Company Licensing Best

Practices Handbook

2023

Revised as of August 14, 2021

Accounng & Reporng

Informaon about statutory accounng principles and the

procedures necessary for ling nancial annual statements

and conducng risk-based capital calculaons.

Consumer Informaon

Important answers to common quesons about auto, home,

health and life insurance — as well as buyer’s guides on annu-

ies, long-term care insurance and

Medicare supplement plans.

Financial Regulaon

Useful handbooks, compliance guides and reports on nancial

analysis, company licensing, state audit

requirements and receiverships.

Legal

Comprehensive collecon of NAIC model laws, regulaons

and guidelines; state laws on insurance topics; and other reg-

ulatory guidance on anfraud and consumer privacy.

Market Regulaon

Regulatory and industry guidance on market-related issues,

including anfraud, product ling requirements, producer

licensing and market analysis.

NAIC Acvies

NAIC member directories, in-depth reporng of state

regulatory acvies and ocial historical records of NAIC na-

onal meengs and other acvies.

Special Studies

Studies, reports, handbooks and regulatory research

conducted by NAIC members on a variety of insurance-

related topics.

Stascal Reports

Valuable and in-demand insurance industry-wide stascal

data for various lines of business, including auto, home,

health and life insurance.

Supplementary Products

Guidance manuals, handbooks, surveys and research

on a wide variety of issues.

Capital Markets & Investment Analysis

Informaon regarding porolio values and procedures for

complying with NAIC reporng requirements.

White Papers

Relevant studies, guidance and NAIC policy posions on

a variety of insurance topics.

© 1999-2023 National Association of Insurance Commissioners. All rights reserved.

ISBN:978-1-64179-183-0

Printed in the United States of America

No part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means,

electronic or mechanical, including photocopying, recording, or any storage or retrieval system, without written permission

from the NAIC.

NAIC Execuve Oce

444 North Capitol Street, NW

Suite 700

Washington, DC 20001

202.471.3990

NAIC Central Oce

1100 Walnut Street

Suite 1500

Kansas City, MO 64106

816.842.3600

NAIC Capital Markets

& Investment Analysis Oce

One New York Plaza, Suite 4210

New York, NY 10004

212.398.9000

The NAIC is the authoritave source for insurance industry informaon. Our expert soluons support the eorts of

regulators, insurers and researchers by providing detailed and comprehensive insurance informaon. The NAIC oers

a wide range of publicaons in the following categories:

For more informaon about NAIC

publicaons, visit us at:

hp://www.naic.org//prod_serv_home.htm

NAIC Company Licensing Best Practices Handbook

© 2005–2023 National Association of Insurance Commissioners i

Introduction ....................................................................................................................................1

Background ..................................................................................................................................2

UCAA Instructions vs. Best Practices Handbook .......................................................................2

Description of the Best Practices Handbook ...............................................................................3

Appendix A – The Uniform Certificate of Authority Application (UCAA) ........................4

Appendix B – Use of Electronic Documents ...........................................................................4

Appendix C – Review of Electronic Application Coordination and Processing

(REACAP) ..................................................................................................................................4

Appendix D – Form A Review Best Practices .........................................................................4

Appendix E – Speed to Market ................................................................................................4

The Company Licensing Function ...............................................................................................5

Interstate Communication ............................................................................................................7

Initiating Interstate Communication ............................................................................................8

Lead State ....................................................................................................................................9

Key State .....................................................................................................................................9

Communications and the Domiciliary State ................................................................................9

Best Practices: Conceptual Framework of Processes and Procedures . Error! Bookmark not

defined.

Chapter Overview ......................................................................................................................12

Components of the Company Licensing Function ....................................................................12

Administrative .........................................................................................................................12

Coordination ......................................................................................................................12

Timeliness ..........................................................................................................................13

Administrative Filing .........................................................................................................13

Analytical Review ....................................................................................................................13

Analysis of Current Condition ...........................................................................................13

Prioritization Framework ...........................................................................................14

Use of Prioritization Factors in Application Review .....................................................14

Priority 1 ....................................................................................................................15

Priority 2 ....................................................................................................................15

Priority 3 ....................................................................................................................16

Priority 4 ....................................................................................................................17

Analysis of Business Plan ..................................................................................................17

NAIC Company Licensing Best Practices Handbook

© 2005–2023 National Association of Insurance Commissioners ii

Intradepartmental Communications ..........................................................................................17

Timeliness of Review ................................................................................................................18

Best Practices: Application Review ...........................................................................................19

Introduction ...............................................................................................................................20

Confidentiality and Safeguarding of Biographical Affidavit Information ................................20

Administrative Safeguards .....................................................................................................20

Technical Safeguards ..............................................................................................................21

Physical Safeguards .................................................................................................................21

Primary Application ..................................................................................................................23

Primary Application - Redomestication ....................................................................................32

Expansion Application ..............................................................................................................35

Corporate Amendment Application – Adding and Deleting Lines of Business........................47

Corporate Amendment Application – Name Change ................................................................54

Corporate Amendment Application – Redomestication of a Foreign Insurer ...........................56

Corporate Amendment Application – Change of Statutory Home Office Address ..................58

Corporate Amendment Application – Merger of Two or More Foreign Insurers .....................60

Corporate Amendment Application – Proposed/Completed Change of Control of Foreign

Insurers ...............................................................................................................................63

Corporate Amendment Application – Amended Articles of Incorporation ..............................66

Corporate Amendment Application – Amended Bylaws ..........................................................68

Corporate Amendment Application – Change of Mailing Address/Contact Notification ........70

Corporate Amendment Application – Uniform Consent to Service of Process ........................71

Corporate Amendment Application – Statement of Withdrawal, Complete Surrender ............72

Appendix A - The Uniform Certificate of Authority Application (UCAA) ............................74

The UCAA .................................................................................................................................75

Primary Application ................................................................................................................75

Primary Application – Redomestication Only ......................................................................75

Primary Application Review Checklist .................................................................................77

Expansion Application ............................................................................................................81

Corporate Amendment Application ......................................................................................82

UCAA Forms ...........................................................................................................................82

Review of the UCAA ................................................................................................................83

Appendix B – Use of Electronic Documents ..............................................................................84

NAIC Company Licensing Best Practices Handbook

© 2005–2023 National Association of Insurance Commissioners iii

Appendix C – Review of Electronic Application Coordination and Processing (REACAP) 86

REACAP Expedited Review Guidelines ...............................................................................88

Appendix D – Form A Review Best Practices ...........................................................................90

Initial Review ...........................................................................................................................91

Background, Identity and Risk Profile of Acquiring Persons .............................................91

Communication and Record Maintenance ...........................................................................92

Transaction Review .................................................................................................................92

Purchase Consideration ..........................................................................................................93

Target License Qualification/Insurer Operations ................................................................93

Market Impact .........................................................................................................................94

Post Approval Considerations, if applicable .........................................................................94

Post Acquisition Considerations ............................................................................................94

Appendix E – Speed to Market ...................................................................................................96

Speed to Market .......................................................................................................................97

NAIC Company Licensing Best Practices Handbook

Introduction

© 2005–2023 National Association of Insurance Commissioners 1

Introduction

NAIC Company Licensing Best Practices Handbook

Introduction

© 2005–2023 National Association of Insurance Commissioners 2

BACKGROUND

In conjunction with the NAIC, the various states, as a part of the former Accelerated Licensing

Evaluation Review Technique (ALERT) Subgroup, have worked toward the goal of streamlining

and achieving uniformity in the insurer licensing process. To that end, a Uniform Certificate of

Authority Application (UCAA) was developed by the former Accelerated Licensing Evaluation

Review Technique (ALERT) Subgroup and is currently in use. However, the implementation of

UCAA requirements and the standards and procedures involved in the reviewing of applications

has not proven to be consistent among the members of the NAIC.

The objective of the Company Licensing Best Practices Handbook (Best Practices Handbook) is

to provide a framework that, while not preempting a state’s authority, promotes consistent

decisions while reviewing the standardized UCAA and improves the efficiency of the review

process. This Best Practices Handbook is not intended to constitute a comprehensive company

licensing procedures manual. Each state must assess its ability, within the confines of existing

statutes, regulations and resource constraints, to implement the recommendations contained

herein.

UCAA INSTRUCTIONS vs. BEST PRACTICES HANDBOOK

The ALERT Subgroup performed a monumental task in bringing order to the various state rules,

regulations, requirements and forms facing an applicant. That work is thoroughly documented on

the UCAA website. This Best Practices Handbook contains numerous references to the forms and

processes described on the UCAA website.

This Best Practices Handbook deals primarily with the qualitative processes involved in reviewing

an application. The concepts and recommended processes and procedures described herein were

developed through interviews with various state regulatory personnel involved in the company

licensing process and a compilation of the observed best practices. During those interviews several

“best practices” concepts became evident. They were:

● LICENSING PROCESSES: The company licensing function can be viewed in light of its

component processes:

− Administrative Filings: Receipt and processing of certain corporate documents that are

needed to establish a corporate existence, but are not subject to qualitative review.

− Analysis of Current Financial Condition: Documentation of the current operating condition

of the company.

− Analysis of Business Plan: Review of the company’s explanation for the proposed

expansion and/or change in its operations and how those changes will affect the company’s

operating condition.

NAIC Company Licensing Best Practices Handbook

Introduction

© 2005–2023 National Association of Insurance Commissioners 3

● INTERSTATE COMMUNICATION: The licensing process in many states involved the re-

determination of the current financial condition of the company. This information should

already be known by the domestic state and can be conveyed to the applicant state. The effort

saved by not reanalyzing company condition in the company license process can be used to

communicate financial condition information to other states when requested.

● PRIORITIZATION FRAMEWORK: Several states incorporated more or less sophisticated

prioritization systems as a part of the licensing function. The scope of the financial review may

be adjusted based upon the prioritization of the insurer. The resources saved by reducing effort

in reviewing companies on the top and bottom of the scale can be better spent performing a

more thorough review of those companies where the effect of an expansion or amendment of

the business plan is not so easily evident.

In addition to gathering information necessary to evaluate an applicant, the UCAA was developed

to incorporate the majority of state’s rules, regulations and requirements relative to company

licensing. The goals of this Best Practices Handbook are uniformity and efficiency in the review

of company licensing applications. In some instances, those goals conflict with filing requirements

noted in the UCAA. Therefore, it is acknowledged that there may be inconsistencies between this

Best Practices Handbook and any specific state’s filing requirements.

DESCRIPTION OF THE BEST PRACTICES HANDBOOK

The Company Licensing Function

This chapter provides an overview of the role of the company licensing function as the initial step

in state regulatory oversight. The goals of the company licensing function and the risk-based

approach to achieving them are described.

Interstate Communication

This chapter discusses a framework for communication and cooperation between an applicant

state, the state of domicile and other stakeholder states (if any).

Best Practices

Conceptual Framework

This chapter presents a risk-based framework for the processes involved in analyzing the

application.

Review of Forms

This chapter presents a summation of best practices compiled as guidance relative to the analysis

and decision making regarding the application.

NAIC Company Licensing Best Practices Handbook

Introduction

© 2005–2023 National Association of Insurance Commissioners 4

Appendix A – The Uniform Certificate of Authority Application (UCAA)

This appendix presents a brief overview of the UCAA and how it is referenced in the “Best

Practices: Application Review” chapter.

Appendix B – Use of Electronic Documents

This appendix presents a description of UCAA contents that are available in electronic media.

Appendix C – Review of Electronic Application Coordination and Processing (REACAP)

This appendix presents the criteria for requesting the National Treatment and Coordination (E)

Working Group to monitor the timing, technology and substantive issues regarding the insurers’

electronic UCAA filings.

Appendix D – Form A Review Best Practices

This appendix presents a guide for regulatory review and analysis of Form A acquisitions,

recognizing that this list may not be comprehensive and not all items will apply to every

acquisition.

Appendix E – Speed to Market

This appendix presents the criteria for requesting the National Treatment and Coordination (E)

Working Group to monitor the timing and coordination of expansion applications for insurers in

good standing with their state of domicile (lead state).

NAIC Company Licensing Best Practices Handbook

The Company Licensing Function

© 2005–2023 National Association of Insurance Commissioners 5

The Company Licensing Function

NAIC Company Licensing Best Practices Handbook

The Company Licensing Function

© 2005–2023 National Association of Insurance Commissioners 6

The company licensing function stands at the threshold of an insurance department’s oversight of

an applicant’s future operations within the state. The function encompasses virtually all areas of

regulatory oversight, from solvency surveillance to market conduct, to rates and forms and

producers’ licensing — and not only within the applicant state insurance department, but also

within the insurance department of the domiciliary state. The most difficult stages of regulatory

oversight occur at the very beginning and at the very end of an insurer’s regulatory life cycle.

Never is a more comprehensive understanding of an insurer and its potential for success more

critical than when a regulator must grant authority to conduct business and in those even more

difficult circumstances when the regulator must withdraw the authority to conduct business.

In developing this Handbook, a great deal of consideration was given to the assessment of risk in

the review of a company license application. All of the current NAIC guidance provided to

insurance department personnel relative to insurance company surveillance deals with the

assessment of risk present in the individual insurers comprising the population to be regulated.

That risk, the risk of financial failure or risk of marketplace improprieties is to be measured and

graded. Current guidance defines procedures in such a manner that regulators maximize the

effectiveness of the surveillance process by concentrating on the areas, or companies, of greatest

risk. This approach by its nature, forgoes the idea of “zero” risk. The cost of obtaining zero risk is

prohibitive and the effort expended in its pursuit is better spent in other endeavors.

Similarly, regulators involved in reviewing company licensing applications must adhere to the

same goals. The review of the company licensing application should be structured so that

applicants’ risks of financial failure or marketplace impropriety are identified and addressed.

Procedures exist in the Financial Analysis Handbook, the Financial Condition Examiners

Handbook and the Market Regulation Handbook for monitoring companies subsequent to

admission. Company licensing personnel should concentrate on those issues that indicate an

applicant may harm the citizens of their state, either through financial failure or marketplace

improprieties, as a result of granting or amending a certificate of authority.

Therefore, the procedures described herein represent a departure from the conventional approach to

the review of a company license application. In some instances, it is recommended that documents

submitted with an application should be subject to minimal review. Those documents, although

necessary to establish an applicant as a legal entity, do not provide significant insight into the risk

profile of a company. By accepting the risk of a minor compliance violation (that, after all, will still

be the subject of ongoing monitoring), the regulator will maximize the effectiveness of their

department and better fulfill their responsibilities to the citizens of their state.

NAIC Company Licensing Best Practices Handbook

Interstate Communication

© 2005–2023 National Association of Insurance Commissioners 7

Interstate Communication

NAIC Company Licensing Best Practices Handbook

Interstate Communication

© 2005–2023 National Association of Insurance Commissioners 8

INITIATING INTERSTATE COMMUNICATION

The expansion and/or alteration of a company’s operations are of equal importance to the

regulators in both the expansion states and the domestic state. The results of unsuccessful

expansion plans cut across state boundaries — a troubled company is “troubled” in all states. It

follows that the analysis of a company’s condition and business plan should be accomplished

through a coordinated effort. Ultimately, each state operates under its own statutory authority and

is responsible for the protection of its own policyholders. Interstate communication and

cooperation is not intended to relinquish the authority of any state or to disadvantage any state;

rather, it is intended to facilitate efficiencies that will be achieved when applicant states coordinate

the company licensing process with all states involved, including, most importantly, the domestic

state.

The NAIC Financial Regulation Standards and Accreditation Program requires states to provide

for the sharing of otherwise confidential information, administrative or judicial orders, or other

action, with other state regulatory officials, provided that those officials are required under their

law to maintain its confidentiality. The NAIC “Master Information Sharing and Confidentiality

Agreement” allows signatory states to share confidential information with other signatory states.

As of this writing, 50 states and the District of Columbia have signed the agreement. Current

information can be accessed through the NAIC I-SITE application under StateNet or

https://i-site-state.naic.org/cgi-bin/statenet.

Prior to submitting an application in a foreign state, the insurer should inform the state of domicile

of its plans in the foreign state(s). If the state of domicile holds important concerns regarding the

applicant’s plans, such concerns should be communicated to the senior financial regulator in the

applicant state(s). Similarly, after receipt and an initial review of an application, the applicant state

may contact the senior financial regulator in the domiciliary state to open a dialogue regarding the

applicant. Preferably, this communication should occur as early in the application process as

possible to allow consideration of the information within an appropriate timeframe. The dialogue

should include:

• Is the Applicant Company concurrently applying to additional states?

– If so, contact other states to coordinate information available from the domiciliary state.

– If so, and the applicant is part of a holding company structure, contact the “Lead State” to

coordinate information sharing.

– If the Applicant Company does the majority of its business in a state other than the

domiciliary state, the Applicant Company and domiciliary states may consider

communication with a “Key State” as discussed below. However, even if a key state is

identified, the domiciliary state will remain the primary regulator.

• Domiciliary (and key) state’s analysis of current condition of the applicant.

– Has the domiciliary state performed a risk analysis of the applicant?

– If the risk analysis performed by the domiciliary state is understandable to the applicant

state and is substantially similar to the prioritization system defined in this Handbook, the

applicant state should consider accepting the analysis in lieu of performing an additional

financial analysis of the Applicant Company.

NAIC Company Licensing Best Practices Handbook

Interstate Communication

© 2005–2023 National Association of Insurance Commissioners 9

• Analysis of Business Plan by Applicant State(s)

– Are the operations described in the business plan consistent with the demonstrated

experience and expertise of the Applicant Company?

– Does the business plan have the potential to significantly alter the condition of the

Applicant Company?

– After consideration of the Applicant Company’s condition, business plan and any other

relevant information, has the domiciliary state transmitted any information having a

bearing on the application?

LEAD STATE

Lead state(s) or designee assumes the role of coordinator and communication facilitator. The lead

state(s) serves as the facilitator and central point of contact for purposes of gathering and

distributing information to all regulators involved.

KEY STATE

In some instances other states may have information pertinent to the application. In those instances,

a “Key State” may be considered for consultation in addition to the domiciliary state. The Key

State may emerge based on the state with the largest premium volume, the state of domicile of the

parent of the holding company, or other reasons. The “Key State” should not assume the

responsibilities of either the applicant state or the domiciliary state. A “Key State” should be

identified solely as an additional source of information regarding the applicant.

COMMUNICATIONS AND THE DOMICILIARY STATE

As previously stated, the Applicant Company should inform the domiciliary state of its plans to

file company licensing applications in foreign states. In addition, communications between the

applicant state(s) and the insurer may contain information regarding specifics of the applicant

state’s marketplace that may significantly impact the insurer’s proposed business plan. The use of

the electronic UCAA provides a mechanism for tracking such correspondence. This will allow the

domiciliary state to remain cognizant of these communications and the relevant information, while

the decision on the expansion remains with the expansion state.

NAIC Company Licensing Best Practices Handbook

Interstate Communication

© 2005–2023 National Association of Insurance Commissioners 10

This page intentionally left blank.

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 11

Best Practices: Conceptual Framework of Processes and Procedures

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 12

CHAPTER OVERVIEW

This chapter will discuss a framework for the process flows that occur within the Company

Licensing Function. The significant procedures within those process flows are discussed in detail,

although guidance on the review of specific UCAA forms is contained in the “Best Practices:

Application Review” chapter.

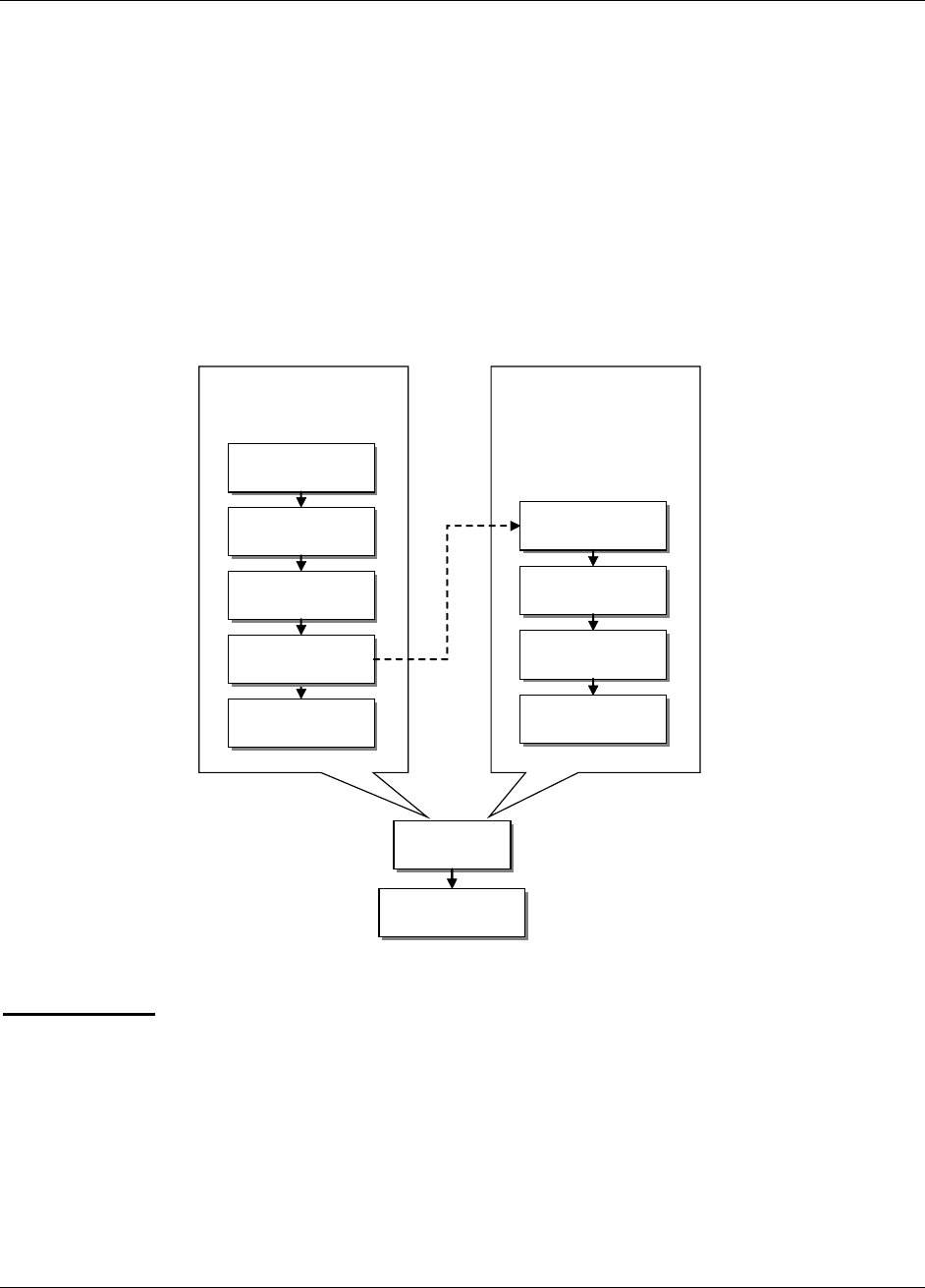

COMPONENTS OF THE COMPANY LICENSING FUNCTION

Depending on the type of application, the processing of a company license application can be

broken down into one or more of the following components as shown in the graphic below.

Administrative

Coordination: This component begins with the receipt and recording of an application and its

supporting documentation. The application should be reviewed to determine that a response exists

for all inquiries. Supporting documents should then be reviewed to determine that they are, in fact,

responsive to the UCAA requirement. The degree of the completeness and/or responsiveness of

the application must be assessed to determine if processing of the application can proceed without

further input from the Applicant Company. It is recommended that the state issue a letter to the

Applicant Company acknowledging receipt of the application.

Make

Recommendation

Make

Recommendation

Receipt of Application

Receipt of Application

Document

Completeness of

Application

Document

Completeness of

Application

Prepare Application

Control sheet (if app is

complete)

Prepare Application

Control sheet (if app is

complete)

File Administrative

Documents

File Administrative

Documents

Receive Application

Sections

Receive Application

Sections

Contact Domiciliary

State

Contact Domiciliary

State

Analyze Current

Condition

(incl. Mgmnt.)

Analyze Current

Condition

(incl. Mgmnt.)

Analyze Business Plan

Analyze Business Plan

Prepare/Amend

C of A or Letter of

Denial

Prepare/Amend

C of A or Letter of

Denial

Analytical Review

Distribute Application

Sections

Distribute Application

Sections

Administrative

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 13

Timeliness: If processing can commence, an “application coordinator” should employ a

spreadsheet, database, TeamMate file, or other mechanism (if the application was not received via

the NAIC electronic UCAA utility) to record the assignment of application review responsibilities

and the progress of the review against the Department or UCAA timelines:

• The Department should have a policy that establishes timing requirements for the review

of applications for primary licensure of new companies and redomestications and Form A

filings. If not, then the following guidelines are acceptable.

• Fourteen days to review an application for completeness.

• The goal is to notify the Applicant Company of supplemental information required from

the Applicant Company within 30 days of applications. However, there may be situations

where supplemental information provided requires clarification or a second review of the

application requires requesting additional information.

• It should be noted, if additional information is needed to complete the review of an

application, the review may also take longer to complete. Once a request for additional

information has been made, the 60-day or 90-day goal is suspended until the requested

information is received.

• Ninety days to process a primary application. Effective January 1, 2012, company licensing

will be part of the accreditation program, Part D of the NAIC Policy Statement on Financial

Regulation Standards, which provides that if a state does not have timing requirements in

statute or regulation, the state will be expected to meet the 90-day goal for accreditation

purposes.

• Sixty days to process all other types of applications.

It is recommended that the state send the company regular correspondence regarding the progress

of the application.

Administrative Filing: This component consists of the review and filing of administrative

documentation, which, while critical to the establishment of the Applicant Company as an

operating business organization, is generally not subject to substantial qualitative analysis. This

includes receipt of filing fees, articles of incorporation and bylaws, statutory deposits, membership

in mandatory associations, consent to service of process, as well as other state-specific

requirements. (See discussion of specific forms in “Best Practices: Application Review” chapter.)

Analytical Review

Analysis of Current Condition: The financial condition and management practices of the

Applicant Company must be ascertained to determine they are of sufficient quality to permit the

applicant to sell insurance products to the citizens of the state.

Except for a primary application, the analysis of the Applicant Company’s current condition

should begin with contact to the domiciliary (and key) state as described in the “Interstate

Communications” chapter. Company licensing analysts should confer with financial analysts in

the domiciliary (and key) state to determine the overall operating condition of the Applicant

Company based on a prioritization system and plan the scope of review activities accordingly.

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 14

Prioritization Framework

The utilization of a prioritization framework is the key to the efficient analysis of an Applicant

Company’s current condition. The Financial Analysis Handbook suggests that domestic insurers

be “prioritized” or ranked according to each insurer’s “relative stability.”

The Financial Analysis Handbook provides general guidance regarding the framework, but leaves

the determination of specific prioritization metrics up to the domiciliary state. Tools currently

available for use in reviewing the financial condition include: Insurance Regulatory Information

System (IRIS) ratios, Analyst Team System results and Financial Analysis Solvency Tools

(FAST). In addition to the financial review, any market conduct information available from the

market analysis chief or collaborative action designee in the state’s market analysis department

should be considered along with data available in the following market analysis tools and systems

that are available on I-SITE: Complaints Database System (CDS), Examination Tracking System

(ETS), Market Analysis Profile (MAP), Market Analysis Review System (MARS), Market

Initiative Tracking System (MITS), Regulatory Information Retrieval System (RIRS), Market

Conduct Annual Statement (MCAS) , Producer Database (PDB), and 1033 State Decision

Repository (SDR)-Data Entry Tool. The analyst should note any unusual items that translate into

financial risks or indicate further review or communication is needed with the insurance

department’s market analysis staff.

Other initiatives have been undertaken to more specifically define a broad-based system of

prioritizing insurers based on operational practices as well as financial condition. During the

development of this Handbook, it was noted that several states have developed such holistic

models. The use of these models is clearly the best practice for determining the current overall

condition of an insurer, and then assigning a prioritization that can be used to determine the

appropriate scope of analytical review for a specific application. However, in each case, the

specifics of the model are considered confidential.

Therefore, for the purpose of this Handbook, a prioritization framework will be discussed, and the

general characteristics of each prioritization category will be described.

Use of Prioritization Framework in Application Review

The use of prioritization in the application review process carries the same risks and benefits

inherent in any prioritization evaluation system. The goal of all such systems are to eschew the

costly practice of reducing risk to zero, and instead to define a level of acceptable risk. The use of

prioritization means that, in some instances, all the documents included with an application will

not be reviewed in detail. However, the risk of not reviewing those documents in detail is mitigated

by a company’s low risk of financial failure and by providing additional time to review the

company’s business plan.

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 15

During the development of this Handbook, almost all company licensing personnel interviewed

indicated that they were able to quickly, even if only informally, identify companies whose

applications were likely to be approved. States that utilized prioritization systems were able to

more formally document those applicants. Through the use of a formal prioritization system,

company licensing analysts can reduce the scope of their review of strong applicants, thus

conserving effort better served in the review of marginal applicants. The following guidance

provides a recommended scope of review for each prioritization category.

Priority 1

Insurers included in Priority 1 are considered troubled and subject to comprehensive annual and

quarterly analysis procedures, detailed considerations outlined with the Troubled Insurance

Company Handbook, and a significantly elevated level of ongoing regulatory monitoring and

oversight. Upon designating an insurer as a Priority 1, the domestic state should follow required

procedures for troubled companies in communicating with other state insurance regulators.

Insurers prioritized at this level would also be considered priority insurers for accreditation

timeliness purposes and should generally be analyzed ahead of Priority 2, Priority 3, and Priority

4 insurers.

Insurers in this group generally are not capable of withstanding even moderate business

fluctuations. There may be significant noncompliance with laws and regulations. Risk-

management practices are generally unacceptable relative to the insurer’s size, complexity and risk

profile. Corporate and group structures or framework may be of a nature that is not conductive to

effective regulation. Close regulatory attention is required, which means formal action is necessary

in most cases to address the problems. Insurers in this group pose a risk to the state guaranty fund.

Failure of the insurer is probable if the problems and weaknesses are not satisfactorily addressed

and resolved. Priority 1 companies should not be considered for expansion.

Priority 2

Insurers in Priority 2 are – high-priority insurers that are not yet considered troubled but may

become so if recent trends or unfavorable metrics are not addressed. High-priority insurers may

also include those subject to heightened monitoring for reasons other than financial solvency risks,

as determined by the department. Insurers prioritized at this level may be subject to full quarterly

analysis procedures and are subject to comprehensive annual analysis and an elevated level of

ongoing regulatory monitoring and oversight. Insurers prioritized at this level would also be

considered priority insurers for accreditation timeliness purposes and should generally be analyzed

ahead of Priority 3 and Priority 4 insurers.

Priority 2 companies are generally not considered good candidates for expansion. However,

senior-level department personnel should contact their counterparts in the domiciliary state to

determine if there is any reason to perform further analysis in consideration of approval of the

application. In certain unique circumstances, based on the line of business offered and the market

conditions in the expansion state, it may be appropriate to pursue licensure under heavily

monitored criteria.

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 16

These insurers, or their holding company groups, have a combination of moderate to severe

weaknesses that may exhibit unsafe and unsound practices or conditions. The insurer is moving

toward meeting criteria indicative that it is operating in a manner that is financially hazardous to

policyholders and/or the public. They have serious financial or managerial deficiencies that result

in unsatisfactory performance and problems are not being satisfactorily addressed or resolved by

the board of directors and management.

Priority 3

Insurers in Priority 3 are considered moderate priority insurers that indicate some need for

additional monitoring. Insurers prioritized at this level should be subject to comprehensive annual

analysis procedures, should generally be analyzed ahead of Priority 4 insurers, and may be subject

to an enhanced level of ongoing regulatory monitoring and oversight.

Priority 3 companies present the greatest challenge to the company licensing analyst. They are

neither an obvious candidate for approval nor for denial, based on their current overall condition.

Insurers in Priority 3 appear fundamentally sound, but may exhibit some degree of regulatory

concern in one or more areas. These insurers and their parent and other members of the holding

company group are relatively stable, could withstand moderate business fluctuations, and are in

substantial compliance with laws and regulations. While the overall, risk-management practices

are satisfactory relative to the insurer’s size, complexity, and risk profile, these companies exhibit

certain notable adverse risk characteristics. There are no current material supervisory concerns

and, as a result, the regulatory response is informal and limited. The risk to policyholders and/or

guaranty funds is currently viewed as remote, however significant factors exist that may result in

financial stress in the longer term.

In this instance the company licensing analyst should re-analyze the financial information provided

with the application in order to better understand the exact nature of the Applicant Company’s

weaknesses. However, it is important that communication between senior-level department

personnel in the domiciliary (and key) state remains active. The domiciliary state can provide

insight into the resolution of adverse financial or market conduct examination findings and the

extent to which the company has remediated the deficiencies. Once the analyst has gained comfort

with his/her knowledge of the Applicant Company’s current operational condition, the business

plan should be diligently reviewed in order to determine whether:

• The Applicant Company has a demonstrated history (e.g., five years) with the lines of business

for which it is applying.

– If the Applicant Company is applying for lines of business for which it has less than five

years of history, the analyst should review the business plan to identify, and/or request

additional information regarding, key managerial personnel responsible for administering

the new lines of business.

• Key personnel have been in place for a sufficient period of time to demonstrate their insurance

management expertise.

• The scope of the expanded operations is not imprudent relative to the financial strength of the

Applicant Company, its parent and other members of the holding company group. If the

expanded operations are in new lines of business, more stringent standards should be applied

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 17

when assessing the potential effect of expanded operations on the condition of the Applicant

Company.

• The domiciliary state noted any operational or compliance deficiencies in lines of business

similar to those planned for the expanded operations.

Priority 4

Priority 4 are lower priority insurers that do not currently indicate a need for additional monitoring.

These insurers should be subject to a basic level of regulatory monitoring and oversight, including

annual analysis.

For these companies, the analysts should consider foregoing an in-depth review of information

relevant to the Applicant Company’s current operating condition (e.g., financial documents

included with public records package or the holding company statements). Rather, the company

licensing analyst should focus on the quality and assumptions of the business plan to determine

whether:

• The Applicant Company has a demonstrated history (e.g., three years) with the lines of

business for which it is applying.

– If the Applicant Company is applying for lines of business for which it has less than three

years of history, the analyst should review the business plan to identify, and/or request

additional information regarding, key managerial personnel responsible for administering

the new lines of business.

• Key personnel have been in place for a sufficient period of time to demonstrate their insurance

management expertise.

• The scope of the expanded operations is not imprudent relative to the financial strength of the

company and its parent and other members of the holding company group.

Analysis of Business Plan

The Applicant Company’s plan for conducting business in new jurisdictions must be evaluated to

determine if the plan is consistent with the Applicant Company’s demonstrated capabilities and

the state’s marketplace. Further guidance for the analysis of business plans is included in the “Best

Practices: Application Review” chapter.

Intradepartmental Communications

In addition to communications with other jurisdictions, it is important that the company licensing

coordinator convey information regarding pending applications to other divisions within the

insurance department. The licensing of a new entity or expansion of authority will impact other

divisions once the new or amended certificate of authority is issued.

Actuarial: This section should understand the business plan filed with an application in order to

adequately monitor any future reserving issues or other actuarial concerns.

Financial Analysis: Once a new or amended certificate of authority has been issued the financial

analysis division of the insurance department will assume monitoring responsibilities. The

NAIC Company Licensing Best Practices Handbook

Best Practices: Conceptual Framework of Processes and Procedures

© 2005–2023 National Association of Insurance Commissioners 18

financial analysis section should understand the business plan filed with an application in order to

monitor future results against that plan.

Market Conduct and/or Analysis (including consumer complaints and enforcement): The Market

Conduct/Analysis section should understand the business plan to anticipate any issues and to

monitor future results against the plan.

Policy Approval: Although policy forms are not a required component of the company license

application, they are one of the most significant indicators of an Applicant Company’s actual

business intentions. The financial analysis section should coordinate with the policy approval

section to monitor policy filings from the newly licensed company to determine that they are

consistent with the filed business plan.

Producer Licensing: Similar to policy approval, the appointment of producers must be consistent

with the scope of the new company’s business plan. The financial analysis section should similarly

coordinate with the producer licensing section to monitor producer appointments by the new

company.

Timeliness of Review

Perhaps no issue surrounding the company licensing process creates greater interest than that of

timeliness. The UCAA website contains suggested guidance for the processing of various types of

applications, including interim timelines. Although regulators should not sacrifice an appropriate

level of review solely in the pursuit of expediency, it is imperative that every effort be made to

adhere to the processing times recommended on the UCAA website when reviewing Priority 4

companies:

• Fourteen days to review an application for completeness.

• The goal is to notify the company of supplemental information required from the applicant

within 30 days of applications. However, there may be situations where supplemental

information provided requires clarification or a second review of the application requires

requesting additional information.

• It should be noted, if additional information is needed to complete the review of an

application, the review may also take longer to complete. Once a request for additional

information has been made, the 60-day or 90-day goal is suspended until the requested

information is received.

• Ninety days to process a primary application.

• Sixty days to process all other types of applications.

• Complexities involved with the review of Priority 2 and Priority 3 companies may

adversely affect a state’s ability to meet these timelines recommendations.

Notwithstanding these complexities, the regulator should make all reasonable efforts to

maintain timely communication with the applicant companies.

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 19

Best Practices: Application Review

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 20

Introduction

In this chapter, recommendations for the review of each type of application are presented. The

recommendations are based on the concepts of prioritization framework and interstate

communications presented in the previous sections of this Handbook.

Within each application type, the review recommendations are presented in the following format:

● Application Type:

− Chart Illustrating the UCAA sections of the application.

− Recommendations for reviewing the “Administrative Filings” sections of an application.

− Recommendations for reviewing the “Analysis of Current Condition” sections of an

application.

Depending on the type of application, there may be subsections based on the risk profile

of the Applicant Company.

− Recommendations for reviewing the “Analysis of Business Plan” sections of an application.

Depending on the type of application, there may be subsections based on the risk profile

of the Applicant Company.

Confidentiality and Safeguarding of Biographical Affidavit Information

The insurance department shall implement a written information security program that includes

administrative, technical, and physical safeguards to protect the security and confidentiality of the

biographical affidavit, fingerprint card (where applicable), independent third-party background

report, and all associated notes, emails or work papers (collectively referred to hereafter as

“documents or records”).

Given: (i) the size and complexity of the insurance department and the nature and scope of its

activities; (ii) the variations in state laws; and (iii) the sensitive and personal information it

maintains, the insurance department is referred to the NAIC Standards for Safeguarding Customer

Information Model Regulation (#673) for further guidance with respect to an information security

program. In addition, the insurance department should be aware that there may be other state-

specific and federal laws and regulations regarding record retention and confidentiality, including

the federal Fair Credit Reporting Act and the Federal Trade Commission regulations.

The following actions and procedures are recommended to the insurance department in

implementing a written information security program.

Administrative Safeguards

• Identify reasonably foreseeable internal or external threats, assess the risk of harm from these

threats, and develop and implement written procedures and policies that will safeguard the

information and minimize the threats.

• Annually assess the sufficiency of current practices and adjust the written program as necessary

to adapt to new threats and technologies.

• Train employees on the policies and procedures developed to safeguard documents or records

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 21

and personal information contained therein. Periodically review the training process and refresh

employees on old and new processes. Provide training and training materials relevant to the

safeguards to employees outside the company licensing division that may handle a public

records request for the documents or records. Educate employees on any state enforcement rules

and/or polices regarding their failure to abide by the training they receive.

• Develop procedures to search for Social Security numbers imbedded in licensure or registration

numbers provided. Licenses or registrations from prior years may have included Social Security

numbers within the number.

• Develop procedures and policies specific to the security of laptops and other portable devices

that may contain personal information from the documents or records.

• Prohibit the sale of personal information, including names and addresses of any affiant for any

purpose.

• Exercise appropriate due diligence in selecting service providers, and require thorough

appropriate confidentiality agreements, that they implement measures to meet the relevant

objectives of the security program.

Technical Safeguards

• Maintain personal information in a secure manner that is appropriate to the size and complexity

of the insurance department and the nature and scope of its activities.

• Transmit documents or records and personal information between the third-party vendor and

insurance department in a secure manner.

Physical Safeguards

• Develop policies and procedures to address retention and destruction of paper and electronic

documents or records.

• Place access controls to the documents or records, whether in paper or electronic form, only to

those individuals that need to know the information contained therein to complete a company’s

review for licensure or to investigate a response to an open records or Freedom of Information

Act (FOIA) request.

• Keep the documents or records out of public view and secure when not being utilized.

• Maintain and secure all electronic and paper documents or records in accordance with state laws

or record retention policies. The insurance department must comply with its written information

security program when responding to the public records request for biographical information

that is outdated or for which the authorization has been revoked by the affiant. In addition, the

Department should include a statement with the documents that notifies the individual

requesting disclosure through a public records request that the information contained therein

may be outdated. (According to the UCAA Instructions, a biographical affidavit is only good

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 22

for 6 months after executed, and an affiant may revoke authorization at any time.)

• Destroy documents or records in a manner that renders the information unreadable and

undecipherable; document and maintain those procedures for secure disposal of Nonpublic

information.

• Develop standards for notifying the affiant and affiant’s employer in the event of a security

breach.

• Store the electronic and hardcopies of these documents or records in a secure manner. (Examples

include storage in a cabinet or room accessible only by individuals that need the information for

permitted purposes.)

For the states that have enacted the NAIC Insurance Data Security Model Law (#668)

refer to the guidance provided in the Financial Examiners Handbook.

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 23

Primary Application

A Primary Application is to be used for domestic insurers. See Appendix A for the Primary

Application Review Checklist.

The classification of the application instruction items is illustrated in the following chart:

Application Instruction Items

Administrative

Filing

Analysis of

Current

Condition

Analysis of

Business Plan

1. Application Form and Attachments

Ξ

2. Filing Fee

Ξ

3. Minimum Capital and Surplus Requirements

Ξ

4. Statutory Deposit Requirements

Ξ

5. Name Approval

Ξ

6. Plan of Operation

Ξ

7. Holding Company Act Filings

Ξ

8. Statutory Memberships

Ξ

9. SEC Filings or Consolidated GAAP Financial

Statement

Ξ

10. Debt-to-Equity Ratio Statement

Ξ

11. Custody Agreements

Ξ

12. Public Records Package

Ξ

13. NAIC Biographical Affidavits

Ξ

Administrative Filing

Application Instruction Items

Item 1. Application Form and Attachments

• Form 1P “Checklist” – The coordinator should review the checklist for completeness and

that all described documents are included in the application.

• Form 2P “Primary Application” – The coordinator should review the form for

completeness.

• Form 3 “Lines of Insurance” – Only the applied for lines will be required for a newly

formed company. The entire Form 3 will be required for a redomestication.

Item 2. Filing Fee

• Review check submitted in payment of fees for correct amount. In some instances, the

check may be held by another section of the insurance department. In that case, review the

description of the check received.

• Forward check for deposit or provide information for proper processing of check.

• Filing fees range from $0 to in excess of $5,000 and are generally retaliatory.

Item 4. Statutory Deposit Requirements

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 24

• Form 7 “Certificate of Deposit” – The coordinator should review the form and compare

the amount of the deposit to the state’s requirement.

• These funds are deposited with the commissioner, generally through a safekeeping or trust

receipt, to be held for the benefit and protection of, and as security for, all policyholders

and, in some instances, creditors of the insurer making the deposit. Additional deposits are

generally required of those insurers applying to write lines of business not covered under

state insurance guaranty funds (e.g., guaranty, fidelity, surety, and bond business) or

otherwise (e.g., workers’ compensation). The ultimate purpose of these funds is to ensure

that liquid assets are unencumbered and available for use by the commissioner, or his/her

designee, for the administration of the insurer’s estate should it become insolvent.

Item 5. Name Approval

• The coordinator should determine that a name approval request consistent with the state’s

requirements has been filed. If state requirements dictate, the request should be forwarded

to the appropriate area for processing.

• Typically, state insurance departments incorporate insurers, but some states require the

involvement of the secretary of state or the attorney general. Names are submitted for

preapproval because the public has the right to know with whom it is dealing and, therefore,

someone must determine that the name is not so similar to another as to be likely to deceive

or mislead. The name should be such as to show that the company is engaged in the

insurance business and preferably to show the type of business. Some states provide for

publication and subsequent hearing to ensure that any objections are addressed.

Item 8. Statutory Memberships

• The coordinator should compare the application to the state requirements for statutory

memberships and determine that appropriate documentation supporting the membership

application is included.

• Some states require a positive application and confirmation regarding membership in state-

mandated risk pools or other organizations. In other words, an insurer may not

automatically be a member by virtue of its certificate of authority, but may be required to

join outside the jurisdiction of the insurance department.

Item 12. Public Records Package

• The coordinator should compare the contents of the public records package with state

requirements. Financial documents should be forwarded to the areas expected to utilize the

documents. Operational documents (other than the application form) should be filed as

required.

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 25

Analysis of Current Condition

Note: Generally, the scope of the analysis of current condition would depend on the prioritization

of the Applicant Company. With a primary application (not a redomestication):

i. If it is a stand-alone company, there is no information upon which to establish a

prioritization and the use of that technique is inapplicable.

ii. However, if the Applicant Company is part of a holding company structure, the reviewer

may want to consider the strengths, structure, ratings, etc. of the holding company.

Application Instruction Items

Item 3. Minimum Capital and Surplus Requirements

• This document should make it clear that the Applicant Company understands state law with

respect to the amount of capital and surplus that must be maintained at a minimum. In some

states, the minimum capital and surplus requirements are determined by the classes of

insurance that the applicant is requesting authority to transact and the classes of insurance

the applicant is authorized to transact in all other jurisdictions. The analyst should

determine the level of surplus required after considering the Applicant Company’s plan of

operation. Compliance with the statutorily prescribed minimum surplus requirement may

not be sufficient for all applicants.

Item 7. Holding Company Act Filings

If the Applicant Company is a member of a holding company system, the application must

include either the most recent Holding Company Act (HCA) filings, including the annual

Form B registration statement and related Form F, or a statement substantially similar to

the Insurance Holding Company System Regulatory Act (#440). Holding Company Act

filing information should be considered to determine the role of the Applicant Company

within the holding company structure, enterprise risk, the financial capacity of the parent

to support an insurance operation and the existence of relevant insurance operations

experience in the proposed parent or affiliates. Affiliates are identified along with a

description of any transactions between the insurer and an affiliate currently outstanding

or during the last calendar year. Copies of all advisory, management and service

agreements and other attachments need be reviewed for fair and equitable terms. Refer to

the Form A Review Best Practices located under Appendix D.

• The applicant state should bear in mind that Holding Company Act filings, including the

Holding Company Form F, are highly confidential, but that state laws providing

confidentiality protections may vary from those of the applicant state. A state that has not

enacted language specified under HCA Item 8 in its entirety will not have the same

confidentiality protections afforded in a state where the language has been enacted. State

confidentiality statutes applicable to HCA filings should be reviewed by Regulators of each

state before any information is exchanged and where an apparent inconsistency is noted,

the state’s legal division should be contacted. Regulators should treat all such materials

with the highest level of protections afforded by any relevant state, in order to preserve the

confidentiality of such materials and to encourage candor and openness in company

discussions and disclosures.

Item 9. SEC Filings or Consolidated GAAP Financial Statement

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 26

• If the Applicant Company, its parent or its ultimate holding company has made a filing or

registration with the U.S. Securities and Exchange Commission (SEC) in connection with

a public offering within the past three years, or filed an 8K, 10K or 10Q within the past 12

months, the filing, including any supplements or amendments, is available electronically

from the SEC. If the applicant, its parent or its ultimate holding company is not publicly

traded, the application must include a copy of the Applicant Company’s most recent

consolidated generally accepted accounting principles (GAAP) financial statement.

• Similar to the Holding Company Act filings, these filings will provide insight into the

financial capacity of the parent to support an insurance operation and the existence of

relevant insurance operations experience in the proposed parent or affiliates, as well as

information regarding control, enterprise risk, and corporate governance.

Item 10. Debt-to-Equity Ratio Statement

• The debt-to-equity ratio statement should be reviewed to determine the debt service burden

that is likely to be placed upon the Applicant Company. Debt service should only be

provided through earnings not needed by the insurer to service its own operations.

Item 13. NAIC Biographical Affidavits

• These documents are used to perform a background check (if required by the state) to

evaluate the suitability, competency, character and integrity of those persons ultimately

responsible for the operations of the insurer. Persons to be reviewed are the controlling

owners, officers, directors and key managerial personnel with the ultimate authority over

the financial and operational decisions of the insurer, such as the chief executive officer

(CEO), chief operating officer (COO), chief financial officer (CFO), secretary, chief

marketing officer and treasurer.

• Independent third-party background reports are used to identify discrepancies in the

biographical affidavit and evaluate the suitability of the controlling owners, officers,

directors or key managerial personnel of the Applicant Company and competency to

perform the responsibilities of the position held with the company. Issues regarding

competency, character and integrity may be self-evident from the information provided in

the affidavit or may be determined from the related background review or criminal

background check.

o Regulators will review the biographical affidavit for completeness – each question

should have a response. The affiant must use the most current form available and

posted on the UCAA website. Insufficient affidavits or affidavits where signature

dates are more than six months from the application submit date should not be

accepted.

o Regulators will review the comparison of information provided on the biographical

affidavit and the results of the independent third-party background reports.

o Regulators will note any discrepancies found in the independent third-party

background reports and follow up with the Applicant Company.

o Any key concerns will be addressed with the Applicant Company.

Fingerprint data, if available, can be used to validate the identity of personnel and check for

criminal background. Information in the biographical affidavit can then be utilized to verify

employment and educational background.

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 27

Analysis of Business Plan

Note: Generally, the scope of the analysis of current condition would depend on the prioritization

of the Applicant Company. With a primary application (not a redomestication):

i. If it is a stand-alone company, there is no information upon which to establish a

prioritization and the use of that technique is inapplicable.

ii. However, if the Applicant Company is part of a holding company structure, the reviewer

may want to consider the strengths, structure, ratings, etc. of the holding company.

Application Instruction Items

Item 6. Plan of Operation

• Business plans are written descriptions of expected market conditions, company operations,

and related forecasted financial results. The plan of operation section of the UCAA refers to

three components: a brief narrative, proforma financial statements/projections and a

completed questionnaire (Form 8).

• Overly rapid growth in premium volume, inappropriate pricing, inappropriate underwriting,

and product mix are important areas of concern when reviewing a business plan.

• The pricing of insurance products is a difficult task. The premium is established based on

estimates of a number of unknown future events. The effects of a failure to accurately

estimate the cost of those events or to provide a sufficient margin for adverse deviation

from the estimate may not be apparent for a long time. The types of business written by an

insurer affect the ability of the insurer to estimate future costs. Certain lines of business

are, by their nature, more volatile than others in claim cost experience. Also, the long-tail

nature of some lines of business increases the level of uncertainty in estimating future costs.

Setting premium rates solely on the basis of rates charged by competitors, without

consideration for possible differences in the quality of the business that the insurer and its

competitors are writing, should be a concern. The description of pricing should indicate the

coordination between the Applicant Company’s actuarial and underwriting and marketing

departments.

• The proforma financials should be reviewed for consistency with the stated business plan

and reasonableness with respect to assumptions. Projections should be based upon well-

described and defensible assumptions that are attainable under the circumstances described

in the business plan. The department should consider a review of the business plan and

proforma financials by department actuaries and/or other experts.

• The insurance department should consider obtaining a pledge from the Applicant Company

to notify the insurance department if any deviations from the filed plan of operation are

initiated by the Applicant Company within three years of admission.

NAIC Company Licensing Best Practices Handbook

Best Practices: Application Review

© 2005–2023 National Association of Insurance Commissioners 28

Best Practices – Review of Plan of Operations (Proforma Financial Statements, Narrative/

Business Plan and Questionnaire)

The depth of the review will depend on the complexity and financial strength as well as known

risks of the insurer(s). Therefore, the analyst may consider a tailored set of procedures that

addresses the specific risks of the insurer(s). The following best practices are presented as a guide

for regulatory review and analysis of the plan of operations and financial projections related to

UCAA primary and expansion applications, recognizing that this is not an all-inclusive list and not

all items on this list will apply to each and every application. This list is intended to be a regulatory

tool only. The analyst may find it useful to utilize the Financial Analysis Handbook in conjunction

to this checklist during their financial review.

1. Background Analysis

• Request the Applicant Company’s Insurer Profile Summary (IPS) from the lead

state. Upon receipt and review of the IPS, document your findings related to the

following:

• State’s Priority Designation

• Scoring System Result

• IRIS Ratio Result

• Analyst Team System Validation Level

• RBC Ratio

• Trend Test

• Review any material issues or concerns of prospective risks noted in the IPS

• Review the Applicant Company’s most recent Annual Financial Statement,

General Interrogatories, Part 1:

o #5.1 and #5.2 in order to ascertain if the insurer has been a party to a

merger or consolidation; and #6.1 and #6.2 in order to ascertain if the

insurer had any certificate of authority, licenses or registrations suspended

or revoked by any governmental entity during the reporting period

• Review the most recent report from a credit rating provider in order to ascertain

the current financial strength and credit rating of the insurer

• Document assessment.

2. Management Assessment

• Review the entity’s biographical affidavits and third-party verifications

• Note any areas of concern that would indicate further review is necessary. In

conducting such review, also consider whether officers, directors and trustees are