Goldman Sachs does and seeks to do business with companies covered in its research reports. As a

result, investors should be aware that the firm may have a conflict of interest that could affect the

objectivity of this report. Investors should consider this report as only a single factor in making their

investment decision. For Reg AC certification and other important disclosures, see the Disclosure

Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by non-US affiliates are not

registered/qualified as research analysts with FINRA in the U.S.

The Goldman Sachs Group, Inc.

EQUITY RESEARCH | September 16, 2018 | 10:40PM EDT

B2B

How the next payments frontier will unleash small business

James Schneider, Ph.D.

+1 917 343-3149

Goldman Sachs & Co. LLC

Bill Schultz

+1 212 902-0044

Goldman Sachs & Co. LLC

Julia McCrimlisk

+1 917 343-2456

Goldman Sachs & Co. LLC

Jesse Hulsing

+1 415 249-7464

Goldman Sachs & Co. LLC

Ryan M. Nash, CFA

+1 212 902-8963

Goldman Sachs & Co. LLC

Global business drives over $120 trillion of B2B

commerce annually – but managing this trade is far

from efficient. In the US, nearly 70% of B2B volume

is still paid by paper checks, which cost up to $22 to

process. Businesses incur over $2.7 trillion in B2B

administrative costs – 80% of which is paid by small

business. But a new generation of payment and

software solutions is emerging which promises to

cut costs by up to 75% and unleash $1.5 trillion in

small business productivity. In this report, we

explore the technology players that are attacking

this $1 trillion B2B revenue opportunity.

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

E

xecutive summary 3

S

etting the stage: The B2B market landscape 6

Today’s B2B market: Significant direct and indirect cost burdens, borne by small business 8

How can payment and software solutions help? 15

Who can make money and how much? 25

Challenges in the adoption of B2B payment solutions 40

Catalog of public and private B2B payments and software companies 41

Disclosure Appendix 44

16 September 2018

2

Goldman Sachs

Global Technology

Table of Contents

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Executive summary

B2B Payments: The biggest untapped market opportunity for the payments industry

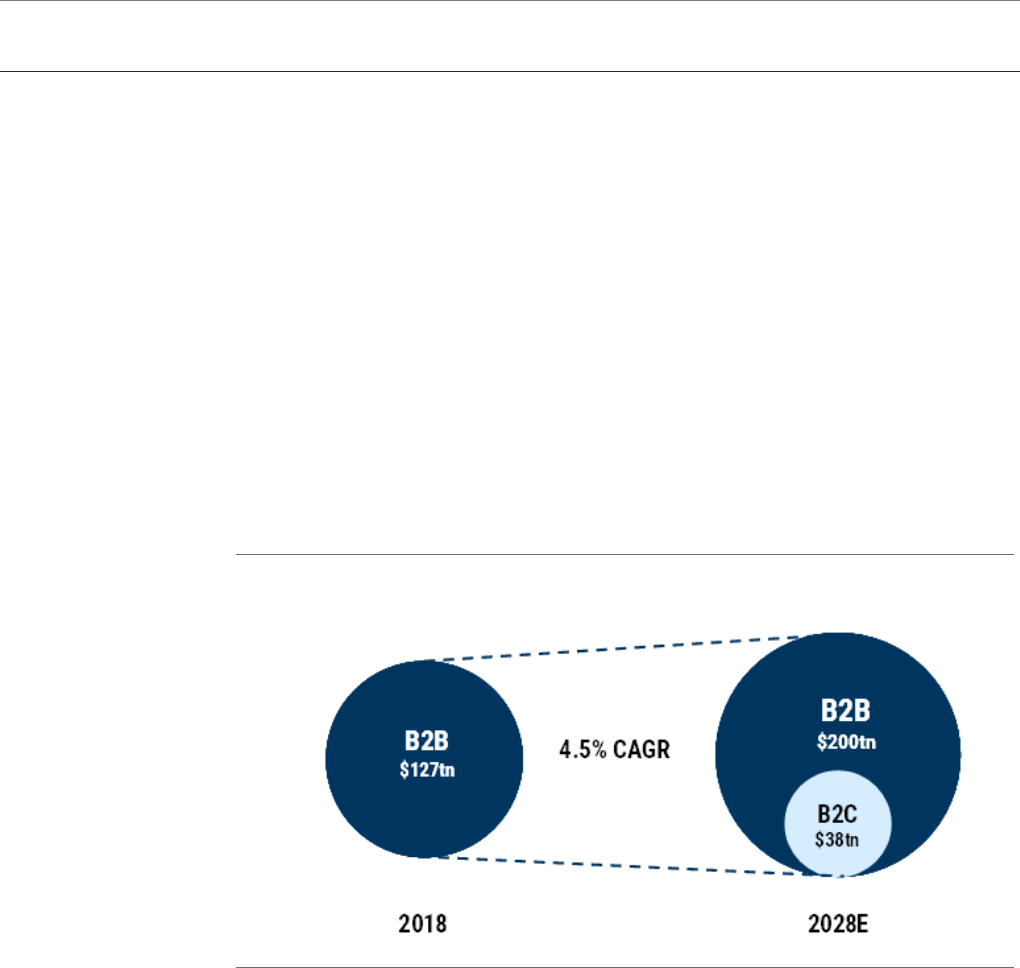

We believe B2B payments currently account for $127tn in payment flows - and we

expect this figure to reach nearly $200tn by 2028, over 5X the volume of the retail

payments market. With the vast majority of invoices still processed manually and paid

by paper check, we see significant opportunities for business to reduce costs - creating

new revenue pools for payment and software companies entering the market with

faster, lower-cost invoice processing and payment solutions. While large businesses and

enterprises account for over half of B2B payment flows, we see the biggest revenue

and cost savings opportunities for small business, where 80% of invoices are still

manually processed and paid by check.

B2B solutions can unleash nearly $1.5 trillion in productivity for global small business

Today, the majority of global businesses still depend on manual, paper-based payment

processes that command a steep price tag in terms of time, money, and operating

friction. We estimate businesses in North America spend $187bn annually on accounts

payable (“AP”) processing - and this estimate captures only direct processing and labor

costs. We believe these same businesses are spending closer to $510bn after taking

indirect costs - such as short-term credit and additional fees for cross-border

transactions - into account. North America represents only a fraction of the B2B market -

and we believe the total global costs related to AP amount to over $2.7tn.

While thus far the digitization of B2B payment flows has been slow - especially among

small business - we believe the market is finally poised to accelerate. We see several

technological and market changes driving this acceleration, including the adoption by

small business of software-based general ledger and accounting systems, the broader

emergence of real-time payment infrastructure, and the introduction of novel business

and financing services.

The opportunity: A fresh $1 trillion revenue opportunity in payments & software

We see a significant revenue opportunity for payments companies, software

companies, and banks to capture meaningful market share over time, while

simultaneously driving substantial cost savings for business. In total, we see a $950bn

global revenue opportunity (with an estimated $186bn in North America) across invoice

processing, AP payment processing, working capital management and factoring, and

cross-border payment optimization. Our analysis assumes that B2B payment solutions

can drive up to 75% savings in total costs (both direct and indirect) for business, with

more savings accruing to small businesses than enterprises.

16 September 2018

3

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

B2B Payments: Who can win?

Public companies: In the public market, we identify several companies we believen

are particularly well positioned and should have the highest B2B revenue exposure

over the next five years. Among the card networks, we believe Mastercard is best

positioned to take a key role in the B2B payment ecosystem and derive a

meaningful portion of its revenue from B2B, with B2B potentially representing over

half of incremental growth by 2023. We believe both Visa and AmEx could use their

incumbent positions to accelerate their growth with B2B as well. We think FleetCor

and WEX are best positioned to leverage their existing B2B franchises and augment

them with M&A over time - and see up to 35%-40% of their revenue derived from

B2B payments in 5 years. We believe Worldpay, PayPal, and Square each have

promising B2B growth initiatives that have the potential to be significantly larger. We

also see Coupa and Intuit expanding their software franchises with B2B capabilities

and payment processing over time.

Private companies: We see a range of private companies benefiting from various

n

parts of the B2B payments ecosystem. In AP & AR invoice software and payment

processing, AvidXchange, Bill.com, Billtrust, and MineralTree appear well positioned

to gain significant market share given their solid product portfolio and first-mover

advantage. Payoneer and Tradeshift also seem well positioned to expand their

market positions in cross-border payments and supply chain financing, respectively.

Exhibit 1: B2B market landscape with key public and private players

Source: Goldman Sachs Global Investment Research

16 September 2018

4

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Small Business Bears

the Brunt …

80%

B2B Payments Volumes

SMBs account for this much of the total

annual spending on labor and accounts

payable processing.

But AP Automation Can

Cut Costs Up to…

What businesses are spending on

manual, paper-based payment

processing, which is a big burden in

terms of time and money.

75%

60%

Our estimate for the

total number of B2B

payments still made

by check.

Paper Checks Still Dominate

The Revenue Opportunity

Today

By 2028

We estimate global B2B volumes will reach over 5 times the

business-to-consumer market over the next decade.

$127 trillion

$200 trillion

Accounts Payable (AP) Costs Today

$2.7 trillion

Vs.

80%

Our estimate for the

number of

small/medium-size

business payments

made by check.

The potential net savings for

businesses who adopt AP automation

solutions.

$950bn

Across the B2B payments universe, we see the

largest revenue opportunities in AP invoice

processing, AP payment processing, working

capital management and factoring, and cross-

border payment optimization.

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Setting the stage: The B2B market landscape

We estimate that B2B payments currently account for nearly $127tn in payment

flows - and expect this figure to reach nearly $200tn by 2028, over 5X the volume

of the retail payments market. With the majority of invoices still processed

manually and paid by paper check, we see significant cost savings opportunities

for businesses plus significant new revenue pools for payments and software

companies entering the market with faster, lower-cost invoice processing and

payment solutions. Although large businesses and enterprises account for over

half of B2B payment flows, we see the biggest cost savings and industry revenue

opportunities for small businesses, where 80% of invoices are still manually

processed and paid by check.

We estimate that B2B payment volumes will reach $200tn by 2028 - five times the

size of the B2C market. We believe global B2B payments account for $127tn in

payment volume today and will reach $200tn in ten years. We believe North America

currently accounts for 20% of the B2B market or $26tn in payment volume.

Large businesses generate just over half of payment volumes...

In the United States, B2B payment flows are dominated by enterprises and large

businesses (over $500mn in revenue), even though less than 10% of firms fall into this

category. We estimate that small businesses (under $25mn revenue) account for only a

quarter of B2B payment volumes even though over half of all US businesses fall into this

category. We use US firm demographics as a proxy for North America (United States,

Canada, and Mexico). Similar to the US and North America, we believe large businesses

generate the majority of global B2B volumes - although we believe the international

business mix is more heavily skewed towards small businesses.

Exhibit 2: We estimate B2B volumes will reach $200tn in the next decade, 5X the size of B2C volumes

Global payment volume estimates, 2018 vs. 2028

Source: Goldman Sachs Global Investment Research

16 September 2018

6

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

...and paper checks dominate the market today.

Overall, we estimate that nearly 60% of B2B payments in North America are still made

with paper checks. While this varies by company size – we estimate checks account for

up to 80% of small/medium-size business payments vs. roughly half of large business

payments – paper checks remain the dominant form of payment across markets despite

generating process inefficiencies and high overhead costs. Digital payment forms -

including ACH and card - account for only 36% of B2B payments today.

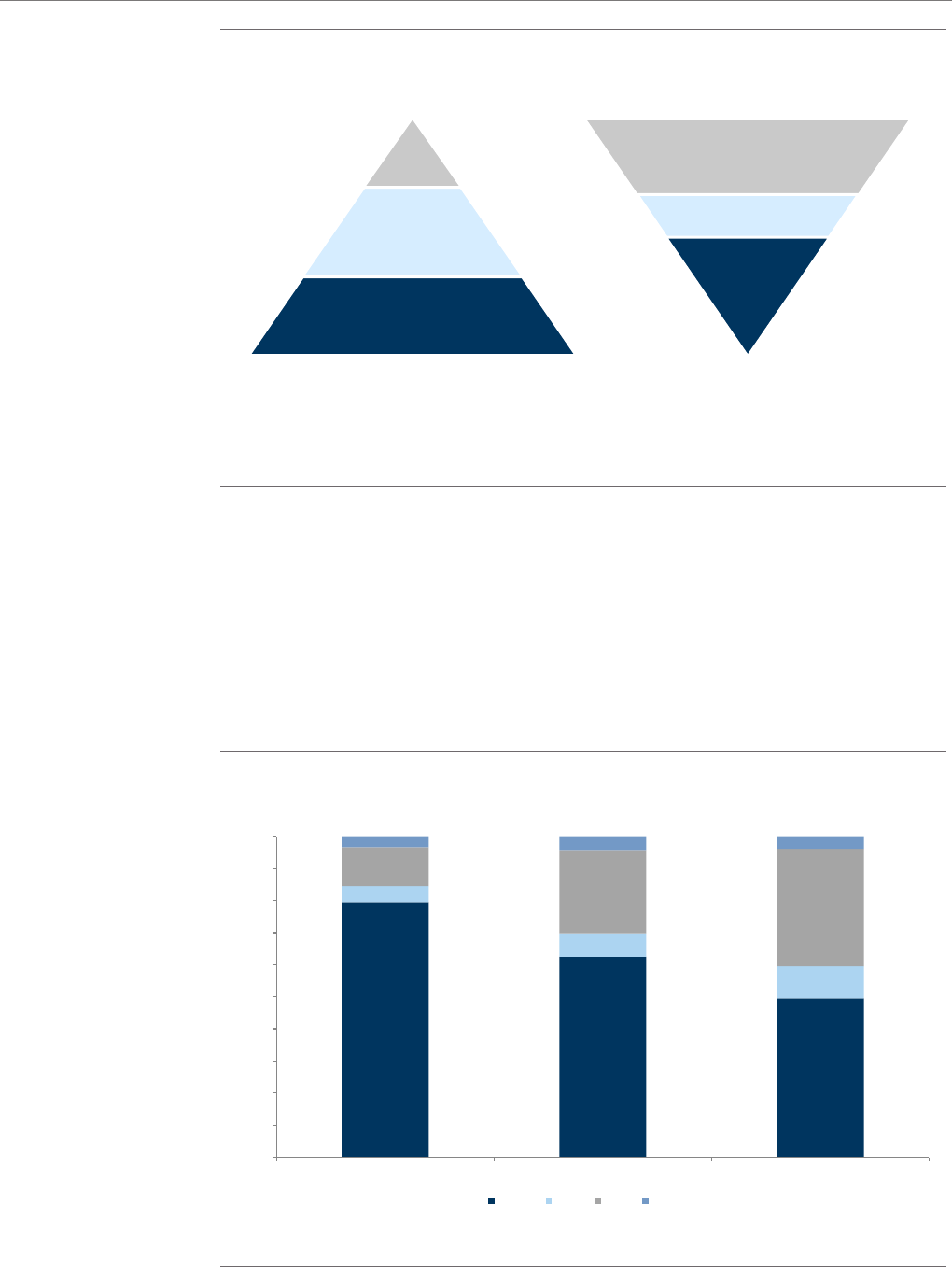

Exhibit 3: SMBs represent over 50% of firms, but large businesses generate over 50% of payment volume

Distribution of US firms by size; distribution of US payment volume by firm size

55% Small

36% Medium

9

%

L

arge

Small

25%

54% Large

21% Medium

% Firms % Payment Volume

We define business by revenue size as follows: Small business under $25mn, medium business $25-$499mn, large business $500mn+.

S

ource: Visa, US Census Bureau, Goldman Sachs Global Investment Research

Exhibit 4: We estimate checks still account for approximately 60% of B2B payments in North America

B2B payments mix by firm size, North America 2018

80%

63%

50%

5%

7%

10%

12%

26%

37%

3%

4%

4%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Small Medium Large

Check Card ACH Other

We define businesses by revenue as follows: Small businesses under $25mn, medium businesses $25-$499mn, large businesses $500mn+.

Source: Goldman Sachs Global Investment Research

16 September 2018

7

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Today’s B2B market: Significant direct and indirect cost burdens, borne by

small business

Today, the majority of businesses still depend on manual, paper-based payment

processing, which represents a significant cost burden in terms of both time and

money. We estimate businesses in North America are spending $187bn annually

on accounts payable (“AP”) processing - and this estimate only captures direct

processing and labor costs. In reality, we believe businesses are shouldering up to

$510bn in B2B payments costs when including indirect costs such as short-term

credit for receivables financing and cross-border transaction fees. We believe the

total direct and indirect B2B payments cost borne by global business is nearly

$2.7tn.

Exhibit 5: We estimate businesses spend over $510bn in North America and $2.7tn globally on AP

Estimates for direct and indirect manual AP costs

Cost per invoice using a manual AP management process

North America World

Small Medium Large Total Total

Payment volume ($bn) $6,500 $5,460 $14,040 $26,000 $127,320

Average invoice ($) $1,000 $3,000 $10,000

Invoices (mn) 6,500 1,820 1,404

Direct costs Small Medium Large Total Total

Processing cost

Average processing cost per invoice $1.47 $1.31 $1.16

Total processing cost ($bn) $10 $2 $2 $14 $66

0.1% 0.0% 0.0% 0.1% 0.1%

Headcount Costs

Invoices processed per month 1,000 3,000 10,000

Average headcount cost per invoice $20.79 $14.69 $8.23

Total headcount cost ($bn) $135 $27 $12 $173 $849

2.1% 0.5% 0.1% 0.7% 0.7%

Direct cost per invoice $22.26 $16.00 $9.39

Total direct cost ($bn) $145 $29 $13 $187 $916

Total cost (%) 2.2% 0.5% 0.1% 0.7% 0.7%

Indirect costs Small Medium Large Total Total

Cross-border cost

Cross-border volume $3,941 $23,099

Cost (% volume) 4.4% 4.4%

Total cross-border cost ($bn) $174 $1,020

Cash management cost

Inventory financing cost ($bn) $125 $610

Late fees ($bn) $25 $122

Total cash management cost ($bn) $150 $732

Total indirect cost ($bn) $324 $1,752

Total direct + indirect costs ($bn) $511 $2,668

Source: Goldman Sachs Global Investment Research

16 September 2018

8

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

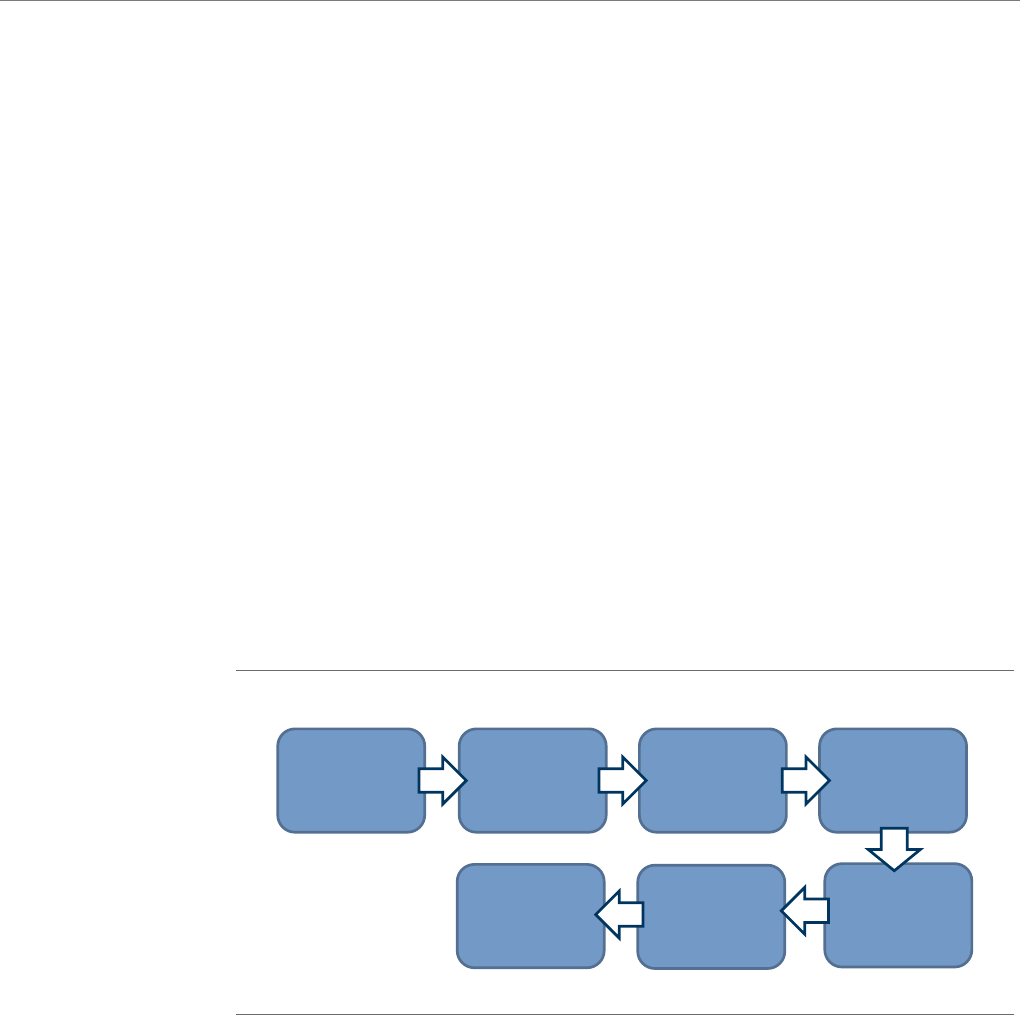

Manual processing: The direct costs

Traditional payables processes are labor-intensive and inefficient, with manual

intervention needed to receive and approve the invoice as well as to make the payment

and reconcile accounts. In Exhibit 6, we outline a typical manual accounts payable

process. Opportunities to automate these processes can yield significant cost savings.

Labor is the most significant single driver of these costs - we estimate it accounts for

over 90% of direct costs incurred (Exhibit 7). According to a survey by Hyland Software,

AP employees spend an average of 30% of their time collecting data (e.g., purchase

orders and invoices) and answering questions from employees, collectors, or vendors

related to the AP process (Exhibit 8). Employees also spend a significant amount of time

resolving issues that arise from input errors and tracking down managers for approval.

These pain points significantly increase the cost of AP processing.

Exhibit 6: Labor accounts for over half the costs in a traditional, manual AP process

Manual accounts payable process

P

urchase order

Invoice Processing

Buyer Supplier

I

nvoice

Payment

Manual

Reconciliation

Print and write

c

heck

Mail check to

s

upplier

Match invoice with

purchase order

G

et

m

anager approval

Enter data into accounting

system

Archive the invoice

R

eceive invoice and store

data

Deposit

check (receive

payment in 2

-

3 days)

Receive check and

ensure accuracy

I

f accurate

Resend Invoice

Manual

Reconciliation

I

f inaccurate

Source: Goldman Sachs Global Investment Research

Exhibit 7: We estimate automated costs are only 33% of manual

costs, mainly due to the elimination of significant labor costs

Comparison of manual costs (processing + labor) to automated costs

Exhibit 8: Accounts payable personnel spend ~30% of their time on

routine tasks

AP team work

6%

7%

8%

9%

30%

0%

5%

10%

15%

20%

25%

30%

35%

Answering AP

related queries

Searching for

documentation

Enforcing Rules

& Policies

Correcting

violations

Total

percentage of time consumed

Source: Goldman Sachs Global Investment Research Source: Hyland Software

16 September 2018

9

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Key pain points in manual AP processing include:

I

nvoice intake: Invoices are not standardized across suppliers and instead are

n

r

eceived in a huge variety of paper and electronic formats with non-standardized

d

ata fields. According to AvidXchange, 56% of invoices are received in a manual

f

ormat (paper, PDF, email, or fax).

Data capture: Given the abundance of non-standard invoice data, data often needs

n

to be manually entered into a company’s accounting and ERP systems. This process

is costly - both in terms of labor and missed cost-savings opportunities - and prone

to human error.

Matching: Invoices must be matched against purchase orders and/or contracts. Thisn

process is highly manual, especially when purchase orders/contracts are housed in

different systems or departments and prone to errors. Unmatched invoices need to

be resolved, which often requires a lengthy dispute resolution process.

Approval: Managers or department heads are frequently called upon to approven

invoices for payment and resolve disputes, but tracking down the appropriate

personnel can be slow and often results in missed discounts or late payments. This

is particularly burdensome for small businesses, where executive officers average

5-10 times higher hourly rates than AP managers, as it substantially increases all-in

labor costs.

Reporting: Many companies have multiple back-office systems (purchasingn

systems, accounting software, ERP systems) that are not integrated with payment

and invoicing data flows. This duplicates the data entry process and increases the

likelihood of errors.

In 2015, Traxpay reported that 60% of B2B payments require some form of manual

intervention that takes at least 15-20 minutes. Manual intervention - to resolve data

entry errors, matching errors, duplicate payments - is a slow process that compounds

labor costs and causes companies to miss rebates, pre-payment discounts, and even

pay late fees.

16 September 2018

10

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Paper checks

We believe 60% of B2B payments are still made by check, despite the fact checks

create maximum inefficiencies for both buyers and suppliers (Exhibit 9). For the buyer,

printing the check, obtaining the required signatures, and mailing the check is a manual,

time-consuming process. We estimate the supplies alone (paper, postage) cost

$1.55/check. For suppliers, checks can cost $7-$10 to process (Billtrust) and take 3-5

days to settle, increasing a supplier’s days payables outstanding (DPO).

Exhibit 9: 60% of B2B volume still flows through checks

B2B payment mix

Exhibit 10: Check processing

Buyer writes, signs,

and mails check

Supplier deposits

check at its bank

Supplier's bank

sends check to

Federal Reserve for

clearing

Federal Reserve

debits buyer's

account, credits

supplier's account

Source: Goldman Sachs Global Investment Research Source: Goldman Sachs Global Investment Research

16 September 2018

11

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Indirect costs more than double spending on accounts payable

Cross-border payments

Funds cannot be directly transferred between banks in different countries. Instead,

funds must be routed through correspondent banks, which have relationships with both

the sending and receiving banks. This process is slow, transactions can take 3-5 days to

clear, and costly. We estimate the transaction and FX fees average 4.0% - 4.5% of

volume.

Based on WTO estimates of global goods and services trade flows, we believe

cross-border volumes account for nearly one-fifth of B2B payments (Exhibit 12). With

non-bank cross-border payment rails just beginning to emerge, we believe over 95% of

cross-border volume still flows through banks. Assuming an average transaction size of

$5,600 (per our analysis of SWIFT transaction data), bank fees of $35-$50 per

transaction (consistent with industry data), and a FX spread, we estimate bank transfers

generate around $1tn of revenue (Exhibit 13).

Exhibit 11: The majority of cross-border payments flow through correspondent banks, which charge hefty settlement and FX fees

Bank-to-bank cross-border payment flow

Correspondent

b

ank

B

uyer

D

omestic

payment

system

Buyer's bank

Correspondent

bank

Seller's

bank

Domestic

payment

system

Seller

FX

conversion

S

ource: Goldman Sachs Global Investment Research

Exhibit 12: Nearly one-fifth of B2B volume flows cross-border...

B2B volume, 2018

Exhibit 13: ...yielding roughly $1tn in revenue

Estimated revenue from B2B cross-border bank transfers

Domestic B2B

$104tn

Cross-border

B2B

$23tn

Cross-border opportunity Revenue % revenue

Cross-border volume ($bn) $23,099

via banks $21,944 95%

via alternate providers

$1,155 5%

Cost to send via Bank

Number of transactions

Daily transactions ('000s) 15,105

Annual transactions ('000s) 3,927,201

Average transaction value ($) $5,588

Cost per transaction $45 0.81%

FX margin $189 3.38%

Total cost to send ($bn) $917 4.18%

Cost to receive via Bank

Average cost to receive transaction $23

Annual transactions ('000s) 3,927,201

Total cost to receive ($bn) $88 0.40%

Total cost via bank ($bn) $1,006 4.58%

Total cost via alt. provider ($bn) $14 1.25%

Total cost - Current ($bn)

$1,020 4.42%

Source: World Trade Organization, Goldman Sachs Global Investment Research Source: World Trade Organization, SWIFT, McKinsey, Goldman Sachs Global Investment

Research

16 September 2018

12

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Cash flow/working capital management

Manual AP processing is time consuming, often causing buyers to miss pre-payment

discounts, rebates, or pay late fees. We estimate that each year late fees cost

businesses an average of $25bn in North America and $122bn globally. Our estimates

assume 5% of all invoices are 30 days past due.

Suppliers often do not receive payments until 30-60 days after sending an invoice or

providing a service. This makes it difficult for small businesses, which often run with

minimal working capital buffers, to manage cash and maintain minimum liquidity

thresholds needed to operate. Many small businesses have to either rely on (1) a credit

line – which can carry substantial interest costs, or (2) invoice factoring services – which

purchase receivables at a steep discount.

Small businesses draw on both commercial and personal credit lines. APRs for smalln

business loans and credit cards typically run in the mid- to high-teens, depending on

credit score, while APRs for personal credit cards can run in excess of 20%. With

US payment terms averaging 30 days, interest costs add up quickly – we estimate

small businesses could spend anywhere from $600 to over $850 just to cover a

one-month $50,000 shortfall (Exhibit 14).

Invoice factoring services offer an alternative to credit lines – allowing businesses ton

sell outstanding invoices at a discount in exchange for cash. The process is fairly

straightforward: factoring companies advance a certain percentage of the invoice

(typically 70-90%) in cash and pay back the remainder of the invoice – less the

factoring fees – after the customer pays. The factoring fee can be a flat fee, a tiered

fee based on the length of time the invoice is outstanding, or a “prime plus” fee

where interest is accrued each day the invoice is outstanding. In Exhibit 15, we

provide an illustrative example of the potential loss if a business sells a $50,000

invoice to a factoring company under each of these three models.

Ultimately, we believe businesses spend over $125bn in North America on supply chain

financing and over $610bn worldwide. Our estimates assume SMBs turn to short-term

financing solutions (30 days at a 9% average APR) to finance around a third of their

invoices each quarter, while large businesses do not use supply chain financing

solutions.

Exhibit 14: Cost to carry $50,000 credit for 30/60/90 days Exhibit 15: Cost to sell $50,000 invoice to a factoring company

APR Cost to carry

Average 30 days 60 days 90 days

Business Loan 14.99% $616 $1,232 $1,848

Commercial credit card 17.99% $739 $1,479 $2,218

Personal Loan 14.99% $616 $1,232 $1,848

Personal credit card

21.12% $868 $1,735 $2,603

Assumptions

Invoice value $50,000

Prime rate 5.0%

Factoring model

Fee 30 days 60 days 90 days

Flat fee 5.0%

$2,500 $2,500 $2,500

Fee 5.0% 5.0% 5.0%

Tiered fee 2.0%

$1,000 $2,000 $3,000

Fee per month 2.0% 4.0% 6.0%

Prime plus prime

$417 $833 $1,250

Fee

+ 5.0%

0.8% 1.7% 2.5%

Source: American Express, JP Morgan, Goldman Sachs Global Investment Research Source: Goldman Sachs Global Investment Research

16 September 2018

13

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Small businesses bear the brunt of AP costs

Accounts payable processing benefits significantly from economies of scale. As such,

we believe small businesses account for nearly 80% of spending on labor and accounts

payable processing (Exhibit 18). Consequently, they stand to benefit the most from AP

automation (Exhibit 19).

Exhibit 16: We believe businesses in North America spend over

$125bn on supply chain financing...

North America financing costs ($bn)

Exhibit 17: ...and global businesses are collectively spending over

$610bn

Global financing costs ($bn)

% invoices financed

$125 10% 20% 30% 40% 50%

2

$44 $64 $83 $103 $122

3$55 $79$104$128$153

4

$66 $95 $125 $154 $183

5$77$111$145$179$214

6$88$127$166$205$244

Mths/yr need

financing

%

invoices financed

$610 10% 20% 30% 40% 50%

2$216$311$407$502$598

3

$270 $389 $508 $628 $747

4$324$467$610$753$897

5

$378 $545 $712 $879 $1,046

6

$432 $623 $814 $1,005 $1,196

Mths/yr need

financing

W

e assume businesses pay a 1-2% annual fee to access 30-day financing at a 9.00% APR.

Source: Goldman Sachs Global Investment Research

W

e assume businesses pay a 1-2% annual fee to access 30-day financing at a 9.00% APR.

Source: Goldman Sachs Global Investment Research

Exhibit 18: Small businesses spend the most on AP...

Total spend on AP by company size

Exhibit 19: ...positioning them to be the biggest beneficiaries of AP

automation

Estimated net savings by business size

Small

77%

Medium

16%

Large

7%

$0

$20

$40

$60

$80

$100

$

120

$140

$160

Small Medium Large

Invoice cost for market ($bn)

Business size

Manual Automated

70% net

s

avings

60% net

savings

55% net

savings

We define businesses by revenue as follows: small businesses <$25mn, medium businesses

$25-499mn, large businesses $500mn+.

Source: Goldman Sachs Global Investment Research

Source: Goldman Sachs Global Investment Research

16 September 2018

14

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

How can payment and software solutions help?

Today, organizations are focused on automating accounts payable processes to

generate G&A savings. We see this as the biggest near-term opportunity in B2B

payments, but over the longer term see significant opportunities for specialist

providers to supply working capital and cash management solutions.

Payables automation

Managing the AP process is a significant hurdle and cost center for many businesses.

Numerous solutions have emerged to address different pain points in the payables

process:

Pre-payment solutions are improving the procurement process, aggregating bills,n

automating invoice processing, and streamlining approval workflows.

Payment solutions are replacing manual check payments with electronicn

alternatives including ACH, card, virtual card, and push payments.

Post-payment solutions are helping companies with account reconciliation andn

cash management.

Exhibit 20: Numerous solutions have emerged to streamline pre-/post-payment workflows and facilitate payments

Opportunities for automating AP processes

See “Who can make money and how much?” for a detailed breakdown of different vendors’ AP processing and reconciliation solutions

Source: Goldman Sachs Global Investment Research

16 September 2018

15

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

These pre- and post-payment solutions often integrate directly with a company’s

existing back office software (Exhibit 21).

Payment Solutions: Cutting the cost burden of paper checks

To reduce the pain points associated with paper checks, providers are pushing a variety

of electronic payment alternatives including ACH/EFT, cards, virtual cards/single-use

accounts, and push payments. We summarize these four alternatives below:

ACH: In ACH transactions, funds are transferred between bank accounts over then

Automated Clearing House (ACH) network – an electronic payment network.

Typically, the buyer sends payment instructions to its bank. The buyer’s bank bundles

all of the ACH requests it has received and sends them to the ACH operator. The

ACH operator then distributes these requests to the appropriate receiving banks.

ACH has been gradually taking share from paper checks and, based on a survey by

the CRF and NACHA, is expected to exceed check volume by 2020. However, ACH

remains slow due to wide technology gaps between the 12,000+ banks in the

United States. Transfers typically take one to two days to process and clear, and

ACH records provide limited detail on the nature of the transaction (sender,

recipient, amount). The lack of underlying transaction details (such as the specific

item being invoiced) makes it difficult to reconcile payments. However, Mastercard

has been working to bring same-day (and eventually real-time) ACH to the United

States after acquiring VocaLink - the United Kingdom’s leading-edge instant payment

clearing system.

Cards: B2B card payments (travel and entertainment, fleet, P-cards, etc.) operaten

the same way as B2C card payments. The supplier charges the card, and the

supplier’s gateway/acquirer captures the request and sends it to the acquiring bank.

The acquiring bank sends a request to the issuing bank over the card network, and

the issuing bank decides whether or not to authorize the transaction. Authorization

Exhibit 21: These solutions integrate directly with a company’s back office software

Typical ERP integration

Buyer

Supplier

T

hird

-p

arty

A

P software

B

ookkeeping/

A

P System

P

urchasing

S

ystem

Purchase

o

rders

Invoice

S

oftware captures

p

urchase orders

and

i

nvoices

(

e

-

i

nvoices

and paper invoices)

S

oftware creates

payment file

P

ayment file

sent

to third-

party

p

ayments provider

Validated data

sent to

bookkeeping

Payment data

(

including supplier

a

ccount info)

retrieved from ERP

Payment provider

Software matches

invoices a

gainst

purchase orders

1

2

3

Source: Basware, Goldman Sachs Global Investment Research

16 September 2018

16

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

is then sent back over the card network to the acquiring bank and through the

acquirer to the merchant.

Although corporate credit cards first emerged in the 1970s, their usage continues to

grow at a rapid clip - with US commercial card volume outpacing US consumer card

volume growth by about 110bps in 2017.

V

irtual cards/single-use accounts: A virtual card is a single-use account number

n

that processes against a predetermined credit limit equal to the amount to be paid.

The virtual card is created by an application that can be hosted by a payment

provider (e.g., WEX), bank issuer, or the card network. The virtual card application

provides a secure, convenient way for users to sign in, request a card, and specify

how it will be used (including things like amount, timeframe, supplier name, number

of transactions). Virtual card payments can either be made in real-time or in batches.

Virtual card transactions include rich remittance data that makes it easier for

suppliers to reconcile accounts compared to ACH transfers, which only provide the

sender’s name and the amount transferred. Using virtual cards for international

payments could also help to minimize cross-border fees and other surcharges since

transactions do not need to be routed through a correspondent bank. While virtual

card solutions have been in existence for 10-15 years, growth is inflecting given a

heightened focus on cash management, product maturity, and and regulation-driven

demand in verticals like healthcare, construction, and online travel.

Exhibit 22: Virtual card payments

Issuing bank posts

transaction to buyer's

account, supplier's

bank credits supplier's

account

Buyer requests virtual

card number (VCN)

from payment

provider

Payment provider

sends VCN to

supplier

Supplier collects

payment using VCN

Bank sends

transaction to

network for

authorization and

clearing

Reconciliation data

sent to

buyer/payment

provider

Network sends the

transaction data to

the issuing bank,

approval to the

supplier's bank

Source: Goldman Sachs Global Investment Research

16 September 2018

17

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

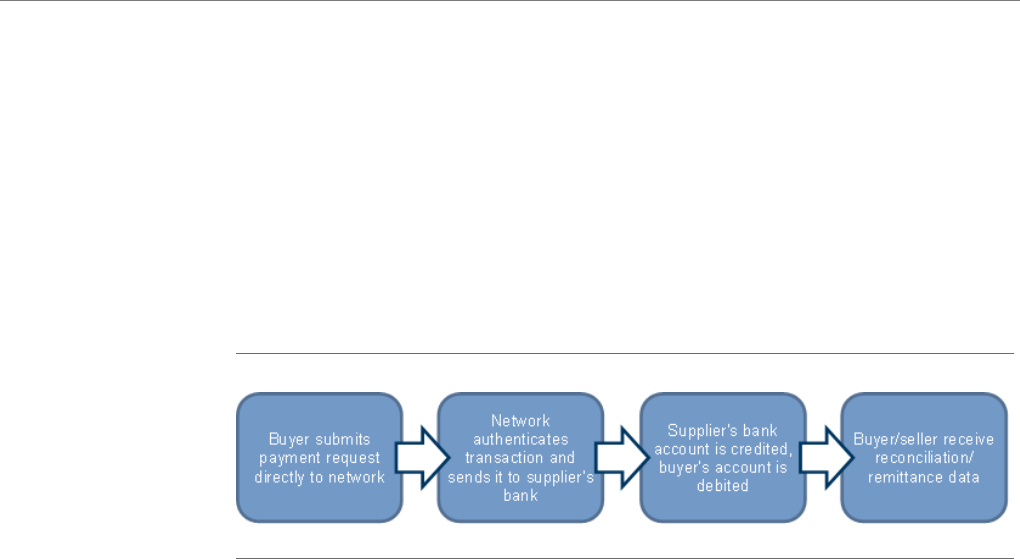

Push payments: Push payments reverse the traditional payment process as buyersn

initiate the transaction and proactively “push” funds into the supplier’s account.

Push payments offer clear time and cost savings: transactions are settled in real

time, giving companies better visibility on cash flows, and run on the networks’

debit rails - so we would expect pricing to begin to approximate current debit card

spreads over time. Push payment transactions also provide rich data records with

details about the underlying transactions, making it easier for businesses to track

payments and reconcile accounts, and security, since transactions only require a

debit card number (versus the recipient’s bank account information, which is needed

for ACH).

Exhibit 23: Push payments

*Also referred to as direct debit, buyer-initiated payments (BIP), and straight-through processing (STP)

S

ource: Goldman Sachs Global Investment Research

16 September 2018

18

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Quantifying the savings

Reducing direct costs - paper, postage, payment processing and labor

We see automating the pre-payment process as the largest immediate revenue

opportunity for the industry. We see automating pre-payment workflows - from

receiving the invoice through authorizing the payment - as the biggest near-term

opportunity. A number of solutions have already emerged targeting small and mid-sized

businesses, which currently shoulder nearly 80% of manual processing costs

worldwide.

Where are the inefficiencies and where are the savings? AP automation speeds up

invoice processing and cuts labor costs. This combination not only drives down costs

and allows companies to reallocate headcount to higher-value work, but enables

growing companies to scale their AP operations without increasing headcount.

Speeding up AP processing also positions companies to capture rebates and

pre-payment discounts.

Exhibit 24: Time savings is the biggest benefit of using AP automation solutions

Various steps involved in AP management (pre-payment)

Pre-payment process Process description Inefficiencies in the process How AP automation can help? Nature of savings

Capturing data from

invoices

Manually enter data from each

invoice into the company's ERP

- Invoices received in numerous formats (paper,

email, or fax)

- Time spent on manual data entry

- Data inaccuracies from manual entry

Automatically reads and captures data

from the invoices (using OCR, other

technologies)

Time savings

Matching invoices against

POs/contracts

Match each invoice against a PO

or contract to ensure the invoice

is valid

- Time spent manually matching each invoice

- POs are typically spread across different

departments

- Difficult to ensure accuracy

- Time spent addressing unmatched invoices

Automatically matches invoices to POs

through integrations with the company's

other systems and accounting software

Time savings

Approvals

Get the necessary approvals to

process the payment

- Time delays when payments require multiple

approvals

- Time spent by AP personnel answering

approver's questions since no centralized

system exists for the approver to independently

check the accuracy

- Time spent by approver

Automatically notifies the Approver

once the invoice is matched with the

PO and approver can send approval

through the App/solution itself

Time savings

Writing and sending

checks

Writing and sending checks

- Time from receiving the approval to the

payment being processed could take 7-10 days

- Time spent writing checks

- Inaccuracies in checks

- Postage costs

- Lost/misplaced checks

Once the invoice is approved, the

solution can process payments in real-

time or one business day if buyers pay

via ACH, virtual card, or a push

payment.

Time savings,

postage/paper

cost savings

Source: Goldman Sachs Global Investment Research

16 September 2018

19

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Based on our conversations with users and providers of AP automation solutions,

we estimate that SMBs pay an average of $16-$22 to manually process an invoice,

but that this can be reduced to $6-$7 (60%-70% net savings) after adopting AP

automation (Exhibit 25). Our key assumptions driving the analysis are as follows:

P

ayment mix

n

We believe checks currently account for 65%-80% of B2B payments foro

SMBs.

After shifting to AP automation solutions, we think ACH will account foro

40-50% of payments, virtual cards will account for approximately 30% of

payments, and checks will only account for 15-25% of payments.

Headcountn

We assume a SMB’s typical AP team includes clerks, analysts, supervisors,o

and a manager. Our headcount assumptions reflect an estimate of the

industry average, but actual headcounts vary substantially depending on the

industry, scale of the business, and existing processes.

We think AP automation can drive 70-80% time savings for AP staff. In ouro

analysis, time savings are represented in USD, but in reality companies do not

recognize hard dollar savings through headcount reduction since excess staff

will typically be reallocated to higher-value work.

Software solution pricing: AP automation solutions typically charge a fixed fee pern

invoice, plus a nominal monthly subscription fee for the solution. Based on our

interactions with various solution providers, we assume pricing of $1.25-$1.50 per

invoice.

For larger companies, we estimate invoices cost roughly $9 each to process, which

can be reduced to roughly $4 (55% net savings) with AP automation. Large

companies usually rely on ERP accounting software, which often provides account

reconciliation and invoice matching, but rarely provides integrated payments. As a result,

we believe roughly 50% of invoices are still paid with paper checks. AP automation

should not only increase electronic payment adoption across large companies, but

reduce the time spent by the AP staff managing the AP process by 65%-70%.

16 September 2018

20

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Exhibit 25: We see potential for net savings of ~70% for SMBs and ~55% for large companies who adopt AP automation

Key assumptions, costs, and savings for SMBs from using an AP automation solution

C

ost per invoice using a manual AP management process

C

ost per invoice using an AP management software/service

P

rocessing costs (paper, postage, processing) Processing costs (paper, postage, processing)

Split of Payment Process used to pay major suppliers Savings in processing costs

Small Medium Large Small Medium Large

P

ayment Method Cost Payment Method Cost

C

hecks $1.55

8

0% 63% 50%

C

hecks $1.65 25% 15% 10%

ACH $0.30

12% 26% 37%

ACH $0.30 42% 50% 55%

V

irtual Cards $1.25

5

%7%10%

V

irtual Cards $0.80 30% 32% 35%

O

thers $4.00

3

%4%4%

O

thers $4.00 3% 3% 0%

A A

verage processing cost per invoice $1.47 $1.31 $1.16

C A

verage processing cost per invoice $0.90 $0.77 $0.61

H

eadcount Costs Headcount Costs

S

mall Medium Large Small Medium Large

Invoices processed per month 1,000 3,000 10,000 Invoices processed per month 1,000 3,000 10,000

Salary ($/hour) Headcount Reduction in working hours on AP

AP Clerk 19 3 6 10 AP Clerk 80% 75% 70%

A

P Analyst 24 1 3 5 AP Analyst 80% 75% 70%

AP Supervisor 29 0 1 3 AP Supervisor 75% 70% 65%

A

P Manager 38 1 1 2 AP Manager 75% 70% 65%

Total Headcount 5 11 20 Total Headcount 2 3 7

Headcount cost per Invoice Headcount cost per Invoice

A

P Clerk 9.98 6.65 3.33 AP Clerk 2.00 1.66 1.00

AP Analyst 4.16 4.16 2.08 AP Analyst 0.83 1.04 0.62

A

P Supervisor 0.00 1.66 1.50 AP Supervisor 0.00 0.50 0.52

AP Manager 6.65 2.22 1.33 AP Manager 1.66 0.67 0.47

B T

otal headcount cost per invoice $20.79 $14.69 $8.23

D T

otal headcount cost per invoice $4.49 $3.87 $2.61

Small Medium Large Small Medium Large

A+B Total cost per invoice $22.26 $16.00 $9.39 C+D Total cost per invoice $5.39 $4.64 $3.22

E

Software/service charge $1.50 $1.25 $1.00

C+D+E Total Cost per invoice $6.89 $5.89 $4.22

Absolute savings 76% 71% 66%

Net savings 69% 63% 55%

Savings based on our 10-year forecasts for AP automation adoption and payment method mix. Absolute savings reflects processing and labor savings; net savings includes software/service charges.

Source: Primary research, Goldman Sachs Global Investment Research

16 September 2018

21

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Beyond AP automation...

In addition to general AP automation solutions, more targeted solutions have emerged

for cross-border payments, disbursements, short-term financing, and specific industry

verticals.

Cross-border payments

We see a significant opportunity for cross-border providers that can undercut bank

pricing by eliminating correspondent bank fees and locking in FX rates. In Exhibit 26, we

show the incremental revenue opportunity for non-bank providers and corresponding

savings for companies as volumes shift from banks to non-bank providers. Our analysis

only captures savings on transaction and FX fees, and does not factor in the value of

faster settlement times. However, with cross-border bank transactions taking up to 3-5

days, we see faster settlement times as a catalyst for faster adoption of non-bank

solutions.

The players: Beyond banks and credit card networks, solution providers include

established niche players (Cambridge FX), traditional remittance providers (Western

Union), and start-ups such as Payoneer, GoCardless, and TransferMate. These providers

offer faster settlement times (e.g., Payoneer offers instant transfers between Payoneer

accounts), low fees (GoCardless charges 1% per transaction and TransferMate charges a

flat $5 fee on transfers under $5,000), and the opportunity to lock in real-time FX rates.

See our company catalogue for more details.

Disbursements

Disbursements are push payments - funds are “pushed” from the buyer’s account into

the supplier’s account (Exhibit 27). There are two primary use cases for disbursements

Exhibit 26: Ultimately, we believe companies can cut costs 75%, a ~$290bn opportunity for non-bank

providers

Cross-border transfers: Estimated cost savings (%) and revenue opportunity ($bn)

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

1

00%

$0

$200

$400

$600

$800

$1,000

$1,200

10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Estimated savings (%)

Revenue opportunity ($bn)

Cross-border volume on non-bank providers (% total)

Non-bank revenue Bank revenue Estimated savings

75%

cost savings

$289bn

non-bank

revenue

Currently ~95% cross-border volume goes through banks.

Source: Goldman Sachs Global Investment Research

16 September 2018

22

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

in B2B: (1) payments to suppliers and (2) direct payroll for contractors, freelancers, and

1099 workers. We expect disbursement solutions to see the fastest adoption in the gig

economy, where companies need to pay contractors, resellers, and suppliers. This

includes both freelancers and contractors in the Sharing Economy - including Uber and

Lyft drivers, Airbnb hosts, and food delivery couriers.

The “Gig Economy” opportunity: We estimate that 30% of US workers participate in

the gig economy on either a full-time basis or as a supplemental source of income and

collectively earn over $1.3tn in 2018.

Shifting check payments to digital disbursements eliminates the inefficiencies tied to

paper checks and gives contractors faster access to funds. Assuming 1.5% pricing, we

see a $20bn revenue opportunity in the United States and - assuming the same mix of

gig workers in the global economy - a $96bn global revenue opportunity.

While our revenue opportunity is limited to “gig workers,” we see a larger opportunities

as the rest of the labor force pushes for faster access to their paychecks. Based on the

size of the US labor force and average hourly earnings, we believe there is an

opportunity to process over $6.8tn in Direct Payroll. Assuming the same 1.5% pricing,

this would equate to over a $100bn revenue opportunity just within the US.

The players: Card networks are the chief infrastructure providers for direct debit

payments, but there are a number of providers who offer disbursement solutions that

run over the networks’ rails or operate their own closed-loop supplier payment

Exhibit 27: Disbursements (direct debit/push payments)

Source: Goldman Sachs Global Investment Research

Exhibit 28: Contract workers represent ~30% of the US labor force...

US labor force

Exhibit 29: ...and will collectively earn about $1.3tn in 2018

Estimate of US gig economy

US population (’000s) % employed

Population (adults) 328,055

Population (16+) 214,843

US labor force (’000s) % employed

Labor force 162,245

Employed 155,965

Gig economy no. workers % employed

All workers 46,790 30.0%

Primary source of income 15,752 10.1%

Secondary source of income 31,037 19.9%

Earnings ($mn) Weekly Annual

Primary source of income 826 41,297

Secondary source of income 781 39,030

Market size ($mn) 1,310,835

Source: US Bureau of Labor Statistics, Federal Reserve, Cornell ILR, Goldman Sachs Global

Investment Research

Source: US Bureau of Labor Statistics, Federal Reserve, Cornell ILR, Goldman Sachs Global

Investment Research

16 September 2018

23

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

networks. We see privately held Payoneer as one of the leaders in disbursement

processing, with over 4mn users collecting payments from major marketplaces and

networks including Amazon and Airbnb. Within our coverage, Square has also launched

a domestic disbursement solution that allows its customers to pay contractors via direct

deposit for $5 per month. See our company catalogue for more information.

Working capital and financing solutions

Automating AP processing allows businesses to pay and get paid faster. For buyers, this

means avoiding late fees and capturing pre-payment discounts and rebates. For

suppliers, this means better working capital and cash flow management.

While we expect invoice and payment processing solutions (domestic + cross-border) to

experience the fastest adoption, we also see tremendous opportunities for working

capital management and cash management (i.e., dynamic discounting) solutions.

Dynamic discounting takes standard prepayment discounts, such as 2% 10 net 30 (i.e.,

a 2% discount if the buyer pays within 10 days following invoice issuance), to the next

level. With dynamic discounting, a buyer can set an APR and the supplier can decide

how early it wants to be paid based on that APR. Working capital and cash management

solutions are only beginning to emerge, but we expect competition to intensify and to

see more solutions that offer direct interfaces between the supplier and buyer, allowing

them to negotiate discounts, and offer real-time payments.

Beyond specific financing solutions, a complete “procure-to-pay” working capital

solution would enable an organization to manage its business more efficiently by raising

purchase orders based on current inventory levels and FX movements, automatically

approving invoices after the procurement process is complete, processing payments,

reconciling accounts, and using analytics to forecast net cash and make decisions

around raising short-term debt or paying down debt. We see a significant opportunity for

these solutions to gain traction with larger organizations that have complex, global

supply chains.

Exhibit 30: With dynamic discounting, the buyer sets an APR and

the seller can choose when it wants to be paid based on the APR

Discount rate (%)

Exhibit 31: This provides more flexibility than traditional “all or

nothing” discounts

Illustrative example of dynamic discounting

Days to payment

0.0% 0102030

6% 0.5% 0.3% 0.2% 0.0%

9% 0.7% 0.5% 0.2% 0.0%

12% 1.0% 0.7% 0.3% 0.0%

15% 1.2% 0.8% 0.4% 0.0%

18% 1.5% 1.0% 0.5% 0.0%

21% 1.7% 1.2% 0.6% 0.0%

24% 2.0% 1.3% 0.7% 0.0%

APR (%)

Source: Goldman Sachs Global Investment Research Source: Goldman Sachs Global Investment Research

16 September 2018

24

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Who can make money and how much?

Payment processors, software companies, banks, and services providers are vying to

help businesses take control of manual, paper-based payables processes - but in many

cases, competition is not the only force at work. Partnerships are becoming vitally

important for vendors across the B2B market looking to distribute complete solutions to

SMBs. We see meaningful revenue opportunities for all these groups:

Payments companies: Payment companies - including card networks, merchantn

acquirers, and virtual card providers - are responsible for transferring funds between

the buyer and the supplier to settle an invoice. Payment processing is often

integrated with ancillary software and services provided by other vendors. In many

cases, payment companies serve as the aggregator of software and services

solutions because of their position at the heart of the B2B ecosystem.

Software and services companies: Software and services companies providen

workflow solutions and ancillary software that integrates with traditional ERP and

accounting software to help ease pain points for businesses. In the core accounts

payable market, a range of vendors offers software to automate AP processing -

receiving and matching invoices and purchase orders, streamlining the approval

process, and reconciling payments in the company’s general ledger. A number of

vendors also provide specialized solutions for cross-border payments, disbursement

payments, and solutions to help companies bridge cash shortfalls and finance

working capital.

Banks and financial institutions: Payment companies and software/servicesn

providers often work with banks to distribute their solutions to market, given that in

many cases banks retain the core client relationship. Payment processors (like

FleetCor and WEX) and software/services providers (like AvidXchange and

MineralTree) will often “white label” their solutions to banks or partner with other

companies offering payments services, such as accounting firms. This enables the

providers to reach a significant number of companies while minimizing sales and

marketing costs.

16 September 2018

25

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

A Small Business Case Study

Consider the example of an independent general contractor who wishes to automate his supplier

payments. The home contractor might bank at a regional bank (such as Fifth Third) and hear about Fifth

Third’s Expert AP offering, which is white label solution provided by AvidXchange. The contractor can use

Fifth Third Expert AP to automate the entire accounts payable process from receiving the invoice to

making payments. If the contractor pays by virtual card or Fast ACH, the payment will be powered by

Mastercard. In this case, the economics would be split between Fifth Third (the distributor), AvidXchange

(the software/services provider), and Mastercard (the payment processor).

Exhibit 32: How the B2B payments process works for small business.

Source: Goldman Sachs Global Investment Research

16 September 2018

26

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Overall, we see a $300bn revenue opportunity in core payment processing and AP

software/services - and a $950bn revenue opportunity when taking into account

specialized B2B solutions for cross-border payments, disbursements, and working

capital financing. We see this broader B2B revenue opportunity reaching $1.5tn by 2028.

Card networks: B2B payments represents the next frontier

Apart from niche corporate payments such as travel and entertainment (T&E), card

networks have historically focused on consumer payments. However, they have now

started to concentrate significant attention and resources on the B2B payment

opportunity - and we believe even modest penetration in the B2B market can drive

meaningful revenue upside for the card networks over time.

We believe 5%-10% of B2B payments can be automated by 2023, which represents a

revenue opportunity of around $12bn for the card networks, depending on pricing and

the split between the network, software provider, and bank (Exhibits 33-34).

Exhibit 33: B2B market landscape with key public and private

Source: Goldman Sachs Global Investment Research

16 September 2018

27

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Among the card networks, we expect Mastercard to be the biggest beneficiary of B2B

payments growth given it currently has the most comprehensive suite of B2B product

product offerings including Fast ACH (through VocaLink), Mastercard Send, and virtual

cards (Exhibit 35). Overall, we believe B2B payments (ex-T&E) could account for as

much as 20% of Mastercard’s revenue by 2023.

Mastercard (MA)

Product: Mastercard’s commercial card offerings include travel and entertainmentn

(T&E), fleet cards, purchasing cards, and corporate virtual cards. Beyond cards,

Mastercard has developed new commercial solutions including the Mastercard B2B

Hub (AP optimization platform), Mastercard Track (global trade platform), Mastercard

Send (for cross-border payments), and Fast ACH (through its acquisition of

VocaLink). Like the other card networks, Mastercard’s commercial card offerings are

the most mature (currently about 11% of global volume and growing in the

Exhibit 34: We believe 5%-10% of AP payment volumes could be

automated by 2023...

Card network revenue opportunity ($mn), 2023

Exhibit 35: ...roughly a $12bn opportunity for the card networks

Card network revenue opportunity ($mn), 2018-23

C

ard network pricing (%)

#

###### 0.05% 0.06% 0.07% 0.08% 0.09% 0.10%

5

%4,0744,8885,7036,5187,3328,147

6% 4,888 5,866 6,844 7,821 8,799 9,777

7% 5,703 6,844 7,984 9,125 10,265 11,406

8% 6,518 7,821 9,125 10,428 11,732 13,035

9% 7,332 8,799 10,265 11,732 13,198 14,665

10% 8,147 9,777 11,406 13,035 14,665 16,294

2023 Market

penetration

$

0.0

$2.0

$4.0

$6.0

$

8.0

$10.0

$12.0

$14.0

2

018

2

019

2

020

2

021

2

022

2

023

B2B revenue - card networks ($bn)

Source: Goldman Sachs Global Investment Research

G

S base case assumes 7.5% market penetration by 2023, 10bp pricing for card networks.

S

ource: Goldman Sachs Global Investment Research

Exhibit 36: We believe Mastercard has the most comprehensive

suite of B2B payment products...

Network comparison

Exhibit 37: ...and should be the biggest beneficiary of B2B growth

over the next 5 years

% growth in B2B, 2018-23

Network comparison V MA AXP

Commercial Cards

++++

B2B

Virtual Cards

++++

Fast ACH

--

+

--

B2B/B2C/G2C

Push payments

+++

Lending

-- --

+

0%

10%

20%

30%

40%

50%

60%

70%

2018 2019 2020 2021 2022 2023

% growth in B2B

Mastercard Visa American Express

Source: Goldman Sachs Global Investment Research

GS base case assumes 7.5% market penetration by 2023, 10bp pricing for card networks.

Source: Goldman Sachs Global Investment Research

16 September 2018

28

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

mid-teens), but it is in the process of rapidly scaling its virtual card and fast ACH

solutions.

Revenue model: Mastercard earns an assessment fee on each transaction itn

processes - with higher fees for cross-border transactions and data processing - and

charges additional fees for other payment-related products and services. On the flip

side, Mastercard gives its customers volume-based rebates to help stimulate

volume growth.

Customers: Mastercard’s commercial card products are used by businesses of alln

sizes worldwide. Mastercard is still in the process of rolling out its newer B2B

offerings - including the Mastercard B2B Hub, Mastercard Track, Fast ACH, and

Mastercard Send – across its client footprint. Some of these products are designed

for narrower audiences; for example, the Mastercard B2B Hub is geared for small-

and mid-size companies.

Differentiation: Although Mastercard ranks third in terms of commercial card

n

volume, we think Mastercard has the most comprehensive portfolio of B2B

payment products across the card networks with virtual cards, Fast ACH, and

Mastercard Send. Mastercard is the leader in virtual cards and the only card network

with Fast ACH, a capability it acquired in 2017 with its acquisition of the United

Kingdom’s leading instant payment clearing system VocaLink. Mastercard is

currently bringing Fast ACH to other markets including the United States (launched

in the United States in partnership with NACHA in late 2017). Mastercard has

partnered with a number of financial institutions to market its cross-border B2B

direct deposit solution and has partnered with technology companies – including

Oracle, AvidXchange, and Nvoicepay – to integrate its payment products directly into

their AP offerings.

Visa (V)

Product: Visa’s B2B portfolio includes corporate cards (T&E, purchasing cards),n

virtual accounts, and Visa Direct. Visa Direct is Visa’s push payment solution, which

allows businesses to transfer funds between accounts via a debit, prepaid, or credit

card number. In addition to its payment solutions, Visa provides data management,

analytics, and the ability to integrate its payment and service solutions into

third-party offerings. Corporate cards are the most mature of Visa’s B2B offerings,

while Visa’s virtual account and Visa Direct offerings are still scaling.

Revenue model: Visa charges an assessment fee for each payment transaction

n

processed and additional fees for its ancillary services. This is offset by incentives

Visa pays to its financial institution and strategic partners to drive volume growth.

Customers: Visa’s commercial solutions serve businesses of all sizes acrossn

industries. While Visa offers commercial cards globally, Visa originally launched Visa

Direct in the United States and expanded into Europe at the end of 2017. Currently,

the main B2B use case for Visa Direct is disbursements to independent contractors

and microbusinesses. For example, Lyft pays its drivers using Stripe’s Instant

Payouts solution, which is powered by Visa Direct.

16 September 2018

29

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Differentiation: Visa is the global leader in commercial cards and has been workingn

to strengthen its virtual card footprint (WEX recently partnered with Visa to

strengthen its international footprint). Visa’s virtual card offering powers Stripe’s

Instant Payout solution, Worldpay’s instant payment offering, and First Data’s

Disburse-to-Debit solution for businesses paying contractors and temporary

workers. Visa has partnered with a number of financial institutions, AP companies,

and technology companies to distribute its products and services. For example, Visa

has partnered with Amazon Business to provide US commercial account holders

with full line-item details on Amazon Business customers’ purchases.

American Express (AXP)

Product: AXP’s commercial offering includes its industry-leading charge and creditn

cards for small and mid-size businesses and its Corporate Card products and

Business Travel accounts for larger companies. Going forward, AXP is focused on

the development of a range of supplier payment and business financing solutions,

such as purchasing cards, buyer-initiated payments, virtual payments, cross-border

payments, and short-term business financing. 90% of AXP’s commercial billings are

on charge card products, with 10% on credit cards. Additionally, two thirds of AXP’s

commercial billings come from B2B payments, while the remaining one third comes

from T&E spend. B2B spend is typically larger recurring transactions, and has grown

at an 11% CAGR since 2015 (5x faster than T&E spend).

Revenue model: American Express offers a range of B2B products which driven

processing or transaction fees. AXP also offers volume-related discount / incentives

to drive growth.

Customers: American Express’s commercial payments segment is used byn

businesses of all sizes internationally. As of 2017, AXP’s commercial billings

distribution consisted of 10% international SME, 25% global & large accounts and

65% US small & medium enterprises.

Differentiation: AXP is the #1 commercial issuer globally, with relationships withn

over 60% of Fortune Global 500 and is the #1 small business card issuer in the US.

AXP’s unique integrated payments platform allows AXP to have direct relationships

with buyers and sellers, creating the opportunity to flexibly price and structure

transactions to meet buyer and supplier needs. Additionally, AXP has established

various partnerships in order to expand its B2B capabilities. Examples include, its

partnership with Ripple to introduce a blockchain solution for cross-border

transactions and its recently announced partnership with Amazon to introduce a

co-branded credit card aimed at small businesses as well as data-related analytics.

Other Public players

FleetCor (FLT)

Product: FleetCor offers virtual cards, purchasing cards, T&E cards, payroll cards,

n

and cross-border payments within its corporate payments business unit, as well as

full AP outsourcing and expense management software. These solutions can be

directly integrated with a client’s ERP system. Comdata accounts for the majority of

16 September 2018

30

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

FleetCor’s domestic corporate payments business - including its AP automation and

domestic virtual card offerings - while Cambridge Global Payments is FleetCor’s

international payments offering. Outside of its corporate payments business unit,

FleetCor offers commercial fleet and lodging cards.

Revenue model: Pricing depends on the customer contract, but is generally basedn

on volume, incentives, and contract duration. For its payment solutions, FleetCor

earns interchange on each transaction processed. Corporate payments currently

account for 16% of FleetCor’s revenue, but we believe the segment could account

for as much as 35% of FleetCor’s revenue in 5 years assuming 20% organic B2B

growth and $750mn inorganic revenue contribution (assuming leverage is

unchanged and half of all M&A is in B2B).

Customers: With the exception of its cross-border payments solution, FleetCor’sn

corporate payment solutions are predominately marketed to businesses in North

America (US and Canada). FleetCor has significant client concentrations in fleets,

healthcare, and construction (approximately 25% Comdata corporate payments

business), and plans to continue expanding its vertical offerings in media and

advertising. FleetCor serves companies of all sizes in its domestic payments

business, but is re-focusing Cambridge on larger accounts.

Differentiation: While most providers focus on either domestic or cross-bordern

payments, FleetCor offers both domestic and international payments solutions. This

gives FleetCor a unique opportunity to cross-sell its domestic Comdata and

cross-border Cambridge products across its client base – especially the Comdata

virtual card offering. FleetCor also benefits from its scale in virtual and commercial

cards – FleetCor claims to be about half of Mastercard’s US virtual card business

and the second-largest Mastercard commercial card issuer across its product lines.

WEX Inc. (WEX)

Product: WEX provides virtual, credit, debit, and prepaid corporate paymentn

products that can be integrated into clients’ AP and reconciliation processes. WEX

also operates a payables platform that integrates directly with a company’s ERP

systems and manages disbursements across ACH, virtual accounts, EFT, and check.

Outside of its corporate payments business, WEX offers a variety of commercial

fleet payment products.

Revenue model: WEX processes payments and earns interchange on each

n

transaction it processes. WEX’s corporate payment business is currently 19% of

revenue (2018), and we think its exposure could double to about 40% of revenue by

2023 assuming 20% organic corporate payments revenue growth and $350mn of

inorganic corporate payments revenue (assuming leverage is unchanged and half of

M&A spend is on B2B).

Customers: WEX markets its accounts payable solution to enterprises and SMBsn

across industry verticals. The company sells directly to large enterprises, while it

reaches SMBs through AP/vendor management partners and financial institutions

(primarily regional banks). WEX sees the greatest demand for AP payments from the

United States and currently only originates payments from the United States, but

16 September 2018

31

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

sees opportunities for future growth around the globe, especially in APAC. Beyond

its general accounts payable solution, WEX offers industry-specific virtual card

solutions for travel, media, and insurance.

Differentiation: WEX issues both Mastercard and Visa virtual cards, givingn

customers greater flexibility and a bigger international reach. WEX’s corporate

payments offerings currently run on the legacy AOC and EFS platforms – with the

AOC platform serving enterprises and EFS serving smaller companies – but WEX

plans to create one unified platform over the next several years by lifting the best

features from both platforms.

Square, Inc. (SQ)

Product: Square is in the early stages of developing a suite of B2B productn

offerings. Square currently offers Square Payroll for Contractors, a disbursement

solution which enables companies to pay contractors via direct deposit (ACH) or

check. In addition to its disbursement offerings, Square has partnered with

Handshake – a B2B commerce platform for manufacturers and distributors – in June

2018 to enable B2B sellers to accept credit card payments.

Revenue model: Square Payroll for Contractors costs $5 per contractor per monthn

and allows companies to make an unlimited number of payments to the enrolled

contractor. The Handshake app is available on the Square App marketplace for

$39.99/month, and Square earns a fee for processing the credit and debit

transactions.

Customers: Square’s Payroll solution is aimed at the company’s core customer basen

– small businesses and micro-merchants in the United States. The Handshake app

targets a smaller subset of Square’s customers, with order solutions specifically

designed for manufacturers and distributors.

Differentiation: While Square primarily provides disbursements and only recentlyn

began facilitating supplier payments, we see potential for Square to expand its

offerings as it builds out its ecosystem. Over time, we also see potential for Square

to offer more robust supply chain financing solutions in conjunction with Square

Capital.

WorldPay (WP)

Product: Worldpay, through its subsidiary Paymetric, offers domestic and

n

cross-border payment processing, as well as PCI compliance and data security

solutions for large enterprises. Paymetric’s solutions integrate with any enterprise

system, including Oracle and SAP. For eCommerce, Paymetric also provides both

web-based and mobile-based payment solutions. Paymetric also offers value-added

solutions like invoice processing automation and analytics – which help optimize

payments and efficiently manage the client’s working capital. Additionally, WorldPay

makes domestic and cross-border payments simple, inexpensive and transparent,

for its merchant network through its VisaDirect and Bankout services.

16 September 2018

32

Goldman Sachs

Global Technology

For the exclusive use of [email protected]

0d9822d7acd44fc29cc9ab08e243da56

Revenue model: As Paymetric offers solutions across the value-chain of B2Bn

payments, pricing depends on the customer contract, but is generally based on

volume and contract duration.

Customers: Paymetric serves large companies, which have complex global supplyn

chains and require sophisticated compliance and security capabilities.

D

ifferentiation: Paymetric’s broad product suite positions it well to penetrate B2B

n

payments, particularly for large enterprises. Data security, compliance, and