facing difficulty in paying their mortgage. The counseling

services are provided to all homeowners, regardless of income, and are provided at no cost to the

homeowner. The FFP also provides legal aid services to lower-income homeowners facing

foreclosure.

When a homeowner finds themselves in conflict with their bank or servicer, they can also access

Commerce’s mediation program. This program is open to all homeowners via a referral from a

foreclosure counselor or attorney, regardless of income, and it provides access to a mediator and

mediation at a reasonable rate. Again, for lower-income homeowners, legal aid can also be

provided during this process.

These partnerships and programs have successfully allowed homeowners to prevent avoidable

foreclosures for nearly decade. These proven partnerships and programs provide the foundation

for our proposed Homeowner Assistance Fund Plan.

THIS PROPOSED WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN ADDRESSES

CURRENT AND FUTURE NEEDS

Our network of providers and programs allowed the State of Washington to successfully

ameliorate the impacts of the Great Recession. There is no reason to believe that it cannot do the

same for the challenges we face post-COVID-19. The pandemic’s impact on the economy and

housing market have yet to be fully exposed. However, there is no reason to believe that the

challenges we will face will be any less significant as those we faced during the Great Recession:

Homeowner’s incomes have been negatively impacted, which may give rise to the need to

modify loans. And there is much uncertainty as to the requirements necessary to exit the

forbearance programs offered by banks/servicers. Many homeowners in Washington state will

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 6

(VERSION 1.1 – MARCH 2022)

need the assistance of housing counselors and legal aid, as they did last decade, to properly

evaluate their options and to negotiate with the banks/servicers.

In addition, the Mortgage Payment Financial Assistance Program, as proposed in this plan, will

provide necessary financial assistance to our lower-income homeowners.

MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM COMPONENTS

At least $120,000,000 of Treasury’s allocation to the State of Washington from the Homeowner

Assistance Fund will be used to fund the Mortgage Payment Financial Assistance Program. This

program will supply grants to homeowners to offset unpaid mortgage payments and other costs

associated with homeownership. This program will be available until the funds are exhausted

or through June 30, 2024. Terms of this program would include, but are not limited to, the

following:

• The reach and focus of any proposed program are ultimately guided by the guidelines set

by the U.S. Department of the Treasury (and/or other overseeing agency).

Notwithstanding the guidelines or requirements proposed in this plan, the terms and

conditions can be modified by program conditions set by other federal agencies.

• A maximum grant amount of up to $15,000 for homeowners that choose not to access the

services of a housing counselor. This can be done by an individual directly accessing the

program’s online portal and applying without the assistance of a housing counselor. Of

the funds dedicated to this program, $15,000,000 is available for these types of grants.

• A maximum grant amount of up to $60,000 for homeowners that work with a housing

counselor or legal aid attorney to evaluate all options and determine the best use of the

program funds in addressing the needs of the homeowner. Of the funds dedicated to this

program, $105,000,000 is available for these types of grants.

• Grants can be used to:

o Allow a homeowner to reinstate a mortgage or to pay other housing-related costs

related to a period of forbearance, delinquency, or default.

o For mortgage principal reduction, including with respect to a second mortgage

provided by a nonprofit or government entity.

o For facilitating mortgage interest rate reductions.

o To preserve a homeowner’s use of their “partial claim.”

• In conjunction with at least one of the types of financial assistance above, the program

can also provide the following financial assistance:

o For homeowner's insurance, flood insurance, and mortgage insurance.

o For homeowner's association fees or liens, condominium association fees, or

common charges, and similar costs payable under a unit occupancy agreement by

a resident member/shareholder in a cooperative housing development.

o For down payment assistance loans provided by non-profit or government

entities.

• The program will also provide for financial assistance for payment of delinquent property

taxes to cure default and for homeowner’s association fees or liens, condominium

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 7

(VERSION 1.1 – MARCH 2022)

association fees, or common charges, and similar costs payable under a unit occupancy

agreement by a resident member/shareholder in a cooperative housing development.

• Requirements of all applicants:

o Property must be located within the State of Washington.

o Applicant household must have a household income of 100%—or less—of the

Area Median Income (AMI) for the county of residence. Please see the HUD FY

2021 Homeowner Assistance Fund Income Limits.

o Has a demonstrable hardship caused by COVID-19 that began on or after January

20, 2020 and is attributed to the COVID-19 pandemic and/or State of Emergency

declared by the State of Washington or United States Government; or economic

hardship resulting from a COVID-19-related illness or medical issue for the

applicant or a household member.

o Is the owner of the dwelling (up to four units) and it is the primary residence

(owner-occupied) of the applicant (this can include a manufactured/mobile home

on rented space).

o Reasonable expectation that homeowner will be able to continue to make

mortgage payments in the future.

o If payments are not sufficient to cure all arrearages, then there must be

reasonable expectation the homeowner can bring all other arrearages current.

• Eligible grants under this program contain the following requirements:

o Payments are made directly to the bank/servicer, homeowner’s association or

taxing authority by the program administrator or its designee.

o Payments can only be made for amounts in arrears: no “future” payments can be

rendered.

MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM CONSIDERATIONS

In developing the bifurcated grant structure of the Mortgage Payment Financial Assistance

Program ($15,000 grant v. $60,000 grant), the Commission is relying on its experience in this

space. Although Treasury’s guidance is largely silent on how it wants potential applicants

evaluated, through conversations with Treasury and other states, as well as our experience, we

believe the best use of the funds will be as a part of the overall evaluation of a homeowner’s

current situation, level of delinquency, and the servicers’ obligations in providing reasonable

assistance to homeowners as they exit the forbearance process and/or deal with a homeowner’s

COVID-related delinquencies. A cash payment to a servicer, without evaluating other options,

may not be the best use of the funds. That is why the Commission has incentivized the use of

default counselors and civil legal aid.

The Commission recognizes that not everyone is willing to work with a third party and requiring

that ALL participants must utilize default counselors and/or legal aid could discourage some

eligible applicants from applying. We are also cognizant that when the program is initially

opened to the public, initial demand could overwhelm our current counseling and legal aid

network, so for these reasons we propose offering a limited direct application process for those

with smaller mortgage deficiencies.

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 8

(VERSION 1.1 – MARCH 2022)

However, the Commission believes that the use of default counselors and civil legal aid in the

application process is the best way to use this limited resource and to maximize the impact on

those in the greatest need.

MORTGAGE PAYMENT FINANCIAL ASSISTANCE PROGRAM ADMINISTRATIVE AND

TECHNOLOGICAL SUPPORT

The Commission will contract with a provider that will offer both the administrative and

technological support for the Mortgage Payment Financial Assistance Program (Program

Support Provider). A Program Support Provider is being identified through regular state

procurement processes. The Program Support Provider shall provide at a minimum:

• Website and other entry or informational portals shall be in multiple languages.

• Support for applicants via a “Call Center” with referral to translation services.

• Ability for homeowners and their advocates to check their initial qualifications for the

program and provide for an application if appropriate.

• Ability for homeowners and their advocates to receive or obtain regular updates as to the

status of their application.

• Ability for homeowners to access foreclosure counselors and/or legal aid assistance.

• Ability for foreclosure counselors and legal aid attorneys to refer potential grant

recipients into the program.

• Ability to track program participants and onboard all necessary documentation to

determine eligibility and complete an application.

• Ability to track, coordinate and facilitate payments to the appropriate entities, such as

banks/servicers, utility companies and/or other authorized recipients.

• Ability to provide all back-end support necessary to conduct eligibility review, authorize

payments and distribute payments to on behalf of eligible applicants.

• Ability to provide any necessary reporting, including reporting required by Treasury.

MORTGAGE DEFAULT ASSISTANCE PROGRAM COMPONENTS

As set forth above, the Commission has administered successful programs that have

demonstrated results in preventing avoidable foreclosures. The following entities are currently a

part of our foreclosure prevention process and are the entities necessary to implement both the

Mortgage Payment Financial Assistance Program and this Mortgage Default Assistance

Program. The amount of funding contemplated for this component is $15,000,000 (itemized

below) and is expected to provide funding through June 30, 2024.

The Homeownership Hotline. The Washington Homeownership Resource Center (WHRC) is a

non-profit that administers Washington State’s “Homeownership Hotline”. The phone number—

1-877-894-4663 (HOME)—is required under Washington state law to be supplied by banks and

loan servicers to all homeowners whenever they are late on a payment or facing default on their

mortgage. When any homeowner calls the hotline, they are triaged and referred to a non-profit

housing counseling agency (or legal aid, as appropriate) for assistance. A homeowner may also

be referred to other support services as necessary. The assistance of the Homeownership Hotline

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 9

(VERSION 1.1 – MARCH 2022)

is currently provided to any owner-occupied homeowner at any income level. Support and

expansion of this component is a critical part of Washington’s Homeowner Assistance Fund

Plan. The amount of funding for this component is $2,000,000 through June 30, 2024.

Default (“Foreclosure”) Housing Counseling. The Commission currently administers contracts to

provide foreclosure counseling throughout the state. This network of counseling agencies has

years of experience in providing foreclosure counseling to homeowners facing, or in, default or

foreclosure. This one-on-one service provides homeowners the assistance they need to ensure

they are properly evaluated by the banks/servicers for all options they qualify for, including

forbearance or loan modification. In Washington’s proposed Mortgage Payment Financial

Assistance Program, evaluation of a homeowner’s situation and eligibility by a counselor or legal

aid will be a prerequisite to application for the larger grant amount ($60,000). It is expected that

all counseling agencies that are receiving funding under this program participate in assisting

clients in applying—as appropriate—to the Mortgage Payment Financial Assistance Program.

Support and expansion of this component is also a critical part of Washington’s Homeowner

Assistance Fund Plan. The amount of funding for this component is $8,000,000 through June

30, 2024.

Civil Legal Aid. Civil legal aid is the assistance of non-profit law firms to income-qualified

homeowners that need legal representation in either the non-judicial or judicial foreclosures of

mortgages, or judicial foreclosures to enforce liens, such as NOA dues or taxes. Because

Treasury’s funds can be used to assist homeowners facing either non-judicial or judicial

foreclosure for the items set forth above, civil legal aid should receive additional funding support

and expansion. As mentioned above, evaluation by a civil legal aid attorney can be a prerequisite

to application for relief in the proposed Mortgage Payment Financial Assistance Program.

Support and expansion of this component is also a critical part of the Washington State

Homeowner Assistance Fund Plan. The amount of funding for this component is $5,000,000

through June 30, 2024.

It is important to note that the amount proposed to be dedicated to default counseling and civil

legal aid as set forth above exceeds Treasury’s stated set aside of 5% of the total funding for

counseling and legal aid. However, Treasury also authorizes an additional 15% to be used for

overall program administration and that amount appears sufficient to include this proposed

program funding in that calculation. Ultimately, this will need to be approved by Treasury.

TREASURY REQUIRED PROGRAM TARGETING FOR HOMEOWNER ASSISTANCE

Treasury has set forth specific requirements regarding the distribution of the funding for

homeowners:

Not less than 60% of amounts made available to each HAF participant must be used for

qualified expenses that assist homeowners having incomes equal to or less than 100% of

the area median income or equal to or less than 100% of the median income for the

United States, whichever is greater. Any amount not made available to homeowners that

meet this income-targeting requirement must be prioritized for assistance to socially

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 10

(VERSION 1.1 – MARCH 2022)

disadvantaged individuals, with funds remaining after such prioritization being made

available for other eligible homeowners.

The Mortgage Payment Financial Assistance Program targets 100% or below of AMI for the

county of residence, therefore it meets Treasury’s targeting requirement.

SOCIALLY DISADVANTAGED INDIVIDUALS

Contained in the targeting set forth above, treasury guidelines state a requirement that there be a

focus on Socially Disadvantaged Individuals for any funds not targeted to 100% or below of

AMI. Treasury defines a Socially Disadvantaged Individual as:

Socially disadvantaged individuals are those whose ability to purchase or own a home

has been impaired due to diminished access to credit on reasonable terms as compared to

others in comparable economic circumstances, based on disparities in homeownership

rates in the HAF participant’s jurisdiction as documented by the U.S. Census. The

impairment must stem from circumstances beyond their control. Indicators of impairment

under this definition may include being a (1) member of a group that has been subjected

to racial or ethnic prejudice or cultural bias within American society, (2) resident of a

majority-minority Census tract; (3) individual with limited English proficiency; (4)

resident of a U.S. territory, Indian reservation, or Hawaiian Home Land, or (5) individual

who lives in a persistent-poverty county, meaning any county that has had 20% or more

of its population living in poverty over the past 30 years as measured by the three most

recent decennial censuses.

Because the Mortgage Payment Financial Assistance Program targets only 100% or below of

area AMI, the Commission does not believe it has an opportunity to create program parameters

around Socially Disadvantaged Individuals. However, if the program is modified in the future to

allow incomes above 100% of AMI, then Socially Disadvantaged Individuals will immediately

become a priority of the Mortgage Payment Financial Assistance Program.

In addition, the Commission wishes to state that it fully supports Treasury’s (and Congress’)

intended goals of serving those that are socially disadvantaged. In fact, the Commission has

explored ways to ensure that even at 100% or below, Socially Disadvantaged Individuals could

also receive priority. Unfortunately, it was concluded that the Treasury guidelines—as currently

published—would not allow us to prioritize Socially Disadvantaged Individuals in the proposed

program.

HAF PILOT PROGRAM

In January of 2022, the Commission contracted with HomeSight to provide a PILOT Program

that offers support to those that were/are currently facing imminent housing loss due to an active

foreclosure or judicial lien extinguishment action filed prior to December 31, 2021. The purpose

of the PILOT Program was to provide assistance to those that could lose their home while this

plan was being developed and approved. This program was funded from the initial 10%

allocation made by Treasury. The PILOT Program received $11,000,000 to provide grants up to

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 11

(VERSION 1.1 – MARCH 2022)

$60,000 for eligible homeowners facing imminent housing loss. More information on this

program can be found www.wschf.org/foreclosure.

It is considered that over time this program could be modified to align with the Mortgage

Payment Financial Assistance Program or to provide other eligible homeowner assistance if the

full amount of the funding is not distributed.

ELIGIBLE HAF OPPORTUNITIES NOT BEING IMPLEMENTED

To be transparent, the Commission does note that there are other potential expenses eligible for

reimbursement from the HAF funding. They include:

• Mortgage payment assistance (for future mortgage payments)

• Utilities

• Internet Service

• Home repairs

• Reimbursement of funds previously expended by state or local governments

The Commission believes that the above are important, but they can, and should be, the subject

of other programs and other funding sources, including ARPA, provided by or to other state

agencies, local governments or service providers. For this reason, we believe they are not the

best use of these funds. Therefore, we are not incorporating those items in the proposed

Washington State Homeowner Assistance Fund Plan.

OUTREACH

Using funds from this allocation, the Commission shall develop an outreach plan that

accomplishes the following short- and long-term goals:

• Short-Term: Alerts homeowners needing an exit from forbearance or other default

issues to the availability of the Hotline and counseling services.

• Short-Term: Partners with other state agencies, including the Department of Financial

Institutions, the Department of Commerce and the Attorney General’s Office, to educate

struggling homeowners about avoiding predatory actions.

• Long-Term: Develop an outreach program that will support localized community non-

profits with expertise in delivering services to under-served communities. These non-

profits will build trust in the system and assist homeowners in participating in programs

that are to be funded by the Washington State Homeowner Assistance Fund Plan. These

efforts will be supported by data, including loan servicers that can identify potential

recipients of program services. The outreach program development shall include:

o Statewide distribution of funds.

o Reaching underserved communities, including Socially Disadvantaged

Individuals as defined by Treasury.

o Focus on non-profits that specialize in serving under-served communities and

have proven experience in reaching BIPOC communities.

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 12

(VERSION 1.1 – MARCH 2022)

o Best practices developed by other state programs providing similar services (such

as rental assistance) using state and federal funds.

ALLOCATION OF FUNDS FROM TREASURY

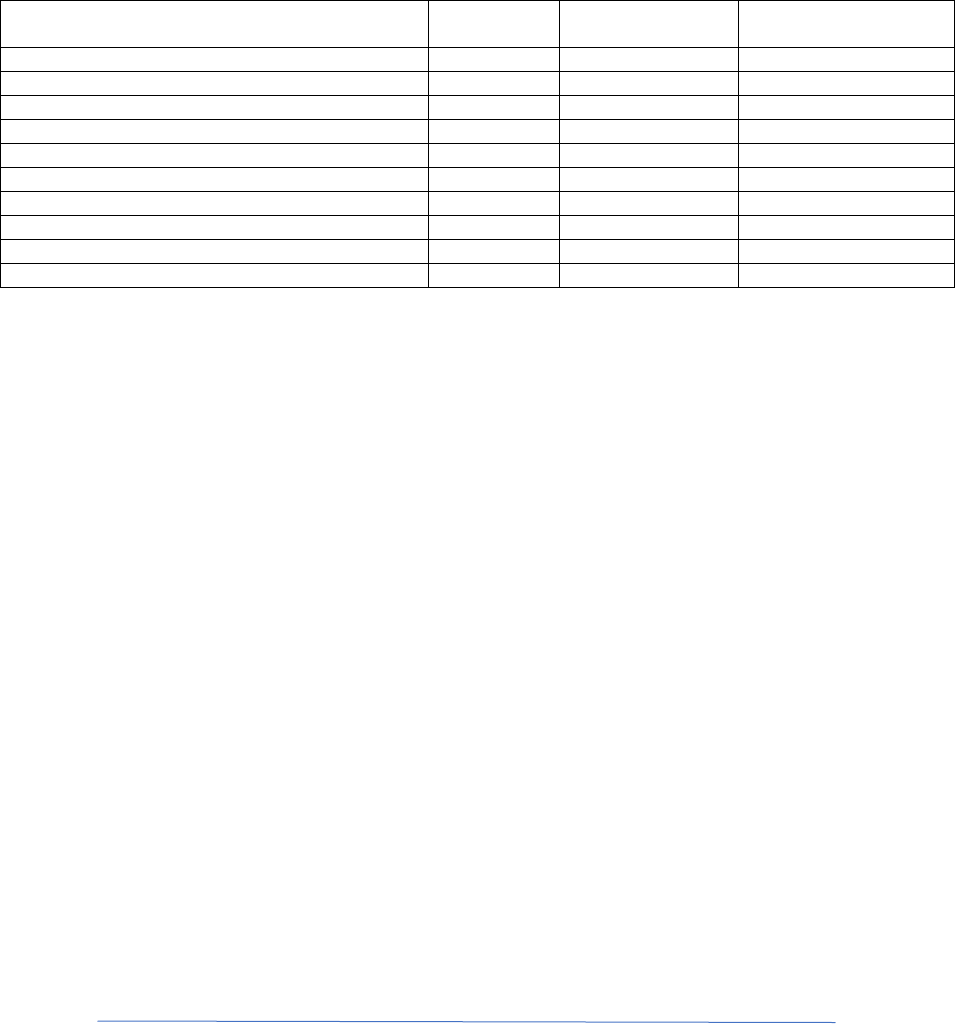

The total amount of the allocation of funds from Treasury is approximately $173,000,000.

Treasury has previously released approximately $17,000,000 to the State of Washington. The

table below reflects allocations made regarding the $17,000,000 advance as well as the proposed

budget for the programs contemplated in the plan, and the administration thereof*.

*Figures are estimated and rounded. Amounts allocated can change based upon Treasury’s review and approval of

the plan and its budget.

PERFORMANCE GOALS

Treasury continues to provide guidance regarding the collection of pertinent data to show the

progress in achieving the HAF Program’s goals. Participants in the proposed program will be

required to collect and supply the data necessary for Treasury reporting as well as other data as

the Commission may require to continually measure the program’s progress and address any

areas of the program that may or may not be meeting the intended goals of the program(s).

PROGRAM IMPLEMENTATION TIMELINE

Opportunities for public comment on this plan will be provided in the month of March, 2022.

The proposed plan will be posted on the Commission’s website with opportunities to comment

online. The proposed plan will be provided to various entities for review, for example the

Commission on African American Affairs and the Commission on Hispanic Affairs, among

other non-profits and governmental agencies with potential interest in this topic.

In addition, a Public Hearing on this plan will occur at the March Special Meeting of the

Washington State Housing Finance Commission, currently scheduled to occur on Thursday,

March 24, 2022 at 1:00 pm via Zoom.

When this plan has been approved by the Commissioners of the Washington State Housing

Finance Commission, it will be submitted to the U.S. Department of the Treasury for review and

comment. When the plan receives Treasury’s approval, it will be implemented, although work on

the plan administration has already begun and will be ongoing.

Component

Proposed

Funding

Allocated from

$17M Advance

Total

Mortgage Payment Financial Assistance Program

$120,000,000

N/A

$120,000,000

Admin/IT Support for MPFAP

$7,000,000

TBD

$7,000,000

Mortgage Default Assistance Program

$15,000,000

$3,200,000

$18,200,000

Marketing for MPFAP and Pilot Program

$2,200,000

$300,000

$2,500,000

Commission Admin Fee (1%)

$1,730,000

N/A

$1,730,000

HAF Pilot Program

N/A

$11,000,000

$11,000,000

HAF Pilot Admin Fee

N/A

$800,000

$800,000

Additional Financial Relief Programs (Hold Back)

$10,000,000

N/A

$10,000,000

Funds Withheld by Dept. of Commerce

N/A

$715,393

$715,393

Total

$155,930,000

$16,015.393

$171,945,393

WASHINGTON STATE HOMEOWNER ASSISTANCE FUND PLAN – PAGE 13

(VERSION 1.1 – MARCH 2022)

Based upon our discussions with potential technology providers, the program then should be

operational within 30-60 days. Therefore, we would estimate a program start of April/May 2022.

OTHER CONSIDERATIONS

The proposed Washington State Homeowner Assistance Fund Plan is a crucial part of the state’s

long-term plan to address the needs of its homeowners, especially those traditionally underserved

and those with lower incomes. During the life of this plan decisions will be informed using data

sources and stakeholder involvement.

The Commission will continue to work closely with Treasury to obtain and use data sets

provided by Treasury and the financial markets that will assist in providing assistance in

identifying those most in need as contemplated by the legislation. We will also work closely with

other states to identify and implement best-practices used throughout the country in

administering these funds.

CONCLUSION

It is the position of the Washington State Housing Finance Commission that the proposed

Washington State Homeowner Assistance Fund Plan complies with the spirit of Congress’

intentions as well as the U. S. Department of the Treasury’s program guidance. We also believe

that because of the proven success of our state’s network of providers and the governmental

agencies that provide assistance for foreclosure prevention, the proposed Washington State

Homeowner Assistance Fund Plan will bring immediate and needed relief to our residents and

meet the goals of the overall program.