Year-End Training

1

Presented by

Department of Finance

Updated 9/21/2020

Presented by

Department of Finance

June 2023

2

Course Objective ………….……………………………………...…………3

Overview of Year-End in FI$Cal ……………………………………………4

Year-End Preparation Activities ……………………………………………6

Monthly Reconciliations and Reports - Period 12 ……………………..22

Year-End Work Plan and FI$Cal Timeline of Activities…………………29

Year-End Adjusting Entries Overview……………………………………..33

Year-End Adjusting Entries ………………………………………………....41

Other Year-End Adjusting Entries …………………………………………73

Period 998 Allocation Process ………...…………………………………..81

Preliminary period 998 Reconciliations and Reports ………………….83

Year-End Plan of Financial Adjustment Reclassification ……………..87

Budgetary Legal Ledger and Department Adjustment Ledger.……93

Final Reconciliations and Online MEC Status..…..…………………….101

Importance of Meeting the Month-End and Year-End Deadlines...109

New Year Reminders ……………………………………………………….117

Course Objective

To obtain the knowledge and skills necessary to

understand what is required to plan, prepare, and

complete accrual entries for year-end.

3

Overview of Year-End in

FI$Cal

4

4

5

The Budgetary Legal ledger

(BUDLEGAL/BLL) is the source of

financial information for the

Budgetary/Legal Year-End Financial

Reports.

It consists of cash basis,

encumbrances, and accrual

transactions.

Budgetary Legal Ledger - Overview

6

Year-End Preparation Activities

6

7

Activities that must be done before closing submodules

Review encumbrances

Liquidate encumbrances in reverting appropriations

Review aging Accounts Receivable

Reclassify Accounts Receivable in reverting appropriations

Certain accounts require a fund and BU affiliate or Alt Account. Review Report

No. 7, Subsidiaries on File, to validate

Accounts that require a fund/BU affiliate must identify the other fund

involved in an inter-fund and intra-fund transaction.

Accounts that require an Alt Account must identify the related AR.

Complete transactions

Refer to Finance Month-End Training - Session I “Pre-Closing Activities” training

segment, for additional activities

Activities that must be done after closing submodules

Ensure Clearing Account has zero balance for all ENYs

Review Trial Balance Report to identify abnormal General Ledger (GL)

account balances and resolve

Verify on the Trial Balance Report the cash account is correct for the fund

category:

Shared fund - Account 6590000

Non-shared or Enterprise fund – Account 1108000

Review GL/KK report to identify mismatches between ledgers and resolve

When creating a FI$Cal Service Center ticket to correct the subsystem

suspense journal, verify that SCO checked the ‘Bypass Budget’ box on the

Journal suspense correction tab. If not, the journal entry will create a GL-KK

mismatch

Complete reconciliations and resolve reconciling items

Refer to Finance Month-End Training - Session I “Closing Activities” training

segment, for additional activities

8

Cut-off Dates in FI$Cal

9

Accounts Receivable (AR) Deposits and Payments Cut-Off Dates

Deposits must be entered by Friday, June 30, 2:30 p.m.

AR Payments requiring SCO manual review must be submitted for approval by Monday,

June 26, 12:00 p.m.

AR Payments that meet pre-approval rules must be submitted by Friday, June 30, 12:00

p.m.

Note: Any AR Payments that miss these cutoffs will have to be updated to FY 2023-24

accounting date and resubmitted starting July 1.

Accounts Receivable Corrections Cut-Off Dates

AR corrections must be submitted to SCO SARD by Wednesday, June 7, 5:00 p.m.

For AR corrections that miss the above cutoff date (including those submitted on time

but subsequently denied), departments will need to submit a paper Transaction Request

form (CA 504) to SCO SARD to be received by Thursday, June 15.

* Refer to FI$Cal CMO e-mail “For your Information – Year-End Deadlines” dated 5/5/2023.

Cut-off Dates in FI$Cal

10

Voucher Cut-Off (AP Module)

All FI$Cal vouchers must be approved and submitted to SCO by Thursday, June 15, and

must reflect a payment date of June 30, or earlier to ensure processing by June 30.

FI$Cal voucher payments for reverting appropriations not submitted to SCO by Thursday,

June 15 at 5:00 p.m. may not be approved by SCO by the Friday, June 30 deadline.

GL Journals and Journal Voucher Cut-Off (excluding ORF Replenishment Journal Voucher).

Departments must submit their journals to SCO SARD by Wednesday, June 7, 5:00 p.m.

For journals that miss the above cutoff date (including those submitted on time but

subsequently denied), departments will need to submit a paper Transaction Request

form (CA 504) to SCO SARD to be received by Thursday, June 15, 5:00 p.m.

* Refer to FI$Cal CMO e-mail “For your Information – Year-End Deadlines” dated 5/5/2023.

Voucher Cut-Off (AP Module)

Voucher Processing Schedule for June

By 5:00 p.m. Thursday, June 15, vouchers must be received by SCO Audits for approval for

payments that need to be issued by June 30.

11

* Refer to FI$Cal CMO e-mail “For your Information – Year-End Deadlines” dated 5/5/2023.

Voucher Processing Schedule for June

After 5:00 p.m., Thursday, June 15, through 5:00 p.m., Thursday, June 22, departments may

continue to submit FI$Cal vouchers to SCO Audits for approval, except for reverting

appropriations.

All vouchers approved by Department AP Approver II on or before 5:00 p.m. on Thursday, June

22, will be approved by SCO Audits by Friday, June 30.

12

Voucher Cut-Off (AP Module)

* Refer to FI$Cal CMO e-mail “For your Information – Year-End Deadlines” dated 5/5/2023.

Voucher Processing Schedule for June

After 5:00 p.m., Thursday, June 22 through Friday, June 30, departments may create new vouchers in FI$Cal,

except for reverting appropriations. Since SCO may not approve vouchers during this period, the accounts

payable will not be in the modified accrual ledger. Departments must reconcile the differences between

the ledgers for year-end. The year-end Budgetary Legal Ledger (BLL) process will include the payables in the

BLL.

For vouchers that are not approved by SCO Audits by Friday, June 30, 2023, and do not need to be

recognized as accounts payable for year-end reporting:

Voucher maybe denied by SCO Audits.

Departments should monitor voucher status to determine if vouchers require additional action by

departments.

13

Voucher Cut-Off (AP Module)

Reverting Year Appropriations

14

Appropriations with a 6/30/2023 reversion date must have a zero balance.

Plan of Financial Adjustment requests must be received by Thursday, June 15, to

allocate all charges in the clearing account.

All voucher payments for June must be charged directly to the ultimate funding

source(s).

Abatements must be credited directly to the ultimate funding source(s) and not to the

clearing account.

Reverting year Encumbrances are liquidated, closed, and budget checked in the Purchase

Orders (PO) submodule

Before period 12 PO submodule is closed, verify all POs for reverting year

appropriations are closed (FISCal.243 and FISCal.437).

Information based on the SCO memorandum “Year-End Procedures for Fiscal Year 2021-22,” dated 4/20/2023,

and CMO email “For your Information - Year End Deadlines,” dated 5/5/2023.

15

Verify reverting year Accounts Receivable (AR) are reclassified to AR – Other and Provision for

Deferred Receivables, before the period 12 AR submodule is closed:

All outstanding ARs in reverting appropriations have been reclassified. Year-End

Adjusting Entry A-4 (Abatement/Reimbursement)

All prior year AR Revenues have been reclassified. Year-End Adjusting Entry A-9

(Revenue)

Refer to Updated Auto AR Reclass Phase III - Job Tool located in FI$Cal Service Now for

instructions

Review Encumbrances

16

Departments must review encumbrance balances per State Administrative Manual (SAM)

Sections 8340 and 10608

Complete Encumbrance Reconciliation

Ensure all open FY2022-23 Purchase Orders (PO) are dispatched, and budget checked

Ensure the Accounting Date for PO is by June 30

Analyze PO encumbrances, expenditures, and outstanding balances (FISCal.243 and

FISCal.437)

Validate Encumbrance balances to the Final Budget Report

Use the following query and report to review encumbrance balances at month-end

and year-end

DFQ_PO_10_ENCUMBRANCE_DTL

Final Budget Report (Report No. 6)

Refer to Finance Month-End Training - Session I, “Encumbrance/Accounts Payable (AP)

Reconciliation” training segment for more information.

17

Allocate clearing account activity to the ultimate funding source by

Allocations

Labor Distribution

Manual GL journal entry*

Research and correct amounts remaining in the Clearing Account

Ensure all Clearing Accounts (Program 9999) expense and encumbrance have zero balances

in FI$Cal

Consider posting reverting year Clearing Account expenditures directly to the ultimate fund.

* If expenditures are not set up for distribution through the allocations process, departments must

manually allocate these costs to the ultimate funding source(s) in the GL module. This can be

done using SCO Transaction Type CARE and Source 11N.

Clearing Account – Commitment Control

18

Note: After allocation, Program 9999 expense and encumbrance must be zero.

19

Review Trial Balance Report (BUDLEGAL) to identify and resolve abnormal GL account balances.

FI$Cal Navigation: Main Menu > FI$Cal Processes > FI$Cal Report > GL Reports > Trial Balance

Reports

If further research is needed:

Review Ledger Activity Report – Allows user to specify selection criteria to view ledger detail and

summary information with drill down capability.

FI$Cal Navigation: Main Menu > General Ledger > General Reports > Ledger Activity

Queries – Results produced by queries may be too large or take too long to generate. It may

require the query to be scheduled for large data.

FI$Cal Navigation: Main Menu > Reporting Tools > Query > Schedule Query

DFQ_GL_01_JOURNAL_DETAIL

DFQ_AP_02_VOUCHERS_LISTING

DFQ_AR_01_PENDING_ITEM_BY_DTL

Refer to MEC Training Session I for details on General Ledger-Trial Balance Reports.

General Ledger – Commitment Control

Mismatch - Report

21

Job Aid FISCal.425 provides instructions on identification and resolution.

General Ledger (GL) – Commitment Control Ledgers (KK) mismatches are the balance differences between

GL and KK. The variance is typically caused by subsystem transactions/GL Journals that are not successfully

posted in GL or KK.

FI$Cal Navigation: Main Menu > FI$Cal Processes > FI$Cal Reports > GL Reports > GL-KK Mismatch Report

Account Type -

Expense or Revenue

Monthly Reconciliations

and Reports - Period 12

22

22

23

SAM Sections 7921-7924 provide some common reconciliations. All reconciliations will be

prepared monthly within 30 days of the preceding month, except for property reconciliations.

Bank Reconciliation (See MEC Session I)

Revolving Fund Reconciliation (See MEC Session I)

SCO/Agency Fund Reconciliation (See MEC Session II)

Appropriation – Program/ENY/Category/Ref/Fund

Cash in State Treasury Account Reconciliation (See MEC Session I)

Deposit in Surplus Money Investment Fund Reconciliation

Property Reconciliation (See SAM Section 7924)

Other reconciliations – each department is responsible for completing any reconciliation

necessary to safeguard the state's assets and ensure reliable financial data (SAM Section

7901).

All reconciliations should be complete and current prior to posting June 30 year-end

activities.

24

25

26

Statement of Revenue, Report No. 4

Current Year revenue should be positive on the report

Final Budget Report, Report No. 6

Review for overspent appropriation or unappropriated cost

Reverted appropriation encumbrance must be zero

Reverted appropriation “Balance” should equal the SCO JE# RV XXXX

Pre-Closing Trial Balance, Report No. 7*

Abnormal account balance

Use of incorrect account/fund

Subsidiaries on File, Report No. 7*

Verify the four-digit subsidiary business unit (Affiliate) and four-digit fund number (Fund Affiliate) reflect the general account used

to identify the other fund involved in an inter-fund and intra-fund transaction.

Statement of Changes in Capital Assets, Report No. 18

Review the Departmental Adjustment Ledger for correct asset balances

Trial Balance Report*

Verify beginning balance equals the prior year’s Trial Balance account ending balance

Verify on the Trial Balance Report the cash account is correct for the fund category:

Shared Fund - Account 6590000

Non-Share or Enterprise Fund – Account 1108000

* Starting July 2022, departments will use ledger BUDLEGAL.

Tips for Successful Year-End

Establish the cut-off date for processing reverting year items through Clearing Account and

which fund(s) will be the ultimate funding source.

Complete and review all reconciliations (SAM Chapter 7900).

Review period 12 Trial Balance and resolve abnormal balances.

Confirm the department's Due To/Due From balances match with the other BU/Fund involved

in inter-fund and intra-fund transactions.

Review encumbrances and receipts to determine if items will need to be adjusted or

reclassified prior to period 998.

Communicate departmental submission deadlines for travel along with directions as to what

to do after the deadline.

Meet with the departmental Human Resources office to determine if there will be a payroll

accrual.

Review the SCO Year-End Procedure memo, BAC#22-001, for SCO’s deadlines.

Review FI$Cal CMO email, dated 5/5/2023, "For Your Information - Year-End Deadlines" for

year-end system deadlines.

27

Tips for Successful Year-End

Create and implement Year-End Work Plan (See slide 31 for examples).

Regularly meet with staff to discuss Work Plan and roles and responsibilities and to

communicate progress.

Review vacation schedule to ensure staff availability for year-end processes.

Review interagency electronic transfers and invoices that are posted in the new fiscal year for

the closing fiscal year. These items will need to be accrued.

Document Journal ID numbers on all source materials and retain for audit purposes.

Ensure adjustments are posted in the correct accounting period.

Note: Work plans and reconciliations may be subject to review by the Department of Finance,

State Controllers Office and the California State Auditor. Upon request, departments must

provide a copy of their year-end work plan to Finance.

28

Year-End Work Plan

and

FI$Cal Timeline of Activities

29

29

Year-End Work Plan

30

Begins as early as March through the completion of year-end close.

Is customized based on specific needs, activities, and business processes

developed by the department coordinator.

Must identify specific MEC/YEC activities, due dates and unit/person

responsibilities, date completed, and a section for comments. The activities

are required to meet the year-end financial report due dates.

Is an essential tool in planning, monitoring, and documenting financial

activities to ensure the timely completion of monthly reconciliations and

year-end financial reports.

Finance’s website provides a work plan

example.

Example: Year-End Work Plan

31

Most lines have been hidden for training purposes. This tool will be helpful to have a successful year-end.

32

Run labor distribution, close submodules, run allocation process, close period 12, and

reconcile

Run the automated BLL Cash Reclassification Application Engine to generate and post

monthly cash reclassification entries.

The net amount of Accounts 6510000/6520000 is reclassified directly to Account 1108000 for

non-shared funds, 6590000 for shared funds, and 1120100, if applicable.

Open period 998, post accruals, run allocation process, and post Plan of Financial Adjustment

Reclassification

Perform preliminary reconciliation, close period 998 and request to build Budgetary Legal

Ledger (BLL)

AP Encumbrance reclass from Account 2000300 to Liability accounts. Account 2000300 must

be $0 at year-end.

Post encumbrance reclassification to DEPTADJ ledger only

Close BLL

Complete all BLL final reconciliations

Request FSC to run the YEC process

Prepare financial reports

Job Aid FISCal.258 Running the Year-End Close Process

Year-End Adjusting Entries

Overview

33

Unless otherwise stated, FI$Cal Year-End Adjusting Journal Entries are posted in the GL Module in

Period 998 – Adjusting Period using:

Direct entry into FI$Cal – for single or simple transactions.

Job Aid FISCal.188 – Create a New Journal Entry

Or the Spreadsheet Journal Upload – for multiple transactions.

Job Aid FISCal.001 – General Ledger Spreadsheet Journal Upload

35

*System defaults blank Source, Non-Adjusting Entry, and current period. Changing Non-Adjusting Entry to

Adjusting Entry will change the period to 998.

Header Criteria

Sample of Posting Adjusting Journal Entries

36

Journal Entry Auto-Reversal Functionality

The auto-reversal functionality also assists departments with reconciliations since the reversal

and original journal entries share the same journal ID.

This functionality cannot be used for journals entered with Source ECM.

37

Departments can use the journal entry auto-reversal functionality for reversing year-end

accrual entries in the new year.

Note: Departments still have the option to manually reverse accruals in period 1.

06/30/20XX

Year-End Adjusting Entry Sources

38

ACC – For standard year-end accrual entries and only if the entries will be reversed in

the new year.

ACJ – For year-end related accrual entries that will not be reversed in the New Year.

ENR – To accrue reimbursement receivables associated with encumbrances.

ECM – To set up encumbrance-only journals.

*********************************************************

ACX – For non-year-end related entries during periods 1-998 that may not need to be

reversed. It should not be used for any transactions involving cash movement

between funds and appropriations.

Tips for Tracking Adjusting Journal Entries

39

Consistent Naming Convention

• Using consistent naming conventions can help users to quickly identify and tie a

transaction with its purpose.

Entry Log

• An entry log can be used for research, to keep staff informed, and is easily customizable.

• Sample:

Note: DFQ_GL_01_JOURNAL_DETAIL can also be downloaded in Excel and sorted for research purposes.

Additional Resources

Year-End eLearning Courses – Finance FI$Cal Training webpage:

https://dof.ca.gov/accounting/fiscal-resources-for-accounting/

Job Aid FISCal.001 – General Ledger Spreadsheet Journal Upload

SCO memorandum – Year-End Procedures for Fiscal Year 2022-23

FI$Cal CMO e-mail – “For Your Information – Year-End Deadlines” dated 5/5/23

40

Year-End Adjusting

Entries

41

41

Year-End Adjusting Entries

The standard adjusting entries required at year-end are illustrated in SAM Sections 10600-10615. They are

designated as A-1 through A-13 entries, and include:

YE – A-1 Record Undeposited Receipts

YE – A-2 Adjust ORF and Cash

YE – A-3 Accrue Reimbursements and Abatements

YE – A-4 Manually Reclassify AR Abatements and Reimbursements for Reverted Appropriations

YE – A-6 Record Receivables Due from SMIF and Condemnation Deposits

YE – A-8 Accrue Accounts Payable (With and Without Open Purchase Orders)

YE – A-9 Accrue Revenue

YE – A-10 Adjustment for Dishonored Checks

YE – A-12 Establish Reserve for Deferred Receivables

Other Year-End Adjusting Entries

42

A-1 Record Undeposited Receipts

43

The A-1 entry is made to record receipts not deposited as of June 30 to recognize the actual amount

of Cash on Hand in the agency/department’s ultimate fund.

The A-1 entry will be posted to the ultimate fund(s) in period 998 within the GL module.

A-1 entries are reversed in the new fiscal year.

To Record Undeposited Receipts

Debit 1100000 Cash on Hand

Credit 12XXXXX Accounts Receivable

Credit 205XXXX Revenue/Reimbursements Received in Advance

Credit 2090110 Uncleared Collections – State Fund

Credit 41XXXXX Revenue

Credit 48XXXXX Reimbursements

Credit 5XXXXXX Appropriation Expenditures

The A-2 entry adjusts the Revolving Fund Cash account so that department accounts will show the actual amount of

Revolving Fund Cash as of June 30 in the department’s advancing fund. In FI$Cal, Revolving Fund activities are

recorded in the department’s CTS Fund. At year-end, adjusting entries are made in the advancing fund to record

the following:

Revolving Fund Cash balance and activities

Record the A-2 entries in period 998 within the GL module.

A-2 Adjust Revolving Fund Cash

44

To Record Year-End Expense Advances

Debit 1301100 Expense Advances

Credit 1101200 Revolving Fund Cash

amount of any unreimbursed ORF advances that are

accrued as expenditures via the A-8 entryr the

amount of any unreimbursed ORF advances that

are accrued as expenditures via the A-8 entry

To Record Cash on Hand

Debit 1100000 Cash on Hand

Credit 1101200 Revolving Fund Cash

for the amount of any unreimbursed ORF advances

that are accrued as expenditures via the A-8

entry

To Record Year-End Revolving Fund Cash

Debit 1101200 Revolving Fund Cash

Credit 1222100 Advances to Agency & Office Revolving Funds

This entry is not reversed in the new fiscal year

These entries are reversed in the new fiscal year.

To record amount of any unreimbursed Revolving Fund advances that are accrued as

expenditures via the A-8 entry

Debit 2000100 Accrued Payables

Credit 1101200 Revolving Fund Cash

A-2 Adjust Revolving Fund Cash

45

* Refer to “Accrue Unremitted Deposits” on slide 75 for posting Uncleared Collections to the Ultimate Funds.

Report ID:

ZGL111

FI$Cal

Page No: 1

DEPARTMENT OF FINANCE Trial Balance Report by Period

Business Unit

: 8860 As Of:

6/30/20XX

Ledger:

BUDLEGAL

Fiscal Year:

20XX

Period From:

12

To Period:

12

Fund Range:

000000244 to 000000244

Fund:

244 General Checking/Rev Fund

SubFund:

244

ACCOUNT ACCOUNT_TITLE BEGINNING BALANCE DEBITS CREDITS ENDING BALANCE

1100000

Cash on Hand

100.00

0.00

0.00

100.00

*1101000

General Cash - CTS Accounts

1,475.00

4,484.00

4,484.00

1,475.00

1101200

Revolving Fund Cash

185,647.24

21,984.71

12,383.50

195,248.45

1109200

Pending Cash Transfers - AP

0.00

24,615.96

24,615.96

0.00

1109300

Pending Cash Transfers - AR

0.00

451.31

451.31

0.00

1200375

AR - CalATERS Adv Repl in Proc

0.00

0.00

0.00

0.00

1200900

Refunds Clearing

0.00

0.00

0.00

0.00

1200910

NSF Receipts Clearing

0.00

0.00

0.00

0.00

1240000

Due From Other Funds

0.00

0.00

0.00

0.00

1301100

Expense Advances

12,093.00

10,763.50

19,406.50

3,450.00

1301200

Travel Advances

375.00

1,800.00

1,607.18

567.82

1301300

Salary Advances

1,784.76

1,151.03

2,302.06

633.73

2000000

Accounts Payable - Control

0.00

19,319.18

19,319.18

0.00

2010000

Due to Other Funds

(200,000.00)

0.00

0.00

(200,000.00)

2021000

Due to Local Governments

0.00

630.00

630.00

0.00

2024000

Due to Other Govt Entities

0.00

0.00

0.00

0.00

*2090050

Unapplied Receipts

(1,385.00)

2,000.00

2,000.00

(1,385.00)

*2090100

Uncleared Collections-CTS Fund

(90.00)

3,284.00

3,284.00

(90.00)

Total Fund:

244

0.00

90,483.69

90,483.69

0.00

Total:

90,483.69

90,483.69

A-2 Adjust Revolving Fund Cash

46

A-2 Adjust Revolving Fund Cash

47

Year-End Revolving Fund Reconciliation and Adjusting Entries (A-2)

Entry # Unit Ledger Approp Ref Fund ENY Account Amount Budget Date Journal Line Description

1

8860

MODACCRL 001 0001 20XX 1301100

1,201.55

6/30/20XX

Expense Advances

8860

MODACCRL 001 0001 20XX 1101200 (1,201.55)

6/30/20XX

Revolving Fund Cash

2

8860

MODACCRL 001 0001 20XX 2000100

3,450.00

6/30/20XX

Accrued Payables

8860

MODACCRL 001 0001 20XX 1101200 (3,450.00)

6/30/20XX

Revolving Fund Cash

3

8860

MODACCRL 001 0001 20XX 1100000

100.00

6/30/20XX

Cash on Hand

8860

MODACCRL 001 0001 20XX 1101200 (100.00)

6/30/20XX

Revolving Fund Cash

4*

8860

MODACCRL 001 0001 20XX 1101200

200,000.00

6/30/20XX

Revolving Fund Cash

8860

MODACCRL 001 0001 20XX 1222100 (200,000.00)

6/30/20XX

Adv to Agency & Off Rev Funds

*DO NOT Reverse on July 1

1. Record year-end expense advances

2. Reduce AP by amounts previously paid by Revolving Fund

3. Record Cash on Hand

4. Record year-end Revolving Fund Cash

Journal entry 4 must use source ACJ

Journal entries 1-3 must use source ACC

A-2 Adjust Revolving Fund Cash

New Year Revolving Fund Entry

48

Unit Ledger Approp Ref Fund ENY Account Amount Budget Date Journal Line Description

8860

MODACCRL

001 0001 20XX 1222100 200,000.00 07/XX/20XX

Adv to Agency & Off Rev Funds

8860

MODACCRL

001 0001 20XX 1101200

(200,000.00)

07/XX/20XX

Revolving Fund Cash

The GL Journal Processor will also record the following entry as part of the A-2 entries to

record New Year Revolving Fund Cash in the Advancing Fund to match SCO JE#

RF0000XX.

The journal date will be 07/XX/XX of the new fiscal year. Enter as SCO Type Transaction

RECL, Source REC, Non-Adjusting Entry, and period 1. The ENY in the journal lines will be the

new fiscal year.

Journal entry must use source REC.

A-3 Accrue Reimbursements and Abatements

Reimbursement and abatement receivables are amounts due to the department at year-

end but not yet recorded and should be accrued. The accounts used to record accruals are

the same that are used during the year to establish receivables as abatements or

reimbursements.

Record the A-3 entries in period 998 within the GL module.

Entry 1 – Use the GL source “ACC” to accrue reimbursement and abatement

invoices.

Entry 2 – Use the GL source “ENR” for encumbrances funded by accrued

reimbursements. The “ENR” source will be useful in identifying the encumbrance

amounts for preparing Report No. 1, Report of Accruals to Controller’s Accounts.

A-3 entries are reversed in the new fiscal year.

49

A-3 Accrue Reimbursements and Abatements

50

Record Billing of Abatements

Debit 1200100 Accounts Receivable Abatements

Debit 126XXXX Due From Other Governments

Debit 124XXXX Due From Other Funds /Appropriations*

Credit 5XXXXXX Appropriation Expenditures*

Record Billing of Reimbursements

Debit 1200050 Accounts Receivable Reimbursements

Debit 126XXXX Due From Other Governments

Debit 1260000 Due From Federal Government

Debit 124XXXX Due From Other Funds/Appropriations*

Credit 44XXXXX Federal Government Receipts (Federal Trust Fund only)

Credit 48XXXXX Reimbursements*

*Journal lines posted to Account 124XXXX – Due From Other Funds/Appropriations must include values in

the “Affiliate” (BU) and “Fund Affiliate” fields. This information will be system-generated on the year-end

Report No. 7, Subsidiaries on File. The Affiliate and Fund Affiliate should be on both the debit and credit

lines.

A-3 Accrue Reimbursements and Abatements

Encumbrances funded by reimbursements

Departments should prepare separate entries using source ENR to accrue reimbursement receivables

resulting from encumbrances. The source ENR will be useful in identifying the encumbrance amounts to

be reported on Report No. 1, Report of Accruals to Controller's Accounts.

Run the DFQ_KK_16_REIMB_RECON query. This query extracts data from the KK utilizing project costing

for reimbursement reconciliations to determine encumbrance amounts funded by reimbursement.

Include period 998 to capture the A-8 activities.

51

20XX

A-3 Accrue Reimbursements and Abatements

To determine the amounts for the A-3 entry, run the DFQ_KK_16_REIMB_RECON query for the

expenditure, encumbrance, and revenue/reimbursement ledgers.

C_DTL_REC – Detail Revenue/Reimbursement Recognized Ledger

C_DTL_EXP – Detail Expense Ledger

C_DTL_ENC – Detail Encumbrance Ledger

Columns C_DTL_REC minus the C_DTL_EXP equals the source ACC amount and the column C_DTL_ENC equals

the ENR amount .

52

A-3 Accrue Reimbursements and Abatements

53

20XX

20XX

06/30/20XX

06/30/20XX

19,300.00

-19,300.00

Journal lines posted to Account 124XXXX – Due From Other Funds/Appropriations should include

values in the “Affiliate” (BU) and “Fund Affiliate” fields.

A-3 Accrue Reimbursements and Abatements

54

Sample of year-end Report No. 7, Subsidiaries on File with system-generated

information, including affiliate and fund affiliate sections.

A-3 Accrue Reimbursements and Abatements

Accrue any over-collected reimbursement which will be refunded after June 30.

Record Over-Collected Reimbursements

Debit 4400000 Federal Government Receipts

Debit 48XXXXX Reimbursements*

Credit 201XXXX Due To Other Funds/Appropriations

*

Credit 2020000 Due Federal Government

Credit 2000100 Accrued Accounts Payable

55

*Journal lines posted to Account 201XXXX – Due to Other Funds/Appropriations must include values in the

“Affiliate” (BU) and “Fund Affiliate” fields. This information will be system-generated on the year-end Report

No. 7, Subsidiaries on File. Adding the Affiliate and Fund Affiliate on both the debit and credit lines will be

helpful for research purposes.

A-4 Manually Reclassify AR Abatements and

Reimbursements for Reverted Appropriations

56

Receivable items for reverting appropriations must be reclassified to Account 1209900-AR–Other and offset by Account

1290000-Prov for Deferred Receivables.

Record the A-4 entry in period 12 before the AR Module is closed.

A-4 entries are not reversed in the new fiscal year.

For manual processing follow the instructions below:

The department will create a $0 Pending Item Group with two transactions within the group.

Transaction 1: Reverse the original AR open item using Credit AR process in the AR module:

Debit 48XXXXX Reimbursement

Debit 5XXXXXX Appropriated Expenditure (Abatement)

Credit 12XXXXX Accounts Receivable

Transaction 2: Create a second transaction in the group with positive amount:

Debit 1209900 Accounts Receivable – Other

Credit 1290000 Provision for Deferred Receivables*

Through this process, Transaction 1 will have a $0 balance and hence be closed. However, Transaction 2 has the reclassified

accounts and will maintain the original Item ID for payment.

*Add the standardized Alternate Account 1209900998 to ensure that the Provision for Deferred Receivables does not exceed

the amount of the related accounts receivable recorded in the system. This will be system-generated on the year-end Report

7, Subsidiaries on File.

Note: Refer to the Updated Auto AR Reclass Phase III – Job Tool located in the FI$Cal Service Now for the automated

reclassification processing instructions.

A-6 Record Receivables Due From SMIF and Condemnation

Deposits Fund for Interest Earnings

The A-6 entry records the receivables due from the Surplus Money Investment Fund (SMIF) and the

Condemnation Deposits Fund for interest earnings as of June 30.

Record interest earned as of June 30

Source document is SCO Notice of Transfer journal

Record the A-6 entry in period 998 within the GL module

A-6 entries are reversed in the new fiscal year

In the new year, the journal will be posted to FI$Cal through the SCO interface

To record SMIF Interest Due

Debit 1240000 Due from Other Funds

*

Credit 4163000 Investment Income – Surplus Money Investment

*

Credit 4160000 Investment Income – Condemnation Deposits Fund

*

*Journal lines posted to account 124XXXX – Due from Other Funds/Appropriations must include values in the

“Affiliate” (BU) and “Fund Affiliate” fields. The Fund Affiliate for Due From Surplus Money Investment Fund is

0681, and Due From Condemnation Deposits Fund is 0910. This information will be system-generated on the

year-end Report No. 7, Subsidiaries on File. Adding the Affiliate and Fund Affiliate on both the debit and

credit lines will be helpful for research purposes.

57

A‐8 Accrue Accounts Payable

58

In FI$Cal, three accounting events accrue amounts for valid encumbrances and expenditure obligations:

1. Open purchase orders budget checked and dispatched as of June 30.

2. Vouchers entered and budget checked in the AP module (within the commitment control ledger)

through period 12, but not scheduled for payment before June 30.

3. Adjusting entry journal(s) in the GL module within the MODACCRL ledger in period 998 for any valid

obligations (goods or services) received/performed but not vouchered for payment by June 30.

The third accounting event is the A-8 accrual entry. The A-8 entry accrues expenditures for valid

encumbrances (commitments) and obligations for the fiscal year just ended. Departments will

analyze invoices at year-end and accrue any that are due as of June 30 but not yet paid.

A‐8 Accrue Accounts Payable (No Open Purchase Orders)

1. Record A-8 Expenditure Obligation Accrual

A‐8 Accrue Accounts Payable (Open Purchase Orders)

1. Record A-8 Expenditure Obligation Accrual

2. Record Encumbrance Reduction

A‐8 Accrue Accounts Payable

(No Open Purchase Orders)

59

The A-8 entry accrues actual and estimated expenditures as Accrued Accounts Payable or Due To for goods

and services received by June 30 but not scheduled for payment by June 30.

Record the A-8 entries in period 998 within the GL module.

A-8 entries are reversed in the new fiscal year.

Private – Corporations, Exempt Corps, Individual/Sole Proprietor, Partnerships, Estate of Trust, or Employee

Debit 51XXXXX Personal Service (Payroll)

Debit 53XXXXX Operating Expense and Equipment

Credit 2000100 Accrued Accounts Payable

Other Funds/Appropriation – CA State Departments including CSU and Trustees

Debit 53XXXXX Operating Expense and Equipment*

Credit 2010000 Due to Other Funds*

Credit 2011000 Due to Other Appropriations*

*Journal lines posted to Account 201XXXX – Due to Other Funds/Appropriations must include values in the

“Affiliate” (BU) and “Fund Affiliate” fields. This information will be system-generated on the year-end Report No. 7,

Subsidiaries on File. Adding the Affiliate and Fund Affiliate on both the debit and credit lines will be helpful for

research purposes.

A‐8 Accrue Accounts Payable

(No Open Purchase Orders)

60

Other Governmental Entities

Debit 53XXXXX Operating Expense and Equipment

Credit 2020000 Due to Federal Government

Credit 2021000 Due to Local Governments (Local Government Agencies including Cities

and Counties)

Credit 2024000 Due to Other Governmental Entities (Other Governmental Agencies

including School Districts, Community Colleges, UC/Regents and other State

Governments)

A‐8 Accrue Accounts Payable

(Open Purchase Orders)

61

The A-8 entry will debit an expenditure account and credit a current liability account. However, the encumbrance

reduction will debit the liability account and credit the expenditure account. Below are the two entries:

Record the A-8 entries in period 998 within the GL module.

Both A-8 expenditure accrual and encumbrance reduction journals are reversed in the new fiscal year.

1. A-8 Entry for Expenditure Obligation Accrual (Source ACC)

Debit 53XXXXX Operating Expense and Equipment*

Credit 2000100 Accrued Accounts Payable

Credit 201XXXX Due to Other Funds/Appropriations*

Credit 202XXXX Due to Other Governments

2. Encumbrance Reduction Entry (Source ECM)**

Credit 53XXXXX Operating Expense and Equipment

* Journal lines posted to Account 201XXXX – Due to Other Funds/Appropriations must include values in the “Affiliate” (BU) and

“Fund Affiliate” fields. This information will be system-generated on the year-end Report No. 7, Subsidiaries on File. Adding the

Affiliate and Fund Affiliate on both the debit and credit lines will be helpful for research purposes.

** Use Source ECM to set up the encumbrance journal. (Using this source will assist with reconciliations.) The encumbrance

reduction entry must pass the budget check and decrease encumbrances in the commitment control. Departments are

responsible for reclassifying the AP to the appropriate Due To liability accounts by recording the Encumbrance Reclassification.

A‐8 Accrue Accounts Payable

(Open Purchase Orders)

62

Debit 53XXXXX Operating Expense and Equipment

Credit 20XXXXX Liabilities

Source ACC.

Journal Status and Budget Status will be Posted “P” and Valid “V” respectively after this journal has

passed budget check, approved, and posted.

1. A-8 Entry for Expenditure Obligation Accrual

A‐8 Accrue Accounts Payable

(Open Purchase Orders)

63

2. Encumbrance Reduction Entry

The credit will be the opposite amount as the previous A-8 expenditure obligation accrual journal.

Credit 53XXXXX Operating Expense and Equipment (one sided entry)

Source ECM.

As Budgetary Legal Ledger is built, the system will determine the Debit account.

For the Commitment Control Type, select: “Encumbrance”.

The A-8 Encumbrance reduction entries must be manually reversed in the new fiscal year.

A‐8 Accrue Accounts Payable

(Open Purchase Orders)

64

2. Encumbrance Reduction Entry

Use the same chartfields as the A-8 entry.

Journal Status and Budget Status remain as Valid “V” and Valid “V”.

Journal will not “Post.”

Note: The encumbrance reduction entry will not offset the A-8 account 53XXXXX chartfield lines because this

journal does not post to GL module. Departments are responsible for reclassifying the AP to the appropriate Due

To liability accounts by recording the Encumbrance Reclassification.

A‐8 Accrue Accounts Payable Reminders

65

Process vouchers and submit actual expenditures to SCO by the cutoff dates if possible. This reduces the

amount of A-8 entries for year-end.

Invoices paid by direct transfer after June 30 must be accrued in period 998. Review expenditures for prior

ENYs on the July SCO tab run.

For goods and services invoices, group and post accrual journal entries by like chartfield lines to reduce

the number of lines for the A-8 entry and encumbrance reduction entry.

Journal lines posted to Account 201XXXXX – Due to Other Funds/Appropriations must have values in the

Fund Affiliate and Affiliate fields.

Encumbrance reduction adjustment and reversal entries should remain as Valid “V” Journal Status and

Valid “V” Budget Status.

Use Source ECM to set up the encumbrance reduction accrual. (Using this Journal Source will help with

reconciliations).

Encumbrance reduction entries must be manually reversed in the new fiscal year. The auto-reversal

functionality is only for journals that are posted in FI$Cal.

Depending on the supplier type related to the POs, amounts posted in the encumbrance reduction

journals may need to be included in the Encumbrance Reclassification.

A-9 Accrue Revenue

The A-9 entry records revenue accruals. Year-End adjusting entries must be made for the

following:

1. Revenue earned but not yet billed

Record in the GL module in period 998

2. Current year AR Revenue not expected to be collectible in the next fiscal year must be

deferred

Record in the GL module in period 998

3. Prior Year AR Revenue must be reclassified as deferred receivables

Record in the AR module in period 12

66

A-9 Accrue Revenue

1. Revenue earned but not yet billed will be accrued in period 998 within the GL module.

This A-9 entry is reversed in the new fiscal year.

Record Earned but not yet billed AR-Revenue

Debit 1200000 Accounts Receivable Revenue

Debit 124XXXX Due From Other Funds/Appropriation

*

Debit 126XXXX Due From Other Governments

Credit 41XXXXX Revenue

*

*Journal lines posted to Account 124XXXX – Due From Other Funds/Appropriations must

include values in the “Affiliate” (BU) and “Fund Affiliate” fields. This information will be system-

generated on the year-end Report No. 7, Subsidiaries on File. Adding the Affiliate and Fund

Affiliate on both the debit and credit lines will be helpful for research purposes.

67

A-9 Accrue Revenue

68

2. Any current enactment year billed revenue accounts receivable not expected to be

collectible in the next fiscal year should be deferred in period 998 within the GL module.

This A-9 entry is reversed in the new fiscal year.

Record current AR not expected to be collectible in new fiscal year.

Debit 41XXXXX Revenue

Credit 1290000 Provision for Deferred Receivables*

* The Alternate Account for GL 1290000 is the standardized statewide level COA values. Use the

appropriate alternate account from the below list of accounts to ensure that the Provision for

Deferred Receivables does not exceed the amount of the related accounts receivable

recorded in the system. This information will be system-generate on the year-end Report No. 7,

Subsidiaries on File report.

A-9 Record Revenue Accruals

3. All prior enactment year revenue accounts receivable must be reclassified as deferred receivable in

Account Receivable Module.

For manual processing, follow the instructions below.

This A-9 entry is not reversed in the new fiscal year.

Create a $0 Pending Item Group with two transactions in period 12 as follow:

Customer is a CA State Departments, CSU, Trustees, or Other Governments

A. Reverse original AR item using Credit AR process to:

Debit 41XXXXX Revenue

Credit 124XXXX Due From Other Funds/Appropriations

Credit 126XXXX Due From Other Governments

B. Create 2nd transaction with the positive amount to:

Debit 1209900 Accounts Receivable - Other

Credit 1290000 Provision for Deferred Receivables*

*Use the standardized Alternate Account 1209900998 to ensure that the Provision for Deferred Receivables

does not exceed the amount of the related accounts receivable recorded in the system. This will be

system-generated on the year-end Report 7, Subsidiaries on File.

Note: Refer to the Updated Auto AR Reclass Phase III – Job Tool located in the FI$Cal Service Now for

reclassification processing instructions.

69

A-9 Record Revenue Accruals

Customer is a Corporation, Individual/Sole Proprietor, or Partnerships

A. Private Supplier reverse original AR item using Credit AR process to:

Debit 41XXXXX Revenue

Credit 1200000 Accounts Receivable - Revenue

B. Create 2nd transaction with positive amount to:

Debit 1200000 Accounts Receivable - Revenue

Credit 1290000 Provision for Deferred Receivables*

This A-9 entry is not reversed in the new fiscal year.

*Use the standardized Alternate Account 1200000998 to ensure that the Provision for Deferred Receivables

does not exceed the amount of the related accounts receivable recorded in the system. This will be

system-generated on the year-end Report 7, Subsidiaries on File.

Note: Refer to the Updated Auto AR Reclass Phase III – Job Tool located in the FI$Cal Service Now for

reclassification processing instructions.

70

A-10 Adjustment for Dishonored Checks

All dishonored checks are established in FI$Cal by the department. The A-10 entry is required for dishonored checks

considered to be collectible during the next year. The A-10 entry removes the collectible dishonored checks from

Provision for Deferred Receivables (1290000) and reflects the amount in the appropriate account.

Record the A-10 entry in period 998 within the GL module.

This A-10 entry is reversed in the new fiscal year.

Debit 1290000 Provision for Deferred Receivables*

Credit 201XXXX Due to Other Funds/Appropriations**

Credit 205XXXX Revenue/Reimbursements Received in Advance

Credit 2090100 Uncleared Collections

Credit 41XXXXX Revenue

Credit 48XXXXX Reimbursements

Credit 51XXXXX Personal Services

Credit 53XXXXX Operating Expense and Equipment

Credit 5901000 Refunds to Reverted Appropriations

*Use the standardized Alternate Account 1200150998 (Provision Deferred A/R – Dishonored Checks) to ensure that

the Provision for Deferred Receivables does not exceed the amount of the related accounts receivable recorded

in the system. This will be system-generated on the year-end Report 7, Subsidiaries on File.

**Journal lines posted to Account 201XXXX – Due to Other Funds/Appropriations must include values in the

“Affiliate” (BU) and “Fund Affiliate” fields. This information will be system-generated on the year-end Report No. 7,

Subsidiaries on File.

71

A-12 Establish Reserve for Deferred Accounts

Receivable

The A-12 entry is required for AR for Abatements and Reimbursements considered not to be collectible

during the next fiscal year. A-12 entries reclassify the uncollectible AR for Abatements and Reimbursements

to reflect the amount in the Provision for Deferred Receivables (1290000).

Record the A-12 entry in period 998 within the GL module.

A-12 entries are reversed in the new fiscal year.

Abatements

Debit 5XXXXXX Appropriated Expenditures

Credit 1290000 Provision for Deferred Receivables*

Reimbursements

Debit 48XXXXX Reimbursements

Credit 1290000 Provision for Deferred Receivables*

* The Alternate Account for GL 1290000 is the standardized statewide level COA value. Use the

standardized alternate account 1200100998 (Abatement) or 1200050998 (Reimbursement) from the list of

accounts to ensure that the Provision for Deferred Receivables does not exceed the amount of the related

accounts receivable recorded in the system. This information will be system-generated on the year-end

Report No. 7, Subsidiaries on File report.

72

Other Year-End

Adjusting Entries

73

Adjusting Entry:

Record Unremitted Deposits

The unremitted deposits are monies received and deposited in the bank before the State Treasurer's Office

(STO) daily cut-off date but are not remitted to STO before the SCO cut-off date. For example, deposit

accounting dates are in June, but deposit payment accounting dates (remittance accounting dates) are in

July or new fiscal year.

All deposit remittances that met SCO cut-off date must be

approved by SCO

interfaced to SCO before the year-end

Any deposit remittances that met the deadline, but not approved and interfaced by SCO as of June

30 will require the departments to change the accounting date to the new fiscal year.

Run DFQ_AR_20_UNREMIT_DEPOSIT_YEC query to confirm if there are any unremitted deposits for the

year-end accruals.

74

Adjusting Entry: Record Unremitted Deposits

If applicable, departments post a year-end accrual entry for unremitted deposits.

Record adjusting entry in period 998 within the GL module.

These entries are reversed in the new fiscal year.

Accrue Unremitted Deposits*

Debit 1101000 General Cash - CTS Accounts

Credit 2090110 Uncleared Collection – State Fund

Credit 2050000 Unearned Revenue

Credit 2052000 Unearned Reimbursement

Credit 41XXXXX Revenue

Credit 48XXXXX Reimbursements

Credit 5XXXXXX Appropriation Expenditures

* Refer to Unapplied Receipts on the CTS Fund.

Accrue Unremitted Deposits – AR Related

Debit 1101000 General Cash - CTS Accounts

Credit 12XXXXX Accounts Receivable

75

Adjusting Entries: Transfers and Loans

76

Per SAM, operating transfers are the amount transferred and/or received from other funds. Departments are to keep a separate

GL account showing the amount transferred and/or received from each fund. When applicable, the following additional year-end

adjusting entries should be posted.

Record accrual entry in period 998 within the GL module.

These entries are reversed in the new fiscal year.

Accrue Operating Transfers In*

Debit 1240000 Due from Other Funds

Credit 63X0000 Unappropriated Operating Transfers from Other Funds

Credit 6521000 Unappropriated Transfers from Other Funds

Accrue Operating Transfer Out*

Debit 62X0000 Appropriated Operating Transfers to Other Funds

Debit 6480000 Transfers to Other Funds

Debit 65110000 Unappropriated Transfers to Other Funds

Credit 2010000 Due to Other Funds

*Journal lines posted to Due To/Due From Other Funds/Appropriations and Transfer accounts must include values in the “Affiliate”

(BU) and “Fund Affiliate” fields. This information will be system-generated on the year-end Report No. 7, Subsidiaries on File.

Adding the Affiliate and Fund Affiliate on both the debit and credit lines will be helpful for research purposes.

Expenditure Transfers*

Expenditure Transfers – Contributing Fund

Debit 5438000 Loans, Transfers, and Other Disbursements

Credit 2010000 Due to Other Funds

Expenditure Transfer – Receiving Fund "Less Funding

Provided By"

Debit 1240000 Due from Other Funds

Credit 5438000 Loans, Transfers, and Other

Disbursements

77

The Deposit Liabilities accounts provide a depository for monies collected in trust for specific

purposes.

Departments holding money in trust will use the following accounts during the year:

5610120 – Other Deductions

5620120 – Other Trust and Agency Funds Addition

Departments will reclassify the balances incurred during the year in the above accounts to

2060000 – Deposits-General or 2061000 – Deposits-Projects as part of the year-end entries.

The reclassification journal is not reversed in the new fiscal year.

78

If accounts 5610120 and/or 5620120 appear on UCM Report 7, departments must reclassify to

account 206XXXX if money is held in trust or the appropriate nominal account.

Departments can utilize the Report No. 7 – Pre-Closing Trial Balance (UCM version) to determine the accounts

and amounts to be reclassified to 2060000 or 2061000.

Sample of Report No. 7

Before reclassification

79

Record the reclassification entry in period 998, Ledger Group: DEPTADJ, Target Source: BL (for BLBAR and

BUDLEGAL) Source ACJ in the General Ledger module.

Sample of Trail Balance Report

After reclassification entries are posted

80

Sample of Report No. 7

After reclassification entries are posted

Period 998

Allocation Process

81

81

Period 998 Allocation Process

82

After all accruals and adjustments are posted in period 998, departments will run the

encumbrance and expenditure allocation process to distribute costs to the ultimate funds for

year-end reporting purposes.

Departments will review 998 configurations before running allocations. If changes

are required, submit a ticket to the FI$Cal Service Center (FSC). FSC will work with

the department to change the allocation configurations.

Do not run period 998 the encumbrance and expenditure allocation process until the

department has verified that all encumbrance and expenditure entries have been posted

and validated to the source data.

Department will run the encumbrance and expenditure allocation process using the period

998 allocation configuration setup by FI$Cal.

Preliminary Period 998

Reconciliations and Reports

83

83

Preliminary Period 998 Reconciliations

84

After the period 998 allocation process is complete, departments should prepare preliminary period 998

reconciliations.

Reconciling items found during this process that are not SCO reconciling items must be corrected.

Any entries affecting account 5XXXXXX – Appropriation Expenditures and clearing account (program

9999) must be manually allocated.

Allocation adjustments – GL Journal Entry for manual allocations should utilize account 5XXXXXX –

Appropriation Expenditures and 1110101 – Intraunit Acc Acct-LD/PFA Aloc, with SCO Transaction Type

CARE and Source 11N.

Departments should order Report 6 to review all appropriations for overspent or inappropriate costs.

If an appropriation is overspent, adjustments must be made prior to report preparation. Review the

correctness of encumbrances, accruals, and expenditures.

Under no circumstances should the Accounting Office reverse accruals, expenditures, or encumbrances

that are legitimate costs of a program or category.

Preliminary Period 998 Reconciliations

and Reports

85

Similar to “Review Period 12 Reports” slide 26, review preliminary period 998 reports:

Statement of Revenue, Report No. 4

Final Budget Report, Report No. 6

Pre-Closing Trial Balance, Report No. 7

Statement of Changes in Capital Assets, Report No. 18

Subsidiaries on File, Report No. 7

Trial Balance Report

Review accruals and adjustments.

Reminders and Tips for the Preliminary

SCO/Agency Reconciliation Worksheet

86

Appropriation Accounts – verify SCO and FI$Cal balances have no variance in all appropriation accounts

– variance line at the bottom is zero.

GL Accounts – verify all applicable GL accounts on Trial Balance Report are reconciled with the

transactions posted in Commitment Control (KK).

All “Pending Cash Transfer” lines must be $0 for period 998.

All departmental reconciling items must be resolved in period 998.

All adjustments to SCO accounts should be supported by transaction requests and reported on Report 3,

Adjustments to Controller's Accounts.

Clearing Account for all ENY “Expenditure” and “Encumbrance” balances should be $0.

Run and review financial reports prior to building Budgetary Legal Ledger (BLL) to check for abnormal

balances.

Year-End

Plan of Financial Adjustment

Reclassification

87

87

Plan of Financial Adjustment Reclassification

At year-end an accrual reclassification entry is required to reflect all outstanding Plan of Financial

Adjustment (PFA) amounts from 1110101 – Intraunit Accrual Account-LD PFA Allocation to the appropriate

accounts 124XXXX/201XXXX – Due From/Due To Other Funds or Appropriations.

Record the PFA accrual reclassification entry in period 998 within the GL module.

All entries are reversed in the new fiscal year.

Source Document

Use the period 998 PFA Reconciliation Worksheet to determine the PFA reclassification entries.

For more information refer to eLearning “Record Year-End Plan of Financial Adjustment.”

For PFA Interface and changes refer to JobAid FISCal.440 – FI$Cal Plan of Financial Adjustment Functionality.

88

Plan of Financial Adjustment Reclassification

89

Account 1110110 – Intraunit Pending PFA Accrual was created for the Year-End PFA accrual

entry.

Program

Debit 1110110 Intraunit Pending PFA Accrual Account

Credit 2010000 Due to Other Funds*

Credit 2011000 Due to Other Appropriations*

Clearing Account

Debit 1240000 Due from Other Funds*

Debit 1240100 Due from Other Appropriations*

Credit 1110110 Intraunit Pending PFA Accrual Account

*Journal lines posted to Account 124XXXX – Due from Other Funds/Appropriations and Account 201XXXX –

Due to Other Funds/Appropriations must include values in the “Affiliate” (BU) and “Fund Affiliate” fields. This

information will be system-generated on the year-end Report No. 7, Subsidiaries on File. Adding the Affiliate

and Fund Affiliate on both the debit and credit lines will be helpful for research purposes.

Plan of Financial Adjustment Reclassification

90

Refer to MEC Training Session II for details on completing the PFA Reconciliation.

SOURCE DOCUMENT

Use the period 998 PFA Reconciliation Worksheet

90

Plan of Financial Adjustment Reclassification

91

Plan of Financial Adjustment Reclassification

92

Budgetary Legal Ledger

and

Departmental Adjustment

Ledger

93

Budgetary Legal Ledger is the source of financial information for Budgetary/Legal Year-End

Financial Reports.

Budgetary Legal Ledger Application (BLL App) engine extracts financial data from the

Modified Accrual Ledger and Departmental Adjustment Ledger and posts transactions

automatically into the BUDLEGAL ledger monthly, and at year-end after the accounting

period is closed. FSC validates all BLL and 998 journals are posted.

BLL contains cash basis, accrual transactions, and encumbrance transactions.

For more information on the above refer to Job Aid FISCal.257

What is the Budgetary Legal Ledger?

94

What is the Departmental Adjustment Ledger?

95

The Departmental Adjustment ledger (DEPTADJ) is used to post/extract capitalized asset and

depreciation, and encumbrance transactions. Departments will post the encumbrance liability

reclassification and reversal in this ledger.

When creating entries in the DEPTADJ ledger, the Target Ledger Code field is required. Each

letter in the Target Ledger Codes corresponds to a specific ledger. Depending on the Target

Ledger Code combination selected, the transaction data flows to the corresponding Target

Ledger Group(s). For the encumbrance liability reclassification journal use Target Ledger Code

“BL” to ensure that the transactions flow to the Budgetary/Legal Basis Annual Report (BLBAR)

and Budgetary Legal (BUDLEGAL) ledgers.

Refer to Job Aid FISCal.490 – Department Adjustment Ledger Entries

Refer to Job Aid FISCal.258 Running the YEC Process for detailed steps:

Request period 998 Close (MODACCRL) – Department

Close period 998 (MODACCRL) and validate BLL and 998 journals are posted – FSC

Run allocation to allocate Account 2000300 to the appropriate liability accounts

Notify departments once the BLL is built and period 998 DEPTADJ is open – FSC

Encumbrance reclassification from Accounts Payable to the appropriate Due To accounts

(DEPTADJ) – Department

Refer to eLearning YE – Encumbrance Liability Reclassification

Complete all final reconciliations (BUDLEGAL) – Department

Provide FSC the encumbrance journal ID(s) and request to run the YEC process to have

Report No. 8, 9 and 20 available – Department

Notify departments once the YEC process is complete – FSC

Prepare Year-End Financial Reports (BUDLEGAL) – Department

FSC and Department Responsibilities for

Period 998 and Budgetary Legal Ledger Process

96

97

Departments are responsible for reclassifying AP liabilities to the appropriate Due To liability

accounts for encumbrances and encumbrance journals.

Encumbrance Liability Reclassification entries are reversed in the new fiscal year.

Post journals to Ledger Group: DEPTADJ, Target Ledger Code: BL, Source ACC

Encumbrances in BLL include data from both:

1. Purchase orders recorded to the direct appropriation

2. Encumbrance Journals (for example, encumbrance journals from allocation, A-8

Encumbrance Reduction, and other encumbrance journals.)

For more information refer to eLearning “YE – Encumbrance Liability Reclassification.”

98

1. Purchase orders recorded to the direct appropriation

The BLL App engine copies the encumbrance accounting entries from the DEPTADJ ledger

and posts them in the BUDLEGAL ledger with the applicable offsetting liability accounts for

the AP, Due to Local Governments, Due to Federal Governments, Due to Other

Governments. However, if the supplier is an Inter-Unit Supplier (State Departments),

Account 2000000 – Accounts Payable is used as the offsetting liability account.

Post journals to Ledger Group: DEPTADJ, Target Ledger Code: BL, Source ACC

Record encumbrance liability reclassification for State Departments

Debit 2000100 Accrued Accounts Payable

Credit 2010000 Due to Other Funds*

Credit 2011000 Due to Other Appropriations*

*Journal lines posted to Account 201XXXX – Due to Other Funds/Appropriations must include

values in the “Affiliate” (BU) and “Fund Affiliate” (Fund) fields. This information will be system-

generated on the year-end Report No. 7, Subsidiaries on File.

99

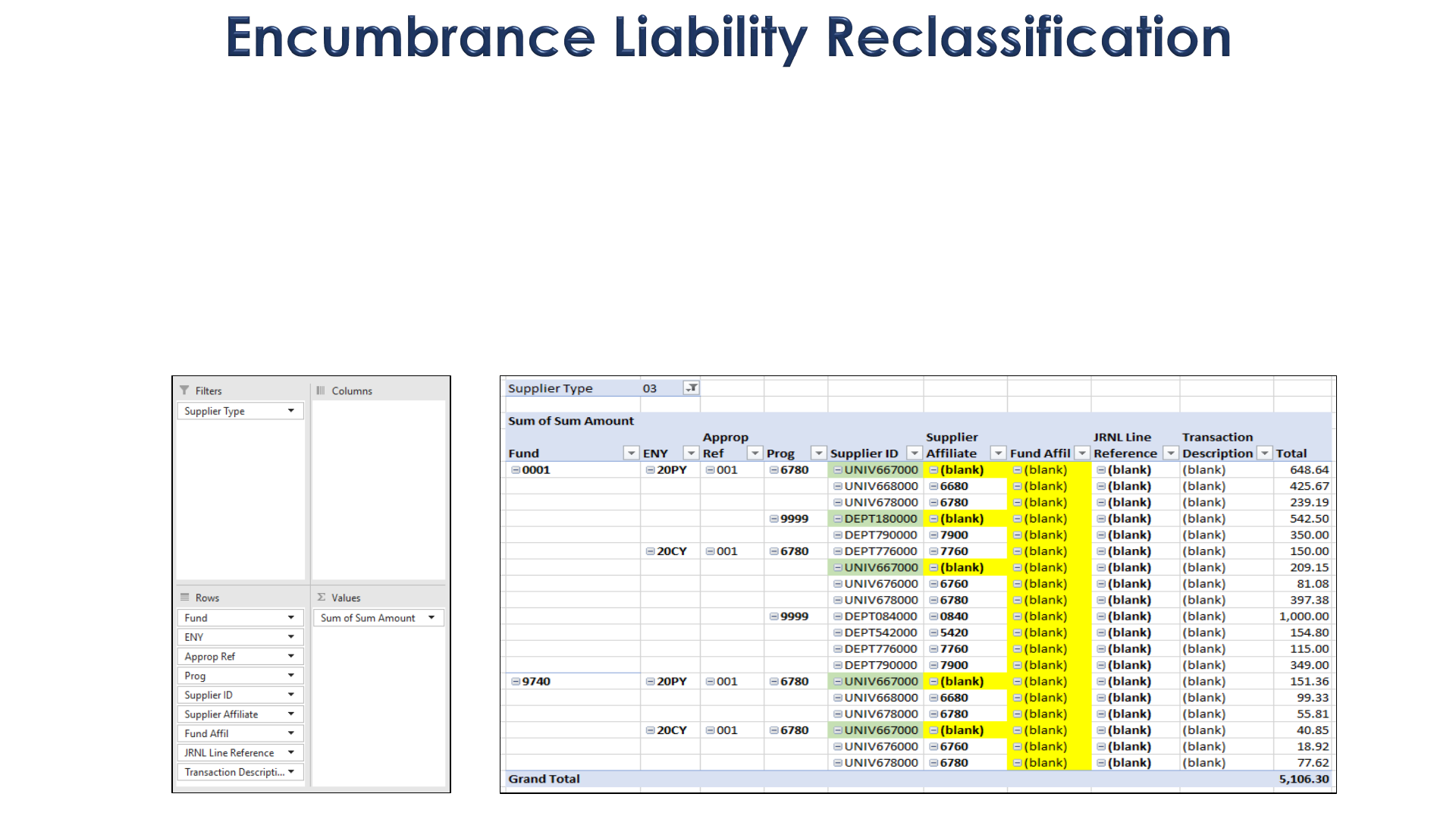

DFQ_PO_05A_ENC_RECLASS_SUMMARY query

Create a pivot table

Filter by Supplier Type: 03 (CA State Departments including CSU and Trustees)

Complete Supplier Affiliate (BU Affiliate) using the Supplier ID

Complete the Fund Affiliate

Post accrual journal in Ledger Group: DEPTADJ, Target Ledger Code: BL, Source ACC

1. Purchase orders recorded to the direct appropriation

100

2. Encumbrance Journals

The BLL App engine copies the encumbrance accounting entries from the DEPTADJ

ledger and posts them in the BUDLEGAL ledger for the allocated encumbrances as

Account 2000000 Accounts Payable. Departments are responsible for reclassifying

Account 2000000 to the appropriate Due to Other Funds/Appropriations, Due to Local

Governments, Due to Federal Governments, or Due to Other Governments.

Post journals to Ledger Group: DEPTADJ, Target Ledger Code: BL, Source ACC.

Record encumbrance liability reclassification for all governmental

entities

Debit 2000100 Accrued Accounts Payable

Credit 2010000 Due to Other Funds*

Credit 2011000 Due to Other Appropriations*

Credit 2020000 Due to Federal Government

Credit 2021000 Due to Local Government

Credit 2024000 Due to Other Governmental Entities

*Journal lines posted to Account 201XXXX – Due to Other Funds/Appropriations must include

values in the “Affiliate” (BU) and “Fund Affiliate” (Fund) fields. This information will be system-

generated on the year-end Report No. 7, Subsidiaries on File.

Final Reconciliations

and

Online MEC Status

101

Final Reconciliations

Complete all final BUDLEGAL reconciliations prior to completing Year-End Financial Reports –

Department

Bank Reconciliation (See MEC Session I)

Revolving Fund Reconciliation (See MEC Session I)

Cash in State Treasury Account Reconciliation (See MEC Session I)

NEW:

o Non-shared funds Report No. 7 and 8 may display GL 1140 and the COA Account 65.

• GL 1140 is the cash balance from 7/1/2020 to the present.

• Account 65 is the cash balance from inception to 6/30/2020.

o Shared funds Report No. 7 will display GL 1140 for the cash balance.

SCO/Agency Fund Reconciliation (See MEC Session II)

Deposit in Surplus Money Investment Fund Reconciliation

Other reconciliations – each department is responsible for completing any reconciliation

necessary to safeguard the state’s assets and ensure reliable financial data

102

Final Reconciliations

Final BUDLEGAL SCO/Agency Fund Reconciliation – Department

No variance exists between the adjusted SCO Appropriation Balance and the Department’s

Adjusted Appropriation Balance

No variance exists in the GL variance balance column

All departmental reconciling items must be resolved

All “Pending Cash Transfer” accounts must be $0 in period 998

NEW: Account 2000300 must be $0 - The Milestone 5 Encumbrance Extract Process reclassified

Account 2000300 balance to the appropriate AP liability based on the DEPTADJ ledger balance

All ENYs Clearing Account balances must be zero

All adjustments to SCO accounts should be supported by transaction requests and reported on

Report No. 3, Adjustments to Controller’s Accounts

NEW: No COA values appear on the UCM Report No. 7 (except Account 65 for non-shared funds)

103

Update Online MEC Status

Online Month-End Closing (MEC) Reporting Tool (Job Aid FISCal.335) provides

departments with the steps on how to report MEC activities online in FI$Cal.

Update the reconciliation status for each fund.

When all tasks are reported as “Completed,” the MEC Dashboard will report 100%

completed for the accounting period.

FI$Cal will produce project status reports based on MEC status. Therefore, departments

must ensure accurate and timely updates after the completion of related MEC activities.

104

Update Online MEC Status

105

Year-End Financial Reports

Due Dates:

8/31/2023 – All Funds

Year-End Financial Reporting Requirements BL 23-02

Review SCO’s “Checklist of Funds Required” to verify what funds SCO requires the

Department to submit financial reports for.

https://www.sco.ca.gov/Files-ARD/BudLeg/Department_Fund_Checklist.pdf

106

All departments using FI$Cal must submit FI$Cal system-generated financial reports to SCO.

List of Required Year-End Financial Reports

SAM Section 7951

107

Tips for Year-End Financial Reports

Use Legacy UCM accounts

Translate COA accounts to UCM accounts using the crosswalk, “COA Crosswalk – Details

from FI$Cal to UCM” is available on the Finance website:

https://dof.ca.gov/budget/resources-for-departments/fiscal-resources-for-budget/

Complete the SCO’s Checklist – it is not required to submit the checklist with the Year-End

Financial Reports

Ensure Report Title, BU, and Fund information is correct

Abnormal balances should have an asterisk(*) next to the balance and footnote the

explanation

Subsidiaries on File is now Report No. 7, Subsidiaries on File

Due To/From Supplemental Report is no longer required to be submitted to SCO

Copy of Report No. 14 is no longer required to be submitted to SCO

108

112

109

Objective

The consistent and timely execution of

Month-End Close processes enables

departments to complete Year-End tasks

promptly to meet Year-End Close deadlines.

110

Importance of Meeting Deadlines

Month-End Close (MEC) deadlines ensure departments can meet Year-End Close (YEC) reporting

deadlines. Deadlines are established to help ensure the state can accomplish its statewide

statutory responsibilities. Meeting the deadlines will have the following benefits:

State Controller’s Office will have final data to publish in their annual reports.

Finance will have final prior year data to build the budget and meet the deadlines for the

Governor’s Budget.

Finance will have the information necessary to meet statewide Single Audit Act reporting

requirements.

The state will have the information necessary to meet bond disclosure requirements.

Departments will have an easier transition to timely monthly closing.

Departments can move forward with working on current year closing activities.

111

Importance of Meeting Deadlines

Delay in providing accurate and timely financial information may:

Impede timely preparation and presentation of the Governor’s Budget to the Legislature.

Create distortion in budget details resulting from inaccurate or absence of required data, or

use of estimates.

Delay in preparation and publication of the Budgetary-Legal Basis Annual Report

Government Code (GC) Section 12460.

Lead to cuts to programs/inability to fund key programs.

Create distrust and loss of public confidence:

Negative press perspective

Voters may reject subsequent ballot measures Delays

112

Importance of Meeting Deadlines

Delay in providing accurate and timely financial information:

Non-compliance with regulatory requirements:

Single Audit (Part 200 of Code of Federal Regulation)

Withhold federal funds

Suspension of grant agreement

Termination of federal award

Non-compliance with law:

Implication for State Leadership and Oversight GC 8546.1(e)

SCO will report delinquent departments to the Legislature.

Departments will be required to testify on correcting this deficiency.

113

Importance of Meeting Deadlines

Delay in providing accurate and timely financial information:

U.S. Securities and Exchange Commission (SEC) Rule 240.15c2-12:

Violation of Bond Contract – has legal implication

Trigger “Failure to File Notice”

If not cured promptly, must disclose again

Must disclose non-compliance for 5 years

Reputational damage:

Withdrawal/downgrade of credit rating

High borrowing cost

May result in the suspension of current rating

Non-Issuance of Government Finance Officers Association (GFOA) certificate of

achievement

Less attractive to investors

114

Tips for Successful Year-End Close

SAM Requirement, see Chapter 7900 Reconciliation and Reports.

Departments must create and implement a work plan to ensure the timely close of

accounting periods and submission of Year-End Financial Reports.*

Departments can utilize an example of the MEC plan found in Job Aid FISCal.009 – Run the

Month-End Process.

Departments must track and update MEC Status using Job Aid FISCal.335 – The Online Month-

End Close MEC Reporting Tool.

Utilize MEC Automation Process by requesting required role, Job Aid FISCal.431 – MEC

Automation Process.

Timely posting and approval of daily transactions are extremely important to the Month-End

Close and Year-End process.

Run Labor, Cost Allocation, and Asset Depreciation timely every month.

Perform and complete Plan of Financial Adjustments and all reconciliations monthly.

Clear reconciling items in the following period.

*Note: Work plans and reconciliations may be subject to review by the Department of Finance,

the State Controllers Office, and the California State Auditor.

115

Year-End Support

Contact the FSCU Hotline for accounting policy

FI$Cal Service Center for tickets

Note “MEC” for period 12 issues or “YEC” for period 998 issues in the subject line

FI$Cal Month-End Close/Year-End Close Team

116

134

New Year Reminders

117

New Year Reminders

Balances:

Review the Final Budget Report to ensure the beginning balances are correct.

Review the Trial Balance to ensure the beginning balances are correct.

Labor:

Review and follow applicable instructions in Job Aid FISCal.255 Establishing New Year

Labor Distribution Configuration Tables.

Ensure configurations for the new year are correctly established (after completing labor

for period 12 and prior to running labor for period 1).

Allocations:

Determine if the CY will need to be treated differently than the PY.

To amend or rescind any current primary or special appropriations, submit a proposed

PFA letter to Finance, FSCU – PFArequests@dof.ca.gov.

To correct or update the PFA Tree configuration only (previously approved PFA Letter

remains the same), submit a Tree update request to the email above.

Validate and update statistic journals for the new FY or ENY.

Validate the need for new cost pools.

Review applicable instructions to update Allocations in Job Aid FISCal.008 Maintaining

Allocations.

118